Management Presentation

November 2005

1

This presentation includes forward-looking statements within

the meaning of the Securities Litigation Reform Act of 1995

regarding future events and the future financial performance of

Valero L.P. All forward-looking statements are based on the

partnership's beliefs as well as assumptions made by and

information currently available to the partnership. These

statements reflect the partnership's current views with respect

to future events and are subject to various risks, uncertainties

and assumptions. These risks, uncertainties and assumptions

are discussed in Valero L.P.’s 2004 annual report on Form 10-K

and subsequent filings with the Securities and Exchange

Commission.

Forward Looking Statements

2

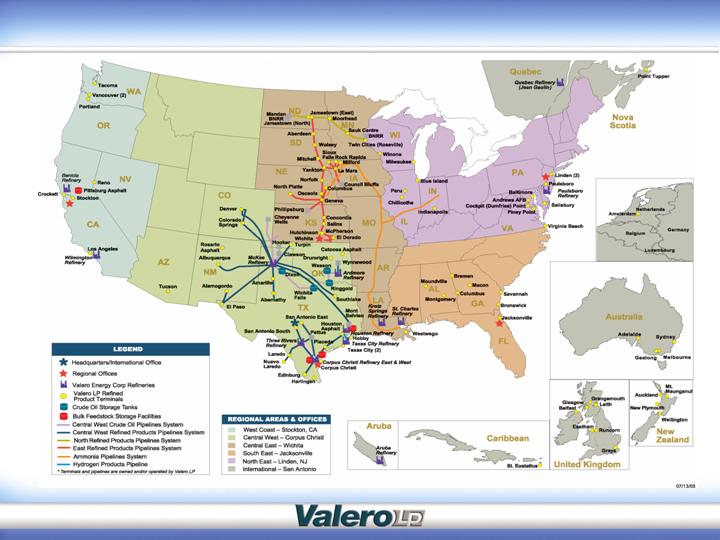

Valero L.P. Overview

6th largest publicly traded MLP in the U.S. (NYSE:VLI)

Valero Energy owns 23% (21% limited partner, 2% general partner)

Market cap at IPO (April 2001) of $470 million; currently $2.7 billion

Total unitholder return of over 200% since IPO

Has delivered outstanding distribution growth while maintaining

one of the strongest distribution coverage ratios in our peer group

Increased quarterly distribution from $0.60 to $0.855 per unit

Owns and operates diversified portfolio of logistics assets

Over 9,100 miles of crude and refined product pipelines

94 terminal facilities and 60 crude oil storage tanks

Around 77 million barrels of storage capacity

Serves 7 Valero Energy refineries

3

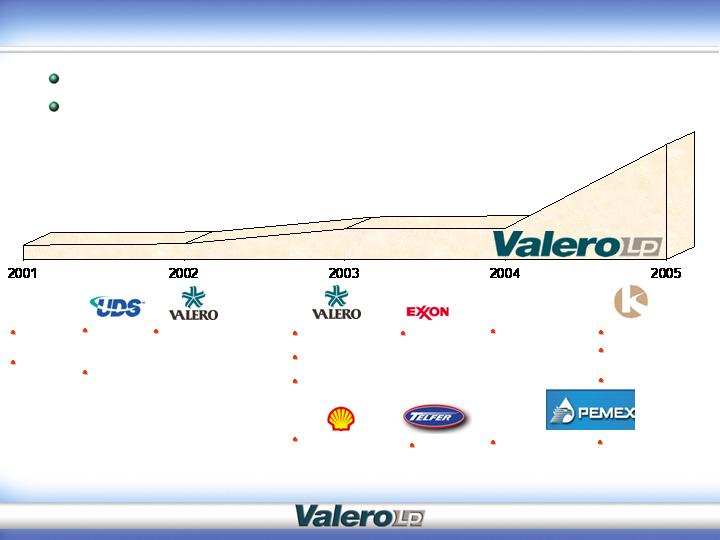

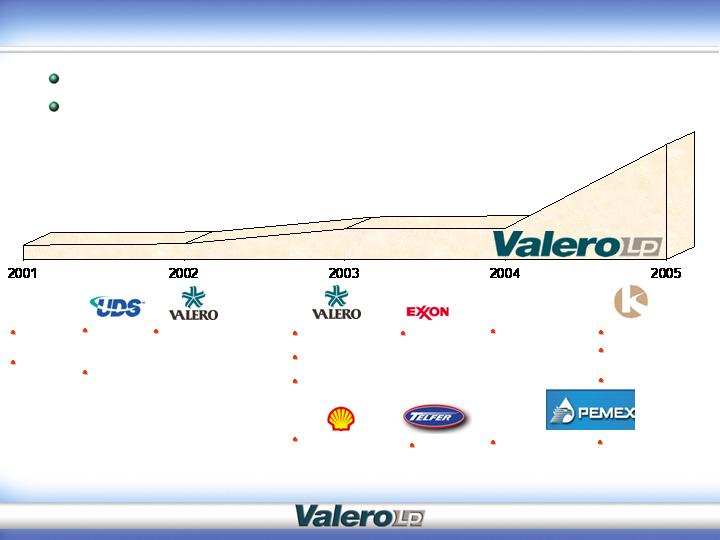

Assets have grown more than eight times since April 2001

Have acquired $2.8 billion in assets

Total Assets

(Year Ended)

$3.2 billion Est.

South Texas

pipeline system

58 crude oil storage

tanks

Southlake, Texas

refined product

pipeline

Wichita Falls, Texas

Business

(272-mile pipeline

and 4 crude oil

storage tanks)

Paulsboro, NJ

refined product

terminal

28% Interest in

Amarillo/Abernathy/

Lubbock, Texas

refined product

pipeline

Asphalt

terminal

(Pittsburg, CA)

April 2001

IPO

Acquired

by Valero

Energy

January

2002

Royal Trading Co.

2 asphalt

terminals

(Oklahoma &

New Mexico

Joint Venture - Dos

Laredos propane

terminal and

pipeline system in

South Texas/Mexico

Southlake,

Texas

terminal

Crude oil

storage

facilities at

Ringgold,

Texas

Kaneb acquisition

4 pipeline systems;

over 5,000 miles

79 terminal facilities

Construction of 110

miles of pipeline in

Northern Mexico/

South Texas

$387 million

Growth through Acquisitions and Growth Projects

4

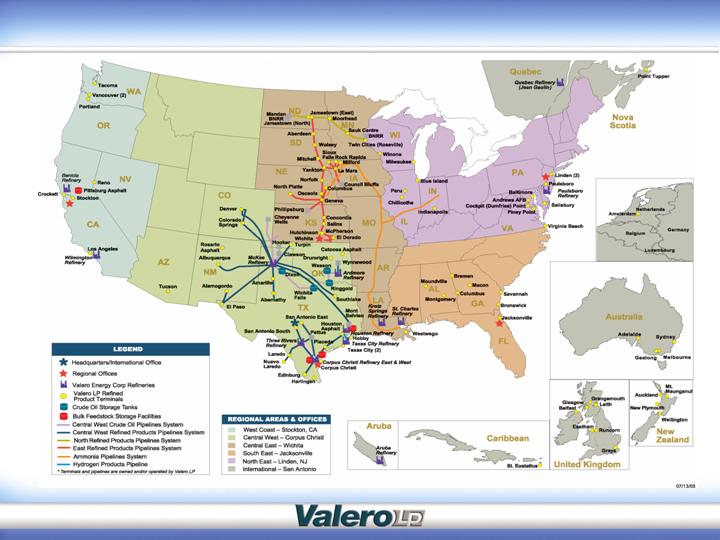

Valero L.P. System Overview

5

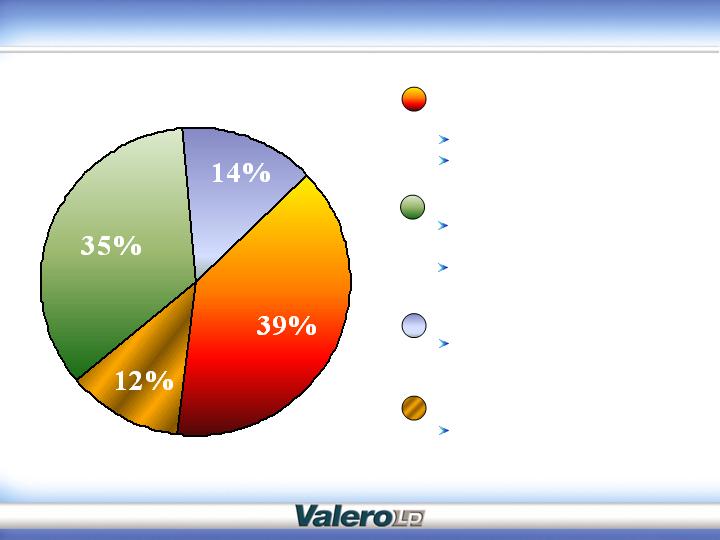

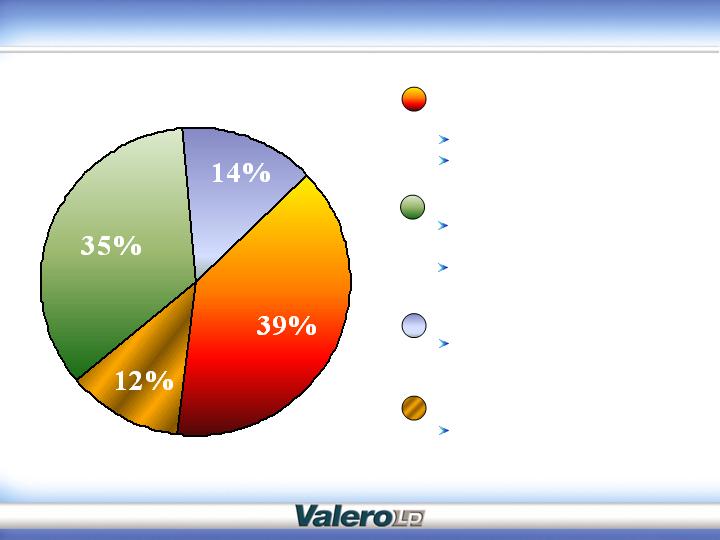

Valero L.P.

Operating Income by Segment*

Refined Product Pipelines

Refined Product

Terminals/Bunkering

Crude Oil Pipelines

Crude Oil Storage Tanks

6,350 miles of refined product

pipelines

2,000 mile ammonia pipeline

94 terminal facilities

Large international presence

800 miles of crude oil pipelines

60 crude oil storage tanks with

12.5 million barrels of capacity

* Based on estimated 2006 operating income.

Diversified Operations

6

Valero L.P. Strategy

Improve safety and reliability

Investments required to raise safety and reliability of Kaneb

assets to Valero L.P. standards

Continuous improvement in operations

Expand use of underutilized assets

Control costs

Remain committed to growth

Focus on abundance of strategic growth projects

Longer term focus on acquiring stable, fee-based assets,

which are immediately accretive to earnings per unit and

distributable cash flow

Strong balance sheet and stable cash flows support growth

strategy

7

Abundance of strategic growth projects from expanded geographic

presence

Reliability capex increases primarily due to investments required to

upgrade Kaneb assets to Valero standards

(Dollars in Millions)

Strategic

Reliability

$80

$105

$30

Projected Capital Expenditures

Note: Reliability capital expenditures include maintenance, regulatory and safety & environmental. 2005 includes

capital expenditures on former Kaneb assets beginning July 1, 2005.

8

Expansion of Valley Pipeline by 10,000 barrels per day completed

Construction of more than 110 miles of pipeline from Burgos gas fields in

northeastern Mexico to third-party terminal in Brownsville

Total investment of approximately $58 million

Scheduled for completion in May 2006

Expected throughputs of approximately 36,000 barrels per day of oil

products

Burgos/Valley Pipeline Projects

9

Portfolio of assets provide for solid long-term growth

opportunities

Identified over $100 million of accretive strategic growth projects from

2006 through 2008*

Kaneb assets provide Valero L.P. with ample high return

investment opportunities

West Region

2Q07

$4.9

Portland Storage

Central West

3Q06

$4.0

Texas City Black Oil System Expansion

Legacy

Kaneb assets

2006

$4.9

IS Automation Upgrades

Central West

3Q07

$8.0

Denver Terminal Expansion

4Q06

2Q06-4Q07

2Q06

Completion

Dates

$5.0

$16.9

$58.0

Estimated

CAPEX

Central East

Ammonia Pipeline Laterals & Storage

Northeast

Linden Terminal Optimization

Central West

Region

Burgos – Valley Pipeline Extension

Strategic Projects

(Dollars in Millions)

Strategic Growth Projects

* Includes approximately $15.7 million carryover from Burgos Project started in 2005.

10

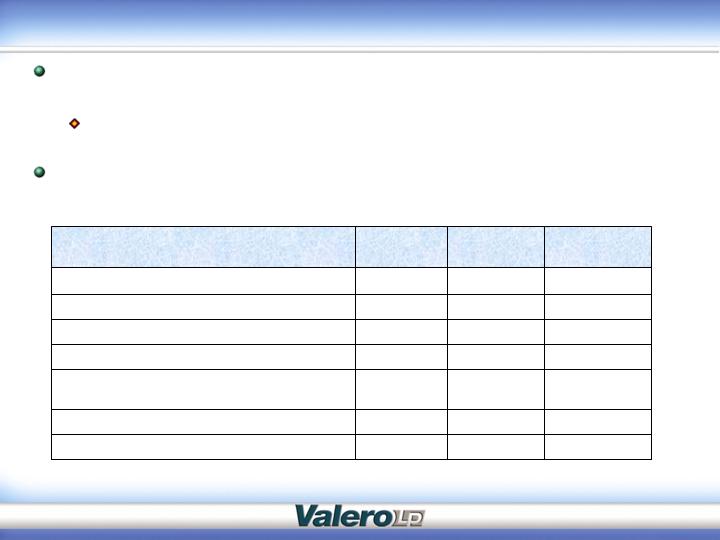

(Dollars and units in thousands, except per unit amounts)

4th quarter 2005 earnings expected to be in range of 65 to 70 cents per unit

Primarily due to loss of held separate businesses, higher power costs, asphalt

seasonality, higher maintenance expense and Valero Energy McKee refinery

turnaround

2005 Financial Highlights

11

Q105

Q205

Q305

Revenues

$56,635

$58,306

$263,546

Cost of Sales

-

-

101,217

Operating Expense

19,685

21,645

71,358

G&A Expense

3,503

3,561

10,391

Depreciation Expense

8,732

8,791

23,902

Interest Expense

5,829

5,878

15,315

Income Tax Expense

-

-

2,147

Income from Continuing Ops.

19,264

18,852

40,757

Income from Discontinued Ops.

-

-

4,410

Net Income Applicable to LPs

$17,788

$17,005

$41,275

EPU applicable to LPs:

Continuing Ops.

$0.77

$0.74

$0.79

Discontinued Ops.

-

-

0.09

$0.77

$0.74

$0.88

EBITDA

$33,825

$33,521

$91,221

Distributable Cash Flow

$26,193

$24,867

$63,574

Weighted Avg. Units Outstanding

23,041

23,041

46,810

Coverage Ratio applicable to LPs

1.25x

1.12x

1.37x

Valero L.P. 2006 Outlook

Operations expected to be impacted first half of 2006

Primarily due to heavy turnaround activity at some of Valero Energy

refineries

Higher maintenance expense to upgrade legacy Kaneb assets

By second half of 2006, throughput levels expected to return to

more normal levels

Additional volumes from strategic growth projects and increased tariff

and throughput fees

* Excludes throughputs related to the storage lease and bunkering operations acquired in the Kaneb acquisition.

12

Estimated Throughputs (thousand barrels per day):

Q106

Q206

Q306

Q406

Crude Oil Pipelines

395-400

390-395

415-420

410-415

Refined Product Pipelines

680-685

690-695

730-735

720-725

Refined Product Terminals*

275-280

275-280

295-300

275-280

Crude Oil Storage Tanks

490-495

510-515

515-520

525-530

(Dollars in Millions)

Debt Position

(As of September 30, 2005)

* Guaranteed by Valero L.P., non-recourse to Valero Energy.

Note: $482 million of proceeds from assets sales in third quarter of 2005 used to pay off $180

million of $400 million revolver and and partially pay off $525 term loan.

13

Issuer

Amount

Maturity

Valero Logistics Operations (6.875%)*

$100

2012

Valero Logistics Operations (6.05%)*

250

2013

Valero Logistics Operations (Port of Corpus

Christi)

8.7

2015

Kaneb Pipe Line Operating Partnership,

L.P. (5.875%)

250

2013

Kaneb Pipe Line Operating Partnership,

L.P. (7.75%)

250

2012

Write-up to FMV of Kaneb Debt

53

Kaneb UK Debt

37

New Valero Logistics Operations

- Term debt

230

2010

- $400 mm revolving credit facility and

other bank borrowings

-

5-Year Revolver

Public Debt Rating

Moodys – baa3, stable

S&P – BBB minus, stable

Fitch – BBB minus, stable

Public Debt Covenants

Limitation on liens

Limitation on sale/leasebacks

Bank Debt Covenants

Debt-to-EBITDA typically not to exceed 4.75x

EBITDA-to-Interest cover to be greater than 3x

Limitation on liens & sale/leasebacks

$167.5 million of fixed-to-floating interest rate swaps

65% fixed versus 35% floating rate debt

Debt Position

14

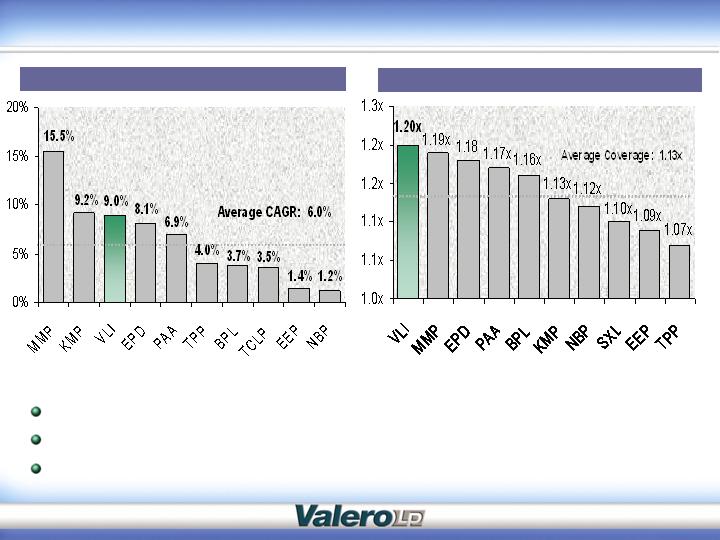

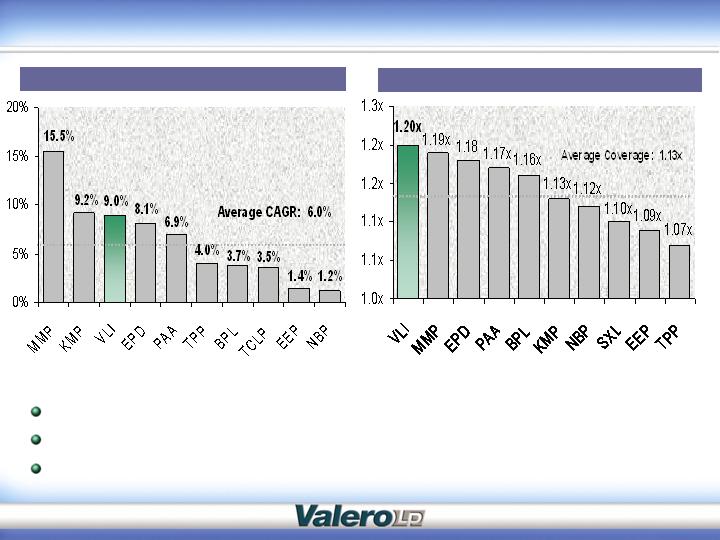

Distribution growth key driver of unit price performance

Target distribution growth in line with top of peer group

Distribution growth of around 9% vs. MLP average of 6.0%

___________________________

(1)

Compound annual growth rates of quarterly distributions to L.P. unitholders since the third quarter distribution of 2001 through the

third quarter distribution of 2005.

(2)

Based on 2006 estimated distributable cash flow per L.P. unit and annualized 3Q05 cash distributions per L.P. unit, per Wall

Street estimates.

Distribution CAGR Since Valero LP IPO (1)

Total Distribution Coverage (2)

Strong Distribution Growth & Coverage

15

207% total unitholder return since IPO (price appreciation

plus yield)

42.5% increase in distribution / L.P. unit

(1)

Buckeye Partners, Enbridge Energy Partners, Enterprise Products Partners, Kinder Morgan Energy Partners, Magellan Midstream

Partners, Northern Border Partners, Plains All American Pipeline, Sunoco Logistics Partners, TEPPCO Partners.

% Change

Valero L.P.: 207%

Peer Group: 111%

S&P 500: 10%

Peer Group(1)

S&P 500

Valero L.P.

Valero L.P. Unit Performance

16

Proven growth and value creation through accretive

acquisitions and internal growth projects

Kaneb acquisition enhances earnings stability

Expands geographic presence

Diversifies customer base

Incentive distribution payments to our general partner

capped at 25 percent

Low cost of capital

Solid financial position

Strong balance sheet and investment grade ratings

Track record of strong and consistent cash flow generation

Committed to top-tier distribution growth and

maintaining strong distribution coverage

Key Investment Highlights

17

Appendix

18

Reconciliation of Net Income to EBITDA and Distributable

Cash Flow

The following is a reconciliation of net income to EBITDA and distributable cash flow (in thousands):

19

Q105

Q205

Q305

Net Income

$19,264

$18,852

$45,167

Plus net interest expense & other

5,829

5,878

20,005

Plus income tax expense

-

-

2,147

Plus depreciation & amortization

8,732

8,79

23,902

EBITDA

33,825

33,521

91,221

Less equity income from joint ventures

(378)

(421)

(1,541)

Less interest expense, net

(5,829)

(5,878)

(20,005)

Less reliability capital expenditures

(1,425)

(2,468)

(8,476)

Plus distributions from joint ventures

-

113

2,375

Distributable Cash Flow

$26,193

$24,867

$63,574