QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on July 30, 2004

Registration No. 333-115331

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RIGHTNOW TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation or Organization) | | 7372

(Primary Standard Industrial Classification Number) | | 81-0503640

(I.R.S. Employer

Identification No.) |

|

40 Enterprise Boulevard

Bozeman, Montana 59718-9300

(406) 522-4200

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices) |

|

Greg R. Gianforte

Chief Executive Officer

RightNow Technologies, Inc.

40 Enterprise Boulevard

Bozeman, Montana 59718-9300

(406) 522-4200

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service) |

| Copies to: |

John W. Manning, Esq.

Dorsey & Whitney LLP

507 Davidson Building

8 Third Street North

Great Falls, Montana 59401

(406) 727-3632 | | Ellen S. Bancroft, Esq.

Parker A. Schweich, Esq.

Dorsey & Whitney LLP

38 Technology Drive

Irvine, California 92618

(949) 932-3600 | | Brooks Stough, Esq.

Anthony J. McCusker, Esq.

Kevin C. Gibson, Esq.

Gunderson Dettmer Stough Villeneuve

Franklin & Hachigian, LLP

155 Constitution Drive

Menlo Park, California 94025

(650) 321-2400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to be

Registered(1)

| | Proposed Maximum

Offering Price

Per Share(2)

| | Proposed Maximum

Aggregate

Offering Price(2)

| | Amount of Registration Fee(3)

|

|---|

|

| Common Stock, par value $0.001 per share | | 7,590,000 | | $11.00 | | $83,490,000 | | $10,579 |

|

- (1)

- Includes 990,000 shares that the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933.

- (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting any offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued July 30, 2004

6,600,000 Shares

COMMON STOCK

RightNow Technologies, Inc. is offering 6,000,000 shares of its common stock and the selling stockholder is offering 600,000 shares. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price will be between $9.00 and $11.00 per share.

We have applied to list our common stock on the Nasdaq National Market under the symbol "RNOW."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 5.

PRICE $ A SHARE

| | Price to

Public

| | Underwriting

Discounts and

Commissions

| | Proceeds to

RightNow

Technologies

| | Proceeds to

Selling Stockholder

|

|---|

| Per Share | | $ | | $ | | $ | | $ |

| Total | | $ | | $ | | $ | | $ |

We and the selling stockholder have granted the underwriters the right to purchase up to an additional 990,000 shares of common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Morgan Stanley & Co. Incorporated expects to deliver the shares to purchasers on , 2004.

| MORGAN STANLEY | THOMAS WEISEL PARTNERS LLC |

| ADAMS HARKNESS | D.A. DAVIDSON & CO. |

, 2004

TABLE OF CONTENTS

| | Page

|

|---|

| Prospectus Summary | | 1 |

| Risk Factors | | 5 |

| Special Note Regarding Forward-Looking Statements | | 18 |

| Use of Proceeds | | 19 |

| Dividend Policy | | 19 |

| Capitalization | | 20 |

| Dilution | | 21 |

| Selected Consolidated Financial Data | | 22 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 24 |

| Business | | 39 |

| Management | | 54 |

| Certain Relationships and Related Party Transactions | | 71 |

| Principal and Selling Stockholders | | 72 |

| Description of Capital Stock | | 74 |

| Shares Eligible for Future Sale | | 78 |

| Underwriters | | 81 |

| Legal Matters | | 85 |

| Experts | | 85 |

| Where You Can Find Additional Information | | 85 |

| Index to Consolidated Financial Statements | | F-1 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

Until , 2004 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we, the selling stockholder nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

(i)

PROSPECTUS SUMMARY

You should read the following summary together with the entire prospectus, including the more detailed information in our consolidated financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision. You should carefully consider, among other things, the matters discussed in "Risk Factors."

RIGHTNOW TECHNOLOGIES, INC.

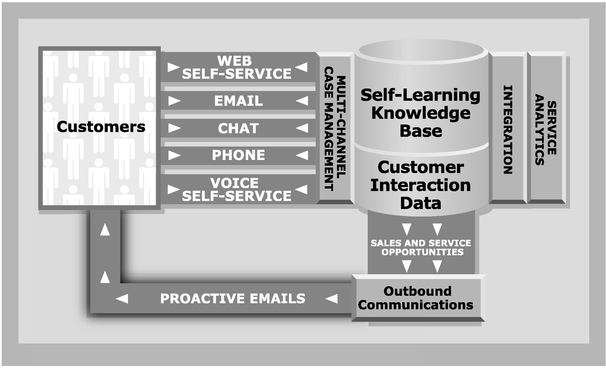

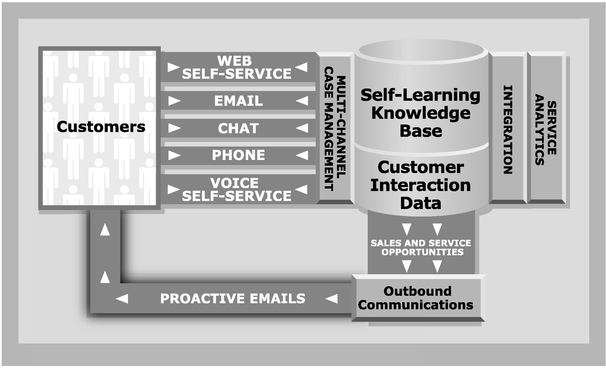

We are a leading provider of on-demand software solutions designed to optimize customer service operations for businesses of all sizes. Our comprehensive customer service solution features a self-learning knowledgebase to ensure accurate and consistent interactions with customers. Our solution is designed to seamlessly support multiple communications channels, including web, interactive voice, e-mail, chat, telephone and proactive outbound e-mail communications, creating a comprehensive record of customer interactions. We offer our solutions through a multi-tenant, hosted on-demand model that reduces the cost and risk associated with deploying traditional enterprise customer relationship management, or CRM, software. To increase the satisfaction and loyalty of our clients, we provide value added services such as business process optimization and product tune-ups throughout the lifecycle of our relationship with our clients.

Since 1998, we have achieved 26 consecutive quarters of sequential revenue growth, but we achieved our initial quarters of profitability in the quarters ended March 31 and June 30, 2004. For the six months ended June 30, 2004, our total revenue was $27.6 million, as compared to $16.1 million during the same period in 2003. As of June 30, 2004, we had more than 1,100 active clients, including large, medium and small enterprises. Our on-demand clients serviced more than 212 million customer interactions, or unique sessions hosted by our solutions, directly through our customer service solutions for the six months ended June 30, 2004, as compared to 109 million customer interactions in the same period in 2003.

We believe the emergence of on-demand application services has the potential to transform the enterprise application software industry, enabling faster deployment, higher return-on-investment and lower total cost of ownership. On-demand application services are accessed over existing Internet architectures through Internet web browsers in a secure and scalable manner, greatly simplifying the application delivery process, compared to traditional enterprise software that is implemented and deployed on-site within an organization's internal information technology, or IT, environment. We believe the on-demand model expands the addressable market opportunity for many enterprise software applications by making them more affordable for divisions of large corporations, middle-market companies and small businesses. The market for on-demand application services is projected to grow from $665 million in 2003 to $3.6 billion in 2008, a compounded annual growth rate of 41%, according to a May 2004 report by International Data Corporation, or IDC, an independent market research firm.

Our solution is focused on the market for customer service applications. According to a March 2004 report by IDC, the customer service and contact center applications market accounted for $2.6 billion, or 36%, of the $7.2 billion CRM applications market in 2003. We believe that customer service applications are strategically important to businesses because they play a critical role in cost-effectively improving customer satisfaction and can serve as a comprehensive record of customer interactions and integrate with other systems to create a single view of the customer. We also believe customer service organizations have a significantly greater and more diverse level of customer interaction compared to sales and marketing organizations, and therefore require more robust solutions. Furthermore, we believe businesses have an opportunity to use their customer service applications to proactively anticipate and solve customer problems and drive revenue through cross-selling and up-selling, rather than simply providing reactive customer service.

1

We believe our on-demand CRM solutions provide our clients with the following benefits:

- •

- Reduced cost of customer service. Our solutions help our clients achieve significant reductions in the cost of customer service by improving the efficiency and effectiveness of their customer service organizations, often leading to a reduction in the number of telephone inquiries, inbound e-mails and customer service representatives. Furthermore, our on-demand solutions provide lower total cost of ownership as compared to traditional enterprise applications by reducing required IT investments and staff.

- •

- Enhanced quality of customer service. Our solutions enable businesses to track and analyze customer interactions across multiple communications channels, enabling enhanced customer service and creating a single view of the customer. Our self-learning knowledgebase provides customer service organizations with real-time access to relevant information to offer effective self-service, better assist their customers, deliver more consistent answers and provide higher customer service levels.

- •

- Increased flexibility and control. We offer clients the flexibility to choose from multiple software licensing and deployment options. We provide both term and perpetual licensing options with each option available either as a hosted on-demand solution or as a non-hosted, on-site implementation. In addition, our solution allows for high levels of configurability and ease of integration with other enterprise applications. Our comprehensive hosting management and automated upgrade systems enable our clients to choose, schedule and test upgrades, and monitor their customer service applications.

- •

- Reduced deployment and lifecycle risks. Our solutions can be quickly deployed and updated, reducing the risks of lengthy and complex implementations typically associated with traditional enterprise software applications. We also provide comprehensive services throughout the lifecycle of our relationship with our clients to help them adopt best practices and achieve improvements in their customer service levels.

- •

- Improved knowledge of customer trends and preferences. Because our solutions provide a comprehensive record of customer interactions, our clients can gain a better understanding of their customers' interests, concerns and preferences. Our solutions leverage advanced intelligence capabilities to help our clients increase sales and marketing opportunities and enhance product development efforts.

We plan to enhance our market position by:

- •

- Remaining intensely focused on our clients' success;

- •

- Continuing our leadership in on-demand application services;

- •

- Increasing our penetration within our existing client base;

- •

- Expanding our client base; and

- •

- Extending our CRM product and service offerings.

We were incorporated in Montana in September 1995 and reincorporated in Delaware in August 2000. Our principal executive offices are located at 40 Enterprise Boulevard, Bozeman, Montana 59718-9300, and our telephone number is (406) 522-4200. Our web site is located at http://www.rightnow.com. Information contained on, or that can be accessed through, our web site does not constitute a part of this prospectus.

2

THE OFFERING

| Common stock offered: | | |

| |

By RightNow Technologies |

|

6,000,000 shares |

| |

By the selling stockholder |

|

600,000 shares |

| | |

Total |

|

6,600,000 shares |

Common stock to be outstanding after this offering |

|

28,485,890 shares |

Use of proceeds |

|

We expect to use the net proceeds of this offering for general corporate purposes, including working capital and capital expenditures. We also may use a portion of the net proceeds to fund possible investments in, or acquisitions of, complementary businesses, products or technologies. We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholder. See "Use of Proceeds." |

Proposed Nasdaq National Market symbol |

|

RNOW |

The number of shares of common stock to be outstanding immediately after the offering is based on 22,485,890 shares outstanding as of June 30, 2004, and does not include:

- •

- 5,300,885 shares of common stock issuable upon exercise of outstanding options as of June 30, 2004 at a weighted average exercise price of $2.15 per share;

- •

- 1,022,122 shares of common stock available for future grant under our 1998 Long-Term Incentive and Stock Option Plan;

- •

- 3,500,000 shares of common stock available for future grant under our 2004 Equity Incentive Plan, subject to certain automatic annual increases;

- •

- 750,000 shares of common stock available for issuance under our 2004 Employee Stock Purchase Plan, subject to certain automatic annual increases; and

- •

- 115,221 shares of common stock issuable upon the exercise of outstanding warrants at an exercise price of $4.50 per share.

Except as otherwise indicated, the information in this prospectus reflects the number of shares outstanding on June 30, 2004 and (a) gives effect to a two-for-three reverse stock split which was effected on July 14, 2004; and (b) assumes:

- •

- an initial public offering price of $10.00 per share;

- •

- the conversion of all outstanding shares of our preferred stock into 7,265,444 shares of common stock upon the closing of this offering; and

- •

- no exercise of the underwriters' over-allotment option.

3

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables provide summary consolidated financial data and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

| | Year Ended December 31,

| | Six Months

Ended

June 30,

|

|---|

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2003

| | 2004

|

|---|

| | (in thousands, except per share data)

|

|---|

| Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | $ | 2,025 | | $ | 11,307 | | $ | 21,007 | | $ | 26,941 | | $ | 35,879 | | $ | 16,051 | | $ | 27,619 |

| Cost of revenue | | | 389 | | | 3,791 | | | 5,971 | | | 6,435 | | | 9,003 | | | 4,063 | | | 6,098 |

| Gross profit | | | 1,636 | | | 7,516 | | | 15,036 | | | 20,506 | | | 26,876 | | | 11,988 | | | 21,521 |

| Total operating expenses | | | 4,113 | | | 27,770 | | | 30,607 | | | 22,898 | | | 30,242 | | | 13,578 | | | 20,666 |

| Income (loss) from operations | | | (2,477 | ) | | (20,254 | ) | | (15,571 | ) | | (2,392 | ) | | (3,366 | ) | | (1,590 | ) | | 855 |

| Net income (loss) | | | (2,445 | ) | | (19,647 | ) | | (15,342 | ) | | (2,749 | ) | | (4,120 | ) | | (1,745 | ) | | 714 |

| Earnings (loss) per share(1): | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | $ | (0.18 | ) | $ | (1.42 | ) | $ | (1.10 | ) | $ | (0.19 | ) | $ | (0.28 | ) | $ | (0.12 | ) | $ | 0.05 |

| | Diluted | | | (0.18 | ) | | (1.42 | ) | | (1.10 | ) | | (0.19 | ) | | (0.28 | ) | | (0.12 | ) | | 0.03 |

| | Pro forma | | | | | | | | | | | | | | | (0.19 | ) | | | | | 0.03 |

| Shares used in the computation(1): | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 13,576 | | | 13,810 | | | 14,006 | | | 14,284 | | | 14,560 | | | 14,396 | | | 15,012 |

| | Diluted | | | 13,576 | | | 13,810 | | | 14,006 | | | 14,284 | | | 14,560 | | | 14,396 | | | 25,582 |

| | Pro forma | | | | | | | | | | | | | | | 21,825 | | | | | | 25,582 |

| | June 30, 2004

|

|---|

| | Actual

| | Pro Forma

| | Pro Forma As

Adjusted

|

|---|

| | (unaudited)

(in thousands)

|

|---|

| Consolidated Balance Sheet Data: | | | | | | | | | |

| Cash and cash equivalents | | $ | 8,912 | | $ | 8,912 | | $ | 63,362 |

| Working capital (deficit) | | | (9,256 | ) | | (9,256 | ) | | 45,194 |

| Total assets | | | 37,593 | | | 37,593 | | | 92,043 |

| Deferred revenue | | | 40,777 | | | 40,777 | | | 40,777 |

| Long-term debt, less current portion | | | 1,377 | | | 1,377 | | | 1,377 |

| Redeemable convertible preferred stock | | | 32,446 | | | — | | | — |

| Total stockholders' equity (deficit) | | | (44,782 | ) | | (12,336 | ) | | 42,114 |

- (1)

- See Note 1 of Notes to Consolidated Financial Statements for an explanation of the calculation of basic and diluted net income (loss) per share and pro forma basic and diluted net income (loss) per share, and for an explanation of the determination of the number of weighted average shares used for such calculations.

The pro forma information in the above tables assumes conversion of all outstanding shares of our preferred stock into 7,265,444 shares of common stock upon the closing of this offering. The pro forma as adjusted information in the above consolidated balance sheet data table is adjusted to reflect the sale of 6,000,000 shares of common stock offered by us in this offering at an assumed initial public offering price of $10.00 per share, after deduction of the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

4

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the following risk factors, as well as the other information in this prospectus, including our consolidated financial statements and the related notes, before deciding whether to invest in shares of our common stock. If any of the following risks actually occurs, our business, financial condition and results of operations would suffer. In this case, the trading price of our common stock would likely decline and you might lose all or part of your investment in our common stock. The risks described below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial also may impair our business operations.

Risks Related to Our Business

Although we recently experienced our first two quarters of profitability, we may not be able to sustain or increase our profitability in the future.

Although we achieved our initial quarters of profitability in the quarters ended March 31 and June 30, 2004, we may not be able to continue to achieve profitability and have historically incurred significant operating losses in all other prior periods. We incurred net losses of approximately $4.1 million in 2003, $2.7 million in 2002 and $15.3 million in 2001. As of June 30, 2004, we had an accumulated deficit of approximately $43.7 million. We expect to continue to incur significant sales and marketing, research and development and general and administrative expenses as we expand our operations and, as a result, we will need to generate significant revenue to maintain profitability. Even if we continue to achieve profitability, we may not be able to increase profitability on a quarterly or annual basis in the future which may cause the price of our stock to decline.

Our quarterly results of operations may fluctuate in the future. As a result, we may fail to meet or exceed the expectations of investors or securities analysts which could cause our stock price to decline.

Our quarterly revenue and results of operations may fluctuate as a result of a variety of factors, many of which are outside of our control. If our quarterly revenue or results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including, but not limited to, those listed below and identified throughout this "Risk Factors" section:

- •

- our ability to retain and increase sales to existing clients, attract new clients and satisfy our clients' requirements;

- •

- changes in the volume and mix of term and perpetual licenses sold in a particular quarter;

- •

- our policy of expensing sales commissions at the time of invoice, while the majority of our revenue is recognized ratably over future periods;

- •

- changes in the mix of revenue between professional services and software, hosting and support;

- •

- the timing and success of new product introductions or upgrades by us or our competitors;

- •

- changes in our pricing policies or those of our competitors;

- •

- the amount and timing of expenditures related to expanding our operations;

- •

- changes in the payment terms for our products and services; and

- •

- the purchasing and budgeting cycles of our clients.

Because the sales cycle for the evaluation and implementation of our solutions typically ranges from 60 to 180 days, we may also experience a delay between increasing operating expenses and the generation of corresponding revenue, if any. Moreover, because the majority of our clients purchase term licenses, and we recognize revenue from these licenses over the term of the agreement, downturns or upturns in sales may not be immediately reflected in our operating results. Most of our expenses, such as salaries and third-party hosting co-location costs, are relatively fixed in the short-term, and our expense levels are based

5

in part on our expectations regarding future revenue levels. As a result, if revenue for a particular quarter is below our expectations, we may not be able to proportionally reduce operating expenses for that quarter, causing a disproportionate effect on our expected results of operations for that quarter.

Due to the foregoing factors, and the other risks discussed in this prospectus, you should not rely on quarter-to-quarter comparisons of our results of operations as an indication of our future performance.

If our efforts to enhance existing solutions, introduce new solutions or expand the applications for our products and solutions to broader CRM markets do not succeed, our ability to grow our business will be adversely affected.

Approximately 90% of our revenue is derived from RightNow Service, a suite of solutions used to optimize customer service operations. If we are unable to successfully develop and sell new and enhanced versions of RightNow Service, or introduce new products and solutions for the customer service market, our financial performance will suffer. Although to date we have focused our business on providing solutions for customer service operations, we plan to expand our solution offerings to broader segments of the CRM market. Our efforts to expand beyond the customer service market may not be successful because certain of our competitors have far greater experience and brand recognition in the broader segments of the CRM market. In addition, our efforts to expand our on-demand software solutions beyond the customer service market may divert management resources from our existing operations and require us to commit significant financial resources to a market where we are unproven, which may harm our business, financial condition and results of operations.

We face intense competition, and our failure to compete successfully could make it difficult for us to add and retain clients and could reduce or impede the growth of our business.

The market for customer service solutions is highly competitive and fragmented, and is subject to rapidly changing technology, shifting client requirements, frequent introductions of new products and services, and increased marketing activities of other industry participants. We expect the intensity of competition to increase in the future as existing competitors continue to develop their capabilities, as new companies enter our market and as we expand into broader CRM markets. Increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. If we are unable to compete effectively, it will be difficult for us to add and retain clients, and our business, financial condition and results of operations will be seriously harmed.

We face competition from:

- •

- companies currently providing customer service solutions, some of whom offer hosted services, including Amdocs Limited, BMC Software Corporation, E.piphany, Inc., eGain Communications Corporation, FrontRange Solutions, Inc., IBM Corporation, Kana Software, Inc., Microsoft Corporation, Oracle Corporation, PeopleSoft, Inc., SAP AG, salesforce.com, inc. and Siebel Systems, Inc.;

- •

- CRM systems that are developed and maintained internally by businesses;

- •

- CRM products or services that are developed, or bundled with other products or services, and installed on a client's premises by software vendors;

- •

- outsourced contact center providers who bundle solutions and agent labor in their service offerings; and

- •

- new companies entering the CRM software market, the on-demand applications market and the on-demand CRM market, or expanding from any one of these markets to the others.

Many of our current and potential competitors have longer operating histories and larger presence in the general CRM market, greater name recognition, access to larger customer bases and substantially greater financial, technical, sales and marketing, management, service, support and other resources than we have. As a result, such competitors may be able to respond more quickly than we can to new or changing opportunities, technologies, standards or client requirements or devote greater resources to the promotion and sale of their products and services than we can. To the extent our competitors have an

6

existing relationship with a potential client, that client may be unwilling to switch vendors due to the time and financial commitments already made with our competitors.

In addition, many of our current and potential competitors have established or may establish business, financial or strategic relationships among themselves or with existing or potential clients, alliance partners or other third parties, or may combine and consolidate to become more formidable competitors with better resources. We also expect that new competitors, such as enterprise software vendors and online service providers that have traditionally focused on enterprise resource planning or back office applications, will continue to enter the on-demand CRM market with competing products as the on-demand CRM market develops and matures. It is possible that these new competitors could rapidly acquire significant market share.

The market for our on-demand application services is at an early stage of development, and if it does not develop or develops more slowly than we expect, our business will be harmed.

The market for on-demand application services is at an early stage of development, and it is uncertain whether these application services will achieve and sustain high levels of demand and market acceptance. Our success will depend to a substantial extent on the willingness of companies to increase their use of on-demand application services in general and for on-demand customer service applications in particular. Many companies have invested substantial personnel and financial resources to integrate traditional enterprise software into their businesses, and therefore may be reluctant or unwilling to migrate to on-demand application services. While we have supported and continue to support traditional on-site deployment of our software applications, widespread market acceptance of our on-demand software solutions is critical to the success of our business. Other factors that may affect the market acceptance of our solutions include:

- •

- on-demand security capabilities and reliability;

- •

- concerns with entrusting a third party to store and manage critical customer data;

- •

- our ability to meet the needs of broader segments of the CRM market or other on-demand markets;

- •

- the level of customization we offer;

- •

- our ability to continue to achieve and maintain high levels of client satisfaction;

- •

- concerns with purchasing critical CRM solutions from a company with a history of operating losses that only recently turned profitable; and

- •

- the price, performance and availability of competing products and services.

If businesses do not perceive the benefits of our on-demand solutions, then the market for these solutions may not develop further, or it may develop more slowly than we expect, either of which would adversely affect our business, financial condition and results of operations.

Failure to effectively develop and expand our sales and marketing capabilities could harm our ability to increase our client base and achieve broader market acceptance of our solutions.

Increasing our client base and achieving broader market acceptance of our solutions will depend to a significant extent on our ability to expand our sales and marketing operations. We plan to continue to expand our direct sales force and engage additional third-party channel partners, both domestically and internationally. This expansion will require us to invest significant financial and other resources. Our business will be seriously harmed if our efforts do not generate a corresponding significant increase in revenue. We may not achieve anticipated revenue growth from expanding our direct sales force if we are unable to hire and develop talented direct sales personnel, if our new direct sales personnel are unable to achieve desired productivity levels in a reasonable period of time, or if we are unable to retain our existing direct sales personnel. We also may not achieve anticipated revenue growth from our third-party channel partners if we are unable to attract and retain additional motivated channel partners, if any existing or

7

future channel partners fail to successfully market, resell, implement or support our solutions for their customers, or if they represent multiple providers and devote greater resources to market, resell, implement and support competing products and services.

The majority of our solutions are sold pursuant to term license agreements, and if our existing clients elect not to renew their licenses or to renew their licenses on terms less favorable to us, our business, financial condition and results of operations will be adversely affected.

The majority of our solutions are sold pursuant to term license agreements that are subject to renewal every two years or less and our clients have no obligation to renew their licenses. Because a large portion of our clients are in their first or second terms, we are not able to consistently and accurately predict future renewal rates. Our clients' renewal rates may decline or fluctuate as a result of a number of factors, including their level of satisfaction with our solutions, their ability to continue their operations or invest in customer service, or the availability and pricing of competing products. If large numbers of existing clients do not renew their licenses, or renew their licenses on terms less favorable to us, and if we cannot replace or supplement those non-renewals with new licenses generating the same or greater level of revenue, our business, financial condition and results of operations will be adversely affected.

We have experienced rapid growth in recent periods. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or adequately address competitive challenges.

We have substantially expanded our overall business, headcount and operations in recent periods. We have increased our total number of full-time employees to 354 at June 30, 2004 from 208 at June 30, 2002. To achieve our business objectives, we will need to continue to expand our business at a rapid pace. This expansion has placed, and is expected to continue to place, a significant strain on our managerial, administrative, operational, financial and other resources. We anticipate that this expansion will require substantial management effort and significant additional investment in our infrastructure. If we are unable to successfully manage our growth, our business, financial condition and results of operations will be adversely affected.

Part of the challenge that we expect to face in the course of our expansion is to maintain the high level of customer service to which our clients have become accustomed. To date, we have focused on providing personalized account management and customer service on a frequent basis to ensure our clients are effectively leveraging the capabilities of our solution. We believe that much of our success to date has been the result of high client satisfaction, attributable in part to this focus on client service. To the extent our client base grows, we will need to expand our account management, client service and other personnel in order to enable us to continue to maintain high levels of client service and satisfaction. If we are not able to continue to provide high levels of client service, our reputation, as well as our business, financial condition and results of operations, could be harmed.

If there are interruptions or delays in our hosting services through third-party error, our own error or the occurrence of unforeseeable events, delivery of our solutions could become impaired, which could harm our relationships with clients and subject us to liability.

As of June 30, 2004, approximately 85% of our clients were using our hosting services for deployment of our software applications. We provide our hosting services through computer hardware that we own and that is currently located in third-party web hosting co-location facilities maintained and operated in California and New Jersey. We do not maintain long-term supply contracts with either of our co-location providers, and neither provider guarantees that our clients' access to hosted solutions will be uninterrupted, error-free or secure. Our operations depend on our co-location providers' ability to protect their and our systems in their facilities against damage or interruption from natural disasters, power or telecommunications failures, criminal acts and similar events. Our back-up computer hardware and systems located in our Montana headquarters have not been tested under actual disaster conditions and may not have sufficient capacity to recover all data and services in the event of an outage occurring simultaneously at both the California and New Jersey co-location facilities. In the event that our

8

co-location facility arrangements were terminated, or there was a lapse of service or accidental or willful damage to such facilities, we could experience lengthy interruptions in our hosting service as well as delays and/or additional expense in arranging new facilities and services. Any or all of these events could cause our clients to lose access to their important data. In addition, the failure by our third-party co-location facilities to meet our capacity requirements could result in interruptions in our service or impede our ability to scale our operations.

We architect the system infrastructure and procure and own the computer hardware used at our hosting co-location facilities. Design and mechanical errors, spikes in usage volume and failure to follow system protocols and procedures could cause our systems to fail, resulting in interruptions in our clients' service to their customers. Any interruptions or delays in our hosting services, whether as a result of third-party error, our own error, natural disasters or security breaches, whether accidental or willful, could harm our relationships with clients and our reputation. This in turn could reduce our revenue, subject us to liability, cause us to issue credits or pay penalties or cause clients to fail to renew their licenses, any of which could adversely affect our business, financial condition and results of operations. In the event of damage or interruption, our insurance policies may not adequately compensate us for any losses that we may incur.

If the security of our clients' confidential information contained in our systems or stored by use of our software is breached or otherwise subjected to unauthorized access, our hosting service or our software may be perceived as not being secure and clients may curtail or stop using our hosting service and our solutions.

Our hosting systems and our software store and transmit proprietary information and critical data belonging to our clients and their customers. Any accidental or willful security breaches or other unauthorized access could expose us to a risk of information loss, litigation and other possible liabilities. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, and, as a result, a third party obtains unauthorized access to any of our clients' data, our relationships with clients and our reputation will be damaged, our business may suffer and we could incur significant liability. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we and our third-party hosting co-location facilities may be unable to anticipate these techniques or to implement adequate preventative measures.

We have significant international sales and are subject to risks associated with operating in international markets.

International sales comprised 29% and 26% of our revenue for the first two quarters of 2004, respectively, and ranged from 18% to 33% of our revenue in each of the quarters during the year ended December 31, 2003. We intend to continue to pursue and expand our international business activities. Adverse political and economic conditions could make it difficult for us to increase our international sales or to operate abroad. International operations are subject to many inherent risks, including:

- •

- political, social and economic instability, including conflicts in the Middle East and elsewhere abroad, terrorist attacks and security concerns in general;

- •

- adverse changes in tariffs and other protectionist laws and business practices that favor local competitors;

- •

- fluctuations in currency exchange rates;

- •

- longer collection periods and difficulties in collecting receivables from foreign entities;

- •

- exposure to different legal standards and burdens of complying with a variety of foreign laws, including employment, tax, privacy and data protection laws and regulations;

- •

- reduced protection for our intellectual property in some countries;

9

- •

- expenses associated with localizing products for foreign countries, including translation into foreign languages; and

- •

- import and export license requirements and restrictions of the United States and each other country in which we operate.

We believe that international sales will continue to represent a significant portion of our revenue for the foreseeable future, and that continued growth will require further expansion of our international operations. A substantial percentage of our international sales are denominated in the local currency. As a result, an increase in the relative value of the dollar could make our products more expensive and potentially less price competitive in international markets. We typically do not engage in any transactions as a hedge against risks of loss due to foreign currency fluctuations. Any of these factors may adversely affect our future international sales and, consequently, affect our business, financial condition and results of operations.

If we fail to respond effectively to rapidly changing technology and evolving industry standards, particularly in the on-demand CRM industry, our solutions may become less competitive or obsolete.

The CRM industry is characterized by rapid technological advances, changes in client requirements, frequent new product and service introductions and enhancements, changes in protocols and evolving industry standards. Our hosted business model and the on-demand CRM market are relatively new and may evolve even more rapidly than the rest of the CRM market. Competing products and services based on new technologies or new industry standards may perform better or cost less than our solutions and could render our solutions less competitive or obsolete. In addition, because our solutions are designed to operate on a variety of network hardware and software platforms using a standard Internet web browser, we will need to continuously modify and enhance our solutions to keep pace with changes in Internet-related hardware, software, communication, browser and database technologies and to integrate with our clients' systems as they change and evolve. Furthermore, uncertainties about the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, could increase our research and development expenses. If we are unable to successfully develop and market new and enhanced solutions that respond in a timely manner to changing technology and evolving industry standards, and if we are unable to satisfy the diverse and evolving technology needs of our clients, our business, financial condition and results of operations will suffer.

Our failure to attract and retain qualified or key personnel may prevent us from effectively developing, marketing, selling, integrating and supporting our products.

Our success and future growth depends to a significant degree upon the skills, experience, performance and continued service of our senior management, engineering, sales, marketing, service, support and other key personnel. Specifically, we believe that our future success is highly dependent on Greg Gianforte, our founder, Chairman and Chief Executive Officer. In addition, we do not have employment agreements with any of our senior management or key personnel that require them to remain our employees and, therefore, they could terminate their employment with us at any time without penalty. If we lose the services of Mr. Gianforte or any of our other key personnel, our business will be severely disrupted and we may be unable to operate effectively. We do not maintain "key person" life insurance policies on any of our key employees except Mr. Gianforte. This life insurance policy would not be sufficient to compensate us for the loss of his services. Our future success also depends in large part upon our ability to attract, train, integrate, motivate and retain highly skilled employees, particularly sales, marketing and professional services personnel, software engineers, product trainers, and senior personnel. Competition for these personnel is intense, especially for engineers with high levels of expertise in designing and developing software and for senior sales executives. Moreover, Bozeman, Montana, the location of our headquarters, is not traditionally considered a technology center, which could result in difficulty attracting qualified personnel.

10

If our solutions fail to perform properly or if they contain technical defects, our reputation will be harmed, our market share would decline and we could be subject to product liability claims.

Our software products may contain undetected errors or defects that may result in product failures or otherwise cause our products to fail to perform in accordance with client expectations. Because our clients use our products for important aspects of their business, any errors or defects in, or other performance problems with, our products could hurt our reputation and may damage our clients' businesses. If that occurs, we could lose future sales, or our existing clients could elect to not renew or to delay or withhold payment to us which could result in an increase in our provision for doubtful accounts and an increase in collection cycles for accounts receivable. Clients also may make warranty claims against us, which could result in the expense and risk of litigation. Product performance problems could result in loss of market share, failure to achieve market acceptance and the diversion of development resources. If one or more of our products fails to perform or contains a technical defect, a client may assert a claim against us for substantial damages, whether or not we are responsible for the product failure or defect. We do not currently maintain any warranty reserves.

Product liability claims could require us to spend significant time and money in litigation or to pay significant settlements or damages. Although we maintain general liability insurance, including coverage for errors and omissions, this coverage may not be sufficient to cover liabilities resulting from such product liability claims. Also, our insurer may disclaim coverage. Our liability insurance also may not continue to be available to us on reasonable terms, in sufficient amounts, or at all. Any product liability claims successfully brought against us would cause our business to suffer.

If we are unable to protect our intellectual property rights, our competitive position could be harmed or we could be required to incur significant expenses to enforce our rights.

Our success depends to a significant degree upon the protection of our software and other proprietary technology rights. We rely on trade secret, copyright and trademark laws, patents and confidentiality agreements with employees and third parties, all of which offer only limited protection. The steps we have taken to protect our intellectual property may not prevent misappropriation of our proprietary rights or the reverse engineering of our solutions. We may not be able to obtain any further patents or trademarks, and our pending applications may not result in the issuance of patents or trademarks. Any of our issued patents may not be broad enough to protect our proprietary rights or could be successfully challenged by one or more third parties, which could result in our loss of the right to prevent others from exploiting the inventions claimed in those patents. Furthermore, legal standards relating to the validity, enforceability and scope of protection of intellectual property rights in other countries are uncertain and may afford little or no effective protection of our proprietary technology. Consequently, we may be unable to prevent our proprietary technology from being exploited abroad, which could diminish international sales or require costly efforts to protect our technology. Policing the unauthorized use of our products, trademarks and other proprietary rights is expensive, difficult and, in some cases, impossible. Litigation may be necessary in the future to enforce or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. Such litigation could result in substantial costs and diversion of management resources, either of which could harm our business. Accordingly, despite our efforts, we may not be able to prevent third parties from infringing upon or misappropriating our intellectual property.

Our product development efforts may be constrained by the intellectual property of others, and we may become subject to claims of intellectual property infringement, which could be costly and time-consuming.

The software and Internet industries are characterized by the existence of a large number of patents, trademarks and copyrights, and by frequent litigation based upon allegations of infringement or other violations of intellectual property rights. As we seek to extend our CRM product and service offerings, we may be constrained by the intellectual property of others. We have in the past been named as a defendant in lawsuits alleging intellectual property infringement, and we may again in the future have to defend

11

against intellectual property lawsuits. We may not prevail in any future intellectual property infringement litigation given the complex technical issues and inherent uncertainties in litigation. Any claims, regardless of their merit, could be time-consuming and distracting to management, result in costly litigation or settlement, cause product development delays, or require us to enter into royalty or licensing agreements. If any of our products violate third-party proprietary rights, we may be required to re-engineer our products or seek to obtain licenses from third parties, which may not be available on reasonable terms or at all. Because many of our license agreements require us to indemnify our clients from any claim or finding of intellectual property infringement, any such litigation or successful infringement claims could adversely affect our business, financial condition and results of operations. Any efforts to re-engineer our products, obtain licenses from third parties on favorable terms or license a substitute technology may not be successful and, in any case, may substantially increase our costs and harm our business, financial condition and results of operations. Further, our software products contain open source software components that are licensed to us under various public domain licenses, such as the GNU General Public License. While we believe we have complied with our obligations under the various applicable licenses for open source software that we use, there is little or no legal precedent governing the interpretation of many of the terms of certain of these licenses and therefore the potential impact of such terms on our business is somewhat unknown. Use of open source standards also may make us more vulnerable to competition because the public availability of open source software could make it easier for new market entrants and existing competitors to introduce similar competing products quickly and cheaply.

Future acquisitions could disrupt our business and harm our financial condition and results of operations.

In order to expand our addressable market, we may decide to acquire additional businesses, products and technologies. We have not made any acquisitions to date, and therefore our ability as an organization to make acquisitions is unproven. Acquisitions could require significant capital infusions and could involve many risks, including, but not limited to, the following:

- •

- an acquisition may negatively impact our results of operations because it may require incurring large one-time charges, substantial debt or liabilities; it may require the amortization or write down of amounts related to deferred compensation, goodwill and other intangible assets; or it may cause adverse tax consequences, substantial depreciation or deferred compensation charges;

- •

- we may encounter difficulties in assimilating and integrating the business, technologies, products, personnel or operations of companies that we acquire, particularly if key personnel of the acquired company decide not to work for us;

- •

- our existing and potential clients and the customers of the acquired company may delay purchases due to uncertainty related to an acquisition;

- •

- an acquisition may disrupt our ongoing business, divert resources, increase our expenses and distract our management;

- •

- the acquired businesses, products or technologies may not generate sufficient revenue to offset acquisition costs;

- •

- we may have to issue equity securities to complete an acquisition, which would dilute our stockholders and could adversely affect the market price of our common stock; and

- •

- acquisitions may involve the entry into a geographic or business market in which we have little or no prior experience.

We cannot assure you that we will be able to identify or consummate any future acquisitions on favorable terms, or at all. If we do pursue any acquisitions, it is possible that we may not realize the anticipated benefits from the acquisitions or that the financial markets or investors will negatively view the acquisitions. Even if we successfully complete an acquisition, it could adversely affect our business, financial condition and results of operations.

12

We may not be able to secure additional financing on favorable terms, or at all, to meet our future capital needs.

We may require additional capital to respond to business challenges, including the need to develop new solutions or enhance our existing solutions, enhance our operating infrastructure, fund expansion, respond to competitive pressures and acquire complementary businesses, products and technologies. Absent sufficient cash flow from operations, we may need to engage in equity or debt financings to secure additional funds to meet our operating and capital needs. In addition, even though we may not need additional funds, we may still elect to sell additional equity or debt securities or obtain credit facilities for other reasons. We may not be able to secure additional debt or equity financing on favorable terms, or at all, at the time when we need such funding. If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution in their percentage ownership of our company, and any new equity securities we issue could have rights, preferences and privileges senior to those of holders of our common stock, including shares of common stock sold in this offering. Any debt financing secured by us in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital, to pay dividends and to pursue business opportunities, including potential acquisitions. In addition, if we decide to raise funds through debt or convertible debt financings, we may be unable to meet our interest or principal payments.

Changes in the accounting treatment of stock options could adversely affect our results of operations.

The Financial Accounting Standards Board has recently announced its tentative decision to require companies to expense employee stock options in accordance with Statement of Financial Accounting Standards ("SFAS") No. 123,Accounting for Stock-Based Compensation, for financial reporting purposes, effective in 2005 ("SFAS 123"). Such stock option expensing would require us to value our employee stock option grants pursuant to a binomial valuation formula, and then amortize that value against our reported earnings over the vesting period in effect for those options. We currently account for stock-based awards to employees in accordance with Accounting Principles Board ("APB") Opinion No. 25,Accounting for Stock Issued to Employees, and have adopted the disclosure-only alternative of SFAS 123. If we are required to expense employee stock options in the future, this change in accounting treatment would materially and adversely affect our reported results of operations as the stock-based compensation expense would be charged directly against our reported earnings. For an illustration of the effect of such a change on our recent results of operations, see Note 1(q) of Notes to Consolidated Financial Statements. Participation by our employees in our employee stock purchase plan may trigger additional compensation charges if the proposed amendments to SFAS 123 are adopted.

Risks Related to Our Industry

The success of our products and our hosted business depends on the continued growth and acceptance of the Internet as a business and communications tool, and the related expansion of the Internet infrastructure.

The future success of our products and our hosted business depends upon the continued and widespread adoption of the Internet as a primary medium for commerce, communication and business applications. Our business growth would be impeded if the performance or perception of the Internet was harmed by security problems such as "viruses," "worms" and other malicious programs, reliability issues arising from outages and damage to Internet infrastructure, delays in development or adoption of new standards and protocols to handle increased demands of Internet activity, increased costs, decreased accessibility and quality of service, or increased government regulation and taxation of Internet activity.

Federal, state or foreign government bodies or agencies have in the past adopted, and may in the future adopt, laws or regulations affecting data privacy, the solicitation, collection, processing or use of personal or consumer information, the use of the Internet as a commercial medium and the use of e-mail for marketing or other consumer communications. In addition, government agencies or private organizations may begin to impose taxes, fees or other charges for accessing the Internet or for sending commercial

13

e-mail. These laws or charges could limit the growth of Internet-related commerce or communications generally, result in a decline in the use of the Internet and the viability of Internet- based services such as ours and reduce the demand for our products, particularly our RightNow Outbound solution.

The Internet has experienced, and is expected to continue to experience, significant user and traffic growth, which has, at times, caused user frustration with slow access and download times. If Internet activity grows faster than Internet infrastructure or if the Internet infrastructure is otherwise unable to support the demands placed on it, or if hosting capacity becomes scarce, our business growth may be adversely affected.

Privacy concerns and laws or other domestic or foreign regulations may adversely affect our business or reduce sales of our solutions.

Businesses using our solutions collect personal information regarding their customers when those customers contact them with customer service inquiries. A valuable component of our solutions is their ability to allow our clients to use and analyze their customers' information to increase sales, marketing and up-sell or cross-sell opportunities. Federal, state and foreign government bodies and agencies, however, have adopted and are considering adopting laws and regulations regarding the collection, use and disclosure of personal information obtained from consumers. The costs of compliance with, and other burdens imposed by, such laws and regulations that are applicable to the businesses of our clients may limit the use and adoption of this component of our solutions and reduce overall demand for our solutions. Furthermore, even where a client desires to make full use of these features in our solutions, privacy concerns may cause our clients' customers to resist providing the personal data necessary to allow our clients to use our solutions most effectively. Even the perception of privacy concerns, whether or not valid, may inhibit market acceptance of our products. For example, regulations such as the Gramm-Leach-Bliley Act, which protects and restricts the use of consumer credit and financial information, and the Children's Online Privacy Protection Act of 1998, which restricts the ability of companies to collect personal information online from children under the age of 13 without their parents' consent, impose significant requirements and obligations on businesses that may affect the use and adoption of our solutions by existing and potential clients.

The European Union has also adopted a directive that requires member states to impose restrictions on the collection and use of personal data that are far more stringent, and impose more significant burdens on subject businesses, than current privacy standards in the United States. All of these domestic and international legislative and regulatory initiatives may adversely affect our clients' ability to collect and/or use demographic and personal information from their customers, which could reduce demand for our solutions.

In addition to government activity, privacy advocacy groups and the technology and direct marketing industries are considering various new, additional or different self-regulatory standards that may place additional burdens on us. If the gathering of profiling information were to be curtailed in this manner, customer service CRM solutions would be less effective, which would reduce demand for our solutions and harm our business.

Non-solicitation concerns, laws or regulations may adversely affect our clients' ability to perform outbound marketing and other e-mail communications, which could reduce sales of our solutions.

In January 2004, the federal Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, or CAN-SPAM Act, became effective. The CAN-SPAM Act regulates the transmission and content of commercial e-mails and, among other things, obligates the sender of such e-mails to provide recipients with the ability to opt-out of receiving future e-mails from the sender, and establishes penalties for the transmission of e-mail messages which are intended to deceive the recipient as to source or content. Many state legislatures also have adopted laws that impact the delivery of commercial e-mail, and laws that regulate commercial e-mail practices are being developed or adopted in many of the international

14

jurisdictions in which we do business, including Europe and Australia. In addition, Internet service providers and licensors of software products have introduced a variety of systems and products to filter out certain types of commercial e-mail, without any common protocol to determine whether the recipient desired to receive the e-mail being blocked. As a result, it is difficult for us to determine in advance whether or not e-mails generated by our clients using our solutions will be permitted by spam filters to reach the intended recipients.

Our recently introduced RightNow Outbound solution specifically serves the market for mass distribution marketing and other e-mail communications. The increasing regulation of e-mail delivery, both domestically and internationally, and the spam filtering practices of Internet service providers and e-mail users generally, will place significant additional burdens on our clients who have outbound communication programs, and may cause those clients to substantially change their outbound communications programs or abandon them altogether. The concerns and legal requirements surrounding non-solicitation and compliance with the CAN-SPAM Act and other laws may reduce sales of our RightNow Outbound solution, may make it necessary to redesign our RightNow Outbound solution to make it easier for our clients to conform to the requirements of the CAN-SPAM Act and other laws and standards, which would increase our expenses, or may make it necessary for us to redefine the market for and use of our RightNow Outbound solution, which could reduce our revenue.

The significant control over stockholder voting matters and our office leases that may be exercised by our founder and Chief Executive Officer will limit your ability to influence corporate actions and may require us to find alternative office space to lease or buy in the future.

After this offering, Greg Gianforte, our founder and Chief Executive Officer, will control approximately 44.8% of our outstanding common stock and, together with our other officers and directors, will control approximately 68.8% of our outstanding stock. In addition, none of the shares of common stock held by Mr. Gianforte are subject to vesting restrictions. As a result, Mr. Gianforte, acting alone, will be able to control all matters requiring stockholder approval, including the election of directors, management changes and approval of significant corporate transactions. This concentration of ownership may have the effect of delaying, preventing or deterring a change in control of RightNow, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of RightNow and might reduce the market price of our common stock.

In addition, Mr. Gianforte owns a 50% membership interest in Genesis Partners, LLC, our landlord from whom we lease our principal offices in Bozeman, Montana. Consequently, Mr. Gianforte has significant control over any decisions by Genesis Partners regarding renewal, modification or termination of our Bozeman, Montana leases. In the event that the Company's current leases with Genesis Partners were terminated or otherwise could not be renewed, or came up for renewal on commercially unreasonable terms, the Company would be required to find alternative office space to lease or buy.

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from this offering, and you will be relying on the judgment of our management regarding the application of these proceeds. They might not apply the net proceeds of this offering in ways that increase the value of your investment. We expect to use the net proceeds from this offering for general corporate purposes, including working capital and capital expenditures, and for possible investments in, or acquisitions of, complementary businesses, services or technologies. We have not allocated these net proceeds for any specific purposes. Our management might not be able to yield a significant return, if any, on any investment of these net proceeds. You will not have the opportunity to influence our decisions on how to use the proceeds.

15

You will experience immediate and substantial dilution in the net tangible book value of the shares you purchase in this offering.

If you purchase shares of our common stock in this offering, you will experience immediate and substantial dilution, in that the price you pay will be substantially greater than the net tangible book value per share of the shares you acquire. This dilution is due in large part to the fact that our earlier investors paid substantially less than the public offering price when they purchased their shares of common stock. Based on an assumed offering price of $10.00 per share, if you purchase our common stock in this offering, you will suffer immediate and substantial dilution of approximately $8.55 per share. If the underwriters exercise their over-allotment option, or if outstanding options and warrants to purchase our common stock are exercised, you will experience additional dilution.

Anti-takeover provisions in our charter documents and Delaware law could discourage, delay or prevent a change in control of our company and may affect the trading price of our common stock.

Provisions of our certificate of incorporation and bylaws and Delaware law may discourage, delay or prevent a merger or acquisition that a stockholder may consider favorable and may limit the market price of our common stock. These provisions include the following:

- •

- establishing a classified board in which only a portion of the total board members will be elected at each annual meeting;

- •

- authorizing the board to issue preferred stock;

- •

- providing the board with sole authority to set the number of authorized directors and to fill vacancies on the board;

- •

- limiting the persons who may call special meetings of stockholders;

- •

- prohibiting certain transactions under certain circumstances with interested stockholders;

- •

- requiring supermajority approval to amend certain provisions of the certificate of incorporation; and

- •

- prohibiting stockholder action by written consent.

It is possible that the provisions contained in our certificate of incorporation and bylaws, the existence of super voting rights held by insiders and the ability of our board of directors to issue preferred stock without stockholder action may have the effect of delaying, deferring or preventing a change in control of our company without further action by the stockholders, may discourage bids for our common stock at a premium over the market price of our common stock and may adversely affect the market price of our common stock and the voting and other rights of the holders of our common stock.

Future sales of shares of our common stock by existing stockholders could depress the market price of our common stock.

If our existing stockholders sell, or indicate an intention to sell, substantial amounts of our common stock in the public market after the contractual lock-ups and other legal restrictions on resale discussed in this prospectus lapse, the trading price of our common stock could decline significantly and could decline below the initial public offering price. Based on shares outstanding as of June 30, 2004, upon completion of this offering, we will have outstanding approximately 28,485,890 shares of common stock, assuming no exercise of the underwriters' over-allotment option. All shares of common stock sold in this offering, other than the shares of common stock sold in our directed share program, will be immediately freely tradable, without restriction, in the public market. Morgan Stanley & Co. Incorporated may, in its sole discretion, permit our officers, directors, employees and current stockholders to sell shares prior to the expiration of the lock-up agreements.

16

After the lock-up agreements pertaining to this offering expire, an additional 21,885,890 shares will be eligible for sale in the public market, 19,140,702 of which are held by directors, executive officers and other affiliates and will be subject to volume limitations under Rule 144 under the Securities Act and various vesting agreements. In addition, the 115,221 shares subject to outstanding warrants, the 5,300,885 shares subject to outstanding options under our 1998 Long-Term Incentive and Stock Option Plan and the 4,250,000 shares reserved for future issuance under our 2004 Equity Incentive Plan and 2004 Employee Stock Purchase Plan will become eligible for sale in the public market to the extent permitted by the provisions of various vesting agreements, the lock-up agreements and Rules 144 and 701 under the Securities Act of 1933, as amended, or the Securities Act. If these additional shares are sold, or if it is perceived that they will be sold, in the public market, the trading price of our common stock could decline.

Some of our existing stockholders have demand and piggyback rights to require us to register with the Securities and Exchange Commission, or SEC, up to 7,265,444 shares of our common stock that they own. In addition, some of our existing warrantholders have piggyback rights to require us upon request by such warrantholders to register with the SEC for the resale of up to 73,889 shares of our common stock that they acquire upon exercise of the warrants. If we register these shares of common stock, the stockholders can freely sell those shares in the public market. All of these shares are subject to lock-up agreements restricting their sale for 180 days after the date of this prospectus.

After this offering, we intend to register approximately 11,431,669 shares of our common stock that we have issued or may issue under our equity plans. Once we register these shares, they can be freely sold in the public market upon issuance, subject to the lock-up agreements, if applicable, described above.

17

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements in "Prospectus Summary," "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Business" and elsewhere. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue" or the negative of these terms, or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under "Risk Factors," that may cause our or our industry's actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of these statements. Except as otherwise required by the federal securities laws, we are under no duty to update any of the forward-looking statements after the date of this prospectus to conform these statements to actual results.