UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number 001-15827

VISTEON CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

| State of Delaware | 38-3519512 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| One Village Center Drive, Van Buren Township, Michigan | 48111 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (800)-VISTEON

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Title of Each Class | Name of Each Exchange on which Registered |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: |

|

Warrants, each exercisable for one share of Common Stock at an exercise price of $58.80 (expiring October 15, 2015) (Title of class) Warrants, each exercisable for one share of Common Stock at an exercise price of $9.66 (expiring October 15, 2020) (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No __

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes __ No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No__

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer," "accelerated filer” and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ü Accelerated filer __ Non-accelerated filer __ Smaller reporting company __

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No ü

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant on June 28, 2013 (the last business day of the most recently completed second fiscal quarter) was approximately $3.2 billion.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ü No__

As of February 17, 2014, the registrant had outstanding 48,395,695 shares of common stock.

Document Incorporated by Reference |

| |

| Document | Where Incorporated |

| 2014 Proxy Statement | Part III (Items 10, 11, 12, 13 and 14) |

Visteon Corporation and Subsidiaries

Index

Part I

Description of Business

Visteon Corporation ("Visteon" or the "Company") is a global supplier of climate, electronics and interiors systems, modules and components to automotive original equipment manufacturers (“OEMs”) including Bayerishe Motoren Werke AG (“BMW”), Chrysler Group LLC (“Chrysler”), Daimler AG (“Daimler”), Ford Motor Company ("Ford"), General Motors Company (“General Motors”), Honda Motor Co., Ltd. (“Honda”), Hyundai Motor Company (“Hyundai”), Kia Motors (“Kia”), Mazda Motor Corporation (“Mazda”), Mitsubishi Motors (“Mitsubishi”), Nissan Motor Company, Ltd. (“Nissan”), PSA Peugeot Citroën, Renault S.A. (“Renault”), Toyota Motor Corporation (“Toyota”) and Volkswagen, as well as emerging new vehicle manufacturers in Asia. Visteon delivers value to its customer and shareholders through a family of businesses including:

| |

| • | Halla Visteon Climate Control Corporation, majority-owned by Visteon and the world's second largest global supplier of automotive climate components and systems. |

| |

| • | Visteon Electronics, a global provider of cockpit electronics, including audio/infotainment, driver information, center stack electronics and feature control modules. |

| |

| • | Visteon Interiors, a global provider of vehicle cockpit modules, instrument panels, consoles and door trim modules. |

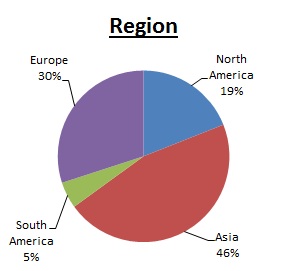

The Company, headquartered in Van Buren Township, Michigan, has an international network of manufacturing operations, technical centers and joint venture operations, supported by approximately 24,000 employees dedicated to the design, development, manufacture and support of its product offering and its global customers. The Company's manufacturing and engineering footprint is principally located outside of the U.S., with a heavy concentration in low-cost geographic regions. Management believes that the Company is strategically well-positioned to capitalize on growth in emerging markets, particularly those in Asia, where the Company generated 46% of its consolidated sales for the year ended December 31, 2013. The Company's sales for the year ended December 31, 2013 totaled $7.4 billion and were distributed by product group, geographic region, and customer as follows.

The Company’s History

The Company was incorporated in Delaware in January 2000 as a wholly-owned subsidiary of Ford Motor Company (“Ford” or “Ford Motor Company”). Subsequently, Ford transferred the assets and liabilities comprising its automotive components and systems business to Visteon. The Company separated from Ford on June 28, 2000 when all of the Company’s common stock was distributed by Ford to its shareholders.

During the latter part of 2008 and through 2009, weakened economic conditions, largely attributable to the global credit crisis, and erosion of consumer confidence, triggered a global economic recession that negatively impacted the automotive sector. On May 28, 2009, the Company and many of its domestic subsidiaries filed voluntary petitions for reorganization relief under the Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware in response to the resulting sudden and severe declines in global automotive production and the related adverse impact on the Company’s cash flows and liquidity. On August 31, 2010, the bankruptcy court entered an order confirming the plan of reorganization and the Company emerged from bankruptcy on October 1, 2010.

The Company’s Value Creation Strategy

In September 2012, the Company announced a comprehensive shareholder value creation plan founded on the pillars of industrial logic, customer focus and financial discipline. The comprehensive shareholder value creation plan includes the following primary elements.

| |

| • | Climate consolidation - Prior to 2013, the Company's Climate operations were comprised of Halla Climate Control Corporation ("Halla"), a 70% owned and consolidated Korean subsidiary, and a series of wholly-owned Visteon Climate operations and other Visteon Climate joint ventures. During the first quarter of 2013, Halla purchased certain subsidiaries and intellectual property relating to Visteon's global climate business for a total purchase price of $410 million. This combination formed the world's second largest global supplier of automotive climate components and systems under the name of Halla Visteon Climate Control Corporation ("HVCC"). HVCC is majority-owned by Visteon and headquartered in South Korea. The Company expects to achieve synergies through improved global scale and common business practices over time in connection with this business combination. |

| |

| • | Electronics optimization - The Company's Electronics business has undergone a transition away from powertrain, body and security electronics over the past several years and today is focused solely on electronics in the cockpit of the vehicle delivering innovative audio, infotainment, clusters and displays to OEM customers. The market for cockpit electronics is projected to grow to $45 billion by 2018. The Company believes that its Electronics business is well-positioned to capitalize on a rapidly changing consumer-driven technology landscape and has taken steps to optimize the size and scale of this business associated with its cockpit electronics products. |

| |

| ◦ | In the fourth quarter of 2013, the Company paid $58 million for an additional 11% ownership interest in Yanfeng Visteon Automotive Electronics Co., Ltd. (“YFVE”), resulting in a 51% controlling ownership interest in YFVE. YFVE provides an important source of global electronics development and engineering capability. Additionally, the Company invested $48 million during the fourth quarter of 2013 in a non-consolidated electronics holding company owned 50% by Visteon and 50% by Yanfeng. |

| |

| ◦ | On January 13, 2014, Visteon reached an agreement to acquire the automotive electronics business of Johnson Controls for cash of $265 million.The acquisition is subject to certain regulatory and other consents and approvals and is expected to be completed in the second quarter of 2014. In the fiscal year ended September 30, 2013, the business to be acquired by Visteon generated approximately $1.3 billion in revenue and about $58 million in EBITDA (earnings before interest, taxes, depreciation and amortization). |

These actions are expected to strengthen Visteon's competitive position in the fast-growing vehicle cockpit electronics segment by expanding its global scale, manufacturing and engineering footprint, product portfolio and customer penetration. On a combined basis following completion of the acquisition of the automotive electronics business of Johnson Controls, Visteon expects that its electronics business will have sales of about $3 billion, a No. 2 global position in driver information, an above-average growth rate for the segment, and penetration of nine of the world's ten largest vehicle manufacturers.

| |

| • | Interiors strategy - The Company determined that its Interiors business is not aligned with its long-term strategic goals and continues to explore alternatives for this non-core business including, but not limited to, divestiture, partnership or alliance. While the Company views Interiors as a non-core business, it continues to make commitments to this business and intends to divest in the future only under acceptable terms and conditions. On December 17, 2013, Visteon completed the sale of its 50% ownership interest in Yanfeng Visteon Automotive Trim Systems Co., Ltd., ("Yanfeng") a significant Interiors equity investee, for cash proceeds of $928 million. The Company's goal is to dispose of the remainder of its Interiors businesses in three separate transactions targeted for 2014. Due to certain liabilities and capital requirements of many of the these remaining businesses, the Company may be required to contribute cash to such businesses in connection with any disposition, which amounts could be material. |

| |

| • | Cost reduction program - In November 2012 the Company announced a $100 million restructuring program designed to reduce fixed costs and to improve operational efficiency by addressing certain under-performing operations. Through December 31, 2013, the Company recorded approximately $76 million of restructuring expenses under this program. The Company anticipates recording additional restructuring charges related to this program in future periods as underlying plans are finalized. |

| |

| • | Balance sheet enhancement - In December 2013 the Company exercised its right to repurchase $50 million or 10% of its outstanding 6.75% senior notes due April 2019 for a redemption price of 103% of the principal amount, plus accrued and unpaid interest to the redemption date. This repurchase was in addition to a similar $50 million repurchase of outstanding 6.75% senior notes due April 2019 that was completed in December 2012. Also during 2012, the Company offered an accelerated pension payment program to most of its U.S. defined benefit plan participants who are former employees with vested benefits not yet in pay status, whereby such participants could elect to receive a single lump sum |

payout. Approximately 70% of eligible participants elected to receive a single lump sum payout resulting in a reduction of the Company's U.S. retirement plan obligations of $408 million and a reduction in plan assets of $301 million, respectively.

| |

| • | Share repurchases - Since July 2012, the Company's board of directors has authorized a total of $1.175 billion in share repurchases. In connection with these authorizations the Company completed two $125 million accelerated share buy-back programs during 2013. Also in connection with these authorizations, the Company repurchased $50 million during 2012 through open market purchases. As of December 31, 2013, $875 million remains authorized and available for repurchase through December 31, 2015. |

The Company’s Industry

The Company operates in the automotive industry, which is cyclical and highly sensitive to general economic conditions. The Company believes that future success in the automotive industry is, in part, dependent on alignment with customers to support their efforts to effectively meet the challenges associated with the following significant trends and developments in the global automotive industry.

| |

| • | Emissions and safety - Governments continue to focus regulatory efforts on cleaner and safer transportation with the objective of securing individual mobility. Accordingly, OEMs are working to lower average vehicle emissions by developing a more diverse range of vehicles including those powered by hybrid technologies, alternative fuels, and electricity. OEMs are also working to improve occupant and pedestrian safety by incorporating more safety oriented content in their vehicles. Suppliers must enable the emissions and safety initiatives of their customers including the development of new technologies. |

| |

| • | Electronic content and connectivity - The electronic content of vehicles continues to increase due to various regulatory requirements and consumer demand for increased vehicle performance and functionality. The use of electronic components can reduce weight, expedite assembly, enhance fuel economy, improve emissions, increase safety and enhance vehicle performance. Additionally, digital and portable technologies have dramatically influenced the lifestyle of today’s consumers who expect products that enable such a lifestyle. This requires increased electronic and technical content such as in-vehicle communication, navigation and entertainment capabilities. While OEMs are taking different paths to connect their vehicles to high-speed broadband internet connections in the short-term, future vehicles are expected to be built with vehicle-to-vehicle connectivity systems. |

| |

| • | Vehicle standardization - OEMs continue to standardize vehicle platforms on a global basis, resulting in a lower number of individual vehicle platforms, design cost savings and further scale of economies through the production of a greater number of models from each platform. Having operations in the geographic markets in which OEMs produce global platforms enables suppliers to meet OEMs’ needs more economically and efficiently, thus making global coverage a source of significant competitive advantage for suppliers with a diverse global footprint. Additionally, OEMs are looking to suppliers for increased collaboration to lower costs, reduce risks, and decrease overall time to market. Suppliers that can provide fully-engineered solutions, systems and pre-assembled combinations of component parts are positioned to leverage the trend toward system sourcing. |

Financial Information about Segments

The Company's operating structure is organized by global product lines, including Climate, Electronics and Interiors. These global product lines have financial and operating responsibility over the design, development and manufacture of the Company's product portfolio. Global customer groups are responsible for the business development of the Company's product portfolio and overall customer relationships. Certain functions such as procurement, information technology and other administrative activities are managed on a global basis with regional deployment. The Company's reportable segments are as follows:

| |

| • | Climate - The Company's Climate product line includes climate air handling modules, powertrain cooling modules, heat exchangers, compressors, fluid transport and engine induction systems. |

| |

| • | Electronics - The Company's Electronics product line includes audio systems, infotainment systems, driver information systems, powertrain and feature control modules, climate controls, and electronic control modules. |

| |

| • | Interiors - The Company's Interiors product line includes instrument panels, cockpit modules, door trim and floor consoles. |

Further information relating to the Company’s reportable segments can be found in Item 8, “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K (Note 19, “Segment Information,” to the Company’s consolidated financial statements).

The Company’s Products

The following discussion provides an overview description of the products associated with major design systems within each of the Company’s global product lines.

Climate

The Company designs and manufactures components, modules and systems that provide automotive heating, ventilation, air conditioning and powertrain cooling.

|

| | |

| Climate Products | | Description |

| Climate Systems | | The Company designs and manufactures fully integrated heating, ventilation and air conditioning (“HVAC”) systems. The Company’s proprietary analytical tools and systems integration expertise enables the development of climate-oriented components, sub-systems and vehicle-level systems. Products contained in this area include: evaporators, condensers, heater cores, climate controls, compressors, air handling cases and fluid transport systems. |

| Powertrain Cooling Systems | | The Company designs and manufactures components and modules that provide cooling and thermal management for the vehicle’s engine and transmission, as well as for batteries and power electronics on hybrid and electric vehicles. The Company’s systems expertise and proprietary analytical tools enable development of components and modules to meet a wide array of thermal management needs. Products include: radiators, oil coolers, charge air coolers, exhaust gas coolers, battery and power electronics coolers and systems and fluid transport systems. |

Electronics

The Company designs and manufactures advanced in-vehicle entertainment, driver information, wireless communication, climate control and body and security electronics products.

|

| | |

| Electronics Products | | Description |

| Audio / Infotainment Systems | | The Company offers a range of audio/infotainment products, including audio head units, infotainment head units, connectivity solutions and various amplifiers and rear seat family entertainment systems. Premium audio and infotainment products are marketed under the brand OpenAir™. |

| Driver Information Systems | | The Company offers a complete line of instrument clusters and displays ranging from standard analog-electronic clusters to high resolution, fully-configurable TFT devices across multiple vehicle segments. Displays can integrate a range of user interface technologies and graphics management capabilities. Premium instrumentation products are marketed under the brand LightScape™. |

| Electronic Climate Controls and Decorative Control Panels | | The Company offers a complete line of electronic climate control modules and decorative control panel technologies. Available climate controls vary from single zone manual electronic modules to fully automatic multiple zone modules. Decorative control panels can include multiple modes for user interface technologies, various display and styling-related technologies, and a wide range of cockpit electronic features including audio, climate and driver information. |

| Body and Security | | The Company designs and manufactures body electronics and security modules. Body electronics modules cover a wide range of comfort and convenience applications. Security modules typically manage a variety of access control and immobilization functions. |

Interiors

The Company designs and manufactures cockpit modules, instrument panels, door and console modules and interior trim. |

| | |

| Interiors Products | | Description |

| Cockpit Modules | | Cockpit modules incorporate structural, electronic, climate control, mechanical and safety components and customers receive services including advanced engineering, design, styling and in-sequence delivery of parts. Cockpit modules are built around instrument panels which consist of a substrate and the optional assembly of structure, ducts, registers, passenger airbag system (integrated or conventional), finished panels and the glove box assembly. |

| Door Panels and Trims | | The Company provides a range of door panels/modules as well as a variety of interior trim products. |

| Console Modules | | Consoles deliver flexible and versatile storage options and are interchangeable units offering consumers a wide range of options that can be tailored to their individual needs. |

The Company’s Customers

The Company sells its products primarily to global vehicle manufacturers including BMW, Chrysler, Daimler, Ford, General Motors, Honda, Hyundai, Kia, Mazda, Mitsubishi, Nissan, PSA Peugeot Citroën, Renault, Toyota and Volkswagen, as well as emerging new vehicle manufacturers in Asia. To a lesser degree, the Company also sells products for use as aftermarket and service parts to automotive original equipment manufacturers and others for resale through independent distribution networks. Hyundai Kia Automotive Group is one of the Company's largest customers, accounting for 33% of total sales in both 2013 and 2012 and 31% of total sales in 2011. Additionally, Ford is one of the Company's largest customers and accounted for approximately 28% of total sales in 2013, 27% of total sales in both 2012 and 2011.

The Company records revenue when persuasive evidence of an arrangement exists, delivery occurs or services are rendered, the sales price or fee is fixed or determinable and collectibility is reasonably assured. Price reductions are typically negotiated on an annual basis between suppliers and OEMs. Such reductions are intended to take into account expected annual reductions in the overall cost to the supplier of providing products and services to the customer, through such factors as manufacturing productivity enhancements, material cost reductions and design-related cost improvements. The Company has an aggressive cost reduction program that focuses on reducing its total costs, which are intended to offset customer price reductions. However, there can be no assurance that the Company’s cost reduction efforts will be sufficient to fully offset such price reductions. The Company records price reductions when probable and reasonably estimable.

The Company’s Competition

The automotive sector is concentrated, but operates under highly competitive conditions resulting from the globalized nature of the industry, high fixed costs and the resulting need for scale economies, market dynamics including share in mature economies and positioning in emerging economies, and the low cost of switching for the end consumer. Accordingly, OEMs rigorously evaluate suppliers on the basis of financial viability, product quality, price competitiveness, technical expertise and development capability, new product innovation, reliability and timeliness of delivery, product design and manufacturing capability and flexibility, customer service and overall management. The Company's primary independent competitors include Behr GmbH & Co. KG, Calsonic Kansei, Continental AG, Delphi Corporation, Denso Corporation, Faurecia Group, Hyundai Mobis Co., Ltd., International Automotive Components Group, Johnson Controls, Inc., Magna International Inc., Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, Sanden Corporation and Valéo S.A.

The Company’s Product Sales Backlog

Expected net product sales in Climate and Electronics for 2014 through 2016 from new programs, less net sales from phased-out, lost and canceled programs are approximately $900 million. The Company’s estimate of expected net sales may be impacted by various assumptions, including vehicle production levels on new programs, customer price reductions, currency exchange rates and the timing of program launches. In addition, the Company typically enters into agreements with its customers at the beginning of a vehicle’s life for the fulfillment of customers’ purchasing requirements for the entire production life of the vehicle. These agreements generally may be terminated by customers at any time and, accordingly, expected net sales information does not represent firm orders or firm commitments.

Seasonality and Cyclicality of the Company’s Business

Historically, the Company’s business has been moderately seasonal because its largest North American customers typically cease production for approximately two weeks in July for model year changeovers and approximately one week in December during the winter holidays. Customers in Europe historically shut down vehicle production during a portion of August and one week in December. Additionally, third quarter automotive production traditionally is lower as new vehicle models enter production.

However, the market for vehicles is cyclical and is heavily dependent upon general economic conditions, consumer sentiment and spending and credit availability. During 2009, the automotive sector was negatively impacted by global economic instability and the lack of available credit. The severity of the decline in 2009 was masked by numerous government stimulus programs and significant growth in certain emerging automotive markets, which caused vehicle production volumes to vary from historical patterns.

The Company’s Workforce and Employee Relations

The Company’s workforce as of December 31, 2013 included approximately 24,000 persons, of which approximately 8,000 were salaried employees and 16,000 were hourly workers. Many of the Company’s employees are members of industrial trade unions and confederations within their respective countries, including Europe, Asia and South America. Many of these organizations

operate under collectively bargained contracts that are not specific to any one employer. The Company constantly works to establish and maintain positive, cooperative relations with its unions around the world and believes that its relationships with unionized employees are satisfactory. The Company experienced work stoppages of varying lengths in Europe, South America and Asia during the past three years. These stoppages primarily were either national in nature, aimed at customers or were in anticipation of Company restructuring activities at particular facilities.

The Company’s Product Research and Development

The Company’s research and development efforts are intended to maintain leadership positions in core product lines and provide the Company with a competitive edge as it seeks additional business with new and existing customers. The Company also works with technology development partners, including customers, to develop technological capabilities and new products and applications. Total research and development expenditures were approximately $325 million in 2013, $299 million in 2012, and $326 million in 2011.

The Company’s Intellectual Property

The Company owns significant intellectual property, including a number of patents, copyrights, proprietary tools and technologies and trade secrets and is involved in numerous licensing arrangements. Although the Company’s intellectual property plays an important role in maintaining its competitive position, no single patent, copyright, proprietary tool or technology, trade secret or license, or group of related patents, copyrights, proprietary tools or technologies, trade secrets or licenses is, in the opinion of management, of such value to the Company that its business would be materially affected by the expiration or termination thereof. The Company’s general policy is to apply for patents on an ongoing basis, in appropriate countries, on its patentable developments which are considered to have commercial significance.

The Company also views its name and mark as significant to its business as a whole. In addition, the Company holds rights in a number of other trade names and marks applicable to certain of its businesses and products that it views as important to such businesses and products.

The Company’s Raw Materials and Suppliers

Raw materials used by the Company in the manufacture of its products include aluminum, resins, precious metals, steel, urethane chemicals and electronics components. All of the materials used are generally available from numerous sources. In general, the Company does not carry inventories of raw materials in excess of those reasonably required to meet production and shipping schedules.

Although not material to the Company's financial position, results of operations or cash flows, supply disruptions occurred during the year ended December 31, 2011 attributable to natural disasters that occurred in Thailand and Japan. Severe flooding from heavy monsoon rains in Thailand occurred in the third quarter of 2011, causing significant supplier and OEM production disruption in the fourth quarter of 2011. The Thailand disruptions primarily affected the Company's Climate and Interiors businesses. During March 2011, a large earthquake triggered a tsunami off the coast of northeastern Japan and resulted in significant casualties, dislocation and extensive infrastructure destruction. The Japan disruptions primarily affected the Company's Electronics business.

As of December 31, 2013 the Company had not experienced any other significant shortages of raw materials. The Company monitors its supply base and endeavors to work with suppliers and customers to attempt to mitigate the impact of potential material shortages and supply disruptions. While the Company does not anticipate any significant interruption in the supply of raw materials, there can be no assurance that sufficient sources or amounts of all necessary raw materials will be available in the future.

The automotive supply industry is subject to inflationary pressures with respect to raw materials which have historically placed operational and financial burdens on the entire supply chain. Accordingly, the Company continues to take actions with its customers and suppliers to mitigate the impact of these inflationary pressures in the future. Actions to mitigate inflationary pressures with customers include collaboration on alternative product designs and material specifications, contractual price escalation clauses and negotiated customer recoveries. Actions to mitigate inflationary pressures with suppliers include aggregation of purchase requirements to achieve optimal volume benefits, negotiation of cost reductions and identification of more cost competitive suppliers. While these actions are designed to offset the impact of inflationary pressures, the Company cannot provide assurance that it will be successful in fully offsetting increased costs resulting from inflationary pressures.

Impact of Environmental Regulations on the Company

The Company is subject to the requirements of federal, state, local and foreign environmental and occupational safety and health laws and regulations. These include laws regulating air emissions, water discharge and waste management. The Company is also subject to environmental laws requiring the investigation and cleanup of environmental contamination at properties it presently owns or operates and at third-party disposal or treatment facilities to which these sites send or arranged to send hazardous waste. The Company makes capital expenditures in the normal course of business as necessary to ensure that its facilities are in compliance with applicable environmental laws and regulations. For 2013, capital expenditures associated with environmental compliance were not material nor did such expenditures have a materially adverse effect on the Company’s earnings or competitive position. The Company does not anticipate that its environmental compliance costs will be material in 2014.

The Company is aware of contamination at some of its properties. The Company is in various stages of investigation and cleanup at these sites and at December 31, 2013, had recorded a reserve of approximately $1 million for this environmental investigation and cleanup. However, estimating liabilities for environmental investigation and cleanup is complex and dependent upon a number of factors beyond the Company’s control and which may change dramatically. Accordingly, although the Company believes its reserve is adequate based on current information, the Company cannot provide any assurance that its ultimate environmental investigation and cleanup costs and liabilities will not exceed the amount of its current reserve.

The Company’s International Operations

Financial information about sales and net property by major geographic region can be found in Note 19, “Segment Information,” included in Item 8 “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K. The attendant risks of the Company’s international operations are primarily related to currency fluctuations, changes in local economic and political conditions, and changes in laws and regulations. The following table sets forth the Company’s sales and net property and equipment by geographic region as a percentage of such consolidated total amounts.

|

| | | | | | | | | | | | | | |

| | Sales | | Property and Equipment, Net |

| | Year Ended December 31 | | December 31 |

| | 2013 | | 2012 | | 2011 | | 2013 | | 2012 |

| United States | 19 | % | | 18 | % | | 16 | % | | 5 | % | | 8 | % |

| Mexico | 1 | % | | 1 | % | | 1 | % | | 2 | % | | 2 | % |

| Canada | 1 | % | | 1 | % | | 1 | % | | 1 | % | | 2 | % |

| Intra-region eliminations | — | % | | — | % | | (1 | )% | | — | % | | — | % |

| Total North America | 21 | % | | 20 | % | | 17 | % | | 8 | % | | 12 | % |

| Germany | 2 | % | | 2 | % | | 2 | % | | 2 | % | | 2 | % |

| France | 7 | % | | 8 | % | | 9 | % | | 5 | % | | 6 | % |

| Portugal | 8 | % | | 8 | % | | 6 | % | | 7 | % | | 6 | % |

| Spain | 3 | % | | 4 | % | | 5 | % | | 2 | % | | 3 | % |

| Slovakia | 5 | % | | 5 | % | | 5 | % | | 4 | % | | 4 | % |

| Czech Republic | 6 | % | | 5 | % | | 7 | % | | 3 | % | | 3 | % |

| Hungary | 4 | % | | 4 | % | | 4 | % | | 5 | % | | 5 | % |

| Other Europe | 3 | % | | 3 | % | | 1 | % | | 5 | % | | 2 | % |

| Intra-region eliminations | (5 | )% | | (4 | )% | | — | % | | — | % | | — | % |

| Total Europe | 33 | % | | 35 | % | | 39 | % | | 33 | % | | 31 | % |

| Korea | 30 | % | | 30 | % | | 31 | % | | 33 | % | | 34 | % |

| China | 15 | % | | 11 | % | | 7 | % | | 13 | % | | 10 | % |

| India | 4 | % | | 5 | % | | 4 | % | | 6 | % | | 6 | % |

| Japan | 3 | % | | 3 | % | | 3 | % | | 1 | % | | 1 | % |

| Thailand | 5 | % | | 5 | % | | 3 | % | | 2 | % | | 2 | % |

| Intra-region eliminations | (7 | )% | | (6 | )% | | (4 | )% | | — | % | | — | % |

| Total Asia | 50 | % | | 48 | % | | 44 | % | | 55 | % | | 53 | % |

| South America | 6 | % | | 6 | % | | 6 | % | | 4 | % | | 4 | % |

| Inter-region eliminations | (10 | )% | | (9 | )% | | (6 | )% | | — | % | | — | % |

| | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

The Company’s Website and Access to Available Information

The Company’s current and periodic reports filed with the United States Securities and Exchange Commission (“SEC”), including amendments to those reports, may be obtained through its internet website at www.visteon.com free of charge as soon as reasonably practicable after the Company files these reports with the SEC. A copy of the Company’s code of business conduct and ethics for directors, officers and employees of Visteon and its subsidiaries, entitled “Ethics and Integrity Policy,” the Corporate Governance Guidelines adopted by the Company’s Board of Directors and the charters of each committee of the Board of Directors are also available on the Company’s website. A printed copy of the foregoing documents may be requested by contacting the Company’s Investor Relations department in writing at One Village Center Drive, Van Buren Township, MI 48111; by phone (734) 710-5800; or via email at investor@visteon.com.

The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties, including those not presently known or that the Company believes to be immaterial, also may adversely affect the Company’s results of operations and financial condition. Should any such risks and uncertainties develop into actual events, these developments could have material adverse effects on the Company’s business and financial results.

The Company is highly dependent on Hyundai Kia Automotive Group and Ford Motor Company and decreases in such customers’ vehicle production volumes would adversely affect the Company.

Hyundai Kia Automotive Group (“Hyundai Kia”) has rapidly become one of the Company’s largest customers, accounting for 33% of total product sales in 2013, 33% of total product sales in 2012 and 31% of total product sales in 2011. Additionally, Ford is one of the Company’s largest customers and accounted for approximately 28% of total product sales in 2013, 27% of total product sales in 2012, and 27% of total product sales in 2011. Accordingly, any change in Hyundai Kia's and/or Ford's vehicle production volumes will have a significant impact on the Company’s sales volume and profitability.

Escalating price pressures from customers may adversely affect the Company’s business.

Downward pricing pressures by automotive manufacturers is a characteristic of the automotive industry. Virtually all automakers have implemented aggressive price reduction initiatives and objectives each year with their suppliers, and such actions are expected to continue in the future. In addition, estimating such amounts is subject to risk and uncertainties because any price reductions are a result of negotiations and other factors. Accordingly, suppliers must be able to reduce their operating costs in order to maintain profitability. The Company has taken steps to reduce its operating costs and other actions to offset customer price reductions; however, price reductions have impacted the Company’s sales and profit margins and are expected to continue to do so in the future. If the Company is unable to offset customer price reductions in the future through improved operating efficiencies, new manufacturing processes, sourcing alternatives and other cost reduction initiatives, the Company’s results of operations and financial condition will likely be adversely affected.

Significant declines in the production levels of the Company’s major customers could reduce the Company’s sales and harm its profitability.

Demand for the Company’s products is directly related to the automotive vehicle production of the Company’s major customers. Automotive sales and production can be affected by general economic or industry conditions, labor relations issues, fuel prices, regulatory requirements, government initiatives, trade agreements and other factors. Automotive industry conditions in North America and Europe have been and continue to be extremely challenging. In North America, the industry is characterized by significant overcapacity and fierce competition. In Europe, the market structure is more fragmented with significant overcapacity and declining sales. While Asia continues to grow, the rate of growth is expected to decline.

The financial distress of the Company’s major customers and within the supply base could significantly affect its operating performance.

Domestic and European automotive manufacturers are burdened with substantial structural costs, such as pension and healthcare costs that have impacted their profitability and labor relations. In this environment, it is difficult to forecast future customer production schedules, the potential for labor disputes or the success or sustainability of any strategies undertaken by any of the Company’s major customers in response to the current industry environment. This environment may also put additional pricing pressure on suppliers to OEMs, such as the Company, which would reduce such suppliers’ (including the Company’s) margins. In addition, cuts in production schedules are also sometimes announced by customers with little advance notice, making it difficult for suppliers to respond with corresponding cost reductions.

The Company’s supply base has also been adversely affected by industry conditions. Lower production levels for the global automotive OEMs and increases in certain raw material, commodity and energy costs have resulted in financial distress among many companies within the automotive supply base. In recent years, several large suppliers have filed for bankruptcy protection or ceased operations. Unfavorable industry conditions have also resulted in financial distress within the Company’s supply base, an increase in commercial disputes and other risks of supply disruption. In addition, the current adverse industry environment has required the Company to provide financial support to distressed suppliers or take other measures to ensure uninterrupted production. While the Company has taken certain actions to mitigate these factors, those actions have offset only a portion of the overall impact on the Company’s operating results. The continuation or worsening of these industry conditions would adversely affect the Company’s profitability, operating results and cash flow.

The discontinuation of, loss of business or lack of commercial success, with respect to a particular vehicle model for which the Company is a significant supplier could reduce the Company’s sales and harm its profitability.

Although the Company has purchase orders from many of its customers, these purchase orders generally provide for the supply of a customer’s annual requirements for a particular vehicle model and assembly plant, or in some cases, for the supply of a customer’s requirements for the life of a particular vehicle model, rather than for the purchase of a specific quantity of products. In addition, it is possible that customers could elect to manufacture components internally that are currently produced by outside suppliers, such as the Company. The discontinuation of, the loss of business with respect to or a lack of commercial success of a particular vehicle model for which the Company is a significant supplier, could reduce the Company’s sales and harm the Company’s profitability.

The Company’s substantial international operations make it vulnerable to risks associated with doing business in foreign countries.

As a result of the Company’s global presence, a significant portion of the Company’s revenues and expenses are denominated in currencies other than the U.S. dollar. In addition, the Company has manufacturing and distribution facilities in many foreign countries, including countries in Europe, Central and South America and Asia. International operations are subject to certain risks inherent in doing business abroad, including:

| |

| • | local economic conditions, expropriation and nationalization, foreign exchange rate fluctuations and currency controls; |

| |

| • | withholding and other taxes on remittances and other payments by subsidiaries; |

| |

| • | investment restrictions or requirements; |

| |

| • | export and import restrictions; and |

| |

| • | increases in working capital requirements related to long supply chains. |

Expanding the Company’s business in Asia and Europe and enhancing the Company’s business relationships with Asian and European automotive manufacturers worldwide are important elements of the Company’s long-term business strategy. In addition, the Company has invested significantly in joint ventures with other parties to conduct business in South Korea, China and elsewhere in Asia. The Company’s ability to repatriate funds from these joint ventures depends not only upon their uncertain cash flows and profits, but also upon the terms of particular agreements with the Company’s joint venture partners and maintenance of the legal and political status quo. As a result, the Company’s exposure to the risks described above is substantial. The likelihood of such occurrences and its potential effect on the Company vary from country to country and are unpredictable. However, any such occurrences could be harmful to the Company’s business and the Company’s profitability and financial condition.

The Company is subject to significant foreign currency risks and foreign exchange exposure.

In addition, as a result of our global presence, a significant portion of the Company's revenues and expenses is denominated in currencies other than the U.S. dollar. The Company is therefore subject to foreign currency risks and foreign exchange exposure. The Company's primary exposures are to the Euro, Korean Won, Czech Koruna, Mexican Peso, Hungarian Forint, Indian Rupee, Thai Baht and Chinese Renminbi. While the Company employs financial instruments to hedge transactional foreign exchange exposure, these activities do not insulate us completely from those exposures. Exchange rates can be volatile and could adversely impact our financial results and comparability of results from period to period. Specifically, there is concern regarding the overall stability of the euro and the future of the euro as a single currency given the diverse economic and political circumstances in individual Eurozone countries. Potential negative developments and market perceptions related to the euro could adversely affect the value of the Company's euro-denominated assets, as well as those of the Company's customers and suppliers.

Work stoppages and similar events could significantly disrupt the Company’s business.

Because the automotive industry relies heavily on just-in-time delivery of components during the assembly and manufacture of vehicles, a work stoppage at one or more of the Company’s manufacturing and assembly facilities could have material adverse effects on the business. Similarly, if one or more of the Company’s customers were to experience a work stoppage, that customer would likely halt or limit purchases of the Company’s products, which could result in the shut down of the related manufacturing facilities. A significant disruption in the supply of a key component due to a work stoppage at one of the Company’s suppliers or any other supplier could have the same consequences, and accordingly, have a material adverse effect on the Company’s financial results.

Visteon’s operations may be restricted by the terms of the Company’s credit agreements.

The Company’s credit agreements include a number of significant restrictive covenants. These covenants could impair the Company’s financing and operational flexibility and make it difficult to react to market conditions and satisfy ongoing capital needs and unanticipated cash requirements. Specifically, such covenants may restrict the ability and, if applicable, the ability of the subsidiaries to, among other things:

| |

| • | make certain investments; |

| |

| • | enter into certain types of transactions with affiliates; |

| |

| • | limit dividends or other payments by restricted subsidiaries; |

| |

| • | use assets as security in other transactions; |

| |

| • | pay dividends on Successor common stock or repurchase equity interests; |

| |

| • | sell certain assets or merge with or into other companies; |

| |

| • | guarantee the debts of others; |

| |

| • | enter into new lines of business; |

| |

| • | prepay, redeem or exchange debt; and |

| |

| • | form any joint ventures or subsidiary investments. |

In addition, the credit agreements require the Company to periodically meet various financial ratios and tests, including maximum leverage, minimum excess availability and minimum interest coverage levels in order to take certain corporate actions such as additional debt incurrence or restricted payments. These financial covenants and tests could limit the ability to react to market conditions or satisfy extraordinary capital needs and could otherwise restrict the Company’s financing and operations. The Company’s ability to comply with the covenants and other terms of the credit agreements will depend on future operating performance. If Visteon fails to comply with such covenants and terms, the Company would be required to obtain waivers from the lenders to maintain compliance under such agreements. If the Company is unable to obtain any necessary waivers and the debt under the credit agreements is accelerated, it would have a material adverse effect on the financial condition and future operating performance.

Inflation may adversely affect the Company’s profitability and the profitability of the Company’s tier 2 and tier 3 supply base.

The automotive supply industry has experienced significant inflationary pressures, primarily in ferrous and non-ferrous metals and petroleum-based commodities, such as resins. These inflationary pressures have placed significant operational and financial burdens on automotive suppliers at all levels, and are expected to continue for the foreseeable future. Generally, it has been difficult to pass on, in total, the increased costs of raw materials and components used in the manufacture of the Company’s products to its customers. In addition, the Company’s need to maintain a continuing supply of raw materials and/or components has made it difficult to resist price increases and surcharges imposed by its suppliers.

Further, this inflationary pressure, combined with other factors, has adversely impacted the financial condition of several domestic automotive suppliers, resulting in several significant supplier bankruptcies. Because the Company purchases various types of equipment, raw materials and component parts from suppliers, the Company may be materially and adversely affected by the failure of those suppliers to perform as expected. This non-performance may consist of delivery delays, failures caused by production issues or delivery of non-conforming products, or supplier insolvency or bankruptcy. Consequently, the Company’s efforts to continue to mitigate the effects of these inflationary pressures may be insufficient if conditions worsen, thereby negatively impacting the Company’s financial results.

The Company could be negatively impacted by supplier shortages.

In an effort to manage and reduce the costs of purchased goods and services, the Company, like many suppliers and automakers, has been consolidating its supply base. In addition, certain materials and components used by the Company, primarily in its electronics products, are in high demand but of limited availability. As a result, the Company is dependent on single or limited sources of supply for certain components used in the manufacture of its products. The Company selects its suppliers based on total value (including price, delivery and quality), taking into consideration production capacities and financial condition. However, there can be no assurance that strong demand, capacity limitations or other problems experienced by the Company’s suppliers will not result in occasional shortages or delays in the supply of components. If the Company were to experience a significant or prolonged shortage of critical components from any of its suppliers, particularly those who are sole sources, and could not procure the components from other sources, the Company would be unable to meet its production schedules for some of its key products or to ship such products to its customers in a timely fashion, which would adversely affect sales, margins, and customer relations.

The Company’s pension expense and funding levels of pension plans could materially deteriorate or the Company may be unable to generate sufficient excess cash flow to meet increased pension benefit obligations.

Many of the Company’s employees participate in defined benefit pension plans or retirement/termination indemnity plans. Effective December 31, 2011, active salaried employees in the U.S. ceased to accrue benefits under the existing defined benefit pension plan. The Company’s worldwide pension obligations exposed the Company to approximately $388 million in unfunded liabilities as of December 31, 2013, of which approximately $121 million and $267 million was attributable to unfunded U.S. and non-U.S. pension obligations, respectively.

The Company has previously experienced declines in interest rates and pension asset values. Future declines in interest rates or the market values of the securities held by the plans, or certain other changes, could materially deteriorate the funded status of the Company’s plans and affect the level and timing of required contributions in 2014 and beyond. Additionally, a material deterioration in the funded status of the plans could significantly increase pension expenses and reduce the Company’s profitability.

The Company’s assumptions used to calculate pension obligations as of the annual measurement date directly impact the expense to be recognized in future periods. While the Company’s management believes that these assumptions are appropriate, significant differences in actual experience or significant changes in these assumptions may materially affect the Company’s pension obligations and future expense. For more information on sensitivities to changing assumptions, please see Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 10 “Employee Retirement Benefits” to the Company’s consolidated financial statements included in Item 8 “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K.

The Company’s ability to generate sufficient cash to satisfy its obligations may be impacted by the factors discussed herein.

The Company's inability to execute its shareholder value creation strategy could adversely affect its financial performance.

The Company's long-term financial and stock performance depends, in part, on the Company's ability to successfully execute a comprehensive shareholder value creation strategy. This strategy involves, among other things, consolidating climate operations, realigning and reducing fixed costs, enhancing or disposing of certain product groups, achieving market recognition for certain businesses, balance sheet improvements, and share repurchases. Various factors, including the industry environment and the other matters described herein and in Part II - Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations,” including “- Forward-Looking Statements,” could adversely affect our ability to execute this strategy. A failure to execute these strategic objectives could adversely affect the Company's financial condition, operating results and cash flows. Moreover, there can be no assurances that, even if implemented, that the strategy will be successful.

The Company’s ability to effectively operate could be hindered if it fails to attract and retain key personnel.

The Company’s ability to operate its business and implement its strategies effectively depends, in part, on the efforts of its executive officers and other key employees. In addition, the Company’s future success will depend on, among other factors, the ability to attract and retain qualified personnel, particularly engineers and other employees with critical expertise and skills that support key customers and products or in emerging regions. The loss of the services of any key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on the Company’s business.

The Company may incur significant restructuring charges.

The Company has taken, and expects to take, restructuring actions to realign and resize its production capacity and cost structure to meet current and projected operational and market requirements. Charges related to these actions could have a material adverse effect on the Company's financial condition, operating results and cash flows. Moreover, there can be no assurances that any future restructurings will be completed as planned or achieve the desired results.

Impairment charges relating to the Company’s goodwill and long-lived assets and possible increases to deferred income tax asset valuation allowances could adversely affect the Company’s financial performance.

The Company regularly monitors its goodwill and long-lived assets for impairment indicators. The Company performs either a qualitative or quantitative assessment of goodwill for impairment at the reporting unit level on an annual basis. In conducting the impairment analysis of long-lived assets, the Company compares the undiscounted cash flows expected to be generated from the long-lived assets to the related net book values. Changes in economic or operating conditions impacting the estimates and assumptions could result in the impairment of goodwill or long-lived assets. In the event that the Company determines that its goodwill or long-lived assets are impaired, the Company may be required to record a significant charge to earnings that could materially affect the Company’s results of operations and financial condition in the period(s) recognized. The Company recorded asset impairment charges of $24 million and $66 million in 2012 and 2011, respectively, to adjust the carrying value of certain assets to their estimated fair value. In addition, the Company cannot provide assurance that it will be able to recover remaining net deferred tax assets, which are dependent upon achieving future taxable income in certain foreign jurisdictions. Failure to achieve its taxable income targets may change the Company’s assessment of the recoverability of its remaining net deferred tax assets and would likely result in an increase in the valuation allowance in the applicable period. Any increase in the valuation allowance would result in additional income tax expense, which could have a significant impact on the Company’s future results of operations.

The Company’s expected annual effective tax rate could be volatile and could materially change as a result of changes in mix of earnings and other factors.

Changes in the Company’s debt and capital structure, among other items, may impact its effective tax rate. The Company’s overall effective tax rate is computed as consolidated tax expense as a percentage of consolidated earnings before tax. However, tax expenses and benefits are not recognized on a global basis but rather on a jurisdictional basis. Further, the Company is in a position whereby losses incurred in certain tax jurisdictions generally provide no current financial statement benefit. In addition, certain jurisdictions have statutory rates greater than or less than the United States statutory rate. As such, changes in the mix and source of earnings between jurisdictions could have a significant impact on the Company’s overall effective tax rate in future periods. Changes in tax law and rates, changes in rules related to accounting for income taxes or adverse outcomes from tax audits that regularly are in process in any of the jurisdictions in which the Company operates could also have a significant impact on the Company’s overall effective rate in future periods.

Warranty claims, product liability claims and product recalls could harm the Company’s business, results of operations and financial condition.

The Company faces the inherent business risk of exposure to warranty and product liability claims in the event that its products fail to perform as expected or such failure results, or is alleged to result, in bodily injury or property damage (or both). In addition, if any of the Company’s designed products are defective or are alleged to be defective, the Company may be required to participate in a recall campaign. As suppliers become more integrally involved in the vehicle design process and assume more of the vehicle assembly functions, automakers are increasingly expecting them to warrant their products and are increasingly looking to suppliers for contributions when faced with product liability claims or recalls. A successful warranty or product liability claim against the Company in excess of its available insurance coverage and established reserves, or a requirement that the Company participate in a product recall campaign, could have materially adverse effects on the Company’s business, results of operations and financial condition.

The Company is involved from time to time in legal proceedings and commercial or contractual disputes, which could have an adverse effect on its business, results of operations and financial position.

The Company is involved in legal proceedings and commercial or contractual disputes that, from time to time, are significant. These are typically claims that arise in the normal course of business including, without limitation, commercial or contractual disputes (including disputes with suppliers), intellectual property matters, personal injury claims and employment matters. No assurances can be given that such proceedings and claims will not have a material adverse impact on the Company’s profitability and financial position.

The Company could be adversely impacted by environmental laws and regulations.

The Company’s operations are subject to U.S. and foreign environmental laws and regulations governing emissions to air; discharges to water; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties. Currently, environmental costs with respect to former, existing or subsequently acquired operations are not material, but there is no assurance that the Company will not be adversely impacted by such costs, liabilities or claims in the future either under present laws and regulations or those that may be adopted or imposed in the future.

Developments or assertions by or against the Company relating to intellectual property rights could materially impact its business.

The Company owns significant intellectual property, including a number of patents, trademarks, copyrights and trade secrets, and is involved in numerous licensing arrangements. The Company’s intellectual property plays an important role in maintaining its competitive position in a number of the markets served. Developments or assertions by or against the Company relating to intellectual property rights could materially impact the Company’s business. Significant technological developments by others also could materially and adversely affect the Company’s business and results of operations and financial condition.

A disruption in our information technology systems could adversely affect our business and financial performance.

We rely on the accuracy, capacity and security of our information technology systems. Despite the security and risk-prevention measures we have implemented, our systems could be breached, damaged or otherwise interrupted by computer viruses, unauthorized physical or electronic access or other natural or man-made incidents or disasters. Such a breach or interruption could result in business disruption, theft of our intellectual property or trade secrets and unauthorized access to personnel information. To the extent that our business is interrupted or data is lost, destroyed or inappropriately used or disclosed, such disruptions could adversely affect our competitive position, relationships with our customers, financial condition, operating results and cash flows.

The Company may not be able to fully utilize its U.S. net operating losses and other tax attributes.

Visteon's emergence from bankruptcy in 2010 resulted in a change of ownership within the meaning of Internal Revenue Code (“IRC”) Sections 382 and 383, causing the use of Visteon's pre-emergence U.S. federal net operating loss (“NOL”) and various other tax attributes to be limited in the post-emergence period. However, NOLs and other tax attributes generated in the post-emergence period are generally not limited by the emergence from bankruptcy, but could be limited if there is a subsequent change of ownership. If the Company were to have another change of ownership within the meaning of IRC Sections 382 and 383, its post-emergence NOL and other tax attributes could be limited to an amount equal to its market capitalization at the time of the subsequent ownership change multiplied by the federal long-term tax exempt rate. The Company cannot provide any assurance that such an ownership change will not occur, in which case the availability of the Company's NOLs and other tax attributes could be significantly limited or possibly eliminated.

Certain tax benefit preservation provisions of our corporate documents could delay or prevent a change of control, even if that change would be beneficial to stockholders.

Our second amended and restated certificate of incorporation provides, among other things, that any attempted transfer of the Company's securities during a Restricted Period shall be prohibited and void ab initio insofar as it purports to transfer ownership or rights in respect of such stock to the purported transferee to the extent that, as a result of such transfer, either any person or group of persons shall become a “Five-percent shareholder” of Visteon pursuant to Treasury Regulation § 1.382-2T(g), other than a “direct public group” as defined in such regulation (a “Five-Percent Shareholder”), or the percentage stock ownership interest in Visteon of any Five-Percent Shareholder shall be increased.

The foregoing restriction does not apply to transfers if either the transferor or transferee gives written notice to the Board of Directors and obtains their approval. A Restricted Period means any period beginning when the Company's market capitalization falls below $1.5 billion (or such other level determined by the Board of Directors not more frequently than annually) and ending when such market capitalization has been above such threshold for 30 consecutive calendar days.

The Company’s business and results of operations could be affected adversely by terrorism.

Terrorist-sponsored attacks, both foreign and domestic, could have adverse effects on the Company’s business and results of operations. These attacks could accelerate or exacerbate other automotive industry risks such as those described above and also have the potential to interfere with the Company’s business by disrupting supply chains and the delivery of products to customers.

A failure of the Company’s internal controls could adversely affect the Company’s ability to report its financial condition and results of operations accurately and on a timely basis. As a result, the Company’s business, operating results and liquidity could be harmed.

Because of the inherent limitations of any system of internal control, including the possibility of human error, the circumvention or overriding of controls or fraud, even an effective system of internal control may not prevent or detect all misstatements. In the event of an internal control failure, the Company’s ability to report its financial results on a timely and accurate basis could be adversely impacted, which could result in a loss of investor confidence in its financial reports or have a material adverse effect on the Company’s ability to operate its business or access sources of liquidity.

These restrictions could prohibit or delay the accomplishment of an ownership change with respect to Visteon by (i) discouraging any person or group from being a Five-Percent Shareholder and (ii) discouraging any existing Five-Percent Shareholder from acquiring more than a minimal number of additional shares of Visteon's stock.

| |

| Item 1B. | Unresolved Staff Comments |

None

The Company's principal executive offices are located in Van Buren Township, Michigan. As of December 31, 2013, the Company and its consolidated subsidiaries owned or leased approximately:

| |

| • | 29 corporate offices, technical and engineering centers and customer service centers in seventeen countries around the world, of which 26 were leased and 3 were owned; |

| |

| • | 30 Climate manufacturing and/or assembly facilities in the United States, Canada, Mexico, Czech Republic, France, Hungary, Portugal, Slovakia, Turkey, South Africa, China, India, South Korea, Thailand and Argentina, of which 13 were leased and 17 were owned; |

| |

| • | 24 Interiors manufacturing and/or assembly facilities in Belgium, France, Germany, Poland, Slovakia, Spain, Russia, Morocco, South Korea, Thailand, India, Brazil and Argentina, of which 14 were leased and 10 were owned; and |

| |

| • | 10 Electronics manufacturing and/or assembly facilities in Mexico, Portugal, Russia, India, Japan, South Korea, China, Thailand and Brazil, of which 7 were leased and 3 were owned. |

In addition, the Company's non-consolidated affiliates operate approximately 19 manufacturing and/or assembly locations, primarily in the Asia Pacific region. The Company considers its facilities to be adequate for its current uses.

In 2003, the Local Development Finance Authority of the Charter Township of Van Buren, Michigan (the “Township”) issued approximately $28 million in bonds finally maturing in 2032, the proceeds of which were used at least in part to assist in the development of the Company’s U.S. headquarters located in the Township. During January 2010, the Company and the Township entered into a settlement agreement (the “Settlement Agreement”) that, among other things, reduced the taxable value of the headquarters property to current market value and facilitated certain claims of the Township in the Company’s chapter 11 proceedings. The Settlement Agreement also provided that the Company would continue to negotiate in good faith with the Township in the event that property tax payments were inadequate to permit the Township to meet its payment obligations with respect to the bonds. In September 2013, the Township notified the Company in writing that it is estimating a shortfall in tax revenues of between $25 million and $36 million, which could render it unable to satisfy its payment obligations under the bonds, but made no specific monetary demand of the Company. The Company disputes the factual and legal assertions made by the Township and intends to vigorously defend the matter should the Township seek to commence a legal proceeding against the Company. The Company is not able to estimate the possible loss or range of loss in connection with this matter.

In November 2013, the Company and Halla Visteon Climate Control Corp., the Company’s South Korean subsidiary (“HVCC”), jointly filed an Initial Notice of Voluntary Self-Disclosure statement with the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”) regarding certain sales of automotive HVAC components by a minority-owned, Chinese joint venture of HVCC into Iran, which the Company updated in December 2013. Pursuant to the notice, the Company and HVCC are reviewing these matters and will furnish OFAC with the results of their investigation. OFAC may conclude that our actions resulted in violations of U.S. economic sanctions laws and warrant the imposition of civil penalties, such as fines, limitations on our ability to export

products from the United States, and/or referral for further investigation by the U.S. Department of Justice. Any such fines or restrictions may be material to the Company’s financial results in the period in which they are imposed. Additionally, disclosure of this conduct and any fines or other action relating to this conduct could harm the Company’s reputation and have a material adverse effect on our business, operating results and financial condition. Although the Company plans to file its full report with OFAC by March 2014, it cannot predict when OFAC will conclude its review of that report or whether it will impose any of the potential penalties described above.

During January 2014, HVCC provided documents and information to the Korean Fair Trade Commission regarding certain subcontracting transactions and practices. HVCC's policy is to comply with all laws and regulations applicable to it and it intends to cooperate fully with the Korean Fair Trade Commission. At this time, HVCC is not able to estimate a reasonably possible range of loss that may ultimately result from this investigation.

On March 29, 2012, the Korean Supreme Court ruled that regular bonuses should be included for purposes of calculating the ordinary wage of applicable employees, which was contrary to previous legal precedent and the position of the Korean Ministry of Employment and Labor. On December 18, 2013, the Korean Supreme Court issued an en banc decision clarifying that (i) regular bonuses, should be included for purposes of calculating such ordinary wage, and (ii) certain incentive pay and family allowances may also be included for purposes of calculating such ordinary wage if they were paid to employees as consideration for the labor actually provided by them. The court also indicated that employers could be excused from liability for excluding such regular bonuses from ordinary wages where an express or implied management-labor agreement or practice to exclude such amounts existed and to require such payment would cause “serious managerial difficulty.” The Company is evaluating the potential financial impact of these new court rulings, and is not able to determine at this time whether it will have a material impact on the results of operations and cash flows of its South Korean subsidiaries. However, the Company believes it qualifies for this provision for prior periods. In addition, on May 24, 2013, Halla Visteon Climate Control Union in Korea, representing 891 hourly employees of HVCC, filed a legal petition with Seoul Southern District Court, claiming unpaid statutory benefits for the past three years based on the initial Supreme Court ruling. The Company is in the process of evaluating these claims, but at this time is not able to estimate the possible loss or range of loss in connection with this matter.

The Company's operations in Brazil are subject to highly complex labor, tax, customs and other laws. While the Company believes that it is in compliance with such laws, it is periodically engaged in litigation regarding the application of these laws. As of December 31, 2013, the Company maintained accruals of approximately $9 million for claims aggregating approximately $150 million. The amounts accrued represent claims that are deemed probable of loss and are reasonably estimable based on the Company's assessment of the claims and prior experience with similar matters.

Several current and former employees of Visteon Deutschland GmbH (“Visteon Germany”) filed civil actions against Visteon Germany in various German courts beginning in August 2007 seeking damages for the alleged violation of German pension laws that prohibit the use of pension benefit formulas that differ for salaried and hourly employees without adequate justification. Several of these actions have been joined as pilot cases. In a written decision issued in April 2010, the Federal Labor Court issued a declaratory judgment in favor of the plaintiffs in the pilot cases. To date, more than 750 current and former employees have filed similar actions or have inquired as to or been granted additional benefits, and an additional 600 current and former employees are similarly situated. The Company's remaining reserve for unsettled cases is approximately $8 million and is based on the Company’s best estimate as to the number and value of the claims that will be made in connection with the pension plan. However, the Company’s estimate is subject to many uncertainties which could result in Visteon Germany incurring amounts in excess of the reserved amount of up to approximately $9 million.