QuickLinks -- Click here to rapidly navigate through this document

Leitch Technology Corporation

150 Ferrand Drive, Suite 700

Toronto, Ontario M3C 3E5

August 25, 2003

Dear Shareholder:

On behalf of the Board of Directors and the management of Leitch Technology Corporation, we invite you to attend our 2003 Annual General Meeting of Shareholders. The meeting will be held at the TSX Conference Centre, Auditorium, Toronto Stock Exchange, The Exchange Tower, 130 King Street West, Toronto, Ontario at 11:00 a.m. (Toronto time) on October 21, 2003. Enclosed are the notice of meeting, management proxy circular and form of proxy for the meeting.

We want all shareholders to be represented at the meeting. If you are unable to attend the meeting, please register your views by completing and returning the form of proxy included with the enclosed meeting materials. Even if you plan to attend the meeting, you can conveniently express your views in advance by returning a completed form of proxy.

We look forward to seeing you at the meeting.

Yours truly,

DAVID CHAIKOF

LEITCH TECHNOLOGY CORPORATION

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual general meeting (the "Meeting") of the shareholders of Leitch Technology Corporation will be held at the TSX Conference Centre, Auditorium, Toronto Stock Exchange, The Exchange Tower, 130 King Street West, Toronto, Ontario, on Tuesday, October 21, 2003, at 11:00 a.m., Toronto time, for the following purposes:

- 1.

- to receive the consolidated financial statements and the auditors' report thereon, for the financial year ended April 30, 2003;

- 2.

- to elect directors for the ensuing year;

- 3.

- to appoint auditors for the ensuing year and to authorize the directors to fix the remuneration to be paid to the auditors;

- 4.

- to transact such other business as may properly come before the Meeting or any adjournment thereof.

The Management Information Circular and form of proxy accompany this Notice.

By Order of the Board of Directors

(Signed)SALIL MUNJAL

Chief Operating Officer

DATED at Toronto, Ontario, Canada, this 25th day of August, 2003.

NOTE:If you are unable to be present in person at the Meeting, please exercise your right to vote by signing and returning the enclosed form of proxy in accordance with the instructions therein, so as to arrive by no later than 5:00 p.m. (Toronto time) on October 20, 2003, or in the case of an adjournment of the Meeting, by no later than 5:00 p.m. (Toronto time) on the business day immediately preceding the date of such adjourned Meeting.

LEITCH TECHNOLOGY CORPORATION

150 Ferrand Drive, Suite 700

Toronto, Ontario

M3C 3E5

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES

The information contained in this management information circular (the "Circular") is furnished in connection with the solicitation by the management of LEITCH TECHNOLOGY CORPORATION (the "Corporation", the "Company" or "Leitch") of proxies to be used at the annual general meeting of shareholders of the Corporation or any adjournment thereof (the "Meeting") to be held at the time, place and for the purposes set out in the accompanying notice of Meeting (the "Notice"). It is expected that solicitation will be made primarily by mail, but proxies may also be solicited personally by directors, officers and employees of the Corporation without special compensation. The cost of solicitation by management will be borne by the Corporation.

Unless otherwise indicated, information contained herein is given as of August 25, 2003. As of the date of this Circular, management knows of no matters to come before the Meeting other than matters referred to in the Notice.

Appointment of Proxies

The persons named in the enclosed form of proxy are representatives of management of the Corporation and are directors and/or officers of the Corporation.A shareholder who wishes to appoint some other person to represent such shareholder at the Meeting may do so by inserting such person's name in the blank space provided in the accompanying form of proxy. Such other person need not be a shareholder of the Corporation.

To be valid, proxies must be deposited with Computershare Trust Company of Canada, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department, in accordance with the instructions therein, by no later than 5:00 p.m. (Toronto time) on October 20, 2003 or in the case of any adjournment of the Meeting, by no later than 5:00 p.m. (Toronto time) on the business day immediately preceding the date of such adjourned Meeting.

Non-Registered Holders

Only registered shareholders or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, common shares of the Corporation beneficially owned by a holder (a "Non-Registered Holder") are registered either:

- (a)

- in the name of an intermediary that the Non-Registered Holder deals with in respect of the common shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or

- (b)

- in the name of a depository (such as The Canadian Depository for Securities Limited or "CDS").

In accordance with Canadian securities law, the Corporation has distributed copies of the Notice, this Circular, the form of proxy, and the 2003 annual report (collectively, the "meeting materials") to CDS and intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward meeting materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Typically, intermediaries will use a service company (such as ADP Investor Communications) ("ADP IC") to forward the meeting materials to Non-Registered Holders.

Non-Registered Holders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit Non-Registered Holders to direct the voting of the shares they beneficially own. Non-Registered Holders should follow the procedures set out below, depending on which type of form they receive.

- A.

- Voting Instruction Form. In most cases, a Non-Registered Holder will receive, as part of the meeting materials, a voting instruction form. If the Non-Registered Holder does not wish to attend and vote at the meeting in person (or have another person attend and vote on the Holder's behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. Voting instruction forms sent by ADP IC permit the completion of the voting instruction form by telephone or through the Internet at www.proxyvotecanada.com. If a Non-Registered Holder wishes to attend and vote at the meeting in person (or have another person attend and vote on the Holder's behalf), the Non-Registered Holder must complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to the Non-Registered Holder.

or

- B.

- Form of Proxy. Less frequently, a Non-Registered Holder will receive, as part of the meeting materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise uncompleted. If the Non-Registered Holder does not wish to attend and vote at the meeting in person (or have another person attend and vote on the Holder's behalf), the Non-Registered Holder must complete the form of proxy and deposit it with Computershare Trust Company as described above. If a Non-Registered Holder wishes to attend and vote at the meeting in person (or have another person attend and vote on the Holder's behalf), the Non-Registered Holder must strike out the names of the persons named in the proxy and insert the Non-Registered Holder's (or such other person's) name in the blank space provided.

Non-Registered Holders should follow the instructions on the forms they receive and contact their intermediaries promptly if they need assistance.

Revocation

A registered shareholder who has given a proxy may revoke the proxy by:

- (a)

- completing and signing a proxy bearing a later date and depositing it with Computershare Trust Company of Canada as described above; or

- (b)

- depositing an instrument in writing executed by the shareholder or by the shareholder's attorney authorized in writing: (i) at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of the Meeting, at which the proxy is to be used, or (ii) with the chairman of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment of the Meeting; or

- (c)

- in any other manner permitted by law.

A Non-Registered Holder may revoke a voting instruction form or a waiver of the right to receive meeting materials and to vote given to an intermediary at any time by written notice to the intermediary, except that an intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by the intermediary at least seven days prior to the Meeting.

VOTING OF PROXIES

The management representatives designated in the enclosed form of proxy will vote or withhold from voting the common shares in respect of which they are appointed by proxy in any ballot that may be called for in accordance with the instructions of the shareholder as indicated on the proxy and, if the shareholder specifies a choice with respect to any matter to be acted upon, the common shares will be voted accordingly.In the absence of such directions, such common shares will be voted by the management representatives for the election of directors named in this Circular and for the appointment of KPMG as auditors and the authorization of the directors to fix the auditors' remuneration.

2

The enclosed form of proxy confers discretionary authority upon the management representatives designated in the form of proxy with respect to amendments or variations of matters identified in the accompanying Notice and with respect to other matters which may properly come before the Meeting. At the date of this Circular, the management of the Corporation knows of no such amendments, variations or other matters.

VOTING SHARES

The authorized share capital of the Corporation consists of an unlimited number of common shares ("Common Shares") and an unlimited number of preference shares, issuable in series, of which, on the date of this Circular, 29,782,080 Common Shares, and no preference shares, are issued and outstanding. On August 12, 2003 the Company announced it entered into an agreement with underwriters to raise $20,025,000 by the issuance of 4,450,000 Common Shares (the "Financing"). Upon the closing of the Financing, estimated to be August 29, 2003, the outstanding share capital will be 34,232,080 Common Shares (net of the exercise of an over-allotment option, which entitles the underwriters for the Financing to purchase an additional 445,000 Common Shares for a 30 day period after closing). Each shareholder of record at the close of business on September 5, 2003, the record date established for the Meeting, will be entitled to one vote for each Common Share on all matters proposed to come before the Meeting, except to the extent that the holder has transferred any Common Shares after the record date and the transferee of such shares establishes ownership of them and demands, not later than the close of business ten days prior to the Meeting, to be included in the list of shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote such shares.

PRINCIPAL HOLDERS OF VOTING SECURITIES

Other than as indicated below, the directors and officers of the Corporation are not aware of any person who, as of August 15, 2003, beneficially owned, directly or indirectly, or exercised control or direction over more than 10 percent of the Common Shares of the Corporation. The ownership percentages below may change upon the closing of the Financing, described above in "Voting Shares".

|

|---|

Entity

| | Common Shares Owned

| | Percentage Ownership

|

|---|

|

| Alliance Capital Management LP(1) | | 3,317,980 common shares | | 11.1% |

|

Fidelity Management & Research Company and Fidelity

Management Trust Company(2) | | 4,390,970 common shares | | 14.74% |

|

| Seamark Asset Management Ltd.(3) | | 3,064,401 common shares | | 10.3% |

|

(1) |

Based on information filed on September 28, 2001. |

(2) |

Based on information filed on March 17, 2003. |

(3) |

Based on information filed on June 10, 2002. |

ELECTRONIC ACCESS TO PROXY-RELATED

MATERIALS AND ANNUAL AND QUARTERLY REPORTS

The Corporation is offering shareholders the opportunity to view future management proxy circulars, annual reports and quarterly reports, etc. through the Internet instead of receiving paper copies in the mail. If you are a registered shareholder you can choose this option by following the instructions on your form of proxy. If you hold your common shares through an intermediary (such as a bank or a broker), please refer to the information provided by the intermediary on how to view the Corporation's management information circulars, annual reports and quarterly reports through the Internet.

3

PARTICULARS OF MATTERS TO BE ACTED ON

Presentation of Financial Statements

The consolidated financial statements for the year ended April 30, 2003, and the report of the auditors thereon will be placed before the Meeting. The consolidated financial statements are included in our 2003 Annual Report which is being mailed to our shareholders with the Notice and this Circular.

Election of Directors (Item 1 on proxy form)

The articles of the Corporation provide for a minimum of three and a maximum of twenty directors. The Corporation currently has eight directors and the Board of Directors has determined that 9 directors will be elected at the Meeting. The management representatives designated in the enclosed form of proxy intend to vote for the election as directors of the proposed nominees whose names are set forth below. All such nominees (other than Graham Savage) are now directors and have been directors since the dates indicated below. Management does not contemplate that any proposed nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the management representatives designated in the enclosed form of proxy reserve the right to vote for another nominee at their discretion. Each director elected will hold office until the next annual meeting of shareholders or until his or her successor is duly elected or appointed.

The Corporation has an Audit Committee, Compensation Committee and Corporate Governance & Nominating Committee. Further information regarding the Committees can be found in the "Statement of Corporate Governance Practices" section in this Circular. Upon the election of the new Board of Directors, the new Board of Directors will determine the composition of each of the three committees.

The following table sets forth the name of each person proposed to be nominated for election to the Board of Directors at the Meeting, all positions and offices of the Corporation currently held by him or her, his or her principal occupation or employment at present, the number of Common Shares beneficially owned, or over which control or direction is exercised, as of August 25, 2003 and the number of Common Shares issuable upon the exercise of stock options that vest on or prior to December 31, 2003.

|

|---|

Name and Municipality of Residence

| | Director Since

| | Principal Occupation(1)

| | Shares of the

Corporation

Beneficially Owned

or Controlled

Directly or

Indirectly(1)

| | Shares Issuable

upon Exercise of

Options that Vest

on or prior to

December 31,

2003

|

|---|

|

WILLIAM F. BAKER(3)(4)

Riverside, Conn., USA | | July 6, 1993 | | President, WNET-Thirteen, New York (Television Station) | | 8,965 | | 14,700 |

|

DAVID A. CHAIKOF(4)

Toronto, ON, Canada | | February 23, 1999 | | Chairman of the Board, Leitch Technology Corporation and Partner, Torys LLP

(Barristers and Solicitors) | | 300 | | 14,250 |

|

ALBERT GNAT(2)(4)

Caledon, ON, Canada | | April 21, 1994 | | Partner, Lang Michener

(Barristers and Solicitors) | | 30,000 | | 14,700 |

|

ANTHONY GRIFFITHS(2)(3)(4)

Toronto, ON, Canada | | November 29, 1994 | | Corporate Director and

Independent Consultant | | 10,000 | | 14,200 |

|

GILLES HURTUBISE(4)

Beaconsfield, QUE, Canada | | June 27, 1995 | | Broadcasting Consultant | | 600 | | 12,950 |

|

STAN J. KABALA(2)

Naples, FL, USA | | June 18, 1996 | | Interim President & CEO, Leitch Technology Corporation | | 5,000 | | 7,100 |

|

JOHN A. MACDONALD

Ottawa, ON, Canada | | November 1, 1999 | | President and Chief Operating Officer, Allstream Inc. | | 11,000 | | 0 |

|

GRAHAM W. SAVAGE

Toronto, ON, Canada | | — | | Chairman,

Callisto Capital LP | | 0 | | 0 |

|

BRIAN SEMKIW(3)

Oakville, ON, Canada | | April 21, 1994 | | Chief Executive Officer,

Rand Worldwide

(Technology Reseller) | | 0 | | 14,700 |

|

| (1) | The information as to Common Shares beneficially owned, not being within the knowledge of the Corporation, has been furnished by the respective directors individually. |

| (2) | Denotes members of the Corporation's Audit Committee. |

| (3) | Denotes members of the Corporation's Compensation Committee. |

| (4) | Denotes members of the Corporation's Corporate Governance & Nominating Committee. |

4

Biographies of Individuals Nominated to Serve as Directors

William Baker has served as President and Chief Executive Officer of Public Television Station Thirteen/WNET New York since 1987. Mr. Baker is a director of Public Broadcasting Service and Rodale Press. Mr. Baker received his bachelor's, master's and Ph.D. degrees from Case Western Reserve University, and is the recipient of honorary degrees from St. John's University, College of St. Elizabeth and Long Island University.

David Chaikof is the Chairman of the Board of Directors of the Corporation. Mr. Chaikof has been a partner of Torys LLP, a law firm, since 1993. He is a director of a number of not-for-profit organizations. Admitted to the Ontario Bar in 1987, David is a graduate of the University of Western Ontario.

Albert Gnat has been a partner of Lang Michener, a law firm, since 1974. Mr. Gnat serves on the boards of a number of public and private entities, including Rogers Communications Inc., Rogers Cablesystems Inc., Rogers Wireless Communications Inc., Ikea Limited and AXA Insurance. Mr. Gnat holds a Bachelor of Arts in Political Science and Economics and an LL.B. from the University of Toronto. He was called to the Bar of Ontario in 1967 and appointed Queen's Counsel in 1984.

Anthony Griffiths is an independent consultant, serving on the boards of a number of public and private entities, including as Chairman of both Russel Metals Inc. and Brazilian Resources, Inc. and a director of Northbridge Financial Corporation, Odyssey Re Holdings Corp., Alliance Atlantis Communications Inc. and Fairfax Financial Holdings Limited. Mr. Griffiths is a graduate of McGill University and the Harvard Graduate School of Business Administration.

Gilles Hurtubise is a broadcasting consultant. Mr. Hurtubise holds a Bachelor of Engineering degree from the University of Montreal, a certificate in digital techniques and a certificate in management.

Stan J. Kabala has been Interim President and Chief Executive Officer of Leitch since July 17, 2003 and also serves on the boards of a number of public and private entities, including as Chairman of eLOT, Inc. (previously known as Executone Information Systems, Inc.). From 1998 to 2000 Mr. Kabala was Chairman, President and Chief Executive Officer of eLOT, Inc. (retiring as President and CEO, but continuing as Chairman) and prior to that was President and CEO of Rogers Cantel Inc. (now Rogers Wireless Communications Inc.) and Unitel Communications Inc. Mr. Kabala holds a Master in Management degree as a Sloan Fellow from the Stanford Graduate School of Business and a degree in psychology from St. Joseph's University.

John A. MacDonald is President and Chief Operating Officer of Allstream Inc. (formerly AT&T Canada Inc.). From November 1999 to December 2001 Mr. MacDonald was the President and Chief Executive Officer of Leitch Technology Corporation. Prior to that he was President and Chief Operating Officer of Bell Canada. Mr. MacDonald is a director of Rogers Cablesystems Inc. and Versatel Networks. Mr. MacDonald holds a Bachelor of Science degree in electrical engineering from Dalhousie University and a Bachelor of Engineering degree from the Technical University of Nova Scotia.

Graham Savage is the Chairman of Callisto Capital LP (formerly Savage Walker Capital Inc.). From November 1996 to April 1998, Mr. Savage was Managing Director at Parkview Capital Partners Inc., a merchant banking firm. He is currently a director of Canadian Tire Corp., Hollinger International Inc., and Vitran Corporation. Mr. Savage is a graduate of Queen's University, holding a post-graduate degree in Business Administration.

Brian Semkiw is the Chief Executive Officer and co-founder of RAND Worldwide. Mr. Semkiw is also a director of ENGINEERING.com Incorporated. Mr. Semkiw holds a Bachelor of Engineering degree from the University of Toronto.

5

Appointment and Remuneration of Auditors (Item 2 on the proxy form)

The management representatives designated in the enclosed form of proxy intend to vote in favour of the re-appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation, to hold office until the next annual meeting of the shareholders, and to authorize the directors to fix the auditors' remuneration. KPMG LLP have served as auditors of the Corporation since August 25, 1992. The following table sets forth the fees paid by the Company for services rendered in the fiscal year ending April 30, 2003.

KPMG LLP

| | 2003

|

|---|

| Audit Services | | $ | 141,875 |

| Audit Related Services | | $ | 95,710 |

| Tax Services | | $ | 403,925 |

Audit related fees paid include fees relating to consultation regarding financial accounting and reporting standards as well as corporate finance matters and translations. Tax services fees paid include fees relating to US tax consulting and structuring and tax compliance services.

EXECUTIVE COMPENSATION

Compensation of Named Executive Officers

The following tables and related narrative below present information about compensation for the fiscal years ended April 30, 2003, April 30, 2002 and April 30, 2001 for the Corporation's Named Executive Officers (determined in accordance with applicable rules). In the table and footnotes below, and elsewhere in this Circular, references to "$" shall mean Canadian dollars and to "US$" shall mean United States dollars.

Summary Compensation Table

|

|---|

| | Annual Compensation

| | Long-Term Compensation

|

|---|

Name and Principal Position

| | Fiscal Year

| | Salary

($)

| | Bonus

($)

| | Other Annual Compensation

($)(1)

| | Shares Under Options Granted

(#)(2)(3)

|

|---|

|

MARGARET CRAIG

Former President and Chief Executive Officer,

Leitch Technology Corporation(4) | | 2003

2002

2001 | | 375,000

370,726

272,138 | | —

195,912

155,040 | | —

—

— | | —

320,000

— |

|

BARRY TODD

Managing Director, Leitch Europe Limited(5) | | 2003

2002

2001 | | 282,000

269,484

45,037 | | —

40,250

9,544 | | —

—

— | | 35,000

5,000

40,000 |

|

REGINALD J. TIESSEN

Chief Financial Officer(6) | | 2003

2002

2001 | | 265,000

233,442

200,000 | | —

74,200

68,000 | | —

—

— | | 55,000

20,000

10,000 |

|

JOHN EDWARDS

Vice-President and General Manager, Servers,

Leitch Incorporated(7) | | 2003

2002

2001 | | 258,000

267,464

207,071 | | —

52,691

63,954 | | —

—

— | | 45,000

20,000

30,000 |

|

BRAD NOGAR

Vice-President and General Manager,

Post Production Products(8) | | 2003

2002

2001 | | 240,000

240,000

120,000 | | —

59,529

105,722 | | —

—

— | | 20,000

10,000

30,000 |

|

- (1)

- The value of perquisites and benefits for each Named Executive Officer does not exceed the lesser of $50,000 or 10% of the total of the annual salary and bonus and is not reported herein.

- (2)

- Of Ms. Craig's 320,000 options granted in fiscal 2002, 200,000 options are performance based options. For details see "Report of Compensation Committee — Compensation of President and CEO".

- (3)

- All options granted to executives in fiscal 2003 were "premium priced" options in that these options have an exercise price that is at least 30% in excess of the five-day weighted average of the closing price of the Company's Common Shares on the Toronto Stock Exchange (the "TSX") preceding the date of grant. See "Report on Executive Compensation".

6

- (4)

- Ms. Craig joined Leitch Incorporated, the Corporation's primary subsidiary in the United States, as President in January 2000. In October, 2001 Ms. Craig became Chief Operating Officer of the Corporation and in January 2002 was appointed President & CEO. Ms. Craig resigned from the Company on July 17, 2003.

- (5)

- Mr. Todd did not receive an increase or decrease in salary in fiscal 2003. Any increase in salary in fiscal 2003 reflected in the table is due to foreign exchange conversion. Mr. Todd joined Leitch Europe Limited, the Corporation's primary subsidiary in Europe, as Managing Director on February 26, 2001. Mr. Todd's annualized salary in fiscal 2001 was $269,484.

- (6)

- Mr. Tiessen received a salary increase to $265,000 on January 1, 2002. Mr. Tiessen did not receive a salary increase in fiscal 2003.

- (7)

- Mr. Edwards did not receive an increase or decrease in salary in fiscal 2003. Any decrease in salary in fiscal 2003 reflected in the table is due to foreign exchange conversion. Mr. Edwards joined Leitch Incorporated, the Corporation's primary subsidiary in the United States, as Vice-President and General Manager Server Products on July 3, 2001. Mr. Edwards' annualized salary in fiscal 2001 was $253,358.

- (8)

- Mr. Nogar joined the Corporation as part of the Corporation's acquisition of Digital Processing Systems ("DPS") during fiscal 2001. Mr. Nogar's annualized salary in fiscal 2001 was $222,750.

Option Grants During Fiscal 2003 to Named Executive Officers

|

|---|

Name and Principal Position

| | Shares Under Options Granted

(#)

| | % of Total Options Granted to Employees in Fiscal 2003

| | Exercise Price

(per share)

($)(2)

| | Market Value of Shares Underlying Options on the Date of Grant (per share)

($)(2)

| | Expiration Date

|

|---|

|

MARGARET CRAIG(1)

Former President & CEO | | — | | — | | — | | — | | — |

|

BARRY TODD

Managing Director, Leitch Europe Limited | | 35,000 | | 9% | | 7.02 | | 5.35 | | February 25, 2008 |

|

REGINALD J. TIESSEN

Chief Financial Officer | | 55,000 | | 13% | | 7.02 | | 5.35 | | February 25, 2008 |

|

JOHN EDWARDS

Vice-President and General Manager, Servers, Leitch Incorporated | | 45,000 | | 11% | | 7.02 | | 5.35 | | February 25, 2008 |

|

BRAD NOGAR

Vice-President and General Manager, Post Production Products | | 20,000 | | 5% | | 7.02 | | 5.35 | | February 25, 2008 |

|

- (1)

- In conjunction with Ms. Craig's appointment as President & CEO on January 1, 2002, Ms. Craig was awarded an additional 310,000 options (in addition to her then existing 90,000 options), of which amount 200,000 options are performance based options which vest in the sole discretion of the Board and based upon numerous criteria established by agreement between Ms. Craig and the Compensation Committee of the Board. In all other respects these options are subject to the conditions of the Corporation's stock option plan. 10,000 of these 200,000 performance based options have been vested by the Board. Given Ms. Craig's resignation on July 17, 2003, all unvested performance options will be cancelled in accordance with Ms. Craig's employment contract. The extent to which all remaining options are cancelled or not will be addressed in Ms. Craig's separation agreement, which is being settled between the Board of Directors and Ms. Craig as at the date of this Circular. See "Report on Executive Compensation — Compensation of President and Chief Executive Officer".

- (2)

- The exercise price of options granted in fiscal 2003 pursuant to the Corporation's stock option plan is equal to at least 30% of the five day weighted average (by volume) of the trading price of the Corporation's common shares on the TSX preceding the date the options are granted. Accordingly, the options were granted at a premium to the market price of the Corporation's underlying Common Shares and were "out of the money" on the date of issuance. See "Report on Executive Compensation".

7

Aggregated Option Exercises During Fiscal 2003 by Named Executive Officers and Financial Year-End

Values of Options Held by Named Executive Officers

|

|---|

| |

| |

| | Unexercised Options

at FY-End

(#)

| | Value of Unexercised In-the-Money Options

at FY-End

($)(2)

|

|---|

| | Shares Acquired on Exercise

(#)

| | Aggregate Value Realized

($)

|

|---|

Name and Principal Position

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

|

MARGARET CRAIG(1)

Former President & CEO | | NIL | | NIL | | 102,000 | | 298,000 | | NIL | | NIL |

|

BARRY TODD

Managing Director, Leitch Europe Limited | | NIL | | NIL | | 21,250 | | 58,750 | | NIL | | NIL |

|

REGINALD J. TIESSEN

Chief Financial Officer | | NIL | | NIL | | 35,750 | | 69,250 | | NIL | | NIL |

|

JOHN EDWARDS

Vice-President and General Manager, Servers, Leitch Incorporated | | NIL | | NIL | | 25,750 | | 69,250 | | NIL | | NIL |

|

BRAD NOGAR

Vice-President and General Manager, Post Production Products | | NIL | | NIL | | 9,000 | | 31,000 | | NIL | | NIL |

|

- (1)

- See footnote (1) above in connection with the table entitled "Option Grants During Fiscal 2003 to Named Executive Officers".

- (2)

- On April 30, 2003 the closing price of a common share of the Corporation on the TSX was $5.00. As the actual value received by a Named Executive Officer on the exercise of a stock option is determined by the market value of the Corporation's common shares on the date of exercise, the actual value received by a Named Executive Officer may bear no relation to the potential realization shown in these columns.

Indebtedness

The aggregate indebtedness of all officers, directors, employees and former officers, directors and employees of the Corporation or any of its subsidiaries outstanding as at August 25, 2003 was $399,868 in respect of indebtedness to the Corporation or any of its subsidiaries. The Company complies with the provisions of Section 402 of the Sarbanes-Oxley Act of 2002 ("SOX") prohibiting publicly traded companies from providing loans to directors and executive officers. The Company began this practice on July 30, 2002 upon the enactment of this provision. However, in accordance with SOX loans existing prior to July 30, 2002 continue in effect under their existing terms. Accordingly, any loans the Company has made to officers as shown in the table below pre-date SOX.

Table of Indebtedness of Directors, Executive Officers and Senior Officers

|

|---|

Name, Principal Position and Place of Residence

| | Involvement of Corporation or Subsidiary

| | Largest Amount Outstanding During Fiscal 2003

($)

| | Amount Outstanding as at August 25, 2003

($)

|

|---|

|

JOHN A. MACDONALD

Former President & CEO(1) | | Lender | | 518,363 | | NIL |

|

SALIL MUNJAL

Chief Operating Officer | | Lender | | 180,000 | | 180,000 |

|

- (1)

- Mr. MacDonald resigned from the Corporation on December 31, 2001 and pursuant to the terms of his consulting arrangement with the Corporation, Mr. MacDonald has repaid the full amount of the loan.

8

Report on Executive Compensation

Composition of the Compensation Committee

During the fiscal year ended April 30, 2003, the Compensation Committee of the Board (the "Compensation Committee") consisted of Messrs. William F. Baker, Chairman of the Compensation Committee, Brian Semkiw and Anthony Griffiths. None of the members of the Compensation Committee is an officer, employee or former officer or employee of the Corporation or any of its affiliates or is eligible to participate in the Corporation's executive compensation program. The Committee has primary responsibility for matters related to the overall effectiveness of the management of human resources and compensation, the design and effectiveness of compensation plans and the evaluation and remuneration of the Chief Executive Officer.

Compensation Philosophy and Objectives

The executive compensation programs are intended to attract, motivate and retain the key talent necessary to drive the Corporation to be successful in the highly competitive business environment in which it operates. The Corporation's overriding objective in regard to compensation is to competitively compensate executive officers for total performance and contribution.

The compensation of the President & Chief Executive Officer is determined by the Board upon recommendations made by the Compensation Committee. The setting of compensation for the senior officers and executives has been delegated to the President & Chief Executive Officer who consults with the Compensation Committee in this regard.

The compensation for senior officers and executives, including the President and Chief Executive Officer, is comprised of a combination of base salary, variable compensation and stock options more particularly discussed below.

Base Salary and Variable Compensation

Base salary and variable compensation (which is set as a targeted percentage of base salary) is determined based on market data for positions of similar responsibilities in respect of companies with a similar industry, revenue, geography and complexity profile, internal equity comparisons and the individual's ability and experience. Accordingly, each employee has a variable compensation component to their overall compensation. The aggregate amount of variable compensation for the Corporation is recommended by the President & Chief Executive Officer to the Compensation Committee for allocation to employees, including executive officers. The Compensation Committee's recommendations regarding the aggregate amount of variable compensation are submitted for approval by the Board of Directors. This aggregate amount may be determined with reference to numerous factors, including the Corporation's overall financial performance, relative financial performance of the Corporation compared to competitors, ensuring competitiveness of the Corporation and its compensation plans going forward, consistent with the Corporation's overall compensation philosophy. While individual variable compensation amounts are determined with reference to individual performance and contribution objectives for fiscal 2003, based on recommendations from the President and Chief Executive Officer and management team, the Company did not pay any variable compensation amount to any senior manager (including all executives) of the Company.

Stock Options

The Corporation established its stock option plan to encourage ownership in the Corporation's common shares by directors, officers and employees of the Corporation and to sustain commitment to profitability and maximize shareholder value over the long term. The stock option plan enables the Corporation to attract and retain individuals with experience and ability and to reward individuals for current and future performance. In fiscal 2003, approximately 89.3% of all options granted were issued with an exercise price at a 30% or greater premium to the market price of the Corporation's common shares at the date of issuance. The reason for this was the view of management and the Board that the common shares were undervalued at the time of issuance of

9

the options and accordingly, the exercise price of these options should be higher than their current share price. Accordingly, immediately upon issuance all options were "out of the money" by at least 30%.

Options may be granted by the Board from time to time. Each of the executive officers of the Corporation have been granted options under the Plan and additional options may be granted in the future.

Compensation of the President & Chief Executive Officer

Effective January 1, 2002 Ms. Craig was appointed President and Chief Executive Officer of the Corporation. Ms. Craig resigned from the Corporation on July 17, 2003.

Ms. Craig's base salary was determined based on market data for positions of similar responsibility in respect of companies with a similar industry, revenue, geography and complexity profile. Ms. Craig's base compensation of US$250,000 per annum was not increased at the time of her promotion to President & Chief Executive Officer in January 2002 and was not increased in fiscal 2003. Having regard to the economic downturn in the global economy and the resulting financial results of the Corporation, Ms. Craig and the Board together agreed that it was appropriate to not provide an increase in base salary to Ms. Craig for fiscal 2003. Ms. Craig's variable compensation amount is targeted at 100% of base salary. Variable compensation is determined with respect to a number of factors, including increasing the Corporation's revenue, increasing net operating income, improving the quality and innovation of products, the achievement of agreed upon targets with respect to joint ventures, acquisitions, research and development and meeting other agreed upon personal goals. While the largest factor in this regard is directly linked to the various measures of the Company's financial performance such as revenue, net operating income and net income, the other non-financial factors (including those described above) are also included in the assessment of variable compensation. Ms. Craig did not receive any variable compensation in fiscal 2003 based upon mutual agreement between her and the Board and based on the overall financial performance of the Company in fiscal 2003.

Ms. Craig was granted 310,000 options in January, 2002 to reflect her appointment as President & Chief Executive Officer. Ms. Craig had 90,000 existing options at the time of the grant of the 310,000 options. Ms. Craig was not granted any further options in fiscal 2003. Of Ms. Craig's total 400,000 options, 200,000 options are performance based options pursuant to which the options vest in the sole discretion of the Board with regard to a number of factors which are described above in connection with the determination of variable compensation. Of the 200,000 performance options, the Board determined that 10,000 options vested effective June 11, 2002. No other performance options have vested since that time and given Ms. Craig's resignation, all unvested performance options will be cancelled in accordance with Ms. Craig's employment contract. The 200,000 ordinary options vest in the ordinary course under the terms of the Corporation's stock option plan, pursuant to which options have a five-year term and vest at a rate of 5% every three months during such five-year term. The exercise price of options granted pursuant to the stock option plan must not be lower than the five day weighted (by volume) average trading price of the common shares on the TSX at the time the options are granted. These ordinary options and the extent to which they continue to vest or not vest, as the case may be, will be addressed in Ms. Craig's separation agreement which is being prepared as at the date of this Circular.

Report submitted on behalf of the Compensation Committee:

William F. Baker,Chairman

Brian Semkiw

Anthony Griffiths

Report of the Audit Committee

The Audit Committee of the Board (the "Audit Committee") consisted in fiscal 2003 of Messrs. Albert Gnat (Chairman), Stan J. Kabala and Anthony Griffiths, all of whom were unrelated directors in fiscal 2003, as defined in the TSX Corporate Governance Guidelines. On July 17, 2003, Stan J. Kabala was appointed Interim President and Chief Executive Officer of the Corporation and accordingly in this role is deemed to be a "related" director. In carrying out its mandate, the Audit Committee met 5 times during the year ended April 30, 2003, on June 10, 2002, August 26, 2002, November 25, 2002, February 24, 2003 and April 2, 2003. At

10

the meeting on June 10, 2002, the Audit Committee reviewed, with the Chief Financial Officer and the auditors of the Corporation, the consolidated financial statements for the fourth quarter and the annual consolidated financial statements for the year ended April 30, 2002 and at the other meetings other than the April 2, 2003 meeting, reviewed with the Chief Financial Officer the consolidated unaudited financial statements for the first, second and third quarters of the year ended April 30, 2002. For the year-end financial statements, the Audit Committee received the input and comments of the Corporation's auditors (both in the presence of management and privately), which included among other things, confirmation of the cooperation of the management of the Corporation in conducting their audit and of the independence of the auditors from the Corporation. On April 2, 2003, the Audit Committee reviewed with the auditors and management the scope of review of the audit for the year ending April 30, 2003. At a meeting on June 9, 2003, the Audit Committee reviewed with the Chief Financial Officer and the auditors of the Corporation, the consolidated financial statements for the fourth quarter and the annual consolidated financial statements for the year ended April 30, 2003.

Report submitted on behalf of the Audit Committee:

Albert Gnat,Chairman

Anthony Griffiths

Stan J. Kabala

11

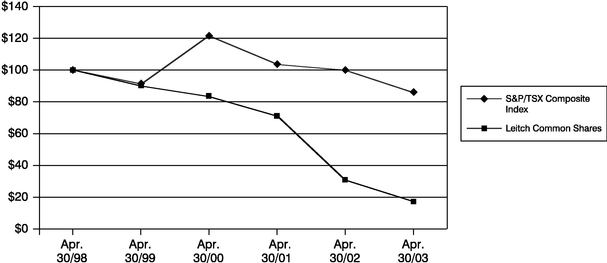

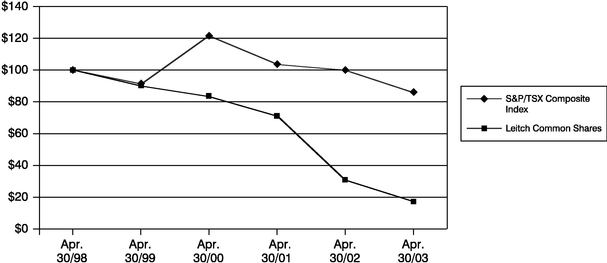

PERFORMANCE GRAPH

The following graph compares the yearly percentage change in the cumulative total shareholder return of the common shares of the Corporation since April 30, 1998 with the cumulative total return of the TSX/S&P Composite Index since that date(1).

COMPARATIVE PERFORMANCE CHART

|

|---|

|

|

Apr. 30/98

|

|

Apr. 30/99

|

|

Apr. 30/00

|

|

Apr. 30/01

|

|

Apr. 30/02

|

|

Apr. 30/03

|

|---|

|

| Leitch Close | | 29.00 | | 26.05 | | 24.20 | | 20.50 | | 8.89 | | 5.00 |

| Leitch Value | | 100.00 | | 89.83 | | 83.45 | | 70.69 | | 30.66 | | 17.24 |

| S&P/TSE Composite Index | | 7,664.99 | | 7,014.70 | | 9,347.61 | | 7,946.60 | | 7,663.39 | | 6,586.07 |

| S&P/TSE Composite Value | | 100.00 | | 91.52 | | 121.95 | | 103.67 | | 99.98 | | 85.92 |

|

- (1)

- Assumes $100 invested in the Corporation's common shares on April 30, 1998 and for the TSX/S&P Composite Index.

MATERIAL TERMS AND CONDITIONS

Employment Agreements

- (a)

- The Corporation entered into an employment contract with Ms. Margaret Craig, upon her promotion to President and Chief Executive Officer on January 1, 2002. The contract extends to the date of Ms. Craig's 55th birthday unless terminated by the Corporation. If terminated other than for just cause (as defined in the agreement), Ms. Craig will be entitled to receive, among other things, an amount equal to twice the annual cash compensation paid to her in the twelve month period prior to termination. If Ms. Craig terminates her employment within one year following a "change in control" (as defined in the contract and other than as a result of death, disability or retirement), and provided Ms. Craig has remained in the employ of the Corporation for at least six months following such change in control, Ms. Craig shall be entitled to receive, among other things, half of the payments and other benefits provided to her for termination other than for just cause, and also that one half of all unvested options shall also automatically vest. Furthermore, upon a change in control, in recognition of Ms. Craig's agreement to abide by certain non-competition and non-solicitation arrangements, Ms. Craig will receive an additional one half of the payments and other benefits provided in the contract for termination without just cause and also that one half of all unvested options held by Ms. Craig shall automatically vest. Additionally, Ms. Craig is eligible to receive, if applicable, a reimbursement of any applicable additional income tax arising from compensation earned in Canada. The reimbursement will be "grossed-up" so that Ms. Craig will receive the reimbursement on an after tax basis. This reimbursement eliminates the burden of additional taxation, if any, due to increased responsibilities in Canada. Ms. Craig and the Board agreed to Ms. Craig's resignation from the Company on July 17, 2003. As at the date of this Circular, August 25, 2003, Ms. Craig and the

12

Board are determining Ms. Craig's separation arrangements that may provide for, amongst other matters, a separation payment.

COMPENSATION OF DIRECTORS

The directors of the Corporation are entitled to receive an annual fee of $12,000, plus $800 for each meeting of the Board or a committee thereof attended. The Chairman of the Board is entitled to receive an annual fee of $50,000. The directors are also entitled to reimbursement from the Corporation for all reasonable out-of-pocket expenses incurred in connection with their attendance at meetings of the Board or a committee thereof.

Directors are also entitled to participate in the Corporation's Stock Option Plan.

DIRECTORS' AND OFFICERS' LIABILITY INSURANCE

The Corporation maintains liability insurance policies covering directors and officers of the Corporation acting in their respective capacities as such. Aggregate coverage for such matters is US$30,000,000 subject to a corporate deductible of US$250,000 and a deductible of US$1,000,000 for claims related to U.S. securities laws, rules and regulations. The total amount of premium paid by the Corporation in respect of this coverage during fiscal 2003 was US$496,357.

Leitch also purchased a seven-year run off endorsement for the former directors and officers of DPS acquired in October 2000, which covers acts and omissions occurring prior to Leitch's acquisition of DPS. The policy provides for the same level of coverage as in place prior to the acquisition, for which the Corporation paid a premium of $45,000 for the entire seven-year period.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Board Mandate

The Board of Directors assumes ultimate responsibility for the stewardship of Leitch and carries out its mandate directly and through considering recommendations it receives from the three Committees of the Board and from management.

Management is responsible for the day-to-day operations of Leitch, and pursues Board approved strategic initiatives within the context of authorized business, capital plans and corporate policies. Management is expected to report to the Board on a regular basis on short-term results and longer term development activities.

The Board is specifically responsible for:

- (a)

- Adoption of a strategic planning process

The Board's role is to ensure a strategic planning process is in place, to review the corporate strategy at least annually and to approve Leitch's annual operating budget. Quarterly updates on achievement of financial objectives of the annual business plan, corporate development and strategic initiatives are presented to the Board by management.

- (b)

- Identification of principal risks and implementing risk-management systems

The strategic planning process involves consideration and understanding by the Board of the principal risks inherent in Leitch's business. The Audit Committee also reviews financial risk-management issues.

- (c)

- Succession planning and monitoring senior management performance

The Board reviews the performance of the Chief Executive Officer and all matters related to senior management recruitment, leadership development, performance, compensation, organization structure and succession planning.

13

Operation of the Board

The Board currently has eight members and is asking that the shareholders elect nine directors at the meeting. Each director is elected annually by the shareholders and serves for a term that will end at the Corporation's next annual meeting. The Board believes that nine directors is a sufficient number to ensure the Board will be able to function independently of management.

All current directors except Mr. Kabala (current Interim President & Chief Executive Officer) and Mr. MacDonald (former President & CEO) are unrelated (within the meaning of that term in the TSX Guidelines).

The Board has regularly scheduled quarterly meetings with special meetings to review matters when needed. The Board of Directors met 9 times in fiscal 2003.

All Committees report and make recommendations to the Board on matters reviewed. Following is a brief description of the Committees of the Board that were in place in fiscal 2003.

Audit Committee

The principal duties of the Audit Committee are to review annual and interim financial statements and all legally required public disclosure documents containing financial information prior to their approval by the directors, review the planned scope of the examination of the annual consolidated financial statements by the auditors of the Corporation and review the adequacy of the systems of internal accounting and audit controls established by the Corporation. The Audit Committee reviews and approves all shareholder communications, including earnings releases and earnings guidance as well as communications of a regulatory nature prior to release, mailing to shareholders or filing with governmental and regulatory agencies. The Audit Committee also oversees the Corporation's investor relations activities and is also responsible for overseeing reporting on internal control and management information systems. Commencing May 2003, the Audit Committee, or in the absence of the full committee, the Chairman of the Audit Committee pre-approves all material engagements of the Corporation's auditors for audit-related and permitted non-audit services.

The current members of the committee are Albert Gnat (Chairman), Stan Kabala and Anthony Griffiths. The Audit Committee met 5 times in fiscal 2003.

Compensation Committee

The principal duties of the Compensation Committee are to review matters relating to executive recruitment, performance, development, compensation, resignations, terminations and organization planning. The duties of the Committee include evaluating the performance of the CEO and senior executives, determining appropriate policies and levels for executive officer compensation, and establishing and administering appropriate short and long-term incentive arrangements for executives.

The current members of the committee are William Baker (Chairman), Brian Semkiw and Anthony Griffiths. The Compensation Committee met 3 times in fiscal 2003.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee is responsible for developing and fostering a healthy corporate governance structure by working with the CEO and Corporate Secretary to set the agenda for the Board of Directors, adopting procedures to ensure effective Board operation, ensuring that functions and roles delegated to committees are appropriately carried out and that results are clearly reported to the Board as well as identifying and approaching qualified candidates to ascertain their interest in joining the Board.

The current members of the committee are Albert Gnat (Chairman), William Baker, Anthony Griffiths, Gilles Hurtubise and David Chaikof. The Corporate Governance and Nominating Committee met 4 times in fiscal 2003.

14

Compliance with TSX Guidelines

The Company believes that adopting sound governance practices is key to a well-run company, to the execution of its strategy and to its successful corporate performance. The corporate governance practices of Leitch are aligned with the guidelines for improved corporate governance adopted by the TSX. In this Schedule, however, the Company's governance practices are compared with new guidelines for improved corporate governance proposed by the TSX ("the TSX Guidelines"). These new TSX Guidelines have not yet been adopted by Toronto Stock Exchange but they reflect enhanced governance practices and are expected to be adopted.

TSX Proposal

| | Comments

|

|---|

| 1. | | The board of directors of every corporation should explicitly assume responsibility for the stewardship of the corporation and adopt a formal mandate setting out the board's stewardship responsibilities, and as part of the overall stewardship responsibility, the board should assume responsibility for the following matters: | | The Board of Directors has adopted a Charter of the Board of Directors pursuant to which the Board has explicitly assumed the stewardship of Leitch. |

(a) |

|

adoption of a strategic planning process and the approval and review, on at least an annual basis, of a strategic plan which takes into account, among other things, the opportunities and risks of the business; |

|

The Charter of the Board of Directors provides that the Board is responsible for (i) the adoption of a strategic planning process; (ii) the approval and review on an annual basis of a strategic plan that addresses opportunities and risks, and (iii) monitoring performance against the plan. |

(b) |

|

the identification of the principal risks of the corporation's business and overseeing the implementation of appropriate systems to manage these risks; |

|

The Board of Directors along with input from the Audit Committee, identifies the principal risks to the Company's business to ensure that systems are in place to manage risks. In addition, these responsibilities are also embedded in the Charter of the Audit Committee. |

(c) |

|

succession planning, including appointing, training and monitoring senior management and the CEO in particular; |

|

The Board of Directors is responsible for the selection, appointment, monitoring, evaluation and, if necessary, the replacement of the Chief Executive Officer. The Board has adopted an evaluation procedure for the Chief Executive Officer, which procedure is now used by the Board in the carrying out of its annual evaluation process of the Chief Executive Officer. |

(d) |

|

communication policies for the corporation, which policies should (i) address how the corporation interacts with analysts, investors, other key stakeholders and the public; (ii) contain measures for the corporation to comply with its continuous and timely disclosure obligations and to avoid selective disclosure; and (iii) be reviewed at least annually; and |

|

The Board of Directors has adopted a compliance policy which amongst other matters, contains comprehensive procedures on timely disclosure of material information, procedures on selective disclosure and electronic communications. |

(e) |

|

the integrity of the corporation's internal control and management information systems. |

|

Pursuant to the charters of the Board of Directors and the Audit Committee, the Board and the Audit Committee are responsible for ensuring the integrity of Leitch's internal control and management information systems. The Audit Committee also assists the Board in ensuring compliance with laws and regulations. |

| | | | | |

15

2. |

|

The board of directors of every corporation should be constituted with a majority of individuals who qualify as unrelated directors. If the corporation has a significant shareholder, in addition to a majority of unrelated directors, the board should include a number of directors who do not have interests in or relationships with either the corporation or the significant shareholder and which fairly reflects the investment in the corporation by shareholders other than the significant shareholder. |

|

The Board is currently composed of 8 members, 6 of whom are unrelated directors. |

3. |

|

The application of the definition of "unrelated director" to the circumstances of each individual director should be the responsibility of the board which is required to disclose whether the board has a majority of unrelated directors or, in the case of a corporation with a significant shareholder, whether the board is constituted with the appropriate number of directors which are not related to either the corporation or the significant shareholder. The board is also required to disclose the analysis supporting this conclusion, identify which directors are related or unrelated and provide a description of the business, family, direct and indirect shareholding or other relationship between each director and the corporation. |

|

Based on information provided by directors as to their individual circumstances, the Board has determined that 2 Board members are "related" directors, namely, Mr. Kabala and Mr. MacDonald. Mr. Kabala in his capacity as current Interim President and Chief Executive Officer is considered "related" since July 17, 2003. Mr. MacDonald, by virtue of the fact that he was an officer of the Corporation within the last 3 years is considered to be "related". All other directors are considered to be sufficiently independent of management and free of any interest or business relationship that may interfere with their ability to act with a view to the best interest of the Corporation. |

4. |

|

The board of directors of every corporation should appoint a committee of directors composed solely of non-management directors, a majority of whom are unrelated directors, with the responsibility for proposing to the full board new nominees to the board and for assessing directors on an ongoing basis. |

|

The Charter of the Corporate Governance and Nominating Committee includes the mandate to identify individuals qualified to become board members and making recommendations to the full Board for election of director nominees to the Board of Directors. The Nominating Committee is composed solely of unrelated directors. |

5. |

|

Every board of directors should implement a process to be carried out by the nominating committee or other appropriate committee for assessing the effectiveness of the board as a whole, the committees of the board and the contribution of individual directors. |

|

The Board of Directors and the Corporate Governance and Nominating Committee have the responsibility to continuously assess the effectiveness of the Board and its committees and the contribution of individual directors. On a more formal basis, Evaluation and Board Member Evaluation Forms are distributed to, and completed by, all directors annually to assist the Board in its self evaluation process. |

| | | | | |

16

6. |

|

Every corporation, as an integral element of the process for appointing new directors, should provide an orientation and education program for new recruits to the board. In addition, every corporation should provide continuing education for all directors. |

|

While no formal program is in place, when new members of the Board are appointed, such individuals meet with management and other members of the Board to familiarize themselves with the business of the Corporation and their responsibilities as members of the Board. |

7. |

|

Every board of directors should examine its size and composition and undertake, where appropriate, a program to establish a board comprised of members who facilitate effective decision-making. |

|

Assessment of the composition of the Board and its effectiveness is the responsibility of the Corporate Governance and Nominating Committee and the Board. As the Board is presently constituted and sought to be constituted, the skills and backgrounds of the members allow for a diversity of perspectives while the number of members of the Board is small enough to allow for effective deliberation. |

8. |

|

A committee of the board of directors comprised solely of unrelated directors should review the adequacy and form of the compensation of senior management and directors, with such compensation realistically reflecting the responsibilities and risks of such positions. |

|

The Compensation Committee is composed of Messrs. Baker (Chairman), Semkiw and Griffiths, all of whom are unrelated directors. In accordance with its Charter, the Compensation Committee reviews the adequacy and form of compensation of senior management, Board members and committee members. |

9. |

|

Committees of the board of directors should generally be composed solely of non-management directors, a majority of whom are unrelated directors. |

|

All the committees of the Board are comprised exclusively of unrelated directors, other than the Audit Committee which includes Mr. Kabala who as of July 17, 2003 is deemed to be "related" by virtue of his role as Interim President and Chief Executive Officer, following Ms. Craig's resignation from the Company. Prior to that date and for all of fiscal 2003 Mr. Kabala was unrelated. The Audit Committee will be reconstituted following the Annual Meeting, in the ordinary course. |

10. |

|

Every board of directors should expressly assume responsibility for, or assign to a committee of directors the general responsibility for, developing the corporation's approach to governance issues. This committee would, among other things, be responsible for the corporation's response to these governance guidelines. |

|

The Corporate Governance and Nominating Committee is responsible for, among other things, overseeing and making recommendations to the Board in developing the approach to the Corporation's corporate governance issues. In this regard, the Committee has adopted a variety of policies and practices in order to ensure sound corporate governance. |

11. |

|

The board of directors, together with the CEO, should develop position descriptions for the board and for the CEO, including the definition of the limits to management's responsibilities. In addition, the board should approve or develop the corporate objectives that the CEO is responsible for meeting and assess the CEO against these objectives. |

|

Pursuant to its Charter, the Board of Directors is responsible for the approval of corporate objectives and goals applicable to senior management. The scope of management's responsibilities and the objectives that the Chief Executive Officer is expected to attain are discussed annually by the Board and the Chief Executive Officer and such objectives form the basis for the assessment of the Chief Executive Officer every year. |

| | | | | |

17

12. |

|

Every board of directors should implement structures and procedures that ensure that the board can function independently of management. An appropriate structure would be to (i) appoint a chair of the board who is not a member of management with responsibility to oversee that the board discharges its responsibilities or (ii) assign this responsibility to a non-management director, sometimes referred to as the "lead director". The chair or lead director should oversee the board in carrying out its responsibilities effectively which will involve the board meeting on a regular basis without management present and may involve assigning the responsibility for administering the board's relationship to management to a committee of the board. |

|

The Board has formally appointed a Chairman who is independent from management. The Chairman has the responsibility, among other things, to oversee that the Board discharges its responsibilities effectively. The Chairman acts as a liaison between the Board and the Chief Executive Officer and chairs Board meetings. Further, the Chairman ensures that the non-management members of the Board can meet on a regular basis without management being present. |

13. |

|

The audit committee should be composed solely of unrelated directors. All of the members of the audit committee should be financially literate and at least one member should have accounting or related financial experience. Each board shall determine the definition of and criteria for "financial literacy" and "accounting or related financial experience" and such definitions shall form part of the disclosure required under the TSX Proposal.

The audit committee should have direct communication channels with the internal and external auditors to discuss and review specific issues as appropriate. The audit committee duties should include oversight responsibility for management reporting on internal control. While it is management's responsibility to design and implement an effective system of internal control, it is the responsibility of the audit committee to oversee this responsibility. |

|

The Audit Committee is composed solely of unrelated directors, other than in respect of Mr. Stan Kabala from July 17, 2003 when he was appointed interim President and CEO. Since this date Mr. Kabala is deemed to be "related" by virtue of his role as an officer of the Company. Prior to that date and for all of fiscal 2003 Mr. Kabala was unrelated. All the members of the Committee are financially literate. The Board reviews financial literacy on an annual basis. It is expected that the Audit Committee Charter will in fiscal 2004 provide for the enhanced definitions of "financial literacy" and "accounting and related financial expertise" once such definitions are finalized by appropriate regulators.

The Audit Committee meets (with and without management) with the Auditors and discusses with them various aspects of the Committee's responsibilities.

As required by its Charter, the Audit Committee is responsible to ensure the adequacy and effectiveness of the Corporation's internal controls. The Committee approves the Corporation's internal control policy and the Auditors' mandates. The Auditors are directly accountable to the Audit Committee. |

14. |

|

The board of directors should implement a system which enables an individual director to engage an external adviser at the expense of the company in appropriate circumstances. The engagement of the external advisor should be subject to the approval of an appropriate committee of the board. |

|

The Corporate Governance and Nominating Committee pursuant to its Charter may consider and approve any requests from directors or committees of directors for the engagement of special external advisers from time to time. Upon such requests being made, the Corporate Governance and Nominating Committee makes recommendations to the Board as to the appropriate external advisers required and the funds of the Corporation that should be allocated for this purpose. |

18

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

To the knowledge of the directors and officers of the Corporation, no insider of the Corporation or any associate or affiliate of an insider has or had any material interest, direct or indirect, in any transaction since the commencement of the Corporation's last financial year or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

No person who has been a director or an officer of the Corporation nor any proposed nominee at the time since the beginning of the last completed financial year, or any associate of any such director or officer, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting, except as disclosed in this Circular.

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

We were a "foreign private issuer" for purposes of the U.S. securities laws in fiscal 2003. As a result, none of our directors, officers or 10% shareholders was required to make any filings under Section 16(a) of theExchange Act during the year ended April 30, 2003 with respect to our securities.

GENERAL

Information contained herein is given as of August 25, 2003, except as otherwise noted. If any matters which are not now known should properly come before the Meeting, the accompanying form of proxy will be voted on such matters in accordance with the best judgement of the person voting it.

Copies of the Corporation's most current Annual Information Form (together with documents incorporated therein by reference), the 2003 annual report of the Corporation containing the comparative consolidated financial statements of the Corporation for the financial year ended April 30, 2003, together with the report of the auditors thereon, the management's discussion and analysis of the Corporation's financial condition and results of operations for fiscal 2003, the interim financial statements of the Corporation for periods subsequent to the end of the Corporation's last financial year and additional copies of this Circular are available upon written request to the Corporate Secretary, upon payment of a reasonable charge where applicable.

DIRECTORS' APPROVAL

The contents of this Circular and its sending to shareholders of the Corporation have been approved by the directors of the Corporation.

DATED at Toronto this 25th day of August, 2003

19

QuickLinks

SOLICITATION OF PROXIESVOTING OF PROXIESVOTING SHARESPRINCIPAL HOLDERS OF VOTING SECURITIESELECTRONIC ACCESS TO PROXY-RELATED MATERIALS AND ANNUAL AND QUARTERLY REPORTSPARTICULARS OF MATTERS TO BE ACTED ONEXECUTIVE COMPENSATIONSummary Compensation TableOption Grants During Fiscal 2003 to Named Executive OfficersAggregated Option Exercises During Fiscal 2003 by Named Executive Officers and Financial Year-End Values of Options Held by Named Executive OfficersTable of Indebtedness of Directors, Executive Officers and Senior OfficersPERFORMANCE GRAPHCOMPARATIVE PERFORMANCE CHARTMATERIAL TERMS AND CONDITIONSCOMPENSATION OF DIRECTORSDIRECTORS' AND OFFICERS' LIABILITY INSURANCESTATEMENT OF CORPORATE GOVERNANCE PRACTICESINTEREST OF INSIDERS IN MATERIAL TRANSACTIONSCOMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACTGENERALDIRECTORS' APPROVAL