QuickLinks -- Click here to rapidly navigate through this documentExhibit 99.1

2003

ANNUAL INFORMATION FORM

LEITCH TECHNOLOGY CORPORATION

150 FERRAND DRIVE

SUITE 700

TORONTO, ONTARIO

M3C 3E5 | | September 15, 2003 |

TABLE OF CONTENTS

| |

|

|---|

| THE COMPANY | | 1 |

| | GENERAL DEVELOPMENT OF THE BUSINESS | | 1 |

| | | Acquisitions and Discontinued Operations | | 2 |

| THE BUSINESS | | 3 |

| | COMPANY OVERVIEW | | 3 |

| | | Video Processing and Distribution | | 3 |

| | | Video Servers | | 3 |

| | | Post Production | | 3 |

| | TRENDS | | 4 |

| | SALES AND MARKETING STRATEGY | | 4 |

| | PRODUCT LINES | | 5 |

| THE INDUSTRY | | 7 |

| | MARKETS | | 7 |

| GENERAL | | 8 |

| | INTELLECTUAL PROPERTY | | 8 |

| | REGULATORY ENVIRONMENT | | 9 |

| | EMPLOYEES | | 9 |

| | RESEARCH & DEVELOPMENT | | 10 |

| | FOREIGN OPERATIONS | | 10 |

| DIVIDEND POLICY | | 11 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 11 |

| MARKET FOR SECURITIES | | 11 |

| DIRECTORS AND OFFICERS | | 11 |

| ADDITIONAL INFORMATION | | 12 |

LEITCH TECHNOLOGY CORPORATION

THE COMPANY

Leitch Technology Corporation ("LTC", and together with its subsidiaries, "Leitch" or the "Company") was incorporated under theBusiness Corporations Act (Ontario) ("OBCA") by certificate of incorporation dated May 3, 1971 under the name Leitch Video Limited. By articles of amendment effective on April 21, 1994, the name of LTC was changed to Leitch Technology Corporation, the "private company" restrictions were removed, LTC's authorized Class A convertible special shares were cancelled, a new class of Preference Shares issuable in series was authorized, the authorized number of Common Shares was increased to an unlimited number of Common Shares and the 2,239,000 issued Common Shares of LTC were subdivided into 8,956,000 Common Shares. By articles of amendment effective on September 23, 1996, each one of LTC's issued and outstanding Common Shares was subdivided into two Common Shares. LTC's registered office is located at 25 Dyas Road, Toronto, Ontario M3B 1V7 and its head office is located at 150 Ferrand Drive, Suite 700, Toronto, Ontario M3C 3E5. LTC's phone number is (416) 445-9640 and its fax number is (416) 443-3088.

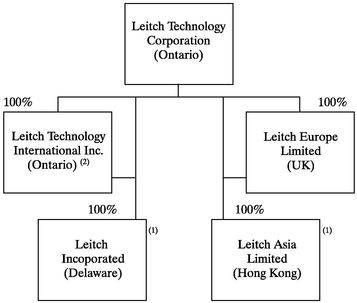

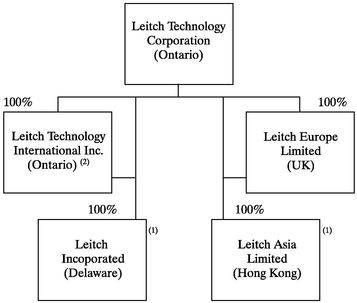

LTC principally conducts its business, directly and indirectly, through four wholly-owned subsidiaries: Leitch Technology International Inc., an Ontario corporation and LTC's Canadian operating subsidiary; Leitch Incorporated, a Delaware corporation and LTC's principal U.S. operating subsidiary; Leitch Europe Limited, a U.K. corporation and LTC's principal European subsidiary; and Leitch Asia Limited, a Hong Kong company and LTC's Asian subsidiary. The chart below outlines Leitch's corporate structure and the jurisdiction of incorporation of LTC and its principal subsidiaries as at April 30, 2003.

- (1)

- Each of Leitch Incorporated and Leitch Asia Limited is directly and indirectly wholly-owned by LTC through an intermediary corporation.

- (2)

- Digital Processing Systems Inc., a Canadian Company LTC acquired in October 2000 (see "THE COMPANY" — General Development of the Business — Acquisitions and Discontinued Operations"), was amalgamated with Leitch Technology International Inc., and thereafter the new company carried forward as Leitch Technology International Inc.

General Development of the Business

Leitch was formed in 1971 in Toronto, Ontario. In June 1994 the Company completed its initial public offering of Common Shares and its listing on the Toronto Stock Exchange (under the symbol "LTV"). An additional offering of Common Shares was completed in June 2000, which resulted in gross proceeds of $52,800,000. In June 2000, the Company's Common Shares began trading on the NASDAQ Stock Market ("NASDAQ") under the symbol "LVID". In July 2003, the Company voluntarily de-listed its Common Shares from NASDAQ effective on the close of business July 22, 2003. In August 2003, the Company completed a further additional offering of Common Shares which resulted in gross proceeds of $20,025,000.

In February 2000, the Company announced its growth strategy aimed at accelerating profitable growth by leveraging its core competencies in video processing in new and expanded markets. However, fiscal 2002 had been

1

challenging for the professional video market. A global economic slowdown that resulted in weaker advertising spending led to a deferral of large capital projects and reduced capital expenditures by the Company's core broadcasting customers. The Company experienced a drop of 9% in revenue during fiscal 2002 compared to the prior year.

Accordingly, during fiscal 2002, the Company announced its revised strategy of refocusing on its core operating segments, Video Processing & Distribution ("VP&D"), Video Servers ("Servers") and Post Production ("Post"). The Company believes that these segments, which target the professional video market, are sizable and have strong growth potential over the next decade. During fiscal 2003, the Company completed a major refresh of its VP&D product line — see "Management's Discussion and Analysis — Business Developments". However, the past year continued to be challenging for the professional video market. The global economic slowdown that began during the Company's 2002 fiscal year continued throughout 2003. This was compounded by other factors including war in Iraq, outbreak of Severe Acute Respiratory Syndrome in Asia, continued uncertainty in South America and a weakening U.S. dollar. As a result of this combination of factors, the Company experienced a further drop of 9% in revenue during its fiscal 2003 compared to the prior year.

On July 17, 2003, the Company's President and Chief Executive Officer ("CEO"), Margaret Craig, announced her resignation from the Company. At that time, the Board of Directors appointed Stan Kabala, a director of the Company since June 1996, as Interim President and CEO. The Board also commenced a search for a permanent CEO. At the time of Mr. Kabala's appointment, the Company announced its short-term strategy to conserve cash while continuing to manage its expenses and balance sheet with a view to returning to profitability. The Company intends to optimize its cost structure and expects to return to profitability independent of an increase in capital spending in the professional video market.

The Company set up its semiconductor business in February 2000 to further develop and market videocentric silicon chips. During fiscal 2002 the Company decided to shut down the North American operations of the semiconductor division and also divested the remaining operations of the semiconductor business, by selling 80.1% of its interest in the operating design facility in Sweden, Silicon Construction AB, maintaining a minority interest of 19.9%. This disposition is not material to the Company. See "Management's Discussion and Analysis — Critical Accounting Policies and Estimates — Discontinued Operations" and Consolidated Financial Statements — Note 3.

In April 2000, the Company acquired approximately 37.7% fully diluted interest in Path 1 Network Technologies Inc. ("Path 1", AMEX: PNO). Path 1 designs and develops software and hardware that allows for broadcast quality video, CD quality audio, telephony and other time-critical data to be transmitted end-to-end over IP Ethernet Networks with guaranteed Quality of Service. The Company's investment in Path 1 is accounted for using the equity method which requires the Company to pick up its pro-rata share of Path 1's net loss. In fiscal 2002, the Company wrote off its remaining investment in Path 1 and recorded non-recurring charges of $25.2 million from its review of the valuation of its equity investment in Path 1. See "Management's Discussion and Analysis — Critical Accounting Policies and Estimates — Investments in Partly Owned Businesses" and Consolidated Financial Statements — Note 5.

In September 2000, the Company acquired a 12.5% interest in Fastvibe Corporation ("Fastvibe"), a private early stage technology company. Fastvibe is a video services provider, currently developing end to end video streaming and content management solutions. In fiscal 2002 the Company wrote off its remaining interest in Fastvibe and recorded a non-recurring charge of $2.6 million from its review of the valuation of its equity investment in Fastvibe. See "Management's Discussion and Analysis — Investments in Partly Owned Businesses" and Consolidated Financial Statements — Note 5.

In October 2000, the Company acquired a 93% interest in Digital Processing Systems, Inc. ("DPS"). In November 2000, Leitch acquired the remaining 7% interest in DPS. On December 1, 2000, DPS was amalgamated with Leitch Technology International, Inc. DPS designs, manufactures and distributes innovative hardware and software products that facilitate the creation, manipulation and dissemination of broadcast quality video and audio content. The aggregate purchase consideration totalled $86.3 million including acquisition costs of $2.4 million. The purchase price of $83.9 million was funded through Leitch's cash resources and the issuance of 1,743,357 common shares valued at $43.9 million.

2

The DPS acquisition has had and will continue to have a significant impact on the financial condition and results of operations of the Company. DPS has an established product line and is well respected in the broadcast industry. The acquisition of DPS enhanced the Company's VP&D product lines and allowed the Company to add Post products. See "THE BUSINESS — Post Production" and Consolidated Financial Statements — Note 4.

As part of the DPS acquisition the Company also acquired a 50% interest in eyeon Software Inc. ("Eyeon"). Eyeon develops compositing and image processing software that is bundled in DPS products as well as sold to third parties.

On February 8, 2002, the Company purchased certain assets and intellectual property of AgileVision. AgileVision has a master control/server product that is targeted at PBS television stations. As part of the acquisition, the Company hired all eight employees from AgileVision. The purchase is not material to the Company.

THE BUSINESS

Company Overview

Leitch designs, develops and distributes high-performance audio and video infrastructure to the professional video industry. Applications for Leitch products span the marketplace and include broadcast, post production, telecommunications, cable, Internet, and business-to-business markets. The Company's strategy is to capitalize on its strong customer position, technical skills, business model and access to capital markets to lead the professional video market. The Company's operating segments are VP&D, Servers and Post.

Leitch designs, manufactures and markets the electronic infrastructure for the professional video market required for quality processing, routing and conversion of all major video signal formats and standards. With over thirty years of experience in this line of business, the Company is a leading presence in the VP&D equipment market. The Company's VP&D products include:

- •

- Interface and conversion systems: NEO™, Genesis™ and 6800+™ modular platforms as well as the "all in one" standalone DPS 575 non-modular solution;

- •

- Production solutions: Opus™ master control and LogoMotion™ II branding;

- •

- Reference products for virtually any synchronization, test and time application;

- •

- Signal distribution and routing: Integrator™ Gold and Panacea™; and

- •

- Network monitoring and control: SuiteView™, Command Control System applications including CCS Navigator™ and CCS Pilot™.

During the past year, the Company completed a major refresh of its VP&D product line and has won significant industry awards for its efforts.

Leitch's Server product line provides high-quality, real-time disk-based solutions for transmission, news, and sports applications. The Company is a leader in storage area networks for the broadcast industry. The product line provides scaleable solutions for the vertical market, accommodates all the current TV formats and provides connectivity over TCP/IP networks. The product line includes hardware infrastructure and software solutions for the transmission and news markets. This includes the ability to ingest, store, browse, edit and playout media. The shared storage environment allows for operational efficiencies and work flow enhancements as the industry transitions from analog to digital TV. Digital TV services for cable and broadcasting are in their infancy. Sales of Server systems, as the core component of digital TV infrastructure, are expected to grow significantly over the next five years.

Following its acquisition of DPS in October 2000, the Company expanded its presence in the area of content creation with a line of hardware and software solutions for editing, special effects, compositing, animation, web video streaming and DVD creation. These products are used by organizations which create video content, including broadcasters, production companies, cable companies, corporations, educational institutions and government entities.

3

The Company has earned recognition for its dpsVelocity™ series of non-linear editing products, most recently for dpsVelocityQ™, which is powered by the Company's advanced dpsQuattrus™ hardware.

Trends

The major trends relevant to the Company's business include broadening of the professional television market to include new delivery mechanisms (direct-to-home satellite, Internet streaming) and new content providers (specialty channels) as well as increasing integration/interoperability across broadcasting products. Reliability requirements and financial pressures are driving customers toward automation, remote control, unmanned operations and highly integrated solutions, all of which create demand for sophisticated hardware and software solutions. Ever-increasing requirements for speed, ease of use, and workflow interoperability in creative tools continue to drive next-generation non-linear editing products. Key technical trends include the ongoing shift from analog to digital technology, the gradual adoption of high definition video technology and the tape-to-disk transition that drives sales of Servers and related software infrastructure. However, the timing for the adoption of these new technologies and processes has been slower than expected and the global economic slowdown over the past three years, particularly with respect to weaker advertising spending, has led to deferral of large capital projects and reduced capital expenditures by broadcast customers.

Sales and Marketing Strategy

The Company currently sells its products in approximately 90 countries through an extensive distribution network. The Company's revenues by geographic regions (as determined by location of customer) are as follows:

Three-Year Revenue Chart

| | Year Ended April 30

|

|---|

| | 2003

| | 2002

| | 2001

|

|---|

| | (all amounts in thousands of Canadian dollars)*

|

|---|

| United States | | $ | 89,874 | | $ | 97,119 | | $ | 101,000 |

| Europe | | $ | 33,034 | | $ | 39,065 | | $ | 60,758 |

| Non-U.S. Americas | | $ | 27,134 | | $ | 32,611 | | $ | 27,815 |

| Pacific Rim | | $ | 29,939 | | $ | 29,447 | | $ | 28,595 |

| | |

| |

| |

|

| Total | | $ | 179,981 | | $ | 198,242 | | $ | 218,168 |

| | |

| |

| |

|

- *

- Effective October 31, 2001, the Company began reflecting the Company's semiconductor segment, SiCon as discontinued operations. The revenue figures with respect to the periods prior to that date have been adjusted to reflect the removal of SiCon's revenues.

For each of the Company's three business segments, the Company's sales strategy is to concentrate on direct sales and sales through dealers and system integrators on a global basis. The Company's principal direct sales offices are in the United States, Canada, the United Kingdom, France and Hong Kong, with representation in other key markets such as China. During July 2003, the Company closed its sales office in Brazil.

To cover its major markets, the Company's internal sales staff includes sales managers, sales engineers and customer service technologists. Additionally, the Company has numerous U.S. and international distributors who are industry experts and are highly familiar with both our equipment and their local customer base. Although distributors in North America and the United Kingdom are non-exclusive, many of the Company's international distributors are independent and have exclusive rights for their markets. In order to reinforce the technical expertise of distributors, particularly in markets outside North America and Europe, Leitch sales engineers are available to carry out on-site training, and many dealers also send staff to the Company's Toronto, Bracknell, Burbank and Hong Kong facilities for further technical training.

The balance between direct sales, sales to OEMs and distributor sales varies significantly within the different markets served by Leitch. For example, Canada and the United Kingdom are strongly oriented toward direct sales; the United States is relatively evenly split between direct and distributor sales; and most other export markets are dominated by distributor sales.

Although the Company's business strategy has evolved over time to reflect the changes and new directions in digital technology and the converging communications industry, management's consistent sales and marketing strategy

4

is to move closer to the end user. The Company attempts to enter the customer's procurement process during the planning stages in order to get Leitch equipment specified in the design, rather than waiting until the final bid stage to quote on products.

The Company believes that it will continue to grow by taking advantage of the migration of video technology from analog to digital and through capitalizing on new market segments. With infrastructure replacement underway as analog television facilities worldwide convert to digital, the Company is broadening the market for its products by adapting them to the needs of cable, telecommunications and video streaming customers. In addition, the Company believes that opportunities still exist for its traditional lines of analog products as some end users will continue to require analog technology to meet their quality/cost needs or to allow them to move incrementally to digital products over a period of time.

There is no one customer in any category of the Company's principal products or services that accounted for greater than 15% of the Company's consolidated revenue in either of the last two completed fiscal years.

Product Lines

Leitch products have applications in most television facilities where they are used in the production of program material (news, sports, entertainment and advertising) and subsequent distribution of these programs to viewers worldwide. Leitch produces over 2,000 products, of which the broad breakdown is shown below by business segment:

| BUSINESS SEGMENT DESCRIPTION | | PRODUCTS |

|

VIDEO PROCESSING AND DISTRIBUTION

Leitch video processing and distribution products provide critical electronic infrastructure for broadcast and post production operations as well as downstream distribution networks. Our products are required for quality processing, routing and conversion of all major signal formats and standards. | |

Extensive portfolio of audio/video products for the professional television industry including:

• Interface and conversion systems: NEO and 6800+ modular platforms and the "all in one", standalone DPS-575 non-modular solution

• Production solutions: Opus master control, LogoMotion Branding, MediaFile clip store and Whiplash2 slow-motion replay system

• Reference products for virtually any sync, test and time application

• Signal distribution and routing with two leading routing platforms, Panacea™ and Integrator™

• Network monitoring and control applications: CCS Pilot™, CCS Navigator, SuiteView and other control and monitoring applications |

|

| | | |

5

VIDEO SERVERS

Leitch video servers provide true shared storage solutions for media content. Solutions are available for transmission, sports and news environments of television broadcast operations. Shared storage systems can be scaled and interconnected to meet a variety of applications and broadcasting business models. The architecture enables interconnection via industry standard infrastructure such as TCP/IP networks. | |

• Transmission Solutions:

• MPEG–2 Transmission Server — NX 4000TXS

• MPEG-2 Integrated Server — NX4000ITS

• ATSC/DVB ASI module — NXIOASI211

• View & Trim Station — NX4100VTS

• News Solutions:

• Non-Linear Editing Platform — NX4465ES NEWSFlash™

• Non-Linear Editing Platform — NX4475ES NEWSFlash FX™

• Proxy Editing System — Browse Cutter

• SAN & Network Products

• Storage — NXS3000

• IP Gateway Server — NX2000GS

• Mirror Server — NX2000MS

• Archive Server — NX2000AS

• Applications

• Ingest Control Manager

• Playlist

• Resource Manager

• Media Management

• Network Monitoring and Control |

|

POST PRODUCTION

Content creation hardware and software solutions for video editing, special effects, compositing, animation, web video streaming and DVD creation. These products are used by broadcasters, production companies, cable companies, corporations, educational institutions, government entities and OEM customers. | |

• Non-linear editing hardware/software bundles and fully integrated turnkey non-linear editing Systems — dpsVelocity & dpsVelocityQ

• Four stream digital disk recorder hardware with 4-channel DVE — dpsQuattrus

• Dual channel digital disk recorder hardware with DVE — dpsReality

• Webstreaming software — dpsNetStreamer |

|

The VP&D segment accounted for approximately 70% of the Company's revenue in fiscal 2003 and 71% in fiscal 2002. The Servers segment accounted for approximately 18% of revenue in fiscal 2003 and fiscal 2002. The Post segment accounted for approximately 12% of revenue in fiscal 2003 and 11% in fiscal 2002.

Manufacturing

The Company manufactures all its products except for a small number of computer-based products, such as disk drive storage devices. Manufacturing is carried out at the company's two strategically positioned plant facilities in Toronto, Canada and Burbank, California. Each plant specializes in the supply and support of certain products and processes. Toronto, Canada, supplies all VP&D and Post products, while Burbank, California, supplies the Server product line.

Two key factors for success for the Company are: (i) the ability to meet its long and short term manufacturing requirements; and (ii) quality and reliability of the components used in its products. Accordingly, the Company is continually improving the procurement process by exploring opportunities offshore, targeting an optimal number of suppliers, optimizing prices for high volume integrated circuits, and extending joint-purchasing by the two plants to all component classes. By diversifying its list of suppliers of components, Leitch significantly minimizes the short-term risk of inventory shortage. In addition, the Company has alternate suppliers for most of its major components and has in certain cases made "lifetime buys" of components for products being phased out which ensure that the Company will reasonably have enough components to satisfy its requirements to service products phased out or being phased out.

6

In addition, the Company conducts a diligent research and selection process in identifying potential third party suppliers of the individual components of its products.

An integral element of the Company's risk management strategy is a dependable global distribution network. With strategic locations in North America, Europe and Asia, Leitch employs a distribution network enabling it to deliver its products to the global marketplace quickly and effectively. To further enhance the Company's sales, marketing and distribution network capabilities the Company implemented an integrated and comprehensive ERP software solution during fiscal 2002.

THE INDUSTRY

Markets

The North American and European markets are the largest and most established, with potential for growth based primarily upon the increasing trend toward digital technology and the convergence of the communications industry. The Asian market has become increasingly more significant with the development of the television and communication industries in the Asian nations. South American markets are smaller but have significant potential for growth based primarily on the development of infrastructure, which may involve either digital or analog technology.

The Company competes in these markets with major international companies, both public and private, as well as with some smaller, local companies in regard to more minor elements of the customer's solution. Leitch's position against these companies varies by product and market resulting in our competitive position being either in the first or second tier of the competitive group usually considered by our customers.

The world market for professional video production equipment comprises five major categories of end users:

Television broadcasters are national and regional television networks such as CBC, CTV and Global in Canada, CBS, NBC, ABC, Fox and PBS in the United States, network affiliates (of which there are approximately 1,500 in North America), cable programmers such as CNN, HBO, Disney and independent stations. International broadcasters also form a significant part of the market including established networks such as the BBC in the U.K. or developing broadcasters such as CCTV in China. Television broadcasters represent the largest market for professional video equipment. Growth in this established market results mainly from the adoption of new technologies and the latest video and audio signal standards, including component digital, composite digital and digital audio. Server storage and transmission technologies are of particular interest to broadcasters to improve workflow, reduce costs and improve their competitiveness in news operations.

Production and post production houses are producers of programming, commercials and other video materials and are the second largest group of purchasers of professional video equipment. The Company estimates that there are over 10,000 production and post production houses in North America, with the major centers located in New York, Chicago, Los Angeles, Toronto, and Orlando. The services of production and post production houses are used by television broadcasters, cable television systems and corporate and institutional video users. These users are highly sensitive to production quality and therefore represent a large target market for digital products.

Corporate and institutional users include business, academic, military, government, health, religious and other organizations, which develop or purchase video programming for various purposes including sales presentations and training films, closed circuit broadcast systems and video conferencing. This is the third largest group of professional video equipment users and the fastest growing market segment. Corporate and institutional users purchase both professional and consumer-quality equipment, including a large volume of audio/visual presentation equipment, with many of these products supplied by the Company. This group is expected to be the main user of multimedia equipment in the future.

7

Cable and satellite television systems redistribute television signals, primarily to residential subscribers. Major cable systems that are customers of the Company include Rogers Cable, Shaw Cable and Videotron. Major satellite companies include Echostar, Direct TV and Bell ExpressVu. Although a very large market for video transmission equipment, cable systems initially used lower quality equipment during their fast growth phase in the 1980s. Although the growth rate of new subscribers has slowed in recent years, the cable television industry is still upgrading its equipment, resulting in demand for higher quality professional equipment such as that produced by the Company. All major cable companies operate their own community television channels and consequently require video production equipment for their broadcast facilities. The increased penetration and diversity of cable services has also created a demand for new programming, which has resulted in increased demand for professional equipment from video production and post production houses. The cable television industry in Canada and the United States is poised for further growth as new technology expands channel capacity, allowing additional specialty channels to be offered. Satellite providers require high quality and reliable transmission and processing equipment to manage their operations. These companies are typically more centralized than cable television systems however, and also carry a vast array of national and local channels. Similar to the cable television market, the satellite television industry has significant growth potential as advances in technology expands the channel capacity of satellite service providers.

Telecommunication common carriers include telephone companies and other transmission service providers such as satellite and microwave systems. This group has increased its use of digital video equipment due to its involvement in cable systems, particularly in the United States. Advances in digital compression and other technologies are making possible video conferencing and other interactive services. Cable and telephone companies are relying more and more extensively on fibre optic technology, creating a substantial market for conversion equipment to translate fibre optic signals to digital and analog signals and vice versa. To meet this demand, the Company has developed fibre optic interfaces for its digital routing switchers and achieved NEBS compliance for its Integrator router. Although capital spending by telecommunications companies has been depressed over the past few years, over time this market will require an increasing amount of professional television equipment.

GENERAL

Intellectual Property

The policy of the Company is to apply for patents, or other appropriate proprietary or statutory protection, when it develops valuable new or improved technology. Leitch believes that the rapid pace of technological change in the broadcast industry makes patent and trade secret protection important, but this protection must be supported by other factors including the ability to attract and retain qualified personnel, new product introductions and frequent product enhancements.

Leitch protects its technology through a combination of patents, copyrights, trade secrets and contractual arrangements. The objective of Leitch's patent strategy is to obtain an exclusive and preferential position in product concept, design features, performance and cost. Leitch seeks to patent key concepts, components, protocols and other inventions that it considers to have commercial value or that will likely give Leitch a technological advantage. Although Leitch applies for patent protection primarily in Canada, the United States and the United Kingdom, the company has filed, and will continue to file, patent applications in other countries where there exists a strategic technological or business reason to do so. To broadly protect Leitch's inventions, the Company has a team of in-house and outside patent attorneys regularly interacting with employees, reviewing invention disclosures and preparing patent applications on a broad array of core technologies and competencies. The Company has also established a program to provide cash incentives to employees who submit invention disclosures which lead to patent applications and issued patents.

The Company's existing portfolio of worldwide patents includes patents covering colour decoding, video standards conversion and motion compensation, and video server network architecture. Leitch's products also contain a number of custom ASICs and FPGAs designed by Leitch's engineering team that embody proprietary circuit designs owned by the Company. Additionally, Leitch's software and firmware, especially the operating systems for its products and the code necessary to remotely operate, monitor and control those products, have been developed through years of research. The Company believes that the proprietary aspects of the ASICs, FPGAs and the software and firmware

8

are not easily discovered or developed, even through attempts at reverse engineering the individual components and/or the binary versions of the code in its products.

It is Leitch's general practice to enter into confidentiality and non-disclosure agreements with its employees, consultants, vendors, contract manufacturers, customers, potential customers and others to attempt to limit access to and distribution of its proprietary rights, and to enter into agreements with employees that include an assignment to the Company of all intellectual property developed in the course of employment. The Company enters into software licensing agreements with its customers, potential customers, and others for use of its software-based intellectual property.

Leitch's intellectual property also takes the form of trademarks, service marks, and trade names. The Company's trademark and trade name, Leitch, is a valuable asset. The Company has registered the Leitch trademark in Canada, the United States, the United Kingdom, and China, and registrations are pending in other countries around the world, including Japan and India. Over thirty other trademarks are used by Leitch to distinguish its products and services from those of competitors, and the Company regularly seeks to obtain registrations to protect those marks and the goodwill associated with them. Other noted trademarks registered by the company or for which applications are pending include Digibus, Digital Glue, XPlus, Virtual Recorder, Integrator, NEO, MediaFile and Logomotion. Although the Company applies for registrations primarily in Canada, the United States, and Europe, the Company has filed, and will continue to file, applications for registration in other countries for marks which increase in value or which are in danger of being infringed.

Regulatory Environment

The Company's target markets are regulated by the FCC in the United States and by the CRTC in Canada. Western European countries have similar regulatory bodies. These agencies set policies governing the content and transmission of television broadcasting.

The Company's designs are subject to standards set by industry groups such as the SMPTE (Society of Motion Pictures and Engineers), ATSC (Advanced Television Systems Committee), EBU (European Broadcast Union) and AES (Audio Engineering Society). While not legally binding, these standards are generally accepted by the industry and are followed as a matter of practice.

Although the Company's products are not normally designed for general consumer use, the Company has taken the extra step of securing Underwriters Laboratories Inc. ("UL"), Canadian Standards Association and Conformitée Européenee approval for most products. Management considers this to be advantageous as certain local governments, such as the City of Los Angeles, have begun requiring UL approval on all equipment purchased.

The Company's operations are subject to a variety of federal, provincial and local environmental laws and regulations. Such laws and regulations relate to, among other things, the discharge of contaminants into water and air and onto land, the disposal of waste, and the handing, storage and transportation of hazardous materials. The Company uses a limited amount of hazardous materials in its operations and management believes that the Company has conducted and is conducting its business in compliance with all applicable environmental laws in all material respects. As such, the financial or operational effect of such environmental protection requirements on capital expenditures, earnings and comparative positions of Leitch for the current fiscal year and the expected impact on future years is not material.

Employees

As at April 30, 2003 the Company had 801 full-time employees, engaged in the following areas:

AREA OF EMPLOYMENT

| | NUMBER OF EMPLOYEES

|

|---|

| Research and Development | | 212 |

| Manufacturing (including customer service) | | 344 |

| Sales and Marketing | | 155 |

| Management & Administration | | 90 |

The Company believes that its ability to attract and retain highly skilled engineering, marketing and management personnel is one of the factors in the success of the Company. Employee turnover is low. Management believes relations and morale are excellent. The Company encourages employee involvement and recognizes both

9

performance and length of service. None of the Company's employees are governed by collective agreements. Leitch has never experienced a labour disruption in its history.

Research & Development

A critical success factor for Leitch to date has been its innovative engineering skill and complementary software expertise. Leitch believes that its commitment to research and development (having spent $36.8 million (gross expenses) for the fiscal year ended April 30, 2003), high quality manufacturing standards and the development of long-term relationships with customers have earned the Company a worldwide reputation for excellence in innovation, quality and reliability.

Foreign Operations

The Company currently has operations in Canada, the United States of America, the United Kingdom, France, and Hong Kong. During July 2003, the Company closed its office in Brazil.

International operations are necessarily subject to differing economic risks and opportunities. The Company's production costs are affected by conditions prevailing in the various locations. The Company is also exposed to currency exchange risks and opportunities, which may affect the Company's consolidated financial reporting negatively or positively as a result of the translation of foreign financial results into Canadian dollars. The Company believes that international diversification has reduced its overall economic business risk.

SELECTED CONSOLIDATED FINANCIAL DATA

The following three tables sets forth selected consolidated financial data of the Company for the fiscal years ended April 30, 2001 to April 30, 2003, inclusive. In fiscal 2001, the Company completed the significant acquisition of DPS. The results for DPS have been included with the results of the Company from the date of acquisition, October 12, 2000. Effective October 31, 2001, the Company began reflecting the Company's semiconductor segment, SiCon, as discontinued operations. The revenue figures with respect to the periods prior to that date have been adjusted to reflect the removal of SiCon's revenues. For a detailed review of the Company's financial results, please see the Consolidated Financial Statements for the Company's fiscal year ended April 30, 2003.

Revenue and Earnings (in thousands of dollars)

| | 2003

| | 2002

| | 2001

|

|---|

| Revenue | | 179,981 | | 198,242 | | 218,168 |

| Net Earnings (Loss) from Continuing Operations | | (98,496 | ) | (37,226 | ) | 4,796 |

| Net Earnings (Loss) | | (98,496 | ) | (44,672 | ) | 2,318 |

Earnings Per Share

| | 2003

| | 2002

| | 2001

|

|---|

| Earnings (loss) per share from continuing operations — basic | | $ | (3.31 | ) | $ | (1.25 | ) | $ | 0.17 |

| Earnings (loss) per share from continuing operations — diluted | | $ | (3.31 | ) | $ | (1.25 | ) | $ | 0.17 |

| Earnings (loss) per share — basic | | $ | (3.31 | ) | $ | (1.50 | ) | $ | 0.08 |

| Earnings (loss) per share — diluted | | $ | (3.31 | ) | $ | (1.50 | ) | $ | 0.08 |

Balance Sheet (in thousands of dollars)

| | 2003

| | 2002

| | 2001

|

|---|

| Total Assets | | 187,466 | | 308,258 | | 345,620 |

| Long-term Debt | | NIL | | NIL | | NIL |

| Shareholders' Equity | | 157,183 | | 261,000 | | 302,414 |

| | |

| |

| |

|

10

DIVIDEND POLICY

The Company retains earnings to finance the development of its business and, accordingly, does not anticipate paying dividends on its Common Shares in the foreseeable future.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Please refer to pages 4 to 21, inclusive, of the 2003 Annual Report of the Company.

MARKET FOR SECURITIES

The Common Shares of the Company are listed and posted for trading on the Toronto Stock Exchange under the symbol "LTV". The Company voluntarily de-listed its Common Shares from NASDAQ effective on the close of business July 22, 2003.

DIRECTORS AND OFFICERS

The names and municipalities of residence of all directors and officers of the Company as at the date hereof, the offices presently held, the principal occupations during the last five years and the year each director first became a director are set out below. The Articles of the Company provide for a minimum of three and a maximum of 20 directors. Directors of the Company are elected at each annual meeting of shareholders and hold office until the next annual meeting of shareholders or until their successors are elected or appointed. On July 17, 2003, the Company's President and CEO, Margaret Craig, announced her resignation from the Company. At that time, the Board of Directors appointed Stan Kabala, a director of the Company since June 1996, as Interim President and CEO. The Board also commenced a search for a permanent CEO. The Company is required to have an Audit Committee and also have a Compensation Committee and Corporate Governance & Nominating Committee. For greater information about the structure of the Board and its committees, including corporate governance matters, please see the Company's 2003 Management Information Circular dated August 25, 2003.

DIRECTORS

Name and Municipality of Residence

| | Director Since

| | Principal Occupation

|

|---|

WILLIAM F. BAKER(1)(2)

Riverside, CT, USA | | July 6, 1993 | | President, WNET-Thirteen, New York (Television Station) |

DAVID A. CHAIKOF(3)

Toronto, ON, Canada |

|

February 23, 1999 |

|

Chairman of the Board, LTC and Partner, Torys LLP

(Barristers and Solicitors) |

ALBERT GNAT(1)(3)(4)

Caledon, ON, Canada |

|

April 21, 1994 |

|

Partner, Lang Michener (Barristers and Solicitors) |

ANTHONY GRIFFITHS(1)(2)(3)(5)

Toronto, ON, Canada |

|

November 29, 1994 |

|

Independent Consultant & Corporate Director |

GILLES HURTUBISE(3)

Beaconsfield, QUE, Canada |

|

June 27, 1995 |

|

Broadcasting Consultant |

STANLEY J. KABALA(1)(6)

Naples, FL, USA |

|

June 18, 1996 |

|

Interim President & CEO, LTC |

JOHN A. MACDONALD(7)

Ottawa, ON, Canada |

|

November 1, 1999 |

|

President and Chief Operating Officer, Allstream Inc. & Corporate Director |

BRIAN SEMKIW(2)

Oakville, ON, Canada |

|

April 21, 1994 |

|

Chief Executive Officer, Rand Worldwide (Technology Reseller) |

Notes:

- (1)

- Denotes members of the Company's Audit Committee.

- (2)

- Denotes members of the Company's Compensation Committee.

11

- (3)

- Denotes members of the Corporate Governance & Nominating Committee

- (4)

- Mr. Gnat is a director of Slater Steel Inc. which filed for protection under theCompanies' Creditors Arrangement Act (Canada) ("CCAA") on June 2, 2003.

- (5)

- Mr. Griffiths is a director of Brazilian Resources Inc. which was subject to insider cease trade orders issued by the Ontario Securities Commission in May 2001 and June 2003 due to the late filing of financial statements. All required documents were filed by Brazilian Resources Inc. and the cease trade orders were rescinded. Mr. Griffiths was formerly a director of Consumers Packaging Inc. while it operated under the protection of the CCAA. During the protection period, cease trade orders were issued against management and insiders due to the failure to file financial statements. Mr. Griffiths was also a director of Confederation Life Insurance Company at the time it was placed into liquidation and a director of Peoples Jewellers Limited at the time a receiver manager was appointed. Mr. Griffiths is also currently a director of Slater Steel Inc. which filed for protection under the CCAA on June 2, 2003.

- (6)

- Mr. Kabala was the Chairman of the board of directors of eLOT, Inc until 2002, during which time eLOT, Inc. filed a voluntary petition under Chapter 11 of the United States Bankruptcy Code on October 15, 2001.

- (7)

- Mr. MacDonald became the President and Chief Operating Officer of Allstream Inc. on November 27, 2002, following its filing for protection under the CCAA on October 15, 2002.

EXECUTIVE OFFICERS

Name and Municipality of Residence

| | Title:

|

|---|

Stanley J. Kabala

Naples, FL, USA | | Interim President and Chief Executive Officer |

Reg J. Tiessen

Markham, ON, Canada |

|

Chief Financial Officer |

Salil Munjal

Toronto, ON, Canada |

|

Chief Operating Officer |

Each of the directors and officers of the Company has held his/her present principal occupation noted above, or other positions with the same organization, for the past five years, except as set out below.

- •

- Mr. Kabala has been Interim President and CEO of Leitch since July 17, 2003, a director of Leitch since June 18, 1996 and also serves on the boards of a number of public and private entities. From 1998 to 2000, Mr. Kabala was Chairman, President and Chief Executive Officer of eLOT, Inc. (retiring as President and CEO, but continuing as Chairman until 2002) and prior to that was President and CEO of Rogers Cantel Inc. (now Rogers Wireless Communications Inc.) and Unitel Communications Inc.

- •

- Mr. Munjal joined Leitch in June 2000 as Vice President, Corporate Development & General Counsel. In July 2003, Mr. Munjal was appointed to the position of Chief Operating Officer of Leitch. Prior to joining Leitch, Mr. Munjal practised corporate law with Torys from 1994 to 2000.

Directors and senior officers of the Company, as a group, beneficially own, directly or indirectly, 0.21% of the currently outstanding Common Shares of the Company.

ADDITIONAL INFORMATION

The Company shall provide to any person, upon request to the Secretary of the Company, the following documents:

- (a)

- when the securities of the Company are in the course of a distribution pursuant to a short form prospectus, or a preliminary short form prospectus has been filed in respect of a distribution of its securities,

- (i)

- one copy of this annual information form ("AIF"), together with one copy of any document, or the pertinent pages of any document, incorporated by reference in this AIF,

- (ii)

- one copy of the Company's consolidated financial statements for its financial year ended April 30, 2003, together with the accompanying report of the auditors, and one copy of the Company's interim financial statements subsequent to the said year end statements,

- (iii)

- one copy of the Company's information circular in respect of its most recent annual meeting of shareholders, and

12

- (iv)

- one copy of any other document that is incorporated by reference into the preliminary short from prospectus, or the short form prospectus, and is not required to be provided under (i) to (iii) above; or

- (b)

- at any other time, one copy of any of the documents referred to in (a) (i), (ii) and (iii) above, provided that the Company may require the payment of a reasonable charge if the request is made by a person who is not a security holder of the Company.

Additional information concerning the Company, including directors' and officers' remuneration and indebtedness, principal holders of securities, options to purchase securities and interests of insiders in material transactions, is, where applicable, contained in the Company's information circular for its most recent annual meeting of shareholders. Additional financial information is provided in the Company's consolidated financial statements for its fiscal year ended April 30, 2003.

Unless otherwise stated, the information contained herein is as at September 15, 2003.

13

QuickLinks

2003 ANNUAL INFORMATION FORMTABLE OF CONTENTSLEITCH TECHNOLOGY CORPORATIONTHE COMPANYTHE BUSINESSThree-Year Revenue ChartTHE INDUSTRYGENERALSELECTED CONSOLIDATED FINANCIAL DATADIVIDEND POLICYMANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONSMARKET FOR SECURITIESDIRECTORS AND OFFICERSADDITIONAL INFORMATION