QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to ss. 240.14a-11(c) or ss. 240.14a-12

|

Avistar Communications Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 1-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 2, 2004

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders ("Annual Meeting") of Avistar Communications Corporation (the "Company" or "Avistar"), a Delaware corporation, will be held on June 2, 2004 at 1:00 p.m. Pacific Daylight Time, at 555 Twin Dolphin Drive, Suite 360, Redwood Shores, CA 94065, for the following purposes:

1. To elect seven (7) directors to serve until the next Annual Meeting of Stockholders or until their successors are duly elected and qualified.

2. To ratify the appointment of KPMG LLP as independent auditors of the Company for the fiscal year ending December 31, 2004.

3. To transact such other business as may properly come before the Annual Meeting including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on April 5, 2004 are entitled to notice of and to vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed Proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if he or she has returned a Proxy.

| | | Sincerely, |

|

|

/s/ GERALD J. BURNETT |

|

|

Gerald J. Burnett

Chairman of the Board and

Chief Executive Officer |

Redwood Shores, California

April 23, 2004 |

|

|

YOUR VOTE IS IMPORTANT |

IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE.

|

2

AVISTAR COMMUNICATIONS CORPORATION

PROXY STATEMENT FOR 2004

ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of Avistar Communications Corporation (the "Company"), for use at the Annual Meeting of Stockholders (the "Annual Meeting") to be held Wednesday, June 2, 2004 at 1:00 p.m. Pacific Daylight Time, or at any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company's principal executive offices located at 555 Twin Dolphin Drive, Suite 360, Redwood Shores, California, 94065. The Company's telephone number at this location is (650) 610-2900.

These proxy solicitation materials and the Company's Annual Report on Form 10-K for the year ended December 31, 2003, including financial statements, were first mailed on or about April 23, 2004 to stockholders entitled to vote at the meeting.

Record Date

Stockholders of record at the close of business on April 5, 2004 (the "Record Date") are entitled to notice of and to vote at the meeting. The Company has one series of common shares outstanding, designated Common Stock, $.001 par value. On the Record Date, 33,277,038 shares of the Company's Common Stock were issued and outstanding and held of record by 70 stockholders. The Company is authorized to issue 10,000,000 shares of Preferred Stock and no such shares were issued or outstanding as of the Record Date.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date or by attending the meeting and voting in person. Deliveries to the Company should be addressed to William L. Campbell, Corporate Secretary, 555 Twin Dolphin Drive, Suite 360, Redwood Shores, California 94065.

Voting

Each share of Common Stock outstanding on the Record Date is entitled to one vote. Every stockholder voting for the election of directors (Proposal One) may cumulate such stockholder's votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares such stockholder is entitled to vote, or distribute such stockholder's votes on the same principle among as many candidates as the stockholder may select, provided that votes cannot be cast for more than seven candidates. No stockholder shall be entitled to cumulate votes unless the candidate's name has been placed in nomination prior to the voting and the stockholder, or any other stockholder, has given notice at the meeting, prior to the voting, of such stockholder's intention to cumulate the stockholder's votes. On all other matters, each share of Common Stock has one vote.

3

Solicitation of Proxies

This solicitation of proxies is made by the Company, and all related costs will be borne by the Company. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies also may be solicited by certain of the Company's directors, officers and other employees, without additional compensation, personally or by other means.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections (the "Inspector") who shall be a representative of the Company's Transfer Agent. The Inspector will determine whether or not a quorum is present. In general, Delaware law also provides that to have a quorum a majority of shares entitled to vote must be present or represented by proxy at the meeting. Except in certain specific circumstances, the affirmative vote of a majority of shares present in person or represented by proxy if a quorum is present is required under Delaware law for approval of proposals presented to stockholders.

The Inspector will treat shares that are voted "WITHHELD" or "ABSTAIN" as being present and entitled to vote for purposes of determining the presence of a quorum. Such shares will not be treated as votes in favor of approving any matter submitted to the stockholders for a vote. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted (i) for the election of the nominees for the Board of Directors set forth herein; (ii) for the ratification of KPMG LLP to serve as independent auditors of the Company for the fiscal year ending December 31, 2004; and (iii) at the discretion of the proxy holders, upon such other business as may properly come before the Annual Meeting or any adjournment thereof.

If a broker indicates on the enclosed proxy or its substitute that such broker does not have discretionary authority as to certain shares to vote on a particular matter ("Broker Non-Votes"), those shares will not be considered as present and will not be voted with respect to that matter.

Deadline for Receipt of Stockholder Proposals for 2005 Annual Meeting

Stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of the proxy rules established by the Securities and Exchange Commission. Proposals of stockholders of the Company that are intended to be presented by such stockholders at the Company's 2005 Annual Meeting of Stockholders must be received by the Company no later than December 22, 2004 in order that they may be considered for inclusion in the proxy statement and form of proxy relating to that meeting unless the date of the meeting is delayed by more than 30 days from June 2, 2005.

If a stockholder intends to submit a proposal at the Company's 2005 Annual Meeting, which is not eligible for inclusion in the proxy statement relating to that meeting, the stockholder must give the Company notice no later than March 6, 2005 in accordance with the requirements set forth in the Securities Exchange Act of 1934, as amended. If such a stockholder fails to comply with the foregoing notice provision, the proxy holders will be allowed to use their discretionary authority when and if the proposal is raised at the Company's 2005 Annual Meeting.

The attached proxy card grants the proxy holders discretionary authority to vote on any matter raised at the 2004 Annual Meeting. As of April 5, 2004, the Company had not received any requests to present matters at the June 2, 2004 Annual Meeting that are not set forth in this Proxy Statement.

4

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding the beneficial ownership of Common Stock of the Company as of April 5, 2004 as to (i) each person or entity who is known by the Company to own beneficially more than 5% of the outstanding shares of Common Stock; (ii) each director of the Company; (iii) each of the Named Executive Officers (as defined below under "Executive Compensation and Other Matters—Executive Compensation—Summary Compensation Table") and (iv) all directors and executive officers of the Company as a group. Except as otherwise noted, the stockholders named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to applicable community property laws. Except as otherwise noted, the address of each person listed on the table is c/o Avistar Communications Corporation, 555 Twin Dolphin Drive, Suite 360, Redwood Shores, CA 94065.

Beneficial Owner

| | Common Stock

Beneficially

Owned(1)

| | Percentage of

Common Stock

Beneficially

Owned(1)

| |

|---|

| Dr. Gerald J. Burnett(2) | | 14,984,375 | | 45.0 | % |

| R. Stephen Heinrichs(3) | | 5,378,933 | | 16.2 | % |

| Fuller & Thaler Asset Management, Inc.(4) | | 3,559,100 | | 10.7 | % |

| William L. Campbell(5) | | 1,533,886 | | 4.6 | % |

| Dr. J. Chris Lauwers(6) | | 627,982 | | 1.9 | % |

| Robert J. Habig(7) | | 322,499 | | * | |

| R. Jan Afridi(8) | | 183,480 | | * | |

| David M. Solo(9) | | 164,250 | | * | |

| Dr. Robert M. Metcalfe(10) | | 119,800 | | * | |

| Robert P. Latta, Esq.(11) | | 63,000 | | * | |

| All directors and current executive officers as a group (10 persons)(12) | | 23,699,042 | | 71.2 | % |

- *

- Less than 1%

- (1)

- Applicable percentage ownership is based on 33,277,038 shares of Common Stock outstanding as of April 5, 2004, together with applicable options or warrants for such stockholder. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, based on factors including voting and investment power with respect to shares subject to the applicable community property laws. Shares of Common Stock subject to options or warrants currently exercisable or exercisable within 60 days after April 5, 2004 are deemed outstanding for computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage of any other person.

- (2)

- The shares are held by Dr. Burnett as a co-trustee of a marital trust, as to which he has sole voting and investing power, except that Dr. Burnett has agreed to vote and hold 1,602,847 of such shares in accordance with certain restrictions on voting and transfer as described in the Schedule 13D/A filed by Dr. Burnett on October 28, 2003.

- (3)

- 5,020,952 shares are held by Heinrichs Revocable Trust, of which Mr. Heinrichs serves as a co-trustee and as to which he has sole voting and investing power. 113,451 shares are held indirectly by Mr. Heinrichs through Fairview Investment Corporation, over which Mr. Heinrichs has sole voting and investment power. Also included above are 244,350 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (4)

- Based solely on Schedule 13G filings and information provided to the Company by Fuller & Thaler Asset Management, Inc. ("FTAM"), the shares reported above are held by FTAM as an

5

investment adviser and such shares include 2,734,100 shares of Avistar common stock beneficially owned by Fuller & Thaler Behavioral Finance Fund, Ltd.

- (5)

- The shares are held by Mr. Campbell as co-trustee of a marital trust, as to which he has sole voting and investing power. Also included above are 585,624 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (6)

- Dr. Lauwers' shares include 366,250 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (7)

- Mr. Habig's shares include 322,499 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (8)

- Mr. Afridi's shares include 170,000 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (9)

- Mr. Solo's shares include 64,250 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (10)

- Dr. Metcalfe's shares include 56,000 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (11)

- Mr. Latta's shares include 53,000 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

- (12)

- Includes 2,169,028 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 5, 2004.

6

PROPOSAL ONE

ELECTION OF DIRECTORS

A Board of seven directors is to be elected at the Annual Meeting of Stockholders. The nominees for directors to be elected at the Annual Meeting are Gerald J. Burnett, William L. Campbell, R. Stephen Heinrichs, Robert P. Latta, Robert M. Metcalfe, David M. Solo and James W. Zeigon. These seven nominees were approved by the Nominating Committee of the Board of Directors. If elected, each nominee will serve for a one-year term and until his successor is elected and qualified or until his earlier resignation or removal.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company's nominees named in this proxy statement, who, with the exception of James Zeigon, are presently directors of the Company. In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. The Company is not aware that any nominee will be unable or will decline to serve as a director. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of as many of the nominees listed below as possible, and, in such event, the specific nominee to be voted for will be determined by the proxy holders.

Vote Required

If a quorum is present and voting, the nominees receiving the highest number of votes will be elected to the Board of Directors. Abstentions and Broker Non-Votes are not counted in the election of directors.

Information Concerning the Nominees and Incumbent Directors

The following table sets forth the name and age of each director of the Company and each nominee as of April 5, 2004, the principal occupation of each, and the period, if any, during which each has served as a director of the Company. If elected to the Board, this will be Mr. Zeigon's first term as a director of the Company.

Nominees for Director:

Name

| | Principal Occupation

| | Age

| | Director

Since

|

|---|

| Gerald J. Burnett | | Gerald J. Burnett is one of our founders and has been Chairman of our Board of Directors and our Chief Executive Officer since March 2000. He served as Chief Executive Officer of Avistar Systems from December 1998 until March of 2000. From 1993 to 1997, he was a director of Avistar Systems or a principal of its predecessor limited partnership. He is a member of the Corporation (Board of Trustees) of the Massachusetts Institute of Technology. Dr. Burnett holds a B.S. and an M.S. from the Massachusetts Institute of Technology in electrical engineering and computer science and a Ph.D. from Princeton University in computer science and communications. | | 61 | | 1997 |

| | | | | | | |

7

William L. Campbell |

|

William L. Campbell is one of our founders and has been a member of our Board of Directors and our Executive Vice President since March 2000. He has been our Corporate Secretary since June 2001 and served as our interim Chief Financial Officer from April 2001 to May 2001. He has been President and Chief Executive Officer of Collaboration Properties, Inc. (CPI) since December 1997. Mr. Campbell holds a B.S. in general engineering from the U.S. Military Academy and an M.S. in management from the Sloan School of the Massachusetts Institute of Technology. |

|

56 |

|

1997 |

R. Stephen Heinrichs |

|

R. Stephen Heinrichs is a founder of the Company and has served as a member of the Board of Directors of the Company since March 2000. Until his retirement in April 2001, he was Chief Financial Officer and Corporate Secretary of the Company and its subsidiaries. Mr. Heinrichs served as a strategic advisor to the Company from May 2001 to May 2003. Mr. Heinrichs is a member of the board of directors of Artisan Components, Inc., a provider of intellectual property components for the design and manufacture of integrated circuits. Mr. Heinrichs holds a B.S. in accounting from California State University in Fresno. He is a Certified Public Accountant. |

|

57 |

|

1997 |

Robert P. Latta |

|

Robert P. Latta has served as a member of the Board of Directors of the Company since February 2001. Mr. Latta is a member of the law firm Wilson Sonsini Goodrich & Rosati, Professional Corporation ("WSGR"). Mr. Latta joined WSGR in 1979 and has been a partner since 1984. Mr. Latta and WSGR have represented the Company and its predecessors as corporate counsel since 1997. Mr. Latta is a member of the board of directors of Artisan Components and Bridge Bank, N.A., a full-service business bank. Mr. Latta holds B.A. degrees in Economics and Psychology and a J.D from Stanford University. |

|

50 |

|

2001 |

| | | | | | | |

8

Robert M. Metcalfe |

|

Robert M. Metcalfe has served as a member of the Board of Directors of the Company since November 2000. Dr. Metcalfe has been a general partner of Polaris Venture Partners since January 2001. Dr. Metcalfe has served as Vice President of Technology for International Data Group ("IDG"), a publisher of technology, consumer and general how-to books from 1993 to 2001, and has served as a member of the board of directors of IDG since 1992. Dr. Metcalfe founded 3Com Corporation, a provider of networking products and solutions, in 1979, and served in various capacities including Chief Executive Officer, President and Chairman of the Board until 1990. Dr. Metcalfe is a member of the board of directors of the Massachusetts Institute of Technology (MIT). Dr.Metcalfe holds Bachelor degrees in electrical engineering and business management from the Massachusetts Institute of Technology, a M.S. degree in applied mathematics from Harvard University and a Ph.D. in computer science from Harvard University. Dr. Metcalfe is a recipient of the IEEE Medal of Honor and is a member of the National Academy of Engineering. |

|

58 |

|

2000 |

David M. Solo |

|

David M. Solo has served as a member of the Company's Board of Directors since March 2000. Mr. Solo has been a strategic advisor to several companies, including UBS AG since 2000. From 1998 through 1999, he was a member of the UBS Executive Committee. Mr. Solo served as SBC Warburg Chief Operating Officer and Deputy Chief Executive Officer with responsibilities including Logistics and Technology from 1996 to 1998. From 1992 to 1996 he was the Head of Fixed Income & Rate Derivatives Division of SBC Warburg and its predecessor SBC. Mr. Solo holds a B.S. and an M.S. in electrical engineering and computer science from the Massachusetts Institute of Technology. |

|

39 |

|

2000 |

James. W. Zeigon |

|

James W. Zeigon has not previously served as a member of the Board of Directors of the Company. Mr. Zeigon currently serves as a strategic consultant to global financial and operating service businesses. From April 2000 until April 2002, Mr. Zeigon served as Managing Director and Chief Executive Officer of Global Institutional Services for Deutsche Bank AG. During the same period, Mr. Zeigon also served as Vice Chairman of the Global Transaction Bank and as co-President of Bankers Trust Corporation, both subsidiaries of Deutsche Bank AG. Prior to that, Mr. Zeigon held several senior executive positions with The Chase Manhattan Corporation, and served as Senior Managing Director for Chase Global Services from 1997 to 1999. Mr. Zeigon served on the Board of the Depository Trust Corporation (DTC) until April of 2003. Mr. Zeigon holds a BBA from Hofstra University and an MBA from Adelphi University. |

|

56 |

|

|

9

Board of Directors Meetings and Committees

The Board of Directors of the Company held seven meetings during 2003 and acted by unanimous written consent three times in 2003. Each director attended, either in person, by teleconference or by video conference, greater than 75% of the meetings held during the period he sat on the Board of Directors and the committees thereof, if any. The Board of Directors has determined that each of Mr. Zeigon and its current directors standing for re-election, except Dr. Burnett, Mr. Campbell and Mr. Heinrichs, is an independent director within the meaning of NASDAQ Marketplace Rule 4200(a)(15), as currently in effect. The Board of Directors has an Audit Committee, a Compensation Committee, a Stock Option Committee and a Nominating Committee.

Audit Committee

The Audit Committee currently consists of Messrs. Solo, Metcalfe and Latta. The Audit Committee oversees the accounting, financial reporting and audit processes; makes recommendations to the Board of Directors regarding the selection of independent auditors; reviews the results and scope of audit and other services provided by the independent auditors; reviews the accounting principles and auditing practices and procedures to be used in preparing our financial statements; and reviews our internal controls. The Audit Committee works closely with management and our independent auditors. The Audit Committee also meets with our independent auditors in an executive session, without the presence of our management, on a quarterly basis, following completion of their quarterly reviews and annual audit and prior to our earnings announcements, to review the results of their work. The Audit Committee also meets with our independent auditors to approve the annual scope of the audit services to be performed.

Following the annual meeting and subject to the election of the nominees named in this Proxy Statement, the Audit Committee is expected to consist of Messrs. Solo, Metcalfe and Zeigon. The Board has determined that the proposed members of the Audit Committee are independent, as independence is defined in NASDAQ Marketplace Rule 4200(a)(15) and Rule 10A-3(b)(2) of the Securities Exchange Act of 1934, as amended. The Board of Directors has further determined that Mr. Solo is an "audit committee financial expert" as defined in Item 401(h) of Regulation S-K promulgated by the SEC. The Audit Committee met four (4) times during the 2003. The Audit Committee Report is included in this Proxy Statement.

Compensation Committee

The Compensation Committee, which currently consists of Messrs. Solo, Metcalfe and Latta, is responsible for reviewing salaries, incentives and other forms of compensation for directors and executive officers, and for other employees of the Company as requested by the Board of Directors. In addition, the Compensation Committee reviews the various incentive compensation and benefit plans. The Compensation Committee met five (5) times in 2003. The report of the Compensation Committee for 2003 is included in this Proxy Statement.

Stock Option Committee

The Stock Option Committee was formed on April 10, 2001 by resolution of the Board of Directors of the Company and currently consists of Messrs. Burnett and Campbell. The Stock Option Committee is responsible for reviewing and approving stock option grants under the Company's 2000 Stock Option Plan to new employees and consultants and, in some cases, to existing employees as retention/recognition options, all in accordance with specific guidelines and directions established by the Compensation Committee. On a regular basis, all actions of the Stock Option Committee are reported to the Compensation Committee and to the Board of Directors. The Stock Option Committee acted by written consent six times in 2003.

10

Nominating Committee

On March 12, 2004, the Board of Directors of the Company approved the formation of a Nominating Committee of the Board. The Nominating Committee was formed to assist the Board of Directors in meeting applicable governance standards by monitoring the composition of the Board of Directors, and, when appropriate, seeking, screening and recommending for nomination qualified candidates (i) for election to the Company's Board at the Company's Annual Meeting of Stockholders and; (ii) to fill vacancies on the Company's Board. A copy of the Charter of the Nominating Committee of the Board of Directors is attached hereto as Exhibit A. The Nominating Committee currently consists of Messrs. Latta, Solo and Metcalfe, each of whom is independent within the meaning of NASDAQ Marketplace Rule 4200(a)(15).

It is the policy of the Nominating Committee to consider both recommendations and nominations for candidates to the Board of Directors from stockholders holding the Company's securities continuously from the time of nomination to the time of election of the Board of Directors. Stockholder recommendations for candidates to the Board of Directors must be directed in writing to Avistar Communications Corporation, Corporate Secretary, 555 Twin Dolphin Drive, 3rd Floor, Redwood Shores, CA 94065 or by telephone at 650-610-2900, and must include: (i) the candidate's name, age, business address and residence address; (ii) the candidate's principal occupation or employment; (iii) the number of shares of the Company which are beneficially owned by such candidate; (iv) detailed biographical data and qualifications and information regarding any relationships between the candidate and the Company within the current year and each of the prior three years; and (v) any other information relating to such candidate that is, or may in the future be required to be disclosed in solicitations of proxies for elections of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the "1934 Act"). A stockholder's recommendation to the Secretary must also set forth: (i) the name and address, as they appear on the Company's books, of the stockholder making such recommendation; (ii) the class and number of shares of the Company which are beneficially owned by the stockholder and the date such shares were acquired by the stockholder; (iii) any material interest of the stockholder in such nomination; (iv) a description of all arrangements or understandings between the stockholder making such nomination and the candidate and any other person or persons (naming such person or persons) pursuant to which the nomination is made by the stockholder; (v) a statement from the recommending stockholder in support of the candidate, references for the candidate, and an indication of the candidate's willingness to serve, if elected; and (vi) any other information that is or may in the future be required to be provided by the stockholder pursuant to Regulation 14A under the 1934 Act, in his/her capacity as a proponent to a stockholder proposal.

Stockholder nominations to the Board of Directors must meet the requirements set forth in Section 2.2 of the Bylaws of the Company, a copy of which is available upon written request to the Corporate Secretary. In addition, procedures for stockholder direct nomination of directors are discussed above under "Deadline for Receipt of Stockholder Proposals for 2005 Annual Meeting."

The Committee currently uses the following procedures to identify and evaluate the individuals that it selects, or recommends that the Board of Directors select, as director nominees: (i) the Committee reviews the qualifications of any candidates who have been properly recommended or nominated by the stockholders, as well as those candidates who have been identified by management, individual members of the Board of Directors or, if the Committee determines, a search firm, (ii) the Committee considers the suitability of each candidate, including the current members of the Board of Directors, in light of the current size and composition of the Board of Directors, (iii) in evaluating the suitability of the candidates, the Committee considers relevant factors, including, among other things, issues of character, judgment, independence, expertise, diversity of experience, length of service, other commitments and the like, and (iv) after such review and consideration, the Committee selects, or recommends that the Board of Directors select, the slate of director nominees, either at a meeting of

11

the Committee at which a quorum is present or by unanimous written consent of the Committee. Except as may be required by rules promulgated by The NASDAQ Stock Market or the SEC, it is the current sense of the Committee that there are no specific, minimum qualifications that must be met by each candidate for the Board of Directors, nor are there specific qualities or skills that are necessary for one or more of the members of the Board of Directors to possess. These procedures may be modified at any time as may be determined by the Committee.

Mr. James Zeigon, who is standing for election to the Board of Directors for the first time, was recommended to the Nominating Committee by the Company's management.

Communication with the Board of Directors

Stockholders may communicate with the Board of Directors by submitting an email to IR@avistar.com indicating 'Board of Directors' in the subject line, or by writing to us at Avistar Communications, Inc., Attention: Board of Directors, c/o Corporate Secretary, 555 Twin Dolphin Drive, 3rd Floor, Redwood Shores, California 94065. Stockholders who would like their submission directed to a specific member of the Board of Directors may so specify, and the communication will be forwarded, as appropriate.

Annual Meeting Attendance

Although we do not have a formal policy regarding attendance by members of the Board of Directors at our annual meetings of stockholders, directors are encouraged to attend annual meetings of Avistar stockholders. Directors Burnett, Heinrichs and Latta attended the 2003 Annual Meeting of Stockholders of the Company.

Compensation of Directors

The Company's employees do not receive any additional compensation for serving on the Board of Directors or its committees. Non-employee directors receive an annual fee of $10,000. All of the Company's directors may be reimbursed for reasonable travel expenses incurred in attending board meetings.

The Company's 2000 Director Option Plan (the "Director Plan") provides options to purchase Common Stock to non-employee directors of the Company pursuant to an automatic non-discretionary grant mechanism. The exercise price of the options is 100% of the fair market value of the Common Stock on the grant date. The Director Plan currently provides for an initial grant (the "Initial Grant") to a non-employee director of an option to purchase 50,000 shares of Common Stock. Subsequent to the Initial Grant, each non-employee director is granted an option to purchase 25,000 shares of Common Stock (the "Subsequent Grant") at the meeting of the Board of Directors following the Annual Meeting of Stockholders, if on the date of the Annual Meeting, the director has served on the Board of Directors for six months or more. Each non-employee director who is a member of the Audit Committee of the Board of Directors is automatically granted an additional option to purchase Common Stock (a "Subsequent Audit Committee Option") on the date of the next meeting of the Board following the Annual Meeting of Stockholders in each year commencing with the 2003 Annual Meeting of Stockholders provided he or she is then a member of the Audit Committee of the Board of Directors. The Subsequent Audit Committee Option is for 10,000 shares for the Chairman of the Audit Committee and 5,000 shares for each other member of the Audit Committee.

The term of the options granted under the Director Plan is ten years, but the options expire three months following the termination of the optionee's status as a director, or 12 months following the termination, if the termination is due to death or disability. The Initial Grants and the Subsequent Grants become exercisable at a rate of one-fourth of the shares on each anniversary of the grant date. In April 2003, Messrs. Latta, Metcalfe and Solo were each granted an option to purchase 50,000 shares

12

of the Company's Common stock, each at an exercise price of $0.90. These options were granted under the Company's 2000 Stock Option Plan. In July 2003, Messrs. Heinrichs, Latta, Metcalfe and Solo were each granted a Subsequent Grant to purchase 25,000 shares of the Company's Common Stock at an exercise price of $0.77 per share under the Company's Director Plan. Also in July 2003, in consideration for service on the Audit Committee of the Board of Directors, Messrs. Latta and Metcalfe were each granted a Subsequent Audit Committee Option to purchase 5,000 shares at an exercise price of $0.77 per share under the Director Plan, and Mr. Solo, as Chairman of the Audit Committee, was granted an option to purchase 10,000 shares of the Company's Common Stock at $0.77 per share under the Director Plan.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is currently, or has been, at any time since the formation of the Company, an officer or employee of the Company. No member of the Compensation Committee, or executive officer of the Company, serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company's Board of Directors or Compensation Committee.

The Company's Board of Directors unanimously recommends voting "For" the nominees set forth herein.

13

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Board of Directors has selected KPMG LLP, independent accountants, to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2004, and recommends that stockholders vote for ratification of such appointment. The decision of the Board of Directors to appoint KPMG LLP was based on the recommendation of the Audit Committee. Before making its recommendation to the Board of Directors, the Audit Committee carefully considered that firm's qualifications as independent auditors. This included a review of the qualifications of the engagement team, the quality control procedures the firm has established, and any issues raised by the most recent quality control review of the firm; as well as its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee's review also included matters required to be considered under the Securities and Exchange Commission's Rules on Auditor Independence, including the nature and extent of non-audit services, to ensure that they will not impair the independence of the accountants. The Audit Committee expressed its satisfaction with KPMG LLP in all of these respects.

KPMG LLP has audited the Company's financial statements since May 2002 when it replaced Arthur Andersen LLP. Representatives of KPMG LLP are expected to be present at the meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Audit Fees

For fiscal 2003, KPMG LLP billed the Company $130,000 in fees for the audit of its annual financial statements included in its annual report on Form 10-K, and review of the Company's unaudited interim quarterly financial statements included in its quarterly reports on Form 10-Q.

For fiscal 2002, KPMG LLP billed the Company $105,000 in fees for the audit of its annual financial statements included in its annual report on Form 10-K, and review of the Company's unaudited interim quarterly financial statements included in its quarterly reports on Form 10-Q.

Audit Related Fees

For fiscal 2003, KPMG LLP billed the Company $9,000 in audit related fees for KPMG's review of the Company's October 2003 private equity financing. KPMG LLP did not bill the Company for any audit related fees in fiscal 2002.

Tax Fees and All Other Fees

KPMG LLP did not provide, and the Company did not pay KPMG LLP for, any other professional services to the Company in the fiscal year ended 2002 or 2003. The Company did not engage KPMG LLP to provide advice regarding financial information systems design and implementation during fiscal 2002 or 2003.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Accountants

The Audit Committee's policy is to pre-approve all audit and permissible non-audit services provided by the independent accountants subject to limited discretionary authority granted to our chief financial officer. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally detailed as to the particular service or category of services and is generally subject to a specific budget. The independent accountants and management are required to periodically report to the Audit Committee regarding the extent of services provided by the

14

independent accountants in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

The Audit Committee considered whether the services rendered by KPMG LLP were compatible with maintaining KPMG LLP independence as accountants of the Company's financial statements.

Vote Required

Stockholder ratification of the selection of KPMG LLP as the Company's independent accountants is not required by applicable law. However, the Board of Directors is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate governance. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee may, at its discretion, direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the Company's best interests and in the best interests of the Company's stockholders.

If a quorum is present and voting, the affirmative vote of a majority of the shares voting shall be required to ratify the appointment of KPMG LLP. Abstentions and "broker non-votes" are not counted in the ratification of KPMG LLP's appointment.

The Company's Board unanimously recommends a vote "For" the ratification of the appointment of KPMG LLP as independent accountants.

15

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation

Summary Compensation Table

The following Summary Compensation Table sets forth certain information regarding the compensation of the Chief Executive Officer of the Company and the four next most highly compensated executive officers (collectively with the Chief Executive Officer, the "Named Executive Officers") of the Company in 2003 for services rendered in all capacities to the Company for the years indicated.

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

| |

|---|

| |

| | Annual Compensation

| | Number of

Securities

Underlying

Options(#)(2)

| |

| |

|---|

Name and Principal Position

| | Fiscal Year

| | Other

Compensation

$

| |

|---|

| | Salary(1)($)

| | Bonus($)

| |

|---|

Gerald J. Burnett

Chairman of the Board and Chief Executive Officer | | 2003

2002

2001 | | 200,000

200,000

200,000 | | —

—

— | | —

—

— | | —

—

— | |

William L. Campbell(3)

Vice Chairman, Executive Vice President and Corporate Secretary |

|

2003

2002

2001 |

|

200,000

200,000

200,000 |

|

—

—

— |

|

320,000

150,000

150,000 |

|

—

—

4,341 |

(4) |

Robert Habig

Chief Financial Officer |

|

2003

2002

2001 |

|

202,500

202,500

166,611 |

|

—

—

— |

|

100,000

70,000

350,000 |

|

—

—

— |

|

R. Jan Afridi

Vice President, Sales—Financial Services |

|

2003

2002

2001 |

|

166,327

170,171

217,516 |

|

7,000

— |

|

20,000

20,000

40,000 |

|

—

— |

|

J. Chris Lauwers

Chief Technology Officer |

|

2003

2002

2001 |

|

202,500

189,375

183,535 |

|

—

—

— |

|

150,000

70,000

100,000 |

|

—

—

— |

|

- (1)

- Includes annual salary and commissions paid in 2003.

- (2)

- These shares are subject to exercise under stock options granted under the Company's 2000 Stock Option Plan. See "—Option Grants in Last Fiscal Year."

- (3)

- Also serves as Chief Executive Officer and President of Collaboration Properties, Inc.

- (4)

- Reimbursement for medical and/or term life insurance premiums paid by the Company.

16

Option Grants in Last Fiscal Year

The following table provides information relating to stock options awarded to each of the Named Executive Officers during 2003. All such options were awarded under the Company's 2000 Stock Option Plan.

| | Individual Grants(5)

| | Potential Realizable

Value at Assumed

Rates of Stock Price

Appreciation for

Option Term(1)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| |

| |

| |

|

|---|

| | Percent of

Total Options

Granted to

Employees in 2003(%)(4)

| |

| |

|

|---|

Name

| | Exercise Price

Per Share

($)(2)(3)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Gerald J. Burnett | | — | | — | | $ | — | | — | | $ | — | | $ | — |

| William L. Campbell | | 320,000 | | 16.4 | | $ | 0.90 | | 4/23/13 | | $ | 469,122 | | $ | 746,998 |

| Robert J. Habig | | 100,000 | | 5.1 | | $ | 0.90 | | 4/23/13 | | $ | 146,601 | | $ | 233,437 |

| R. Jan Afridi | | 20,000 | | 1.0 | | $ | 0.90 | | 4/23/13 | | $ | 29,320 | | $ | 46,687 |

| J. Chris Lauwers | | 150,000 | | 7.7 | | $ | 0.90 | | 4/23/13 | | $ | 219,901 | | $ | 350,155 |

- (1)

- The potential realizable values are (i) net of exercise price and before taxes, (ii) assume that the option is exercised at the exercise price and is sold on the last day of its term at the appreciated price, and (iii) are based on the assumption that the Common Stock of the Company appreciates at the annual rate shown (compounded annually) from the date of grant to the expiration of the ten year option term (or such shorter option term applicable to an affiliate). These numbers are calculated based on the requirements promulgated by the Securities and Exchange Commission and do not reflect the Company's estimate of future price growth.

- (2)

- Options were granted at an exercise price equal to the fair market value of the Company's Common Stock on the date of grant, as determined by reference to the closing sale price of the Common Stock on The NASDAQ SmallCap Market on the date of the grant, except in the case of executive officers who hold more than 10% of the outstanding voting stock, in which case the exercise price equals 110% of the fair market value on the date of grant.

- (3)

- Payment for shares issued upon exercise of an option may consist of (i) cash, (ii) check, (iii) other shares which (x) in the case of shares acquired upon exercise of an option either have been owned by the optionee for more than six months on the date of surrender, and (y) have a fair market value on the date of surrender equal to the aggregate exercise price of the shares as to which said option shall be exercised, (iv) consideration received under a cashless exercise program implemented by the Company, (v) delivery of a properly executed exercise notice and any other such documents as the Administrator shall require and delivery to the Company of the sale proceeds required to pay the exercise price, or (vii) such other consideration and method of payment for the issuance of shares to the extent permitted under applicable laws.

- (4)

- Based on options to purchase 1,794,500 shares of Common Stock granted to employees in 2003.

- (5)

- 25% of the shares subject to these options vest twelve months after their grant date, and 6.25% of the shares subject to such options vest at the conclusion of each three-month period thereafter provided that the optionee continues to provide services to the Company on each such date.

17

Aggregate Option Exercises In Last Fiscal Year

and Fiscal Year-End Option Values

The following table sets forth certain information regarding the exercise of stock options by the Named Executive Officers during 2003 and the value of stock options held as of December 31, 2003 by the Named Executive Officers. In addition, this table includes the number of shares covered by both exercisable and non-exercisable stock options as of December 31, 2003. Also reported are the values for "in-the-money" options, which represent the positive spread between the exercise price of any such existing stock options and the December 31, 2003 price of the Company's common stock.

| |

| |

| | Number of Securities

Underlying Unexercised Options

at December 31, 2003

| | Value of Unexercised

In-the-Money Options

at December 31, 2003($)(2)

|

|---|

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized(#)(1)

|

|---|

| | Exercisable(#)

| | Unexercisable(#)

| | Exercisable

| | Unexercisable

|

|---|

| Gerald J. Burnett | | — | | $ | — | | — | | — | | $ | — | | $ | — |

| William L. Campbell | | — | | | — | | 447,186 | | 507,814 | | | 22,125 | | | 230,275 |

| Robert J. Habig | | — | | | — | | 245,000 | | 275,000 | | | 8,138 | | | 75,563 |

| R. Jan Afridi | | — | | | — | | 152,499 | | 57,501 | | | 32,075 | | | 17,025 |

| J. Chris Lauwers | | — | | | — | | 301,249 | | 243,751 | | | 135,013 | | | 108,438 |

- (1)

- Fair market value of the Company's Common Stock as of the date of exercise minus the exercise price.

- (2)

- Fair market value is the closing sale price of the Company's Common Stock as of December 31, 2003 ($1.52) as reported on The NASDAQ SmallCap Market minus the exercise price.

Equity Compensation Plan Information

The following table provides information as of December 31, 2003 with respect to the shares of the Company's Common Stock that may be issued under the Company's existing equity compensation plans.

| | A

| | B

| | C

| |

|---|

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options

| | Weighted-average

exercise price of

outstanding options

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected

in Column A)

| |

|---|

| Equity compensation plans approved by security holders | | 5,508,012 | (1) | $ | 3.70 | | 3,686,414 | (2) |

| Equity compensation plans not approved by security holders | | — | | | — | | — | |

| | |

| |

| |

| |

| | Total | | 5,508,012 | | $ | 3.70 | | 3,686,414 | |

| | |

| |

| |

| |

- (1)

- This number reflects the number of shares to be issued upon exercise of outstanding options under the 2000 Director Option Plan ("Director Plan"), the 1997 Stock Option Plan (the "1997 Plan") and the 2000 Stock Option Plan (the "2000 Option Plan") of the Company. This number excludes purchase rights accruing under the Employee Stock Purchase Plan ("Purchase Plan"). The Purchase Plan authorizes the granting of stock purchase rights to eligible employees during two-year offering periods with exercise dates approximately every six months. Shares are purchased through employee payroll deductions at purchase prices equal to 85% of the lesser of the fair

18

market value of the Company's Common Stock at either the first day of each offering period or the date of purchase.

- (2)

- Includes 1,571,985 shares available for issuance under the 2000 Plan, 110,000 shares available for issuance under the Director Plan and 2,004,429 shares available for issuance under the Purchase Plan. No securities are available for future issuance under the 1997 Plan. The 2000 Option Plan provides for an annual increase in the number of shares of Common Stock reserved for issuance thereunder on the first day of the Company's fiscal year in an amount equal to the lesser of (x) 1,200,000 shares, (y) four percent (4.0%) of the outstanding shares of the Company as of the last day of the prior fiscal year or (z) such lesser amount as determined by the Board. The Director Plan currently provides for an annual increase to the number of shares reserved thereunder on the first day of the Company's fiscal year equal to the lesser of (x) 175,000 shares, (y) one percent (1.0%) of the outstanding shares of Common Stock of the Company on such date or (z) such amount as determined by the Board. The Purchase Plan provides for an annual increase in the number of shares of Common Stock reserved thereunder on the first day of the Company's fiscal year in an amount equal to the lesser of (x) 900,000 shares, (y) three percent (3.0%) of the outstanding shares of the Company on the last day of the prior fiscal year or (z) such amount as determined by the Board. Under the terms of the Plans, on January 1, 2004, 1,200,000 and 175,000 shares were added to the 2000 Option Plan and the Director Plan, respectively. No shares were added to the Purchase Plan on January 1, 2004.

19

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

In accordance with the written charter adopted by the Board of Directors, the Audit Committee of the Board of Directors (the "Committee") reviews and evaluates the Company's accounting principles and its system of internal accounting controls and monitors the corporate financial reporting of the Company. It also recommends the appointment of the Company's independent auditors and approves the services performed by the independent auditors.

The Committee received from the independent auditors a formal written statement describing all relationships between the independent auditors and the Company that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1, "Independence Discussion with Audit Committees," and discussed with the auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors' independence. The Committee also discussed with management and the independent auditors the quality and adequacy of the Company's internal controls and responsibilities, budget and staffing.

The Committee discussed and reviewed with the independent auditors all communications required by the Statement on Auditing Standards No. 61, as amended, "Communication with Audit Committees" and, with and without management present, discussed and reviewed the results of the independent auditors' examination of the financial statements. The Committee reviewed and discussed the quarterly financial statements and the audited financial statements of the Company as of and for the year ended December 31, 2003, with management and the independent auditors. Management had the responsibility for the preparation of the Company's financial statements and the independent auditors had the responsibility for the examination of those statements. The Committee's responsibility is to monitor and review these processes. It is not the Committee's duty or responsibility to conduct auditing or accounting reviews or procedures. As such, the Committee has relied, without independent verification, on management's representations that the Company's financial statements have been prepared with integrity and objectivity and in conformity with the generally accepted accounting principles and on the representations of the independent auditors, included in their report on the Company's financial statements.

Based on its review and discussions with management and the independent auditors, the Committee recommended to the Board of Directors that the Company file with the Securities and Exchange Commission the Company's audited financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003. The Committee also recommended the reappointment, subject to stockholder ratification, of the independent auditors, and the Board concurred in such recommendation.

Respectfully submitted by the Audit Committee of the Company's Board of Directors:

| | | David M. Solo

Dr. Robert M. Metcalfe

Robert P. Latta, Esq. |

20

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board of Directors reviews and approves the Company's executive compensation policies. The following is the report of the Compensation Committee describing the compensation policies and rationales applicable to the Company's executive officers with respect to the compensation paid to such executive officers for the fiscal year ended December 31, 2003. Actual compensation earned during the fiscal year by the Named Executive Officers is shown in the Summary Compensation Table above.

Compensation Philosophy

The Company's philosophy in setting its compensation policies for executive officers is to maximize stockholder value over time. The primary goal of the Company's executive compensation program, therefore, is to closely align the interests of the executive officers with those of the Company's stockholders. To achieve this goal, the Company attempts to (i) offer compensation opportunities that attract and retain executives whose abilities are critical to the long-term success of the Company, motivate individuals to perform at their highest level and reward outstanding achievement, (ii) maintain a portion of the executive's total compensation at risk, tied to achievement of financial, organizational and management performance goals, and (iii) encourage executives to manage from the perspective of owners with an equity stake in the Company. To achieve these goals, the Compensation Committee has established an executive compensation program primarily consisting of cash compensation and stock options.

The cash component of total compensation, which consists primarily of base salary, is designed to compensate executives competitively within the industry and marketplace. Generally, executive officer salaries are targeted at or above the average rates paid by competitors so as to enable the Company to attract, motivate and retain highly skilled executives. Executive salaries in fiscal 2001 were established by the Compensation Committee based upon the Radford Survey, a nationally recognized executive compensation survey, and the recommendations of an independent outside consultant retained by the Company. Using the comparable recommended salary ranges, the Compensation Committee established the 2002 salaries for executives based on job responsibilities, level of experience, individual performance and contribution to the business.

In addition to base salary, the Company occasionally pays bonuses to its executive officers, based on individual and overall Company performance. Sales executives are also eligible for additional cash payments above their base salaries for achieving specific performance goals or in connection with sales commissions.

The Company provides long-term incentives through its 2000 Stock Option Plan (the "Plan"). The purpose of the Plan is to attract and retain its best employee talent available and to create a direct link between compensation and the long-term performance of the Company. The Compensation Committee believes that stock options directly motivate an executive to maximize long-term stockholder value. The options also utilize vesting periods that encourage key executives to continue in the employ of the Company. All options granted to executive officers to date have been granted at the fair market value of the Company's common stock on the date of grant except in the case of executive officers who hold more than 10% of the outstanding voting stock, in which case the exercise price equals 110% of the fair market value on the date of grant. The Compensation Committee considers the grant of each option subjectively, considering factors such as the individual performance of the executive officer and the anticipated contribution of the executive officer to the attainment of the Company's long-term strategic performance goals.

During fiscal 2003, the compensation of Gerald J. Burnett, the Company's Chairman of the Board of Directors and Chief Executive Officer, consisted of a total salary of $200,000. The Committee reviewed the Chief Executive Officer's salary, without Dr. Burnett present, using the same criteria and

21

policies as are employed for the other executive officers. Specific factors considered in compensation decisions regarding Dr. Burnett included CEO compensation among the Company's peer group of companies, publicly available compensation survey results, the Company's revenue and operating income in 2003 as compared to 2002, the strategic decisions made by Dr. Burnett and the overall contribution of Dr. Burnett to the Company's business in 2003.

Section 162(m)

The Compensation Committee has considered the potential future effects of Section 162(m) of the Internal Revenue Code on the compensation paid to the Company's executive officers. Section 162(m) disallows a tax deduction for any publicly-held corporation for individual compensation exceeding $1.0 million in any taxable year for any of the Named Executive Officers, unless compensation is performance-based.

Respectfully submitted by the Compensation Committee of the Company's Board of Directors.

| | | Dr. Robert M. Metcalfe

Robert P. Latta, Esq.

David M. Solo |

22

Certain Transactions

Transactions with UBS Warburg LLC

UBS Warburg LLC and its affiliates have purchased systems and services from the Company in the past and may continue to do so in the future. In 2003, such purchases constituted 9.4% of the Company's revenue. David M. Solo, one of the Company's directors, was an executive officer of UBS AG, an affiliate of UBS Warburg LLC, during 2000, and continues to act as a strategic advisor to UBS AG. Mr. Barry McQuain, an employee of UBS Warburg, served as a director of the Company's intellectual property subsidiary, Collaboration Properties from May 2001 until December 2002.

Transactions with Management and Others

On February 27, 2002, the Company entered into a Loan and Security Agreement with a financial institution for a revolving line of credit. As collateral under this Loan and Security Agreement, the Company granted a first priority interest in all of the Company's assets, excluding intellectual property. On December 16, 2002, Gerald Burnett, Chairman and Chief Executive Officer of the Company provided a collateralized guarantee, assuring payment of the Company's obligations under the agreement and as a consequence, restrictive covenants from the original Loan and Security agreement were deleted in the amendment, except for a quick ratio and loan to value covenant, allowing the Company greater access to the full amount of the facility. On February 27, 2004, the Loan and Security Agreement was amended to change the maximum borrowings under the line to $3.5 million, subject to certain quick ratio and loan to value covenants, and to extend the term of the Loan and Security Agreement to February 27, 2005. In connection with this amendment, Dr. Burnett's collateralized guarantee was amended to reduce the amount of such guarantee to $3.5 million. As of April 23, 2004, the Company had no outstanding borrowings under the line of credit and was eligible to borrow up to $3.5 million.

For his services as a strategic advisor to the Company, the Company paid Mr. Heinrichs $100,833 in 2003 pursuant to the Separation Agreement between Mr. Heinrichs and the Company dated April 26, 2001. The Company also agreed to procure, or reimburse, medical, dental, term life, and disability insurance for Mr. Heinrichs and his wife until May 31, 2003. Mr. Heinrichs' status as a strategic advisor to the Company terminated in May 2003 pursuant to the terms of the Separation Agreement.

Wilson Sonsini Goodrich & Rosati, Professional Corporation ("WSGR") is a law firm that has provided legal services to the Company since its inception, and prior to that, to its predecessor entities. For the year ended December 31, 2003, the Company paid WSGR $144,817 in legal fees. Mr. Latta, a director of the Company, is a member of WSGR. It is anticipated that WSGR will continue to provide legal services to the Company in the current year.

Family Relationships

Wendolyn Hearn, the Company's Vice President, Sales Management, is the daughter of Dr. Gerald Burnett, the Company's Chairman of the Board and Chief Executive Officer.

23

PERFORMANCE GRAPH

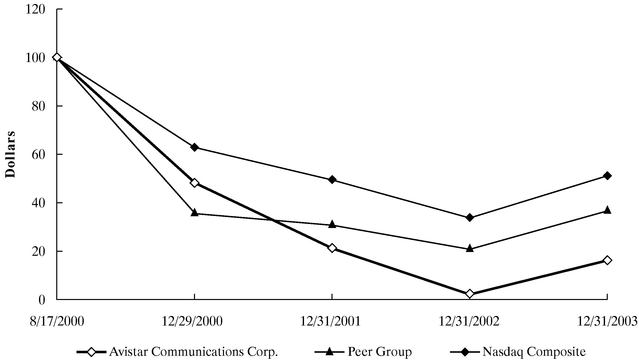

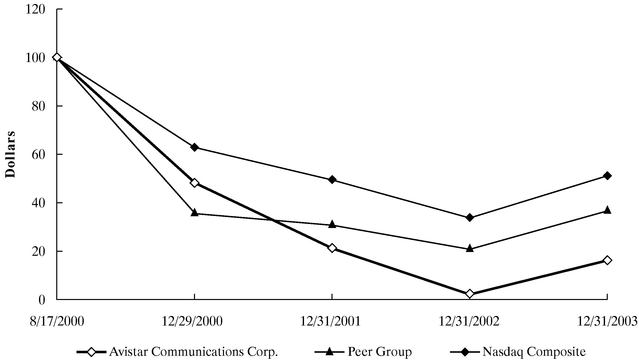

Set forth below is a line graph comparing the percentage change in the cumulative return to the stockholders of the Company's Common Stock with the cumulative return of The NASDAQ National Market, U.S. Index and a group of industry peers within the communications software infrastructure and video communications industries (the "Industry Peer Group") for the period commencing August 17, 2000 and ending on December 31, 2003. Returns for the indices are weighted based on market capitalization at the beginning of each fiscal year. The Company's Common Stock was transferred from The NASDAQ National Market to The NASDAQ SmallCap Market on October 30, 2002.

Total Return Analysis

| | 8/17/2000

| | 12/29/2000

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

|

|---|

| Avistar Communications Corp. | | $ | 100.00 | | $ | 48.00 | | $ | 21.33 | | $ | 2.45 | | $ | 16.19 |

| Peer Group | | $ | 100.00 | | $ | 35.67 | | $ | 30.98 | | $ | 20.95 | | $ | 36.85 |

| Nasdaq Composite | | $ | 100.00 | | $ | 62.69 | | $ | 49.49 | | $ | 33.89 | | $ | 50.84 |

- (1)

- The above graph sets forth the cumulative total return to Avistar's stockholders during the period from August 17, 2000 to December 31, 2003. The graph assumes the investment on August 17, 2000 (the date of the Company's initial public offering) of $100 in the Common Stock of the Company, The NASDAQ Stock Market Index, and an Industry Peer Group. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

- (2)

- The Industry Peer Group consists of Webex Communications, Inc., RealNetworks Inc., Packeteer, Inc., and Radvision Ltd. Although the companies included in the industry peer group were selected because of similar industry characteristics, they are not entirely representative of the Company's business.

The information contained above under the captions "Report of the Audit Committee of the Board of Directors," "Report of the Compensation Committee of the Board of Directors" and "Performance Graph" shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended (the "Exchange Act"), except to the extent that the Company specifically incorporates it by reference into such filing.

24

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission ("SEC") and the National Association of Securities Dealers, Inc. Executive officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it, or written representations from reporting persons, the Company believes that during 2003, all executive officers, directors and greater than ten percent stockholders complied with all applicable filing requirements, except that Form 4s relating to options granted to Messrs. Metcalfe, Solo and Latta on April 23, 2003 and July 23, 2003 were filed on July 17, 2003 and August 18, 2003, a Form 4 for William L. Campbell, Executive Vice President of the Company, was filed on July 1, 2003 reporting a transaction that occurred on April 23, 2003, a Form 4 for Robin Gilthorpe, former Vice President of Sales of the Company, was filed on August 15, 2003 reporting transactions that occurred on January 31, 2003 and April 23, 2003, and a Form 4 for Chris Lauwers, Chief Technology Officer of the Company, was filed on July 1, 2003 for a transaction that occurred on April 23, 2003.

Other Matters

The Company knows of no other matters to be submitted at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend.

THE BOARD OF DIRECTORS

Dated: April 23, 2004

25

Exhibit A

AVISTAR COMMUNICATIONS CORPORATION

a Delaware corporation

CHARTER OF THE NOMINATING COMMITTEE

OF THE BOARD OF DIRECTORS

(As adopted by the Board of Directors on March 12, 2004)

PURPOSE:

The Nominating Committee (the "Committee") of the Board of Directors (the "Board") of Avistar Communications Corporation, a Delaware corporation (the "Company"), will assist the Company in meeting applicable governance standards by monitoring the composition of the Board and, when appropriate, seeking, screening and recommending for nomination qualified candidates for election to the Board at the Company's Annual Meeting of Stockholders. In addition, the Committee will seek qualified candidates to fill vacancies on the Board subject to appointment by the Board. The Committee will evaluate candidates identified on its own initiative, including incumbent directors, as well as candidates referred to it by other members of the Board, by the Company's management, by stockholders who submit names to the Company's corporate secretary for referral to the Committee in accordance with the Bylaws of the Company, or by other external sources. The Committee will also evaluate the Board's structure and practices and, when appropriate, recommend new policies to the full Board.

MEMBERSHIP:

The Committee will consist of a minimum of two (2) members of the Board. The Committee shall be constituted in a manner that meets the requirements of Nasdaq Marketplace Rules, including applicable "independent director" requirements.

RESPONSIBILITIES AND AUTHORITY:

The responsibilities and authority of the Committee shall include the following:

- •

- Review Board and Board committee structure, composition, practices and future requirements, and make recommendations on these matters to the Board.

- •

- As needed or appropriate, conduct or authorize searches for potential Board members.

- •

- Evaluate, propose and approve nominees for election or appointment to the Board.

- •

- Consider, evaluate and, as applicable, propose and approve, security holder nominees for election to the Board.

- •

- In performing its responsibilities, the Committee shall have the authority to retain, compensate and terminate any search firm to be used to identify director candidates.

- •

- Evaluate and make recommendations to the Board concerning the appointment of directors to Board committees and the selection of Board committee chairs.

- •

- Evaluate and recommend termination of membership of individual directors in accordance with the Board's governance principles, for cause or for other appropriate reasons.

- •

- Oversee, and implement as necessary, director continuing education programs, including complying with any applicable director continuing education requirements.

A-1

- •

- Consider and/or adopt a policy regarding the consideration of candidates for the Board recommended by security holders, including, if adopted, procedures to be followed by security holders in submitting recommendations.

- •

- Periodically determine, as appropriate, whether there are any specific, minimum qualifications that the Committee believes must be met by a nominee approved by the Committee for a position on the Board and whether there are any specific qualities or skills that the Committee believes are necessary for one or more directors to possess.

- •

- The Committee shall review the disclosure in the Company's proxy statement for its annual meeting of stockholders and shall inform management whether there are any changes that are necessary or appropriate with respect to disclosure in the proxy statement regarding: (i) the Committee's process for identifying and evaluating nominees for director, including nominees recommended by security holders; (ii) any minimum qualifications that the Committee believes must be met by nominees recommended by the Committee; (iii) any specific qualities or skills that the Committee believes are necessary for one or more of the Company's directors to possess; (iv) the procedures to be followed by security holders in submitting director recommendations; and (v) the policy of the Committee with regard to the consideration of director candidates recommended by security holders.

- •

- Review and re-examine this Charter annually and make recommendations to the Board for any proposed changes.

- •

- Form and delegate authority to subcommittees when appropriate;provided,however, that any such subcommittee member must be a member of the Committee.

- •

- Perform such other tasks as may be delegated to the Committee from time to time by the Board.

- •

- In performing its responsibilities hereunder, the Committee shall have the authority to obtain advice, reports or opinions from such internal or external counsel and expert advisors as the Committee shall deem necessary or advisable.

The Committee shall not be required to address each responsibility set forth above at each meeting of the Committee, but rather shall take such actions at such times as are reasonably necessary to carry out the responsibilities set forth herein.

MEETINGS:

Meetings of the Committee will be held at the pleasure of the Board and the members of the Committee, from time to time, in response to needs of the Board. Notwithstanding the foregoing, the Committee will meet at least once annually to evaluate and make nominations of qualified candidates for election to the Board at the Annual Meeting of Stockholders.

MINUTES:

The Committee will maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

REPORTS:

The Committee will summarize its examinations and recommendations to the Board as appropriate, consistent with the Committee's charter.

The Committee will provide written reports to the Board regarding the Committee's nominations for election to the Board.

A-2

COMPENSATION:

Members of the Committee shall receive such fees for their service as Committee members as may be determined by the Board in its sole discretion. Such fees may include retainers or per meeting fees. Fees may be paid in such form of consideration as is determined by the Board. Changes in such compensation shall be determined by the Board in its sole discretion.

No members of the Committee may receive any compensation from the Company other than the fees that they receive for service as a member of the Board or any committee thereof and except as permitted by applicable Nasdaq Marketplace Rules.

A-3

DETACH HERE

PROXY

AVISTAR COMMUNICATIONS CORPORATION

2004 ANNUAL MEETING OF STOCKHOLDERS

JUNE 2, 2004

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of AVISTAR COMMUNICATIONS CORPORATION, a Delaware corporation, hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 23, 2004, and hereby appoints Gerald J. Burnett and William L. Campbell each as proxy and attorney-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2004 Annual Meeting of Stockholders of AVISTAR COMMUNICATIONS CORPORATION to be held on June 2, 2004 at 1:00 p.m. local time, at 555 Twin Dolphin Drive, Suite 360, Redwood Shores, California 94065 and at any adjournment or adjournments thereof, and to vote all shares of common stock which the undersigned would be entitled to vote if then and there personally present, on the mattes set forth on the reverse side.

SEE REVERSE SIDE

| | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | |

SEE REVERSE SIDE

|

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

| ý | | Please mark

Votes as in

this example. |

THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF DIRECTORS.

1. Election of Directors. NOMINEES:

(01) Gerald J. Burnett, (02) William L. Campbell, (03) R. Stephen Heinrichs, (04) Robert P. Latta,

(05) Robert M. Metcalfe, (06) David M. Solo, and (07) James W. Zeigon.

| | | FOR

ALL

NOMINEES | o | | o | WITHHELD