DEF 14A 1 proxy.htm DEFINITIVE PROXY FOR FISCAL YEAR 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

oPreliminary Proxy Statement

oConfidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

xDefinitive Proxy Statement

oDefinitive Additional Materials

oSoliciting Material Pursuant to §240.14a-11(c) or §240.14a-2

Avistar Communications Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

xNo fee required.

oFee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | o | Fee paid previously with preliminary materials. |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) �� Filing Party:

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 8, 2011

TO THE STOCKHOLDERS:

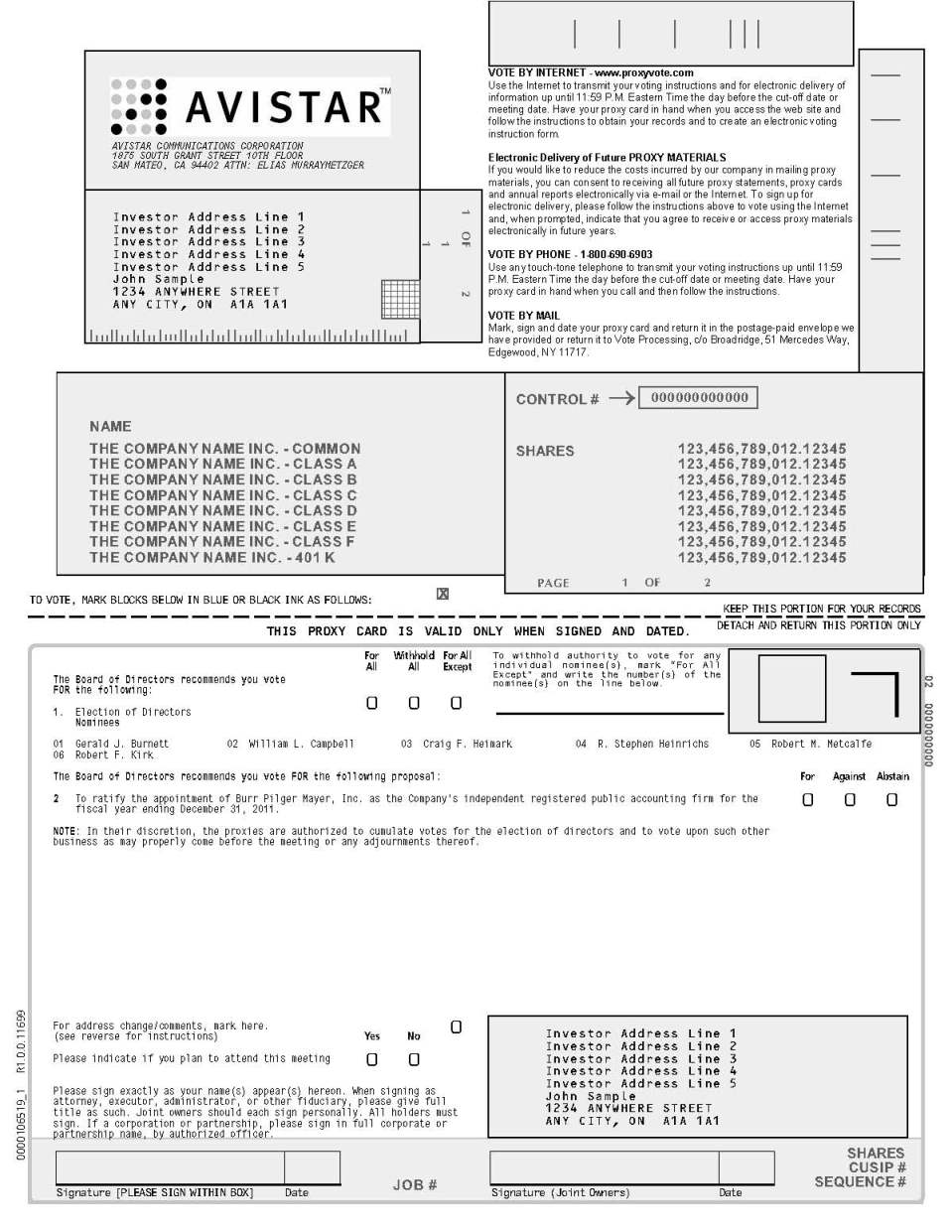

NOTICE IS HEREBY GIVEN that the 2011 annual meeting of stockholders (“Annual Meeting”) of Avistar Communications Corporation (the “Company” or “Avistar”), a Delaware corporation, will be held on June 8, 2011 at 10:00 a.m. Pacific Daylight Savings Time, at 1875 S. Grant Street, 10th Floor, San Mateo, California 94402 for the following purposes:

| | 1. | To elect six (6) directors to serve until the next Annual Meeting or in each case until his successor is duly elected and qualified (this matter only concerns the election as directors of the individuals listed; no other nominations or elections are before the Annual Meeting); |

| | 2. | To ratify the appointment of Burr Pilger Mayer, Inc. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011; and |

| | 3. | To transact such other business as may properly come before the Annual Meeting including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. Only stockholders of record at the close of business on April 20, 2011 are entitled to attend and vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. You will receive a Notice of Internet Availability of Proxy Materials (the “Notice”), unless you previously asked to receive our proxy materials in paper form. However, to ensure your representation at the Annual Meeting, please vote as soon as possible using the Internet or telephone, as instructed in the Notice. Alternatively, you may follow the procedures outlined in the Notice to request a paper proxy card to submit your vote by mail.

| | |

| | Sincerely, |

| | |

| | Elias A. MurrayMetzger |

San Mateo, California April 29, 2011 | Chief Financial Officer, Chief Administrative Officer and Corporate Secretary |

IN ORDER TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED AT THE ANNUAL MEETING, IN THE EVENT YOU ARE NOT PERSONALLY PRESENT, PLEASE SUBMIT YOUR PROXY ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS IN THE NOTICE OR IF YOU ASKED TO RECEIVE THE PROXY MATERIALS IN PAPER FORM, PLEASE COMPLETE, SIGN AND DATE THE PROXY CARD AND RETURN IT IN THE POSTAGE PAID ENVELOPE PROVIDED.

Important Notice Regarding The Proxy Materials for the Stockholder Meeting to be held on June 8, 2011: the Proxy Statement and Annual Report to Stockholders for the fiscal year ended December 31, 2010 are available electronically free of charge at http://proxyvote.com.

AVISTAR COMMUNICATIONS CORPORATION

PROXY STATEMENT FOR 2011

ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the board of directors of Avistar Communications Corporation (the “Company”), for use at the 2011 annual meeting of stockholders (the “Annual Meeting”) to be held Wednesday, June 8, 2011 at 10:00 a.m. Pacific Daylight Savings Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying notice of Annual Meeting. The Annual Meeting will be held at the Company’s principal executive offices located at 1875 S. Grant Street, 10th Floor, San Mateo, California 94402. The Company’s telephone number at this location is (650) 525-3300.

These proxy solicitation materials and the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, including financial statements, were first furnished over the Internet and the Notice was first mailed on or about April 29, 2011 to stockholders entitled to vote at the meeting.

Stockholders may receive an additional copy of the Annual Report on Form 10-K for the year ended December 31, 2010, or a copy of the exhibits to the Annual Report on Form 10-K without charge by sending a written request to the Secretary of the Company at our principal executive office located at 1875 S. Grant Street, 10th Floor, San Mateo, California 94402.

Record Date

Stockholders of record at the close of business on April 20, 2011 (the “Record Date”) are entitled to notice of and to vote at the meeting. The Company has one series of common shares outstanding, designated Common Stock, $.001 par value. On the Record Date, 39,358,995 shares of the Company’s Common Stock were issued and outstanding and held of record by 70 stockholders. The Company is authorized to issue 10,000,000 shares of Preferred Stock, although no such shares were issued or outstanding as of the Record Date.

Internet Availability

Pursuant to the rules promulgated by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we will first mail, on or about April 29, 2011, the Notice to our stockholders of record and beneficial owners at the close of business on April 20, 2011. On the date of mailing of the Notice, all stockholders and beneficial owners will have the ability to access all of the proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge.

The Notice will identify the website where the proxy materials will be made available; the date, the time and location of our Annual Meeting; the matters to be acted upon at the meeting and the board of directors’ recommendations with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request a paper or e-mail copy of the proxy statement; our Annual Report on Form 10-K for the year ended December 31, 2010 and a form of proxy relating to our Annual Meeting; information on how to access the form of proxy; and information on how to obtain directions to attend the meeting and vote in person.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date, or by submitting a new later dated proxy by telephone or over the Internet, or by attending the meeting and voting in person. Attendance at the meeting will not by itself revoke a previously granted proxy. Deliveries to the Company should be addressed to Elias MurrayMetzger, Corporate Secretary, 1875 S. Grant Street, 10th Floor, San Mateo, California 94402.

However, please note that beneficial owners of shares held in street name may revoke their proxy by timely submitting new voting instructions to their broker, bank or other nominee or by obtaining a legal proxy from the broker, trustee or other nominee that holds their shares giving the beneficial owners the right to vote the shares, or by attending the Annual Meeting and voting in person.

All shares that have been properly voted without timely revocation will be voted at the Annual Meeting.

Voting Procedures

Each share of Common Stock outstanding on the Record Date is entitled to one vote. Every stockholder voting for the election of directors (Proposal One) may cumulate such stockholder’s votes and give one candidate a number of votes equal to the number of directors to be elected, multiplied by the number of shares such stockholder is entitled to vote, or distribute such stockholder’s votes on the same principle among as many candidates as the stockholder may select, provided that votes cannot be cast for more than six candidates. The candidates receiving the highest number of votes, up to the number of directors to be elected, shall be elected. Additional information on cumulative voting is located in the section captioned “Election of Directors – Cumulative Voting.” Cumulative voting applies only to the election of directors. The proxy holders will cumulate all shares voted and will distribute those shares in such a manner to effect the election of as many nominees set forth in these proxy materials as possible. On all other matters, each share of Common Stock has one vote.

Solicitation of Proxies

This solicitation of proxies is made by the Company, and all related costs will be borne by the Company. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies also may be solicited by certain of the Company’s directors, officers and other employees, without additional compensation, personally or by other means.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of elections (the “Inspector”) who shall be a representative of the Company’s transfer agent. The Inspector will determine whether or not a quorum is present. In general, Delaware law also provides that to have a quorum a majority of shares entitled to vote must be present or represented by proxy at the meeting. Except in certain specific circumstances, the affirmative vote of a majority of shares present in person, or represented by proxy if a quorum is present, is required under Delaware law for approval of proposals presented to stockholders.

The Inspector will treat shares that are voted “WITHHELD” or “ABSTAIN” as being present and entitled to vote for purposes of determining the presence of a quorum. Such shares will not be treated as votes in favor of approving any matter submitted to the stockholders for a vote. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted (i) for the election of the nominees for the board of directors set forth herein; (ii) to ratify the appointment of Burr Pilger Mayer, Inc. to serve as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2011; and (iii) at the discretion of the proxy holders, upon such other business as may properly come before the Annual Meeting or any adjournment thereof.

Under the rules that govern brokers who have record ownership of shares that are held in street name for their clients, who are the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. Thus, if a stockholder does not otherwise instruct his or her broker, the broker may turn in a proxy card voting the stockholder’s shares “FOR” routine matters, but expressly instructing that the broker is not voting on non-routine matters. A broker non-vote occurs when a broker expressly instructs on a proxy card that the broker is not voting on a matter, whether routine or non-routine. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum, but are not counted for determining the number of votes cast for or against a proposal. Unless the stockholder has provided otherwise his or her broker will have discretionary authority to vote his or her shares on the ratification of auditors, which is considered a routine matter.

Unlike at previous annual meetings brokers do not have discretionary authority to vote on the election of directors, so it is very important that a stockholder instruct his or her broker how to vote on these proposals.

Votes Required for Each Proposal

To elect our directors and approve the other proposals being considered at the Annual Meeting, the voting requirements are as follows:

| | Discretionary Voting Permitted? |

Election of Directors | Plurality | No |

Ratification of Burr Pilger Mayer, Inc. | Majority | Yes |

“Discretionary Voting Permitted” means that brokers will have discretionary voting authority with respect to shares held in street name for their clients, even if the broker does not receive voting instructions from their client.

“Majority” means a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the specified matter.

“Plurality” means a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the election of directors.

The vote required and method of calculation for the proposals to be considered at the Annual Meeting are as follows:

Proposal One – Election of Directors. If a quorum is present, the six director nominees receiving the highest number of votes, in person or by proxy, will be elected as directors. You may vote “FOR” all nominees, “WITHHOLD” for all nominees or “WITHHOLD” for certain nominees by specifying the name(s) of such nominees on your proxy card. A properly executed proxy marked "withhold" with respect to the election of the directors will not be voted with respect to the directors and will not affect the outcome of the election, although it will be counted for purposes of determining whether there is a quorum.

Proposal Two – Ratification of Burr Pilger Mayer, Inc. as Independent Registered Public Accounting Firm. Ratification of Burr Pilger Mayer, Inc. as Avistar’s independent registered public accounting firm for the year ending December 31, 2011 will require the affirmative vote of a majority of the shares present at the Annual Meeting in person or by proxy. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal.

Deadline for Receipt of Stockholder Proposals for the 2012 Annual Meeting

In order to be considered for inclusion in the proxy statement and form of proxy relating to the 2012 annual meeting of stockholders of the Company, proposals of stockholders of the Company that are intended to be presented by such stockholders at the Company’s 2012 annual meeting of stockholders must be received by the Company no later than December 31, 2011 (which is 120 days prior to the anniversary date of the mailing of this proxy statement).

The SEC rules establish a different deadline with respect to discretionary voting (the “Discretionary Vote Deadline”) for stockholder proposals that are not intended to be included in a company’s proxy statement. The Discretionary Vote Deadline for our 2012 annual meeting of stockholders is March 15, 2012, which is 45 days prior to the anniversary of the mailing date of this proxy statement. If a stockholder fails to comply with the foregoing notice provision, the proxy holders will be allowed to use their discretionary authority when and if the proposal is raised at the Company’s 2012 annual meeting of stockholders.

Section 2.4 of the Company’s amended and restated bylaws provides that stockholders may submit proposals, including director nominations, for consideration at future stockholder meetings:

Requirements for stockholder proposals to be considered for inclusion in the Company’s proxy materials—Stockholders may present proper proposals for inclusion in the Company’s proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the proxy statement for the 2012 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than December 31, 2011 and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Requirements for stockholder proposals to be brought before an annual meeting—In addition, the Company’s amended and restated bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made (1) by or at the direction of the board of directors, or (2) by any stockholder entitled to vote who has timely delivered written notice to the Secretary of the Company during the Notice Period (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. However, if a stockholder wishes only to recommend a candidate for consideration by the Nominating Committee as a potential nominee for director, see the procedures discussed in "Nominating Committee —Requirements for stockholder recommendations of a candidate to the board of directors."

The Company’s amended and restated bylaws also provides that the only business that may be conducted at an annual meeting is business that is brought (1) pursuant to the notice of meeting (or any supplement thereto), (2) by or at the direction of the board of directors, or (3) by a stockholder who has timely delivered written notice which sets forth all information required by the Company’s amended and restated bylaws to the Secretary of the Company during the Notice Period (as defined below).

The "Notice Period" is defined as the period commencing on the date 75 days prior to the one year anniversary of the date on which we first mailed our proxy materials to stockholders for the previous year's annual meeting of stockholders and terminating on the date 45 days prior to the one year anniversary of the date on which we first mailed our proxy materials to stockholders for the previous year's annual meeting of stockholders. As a result, the Notice Period for the 2012 annual meeting of stockholders will be from February 14, 2012 to March 15, 2012.

If a stockholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we need not present the proposal for vote at such meeting.

The foregoing deadlines assume that the Company’s 2012 annual meeting of stockholders will be held within 30 days of the anniversary date of the 2011 Annual Meeting. If the Company elects to hold the 2012 annual meeting of stockholders on a date that is more than 30 days before or after June 8, 2012, the Company will include revised deadlines in an annual report on Form 10-K or a quarterly report on Form 10-Q filed with the SEC.

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding the beneficial ownership of Common Stock of the Company as of April 20, 2011 as to (i) each person or entity who is known by the Company to own beneficially more than 5% of the outstanding shares of Common Stock; (ii) each director or nominee to the board of directors of the Company; (iii) each of the Named Executive Officers (as defined below under “Executive Compensation and Other Matters — Executive Compensation — Summary Compensation Table”) and (iv) all directors, nominees to the board of directors and executive officers of the Company as a group. Except as otherwise noted, the stockholders named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to applicable community property laws. Except as otherwise noted, the address of each person listed on the table is c/o Avistar Communications Corporation, 1875 S. Grant Street, 10th Floor, San Mateo, California 94402.

| Common Stock Beneficially Owned (1) | Percentage of Common Stock Beneficially Owned (1) |

Gerald J. Burnett (2) | 16,475,116 | 41.8% |

R. Stephen Heinrichs (3) | 7,250,793 | 18.4% |

William L. Campbell (4) | 1,457,177 | 3.7% |

Robert F. Kirk (5) | 796,131 | 2.0% |

J. Chris Lauwers (6) | 696,221 | 1.8% |

Anton F. Rodde (7) | 500,441 | 1.3% |

Craig F. Heimark (8) | 474,156 | 1.2% |

Robert M. Metcalfe (9) | 232,479 | * |

Elias A. MurrayMetzger (10) | 204,953 | * |

Stephen M. Epstein (11) | 152,244 | * |

Stephen W. Westmoreland | 41,293 | * |

Michael J. Dignen | 11,011 | * |

| All directors and current executive officers as a group 13 persons (12) | 28,292,015 | 67.4% |

————————————————

| (1) | Applicable percentage ownership is based on 39,358,995 shares of Common Stock outstanding as of April 20, 2011, together with applicable options or warrants for such stockholder. Beneficial ownership is determined in accordance with the rules of the SEC, based on factors including voting and investment power. Shares of Common Stock subject to options or warrants currently exercisable or exercisable within 60 days after April 20, 2011 are deemed outstanding for computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage of any other person. |

| (2) | The shares are held by Dr. Burnett as a co-trustee of a marital trust, as to which he has sole voting and investing power. Also included above are 60,416 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (3) | 6,449,523 shares are held by Heinrichs Revocable Trust, of which Mr. Heinrichs serves as a co-trustee and as to which he has sole voting and investing power. 665,229 shares are held indirectly by Mr. Heinrichs through Fairview Financial Corporation, over which Mr. Heinrichs has sole voting and investment power. Also included above are 136,041 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (4) | The shares are held by Mr. Campbell as co-trustee of a marital trust, as to which he has sole voting and investing power. Also included above are 366,058 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (5) | Mr. Kirk’s shares include 656,250 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (6) | Dr. Lauwers’ shares include 353,196 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (7) | Dr. Rodde’s shares include 500,441 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (8) | Mr. Heimark’s shares include 108,354 shares of Common Stock that may be acquired upon exercise of stock options within 60 days after April 20, 2011. |

| (9) | Dr. Metcalfe’s shares include 168,679 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (10) | Mr. MurrayMetzger’s shares include 130,041 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

| (11) | Mr. Epstein’s shares include 152,244 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011 |

| (12) | Includes 2,631,720 shares of Common Stock that may be acquired upon exercise of stock options exercisable within 60 days after April 20, 2011. |

PROPOSAL ONE

ELECTION OF DIRECTORS

A board of six directors is to be elected at the Annual Meeting. The nominees for directors to be elected at the Annual Meeting are Gerald J. Burnett, William L. Campbell, Robert F. Kirk, Craig F. Heimark, R. Stephen Heinrichs, and Robert M. Metcalfe. These six nominees were approved by the Nominating Committee of the board of directors. If elected, each nominee will serve for an approximate one-year term and until his successor is elected and qualified, or until his earlier resignation or removal. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s nominees named in this proxy statement, who are presently directors of the Company. In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present board of directors to fill the vacancy. The Company is not aware that any nominee will be unable or will decline to serve as a director. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of as many of the nominees listed above as possible, and, in such event, the specific nominee to be voted for will be determined by the proxy holders.

Cumulative Voting

Every stockholder voting to elect a director may cumulate such stockholder’s votes and give to one of the candidates to be elected a number of votes equal to the number of directors to be elected multiplied by the number of votes to which such stockholder is entitled, or distribute the stockholder’s votes on the same principle among as many candidates as the stockholder thinks fit, provided that votes cannot be cast for more than the number of directors to be elected. The proxy holders will, when voting for directors, cumulate the votes represented by the proxies received. No stockholder shall be entitled to cumulate votes for a candidate unless such candidate’s name has been properly nominated prior to the voting.

Cumulative voting will be in effect this year. As a result, the proxy holders will cumulate all shares voted at their discretion and will distribute those shares in such a manner to effect the election of as many of the directors proposed in these proxy materials as possible.

Information Concerning the Nominees and Incumbent Directors

The following table sets forth the name and age of each director of the Company and each nominee as of April 20, 2011, the principal occupation of each, and the period, if any, during which each has served as a director of the Company. Each nominee is currently a director of the Company and the information below includes the experiences, qualifications, attributes or skills that caused the Board of Directors to determine that the individual should continue to serve as a director of the Company.

| Name | Principal Occupation | Age | Director Since |

| Gerald J. Burnett | Gerald J. Burnett is one of the Company's founders and has been Chairman of the Company's board of directors since March 2000. Dr. Burnett served as the Company's Chief Executive Officer from March 2000 until December 2007, and as Chief Executive Officer of Avistar Systems from December 1998 until March of 2000. From 1993 to 1997, he was a director of Avistar Systems or a principal of its predecessor limited partnership. Until recently, he has been a member of the Corporation (Board of Trustees) of the Massachusetts Institute of Technology. Dr. Burnett holds a B.S. and an M.S. from the Massachusetts Institute of Technology in electrical engineering and computer science and a Ph.D. from Princeton University in computer science and communications. Dr. Burnett, a Ph.D., has a wealth of experience with the science underlying our technologies and is a named inventor on some of the patents underlying our products. Dr. Burnett has over 35 years of experience founding, managing and growing technology firms. We believe his qualifications to serve on our Board include his previous experience as our Chief Executive Officer. | 68 | 1997 |

| Name | Principal Occupation | Age | Director Since |

| William L. Campbell | William L. Campbell is one of the Company’s founders and has been a member of the Company’s board of directors since March 2000. Mr. Campbell served as the Company’s Chief Operating Officer from January 2005 until June 2007. From September 2007 until December 2007, Mr. Campbell held the position of Director of Strategic Initiatives. He served as the Company’s Corporate Secretary from June 2001 until December 2007, and served as its interim Chief Financial Officer from April 2001 to May 2001. He served as Chief Executive Officer of Collaboration Properties, Inc. (CPI) a wholly-owned subsidiary of the Company from December 1997 until it was merged into the parent corporation in October 2007. He was Chairman of Vicor, Inc. from 1994 until its sale in 2005. Mr. Campbell holds a B.S. in general engineering from the U.S. Military Academy and an M.S. in management from the Sloan School of the Massachusetts Institute of Technology. Mr. Campbell’s qualifications to serve on the Company’s board include his substantial operational and management expertise, his experience as both a director and chairman of the board of private companies, and his finance skills. Mr. Campbell has successfully sold a number of technology companies he co-founded including most recently, Vicor Inc. He has a background in shareholder communications and investor relations as a result of his previous role as the Company’s Corporate Secretary. | 63 | 1997 |

| Craig F. Heimark | Craig Heimark has served as a member of the Company's board of directors since June 2005. He has been the Managing Partner of the Hawthorne Group, a strategic advisory firm focused on equity consulting to high growth information technology and financial companies, since 1998. During 2000 and 2001, Mr. Heimark provided consulting services to the Company. From 1990 to 1997, he served in various capacities at Swiss Bank Corporation Warburg, the predecessor company to UBS Warburg. He is a member of the board of directors of Austin Packaging Company and Deutsche Borse. Mr. Heimark holds a B.A. degree in Economics and a B.S. in Biology from Brown University. Mr. Heimark’s qualifications to serve on our Board include his business development and investment expertise. Mr. Heimark possesses the skills to provide in-depth financial analysis of our business operations as well as potential investment opportunities. Furthermore, he is an experienced investor and a venture capitalist, with extensive experience in finance, public company corporate governance and executive compensation matters. | 56 | 2005 |

| R. Stephen Heinrichs | R. Stephen Heinrichs is a founder of the Company and has served as a member of the board of directors of the Company since March 2000. Until his retirement in April 2001, he was Chief Financial Officer and Corporate Secretary of the Company and its subsidiaries. Mr. Heinrichs served as a strategic advisor to the Company from May 2001 to May 31, 2003. He is a member of the board of directors and the chair of the Audit Committee of PDF Solutions, a technology company. Mr. Heinrichs holds a B.S. in accounting from California State University in Fresno. He is a Certified Public Accountant. Mr. Heinrichs brings more than thirty years of financial analysis and business planning from his experiences as a Certified Public Accountant and Chief Financial Officer of several private companies. Mr. Heinrichs is skilled in merger and acquisition negotiation as well as the financial reporting requirements applicable to public companies. As a result of being a co-founder and previous CFO of the Company, he has a long history with and knowledge of the Company and of the markets and communities in which the Company operates. | 64 | 1997 |

| Name | Principal Occupation | Age | Director Since |

| Robert F. Kirk | The board of directors of the Company appointed Mr. Robert Kirk as Chief Executive Officer of the Company in July 2009 whereupon shortly thereafter he was appointed to the board of directors. Mr. Kirk most recently served as Chief Executive Officer of ChoicePay, Inc., a payment services company, from August 2008 to its sale to Tier Technologies, Inc. in January 2009. Mr. Kirk served as Chief Executive Officer of Vicor, Inc., a provider of image-enabled receivables processing and management solutions company, from August 2005 to its sale to Metavante Corporation in September 2006. Prior to his appointment as Chief Executive Officer of Vicor, Inc., in August 2005, Mr. Kirk served continuously in various management positions at Vicor, Inc. beginning in January 1999. Mr. Kirk holds a Master’s and Bachelor’s degree in Business Administration from West Virginia University. Mr. Kirk’s qualifications to serve on our Board and as CEO of the Company include his extensive business development and investment expertise and his experience in executive management for a broad array of technology-based businesses. Mr. Kirk brings extensive entrepreneurial experience developing and managing small and medium size businesses. As such, he has hands on experience in marketing and sales, the human resources function and strategic planning and implementation. | 55 | 2009 |

| Robert M. Metcalfe | Robert M. Metcalfe has served as a member of the board of directors of the Company since November 2000. Dr. Metcalfe is Professor of Innovation at the University of Texas at Austin, and has been a partner of Polaris Venture Partners since January 2001. Dr. Metcalfe served as Vice President of Technology for International Data Group (“IDG”), a publisher of technology, consumer and general how-to books from 1993 to 2001, and served as a member of the board of directors of IDG from 1998 to 2006. Dr. Metcalfe founded 3Com Corporation, a provider of networking products and solutions, in 1979, and served in various capacities, including Chief Executive Officer and Chairman of the Board, until 1990. Dr. Metcalfe is a member of the Corporation (Board of Trustees) of the Massachusetts Institute of Technology (“MIT”). Dr. Metcalfe also serves on the board of directors of five privately held companies. Dr. Metcalfe holds Bachelor degrees in electrical engineering and industrial management from MIT, a M.S. degree in applied mathematics from Harvard University and a Ph.D. in computer science from Harvard University. Dr. Metcalfe is a recipient of the IEEE Medal of Honor and is a member of the National Academy of Engineering. He was awarded the National Medal of Technology by President Bush in 2005, and was inducted into the National Inventors’ Hall of Fame in 2007. Dr. Metcalfe’s extensive technology know-how, in-depth background in network technologies, protocols and designs, in addition to deep industry knowledge provide invaluable guidance to the Company. Dr. Metcalfe’s experience as a member of a wide-range of other public and private companies has given him a strong understanding of corporate responsibility and corporate governance. With his experience advising a broad array of technology-based businesses within our industry, he contributes significant insight into product development, product markets, and operational synergies affecting our business. | 65 | 2000 |

Board of Directors Meetings and Committees

The board of directors of the Company held five meetings during 2010 and acted by unanimous written consent one time during 2010. Each director then in office attended, either in person, by teleconference or by video conference, at least 75% of the meetings held during the period he sat on the board of directors. Each director attended, either in person, by teleconference, or by video conference, at least 75% of the committee meetings held during the period he sat on a committee of the board of directors, if any.

Board Independence

The board of directors has determined that each of Messrs. Campbell, Heimark, Heinrichs and Dr. Metcalfe is “independent” as the term is defined by Item 407(a)(1)(ii) of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”) as currently in effect. There are no immediate family relationships between or among any of our executive officers or directors.

Risk Management

The board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. With the oversight of the full board of directors, the officers are responsible for the day-to-day management of the material risks the Company faces. In its oversight role, the board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. The involvement of the full board of directors in setting the Company’s business strategy at least annually is a key part of its oversight of risk management, its assessment of management’s appetite for risk and its determination of what constitutes an appropriate level of risk for the Company. The full board of directors regularly receives updates from management and outside advisors regarding certain risks we face, including litigation and various operating risks.

In addition, the board committees each oversee certain aspects of risk management. For example, the audit committee is responsible for overseeing risk management of financial matters, financial reporting, the adequacy of our risk-related internal controls, internal investigations and enterprise risks; the compensation committee oversees risks related to compensation policies and practices; and the Nominating Committee oversees governance related risks, such as board independence and conflicts of interest, as well as management and director succession planning. The board committees report their findings to the full board of directors.

Senior management attend, as needed, board and board committee meetings and are available to address any questions or concerns raised by the board on risk management-related and any other matters. Annually, the board of directors holds strategic planning sessions with senior management to discuss strategies, key challenges, and risks and opportunities for the Company.

Board and Leadership Structure

We currently separate the positions of Chief Executive Officer and Chairman of the Board. Since March 2000, Dr. Burnett has served as the Chairman of the board of directors. The responsibilities of the Chairman of the Board include: setting the agenda for each board meeting in consultation with the Chief Executive Officer; presiding at executive sessions; and communicating the formal evaluations of the Chief Executive Officer in the context of the annual compensation review to the Chief Executive Officer.

Separating the positions of Chief Executive Officer and Chairman of the Board allows the Chief Executive Officer to focus on the Company’s day-to-day business, while allowing the Chairman of the board to lead the board in its fundamental role of providing advice to and independent oversight of management. The board believes that having a separate director serve as chairman of the board is the appropriate leadership structure for the Company at this time and demonstrates the Company’s commitment to good corporate governance.

The board delegates substantial responsibility to each board committee, which reports their activities and actions back to the full board of directors. We believe that the board committees and their chairs are an important aspect of the Company’s board leadership structure.

Board Committees

The board has established four standing board committees: the Audit Committee, the Compensation Committee, the Nominating Committee and the Stock Option Committee.

The board committees are currently constituted as follows:

Audit Committee | | Compensation Committee | | Nominating Committee | | Stock Option Committee |

| William L. Campbell, Chair | | Craig F. Heimark, Chair | | Robert M. Metcalfe, Chair | | Gerald J. Burnett |

| Craig F. Heimark | | R. Stephen Heinrichs | | William L. Campbell | | Robert F. Kirk |

Audit Committee

Mr. Campbell serves as the Chairman of the Audit Committee. The Company is no longer listed on the NASDAQ Capital Market and the Audit Committee as constituted does not satisfy the director independence requirements that apply to companies listed on the NASDAQ Capital Market. The board of directors has determined that Mr. Campbell and Mr. Heimark are "audit committee financial experts" as defined by Item 407(d)(5) of Regulation S-K under the Securities Act. This designation is a disclosure requirement of the SEC and does not impose upon Mr. Campbell any duties, obligations, or liabilities greater than that which would otherwise be imposed by virtue of his membership on the board or the Audit Committee. In addition, this designation does not affect the duties, obligations, or liabilities of any other director or Audit Committee member. The board has determined that each audit committee member has sufficient knowledge in reading and understanding financial statements to serve on the audit committee.

The Audit Committee oversees the accounting, financial reporting and audit processes; makes determinations regarding the selection of an independent registered public accounting firm; reviews the results and scope of audit and other services provided by the independent registered public accounting firm; reviews the accounting principles and auditing practices and procedures to be used in preparing the Company’s financial statements; and reviews the Company’s internal controls. The Audit Committee works closely with management and the Company’s independent registered public accounting firm. The Audit Committee meets with the Company’s independent registered public accounting firm in an executive session, without the presence of management, on a quarterly basis following completion of their quarterly reviews and annual audit, and prior to the Company’s earnings announcements, to review the results of their work. The Audit Committee also meets with the Company’s independent registered public accounting firm annually to approve the scope of the audit services to be performed. In light of the Company’s delisting from the NASDAQ Capital Market, the Board approved an amendment and restatement of the Audit Committee’s charter on April 21, 2010 to remove the NASDAQ Capital Market independence requirements from the charter. The Audit Committee met four times during 2010. The Audit Committee’s Report for 2010 is included in this proxy statement. The amended and restated charter of the Audit Committee was filed with SEC on April 30, 2010 as an attachment to the Company’s proxy statement for its 2010 annual meeting of stockholders. Following the Annual Meeting and subject to the election of the nominees named in this proxy statement, the Audit Committee membership is expected to remain unchanged.

Compensation Committee

The Compensation Committee currently consists of Mr. Heinrichs and Mr. Heimark. Each of Mr. Heinrichs and Mr. Heimark is independent within the meaning of NASDAQ Marketplace Rules and SEC regulations. Mr. Heimark is currently the Chair of the Compensation Committee. The Compensation Committee is responsible for reviewing salaries, incentives and other forms of compensation for directors and executive officers, and for other employees of the Company as requested by the board of directors. In addition, the Compensation Committee reviews the various incentive compensation and benefit plans of the Company. The Compensation Committee met four times and acted by unanimous written consent twice during 2010. The Compensation Committee charter was filed with the SEC on April 28, 2006 as an attachment to the Company’s 2006 proxy statement. Following the Annual Meeting and subject to the election of the nominees named in this proxy statement, the Compensation Committee membership is expected to remain unchanged.

Nominating Committee

The Nominating Committee currently consists of Dr. Metcalfe and Mr. Campbell. The Nominating Committee was formed to assist the board of directors in meeting applicable governance standards by monitoring the composition of the board of directors, and, when appropriate, seeking, screening and recommending for nomination qualified candidates (i) for election to the Company’s board of directors at the Company’s annual meetings and; (ii) to fill vacancies on the Company’s board of directors. In light of the Company’s delisting from NASDAQ, at its April 21, 2010 meeting the Board approved an amendment and restatement of the Nominating Committee’s charter to remove the NASDAQ independence requirements from the charter. The Nominating Committee met twice in 2010. The amended and restated charter of the Nominating Committee was filed with SEC on April 30, 2010 as an attachment to the Company’s proxy statement for its 2010 annual meeting of stockholders. Following the Annual Meeting and subject to the election of the nominees named in this proxy statement, the Nominating Committee membership is expected to remain unchanged.

Requirements for stockholder recommendations of a candidate to the Board

The Nominating Committee will consider recommendations for candidates to the board of directors from stockholders of the Company. A stockholder that desires to recommend a candidate for consideration by the committee as a potential candidate for director must direct the recommendation in writing to the Company at its principal executive offices in San Mateo, California (Attention: Elias MurrayMetzger, Corporate Secretary) and must include the candidate's name, age, home and business contact information, principal occupation or employment, the number of shares beneficially owned by the candidate, information regarding any arrangements or understandings between the candidate and the stockholder recommending the candidate or any other persons relating to the recommendation, and any other information required to be disclosed about the candidate if proxies were to be solicited to elect the candidate as a director pursuant to Regulation 14 of the Exchange Act. The Nominating Committee will consider the recommendation but will not be obligated to take any further actions with respect to the recommendation.

Requirements for stockholder nominations to be brought before an annual meeting

The amended and restated bylaws contain specific requirements governing the processes and procedures for stockholders who wish to formally nominate a candidate and ensure that he or she is nominated and eligible for election at an annual meeting of stockholders. Generally, nominations for the election of directors may be made by stockholders who have timely delivered written notice to the Company at its principal executive offices in San Mateo, California (Attention: Elias MurrayMetzger, Corporate Secretary) in compliance with the advance notice provisions included in the amended and restated bylaws. Such notice must contain specified information concerning the nominees such as the nominees' name, age, home and business contact information, principal occupation or employment, the class and number of shares beneficially owned by the nominee and any derivative positions held or beneficially held by the nominee, whether any hedging transactions have been entered into by the nominee or on his or her behalf, information regarding any arrangements or understandings between the nominee and the stockholder nominating the nominee or any other persons relating to the nomination, a written statement by the nominee acknowledging that the nominee will owe a fiduciary duty to the Company and the stockholders if elected, and any other information required to be disclosed about the nominee if proxies were to be solicited to elect the nominee as a director pursuant to Regulation 14 of the Exchange Act. For a stockholder recommendation to be considered by the Nominating Committee of a potential candidate at an annual meeting, written notice of nominations must be received timely on or before the deadline for receipt of stockholder proposals for such meeting. In the event a stockholder decides to nominate a candidate for director and solicits proxies for such candidate, the stockholder will need to follow the rules set forth by the SEC and in the amended and restated bylaws. See "Deadline for Receipt of Stockholder Proposals for the 2012 Annual Meeting".

Except as may be required by rules promulgated by the SEC, it is the current position of the committee that there are no specific qualifications that must be met by any candidate for the board, nor are there specific qualities or skills that are necessary for any candidate for the board to possess. These procedures may be modified at any time as may be determined by the committee.

In evaluating the suitability of the candidates, the committee considers relevant factors, including, among other things, issues of character, judgment, independence, expertise, diversity of experience, length of service, other commitments and the like. The committee considers the diversity of the candidates and the board based on factors such as business background and experience and potential contributions to the board.

The board of directors has the final authority in determining the selection of director candidates for nomination to the board.

Stock Option Committee

The Stock Option Committee was formed in April 2001 by resolution of the board of directors of the Company, and currently consists of Dr. Burnett and Mr. Kirk. The Stock Option Committee is not a formal or standing committee of the board of directors. The Stock Option Committee is responsible for reviewing and approving stock option grants under the Company’s 2009 Equity Incentive Plan to new employees (excluding executive officers) and consultants, all in accordance with specific guidelines and directions established by the Compensation Committee. On a regular basis, all actions of the Stock Option Committee are reported to the Compensation Committee and to the board of directors. The Stock Option Committee acted by written consent three times in 2010. Following the Annual Meeting and subject to the election of the nominees named in this proxy statement, the Stock Option Committee membership is expected to remain unchanged.

Communication with the Board of Directors

Stockholders may communicate with the board of directors by submitting an email to IR@avistar.com indicating ‘Board of Directors’ in the subject line, or by writing to the Company at Avistar Communications Corporation, Attention: Board of Directors, ℅ Corporate Secretary, 1875 S. Grant Street, 10th Floor, San Mateo, California 94402. Stockholders who would like their submission directed to a specific member of the board of directors may so specify, and the communication will be forwarded.

Attendance of the 2010 Annual Meeting of Stockholders

Although the Company does not have a formal policy regarding attendance by members of the board of directors at the Company’s annual meetings of stockholders, directors are encouraged to attend annual meetings. Dr. Burnett and Mr. Campbell attended the 2010 annual meeting of stockholders.

Code of Ethics

The board of directors has adopted a Business Conduct and Ethics Policy that is applicable to all the Company’s employees, officers and directors and to certain of its agents, contractors and consultants. A copy of the Business Conduct and Ethics Policy is available at http://www.avistar.com/about-us/investor-relations/ethics-policy/. The Company will report any amendments or waivers for the Business Code and Ethics Policy for any of its officers or directors at http://www.avistar.com/about-us/investor-relations/ethics-policy/.

Compensation of Directors

The Company’s employees do not receive any additional compensation for serving on the board of directors or its committees. Non-employee directors receive a fee of $2,500 per meeting, if not waived by the director. All of the Company’s directors may be reimbursed for reasonable travel expenses incurred in attending board of directors meetings.

The Company’s 2000 Director Option Plan (the “Director Plan”) provides options to purchase Common Stock to non-employee directors of the Company pursuant to an automatic non-discretionary grant mechanism. The exercise price of the options is 100% of the fair market value of the Common Stock on the grant date. The Director Plan currently provides for an initial grant (the “Initial Grant”) to a non-employee director of an option to purchase 50,000 shares of Common Stock. Subsequent to the Initial Grant, each non-employee director is granted an option to purchase 25,000 shares of Common Stock (the “Subsequent Grant”) automatically on January 1 of each year, provided that the non-employee director has served on the board of directors for at least the preceding six months.

Each director who is a member of the Audit Committee of the board of directors is granted an additional option to purchase Common Stock (a “Subsequent Audit Committee Option”) automatically on January 1 of each year, provided he or she is then a member of the Audit Committee of the board of directors. The Subsequent Audit Committee Option is for 10,000 shares for the Chairman of the Audit Committee and 5,000 shares for each other member of the Audit Committee.

The Director Plan provides for the following:(i) options granted under the plan shall continue to vest and be exercisable for so long as the option holder remains a director or consultant to the Company, subject to the term of the option; (ii) the time period for optionees to exercise options following the date on which they are no longer a director or consultant to the Company continues for a period of time that is determined by that service provider’s length of service, and (iii) the board of directors has the authority to make amendments to the Director Plan applicable to all options granted under the Director Plan, including options granted prior to the effective date of the amendment. The term of the options granted under the Director Plan is ten years, but the exercise period of such options may be extended until the second anniversary of a director’s termination depending on the director’s length of service with the Company, or 12 months following the termination, if such termination is due to death or disability. The Initial Grants and the Subsequent Grants become exercisable at a rate of one-fourth of the shares on the first anniversary of the grant date, and then 1/48 of the shares during each subsequent month. In January 2010, Messrs. Campbell, Heinrichs, Heimark and Dr. Burnett and Dr. Metcalfe were each granted a Subsequent Grant to purchase 25,000 shares of the Company’s Common Stock at an exercise price of $0.45 per share. Also in January 2010, in consideration for service on the Audit Committee of the board of directors, Mr. Heimark and Dr. Metcalfe were each granted a Subsequent Audit Committee Option to purchase 5,000 shares at an exercise price of $0.45 per share. No options were granted to Mr. Zeigon who resigned from the Board and various committees of the Board effective January 4, 2010.

The Director Plan expired in April 2010. On April 21, 2010, pursuant to the pending expiration of the Director Plan, the Board approved the automatic grant under the 2009 Equity Incentive Plan, effective as of the first day of each fiscal year commencing on January 1, 2011, of (a) a nonqualified stock option to purchase 25,000 shares of the Company’s common stock to each non-employee director, (b) a nonqualified stock option to purchase an additional 5,000 shares of the Company’s common stock to each outside director who is a member of the Audit Committee, and (c) a nonqualified stock option to purchase an additional 5,000 shares of the Company’s common stock to the chairperson of the Audit Committee. The options shall have the same terms as the automatic annual grants previously issued under the Director Plan.

The following table sets forth information concerning total compensation paid or accrued for services rendered to the Company in all capacities by the non-employee directors for the fiscal year ended December 31, 2010.

DIRECTOR COMPENSATION

| Fees Earned or Paid in Cash ($)(1) | | |

| Gerald J. Burnett | $ 12,500 | $9,378 | $ 21,878 |

| William L. Campbell (2) | $ 12,500 | $27,279 | $ 39,779 |

| Craig F. Heimark | $ 12,500 | $11,253 | $ 23,753 |

| R. Stephen Heinrichs | $ 12,500 | $9,378 | $ 21,878 |

| Robert M. Metcalfe (3) | $ 12,500 | $16,000 | $ 28,500 |

| James W. Zeigon (4) | $ — | $— | $ — |

————————————

(1) | Amounts do not reflect compensation actually received by the director. Instead the amounts included under the “Option Awards” column represent the aggregate grant date fair value of option awards granted during the fiscal year ended December 31, 2010, computed in accordance with Financial Accounting Standards Codification Topic, 718, Compensation – Stock Compensation (“ASC 718”). See “Compensation of Directors” above for a full description of these awards. For a discussion of the valuation assumptions, see Note 7 to our consolidated financial statements included in our annual Report on Form 10-K for the year ended December 31, 2010. |

| (2) | “Option Awards” column reflects $9,378 in options granted for 2010 and $17,901 incremental fair value for exchanged options under the Company’s Stock Option Exchange Program on June 15, 2010 (the “Exchange Program”). For more detail on the Exchange Program, see Note 7 to our consolidated financial statements included in our Annual Report on Form 10-K for the year-ended December 31, 2010. The incremental fair value was calculated in accordance with ASC 718 provisions. |

| (3) | “Option Awards” column reflect $11,253 in options granted for 2010 and $4,747 incremental fair value for exchanged options under the Company’s Exchange Program. |

| (4) | Mr. Zeigon resigned from the board effective January 4, 2010. |

Vote Required; Recommendation of Board of Directors

If a quorum is present and voting, the nominees receiving the highest number of votes will be elected to the board of directors. Abstentions and broker non-votes are not counted in the election of directors.

The Company’s board of directors unanimously approved the nomination of each of the individuals listed above and recommends that the stockholders vote “FOR” the elections of these nominees.

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Burr Pilger Mayer, Inc., or BPM, as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2011, and recommends that stockholders vote for ratification of such appointment. Before making its selection, the Audit Committee carefully considered the firm’s qualifications as independent auditors. This included a review of the qualifications of the engagement team, the quality control procedures the firm has established, and any issues raised by the most recent quality control review of the firm; as well as its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee’s review also included matters required to be considered under the SEC’s rules on auditor independence, including the nature and extent of non-audit services provided by BPM, to ensure that they will not impair the independence of the accountants. The Audit Committee expressed its satisfaction with BPM in all of these respects. Representatives of BPM are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Audit Fees

For fiscal 2010, BPM billed the Company $206,993 in fees and expenses for the audit of its annual financial statements included in its annual report on Form 10-K, review of the Company’s unaudited interim quarterly financial statements included in its quarterly reports on Form 10-Q, and review of the Company’s prepared response to the SEC comment letter. Additionally, BPM billed the Company $6,515 for its review of the 2010 annual Proxy Statement and 2010 Employee Stock Purchase Plan registration statement.

For fiscal 2009, BPM billed the Company $201,283 in fees and expenses for the audit of its annual financial statements included in its annual report on Form 10-K, and review of the Company’s unaudited interim quarterly financial statements included in its quarterly reports on Form 10-Q. Additionally, BPM billed the Company $6,486 for its review of the 2009 annual Proxy Statement and 2009 Equity Incentive Plan registration statement.

Non-audit Related Fees

BPM did not bill the Company for non-audit related fees in fiscal 2010 or 2009.

Tax Fees and All Other Fees

BPM did not provide, and the Company did not pay, BPM for any tax or other professional services to the Company in fiscal 2010 or 2009. The Company did not engage BPM to provide advice regarding financial information systems design and implementation during fiscal 2010 or 2009.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm subject to limited discretionary authority granted to the Company’s chief financial officer. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. The services provided by BPM as described above were approved by the Audit Committee.

For fiscal 2010, the Audit Committee considered whether the services rendered by BPM were compatible with maintaining BPM’s independence as independent registered public accounting firm of the Company’s financial statements, and concluded that they were.

Vote Required; Recommendation of Board of Directors

Stockholder ratification of the selection of BPM as the Company’s independent registered public accounting firm is not required by applicable law. However, the board of directors is submitting the selection of BPM to the stockholders for ratification as a matter of good corporate governance. If the stockholders fail to ratify the selection, the Audit Committee and the board of directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee may, at its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

If a quorum is present and voting, the affirmative vote of a majority of the shares voting shall be required to ratify the appointment of BPM. Abstentions and “broker non-votes” are not counted in the ratification of BPM’s appointment.

The Company’s board of directors unanimously recommends a vote “FOR” the ratification of the appointment of Burr Pilger Mayer, Inc. as the Company’s independent registered public accounting firm for fiscal 2011.

EXECUTIVE COMPENSATION

Executive Officers

Our executive officers and their respective ages as of April 20, 2011 were as follows:

| | |

Robert F. Kirk | 55 | Chief Executive Officer |

| Elias A. MurrayMetzger | 41 | Chief Financial Officer, Chief Administrative Officer & Corporate Secretary |

Stephen M. Epstein | 46 | Chief Marketing Officer |

J. Chris Lauwers | 51 | Chief Technology Officer |

| Stephen W. Westmoreland | 55 | Chief Information Officer |

Anton F. Rodde | 68 | President, Intellectual Property Division |

Michael J. Dignen | 56 | Senior Vice President, Sales |

Bryan M. Kennedy | 55 | Vice President, Business Development |

Robert F. Kirk - see biography in the board of directors section of this proxy.

Elias (Eli) A. MurrayMetzger joined Avistar in January 2006 as the Company’s Controller. In January 2010, Mr. MurrayMetzger received the additional title of Chief Administrative officer. In April 2009 Mr. MurrayMetzger was appointed Chief Financial Officer and Corporate Secretary by the Board of Directors after being promoted to Acting Chief Financial Officer and Acting Corporate Secretary of the Company in January 2009. Mr. MurrayMetzger brings to Avistar more than 12 years of experience in financial management, regulatory compliance and operations at technology organizations. Prior to joining Avistar, Mr. MurrayMetzger served as Assistant Controller of Centra Software, Inc., a provider of software solutions for online business communication, collaboration and learning. During his tenure at Centra from April 2004 to January 2006, Mr. MurrayMetzger successfully navigated the company’s Sarbanes-Oxley compliance effort and all SEC reporting and compliance functions as the company reached profitability and was sold to Saba, Inc. in February 2006. Prior to Centra, Mr. MurrayMetzger worked for the technology audit practice of PricewaterhouseCoopers from February 2000 to March 2004. He is a Certified Public Accountant and has a Bachelor of Science in Agribusiness with a concentration in finance from California Polytechnic State University, San Luis Obispo.

Stephen M. Epstein joined Avistar in January 2008 as the Company’s Chief Marketing Officer. Prior to Avistar, he was Vice President, Head of Product Management at Mantas Inc. from July 2003 to January 2008. From May 2002 to July 2003, Mr. Epstein was Head of Product & Business Development at Bang Networks. From 1995 to 2002, Mr. Epstein held senior-level management and product development positions including, Head of Global Foreign Exchange Sales Technology and Group CTO at Deutsche Bank. Mr. Epstein attended Vanier College in Montreal, Canada.

J. Chris Lauwers has been the Company’s Chief Technology Officer since February 2000. He served as Vice President of Engineering of Avistar Systems from 1994 to 2000. He previously served as Principal Software Architect at Vicor Inc., a private e-business product solutions and engineering consulting company, from 1990 to 1994, and as a research associate at Olivetti Research Center from 1987 to 1990. Dr. Lauwers holds a B.S. in electrical engineering from the Katholieke Universiteit Leuven of Belgium. Dr. Lauwers also holds an M.S. and a Ph.D. in electrical engineering and computer science from Stanford University.

Stephen W. Westmoreland joined Avistar in September 2009 as Chief Information Officer. Prior to Avistar, Mr. Westmoreland was the Senior Vice President of Support Operations for Vicor from December 2003 to September 2009, where he helped grow the company and played a leading role as part of Metavante’s successful acquisition of Vicor. Mr. Westmoreland also previously held chief information officer positions at Damage Studios and VALinux Systems from 1999 to 2003 and earlier, he held operations and technology positions with Bank of America, Wells Fargo, and Centex. Mr. Westmoreland holds a B.S. degree in Computer Science from Louisiana Tech University.

Anton F. Rodde has been the President of the Company’s Intellectual Property division (organized as a separate subsidiary and legal entity up until October 2007) since December 2003. Prior to joining Avistar, he served as President and CEO of Western Data Systems, an ERP software company, from 1991 to 2003, as President and General Manager of several subsidiaries of Teknekron Corporation, a technology incubator, from 1984 to 1991, as founder and President of Control Automation, a robotics company, from 1980 to 1984, and held a variety of technical and management positions at AT&T from 1970 to 1980. Dr. Rodde holds a B.S. in physics from Benedictine University and an M.S. and Ph.D. in physics from the Illinois Institute of Technology.

Michael J. Dignen joined Avistar in July 2010 and is responsible for the Company’s sales and account management initiatives. Prior to joining Avistar, Mr. Dignen held executive sales management positions at US Dataworks from April 2009 to July 2010, Vicor (a business unit of Metavante Corp) from February 2002 to April 2009, and Profit Technologies Corporation from April 1995 to February 2002. Mr. Dignen has successfully sold enterprise sized software solutions to Fortune 500 companies, as well as emerging small and medium sized businesses. He has a proven track record driving sales efforts into promising new product areas while optimizing the efforts of his sales and account management teams. Mr. Dignen holds a Bachelor of Business Administration degree with a major in Finance from George Washington University.

Bryan M. Kennedy joined Avistar in December 2009 as Avistar’s Vice President, Business Development. Prior to Avistar, Mr. Kennedy held executive management positions at Avid Technology, a leader in digital media solutions, from November 2005 to January 2009. From 2001 to November 2005, Mr. Kennedy was self employed and provided consulting services related to mergers, acquisitions and corporate strategy to a variety of businesses. From 1992 to 2001, Mr. Kennedy was General Partner for Platinum Venture Partners, a leading venture capital firm. Mr. Kennedy was also a consultant for McKinsey and Company from 1988 to 1992. Mr. Kennedy holds a B.S. in Economics and Finance from Farleigh Dickenson University and an M.B.A. from Harvard Business School.

The following table presents information concerning the total compensation of the Company’s Chief Executive Officer, Chief Financial Officer and two other most highly compensated officers (the “Named Executive Officers”) for services rendered to the Company in all capacities for the fiscal year ended December 31, 2010 and 2009:

SUMMARY COMPENSATION TABLE

Name and Principal Position | | | Discretionary Non-Plan Based Bonus ($) | | | |

| Robert F. Kirk (2) | 2010 | 270,000 | — | 150,000 | — | 420,000 |

| Chief Executive Officer | 2009 | 125,827 | — | — | 881,700 | 1,007,527 |

| | | | | | | |

| Elias A. MurrayMetzger | 2010 | 210,469 | — | — | — | 210,469 |

| Chief Financial Officer, Chief Administrative Officer and Corporate Secretary | 2009 | 181,383 | — | 44,000 | 151,934 | 377,317 |

| | | | | | | |

| Anton F. Rodde (3) | 2010 | 250,000 | 250,000 | — | — | 500,000 |

| President, Intellectual Property Division | 2009 | 218,750 | — | 88,000 | 10,435 | 317,185 |

| | | | | | | |

| J. Chris Lauwers (4) | 2010 | 250,000 | — | — | 10,091 | 260,091 |

| Chief Technology Officer | 2009 | 250,000 | 20,000 | 176,000 | 20,871 | 466,871 |

————————————

| (1) | Amounts shown do not reflect compensation actually received by the Named Executive Officer. Instead, the amounts represent the aggregate grant date fair value related to stock option awards, and the aggregate grant date fair market value related to restricted stock unit awards, granted in the year indicated, pursuant to Financial Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“ASC 718”). For a discussion of the valuation assumptions, see Note 7 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2010. The actual value that may be realized from an award is contingent upon the satisfaction of the conditions to vesting in that award on the date the award is vested. Thus, there is no assurance that the value, if any, eventually realized will correspond to the amount shown. |

| (2) | Mr. Kirk joined Avistar in July 2009 and has an annual base salary of $270,000 per year. |

| (3) | “Discretionary Non-Plan Based Bonus” column for 2010 represents bonus compensation that was awarded as a result of the completion of the sale of substantially all of Avistar’s intellectual property portfolio in January 2010. |

| (4) | “Option Awards” column for 2010 reflects $10,091 incremental fair value for exchanged options under the Company’s Stock Option Exchange Program on June 15, 2010 (the “Exchange Program”). For more detail on the Exchange Program, see Note 7 to our consolidated financial statements included in our Annual Report on Form 10-K for the year-ended December 31, 2010. The incremental fair value was calculated in accordance with ASC 718 provisions. |

The following table presents certain information concerning equity awards held by the Named Executive Officers at December 31, 2010.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| Number of Securities Underlying Unexercised Options (#) Exercisable (1) | Number of Securities Underlying Unexercised Options (#) Unexercisable (1) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Option (#) | Option Exercise Price ($) | | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(2) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

| Robert F. Kirk | 343,750 | 656,250 | | $0.8000 | 7/14/2019 | | | | |

| Chief Executive Officer | 125,000 | 375,000 | | $0.8000 | 7/14/2019 | | | | |

| | | | | | 4/21/2012 | | | 300,000 | $141,000 |

| | | | | | | | | | |

| Elias A. MurrayMetzger | 37,500 | 12,500 | | $0.6100 | 12/15/2017 | | | | |

| Chief Financial Officer, Chief Administrative Officer and Corporate Secretary | | 128,000 | | $0.5500 | 6/15/2020 | | | | |

| | 38,400 | | $0.5500 | 6/15/2020 | | | | |

| | 30,029 | | $0.5500 | 6/15/2020 | | | | |

| | 14,000 | | $0.5500 | 6/15/2020 | | | | |

| | 8,400 | | $0.5500 | 6/15/2020 | | | | |

| | 7,000 | | $0.5500 | 6/15/2020 | | | | |

| | | | | | 12/8/2011 | | | 100,000 | $47,000 |

| | | | | | | | | | |

| Anton F. Rodde | 187,500 | 62,500 | | $0.6100 | 12/15/2017 | | | | |

| President, Intellectual Property Division | | 4,500 | | $0.5500 | 6/15/2020 | | | | |

| | 7,500 | | $0.5500 | 6/15/2020 | | | | |

| | | 29,069 | | $0.5500 | 6/15/2020 | | | | |

| | | 102,934 | | $0.5500 | 6/15/2020 | | | | |

| | | 107,065 | | $0.5500 | 6/15/2020 | | | | |

| | | 33,441 | | $0.5500 | 6/15/2020 | | | | |

| | | 1,558 | | $0.5500 | 6/15/2020 | | | | |

| | | 21,875 | | $0.5500 | 6/15/2020 | | | | |

| | | 13,125 | | $0.5500 | 6/15/2020 | | | | |

| | | 18,281 | | $0.5500 | 6/15/2020 | | | | |

| | | 30,468 | | $0.5500 | 6/15/2020 | | | | |

| | | 195,000 | | $0.5500 | 6/15/2020 | | | | |

| | | | | | 12/8/2011 | | | 200,000 | $94,000 |

| | | | | | | | | | |

| J. Chris Lauwers | 25,000 | — | | $0.6100 | 12/15/2017 | | | | |

| Chief Technology Officer | 50,000 | 25,000 | | $0.6100 | 12/15/2017 | | | | |

| | 24,000 | | $0.5500 | 6/15/2020 | | | | |

| | | 3,125 | | $0.5500 | 6/15/2020 | | | | |

| | | 25,944 | | $0.5500 | 6/15/2020 | | | | |

| | | 26,250 | | $0.5500 | 6/15/2020 | | | | |

| | | 15,750 | | $0.5500 | 6/15/2020 | | | | |

| | | 17,327 | | $0.5500 | 6/15/2020 | | | | |

| | | 17,672 | | $0.5500 | 6/15/2020 | | | | |

| | | 39,180 | | $0.5500 | 6/15/2020 | | | | |

| | | 25,819 | | $0.5500 | 6/15/2020 | | | | |

| | | 80,913 | | $0.5500 | 6/15/2020 | | | | |

| | | 19,086 | | $0.5500 | 6/15/2020 | | | | |

| | | 90,166 | | $0.5500 | 6/15/2020 | | | | |

| | | 29,833 | | $0.5500 | 6/15/2020 | | | | |

| | | 30,625 | | $0.5500 | 6/15/2020 | | | | |

| | | 18,375 | | $0.5500 | 6/15/2020 | | | | |

| | | 26,250 | | $0.5500 | 6/15/2020 | | | | |

| | | 43,750 | | $0.5500 | 6/15/2020 | | | | |

| | | 5,000 | | $0.5500 | 6/15/2020 | | | | |

| | | | | | 12/8/2011 | | | 400,000 | $188,000 |

| | | | | | | | | | |

————————————————

| (1) | Options expiring on June 15, 2020 represent options granted pursuant to the Company’s Exchange Program that was completed on June 15, 2010. These exchanged options vest 50% annually or 33% annually and contain a change-in-control provision. Other options identified above generally vest over a four-year period with 1/4th of the shares vesting on the first anniversary of the vesting commencement date and 1/16th of the shares subject to the option vesting at the end of each subsequent three month period until the option is fully vested. These options are also included in the Summary Compensation Table and do not constitute additional compensation. |