COVID-19 Supplemental Investor Update May 26, 2020 Exhibit 99.1

Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of federal securities laws. Investors and prospective investors should understand that many factors govern whether any forward-looking statement contained herein will be or can be realized. Any one of those factors could cause actual results to differ materially from those projected. Examples of forward-looking statements in this presentation include, but are not limited to, statements and expectations regarding NiSource’s or any of its subsidiaries' plans, strategies, objectives, expected performance, expenditures, recovery of expenditures through rates, stated on either a consolidated or segment basis, and any and all underlying assumptions and other statements that are other than statements of historical fact. All forward-looking statements are based on assumptions that management believes to be reasonable; however, there can be no assurance that actual results will not differ materially. Factors that could cause actual results to differ materially from the projections, forecasts, estimates, and expectations discussed in this presentation include, among other things the ongoing impact of the coronavirus (COVID-19) pandemic; NiSource’s debt obligations; any changes in NiSource’s credit rating or the credit rating of certain of NiSource's subsidiaries; NiSource’s ability to execute its growth strategy; changes in general economic, capital and commodity market conditions; pension funding obligations; economic regulation and the impact of regulatory rate reviews; NiSource's ability to obtain expected financial or regulatory outcomes; NiSource’s ability to adapt to, and manage costs related to, advances in technology; any changes in NiSource’s assumptions regarding the financial implications of the Greater Lawrence Incident; compliance with the agreements entered into with the U.S. Attorney’s Office for the District of Massachusetts to settle the U.S. Attorney’s Office investigation relating to the Greater Lawrence Incident; the pending sale of the Columbia Gas of Massachusetts business, including the terms and closing conditions under the asset purchase agreement; potential incidents and other operating risks associated with NiSource’s business; NiSource’s ability to obtain sufficient insurance coverage; the outcome of legal and regulatory proceedings, investigations, incidents, claims and litigation; any damage to NiSource's reputation, including in connection with the Greater Lawrence Incident; compliance with environmental laws and the costs of associated liabilities; fluctuations in demand from residential and commercial customers; economic conditions of certain industries; the success of NIPSCO's electric generation strategy; the price of energy commodities and related transportation costs; the reliability of customers and suppliers to fulfill their payment and contractual obligations; potential impairments of goodwill or definite-lived intangible assets; changes in taxation and accounting principles; the impact of an aging infrastructure; the impact of climate change; potential cyber-attacks; construction risks and natural gas costs and supply risks; extreme weather conditions; the attraction and retention of a qualified work force; the ability of NiSource's subsidiaries to generate cash; NiSource’s ability to manage new initiatives and organizational changes; the performance of third-party suppliers and service providers; changes in the method for determining LIBOR and the potential replacement of the LIBOR benchmark interest rate; and other matters set forth in Item 1A, "Risk Factors" section of NiSource’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and in NiSource’s Quarterly Report on Form 10Q for the quarter ended March 31, 2020. A credit rating is not a recommendation to buy, sell or hold securities, and may be subject to revision or withdrawal at any time by the assigning rating organization. In addition, dividends are subject to board approval. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. NiSource expressly disclaims any duty to update, supplement or amend any of its forward-looking statements contained in this presentation, whether as a result of new information, subsequent events or otherwise, except as required by applicable law.

Following CDC and local guidelines intended to ensure the health and safety of our employees and customers Activated Incident Command Structure to coordinate strategy, execution and communication across all seven states For Customers Suspended shut-offs for non-payment and are offering flexible payment plans Directed field employees to follow CDC and local health department guidance including social distancing at any customer premises and minimized all non-essential field work that requires entry to customer homes and locations On-going and frequent communications For Communities NiSource foundation donation of $1M to American Red Cross Nearly $500K donated by the foundation to support operating company initiatives at the local level For Employees Approximately 75% are working remotely or reporting directly to job sites Sequestering employees in critical operations Employees who need to enter company facilities are required to submit to temperature checks, adhere to social distancing measures and wear face masks More frequent cleaning and sanitizing of equipment and buildings Generally limiting company vehicle occupancy to one person Primary Focus on Customer and Employee Safety and Health 3

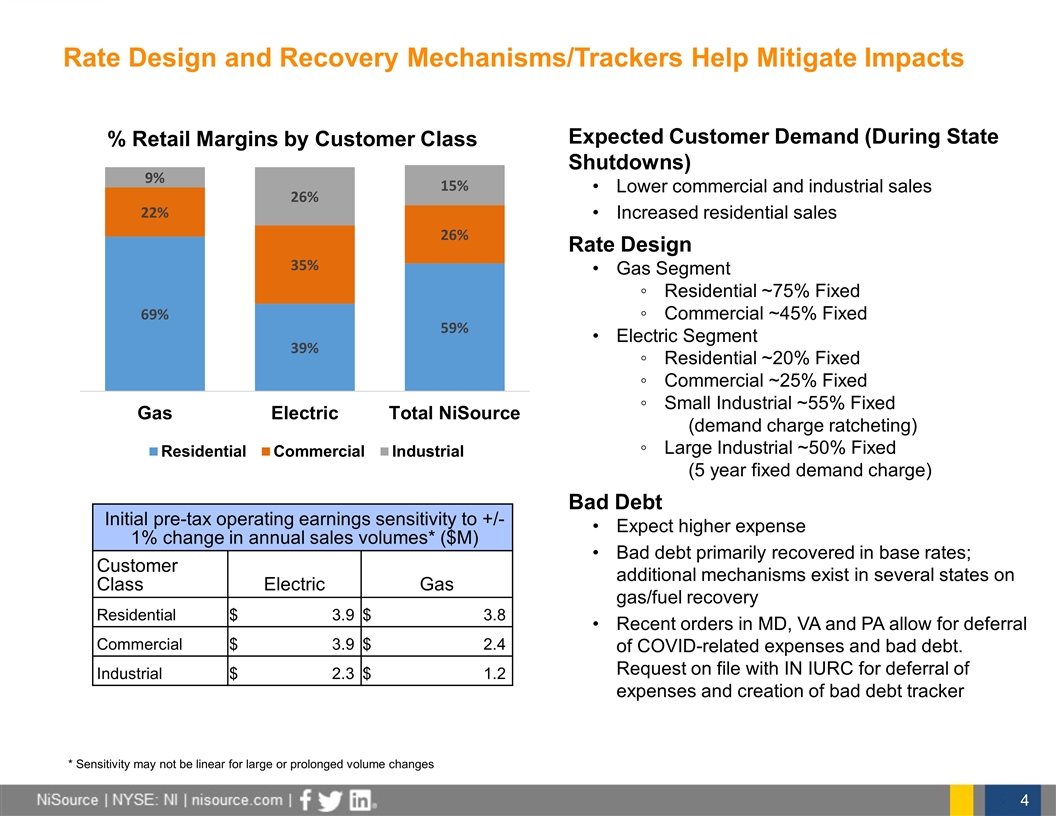

Expected Customer Demand (During State Shutdowns) Lower commercial and industrial sales Increased residential sales Rate Design Gas Segment Residential ~75% Fixed Commercial ~45% Fixed Electric Segment Residential ~20% Fixed Commercial ~25% Fixed Small Industrial ~55% Fixed (demand charge ratcheting) Large Industrial ~50% Fixed (5 year fixed demand charge) Bad Debt Expect higher expense Bad debt primarily recovered in base rates; additional mechanisms exist in several states on gas/fuel recovery Recent orders in MD, VA and PA allow for deferral of COVID-related expenses and bad debt. Request on file with IN IURC for deferral of expenses and creation of bad debt tracker Initial pre-tax operating earnings sensitivity to +/- 1% change in annual sales volumes* ($M) Customer Class Electric Electric Gas Gas Residential $ 3.9 $ 3.8 Commercial $ 3.9 $ 2.4 Industrial $ 2.3 $ 1.2 * Sensitivity may not be linear for large or prolonged volume changes Rate Design and Recovery Mechanisms/Trackers Help Mitigate Impacts

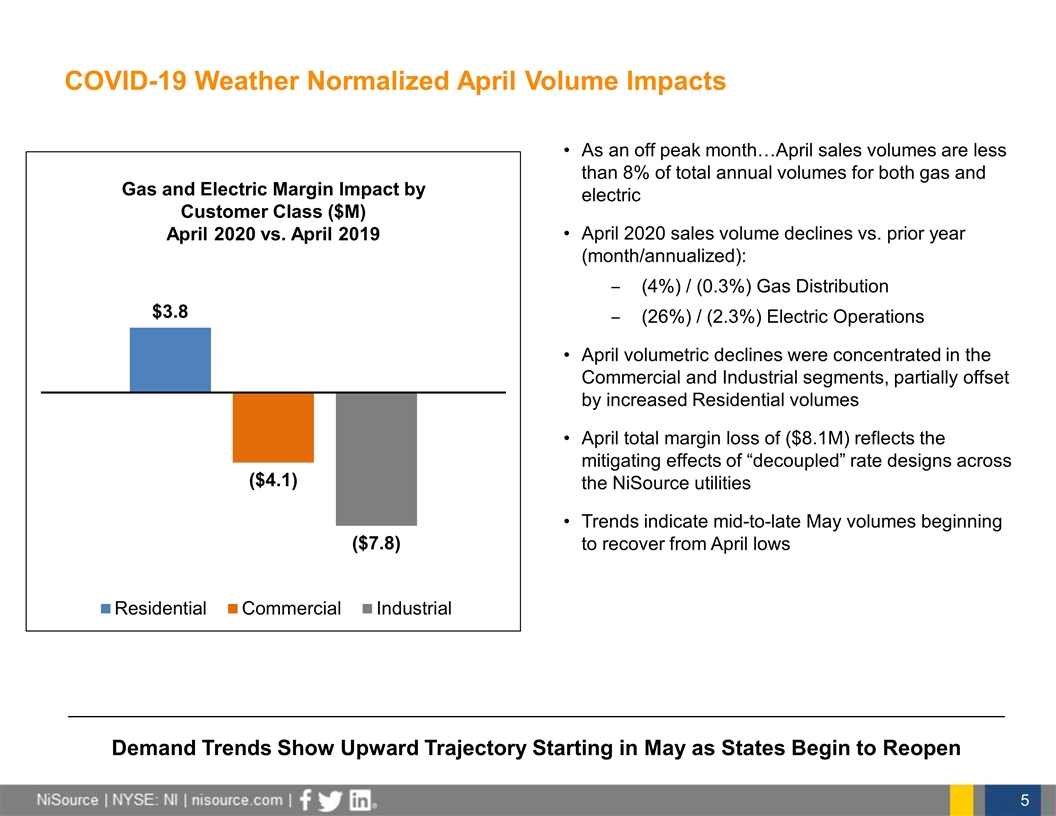

COVID-19 Weather Normalized April Volume Impacts As an off peak month…April sales volumes are less than 8% of total annual volumes for both gas and electric April 2020 sales volume declines vs. prior year (month/annualized): (4%) / (0.3%) Gas Distribution (26%) / (2.3%) Electric Operations April volumetric declines were concentrated in the Commercial and Industrial segments, partially offset by increased Residential volumes April total margin loss of ($8.1M) reflects the mitigating effects of “decoupled” rate designs across the NiSource utilities Trends indicate mid-to-late May volumes beginning to recover from April lows Gas and Electric Margin Impact by Customer Class ($M) April 2020 vs. April 2019 Demand Trends Show Upward Trajectory Starting in May as States Begin to Reopen

COVID-19 Impact Base Case Assumptions Customer load and demand changes highly concentrated in 2020 during state shutdowns; assumes current state level reopen plans and a gradual recovery into normal usage patterns in 1H 2021 Modest customer attrition and load declines in 2021 Base Case margin reduction of ($30-$40M) in 2020 and ($0-$25M) in 2021 Lost late payment and reconnection fee revenues and increased bad debt expenses continue into second half of 2020 with a modest impact into 2021 Increased operational expenses and supply costs primarily during 2020 with some potential impact into 2021 Other potential 2020/2021 impacts include regulatory timing and additional financing expenses Mitigation Efforts Underway - Initiated in April O&M Reductions (non-safety related): Employee and administrative expenses, deferral of some non-essential field work Regulatory deferrals/recovery for COVID related impacts currently allowed in several states with ongoing conversations across all jurisdictions Organizational repositioning (announced May 21, 2020) includes adjustments to address dis-synergies and improve efficiencies. Timing of implementation/execution will impact the level of benefit in 2021 Actions Underway to Mitigate 2020/2021 Headwinds from COVID-19 Estimated COVID Related NOEPS* Impacts 2020 2021 ($0.15 - $0.20) ($0.00 - $0.10) Estimated NOEPS Impact of Mitigation Efforts Underway 2020 2021 $0.10 - $0.15 $0.05 - $0.10 Estimated Net NOEPS Impact (Base Case Scenario) 2020 ($0.00 - $0.10) 2021 ($0.00 - $0.10) * Net Operating Earnings Per Share (Non-GAAP)

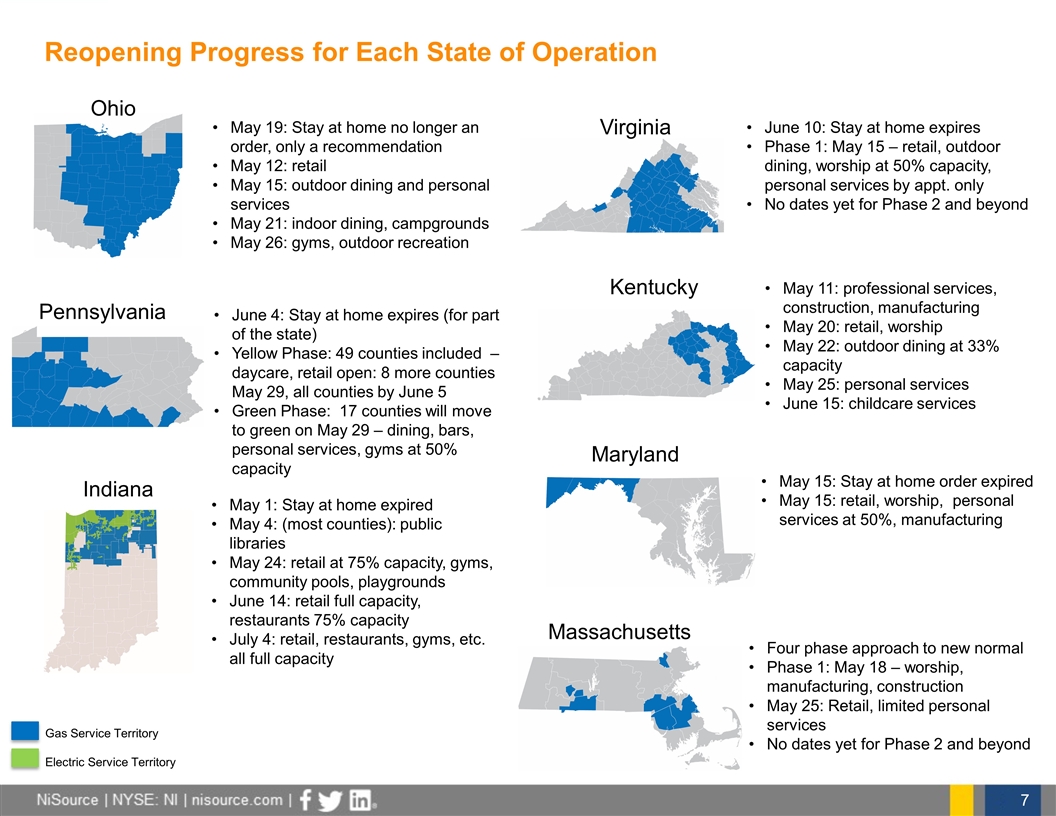

Reopening Progress for Each State of Operation May 19: Stay at home no longer an order, only a recommendation May 12: retail May 15: outdoor dining and personal services May 21: indoor dining, campgrounds May 26: gyms, outdoor recreation June 4: Stay at home expires (for part of the state) Yellow Phase: 49 counties included – daycare, retail open: 8 more counties May 29, all counties by June 5 Green Phase: 17 counties will move to green on May 29 – dining, bars, personal services, gyms at 50% capacity May 1: Stay at home expired May 4: (most counties): public libraries May 24: retail at 75% capacity, gyms, community pools, playgrounds June 14: retail full capacity, restaurants 75% capacity July 4: retail, restaurants, gyms, etc. all full capacity Four phase approach to new normal Phase 1: May 18 – worship, manufacturing, construction May 25: Retail, limited personal services No dates yet for Phase 2 and beyond June 10: Stay at home expires Phase 1: May 15 – retail, outdoor dining, worship at 50% capacity, personal services by appt. only No dates yet for Phase 2 and beyond May 11: professional services, construction, manufacturing May 20: retail, worship May 22: outdoor dining at 33% capacity May 25: personal services June 15: childcare services May 15: Stay at home order expired May 15: retail, worship, personal services at 50%, manufacturing Ohio Pennsylvania Indiana Maryland Kentucky Virginia Massachusetts Gas Service Territory Electric Service Territory

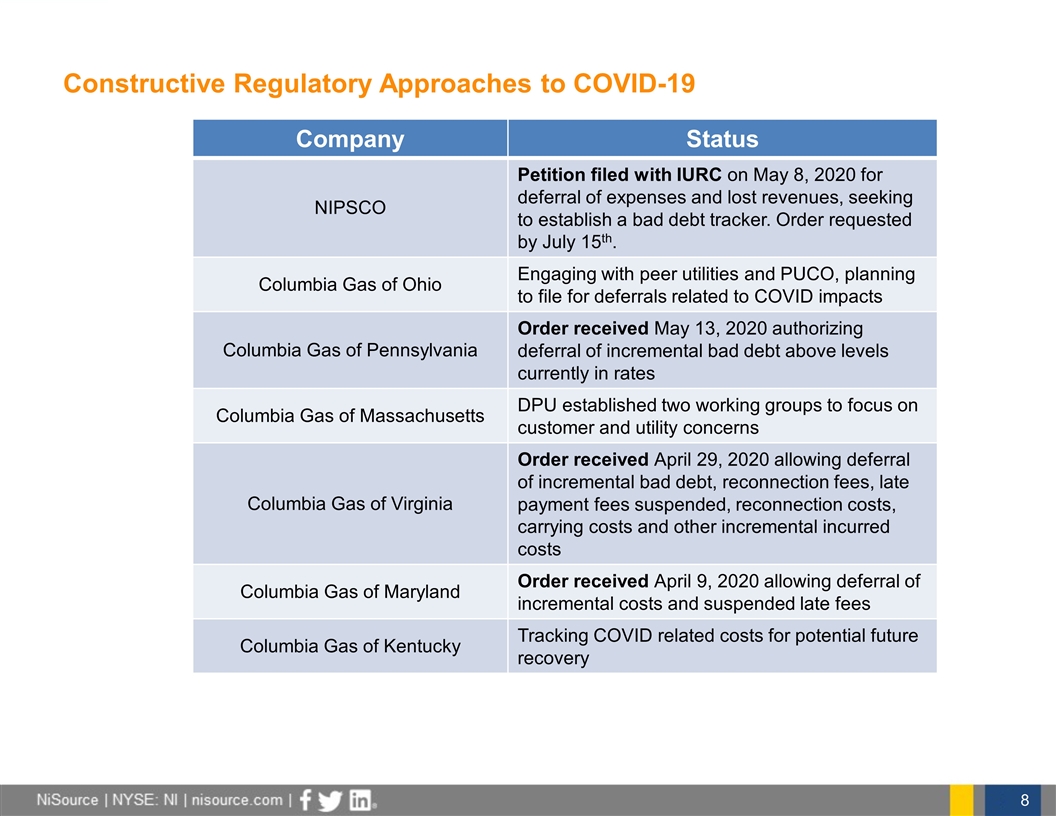

Constructive Regulatory Approaches to COVID-19 Company Status NIPSCO Petition filed with IURC on May 8, 2020 for deferral of expenses and lost revenues, seeking to establish a bad debt tracker. Order requested by July 15th. Columbia Gas of Ohio Engaging with peer utilities and PUCO, planning to file for deferrals related to COVID impacts Columbia Gas of Pennsylvania Order received May 13, 2020 authorizing deferral of incremental bad debt above levels currently in rates Columbia Gas of Massachusetts DPU established two working groups to focus on customer and utility concerns Columbia Gas of Virginia Order received April 29, 2020 allowing deferral of incremental bad debt, reconnection fees, late payment fees suspended, reconnection costs, carrying costs and other incremental incurred costs Columbia Gas of Maryland Order received April 9, 2020 allowing deferral of incremental costs and suspended late fees Columbia Gas of Kentucky Tracking COVID related costs for potential future recovery

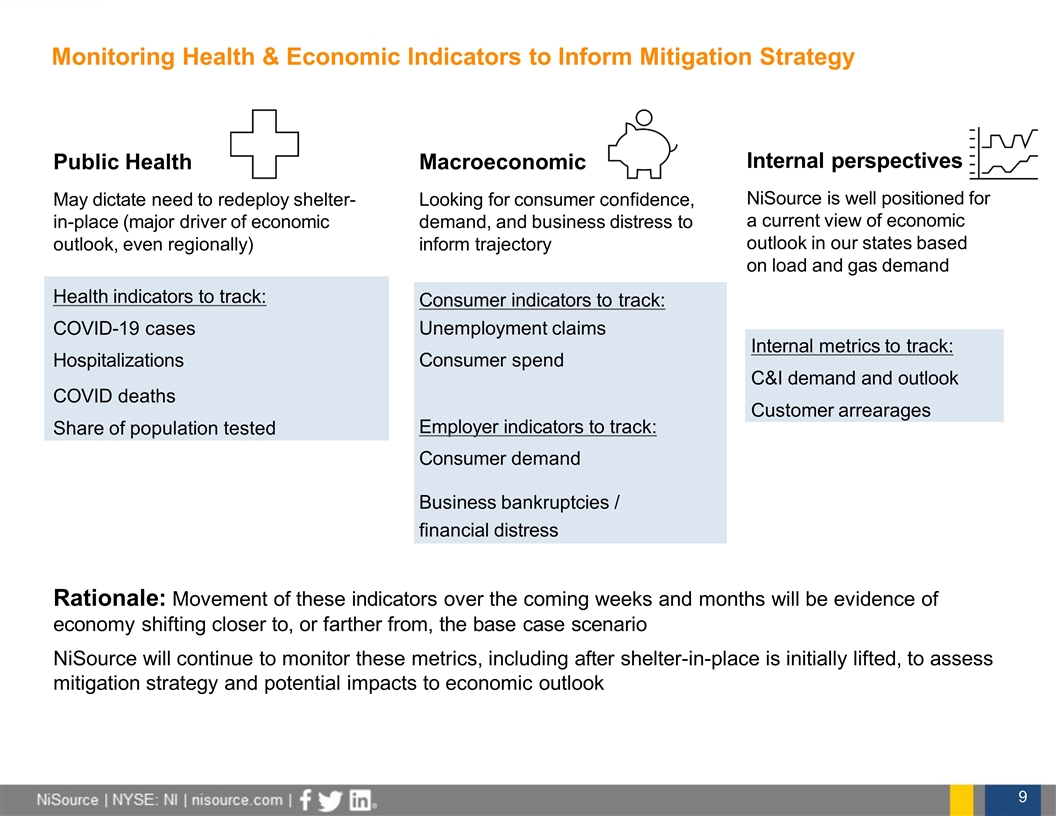

Public Health May dictate need to redeploy shelter-in-place (major driver of economic outlook, even regionally) Health indicators to track: COVID-19 cases Hospitalizations COVID deaths Share of population tested Rationale: Movement of these indicators over the coming weeks and months will be evidence of economy shifting closer to, or farther from, the base case scenario NiSource will continue to monitor these metrics, including after shelter-in-place is initially lifted, to assess mitigation strategy and potential impacts to economic outlook Macroeconomic Looking for consumer confidence, demand, and business distress to inform trajectory Consumer indicators to track: Unemployment claims Consumer spend Employer indicators to track: Consumer demand Business bankruptcies / financial distress Internal perspectives NiSource is well positioned for a current view of economic outlook in our states based on load and gas demand Internal metrics to track: C&I demand and outlook Customer arrearages Monitoring Health & Economic Indicators to Inform Mitigation Strategy

Key Takeaways Continued Focus on Customer and Employee Safety and Health Currently no Significant Impacts to Supply Chain or Operating Activities Proactively Managing Impacts to our Business Plan O&M Reductions Underway Regulatory Solutions – in dialogue across all jurisdictions Organizational Repositioning announced May 21, 2020 5 to 7% Long-Term Growth and Generation Strategy Remain Intact

Appendix: COVID-19 Update

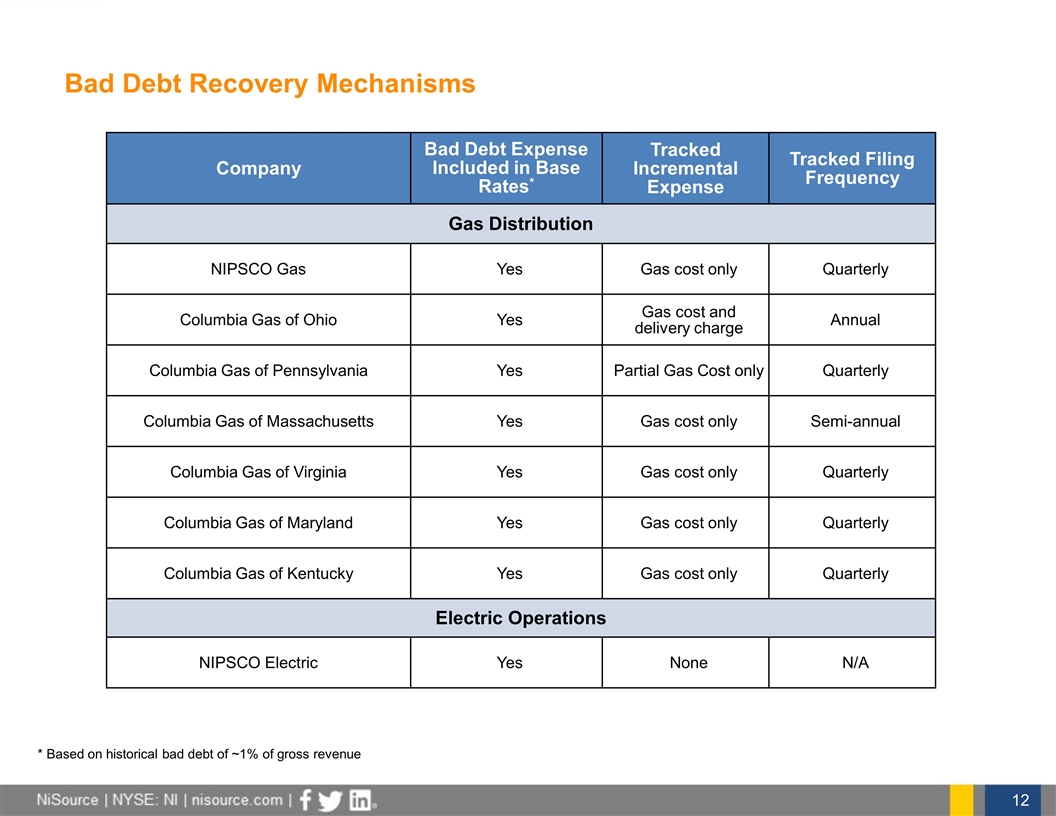

Bad Debt Recovery Mechanisms Company Bad Debt Expense Included in Base Rates* Tracked Incremental Expense Tracked Filing Frequency Gas Distribution NIPSCO Gas Yes Gas cost only Quarterly Columbia Gas of Ohio Yes Gas cost and delivery charge Annual Columbia Gas of Pennsylvania Yes Partial Gas Cost only Quarterly Columbia Gas of Massachusetts Yes Gas cost only Semi-annual Columbia Gas of Virginia Yes Gas cost only Quarterly Columbia Gas of Maryland Yes Gas cost only Quarterly Columbia Gas of Kentucky Yes Gas cost only Quarterly Electric Operations NIPSCO Electric Yes None N/A * Based on historical bad debt of ~1% of gross revenue

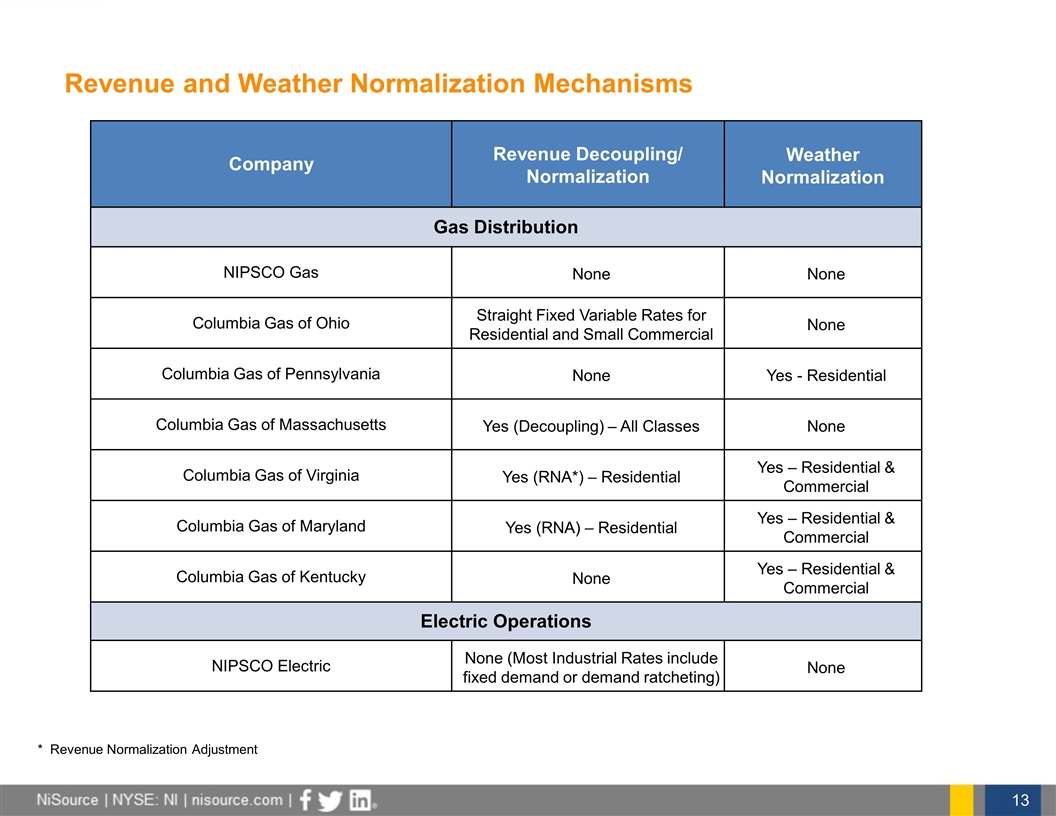

Company Revenue Decoupling/ Normalization Weather Normalization Gas Distribution NIPSCO Gas None None Columbia Gas of Ohio Straight Fixed Variable Rates for Residential and Small Commercial None Columbia Gas of Pennsylvania None Yes - Residential Columbia Gas of Massachusetts Yes (Decoupling) – All Classes None Columbia Gas of Virginia Yes (RNA*) – Residential Yes – Residential & Commercial Columbia Gas of Maryland Yes (RNA) – Residential Yes – Residential & Commercial Columbia Gas of Kentucky None Yes – Residential & Commercial Electric Operations NIPSCO Electric None (Most Industrial Rates include fixed demand or demand ratcheting) None Revenue and Weather Normalization Mechanisms * Revenue Normalization Adjustment