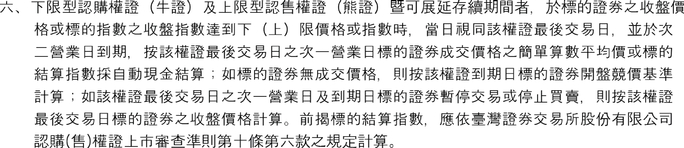

QuickLinks -- Click here to rapidly navigate through this document

Exhibit (a)(3)

COMMON SHARE FORM OF ACCEPTANCE

To Tender Common Shares

of

Siliconware Precision Industries Co., Ltd.

Pursuant to the U.S. Offer to Purchase dated December 29, 2015

by

Advanced Semiconductor Engineering, Inc.

|

| |

| THE U.S. OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 1:30 A.M., NEW YORK CITY TIME, ON FEBRUARY 16, 2016, UNLESS THE U.S. OFFER IS EXTENDED |

| |

NO GUARANTEED DELIVERY

Please deliver this properly completed and duly executed Common Share Form of Acceptance and accompanying documents to KGI Securities Co. Ltd., in its capacity as the Republic of China tender agent for the U.S. Offer (the "Common Share Tender Agent"), at one of the addresses set forth below, with a copy delivered simultaneously delivered to your registered custodian bank or local agent (the "Custodian Bank") in the Republic of China:

By First Class, Registered, Certified, Express or Overnight Mail:

KGI Securities Co. Ltd.

US Offer Designated Account

6F, No.700, Mingshui Road,

Taipei, Taiwan, 10462, Republic of China

THE INSTRUCTIONS ACCOMPANYING THIS COMMON SHARE FORM OF ACCEPTANCE SHOULD BE READ CAREFULLY BEFORE THIS COMMON SHARE FORM OF ACCEPTANCE IS COMPLETED. REQUESTS FOR ASSISTANCE OR ADDITIONAL COPIES OF THE U.S. OFFER TO PURCHASE AND THIS COMMON SHARE FORM OF ACCEPTANCE MAY BE MADE TO OR OBTAINED FROM THE U.S. INFORMATION AGENT AT ITS ADDRESS OR TELEPHONE NUMBERS SET FORTH BELOW.

You must sign this Common Share Form of Acceptance in the appropriate space provided below and complete the substitute W-9 set forth below (or an applicable IRS Form W-8) and other specified documents.

The U.S. Offer (as defined below) is subject to the terms described in "Terms of the U.S. Offer" of the U.S. Offer to Purchase, dated December 29, 2015 (the "U.S. Offer to Purchase"). You should only use this Common Share Form of Acceptance to tender your Common Shares of Siliconware Precision Industries Co., Ltd. held directly on the register maintained by the TDCC (as defined below) and if you are a U.S. holder (within the meaning of Rule 14d-1(d) under the Securities Exchange Act of 1934, as amended (the "Exchange Act")).

The U.S. Offer is not being made to, nor will tenders be accepted from or on behalf of, holders of Common Shares in any jurisdiction in which the making of the U.S. Offer or acceptance thereof would not be in compliance with the laws of such jurisdiction.

NOTE: SIGNATURE(S) MUST BE PROVIDED BELOW.

PLEASE READ THE INSTRUCTIONS SET FORTH IN THIS COMMON SHARE

FORM ON ACCEPTANCE CAREFULLY.

Ladies and Gentlemen:

The undersigned hereby tenders to Advanced Semiconductor Engineering, Inc. ("Purchaser") the above-described Common Shares, par value NT$10.00 per share ("Common Shares"), of Siliconware Precision Industries Co., Ltd., a company limited by shares under the Company Law of the Republic of China ("SPIL"), upon the terms set forth in the U.S. Offer to Purchase, receipt of which is hereby acknowledged, and this Common Share Form of Acceptance (which, together with any amendments or supplements thereto or thereto, collectively constitute the "U.S. Offer"). I understand that concurrently with the U.S. Offer, in the Republic of China Purchaser is offering to purchase Common Shares (the "ROC Offer" and, together with the U.S. Offer, the "Offers"), as more fully described in "The Offer—Section 1—Dual Offer Structure" in the U.S. Offer to Purchase. I will execute all other documents and take all other actions required to enable Purchaser to receive all rights to, and benefits of, the Common Shares represented by the tendered Common Shares.

Subject to my withdrawal rights and the acceptance of the Common Shares tendered by this Common Share Form of Acceptance, in each case, in accordance with the terms of the U.S. Offer—including any necessary proration as described in the U.S. Offer to Purchase and including, if the U.S. Offer is extended or amended, the terms of any extension or amendment—I hereby sell, assign and transfer to, or upon the order of, Purchaser, all right, title and interest in the Common Shares tendered by this Common Share Form of Acceptance.

I hereby represent and warrant that I or my agent holds title to the Common Shares being tendered or, if I am tendering Common Shares on behalf of another person, such person holds title to Common Shares being tendered; that neither I nor my agent nor any person on whose behalf I am tendering Common Shares has granted to any person any right to acquire any of the Common Shares being tendered or any other right with respect to these Common Shares; that I have full power, authority and capacity under applicable law to tender, sell, assign and transfer the Common Shares tendered by this Common Share Form of Acceptance, that, when the tendered Common Shares are accepted, Purchaser will acquire good, marketable and unencumbered title to such Common Shares, free and clear of all liens, equities, restrictions, charges and encumbrances, together with all rights that they now have or may acquire in the future, including voting rights and rights to all dividends, other distributions and payments hereafter declared, made or paid, and the same will not be subject to any adverse claim; and that the tendered Common Shares are not subject to any adverse claims or proxies; and that I am a U.S. holder (within the meaning of Rule 14d-1(d) under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

I hereby irrevocably authorize and request the Common Share Tender Agent to procure the registration of the transfer of the tendered Common Shares and the delivery of these Common Shares to Purchaser and to record and act upon any instructions with respect to notices and payments relating to my Common Shares which have been recorded in SPIL's books and records, including any actions necessary with respect to the Taiwan Depositary & Clearing Corporation ("TDCC"). I will, upon request, execute and deliver any additional documents deemed by Purchaser or the Common Share Tender Agent to be necessary or desirable to complete the sale, assignment and transfer of the Common Shares tendered by this Common Share Form of Acceptance and take any and all steps necessary to ensure that there are no liens, restrictions, charges or encumbrances upon the tendered Common Shares. I have received a copy of, and I agree to all of the terms of, the U.S. Offer to Purchase and the U.S. Offer described therein.

2

I understand that I may only participate in the U.S. Offer by one of the two following options:

- •

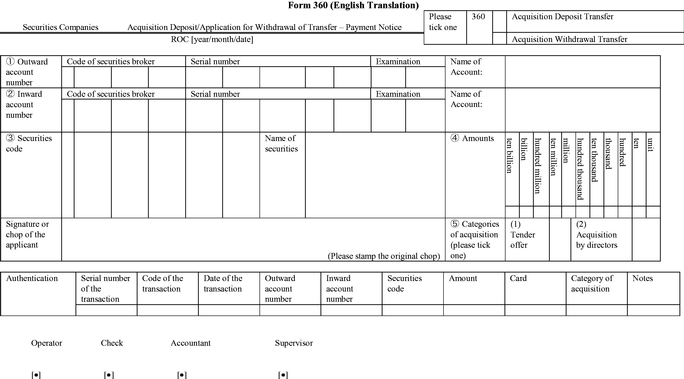

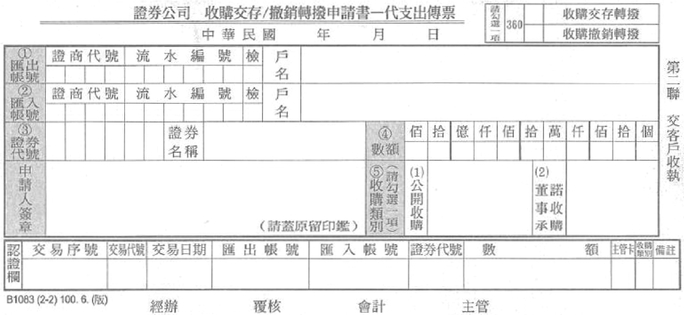

- Option 1: By delivering (i) this Common Share Form of Acceptance to the Common Share Tender Agent at the address set forth on the back cover of this Common Share Form of Acceptance, with a copy to my Custodian Bank, and (ii) written instruction to my Custodian Bank, in the form attached as Annex A to this Common Share Form of Acceptance, with a copy to the Common Share Tender Agent, requesting your Custodian Bank to (a) open a securities brokerage account with the Common Share Tender Agent (a "KGI Brokerage Account") by completing the necessary account opening documents on my behalf, including, among others, the Account Opening Master Agreement (the "KGI Brokerage Agreement") in the form attached as Annex B to this Common Share Form of Acceptance, and (b) complete on my behalf a Republic of China securities tender transfer form (a "Form 360"), in the form attached as Annex C to this Common Share Form of Acceptance. I understand that if I chose this option, my KGI Brokerage Account should be opened and the Form 360 Form should be delivered to the Common Share Tender Agent no later than 12:00 midnight, New York City time, on February 15, 2016.

- •

- Option 2: By delivering (i) this Common Share Form of Acceptance to the Common Share Tender Agent at the address set forth on the back cover of this Common Share Form of Acceptance, with a copy to my Custodian Bank, and (ii) a power of attorney, in the form attached as Annex D to the Common Share Form of Acceptance (a "Common Share POA"), to my Custodian Bank, with a copy to the Common share Tender Agent. The Common Share POA will authorize the Common Share Tender Agent to act on my behalf for all matters in connection with my request to tender all or any portion of my Common Shares in the U.S. Offer, including for the Common Share Tender Agent to act on my behalf and instruct my Custodian Bank to transfer such Common Shares through the book-entry system maintained by the TDCC prior to the expiration of the U.S. Offer in accordance with the instructions, procedures and deadlines established by TDCC. I understand that if I chose this option, the Common Share Tender Agent must receive my Common Share POA no later than 1:20 a.m., New York City time, on February 16, 2016.

The name(s) and address(es) of the registered holder(s) are printed above as they appear on the register maintained by the TDCC. The foreign institutional investor ("FINI") identification number or Foreign Individual Investor ("FIDI") identification number, the name(s), address(es) and contact number(s) of my Custodian Bank(s) and the TDCC account number(s) are printed above as they appear on the register maintained by the TDCC. The number of Common Shares that I wish to tender are indicated in the appropriate boxes above or, in the event that I left such information blank, I wish to tender all my Common Shares.

I understand that if I decide to tender Common Shares, and Purchaser accepts such Common Shares for payment, this will constitute a binding agreement between me and Purchaser, subject to the terms set forth in the U.S. Offer.

All authority conferred in or agreed to be conferred in this Common Share Form of Acceptance will survive my death or incapacity, and any obligation of mine under this Common Share Form of Acceptance will be binding upon my heirs, executors, administrators, personal representatives, trustees in bankruptcy, legal representatives, successors and assigns. Except as stated in the U.S. Offer to Purchase, this tender is irrevocable.

3

| | |

|

IMPORTANT

COMMON SHARE HOLDER: SIGN HERE |

(Please complete Substitute Form W-9 below, if applicable) |

|

Signature(s) of U.S. holder of Common Shares

| | |

| Dated | | , 2016 |

Name(s) |

|

|

|

|

|

| | | (Please Print) |

Number of Common Shares Tendered |

|

|

FINI or FIDI ID Number(s) |

|

|

TDCC Account Number(s) |

|

|

Name of Custodian Bank(s) or Local Agent(s) |

|

|

Custodian Bank or Local Agent Contact (full title) |

|

|

Custodian Bank or Local Agent Contact |

|

|

|

|

|

| | | (Zip Code) |

| | |

Area Code and Telephone Number |

|

|

Method of Tender (Option 1 or Option 2): |

|

|

(Must be signed by registered holder(s) exactly as name(s) appear(s) on stock certificate(s) or on a security position listing or by person(s) authorized to become registered holder(s) by certificates and documents transmitted herewith. If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or other person acting in a fiduciary or representative capacity, please set forth full title and see Instruction 5.)

Please deliver a signed copy of this Common Share Form of Acceptance, along with the following required documents:

- •

- if you chose Option 1: please sign and deliver the written instruction to your Custodian Bank, in the form attached as Annex A, with a copy to the Common Share Tender Agent. You

4

understand that if you chose this option, your KGI Brokerage Account should be opened and the Form 360 Form should be delivered to the Common Share Tender Agent no later than 12:00 midnight, New York City time, on February 15, 2016; or

- •

- if you chose Option 2: please sign a deliver a Common Share POA, in the form attached at Annex D, to your Custodian Bank, with a copy to the Common share Tender Agent. You understand that if you chose this option, the Common Share Tender Agent must receive your Common Share POA no later than 1:20 a.m., New York City time, on February 16, 2016.

You should deliver the necessary documents listed above to KGI Securities Co. Ltd., the US Offer Designated Account located at 6F, No.700, Mingshui Road, Taipei, Taiwan, 10462, Republic of China. If you or your Custodian Bank have questions regarding the U.S. Offer for the Common Shares, please contact the following persons:

Gary Su

Tel : +886-2-2181 8888 ext. 8345

Email : gary.su@kgi.com

Kally Kuo

Tel : +886-2-2181 8888 ext. 8346

Email : kally.kuo@kgi.com

Linda Su

TEL : +886-2-2181 8888 ext. 8347

Email : linda.su@kgi.com

5

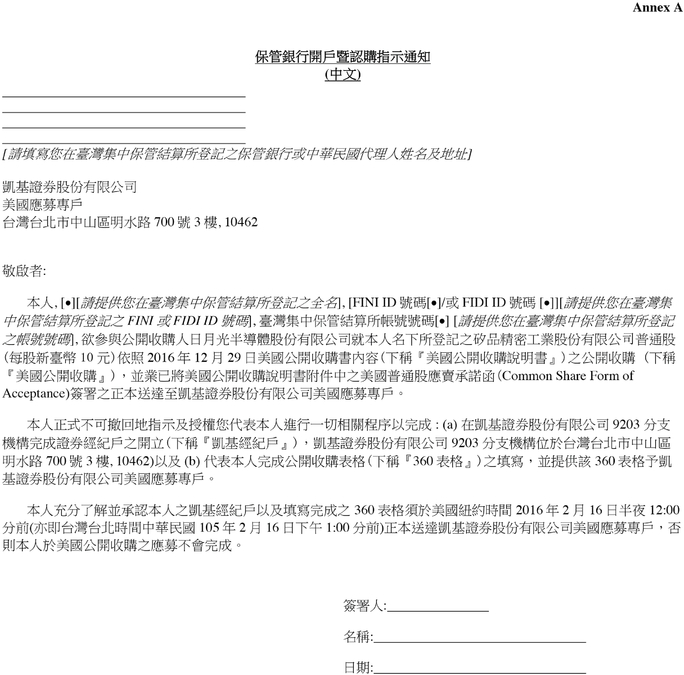

Annex A

Written Instructions to Custodian Bank

(English)

| | |

| | |

|

|

|

|

|

|

|

|

|

| [name and address of your custodian bank or agent registered with the TDCC] | | |

c/o KGI Securities Co. Ltd.

US Offer Designated Account

6F, No.700, Mingshui Road,

Taipei, Taiwan, 10462, Republic of China |

|

|

- RE:

- Foreign Institutional Investor or Foreign Individual Investor Number

Taiwan Depository & Clearing Corporation Account Number

Ladies and Gentlemen:

I, [provide name as registered with TDCC], intend to tender to Advanced Semiconductor Engineering, Inc. common shares, par value NT$10.00 per share ("Common Shares"), of Siliconware Precision Industries Co., Ltd., a company limited by shares under the Company Law of the Republic of China, upon the terms set forth in the U.S. Offer to Purchase, dated December 29, 2015 ("U.S. Offer to Purchase") and have delivered a signed Common Share Form of Acceptance pursuant thereto to KGI Securities Co. Ltd. (the "Common Share Tender Agent").

I hereby irrevocably instruct and authorize you to complete on my behalf all necessary documents to (i) open a securities brokerage account (a "KGI Brokerage Account") with the Common Share Tender Agent at its 9203 branch, located at 3F, No.700, Mingshui Road, Taipei, Taiwan, 10462, Republic of China and (ii) complete a Republic of China securities tender transfer form (a "Form 360") and transmit such Form 360 to the Common Share Tender Agent.

I understand and acknowledge that my KGI Brokerage Account and the delivery of the signed Form 360 to the Common Share Tender agent should occur no later than 12:00 midnight, New York City time, on February 15, 2016 (which is 1:00 p.m. noon, Taipei City Time, on February 16, 2016) in order for my Common Shares to be validly tendered pursuant to the terms of the U.S. Offer to Purchase.

A-1

A-2

Annex B

Account Opening Master Agreement

The Client (Foreign Investor and Mainland Area Investor permitted by applicable R.O.C. Laws and Regulations; the "Client") pursuant to the relevant regulations of the Taiwan Stock Exchange Corporation (the "TSE") and GreTai Securities Market (the "GTSM") hereby appoints KGI Securities Co. Ltd. (the "Broker") to buy and sell securities on the TSE and GTSM market. The Client will advise the Broker of the names and quantities of securities and other terms of the order. The Broker's sales representatives will, accordingly, fill out the required order slips. The settlement and custody of securities shall be handled by the Custodian. This Account Opening Master Agreement (the "Agreement") is executed to stipulate the general terms and conditions for the purchase and sale of securities and the provisions hereunder shall be duly complied with by all parties:

Article 1. Account Opening Agreement for the Securities Transaction at the Centralized Market

The TSE Articles of Incorporation, the TSE Operational Rules, the Guidelines for Brokerage Agreement, announcements or amendments with respect thereto made by the TSE from time to time, the rules, and other regulations, announcements, and interpretation made by the Financial Supervisory Commission, Taiwan Depository & Clearing Corporation, and/or Taiwan Securities Association (the "Rules and Regulations"), shall be incorporated herein by reference and made a part of this Agreement. If the Rules and Regulations are amended, the amended Rules and Regulations shall be deemed to be incorporated herein and made a part of this Agreement.

The Broker shall correctly complete order slips, print out the order record or maintain transaction records, based on the Client's written, telegraphic, telephone, IC Card, internet, or face-to-face

B-1

instruction or via other means permitted by the competent authorities. The Broker shall complete the orders in accordance with the order slips or the transaction records.

The Broker may refuse or limit orders placed by the Client on the grounds of risk control or related conditions with the Client, etc.

If any error exists in an order placed by the Client as above and such error is not attributable to the Broker, the Client will be responsible for the error.

The Client shall confirm the matched securities transactions prior to the settlement time prescribed by the applicable Rules and Regulations and settle the transactions.

After the trade is matched, the Broker shall be entitled to commissions and other related expenses from the Client as agreed with the Client and the Client shall pay such commission and such expenses in full. The Broker may, to the extent permitted by the Rules and Regulations, deduct the above amounts from the funds of the Client in accordance with then market practices.

If the Client defaults in delivery of securities or making payments as required hereunder, such shall constitute a breach of this Agreement; provided, that the Broker shall report the default, on the Client's behalf, nevertheless complete the settlement procedures for such transactions pursuant to the applicable Rules and Regulations. The Broker may further collect a default penalty equal to not more than 7% of the transaction amount.

When the Client is in default, the Broker that accepted the order may postpone the termination of this Agreement and the cancellation of its brokerage account, and during the three (3) business days beginning from the business day after it reports the default, accept the Client's transferring its securities into the Broker's special account for handling default events for purposes of sale, in order to satisfy the Client's debts and fees incurred by the default. After the Client has satisfied its debts and fees during the aforesaid postponement period, and the Broker has reported the default

B-2

case closed, the Client may continue to use its original account for transactions. If the Client fails to settle its default debts and fees within the period, the Broker that accepted the order shall immediately terminate this Agreement and cancel its brokerage trading account.

On the day the Client is determined to be in default, the Broker shall request other securities brokers to handle the securities or funds it received through settling the transaction referred to in paragraph 1 on the centralized trading market of the securities exchange. Surplus remaining from the proceeds from such handling, after offsetting debt and fees resulting from the Client's default, may be returned to the Client. If there is a shortfall, compensation may be deducted from financial assets already received from or payable to the Client pursuant to other brokerage trades; if a shortfall remains, compensation may be sought from the Client.

A delay in settlement results in borrowing of securities, payments made by the Broker on behalf of the Client, or other related fees, the Client shall pay all such amounts to the Broker when completing settlement.

The Client's assets obtained by the Broker due to any mandated sale or purchase relationship and any proceeds payable to the Client as a result of any trade transaction may be retained by the Broker and applied to the indebtedness arising out of such trade transaction and shall not be returned to the Client until the Client has settled its debt.

The Broker shall not be responsible for the Broker's inability to perform or delay in performing its obligations to the Client under this Agreement as a result of any disruptions of transmission or computer link operation or other obstacles caused by force majeure events that are out of the control of the Broker.

Article 2. GTSM Trading Account Opening Agreement

The "Business Operation Rules for the Purchase and Sale of Securities at the Business Premises of Securities Firms (the "GTSM Rules"), regulations, announcements and amendments with respect thereto made by the GTSM from time to time, the rules, and other regulations, announcements and interpretations made by the Financial Supervisory Commission, Taiwan Depository & Clearing Corporation, and/or Taiwan Securities Association (the "GTSM Rules and Regulations") shall be incorporated herein by reference and made a part of this Agreement. If the Rules and Regulations are amended, the amended Rules and Regulations shall be deemed to be incorporated herein and made a part of this Agreement.

B-3

GTSM transactions may be conducted by brokerage or principal trading, at the price negotiated, or through the price match or yield match system. If GTSM transactions are handled by brokerage, after the trade is matched, the Broker shall be entitled to commissions and other related expenses from the Client as agreed with the Client from time to time and the Client shall pay such commissions and such expenses in full. The Broker may, to the extent permitted by the GTSM Rules and Regulations, deduct the above amounts from the funds of the Client in accordance with then market practices from time to time. If the GTSM transactions are conducted by trading with the Broker as principal, no commission shall be collected.

When accepting orders for brokerage transactions, the Broker shall correctly complete order slips, print out the order record or maintain transaction records, based on the Client's written, telegraphic, telephone, IC Card, internet, or face-to-face instruction or via other means permitted by the competent authorities. The Broker shall complete the orders in accordance with the order slips or the transaction records.

The Broker may refuse or limit orders placed by the Client on the grounds of risk control or related condition with the Client, etc.

If any error exists in an order placed by the Client as above and such error is not attributable to the Broker, the Client will be responsible for the error.

Where a GTSM transaction is conducted by brokerage, the Broker shall prepare a Buy/Sell Report for the Client's signature or chop in accordance with the GTSM Rules and Regulations (the Client need not sign or chop if (i) the Client has executed a letter of consent to the delivery or receipt of cash and/or securities directly from the relevant bank account and securities book-entry account; or (ii) the receipt or delivery of payment may be made by remittance pursuant to the Rules and Regulations). The purchase price to be received by the Broker or delivered to the Client shall be transferred through the Client's bank account, and the securities to be received by the Broker or

B-4

to be delivered to the Client shall be handled in accordance with the relevant provisions of the "Business Operation Procedures of the Taiwan Depository & Clearing Corporation."

Where a GTSM transaction is conducted by trading with the Broker as principal, the Broker shall prepare a Buy/Sell Report and a Payment Settlement Slip and Delivery Slip (if share certificates are delivered) for the Client's signature or chop in accordance with the GTSM Rules and Regulations, and the Broker shall settle the purchase price, handle the collection of the securities and/or the delivery thereof by such time and date as prescribed by the GTSM or in accordance with the relevant provisions of the "Business Operation Procedures of the Taiwan Depository & Clearing Corporation."

Where the Broker accepts an order placed by the Client for the purchase or sale of bonds, and the counterparty securities firm defaults in its obligation to settle the transaction, the Broker may demand from the counterparty securities firm a penalty equal to 0.1% of the transaction amount for every business day during the default period. If the counterparty securities firm fails to complete settlement within three (3) business days, the Broker may immediately exercise its right to terminate the transaction agreement, and claim against the counterparty securities firm for return of the bond or payments already delivered to such counterparty securities firm, plus indemnification for losses and damages GTSM.

The bond or payments, penalty and losses and damages received by the Broker in accordance with the proceeding paragraph shall be delivered to the Client.

B-5

In the event the Client breaches its obligation to settle, the Broker may terminate this Agreement and close the Client's account, report such breach to the GTSM in accordance with the GTSM's "Criteria for the Handling of the Client's Delay in Settlement and Failed Trades as Reported by the Broker for GTSM Transactions" and complete the settlement procedures on behalf of the Client. Where the Broker settles such transaction for and on behalf of the Client, the Broker may claim against the Client for a penalty within 7% of the settlement mount.

When the Client breaches its obligation to settle, the Broker may postpone the termination of this Agreement and the cancellation of its trading account, and during the three (3) business days beginning from the business day after it reports the default, accept the Client's transferring its securities into the Broker's special account for handling default events to be sold at a price agreed by both parties, in order to satisfy the Client's debts and fees incurred by the default. After the Client has satisfied its debts and fees during the aforesaid postponement period, and the Broker has reported the default case closed, the Client may continue to use its original account for transactions. If the Client fails to settle its default debts and fees within the period, the Broker shall immediately terminate this Agreement and cancel its trading account.

The securities or funds received by the Broker pursuant to such settlement mentioned in paragraph 1 shall be placed in a special account for failed trades not later than the business day following the date of the Client's failed trade. The proceeds thereof shall be applied to set-off the debts and costs resulting from the Client's such default (the "Client's Obligations"). If such proceeds exceed the Client's Obligations, the excess shall be returned to the Client. If such proceeds are insufficient to meet the Client's Obligations, the Broker may apply the proceeds resulting from the sale of any financial assets received or payable to the Client from other mandated trades to such shortfall. If such proceeds remain insufficient to meet the Client's Obligations, the Broker may seek payment from the Client.

A delay in settlement results in borrowing of securities, payments made by the Broker on behalf of the Client, or other related fees, the Client shall pay such amounts to the broker in full when the settlement is completed.

After the Broker has completed the procedures described in the preceding three paragraphs, the Broker shall report in accordance with "Criteria for the Handling of the Client's Delay in Settlement and Failed Trades as Reported by the Broker for GTSM Transactions" to the GTSM and notify the Client.

The Broker shall not be responsible for the Broker's inability to perform or delay in performing its obligations to the Client under this Agreement as a result of any disruptions of transmission or computer link operation or other obstacles caused by force majeure events that are out of the control of the Broker.

GTSM Trading Affirmation

Upon executing this GTSM Trading Account Opening Agreement, the Client hereby affirms that it understands the matters stated in the attached GTSM Trading Affirmation (Appendix I) and

B-6

agrees to abide by the regulations, announcements and other relevant rules made by the GTSM for the securities traded over-the-counter.

Article 3. Warrant Risk Notice

Upon executing this Account Opening Master Agreement, the Client hereby

- (i)

- acknowledges receipt of the attached Warrant Risk Notice (Appendix II), and

- (ii)

- confirms that it fully understands the risk associated with trading of warrants as set forth in the Warrant Risk Notice and agrees to be fully responsible for the above risks.

Article 4. Account Statement

At the end of each month, the Broker shall produce reconciliation statements and deliver them to the Client or its local agent as required by Rules and Regulations. The delivery of such statements may be done via the Electronic Information Exchange Platform of TSE.

Article 5. Arbitration

This Agreement shall be deemed an arbitration agreement. Disputes arising under this Agreement shall be settled by arbitration in accordance with the arbitration provisions of the Securities and Exchange Act or by applying for a conciliation with the Taiwan Securities Association, Securities and Futures Investors Protection Center. Arbitration procedures shall be conducted in accordance with the Arbitration Act. The place of arbitration shall be Taipei.

Article 6. Confidentiality

B-7

The Broker shall keep all mandated matters of the Client strictly confidential. However, the above shall not apply to disclosures (i) made in accordance with laws or regulations; (ii) made in response to inquiries from the competent authorities, judicial authorities (including courts and prosecutors), TSE, GTSM or the Taiwan Depository & Clearing Corporation; (iii) made internally within the Broker or its affiliates in accordance with the relevant confidentiality provisions in the relevant laws with respect to personal data protection or financial transactions of the R.O.C.; or (iv) made under outsourcing arrangement for purposes of credit review, risk control, audit, or information management, etc.; or (v) made under this Agreement or in relation to the shareholder matters of the purchased shares in compliance with applicable confidentiality principles.

Article 7. Cancellation of the Account and Termination of the Agreement

Except as otherwise provided by the Rules and Regulation or by this Agreement, either the Broker or the Client may cancel any individual securities transaction account by giving a written notice fourteen days prior to such cancellation to the other party. If the Client fails to place orders for transaction for three consecutive years, the Broker may notify the Client in writing to cancel the account.

Except as otherwise provided for in the Rules and Regulation, either the Broker or the Client may terminate this Agreement by giving one month's prior written notice to the other.

Article 8. The Governing Law

If there is any discrepancy between the English and Chinese versions of this Agreement, the Chinese version shall prevail.

The Client:

FINI No.:

Date of FINI Registration:

The Client's Agent in Taiwan:

GIIN:

B-8

Legal Representative:

Address:

The Broker : KGI Securities Co. Ltd.

Legal Representative:

Address:

Date:

B-9

Appendix I

GTSM Trading—Affirmation.

The Client has understood the following matters upon executing the account opening master agreement with the Broker, and should abide by the regulations, announcements and other relevant rules made by GTSM for the securities traded over-the-counter.

| | | |

| |

|

| | The securities traded over-the-counter shall be made based upon the Client's judgment. |

|

|

| | The Client understood completely the trading procedures, obligations and duties of settlement of payment and relevant rules regarding securities traded over-the-counter. |

B-I-10

Appendix II

Warrant Risk Notice.

This Risk Notice has been drafted pursuant to Article 4 of the Procedures of the TSE and the GTSM in the Purchase and Sale of Warrants.

The nature of warrants differs from that of stocks. While warrants may be a high return investment lever device providing great profits, the Client may also lose his or her entire investment within a very short period of time. Thus, in purchasing warrants, the Client should fully evaluate whether his or her own economic situation and financial ability matches the risks of the high return device. The Client should understand the following before he/she decides to conduct such trading:

The characteristic of warrants is that it is established based on transaction indexes of the right to purchase and sell underlying securities. Thus, the price of the warrants during its term will fluctuate based on the movement of the underlying security in question. The Client should observe the fluctuations of the price of the underlying securities and its effects on the warrant.

The issuing criteria such as the issuing price and exercise rate etc., of unlisted warrants is established by the issuer. Once the warrant becomes publicly listed and freely exchangeable, its price will be determined by the supply and demand mechanism of the market.

Prior to purchasing the warrant, the Client should first understand the issuer's performance ability in terms of its financial and credit situations. The TSE / GTSM does not guarantee nor is responsible for the performance responsibility of the issuer.

Where the issuer has violated the public listing agreement or where the underlying stock of the warrant has been delisted causing the warrant to terminate its public listing, the issuer shall, in accordance with the original issuing conditions, redeem the outstanding warrants at the price established in the contract to complete the issuer's contractual responsibilities.

B-II-11

Where the underlying of the warrants is exchange traded fund(s) composed of foreign securities, exchange traded fund(s) tracking foreign futures index(es), offshore exchange traded fund(s), foreign securities or index(es), there is no daily fluctuation limits. In the case of the purchase and sale of warrants with foreign securities or indexes as underlying, the Client should also take into account the foreign exchange rate and other risks.

On the day when the closing price/index of the underlying securities/index of the knock-out call warrant (bull warrants), knock-out put warrant (bear warrants), and warrants that are able to extend durations, reaches the floor and ceiling respectively, such day shall be deemed as the last trading day of the warrant, and the warrant shall expire on the following second business day and shall automatically be settled in cash based on the simple mathematical moving average strike price of such underlying securities or underlying settlement index on the business day following the last trading day of the warrant. If there is no strike price for the underlying securities, the opening price of the underlying securities one the expiration day shall be used for calculation. If the underlying securities are suspended for trading or stopped for sale/purchase on the business day following the last trading day of the warrant or on the expiration day of the warrant, the closing price of the underlying securities on the last trading day of the warrant shall be used for calculation. The underlying settlement index mentioned in the above shall be calculated pursuant to Sub-article 6, Article 10 of Taiwan Stock Exchange Corporation Rules Governing Review of Call (Put) Warrant Listings.

The items contained in the risk notice are only examples. This notice can not account for all the possible risks associated with warrants and factors which may influence the market. Apart from reading this notice, the Client is advised to take precaution of other factors which may influence the investment and to fully evaluate the risk associated therewith in his or her financial planning. This will reduce the possibility of the Client making a hasty investment decision in derivative financial products which may result in tremendous losses.

B-II-12

Annex C

C-1

Form 360 (Chinese)

C-2

Annex D

Common Share Power of Attorney

| | |

| | |

|

|

|

|

|

|

|

|

|

| [name and address of your custodian bank or agent registered with the TDCC] | | |

c/o KGI Securities Co. Ltd.

US Offer Designated Account

6F, No.700, Mingshui Road,

Taipei, Taiwan, 10462, Republic of China |

|

|

Ladies and Gentlemen:

I hereby irrevocably constitute and appoint KGI Securities Co. Ltd. (the "Common Share Tender Agent") as the agent and attorney-in-fact with respect to my tendered common shares, par value NT$10.00 per share ("Common Shares"), of Siliconware Precision Industries Co., Ltd., a company limited by shares under the Company Law of the Republic of China ("SPIL"), with full power of substitution, such power of attorney being deemed to be an irrevocable power coupled with an interest, subject only to the limited right of withdrawal as set forth in the U.S. Offer to Purchase, dated December 29, 2015 ("U.S. Offer to Purchase Offer"), to take the following actions:

- •

- execute and deliver, on the undersigned's behalf, all forms of transfer and other documents in order to instruct my registered Republic of China custodian bank or agent ("Custodian Bank") to effect the tender of the Common Shares indicated in the Common Share Form of Acceptance included herewith and the transfer of the Common Shares underlying such Common Shares; and

- •

- take all such other actions as the attorney-in-fact considers necessary or expedient to vest in Purchaser or its nominees title to the Common Shares represented by the tendered Common Shares indicated in the Common Share Form of Acceptance.

I hereby irrevocably authorize and request the Common Share Tender Agent to act on my behalf for all matters in connection with my request to tender all or any portion of those Common Shares in the U.S. Offer, including for the Common Share Tender Agent to act on my behalf and instruct my Custodian Bank to transfer such Common Shares through the book-entry system maintained by the Taiwan Depository & Clearing Corporation (the "TDCC") prior to the expiration of the U.S. Offer (as defined in the U.S. Offer to Purchase Offer) in accordance with the instructions, procedures and deadlines established by TDCC.

I understand and acknowledge that the Common Share Tender Agent is also acting as the agent of Advanced Semiconductor Engineering, Inc. (the "Purchaser") in connection with the U.S. Offer.

I understand and acknowledge that the Common Share Tender Agent must receive a copy of this Common Share POA on or before 1:20 a.m., New York City time, on February 16, 2016, in order for my Common Shares to be validly tendered in the U.S. Offer.

D-1

This Common Share Power of Attorney shall be governed by, and construed in accordance with the laws of the Republic of China.

D-2

| | | | | | |

| |

| PAYER'S NAME: |

| |

| SUBSTITUTE | | Part I Taxpayer Identification No.—For All Accounts | | Part II For Payees Exempt |

FORMW-9

Department of the Treasury

Internal Revenue Service

Payer's Request for Taxpayer

Identification No. |

|

Enter your taxpayer identification number in the appropriate box. For most individuals and sole proprietors, this is your social security number. For other entities, it is your employer identification number. If awaiting a TIN, write "Applied For" in the space at the right and complete the Certificate of Awaiting Taxpayer Identification Number below. If you do not have a number, see "How to Obtain a TIN" in the enclosedGuidelines

Note: If the account is in more than one name, see the chart in the enclosedGuidelines to determine what number to enter. |

|

Social Security Number

OR

Employer Identification Number |

|

From Backup Withholding, see enclosedGuidelines. |

| |

Check appropriate box:

o Individual/Sole Proprietor o Corporation o Partnership o Limited liability company. Enter tax classification

(D = disregarded entity, C = corporation, P = partnership)—> o Other (specify)

o Exempt from Backup Withholding |

| |

| Part III Certification—Under penalties of perjury, I certify that: |

(1) The number shown on this form is my correct taxpayer identification number or I am waiting for a number to be issued to me; |

(2) I am not subject to backup withholding either because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service ("IRS") that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and |

(3) I am a U.S. person (including a U.S. resident alien). |

Certification Instructions—You must cross out item (2) above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. |

| |

| SIGNATURE DATE , 20 |

| |

YOU MUST COMPLETE THE FOLLOWING CERTIFICATE IF YOU WROTE

"APPLIED FOR" IN PART I OF THIS SUBSTITUTE FORM W-9

| | | | | | | | |

| |

| CERTIFICATE OF AWAITING TAXPAYER IDENTIFICATION NUMBER |

I certify under penalties of perjury that a Taxpayer Identification Number has not been issued to me, and either (a) I have mailed or delivered an application to receive a taxpayer identification number to the appropriate Internal Revenue Service Center or Social Security Administration Office or (b) I intend to mail or deliver an application in the near future. I understand that, notwithstanding the information I provided in Part III of the Substitute Form W-9 (and the fact that I have completed this Certificate of Awaiting Taxpayer Identification Number), 28% of all payments made to me pursuant to this Offer to Purchase shall be retained until I provide a Taxpayer Identification Number to the Payor and that, if I do not provide my Taxpayer Identification Number within sixty (60) days, such retained amounts shall be remitted to the IRS as backup withholding. |

Signature |

|

|

|

Date |

|

|

|

, 2015 |

| |

| | |

NOTE: |

|

FAILURE TO COMPLETE AND RETURN THIS FORM MAY RESULT IN BACKUP WITHHOLDING OF 28% ON ANY PAYMENTS MADE TO YOU PURSUANT TO THE U.S. OFFER. PLEASE REVIEW ENCLOSEDGUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION NUMBER ON SUBSTITUTE FORM W-9 FOR ADDITIONAL DETAILS. |

D-3

INSTRUCTIONS

FORMING A PART OF THE TERMS AND CONDITIONS OF THE U.S. OFFER

To complete this Common Share Form of Acceptance, you must do the following:

- •

- Sign and date this Common Share Form of Acceptance in the box entitled "Sign Here";

- •

- either: (i) fill in and sign the written instructions attached as Annex A or (ii) sign the Common Share POA attached as Annex D; and

- •

- Fill in and sign in the box entitled "Substitute Form W-9" or an applicable IRS Form W-8.

1. Delivery of Common Share Form of Acceptance. This Common Share Form of Acceptance is to be used for the tender of Common Shares into the U.S. Offer by U.S. holders of Common Shares held in registered form (i.e., held directly on the books of the TDCC) and is to be forwarded herewith pursuant to the procedure set forth in the U.S. Offer to Purchase under"The Offer—Section 4—Procedure for Tendering Common Shares." A properly completed and duly executed Common Share Form of Acceptance and any other documents required by this Common Share Form of Acceptance must be received by the Common Share Tender Agent at its address set forth herein prior to 1:30 a.m., New York City time, on the expiration date of the U.S. Offer.

The method of delivery of this Common Share Form of Acceptance and all other required documents is at the option and risk of the tendering Common Share holder, and the delivery will be deemed made only when actually received by the Common Share Tender Agent. If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to ensure timely delivery.

No alternative, conditional or contingent tenders will be accepted, and no fractional Common Shares will be purchased or accepted. By execution of this Common Share Form of Acceptance, all tendering U.S. holders of Common Shares waive any right to receive any notice of the acceptance of their Common Shares for purchase.

2. Inadequate Space. If the space provided herein in this Common Share Form of Acceptance in the box entitled "Sign Here" is inadequate, the number of Common Shares tendered should be listed on a separate schedule and attached hereto.

3. Partial Tenders. If fewer than all of the Common Shares held by a registered U.S. holder of Common Shares (i.e., held directly on the books of the TDCC) are to be tendered, fill in the number of Common Shares that are to be tendered in the box entitled "Number of Common Shares Tendered." All Common Shares held in registered form directly on the books of the TDCC by a U.S. holder delivering this Common Share Form of Acceptance to the Common Share Tender Agent will be deemed to have been tendered unless otherwise indicated.

4. Signatures on the Common Share Form of Acceptance, Stock Powers and Endorsements. If any Common Share tendered hereby is owned of record by two or more persons, all such persons must sign this Common Share Form of Acceptance.

If any of the tendered Common Shares are registered in the names of different holders, it will be necessary to complete, sign and submit as many separate Common Share Forms of Acceptance as there are different registrations of such Common Shares.

If this Common Share Form of Acceptance is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, such person should so indicate when signing, and proper evidence satisfactory to Purchaser of such person's authority to so act must be submitted.

D-4

5. Requests for Assistance or Additional Copies. Questions and requests for assistance or for additional copies of the U.S. Offer to Purchase and this Common Share Form of Acceptance, may be directed to MacKenzie Partners, Inc. (the "U.S. Information Agent"), at its telephone numbers and address set forth below. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the U.S. Offer.

6. Waiver of Conditions. Purchaser reserves the right to waive any of the specified conditions of the U.S. Offer in the case of any Common Shares tendered.

7. Non-U.S. holders of SPIL Common Shares. Non-U.S. holders of Common Shares may not accept the U.S. Offer in respect of such Common Shares pursuant to this Common Share Form of Acceptance.

8. No Interest; Foreign Exchange Currency. Under no circumstances will interest be paid on the purchase of Common Shares tendered, regardless of any delay in making the purchase or extension of the expiration date for the U.S. Offer. Tendering U.S. holders of Common Shares will receive the U.S. Offer price of NT$55 per Common Share, without interest, payable in new Taiwan dollars. For further information, see"The Offer—Section 3—Acceptance for Payment and Payment" in the U.S. Offer to Purchase.

9. Expiration Date. The expiration date of the U.S. Offer will be 1:30 a.m., New York City time, on February 16, 2016.

If Purchaser decides to extend the U.S. Offer (in accordance with applicable law), Purchaser will notify the Common Share Tender Agent by written notice or oral notice confirmed in writing and make an announcement to that effect no later than the next business day after the previously scheduled expiration date of the U.S. Offer. During any such extension, any Common Shares validly tendered and not properly withdrawn will remain subject to the U.S. Offer, subject to the right of each U.S. holder to withdraw Common Shares already tendered.

Subject to the requirements of the Republic of China mandatory tender offer rules and the U.S. federal securities laws (including U.S. federal securities laws which require that material changes to an offer be promptly disseminated to shareholders in a manner reasonably designed to inform them of such changes) and without limiting the manner in which Purchaser may choose to make any public announcement, Purchaser will have no obligation to communicate any public announcement other than as described above.

10. No Guaranteed Delivery. Purchaser is not providing for a guaranteed delivery procedure; therefore, you may not accept the U.S. Offer by delivery of a notice of guaranteed delivery. The only method for accepting the U.S. Offer is the procedure described above and in the U.S. Offer to Purchase under"The Offer—Section 4—Procedure for Tendering Common Shares."

11. Stock Transfer Taxes. Except as otherwise provided in this Instruction 11, Purchaser will pay any stock transfer taxes with respect to the sale and transfer of any Common Shares to it or its order pursuant to the U.S. Offer. If, however, payment of the purchase price is to be made to, or Common Shares not tendered or not accepted for payment are to be returned in the name of, any person other than the registered holder(s), or if a transfer tax is imposed for any reason other than the sale or transfer of Common Shares to the Purchaser pursuant to the U.S. Offer, then the amount of any stock transfer taxes (whether imposed on the registered holder(s), such other person or otherwise) will be deducted from the purchase price unless satisfactory evidence of the payment of such taxes, or exemption therefrom, is submitted herewith.

12. Backup Withholding. Federal income tax law imposes "backup withholding" unless a surrendering U.S. holder, and, if applicable, each other payee, has provided such holder's or payee's correct taxpayer identification number ("TIN") which, in the case of a holder or payee who is an

D-5

individual, is his or her social security number, and certain other information, or otherwise establishes a basis for exemption from backup withholding. Completion of the attached Substitute Form W-9 should be used by U.S. holders for this purpose. If the Common Share Tender Agent is not provided with the correct TIN, the holder or payee may be subject to a $50 penalty imposed by the Internal Revenue Service ("IRS"). Exempt holders and payees (including, among others, certain non-U.S. persons) are not subject to these backup withholding and information reporting requirements, provided that they properly demonstrate their eligibility for exemption. Exempt U.S. holders should furnish their TIN, write "EXEMPT" in Part II of the attached Substitute Form W-9, and sign, date and return the Substitute Form W-9 to the Common Share Tender Agent. In order for a non-U.S. holder to qualify as an exempt recipient, that non-U.S. holder should submit the appropriate IRS Form W-8 (which is available from the Internal Revenue Service at www.irs.gov) signed under penalties of perjury, attesting to that non-U.S. holder's foreign status.

Failure to complete the Substitute Form W-9 or appropriate IRS Form W-8 may require the Common Share Tender Agent to withhold 28% (or such other rate specified by the Internal Revenue Code of 1986, as amended) of the amount of any payments made pursuant to the U.S. Offer. Backup withholding is not an additional federal income tax. Rather, the federal income tax liability of a person subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund may be obtained, provided that the required information is timely furnished to the IRS.

A U.S. holder (or other payee) should write "Applied For" in the space for the TIN provided on the attached Substitute Form W-9 and must also complete the above "Certificate of Awaiting Taxpayer Identification Number" if such U.S. holder (or other payee) has not been issued a TIN and has applied for a TIN or intends to apply for a TIN in the near future. If the Common Share Tender Agent is not provided with a TIN by the time of payment, the Common Share Tender Agent will withhold 28% on payments made pursuant to the U.S. Offer. A U.S. holder who writes "Applied For" in the space in Part I in lieu of furnishing his or her TIN should furnish the Common Share Tender Agent with such holder's TIN as soon as it is received.

For further information concerning backup withholding and instructions for completing the Substitute Form W-9 or applicable IRS Form W-8 (including how to obtain a TIN if you do not have one and how to complete the Substitute Form W-9 if the ADRs are held in more than one name), consult the enclosed Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9 or the instructions to the applicable Form W-8.

Important: This Common Share Form of Acceptance, together with any other required documents, must be received by the Common Share Tender Agent prior to 1:30 a.m., New York City time, on the expiration date of the U.S. Offer, and Receipts evidencing the tendered Common Shares, if applicable, must be received by the Common Share Tender Agent prior to the expiration date of the U.S. Offer.

D-6

The Common Share Tender Agent for the U.S. Offer is:

KGI Securities Co. Ltd.

By First Class, Registered, Certified, Express or Overnight Mail:

KGI Securities Co. Ltd.

US Offer Designated Account

6F, No.700, Mingshui Road,

Taipei, Taiwan, 10462, Republic of China

If you have questions or need additional copies of the U.S. Offer to Purchase and this Common Share Form of Acceptance, you can contact the U.S. Information Agent at its address and telephone numbers set forth below. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the U.S. Offer.

The U.S. Information Agent for the U.S. Offer is:

105 Madison Avenue

New York, New York 10016

Common Share Holders May Call:

Toll-Free +1 (800) 322-2885 (for Common Share Holders in the U.S. and Canada)

or

+1 (212) 929-5500 (Call Collect) (for Common Share Holders in Other Countries)

Email: tenderoffer@mackenziepartners.com

GUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION

NUMBER ON SUBSTITUTE FORM W-9

Guidelines for Determining the Proper Identification Number to Give the Payer—Social Security numbers have nine digits separated by two hyphens:i.e., 000-00-0000. Employer identification numbers have nine digits separated by only one hyphen:i.e., 00-0000000. The table below will help determine the number to give the payer.

| | | | | | |

| |

|---|

For this type of account:

| | Give the

SOCIAL SECURITY

number of:

|

|---|

| |

|---|

| 1. | | An individual | | The individual |

2. |

|

Two or more individuals (joint account) |

|

The actual owner of the account or, if combined funds, the first individual on the account(1) |

3. |

|

Custodian account of a minor (Uniform Gift to Minors Act) |

|

The minor(2) |

4. |

|

a. |

|

The usual revocable savings trust (grantor is also trustee) |

|

The grantor-trustee(1) |

|

|

b. |

|

So-called trust account that is not a legal or valid trust under state law |

|

The actual owner(1) |

5. |

|

Sole proprietorship or single-owner LLC |

|

The owner(3) |

| | | | |

| |

|---|

For this type of account:

| | Give the

EMPLOYER IDENTIFICATION

number of:

|

|---|

| |

|---|

| 6. | | Disregarded entity not owned by an individual | | The owner |

7. |

|

A valid trust, estate or pension trust |

|

The legal entity(4) |

8. |

|

Corporate or LLC electing corporate status on Form 8832 |

|

The corporation |

9. |

|

Association, club, religious, charitable, educational or other tax-exempt organization |

|

The organization |

10. |

|

Partnership or multi-member LLC |

|

The partnership |

11. |

|

A broker or registered nominee |

|

The broker or nominee |

12. |

|

Account with the Department of Agriculture in the name of a public entity (such as a state or local government, school district or prison) that receives agricultural program payments |

|

The public entity |

- (1)

- List first and circle the name of the person whose number you furnish. If only one person on a joint account has an SSN, that person's number must be furnished.

- (2)

- Circle the minor's name and furnish the minor's SSN.

- (3)

- You must show your individual name and you may also enter your business or "doing business as" name on the second name line. You may use either your SSN or EIN (if you have one). If you are a sole proprietor, the IRS encourages you to use your SSN.

- (4)

- List first and circle the name of the legal trust, estate or pension trust. (Do not furnish the identifying number of the personal representative or trustee unless the legal entity itself is not designated in the account title.)

Note: If no name is circled when there is more than one name listed, the number will be considered to be that of the first name listed.

GUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION

NUMBER ON SUBSTITUTE FORM W-9

Page 2

Obtaining a Number

If you don't have a taxpayer identification number or you don't know your number, obtain Form SS-5, Application for a Social Security Number Card, or Form SS-4, Application for Employer Identification Number, at the local office of the Social Security Administration or the Internal Revenue Service ("IRS") and apply for a number. These forms can also be obtained from the IRS's website (www.irs.gov).

Payees Exempt from Backup Withholding

Payees specifically exempted from backup withholding on all payments include the following:

- 1.

- An organization exempt from tax under section 501(a) of the Internal Revenue Code of 1986, as amended (the "Code"), an individual retirement plan or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2).

- 2.

- The United States or any of its agencies or instrumentalities.

- 3.

- A state, the District of Columbia, a possession of the United States or any of their subdivisions or instrumentalities.

- 4.

- A foreign government, a political subdivision of a foreign government or any of their agencies or instrumentalities.

- 5.

- An international organization or any of their agencies or instrumentalities.

Other payees that may be exempt from backup withholding include:

- 6.

- A corporation.

- 7.

- A foreign central bank of issue.

- 8.

- A dealer in securities or commodities required to register in the United States, the District of Columbia or a possession of the United States.

- 9.

- A futures commission merchant registered with the Commodity Futures Trading Commission.

- 10.

- A real estate investment trust.

- 11.

- An entity registered at all times during the tax year under the Investment Company Act of 1940.

- 12.

- A common trust fund operated by a bank under section 584(a) of the Code.

- 13.

- A financial institution.

- 14.

- A middleman known in the investment community as a nominee or custodian.

- 15.

- A trust exempt from tax under section 664 or described in section 4947 of the Code.

Payments of dividends and patronage dividends not generally subject to backup withholding include the following:

- •

- Payments to nonresident aliens subject to withholding under section 1441 of the Code.

- •

- Payments to partnerships not engaged in a trade or business in the United States and that have at least one non-resident alien partner.

- •

- Payments of patronage dividends not paid in money.

- •

- Payments made by certain foreign organizations.

The chart below shows two of the types of payments that may be exempt from backup withholding. The chart applies to the exempt recipients listed above, 1 through 15.

| | |

| IF the payment is for ... | | THEN the payment is exempt for ... |

| Interest and dividend payments | | All exempt recipients except for 9 |

| Broker transactions | | Exempt recipients 1 through 13; also, a person who regularly acts as a broker and who is registered under the Investment Advisers Act of 1940 |

Exempt payees should file the Substitute Form W-9 to avoid possible erroneous backup withholding. FURNISH YOUR TAXPAYER IDENTIFICATION NUMBER, WRITE "EXEMPT" ON THE FACE OF THE FORM IN PART II, SIGN AND DATE THE FORM, AND RETURN IT TO THE PAYER. Foreign payees who are not subject to backup withholding should complete the appropriate IRS Form W-8 and return it to the payer.

Privacy Act Notice

Section 6109 of the Code requires most recipients of dividend, interest or other payments to give their correct taxpayer identification numbers to payers who must report the payments to the IRS. The IRS uses the numbers for identification purposes and to help verify the accuracy of tax returns. It may also provide this information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia and U.S. possessions to carry out their tax laws. It may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, and to federal law enforcement and intelligence agencies to combat terrorism.

Payees must provide payers with their taxpayer identification numbers whether or not they are required to file tax returns. Payers must generally withhold 28% of taxable interest, dividend and certain other payments to a payee who does not furnish a taxpayer identification number to a payer. Certain penalties may also apply.

Penalties

(1) Penalty for Failure to Furnish Taxpayer Identification Number—If you fail to furnish your correct taxpayer identification number to a payer, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.

(2) Civil Penalty for False Information With Respect to Withholding—If you make a false statement with no reasonable basis which results in no imposition of backup withholding, you are subject to a penalty of $500.

(3) Criminal Penalty for Falsifying Information—Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment.

FOR ADDITIONAL INFORMATION CONTACT YOUR TAX CONSULTANT OR THE INTERNAL REVENUE SERVICE.

QuickLinks

NOTE: SIGNATURE(S) MUST BE PROVIDED BELOW. PLEASE READ THE INSTRUCTIONS SET FORTH IN THIS COMMON SHARE FORM ON ACCEPTANCE CAREFULLY.Written Instructions to Custodian Bank (English)Account Opening Master AgreementCommon Share Power of AttorneyINSTRUCTIONS FORMING A PART OF THE TERMS AND CONDITIONS OF THE U.S. OFFERGUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION NUMBER ON SUBSTITUTE FORM W-9GUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION NUMBER ON SUBSTITUTE FORM W-9Page 2