1934 Act Registration No. 1- 30702

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2016

Siliconware Precision Industries Co., Ltd.

(Translation of Registrant’s Name Into English)

NO. 123, SEC. 3, DA FONG RD. TANTZU

TAICHUNG, TAIWAN

(Address of Principal Executive Offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F x ¨ Form 40-F

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): )

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): )

Siliconware Precision Industries Co., Ltd. (the “Company”) filed a 6-K (“April 15 6-K”) with the U.S. Securities and Exchange Commission on April 15, 2016 enclosing a letter to the Company’s shareholders. Pursuant to the resolutions of the board of directors of the Company dated April 18, 2016, the Company has no longer wished to propose in its next shareholders’ meeting to increase its authorized share capital as indicated in the April 15 6-K. Therefore, the Company is filing a revised 6-K as attached hereto, in which the statements relevant to such increase in authorized share capital have been deleted, including references to Section 1(b) on page 2 of the April 15 6-K, and Section 2 of page 11 and pages 12 and 13 of the Appendix to the April 15 6-K.

Dear Shareholders,

Siliconware Precision Industries Co., Ltd. (“we”, “SPIL” or “the Company”) has always strived to provide high-value added solutions for our clients through our unique talent and advanced technology in IC packaging and testing. We firmly believe our consistent focus on improving our business and operations will continue to create shareholder value in this ever-changing industry.

In 2015, the global semiconductor industry faced an overall slowdown driven by higher competition combined with a saturated computer and mobile devices market. Additionally, lower-than-expected growths in developing countries led by the slowdown in China added further headwinds. Despite these challenges, SPIL still managed to outperform the OSAT industry in this past year. To further reflect our commitment in maximizing shareholder value, the board is proposing an increased dividend payout ratio of nearly 100% plus an additional distribution of NT$1 per share from capital reserves, marking a dividend totaling NT$3.8 per share.

For 2016 and beyond, our aim is to become a world-class benchmark in the semiconductor assembly and testing industry by continuously upgrading quality of service and competitiveness to meet customers’ satisfaction. We plan to centralize our manufacturing capacity and capabilities to our ZhongKe site, which will help to shorten lead time for product delivery and allow greater flexibility in raw material procurement. In addition, we plan to focus our ZhongKe facility on high-value added services like bumping, flip chip, testing, turn-key solutions and invest in advanced Fan-out technology, 2.5/3D IC, etc. For our business in China, we plan to build a wafer bumping and Flip Chip line at SPIL’s China subsidiary in Suzhou to capture customer’s rapidly growing market. SPIL’s presence in China remains strong as the Company captured more market share and increased its revenue contribution from Chinese clients in 2015. To be ready for the next wave of growth drivers, we also plan to progress towards miniaturization IC level advanced SiP (system-in-package) to capture the IoT (Internet of Things) market.

Over the past year, while there have been distractions of hostile interest in acquiring the Company, we firmly believe that with your support, we are in a good position to grow our business the way we have strived to do in the past and do not need to be merged with our competitors. In fact, a merger out of hostile interest will result in the loss of overlapping clients and will drain our talent - one of our key competitive advantages. Though we understand the uncertainty associated with the outcome of such matters, our focus on growing the Company and generating shareholder value has never wavered. With that in mind, we seek your support at the upcoming annual general meeting for the below proposed items, in addition to routine business matters:

| | 1) | Update the Company’s Articles of Incorporation (AOIs) to be in line with the latest regulatory environment |

1

| | 2) | Additional cash payout of NT$1 per share from capital reserves |

| | 3) | Amendments to certain articles of the Procedure for the Acquisition and Disposal of Assets |

These proposals will allow us to focus our efforts on the organic growth of the business and will provide the much needed operational flexibility required to support our growth aspirations.

AGM Proposals to Seek Shareholder Support

| 1. | Amendments to certain articles of the Company’s Articles of Incorporation (AOIs) |

| | a. | Proposal to update the business scope:To comply with the Company Act and business codes published by the Ministry of Economic Affairs (“MOEA”). |

| | b. | Proposal to replace supervisors with audit committee and associated technical/language changes: In order to comply with regulations, we have created an audit committee in lieu of the supervisors and the necessary AOI revisions to reflect such change has to be effected this year. Additionally, we are required to have at least three and at least 1/5th of the board as independent directors. These changes ensure an independent voice that represents shareholder interest, in all matters of the board including remuneration, nomination of directors, and mergers and acquisition. |

| | c. | Proposal to update employee bonus and director compensation scheme:To comply with the Company Act and official order from the MOEA, employee and director compensation will be based on pre-tax profit and recognized as an expense in income statement as opposed to be based on after-tax profit and treated as earnings distribution previously. |

According to the rulings promulgated by the Ministry of Economic Affairs of the Republic of China, after the amendment to the Company Act in 2015, companies cannot issue employee bonuses pursuant to their old Articles of Incorporation any more. If a company does not amend its Articles of Incorporation in accordance to the amended Company Act by the end of June 2016, such company shall have no basis to distribute employee compensation and thus employees will not be able to receive compensation distributions. Consequently, such company shall also not be able to distribute earnings to shareholders. Therefore, please support the passage of the amendment to the Company’s Articles of Incorporation in the 2016 AGM, to prevent the Company’s employees and shareholders from not being able to receive their respective compensation and dividend distributions.

Matters to be Recognized:

| 1. | Recognition of the Company’s 2015 Business Report and Financial Statements |

2

| | 2. | Recognition of 2015 Earnings Distribution (NT$ 2.8 per share) |

Other Proposals to Seek Shareholder Support

| 1. | Additional cash payout from capital reserves |

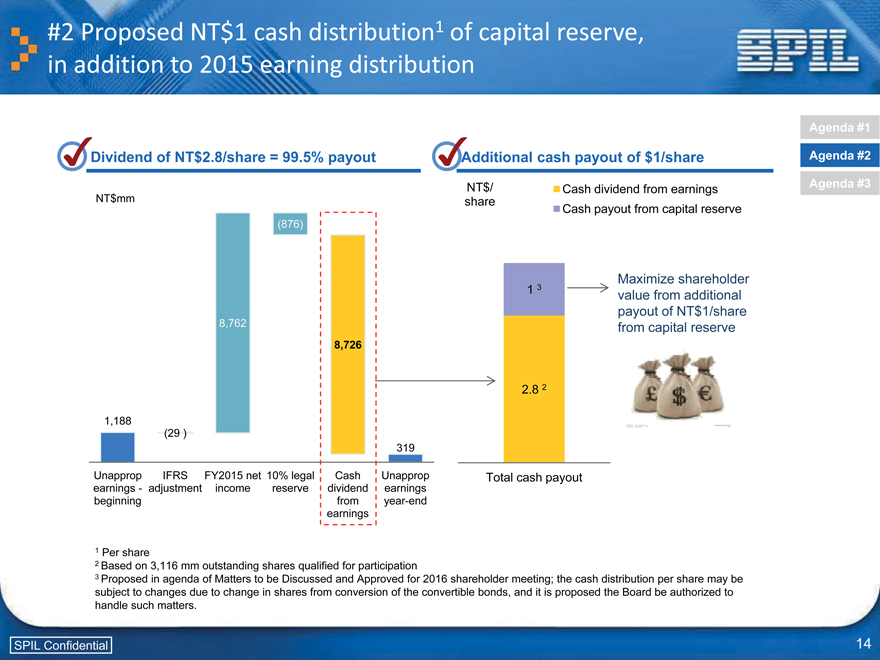

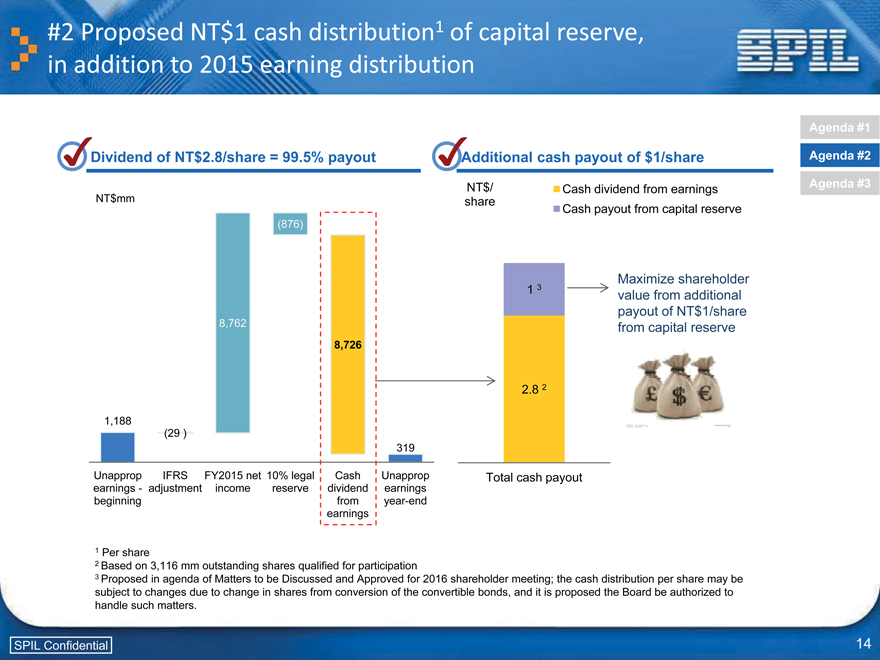

Propose additional cash payout of NT$1 per share from capital reserves:The board of SPIL has approved to distribute cash dividend of NT$2.8 from 2015 earnings, which equates to an increased payout ratio of nearly 100%. To further reflect our commitment in maximizing shareholder value, the board has proposed an additional cash distribution of NT$1 per share from capital reserves, bringing total cash distribution to NT$3.8 per share.

| 2. | Amendment to the Procedures for Acquisition and Disposal of Assets |

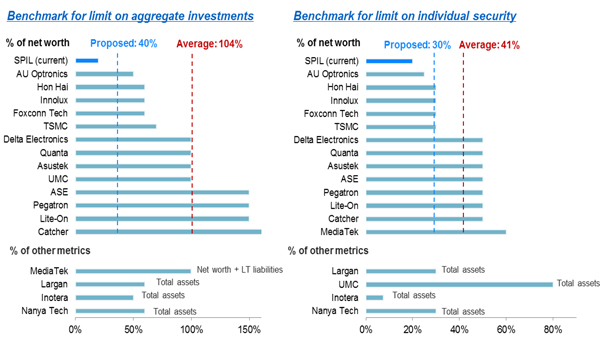

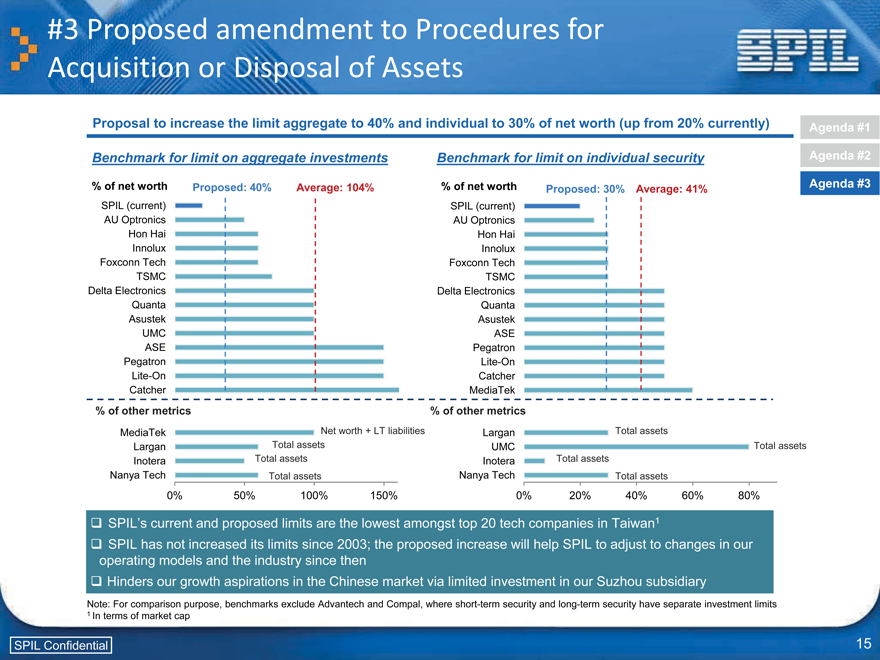

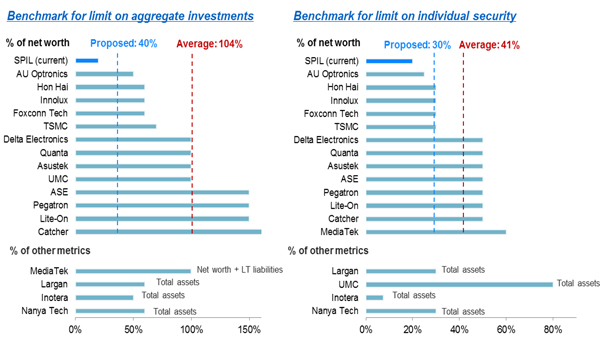

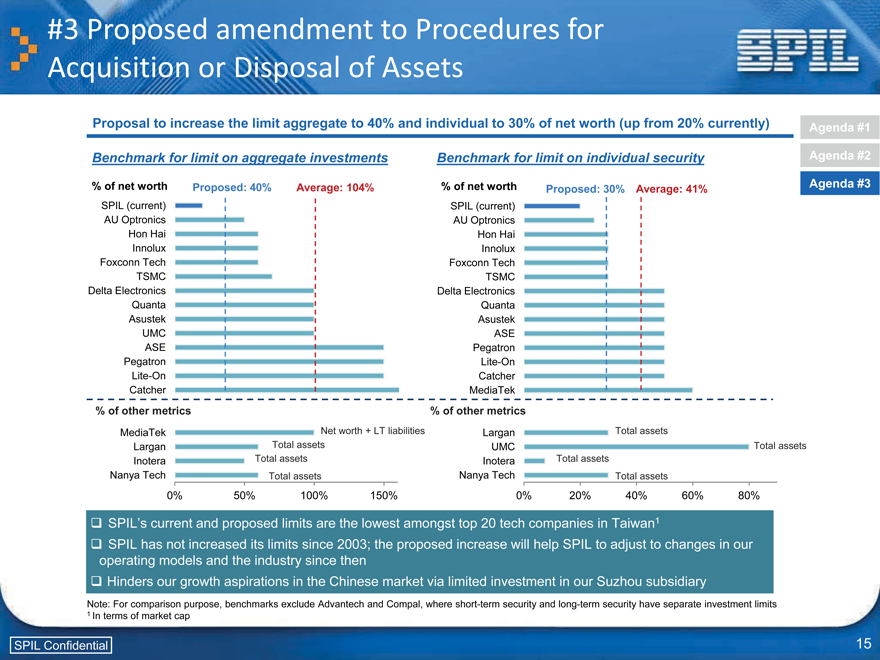

Proposal to increase the aggregate and individual limits on investments in securities: In order to maintain our competitive advantage through operational flexibility as well as required business expansions, we are putting forth a proposal to increase both the aggregate and individual limits on investments in securities. Our current aggregate and individual security investment limits are 20% of our Company’s net worth, which is well below the average of the top 20 technology companies in Taiwan, putting us at significant disadvantage relative to our peers.

We propose to increase the limit on aggregate investments from 20% to 40% and the limit on individual security investment from 20% to 30%. This will afford us the requisite flexibility while still places us below the average and the median of our peer group, thus providing appropriate safeguards for our shareholders.

The limits have been unchanged since 2003, and given how the industry has evolved since then, such flexibility will allow us to support our growth aspirations in the Chinese market. We plan to invest in our Suzhou subsidiary for advanced IC packaging and testing solutions to capture the growth of China’s semiconductor industry as it progresses. Your support in this matter is of utmost importance and will allow our board to make decisions that will benefit shareholders in a timely and pragmatic manner.

3

As mentioned earlier, the intent behind these changes is to ensure that we can focus on sustainable business growth. Despite outside distractions and hostile interests, our primary goal remains to maximize shareholder value over the long term. Your support on these matters will allow us to set the foundation for the long term and is extremely important so that we can collectively continue towards increasing shareholder value.

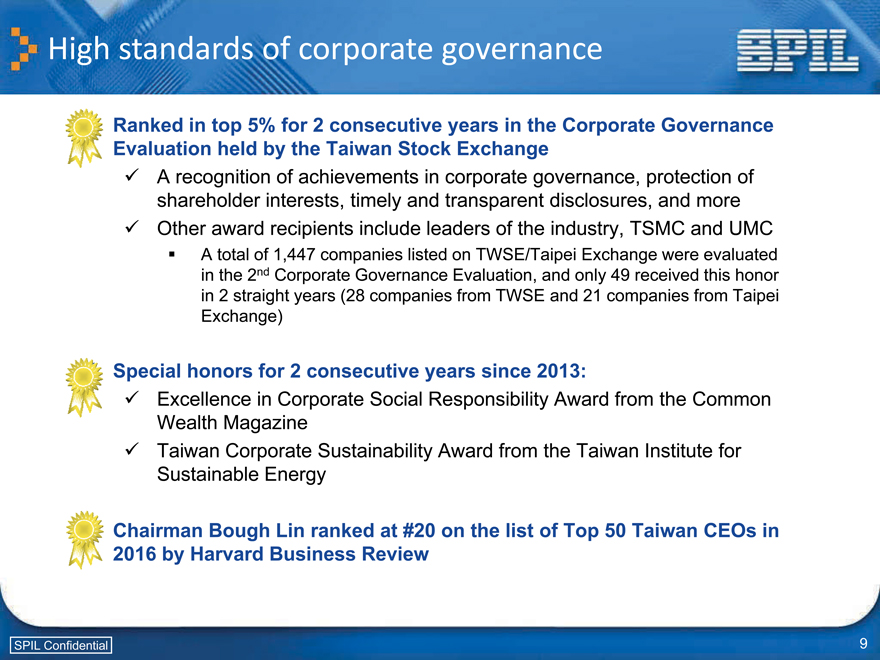

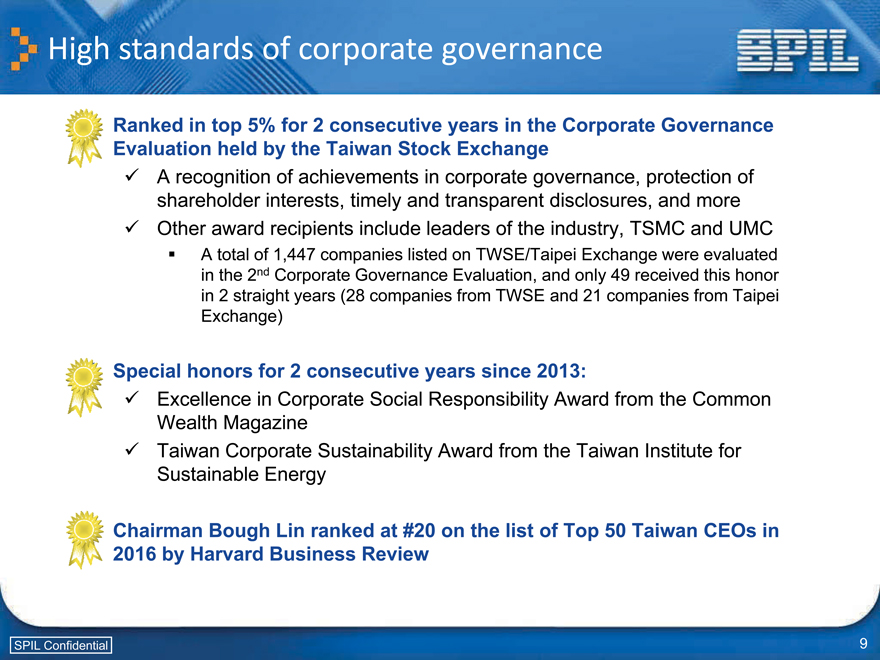

SPIL will continue to comply with the high standards of corporate governance as demonstrated in our track record. The company has ranked among the top 5% for two consecutive years in the Corporate Governance Evaluation held by the Taiwan Stock Exchange Corporation since it began in 2015. A total of 1,447 companies listed on the TWSE/Taipei Exchange were evaluated in the Second Corporate Governance Evaluation, and only 49 companies received this award in two straight years. Further, the Company received special honors for two consecutive years since 2013 in the Excellence in Corporate Social Responsibility Award by the Common Wealth Magazine and the Taiwan Corporate Sustainability Award from the Taiwan Institute for Sustainable Energy. Chairman Bough Lin is also ranked at #20 on the list of Top 50 Taiwan CEOs in 2016 by Harvard Business Review.

The optimism about the future shared by all members of the Company remains strong in our culture. With the support of our employees, customers, partners and you – the shareholders, we have built a solid foundation for a bolder SPIL. We are now on the path for future success without the need for any outside intervention. We look forward to your support and seeing you at the upcoming AGM.

Yours Sincerely,

Chairman Bough Lin

4

Siliconware Precision Industries Co., Ltd. Shareholder Communication April 2016

Safe harbor statement NOTE CONCERNING FORWARD-LOOKING STATEMENTS This release contains forward-looking statements. These statements constitute “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by use of words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual performance, financial condition or results of operations of SPIL to be materially different from what is stated or may be implied in such forward-looking statements. Investors are cautioned that actual events and results could differ materially from those statements as a result of a number of factors including, but not limited to: (i) our dependence upon the frequent introduction of new services and technologies based on the latest developments in our industry; (ii) the intensely competitive semiconductor packaging and test industries and markets; (iii) our dependence upon key personnel; (iv) general economic and political conditions; (v) possible disruptions in commercial activities caused by natural and human-induced events and disasters, including terrorist activity, armed conflict and highly contagious diseases; and (vi) fluctuations in foreign currency exchange rates. Further information regarding these and other risks is included in SPIL’s filings with the U.S. Securities and Exchange Commission, including its reports on Forms F-6 and 20-F and 6-K, in each case as amended. SPIL does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law. The financial statements included in this release are prepared and published in accordance with TIFRSs recognized by Financial Supervisory Commission in the ROC, which is different from IFRSs issued by the International Accounting Standards Board. Investors are cautioned that there may be significant differences between TIFRSs and IFRSs. In addition, TIFRSs and IFRSs differ in certain significant respects from ROC GAAP and US GAAP. This presentation is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from the issuer or selling security holder and that will contain detailed information about the company and management, as well as financial statements. SPIL Confidential 2

Agenda 1 2015 performance & 2016 key strategies 2 2016 annual general meeting agenda & proposals 3 Appendix SPIL Confidential 3

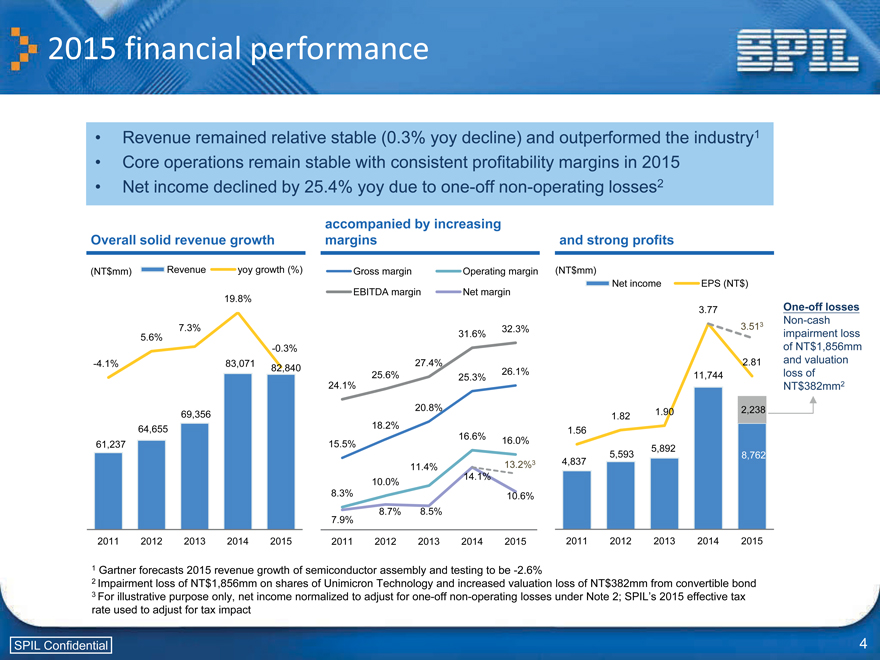

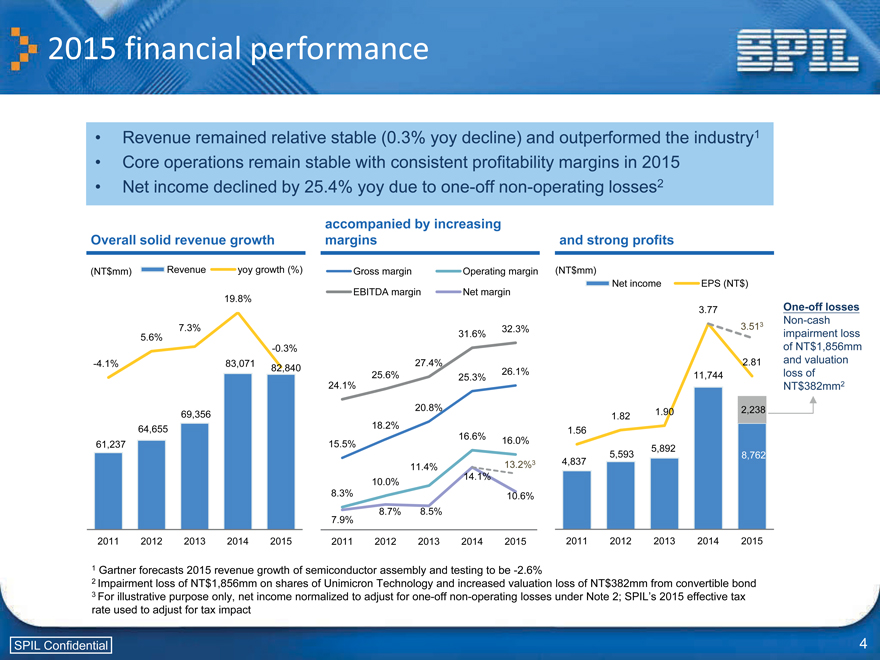

2015 financial performance • Revenue remained relative stable (0.3% yoy decline) and outperformed the industry1 • Core operations remain stable with consistent profitability margins in 2015 • Net income declined by 25.4% yoy due to one-off non-operating losses2 accompanied by increasing Overall solid revenue growth margins and strong profits (NT$mm) Revenue yoy growth (%) Gross margin Operating margin (NT$mm) Net income EPS (NT$) EBITDA margin Net margin 19.8% 3.77 One-off losses Non-cash 7.3% 32.3% 3.513 5.6% 31.6% impairment loss -0.3% of NT$1,856mm -4.1% 83,071 27.4% 2.81 and valuation 82,840 26.1% loss of 24.1% 25.6% 25.3% 11,744 NT$382mm2 20.8% 1.90 2,238 69,356 1.82 64,655 18.2% 1.56 16.6% 16.0% 61,237 15.5% 5,892 5,593 8,762 13.2%3 4,837 11.4% 14.1% 10.0% 8.3% 10.6% 8.7% 8.5% 7.9% 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 1 Gartner forecasts 2015 revenue growth of semiconductor assembly and testing to be -2.6% 2 Impairment loss of NT$1,856mm on shares of Unimicron Technology and increased valuation loss of NT$382mm from convertible bond 3 For illustrative purpose only, net income normalized to adjust for one-off non-operating losses under Note 2; SPIL’s 2015 effective tax rate used to adjust for tax impact SPIL Confidential 4

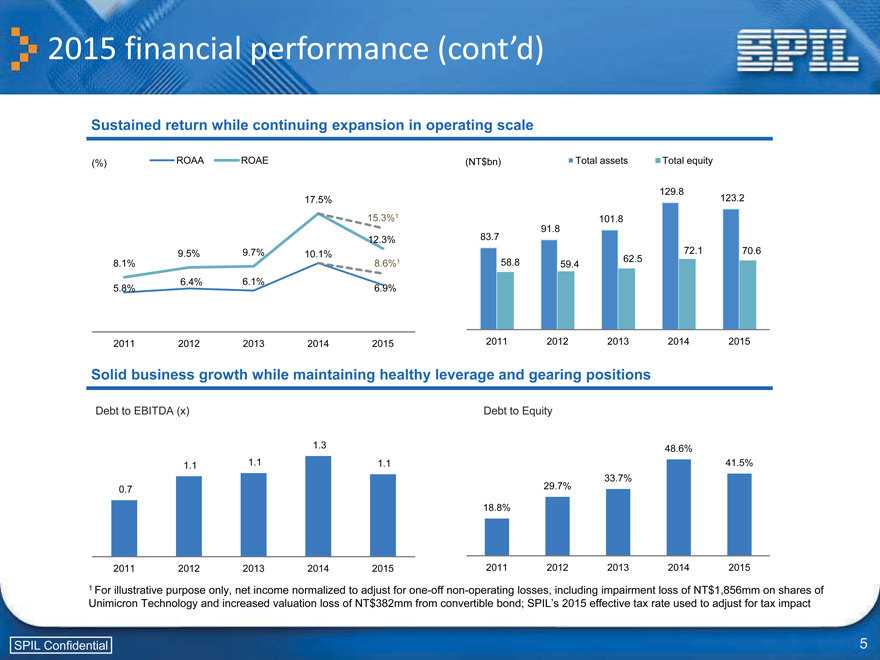

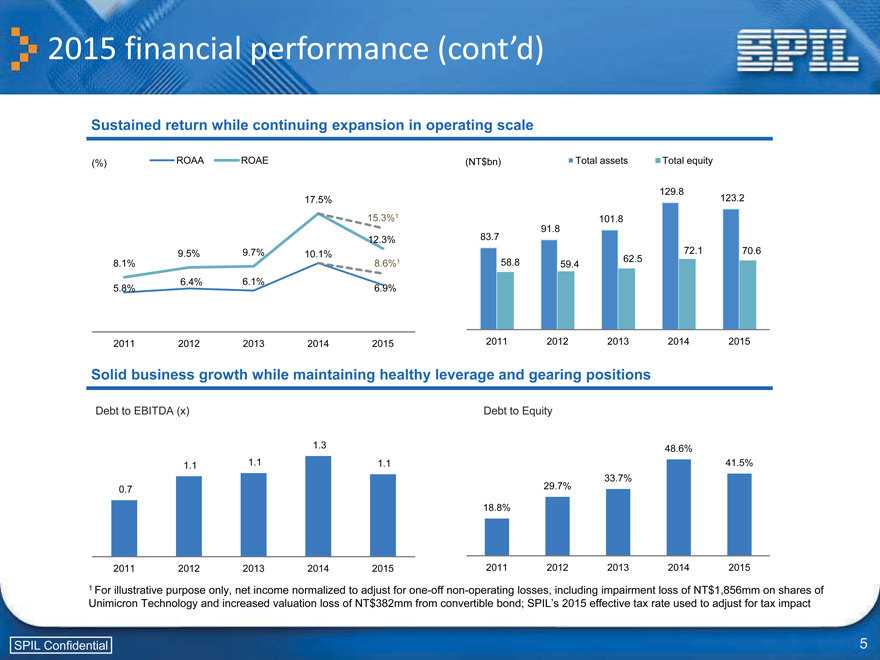

2015 financial performance (cont’d) Sustained return while continuing expansion in operating scale (%) ROAA ROAE (NT$bn) Total assets Total equity 129.8 17.5% 123.2 15.3%1 101.8 91.8 12.3% 83.7 9.5% 9.7% 10.1% 72.1 70.6 8.1% 8.6%1 58.8 62.5 59.4 6.4% 6.1% 5.8% 6.9% 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 Solid business growth while maintaining healthy leverage and gearing positions Debt to EBITDA (x) Debt to Equity 1.3 48.6% 1.1 1.1 1.1 41.5% 33.7% 0.7 29.7% 18.8% 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 1 For illustrative purpose only, net income normalized to adjust for one-off non-operating losses, including impairment loss of NT$1,856mm on shares of Unimicron Technology and increased valuation loss of NT$382mm from convertible bond; SPIL’s 2015 effective tax rate used to adjust for tax impact SPIL Confidential 5

2016 key business strategies 1 Continue to optimize capacity and capability of ZhongKe facility that began production in 2015 Centralized manufacturing to shorten lead time for product delivery and allow greater flexibility in raw material procurement ? Focus on high-value added services like bumping, flip chip, testing, turn-key solutions and invest in advanced Fan-out technology, 2.5/3D IC, etc. 2 Building wafer bumping and Flip Chip line in SPIL China subsidiary Suzhou to capture customers’ rapidly growing market. 3 Progress towards miniaturization IC level advanced SiP to capture IoT market Be ready for the next wave of growth driver for revenues SPIL Confidential 6

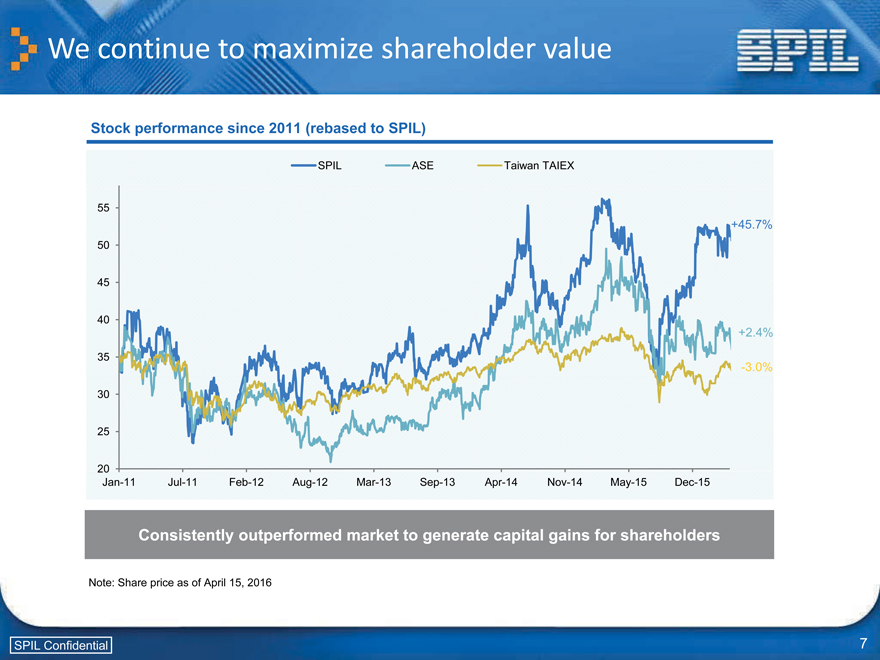

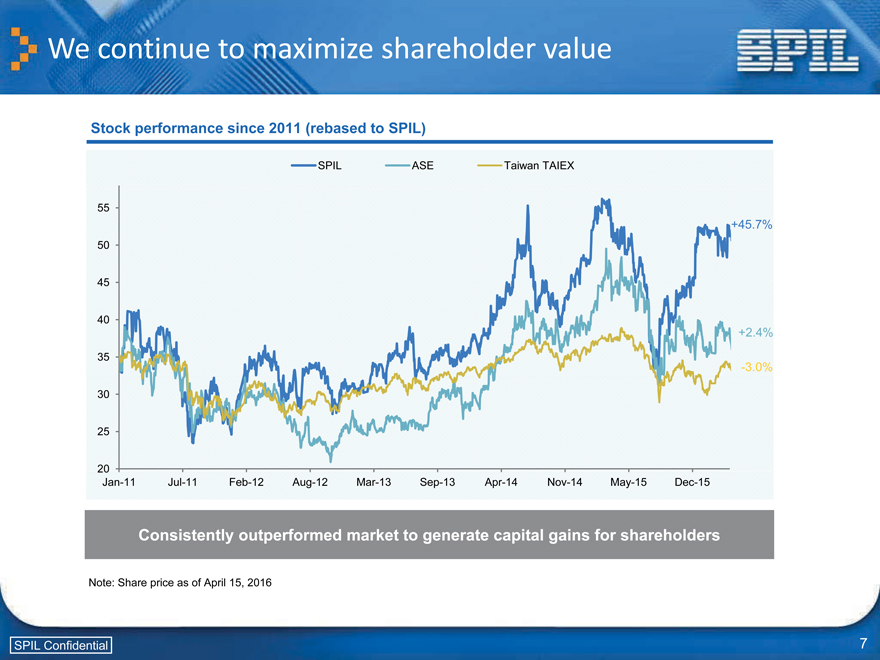

We continue to maximize shareholder value Stock performance since 2011 (rebased to SPIL) SPIL ASE Taiwan TAIEX 55 +45.7% 50 45 40 +2.4% 35 -3.0% 30 25 20 Jan-11 Jul-11 Feb-12 Aug-12 Mar-13 Sep-13 Apr-14 Nov-14 May-15 Dec-15 Consistently outperformed market to generate capital gains for shareholders Note: Share price as of April 15, 2016 SPIL Confidential 7

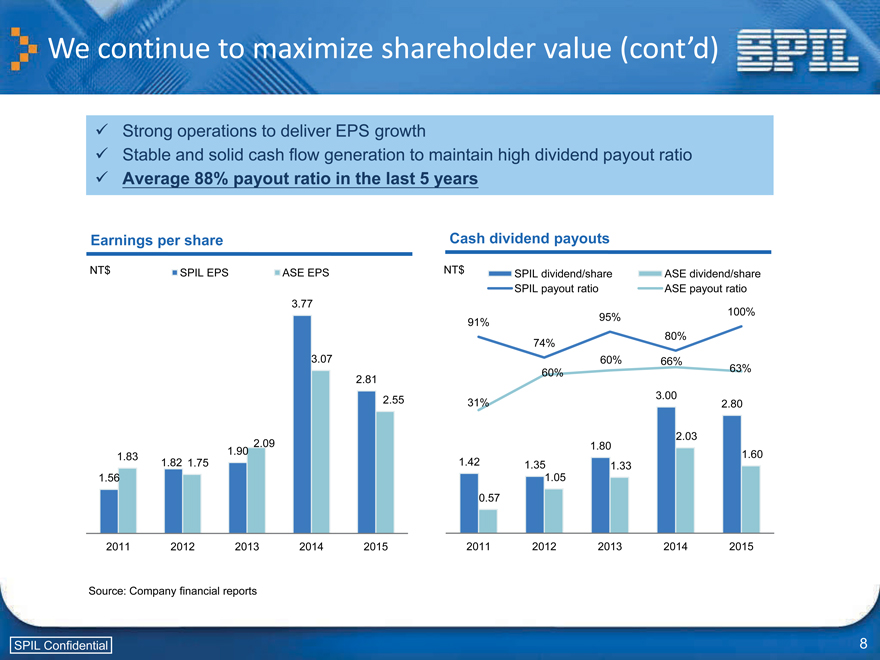

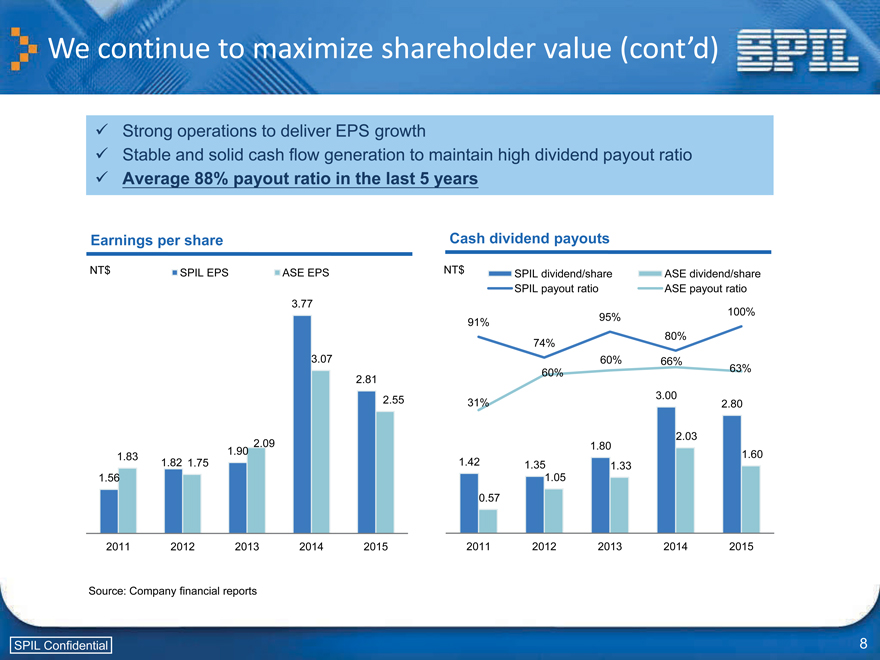

We continue to maximize shareholder value (cont’d)

Strong operations to deliver EPS growth

Stable and solid cash flow generation to maintain high dividend payout ratio

Average 88% payout ratio in the last 5 years

Earnings per share Cash dividend payouts

NT$ SPIL EPS ASE EPS NT$ SPIL dividend/share ASE dividend/share SPIL payout ratio ASE payout ratio 3.77 91% 95% 100% 80% 74% 3.07 60% 66% 2.81 60% 63% 2.55 3.00 31% 2.80

2.03 2.09 1.80

1.83 1.82 1.90 1.42 1.60 1.75 1.35 1.33 1.56 1.05 0.57

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

Source: Company financial reports

SPIL Confidential 8

High standards of corporate governance

Ranked in top 5% for 2 consecutive years in the Corporate Governance Evaluation held by the Taiwan Stock Exchange

A recognition of achievements in corporate governance, protection of shareholder interests, timely and transparent disclosures, and more Other award recipients include leaders of the industry, TSMC and UMC

A total of 1,447 companies listed on TWSE/Taipei Exchange were evaluated in the 2nd Corporate Governance Evaluation, and only 49 received this honor in 2 straight years (28 companies from TWSE and 21 companies from Taipei Exchange)

Special honors for 2 consecutive years since 2013:

Excellence in Corporate Social Responsibility Award from the Common Wealth Magazine Taiwan Corporate Sustainability Award from the Taiwan Institute for Sustainable Energy

Chairman Bough Lin ranked at #20 on the list of Top 50 Taiwan CEOs in 2016 by Harvard Business Review

SPIL Confidential 9

Agenda

1 2015 performance & 2016 key strategies

2 2016 annual general meeting agenda & proposals

# 1 Proposed amendments to articles of incorporation # 2 Proposed cash distribution from capital reserves

# 3 Proposed amendment to procedures for acquisition or disposal of assets

3 Appendix

SPIL Confidential 10

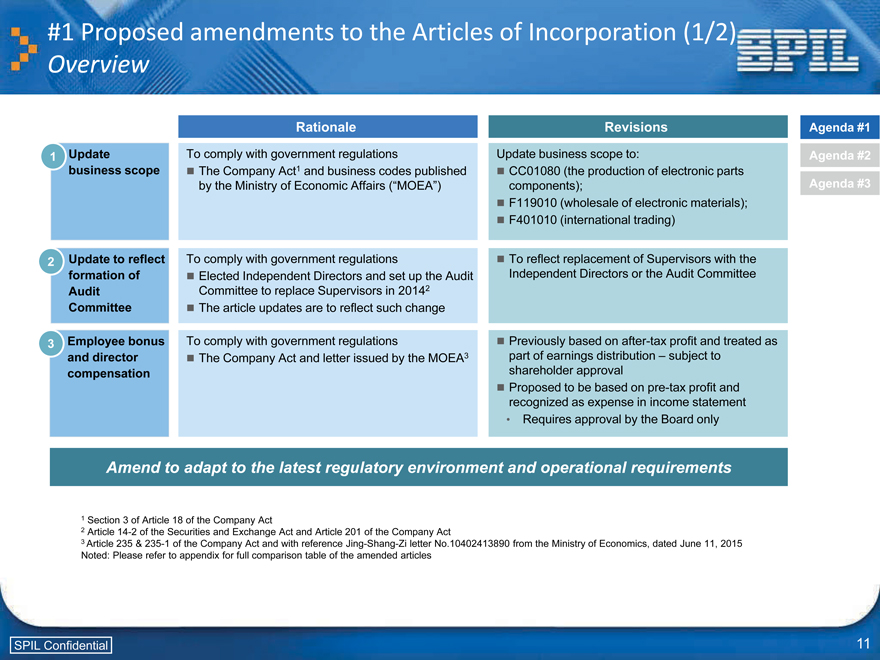

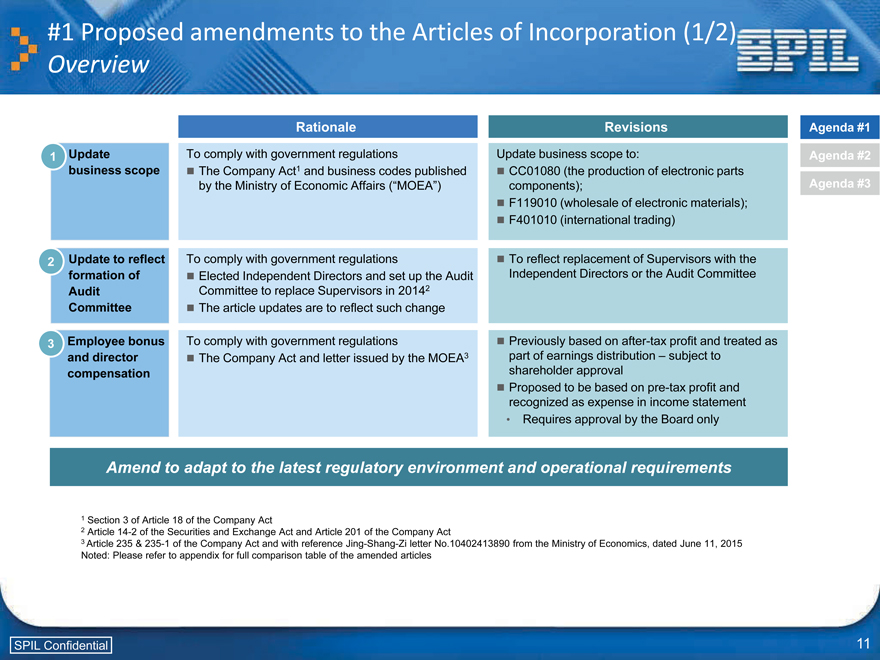

#1 Proposed amendments to the Articles of Incorporation (1/2)

Overview

Rationale Revisions Agenda #1

1 Update To comply with government regulations Update business scope to: Agenda #2 business scope The Company Act1 and business codes published CC01080 (the production of electronic parts by the Ministry of Economic Affairs (“MOEA”) components); Agenda #3 F119010 (wholesale of electronic materials); F401010 (international trading)

2 Update to reflect To comply with government regulations To reflect replacement of Supervisors with the formation of Elected Independent Directors and set up the Audit Independent Directors or the Audit Committee Audit Committee to replace Supervisors in 20142 Committee The article updates are to reflect such change

3 Employee bonus To comply with government regulations Previously based on after-tax profit and treated as and director The Company Act and letter issued by the MOEA3 part of earnings distribution – subject to compensation shareholder approval Proposed to be based on pre-tax profit and recognized as expense in income statement

Requires approval by the Board only

Amend to adapt to the latest regulatory environment and operational requirements

1 Section 3 of Article 18 of the Company Act

2 Article 14-2 of the Securities and Exchange Act and Article 201 of the Company Act

3 Article 235 & 235-1 of the Company Act and with reference Jing-Shang-Zi letter No.10402413890 from the Ministry of Economics, dated June 11, 2015 Noted: Please refer to appendix for full comparison table of the amended articles

SPIL Confidential 11

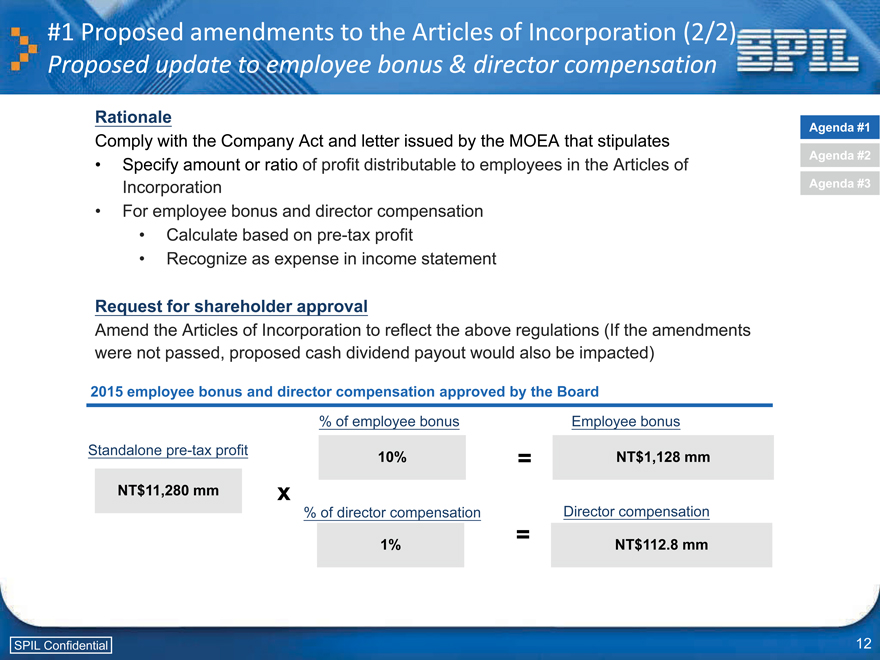

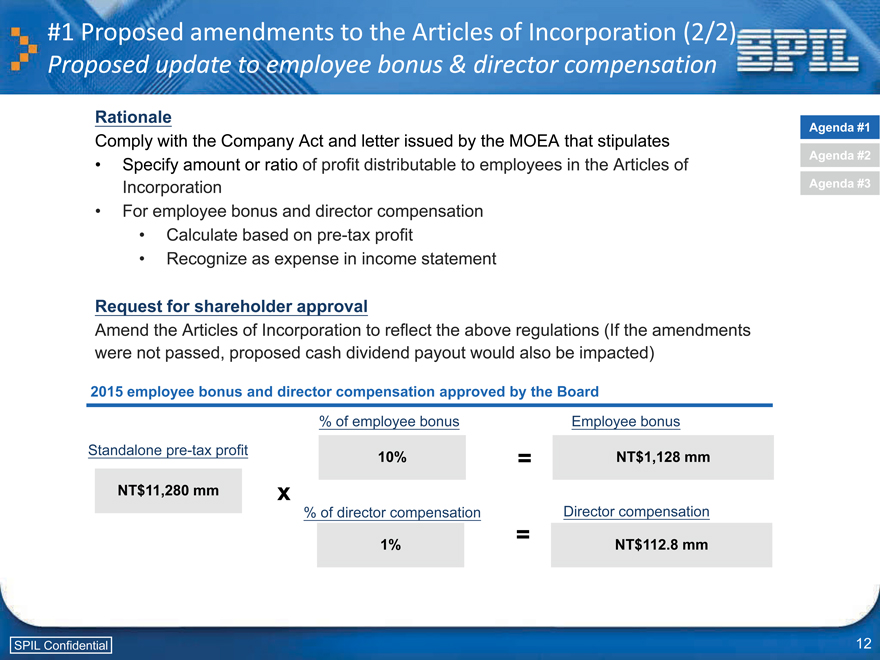

#1 Proposed amendments to the Articles of Incorporation (2/2)

Proposed update to employee bonus & director compensation

Rationale

Agenda #1

Comply with the Company Act and letter issued by the MOEA that stipulates

Specify amount or ratio of profit distributable to employees in the Articles of Agenda #2 Incorporation Agenda #3

For employee bonus and director compensation

Calculate based on pre-tax profit

Recognize as expense in income statement

Request for shareholder approval

Amend the Articles of Incorporation to reflect the above regulations (If the amendments were not passed, proposed cash dividend payout would also be impacted)

2015 employee bonus and director compensation approved by the Board

% of employee bonus Employee bonus Standalone pre-tax profit 10% = NT$1,128 mm

NT$11,280 mm x

% of director compensation Director compensation

1% = NT$112.8 mm

SPIL Confidential 12

#1 Proposed amendments to the Articles of Incorporation

Note to shareholders

According to the rulings promulgated by the Ministry of Economic Affairs of Agenda #1 the Republic of China, after the amendment to the Company Act in 2015, Agenda #2 companies cannot issue employee bonuses pursuant to their old Articles of Agenda #3 Incorporation any more.

If a company does not amend its Articles of Incorporation in accordance to the amended Company Act by the end of June 2016, such company shall have no basis to distribute employee compensation and thus employees will not be able to receive compensation distributions.

Consequently, such company shall also not be able to distribute earnings to shareholders.

Therefore, please support the passage of the amendment to the Company’s Articles of Incorporation in the 2016 AGM, to prevent the Company’s employees and shareholders from not being able to receive their respective compensation and dividend distributions.

SPIL Confidential 13

#2 Proposed NT$1 cash distribution1 of capital reserve, in addition to 2015 earning distribution

Agenda #1

Dividend of NT$2.8/share = 99.5% payout Additional cash payout of $1/share Agenda #2

NT$/ Agenda #3

Cash dividend from earnings NT$mm share Cash payout from capital reserve

(876)

Maximize shareholder

1 3 value from additional 8,762 payout of NT$1/share from capital reserve

8,726

2.8 2

1,188

(29 )

319

Unapprop IFRS FY2015 net 10% legal Cash Unapprop Total cash payout earnings—adjustment income reserve dividend earnings beginning from year-end earnings

1 Per share

2 Based on 3,116 mm outstanding shares qualified for participation

3 Proposed in agenda of Matters to be Discussed and Approved for 2016 shareholder meeting; the cash distribution per share may be subject to changes due to change in shares from conversion of the convertible bonds, and it is proposed the Board be authorized to handle such matters.

SPIL Confidential 14

#3 Proposed amendment to Procedures for Acquisition or Disposal of Assets

Proposal to increase the limit aggregate to 40% and individual to 30% of net worth (up from 20% currently) Agenda #1

Benchmark for limit on aggregate investments Benchmark for limit on individual security Agenda #2

% of net worth Proposed: 40% Average: 104% % of net worth Proposed: 30% Average: 41% Agenda #3

SPIL (current) SPIL (current) AU Optronics AU Optronics Hon Hai Hon Hai Innolux Innolux Foxconn Tech Foxconn Tech TSMC TSMC

Delta Electronics Delta Electronics Quanta Quanta Asustek Asustek UMC ASE

ASE Pegatron Pegatron Lite-On Lite-On Catcher Catcher MediaTek

% of other metrics % of other metrics

MediaTek Net worth + LT liabilities Largan Total assets

Largan Total assets UMC Total assets Inotera Total assets Inotera Total assets Nanya Tech Total assets Nanya Tech Total assets

0% 50% 100% 150% 0% 20% 40% 60% 80%

SPIL’s current and proposed limits are the lowest amongst top 20 tech companies in Taiwan1

SPIL has not increased its limits since 2003; the proposed increase will help SPIL to adjust to changes in our operating models and the industry since then Hinders our growth aspirations in the Chinese market via limited investment in our Suzhou subsidiary

Note: For comparison purpose, benchmarks exclude Advantech and Compal, where short-term security and long-term security have separate investment limits 1 In terms of market cap

SPIL Confidential 15

Agenda

1 2015 performance & 2016 key strategies

2 2016 annual general meeting agenda & proposals

3 Appendix

SPIL Confidential 16

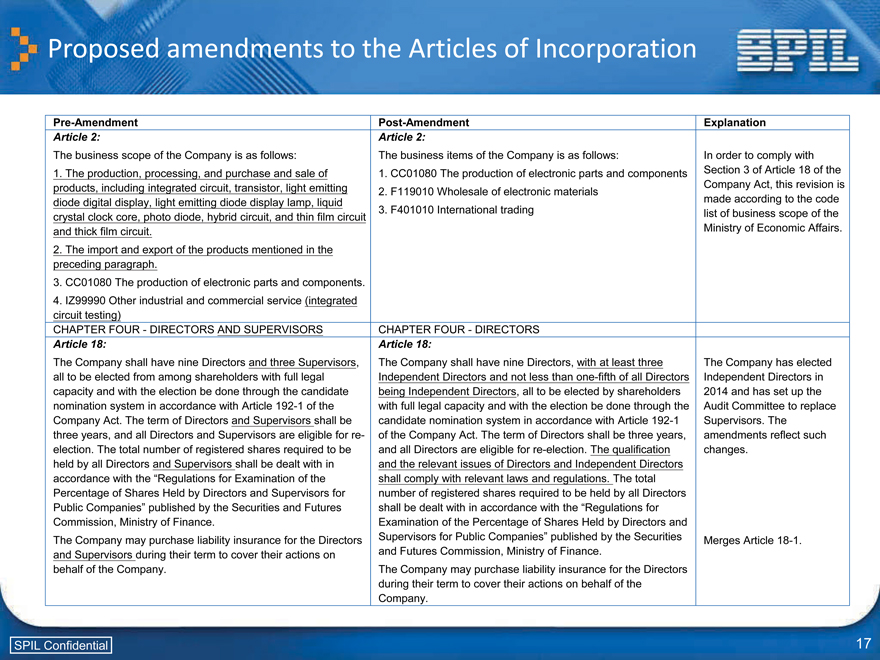

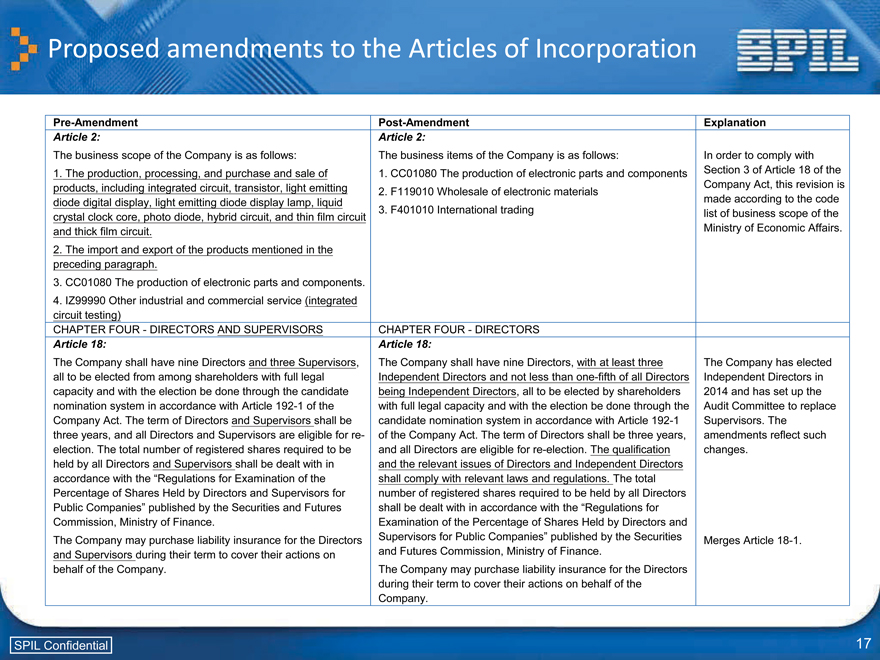

Proposed amendments to the Articles of Incorporation

Pre-Amendment

Article 2:

The business scope of the Company is as follows:

1. The production, processing, and purchase and sale of products, including integrated circuit, transistor, light emitting diode digital display, light emitting diode display lamp, liquid crystal clock core, photo diode, hybrid circuit, and thin film circuit and thick film circuit.

2. The import and export of the products mentioned in the preceding paragraph.

3. CC01080 The production of electronic parts and components.

4. IZ99990 Other industrial and commercial service (integrated circuit testing)

Post-Amendment

Article 2:

The business items of the Company is as follows:

1. CC01080 The production of electronic parts and components

2. F119010 Wholesale of electronic materials

3. F401010 International trading

Explanation

In order to comply with Section 3 of Article 18 of the Company Act, this revision is made according to the code list of business scope of the Ministry of Economic Affairs.

CHAPTER FOUR—DIRECTORS AND SUPERVISORS

CHAPTER FOUR—DIRECTORS

Article 18:

The Company shall have nine Directors and three Supervisors, all to be elected from among shareholders with full legal capacity and with the election be done through the candidate nomination system in accordance with Article 192-1 of the Company Act. The term of Directors and Supervisors shall be three years, and all Directors and Supervisors are eligible for reelection. The total number of registered shares required to be held by all Directors and Supervisors shall be dealt with in accordance with the “Regulations for Examination of the Percentage of Shares Held by Directors and Supervisors for Public Companies” published by the Securities and Futures Commission, Ministry of Finance.

The Company may purchase liability insurance for the Directors and Supervisors during their term to cover their actions on behalf of the Company.

Article 18:

The Company shall have nine Directors, with at least three Independent Directors and not less than one-fifth of all Directors being Independent Directors, all to be elected by shareholders with full legal capacity and with the election be done through the candidate nomination system in accordance with Article 192-1 of the Company Act. The term of Directors shall be three years, and all Directors are eligible for re-election. The qualification and the relevant issues of Directors and Independent Directors shall comply with relevant laws and regulations. The total number of registered shares required to be held by all Directors shall be dealt with in accordance with the “Regulations for Examination of the Percentage of Shares Held by Directors and Supervisors for Public Companies” published by the Securities and Futures Commission, Ministry of Finance.

The Company may purchase liability insurance for the Directors during their term to cover their actions on behalf of the Company.

The Company has elected Independent Directors in 2014 and has set up the Audit Committee to replace Supervisors. The amendments reflect such changes.

Merges Article 18-1.

SPIL Confidential 17

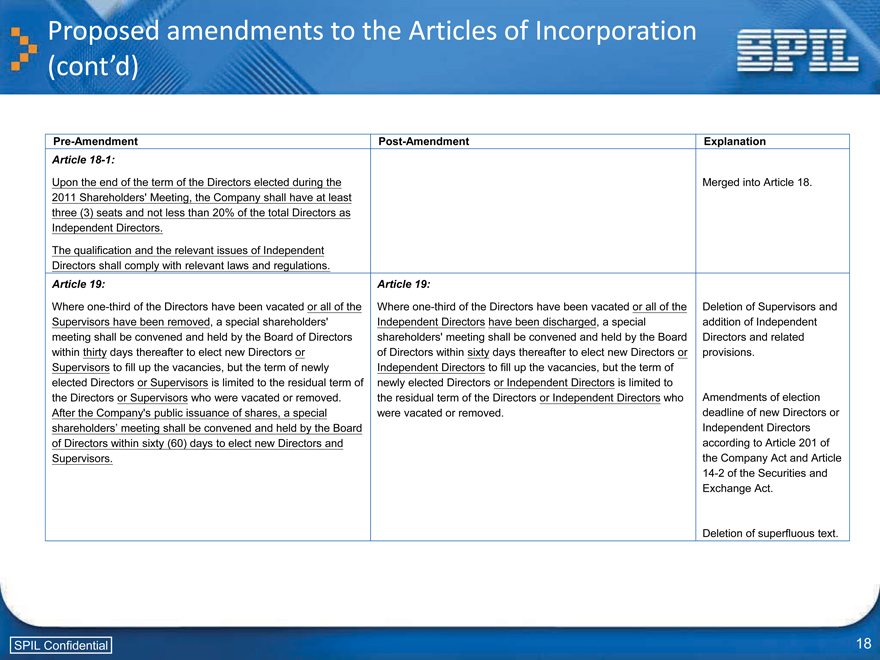

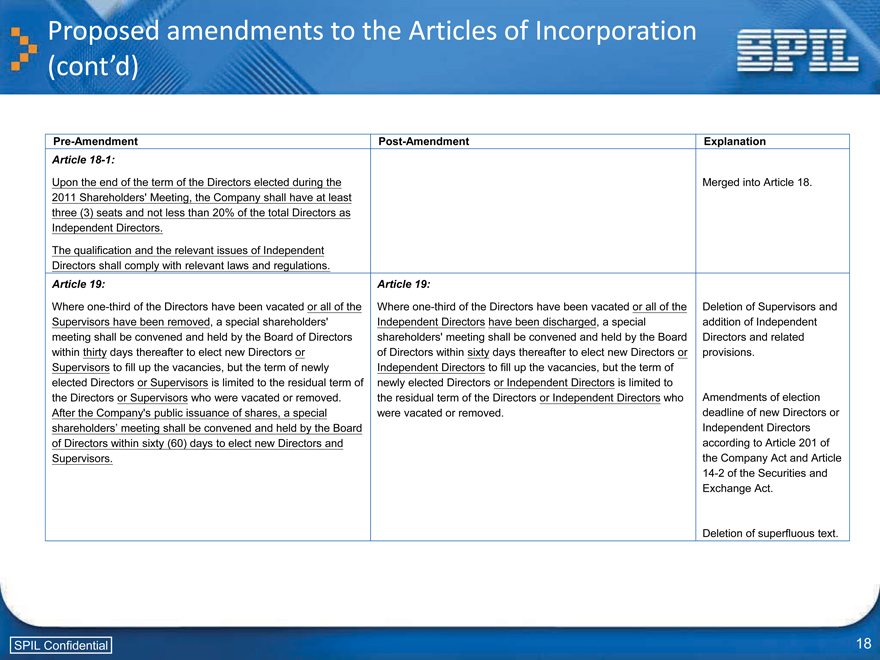

Proposed amendments to the Articles of Incorporation (cont’d)

Pre-Amendment

Article 18-1:

Upon the end of the term of the Directors elected during the 2011 Shareholders’ Meeting, the Company shall have at least three (3) seats and not less than 20% of the total Directors as Independent Directors.

The qualification and the relevant issues of Independent Directors shall comply with relevant laws and regulations.

Post-Amendment

Explanation

Article 19:

Where one-third of the Directors have been vacated or all of the Supervisors have been removed, a special shareholders’ meeting shall be convened and held by the Board of Directors within thirty days thereafter to elect new Directors or Supervisors to fill up the vacancies, but the term of newly elected Directors or Supervisors is limited to the residual term of the Directors or Supervisors who were vacated or removed. After the Company’s public issuance of shares, a special shareholders’ meeting shall be convened and held by the Board of Directors within sixty (60) days to elect new Directors and Supervisors.

Article 19:

Where one-third of the Directors have been vacated or all of the Independent Directors have been discharged, a special shareholders’ meeting shall be convened and held by the Board of Directors within sixty days thereafter to elect new Directors or Independent Directors to fill up the vacancies, but the term of newly elected Directors or Independent Directors is limited to the residual term of the Directors or Independent Directors who were vacated or removed.

Deletion of Supervisors and addition of Independent Directors and related provisions.

Amendments of election deadline of new Directors or Independent Directors according to Article 201 of the Company Act and Article 14-2 of the Securities and Exchange Act.

Deletion of superfluous text.

SPIL Confidential 18

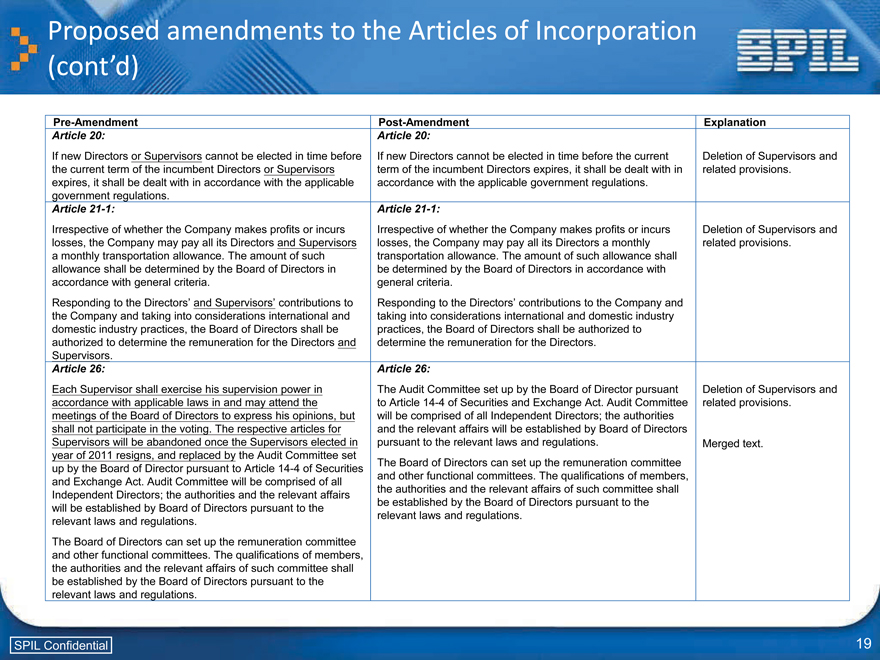

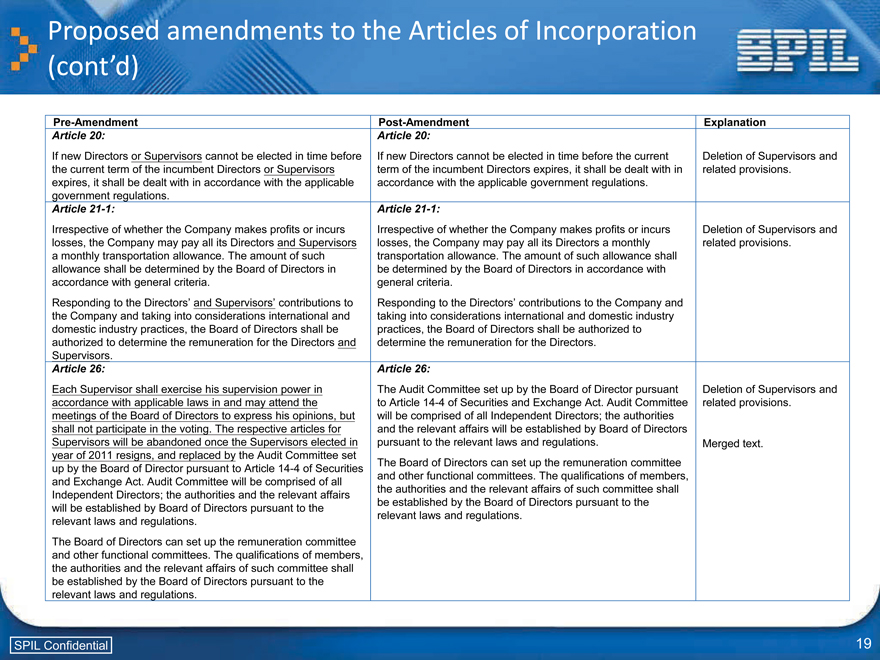

Proposed amendments to the Articles of Incorporation (cont’d)

Pre-Amendment

Article 20:

If new Directors or Supervisors cannot be elected in time before the current term of the incumbent Directors or Supervisors expires, it shall be dealt with in accordance with the applicable government regulations.

Post-Amendment

Article 20:

If new Directors cannot be elected in time before the current term of the incumbent Directors expires, it shall be dealt with in accordance with the applicable government regulations.

Explanation

Deletion of Supervisors and related provisions.

Article 21-1:

Irrespective of whether the Company makes profits or incurs losses, the Company may pay all its Directors and Supervisors a monthly transportation allowance. The amount of such allowance shall be determined by the Board of Directors in accordance with general criteria.

Responding to the Directors’ and Supervisors’ contributions to the Company and taking into considerations international and domestic industry practices, the Board of Directors shall be authorized to determine the remuneration for the Directors and Supervisors.

Article 21-1:

Irrespective of whether the Company makes profits or incurs losses, the Company may pay all its Directors a monthly transportation allowance. The amount of such allowance shall be determined by the Board of Directors in accordance with general criteria.

Responding to the Directors’ contributions to the Company and taking into considerations international and domestic industry practices, the Board of Directors shall be authorized to determine the remuneration for the Directors.

Deletion of Supervisors and related provisions.

Article 26:

Each Supervisor shall exercise his supervision power in accordance with applicable laws in and may attend the meetings of the Board of Directors to express his opinions, but shall not participate in the voting. The respective articles for Supervisors will be abandoned once the Supervisors elected in year of 2011 resigns, and replaced by the Audit Committee set up by the Board of Director pursuant to Article 14-4 of Securities and Exchange Act. Audit Committee will be comprised of all Independent Directors; the authorities and the relevant affairs will be established by Board of Directors pursuant to the relevant laws and regulations.

The Board of Directors can set up the remuneration committee and other functional committees. The qualifications of members, the authorities and the relevant affairs of such committee shall be established by the Board of Directors pursuant to the relevant laws and regulations.

Article 26:

The Audit Committee set up by the Board of Director pursuant to Article 14-4 of Securities and Exchange Act. Audit Committee will be comprised of all Independent Directors; the authorities and the relevant affairs will be established by Board of Directors pursuant to the relevant laws and regulations.

The Board of Directors can set up the remuneration committee and other functional committees. The qualifications of members, the authorities and the relevant affairs of such committee shall be established by the Board of Directors pursuant to the relevant laws and regulations.

Deletion of Supervisors and related provisions.

Merged text.

SPIL Confidential 19

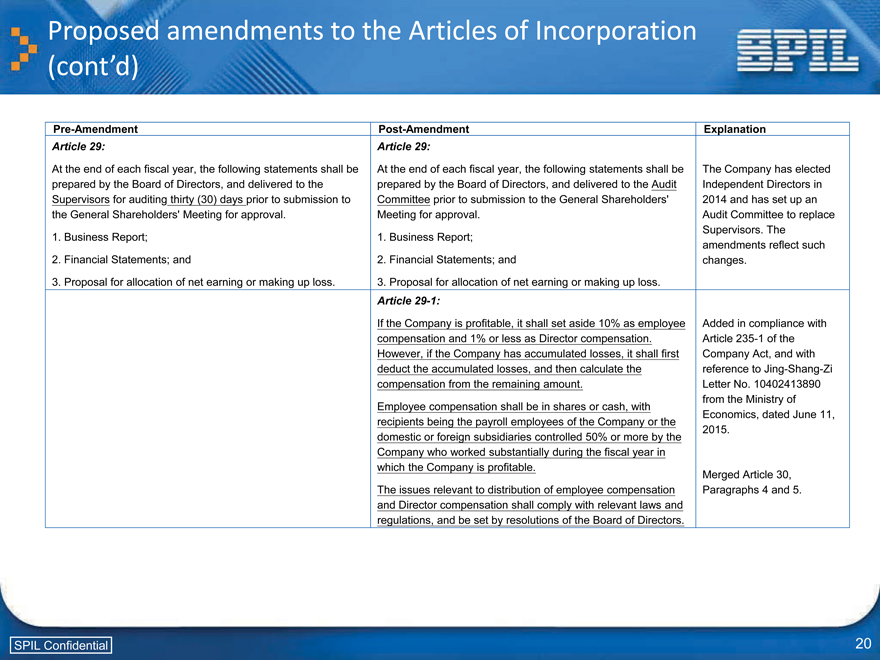

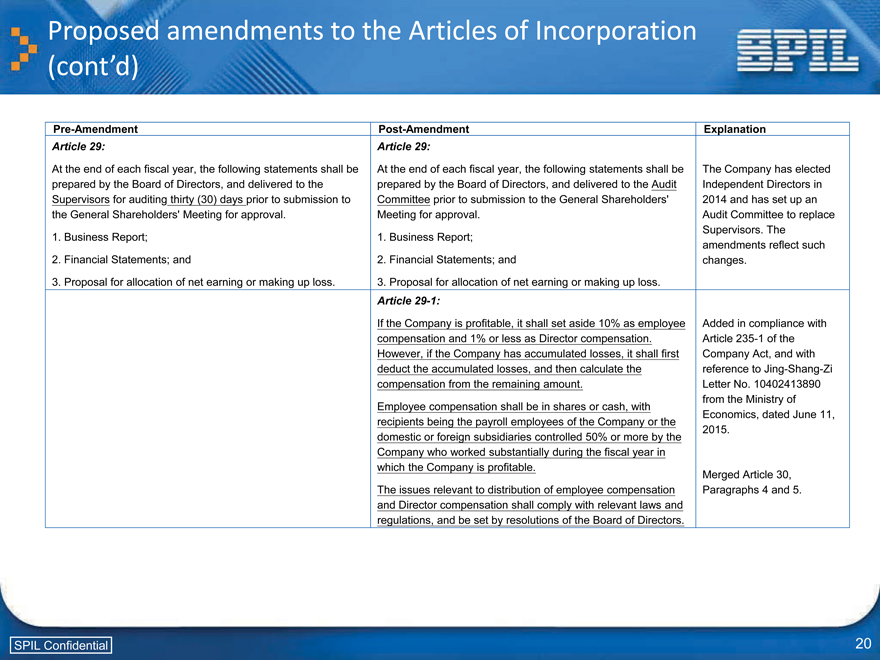

Proposed amendments to the Articles of Incorporation (cont’d)

Pre-Amendment

Article 29:

At the end of each fiscal year, the following statements shall be prepared by the Board of Directors, and delivered to the Supervisors for auditing thirty (30) days prior to submission to the General Shareholders’ Meeting for approval.

1. Business Report;

2. Financial Statements; and

3. Proposal for allocation of net earning or making up loss.

Post-Amendment

Article 29:

At the end of each fiscal year, the following statements shall be prepared by the Board of Directors, and delivered to the Audit Committee prior to submission to the General Shareholders’ Meeting for approval.

1. Business Report;

2. Financial Statements; and

3. Proposal for allocation of net earning or making up loss.

Explanation

The Company has elected Independent Directors in 2014 and has set up an Audit Committee to replace Supervisors. The amendments reflect such changes.

Article 29-1:

If the Company is profitable, it shall set aside 10% as employee compensation and 1% or less as Director compensation. However, if the Company has accumulated losses, it shall first deduct the accumulated losses, and then calculate the compensation from the remaining amount.

Employee compensation shall be in shares or cash, with recipients being the payroll employees of the Company or the domestic or foreign subsidiaries controlled 50% or more by the Company who worked substantially during the fiscal year in which the Company is profitable.

The issues relevant to distribution of employee compensation and Director compensation shall comply with relevant laws and regulations, and be set by resolutions of the Board of Directors.

Added in compliance with Article 235-1 of the Company Act, and with reference to Jing-Shang-Zi Letter No. 10402413890 from the Ministry of Economics, dated June 11, 2015.

Merged Article 30, Paragraphs 4 and 5.

SPIL Confidential 20

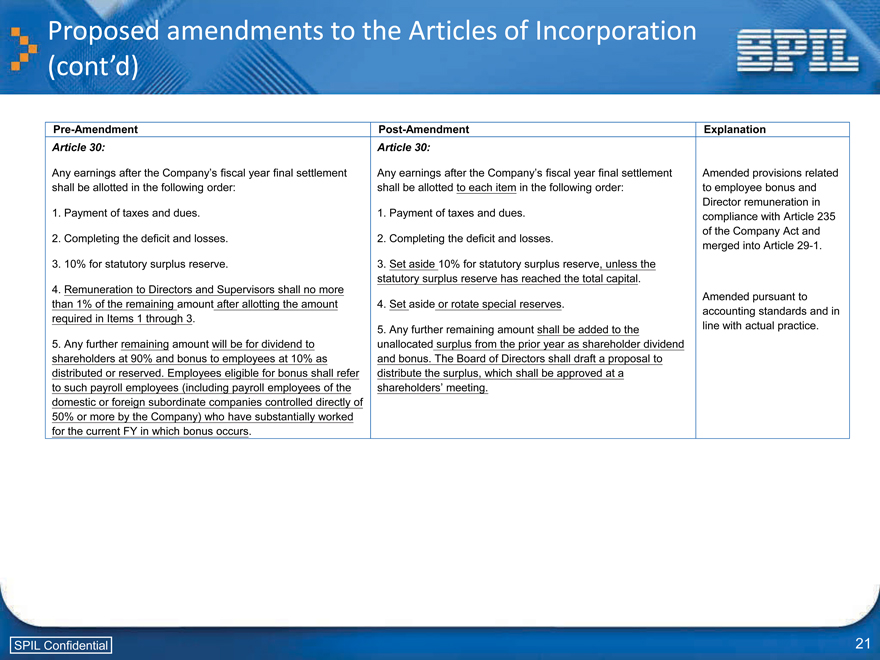

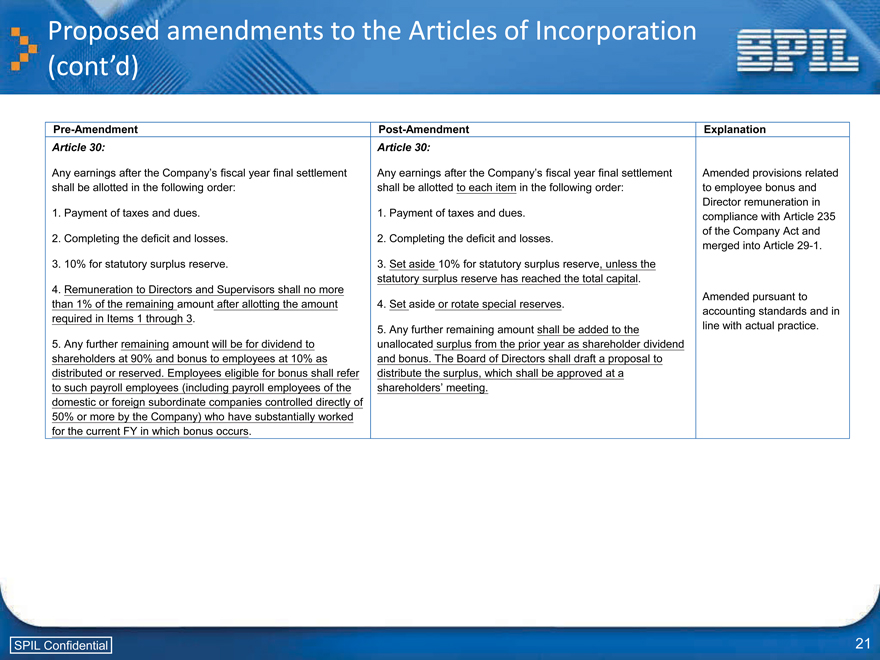

Proposed amendments to the Articles of Incorporation (cont’d)

Pre-Amendment

Article 30:

Any earnings after the Company’s fiscal year final settlement shall be allotted in the following order:

1. Payment of taxes and dues.

2. Completing the deficit and losses.

3. 10% for statutory surplus reserve.

4. Remuneration to Directors and Supervisors shall no more than 1% of the remaining amount after allotting the amount required in Items 1 through 3.

5. Any further remaining amount will be for dividend to shareholders at 90% and bonus to employees at 10% as distributed or reserved. Employees eligible for bonus shall refer to such payroll employees (including payroll employees of the domestic or foreign subordinate companies controlled directly of 50% or more by the Company) who have substantially worked for the current FY in which bonus occurs.

Post-Amendment

Article 30:

Any earnings after the Company’s fiscal year final settlement shall be allotted to each item in the following order:

1. Payment of taxes and dues.

2. Completing the deficit and losses.

3. Set aside 10% for statutory surplus reserve, unless the statutory surplus reserve has reached the total capital.

4. Set aside or rotate special reserves.

5. Any further remaining amount shall be added to the unallocated surplus from the prior year as shareholder dividend and bonus. The Board of Directors shall draft a proposal to distribute the surplus, which shall be approved at a shareholders’ meeting.

Explanation

Amended provisions related to employee bonus and Director remuneration in compliance with Article 235 of the Company Act and merged into Article 29-1.

Amended pursuant to accounting standards and in line with actual practice.

SPIL Confidential 21

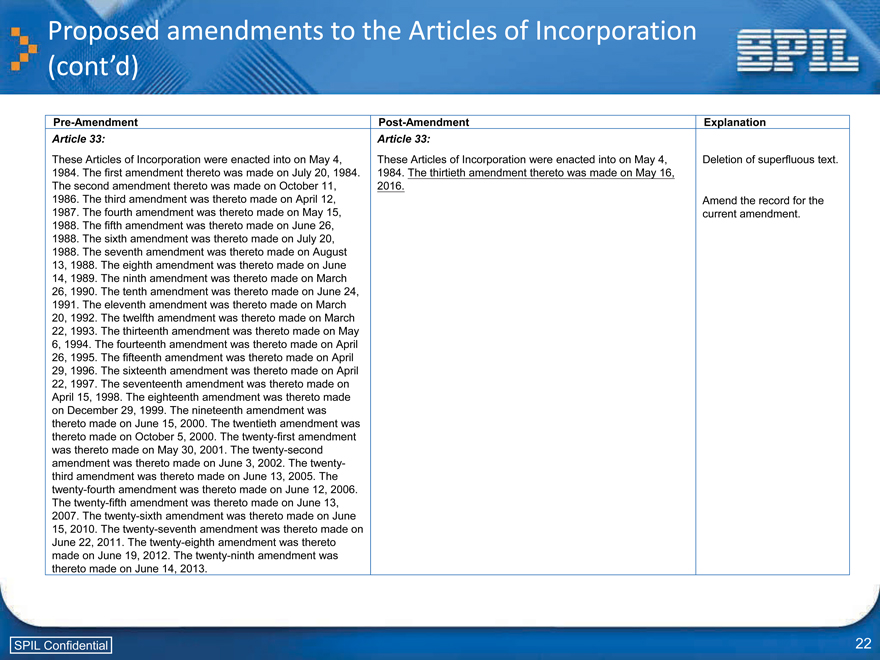

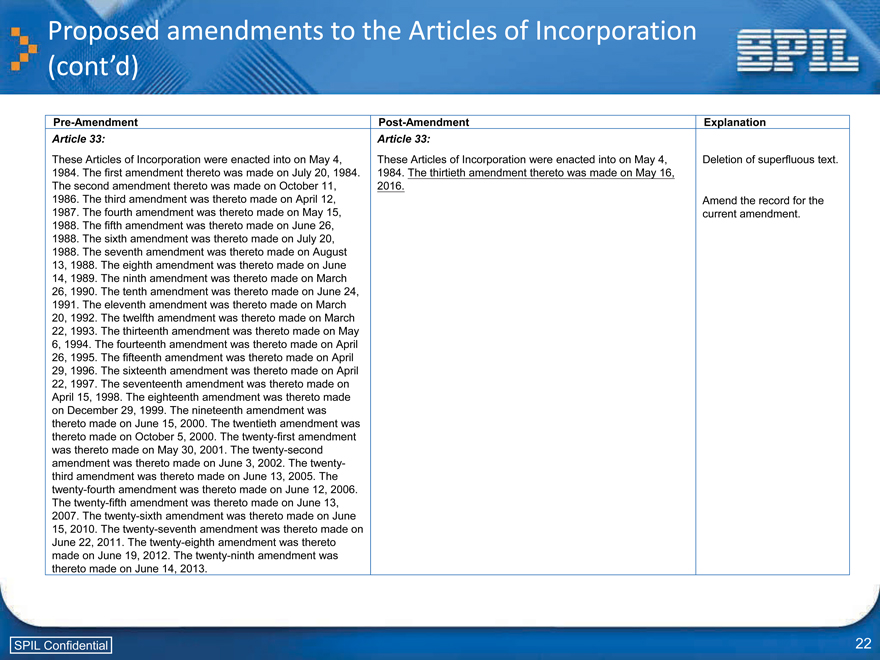

Proposed amendments to the Articles of Incorporation (cont’d)

Pre-Amendment

Article 33:

These Articles of Incorporation were enacted into on May 4, 1984. The first amendment thereto was made on July 20, 1984. The second amendment thereto was made on October 11, 1986. The third amendment was thereto made on April 12, 1987. The fourth amendment was thereto made on May 15, 1988. The fifth amendment was thereto made on June 26, 1988. The sixth amendment was thereto made on July 20, 1988. The seventh amendment was thereto made on August 13, 1988. The eighth amendment was thereto made on June 14, 1989. The ninth amendment was thereto made on March 26, 1990. The tenth amendment was thereto made on June 24, 1991. The eleventh amendment was thereto made on March 20, 1992. The twelfth amendment was thereto made on March 22, 1993. The thirteenth amendment was thereto made on May

6, 1994. The fourteenth amendment was thereto made on April 26, 1995. The fifteenth amendment was thereto made on April 29, 1996. The sixteenth amendment was thereto made on April 22, 1997. The seventeenth amendment was thereto made on April 15, 1998. The eighteenth amendment was thereto made on December 29, 1999. The nineteenth amendment was thereto made on June 15, 2000. The twentieth amendment was thereto made on October 5, 2000. The twenty-first amendment was thereto made on May 30, 2001. The twenty-second amendment was thereto made on June 3, 2002. The twenty-third amendment was thereto made on June 13, 2005. The twenty-fourth amendment was thereto made on June 12, 2006. The twenty-fifth amendment was thereto made on June 13, 2007. The twenty-sixth amendment was thereto made on June 15, 2010. The twenty-seventh amendment was thereto made on June 22, 2011. The twenty-eighth amendment was thereto made on June 19, 2012. The twenty-ninth amendment was thereto made on June 14, 2013.

Post-Amendment

Article 33:

These Articles of Incorporation were enacted into on May 4, 1984. The thirtieth amendment thereto was made on May 16, 2016.

Explanation

Deletion of superfluous text.

Amend the record for the current amendment.

SPIL Confidential 22

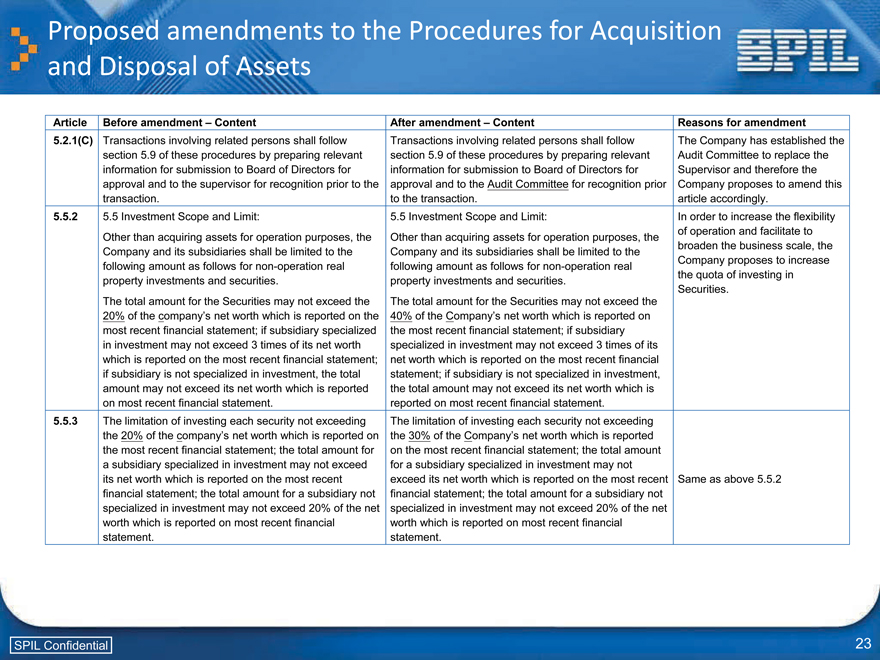

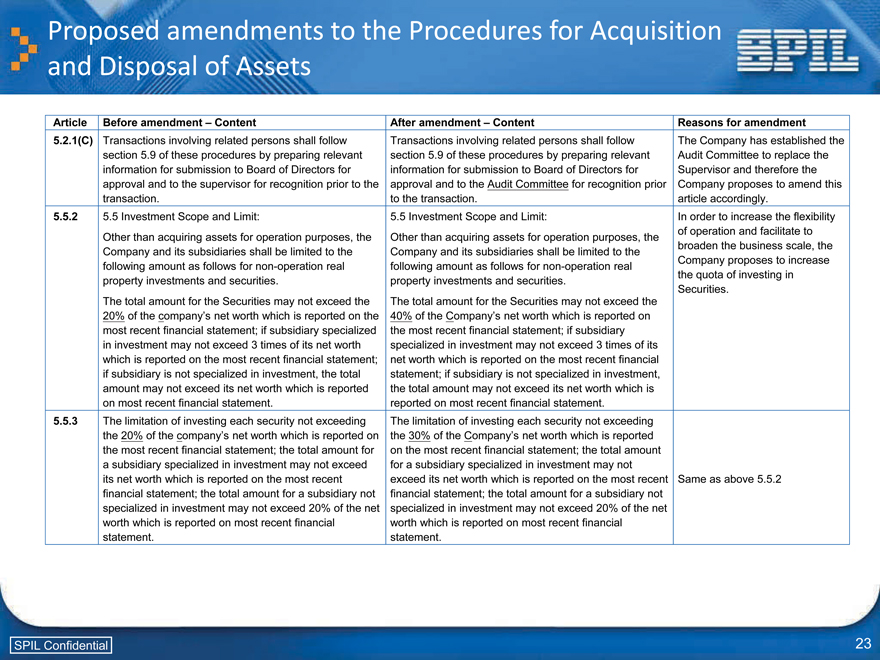

Proposed amendments to the Procedures for Acquisition and Disposal of Assets

Article Before amendment – Content

5.2.1(C) Transactions involving related persons shall follow section 5.9 of these procedures by preparing relevant information for submission to Board of Directors for approval and to the supervisor for recognition prior to the transaction.

After amendment – Content

Transactions involving related persons shall follow section 5.9 of these procedures by preparing relevant information for submission to Board of Directors for approval and to the Audit Committee for recognition prior to the transaction.

Reasons for amendment

The Company has established the Audit Committee to replace the Supervisor and therefore the Company proposes to amend this article accordingly.

5.5.2 5.5 Investment Scope and Limit:

Other than acquiring assets for operation purposes, the Company and its subsidiaries shall be limited to the following amount as follows for non-operation real property investments and securities.

The total amount for the Securities may not exceed the 20% of the company’s net worth which is reported on the most recent financial statement; if subsidiary specialized in investment may not exceed 3 times of its net worth which is reported on the most recent financial statement; if subsidiary is not specialized in investment, the total amount may not exceed its net worth which is reported on most recent financial statement.

5.5 Investment Scope and Limit:

Other than acquiring assets for operation purposes, the Company and its subsidiaries shall be limited to the following amount as follows for non-operation real property investments and securities.

The total amount for the Securities may not exceed the 40% of the Company’s net worth which is reported on the most recent financial statement; if subsidiary specialized in investment may not exceed 3 times of its net worth which is reported on the most recent financial statement; if subsidiary is not specialized in investment, the total amount may not exceed its net worth which is reported on most recent financial statement.

In order to increase the flexibility of operation and facilitate to broaden the business scale, the Company proposes to increase the quota of investing in Securities.

5.5.3 The limitation of investing each security not exceeding the 20% of the company’s net worth which is reported on the most recent financial statement; the total amount for a subsidiary specialized in investment may not exceed its net worth which is reported on the most recent financial statement; the total amount for a subsidiary not specialized in investment may not exceed 20% of the net worth which is reported on most recent financial statement.

The limitation of investing each security not exceeding the 30% of the Company’s net worth which is reported on the most recent financial statement; the total amount for a subsidiary specialized in investment may not exceed its net worth which is reported on the most recent financial statement; the total amount for a subsidiary not specialized in investment may not exceed 20% of the net worth which is reported on most recent financial statement.

Same as above 5.5.2

SPIL Confidential 23

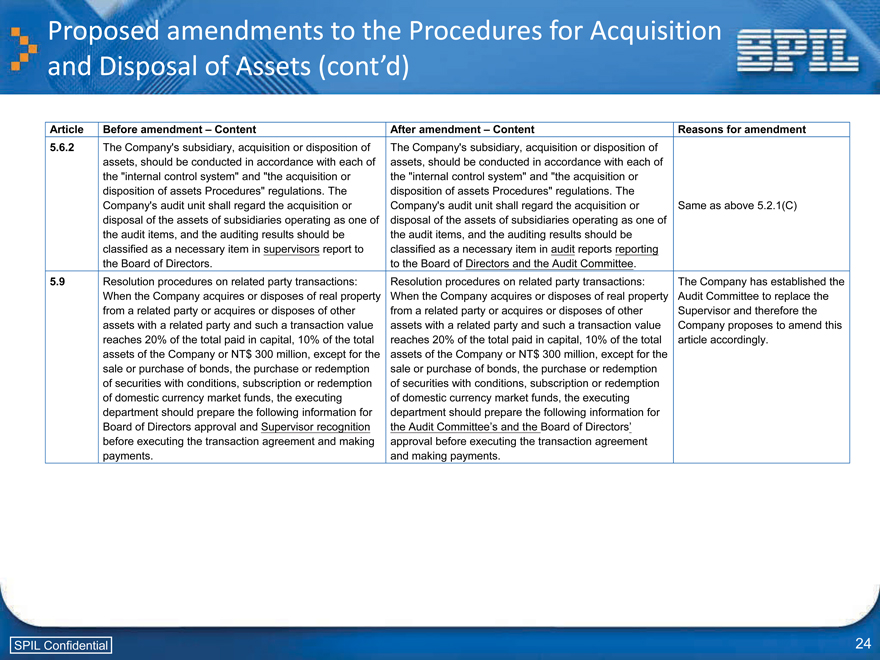

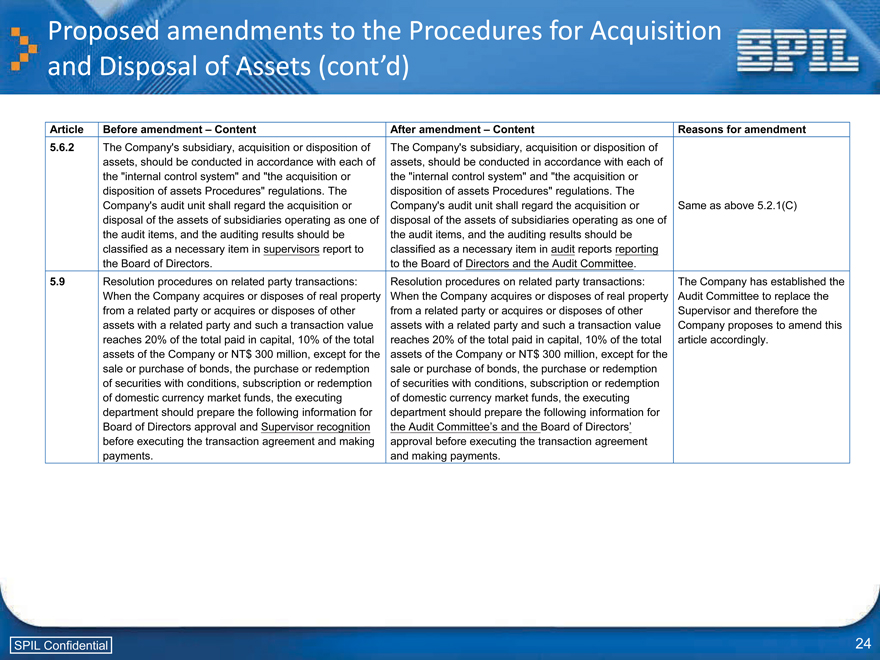

Proposed amendments to the Procedures for Acquisition and Disposal of Assets (cont’d)

Article Before amendment – Content

5.6.2 The Company’s subsidiary, acquisition or disposition of assets, should be conducted in accordance with each of the “internal control system” and “the acquisition or disposition of assets Procedures” regulations. The Company’s audit unit shall regard the acquisition or disposal of the assets of subsidiaries operating as one of the audit items, and the auditing results should be classified as a necessary item in supervisors report to the Board of Directors.

After amendment – Content

The Company’s subsidiary, acquisition or disposition of assets, should be conducted in accordance with each of the “internal control system” and “the acquisition or disposition of assets Procedures” regulations. The Company’s audit unit shall regard the acquisition or disposal of the assets of subsidiaries operating as one of the audit items, and the auditing results should be classified as a necessary item in audit reports reporting to the Board of Directors and the Audit Committee.

Reasons for amendment

Same as above 5.2.1(C)

5.9 Resolution procedures on related party transactions: When the Company acquires or disposes of real property from a related party or acquires or disposes of other assets with a related party and such a transaction value reaches 20% of the total paid in capital, 10% of the total assets of the Company or NT$ 300 million, except for the sale or purchase of bonds, the purchase or redemption of securities with conditions, subscription or redemption of domestic currency market funds, the executing department should prepare the following information for Board of Directors approval and Supervisor recognition before executing the transaction agreement and making payments.

Resolution procedures on related party transactions: When the Company acquires or disposes of real property from a related party or acquires or disposes of other assets with a related party and such a transaction value reaches 20% of the total paid in capital, 10% of the total assets of the Company or NT$ 300 million, except for the sale or purchase of bonds, the purchase or redemption of securities with conditions, subscription or redemption of domestic currency market funds, the executing department should prepare the following information for the Audit Committee’s and the Board of Directors’ approval before executing the transaction agreement and making payments.

The Company has established the Audit Committee to replace the Supervisor and therefore the Company proposes to amend this article accordingly.

SPIL Confidential 24

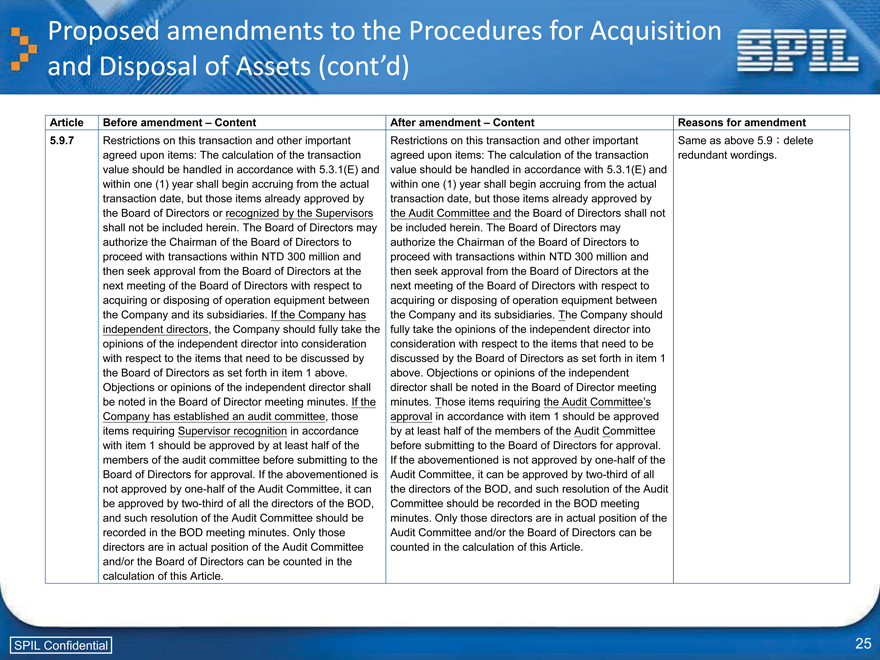

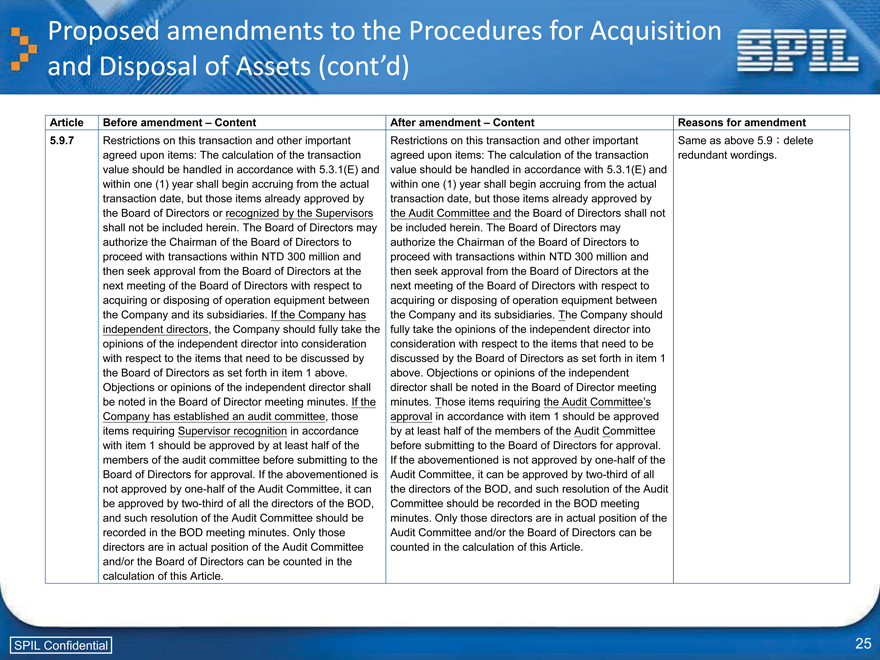

Proposed amendments to the Procedures for Acquisition and Disposal of Assets (cont’d)

Article Before amendment – Content

5.9.7 Restrictions on this transaction and other important agreed upon items: The calculation of the transaction value should be handled in accordance with 5.3.1(E) and within one (1) year shall begin accruing from the actual transaction date, but those items already approved by the Board of Directors or recognized by the Supervisors shall not be included herein. The Board of Directors may authorize the Chairman of the Board of Directors to proceed with transactions within NTD 300 million and then seek approval from the Board of Directors at the next meeting of the Board of Directors with respect to acquiring or disposing of operation equipment between the Company and its subsidiaries. If the Company has independent directors, the Company should fully take the opinions of the independent director into consideration with respect to the items that need to be discussed by the Board of Directors as set forth in item 1 above.

Objections or opinions of the independent director shall be noted in the Board of Director meeting minutes. If the Company has established an audit committee, those items requiring Supervisor recognition in accordance with item 1 should be approved by at least half of the members of the audit committee before submitting to the Board of Directors for approval. If the abovementioned is not approved by one-half of the Audit Committee, it can be approved by two-third of all the directors of the BOD, and such resolution of the Audit Committee should be recorded in the BOD meeting minutes. Only those directors are in actual position of the Audit Committee and/or the Board of Directors can be counted in the calculation of this Article.

After amendment – Content

Restrictions on this transaction and other important agreed upon items: The calculation of the transaction value should be handled in accordance with 5.3.1(E) and within one (1) year shall begin accruing from the actual transaction date, but those items already approved by the Audit Committee and the Board of Directors shall not be included herein. The Board of Directors may authorize the Chairman of the Board of Directors to proceed with transactions within NTD 300 million and then seek approval from the Board of Directors at the next meeting of the Board of Directors with respect to acquiring or disposing of operation equipment between the Company and its subsidiaries. The Company should fully take the opinions of the independent director into consideration with respect to the items that need to be discussed by the Board of Directors as set forth in item 1 above. Objections or opinions of the independent director shall be noted in the Board of Director meeting minutes. Those items requiring the Audit Committee’s approval in accordance with item 1 should be approved by at least half of the members of the Audit Committee before submitting to the Board of Directors for approval. If the abovementioned is not approved by one-half of the Audit Committee, it can be approved by two-third of all the directors of the BOD, and such resolution of the Audit Committee should be recorded in the BOD meeting minutes. Only those directors are in actual position of the Audit Committee and/or the Board of Directors can be counted in the calculation of this Article.

Reasons for amendment

Same as above 5.9 ; delete redundant wordings.

SPIL Confidential 25

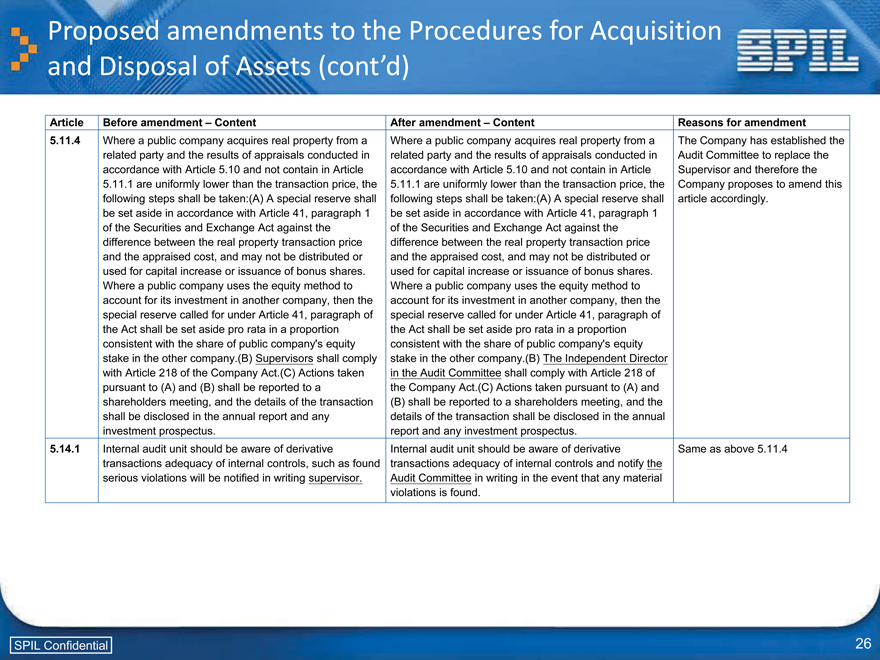

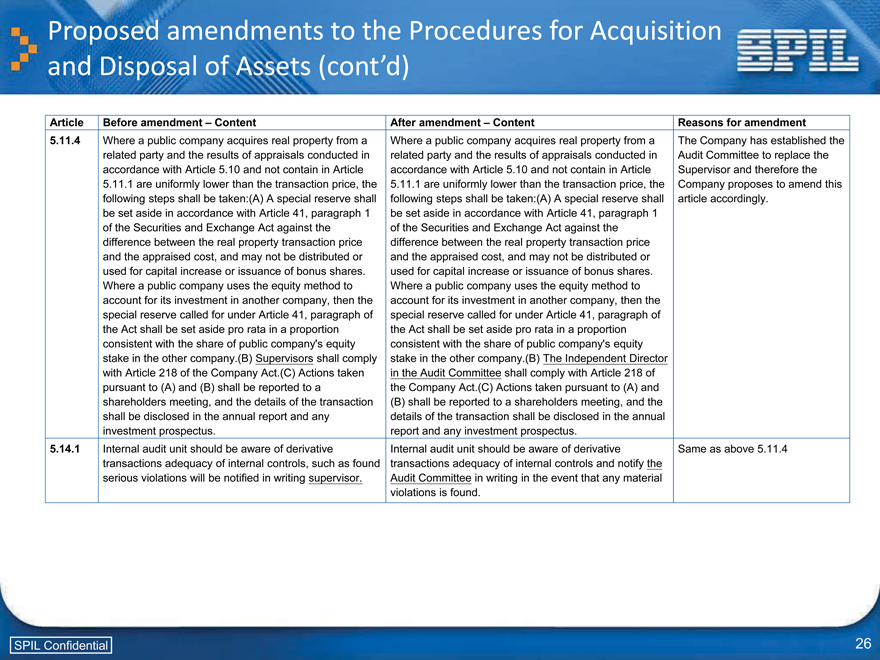

Proposed amendments to the Procedures for Acquisition and Disposal of Assets (cont’d)

Article Before amendment – Content

5.11.4 Where a public company acquires real property from a related party and the results of appraisals conducted in accordance with Article 5.10 and not contain in Article 5.11.1 are uniformly lower than the transaction price, the following steps shall be taken:(A) A special reserve shall be set aside in accordance with Article 41, paragraph 1 of the Securities and Exchange Act against the difference between the real property transaction price and the appraised cost, and may not be distributed or used for capital increase or issuance of bonus shares.

Where a public company uses the equity method to account for its investment in another company, then the special reserve called for under Article 41, paragraph of the Act shall be set aside pro rata in a proportion consistent with the share of public company’s equity stake in the other company.(B) Supervisors shall comply with Article 218 of the Company Act.(C) Actions taken pursuant to (A) and (B) shall be reported to a shareholders meeting, and the details of the transaction shall be disclosed in the annual report and any investment prospectus.

After amendment – Content

Where a public company acquires real property from a related party and the results of appraisals conducted in accordance with Article 5.10 and not contain in Article 5.11.1 are uniformly lower than the transaction price, the following steps shall be taken:(A) A special reserve shall be set aside in accordance with Article 41, paragraph 1 of the Securities and Exchange Act against the difference between the real property transaction price and the appraised cost, and may not be distributed or used for capital increase or issuance of bonus shares. Where a public company uses the equity method to account for its investment in another company, then the special reserve called for under Article 41, paragraph of the Act shall be set aside pro rata in a proportion consistent with the share of public company’s equity stake in the other company.(B) The Independent Director in the Audit Committee shall comply with Article 218 of the Company Act.(C) Actions taken pursuant to (A) and (B) shall be reported to a shareholders meeting, and the details of the transaction shall be disclosed in the annual report and any investment prospectus.

Reasons for amendment

The Company has established the Audit Committee to replace the Supervisor and therefore the Company proposes to amend this article accordingly.

5.14.1 Internal audit unit should be aware of derivative transactions adequacy of internal controls, such as found serious violations will be notified in writing supervisor.

Internal audit unit should be aware of derivative transactions adequacy of internal controls and notify the Audit Committee in writing in the event that any material violations is found.

Same as above 5.11.4

SPIL Confidential 26

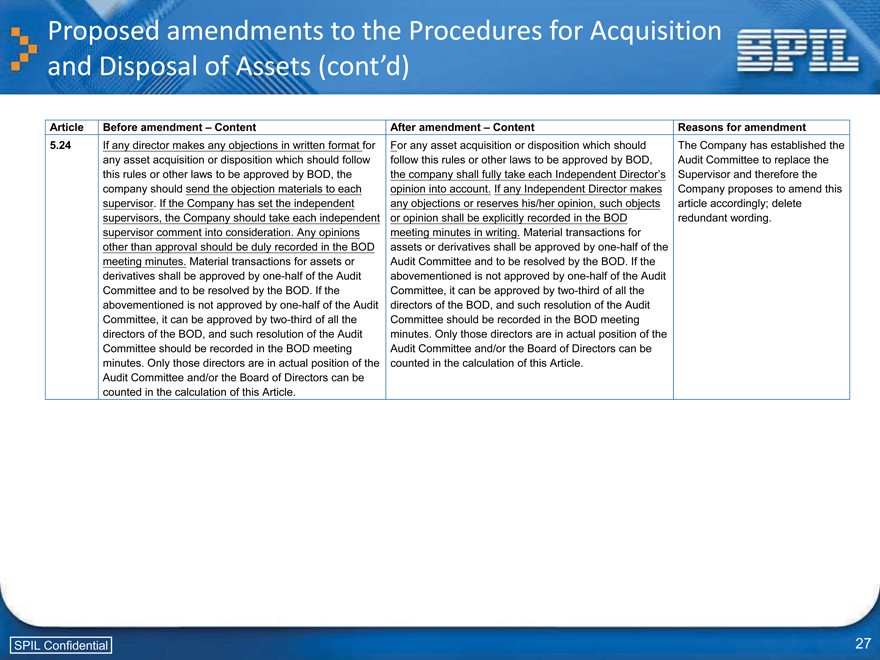

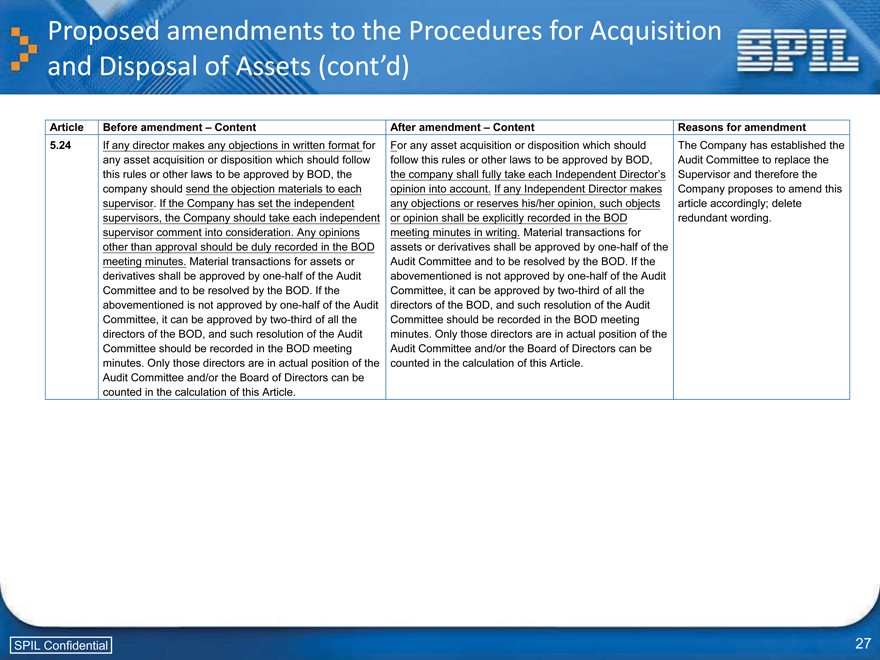

Proposed amendments to the Procedures for Acquisition and Disposal of Assets (cont’d)

Article Before amendment – Content

5.24 If any director makes any objections in written format for any asset acquisition or disposition which should follow this rules or other laws to be approved by BOD, the company should send the objection materials to each supervisor. If the Company has set the independent supervisors, the Company should take each independent supervisor comment into consideration. Any opinions other than approval should be duly recorded in the BOD meeting minutes. Material transactions for assets or derivatives shall be approved by one-half of the Audit Committee and to be resolved by the BOD. If the abovementioned is not approved by one-half of the Audit Committee, it can be approved by two-third of all the directors of the BOD, and such resolution of the Audit Committee should be recorded in the BOD meeting minutes. Only those directors are in actual position of the Audit Committee and/or the Board of Directors can be counted in the calculation of this Article.

After amendment – Content

For any asset acquisition or disposition which should follow this rules or other laws to be approved by BOD, the company shall fully take each Independent Director’s opinion into account. If any Independent Director makes any objections or reserves his/her opinion, such objects or opinion shall be explicitly recorded in the BOD meeting minutes in writing. Material transactions for assets or derivatives shall be approved by one-half of the Audit Committee and to be resolved by the BOD. If the abovementioned is not approved by one-half of the Audit Committee, it can be approved by two-third of all the directors of the BOD, and such resolution of the Audit Committee should be recorded in the BOD meeting minutes. Only those directors are in actual position of the Audit Committee and/or the Board of Directors can be counted in the calculation of this Article.

Reasons for amendment

The Company has established the Audit Committee to replace the Supervisor and therefore the Company proposes to amend this article accordingly; delete redundant wording.

SPIL Confidential 27

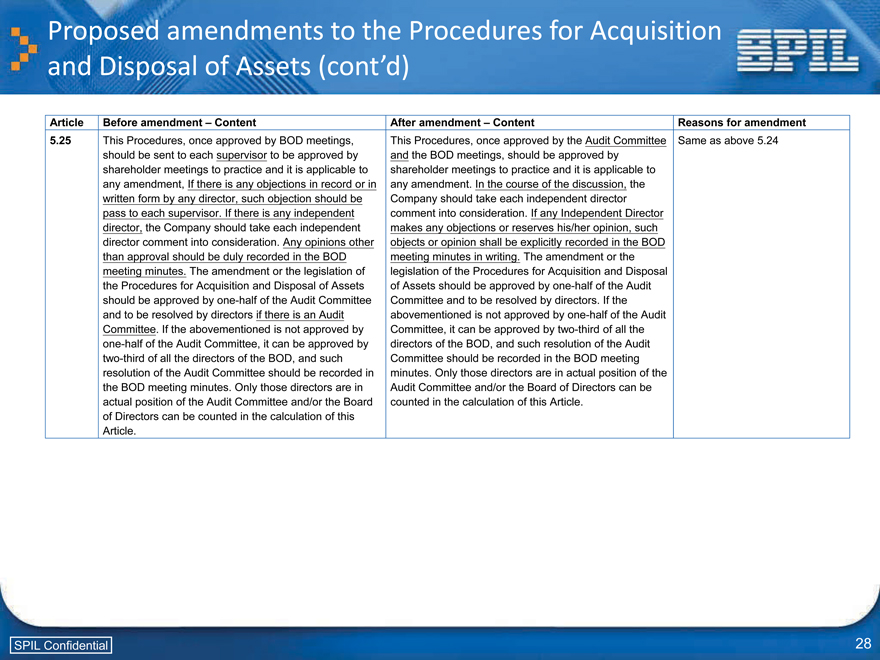

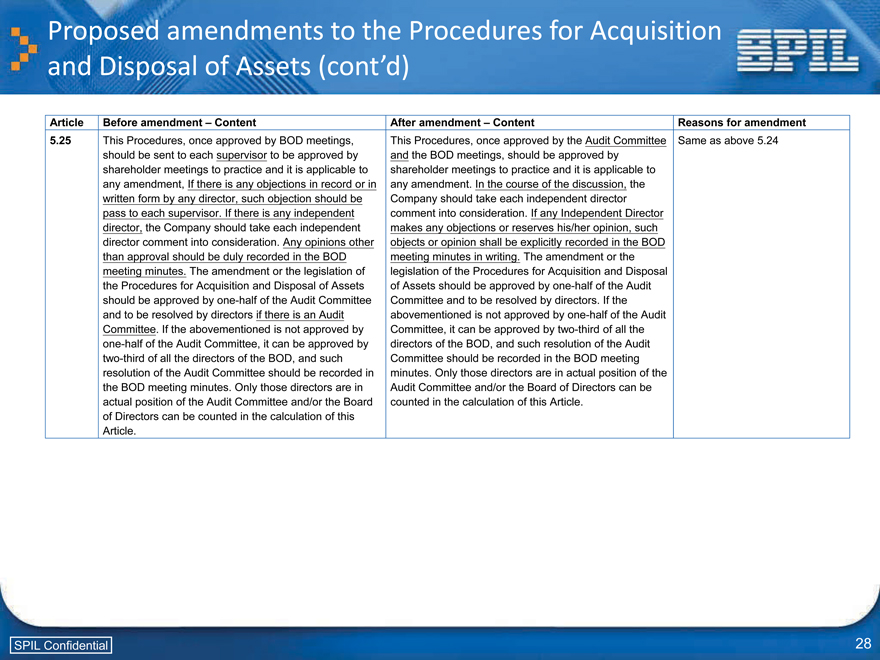

Proposed amendments to the Procedures for Acquisition and Disposal of Assets (cont’d)

Article Before amendment – Content

5.25 This Procedures, once approved by BOD meetings, should be sent to each supervisor to be approved by shareholder meetings to practice and it is applicable to any amendment, If there is any objections in record or in written form by any director, such objection should be pass to each supervisor. If there is any independent director, the Company should take each independent director comment into consideration. Any opinions other than approval should be duly recorded in the BOD meeting minutes. The amendment or the legislation of the Procedures for Acquisition and Disposal of Assets should be approved by one-half of the Audit Committee and to be resolved by directors if there is an Audit Committee. If the abovementioned is not approved by one-half of the Audit Committee, it can be approved by two-third of all the directors of the BOD, and such resolution of the Audit Committee should be recorded in the BOD meeting minutes. Only those directors are in actual position of the Audit Committee and/or the Board of Directors can be counted in the calculation of this Article.

After amendment – Content

This Procedures, once approved by the Audit Committee and the BOD meetings, should be approved by shareholder meetings to practice and it is applicable to any amendment. In the course of the discussion, the Company should take each independent director comment into consideration. If any Independent Director makes any objections or reserves his/her opinion, such objects or opinion shall be explicitly recorded in the BOD meeting minutes in writing. The amendment or the legislation of the Procedures for Acquisition and Disposal of Assets should be approved by one-half of the Audit Committee and to be resolved by directors. If the abovementioned is not approved by one-half of the Audit Committee, it can be approved by two-third of all the directors of the BOD, and such resolution of the Audit Committee should be recorded in the BOD meeting minutes. Only those directors are in actual position of the Audit Committee and/or the Board of Directors can be counted in the calculation of this Article.

Reasons for amendment

Same as above 5.24

SPIL Confidential 28

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | Siliconware Precision Industries Co., Ltd |

| | | |

| Date: April 18, 2016 | | | | By: | | /s/ Ms. Eva Chen |

| | | | | | Eva Chen |

| | | | | | Chief Financial Officer |