23

Summary

§ A leading wholesaler / distributor of diesel, gasoline, fuel oil and kerosene in Taiyuan City,

and Gujiao City, in Shanxi Province, PRC.

§ Business founded 1995. Strong competitive position in a challenging geographic

marketplace in Shanxi Province with 120,000 metric tons (mt) of storage tank capacity.

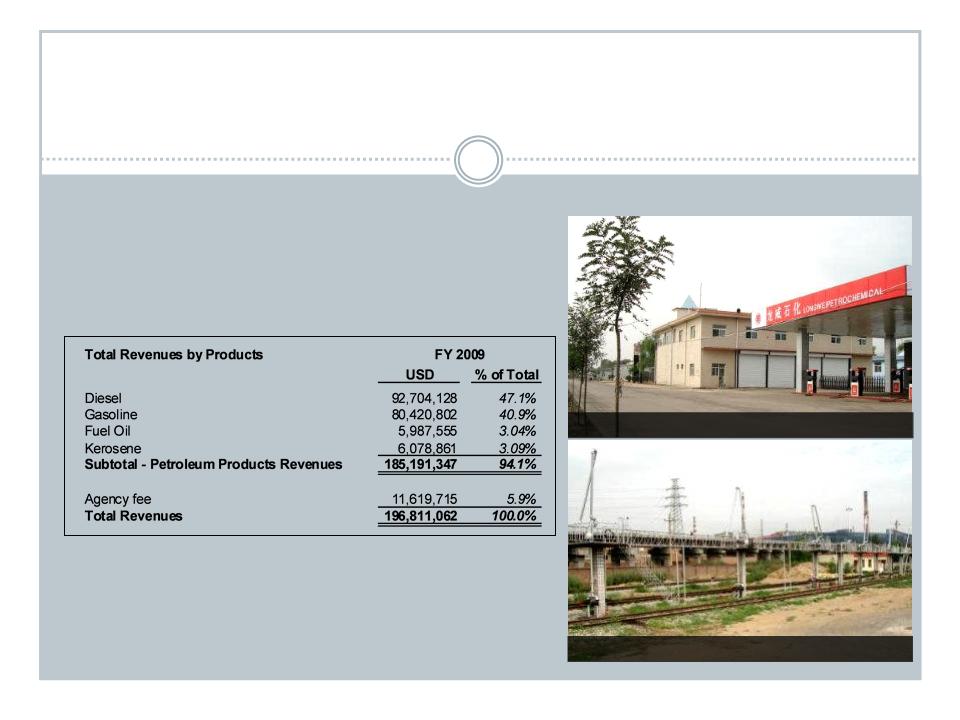

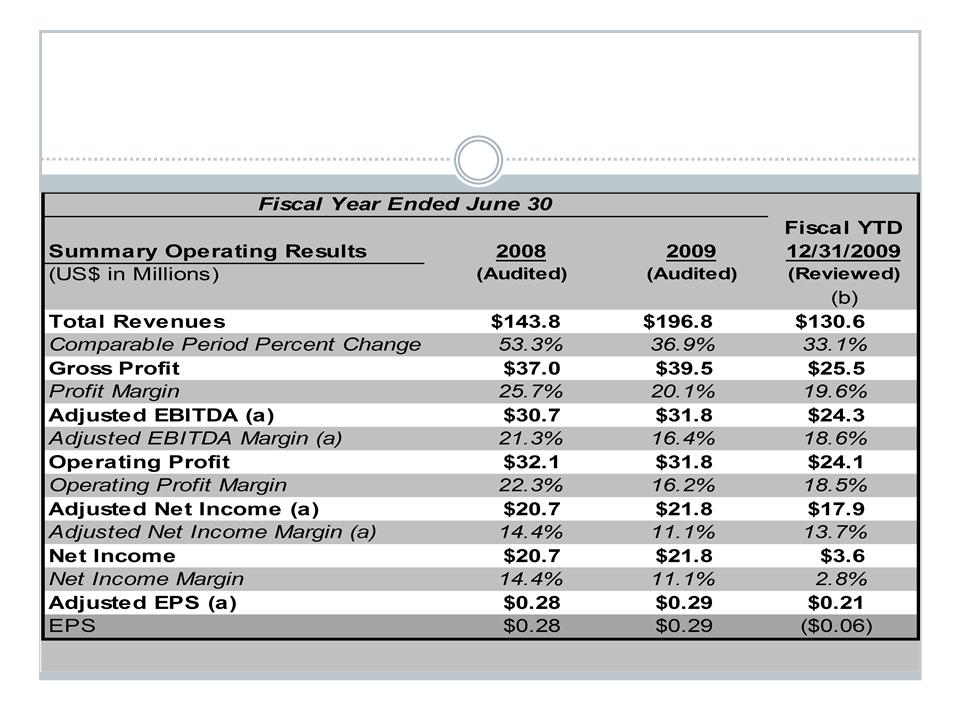

§ Revenues have increased at a 48+% CAGR% between 2005 and 2009 due to strong

increases in demand for diesel and gasoline in Shanxi Province.

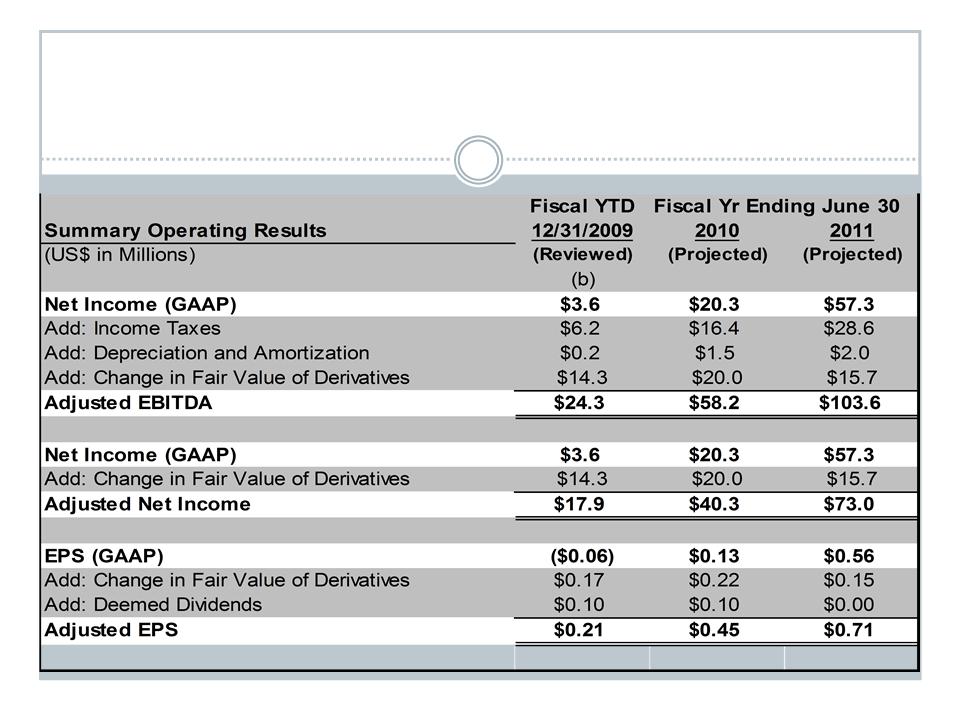

§ Highly profitable with audited FY 2009 Revenues, Operating Profit and Net Income of

$196.8 M, $39.5 M and $21.8 M, respectively.

§ A total of 2.4 M shares of the Series A Preferred Stock was converted to common stock as

of March 31, 2010. No common stock warrants associated with the October 2009 PIPE

have been exercised as of April 27, 2010.

§ Management currently owns 49% of the shares outstanding (42.1 M shares) and has

pledged a total of 13.5 M shares of common stock (not included in totals above) they

already owned in order to close the October 2009 Financing. Management will receive the

shares back without further liability or potential loss of the shares, if Longwei generates

net income of $23.9 M for the year ending June 30, 2010.

§ Longwei has filed an application to list its common stock on the NYSE Amex Stock

Exchange and will work with the NYSE Amex Stock Exchange to complete the listing

process as soon as possible.

§ As of April 26, 2010, Longwei’s current price to earnings ratio based on the trailing twelve

months adjusted net income is 9.48, well below industry comparables.