UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.__ )

| þ | Filed by the Registrant | ¨ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| þ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 | |

IPG Photonics Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| þ | No fee required. | ||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | ||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

| |

| IPG Photonics Corporation | |

| 2020 Annual Letter | |

Valentin P. Gapontsev, Ph.D. Chairman and Chief Executive Officer |  |

| To Our Stockholders, | |

Although 2019 proved to be a challenging year, we demonstrated good progress in a number of key growth initiatives. We delivered product cost reductions and differentiated new features and accessories for our core products. Furthermore, we are leveraging one of the largest R&D investments in the laser industry to launch leading edge laser products and systems for new markets to enhance our growth and margin profile and provide greater geographic and end market diversification. The weaker global macroeconomic backdrop, US-China trade conflict and a more intense competitive landscape in China affected our 2019 financial performance. As a result of these challenges, we experienced a significant decrease in the average selling prices for our products in China, which reduced the dollar value of the laser cutting market. Although we shipped a record number of high power lasers, increasing laser units at 1 kilowatt or greater by 23%, achieving revenue growth was challenging. Despite this challenge, we continue to see customers in the laser cutting market adopt higher power solutions. We increased sales of lasers at 10 kilowatts or greater by more than 25%, even though the second half of the year was weaker for these ultra high power solutions. |  |

However, multiple IPG customers are launching new cutting systems using our 12 kilowatt lasers, and we increased sales of 20 kilowatt lasers for cutting applications 8-fold. Many of these are sold with our new ultra high power cutting heads. In addition, we sold our first lasers with high peak power (HPP) and adjustable mode beam (AMB) capability. HPP products deliver peak energy twice the average power of the laser, increasing cutting speed and quality while reducing scrap through closer nesting of parts. Our new AMB lasers permit the broadest range of beam tunability, enabling spatterless welding and enhancing the speed of electric vehicle battery production. When combined with our unique high power pulsed lasers for foil cutting and ultra high power continuous wave (CW) lasers for welding, we see significant opportunities in the electric vehicle battery market in 2020 and beyond. Augmenting our laser solutions with high power optical heads is a key differentiator versus our laser competitors. In 2019, we delivered record sales of optical heads and other beam delivery accessories, growing sales of these products by 10%. We also shipped our first volume orders of our Laser Depth Dynamics (LDD) process monitoring systems, our patented real-time weld monitoring solution. LDD enables greater use of laser-based welding in automated production environments, and we are pursuing multiple million dollar plus opportunities with this technology and associated laser product sales. Further, we sold a record number of systems for materials processing in 2019 with revenue increasing 33% excluding Genesis, acquired in December 2018. Standard and custom systems for vehicle and battery production, medical device manufacturing, pipe welding, cleaning and inspection applications drove systems growth. We plan to leverage Genesis’ expertise in robotic systems integration to accelerate laser processing within the transportation, aerospace and industrial end markets. | |

1

1| Product innovation remains core to our success and the source of growth over the coming years. In 2019, new product sales were 19% of total revenue and 24% in the fourth quarter alone. Sales of green pulsed lasers used to improve solar cell efficiency increased by more than 60% in 2019. Sales of ultrafast pulsed lasers increased more than 80% year over year off a small base, with more than 50 new projects for these lasers across a wide range of applications processing glass, ceramics, circuit boards, OLED film, batteries and solar cells. We plan to enhance the pulse energy and expand the portfolio of new green, ultraviolet and ultrafast pulsed lasers to increase our available markets. | |

Sales of medical lasers increased 80% in 2019 as our fiber laser-based system solution received approvals in China and the US. We expect sales into urology and other soft tissue applications to ramp over the coming years off a low base. Our lithotripsy medical laser application uses consumable fibers, which have the potential to develop into a more meaningful recurring revenue stream as the number of installed systems increases. We continue to invest in transformative new products for new application areas as well, including new medical treatments, mid-infrared lasers for spectroscopy, inspection and sensing applications, and ultra high power single mode lasers for aerospace and defense. We have one of the strongest balance sheets in the industrial automation industry, with more than $1 billion net cash and ample liquidity. This strength allows us to prioritize R&D investments and capital expenditures focusing on long-term objectives - diversifying our business with new products, finding new markets and driving innovations to maintain and increase margins. In 2019, we spent $130 million on research and development and $134 million on capital expenditures for these purposes. In addition, we repurchased $41 million worth of stock and have offset all dilution from employee equity compensation since our anti-dilutive repurchase program began in July 2016. |  |

We believe we have significant long-term growth opportunities in laser welding, fine processing of electric vehicle batteries and our portfolio of new products addressing opportunities in micro processing, medical, systems and beam delivery solutions. Within our core business, we believe there is no company that can deliver high power laser solutions at our quality, scale, cost and lead time. We will rely on our core scientific strengths to optimize investment in strategic initiatives critical to the long-term success of the Company, enabling IPG to deliver strong growth in revenue and cash flow. I want to thank our talented employees for their hard work during a difficult year. I would also like to thank you, our stockholders, for your loyalty and support. As ever, I remain confident in our ability to execute during this more challenging period and deliver on our mission to make our fiber laser technology the tool of choice in mass production. | |

| |

VALENTIN P. GAPONTSEV, PH.D. Chairman and Chief Executive Officer April 1, 2020 | |

2 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Notice of Annual Meeting of Stockholders

DATE AND TIME May 28, 2020 10:00 AM (Eastern Time) | LOCATION IPG Photonics Corporation 50 Old Webster Road Oxford, Massachusetts 01540 | WHO CAN VOTE Only stockholders of record at the close of business on April 1, 2020 may vote at the Annual Meeting |

Voting Items

| Proposals | Board Vote Recommendation | For Further Details | ||

| 1 | Election of nine directors named in this proxy statement | ü FOR each director nominee | Page 12 | |

| 2 | Advisory approval of our executive compensation | ü FOR | Page 37 | |

| 3 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2020 | ü FOR | Page 58 | |

| 4 | A stockholder proposal, if properly presented at the Annual Meeting | û AGAINST | Page 61 | |

Stockholders will also transact any other business that may properly come before the meeting.

You may vote on these matters in person or by proxy. Whether or not you plan to attend the Annual Meeting, we ask that you promptly vote your shares.

We are monitoring coronavirus (COVID-19) developments and the related recommendations and protocols issued by public health authorities and federal, state, and local governments. If we determine that alternative Annual Meeting arrangements are advisable or required, which may include switching to a virtual meeting format, or changing the time, date or location of the Annual Meeting, then we will announce our decision via press release and the filing of additional proxy materials with the Securities and Exchange Commission. Please monitor our investor website (investor.ipgphotonics.com) in advance of the Annual Meeting date if you are planning to attend in person. Food and drink will not be served as in past years.

By order of the Board of Directors

IPG PHOTONICS CORPORATION

IPG PHOTONICS CORPORATION

ANGELO P. LOPRESTI

Secretary

April 1, 2020

Secretary

April 1, 2020

Oxford, Massachusetts

How to Vote

INTERNET Go to www.investorvote.com/ipgp or scan the QR code contained in the attached proxy card | TELEPHONE 1-800-652-VOTE (8683) | MAIL Mark, sign, date and promptly mail the enclosed proxy card in the postage-paid envelope |

| As permitted by the rules of the United States Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and Annual Report on Form 10-K available to stockholders electronically via the Internet at investor.ipgphotonics.com. On or about April 9, 2020, we will mail to most of our stockholders a notice (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and to vote via the Internet or by telephone. Other stockholders, in accordance with their prior requests, will receive e-mail notification of how to access our proxy materials and vote via the Internet or by telephone, or will be mailed paper copies of our proxy materials and a proxy card on or about April 9, 2020. |

3

3Proxy Statement Summary

This summary highlights information available within our proxy statement. You should consider all of the information available in this proxy statement (the "Proxy Statement") and our Annual Report on Form 10-K for fiscal year 2019 ("Annual Report") prior to voting your shares. Page references are supplied to help you find further information in this Proxy Statement. In this Proxy Statement, the terms "IPG", the "Company", "we" and "our" refer to IPG Photonics Corporation.

| Company Overview |

IPG Photonics Corporation is the world leader in fiber laser technology, enabling greater precision, higher productivity and more flexible production for industrial applications and other diverse end markets. The Company has a vertically-integrated business model, producing key components of its technology in-house, enabling more powerful and efficient solutions with rapid ongoing cost reduction. Within industrial applications, automated production and miniaturization trends are driving replacement of mechanical machine tools with IPG laser-based solutions. In other end markets, IPG is introducing new products that more than double our addressable market while diversifying end market exposure.

| Performance Highlights |

2019 Highlights

Despite industrial demand headwinds within our largest markets, IPG delivered industry-leading profit and operating cash flow while introducing new solutions that significantly enhance our competitive position and addressable market.

Financial Performance

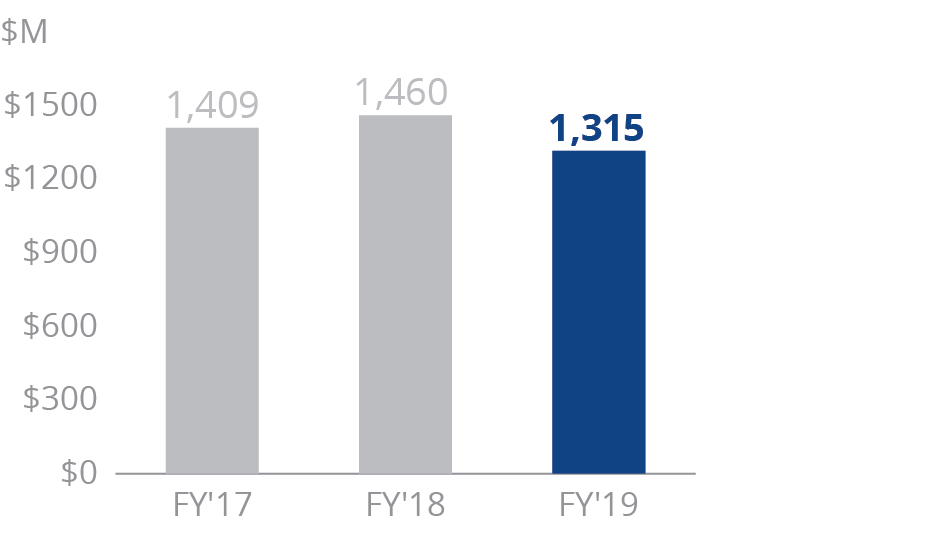

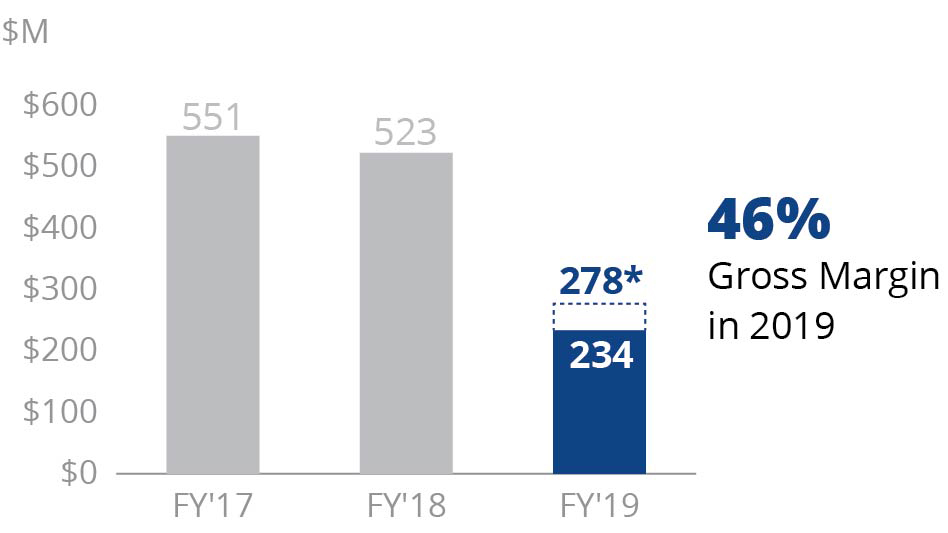

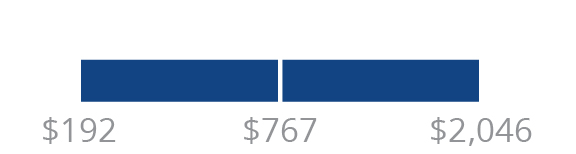

| NET SALES | OPERATING INCOME |

|  |

| * Excluding extraordinary charges related to impairment of goodwill and other long-lived assets and restructuring. | |

Financial Highlights

| • | Shipped a record number of high power lasers and increased sales of lasers at 10 kilowatts or greater by more than 25% |

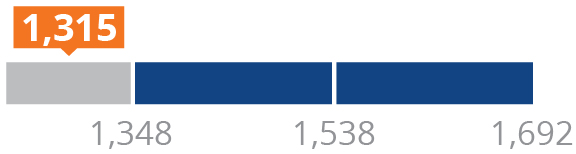

| • | Given weaker industrial demand trends resulting from escalation of the US-China trade conflict and macroeconomic challenges in our largest regions, revenue in 2019 decreased by 10% |

| • | As we enhance our capability in providing complete laser solutions to end customers, we sold a record number of laser systems for materials processing in 2019 |

| • | We are leveraging one of the largest R&D investments in the laser industry to launch leading edge products, and in 2019 new product sales were 19% of total revenue |

| • | Because of lower absorption of fixed costs in our vertically-integrated business model, lower product pricing, foreign exchange headwinds and other factors, our industry-leading gross margin declined to 46% |

| • | We delivered operating cash flow of $324 million |

| • | We have one of the strongest balance sheets in the industrial automation industry, with more than $1 billion net cash and ample liquidity at December 31, 2019 |

4 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proxy Statement Summary

| Voting Items |

Proposal 1 | Election of Nine Directors The Board recommends a vote FOR each director nominee named in this Proxy Statement. | |

See page 12 | ||

Director Nominees

The following provides summary information about each director nominee for our Board of Directors (the "Board").

| Committee Membership | ||||||

| Name and Principal Occupation | Age | Director Since | AC | CC | NCGC | |

| Valentin P. Gapontsev, Ph.D. | |||||

| Chief Executive Officer and Chairman of the Board | 81 | 1998 | ||||

| Eugene A. Scherbakov, Ph.D. | |||||

Chief Operating Officer Managing Director, IPG Laser GmbH | 72 | 2000 | ||||

| Igor Samartsev | |||||

| Chief Technology Officer | 57 | 2006 | ||||

| Michael C. Child IND | |||||

| Senior Advisor, T.A. Associates, Inc. | 65 | 2000 | ● | |||

| Gregory P. Dougherty IND | |||||

| Former CEO, Oclaro, Inc. | 60 | 2019 | ● | ● | ||

| Catherine P. Lego IND | |||||

| Professional board director | 63 | 2016 | ● | ● | ||

| Eric Meurice IND | |||||

| Former President, CEO and Chairman, ASML Holding NV | 63 | 2014 | ● | ● | ||

| John R. Peeler Presiding Independent Director | |||||

| Chairman, Veeco Instruments, Inc. | 65 | 2012 | ● | ● | ||

| Thomas J. Seifert IND | |||||

| Chief Financial Officer, Cloudflare, Inc. | 56 | 2014 | ● | ● | ||

AC Audit Committee | ● | Chair |

CC Compensation Committee | ● | Member |

NCGC Nominating and Corporate Governance Committee | ||

5

5Proxy Statement Summary

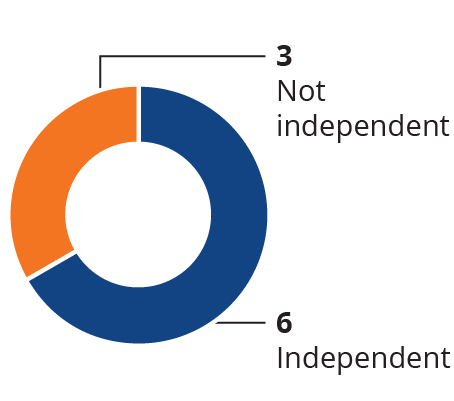

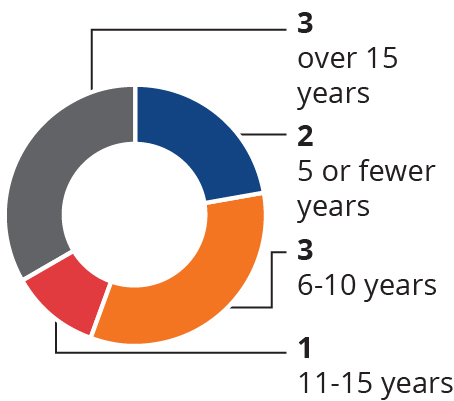

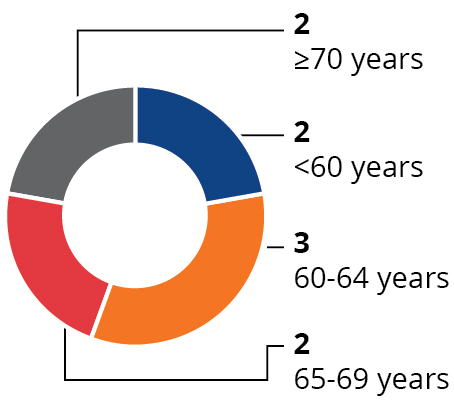

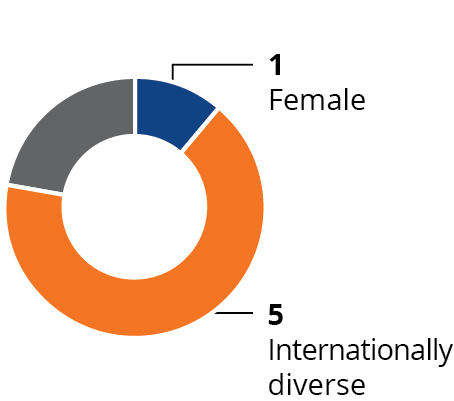

Board Snapshot*

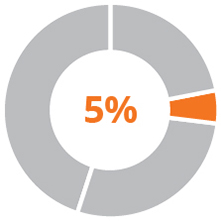

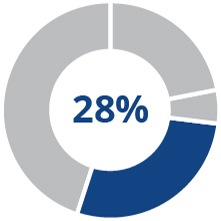

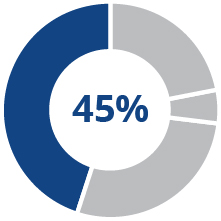

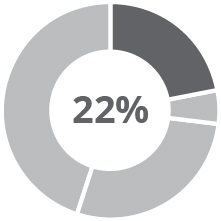

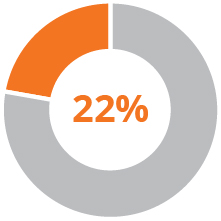

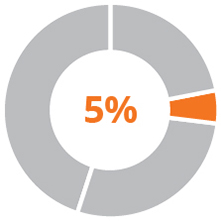

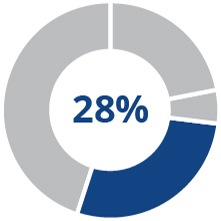

| DIRECTOR INDEPENDENCE | BALANCED TENURE | AGE | DIVERSITY |

|  |  |  |

6/9 directors are independent** | 11 years Average Tenure | 65 years Average Age | Over 50% Diverse |

| * | Following the Annual Meeting |

| ** | Audit, Compensation and Nominating and Corporate Governance Committees are composed entirely of independent directors |

Skills and Experience*

| Lasers and Technology |  | Business Development and M&A |  | |||

| Financial Literacy |  |  | Risk Management |  | ||

| Global Business |  |  | Executive Leadership |  | ||

| Manufacturing and Operating |  |  | Other Public Company Boards |  | ||

| * | Following the Annual Meeting |

6 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proxy Statement Summary

Corporate Governance Highlights

ü Stockholder proxy access right adopted in March 2019 ü Director majority voting policy adopted October 2018 ü Ongoing Board refreshment: 1 independent director added in 2019, for a total of 2 directors added in 4 prior fiscal years ü Supermajority of independent directors and 100% independent Board committees | ü 55% of Board members come from internationally diverse backgrounds ü 11% of Board members are women ü Presiding independent director ü Single class of voting stock and no supermajority voting provisions ü Annual election of all directors ü Stockholder right to act by written consent | ü 80% of director compensation at risk based upon stock performance ü Annual Board performance evaluations ü Robust director and executive officer stock ownership guidelines ü Anti-hedging policy applicable to all employees and directors ü Stockholder right to act by written consent |

Stockholder Engagement

We value the views of our stockholders and we believe that building positive relationships with our stockholders is critical to our long-term success. Our investor communications and outreach include periodic site visits, investor conferences and quarterly conference calls. Our quarterly conference calls and presentations at investor conferences are open to the public and are available live and as archived webcasts on our website. During 2019, we engaged with a stockholder with respect to a majority voting by-law provision, which we then adopted. To help management and the Board understand and consider the issues that matter most to our stockholders, we periodically engage with our stockholders on a range of topics including performance, executive compensation, governance and sustainability matters.

Proposal 2 | Advisory Approval of Our Executive Compensation The Board recommends a vote FOR this proposal. | |

See page 37 | ||

7

7Proxy Statement Summary

2019 Executive Compensation Highlights

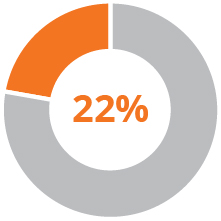

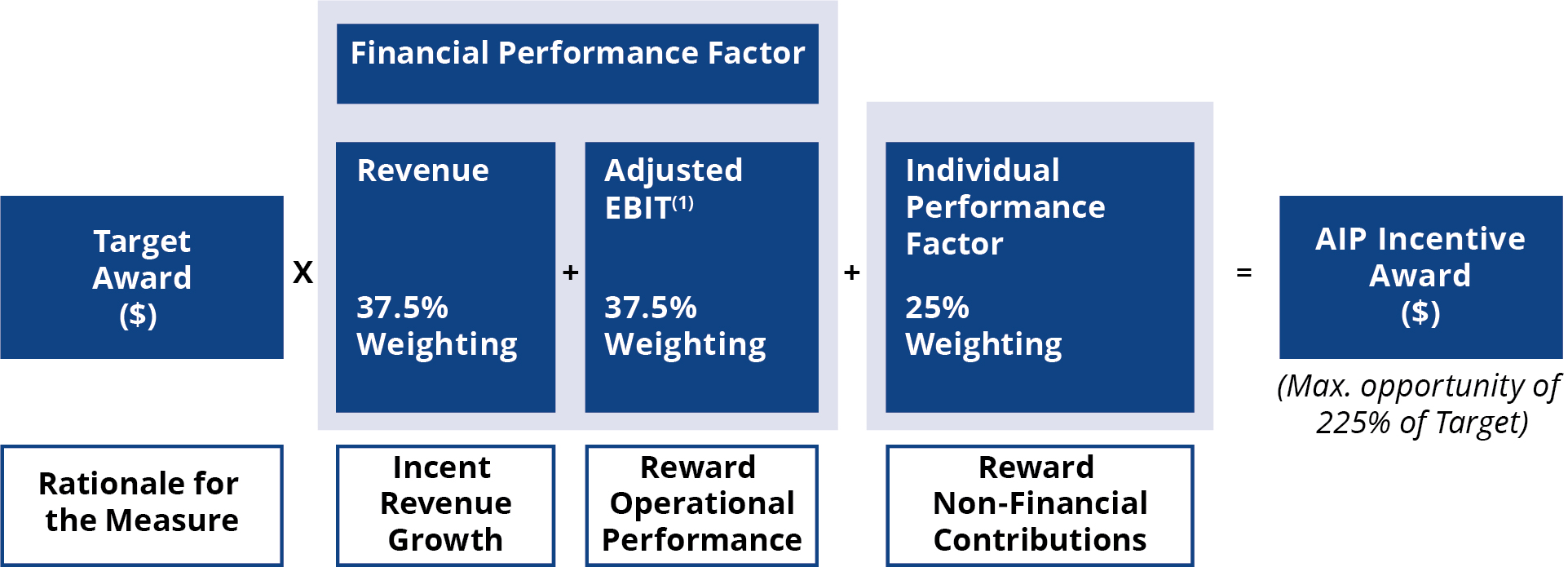

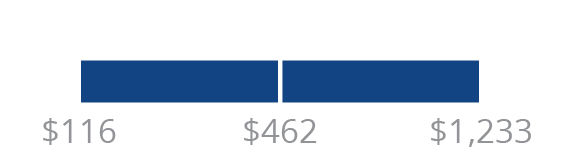

As further discussed in Compensation Discussion and Analysis starting on page 38, the guiding principles of our executive compensation philosophy are pay-for-performance, accountability for annual and long-term performance, alignment with stockholders’ interests, and providing competitive pay to attract and retain executives. The 2019 compensation program for our named executive officers ("NEOs") has three primary components: annual base salary, annual cash incentives and long-term equity incentives.

| Fixed | At-risk | |||||||

| Base Salary | Annual Cash Incentive | Long-Term Equity Incentives | ||||||

| Target Mix | CEO* | OTHER NEOs (Average) | CEO | OTHER NEOs (Average) | OTHER NEOs (Average) | |||

|  |  |  |  |  | |||

| * CEO receives no equity awards | Performance based RSUs | Service based Equity Award | ||||||

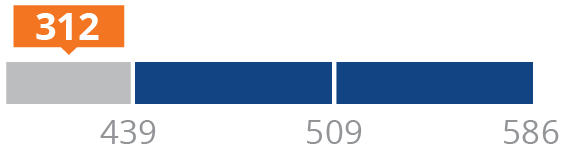

| Performance | • Executive base salaries were not increased for 2019 in light of the challenging macro-economic environment facing the Company | • Financial performance fell short of minimum revenue and earnings thresholds in 2019, resulting in no annual incentive payout based on financial performance • Individual performance awards were earned for managing through challenging business conditions | • Type and proportion of equity grants reflected a 2019 review by our Compensation Committee with the assistance of our independent compensation consultant of grant practices at peer companies • Our CEO, as the founder and a significant stockholder, has not received an equity award since the Company’s 2006 IPO, resulting in lower compensation expenses and equity burn rate | |||||

| Objective | • Provide a competitive fixed component to attract and retain talented and experienced executives | • Variable cash compensation opportunity is based upon annual net sales and profitability against threshold, target and maximum performance goals • Additional compensation opportunities are based upon individual performance | • Align interests of our executives and stockholders by motivating executive officers to increase long-term stockholder value • Service-based equity awards vest over four years providing long-term retention and additional compensation opportunity for stock price increases • PSU awards provide additional incentives and are earned based on IPG’s total stockholder return relative to a comparable stock index | |||||

8 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proxy Statement Summary

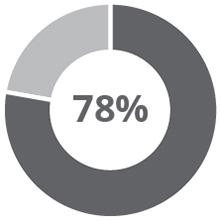

Alignment with Stockholder Interests and Performance

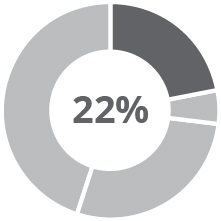

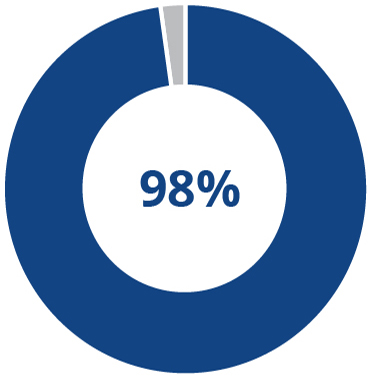

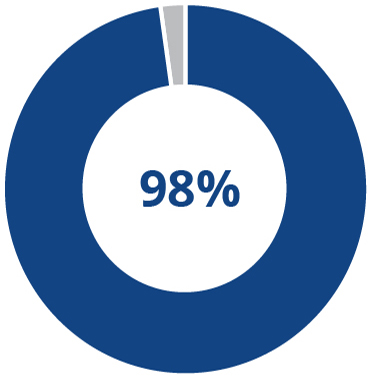

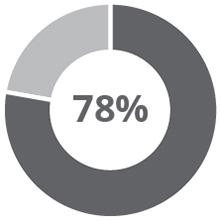

• Annual cash incentive payouts are capped and have challenging performance goals linked to key financial performance metrics • Long-term equity incentives are aligned with long-term stockholder value creation • Approximately 78% of non-CEO compensation in 2019 was at risk based on performance • Executives exceed stock ownership guidelines, aligning with interests of stockholders |  | Say-on-pay approval during last stockholder vote in 2017 |

Governance Features of Our Executive Compensation Program |

| PRACTICES WE EMPLOY | PRACTICES WE AVOID | |

ü Align our officer pay with performance ü Balance annual and long-term incentives ü Use long-term incentives to link executive pay to company performance ü Cap on incentive award payouts ü Maximize stockholder value while mitigating risk ü Independent compensation consultant ü Robust stock ownership requirements ü Clawbacks on executive compensation | û No guaranteed annual bonuses û No retirement benefits û No tax gross-ups û No significant perquisites û Hedging of Company stock is prohibited û No severance for “cause” terminations û No single-trigger change in control provisions û No stock option repricing without stockholder approval û Pledging of Company stock is limited | |

Proposal 3 | Ratify Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for 2020 The Board recommends a vote FOR this proposal. | |

See page 58 | ||

The Audit Committee has sole authority to appoint and replace the Company’s independent registered public accounting firm, which reports directly to the Audit Committee, and is directly responsible for its compensation and oversight of its work. The Audit Committee conducted its annual evaluation of Deloitte & Touche LLP and, after assessing the performance and independence of Deloitte & Touche LLP, the Audit Committee concluded that the best course of action was to reappoint Deloitte & Touche LLP as our independent external auditor for 2020.

We are asking you to ratify this appointment. If stockholders fail to ratify the appointment, the Audit Committee will consider it a directive to consider other accounting firms for the subsequent year.

9

9Proxy Statement Summary

Fees Paid to Deloitte & Touche. The fees for services provided by Deloitte & Touche LLP, member firm of Deloitte Touche Tohmatsu, and their respective affiliates, to the Company were:

| Fees | ||||||

| Fee Category | 2019 | 2018 | ||||

| Audit fees | $ | 2,440,990 | $ | 2,051,757 | ||

| Audit-related fees | — | 170,470 | ||||

| Tax fees | 90,000 | 111,000 | ||||

| All other fees | — | — | ||||

| Total Fees | $ | 2,530,990 | $ | 2,333,227 | ||

In 2019 and 2018, the percentage of total fees paid to our independent registered public accounting firm for audit fees were 96% and 88%, respectively.

Proposal 4 | Stockholder Proposal to Prepare a Report on Management Team Diversity The Board recommends a vote AGAINST the stockholder proposal to be presented at the meeting. | |

See page 61 | ||

10 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Table of Contents

| Page | |

| 2020 ANNUAL LETTER | |

PROPOSAL 4: STOCKHOLDER PROPOSAL TO PREPARE A REPORT ON MANAGEMENT TEAM DIVERSITY | |

| This Proxy Statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements be subject to the safe harbors created thereby. For this purpose, any statements contained in this Proxy Statement except for historical information are forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. The forward-looking statements included herein are based on current expectations of our management based on available information and involve a number of risks and uncertainties, all of which are difficult or impossible to accurately predict and many of which are beyond our control. As such, our actual results may differ significantly from those expressed in any forward-looking statements. Factors that may cause or contribute to such differences include, but are not limited to, those discussed in more detail in the section titled “Risk Factors” and elsewhere in our Annual Report and other filings with the SEC. We undertake no obligation to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. |

11

11Proposal 1 | Election of Nine Directors The Board of Directors recommends a vote FOR each director nominee named in this Proxy Statement. | |

| Director Qualifications |

The Nominating and Corporate Governance Committee (the "NCGC") is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the Annual Meeting. The NCGC has recommended, and the Board has approved, the following nominees for terms expiring at the annual meeting to be held in 2021, until a successor is elected and qualified or until his or her earlier death, resignation or removal and, unless otherwise marked, a proxy will be voted for such nominees: Dr. Gapontsev, Dr. Scherbakov, Mr. Samartsev, Mr. Child, Mr. Dougherty, Ms. Lego, Mr. Meurice, Mr. Peeler and Mr. Seifert. All of the director nominees set forth in our proxy card have consented to being named in this Proxy Statement and to serving if elected. For more information regarding the nominees for director, see Director Nominees below. Mr. Henry E. Gauthier decided to retire from the Board and will not stand for re-election at the Annual Meeting. We extend our sincere appreciation to Mr. Gauthier for the valuable contributions and guidance he provided to our Company and stockholders during his service as a member of our Board since 2006. At the Annual Meeting our Board size is being reduced from ten to nine directors.

In considering each director nominee and the composition of the Board as a whole, the NCGC evaluates members based on their expertise and diverse perspectives, experiences, qualifications, attributes and skills because the NCGC believes that these attributes enable a director nominee to make significant contributions to the Board, IPG and our stockholders.

The director nominees have a mix of various skills and qualifications, some of which are listed in the table below. These collective attributes enable the Board to provide insightful leadership as it strives to advance our strategies and deliver returns to stockholders.

| Lasers and Technology | We have sought directors with management and operational experience in the industries in which we compete. For example, last year we added a director with expertise in optical and electronics components, and telecommunications products. As a diversified technology, science-based company, directors with technology backgrounds understand the Company’s technology platforms and the importance of investing in new technologies for future growth. | |||

| ||||

| Financial Literacy | Knowledge of finance or financial reporting; experience with debt/capital market transactions and/or mergers and acquisitions strengthen the Board’s oversight of financial reporting and internal controls. Financial metrics are used to measure our performance. All directors must understand finance and financial reporting processes. Two of the Audit Committee members qualify as “audit committee financial experts.” | |||

| ||||

| Global Business | Global business experience is critical to the Company’s international operations and growth with 79% of sales from outside the U.S. in 2019. Knowledge of Asian and European business practices are valuable to understanding our business and strategy. | |||

| ||||

| Manufacturing and Operating | As a vertically-integrated company, manufacturing experience and customer service on a global scale are important to understanding the operations and capital needs of the Company. | |||

| ||||

12 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

| Business Development and M&A | We have used and will continue to use acquisitions to achieve our strategic goals. Directors with experience in business development and mergers and acquisitions provide valuable perspectives regarding process, due diligence, risk assessment and integration of potential partners. | |||

| ||||

| Risk Management | In light of the Board’s role in overseeing risk management and understanding the most significant risks facing the Company, including cybersecurity risk, we continue to require directors with experience in risk management and oversight. | |||

| ||||

| Executive Leadership | Significant leadership experience, including services as a CEO, senior executive, division president or functional leader within a complex organization enhances the Board’s leadership role. | |||

| ||||

| Other Public Company Boards | Directors with current or recent membership on other public company boards provide valuable perspectives in many areas including operations, strategy, governance and compensation. | |||

| ||||

| Gapontsev | Scherbakov | Samartsev | Child | Dougherty | Lego | Meurice | Peeler | Seifert | ||

| Skills and Expertise | ||||||||||

| Lasers and Technology | ● | ● | ● | ● | ● | ● | ||||

| Financial Literacy | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Global Business | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Manufacturing and Operating | ● | ● | ● | ● | ● | ● | ● | |||

| Business Development and M&A | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Risk Management | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Executive Leadership | ● | ● | ● | ● | ● | ● | ● | |||

| Other Public Company Boards | ● | ● | ● | ● | ● | ● | ||||

| Background | ||||||||||

| Years on Board | 22 | 20 | 14 | 20 | 1 | 4 | 6 | 8 | 6 | |

| Age | 81 | 72 | 57 | 65 | 60 | 63 | 63 | 65 | 56 | |

| Gender | M | M | M | M | M | F | M | M | M | |

| Internationally Diverse | ● | ● | ● | ● | ● | |||||

13

13Proposal 1 Election of Nine Directors

| Director Nominees |

The following table sets forth certain information as of the date of this Proxy Statement regarding the director nominees.

Valentin P. Gapontsev, Ph.D.

Chief Executive Officer and Chairman of the Board

| Dr. Gapontsev has been the CEO and Chairman of the Board of IPG since our inception. Prior to founding the Company's predecessor in 1990, Dr. Gapontsev served as senior scientist in laser material physics and head of the laboratory at the Soviet Academy of Science’s Institute of Radio Engineering and Electronics in Moscow. In 2006, he was awarded the Ernst & Young® Entrepreneur of the Year Award for Industrial Products and Services in New England and in 2009, he was awarded the Arthur L. Schawlow Award by the Laser Institute of America. In 2011, he received the Russian Federation National Award in Science and Technology, and he was selected as a Fellow of the Optical Society of America. Dr. Gapontsev holds a Ph.D. in Laser Materials from the Moscow Institute of Physics and Technology. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Dr. Gapontsev is the founder of the Company and has successfully led the Company and the Board since the Company was formed to now. In the roles of CEO and Chairman of the Board, he has been responsible for formulation and execution of IPG’s strategy and providing leadership and oversight of IPG’s business during a period of rapid and profitable growth, as well as business contractions. He has over thirty years of academic research experience in the fields of solid state laser materials, laser spectroscopy and non-radiative energy transfer between rare earth ions and is the author of many scientific publications and several international patents. His strategic foresight and entrepreneurial spirit along with his deep scientific understanding has guided the Company’s continued growth and technology leadership. | ||||||||

AGE: 81 DIRECTOR SINCE: 1998 COMMITTEES: None | |||||||||

| |||||||||

| Lasers and Technology | Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Executive Leadership | |||

14 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Eugene A. Scherbakov, Ph.D.

Chief Operating Officer, Managing Director of IPG Laser GmbH and Senior Vice President of Europe

| Dr. Scherbakov has served as Chief Operating Officer since February 2017, Managing Director of IPG Laser GmbH, our German subsidiary, since August 2000 and Senior Vice President-Europe since 2013. He served as the Technical Director of IPG Laser from 1995 to August 2000. From 1983 to 1995, Dr. Scherbakov was a senior scientist in fiber optics and head of the optical communications laboratory at the General Physics Institute, Russian Academy of Science in Moscow. Dr. Scherbakov graduated from the Moscow Physics and Technology Institute with an M.S. in Physics. In addition, Dr. Scherbakov attended the Russian Academy of Science in Moscow, where he received a Ph.D. in Quantum Electronics from its Lebedev Physics Institute and a Dr.Sci. degree in Laser Physics from its General Physics Institute. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Dr. Scherbakov has extensive knowledge of the Company’s business as Managing Director of IPG Laser GmbH, which produces a large volume of our products and is the source of many developments in products, technology and applications. He applies his knowledge and experience across our many international branches. The leadership and operational expertise of Dr. Scherbakov have contributed to IPG increasing production, lowering manufacturing costs, managing risk and maintaining high margins compared to our industry peers. He also has extensive technological knowledge of fiber lasers, their components and manufacturing processes. His service as an executive officer of the Company provides the Board with a detailed understanding of the Company’s operations, sales and customers. | ||||||||

AGE: 72 DIRECTOR SINCE: 2000 COMMITTEES: None | |||||||||

| |||||||||

| Lasers and Technology | Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Executive Leadership | |||

15

15Proposal 1 Election of Nine Directors

Igor Samartsev

Chief Technology Officer

| Since 2011, Mr. Samartsev has served as our Chief Technology Officer. Prior to that time, he served in management and technical leadership roles at NTO IRE-Polus, our subsidiary in Russia. Mr. Samartsev holds an M.S. in Physics from the Moscow Institute of Physics and Technology. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Samartsev is one of the founders of the Company and has a significant management role in the Company as Chief Technology Officer. As one of the key developers of the technology platform of the Company and leader in the development of many new optical technologies, components and products spanning our global development centers that form part of the Company’s strategic plan, the Board values Mr. Samartsev’s understanding of technology developments at our company. | ||||||||

AGE: 57 DIRECTOR SINCE: 2006 COMMITTEES: None | |||||||||

| |||||||||

| Lasers and Technology | Financial Literacy | Global Business | Risk Management | Executive Leadership | |||||

Michael C. Child

Independent Director

| Since July 1982, Mr. Child has been employed by TA Associates, Inc., a private equity investment firm, where he currently serves as Senior Advisor and, prior to January 2011, he was Managing Director. Mr. Child holds a B.S. in Electrical Engineering from the University of California at Davis and an M.B.A. from the Stanford University Graduate School of Business. From September 2011 until December 2015, Mr. Child was a Lecturer at the Stanford University Graduate School of Business. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Child is an established and experienced investor, including in technology companies, from his three decades of experience at TA Associates, Inc. Over the course of his career, he has overseen numerous investments and sales of portfolio companies, and served on the boards of many public and private companies. Through his experiences, he has gained valuable knowledge in the management, operations and finance of technology growth companies. | ||||||||

AGE: 65 DIRECTOR SINCE: 2000 COMMITTEES: NCGC | |||||||||

| |||||||||

| Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Other Public Company Boards | ||||

16 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Gregory P. Dougherty

Independent Director

| Mr. Dougherty served as Chief Executive Officer of Oclaro, Inc., a maker of optical components and modules for the long-haul, metro and data center markets, from June 2013 and has served as a director of Oclaro from April 2009, until its December 2018 acquisition. Prior to Oclaro, Mr. Dougherty served as a director of Avanex Corporation (“Avanex”), a leading global provider of intelligent photonic solutions, from April 2005 to April 2009. Mr. Dougherty also served as a director of Picarro, Inc., a manufacturer of ultra-sensitive gas spectroscopy equipment using laser-based technology, from October 2002 to August 2013, and as its Interim Chief Executive Officer from January 2003 to April 2004. From February 2001 until September 2002, Mr. Dougherty was the Chief Operating Officer at JDS Uniphase Corporation (“JDS”), an optical technology company. Prior to JDS he was the Chief Operating Officer of SDL, Inc., a maker of laser diodes, from March 1997 to February 2001 when they were acquired by JDS. Mr. Dougherty serves on the boards of directors of Infinera Corporation, a provider of optical transport networking equipment, software and services to telecommunications service providers and others, since January 2019, Fabrinet, a provider of advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to OEMs of complex products, since February 2019, and MaxLinear, Inc., a provider of radio frequency (RF), analog and mixed-signal integrated circuits, since March 2020. Mr. Dougherty earned a B.S. in optics from the University of Rochester. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Dougherty contributes to the Board significant leadership, operations, sales, marketing and general management experience in optics and components for telecommunications and other applications. For over three decades, Mr. Dougherty has worked in the optical and components industry and can provide the Board with insight into the industry and conditions in which the Company operates. Having been recently a CEO at a publicly-held company, he is familiar with a large range of management, corporate and board responsibilities and brings valuable perspectives to the Board as an independent director. | ||||||||

AGE: 60 DIRECTOR SINCE: 2019 COMMITTEES: Audit Committee, Compensation Committee DIRECTORSHIP AT OTHER PUBLIC COMPANY: Infinera Corporation, Fabrinet and MaxLinear, Inc. | |||||||||

| |||||||||

| Lasers and Technology | Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Executive Leadership | Other Public Company Boards | ||

17

17Proposal 1 Election of Nine Directors

Catherine P. Lego

Independent Director

| Ms. Lego is a professional board member and also provides consulting services to early-stage technology companies. From 1999 to 2009, Ms. Lego served as the general partner of The Photonics Fund, LLP, a venture capital investment firm focused on early stage investing in component, module and systems companies in the fiber optic telecommunications market. She served as the director of finance and investment analyst at Oak Investment Partners from 1981 to 1984, and as a general partner from 1985 to 1992. Ms. Lego serves on the boards of directors of Lam Research Corporation, a semiconductor equipment company, Cypress Semiconductor Corporation, a maker of microcontrollers, integrated circuits and memory devices and Guidewire Software, Inc., a provider of a technology platform for the property and casualty insurance industry. Ms. Lego holds a B.A. in Economics and Biology from Williams College and an M.S. in Accounting from the New York University Stern Graduate School of Business. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Ms. Lego has extensive experience working with advanced technology and semiconductor companies. From her current and prior service on the boards of several technology companies as well as her memberships of other audit, compensation and nominating and corporate governance committees, she is familiar with the issues faced and the processes that boards use to manage growth, risk, accounting, acquisitions, due diligence and integration, compensation and investor relations. In addition, she is a frequent speaker on board governance, ethics and audit quality at directors’ colleges and events, including the E&Y Tapestry and KPMG audit committee round tables. Ms. Lego is a member of the NACD’s Audit Committee Advisory Council. She brings valuable perspectives on the latest developments in audit, compensation and other matters to the Board. | ||||||||

AGE: 63 DIRECTOR SINCE: 2016 COMMITTEES: Audit Committee - Audit Committee Financial Expert, Compensation Committee (Chair) DIRECTORSHIP AT OTHER PUBLIC COMPANY: Lam Research Corporation, Cypress Semiconductor Corporation and Guidewire Software, Inc. | |||||||||

| |||||||||

| Financial Literacy | Global Business | Business Development and M&A | Risk Management | Other Public Company Boards | |||||

18 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Eric Meurice

Independent Director

| Mr. Meurice was President and Chief Executive Officer of ASML Holding NV, a provider of semiconductor manufacturing equipment and technology, from October 2004 to June 2013, and Chairman until March 2014. From 2001 to 2004, he was Executive Vice President of the Thomson Television Division of Thomson, SA, an electronics manufacturer. From 1995 to 2001, he served as head of Dell Computer’s Western, Eastern Europe and EMEA emerging market businesses. Before 1995, he gained significant technology experience at ITT Semiconductors and at Intel Corporation. Mr. Meurice previously served on the boards of Verigy Ltd., a manufacturer of semiconductor test equipment, ARM Holdings plc, a semiconductor intellectual property supplier, NXP Semiconductors N.V., a semiconductor company, and Meyer Burger Technology AG, a solar equipment vendor. Mr. Meurice serves on the boards of UMICORE S.A., a recycling and materials company, since April 2015, and SOITEC S.A., a semiconductor materials manufacturer, since July 2018, and where he was appointed Chairman since March 2019. Mr. Meurice earned a Master’s degree in Mechanics and Energy Generation at the Ecole Centrale de Paris, a Master’s degree in Economics from la Sorbonne University, Paris, and an M.B.A. from the Stanford University Graduate School of Business. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Meurice has extensive skills and experience as a manager of several rapidly-growing, complex and global businesses in the capital equipment and electronics fields with several billions of dollars in revenues, most recently as former President and Chief Executive Officer of ASML Holding NV. He has experience managing a publicly-held company as well as experience on serving on several public company boards in the equipment and technology fields. Mr. Meurice also has a record of proven leadership as a strategic thinker, operator and marketer at the businesses he managed. | ||||||||

AGE: 63 DIRECTOR SINCE: 2014 COMMITTEES: NCGC (Chair), Compensation Committee DIRECTORSHIP AT OTHER PUBLIC COMPANY: UMICORE S.A. and SOITEC S.A. | |||||||||

| |||||||||

| Lasers and Technology | Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Executive Leadership | Other Public Company Boards | ||

19

19Proposal 1 Election of Nine Directors

John R. Peeler

Presiding Independent Director

| Mr. Peeler was Chief Executive Officer of Veeco Instruments Inc. (“Veeco”) from July 2007 until September 2018, and Chairman or Executive Chairman of its board of directors from May 2012 until May 2020. Veeco is a developer and manufacturer of MOCVD, molecular beam epitaxy, ion beam and other advanced thin film processes equipment. He was Executive Vice President of JDS and President of the Communications Test & Measurement Group of JDS, which he joined upon the closing of JDS’s merger with Acterna, Inc. in August 2005. Before joining JDS, Mr. Peeler served as President and Chief Executive Officer of Acterna. He has a B.S. and M.E. in Electrical Engineering from the University of Virginia. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Over the course of his career, Mr. Peeler has managed several high-growth technology companies. In addition, he has developed managerial leadership skills through his former position as Chief Executive Officer of Veeco, a publicly-traded company with substantial international operations. His managerial positions have provided him with in-depth knowledge of the service needs of customers in demanding markets, including semiconductor capital equipment, various manufacturing models, marketing and sales. In these roles, he has also been responsible for attracting and incentivizing executives on his team. These experiences have provided him important insights in support of his positions as Presiding Independent Director and a member of the Compensation Committee and the NCGC. | ||||||||

AGE: 65 DIRECTOR SINCE: 2012 COMMITTEES: Compensation Committee, NCGC DIRECTORSHIP AT OTHER PUBLIC COMPANY: Veeco Instruments Inc. | |||||||||

| |||||||||

| Lasers and Technology | Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Executive Leadership | Other Public Company Boards | ||

20 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Thomas J. Seifert

Independent Director

| Mr. Seifert is Chief Financial Officer of Cloudflare, Inc., an internet performance and security provider, from June 2017 to the present. Since February 2018, he is a member of the board of CompuGroup Medical SE, a publicly held company in Germany, which provides software to support medical and organization activities in medical offices and facilities. Mr. Seifert was the Executive Vice President and Chief Financial Officer of Symantec Corporation, a provider of security, backup and availability solutions, from March 2014 to December 2016. Mr. Seifert served as Executive Vice President and Chief Financial Officer of Brightstar Corporation, a wireless distribution and services company, from December 2012 to March 2014. He was Senior Vice President and Chief Financial Officer at Advanced Micro Devices Inc., a semiconductor company, from October 2009 to August 2012, and served as Interim Chief Executive Officer from January 2011 to September 2012. From October 2008 to August 2009, Mr. Seifert served as Chief Operating Officer and Chief Financial Officer of Qimonda AG, a German memory chip manufacturer, and as Chief Operating Officer from June 2004 to October 2008. He also held executive positions at Infineon AG, White Oak Semiconductor, including the position as Chief Executive Officer, and Altis Semiconductor. Mr. Seifert has a Bachelor’s degree and a Master’s degree in Business Administration from Friedrich Alexander University and a Master’s degree in Mathematics and Economics from Wayne State University. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Seifert has extensive experience as both an operating executive and chief financial officer of large publicly-held international technology businesses, such as Symantec and Advanced Micro Devices. In these and other senior positions, he developed deep financial and accounting knowledge, as well as managerial leadership skills, in larger organizations. With his background in accounting, finance and management, Mr. Seifert brings broad skills and knowledge to the Board, the Audit Committee, and the NCGC including internal controls, mergers and acquisitions, integrations and information technology security. | ||||||||

AGE: 56 DIRECTOR SINCE: 2014 COMMITTEES: Audit Committee (Chair) - Audit Committee Financial Expert, NCGC DIRECTORSHIP AT OTHER PUBLIC COMPANY: CompuGroup Medical, SE | |||||||||

| |||||||||

| Financial Literacy | Global Business | Manufacturing and Operating | Business Development and M&A | Risk Management | Executive Leadership | Other Public Company Boards | |||

The Board of Directors recommends that you vote FOR each director nominee named in this Proxy Statement. |

21

21Proposal 1 Election of Nine Directors

| Board Refreshment and Composition |

Board Succession Planning

Our Board’s succession planning focuses primarily on the composition of our Board and its committees, anticipated retirements, succession plans for committee members and chairs, our commitment to Board diversity, and recruiting strategies for adding new directors. In its succession planning, the NCGC and our Board consider the results of our Board’s annual self-assessment, as well as other appropriate information, including the types of skills and experience desirable for future Board members and the needs of our Board and its committees at the time in light of the Company’s long-term strategy.

| • | Thoughtful, Deliberate Board Refreshment Process. The Board’s refreshment actions reflect a thoughtful and deliberate process that was informed by our Company’s strategic needs as well as the Board’s annual self-assessment and director nomination processes. |

| • | Appropriately Balance Experience and Perspectives While Ensuring an Orderly Transition. Our Board has taken care as part of its Board refreshment process to appropriately balance new perspectives and the experience of existing directors while undergoing an orderly transition of roles and responsibilities on the Board and its committees. |

| • | Importance of Board Diversity. In addition, our Board continues to focus on the importance of Board diversity. One of the two new directors who joined our Board since 2016 is female. Gender diverse candidates have been and are included in our board searches. |

DIRECTOR TENURE AND RETIREMENT AGE POLICIES • No Term Limits; Appropriate Balance of Skills, Knowledge, Experience and Perspectives. • Our Board recognizes the importance of periodic Board refreshment and maintaining an appropriate balance of tenure, experience and perspectives on the Board. • We believe it is desirable to maintain a mix of longer-tenured, experienced directors with institutional memory and understanding of our business and culture and newer directors with fresh perspectives. However, we do not impose director tenure limits. • The Board believes that directors should not have an expectation of being renominated annually and that the NCGC’s assessment is a key component of its director nomination process. • In connection with the Board’s annual self-assessment and director nomination processes, the Board considers upcoming retirements, the average tenure and overall mix of individual director tenures of the Board, the overall mix of the skills, knowledge, experience and diversity, each individual director’s performance and contributions to the work of the Board and its committees, the personal circumstances and other time commitments of directors, along with other factors the Board deems appropriate. • The Board believes that, as an alternative to term limits, non-management directors should submit their resignation from the Board upon attaining the age of 72 and on each subsequent anniversary. The Board then considers the needs and circumstances confronting the Board and, upon recommendation of the NCGC, determines whether to accept or decline the resignation. • Our Board’s age resignation policy is intended to facilitate our Board’s recruitment of new directors with appropriate skills, experience and backgrounds and provide for an orderly transition of leadership on our Board. |

22 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Board Nomination Process

| 1 |  | 2 |  | 3 |  | 4 |

| EVALUATION OF BOARD COMPOSITION | IDENTIFICATION OF POOL OF CANDIDATES | MEETINGS WITH POTENTIAL CANDIDATES | RECOMMENDATION OF POTENTIAL DIRECTORS FOR APPROVAL | |||

• The NCGC and the Board evaluate Board composition annually and identify skills, experience and capabilities desirable for new directors in light of the Company’s long-term strategy | • The NCGC identifies potential nominees through multiple sources, including third party search firm and input from stakeholders | • Evaluation and assessment of candidate interest, minimum qualifications, conflicts, independence, background and other information • Members of the NCGC, other Board members and executives meet with qualified candidates | • NCGC recommends potential nominees to the Board for approval • Stockholders vote on nominees approved by Board at next annual meeting of stockholders | |||

The NCGC’s evaluation process and criteria does not vary based upon whether a candidate is recommended by a stockholder. However, the procedural requirements set forth in our bylaws and the procedures described below in Additional Information - 2021 Annual Meeting and Nominations must be met.

The composite skills of the Board members and the ability and willingness of individual Board members to complement each other and to rely on each other's knowledge and expertise should produce informed Board members who are not afraid to disagree and who can intelligently assess management's performance and evaluate our strategic direction. In considering whether to recommend any candidate for nomination to the Board, including candidates recommended by stockholders, the NCGC must be satisfied that the recommended nominee meets the following qualifications at a minimum:

| Character and Integrity | Must be an individual of the highest character and integrity |

| Leadership Experience | Demonstrated excellence, leadership and significant experience in their field of endeavor |

| Financial Literacy and Commitment to Representing Stockholders | Ability to read and understand financial statement fundamentals and commitment to representing the long-term interests of the Company’s stockholders, while keeping in perspective the interests of the Company’s customers, employees and the public |

| Independence and Constructive Collegiality | Must have a demonstrated ability to think and act independently as well as the ability to work constructively in a collegial environment. Must satisfy independence criteria of the SEC and NASDAQ, where independence is desired |

| Age | A potential director (excluding any incumbent) cannot be aged less than 21 or greater than 72 years |

| Limit on Other Public Boards | Independent directors – 3 (or 4 with Board approval) CEO - 1 |

The NCGC also considers experience in our industry or markets, international business and cultural experience, experience serving on the boards of public companies, experience acquiring companies and diversity to be favorable characteristics in evaluating recommended nominees. With over two-thirds of our sales and employees in locations outside of the U.S.A., it is important to have the appropriate experience and background coming from being born and operating in other countries. Diversity is meant to be interpreted broadly. It includes gender, age, race, national origin, geographic background and also includes differences of professional experience, global experience, education, and other individual qualities and attributes. The NCGC does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. The NCGC believes that our Board should be composed of directors who, as a group, have the experience and skills that are collectively required to make informed Board decisions, provide effective Board oversight to allow the Board to fulfill its responsibilities.

23

23Proposal 1 Election of Nine Directors

| Board Roles and Responsibilities |

Role in Risk Management

BOARD OVERSIGHT OF RISK The Board recognizes that effectively monitoring and managing risk are essential to the successful execution of the Company’s strategy. The Board has oversight for risk management at IPG with a focus on the most significant risks facing the Company, including strategic, operational, financial and compliance risks. Upon recommendation of the NCGC, the Board allocates risk oversight responsibility among the full Board, the independent directors acting as a group and the three standing committees of the Board as described below. Throughout the year, the Board, the independent directors and the committees to which the Board has delegated responsibility dedicate a portion of their meetings to review and discuss specific risk topics in greater detail. | ||

| ||

AUDIT COMMITTEE The Audit Committee oversees the policies, processes and risk relating to the financial statements, financial reporting processes, auditing, cybersecurity and compliance risks. The Audit Committee discusses with management the Company’s risk assessment and risk management practices and, when reviewing and approving the annual audit plan for the Company’s internal audit function, prioritizes audit focus areas based on their potential risk. | COMPENSATION COMMITTEE The Compensation Committee oversees risk associated with management resources, including executive retention and non-CEO succession planning. It reviews the Company’s executive compensation practices, their effectiveness at linking executive pay to performance and aligning the interests of our executives and our stockholders, without encouraging excessive risk taking. The Compensation Committee annually reviews management’s assessment of compensation risk. | THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE The NCGC oversees risk related to the Company’s governance structure and processes, and risks arising from related person transactions. It reviews processes and risk related to Board succession planning, authority delegated to management and certain compliance risk. |

| ||

FULL BOARD Our entire Board as a whole reviews risk management practices and a number of significant risks in the course of its reviews of corporate strategy, management reports and others. | ||

| ||

INDEPENDENT DIRECTORS As a group, the independent directors oversee risks related to CEO succession planning. | ||

The Board’s risk oversight process builds upon management’s risk assessment and mitigation processes, which include reviews of strategic and operational planning; compliance under the Company’s Code of Business Conduct and other policies; the Company’s integrity programs; health, safety and environmental compliance; financial reporting and controllership; and information technology and cybersecurity programs. The Board's oversight role is independent from the Company’s day-to-day management, as more than two-thirds of the current directors are independent and therefore have no conflicts that might discourage critical review of the Company’s risks.

24 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Role in Management Succession Planning

The Board is focused on ensuring that the Company has emergency and long-term succession plans in place for key senior executive positions. The entire Board annually reviews with the CEO the Company’s plan for succession for the position of the chief executive officer, including the appropriate individual or individuals who are candidates to succeed to this position. In the event of an unexpected departure of the CEO, an emergency succession plan allows for smooth transfer of responsibilities to an individual who may or may not be permanently tasked with the new role. The Compensation Committee, composed entirely of independent directors, periodically reviews the Company’s plan for succession for other senior executive officers.

If the succession plan is triggered for any of these roles, the full Board would participate in the discussion and consideration of any action with a final decision to be made by the full Board. In the event of a senior executive’s departure, both internal and external candidates may be considered for permanent appointment to a given role.

Role in Ethics

All directors, officers and employees are required to abide by IPG’s Code of Business Conduct to ensure that our business is conducted in a consistently legal and ethical manner. These policies form the foundation of a comprehensive process that includes compliance with corporate policies and procedures and a Company-wide focus on uncompromising integrity in every aspect of our operations. Our Code of Business Conduct covers many topics, including antitrust and competition law, conflicts of interest, financial reporting, protection of confidential information, and compliance with all laws and regulations applicable to the conduct of our business. All of our directors and employees receive bi-annual training on our Code of Business Conduct, which is posted on our website at investor.ipgphotonics.com/governance/governance-documents. If the Board grants any waivers from our Code of Business Conduct to any directors or executive officers, or if we amend our Code of Business Conduct, we will, if required, disclose these matters via updates on our website.

Role in Stockholder Engagement

Accountability to our stockholders is an important component of the Company’s success. We recognize the value of building informed relationships with our investors that promote further transparency and accountability.

While proxy voting is one direct way to influence corporate behavior, proactive engagement with our investors can be effective and impactful. Investor views are continuously communicated to the Board and are instrumental in the development of our governance, compensation and other policies and inform our business strategy. The Board continues to seek investor input on a range of issues and practices in furtherance of enhancing long-term stockholder value.

| Publish Annual Report and Proxy Statement. Speak with investors about topics to be addressed at the annual meeting. | Review results of the annual meeting, governance trends, regulatory developments. Board conducts annual self-assessment of its performance and effectiveness. | ||||||||

| |||||||||

| Consider input from investors to enhance disclosures, governance practices and compensation programs. | Communicate investor feedback to the Board. Board uses self-assessment to develop and implement changes improving effectiveness. | ||||||||

25

25Proposal 1 Election of Nine Directors

| Board Structure |

Board Leadership Structure

| • | Chairman of the Board and Chief Executive Officer: Dr. Valentin P. Gapontsev |

| • | Presiding Independent Director: John R. Peeler |

| ◦ | Presiding Independent Director position is appointed annually by independent directors |

| • | All three Board committees composed of independent directors |

| • | Independent directors meet in executive session at each of the Board's in person meetings and as needed outside of regular meetings |

There is no single board leadership structure that is optimal in all circumstances. The Board, with its diverse skills and experience, considers the most appropriate leadership structure for the Company in the context of the specific circumstances and challenges facing IPG. The directors come from a variety of organizational backgrounds with direct experiences a wide range of leadership and management structures. The independent directors, who comprise two-thirds of our Board, appropriately challenge management and demonstrate the independence necessary for effective oversight. As a result, the Board is in the best position to evaluate the relative benefits and challenges of different leadership structures and ultimately decide which one best serves the interests of our stockholders.

The independent directors believe that having Dr. Gapontsev serve in the combined role of Chairman and CEO is in the best interest of the Company and its stockholders because it allows Dr. Gapontsev to more effectively execute the Company’s strategic initiatives and business plans. He is the Company's founder and beneficially owns approximately 14% of the Company’s common stock. The duality of Dr. Gapontsev’s roles creates clear and unambiguous authority, which is essential to effective management. Further, given that he is closer to the Company’s business than any other Board member and has the benefit of thirty years of operations, technology, strategy and executive management experience within the Company and its subsidiaries, the Board believes that Dr. Gapontsev is best-positioned to set the Board’s agenda and provide leadership of the board of a company operating in a highly technical industry.

The Board also recognizes the importance of having in place, and building upon, a counterbalancing structure to ensure that it functions in an appropriately independent manner. The governance structure approved by the Board endows the position of Presiding Independent Director with leadership duties and responsibilities including:

| • | setting the agenda for and leading executive sessions of the independent directors; |

| • | providing consolidated feedback from those meetings to the Chairman and CEO; |

| • | providing input on Board meeting agendas; |

| • | providing feedback on the quality and quantity of information flow from management; |

| • | calling and managing meetings of the independent directors; |

| • | facilitating discussions outside of scheduled Board meetings among the independent directors on key issues; |

| • | serving as a liaison with the Chairman and CEO; |

| • | interviewing Board candidates; and |

| • | leading the independent directors in setting the Chairman's and CEO's compensation, goals and objectives, and his annual performance evaluation. |

In the event of a crisis, the Presiding Independent Director has an increased role in crisis management oversight. The independent directors of our Board elected Mr. Peeler as the Presiding Independent Director for the term ending May 2020, and this position is voted upon annually by our independent directors.

The Board believes that the position and responsibilities of the Presiding Independent Director and the regular use of executive sessions of the independent directors without the CEO or other executive officers present, along with the Company’s strong committee system and substantial majority of independent directors, allow the Board to maintain effective oversight.

26 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Director Independence

Seven of our ten current directors are independent as defined by Nasdaq and SEC rules. A predominantly independent Board ensures that the Board is acting objectively and in the best interests of our stockholders. The independent directors also bring expertise and a diversity of perspectives to the Board. The culture of the Board enables directors to openly express their opinions in the boardroom and to raise challenges. Nasdaq listing standards governing independence require that a majority of the members of the Board be independent as defined by Nasdaq. The Board conducted its annual review of director independence in March 2020. During this review, the Board examined all direct and indirect transactions or relationships between the Company or any of its subsidiaries and each current director and any immediate family member of the director and determined that no material relationships with the Company existed during 2019. On the basis of this review, the Board determined that each of the following directors qualifies as an independent director as defined in Nasdaq guidelines and SEC rules: Michael C. Child, Gregory P. Dougherty, Henry E. Gauthier, Catherine P. Lego, Eric Meurice, John R. Peeler and Thomas J. Seifert. Additionally, the Board has determined that each member of the Audit Committee and the Compensation Committee meets the independence standards specific for members of such committees under Nasdaq guidelines and SEC rules.

Our Corporate Governance Guidelines require that a majority of the Board members must consist of independent directors. In general, our Corporate Governance Guidelines also require that an independent director must have no material relationship with the Company, directly or indirectly, that might interfere with the exercise of independent judgment in the performance of director responsibilities. The Board determines independence on the basis of the standards specified by Nasdaq, the additional standards referenced in our Corporate Governance Guidelines, and other facts and circumstances the Board considers relevant. The NCGC conducts an annual review of the independence of the directors (and candidates for membership on the Board), taking into account all relevant facts and circumstances, and reports its findings to the full Board.

Executive Sessions. Our independent directors meet privately, without employee directors or management present, at least four times during the year. These private sessions are generally held in conjunction with the regular quarterly Board meetings. Other private meetings of the independent directors are held as often as deemed necessary by them and are lead by the Presiding Independent Director. The Audit Committee, the Compensation Committee and the NCGC meet without employee directors or management present from time to time as they deem necessary.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of our Compensation Committee (Ms. Lego and Messrs. Dougherty, Meurice and Peeler) is or has been an officer or employee of our Company or any of our subsidiaries. None of our executive officers served as a member of:

| • | the compensation committee of another entity in which one of the executive officers of such entity served on our Compensation Committee; |

| • | the compensation committee of another entity in which one of the executive officers of such entity served as a member of our Board; or |

| • | the board of directors of another entity, one of whose executive officers served on our Compensation Committee. |

27

27Proposal 1 Election of Nine Directors

| Standing Committees and Board Committee Membership |

The Board has a standing Audit Committee, Compensation Committee and NCGC, each composed entirely of non-employee, independent directors. Under their written charters adopted by the Board, each of these committees is authorized and assured appropriate funding to retain and consult with external advisors, consultants and counsel. Below we provide the principal functions and current members of the standing Board committees.

Audit Committee

| MEMBERS | FUNCTIONS: |

Thomas J. Seifert (Chair) Gregory P. Dougherty Henry E. Gauthier Catherine P. Lego Meetings in 2019: 8 | • Providing oversight of financial management, the internal auditor function and the independent auditor. • Providing oversight with respect to our internal controls including that management is maintaining an adequate system of internal control such that there is reasonable assurance that assets are safeguarded and that financial reports are properly prepared; that there is consistent application of generally accepted accounting principles; and that there is compliance with management’s financial reporting policies and procedures. • Pre-approving auditing and permissible non-audit services by our independent auditor, reviewing and discussing out annual and quarterly financial statements and related disclosures, and coordinating. • Meeting periodically with the independent auditor, management and internal auditor function (including in private sessions) to review their work and confirm that they are properly discharging their respective responsibilities. • Appointing the independent auditor. |

The Board has determined that each member of the Audit Committee is independent and financially literate. The Board has designated Ms. Lego and Mr. Seifert, who are each independent directors under the Nasdaq listing standings and the SEC's audit committee requirements, as “audit committee financial experts” pursuant to the SEC’s final rules implementing Section 407 of the Sarbanes-Oxley Act. Stockholders should understand that the designation of Ms. Lego and Mr. Seifert each as an “audit committee financial expert” is an SEC disclosure requirement and that it does not impose upon them any duties, obligations or liabilities that are greater than those imposed on them as members of the Audit Committee and the Board in the absence of such designation.

28 NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Compensation Committee

| MEMBERS | FUNCTIONS: |

Catherine P. Lego (Chair) Gregory P. Dougherty Eric Meurice John R. Peeler Meetings in 2019: 8 | • Reviewing and recommending to the independent directors the CEO’s base salary and opportunities for annual and long-term compensation. • Reviewing and approving compensation decisions recommended by the CEO for the other executive officers, including setting base salaries, annual performance bonuses, long-term incentive awards, severance benefits and perquisites. • Setting our compensation philosophy and composition of the group of peer companies used for comparison of executive compensation. • Reviewing and recommending for approval by the Board the compensation for non-employee directors. • Administering the equity compensation plans under which we compensate our executive officers and other key employees. • Retaining an independent compensation consultant firm, Radford, a unit of Aon Hewitt (“Radford”), for matters related to executive officer and director compensation, and outside legal counsel to provide advice on compensation-related matters. • Preparing the Compensation Committee Report included in this Proxy Statement on page 37 and overseeing management’s risk assessment of compensation for all employees and compensation-related risks as delegated by the Board. |

Nominating and Corporate Governance Committee

| MEMBERS | FUNCTIONS: |

Eric Meurice (Chair) Michael C. Child John R. Peeler Thomas J. Seifert Meetings in 2019: 5 | • Overseeing matters of corporate governance, including the evaluation of the performance and practices of the Board. • Developing and recommending criteria for Board membership. • Reviewing possible candidates for the Board and recommending director nominees to the Board for approval. • Overseeing the process for the performance evaluations of the Board and its committees. • Engaging in Board succession planning to ensure boardroom skills are aligned with IPG’s long-term strategic plan. • Reviewing and recommending director orientation, stock ownership guidelines, delegation of authority to management, insider trading guidelines, and consider questions of possible conflict of interest, including related party transactions, as such questions arise. • Reviewing and recommending risk oversight responsibilities of the Board and its committees and of the independent directors as a group. |

Each of the Board committees has a written charter that states their respective purposes, goals and responsibilities as well as qualifications for committee membership, appointment and removal, committee structure and operations and reporting to the entire Board. The three committee charters and our Corporate Governance Guidelines can be found at investor.ipgphotonics.com/governance/governance-documents. Information on our website does not constitute part of this Proxy Statement.

29

29Proposal 1 Election of Nine Directors

| Board Practices, Policies and Processes |

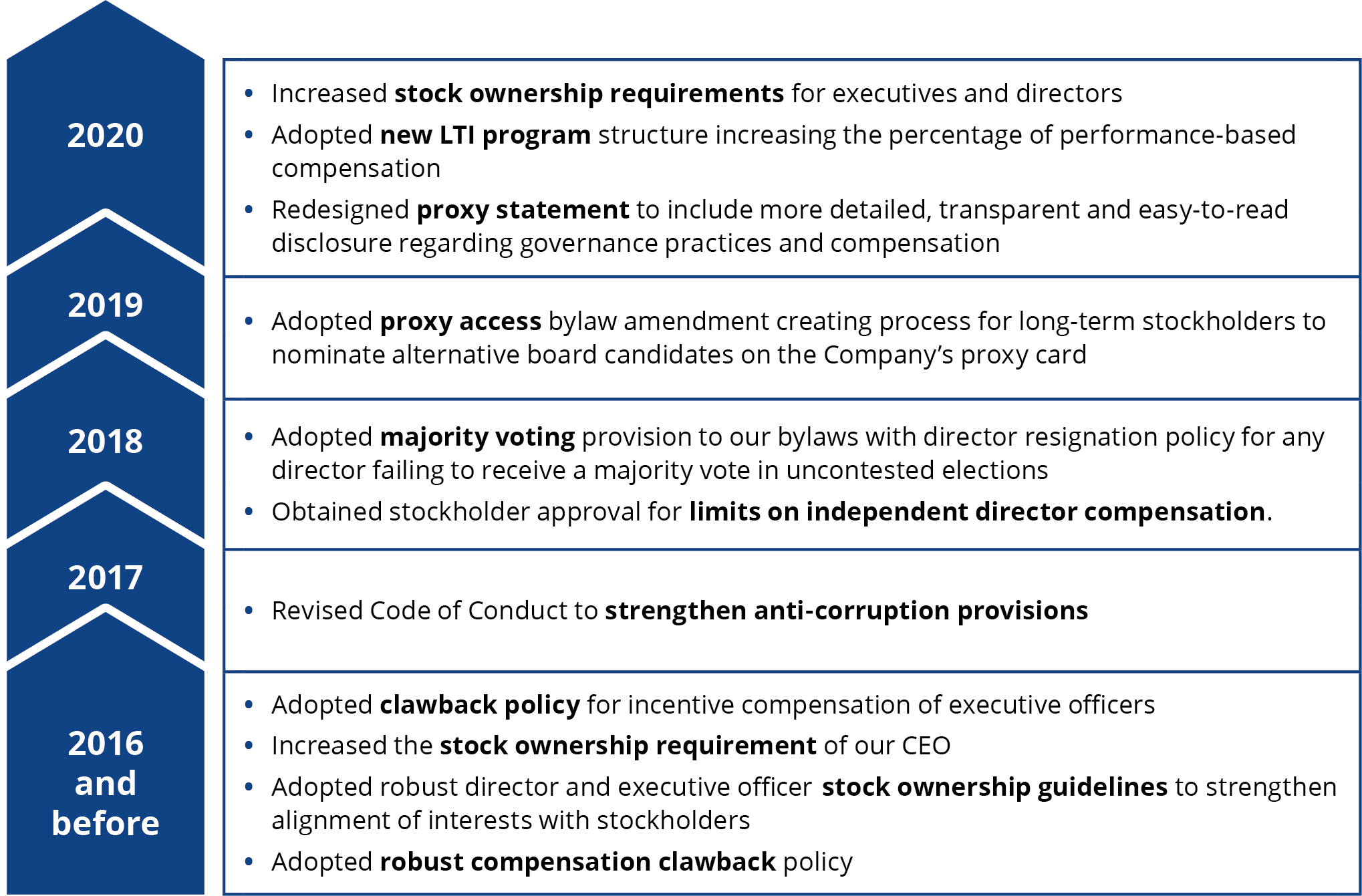

IPG’s Ongoing Commitment to Enhancing Governance Practices

Director Meetings and Policy Regarding Board Attendance