EXECUTIVE COMPENSATION

The following table provides summary information for the years 2005, 2004, and 2003 concerning cash and non-cash compensation paid or accrued by the Corporation to or on behalf of (i) the chief executive officer at the year ended December 31, 2005, and (ii) any other employees to receive compensation in excess of $100,000.

- ----------------------------------------------------------------------------------------------------------------------

Summary Compensation Table

- ----------------------------------------------------------------------------------------------------------------------

- ------------------------------ ---------------------------------- ----------------------------------------------------

Annual Compensation Long Term Compensation

----------------------------------------------------

------------------------- --------------------------

Awards Payouts

- ------------------------------ ---------------------------------- ------------------------- --------------------------

- ---------------------- ------- --------- -------- --------------- ------------ ------------ --------- ----------------

Name and Principal Year Salary Bonus Other Annual Restricted Securities LTIP All Other

Position ($) ($) Compensation Stock Underlying payouts Compensation

($) Award(s) Options ($) ($)

($) SARs(#)

- ---------------------- ------- --------- -------- --------------- ------------ ------------ --------- ----------------

- ---------------------- ------- --------- -------- --------------- ------------ ------------ --------- ----------------

Nora Coccaro - 2005 43,331 - - 25,000 - - -

CEO, CFO, principal 2004 32,000 - - - - - -

accounting officer, 2003 32,100 - - - - - -

and director

- ---------------------- ------- --------- -------- --------------- ------------ ------------ --------- ----------------

COMPENSATION OF DIRECTORS

The Corporation’s directors are not currently compensated for their services as directors of the Corporation. Directors currently are not reimbursed for out-of-pocket costs incurred in attending meetings.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On September 29, 2006, the board of directors of the Corporation authorized the issuance of 2,160,949 shares of common stock valued at $0.11 per share or $242,511, to Markus Mueller, a director of the Corporation, pursuant to a Note Exchange Agreement dated April 10, 2006.

On April 26, 2006, the board of directors of the Corporation authorized the issuance of 300,000 shares of common stock valued at $1.20 per share or $360,000, to Nora Coccaro, one of the Corporation’s directors and sole officer, as additional consideration for consulting services rendered.

On October 25, 2005, the board of directors of the Corporation authorized the issuance of 2,092,293 shares of common stock valued at $0.10 per share or $209,229, to Markus Mueller, a director of the Corporation, pursuant to an agreement for the cancellation of debt from consulting fees, loans made to the Corporation, and interest.

On October 25, 2005, the board of directors of the Corporation authorized the issuance of 50,000 shares of common stock valued at $0.25 per share or an aggregate of $25,000, to Nora Coccaro, one of the Corporation’s directors and sole officer, as additional consideration for services rendered.

On December 5, 2004, the board of directors of the Corporation authorized the issuance of 2,931,142 shares of common stock to Mr. Mueller valued at $0.07 per share, for settlement of loans to the Corporation of $138,680 and consulting services rendered to the Corporation of $66,500, pursuant to a Debt Settlement Agreement dated December 5, 2004.

9

On July 1, 2003, the board of directors of the Corporation entered into a consulting agreement with Markus Mueller, a director and significant shareholder of the Corporation. The agreement has an automatic renewal provision unless terminated by either party. During the six months ended June 30, 2006 and 2005, the Corporation recognized consulting expense of $28,500 and $21,000 respectively.

On March 16, 2000, the board of directors of the Corporation entered into a consulting agreement with Ms. Coccaro, one of the Corporation’s directors and sole officer. The agreement has an automatic renewal provision unless terminated by either party. During the six months ended June 30, 2006 and 2005, the Corporation recognized consulting expense of approximately $388,500 and $20,981 respectively. Of the current year’s expense, $360,000 relates to the deemed value of 300,000 shares of common stock issued to the chief executive officer on April 26, 2006.

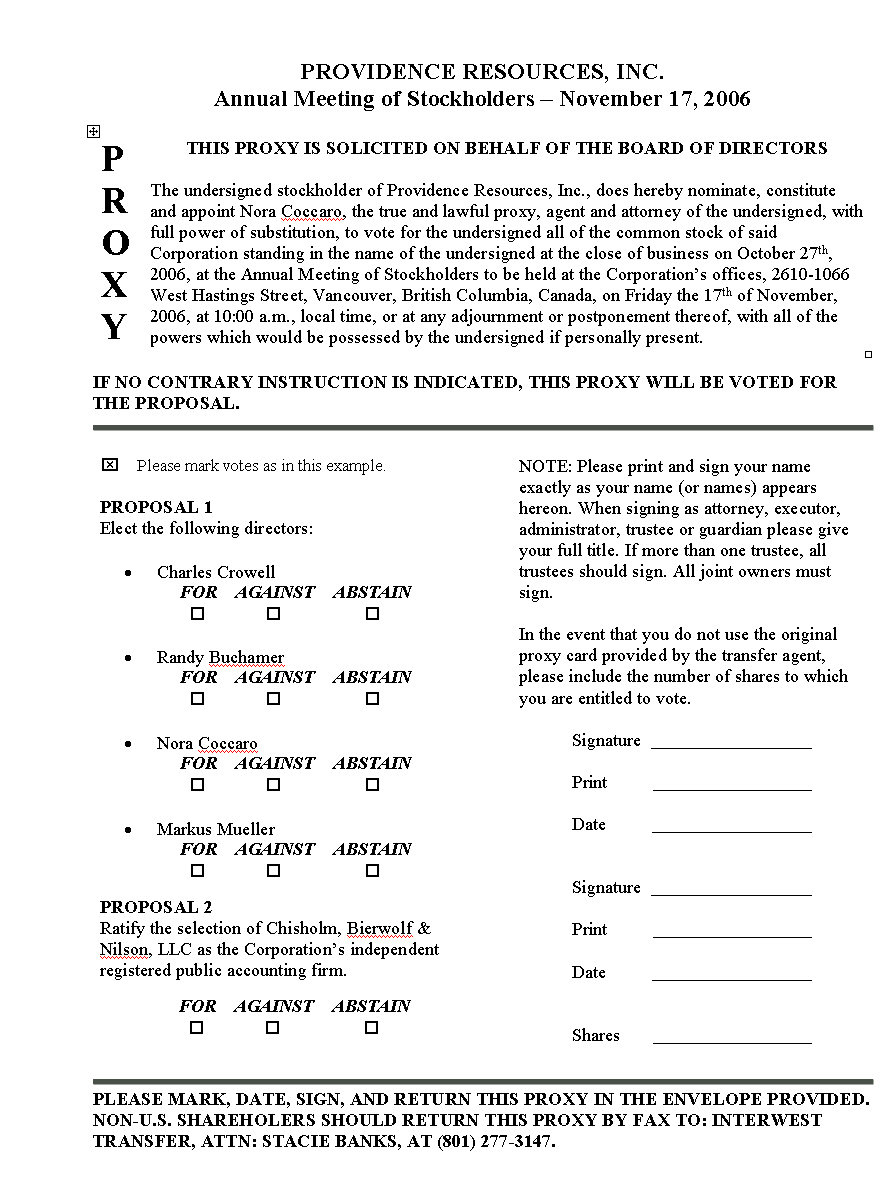

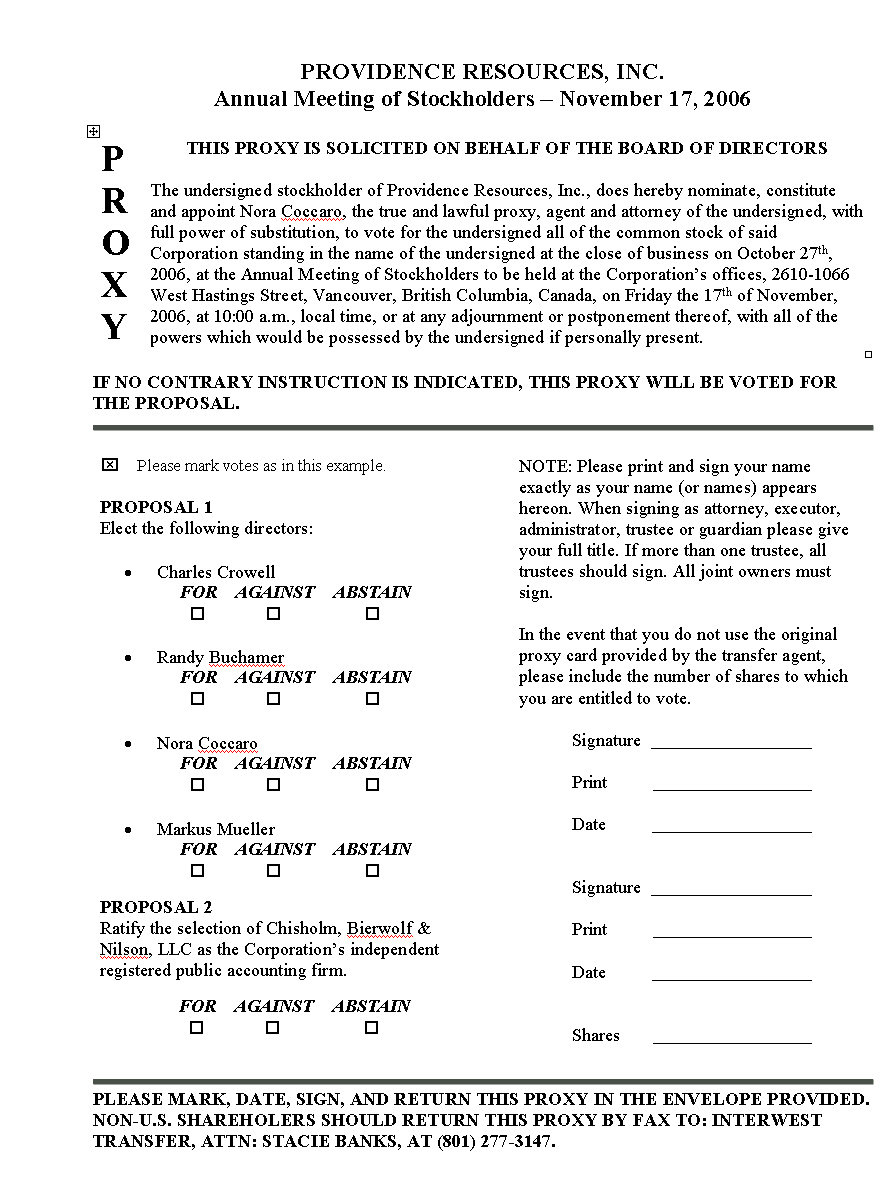

PROPOSAL 2 — RATIFY SELECTION OF PUBLIC ACCOUNTANT

Subject to ratification by our stockholders, the board of directors has selected the firm of Chisholm, Bierwolf & Nilson, LLC, 533 W. 2600 S., Bountiful, Utah, as our independent registered public accounting firm to examine and audit our financial statements for the fiscal year ending December 31, 2006. This firm has audited our financial statements for two years and is considered to be well qualified. Though action by stockholders is not required under the law for the selection of an independent registered public accounting firm, the ratification of Chisholm, Bierwolf & Nilson, LLC’s selection is being submitted by the board of directors in order to give our stockholders an opportunity to vote on our selection of auditors. In the event that a majority of the votes represented at the Annual Meeting are not voted in favor of the selection of Chisholm, Bierwolf & Nilson, LLC, the board of directors will reconsider its decision.

PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

Chisholm, Bierwolf & Nilson, LLC, reviewed the Corporation’s quarterly financial statements in 2006, 2005 and 2004, and provided audit services to the Corporation in connection with our annual report for the fiscal year ended December 31, 2005 and 2004. The aggregate fees billed by Chisholm, Bierwolf & Nilson, LLC, for services in 2006, 2005 and 2004 have been $14,955, $6,500, and $6,500 respectively.

Audit Related Fees

Chisholm, Bierwolf & Nilson, LLC, billed to the Corporation no fees in 2006, 2005 or 2004 for professional services that are reasonably related to the audit or review of the Corporation’s financial statements that are not disclosed in “Audit Fees” above.

Tax Fees

Chisholm, Bierwolf & Nilson, LLC, billed to the Corporation no fees in 2006, 2005 or 2004 for professional services rendered in connection with the preparation of the Corporation’s tax returns for the period.

All Other Fees

Chisholm, Bierwolf & Nilson, LLC, billed to the Corporation no fees in 2006, 2005 or 2004 for other professional services rendered or any other services not disclosed above.

10

Audit Committee Pre-Approval

The Corporation does not have a standing audit committee. Therefore, all services provided to the Corporation by Chisholm, Bierwolf & Nilson, LLC, as detailed above, were pre-approved by the Corporation’s board of directors. The Corporation’s independent auditors, Chisholm, Bierwolf & Nilson, LLC, performed all work using only their own full time permanent employees.

REQUIRED VOTE

Ratification of Chisholm, Bierwolf & Nilson, LLC’s selection as our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the Annual Meeting, assuming a quorum is present. Broker non-votes are counted solely for the purpose of determining a quorum. Abstentions will have the same effect as a vote against this proposal.

BOARD RECOMMENDATION

| | The board of directors unanimously recommends a vote “For” ratifying the selection of Chisholm, Bierwolf & Nilson, LLC, as the Corporation’s independent registered public accounting firm. |

ADDITIONAL GENERAL INFORMATION

VOTING SECURITIES

As of October 27, 2006, there were 51,449,627 shares of common stock and no shares of preferred stock issued and outstanding. Each holder of common stock is entitled to one vote for each share held by such holder.

STOCKHOLDER PROPOSALS

Stockholders wishing to submit a proposal or director nomination to be included in the board of directors’ solicitation of proxies for annual meetings must be sent to Nora Coccaro at: Providence Resources, Inc., 2610-1066 West Hastings Street, Vancouver, British Columbia, V6E 3X2, Canada. The submission must be received a reasonable amount of time prior to the time that the proxy materials are to be mailed in connection with such meeting in order to be included in the proxy statement and proxy relating to that meeting. In accordance with the Corporation’s bylaws, the submission must be delivered to the Corporation’s principal offices not less than 30 days nor more than 60 days prior to the meeting. However, in the event that public disclosure of the date of the meeting is first made less than forty days prior to the date of the meeting, the submission must be received no later than the close of business on the tenth day following the day on which such public disclosure of the date of the meeting was made. Such proposals must comply with all of the requirements of Commission Rule 14a-8.

GENERAL AND OTHER MATTERS

The board of directors knows of no matter, other than those referred to in this proxy statement, which will be represented at the Annual Meeting. However, if any other matters are properly brought before the Annual Meeting or any of its adjournments, Ms. Coccaro, acting as proxy, will vote upon such matters in accordance with her judgment on such matters.

11

The cost of preparing, assembling, and mailing this proxy statement, the enclosed proxy card and the notice of the Annual Meeting will be paid by us. Additional solicitation by mail, telephone, telegraph or personal solicitation may be done by our directors, officers and regular employees. Such persons will receive no additional compensation for such services. Brokerage houses, banks and other nominees, fiduciaries and custodians nominally holding shares of common stock of record will be requested to forward proxy soliciting material to the beneficial owners of such shares, and will be reimbursed by us for their reasonable expenses.

WHERE YOU CAN FIND MORE INFORMATION

The Corporation is subject to the informational requirements of the Exchange Act. The Corporation files reports, proxy statements and other information with the Commission. The public may read and copy any materials that we file with the Commission at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. The public may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330. The statements and forms we file with the Commission have been filed electronically and are available for viewing or copy on the Commission maintained Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission. The Internet address for this site can be found at www.sec.gov.

A copy of the Corporation’s yearly report on Form 10-KSB for the fiscal year ended December 31, 2005, can be found at the Commission’s Internet site. The yearly report does not form any part of the materials for the solicitation of proxies. Copies of the yearly report will be sent to any stockholder without charge upon written request addressed to: Providence Resources, Inc., 2610-1066 West Hastings Street, Vancouver, British Columbia, V6E 3X2, Canada, attention: Nora Coccaro.

STOCKHOLDERS ARE URGED TO IMMEDIATELY MARK, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED. NON-U.S. SHAREHOLERS, PLEASE RETURN YOUR EXECUTED PROXY BY FAX TO INTERWEST TRANSFER, ATTN: STACIE BANKS, AT (801) 277-3147. MS. BANKS’ PHONE NUMBER IS (801) 272-9294.

By Order of the Board of Directors,

/s/ Nora Coccaro

Nora Coccaro, Chief Executive Officer and Director

October 27, 2006

12