UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Under Rule 14a-12 |

ENDEAVOUR INTERNATIONAL CORPORATION

(Name of Registrant as Specified in Its Charter)

TALISMAN GROUP INVESTMENTS, L.L.C.

TALISMAN REALTY CAPITAL MASTER, L.P.

THE TALISMAN GROUP L.L.C.

TALISMAN GROUP PARTNERS, L.L.C.

TALISMAN FAMILY, L.L.C

JASON TAUBMAN KALISMAN

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

On May 2, 2014, Talisman Group Investments, L.L.C. delivered the following presentation to Institutional Shareholder Services Inc.:

|

The Case for Change at $11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 |

|

1 Important Information Forward-Looking Statements Certain statements in this presentation and our response to various questions may constitute “forward-looking statements” as the term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of words such as “expects,” “plans,” “estimates,” “projects,” “intends,” “believes,” “guidance,” and similar expressions that do not relate to historical matters. Such forward-looking statements are based on current expectations and involve certain risks and uncertainties. Actual results might differ materially from those projected in the forward-looking statements. All forward-looking statements in this presentation and our responses to various questions are made as of the date hereof, based upon information known to us as of the date hereof, and we assume no obligations to update or revise any of the forward-looking statements even if experience or future changes show that indicated results or events will not be realized. Important Additional Information Stockholders are advised to read the proxy statement and other documents related to the solicitation of proxies by Talisman Group Investments, L.L.C. and its affiliates (“Talisman”) from the stockholders of Endeavour International Corporation (“Endeavour” and the “Company”) for use at its 2014 annual meeting of stockholders when they are available because they will contain important information. When completed, such materials will, along with other relevant documents, be available at no charge at the Securities and Exchange Commission’s website at http://www.sec.gov or by contacting Talisman’s proxy solicitor, Okapi Partners LLC, toll free at (877) 796-5274, or by email to info@okapipartners.com. Talisman manages funds that are in the business of trading - buying and selling - public securities. It is possible that there will be developments in the future that cause Talisman to change its position regarding the Company and possibly increase, reduce, dispose of, or change the form of its investment in the Company. This presentation should not be considered a recommendation to buy, sell or hold any investment. |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 2 Table of Contents PAGE 3 Talisman: Who We Are and What Value We See PAGE 6 Executive Summary: Why We Are Here PAGE 9 Endeavour’s Track Record of Value Destruction and Misinformation PAGE 15 Endeavour’s Track Record of Poor Corporate Governance PAGE 23 Talisman’s Plan to Protect and Create Value at Endeavour PAGE 30 Appendix: History of Misinformation |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 3 TALISMAN: WHO WE ARE AND WHAT VALUE WE SEE |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 4 Who We Are Talisman is a value-oriented investor focused on real assets • Talisman is a long-term investor in Endeavour, with beneficial ownership of 14.67% of Endeavour’s outstanding common stock • Led by Jason T. Kalisman, Talisman has extensive experience investing in real assets and restructuring distressed corporations • Mr. Kalisman has extensive experience working constructively with the board members and management teams of Talisman’s portfolio companies • Prior to founding Talisman, Mr. Kalisman was Vice President of Special Situations Investments at GEM Realty Capital in Chicago • Previously, Mr. Kalisman was at Goldman Sachs in New York and London, where his tenure included extensive real estate industry and investing experience as a member of both the Real Estate and Structured Products Groups • Mr. Kalisman earned his Masters of Business Administration degree from the Stanford Graduate School of Business and his Bachelor of Arts degree in Economics from Harvard College • Mr. Kalisman was also awarded the right to use the Chartered Financial Analyst designation |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 5 (1) Based on reports from a leading energy research and consulting firm dated September 2013 for Alba, July 2013 for Bacchus, and December 2013 for Rochelle (represents pre-tax PV-10 value). (2) Includes $167 million of Monetary Production Payment (“MPP”) and $37 million of preferred stock outstanding at December 31, 2013. (3) Assumes 62.4 million fully diluted shares. We have performed extensive diligence and estimate that intrinsic value is at least $5 per share and could potentially be worth more than $10 per share with a change in strategy and leadership Intrinsic Value Per Share (3) 53% to 207% Upside Low case applies third party estimates (1) What Value We See •26% working interest •Operated by Chevron Alba •30% working interest •Operated by Apache Bacchus •44% working interest •Operated by Nexen Rochelle •P50 reserve potential of 35 to 80 million barrels of oil equivalents Rossini •Colorado Niobrara •Pennsylvania Marcellus U.S. Portfolio Net Debt / MPP Equity Value $306.9 (1) to ~$460 million $406.1 (1) to ~$425 million $574.5 (1) to ~$640 million $53 to ~$120 million $50 to ~$100 million -$1.1 billion (2) $328.7 to $658.6 million $4.92 (1) to $7.37 $6.51 (1) to $6.81 $9.20 (1) to $10.25 $0.84 to $1.92 $0.80 to $1.20 ($17.00) (2) $5.26 to $10.55 |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 6 EXECUTIVE SUMMARY: WHY WE ARE HERE |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 7 Executive Summary • Our analysis shows the Company is significantly undervalued and that its assets hold substantial underlying value Specifically, we estimate that Endeavour’s intrinsic value – which is at least $5 per share today – could potentially be worth more than $10 per share with a change in strategy and leadership Talisman has performed extensive diligence on Endeavour’s assets and our valuation implies significant upside to the current stock price of $3.44 with minimal need for additional capital if managed correctly We supplemented our own research with third-party independent analysis from a leading energy research and consulting firm • We attribute the market’s substantial discount to numerous project delays and missteps made by the current Board and management team led by Chairman and CEO Bill Transier and Lead Director John Connally III These missteps have severely damaged Endeavour’s credibility and reputation, have directly led to the destruction of stockholder value, and have put the Company at risk unnecessarily • We believe the Board’s lack of independence and poor corporate governance practices have insulated management from accountability and earned them a negative market reputation • Endeavour will undoubtedly continue to trade at a large discount until the Board takes a number of corrective actions which we identify in this presentation • We sought an amicable and constructive resolution with the Company by seeking the appointment of two skilled and experienced professionals to the Board: Jason T. Kalisman and William D. Lancaster • As a result, Endeavour has nominated Mr. Lancaster to its Board but in our view this is not enough Based on the Board’s history of significant missteps and poor corporate governance, we strongly feel the Company’s Board needs stockholder representation to provide oversight, ensure the Company is on the right path, and protect and enhance stockholder value |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 8 Our Plan What is Talisman suggesting specifically? 1. Elect Jason T. Kalisman to replace John B. Connally III 2. Immediately correct poor corporate governance practices 3. Focus on aggressively deleveraging the balance sheet 4. Initiate a credible review of strategic alternatives |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 9 ENDEAVOUR’S TRACK RECORD OF VALUE DESTRUCTION AND MISINFORMATION |

|

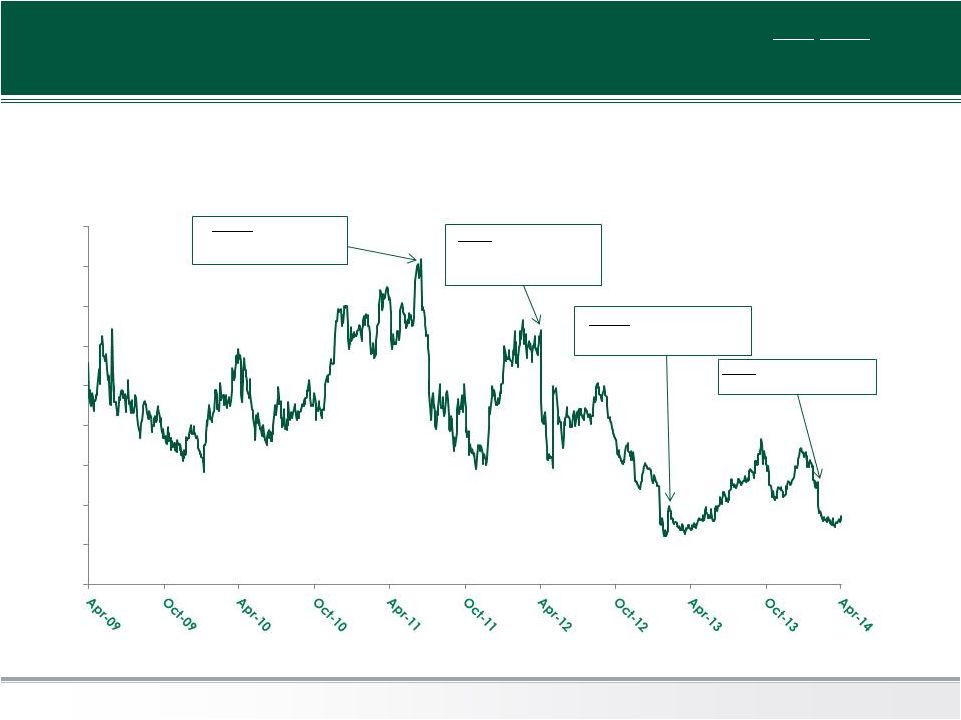

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 Stock Price Has Plummeted 10 Current Board led by Chairman and CEO Bill Transier and Lead Director John Connally III have overseen the actions that have resulted in enormous value destruction over the past five years –69.1% in closing ConocoPhillips acquisition, raising liquidity concerns from Monetary Production Payment rescue financing $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 7/18/11: Announces ill- conceived acquisition of Marcellus Shale assets Announces delays 5/2/12: First discloses dilution 3/11/13: Announces dilutive 3/5/14: |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 Value Destruction and Misinformation • In its fourth quarter of 2012 earnings release, Endeavour announced it entered into a Monetary Production Payment with a group of investors, raising $107.5 million – citing that it “would be satisfied out of the production from certain U.K. North Sea assets and is expected to be satisfied over a two year period” • Not until Endeavour filed a Form 8-K a week later, however, did it disclose the issuance of 3,440,000 warrants in connection with the Monetary Production Payment at an exercise price of $3.014 per share At the time, these warrants represented a 7.4% expansion of the fully diluted share count as of December 31, 2012 when exercised We believe Endeavour should have disclosed this material fact about the Monetary Production Payment when it first announced the transaction • During the fourth quarter of 2012 conference call, the Company applauded this transaction, stating it helped remove immediate liquidity concerns and took capital raising activities off the table We believe these statements were materially misleading since issuing warrants was economically equivalent to raising capital • We note Endeavour issued an additional 560,000 warrants to purchase shares at an exercise price of $3.685 per share after increasing the Monetary Production Payment to $125 million on May 21, 2013 • Again, the true cost of the expanded Monetary Production Payment was not announced in an earnings release or discussed openly during a conference call, but rather hidden in a separate Form 8-K filing Undisclosed Dilution from Monetary Production Payment 11 |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 Value Destruction and Misinformation ConocoPhillips Acquisition Debacle 12 • On December 27, 2011, Endeavour announced the acquisition of three producing U.K. oil fields (Alba, MacCulloch and Nicol) in the Central North Sea from ConocoPhillips for $330 million • On a Company hosted business update call on January 4, 2012, Mr. Transier gave explicit guidance for when the transaction was expected to close "And then the other positive thing about this entire transaction is that we expect to close it as early as the end of the first quarter” • However, the “entire transaction” never closed as MacCulloch and Nicol were terminated • The Alba portion of the transaction was also delayed and did not close until May 31, 2012 This proved very costly to stockholders since on February 23, 2012, Endeavour raised $500 million through a senior note offering consisting of $350 million of 12% first priority notes and $150 million of 12% second priority notes both issued at 96% of par to yield nearly 13% For months stockholders were forced to pay extremely high levels of interest costs with no associated cash flows from the “three oil fields” In total, Endeavour paid $16 million in interest expense before recognizing any associated cash flow • Stockholders eventually learned that delays in closing Alba were due to disagreements surrounding decommissioning obligations not previously disclosed • Mr. Transier had not been forthcoming about future decommissioning obligations and what risk they could pose to the completion of the deal until its first quarter of 2012 earnings call more than six months later when he lamented… "We believe Chevron, the Operator in particular, has attempted to impose certain ultraconservative views regarding future decommissioning liabilities that put Endeavour at a competitive disadvantage among the partners and put themselves in a better position than they are today” • To make matters worse, if Endeavour did not close on the transaction it would have been required to redeem the 2018 Notes, including penalties and interest, which was well in excess of the net proceeds from the offering in escrow • Additionally, Endeavour would have been required to repay the $40 million of outstanding borrowings under its revolving credit facility |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 Value Destruction and Misinformation • Following the first quarter of 2012 earnings call on May 2, 2012 through May 30, 2012 Endeavour’s stock fell approximately 55% as liquidity concerns emerged • While the Alba portion of the transaction closed on May 31, 2012, Endeavour was required to post a letter of credit for $32 million at a very high cost consisting of 11.5% interest per year and an initial fee of 2% Endeavour also issued 2 million 5-year warrants with a strike of $10.50 • Following the closing of Alba, the stock quickly shot up, which the Board used as an opportunity to subject stockholders to a dilutive share offering of 7.5 million shares on June 13, 2012 • This move was in stark contrast to Mr. Transier’s comments regarding raising equity as part of the financing: "As noted in the press release, Citi provided the commitment letter, but we expect that that bridge not to be needed. But some people have asked, last week we had a lot of calls from people, some people have asked about equity needed in this transaction. I will tell you there is no equity needed or contemplated in this transaction. The commitment letter or the financing under the commitment letter, if used, does not have an equity takeout provision, so you should expect no equity to be used in this transaction” (Business Update Call on January 4, 2012. Source: Bloomberg transcript) • On November 29, 2012, Mr. Transier presented at the Jefferies Global Energy Conference and indicated the closing of MacCulloch and Nicol was proceeding as planned "In terms of near-term catalysts, we have one piece of an acquisition from ConocoPhillips that we're still intending to close here in the near term“ (Jefferies Energy Conference on November 29, 2012. Source: Bloomberg transcript) • On December 14, 2012 – just two weeks later – Endeavour released a Form 8-K announcing the MacCulloch and Nicol Purchase Agreement had been terminated and the Company would lose its $10 million non-refundable deposit in connection with the transaction ConocoPhillips Acquisition Debacle (continued) 13 |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 Value Destruction and Misinformation • When production from Rochelle was suspended in January 2014 due to an unexpected valve shut-in, Endeavour found itself in need of emergency rescue financing We believe this situation could have been avoided had Endeavour not continued to spend money on its low return and poorly conceived U.S. on-shore portfolio, thereby impairing the Company’s liquidity and margin for error The Company has a history of desperate financings executed from positions of profound weakness resulting in higher than necessary costs of capital • On March 3, 2014 the Company raised $25 million – with the potential for an additional $30 million at the purchaser’s option – in a privately negotiated deal at terms that were highly dilutive to stockholders Implied a 23% expansion of the share base – with no stockholders vote – assuming full conversion of converts that were issued • We believe Endeavour rebuffed several institutions who offered to provide capital at more favorable terms for stockholders because the Board wanted to ensure the stock was issued to friendly hands • Endeavour’s stock fell – 23.5% the day this financing was announced and has since fallen an additional –12.5% • We believe Endeavour should have given all stockholders an opportunity to participate in a publicly marketed offering when the financing need was first apparent in January 2014 • We believe Endeavour should not have ignored offers from other institutions with terms that were more favorable for all stockholders Dilution From Last Minute Rescue Financing 14 |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 15 ENDEAVOUR’S TRACK RECORD OF POOR GOVERNANCE |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 16 Why Board Change is Needed Now Board’s Mistakes & Misinformation • Consistently providing inaccurate and inconsistent guidance • Have missed twelve consecutive quarters of earnings estimates • Conducting expensive and ill-conceived capital markets activities • Subjecting long-term stockholders to substantial and repeated dilution • Putting value at risk through imprudent levels of leverage • Providing unrealistic and inaccurate assessments of recent transactions and production forecasts • Further examples of misinformation are provided in the Appendix Poor Corporate Governance • Average tenure of “independent” incumbents is 9 years • Interlocking directorships further bring independence into question • Board is still staggered which entrenches incumbents • Lack of significant stockholder representation • Adverse bylaw amendment without stockholder ratification • Excessive executive compensation despite poor performance • No apparent interest in separating Chairman and CEO roles • Incorporated in Nevada, which we believe is one of the most stockholder-unfriendly states |

|

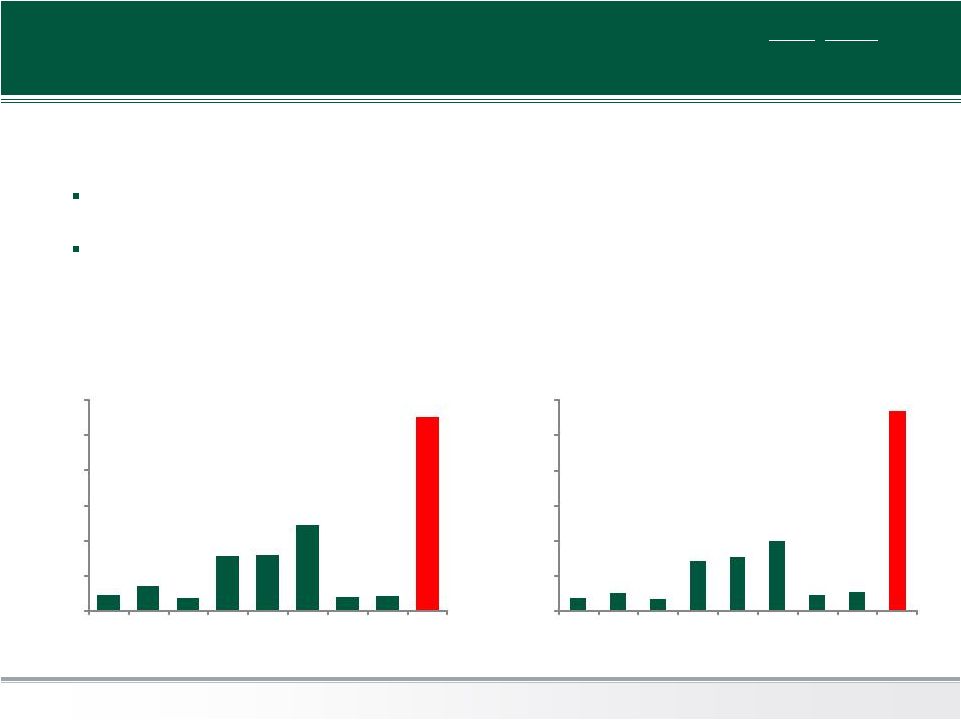

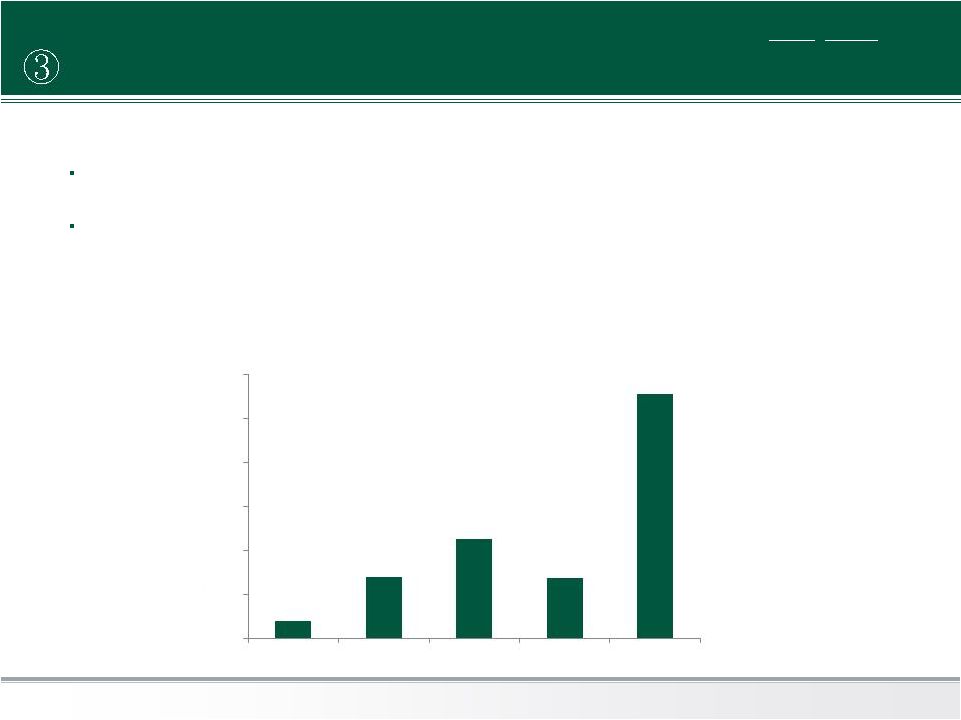

17 • We believe Endeavour’s executive compensation is excessive versus its peers given the Company’s losses totaling $366.2 million over the last five years 2009 to 2013 Executive Compensation as % of Market Capitalization (1) Executive Compensation is Excessive… 2009 to 2013 CEO Compensation as % of Market Capitalization (1) (1) Based on 50,340,888 common shares outstanding as of the Record Date and a closing price of $3.44 on April 30, 2014. During this five year period, executive compensation totaled $46.7 million or approximately 27% of Endeavour’s current market capitalization (1) Mr. Transier’s compensation during this five year period totaled $19.3 million or approximately 11% of Endeavour’s current market capitalization (1) 2.2% 3.4% 1.8% 7.7% 7.9% 12.1% 1.9% 2.1% 27.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% CRZO GDP REXX NOG REN SFY ROSE PDCE END 0.7% 1.0% 0.7% 2.8% 3.0% 4.0% 0.9% 1.0% 11.1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% CRZO GDP REXX NOG REN SFY ROSE PDCE END May 1, 2009 April 30, 2014 $11.13|$3.44 (–69.1%) Value Destruction |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 18 …and NOT Deserved • We believe Endeavour’s executive compensation is not properly linked to performance Over the last 5 years, annual executive compensation grew 52% despite prolonged underperformance and stock price declines of nearly –70% Despite underperformance in both absolute terms and relative to its peers, Endeavour’s Board has continued to reward the CEO and management at the expense of stockholders and drain much-needed liquidity out of the business (1) ISS Proxy Peers: Abraxas Petroleum, BPZ Resources, Contango Oil & Gas, Halcon Resources, Kodiak Oil & Gas, Panhandle Oil and Gas, PetroQuest Energy, TransAtlantic Petroleum, Warren Resources, Approach Resources, Callon Petroleum Company, Dune Energy, Gulfport Energy, Isramco, Magnum Hunter Resources, Penn Virginia, Resolute Energy and VAALCO Energy. (2) Endeavour Selected Peer Group: Carrizo Oil & Gas, Gastar Exploration, Goodrich Petroleum, Northern Oil & Gas, PDC Energy, Resolute Energy, Rex Energy, Rosetta Resources and Swift Energy. Total Returns 5-Year 4-Year 3-Year 2-Year 1-Year Endeavour -69.1% -69.6% -76.2% -72.4% 25.5% ISS Proxy Peers (1) 175.2% 19.9% -9.8% 20.2% 64.8% Endeavour Underperformance -244.3% -89.6% -66.4% -92.6% -39.3% Endeavour Selected Peer Group (2) 161.7% 30.3% -1.8% 30.4% 49.1% Endeavour Underperformance -230.8% -99.9% -74.5% -102.8% -23.5% Russell 2000 Energy Index 159.5% 62.4% 10.6% 36.8% 37.0% Endeavour Underperformance -228.6% -132.0% -86.8% -109.2% -11.4% |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 19 Interlocking Directorships • Directors John Connally III and John Seitz both serve the board of directors of Gulf United Energy Mr. Connally is the Chairman and CEO of Gulf United Energy, and is the Lead Director, the Chairman of the Compensation Committee, a Member of the Nominating & Corporate Governance Committee and a Member of the Audit Committee of Endeavour Mr. Connally has been a Director of Endeavour and its predecessor company since 2002 Mr. Seitz has been a Director of Gulf United Energy since January 2011, and is the Co-Founder, Vice Chairman and former Co-CEO of Endeavour • Directors Bill Transier and Nancy Quinn both serve the board of directors of Helix Energy Solutions and are being sued by its stockholders for excessive compensation despite its poor performance Mr. Transier has been a Director of Helix Energy Solutions since October 2000, and is the Co-Founder, Chairman and CEO of Endeavour Ms. Quinn has been a Director of Helix Energy Solutions since February 2009, and is a Director, the Chairman of the Audit Committee and a Member of the Compensation Committee of Endeavour Ms. Quinn has been a Director of Endeavour since March 2004 • Directors Bill Transier and James Browning are both former partners at KPMG in Houston Mr. Transier worked at KPMG from 1986 to 1996 Mr. Browning worked at KPMG from 1971 to 2009 |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 20 Adverse Bylaw Amendment • We believe Endeavour’s recent bylaw amendment was a desperate attempt to disenfranchise stockholders and further entrench the Board • In our view these amendments substantially impair stockholder rights since they: Eliminate stockholders’ right to act by written consent, requiring all action must be taken at a stockholder meeting Special meetings can be called only by stockholders who hold more than 50% of outstanding common stock Restrict business that can be conducted at special meetings to exclude similar business items, with the election of directors specifically deemed to be a similar business item • In 2013, ISS also viewed this as a material failure of governance: “The bylaw amendments significantly diminish shareholder rights, and are particularly egregious because shareholders were not given the opportunity to vote on whether they desired such changes” (Source: 2013 ISS Report, page 10) “In particular, the material restrictions on the ability to call special meeting and the inability to act by written consent infringes on shareholders’ ability to take action between annual meetings and could promote management or board entrenchment. As such, the board should have disclosed its rationale for amending the bylaws and sought shareholder ratification on the matter. Its failure to do so represents a material failure of governance” (Source: 2013 ISS Report, page 10) |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 21 Board Lacks Self-Awareness Endeavour’s Perspective: – Bill Transier (March 5, 2014 quarterly earnings call. Source: Bloomberg transcript) ISS Disagreed: • “We have what we consider to be a very strong board… I don’t think anybody’s ever questioned our strong governance” • On May 5, 2013, ISS recommended that WITHHOLD votes were warranted for Mr. Transier last year (the only nominee up for re-election at the 2013 annual meeting given the staggered board) • On May 11, 2012, ISS also recommended that WITHHOLD votes were warranted for Nancy Quinn and Sheldon R. Erikson (two of the three nominees up for re-election at the 2012 annual meeting) “WITHHOLD votes are warranted for William L. Transier for the unilateral amendment to the company’s bylaws to diminish shareholder rights” (Source: 2013 ISS Report) “WITHHOLD votes are also warranted for the continued misalignment between pay and performance at the company” (Source: 2013 ISS Report) |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 22 Demand for Accountability • “It is one more in a string of countless delays that has been suffered by the Company and which seem to always push the promise of meaningful cash flows out to a later date” (Source: CRT Capital Group morning notes dated February 7, 2014) • “We continue to believe in the potential of the Endeavour story, but it admittedly has caused investor fatigue and has taken longer than our expectations due to constant execution issues… we believe the gap between our NAV of $8.50 and the current price will not close until management retains some execution credibility with investors” (Source: Imperial Capital research report dated February 19, 2013) • “Project delays and liquidity concerns have become more of a norm than an exception for END” (Source: Citi research report dated February 14, 2013) • “Management had little credibility before and has even less now” (Source: CRT Capital Group research report dated February 14, 2013) Stockholders’ Perspective: Analysts’ Perspective: Nearly 25% of voted shares were withheld to re-elect Mr. Transier • Stockholders have expressed dissatisfaction with the Board’s performance by withholding votes for incumbent candidates at the prior Annual Meeting despite no alternative slate |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 23 TALISMAN’S PLAN TO PROTECT AND CREATE VALUE AT ENDEAVOUR |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 24 Our Plan What is Talisman suggesting specifically? 1. Elect Jason T. Kalisman to replace John B. Connally III 2. Immediately correct poor corporate governance practices 3. Focus on aggressively deleveraging the balance sheet 4. Initiate a credible review of strategic alternatives |

|

25 Stockholders Have a Clear Choice Elect Jason T. Kalisman to Represent Stockholders and Replace John B. Connally III Jason T. Kalisman Talisman Nominee Beneficially owns ~0.2% of Company (solely from stock awards) As Lead Director, is directly accountable for Company’s mistakes As Chairman of the Compensation Committee, supported excessive compensation despite poor performance Has served as director of Endeavour and its predecessor company since 2002 Interlocking director relationship with one of Endeavour’s founders Stockholder representative beneficially owns ~14.7% of Company Proven fiduciary incentivized to champion improved accountability and corporate governance Significant experience investing in real assets and turning around companies Offers fresh perspectives to the Board and concrete recommendations Brings much needed independence to the Board John B. Connally III Endeavour Incumbent Nominee We are nominating Mr. Kalisman to replace John B. Connally III because we believe it is critical that the Board also include a stockholder representative Mr. Kalisman will work to protect the interests of stockholders and bring much needed independence to the Board • $11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 26 Improve Corporate Governance Immediately Correct Poor Corporate Governance Practices De-stagger the Board Split the roles of Chairman and Chief Executive Officer Appoint a new independent director as Chairman Amend existing bylaws to conform to ISS and Glass Lewis best practices Make performance-based compensation targets more rigorous and align executive compensation to the achievement of specific financial and leverage targets • Endeavour’s misaligned Board has, in our view, impaired the Company’s valuation and has directly contributed to its underperformance in recent years • We believe the Board must immediately take the following corrective actions: |

|

27 Deleverage the Balance Sheet Focus on Aggressively Deleveraging the Balance Sheet • We believe the primary financial priority for the Board should be to aggressively reduce leverage Deleveraging remains the Company’s most accretive incremental use of capital • Endeavour must set explicit near to intermediate term leverage targets to which the Board should be held accountable • Should replace Monetary Production Payments, which have an accelerated principal repayment schedule, with lower cost, conventional debt • Should also consider issuing perpetual preferred stock Debt Maturity Schedule (1) ($ in millions) (1) Company pro forma from April 8, 2014 IPAA OGIS New York Presentation plus $191 million of Monetary Production Payments. May 1, 2009 April 30, 2014 $11.13|$3.44 (–69.1%) Value Destruction $39 $139 $226 $138 $554 $0 $100 $200 $300 $400 $500 $600 2014 2015 2016 2017 2018 The Company must also commit to not pursuing any discretionary spending – specifically on its non-core U.S. portfolio – until these targets are met |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 28 Undergo Strategic Review Process Initiate a Credible Review of Strategic Alternatives We also believe the Board either erred or intentionally concluded its strategic review before key assets like Alba and Rochelle stabilized (and best values could be achieved) We believe the Board should fully explore these strategic alternatives, in a process led exclusively by true independents We see no business justification for these assets considering Endeavour’s deleveraging priorities, limited budget for discretionary capital expenditures and focus on the U.K. North Sea market In our view this portfolio is a distraction, too expensive to carry, and demonstrates a lack of capital discipline on the part of the Board We estimate Endeavour has spent over $100 million on this portfolio over the years and plans to spend approximately $30 million more this year between overhead and capital expenditures (1) , despite the fact that the public markets currently ascribe little to no value to these assets (1) $20 to $25 million of Company guidance for U.S. capital expenditures and an additional $8 million of U.S. overhead. • Last year’s strategic review lacked credibility since it was conducted, in part, by a firm that employs one of Endeavour’s directors • We believe Endeavour should immediately monetize its non-core U.S. portfolio as these asset are far more valuable in the hands of a dedicated on-shore operator |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 Conclusion 29 • The Company is significantly undervalued and its assets have substantial underlying value • If we do not take action now to effectuate change, the current Board will continue to destroy stockholder value Current Board led by Chairman and CEO Bill Transier and Lead Director John Connally III have a track record of overseeing numerous project delays and missteps, while extracting egregious personal compensation The Board’s lack of independence and poor corporate governance practices have insulated management from accountability • Given the restructuring required over the coming quarters and continued precipitous decline in stock price, we do NOT have the luxury of waiting for the next annual meeting • Talisman’s plan will protect the interests of stockholders and bring much needed independence to the Board |

|

$11.13|$3.44 (–69.1%) Value Destruction May 1, 2009 April 30, 2014 30 APPENDIX: HISTORY OF MISINFORMATION |

|

31 History of Misinformation: Bacchus • Mr. Transier misled stockholders about the timing of first production from Bacchus: “But we do anticipate turning on each of the three wells successively as we drill those wells going forward. And we anticipate having first production out of that asset sometime in the fourth quarter [of 2012]” • Initial production from the first Bacchus development well did not occur until April 30, 2012 By that time, Endeavour already announced its major ConocoPhillips acquisition and a $500 million senior note offering, putting additional leverage and a huge interest burden on the Company without the Bacchus cash flows due to the delays • Then on the first quarter of 2013 earnings call Mr. Transier offered explicit guidance for production potential at Bacchus: “So with the third well on line, B1, we expect to see Bacchus delivering gross production in line with the higher end of expectations, which is around 16,000 to 18,000 barrels of oil per day” • Endeavour reiterated this guidance on its next quarterly conference call: “So we haven’t, in our view, reached steady-state production from all three wells. So there may be more to come from B1 when we bring it on together with the other two wells. We’ll see when it all settles out at. We expect to see production at least to the levels that we’ve talked about, approaching 18,000 barrels a day, gross production” (Second quarter of 2013 earnings call. Source: Bloomberg transcript) Appendix: History of Misinformation (Enercom Conference on August 16, 2011. Source: Bloomberg transcript) (First quarter of 2013 earnings call. Source: Bloomberg transcript) May 1, 2009 April 30, 2014 $11.13|$3.44 (–69.1%) Value Destruction |

|

32 History of Misinformation: Bacchus (continued) • At a conference, Mr. Transier told investors that Bacchus was producing 18,000 barrels per day “The three wells now combined are producing around 18,000 BOEs a day... So, a great success story for us” (Johnson Rice & Company Conference on October 2, 2013. Source: Bloomberg transcript) • A month later, however, Endeavour announced in its third quarter earnings release that Bacchus was producing just 13,000 barrels a day, which Endeavour said was “in line with expected field performance” • When asked about this decline on the conference call Mr. Transier retreated from his prior guidance of at least 16,000 to 18,000 barrels a day: “I think it’s expected decline, Steve. I mean we – the numbers that you’re talking about were the initial production rates that were put out by Apache at the time of the last quarter, and we did have some initial production rates that were in that 17,000 BOEs a day. But what I think Derek would tell you is that this is actually ahead of what we thought the full field performance would be at 13,000 BOEs a day…. And we’ve tried not to give people the idea that it was going to be producing at 17,000 BOE a day last time…I would say this, this is right in line with our expectations and we will continue to have declines until we put water injection into this” (Third quarter of 2013 earnings call. Source: Bloomberg transcript) • Mr. Transier claimed these declines were expected but when asked about decline rates for Bacchus earlier during the year he gave a very different outlook: “I don’t think we’re, Dave, seeing very much in the way of decline this year on these two wells. What surprises us to the positive is the performance of the first well. It’s production profile is now flat, whereas we expected that to continue declining through this year. So we’re seeing none of that happening and the performance of the second well it’s still on plateau, and we expect that to be on plateau right the way through this year.” (First quarter of 2013 earnings call. Source: Bloomberg transcript) Appendix: History of Misinformation May 1, 2009 April 30, 2014 $11.13|$3.44 (–69.1%) Value Destruction |

|

33 History of Misinformation: Rochelle • While weather-related damage to the first East Rochelle well was admittedly out of Endeavour’s control, in the years leading up to the storm Mr. Transier guided to Rochelle entering production in the fourth quarter of 2012 After Endeavour missed this deadline, Mr. Transier modified the expected production date to January 2013 Endeavour announced the suspension of drilling operations due to the storm on February 14, 2013 • On the first quarter of 2013 earnings conference call Mr. Transier guided to first production at the West Rochelle well by the middle of the year Routine summer maintenance at the Scott Platform typically occurs in the July and August timeframe, therefore there was always the risk that West Rochelle would not start production before this maintenance period and that first production would need to be pushed out by several additional months Mr. Transier did not discuss this risk with stockholders until July 10, 2013, a day before the planned shutdown, when he pushed out the timeframe for first production at West Rochelle to September, 2013 • At a conference, Mr. Transier reiterated his September guidance for first gas at Rochelle (Imperial Capital Conference on September 19, 2013, source: Bloomberg transcript) First production at West Rochelle was not announced until October 25, 2013 • Not only did Endeavour repeatedly miss its own deadlines but it also misinformed investors as to how quickly Rochelle would ramp up to full capacity: “Well, Steve, as we’ve previously said, the ramp-up typically of a gas well is fairly quick once it comes online…But a gas well typically comes online very, very quickly from zero to full capacity within days, providing all the process system works as designed” (Second quarter of 2013 earnings call. Source: Bloomberg transcript) As of January 6, 2014 – over 10 weeks after first production was announced – Rochelle was only producing at less than 70% of full capacity Appendix: History of Misinformation May 1, 2009 April 30, 2014 $11.13|$3.44 (–69.1%) Value Destruction |

|

34 History of Misinformation: Marcellus • On July 18, 2011, Endeavour announced it entered into a purchase and sale agreement with SM Energy to acquire assets in the Marcellus shale for $110 million We believe this was a poorly conceived transaction since it increased leverage prior to having the North Sea related cash flows online • Astonishingly, Mr. Transier admitted to raising the capital before completing due diligence • "We are excited about it. We haven't formally closed on it. We have raised the capital already. And many of you've asked me about that, but I'll show you that in a minute when we go through our capital structure. But we did raise the capital, we are in a position to close once we get to our due diligence done, we're excited about it" (Johnson Rice & Company Energy Conference on October 5, 2011. Source: Bloomberg transcript) • On December 14, 2011 Endeavour terminated the acquisition of the Marcellus assets citing title defects and the poor condition of the pipeline Meanwhile, stockholders were left with $135 million of incremental debt, further equity dilution, loss of a $6 million deposit and a lawsuit filed by the seller for breach of contract • On April 16, 2014, Endeavour finally settled with SM Energy for a total cost to stockholders of $19.3 million, including the issuance of warrants to purchase 2.13 million shares at $5.29 per share • Court records show that Mr. Transier met with SM Energy to try to extricate Endeavour from its purchase obligation “At that meeting, Mr. Transier asserted that Endeavour had liquidity problems with its capital commitments related to two wells currently being drilled in the North Sea and that its board/investors did not want to consummate the transactions” (Plaintiffs' First Amended Petition. Source: Harris County District Clerk) Appendix: History of Misinformation May 1, 2009 April 30, 2014 $11.13|$3.44 (–69.1%) Value Destruction |

Information relating to the above-named participants in this proxy solicitation is filed herewith as Exhibit 1.

STOCKHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO SOLICITATION OF PROXIES BY TALISMAN GROUP INVESTMENTS, L.L.C. AND ITS AFFILIATES FROM THE STOCKHOLDERS OF ENDEAVOUR INTERNATIONAL CORPORATION FOR USE AT THE 2014 ANNUAL MEETING OF ENDEAVOUR INTERNATIONAL CORPORATION WHEN THEY ARE AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. WHEN COMPLETED, SUCH MATERIALS WILL, ALONG WITH OTHER RELEVANT DOCUMENTS, BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE ATHTTP://WWW.SEC.GOV OR BY CONTACTING THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI PARTNERS, TOLL FREE AT (877) 869-0171, OR BY EMAILTO INFO@OKAPIPARTNERS.COM.

EXHIBIT 1

Direct and indirect interests of participants in the solicitation.

| | | | | | |

Participant | | Securities of Endeavour

International Corporation

beneficially owned | | | Other Interests |

Talisman Group Investments, L.L.C. | | | 7,620,570 | * | | |

Talisman Realty Capital Master, L.P. | | | 7,620,570 | * | | |

Talisman Group Partners, L.L.C. | | | 7,620,570 | * | | |

The Talisman Group L.L.C. | | | 7,620,570 | * | | |

Talisman Family, L.L.C. | | | 7,620,570 | * | | |

Jason Taubman Kalisman | | | 7,620,570 | * | | |

| * | Talisman Realty Capital Master, L.P., a Cayman Islands exempted limited partnership (the “Talisman Fund”) is the beneficial owner of 7,620,570 shares of the Registrant’s common stock, par value per share $0.001 (“Common Stock”) consisting of (a) 2,000,000 shares of Common Stock, (b) 1,620,570 shares of Common Stock issuable upon conversion of the Registrant’s 5.5% Senior Notes due 2016, and (c) 4,000,000 shares of Common Stock deliverable upon exercise of options that are exercisable within 60 days of the date hereof. |

Talisman Group Partners, L.L.C., a Delaware limited liability company (“Talisman GP”), is the general partner of the Talisman Fund. Talisman Group Investments, L.L.C., a Delaware limited liability company (“TGI”), is the investment manager of the Talisman Fund. The Talisman Group L.L.C., a Delaware limited liability company (“Talisman Group”), is the manager of TGI. Talisman Family, L.L.C., a Delaware limited liability company (“Talisman Family”), is the manager of Talisman Group. Jason Taubman Kalisman is the managing member of Talisman Family. Due to the relationships described above, Talisman GP, TGI, Talisman Group, Talisman Family, and Mr. Kalisman may be deemed to share voting and dispositive power with respect to shares held by the Talisman Fund. Each of these entities and Mr. Kalisman disclaims beneficial ownership of the securities held by the Talisman Fund except to the extent of any pecuniary interest therein.