UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| þ | Definitive Additional Materials | |

| ¨ | Soliciting Material pursuant to §240.14a-12 | |

Endeavour International Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) Title of each class of securities to which transaction applies:

| ||||

(2) Aggregate number of securities to which transaction applies:

| ||||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||||

(4) Proposed maximum aggregate value of transaction:

| ||||

(5) Total fee paid:

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the Offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) Title of each class of securities to which transaction applies:

| ||||

(2) Aggregate number of securities to which transaction applies:

| ||||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||||

(4) Proposed maximum aggregate value of transaction:

| ||||

(5) Total fee paid: | ||||

Endeavour International Committed to Delivering Value for All Stockholders May 8, 2014 |

2 This is an oral presentation which is accompanied by slides. Investors are urged to review our SEC filings. This presentation contains certain forward-looking statements regarding various oil and gas discoveries, oil and gas exploration, development and production activities, anticipated and potential production and flow rates; anticipated revenues; the economic potential of properties and estimated exploration costs. Accuracy of the projections depends on projections / speculations about events that change over time and is thus susceptible to periodic change based on actual experience and new developments. Endeavour cautions readers that it assumes no obligation to update or publicly release any revisions to the projections in this presentation and, except to the extent required by applicable law, does not intend to update or otherwise revise the projections. Important factors that might cause future results to differ from these projections include: variations in the market prices of oil and natural gas; drilling results; access to equipment and oilfield services; unanticipated fluctuations in flow rates of producing wells related to mechanical, reservoir or facilities performance; oil and natural gas reserves expectations; the ability to satisfy future cash obligations and environmental costs; and general exploration and development risks and hazards. The Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only proved reserves, but also probable reserves and possible reserves that meet the SEC's definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. We may use certain terms in our presentations, such as "reserve potential," that the SEC's guidelines strictly prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. In addition, we do not represent that the probable or possible reserves described herein meet the recoverability thresholds established by the SEC in its new definitions. |

Forward-looking Statements This presentation contains certain “forward-looking statements,” as such term is defined in Section 21E of the Securities Exchange Act of 1934, as amended, relating to future events and the financial performance of Endeavour. Such statements are only predictions and involve risks and uncertainties, resulting in the possibility that the actual events or performance will differ materially from such predictions as a result of certain risk factors. As such, readers are cautioned not to place undue reliance on forward- looking statements, which speak only as to management’s plans, assumptions and expectations as of the date hereof. Please refer to Endeavour’s Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC on March 17, 2014, Form 10-K/A filed on March 21, 2014 and other filings for a discussion of material risk factors. Endeavour disclaims any duty to update or alter any forward- looking statements, except as required by applicable law. Important Additional Information Endeavour, its directors, director nominees and certain of its executive officers are participants in the solicitation of proxies from Endeavour’s stockholders in connection with Endeavour’s 2014 Annual Meeting of Stockholders. Endeavour has filed its definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) with respect to the 2014 Annual Meeting of the Stockholders. ENDEAVOUR STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS), THE ACCOMPANYING WHITE PROXY CARD AND ALL OTHER MATERIALS FILED BY ENDEAVOUR WITH THE SEC AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the names of Endeavour’s directors, director nominees and executive officers and their respective interests in Endeavour, by security holdings or otherwise, is set forth in Endeavour’s definitive proxy statement and other materials filed with the SEC. Additional information can also be found in Endeavour’s Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC on March 17, 2014 and Form 10-K/A filed on March 21, 2014. These documents, including the definitive proxy statement (and any amendments or supplements thereto) and other documents filed by Endeavour with the SEC, are available for no charge at the SEC’s website at www.sec.gov and at Endeavour’s investor relations website at www.endeavourcorp.com/2014AnnualMeeting.htm. 3 |

Executive Summary As owners of over 6% of Endeavour’s common stock, the interests of the Board and management team are fully aligned with all stockholders Endeavour takes corporate governance seriously, regularly engages with stockholders and frequently reviews the Board’s composition and best practices Endeavour has a clear and achievable strategy to drive long-term stockholder value Endeavour has the right board and leadership to deliver stockholder value now and into the future Endeavour welcomes new ideas and fresh perspectives on our Board. A majority of Endeavour’s Board has turned over in just the last three years (60%), including two new independent directors this year, one of whom was recommended to us by one of its largest stockholders in 2013 and who appeared on Talisman’s initial slate of two nominees The Endeavour Board feels strongly that the addition of Mr. Kalisman is not in the best interests of the Company or its stockholders. Talisman has not presented a plan to achieve value creation, and its director nominee, Mr. Kalisman, does not possess the necessary experience or qualifications to add value to the Company 4 |

Independent, active and well-qualified Board Strong governance practices Talisman has no detailed plan to create value Talisman’s interests are NOT aligned with those of the stockholders and Talisman is seeking a short-term, opportunistic gain Agenda Endeavour has the right Board, the right team and the right strategy to deliver value to ALL stockholders Overview of Endeavour Endeavour at a glance Strategic plan for value creation Portfolio of high-quality assets Financial profile Setting the Record Straight 5 |

OVERVIEW OF ENDEAVOUR 6 |

7 Endeavour at a Glance Distinctive Portfolio • Exceptional operating margins from three core assets • Brent crude oil and European natural gas exposure • Developing U.S. resource plays at very low cost Strong Production Growth • All three U.K. developments on-line • Rochelle – Gas with associated condensate • Alba – Brent priced oil • Bacchus – Brent priced oil • 2013 physical production volumes increased to 9,922 boepd – a 126% increase year-over-year • 2013 Adjusted EBITDA increased to $203.3 million – a 157% increase year-over- year • 4 quarter average daily production of 12,422 boepd • Proved and probable reserves of 40.1 MMBOE th |

2013 Accomplishments Sale of 50% of upstream and midstream assets in the Pennsylvania Marcellus and formed a joint venture with Samson Exploration, LLC • Partnership has fracture stimulated two wells and plans to complete the third previously drilled and cased horizontal Marcellus well in June 2014. • Tied into third-party pipeline that allows firm capacity of up to 10 Mmcf/d, with potential for future expansion JV delivers the capital necessary for the next phase of development in the core Daniel Field area in Cameron County Rochelle field achieved production Third Bacchus production well completed in July Entered into a monetary production payment for $125 million in Q1 2013 for a portion of production from Alba field, increasing liquidity to fund the development program • Expanded the agreement in August and December 2013 to $175 million Entered into forward sale agreements for a total of $45 million Closed the London office and consolidated technical teams in Aberdeen • $15 to $20 million of annual cash savings expected Discovered by Endeavour in 2012 Significant upside and prospectivity in adjacent Endeavour operated acreage 8 Operations Samson Joint Venture Rossini |

STRATEGIC PLAN 9 |

Your Board Is Delivering on Its Strategic Plan 10 Since announcing the commencement of the Board’s strategic review process in February 2013, the Board has: Concluded its strategic review and determined it was in the best interest of stockholders to continue to execute our business plan, rather than disposing of assets or businesses at less than favorable valuations Increased production by 126% year-over-year Increased Adjusted EBITDA by 157% year-over-year Withstood and addressed multiple operational difficulties at Rochelle and achieved first production at that location Closed London office and consolidated technical teams in Aberdeen, Scotland resulting in an expected annual cash savings of $15 to $20 million Refinanced term loan and procurement agreements at a significantly lower cost of capital, a combined interest rate reduction of approximately 4.75% (from 13% to approximately 8.25%) Entered into monetary production payment in the U.K. for $175 million for a portion of production from the Alba field, increasing liquidity to fund development program at Rochelle |

Improve and maintain production across portfolio Reduce G&A, cost of capital and work to strengthen the balance sheet Maintain operational margins in existing asset base Accelerate value capture from existing portfolio – Rossini in the U.K., the Piceance Basin and Pennsylvania Marcellus in the U.S. Continue to pursue the development of exploration inventory through joint ventures with partners who share our strategic vision Creating Value in 2014 Endeavour is focused on the continued successful execution of the Company’s strategic plan to maximize stockholder value 11 |

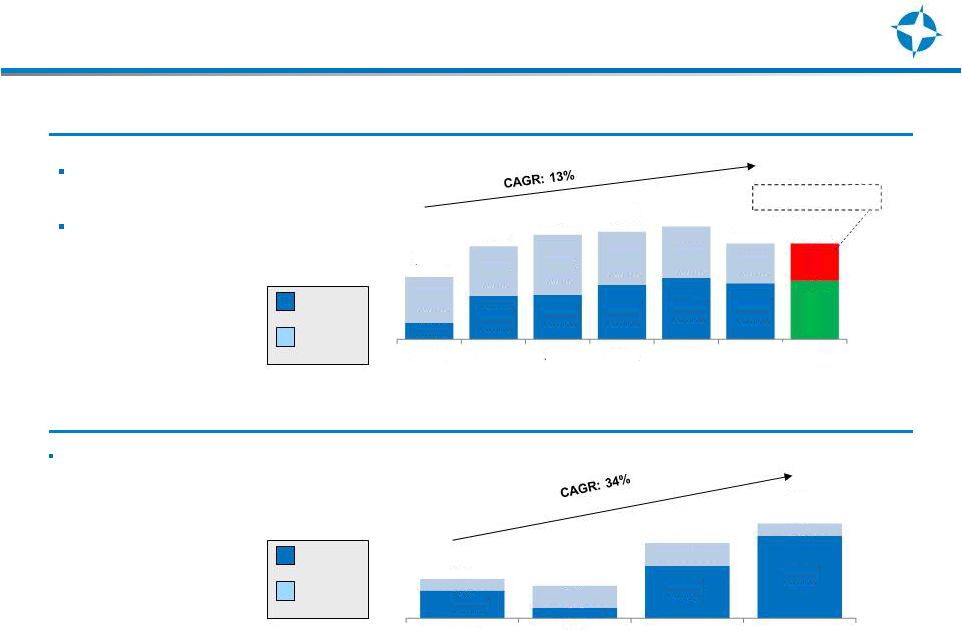

Endeavour’s Growing Resource Base Asset base has become increasingly oil weighted 87% of proved and probable (2P) gas reserves are in the U.K. Reserve Growth Production Growth Production has grown over time with significant contribution increases from the North Sea (Mboe/d) 12 (MMboe/d) Proved Probable U.K. 6.8 18.2 18.7 22.7 25.7 23.5 61% Oil 19.3 20.7 25.0 22.3 21.5 16.6 39% Gas 26.1 38.9 43.7 45.0 47.2 40.1 100% 2008 2009 2010 2011 2012 83% U.K. gas 2013 2.9 1.1 5.5 8.6 1.2 2.3 2.4 1.3 4.1 3.4 7.9 9.9 2010 2011 2012 2013 U.S. |

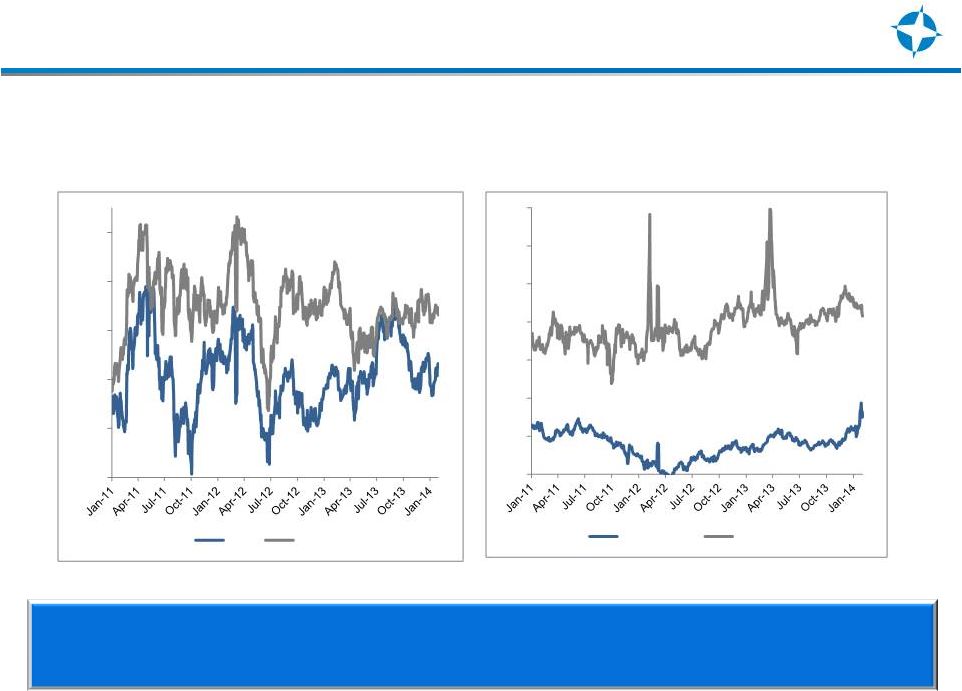

Production Sold Into Higher-Valued European Markets Crude Oil Natural Gas Average spread over the period: $14.34 Average spread over the period: $6.21 13 Leveraging robust pricing in European markets $75 $85 $95 $105 $115 $125 WTI Brent $2 $4 $6 $8 $10 $12 $14 $16 Henry Hub UK NBP |

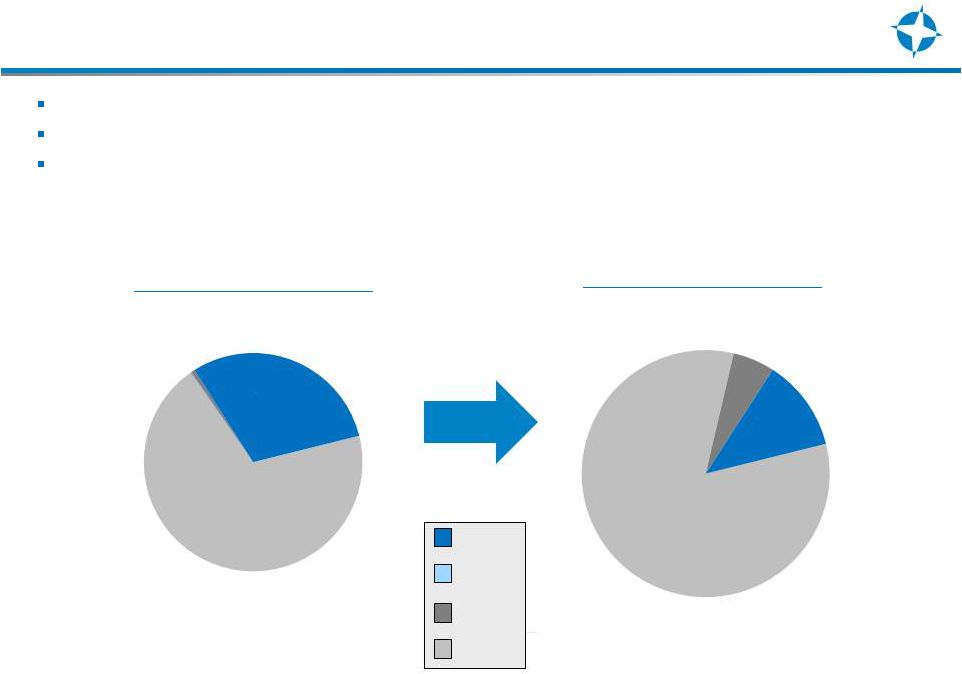

Production volume up 27% year-over-year Increasing production in higher valued commodity markets Brent and U.K. NBP prices have averaged ~$108.46 and ~$10.63, respectively for 2013$$$$ Significant Proved Reserves and Production 2012 Production Volumes 2013 Production Volumes 14 Full Year = 7,868 BOEPD Full Year = 10,017 BOEPD US Oil UK Gas UK Oil 69% 1% 30% 83% 5% 12% US Gas |

HIGH-QUALITY ASSETS 15 |

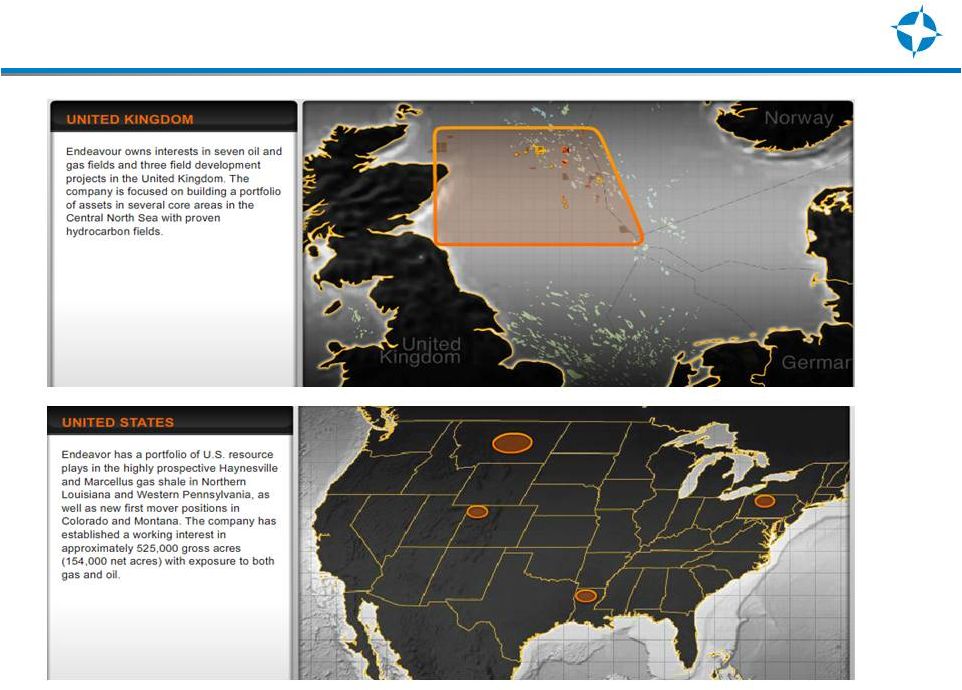

Endeavour’s Operations 16 |

U.S. & U.K. Assets 17 |

FINANCIAL PROFILE 18 |

Reserve Valuation Reserve Valuation 12-31-2013 (1) Excluding monetary production payment of $162 million. ($ in millions) 19 Poised to realize the results of our capital investments Note: Data per NSAI reserve report 12-31-2013. $1,531 $773 $883 $848 2P and 3P PV-10 1P PV-10 Total debt Net debt $2,309 (1) (1) |

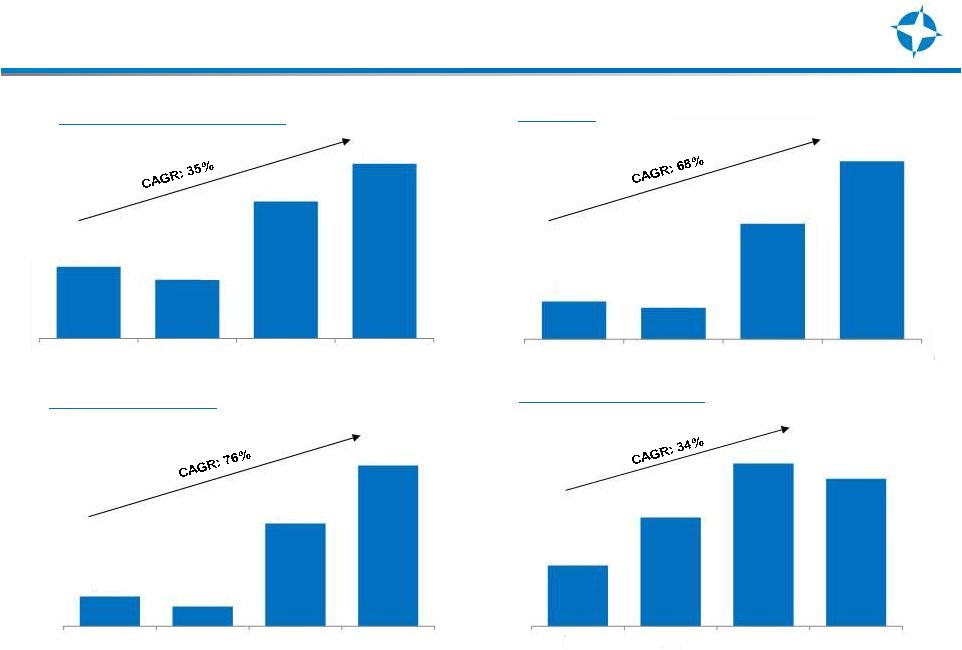

Historical Financials Summary ($ in millions) ($ in millions) ($ in millions) Average Daily Production Revenue Adjusted EBITDAX Capital Expenditures 20 (boepd) $37.6 $25.1 $129.9 $203.3 2010 2011 2012 2013 $92.0 $165.1 $246.9 $223.7 2010 2011 2012 2013 $71.7 $60.1 $219.1 $337.7 2010 2011 2012 2013 4,115 3,382 7,868 10,017 2010 2011 2012 2013 |

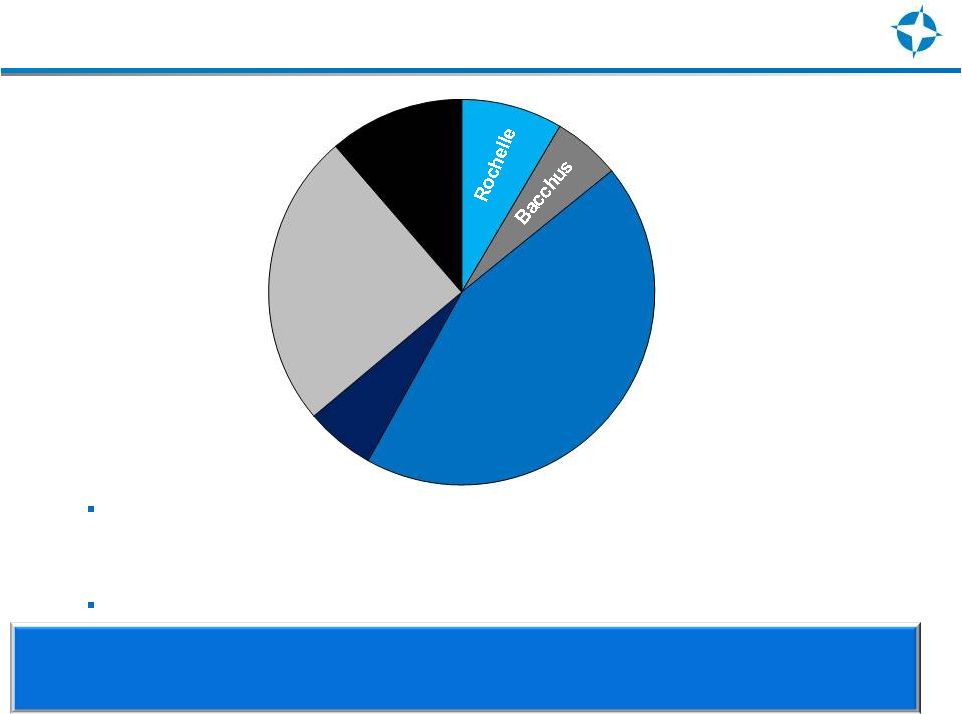

2014 Direct Capital Expenditure Budget 21 U.S. Other Colorado Alba U.K. Other 2014 Direct CapEx = $60 million - $80 million • U.K. = $40 million - $55 million • U.S. = $20 million - $25 million Decommissioning costs for IVRR, Renee and Rubie fields = $50 million Capital expenditure down by approximately 60% in 2014 and development phase has concluded |

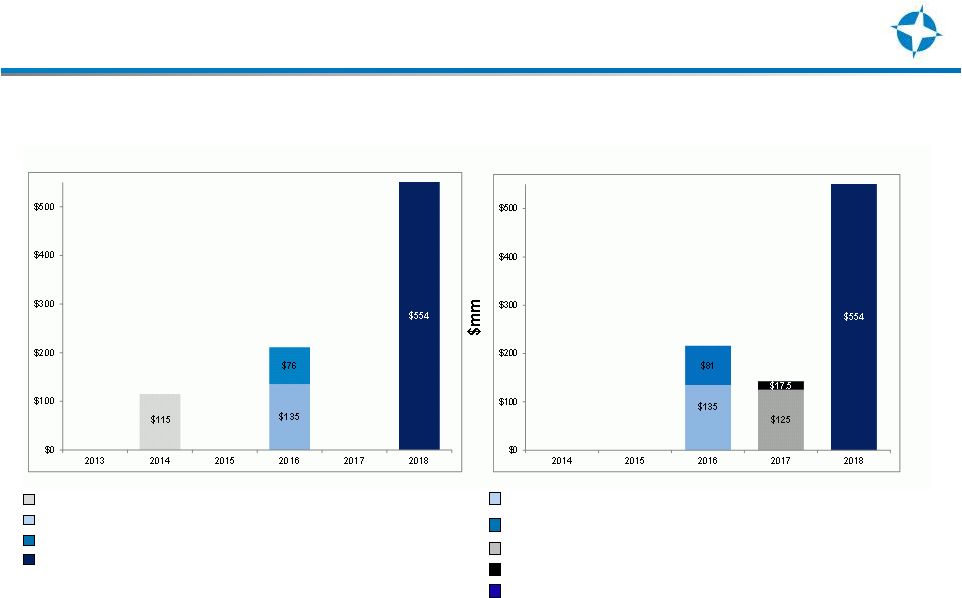

Debt Maturity Schedule Convertible Notes due 2016 at 5.5% ($18.52 per share conversion price) Convertible Bonds due 2016 at 7.5% ($16.52 per share conversion price) Senior Notes due 2018 at 12% Senior Secured First Lien Term Loan due 2017 at 8.25% Convertible Notes due 2017 at 6.5% ($4.66 per share conversion price) 22 Q3 2013 Convertible Notes due 2016 ($18.52 per share conversion price) at 5.5% Convertible Bonds due 2016 ($16.52 per share conversion price) at 11.5% Senior Notes due 2018 at 12% Revolving Credit Facility due 2014 at 13% Q1 2014 |

Attractive Margins and Expense Structure 23 $106.00 Cash Operating Expense Operating Cash Flow $9.00 $97.00 NBP Spot Cash Operating Expense Operating Cash Flow $106.00 Cash Operating Expense Operating Cash Flow $20.00 $86.00 Note: Cash operating expense is midpoint of management estimates. Brent Spot Brent Spot $1.50 $11.00 Alba Bacchus Rochelle $9.50 23 $/boe $/boe $/mcfe Low operating costs driving strong cash flow |

SETTING THE RECORD STRAIGHT 24 |

An Experienced, Independent and Proven Group of Leaders Independent oversight • 6 of 7 current directors are independent • All key committees are independent • Average director tenure is 7 years A refreshed Board • Board membership has changed almost 60% over last three years, including the appointment of James Browning and nomination of William Lancaster • In 2014, added two highly qualified independent directors, William Lancaster (if elected at the upcoming annual meeting), and James Browning • 3 former CEO’s and other relevant executive experience among 6 independent directors • Significant experience serving on other public boards as well as accounting, financial, legal and industry expertise Interests aligned with ALL stockholders • Directors collectively own over 6% of the common stock • CEO owns 1.2 million shares (2.2%), with exposure to 1.3 million additional shares if equity performs in the top 10% of its peer group, or 685,000 shares if performance is at 50% of peer group • Appreciates and welcomes stockholder input, as evidenced by Mr. Lancaster’s nomination An active and engaged Board • Directly involved in positioning the Company for long-term growth, including the strategic review process conducted in 2013 • Continuously evaluates the needs and strengths of the Board • Thorough and deliberate director nominee evaluation process 25 Endeavour’s current Board has the relevant experience and qualifications necessary to continue to deliver effective and independent oversight and direction • Mr. Lancaster was recommended by one of Endeavour’s largest stockholders in early 2013; the Board and Governance and Nominating Committee reviewed Mr. Lancaster’s candidacy and voted to nominate him for election at the 2014 Annual Meeting |

Board with Necessary Experience and Expertise Director Nominees 26 7 highly qualified directors; 6 independent; 4 have been added in the past 3 years William D. Lancaster brings over 34 years of U.S. onshore oil and gas experience to the Board of Directors. The technical and management knowledge acquired by Mr. Lancaster throughout his career in both public and private companies is especially valuable to the Board. James H. Browning brings almost 40 years of public company accounting experience to the Board of Directors in addition to experience in the energy sector. His in-depth knowledge of oil and gas, financial markets and securities regulation is of immense value to the Board of Directors. Mr. Browning qualifies as an audit committee financial expert under SEC guidelines. John B. Connally III brings many years of experience as a successful independent oil and gas investor, attorney and business executive to the Board of Directors. As the founder of several oil and gas exploration and production companies and former partner of Baker Botts, one of the most prestigious energy law firms in the country, Mr. Connally is well versed in our industry. Mr. Connally qualifies as an audit committee financial expert under SEC guidelines. Continuing Directors John N. Seitz brings his many years of experience in executive and management roles within the oil and gas industry to the Board of Directors. Mr. Seitz also brings his knowledge and expertise as a petroleum geologist to the Board of Directors. William L. Transier serves as our Chief Executive Officer and President and brings his invaluable perspective as our top executive officer to the Board. Mr. Transier also brings his 38 years of experience in international energy and public companies to the Board of Directors, including a strong financial foundation from his experience as a CPA, as a partner in an international accounting firm and as a Chief Financial Officer prior to founding and leading the Company. He has served on multiple public company boards as lead director and as chairman of audit and compensation committees. Sheldon R. Erikson brings more than 40 years of energy industry experience, knowledge and insight to the Board of Directors. His experience in the design, engineering and marketing of energy products and services is especially valuable to the Company. Mr. Erikson has served on multiple public company boards as chairman, CEO, lead director and as chairman of key committees. He also brings over 20 years of corporate governance experience to the Board of Directors. He was the CEO of a major international energy and a fortune 500 company for 14 years. Nancy K. Quinn brings her many years of experience in the U.S. financial services industry as well as her superior business leadership skills to the Board of Directors. Ms. Quinn qualifies as an audit committee financial expert under SEC guidelines. |

Management Incentives Aligned with Stockholders Pay for performance – Majority of executive officer pay is performance-based and not guaranteed In 2013, total target annual incentive bonus and performance-based long-term incentives were 80% of our CEO’s total target compensation Focus on shareholder return performance – Endeavour grants long-term TSR performance shares to executives that vest solely upon achievement of multi-year TSR results relative to peer companies, and long-term cash performance awards with payouts dependent upon the Company’s stock performance over a three-year period Independent compensation committee – Compensation Committee, which is comprised solely of independent directors, reviews and approves all elements of CEO and other named executive officer compensation Independent compensation consulting firm – Compensation Committee retains an independent compensation consultant to advise on executive compensation matters and best practices Stringent stock ownership guidelines – Required ownership levels are expressed as a multiple of annual base salary and are six, three and five times for our CEO, other named executive officers and directors, respectively 27 |

Endeavour’s Board has Relevant Experience and Qualifications Endeavour’s Board has the relevant experience and qualifications necessary to continue to deliver effective and independent oversight and direction Exploring and developing oil and gas properties Managing international oil and gas investment portfolios Legal, finance, auditing, accounting, and mergers and acquisitions CEO and other pertinent executive experience Significant experience serving on public company boards 28 Talisman’s nominee adds no experience or expertise that is not already amply and better represented on your Board of Directors or that is specifically relevant to Endeavour |

Endeavour Has Attempted to Engage with Talisman The Company has not had contact with, or been contacted by, Mr. Kalisman since Endeavour CEO Bill Transier, on behalf of the Board of Directors and management team, spoke with him on March 26, 2014. In this conversation, Mr. Kalisman promised he would present his ideas for the Company in a written document to be reviewed by Endeavour’s Board of Directors. To date, no such document has been presented. Following the March 26 conversation, Mr. Kalisman did not reply to any requests for communication. The last time the Company attempted to contact Mr. Kalisman was on April 7, 2014 when Mr. Transier called Mr. Kalisman’s office at a time scheduled with his secretary to discuss the Board of Director’s nomination of Mr. Lancaster. His office took a message and promised a call back. There was never a call back, and the Company has had no communication with Mr. Kalisman or his Company since March 26. Endeavour has attempted to have discussions with Talisman to avoid a costly and disruptive proxy contest, but Talisman has ignored the Company’s outreach 29 |

Talisman’s Interests are not Aligned with ALL Stockholders Talisman owns only 3.67% of Endeavour’s common stock The remainder of the dissidents’ beneficial ownership is based on ownership of out-of-the- money convertible notes (with a conversion price of $18.512 per share) and call options (with an exercise price of $5.00 per share). Conversion of these notes and options, which are considerably above today’s market price, makes the “beneficial ownership” in the underlying shares illusory from an economic perspective. These notes and options were not converted or exercised prior to the record date and therefore have no voting power regarding the underlying shares at the Annual Meeting. As part of what appears to be a self-serving agenda, on February 4, 2014 and prior to nominating himself, Mr. Kalisman told Mr. Transier that he wanted the Company to buy him out of his convertible notes at a price significantly higher than current market value. Mr. Kalisman, who is the second largest holder of our 5.5% convertible notes, repeated this demand during a phone call with Mr. Transier on March 26, 2014. This demand would enrich Mr. Kalisman at a significant cost to Endeavour’s stockholders. 30 Talisman is seeking a short-term opportunistic gain as a creditor and at the expense of the other stockholders of Endeavour Talisman is seeking a short-term opportunistic gain |

Endeavour’s CEO Is a Proven Leader Bill Transier is a highly respected oil and gas entrepreneur with over 38 years of industry experience • Former partner and head of worldwide energy practice at KPMG • Former Chief Financial Officer at Seagull Energy Corp. and Ocean Energy, Inc. Founder of Endeavour International Corporation 10 years E&P experience in the U.K. North Sea • A demonstrated thought leader in this arena • Fought for access to infrastructure • Fought for equitable decommissioning costs • Entered into, what we believe is, the first ever Monetary Production Payment (MPP) in the U.K. • Under his stewardship, Endeavour has succeeded in the North Sea where many E&P companies of similar size have failed Served on numerous public company boards including US Steel, Relient Resources, Cal Dive International and Helix Energy Solutions • Has held key positions on all boards including: • Lead independent director • Audit committee chairman • Compensation committee chairman 31 |

Mr. Connally’s Experience and Qualifications Far Outweigh Those of Mr. Kalisman 32 Experience and Qualifications John Connally III Jason Taubman Kalisman Energy industry experience • Over 40 years of experience as an independent energy investor and proven entrepreneur • Current chairman and CEO of Gulf United Energy, Inc., a publicly traded oil & gas exploration and production (E&P) company, and former CEO and President of BPK Resources, a publicly-traded E&P company NONE Structured oil & gas financial transactions experience • Former partner in the prestigious law firm of Baker Botts and specialized in corporate finance transactions principally for the oil & gas and oil field services industries NONE Entrepreneurial experience • Founder and principal of a number of privately-held E&P companies, including Pure Gas Partners Ltd. • Founded investment firm, Talisman Group Investments Public board experience Mr. Connally’s experience far outweighs that of the dissident nominee’s – Mr. Connally is the obvious and clear choice FIVE ONE • Has served on Endeavour’s Board and its predecessor since 2002 • Initial director of Nuevo Energy • Initial director and CEO of both Pure Energy Group, Inc. and Pure Gas Partners • Former director of BPK Resources • Morgans Hotel Group - during Mr. Kalisman’s tenure on the Board, he was involved in two proxy fights and a lawsuit against his fellow directors |

Setting the Record Straight 33 Dissident Claim FACT Talisman is targeting Endeavour‘s Lead Independent Director, John B. Connally III, and proposing he be replaced by Jason Kalisman, Talisman’s CEO, claiming that Mr. Kalisman is a better choice for stockholders. • Mr. Connally brings to the Board over 40 years of experience as a successful, independent oil and gas investor, attorney and businessman. • Mr. Kalisman has no previous experience in the oil and gas industry, let alone in the challenging U.K. North Sea, or in oil and gas financial transactions. Mr. Kalisman claims that he wants to join the Endeavour Board of Directors to “correct poor corporate governance practices.” • The Board takes corporate governance seriously, regularly engages with stockholders and frequently reviews the Board’s composition and best practices. • Membership has changed by almost 60% over past 3 years, including appointment of Mr. Browning and nomination of Mr. Lancaster. • The Board takes the views of stockholders seriously and has discussions on a regular basis – one of the Company’s largest stockholders had recommended Mr. Lancaster as a potential Director nominee in early 2013. • Board owns over 6% of common stock – interests are aligned with all stockholders • Executive compensation includes practices to drive performance and to serve our stockholders’ long-term interests . Mr. Kalisman believes the Company would be worth more following “a change in strategy.” • Talisman has yet to articulate a concrete strategy to improve upon the results the Endeavour Board and management team have achieved. |

Setting the Record Straight 34 Dissident Claim FACT Talisman refers to itself as a “significant” or even the “largest” stockholder” of Endeavour in reference to its 14.67% “beneficial ownership.” • This claim is disingenuous, since Talisman holds only 3.67% of the outstanding shares. The remaining portion of their ownership is based on out-of-the-money convertible notes and options. • Talisman is the second largest holder of our 5.5% convertible notes and is looking out for interests of creditors, NOT stockholders. Mr. Kalisman claims that he and Mr. Lancaster had “several conversations with the Company regarding its business strategy and board composition” during the week of March 31, 2014. • Company has not had contact with, or been contacted by, Mr. Kalisman since Endeavour CEO Bill Transier, on behalf of the Board of Directors and management team, spoke with him on March 26, 2014. • Mr. Kalisman promised he would present his ideas for the Company in a written document and to date, no such document has been presented. • Last time Company attempted to contact Mr. Kalisman was on April 7, 2014 when Mr. Transier called Mr. Kalisman’s office at a scheduled time to talk about the lack of response from the March 26th conversation and discuss the Board of Director’s nomination of Mr. Lancaster. His office took a message and promised a call back. • The Company never received a call back, and the Company has had no communication with Talisman since then. Talisman takes issue with Bill Transier Talisman ignores Mr. Transier’s experience: • 38 years experience • Former partner at KPMG – head of worldwide energy practice • Former CFO at Seagull and Ocean Energy • Founder and CEO of END • 10 years experience in U.K. North Sea • Has served on multiple public boards and has held key positions on all i.e. lead director, audit committee chair, comp committee chair: US Steel, Reliant Resources, Cal Dive International and Helix Energy Solutions |

Conclusion Endeavour has the right strategy to drive stockholder value Endeavour’s Board is independent and has the experience and qualifications to continue to provide excellent oversight and continue delivering value for ALL stockholders Endeavour regularly engages with stockholders and our Board is committed to aggressively pursuing the best interests of all Endeavour stockholders. We do not believe that Talisman will do the same Endeavour has made many attempts to engage with Talisman to avoid a costly and disruptive proxy contest, but they have ignored the Company’s outreach Talisman’s nominee adds no relevant skills, experience or expertise not already amply represented on the Board 35 |

APPENDIX 36 |

Appendix - Talisman’s Materials are Misleading and Incorrect ASSERTION FACT Mr. Kalisman is the Chief Executive Officer of Talisman Group Investments, L.L.C., an investment firm, which is the largest beneficial owner of Endeavour International Corporation (From Talisman’s preliminary proxy) This statement is misleading and false. Talisman Group Investments, based on information filed by the Company and Talisman, is not the largest beneficial owner of the Company. Their preliminary Proxy Statement refers to Talisman’s 14.67% beneficial ownership in the Company to support the claim that Talisman Group Investments is the “largest beneficial owner” of the Company. However, as stated in Endeavour’s definitive proxy statement filed with the SEC on April 17, 2014, Smedvig QIF Plc is the Company’s largest beneficial owner with 15.33% beneficial ownership. Furthermore, Talisman deliberately and deceptively mislead stockholders by failing to inform stockholders that Talisman only has voting power with respect to approximately 3.67% of the Company’s common stock—a point of particular importance with reference to voting at the Annual Meeting. If you agree that it is time for the Board of Directors to hold the Company’s management accountable, we urge you to vote for a much needed change (From Talisman’s preliminary proxy) Talisman makes the unsubstantiated and inflammatory claim that the Board has not held the Company’s management team accountable but do not refer to a single instance of the Board’s failure “to hold the Company’s management accountable.” During the week of March 31, 2014, Mr. Kalisman and Mr. Lancaster had several conversations with the Company regarding its business strategy and board composition. The Company then asked Mr. Lancaster to join its slate of director nominees to be elected at the Annual Meeting (From Talisman’s preliminary proxy) Mr. Kalisman had no contact with the Company at any time during the 7-day week commencing on March 31, 2014. The Company has not had contact with, or been contacted by, Mr. Kalisman by any means of communication—in-person meeting, phone, email, letter, fax or otherwise—since March 26, 2014 when Mr. Transier and Mr. Kalisman had a phone conversation. Mr. Kalisman did not reply to requests for communication made by Mr. Transier. The last time Mr. Transier attempted to contact Mr. Kalisman was on April 7, 2014 when Mr. Transier called Mr. Kalisman’s office at a scheduled time to talk about the lack of response from their March 26 conversation and discuss the Board’s nomination of Mr. Lancaster. His office took a message and promised a call back. There was never a call back, and the Company had no communication with Talisman since then. Endeavour believes there to be numerous inaccurate and false statements contained within both Talisman’s preliminary proxy statement and white paper – the most egregious of which are listed below 37 |

Appendix - Talisman’s Materials are Misleading and Incorrect ASSERTION FACT Mr. Jason T. Kalisman is a proven fiduciary (From Talisman’s white paper) Talisman’s white paper points to no experience of Mr. Kalisman on the board of any company. Led by Jason T. Kalisman, Talisman has extensive experience investing (From Talisman’s preliminary proxy) If Talisman and Mr. Kalisman are to be attributed with such “extensive experience,” the white paper should include, at a minimum, information that specifies where exactly their breadth of experience arises. No such information is provided. Undisclosed Dilution from Monetary Production Payment… The true cost of the expanded Monetary Production Payment was not announced in an earnings release or discussed openly during a conference call, but rather hidden in a separate Form 8-K filing (From Talisman’s white paper) The use of the terms “undisclosed” or “hidden” is false because this dilution was disclosed in a timely fashion in proper filings with the SEC. On March 11, 2013, the Company disclosed in a Current Report on Form 8-K the following information: “Contemporaneously with completion under the Sale and Purchase Agreement, the Company expects to issue 3,440,000 warrants to purchase shares of common stock at an exercise price of $3.014 per share (the “Warrants”).” (Form 8-K, March 11, 2013) Similarly, on May 28, 2013, the Company disclosed in a Current Report on Form 8-K the following information: “In connection with the entrance into the Supplemental Deed, on May 21, 2013, the Company entered into a Warrant Agreement for the Purchase Common Stock (the “Warrant Agreement”) with Macquarie Bank Limited (the “Investor”). Pursuant to the Warrant Agreement, the Company issued the Investor warrants (the “Warrants”) to purchase a total of 560,000 shares of the Company’s common stock at an exercise price of $3.685 per share (the “Exercise Price”). The Warrants expire on May 21, 2018 (the “Expiration Date”) and are subject to customary anti- dilution provisions.” (Form 8-K, May 28, 2013) We believe it is critical that the Board of Directors also include a stockholder representative. (From Talisman’s preliminary proxy All incumbent directors are also stockholders. To the extent this statement means or implies that the current directors do not represent the interests of stockholders, this is a statement of opinion for which no factual basis is offered. Talisman’s Proxy Statement does not point to a single fact supporting the claim that sitting directors do not represent stockholders. Mr. Kalisman does not have a material interest adverse to the Company. (From Talisman’s preliminary proxy) This statement is misleading and omits to state a material fact. Mr. Kalisman is a principal and an investor in entities that hold significant portions of the Company’s convertible debt. Insofar as Mr. Kalisman is a principal and an investor in one or more of the Company’s debt holders, Mr. Kalisman’s interests will be at odds with those of the stockholders in many situations, for example, should the Company consider selling assets to satisfy debts at the expense of stockholder value or seek a restructuring of its capital structure. 38 |

Appendix - Talisman’s Materials are Misleading and Incorrect ASSERTION FACT The 2014 Stock Incentive Plan would replace the Company’s current long- term incentive plans by consolidating the current plans and increase the number of shares of common stock available for issuance under awards by 2,075,000 shares, for a total of 5,016,204 shares which may be issued under the 2014 Stock Incentive Plan. This represents more than 10% of the shares of common stock currently outstanding. (From Talisman’s preliminary proxy) The figures presented by this statement contain factual inaccuracies and contribute to a gross distortion of the amount of shares that would be issuable under the Company’s proposal. The referenced proposal would add 2,075,000 shares to the Company’s 2014 Stock Incentive Plan which would result in a total of 2,980,039 shares, significantly less than the erroneous number provided by Talisman. Talisman’s Proxy Statement, without any support for its findings, irresponsibly overstates the number of shares that would be included by over 2,000,000 shares or approximately 40%. It would be overly burdensome to expect stockholders to make a rational decision regarding the adoption of the Company’s 2014 Stock Incentive Plan when forced to consider such flagrantly inaccurate information regarding such a material element of the plan. Value Destruction and Misinformation (From Talisman’s white paper) Talisman, by labeling an entire section in its white paper “Value Destruction and Misinformation,” makes the bold yet patently false allegation that the Company has attempted to deceive investors with no facts to support the allegation other than suggesting information was “hidden” in a publicly issued document in accordance with SEC protocol. This baseless and unsubstantiated act severely impugns the character of the Company with absolutely no merit to support doing so. As Lead Director, [John B. Connally III] is directly accountable for Company’s mistakes (From Talisman’s white paper) This blanket statement is baseless and misleading. It argues there is direct causation between actions allegedly taken by Mr. Connally and supposed mistakes by the Company without citing what these actions were or how they “directly” relate to mistakes which are also not cited. Additionally, this statement impugns the professional credibility of Mr. Connally in the form of a fact when it is an unsupported opinion. For months stockholders were forced to pay extremely high levels of interest costs with no associated cash flows from the “three oil fields” (From Talisman’s white paper) This statement is false, because the effective date of the acquisition was January 1, 2011. As a result, the Company was able to benefit from the economic impact of the acquisition during the period while the completion of the acquisition was still pending. 39 |

Appendix - Talisman’s Materials are Misleading and Incorrect ASSERTION FACT On March 3, 2014 the Company raised $25 million – with the potential for an additional $30 million at the purchaser’s option – in a privately negotiated deal at terms that were highly dilutive to stockholders (From Talisman’s white paper) The statement about an “additional $30 million at the purchaser’s option” is misleading because it ignores the fact that the Company’s exercise of its option to sell an additional $5 million of convertible notes to the purchaser would reduce the purchaser’s option on a dollar-for-dollar basis. On March 6, 2013, the Company disclosed in a Current Report on Form 8-K the following information: “In addition, if the closing price of the Company’s common stock exceeds $5.00 per share on any day within 30 days of March 3, 2014, the Company has the option (the “Company’s Option”) under the Purchase Agreement to sell up to an additional $5,000,000 of Notes; however, any such exercise would reduce the Purchasers’ Option by an equal amount.” (emphasis added) (Form 8-K, March 6) Moreover, the Company subsequently disclosed the exercise of its option in a timely fashion in a Current Report on Form 8-K on March 13, 2013. Implied a 23% expansion of the share base – with no stockholders vote – assuming full conversion of converts that were issued (From Talisman’s white paper) This statement is incorrect as this issuance represented less than 20% of the outstanding shares of common stock on an as-converted basis. In fact, any issuance in excess of 20% of the outstanding shares of the Company’s common stock would have required stockholder approval under the rules of the NYSE. We believe Endeavour should not have ignored officers from other institutions with terms that were more favorable for all stockholders (From Talisman’s white paper) This statement is false and misleading. It suggests that the Company received other offers and ignored them, when the fact is that the Company engaged a reputable investment bank, Credit Suisse, which was unable to line up a more favorable financing transaction. Board is still staggered which entrenches incumbents (From Talisman’s white paper) This statement is false and extremely misleading because it completely ignores the fact that the Board voluntarily elected to eliminate its classified structure on May 22, 2013, a process which has already begun and will be completed in 2016. 40 |

Appendix - Talisman’s Materials are Misleading and Incorrect ASSERTION FACT We believe Endeavour’s executive compensation is excessive versus its peers . . . . ;Excessive executive compensation despite poor performance ;CEO Bill Transier and Lead Director John Connally III have a track record of . . . extracting egregious personal compensation (From Talisman’s white paper) The white paper refers to the Company’s compensation policies, in certain parts, as “excessive” or “egregious” without clarifying that these are statements of opinion or belief. In all cases where such terms are used, the white paper fails to point to a reasonable factual basis that would support the statements. At best, for support, white paper only makes irrelevant and misleading observations comparing CEO compensation to market capitalization, comparing the Company in this regard to other companies. This method of evaluating compensation is almost unheard of in the oil and gas exploration industry or in any other industry of which the Company is aware. Moreover, the companies chosen for comparison were chosen seemingly at random or for the single purpose of supporting a preferred conclusion. This ostensible methodology is an unreasonable factual basis on which to cast aspersions on the Company’s compensation policies. In discussing compensation, the white paper also omits to state the material fact that 80% of the Company’s executive compensation is tied to performance. This is reflected clearly on the Company Proxy Statement (Form PREC14A, Apr. 4, 2014 at page 50), showing the substantial difference between compensation awarded versus realized in CEO compensation. “Focus on Aggressively Deleveraging the Balance Sheet” (From Talisman’s white paper) The white paper states that “deleveraging remains the Company’s most accretive incremental use of capital” without providing any analytical substantiation for the statement. The Company, for some time now, has noted the importance of deleveraging the balance sheet in multiple investor presentations . The egregious assertion, however, is the fact that Talisman ignores the structural and covenant related concerns arising from such a plan. Talisman’s state that the Company should consider issuing perpetual preferred stock without considering that the Company is severely limited by its debt covenants. In other words, Talisman’s statements about their proposed strategies to increase shareholder value are deceiving because they mislead investors into thinking that the Company’s failure to de-lever is a result of the Company’s failure to try to de-lever, when in fact, it is due to the Company’s complicated capital structure. 41 |

Appendix - Talisman’s Materials are Misleading and Incorrect ASSERTION FACT John B. Connally III . . . As Chairman of the Compensation Committee, supported excessive compensation despite poor performance (From Talisman’s white paper) This statement impugns Mr. Connally’s character, integrity and personal reputation without factual foundation. The statement implies that he misused his position as Chairman of the Compensation Committee for personal benefit, but it provides no facts supporting this implication either directly or indirectly. “Endeavour should immediately monetize its non-core U.S. portfolio (From Talisman’s white paper) Talisman states that the Company should “immediately monetize its non-core U.S. portfolio” without considering these assets were also part of the strategic review by Board. The Company had no acceptable offers for the U.S. assets. Additionally, Talisman ignores the structural and covenant related concerns arising from such a plan. Last year’s strategic review lacked credibility since it was conducted, in part, by a firm that employs one of Endeavour’s directors . . . We also believe the Board either erred or intentionally concluded its strategic review before key assets like Alba and Rochelle stabilized (and best values could be achieved) . . . the public markets currently ascribe little to no value to these assets (From Talisman’s white paper) Talisman falsely claims in their white paper that the firm who conducted the strategic review employs a director of the Company. The strategic review was run by Tudor, Pickering, Holt & Co., which does not employ any directors of the Company. Additionally, the aforementioned statement impugns the character of the Board by asserting that incompetence or sabotage are the only two possible options for the timing of the strategic review when there is a host of legitimate business decisions that could have informed the decision on when to proceed with the strategic review such as the ability to respond to a dissident shareholder. 42 |

Non-GAAP Financial Measures and Reconciliations Net income can be significantly affected by various non-cash items, such as unrealized gains and losses on our commodity derivatives, currency impact of long-term liabilities and deferred taxes. Given the significant impact that non-cash items may have on our net income, we use various measures in addition to net income and net cash provided by operating activities, including non- financial performance indicators and non-GAAP measures, such as income (loss) as adjusted and Adjusted EBITDA, as key metrics to manage our business. These metrics demonstrate our ability to maintain or grow production levels and reserves, internally fund capital expenditures and service debt as well as provide comparisons to other oil and gas exploration and production companies. We define “net income (loss), as adjusted” as net income (loss), without the effect of impairments, derivative transactions and currency impacts of deferred taxes. We define “Adjusted EBITDA” as net income (loss) before interest, taxes, depreciation, depletion and amortization adjusted for the early termination of commodity derivatives and income (loss) from discontinued operations. These measures are internal, supplemental measures of our performance that are not required by, or presented in accordance with GAAP. The calculations of these non-GAAP measures and the reconciliation of net income (loss) to these non-GAAP measures are provided below. We view these non-GAAP measures, and we believe that others in the oil and gas industry, securities analysts, investors, and other interested parties view these, or similar, non-GAAP measures, as commonly used analytic indicators to compare performance among companies in our industry and in the evaluation of issuers. Because net income (loss) as adjusted and Adjusted EBITDA are not measures determined in accordance with GAAP and thus are susceptible to varying calculations, they may not be comparable to similarly titled measures of other companies. Net income (loss) as adjusted and Adjusted EBITDA have limitations as analytical tools, and you should not consider these measures in isolation, or as a substitute for analysis of our financial statement data presented in the consolidated financial statements as reported under GAAP. |

Vote the White Proxy Card for Endeavour’s Current Board |