UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedJune 30, 2008

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER:000-33189

CANYON COPPER CORP.

(Exact name of registrant as specified in its charter)

| NEVADA | 88-0452792 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| | |

| Suite 408 - 1199 West Pender Street | |

| Vancouver, BC, Canada | V6E 2R1 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| Registrant’s telephone number, including area code | (604) 331-9326 |

| | |

| Securities registered under Section 12(b) of the Exchange Act: | NONE. |

| Securities registered under Section 12(g) of the Exchange Act: | Common Stock, $0.00001 Par Value per Share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter)

is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a

smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | | Accelerated filer [ ] |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to

the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last

business day of the registrant’s most recently completed second fiscal quarter.$8,570,976 on the basis of the averageof

the bid and ask price of the registrant’s common stock on December 31, 2007.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:

76,981,399, as at September 22, 2008.

CANYON COPPER CORP.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED JUNE 30, 2008

TABLE OF CONTENTS

2

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "intend," "anticipate," "believe," "estimate,” "predict," "potential" or "continue," the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Canyon Copper,” and the “Company” refer to Canyon Copper Corp., unless otherwise indicated.

All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

Overview

We were incorporated on January 21, 2000 under the laws of the State of Nevada under the name “Aberdene Mines Limited”. We subsequently changed our name to “Canyon Copper Corp.” on August 8, 2006.

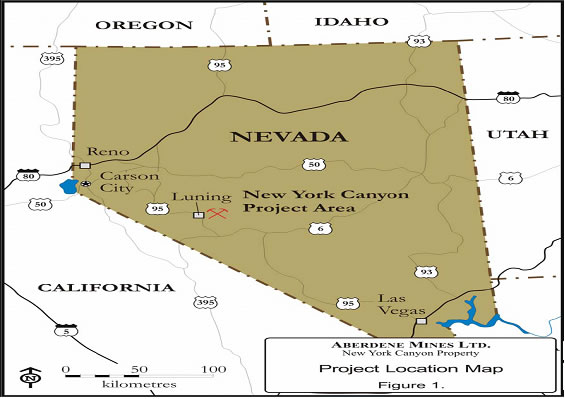

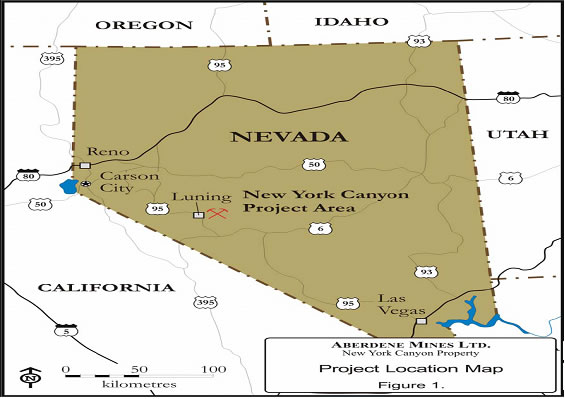

We are an exploration stage company engaged in the acquisition, exploration and development of mineral properties. We currently hold 100% title in two major claim blocks comprising a total of 1,332 mineral claims, covering approximately 27,440 acres in Mineral County, Nevada (the “New York Canyon Claims”). We also hold 21 patented mineral claims covering an area of approximately 420 acres, located within the vicinity of the New York Canyon Claims area. We collectively refer to the New York Canyon Claims and the patented mineral claims as the “New York Canyon Project.”

Recent Corporate Developments

Since our fiscal quarter ended March 31, 2008, we experienced the following significant corporate developments:

| 1. | On April 1, 2008, we entered into a loan agreement with Anthony Harvey, our Chief Executive Officer, Chairman and member of our Board of Directors, whereby Mr. Harvey loaned us $25,000. The loan is due on or before October 1, 2008 and incurs interest at a rate of 15% per annum, payable upon maturity. |

| | |

| 2. | On May 8, 2008, we entered into a loan agreement with Mr. Harvey whereby Mr. Harvey loaned us CDN $25,000. The loan is due on or before November 8, 2008 and incurs interest at a rate of 15% per annum, payable on maturity. |

| | |

| 3. | On May 9, 2008, we entered into amendments to our loan agreements with each of Anthony Harvey and Aton Select Fund Limited (“ASF”). Under the terms of the amendment agreements, ASF agreed to extend the term of its loan from March 20, 2008 to June 20, 2009 and Mr. Harvey agreed to extend the term of his loans from March 14, 2008 and April 25, 2008 to June 14, 2009 and July 25, 2009, respectively. |

| | |

| 4. | On July 7, 2008, we entered into a loan agreement with Mr. Harvey whereby Mr. Harvey loaned us CDN $25,000. The loan is due on or before January 7, 2009 and incurs interest at a rate of 15% per annum, payable upon maturity. |

3

| 5. | On August 18, 2008, we completed a private placement to three investors of a total of 5,000,000 units at a price of $0.10 per unit for total proceeds of $500,000. Each unit consisted of one share of our common stock and one share purchase warrant, entitling the holder to purchase one additional share of our common stock at a price of $0.12 per share for a period ending August 17, 2010. This private placement was completed pursuant to the provisions of Regulation S promulgated under the Securities Act of 1933. We did not engage in a distribution of this offering in the United States. The investors represented that they were not US persons as defined in Regulation S, and have provided representations indicating that they were acquiring our securities for investment purposes only and not with a view towards distribution. |

NEW YORK CANYON PROJECT

Property Option Agreement with Nevada Sunrise, LLC

Effective March 16, 2007, we acquired 100% title to the mineral claims underlying the New York Canyon Claims. The acquisition of title to the claims was completed pursuant to the terms of the Property Option Agreement (the “Property Option Agreement”) we entered into with Nevada Sunrise LLC (“Nevada Sunrise”), Robert Weicker, Sharon Weicker, Kurt Schendel, and Tami Schendel (collectively, the “Optionors”) on March 18, 2004.

Under the terms of the Property Option Agreement, we exercised our option to acquire the New York Canyon Claims by: (i) paying $460,000 to the Optionors; (ii) issuing 2,000,000 shares of our common stock to the Optionors; and (iii) incurring exploration expenditures of a minimum of $2,250,000 on the New York Canyon Claims.

The Optionors also retained a 2% net smelter returns royalty (the “Royalty”) over any future production. We have the option to reduce the Royalty to 1% by making a lump sum payment of $1,000,000 to the Optionors.

In accordance with the terms of the Property Option Agreement and upon our acquisition of the New York Canyon Claims, Nevada Sunrise assigned us its interest under two lease agreements. On October 9, 2004, Nevada Sunrise entered into a lease agreement with Tammy Gentry and Pat Hannigan pursuant to which it obtained a nine year lease over the Copper Queen #2 patented mineral claim. As a result of the assignment of this lease to us, we are required to pay $1,500 per quarter commencing on October 1, 2004. We have the option to acquire Copper Queen #2 by paying $50,000, of which the quarterly payments may be applied, to the lessors.

In addition, on January 1, 2005, Nevada Sunrise entered into a lease agreement with Clifford DeGraw and Richard Markiewicz pursuant to which it obtained a seven year lease over the Mildred and Copper Queen #1 patented mineral claim. As a result of the assignment of these leases to us, we are required to pay:

| | (a) | $2,500 per quarter commencing on April 1, 2005 (which payments have been made); |

| | | |

| | (b) | $3,500 per quarter commencing on April 1, 2006 (which payments have been made); |

| | | |

| | (c) | $4,000 per quarter commencing on April 1, 2007 (which payments have been made); |

| | | |

| | (d) | $5,000 per quarter commencing on April 1, 2008; and |

| | | |

| | (e) | $7,500 per quarter commencing on April 1, 2009. |

We also have the option to acquire the Mildred and Copper Queen #1 patented claims by paying $130,000, of which the quarterly payments may be applied, to the lessors.

Lease Agreement with Jaycor Mining Inc.

On July 21, 2004, we entered into a lease agreement (the “Lease Agreement”) with Jaycor Mining, Inc. (“Jaycor”). Under the terms of the Lease Agreement, we were granted rights to explore and, if proved feasible, develop 18 patented mineral claims held by Jaycor (the “Jaycor Claims”). These rights were granted as a

4

lease for an initial term of 15 years, and are renewable for a further 15 years. The claims cover a geographic area of approximately 361 acres, located within the vicinity of the New York Canyon Project area.

As consideration for the lease of the Jaycor Claims, we are required to pay Jaycor the following amounts prior to the commencement of any future production activities:

| | (a) | $25,000 on execution of the Lease Agreement (which payments have been made); |

| | | |

| | (b) | $1,000 monthly commencing on July 21, 2005, the first anniversary of the effective date of the Lease Agreement (which payments have been made); |

| | | |

| | (c) | $2,000 monthly commencing on July 21, 2006, the second anniversary of the effective date of the Lease Agreement (which payments have been made);and |

| | | |

| | (d) | $3,000 monthly commencing on July 21, 2007, the third anniversary of the effective date of the Lease Agreement, and continuing for as long as the Lease Agreement is in effect (collectively, the “Minimum Payments”) |

In addition to the Minimum Payments, we issued 10,000 shares of its common stock in 2005 to Jaycor and a further 15,000 common shares in 2006 pursuant to the terms of the Lease Agreement. As of the date of this Annual Report, we have made all required Minimum Payments under the Lease Agreement and are in good standing under the Lease Agreement.

The Minimum Payments are considered to be minimum advance royalty payments. If the production commences in the future, of which there can be no assurance, the Minimum Payments would be credited against any actual future royalty payments. If actual royalties payable from production exceed $9,000 per quarter, the Minimum Payments would cease. If actual royalty payments are less than $9,000 quarterly, we would be required to pay the difference between the actual royalty payments and the Minimum Payments. We are also required to perform at least $100,000 of exploration work annually on the Jaycor Claims over a four-year period.

The Jaycor Claims under the Lease Agreement are subject to an overriding royalty deed granted to Kookaburra Resources Ltd. (“Kookaburra”) by Jaycor. Upon commencement of production, we are required to pay Kookaburra a net smelter returns royalty of 1.75%, up to a maximum of $2,000,000. In addition, we have also agreed to pay Jaycor a net smelter return royalty of 0.5% until such time as Kookaburra has been paid $2,000,000, at which time the royalty payable to Jaycor will then increase to 1.5% . The 1.5% rate payable is subject to a maximum of $2,000,000, at which time the ongoing royalty payment to Jaycor will be reduced to 0.5% for as long as the Lease Agreement is in effect.

The Jaycor Claims are located in Sections 32, 33 and 34 T8N; R35E MDBM in Mineral County, Nevada and are recorded as follows:

| Name of Claim | Mineral Survey No. | US Patent # | County Land Parcel |

| Mayflower | 38 | 10541 | 009-170-11 |

| Wall Street | 43 | 21509 | 009-170-09 |

| Turk | 44 | 21510 | 009-170-09 |

| Footwall | 3447 | 264845 | 009-170-03 |

| Nora Higgins | 3447 | 264845 | 009-170-02 |

| Willie Higgins | 3447 | 264845 | 009-170-02 |

| Annex No. 1 | 3447 | 264845 | 009-170-03 |

| Annex No. 2 | 3447 | 264845 | 009-170-03 |

| Annex No. 3 | 3447 | 264845 | 009-170-03 |

| Annex No. 4 | 3447 | 264845 | 009-170-03 |

| Iron Gate | 4444 | 806518 | 009-170-02 |

| Velvet | 4444 | 806518 | 009-170-02 |

| Saddle | 4444 | 806518 | 009-170-02 |

| Vacation | 4571 | 982162 | 009-170-12 |

| Goodenough | 4612 | 989401 | 009-170-02 |

| Copper Butte | 4612 | 989401 | 009-170-02 |

| Copper Bar | 4612 | 989401 | 009-170-02 |

| Hecla | 4612 | 989401 | 009-170-02 |

5

The holders of patented minerals claims generally retain all mineral and property rights, and the permitting procedures for both exploration and development can be streamlined and fast tracked.

PRODUCTS, MARKETS, DISTRIBUTION, SUPPLIERS, AND CUSTOMERS

We do not currently produce any products, metals, or minerals nor do we offer any products for sale. We are not party to any distribution arrangements, and have no principal customers or suppliers. We do not anticipate any changes in this status for at least the next 12 months, or until such time as there is a commercially viable mineral or metal deposits located on our mineral property.

COMPETITION

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

MARKETS AND ECONOMICS

Although we compete with other junior exploration companies for financing, properties of merit, and subcontractors, there is no competition for the exploration or removal of mineralized material from the New York Canyon Project. Although there can be no assurance, large and well capitalized markets are readily available for all metals and precious metals throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. At present there are no limitations with respect to the sale of metals or precious metals other than price. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject metals.

DESCRIPTION OF MINING INDUSTRY

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

GOVERNMENTAL CONTROLS AND APPROVALS

Exploration and development activities are all subject to stringent national, state and local regulations. All permits for exploration and testing must be obtained through the local Bureau of Land Management (“BLM”) offices of the Department of Interior in the State of Nevada. The granting of permits requires detailed

6

applications and filing of a bond to cover the reclamation of areas of exploration. From time to time, an archaeological clearance may need to be obtained prior to proceeding with any exploration programs.

We plan to secure all necessary permits for any future exploration. We must provide for all environmental concerns and ensure no discharge of water into any body of water regulated by environmental law or regulation. Indigenous and endangered species must only be subject to very minimal or nil disturbances. Restoration of the disturbed land will be completed according to applicable regulations and laws. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental laws since the full nature and extent of our proposed activities cannot be determined until we start our operations.

We have applied for and received permits from the BLM to conduct drilling activities on BLM administered lands within the New York Canyon Project. The BLM reference the property as case file NV N-79198. We are required to adhere to the stipulations of the permit, primarily to plug all drill holes as they are completed and to reclaim roads and drill sites when they are no longer necessary. Reclamation work is ongoing but not complete as the project remains active.

Our mining operation is regulated by Mine and Safety Health Administration (“MSHA”). MSHA inspectors periodically visit our project to monitor health and safety for the workers, and to inspect equipment and installations for code requirements. All of our workers have completed MSHA safety training and must take refresher courses annually when working on our project. A safety officer for the project is also on site.

Other regulatory requirements monitor the following:

| | (a) | Explosives and explosives handling. |

| | (b) | Use and occupancy of site structures associated with mining. |

| | (c) | Hazardous materials and waste disposal. |

| | (d) | State Historic site preservation. |

| | (e) | Archaeological and paleontological finds associated with mining. |

We believe that we are in compliance with all laws and plans to continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect its business operations. There is however no assurance that any change in government regulation in the future will not adversely affect our business operations.

Federal Claim Maintenance Fees

In order to maintain our New York Canyon Project claims each year we must pay a maintenance fee of $125 per claim to the Nevada State Office of the Bureau of Land Management and on November 1 of each year we must file an affidavit and Notice of Intent to Hold the claims in Mineral County. We have paid the required maintenance fees and filed the affidavits required in order to extend the claims to August 31, 2009.

Environmental Liability

The New York Canyon Project property has a history of exploration and development dating back to the early 1900’s. As such there are a series of prospect pits, exploration and mine shafts, road cuts and general mining debris scattered throughout the property. None of this is considered to be an environmental hazard; however, open mine workings are required to be fenced for public safety. Operators during the bulk of the exploration of the property during the 1960’s through 1990’s conducted their activities in compliance with BLM requirements. This work has been either reclaimed or accepted by the BLM. We are not responsible for existing disturbance from prior activities on the New York Canyon Project.

PATENTS AND TRADEMARKS

We do not own, either legally or beneficially, any patents or trademarks.

7

RESEARCH AND DEVELOPMENT ACTIVITIES AND COSTS

We have no plans to undertake any research and development activities in the foreseeable future, and have not incurred research and development expenditures to date.

EMPLOYEES

Aside from our officers and directors, we have one full-time employee at present.

ITEM 1A. RISK FACTORS.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

If we do not obtain additional financing, our business will fail.

Our current operating funds are inadequate to complete our planned exploration of the New York Canyon Project and our general and administrative expenses. Our business plan calls for significant expenses in connection with the exploration and development of those mineral claims. As a result, we will require additional financing to complete our exploration and development plans. We will also require additional financing if the costs of exploration are greater than anticipated and to sustain our business operations if we are not successful in earning revenues once exploration is complete. Obtaining additional financing would be subject to a number of factors, the known material factors being market prices for copper, investor acceptance of our mineral claims, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

If we complete a financing through the sale of additional shares of our common stock, shareholders will experience dilution.

The most likely source of future financing presently available to us is through the issuance of our common stock. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated.

In order to maintain our rights to the New York Canyon Project, we will be required to make annual filings with federal and state regulatory agencies and/or be required to complete assessment work on the New York Canyon Project.

In order to maintain our rights to the New York Canyon Project, we will be required to make annual filings with federal and state regulatory authorities. Currently the amount of these fees is nominal; however, these maintenance fees are subject to adjustment. In addition, we may be required by federal and/or state legislation or regulations to complete minimum annual amounts of mineral exploration work on the New York Canyon Project. A failure by us to meet the annual maintenance requirements under federal and state laws could cause our rights to the New York Canyon Project to lapse.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease exploration activities and if we do not obtain additional financing, our business will fail.

We were incorporated on January 21, 2000 and to date have been involved primarily in organizational activities, the acquisition of mineral claims and the exploration and development on these claims. We have no exploration history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

8

| - | our ability to locate a profitable mineral property; and |

| | |

| - | our ability to generate revenues. |

Our plan of operation calls for significant expenses in connection with the exploration of the New York Canyon Project, which will require us to obtain additional financing. We recorded a net loss of $1,216,504for the year ended June 30, 2008 and have an accumulated deficit of $17,076,472 since inception. As at June 30, 2008 we had cash of $15,580 and for the next twelve months, management anticipates that the minimum cash requirements to fund our proposed exploration program and our continued operations will be $3,200,000. Accordingly we do not have sufficient funds to meet our planned expenditures over the next twelve months and will need to seek additional financing to meet our planned expenditures.

Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and base and precious metals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Since our inception, we have used our common stock to raise money for our operations and for our property acquisitions. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation. For these reasons, our independent auditors believe there exists a substantial doubt about our ability to continue as a going concern.

Because we have not commenced business operations, we face a high risk of business failure.

We have not earned any revenues as of the date of this Annual Report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no mineral reserves. Mineral exploration is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our property our production capability is subject to further risks including:

| - | Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for; |

| - | Availability and costs of financing; |

| - | Ongoing costs of production; and |

| - | Environmental compliance regulations and restraints. |

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near the New York Canyon Project and such other factors as government regulations, including regulations relating to allowable production, exporting of minerals, and environmental protection. If we do not find a mineral reserve or define a mineral inventory containing gold, silver, copper, zinc or iron or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and investors will lose their investment.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

9

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages if and when we conduct mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, if and when we conduct exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

If the price of base and precious metals declines, our financial condition and ability to obtain future financings will be impaired.

The price of base and precious metals is affected by numerous factors, all of which are beyond our control. Factors that tend to cause the price of base and precious metals to decrease include the following:

| | (a) | Sales or leasing of base and precious metals by governments and central banks; |

| | | |

| | (b) | A low rate of inflation and a strong US dollar; |

| | | |

| | (c) | Speculative trading; |

| | | |

| | (d) | Decreased demand for base and precious metals industrial, jewelry and investment uses; |

| | | |

| | (e) | High supply of base and precious metals from production, disinvestment, scrap and hedging; |

| | | |

| | (f) | Sales by base and precious metals producers and foreign transactions and other hedging transactions; and |

| | | |

| | (g) | Devaluing local currencies (relative to base and precious metals price in US dollars) leading to lower production costs and higher production in certain major base and precious metals producing regions. |

Our business is dependent on the price of base and precious metals. We have not undertaken hedging transactions in order to protect us from a decline in the price of base and precious metals. A decline in the price of base and precious metals may also decrease our ability to obtain future financings to fund our planned development and exploration programs.

Because we are an exploration stage company, our business has a high risk of failure.

As noted in the financial statements that are included with this Annual Report, we are an exploration stage company that has incurred net losses since inception, we have not attained profitable operations and we are dependent upon obtaining adequate financing to complete our exploration activities. These conditions, as indicated in our audit report on our Annual Report on Form 10-K, raise substantial doubt as to our ability to continue as a going concern. The success of our business operations will depend upon our ability to obtain further financing to complete our planned exploration program and to attain profitable operations. If we are not able to complete a successful exploration program and attain sustainable profitable operations, then our business will fail.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our success is dependent upon the performance of key personnel working full-time in management, supervisory and administrative capacities or as consultants. This is particularly true in highly technical businesses such as mineral exploration. These individuals are in high demand and we may not be able to attract the personnel we need. The loss of the services of senior management or key personnel could have a material and adverse effect on us, our business and results of operations. Failure to hire key personnel when needed, or on acceptable terms, would have a significant negative effect on our business.

10

As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We are required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| | (a) | Water discharge will have to meet drinking water standards; |

| | | |

| | (b) | Dust generation will have to be minimal or otherwise re-mediated; |

| | | |

| | (c) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| | | |

| | (d) | An assessment of all material to be left on the surface will need to be environmentally benign; |

| | | |

| | (e) | Ground water will have to be monitored for any potential contaminants; |

| | | |

| | (f) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and |

| | | |

| | (g) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. If remediation costs exceed our cash reserves we may be unable to complete our exploration program and have to abandon our operations.

If we become subject to increased environmental laws and regulation, our operating expenses may increase.

Our development and production operations are regulated by both US Federal and Nevada state environmental laws that relate to the protection of air and water quality, hazardous waste management and mine reclamation. These regulations will impose operating costs on us. If the regulatory environment for our operations changes in a manner that increases costs of compliance and reclamation, then our operating expenses would increase with the result that our financial condition and operating results could be adversely affected.

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system.

11

Because our securities constitute "penny stocks" within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the quotation price of our common stock is less than $5.00 per share, the common stock will be subject to Rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| 1. | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | |

| 2. | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| | |

| 3. | contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | |

| 4. | contains a toll-free telephone number for inquiries on disciplinary actions; |

| | |

| 5. | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | |

| 6. | contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

ITEM 2. PROPERTIES.

We currently do not own any real property.

We rent approximately 1,606 square feet of office space located at Suite 408 - 1199 West Pender Street, Vancouver, British Columbia, Canada from ESO Uranium Corp. at a cost of approximately $1,500 per month. This rental is on a month-to-month basis with no formal agreements.

NEW YORK CANYON PROJECT

We hold 100% title to our New York Canyon Claims, subject to certain royalties, and pursuant to various lease agreements, we were granted a seven year lease to explore and develop the Copper Queen #2 patented mineral claim, a nine year lease to explore and develop the Mildred and Copper Queen #1 patented mineral claims and a 15 year lease to explore and develop the Jaycor Claims.

Our New York Canyon Claims consist of two major claim blocks covering a total of 1,332 mineral claims, covering approximately 27,440 acres located in Mineral County, Nevada. We refer to the first block of claims as the "Copper Queen Claims,” and the second contiguous block of claims as the "Longshot Ridge Claims.” Further, we hold 21 patented mineral claims covering an area of approximately 420 acres, located within the vicinity of the New York Canyon Claims.

12

Figure 1 – New York Canyon Property

Location and Access, Climate, Local Resources, and Physiography

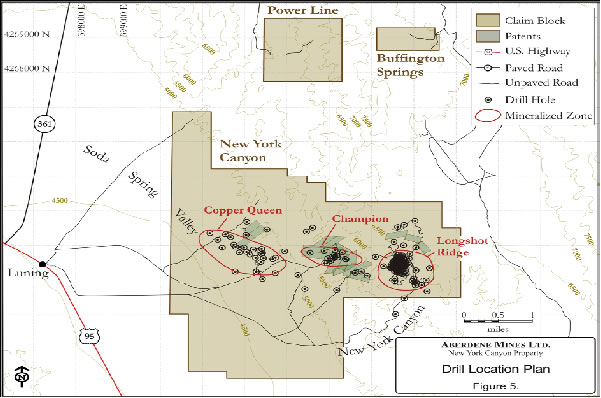

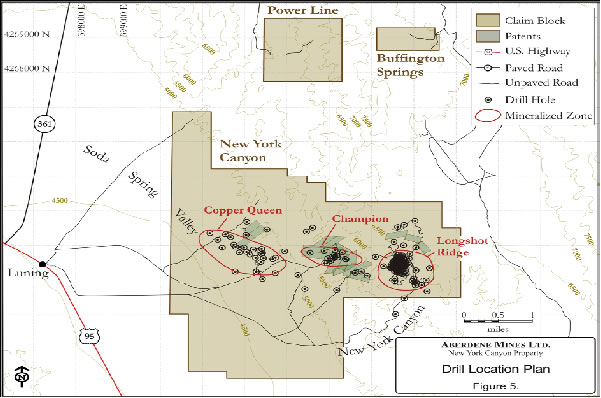

The New York Canyon Project is situated in southern Mineral County, Nevada. It is located 30 miles east of the county seat at Hawthorne and five miles east of the community of Luning, Nevada. Paved state highway US95 provides road access to Reno, Nevada 160 miles to the north and Las Vegas, NV 290 miles to the southeast.

Access to the property from Luning is by county maintained gravel surfaced roads and a network of unimproved gravel roads that extend throughout the property. The claims cover a portion of the western slope of the Gabbs Valley Range and extend westward into Soda Spring Valley. Elevations range from 4,600 feet in the valley bottom to over 7,000 feet at the crest of the Gabbs Valley Range. Relief is gentle to steep over the property and is moderate in the vicinity of the known mineralized zones.

The New York Canyon region is arid to semi-arid desert with temperatures to 95F in the summer and average temperatures of 25F in winter. Precipitation varies between two and 6 inches per year. Physical work could be conducted on the New York Canyon property year round.

Vegetation of the New York Canyon area is typical of central Nevada and consists of sagebrush and other desert plants on the lower slopes and valleys. Shadscale, white sage and greasewood occur with sagebrush on the drier slopes and hills. Sparse cover of pinion pine and juniper trees occurs at higher elevations on the property.

Depending on the ultimate extent of mineralization identified on the New York Canyon Project, the current claim base may be insufficient to support mining operations, tailings and waste storage and processing plants. Additional surface lands may be required for such operations. The existing infrastructure within the project area and the proximity to major centers such as Hawthorne and Reno are key factors in supporting mining operations.

13

Figure 2 – New York Canyon Property

History

The Santa Fe Silver Mine established this mining district in 1879 with silver production from silver deposits in the district. The discovery of significant copper deposits in 1893 superseded the silver mining operations in the area. The New York Canyon Project property has a long history of exploration, development and production dating back to 1875 when the copper oxide deposits were first discovered. Between 1906 and 1929, an estimated 8.9 million pounds of copper were recovered from 110,000 tons of ore at an average grade of 5.5% . Copper production exceeded 4,454 tons between 1906 and 1935. There was also significant silver production during this period when copper production reached its zenith.

Modern exploration began in 1964 when Banner Mining Company (“Banner”) drilled the Copper Queen and Champion mineral occurrences. During the mid-1960’s through to the late-1970’s, several mining companies explored the New York Canyon Project, primarily for the porphyry copper sulphide potential completing 124 holes totaling 106,000 feet. In the 1970's, Amax Inc., and later Conoco Inc. (“Conoco”), conducted significant exploration programs, completing 24 holes totaling 20,226 feet. A total of 15 holes were drilled to test the Long Shot Ridge occurrence. This historic drilling by Conoco, from 1977 to 1981, indicated 13.2 million tons of mineralized material with an average grade of 0.55% copper for the Longshot Ridge area and 142 million tons grading 0.35% and 0.015% molybdenum for the Copper Queen deposit. In 1979, Conoco conducted a preliminary metallurgical testing program for copper recovery using drill core. The Copper Queen deposit yielded average recoveries of 70% copper over the six day leach period. Acid consumptions varied with rock type: porphyry copper mineralized rock consumed 160 pounds sulphuric acid per ton while carbonate rich mineralized rock consumed 509 pounds of sulphuric acid (H2SO4) per ton. Copper oxide mineralized material provided recoveries ranging from 75.0% to 84.45% with acid consumption of 232 to 349 pounds H2SO4 per ton of ore.

Further exploration of the property was conducted between 1992 and 1997. Over this time, various joint venture partners primarily tested the Longshot Ridge and Copper Queen deposit areas with an additional 46 drill holes totaling 13,018 feet. In 1993, Peter Cowdery, PhD., P.Eng. of CORE Engineering and Associates conducted an estimate of the mineralized material at the Longshot Ridge copper oxide deposit for Kookaburra Resources Ltd. The CORE technical report indicated 17.7 million tons of mineralized material with an average grade of 0.55% copper using a 0.23% copper cutoff.

14

Prior to the acquisition of our interest in the New York Canyon Project, 129 drill holes totaling 93,858 feet of drilling had been completed on the property. Mountain States R & D International, Inc.’s simulated vat leach test on minus three-quarter inch copper mineralized material from Longshot Ridge indicated a 39.41% copper recovery with total acid consumption of 174.7 pounds per ton of mineralized material. The 1993 report states that at an average copper content of 0.57 percent, a ton of Long Shot Ridge mineralized material contains 11.4 pounds of copper.

General Geology

The New York Canyon Project lies within the central portion of the Walker Lane Structural Belt, a zone of northwest striking parallel and sub-parallel, right lateral strike slip faults in the western part of the Great Basin region. The Walker Lane structural belt developed in an intra-arc setting during the Cenozoic and extends for more than 400 miles through western Nevada and into northern California. Tertiary volcanism and related hydrothermal mineralization have been recognized throughout the length of this structural break. Significant mining districts are associated with the Walker Lane Belt and include Comstock, Goldfield, Rawhide, Tonopah-Hall, and Yerington.

The New York Canyon area consists mostly of a conformable sequence of marine sedimentary rocks of Triassic and Jurassic ages. These rocks are intruded by granitic rocks of Cretaceous age and locally covered by non-mineralized volcanic flows of Tertiary age and by Quaternary alluvium and colluvium in the valley bottoms. Structural displacement of mineralized host rocks at New York Canyon is generally associated with Walker Lane style structures that disrupt bedding and provide conduits for mineralized source fluids.

The oldest rocks are middle to late Triassic age Luning Formation, predominately dolomite, dolomitic limestone and limestone with subordinate shale, argillite and conglomerate. Regionally, the Luning Formation is thought to be more than 10,000 feet thick with thin to medium bedded carbonate rocks intercalated with siltstone in the lower 1,000-foot portion of the sequence, and massive to thick bedded carbonate rocks in the upper 4,000-foot portion of the sequence.

The late Triassic age Gabbs Formation conformably overlies the Luning Formation. The Gabbs Formation is comprised of three members and consists of a sequence of thin bedded fossiliferous limestone, argillaceous limestone and calcareous tuffaceous siltstone totaling 400 feet thick at the type locality in New York Canyon.

The Sunrise Formation of Jurassic age conformably overlies the Gabbs Formation. The Sunrise is comprised of five members and consists of a sequence of quartz latite porphyry flows near the base, thin bedded limestones, siltstones, silty limestone, tuffaceous siltstone, shale and claystone totaling about 600 to 800 feet thick at New York Canyon and as much as 1,200 feet thick in the Pilot Mountains to the southeast. The Sunrise Formation is distinguished from the Gabbs Formation primarily by fossil type.

Conformably overlying the Sunrise Formation is the Jurassic age Dunlap Formation, a 3,000 foot thick sequence of basal conglomerate, limestone, clastic sediment, and andesite and rhyolite flows. Intruding these formations are Jurassic to Cretaceous age multiphase domes, plugs, dikes and sills consisting primarily of diorite and granodiorite with areas of quartz monzonite, granite and other associated felsic rock types.

Tertiary age (mostly Oligocene and Miocene age) mafic to felsic volcanics, volcanoclastics, flows, tuffs, tuffaceous sediments, and continental sediments form capping units throughout the region in varying thickness to 8,000 feet. Quaternary rocks consist of various alluvial and lacustrine deposits forming basin fill deposits, with fanglomerates extending out as debris from the ranges. These units can be 200 feet or more thick.

Property Geology at New York Canyon

The upper New York Canyon area consists primarily of Luning Formation limestone with the small area of Longshot Ridge overlain by rocks of the Gabbs and Sunrise Formations. These sedimentary units are in turn intruded by felsic sills and dikes. In the Longshot Ridge area the Luning Formation (Lfm) consists of thick-bedded limestone and dolomite, typically gray to tan colored units, which are exposed in the hillsides below the main ridge.

15

The Gabbs Formation at Longshot Ridge originally consisted of very thin bedded to laminated limestone and silty limestone intercalated with siltstone and shale, all of which have been moderately to highly calc-silicate altered. Remnant bedding textures are locally evident. The three members of the formation consist of: G1, the lowest unit, a black, bioclastic limestone intercalated with siltstone, approximately 250 feet thick; G2, the middle unit, predominantly argillaceous limestone intercalated with calcareous and tuffaceous siltstone, approximately 200 feet thick consisting; and G3, the upper unit, predominantly argillaceous limestone intercalated with siltstone, 0 to 200 feet thick. The Luning-Gabbs contact at the base of the Gabbs Formation is clearly marked by a carbonaceous (black bioclastic) limestone.

The two lowest members of the Sunrise Formation (Sfm) at Longshot Ridge are also moderately skarn and calc-silicate altered. The five Sunrise members are: S1, the lowest unit, argillaceous limestone intercalated with siltstone and some quartz latite porphyry flows near the base, approximately 100 feet thick; S2, fossiliferous bedded limestone intercalated with siltstone and silty limestone, 50 feet thick; S3, shale and siltstone, 250 feet thick; S4, consists of 200 feet of silty limestone and limestone, 200 feet thick; and S5, the uppermost unit, claystone and limestone, 200 feet thick.

The Dunlap formation, mentioned in the regional description, is not present in the Longshot Ridge area. Further, only one of the various regional Tertiary age volcanic sequences is present along the northern flank of Longshot Ridge. The felsic intrusive rocks (Fi) of Longshot Ridge are primarily sills with some local dikes. These sills and dikes are typically only 5 to 20 feet thick but quite abundant. Rock types include granodiorite porphyry, porphyritic quartz monzonite, quartz monzonite porphyry and quartz-feldspar porphyry. The average bedding at Longshot ridge strikes N75°E and dips 35° south.The rocks have been severely faulted and folded with drag and overturned features common. The major faults are curvilinear with general trends toward the northeast and northwest. Although many of these faults are fairly high angle, they commonly change dip direction due to the change of strike of the structure. There are generally two sets of faults, one trending NE and the other trending NW, with some local faults that strike N and dip steeply E. For the most part, these appear to be normal faults with displacements ranging from 50 to 200 feet.

Deposit Types at New York Canyon Project

Mineralization within the New York Canyon Project consists principally of contact metasomatic copper skarn deposits, porphyry-type copper-molybdenum mineralization, and a combination or transition of these two types of mineralization. The property’s copper skarns may be almost entirely oxidized, as at Longshot Ridge, or consist of both oxide and sulphide skarns as at the Champion prospect, located midway between the Longshot Ridge and Copper Queen prospects. At Copper Queen, the mineralization consists of copper sulphide skarn and porphyry copper-molybdenum sulphide.

Contact metasomatic skarn (also known as tactite) typically occurs in carbonate sedimentary rocks adjacent to small to moderate sized intrusive rock bodies of intermediate composition, such as monzonite and granodiorite. Heat and fluids from the intrusion recrystallize and alter the carbonate rocks, converting limestone and limy sediments to higher temperature calc-silicate minerals such as garnet, epidote, diopside, tremolite and calcite. A variety of metalliferous deposits can be formed, including those that are copper-rich, iron-rich or tungsten-rich.

Copper skarns often occur transitional to porphyry-type copper deposits and are one of the world’s most abundant types of skarn deposits. Sizes range from small up to 100 million tons or more with grades averaging 1 to 2% Cu. Associated metallic minerals include chalcopyrite, bornite, magnetite, specularite, pyrite, pyrrhotite, sphalerite, and molybdenite. Examples of copper skarn deposits in the southwest US include Carr Fork (Utah), Santa Rita-Pinos Altos (New Mexico), Mason Valley-Copper Canyon (Nevada) and Mission-Pima (Arizona).

Porphyry-type copper-molybdenum deposits are closely associated with and related to moderate sized intrusive rock bodies of intermediate to felsic composition. Mineralization occurs as disseminated sulphides and as crosscutting stockwork quartz-sulphide veins within the intrusive and extending outward into the surrounding rocks. The intrusive bodies are commonly 0.5 to 2 kilometers or more across and their emplacement produces large volumes of altered and intensely fractured ground.

16

Porphyry-type deposits are classic large tonnage systems with large metal contents amenable to low cost bulk mining methods, and these deposits account for a major portion of the world’s copper and molybdenum production. Sizes range from 20 million to several billion tons with grades ranging from about 0.5% to 1.5% Cu. In the southwest US, one of the world’s best-endowed copper provinces, a typical porphyry copper deposit contains 447 million tons of 0.67% Cu. Examples from this region include Silver Bell, Yerington, Piedras Verdes and Sanchez.

Mineralization at New York Canyon Project

Mineralization at the New York Canyon Project consists of three principal copper prospects along a west-northwest structural trend: Copper Queen on the west, Champion in the center and Longshot Ridge on the east. The Copper Queen prospect has no exposed mineralization at the surface but contains copper sulfide skarn at depth and an incompletely confirmed copper-molybdenum sulphide porphyry system at greater depth. The Champion and Longshot Ridge prospects, however, have numerous widespread exposures of copper skarn mineralization, both in surface outcrop and abundant old mine workings. The majority of recent exploration efforts on the New York Canyon Project have focused on the extensive oxide copper skarn mineralization at Longshot Ridge. This mineralization is the subject of the current report.

The copper mineralization and associated alteration at Longshot Ridge are products of an extensive copper-rich skarn system formed in carbonaceous sediments of the Luning, Gabbs and Sunrise Formations. Small amounts of copper occur also in stockwork veinlets in felsic porphyry intrusive sills and dikes. The copper mineralization consists almost entirely of secondary copper minerals, principally malachite, azurite, chrysocolla and copper wad, in order of abundance. Additionally, some copper-rich limonite (goethite) has been reported. The oxide copper minerals apparently are the products of supergene weathering and oxidation of primary copper sulphide minerals present in the original skarn. Because limestones tend to buffer any solution carrying copper in the supergene environment, copper can be enriched as much as 300 to 400 percent by this supergene weathering process. Oxide copper deposits formed in a similar manner in many copper districts throughout the southwest US, have contributed substantially to the copper produced from the associated primary copper deposits in these districts.

About 90 percent of the Longshot Ridge mineralization is within the two upper units of the Gabbs Formation. Drilling reveals that the strongest, thickest and most continuous mineralization occurs in a NE-trending zone, 200 feet wide by 1300 feet long, which is crossed by two NW-trending structurally-controlled high grade zones, each about 100 feet wide and from 400 to 700 feet long.

Luning Formation – Dolomite and limestone units of the Luning Formation are altered with the skarn minerals serpentine, talc, garnet, magnetite and locally diopside. Serpentine and talc form sinuous veins along structures in the dolomite, a diagnostic feature of dolomite skarns. Due to the massive nature of the Luning, the skarn suite is confined mostly to small halos along high-angle structures; for this reason, the copper mineralization is limited in area but of moderately high grade. Additionally, the Luning contains small local zones of hematite and dolomite with jasperoid veins a few feet thick; these zones have fine-grained silica, hematite, goethite, limonite and copper oxides. Historically, all the higher-grade copper shipped from the New York Canyon area during World War I was from copper skarns in the Luning, not from the Gabbs.

Gabbs Formation – Copper mineralization in the Gabbs is much more widespread but lower grade than in the Luning. The vast majority of the copper mineralization at Longshot Ridge is in the two upper units of the Gabbs Formation, principally impure thin-bedded sandy limestone and siltstone. The limestone is extensively altered to a skarn mineral suite of garnet, diopside and magnetite; the siltstone is altered to hornfels. Due to the brittle nature of diopside, the diopside-rich skarns are more abundantly fractured and slightly rich in copper than the garnet-rich skarns. Typical Gabbs skarns are only 5 to 15 feet thick, but there are many of them.

The lowest Gabbs unit, a carbonaceous bioclastic limestone contains the boundary between marbleized limestone and calc-silica altered limestone (the so-called “marble line”) but it rarely contains skarn mineralization. It is cut by high-angle structures that were used as feeders for the plentiful skarns and hornfels which formed in the more reactive or permeable rocks of the two overlying Gabbs units. Granodiorite porphyry intrusions were later emplaced as dikes along the same structures and as sills in the permeable beds. The skarns are more commonly proximal to the sills.

17

Sunrise Formation – The two lowest sedimentary units of the Sunrise Formation, impure thin-bedded sandy limestone and siltstone, are altered to a skarn suite of garnet, diopside and magnetite in the limestone and to hornfels in the siltstone. As in the Gabbs, copper mineralization is widespread but relatively low grade. However the Sunrise skarns are relatively thick, on the order of 50 feet. The largest skarn bed is the Mayflower Mine, which was mined on a fairly large scale. It is capped by hornfels-altered sedimentary rocks

Current State of Exploration

We are continuing to pursue our exploration program on the New York Canyon Project. Due to insufficient financing, we did not carry out our exploration program during the year ended June 30, 2008. The current work program for New York Canyon Project comprises of drilling an initial 56 holes at Longshot Ridge to outline the mineralized zone followed by 14 drill holes at Copper Queen to test the mineralization at depth there. Geophysical surveys are intended to cover the main areas of interest to develop further drill targets. Drilling to date at the Longshot Ridge copper deposit has confirmed and expanded on the known extent of the copper oxide mineralization, which is exposed at surface and has been tested to depths up to 400 feet. With the exception of holes 06-13R and 06-14R, all drill holes completed in 2006 have indicated the consistent and wide spread nature of the copper mineralization at Longshot Ridge. The recent data is being incorporated into the overall New York Canyon Project database in order to develop a resource estimate of the copper content at Longshot Ridge.

Previous Exploration Work Completed on the New York Canyon Project

On October 18, 2006, we announced that nine new targets have been identified from the geophysical surveys completed on the New York Canyon Project. The 2006 geophysical survey program completed on the New York Canyon Project consisted of a ground magnetic survey, an induced polarization ("IP") survey, compilation and review of historic geophysical surveys and interpretation that identified additional target areas for further drilling. A 134 line kilometre ground magnetics survey was completed by Magee Geophysical Services LLC in March, 2006. Lines were oriented N15E, spaced 100 metres apart and extend from the western side of the Copper Queen zone six kilometres to the east to cover the Champion and Longshot Ridge zones. A 50.4 line kilometre dipole-dipole IP survey was completed on 17 grid lines by Zonge Geosciences Inc. Readings were taken at N=1 to 7 separations allowing an effective depth penetration of approximately 400 metres. The lines were generally spaced at 100 metres except over areas of low magnetic response where the spacing was increased to 200 or 400 metres. This IP survey provides expansive coverage over the key mineralized areas and was of sufficient density to permit 3D inversion imagery. Jim Wright of J.L. Wright Geophysics Inc. conducted the data processing, inversion and interpretation of the geophysical data.

In his report, Mr. Wright notes that the historic gravity data is important for constraining the western limits for exploration. Structures interpreted from the gravity indicate multiple stepped faults that down drop mineralized zones to the west. The magnetic survey outlines a number of possible intrusive centers, including those that are associated with the Champion, Copper Queen and Longshot Ridge mineralized zones. A substantial area measuring 1.9 km by 1.3 km correlates well with the mapped skarn and intrusive rocks at Longshot Ridge. Drilling to date on this zone has covered an approximate 450 metre by 600 metre area.

Mr. Wright notes that the mineralized zones and associated magnetic high areas are relative chargeability lows surrounded by very large chargeability high areas. Low resistivity has a direct correlation with all mineralized zones and active magnetic areas. Through his compilation and interpretation of the geophysical survey data, Mr. Wright developed target criteria based upon geophysical characteristics. Based on these selection criteria, nine target zones are identified that require follow up drill testing. The targets show consistent line to line correlation with structures or magnetic trends and are in areas that have not been previously drilled. Mr. Wright has recommended 14 drill holes totaling 5,320 metres to test these target zones. Our drilling has indicated that the mineralized systems have not as yet been thoroughly evaluated and substantial drilling is required to outline the extent of mineralization at Copper Queen, Champion and Longshot Ridge. The geophysical surveys provide further evidence that these three key mineralized zones may form part of the same system offset by basin and range structures and that there are additional targets that require further evaluation.

We contracted Leroy Kay Drilling of Yerington, Nevada to provide core drilling services at the New York Canyon Project in 2006. Mr. Kay has provided drilling services to us for the past two years and began core drilling operations at the New York Canyon Project in early May, 2006. Drill core is expected to allow thorough

18

geological modeling of both the Longshot Ridge Claims copper oxide skarn system and the Copper Queen Claims copper-molybdenum porphyry mineralized area. Core samples will be used for metallurgical testing in order to identify a beneficial copper extraction technique in the oxide mineralized zones. Equipment and crew were mobilized to the project site at the end of March, with drilling commencing April 3, 2006. Drilling, grid work, geophysical surveys and permitting were ongoing during April and continued to June, 2006.

In fiscal 2007, the following results were received by Canyon Copper from re-analyses conducted on all pulps generated from the 2006 drill program:

| Hole ID | From(ft) | To(ft) | Length(ft) | Copper(%) |

| 06-11R* | 0 | 10 | 10 | 1.03 |

| | 55 | 95 | 40 | 0.26 |

| | 195 | 215 | 20 | 0.44 |

| 06-13R* | No Significant Results | | | |

| 06-14R* | No Significant Results | | | |

| 06-15R* | 95 | 135 | 40 | 0.39 |

| 06-20R* | 85 | 95 | 10 | 0.78 |

| | 125 | 140 | 15 | 0.43 |

| 06-21C* | 10 | 125 | 115 | 0.54 |

| including | 105 | 125 | 20 | 1.03 |

| 06-22R* | 0 | 25 | 25 | 0.39 |

| | 55 | 125 | 70 | 0.32 |

| | 295 | 310 | 15 | 0.90 |

| 06-23C* | 0 | 45 | 45 | 0.35 |

| | 80 | 310 | 230 | 0.78 |

| including | 210 | 270 | 60 | 1.72 |

| 06-24R* | 30 | 70 | 40 | 0.29 |

| | 95 | 165 | 70 | 0.41 |

| 06-25R* | 70 | 180 | 110 | 0.47 |

| including | 120 | 150 | 30 | 0.96 |

| | 450 | 485 | 35 | 0.34 |

| 06-26C* | 20 | 115 | 95 | 0.29 |

| 06-27R* | 0 | 70 | 70 | 0.16 |

| including | 55 | 70 | 15 | 0.37 |

| | 290 | 330 | 40 | 0.23 |

| 06-28R* | 0 | 185 | 185 | 0.53 |

| including | 35 | 85 | 50 | 1.08 |

| 06-29C* | 10 | 45 | 35 | 0.28 |

| 06-30R* | 0 | 50 | 50 | 0.23 |

| | 120 | 225 | 105 | 0.28 |

| including | 120 | 170 | 50 | 0.45 |

| 06-31R* | 0 | 130 | 130 | 0.32 |

| | 190 | 380 | 190 | 0.87 |

| including | 285 | 375 | 90 | 1.06 |

| 06-32C* | 65 | 148 | 83 | 0.66 |

| including | 110 | 148 | 38 | 1.09 |

| 06-33C* | 10 | 200 | 190 | 0.52 |

| including | 60 | 95 | 35 | 0.84 |

| | 175 | 195 | 20 | 1.50 |

Notes

* Reverse Circulation holes are designated “R” and diamond drill core holes are designated “C”.

19

The analyses of total copper content reported were completed by ALS Chemex using their AA62 atomic absorption procedure. A thorough quality assurance/quality control protocol of certified standard reference materials, duplicates and blanks was conducted during the analytical process.

Core hole 06-23C returned an average of 0.78% copper over a 230 foot interval starting from 80 feet. Included in this interval is a 60 foot section that averaged 1.72% copper from 210 to 270 feet. An upper interval from surface to 45 feet intersected 0.35% copper. RC drill 06-11R was drilled vertically to a depth of 265 feet. As shown in the table above, three mineralized horizons were encountered starting from surface to a depth of 215 feet within skarn altered siltstone varying from 0.26% copper over 40 feet to 1.03% copper over 10 feet. Drill holes 06-13R and 06-14R were both drilled vertically to depths of 365 feet and 350 feet respectively. These holes are located in the south-western area of Longshot Ridge within variably skarn altered siltstone. These holes, spaced approximately 120 feet apart, did not return any significant copper mineralization and may define the near surface limit of mineralization in this direction.

Hole 06-15R, located in the south central area of Longshot Ridge, returned an average of 0.39% copper over a 35 foot interval from 95 to 130 feet. Hole 06-20R was drilled in the south central portion of Longshot Ridge. This vertical hole returned an average of 0.80% copper over a 10 foot interval from 85 to 95 feet from within skarn altered marble and a 15 foot interval from 125 feet that averaged 0.43% copper in altered siltstone. Core hole 06-21C is located in the northwest area of Longshot Ridge. This vertical drill hole returned 0.54% copper over a 115 foot interval starting at 10 feet, including 1.03% copper over 20 feet from 105 to 125 feet. Hole 06-22R is located in the central portion of Longshot Ridge and intersected three mineralized horizons as shown in the table above, including 0.90% copper over 15 feet starting at 295 feet. Hole 06-24R is located in the south central portion of the Longshot Ridge deposit and returned an average of 0.29% copper over 40 feet starting at 30 feet depth and a 70 foot interval averaging 0.41% copper starting at 95 feet.

Hole 06-25R was drilled from the same setup as 06-24R and oriented towards the northwest at a 60 degree angle to a depth of 600 feet. The hole returned 0.47% copper over a 110 foot interval starting at 70 feet, including a 30 foot interval from 120 feet that averaged 0.96% copper. A further 35 foot interval from 450 feet returned an average of 0.34% copper. Drill hole 06-26C is located in the north east portion of Longshot Ridge and was drilled vertically to a depth of 534 feet. Drilling intersected weak skarn alteration in siltstone and limestone of the Gabbs Formation overlying Luning Formation limestone. The hole intersected weak to moderate copper mineralization from the start of sampling at 20 feet to 115 feet and averaged 0.29% Cu over this 95 foot distance. Copper mineralization in nearby outcrop indicates that the mineralization extends from surface.

06-27R is located in the central west edge of the tested limit of Longshot Ridge and was drilled vertically to a depth of 335 feet. Mineralization is hosted within variable skarn alteration in siltstone and limestone. Sampling returned a 15 foot interval from 55 to 70 feet that averaged 0.37% Cu and a 40 foot interval further down the hole from 290 to 330 feet that averaged 0.23% Cu. 06-28R is located 300 feet northwest of 06-27R within a zone of strong skarn alteration of siltstone and limestone within the Gabbs Fm. The hole was drilled vertically to a depth of 345 feet and is the most westerly located hole drilled to date on Longshot Ridge. Surface workings indicate that mineralization extends at least 300 feet further west. Hole 06-28R returned a broad zone of copper mineralization extending from surface to 185 feet that averaged 0.53% Cu and included a strong zone of mineralization extending from 35 feet to 85 feet that averaged 1.08% Cu.

06-29C is located in the northern end of Longshot Ridge and was drilled vertically to a depth of 500 feet. The hole intersected the Luning Formation limestone unit that was non to weakly altered. An interval from the start of sampling at 10 feet to 45 feet averaged 0.28% Cu. 06-30R is located 260 feet southwest of 06-29C and was drilled vertically to a depth of 225 feet. Copper mineralization is hosted within calc-silicate and skarn altered limestone adjacent to quartz monzonite sills. An interval from surface to 50 feet averaged 0.23% Cu and a second interval from 120 to 225 feet averaged 0.28% Cu. The mineralization remains open to the north, west and at depth.

06-31R is located in the west central area of Longshot Ridge. The hole was angled to the northwest at a dip of 600 to a depth of 545 feet. The hole intersected moderate skarn alteration within siltstone and limestone of the Gabbs Fm. Mineralization extends from surface to 380 feet with an upper 130 foot zone averaging 0.32% Cu and a lower 190 foot zone starting at 190 feet that averages 0.87% Cu. Included within this interval is a 90 foot zone extending from 285 feet that averages 1.06% Cu. 06-32C is located at the northern portion of

20

Longshot Ridge. The hole was drilled northwest across stratigraphy at an angle of 700 to a depth of 284 feet. An 83 foot interval starting at 65 feet returned an average of 0.66% Cu.

06-33C is located in north central Longshot Ridge, approximately 350 feet south of 06-32C. The hole was drilled towards the northwest at an angle of 70° to a depth of 345 feet. A 190 foot zone from the start of sampling at 10 feet to 200 feet averaged 0.52% Cu, with a 20 foot zone from 175 to 195 feet averaging 1.50% Cu.

Drilling to date at the Longshot Ridge copper deposit has confirmed and expanded on the known extent of the copper oxide mineralization, which is exposed at surface and has been tested to depths up to 400 feet. With the exception of holes 06-13R and 06-14R, all drill holes completed in 2006 have indicated the consistent and wide spread nature of the copper mineralization at Longshot Ridge. The recent data is being incorporated into the overall New York Canyon project database in order to develop a resource estimate of the copper content at Longshot Ridge.

ITEM 3. LEGAL PROCEEDINGS.

On May 25, 2005, the United States Securities and Exchange Commission (the “SEC”) issued a formal order of private investigation to Canyon Copper Corp. (formerly “Aberdene Mines Limited”). In connection with the investigation order, we received subpoenas from the SEC requesting the production of certain of our documents, relating to, among other things, our transactions with Langley Park, PLC and the principals of Langley Park, PLC, certain of our news releases and certain materials sent to our stockholders. Effective October 23, 2007, the SEC informed us that it completed its investigation and did not intend to seek any enforcement action against us.

On December 20, 2005, the British Columbia Securities Commission (the “BCSC”) issued a formal investigation order to Canyon Copper and certain of our former officers pursuant to the Securities Act of British Columbia in connection with certain news releases and materials sent to our stockholders in 2004. We are cooperating fully with the BCSC inquiry and have submitted all requested documents in connection with the investigation to date. Effective October 3, 2007, the BCSC informed us that it completed its investigation and did not intend to seek any enforcement action against us.

On January 29, 2007, we received a statement of claim filed in the Ontario Superior Court of Justice from a company claiming unpaid investor relations fees of $25,916 and requesting the balance of an alleged retainer of $84,000. Canyon Copper is vigorously disputing this claim and believes this action is without merit.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

21

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATEDSTOCKHOLDERMATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Quotations for our common stock are currently on the Over-The-Counter Bulletin Board (the “OTC Bulletin Board”) under the symbol “CYOO.” The high and the low bid prices for our shares for the last two fiscal years of actual trading, as quoted in the OTC Bulletin Board, as applicable, were:

QUARTER

| HIGH

($) | LOW

($) |

| 1stQuarter 2007 | 0.60 | 0.28 |

| 2ndQuarter 2007 | 0.34 | 0.21 |

| 3rdQuarter 2007 | 0.355 | 0.24 |

| 4thQuarter 2007 | 0.37 | 0.28 |

| 1stQuarter 2008 | 0.32 | 0.15 |

| 2ndQuarter 2008 | 0.30 | 0.11 |

| 3rdQuarter 2008 | 0.24 | 0.13 |

| 4thQuarter 2008 | 0.16 | 0.08 |

Quotations entered on the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

Holders of Our Common Stock

As of September 22, 2008, we had 77 registered stockholders holding 76,981,399 of our issued and outstanding common stock.

Dividends

There are no restrictions in our Articles of Incorporation or Bylaws that prevent us from declaring dividends. Our governing status, Chapter 78 of the Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| | 1. | We would not be able to pay our debts as they become due in the usual course of business; or |

| | | |

| | 2. | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.