Filed Pursuant to Rule 424(b)(3)

Registration No. 333-187188

April 22, 2013

Dear Fellow Stockholder:

You are cordially invited to attend a special meeting of stockholders to be held on May 21, 2013, at 10:00 am (Pacific Standard Time) at Suite 408, 1199 West Pender Street, Vancouver, British Columbia, Canada for the following purposes:

| 1. | to approve the Plan of Conversion, a copy of which is attached as Schedule “A” to this Proxy Statement/Prospectus, whereby our corporate jurisdiction will be changed from the State of Nevada to the Province of British Columbia, Canada by means of a process called a “Conversion” and a “Continuation”; and |

| | |

| 2. | to transact such other business as may properly come before the meeting or any adjournment thereof. |

Our Board of Directors has approved the Plan of Conversion to change our corporate jurisdiction from Nevada to British Columbia. Therefore, our Board of Directorsrecommends that you vote “FOR” the Continuation of Canyon from Nevada to British Columbia.

Following completion of the Continuation, we will continue to be listed on the TSX Venture Exchange under the symbol “CNC” and quoted on the OTC Bulletin Board and OTC Markets QB (“OTCQB”) under the symbol “CNYC”.

See the “Risk Factors” beginning on page 8 of this Proxy Statement/Prospectus for a discussion of certain risks that you should consider as stockholders of our company in regards to the Continuation and the ownership of shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus is dated April 22, 2013 and is first being sent or given to our stockholders on or about April 22, 2013.

Sincerely,

CANYON COPPER CORP.

| /s/ Benjamin Ainsworth | |

| Benjamin Ainsworth, | |

| Chief Executive Officer and President | |

1

| NOTICE OF SPECIAL MEETING OF STOCKHOLDERS |

| TO BE HELD ON |

| MAY 21, 2013 |

To Our Stockholders:

A special meeting of the stockholders of Canyon Copper Corp. will be held on May 21, 2013, at 10:00 am (Pacific Standard Time) at Suite 408, 1199 West Pender Street, Vancouver, British Columbia, Canada, for the following purpose:

| 1. | to approve the Plan of Conversion, a copy of which is attached as Schedule “A” to this Proxy Statement/Prospectus, whereby our corporate jurisdiction will be changed from the State of Nevada to the Province of British Columbia, Canada by means of a process called a “Conversion” and a “Continuation”; and |

| | |

| 2. | to transact such other business as may properly come before the special meeting or any adjournment thereof. |

The accompanying Proxy Statement/Prospectus provides additional information in relation to the special meeting and is supplemental to, and expressly made part of the Notice of Special Meeting. Our Board of Directors approved the Plan of Conversion to change our corporate jurisdiction from Nevada to British Columbia. Therefore, our Board of Directors recommends that you vote “FOR” the continuation of Canyon from Nevada to British Columbia.

Only stockholders of record at the close of business on April 19, 2013 are entitled to notice of and to vote at the meeting. Whether or not you expect to attend the special meeting in person, we urge you to submit your vote as promptly as possible by marking, signing and dating the enclosed proxy card and returning it to our office at Suite 408, 1199 West Pender Street, Vancouver, British Columbia V6E 2R1 or by facsimile at (604) 684-9365. You may revoke your proxy at any time before the special meeting. If your shares are held in the name of a bank, broker, or other nominee, please follow the instructions in the voting instruction card furnished to you by such record holder.

Under Nevada law, stockholders of record who do not vote in favor of the Plan of Conversion may exercise their dissent rights to obtain fair value of their shares of stock if the Continuation is completed. You must strictly follow the procedures of Nevada law including, among other things, submitting a written demand before the vote is taken on the adoption of the Plan of Conversion and you must not vote in favor of the Plan of Conversion.

Dated at Vancouver, British Columbia, this 22nd day of April, 2013

BY ORDER OF THE BOARD OF DIRECTORS

CANYON COPPER CORP.

| /s/ Benjamin Ainsworth | |

| Benjamin Ainsworth, | |

| Chief Executive Officer and President | |

| Vancouver, British Columbia | |

2

PROXY STATEMENT/PROSPECTUS

TABLE OF CONTENTS

3

PROXY STATEMENT/PROSPECTUS SUMMARY

As used in this Proxy Statement/Prospectus, unless the context otherwise requires, “we,” “us,” “our,” the “Company”, “Canyon” and “Canyon Nevada” refers to Canyon Copper Corp. The term “Canyon B.C.” means Canyon Copper Corp. a British Columbia company, whose shares you are expected to own after we change our corporate jurisdiction from the state of Nevada to the province of British Columbia. All dollar amounts in this Proxy Statement/Prospectus are in U.S. dollars unless otherwise stated. You should read the entire Proxy Statement/Prospectus before making a decision.

About Us

We were incorporated on January 21, 2000 under the laws of the State of Nevada. Our principal executive office is located at Suite 408, 1199 West Pender Street, Vancouver, British Columbia, Canada V6E 2R1. Our telephone number is (604) 331-9526.

Overview of Our Business

We are an exploration stage company engaged in the acquisition, exploration and development of mineral properties. We currently hold 100% title in a major claim block totalling 661 unpatented mineral claims, covering approximately 13,220 acres located in Mineral County, Nevada (the “New York Canyon Claims”). We also hold 21 patented mineral claims covering an area of approximately 420 acres, located within the New York Canyon Claims area. We collectively refer to the New York Canyon Claims and the patented claims as the “New York Canyon Project.” See the sections titled “Our Business” and “Properties – New York Canyon Project” for additional information.

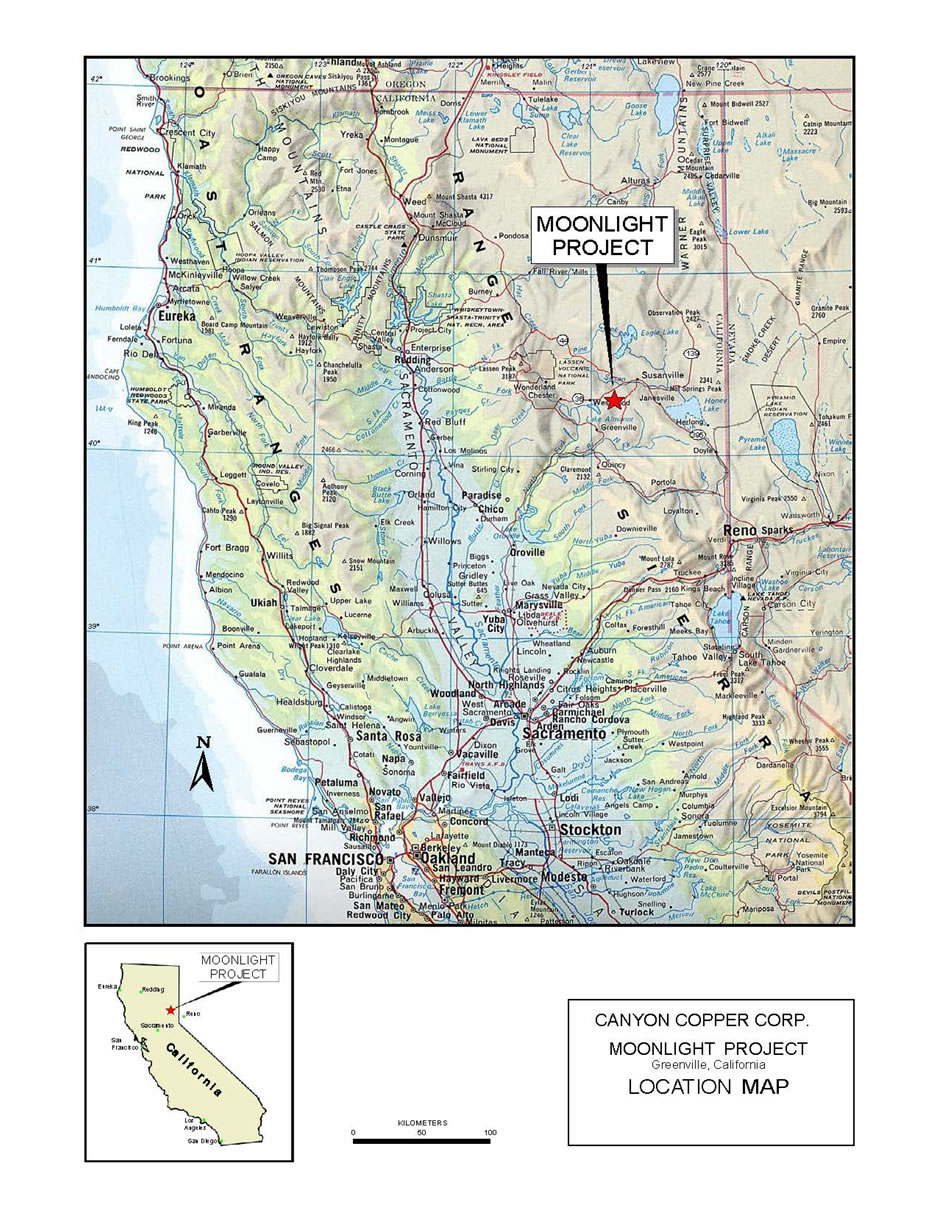

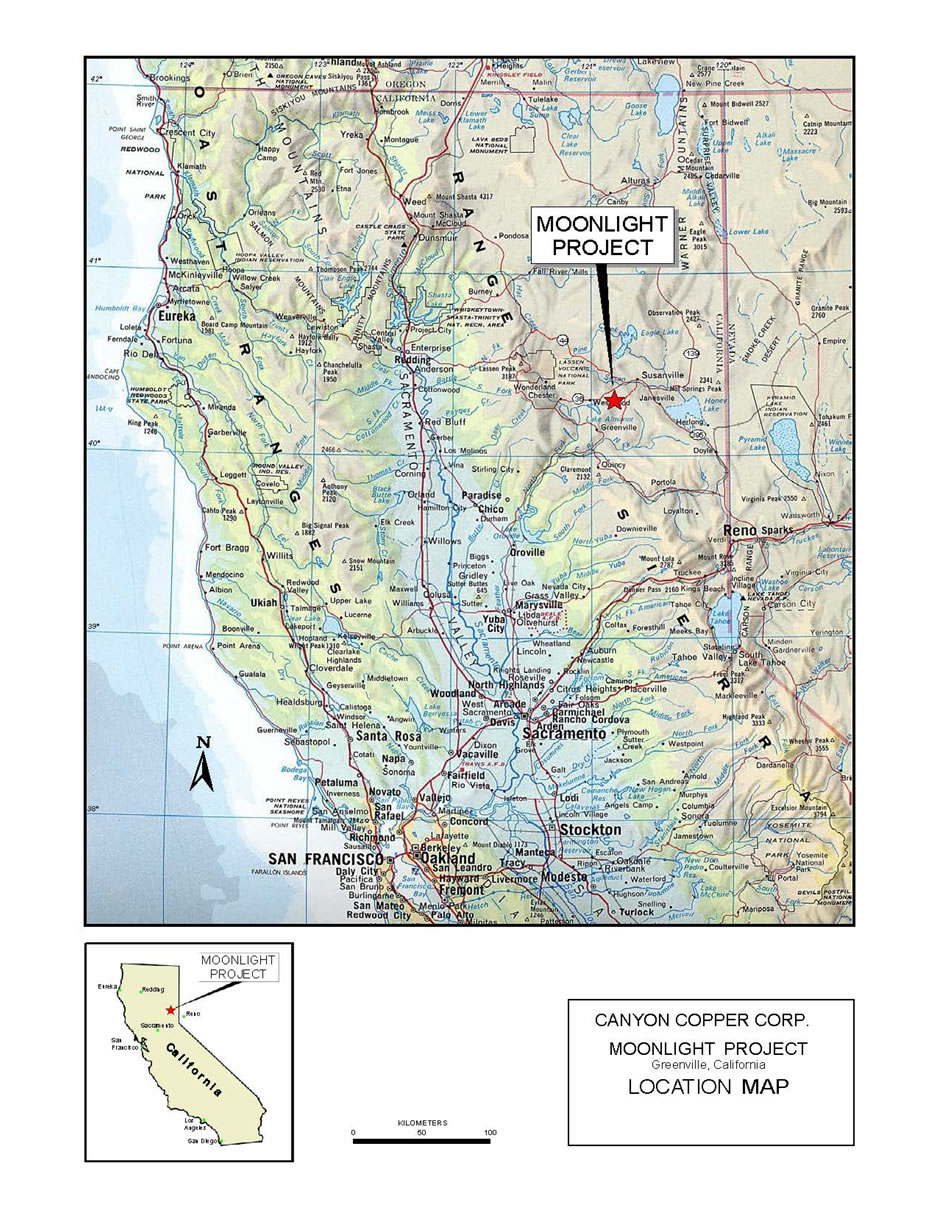

We also hold an option to acquire a 100% interest in a copper porphyry project comprised of 307 unpatented mineral claims having an area of approximately 6,300 acres located on the northern end of the Walker Lane Belt in Plumas County, California (the “Moonlight Property”). We acquired our interest in the Moonlight Property pursuant to an assignment agreement dated November 25, 2011 among Metamin Enterprises Inc. (the “Assignor”), a company controlled by Benjamin Ainsworth, our Chief Executive Officer, President, Secretary and director, Metamin Enterprises USA Inc., a wholly owned subsidiary of the Assignor, and Canyon. On January 24, 2013, we entered into an agreement with Sandfield Resources Ltd. (“Sandfield”) and Sandfield Resources (USA) Inc. whereby we agreed to transfer to Sandfield up to a 70% interest in our optioned Moonlight Property. See the sections titled “Our Business” and “Properties – Moonlight Property” for additional information.

We have not earned any revenues to date and do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable mineral deposits exist on our claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Proposal – The Continuation

We are proposing to change our jurisdiction of incorporation from Nevada to British Columbia through a process known as a conversion under Nevada corporate law, and known as a continuation under British Columbian corporate law (the "Continuation" or the "Conversion").

If the stockholders approve the Continuation at the special meeting, we intend to file articles of conversion with the Secretary of State of Nevada and a continuation application with the Registrar of Companies of British Columbia. Upon receipt of a certificate of continuation from the Registrar of Companies of British Columbia, we will be continued as a British Columbia company and will be governed by the laws of British Columbia. The assets and liabilities of the British Columbia company immediately after the Continuation will be identical to the assets and liabilities of the Nevada corporation immediately prior to the Continuation. The officers and directors of our company immediately before the Continuation becomes effective will be the officers and directors of the British Columbia company. The change of our corporate jurisdiction will not result in any material change to our business and will not have any effect on the relative equity or voting interests of our stockholders. Each previously outstanding share of our common stock will become one common share of the British Columbia company.

4

The Continuation and the Plan of Conversion are also subject to approval by the holders of a majority of the outstanding shares of our common stock and the TSX Venture Exchange.

Our directors and executive officers, who currently hold an aggregate of 1,959,251 shares of our common stock, approximately 2.9% of our outstanding common stock, have approved the Continuation and indicated that they intend to vote their shares for the approval of the Continuation and adopt the Plan of Conversion.

Our Board of Directors recommends that you vote “FOR” the approval of the Plan of Conversion.

The Continuation is set out in detail under the section titled “Continuation to British Columbia”.

Reasons for the Continuation

We believe that it is in the best interests of Canyon to become a British Columbia company because we believe that the change of our corporate jurisdiction to the Province of British Columbia, Canada will more accurately reflect our operations, which are headquartered in and managed from the Province of British Columbia, Canada. We also believe that changing our corporate jurisdiction to the Province of British Columbia, Canada more accurately reflects the identity of our company because Canada is the country from which we have derived much of our financing, and our common stock is listed on the TSX Venture Exchange in Canada. See “Continuation to British Columbia – Reasons for Continuation”.

Regulatory Approvals

In order for our company to carry out the Continuation, it will be necessary for us to comply with the provisions of the corporate law of the Nevada Revised Statutes (“NRS”)and theBusiness Corporations Act(British Columbia). Under the NRS, a Nevada corporation is required to obtain approval from the holders of a majority of its voting power in order to carry out a conversion.

If our stockholders adopt the Plan of Conversion, then we intend to file articles of conversion with the Secretary of State of Nevada. After that, we intend to submit a continuation application to the Registrar of Companies of British Columbia. Upon the filing of the continuation application and subsequent receipt of a certificate of continuation from the Registrar of Companies of British Columbia, we will be continued as a British Columbia company.

The Continuation is subject to the approval of the TSX Venture Exchange.

Material Tax Consequences

The following is a brief summary of certain tax consequences the Continuation will have for stockholders. Stockholders should consult their own tax advisers with respect to their particular circumstances. A more detailed summary of the factors affecting the tax consequences for stockholders is set out under the sections of this Proxy Statement/Prospectus titled "Material United States Federal Tax Consequences" and "Material Canadian Income Tax Consequences".

United States Federal Tax Consequences

The Continuation will result in the application of the U.S. “corporate inversion” rules. United States federal income tax law with respect to corporate inversions provides in certain cases that a non-U.S. corporation may be treated as a U.S. corporation for all purposes of the Code. An inversion can occur in certain transactions in which a non-U.S. corporation acquires substantially all of the assets of or equity interests in a U.S. corporation, if, after the transaction, former equity owners of the U.S. corporation own 80% or more of the stock, by vote or by value, in the non-U.S. corporation. We believe that these conditions will be met as a result of the Continuation.

Thus, even though following the Continuation, we will be organized under the laws of British Columbia, Canada and treated as a Canadian company for corporate law and Canadian tax purposes, we will be treated also as a U.S. domestic corporation under United States federal tax law, fully subject to United States federal income tax on our worldwide income under Section 7874(b) of the Code.

5

The Continuation will be treated as a tax-free reorganization pursuant to Section 368(a)(1)(F) of the Code, and will therefore not be taxable to us. Moreover, U.S. Holders (as defined hereinafter) will not recognize gain or loss on their shares of common stock as a result of the Continuation. Accordingly, such stockholders’ tax bases in and holding periods for their shares of common stock after the Continuation will be the same as their tax bases in and holding periods for the shares of common stock before the Continuation.

However, we are a U.S. real property holding corporation (“USRPHC”) for U.S. federal income tax purposes with respect to our Non-U.S. Holders (as defined hereafter). Therefore, unless certain trading requirements are met, the deemed exchange of shares of our common stock by a Non-U.S. Holder pursuant to the Continuation will be a taxable transaction to Non-U.S. Holders, who will be subject to U.S. federal income tax with respect to the gain recognized (unless the Non-U.S. Holder complies with certain notice requirements of the IRS). In addition, we would be required to withhold tax at a rate of 10% of the value of the shares of our common stock received by such Non-U.S. Holder in the Continuation and to report and remit such tax to the IRS within 20 days of the Continuation, absent of receiving certification from a Non-U.S. Holder that it will comply with certain notice requirements to the IRS.

Our company and our stockholders may be required to report certain information to the IRS in connection with the Continuation. Accordingly, U.S. Holders and Non-U.S. Holders should consult with their own tax advisors regarding any statements or information reporting to the IRS in connection with the Continuation.

Canadian Tax Consequences

The Continuation should not give rise to Canyon having any liability for Canadian income tax. Following Continuation, Canyon will be a resident of Canada and subject to Canadian income tax on a worldwide basis. In addition, the Continuation shall not cause any tax liability for shareholders of Canyon, whether resident in Canada or elsewhere. However, Canyon will be required to withhold the required withholding tax on dividends paid to a shareholder not resident in Canada following Continuation.

Accounting Treatment of the Continuation

For United States accounting purposes, the Continuation of our company from a Nevada corporation to a British Columbia company represents a non-substantive exchange to be accounted for in a manner consistent with a transaction between entities under common control. All assets, liabilities, revenues and expenses will be reflected in the accounts of Canyon B.C. based on existing carrying values at the date of the exchange. The historical comparative figures of Canyon B.C. will be those of Canyon Nevada. See “Continuation to British Columbia – Accounting Treatment of the Continuation”.

Reporting Obligations under Securities Laws

If we change our corporate jurisdiction to the Province of British Columbia, Canada, we will still have to comply with reporting requirements under both the United States and Canadian securities laws. However, these requirements should be reduced because we would no longer be a United States company.

We currently prepare our financial statements in accordance with United States generally accepted accounting principles (“US GAAP”). We file our audited annual financial statements with the Securities and Exchange Commission on annual reports on Form 10-K and our unaudited interim financial statements with the Securities and Exchange Commission on quarterly reports on Form 10-Q. Additionally, we are a reporting issuer in the Provinces of British Columbia and Alberta, Canada.

Upon completion of the Continuation, we anticipate that we will meet the definition of a “foreign private issuer” under the Securities Exchange Act of 1934 (the “Exchange Act”). Although we plan to file a Form 15 (the “Form 15”) to terminate and suspend our duty to file reports under the Exchange Act, rule 12h-3(c) of the Exchange Act provides that we will be required to file the balance of our quarterly and annual reports for our fiscal year ended June 30, 2013. As a foreign private issuer, we anticipate that we will file an annual report on Form 20-F for the fiscal year ended June 30, 2013. We will file our interim financial statements and management’s discussion and analysis, in the form required by Canadian securities legislation, with the Securities and Exchange Commission on Form 6-K. We anticipate that we will continue to prepare our financial statements for the balance of fiscal 2013 in accordance with US GAAP and then will prepare our financial statements in accordance with International Financial Reporting Standards (“IFRS”).

6

In addition, as a foreign private issuer, our directors, officers and stockholders owning more than 10% of our outstanding common stock will no longer be subject to the insider reporting requirements of Section 16(b) of the Exchange Act and we will no longer be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-United States companies and will not apply to us upon completion of the Continuation.

Whether or not we change our corporate jurisdiction to the Province of British Columbia, Canada, we will remain subject to Canadian disclosure requirements including those requiring that we publish news releases and file reports about material changes to or for our company, send you information circulars with respect to meetings of our stockholders, file annual and quarterly financial statements and related management’s discussion and analysis and those that require that our officers, directors and major shareholders to file reports about trading in our shares.

Comparative Rights of Stockholders

You will continue to hold the same shares you now hold following the Continuation from Nevada to British Columbia. However, the rights of stockholders under the NRS differ in certain ways from the rights of shareholders under British Columbia law. See the section titled “Material Differences of the Rights of our Stockholders After the Change of our Corporate Jurisdiction”.

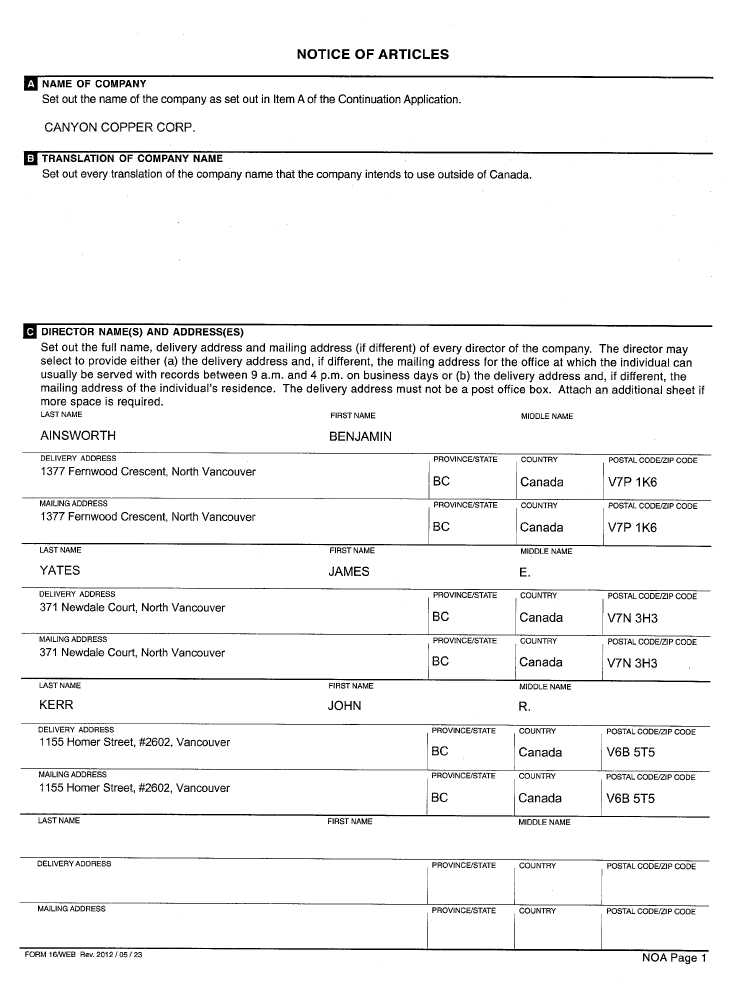

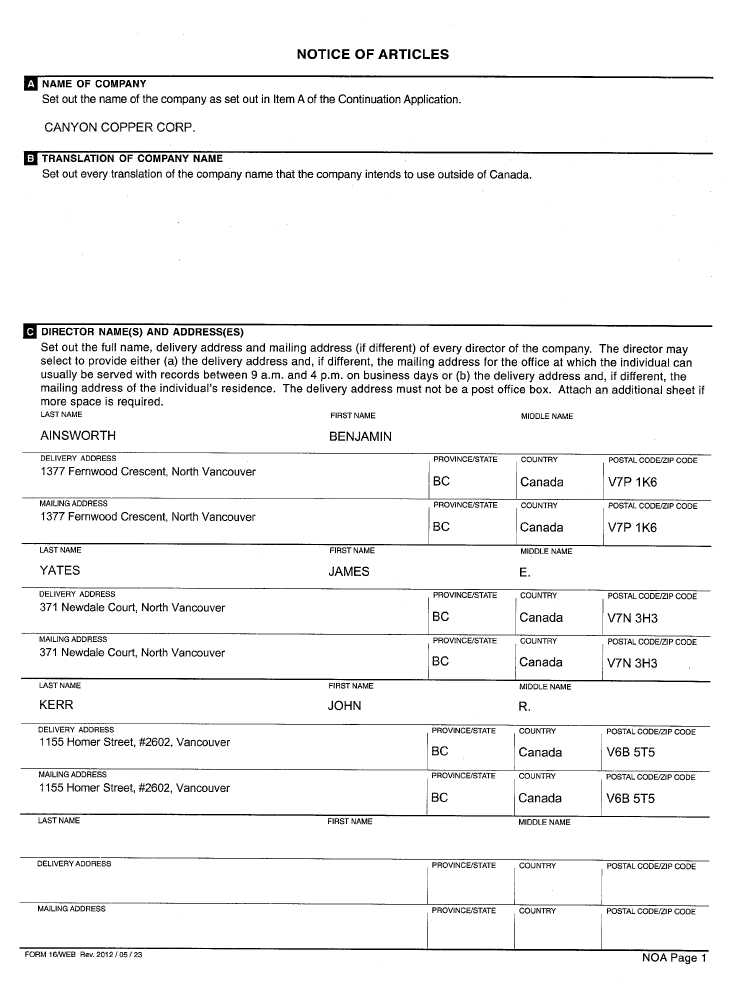

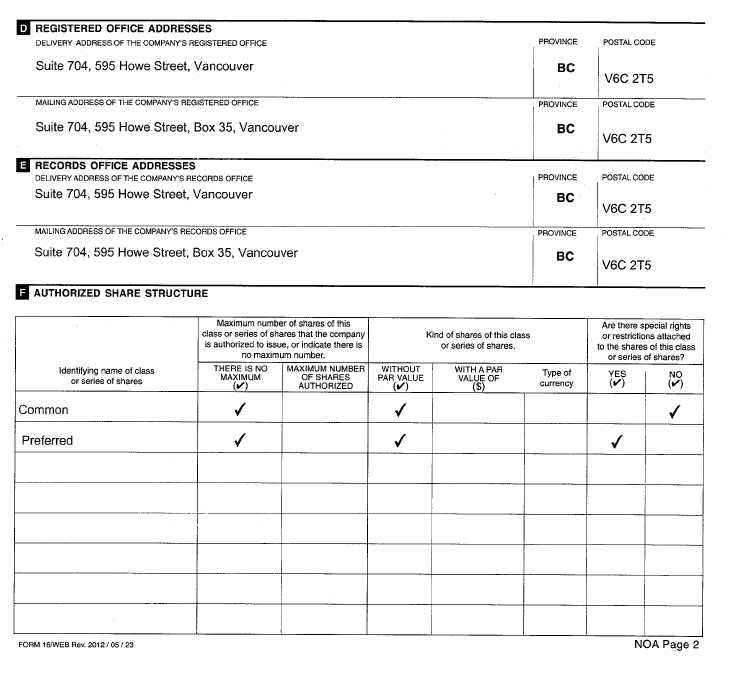

Our Authorized Capital after the Change of Our Corporate Jurisdiction

The application for the Continuation provides that our authorized capital after the change of our corporate jurisdiction will consist of an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. Our Articles of Incorporation, as amended, presently provides that our authorized capital is 131,666,666 shares of common stock with a par value of $0.00001 per share and 100,000,000 shares of preferred stock with a par value of $0.00001 per share.

Dissenters’ Rights

Under the NRS, our stockholders are entitled to dissent from approval of the Continuation pursuant to section 92A.380 of the NRS and to be paid the “fair value” of their shares of our common stock if the Continuation is completed. Stockholders electing to exercise these dissenter rights must comply with the provisions of sections 92A.300 to 92A.500 of the NRS. We will require strict compliance with the statutory procedures. A copy of the relevant provisions of the NRS is attached as Schedule B to this Proxy Statement/Prospectus. A more comprehensive discussion of dissenters’ rights is set out in the section titled “The Special Meeting – Dissenters’ Rights”.

Exchange of Share Certificates

Upon the effectiveness of the Continuation, Canyon B.C. will mail a letter of transmittal with instructions to each holder of record of our shares outstanding immediately before the effective time of the Continuation for use in exchanging certificates formerly representing shares of Canyon Nevada for certificates representing shares of Canyon B.C. Certificates should not be surrendered by the holder thereof until they have received the letter of transmittal from Canyon B.C.

Listing on the TSX Venture Exchange and Quotation on the OTC Bulletin Board and OTCQB

Our common stock is listed for trading on the TSX Venture Exchange under the symbol “CNC” and quoted on the OTC Bulletin Board and OTCQB under the symbol “CNYC”. We expect that immediately following the Continuation, the common shares of Canyon B.C. will continue to be quoted on the OTC Bulletin Board and the OTCQB and listed on the TSX Venture Exchange under the same symbols.

However, upon our terminating and suspending our reporting obligations under the Exchange Act after fiscal 2013, the shares of our common stock will no longer be eligible for quotation on the OTC Bulletin Board and OTCQB.

7

RISK FACTORS

An investment in our common stock involves certain risks. In evaluating us and our business, investors should carefully consider the following risk factors in addition to the other information included in this Proxy Statement/Prospectus.

You should read the first set of risk factors in deciding whether to approve our Continuation from Nevada to British Columbia. You may also find it helpful to read the subsequent risk factors so you understand more clearly the risks associated with our business. The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

Risk Related to the Continuation

We will still be treated as a U.S. corporation and taxed on our worldwide income after the Continuation.

The continuation of our company from the State of Nevada to the Province of British Columbia, Canada is considered a migration of our company from the State of Nevada to the Province of British Columbia, Canada. Certain transactions whereby a U.S. corporation migrates to a foreign jurisdiction can be considered by the United States Congress to be an abuse of the U.S. tax rules because thereafter the foreign entity is not subject to U.S. tax on its worldwide income. Section 7874(b) of the Internal Revenue Code of 1986, as amended (the “Code”), was enacted in 2004 to address this potential abuse. Section 7874(b) of the Code provides generally that certain corporations that migrate from the United States will nonetheless continue to be treated as United States corporations for all U.S. federal tax purposes, including being subject to U.S. tax on their worldwide income unless the migrating entity has substantial business activities in the foreign country to which it is migrating when compared to its total business activities.

Section 7874(b) of the Code will apply to the migration of our company from the State of Nevada to the Province of British Columbia, Canada, and our company will continue to be a U.S. domestic corporation for U.S. federal tax purposes and will be subject to United States federal income taxation on its worldwide income. Section 7874(b) of the Code will apply to our migration unless we have substantial business activities in Canada when compared to our total business activities, which we do not anticipate will be the case.

If we complete the Continuation, we will no longer be required to file quarterly financial statements that havebeen reviewed by our independent auditors, as required by the Exchange Act.

If we change our corporate jurisdiction to the Province of British Columbia, Canada, we will still have to comply with reporting requirements under United States securities laws. However, these requirements could be reduced because we will no longer be incorporated in a state of the United States.

We currently prepare our financial statements in accordance with US GAAP. We file our audited annual financial statements with the Securities and Exchange Commission with our annual reports on Form 10-K and we file our unaudited interim financial statements with the Securities and Exchange Commission with our quarterly reports on Form 10-Q. Upon completion of the Continuation, we anticipate that we will meet the definition of a “foreign private issuer” under the Exchange Act. As a foreign private issuer, we anticipate that we will be eligible to file our annual report for fiscal 2013 with the Securities and Exchange Commission on Form 20-F. We would also not be required to file quarterly reports on Forms 10-Q. Instead, we would file with the Securities and Exchange Commission on a quarterly basis interim financial statements that have not been reviewed by our auditors, together with management’s discussion and analysis in the form required under Canadian securities legislation. We anticipate that we will continue to prepare our financial statements in accordance with US GAAP for the balance of fiscal 2013 and thereafter will prepare our financial statements in accordance with IFRS.

8

If we complete the Continuation, insiders of our company will no longer be required to file insider reports underSection 16(a) of the Exchange Act and they will no longer be subject to the “short swing profit rule” of Section16(b) of the Exchange Act.

As a foreign private issuer, our directors, officers and stockholders owning more than 10% of our outstanding common stock will be subject to the insider filing requirements imposed by Canadian securities laws but they will be exempt from the insider requirements imposed by Section 16 of the Exchange Act. The Canadian securities laws do not impose on insiders any equivalent of the “short swing profit rule” imposed by Section 16 and, after completion of the Continuation, our insiders will not be subject to liability for profits realized from any “short swing” trading transactions, or a purchase and sale, or a sale and purchase, of our equity securities within less than six months. As a result, our stockholders may not enjoy the same degree of protection against insider trading as they would under Section 16 of the Exchange Act.

If we complete the Continuation, our company will no longer be required to comply with Regulation FD.

Regulation FD, which prevents certain selective disclosure by reporting companies, does not apply to non-United States companies and will not apply to us upon completion of the Continuation. As a result, our stockholders may not enjoy the same degree of protection against selective disclosure as they would under Regulation FD.

Your rights as a stockholder of our company will change as a result of the Continuation.

Because of the differences between Nevada law and British Columbia law, your rights as a stockholder will change if the Continuation is completed. A detail discussion is set forth under the section titled “Material Differences of the Rights of Our Stockholders After the Change of Our Corporate Jurisdiction”.

The market for shares of our company as a British Columbia company may differ from the market for shares ofour company as a Nevada corporation.

Although we anticipate that our common shares will continue to be quoted on the OTC Bulletin Board and OTCQB and listed on the TSX Venture Exchange following the completion of the Continuation, the market prices, trading volume and volatility of the shares of our company as a British Columbia company could be different from those of the shares of our company as a Nevada corporation. We cannot predict what effect, if any, the Continuation will have on the market price prevailing from time to time or the liquidity of our common shares.

Risk Factors Related to Our Business

We lack an operating history and have losses which we expect to continue into the future. As a result, we mayhave to suspend or cease exploration activities and if we do not obtain sufficient financing, our business will fail.

We were incorporated on January 21, 2000 and to date have been involved primarily in the acquisition of our mineral property and the exploration and development on this property. We have no exploration history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

| - | our ability to locate a profitable mineral property; and |

| | |

| - | our ability to generate revenues. |

Our plan of operation calls for significant expenses in connection with the exploration of the New York Canyon Project, which may require us to obtain financing. We recorded a net loss of $596,018 for the six months ended December 31, 2012 and have an accumulated deficit of $23,031,631 since inception. As at December 31, 2012, we had cash of $198,535. For the next twelve months, we have sufficient funds to meet our annual claim payments and meet our ongoing reporting obligations. However, we will require additional financing in order to implement our geochemical sampling program and the test drilling program on the New York Canyon Project. There is no assurance we will be successful in raising such funding or on terms that are acceptable to us. Since inception, we have been dependent on investment capital and debt financing from third parties as our primary source of liquidity. We anticipate continuing to rely on sales of shares of our common stock and loans in order to continue to fund our business operations. Issuances of additional shares will result in further dilution of our existing shareholders.

9

Obtaining financing would be subject to a number of factors, including the market prices for the mineral property and base and precious metals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Since our inception, we have used our common stock to raise money for our operations and for our property acquisitions. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may neverachieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral properties and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because we are an exploration stage company, our business has a high risk of failure.

As noted in the financial statements that are included with this Proxy Statement/Prospectus, we are an exploration stage company that has incurred net losses since inception, we have not attained profitable operations and we are dependent upon obtaining adequate financing to complete our exploration activities. The success of our business operations will depend upon our ability to obtain further financing to complete our planned exploration program and to attain profitable operations. If we are not able to complete a successful exploration program and attain sustainable profitable operations, then our business will fail.

Because we have not commenced business operations, we face a high risk of business failure.

We have not earned any revenues as of the date of this Proxy Statement/Prospectus. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no mineral reserves. Mineral exploration is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our property our production capability is subject to further risks including:

- | Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for; |

| - | Availability and costs of financing; |

| - | Ongoing costs of production; and |

| - | Environmental compliance regulations and restraints. |

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near our mineral properties and such other factors as government regulations, including regulations relating to allowable production, exporting of minerals, and environmental protection. If we do not find a mineral reserve or define a mineral inventory containing gold, silver or copper or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and investors will lose their investment.

10

In order to maintain our rights to our mineral properties, we will be required to make annual filings with federaland state regulatory agencies and/or be required to complete assessment work on our mineral properties.

In order to maintain our rights to our mineral properties, we will be required to make annual filings with federal and state regulatory authorities. In addition, we may be required by federal and/or state legislation or regulations to complete minimum annual amounts of mineral exploration work on our mineral properties. A failure by us to meet the annual maintenance requirements under federal and state laws could cause our rights to our mineral properties to lapse.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability ordamages if and when we conduct mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, if and when we conduct exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

If the price of base and precious metals declines, our financial condition and ability to obtain future financings willbe impaired.

The price of base and precious metals is affected by numerous factors, all of which are beyond our control. Factors that tend to cause the price of base and precious metals to decrease include the following:

| | (i) | Sales or leasing of base and precious metals by governments and central banks; |

| | | |

| | (ii) | A low rate of inflation and a strong US dollar; |

| | | |

| | (iii) | Speculative trading; |

| | | |

| | (iv) | Decreased demand for base and precious metals industrial, jewelry and investment uses; |

| | | |

| | (v) | High supply of base and precious metals from production, disinvestment, scrap and hedging; |

| | | |

| | (vi) | Sales by base and precious metals producers and foreign transactions and other hedging transactions; and |

| | | |

| | (vii) | Devaluing local currencies (relative to base and precious metals price in US dollars) leading to lower production costs and higher production in certain major base and precious metals producing regions. |

Our business is dependent on the price of base and precious metals. We have not undertaken hedging transactions in order to protect us from a decline in the price of base and precious metals. A decline in the price of base and precious metals may also decrease our ability to obtain future financings to fund our planned development and exploration programs.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our success is dependent upon the performance of key personnel working full-time in management, supervisory and administrative capacities or as consultants. This is particularly true in highly technical businesses such as mineral exploration. These individuals are in high demand and we may not be able to attract the personnel we need. The loss of the services of senior management or key personnel could have a material and adverse effect on us, our business and results of operations. Failure to hire key personnel when needed, or on acceptable terms, would have a significant negative effect on our business.

As we undertake exploration of our mineral properties, we will be subject to compliance with governmentregulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We are required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

11

| | (i) | Water discharge will have to meet drinking water standards; |

| | | |

| | (ii) | Dust generation will have to be minimal or otherwise re-mediated; |

| | | |

| | (iii) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| | | |

| | (iv) | An assessment of all material to be left on the surface will need to be environmentally benign; |

| | | |

| | (v) | Ground water will have to be monitored for any potential contaminants; |

| | | |

| | (vi) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and |

| | | |

| | (vii) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. If remediation costs exceed our cash reserves we may be unable to complete our exploration program and have to abandon our operations.

If we become subject to increased environmental laws and regulation, our operating expenses may increase.

Our exploration and development programs are regulated by US Federal, California and Nevada state environmental laws that relate to the protection of air and water quality, hazardous waste management and mine reclamation. These regulations will impose operating costs on us. If the regulatory environment for our operations changes in a manner that increases costs of compliance and reclamation, then our operating expenses would increase with the result that our financial condition and operating results could be adversely affected.

There has been a very limited public trading market for our securities, and the market for our securities maycontinue to be limited and be sporadic and highly volatile.

There is currently a limited public market for our common stock. Our common stock trades in Canada on the TSX Venture Exchange and over the counter in the United States on the OTC Bulletin Board and OTCQB market place. We cannot assure you that an active market for our shares will be established or maintained in the future. The OTC Bulletin Board and OTCQB are not national securities exchanges, and many companies have experienced limited liquidity when traded through these quotation systems. Holders of our common stock may, therefore, have difficulty selling their shares, should they decide to do so. In addition, there can be no assurances that such markets will continue or that any shares, which may be purchased, may be sold without incurring a loss. The market price of our shares, from time to time, may not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value, and may not be indicative of the market price for the shares in the future.

In addition, the market price of our common stock may be volatile, which could cause the value of our common stock to decline. Securities markets experience significant price and volume fluctuations. This market volatility, as well as general economic conditions, could cause the market price of our common stock to fluctuate substantially. Many factors that are beyond our control may significantly affect the market price of our shares. These factors include:

12

| | (a) | price and volume fluctuations in stock markets; |

| | (b) | changes in our operating results; |

| | (c) | any increase in losses from levels expected by securities analysts; |

| | (d) | changes in regulatory policies or law; |

| | (e) | operating performance of companies comparable to us; and |

| | (f) | general economic trends and other external factors. |

Even if an active market for our common stock is established, stockholders may have to sell their shares at prices substantially lower than the price they paid for the shares or might otherwise receive than if an active public market existed.

If we complete a financing through the sale of additional shares of our common stock, shareholders willexperience dilution.

The most likely source of future financing presently available to us is through the issuance of our common stock. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated.

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system.

Because our securities constitute "penny stocks" within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the quotation price of our common stock is less than $5.00 per share, the common stock will be subject to Rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| | 1. | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | | |

| | 2. | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| | | |

| | 3. | contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | | |

| | 4. | contains a toll-free telephone number for inquiries on disciplinary actions; |

| | | |

| | 5. | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | | |

| | 6. | contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

13

Non-U.S. holders of our common stock, in certain situations, could be subject to U.S. federal income tax uponthe sale, exchange or disposition of our common stock.

We believe that we are, and will remain for the foreseeable future, a “U.S. real property holding corporation” for U.S. federal income tax purposes. As a result, under the Foreign Investment in Real Property Tax Act (“FIRPTA”) certain non-U.S. investors may be subject to U.S. federal income tax on gain from the disposition of shares of our common stock, in which case they would also be required to file U.S. tax returns with respect to such gain, and may be subject to a withholding tax with respect to a disposition of our stock. In general, whether these FIRPTA provisions apply depends on the amount of our common stock that such non-U.S. investors hold and whether, at the time they dispose of their shares, our common stock is regularly traded on an established securities market within the meaning of the applicable Treasury Regulations. So long as our common stock continues to be regularly traded on an established securities market, only a non-U.S. investor who has held, actually or constructively, more than 5% of our common stock at any time during the shorter of (i) the five-year period ending on the date of disposition, and (ii) the non-U.S. investor’s holding period for its shares, may be subject to U.S. federal income tax on the disposition of our common stock under FIRPTA.

14

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Proxy Statement/Prospectus constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate,” "believe,” "estimate,” "should,” "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of Canyon to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; changes in project parameters as plans continue to be refined; changes in labour costs; future mineral prices; equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or unfavourable operating conditions and losses; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section titled "Risk Factors" in this Proxy Statement/Prospectus.

Forward looking statements are based on a number of material factors and assumptions, including the results of exploration and drilling activities, the availability and final receipt of required approvals, licenses and permits, that sufficient working capital is available to complete proposed exploration and drilling activities, that contracted parties provide goods and/or services on the agreed time frames, the equipment necessary for exploration is available as scheduled and does not incur unforeseen break downs, that no labour shortages or delays are incurred and that no unusual geological or technical problems occur. While we consider these assumptions may be reasonable based on information currently available to it, they may prove to be incorrect. Actual results may vary from such forward-looking information for a variety of reasons, including but not limited to risks and uncertainties disclosed in the section titled “Risk Factors” in this Proxy Statement/Prospectus.

We intend to discuss in our Quarterly Reports and Annual Reports any events or circumstances that occurred during the period to which such documents relate that are reasonably likely to cause actual events or circumstances to differ materially from those disclosed in this Proxy Statement/Prospectus. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on our business or the extent to which any factor, or combination of such factors, may cause actual results to differ materially from those contained in any forwarding looking statement.

15

CONTINUATION TO BRITISH COLUMBIA

Overview of the Continuation

On March 8, 2013, our Board of Directors determined that it would be in the best interest of our company to change our corporate jurisdiction from the State of Nevada to the Province of British Columbia, Canada. This process is called a “Conversion” under the NRS and a “Continuation” under theBusiness Corporations Act (British Columbia). A copy of the Plan of Conversion is attached as Schedule A.

If our stockholders approve the Continuation, we intend to file articles of conversion with the Secretary of State of Nevada and a continuation application with the Registrar of Companies of British Columbia. Upon filing the articles of conversion, continuation application and receipt of a certificate of continuation from the Registrar of Companies of British Columbia, we will be continued as a British Columbia company and will be governed by the laws of British Columbia. The assets and liabilities of the British Columbia company immediately after the Continuation will be identical to the assets and liabilities of the Nevada corporation immediately prior to the Continuation. Our officers and directors immediately before the Continuation becomes effective will be the officers and directors of the British Columbia company. The change of our corporate jurisdiction will not result in any material change to our business and will not have any effect on the relative equity or voting interests of our stockholders. Each previously outstanding share of our common stock will become one common share of the British Columbia company.

The Continuation and the Plan of Conversion are subject to approval by the holders of a majority of the outstanding shares of our common stock and the TSX Venture Exchange.

The change of our corporate jurisdiction will result in changes in the rights and obligations of our current stockholders under applicable corporate laws. A detailed discussion of these differences is set forth under the section titled “Material Differences of the Rights of our Stockholders after the Change of our Corporate Jurisdiction” below.

In addition, the change of our corporate jurisdiction may have material tax consequences to stockholders which may or may not be adverse to any particular stockholder depending on the stockholder’s particular circumstances. A detailed discussion of the tax consequences is set out in the sections titled “Material United States Federal Tax Consequences” and “Material Canadian Income Tax Consequences” below.

Principal Terms of the Continuation

The Plan of Conversion provides that, at the effective time of the Continuation, Canyon Nevada will be converted into Canyon B.C. At the effective time of the Continuation, the continuation application and articles of Canyon B.C., in the forms attached as Appendix “A” and Appendix “B”, respectively, to the Plan of Conversion will replace the articles of incorporation and bylaws of Canyon Nevada.

Effective Time of the Continuation

The Plan of Conversion provides that, as promptly as practicable after the approval of the Plan of Conversion by our stockholders, we will file the articles of conversion with the Secretary of State of Nevada and a continuation application with the Registrar of Companies of British Columbia. The Plan of Conversion provides that the effective date and time of the Continuation will be the date and time on and at which the Continuation becomes effective under the laws of Nevada or the date and time on and at which the Continuation becomes effective under the laws of British Columbia, whichever occurs later.

Conditions to Effectuating the Conversion

The Plan of Conversion is subject to: (i) approval by our stockholders, (ii) approval by the TSX Venture Exchange, and (iii) stockholders holding no more than an aggregate of five percent (5%) of our shares of common stock exercising their dissenters’ rights.

16

Manner and Basis of Converting Shares of Common Stock

At the effective time of the Continuation, each share of our common stock, with a par value of $0.00001 per share, issued and outstanding immediately before the effective time of the Continuation will, by virtue of the Conversion and without any action on the part of the holder thereof, be converted into and become one validly issued, fully paid and non-assessable common share, without par value, of Canyon B.C.

Manner and Basis of Converting Warrants, Options and Other Rights

At the effective time of the Continuation, each option, warrant, option or other right to acquire shares of our common stock that is or was outstanding immediately before the effective time of the Conversion will, by virtue of the Conversion and without any action on the part of the holder thereof, be converted into and become a warrant, option or right, respectively, to acquire, upon the same terms and conditions, the number of common shares of Canyon B.C. that such holder would have received had such holder exercised such warrant, option or right, respectively, in full immediately before the effective time of the Continuation (whether or not such warrant, option or right was then exercisable) and the exercise price per share under each such warrant, option or right, respectively will be equal to the exercise price per share thereof immediately before the effective time of the Continuation, unless otherwise provided in the instrument or agreement granting such warrant, option or right, respectively.

Effect of the Continuation

At the effective time of the Continuation, Canyon Nevada will cease to exist as a Nevada corporation, and the title to all real estate vested by deed or otherwise under the laws of any jurisdiction, and the title to all other property, real and personal, owned by Canyon Nevada, and all debts due to Canyon Nevada on whatever account, as well as all other things in action or belonging to Canyon Nevada immediately before the Conversion, will be vested in Canyon B.C., without reservation or impairment. Canyon B.C. will have all of the debts, liabilities and duties of Canyon Nevada, and all rights of creditors accruing and all liens placed upon any property of Canyon Nevada up to the effective time of the Conversion will be preserved unimpaired, and all debts, liabilities and duties of Canyon Nevada immediately before the Conversion will attach to Canyon B.C. and may be enforced against it to the same extent as if it had incurred or contracted such debts, liabilities and duties. Any proceeding pending against Canyon Nevada may be continued as if the Continuation had not occurred or Canyon B.C. may be substituted in the proceeding in place of Canyon Nevada.

Amendment

Our Board of Directors may amend the Plan of Conversion at any time before the effective time of Continuation, provided, however, that an amendment made subsequent to the approval of the Continuation by our stockholders must not (a) alter or change the manner or basis of exchanging a stockholder’s shares of Canyon Nevada for a stockholder’s shares, rights to purchase a stockholder’s shares, or other securities of Canyon B.C., or for cash or other property in whole or in part or (b) alter or change any of the terms and conditions of the Plan of Conversion in a manner that adversely affects our stockholders.

Termination

At any time before the effective time of the Continuation, the Plan of Conversion may be terminated and the Continuation may be abandoned by our Board of Directors of Canyon Nevada, notwithstanding approval of the Plan of Conversion by our stockholders. We anticipate that the Plan of Conversion will be terminated if the proposed Conversion is not approved by our stockholders at the special meeting.

Reasons for the Continuation

We believe that the change of our corporate jurisdiction to the Province of British Columbia, Canada will more accurately reflect our operations, which are headquartered in and managed from the Province of British Columbia, Canada. We also believe that changing our corporate jurisdiction to the Province of British Columbia, Canada more accurately reflects the identity of our company because Canada is the country from which we have derived much of our financing, and our common stock is listed on the TSX Venture Exchange in Canada. Furthermore, all of our officers and directors are located in Canada, and a large amount of our issued and outstanding stock is owned of record by persons not resident in the United States. We believe that the change of our corporate jurisdiction may also enable us to qualify as a “foreign private issuer” in the United States. As a foreign private issuer, we believe that our regulatory compliance costs may decrease and our ability to raise capital should improve because it should, under certain circumstances, enable us to issue securities in private placement offerings with a four-month hold period (for which we believe there is more demand than there is for securities issued in a private placement with a minimum hold period of six-months, which is currently the case) without limiting our access to the U.S. capital markets.

17

In addition to the potential benefits described above, the Continuation will impose some moderate costs on our company and will expose us and our stockholders to some risk, including the risk of liability for taxation and the potential for greater impediments to enforcement of judgments and orders of United States courts and regulatory authorities against our company following the consummation of the Continuation. See the section titled “Risk Factors”. There are also differences between the laws of the State of Nevada and the laws of the Province of British Columbia. See the section titled “Material Differences of the Rights of Our Stockholders After the Change of Our Corporate Jurisdiction”. Regardless of the risks and costs associated with the change of our corporate jurisdiction, our Board of Directors has determined that the potential advantages of the change of our corporate jurisdiction outweigh the risks and costs.

Although our Board of Directors evaluated variations in the basic structure of the Continuation, our Board of Directors believes, based on advice from management and its professional advisors, that the proposed structure of our company as a British Columbia company is the best structure to provide the advantages which our company is seeking without substantial operational or financial risks. No assurance can be given, however, that the anticipated benefits of the Continuation will be realized.

Corporate Law Requirements

In order for our company to carry out the Continuation, it will be necessary for us to comply with the provisions of the NRS and theBusiness Corporations Act (British Columbia).

The NRS allows a corporation that is incorporated under the Nevada corporate law to convert into a foreign entity pursuant to a Conversion approved by the stockholders of the Nevada corporation. Pursuant to the NRS, our Board of Directors has adopted the Plan of Conversion attached as Schedule A to this Proxy Statement/Prospectus.

If holders of a majority of the voting power of our stockholders vote to approve the Plan of Conversion, we intend to file articles of conversion with the Nevada Secretary of State. After we file the articles of conversion and pay to the Secretary of State of the State of Nevada all prescribed fees, and we comply with all other requirements, the Conversion will become effective in accordance with the Nevada corporate law.

As we are proposing to continue into the jurisdiction of the Province of British Columbia, we must also comply with the applicable provisions of theBusiness Corporations Act (British Columbia) in order to successfully complete the Continuation.

A foreign corporation is permitted to continue from a foreign jurisdiction into British Columbia by filing with the Registrar of Companies of British Columbia a continuation application and providing to the Registrar of Companies certain records and information that the Registrar of Companies may require. We expect that our continuation into British Columbia will be effective on the date and time that the continuation application, the form of which is attached hereto as Appendix “A” of the Plan of Conversion, is filed with the Registrar of Companies, assuming we provide the Registrar of Companies with any records and information it may require. After we have continued into British Columbia, the Registrar of Companies must issue a certificate of continuation showing the name of the continued company (expected to be “Canyon Copper Corp.”) and the date and time on which it is continued into British Columbia as a continued company.

If the Continuation is approved by our stockholders, we expect to file the articles of conversion and the continuation application promptly after the consummation of the merger described above.

Exchange of Share Certificates

Upon the effectiveness of the Continuation, Canyon B.C. will mail a letter of transmittal with instructions to each holder of record of our shares outstanding immediately before the effective time of the Continuation for use in exchanging certificates formerly representing shares of Canyon Nevada for certificates representing shares of Canyon B.C. Certificates should not be surrendered by the holder thereof until they have received the letter of transmittal from Canyon B.C.

18

Description of Our Securities after the Continuation

Upon completion of the Continuation, we will be authorized to issue an unlimited number of common shares without par value, and an unlimited number of preferred shares, without par value.

Common Shares

The holders of our common shares will be entitled to receive notice of and to attend and vote at all meetings of the shareholders of Canyon B.C. and each common share shall confer the right to one vote in person or by proxy at all meetings of the shareholders of Canyon B.C. The holders of our common shares, subject to the prior rights, if any, of any other class of shares of Canyon B.C., are entitled to receive such dividends in any financial year as our Board of Directors may by resolution determine. In the event of the liquidation, dissolution or winding-up of Canyon B.C., whether voluntary or involuntary, the holders of our common shares are entitled to receive, subject to the prior rights, if any, of the holders of any other class of shares of Canyon B.C., the remaining property and assets of Canyon B.C. Our common shares do not carry any pre-emptive, subscription, redemption or conversion rights, nor do they contain any sinking or purchase fund provisions.

Preferred Shares

Canyon B.C. will be authorized to issue preferred shares in one or more series. Holders of preferred shares will not be entitled to receive notice or vote at any meeting of Canyon B.C.

Subject to theBusiness Corporations Act(British Columbia), the directors of Canyon B.C. may, by resolution, if none of the shares of any particular series are issued, alter articles of Canyon B.C. and authorize the alteration of the notice of articles of Canyon B.C., as the case may be, to do one or more of the following: (i) determine the maximum number of shares of that series that Canyon B.C. is authorized to issue, determine that there is no such maximum number, or alter any such determination; (ii) create an identifying name for the shares of that series, or alter any such identifying name; and (iii) attach special rights or restrictions to the shares of that series, or alter any such special rights or restrictions.

The holders of our preferred shares, subject to the prior rights, if any, of any other class of shares of Canyon B.C., are entitled to receive such dividends in any financial year as our Board of Directors may by resolution determine.

The holders of preferred shares will be entitled, on the liquidation or dissolution of Canyon B.C., or on any other distribution of the assets of Canyon B.C. among shareholders of Canyon B.C. for the purpose of winding up its affairs, to receive, before any distribution is made to the holders of common shares of Canyon B.C. the amount paid up with respect to each preferred share together with all declared and unpaid dividends. After payment of this amount, they will not be entitled to share in any further distribution of the property or assets of Canyon B.C.

Recommendation of the Board of Directors

Our Board of Directors recommends that you vote FOR the approval of the Plan of Conversion.

Material Differences of the Rights of Our Stockholders After the Change of Our Corporate Jurisdiction

After the Continuation, the stockholders of the former Nevada corporation will become the holders of common shares in the capital of a British Columbia company. Differences between the NRS andBusiness Corporations Act (British Columbia) (“BCA”) will result in various changes in the rights of our stockholders. The following is a summary description of the more significant differences. This summary description is qualified by reference to the NRS and the BCA.

19

| Subject Matter | Nevada | British Columbia | Discussion of MaterialChange |

Qualification andNumber of Directors

| A director must be a natural person who is at least 18 years of age. A company must have at least one director. Unless otherwise provided in the articles of incorporation of the company, directors need not be stockholders.

| Only an individual who is properly qualified may become or act as a director of a company. An individual is not qualified to act as a director or officer if the person is (i) under the age of 18, (ii) found to be incapable of managing their own affairs, (iii) an undischarged bankrupt, or (iv) has been convicted of an offence concerning the promotion, formation or management of a corporation or an unincorporated business or an offence involving fraud, subject to certain exceptions.

BCA companies must have at least one director, and "public companies" must have at least three directors. Canyon is a "public company" because it has registered its securities under the Exchange Act and is a reporting issuer under the laws of British Columbia and Alberta. | The BCA will require that Canyon have a minimum of three directors. As Canyon is currently required to have a minimum of three directors to maintain its listing on the TSX Venture Exchange, Canyon does not anticipate any material changes as a result of the Continuation.

|

| Election and Removalof Directors | Directors are elected at the annual meeting of the stockholders by a plurality of the votes cast at the election. Under the NRS, directors may fill vacancies on the board and appoint additional directors. Any director may be removed by the stockholders by a vote of not less than two-thirds of the issued and outstanding shares entitled to vote. | Shareholders of a company shall, by ordinary resolution at each annual meeting, elect directors to hold office for the ensuing year. In addition, directors may fill vacancies on the board and appoint additional directors as long as the appointment does not exceed 1/3 of the number of current directors. Directors may be removed by the shareholders by special or ordinary resolution, depending on the Articles. | The BCA imposes a lower threshold for removal of directors than under NRS. NRS requires approval of the removal of a director by not less than two-thirds of outstanding shares. In contrast, while two-thirds approval is required by the BCA, the number of shares required may be significantly less than the requirement in Nevada, due to the fact that the quorum requirement under the BCA is only two shareholders, in person or by proxy. |

20

| Subject Matter | Nevada | British Columbia | Discussion of MaterialChange |

| Transactions withOfficers and Directors | Under NRS, contracts or transactions between the corporation and a director or officer are not automatically void or voidable if (i) the fact of the common directorship, office or financial interest is known to the board of directors or committee, and the board or committee authorizes, approves or ratifies the contract or transactions in good faith by a vote sufficient for the purpose, without counting the vote or votes of the common or interested director or directors, (ii) the fact that the common directorship, office or financial interest is known to the stockholders and the contract or transaction is approved or ratified, in good faith, by the holders of a majority of the voting power, (iii) the fact of common directorship, office or financial interest known to the director or officer at the time of the transactions is brought before the board of directors for actions, or (iv) the contract or transaction is fair and reasonable to the corporation at the time it is authorized or approved. Common or interested directors may be counted to determine presence of a quorum and if the votes of the common or interested directors are not counted at the meeting, then a majority of directors may authorize, approve or ratify a contract or transaction. | Under the BCA, a director or senior officer of a company is liable to account to the company for any profit that accrues to a director or senior officer under a material contract or transaction between the company and its directors or senior officers, or between a corporation and another entity in which a director or senior officer of the corporation is a director or officer or has a material interest in. A director or senior officer will not be liable to account to the company for any profit if: (i) the director or senior officers discloses the material contract and transaction, and (ii) the material contract and transaction is approved by the disinterested directors or by a special resolution of the shareholders. An interested director may be counted to determine the presence of quorum. A contract or transaction is not invalid merely because a director or senior officer has not disclosed an interest in the contract or transaction or the directors or shareholders have not approved the contract or transaction in which the director or senior officer has an interest. | Both the BCA and NRS provide for disclosure and approval by disinterested directors of transactions in which a director has a material interest. |

21

| Subject Matter | Nevada | British Columbia | Discussion of MaterialChange |

Indemnification ofOfficers and Directors

| The NRS provides that a corporation must indemnify a director or officer of all expenses, including attorneys’ fees, if such person has been successful on the merits or in the defense of the action, suit or proceeding.

A corporation may elect to indemnify a director or officer against expenses, including attorneys’ fees, if the person (i) is not found to be liable in breaching their fiduciary duties to the corporation, or (ii) acted in good faith and in a manner not reasonably believed to be opposed to the best interests of the corporation and, for a criminal proceeding, no reasonable cause to believe conduct was unlawful. Discretionary indemnification may be made by a corporation if determined that it is proper to indemnify the director or officer. The determination must be made either: (i) by the stockholders; (ii) by the board of directors by majority vote of a quorum consisting of directors who were not parties to the actions, suit or proceeding; (iii) if a majority vote of a quorum consisting of directors who were not parties to the actions, suit or proceeding so orders, by independent legal counsel in a written opinion; or (iv) if a quorum consisting of directors who were not parties to the actions, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion. | The BCA provides that a company must indemnify a director or officer or former director or officer (“eligible party”) of all costs, charges, and expenses, including legal and other fees, if the director or officer is successful or substantially successful in the outcome of the proceeding.

A company may elect to indemnify an eligible party against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by the individual in respect of a proceeding to which such person was a party by reason of being or having been an eligible party, if the person: (i) acted honestly and in good faith with a view to the best interests of the company; and (ii) in the case of a criminal or administrative proceeding enforced by a monetary penalty, the individual had reasonable grounds for believing that the individuals conduct was lawful. In addition, a company must not indemnify an eligible party in the case of a proceeding brought by the company, such as a derivative action. Payment of advance expenses is allowed as long as the company obtains a written undertaking from the eligible party that it will repay the amounts advanced if the payment is prohibited under corporate law. | Both the BCA and NRS provide for discretionary indemnification of directors

|

22

| Subject Matter | Nevada | British Columbia | Discussion of MaterialChange |