| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco American Franchise Fund (Class A) | $111 | 0.96% |

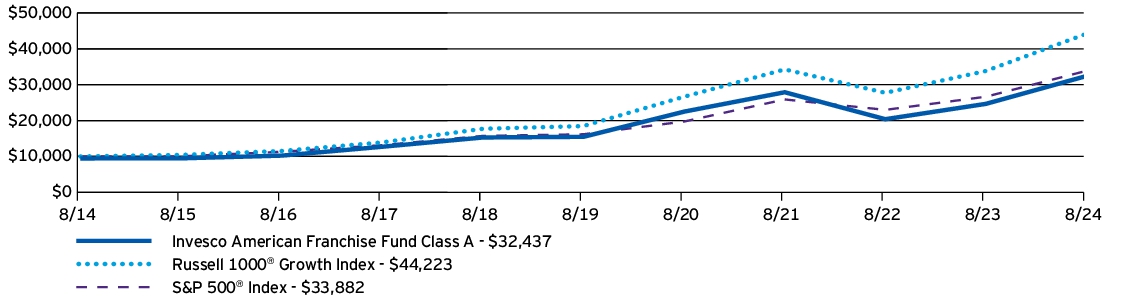

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco American Franchise Fund (Class A) —including sales charge | 24.27% | 14.65% | 12.49% |

| Invesco American Franchise Fund (Class A) —excluding sales charge | 31.53% | 15.96% | 13.12% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $15,771,565,003 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $80,383,417 |

| Portfolio turnover rate | 51% |

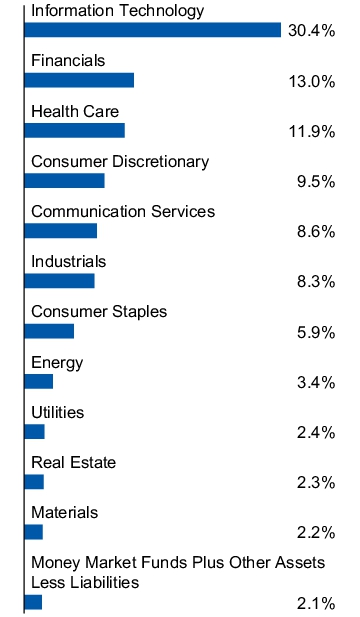

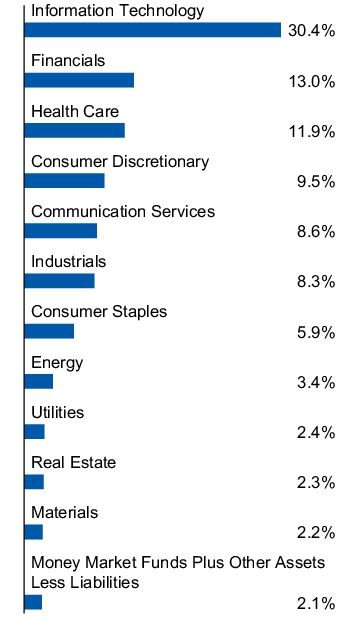

(% of net assets)

| NVIDIA Corp. | 10.91% |

| Microsoft Corp. | 9.58% |

| Apple, Inc. | 9.36% |

| Amazon.com, Inc. | 7.22% |

| Alphabet, Inc., Class A | 4.72% |

| Meta Platforms, Inc., Class A | 4.64% |

| Eli Lilly and Co. | 3.24% |

| Broadcom, Inc. | 3.20% |

| KKR & Co., Inc., Class A | 2.87% |

| Intuitive Surgical, Inc. | 2.44% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco American Franchise Fund (Class C) | $197 | 1.71% |

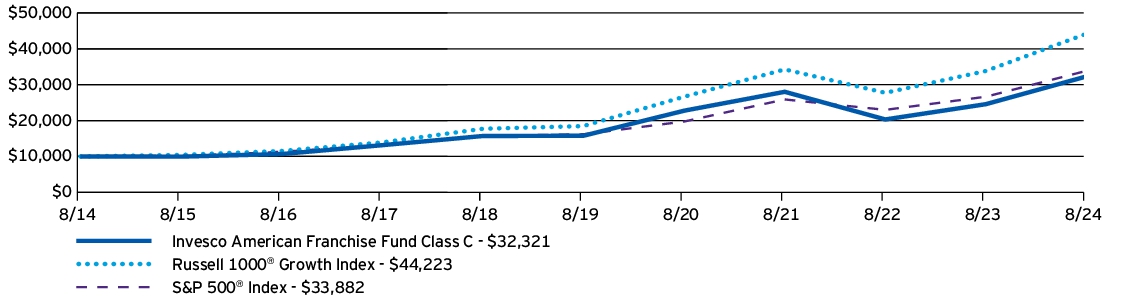

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco American Franchise Fund (Class C) —including sales charge | 29.52% | 15.08% | 12.45% |

| Invesco American Franchise Fund (Class C) —excluding sales charge | 30.52% | 15.08% | 12.45% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $15,771,565,003 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $80,383,417 |

| Portfolio turnover rate | 51% |

(% of net assets)

| NVIDIA Corp. | 10.91% |

| Microsoft Corp. | 9.58% |

| Apple, Inc. | 9.36% |

| Amazon.com, Inc. | 7.22% |

| Alphabet, Inc., Class A | 4.72% |

| Meta Platforms, Inc., Class A | 4.64% |

| Eli Lilly and Co. | 3.24% |

| Broadcom, Inc. | 3.20% |

| KKR & Co., Inc., Class A | 2.87% |

| Intuitive Surgical, Inc. | 2.44% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco American Franchise Fund (Class R) | $140 | 1.21% |

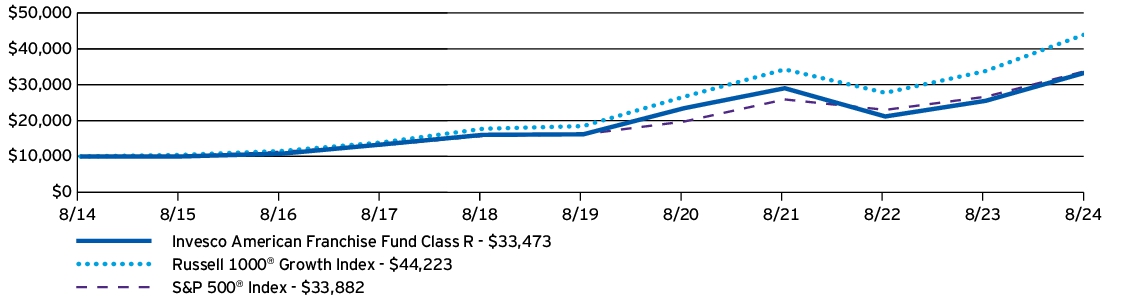

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco American Franchise Fund (Class R) | 31.16% | 15.65% | 12.84% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $15,771,565,003 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $80,383,417 |

| Portfolio turnover rate | 51% |

(% of net assets)

| NVIDIA Corp. | 10.91% |

| Microsoft Corp. | 9.58% |

| Apple, Inc. | 9.36% |

| Amazon.com, Inc. | 7.22% |

| Alphabet, Inc., Class A | 4.72% |

| Meta Platforms, Inc., Class A | 4.64% |

| Eli Lilly and Co. | 3.24% |

| Broadcom, Inc. | 3.20% |

| KKR & Co., Inc., Class A | 2.87% |

| Intuitive Surgical, Inc. | 2.44% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco American Franchise Fund (Class Y) | $82 | 0.71% |

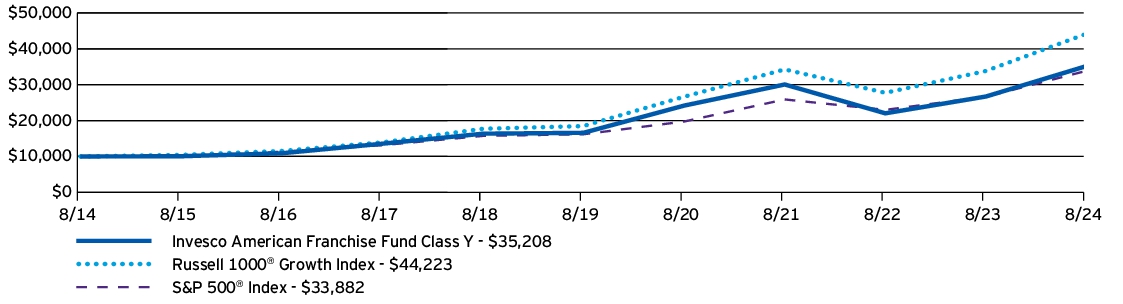

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco American Franchise Fund (Class Y) | 31.85% | 16.24% | 13.41% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $15,771,565,003 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $80,383,417 |

| Portfolio turnover rate | 51% |

(% of net assets)

| NVIDIA Corp. | 10.91% |

| Microsoft Corp. | 9.58% |

| Apple, Inc. | 9.36% |

| Amazon.com, Inc. | 7.22% |

| Alphabet, Inc., Class A | 4.72% |

| Meta Platforms, Inc., Class A | 4.64% |

| Eli Lilly and Co. | 3.24% |

| Broadcom, Inc. | 3.20% |

| KKR & Co., Inc., Class A | 2.87% |

| Intuitive Surgical, Inc. | 2.44% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

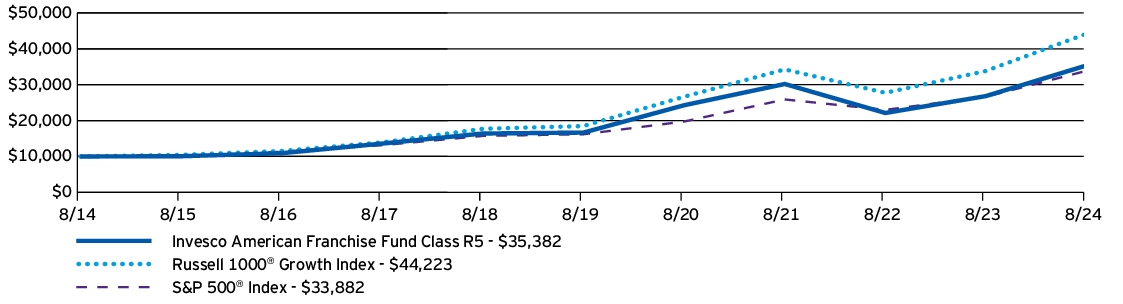

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco American Franchise Fund (Class R5) | $81 | 0.70% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco American Franchise Fund (Class R5) | 31.89% | 16.27% | 13.47% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $15,771,565,003 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $80,383,417 |

| Portfolio turnover rate | 51% |

(% of net assets)

| NVIDIA Corp. | 10.91% |

| Microsoft Corp. | 9.58% |

| Apple, Inc. | 9.36% |

| Amazon.com, Inc. | 7.22% |

| Alphabet, Inc., Class A | 4.72% |

| Meta Platforms, Inc., Class A | 4.64% |

| Eli Lilly and Co. | 3.24% |

| Broadcom, Inc. | 3.20% |

| KKR & Co., Inc., Class A | 2.87% |

| Intuitive Surgical, Inc. | 2.44% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

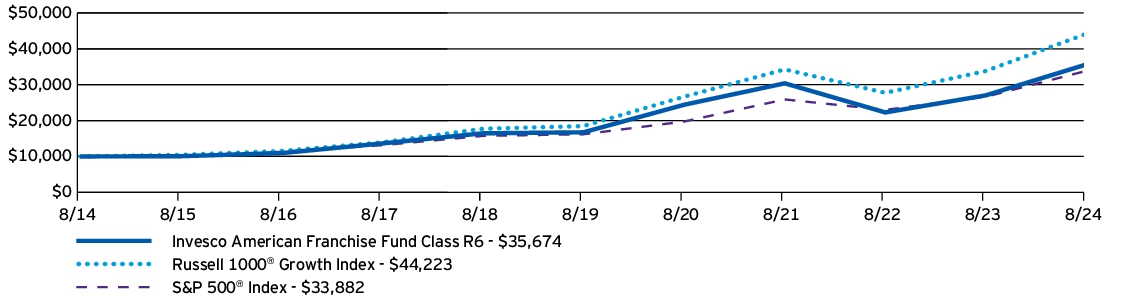

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco American Franchise Fund (Class R6) | $73 | 0.63% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco American Franchise Fund (Class R6) | 31.94% | 16.35% | 13.56% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $15,771,565,003 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $80,383,417 |

| Portfolio turnover rate | 51% |

(% of net assets)

| NVIDIA Corp. | 10.91% |

| Microsoft Corp. | 9.58% |

| Apple, Inc. | 9.36% |

| Amazon.com, Inc. | 7.22% |

| Alphabet, Inc., Class A | 4.72% |

| Meta Platforms, Inc., Class A | 4.64% |

| Eli Lilly and Co. | 3.24% |

| Broadcom, Inc. | 3.20% |

| KKR & Co., Inc., Class A | 2.87% |

| Intuitive Surgical, Inc. | 2.44% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

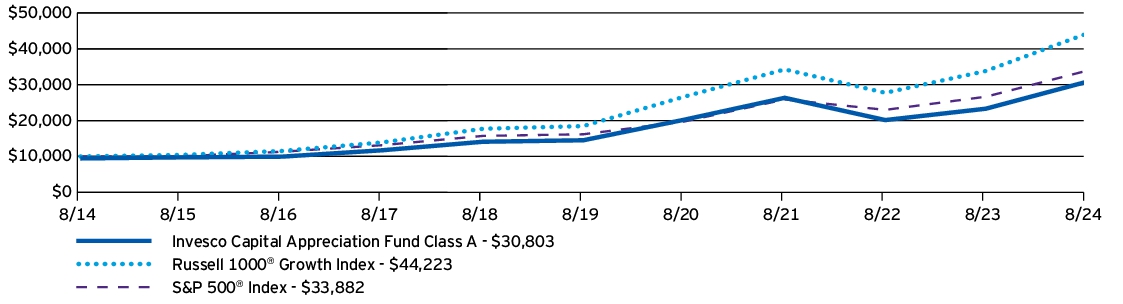

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Capital Appreciation Fund (Class A) | $109 | 0.94%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Capital Appreciation Fund (Class A) —including sales charge | 24.88% | 14.93% | 11.91% |

| Invesco Capital Appreciation Fund (Class A) —excluding sales charge | 32.15% | 16.24% | 12.54% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $5,515,842,000 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $28,491,066 |

| Portfolio turnover rate | 55% |

(% of net assets)

| NVIDIA Corp. | 10.71% |

| Microsoft Corp. | 9.70% |

| Apple, Inc. | 9.24% |

| Amazon.com, Inc. | 6.72% |

| Alphabet, Inc., Class C | 4.58% |

| Meta Platforms, Inc., Class A | 4.32% |

| Broadcom, Inc. | 3.14% |

| Eli Lilly and Co. | 2.93% |

| Netflix, Inc. | 2.24% |

| Boston Scientific Corp. | 2.15% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

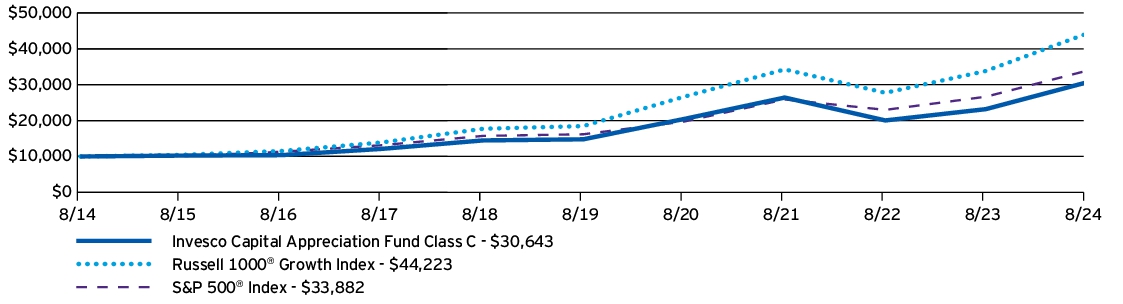

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Capital Appreciation Fund (Class C) | $198 | 1.71%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Capital Appreciation Fund (Class C) —including sales charge | 30.10% | 15.34% | 11.85% |

| Invesco Capital Appreciation Fund (Class C) —excluding sales charge | 31.10% | 15.34% | 11.85% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $5,515,842,000 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $28,491,066 |

| Portfolio turnover rate | 55% |

(% of net assets)

| NVIDIA Corp. | 10.71% |

| Microsoft Corp. | 9.70% |

| Apple, Inc. | 9.24% |

| Amazon.com, Inc. | 6.72% |

| Alphabet, Inc., Class C | 4.58% |

| Meta Platforms, Inc., Class A | 4.32% |

| Broadcom, Inc. | 3.14% |

| Eli Lilly and Co. | 2.93% |

| Netflix, Inc. | 2.24% |

| Boston Scientific Corp. | 2.15% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

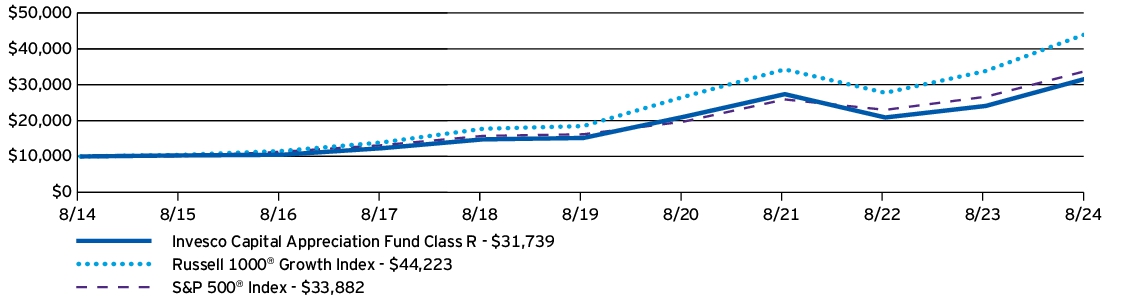

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Capital Appreciation Fund (Class R) | $140 | 1.21%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Capital Appreciation Fund (Class R) | 31.79% | 15.93% | 12.24% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $5,515,842,000 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $28,491,066 |

| Portfolio turnover rate | 55% |

(% of net assets)

| NVIDIA Corp. | 10.71% |

| Microsoft Corp. | 9.70% |

| Apple, Inc. | 9.24% |

| Amazon.com, Inc. | 6.72% |

| Alphabet, Inc., Class C | 4.58% |

| Meta Platforms, Inc., Class A | 4.32% |

| Broadcom, Inc. | 3.14% |

| Eli Lilly and Co. | 2.93% |

| Netflix, Inc. | 2.24% |

| Boston Scientific Corp. | 2.15% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

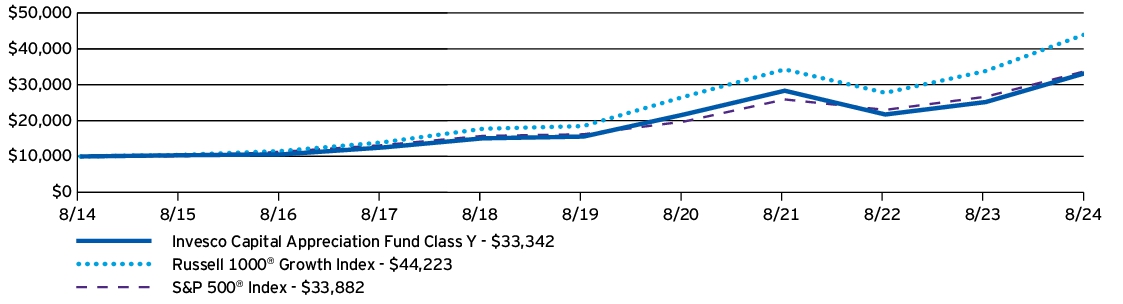

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Capital Appreciation Fund (Class Y) | $83 | 0.71%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Capital Appreciation Fund (Class Y) | 32.43% | 16.50% | 12.80% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $5,515,842,000 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $28,491,066 |

| Portfolio turnover rate | 55% |

(% of net assets)

| NVIDIA Corp. | 10.71% |

| Microsoft Corp. | 9.70% |

| Apple, Inc. | 9.24% |

| Amazon.com, Inc. | 6.72% |

| Alphabet, Inc., Class C | 4.58% |

| Meta Platforms, Inc., Class A | 4.32% |

| Broadcom, Inc. | 3.14% |

| Eli Lilly and Co. | 2.93% |

| Netflix, Inc. | 2.24% |

| Boston Scientific Corp. | 2.15% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

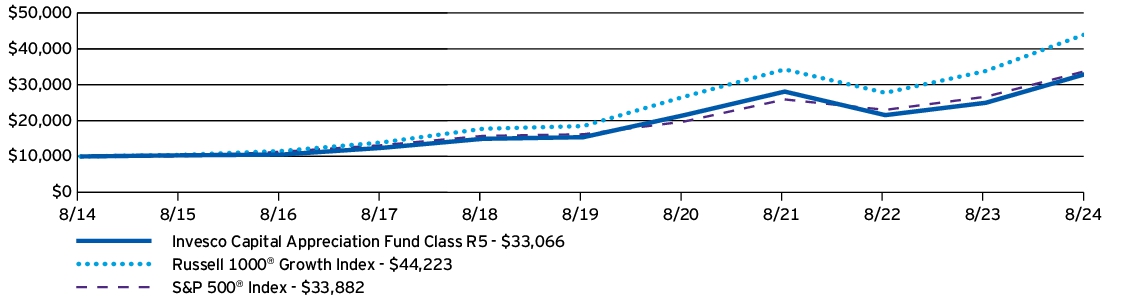

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Capital Appreciation Fund (Class R5) | $83 | 0.71% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Capital Appreciation Fund (Class R5) | 32.43% | 16.55% | 12.70% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $5,515,842,000 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $28,491,066 |

| Portfolio turnover rate | 55% |

(% of net assets)

| NVIDIA Corp. | 10.71% |

| Microsoft Corp. | 9.70% |

| Apple, Inc. | 9.24% |

| Amazon.com, Inc. | 6.72% |

| Alphabet, Inc., Class C | 4.58% |

| Meta Platforms, Inc., Class A | 4.32% |

| Broadcom, Inc. | 3.14% |

| Eli Lilly and Co. | 2.93% |

| Netflix, Inc. | 2.24% |

| Boston Scientific Corp. | 2.15% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

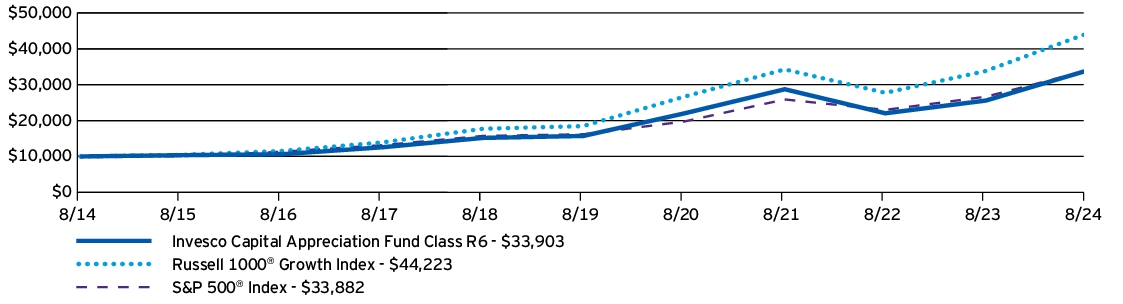

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Capital Appreciation Fund (Class R6) | $74 | 0.64% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Capital Appreciation Fund (Class R6) | 32.54% | 16.61% | 12.99% |

| Russell 1000® Growth Index | 30.75% | 19.08% | 16.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $5,515,842,000 |

| Total number of portfolio holdings | 55 |

| Total advisory fees paid | $28,491,066 |

| Portfolio turnover rate | 55% |

(% of net assets)

| NVIDIA Corp. | 10.71% |

| Microsoft Corp. | 9.70% |

| Apple, Inc. | 9.24% |

| Amazon.com, Inc. | 6.72% |

| Alphabet, Inc., Class C | 4.58% |

| Meta Platforms, Inc., Class A | 4.32% |

| Broadcom, Inc. | 3.14% |

| Eli Lilly and Co. | 2.93% |

| Netflix, Inc. | 2.24% |

| Boston Scientific Corp. | 2.15% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

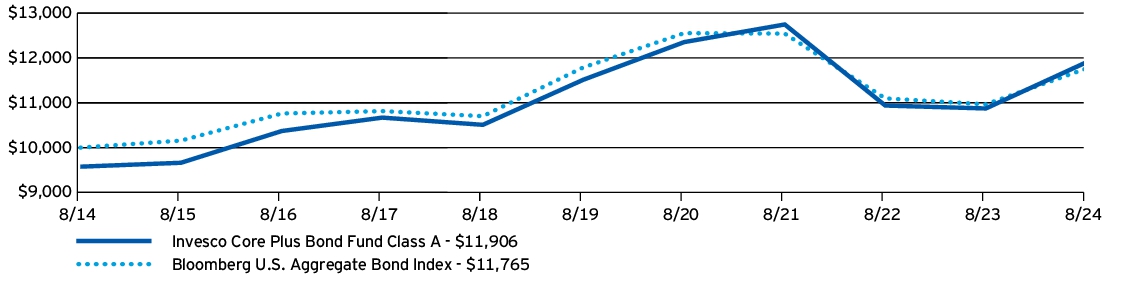

| Invesco Core Plus Bond Fund (Class A) | $78 | 0.74%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Core Plus Bond Fund (Class A) —including sales charge | 4.79% | (0.20)% | 1.76% |

| Invesco Core Plus Bond Fund (Class A) —excluding sales charge | 9.45% | 0.66% | 2.20% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $5,494,700,631 |

| Total number of portfolio holdings | 1,446 |

| Total advisory fees paid | $16,707,685 |

| Portfolio turnover rate | 465% |

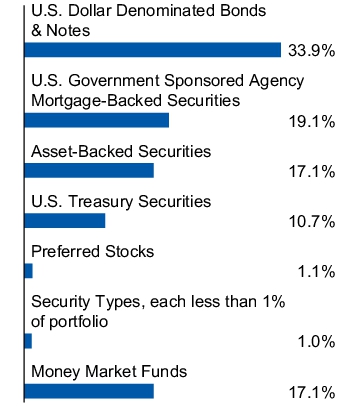

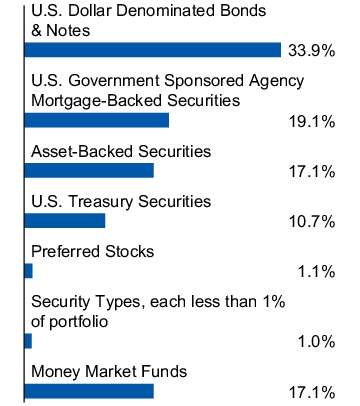

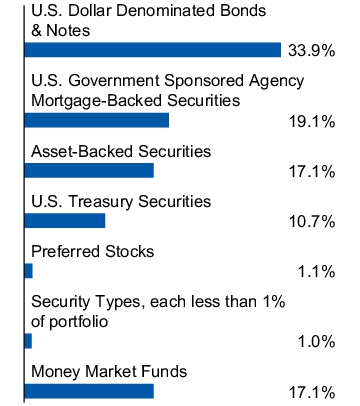

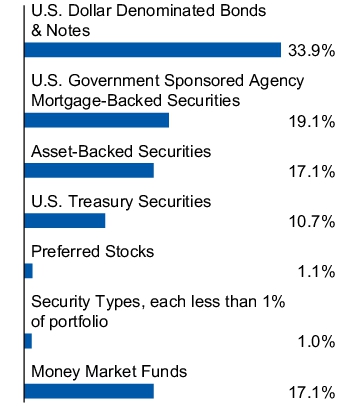

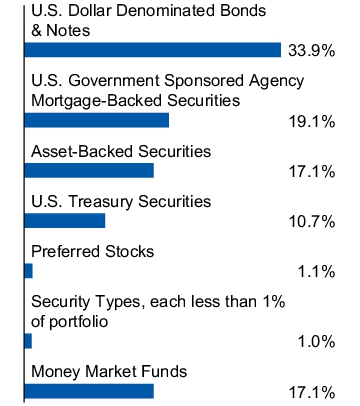

(% of total investments)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

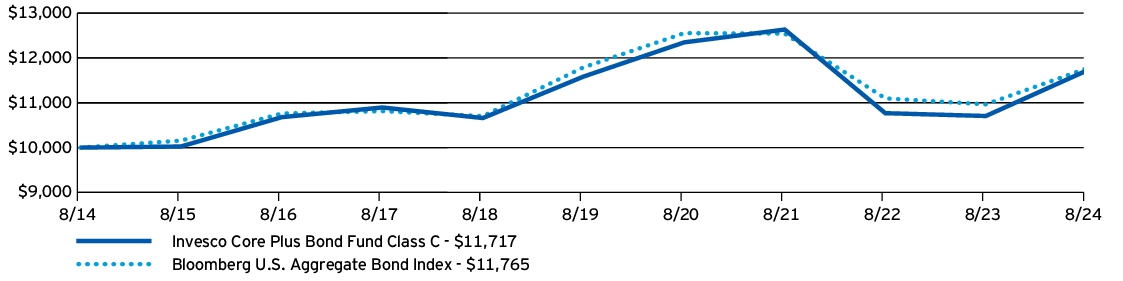

| Invesco Core Plus Bond Fund (Class C) | $155 | 1.49%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Core Plus Bond Fund (Class C) —including sales charge | 7.64% | (0.07)% | 1.60% |

| Invesco Core Plus Bond Fund (Class C) —excluding sales charge | 8.64% | (0.07)% | 1.60% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $5,494,700,631 |

| Total number of portfolio holdings | 1,446 |

| Total advisory fees paid | $16,707,685 |

| Portfolio turnover rate | 465% |

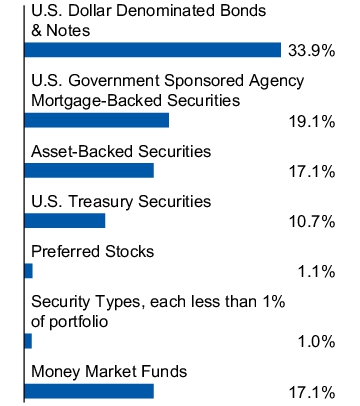

(% of total investments)

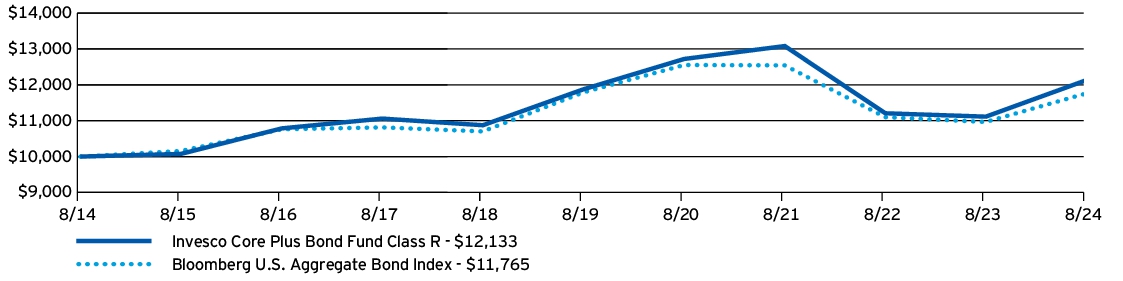

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Core Plus Bond Fund (Class R) | $104 | 0.99%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Core Plus Bond Fund (Class R) | 9.18% | 0.43% | 1.95% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $5,494,700,631 |

| Total number of portfolio holdings | 1,446 |

| Total advisory fees paid | $16,707,685 |

| Portfolio turnover rate | 465% |

(% of total investments)

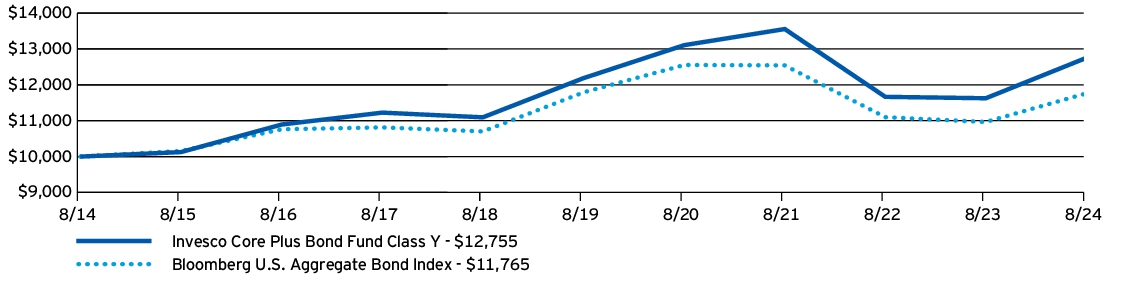

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Core Plus Bond Fund (Class Y) | $51 | 0.49%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Core Plus Bond Fund (Class Y) | 9.72% | 0.92% | 2.46% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $5,494,700,631 |

| Total number of portfolio holdings | 1,446 |

| Total advisory fees paid | $16,707,685 |

| Portfolio turnover rate | 465% |

(% of total investments)

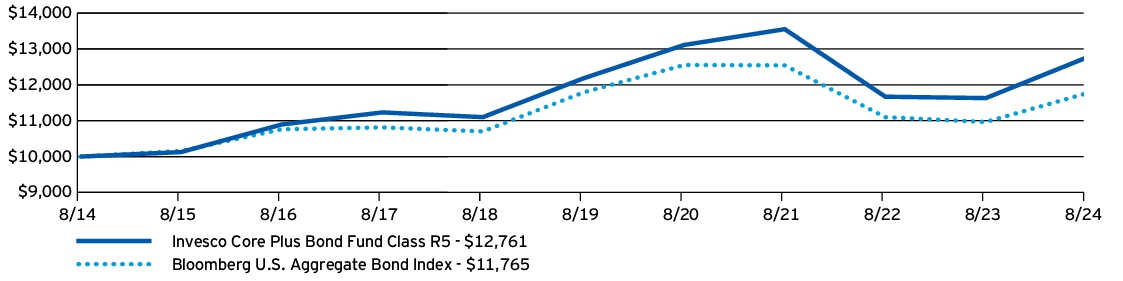

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Core Plus Bond Fund (Class R5) | $51 | 0.49%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Core Plus Bond Fund (Class R5) | 9.72% | 0.93% | 2.47% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $5,494,700,631 |

| Total number of portfolio holdings | 1,446 |

| Total advisory fees paid | $16,707,685 |

| Portfolio turnover rate | 465% |

(% of total investments)

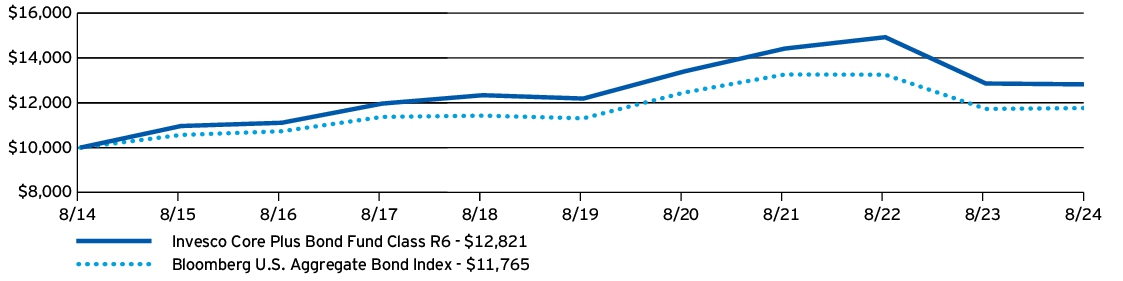

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Core Plus Bond Fund (Class R6) | $48 | 0.46%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Core Plus Bond Fund (Class R6) | 9.77% | 0.97% | 2.52% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $5,494,700,631 |

| Total number of portfolio holdings | 1,446 |

| Total advisory fees paid | $16,707,685 |

| Portfolio turnover rate | 465% |

(% of total investments)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

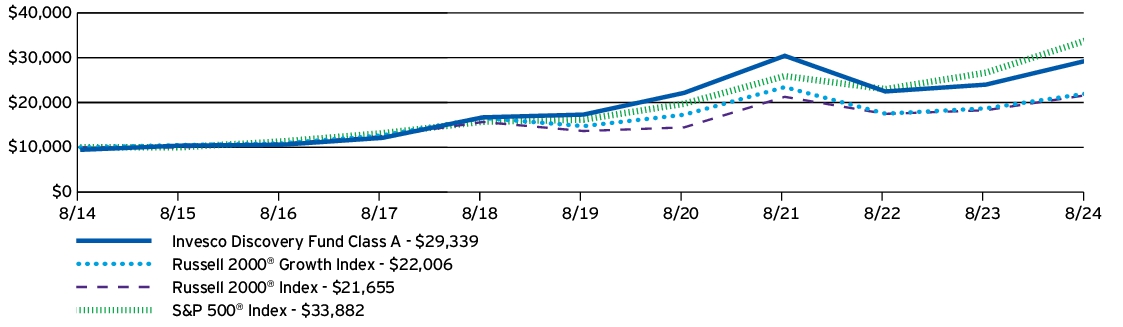

| Invesco Discovery Fund (Class A) | $116 | 1.04% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Discovery Fund (Class A) —including sales charge | 15.59% | 9.89% | 11.36% |

| Invesco Discovery Fund (Class A) —excluding sales charge | 22.33% | 11.14% | 12.00% |

| Russell 2000® Growth Index | 17.67% | 8.35% | 8.21% |

| Russell 2000® Index | 18.47% | 9.68% | 8.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,716,854,154 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $24,136,937 |

| Portfolio turnover rate | 86% |

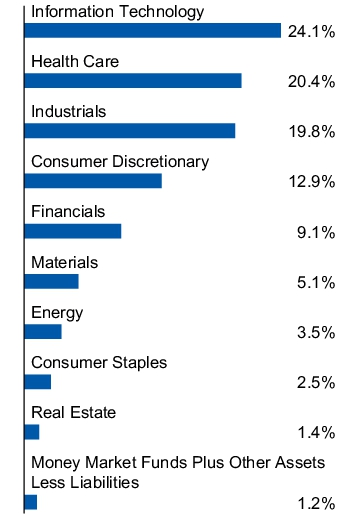

(% of net assets)

| Clean Harbors, Inc. | 2.64% |

| Comfort Systems USA, Inc. | 2.46% |

| Hamilton Lane, Inc., Class A | 2.34% |

| Evercore, Inc., Class A | 2.16% |

| Encompass Health Corp. | 1.88% |

| Carpenter Technology Corp. | 1.87% |

| Wingstop, Inc. | 1.85% |

| Modine Manufacturing Co. | 1.75% |

| CyberArk Software Ltd. | 1.73% |

| Onto Innovation, Inc. | 1.72% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

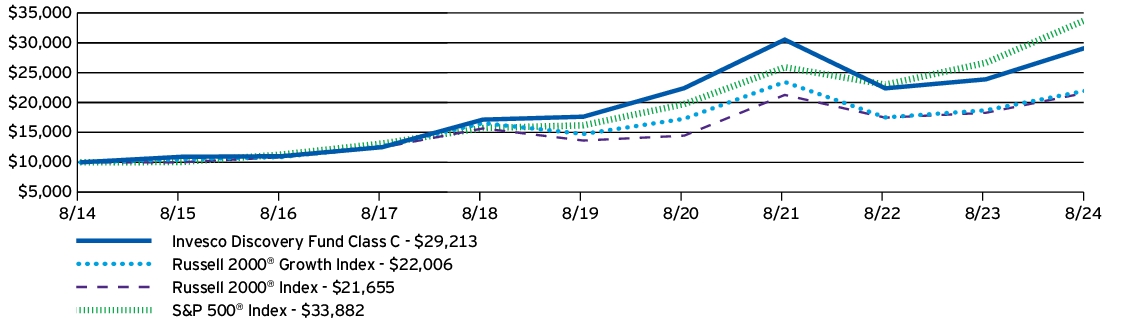

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Discovery Fund (Class C) | $199 | 1.80% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Discovery Fund (Class C) —including sales charge | 20.38% | 10.29% | 11.32% |

| Invesco Discovery Fund (Class C) —excluding sales charge | 21.38% | 10.29% | 11.32% |

| Russell 2000® Growth Index | 17.67% | 8.35% | 8.21% |

| Russell 2000® Index | 18.47% | 9.68% | 8.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,716,854,154 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $24,136,937 |

| Portfolio turnover rate | 86% |

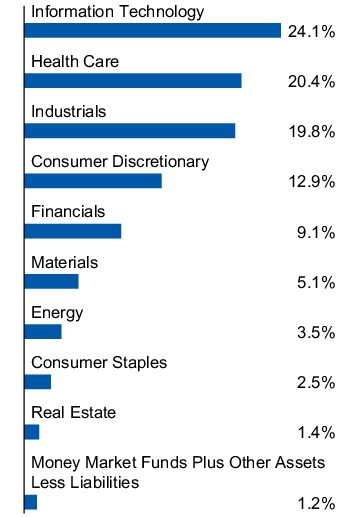

(% of net assets)

| Clean Harbors, Inc. | 2.64% |

| Comfort Systems USA, Inc. | 2.46% |

| Hamilton Lane, Inc., Class A | 2.34% |

| Evercore, Inc., Class A | 2.16% |

| Encompass Health Corp. | 1.88% |

| Carpenter Technology Corp. | 1.87% |

| Wingstop, Inc. | 1.85% |

| Modine Manufacturing Co. | 1.75% |

| CyberArk Software Ltd. | 1.73% |

| Onto Innovation, Inc. | 1.72% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

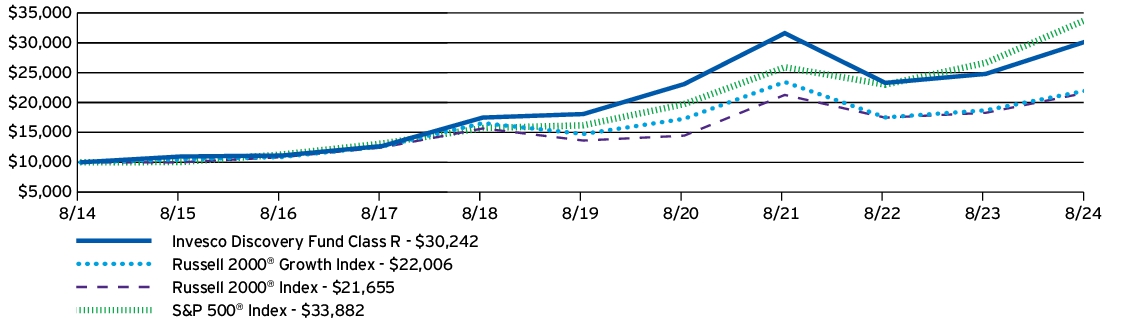

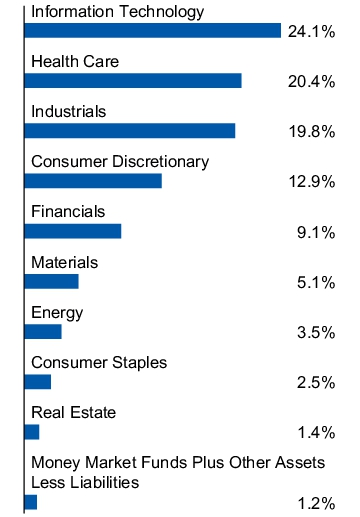

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Discovery Fund (Class R) | $144 | 1.30% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Discovery Fund (Class R) | 21.98% | 10.85% | 11.70% |

| Russell 2000® Growth Index | 17.67% | 8.35% | 8.21% |

| Russell 2000® Index | 18.47% | 9.68% | 8.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,716,854,154 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $24,136,937 |

| Portfolio turnover rate | 86% |

(% of net assets)

| Clean Harbors, Inc. | 2.64% |

| Comfort Systems USA, Inc. | 2.46% |

| Hamilton Lane, Inc., Class A | 2.34% |

| Evercore, Inc., Class A | 2.16% |

| Encompass Health Corp. | 1.88% |

| Carpenter Technology Corp. | 1.87% |

| Wingstop, Inc. | 1.85% |

| Modine Manufacturing Co. | 1.75% |

| CyberArk Software Ltd. | 1.73% |

| Onto Innovation, Inc. | 1.72% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

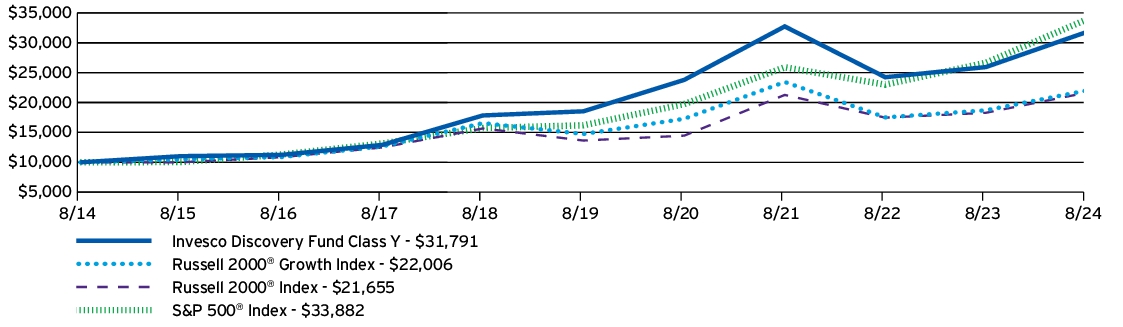

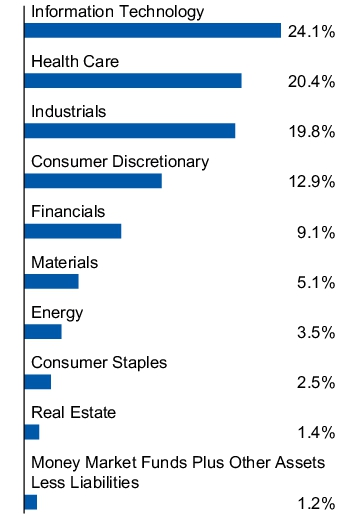

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Discovery Fund (Class Y) | $89 | 0.80% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Discovery Fund (Class Y) | 22.61% | 11.40% | 12.26% |

| Russell 2000® Growth Index | 17.67% | 8.35% | 8.21% |

| Russell 2000® Index | 18.47% | 9.68% | 8.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,716,854,154 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $24,136,937 |

| Portfolio turnover rate | 86% |

(% of net assets)

| Clean Harbors, Inc. | 2.64% |

| Comfort Systems USA, Inc. | 2.46% |

| Hamilton Lane, Inc., Class A | 2.34% |

| Evercore, Inc., Class A | 2.16% |

| Encompass Health Corp. | 1.88% |

| Carpenter Technology Corp. | 1.87% |

| Wingstop, Inc. | 1.85% |

| Modine Manufacturing Co. | 1.75% |

| CyberArk Software Ltd. | 1.73% |

| Onto Innovation, Inc. | 1.72% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

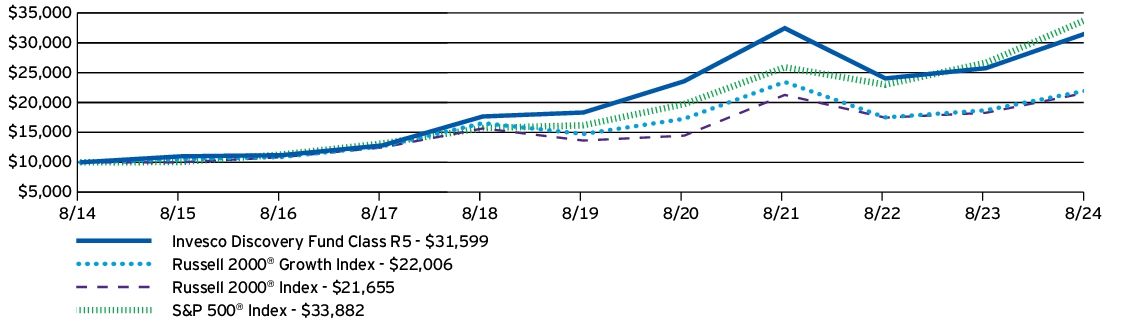

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Discovery Fund (Class R5) | $77 | 0.69% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Discovery Fund (Class R5) | 22.76% | 11.51% | 12.19% |

| Russell 2000® Growth Index | 17.67% | 8.35% | 8.21% |

| Russell 2000® Index | 18.47% | 9.68% | 8.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,716,854,154 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $24,136,937 |

| Portfolio turnover rate | 86% |

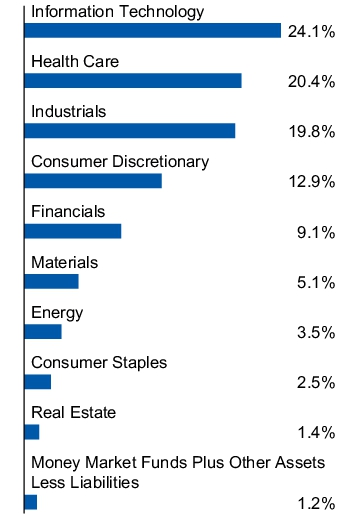

(% of net assets)

| Clean Harbors, Inc. | 2.64% |

| Comfort Systems USA, Inc. | 2.46% |

| Hamilton Lane, Inc., Class A | 2.34% |

| Evercore, Inc., Class A | 2.16% |

| Encompass Health Corp. | 1.88% |

| Carpenter Technology Corp. | 1.87% |

| Wingstop, Inc. | 1.85% |

| Modine Manufacturing Co. | 1.75% |

| CyberArk Software Ltd. | 1.73% |

| Onto Innovation, Inc. | 1.72% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

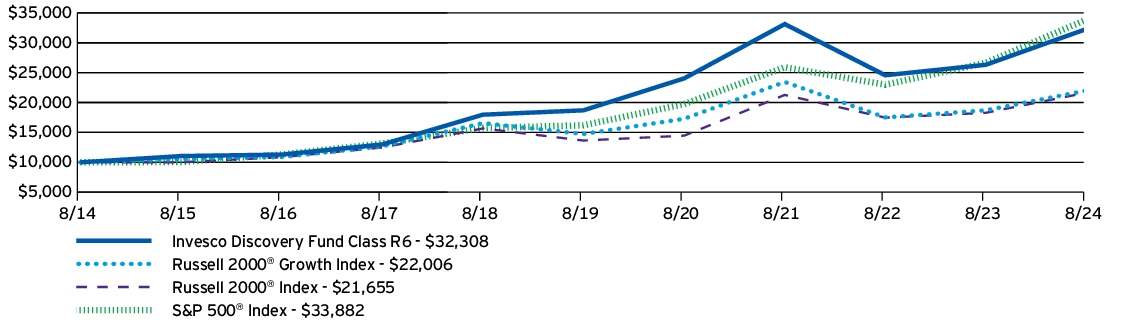

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Discovery Fund (Class R6) | $74 | 0.66% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Discovery Fund (Class R6) | 22.78% | 11.56% | 12.44% |

| Russell 2000® Growth Index | 17.67% | 8.35% | 8.21% |

| Russell 2000® Index | 18.47% | 9.68% | 8.03% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,716,854,154 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $24,136,937 |

| Portfolio turnover rate | 86% |

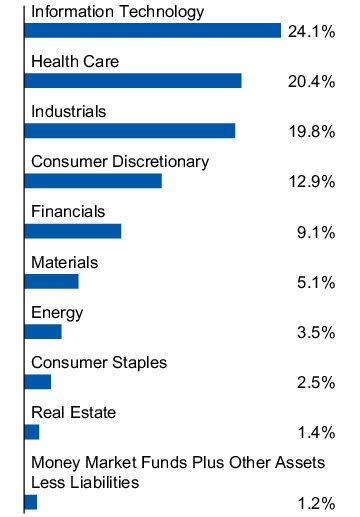

(% of net assets)

| Clean Harbors, Inc. | 2.64% |

| Comfort Systems USA, Inc. | 2.46% |

| Hamilton Lane, Inc., Class A | 2.34% |

| Evercore, Inc., Class A | 2.16% |

| Encompass Health Corp. | 1.88% |

| Carpenter Technology Corp. | 1.87% |

| Wingstop, Inc. | 1.85% |

| Modine Manufacturing Co. | 1.75% |

| CyberArk Software Ltd. | 1.73% |

| Onto Innovation, Inc. | 1.72% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

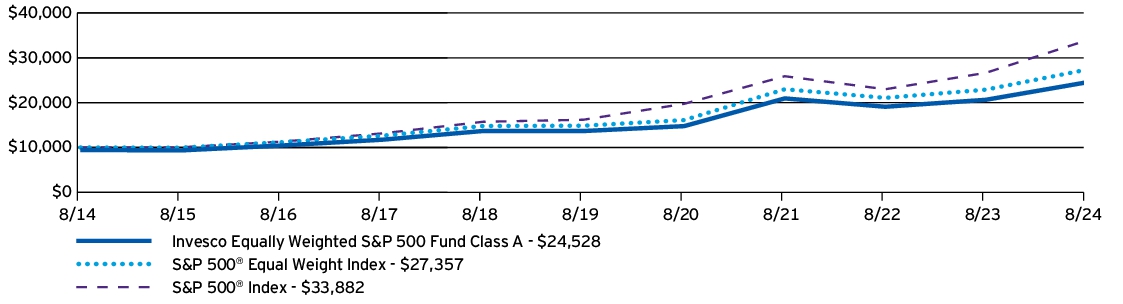

| Invesco Equally-Weighted S&P 500 Fund (Class A) | $59 | 0.54% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equally-Weighted S&P 500 Fund (Class A) —including sales charge | 12.35% | 11.15% | 9.39% |

| Invesco Equally-Weighted S&P 500 Fund (Class A) —excluding sales charge | 18.88% | 12.42% | 10.01% |

| S&P 500® Equal Weight Index | 19.49% | 12.99% | 10.59% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $6,867,543,191 |

| Total number of portfolio holdings | 508 |

| Total advisory fees paid | $6,779,584 |

| Portfolio turnover rate | 22% |

(% of net assets)

| Kellanova | 0.26% |

| Mohawk Industries, Inc. | 0.26% |

| Globe Life, Inc. | 0.25% |

| 3M Co. | 0.25% |

| CBRE Group, Inc., Class A | 0.25% |

| D.R. Horton, Inc. | 0.25% |

| Newmont Corp. | 0.24% |

| Iron Mountain, Inc. | 0.24% |

| KeyCorp | 0.24% |

| Equifax, Inc. | 0.24% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

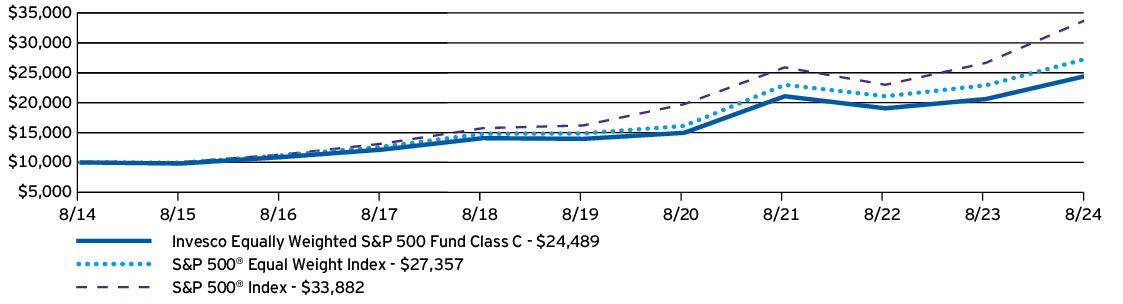

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equally-Weighted S&P 500 Fund (Class C) | $140 | 1.28% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equally-Weighted S&P 500 Fund (Class C) —including sales charge | 17.01% | 11.59% | 9.37% |

| Invesco Equally-Weighted S&P 500 Fund (Class C) —excluding sales charge | 18.01% | 11.59% | 9.37% |

| S&P 500® Equal Weight Index | 19.49% | 12.99% | 10.59% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $6,867,543,191 |

| Total number of portfolio holdings | 508 |

| Total advisory fees paid | $6,779,584 |

| Portfolio turnover rate | 22% |

(% of net assets)

| Kellanova | 0.26% |

| Mohawk Industries, Inc. | 0.26% |

| Globe Life, Inc. | 0.25% |

| 3M Co. | 0.25% |

| CBRE Group, Inc., Class A | 0.25% |

| D.R. Horton, Inc. | 0.25% |

| Newmont Corp. | 0.24% |

| Iron Mountain, Inc. | 0.24% |

| KeyCorp | 0.24% |

| Equifax, Inc. | 0.24% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

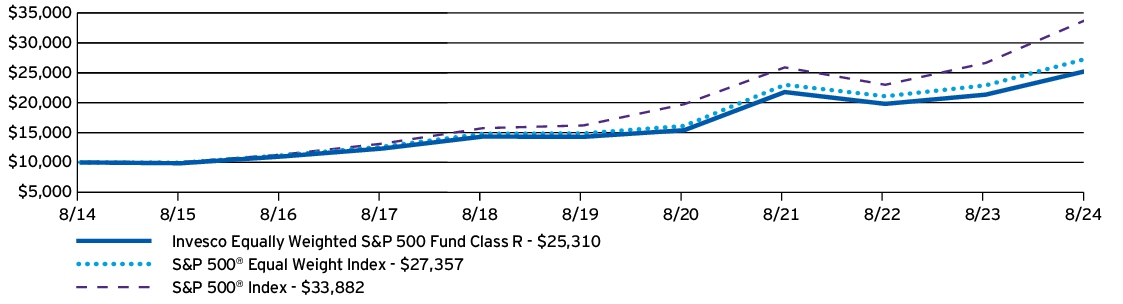

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equally-Weighted S&P 500 Fund (Class R) | $86 | 0.79% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equally-Weighted S&P 500 Fund (Class R) | 18.60% | 12.13% | 9.73% |

| S&P 500® Equal Weight Index | 19.49% | 12.99% | 10.59% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $6,867,543,191 |

| Total number of portfolio holdings | 508 |

| Total advisory fees paid | $6,779,584 |

| Portfolio turnover rate | 22% |

(% of net assets)

| Kellanova | 0.26% |

| Mohawk Industries, Inc. | 0.26% |

| Globe Life, Inc. | 0.25% |

| 3M Co. | 0.25% |

| CBRE Group, Inc., Class A | 0.25% |

| D.R. Horton, Inc. | 0.25% |

| Newmont Corp. | 0.24% |

| Iron Mountain, Inc. | 0.24% |

| KeyCorp | 0.24% |

| Equifax, Inc. | 0.24% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

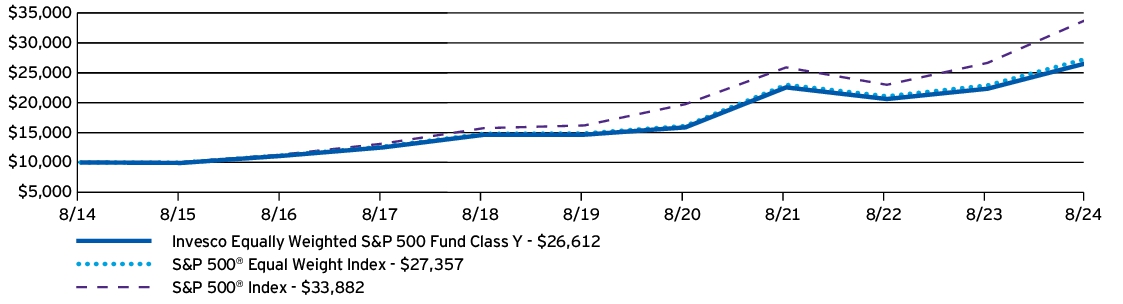

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equally-Weighted S&P 500 Fund (Class Y) | $32 | 0.29% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equally-Weighted S&P 500 Fund (Class Y) | 19.17% | 12.69% | 10.28% |

| S&P 500® Equal Weight Index | 19.49% | 12.99% | 10.59% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $6,867,543,191 |

| Total number of portfolio holdings | 508 |

| Total advisory fees paid | $6,779,584 |

| Portfolio turnover rate | 22% |

(% of net assets)

| Kellanova | 0.26% |

| Mohawk Industries, Inc. | 0.26% |

| Globe Life, Inc. | 0.25% |

| 3M Co. | 0.25% |

| CBRE Group, Inc., Class A | 0.25% |

| D.R. Horton, Inc. | 0.25% |

| Newmont Corp. | 0.24% |

| Iron Mountain, Inc. | 0.24% |

| KeyCorp | 0.24% |

| Equifax, Inc. | 0.24% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

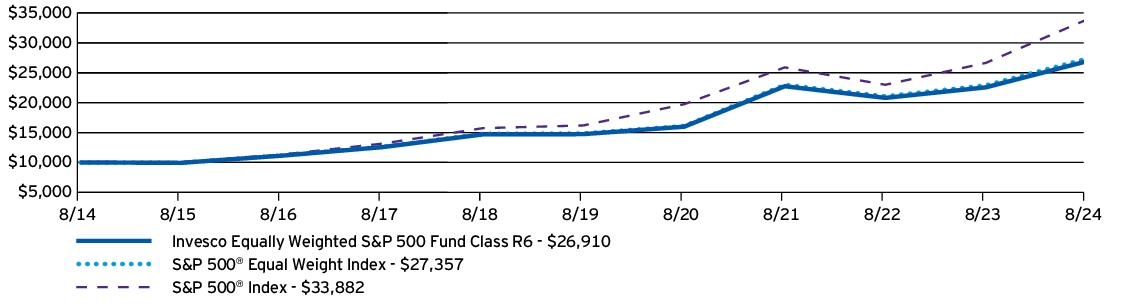

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equally-Weighted S&P 500 Fund (Class R6) | $21 | 0.19% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equally-Weighted S&P 500 Fund (Class R6) | 19.30% | 12.81% | 10.41% |

| S&P 500® Equal Weight Index | 19.49% | 12.99% | 10.59% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $6,867,543,191 |

| Total number of portfolio holdings | 508 |

| Total advisory fees paid | $6,779,584 |

| Portfolio turnover rate | 22% |

(% of net assets)

| Kellanova | 0.26% |

| Mohawk Industries, Inc. | 0.26% |

| Globe Life, Inc. | 0.25% |

| 3M Co. | 0.25% |

| CBRE Group, Inc., Class A | 0.25% |

| D.R. Horton, Inc. | 0.25% |

| Newmont Corp. | 0.24% |

| Iron Mountain, Inc. | 0.24% |

| KeyCorp | 0.24% |

| Equifax, Inc. | 0.24% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

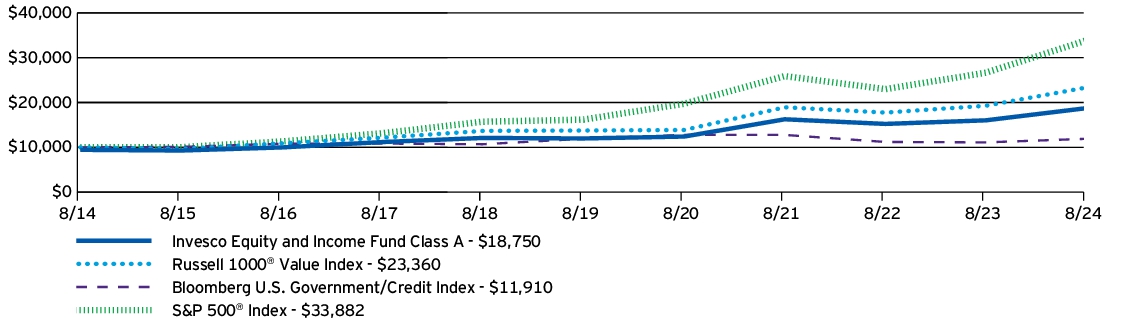

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equity and Income Fund (Class A) | $84 | 0.77%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equity and Income Fund (Class A) —including sales charge | 10.48% | 8.12% | 6.49% |

| Invesco Equity and Income Fund (Class A) —excluding sales charge | 16.93% | 9.35% | 7.09% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| Bloomberg U.S. Government/Credit Index | 7.21% | (0.02)% | 1.76% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $12,580,924,604 |

| Total number of portfolio holdings | 358 |

| Total advisory fees paid | $41,636,024 |

| Portfolio turnover rate | 139% |

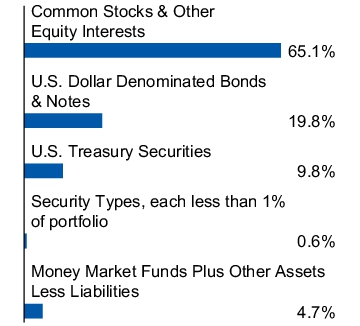

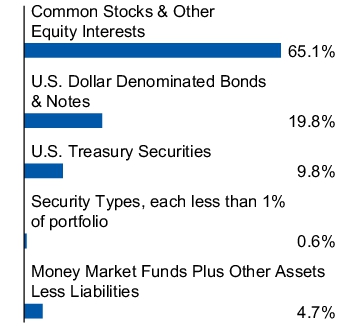

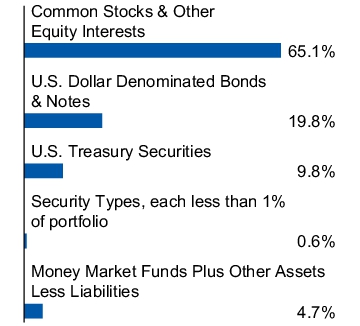

(% of net assets)

| U.S. Treasury Notes, 4.00%, 07/31/2029 | 2.56% |

| U.S. Treasury Notes, 4.38%, 07/31/2026 | 2.51% |

| Wells Fargo & Co. | 2.25% |

| Bank of America Corp. | 2.16% |

| U.S. Treasury Notes, 3.75%, 08/15/2027 | 1.81% |

| U.S. Treasury Notes, 4.13%, 07/31/2031 | 1.68% |

| Exxon Mobil Corp. | 1.57% |

| Parker-Hannifin Corp. | 1.46% |

| CBRE Group, Inc., Class A | 1.43% |

| Johnson & Johnson | 1.41% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

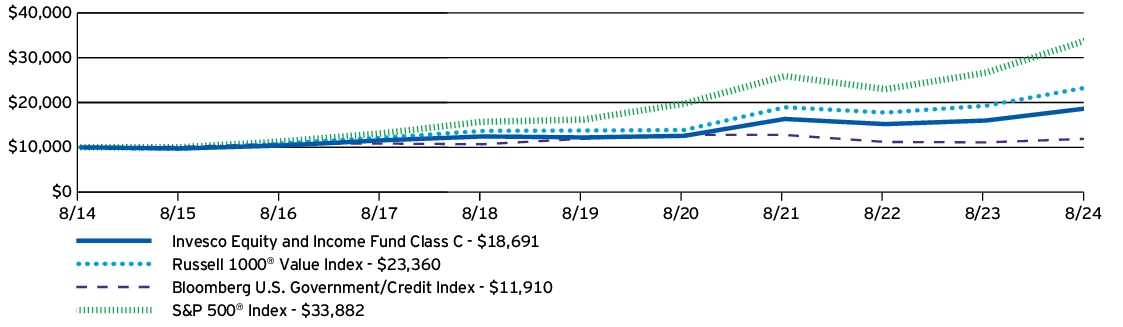

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equity and Income Fund (Class C) | $163 | 1.51%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equity and Income Fund (Class C) —including sales charge | 15.13% | 8.55% | 6.45% |

| Invesco Equity and Income Fund (Class C) —excluding sales charge | 16.13% | 8.55% | 6.45% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| Bloomberg U.S. Government/Credit Index | 7.21% | (0.02)% | 1.76% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $12,580,924,604 |

| Total number of portfolio holdings | 358 |

| Total advisory fees paid | $41,636,024 |

| Portfolio turnover rate | 139% |

(% of net assets)

| U.S. Treasury Notes, 4.00%, 07/31/2029 | 2.56% |

| U.S. Treasury Notes, 4.38%, 07/31/2026 | 2.51% |

| Wells Fargo & Co. | 2.25% |

| Bank of America Corp. | 2.16% |

| U.S. Treasury Notes, 3.75%, 08/15/2027 | 1.81% |

| U.S. Treasury Notes, 4.13%, 07/31/2031 | 1.68% |

| Exxon Mobil Corp. | 1.57% |

| Parker-Hannifin Corp. | 1.46% |

| CBRE Group, Inc., Class A | 1.43% |

| Johnson & Johnson | 1.41% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

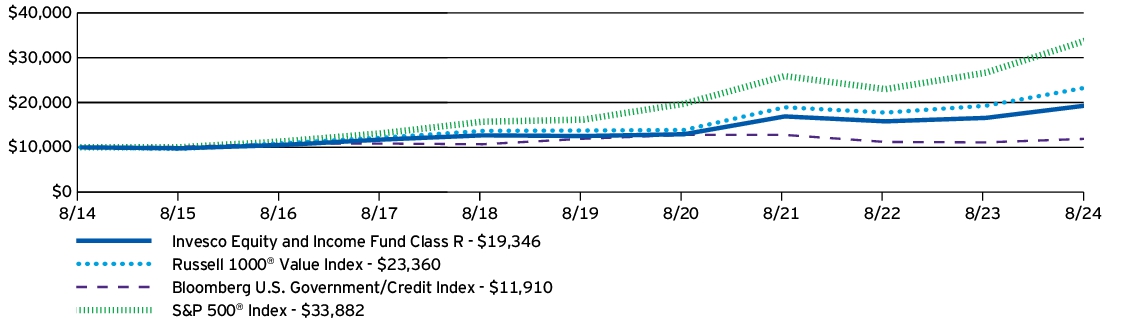

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equity and Income Fund (Class R) | $111 | 1.02%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equity and Income Fund (Class R) | 16.74% | 9.10% | 6.82% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| Bloomberg U.S. Government/Credit Index | 7.21% | (0.02)% | 1.76% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $12,580,924,604 |

| Total number of portfolio holdings | 358 |

| Total advisory fees paid | $41,636,024 |

| Portfolio turnover rate | 139% |

(% of net assets)

| U.S. Treasury Notes, 4.00%, 07/31/2029 | 2.56% |

| U.S. Treasury Notes, 4.38%, 07/31/2026 | 2.51% |

| Wells Fargo & Co. | 2.25% |

| Bank of America Corp. | 2.16% |

| U.S. Treasury Notes, 3.75%, 08/15/2027 | 1.81% |

| U.S. Treasury Notes, 4.13%, 07/31/2031 | 1.68% |

| Exxon Mobil Corp. | 1.57% |

| Parker-Hannifin Corp. | 1.46% |

| CBRE Group, Inc., Class A | 1.43% |

| Johnson & Johnson | 1.41% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

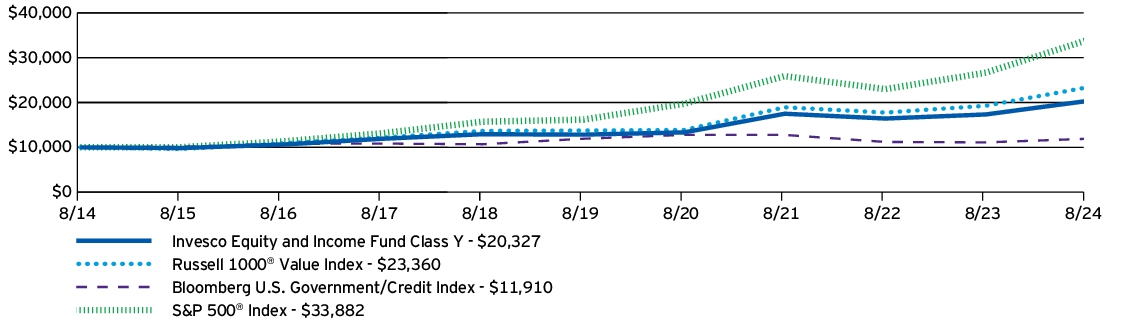

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equity and Income Fund (Class Y) | $56 | 0.52%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equity and Income Fund (Class Y) | 17.23% | 9.63% | 7.35% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| Bloomberg U.S. Government/Credit Index | 7.21% | (0.02)% | 1.76% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $12,580,924,604 |

| Total number of portfolio holdings | 358 |

| Total advisory fees paid | $41,636,024 |

| Portfolio turnover rate | 139% |

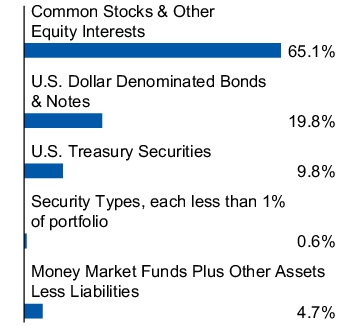

(% of net assets)

| U.S. Treasury Notes, 4.00%, 07/31/2029 | 2.56% |

| U.S. Treasury Notes, 4.38%, 07/31/2026 | 2.51% |

| Wells Fargo & Co. | 2.25% |

| Bank of America Corp. | 2.16% |

| U.S. Treasury Notes, 3.75%, 08/15/2027 | 1.81% |

| U.S. Treasury Notes, 4.13%, 07/31/2031 | 1.68% |

| Exxon Mobil Corp. | 1.57% |

| Parker-Hannifin Corp. | 1.46% |

| CBRE Group, Inc., Class A | 1.43% |

| Johnson & Johnson | 1.41% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

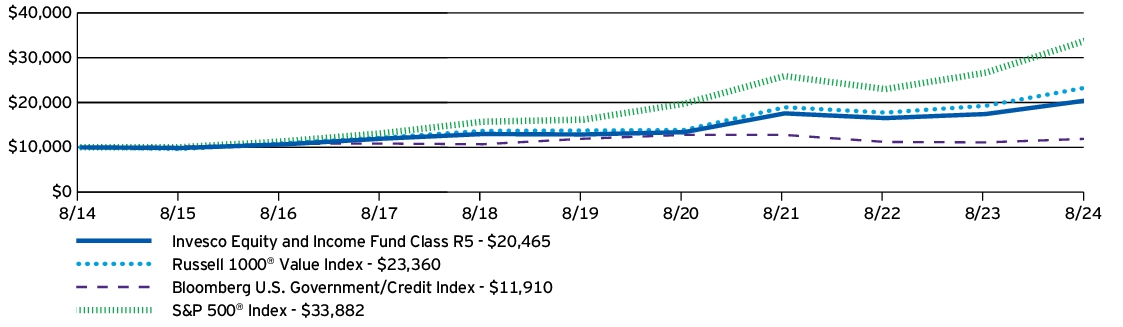

| Invesco Equity and Income Fund (Class R5) | $52 | 0.48%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equity and Income Fund (Class R5) | 17.39% | 9.71% | 7.42% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| Bloomberg U.S. Government/Credit Index | 7.21% | (0.02)% | 1.76% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $12,580,924,604 |

| Total number of portfolio holdings | 358 |

| Total advisory fees paid | $41,636,024 |

| Portfolio turnover rate | 139% |

(% of net assets)

| U.S. Treasury Notes, 4.00%, 07/31/2029 | 2.56% |

| U.S. Treasury Notes, 4.38%, 07/31/2026 | 2.51% |

| Wells Fargo & Co. | 2.25% |

| Bank of America Corp. | 2.16% |

| U.S. Treasury Notes, 3.75%, 08/15/2027 | 1.81% |

| U.S. Treasury Notes, 4.13%, 07/31/2031 | 1.68% |

| Exxon Mobil Corp. | 1.57% |

| Parker-Hannifin Corp. | 1.46% |

| CBRE Group, Inc., Class A | 1.43% |

| Johnson & Johnson | 1.41% |

| * Excluding money market fund holdings, if any. |

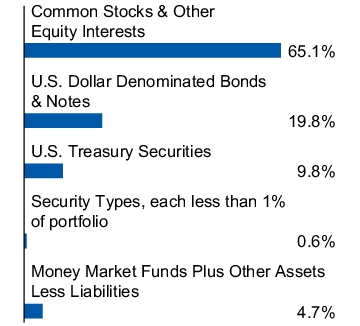

(% of net assets)

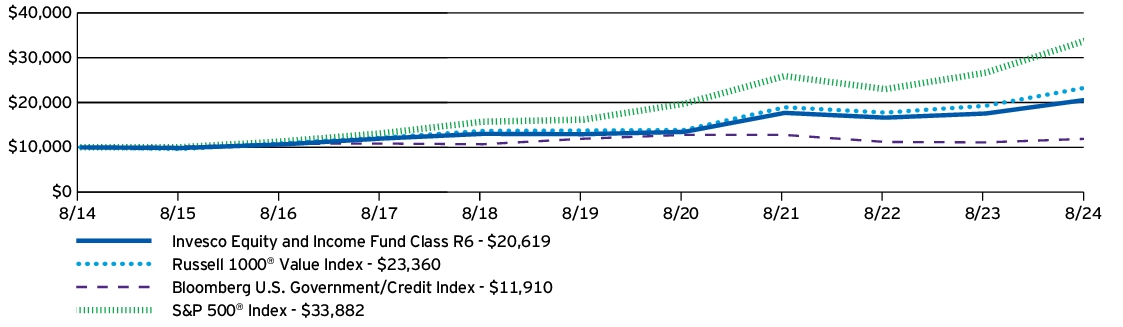

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Equity and Income Fund (Class R6) | $45 | 0.41%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Equity and Income Fund (Class R6) | 17.48% | 9.77% | 7.50% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| Bloomberg U.S. Government/Credit Index | 7.21% | (0.02)% | 1.76% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $12,580,924,604 |

| Total number of portfolio holdings | 358 |

| Total advisory fees paid | $41,636,024 |

| Portfolio turnover rate | 139% |

(% of net assets)

| U.S. Treasury Notes, 4.00%, 07/31/2029 | 2.56% |

| U.S. Treasury Notes, 4.38%, 07/31/2026 | 2.51% |

| Wells Fargo & Co. | 2.25% |

| Bank of America Corp. | 2.16% |

| U.S. Treasury Notes, 3.75%, 08/15/2027 | 1.81% |

| U.S. Treasury Notes, 4.13%, 07/31/2031 | 1.68% |

| Exxon Mobil Corp. | 1.57% |

| Parker-Hannifin Corp. | 1.46% |

| CBRE Group, Inc., Class A | 1.43% |

| Johnson & Johnson | 1.41% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Floating Rate ESG Fund (Class A) | $113 | 1.09% |

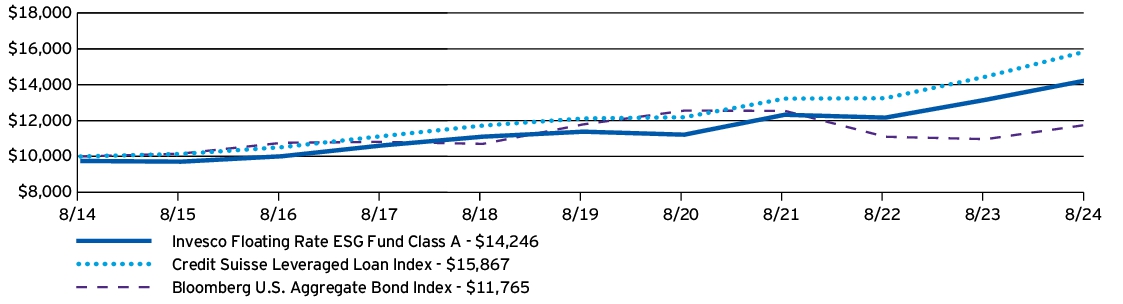

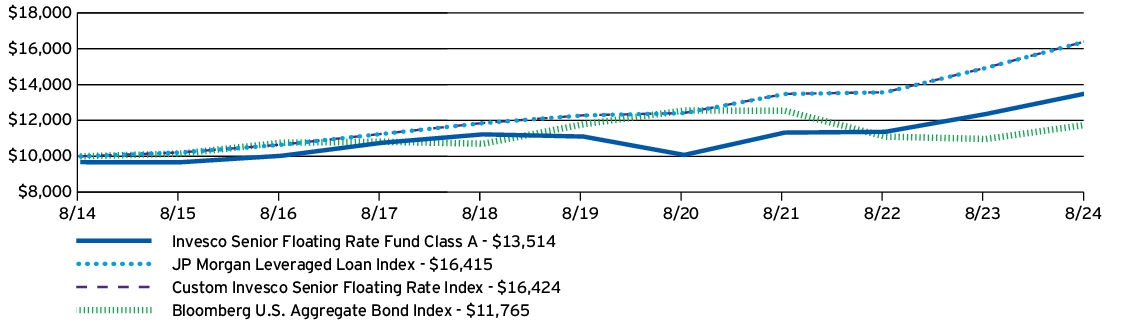

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Floating Rate ESG Fund (Class A) —including sales charge | 5.41% | 4.05% | 3.60% |

| Invesco Floating Rate ESG Fund (Class A) —excluding sales charge | 8.03% | 4.58% | 3.86% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.72% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $2,664,652,241 |

| Total number of portfolio holdings | 555 |

| Total advisory fees paid | $16,620,390 |

| Portfolio turnover rate | 46% |

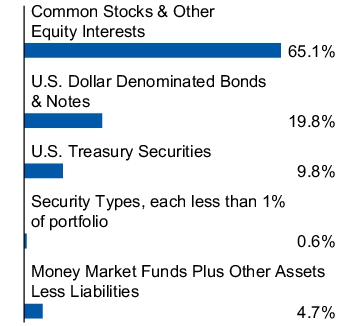

(% of net assets)

| Monitronics International, Inc., Term Loan B, 13.01%, 06/30/2028 | 1.00% |

| Spin Holdco, Inc., Term Loan, 9.60%, 03/04/2028 | 0.94% |

| V Global Holdings LLC, Term Loan, 10.96%, 12/22/2027 | 0.79% |

| Virgin Media 02 - LG, Term Loan Q, 8.70%, 01/31/2029 | 0.76% |

| UPC - LG (Sunrise), Term Loan AX, 8.44%, 01/31/2029 | 0.71% |

| Restoration Forest Products Group, LLC | 0.69% |

| Robertshaw US Holding Corp., First Lien Term Loan, 0.00%, 02/28/2027 | 0.67% |

| Dun & Bradstreet Corp. (The), Incremental Term Loan B-2, 8.03%, 01/18/2029 | 0.66% |

| AI Aqua Merger Sub, Inc., Term Loan B, 8.84%, 07/31/2028 | 0.61% |

| Acrisure LLC, Term Loan B-6, 8.59%, 11/06/2030 | 0.61% |

| * Excluding money market fund holdings, if any. |

(% of total investments)

| BBB- | 1.4% |

| BB+ | 1.3% |

| BB | 8.5% |

| BB- | 7.9% |

| B+ | 14.7% |

| B | 23.3% |

| B- | 19.7% |

| CCC+ | 5.1% |

| CCC | 3.4% |

| CCC- | 0.2% |

| CC | 0.2% |

| D | 1.1% |

| Not-Rated | 9.9% |

| Equity | 3.3% |

| ** Source: S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on S&P Global Ratings’ rating methodology, please visit spglobal.com and select “Understanding Credit Ratings” under About Ratings on the homepage. |

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

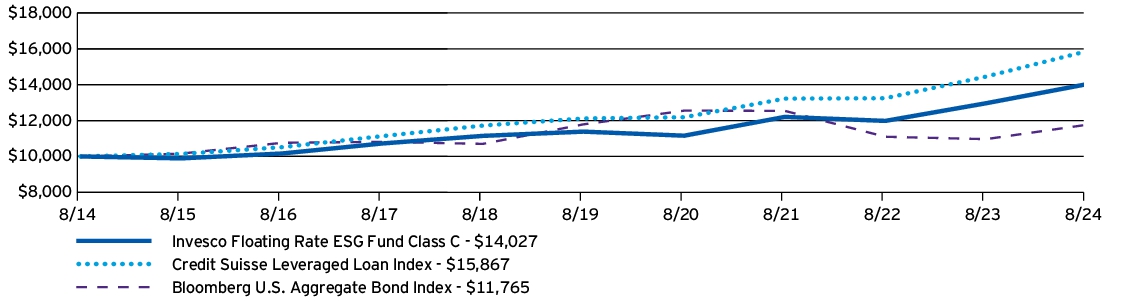

| Invesco Floating Rate ESG Fund (Class C) | $165 | 1.59% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Floating Rate ESG Fund (Class C) —including sales charge | 6.66% | 4.05% | 3.44% |

| Invesco Floating Rate ESG Fund (Class C) —excluding sales charge | 7.49% | 4.05% | 3.44% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.72% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $2,664,652,241 |

| Total number of portfolio holdings | 555 |

| Total advisory fees paid | $16,620,390 |

| Portfolio turnover rate | 46% |

(% of net assets)

| Monitronics International, Inc., Term Loan B, 13.01%, 06/30/2028 | 1.00% |

| Spin Holdco, Inc., Term Loan, 9.60%, 03/04/2028 | 0.94% |

| V Global Holdings LLC, Term Loan, 10.96%, 12/22/2027 | 0.79% |

| Virgin Media 02 - LG, Term Loan Q, 8.70%, 01/31/2029 | 0.76% |

| UPC - LG (Sunrise), Term Loan AX, 8.44%, 01/31/2029 | 0.71% |

| Restoration Forest Products Group, LLC | 0.69% |

| Robertshaw US Holding Corp., First Lien Term Loan, 0.00%, 02/28/2027 | 0.67% |

| Dun & Bradstreet Corp. (The), Incremental Term Loan B-2, 8.03%, 01/18/2029 | 0.66% |

| AI Aqua Merger Sub, Inc., Term Loan B, 8.84%, 07/31/2028 | 0.61% |

| Acrisure LLC, Term Loan B-6, 8.59%, 11/06/2030 | 0.61% |

| * Excluding money market fund holdings, if any. |

(% of total investments)

| BBB- | 1.4% |

| BB+ | 1.3% |

| BB | 8.5% |

| BB- | 7.9% |

| B+ | 14.7% |

| B | 23.3% |

| B- | 19.7% |

| CCC+ | 5.1% |

| CCC | 3.4% |

| CCC- | 0.2% |

| CC | 0.2% |

| D | 1.1% |

| Not-Rated | 9.9% |

| Equity | 3.3% |

| ** Source: S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on S&P Global Ratings’ rating methodology, please visit spglobal.com and select “Understanding Credit Ratings” under About Ratings on the homepage. |

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Floating Rate ESG Fund (Class R) | $139 | 1.34% |

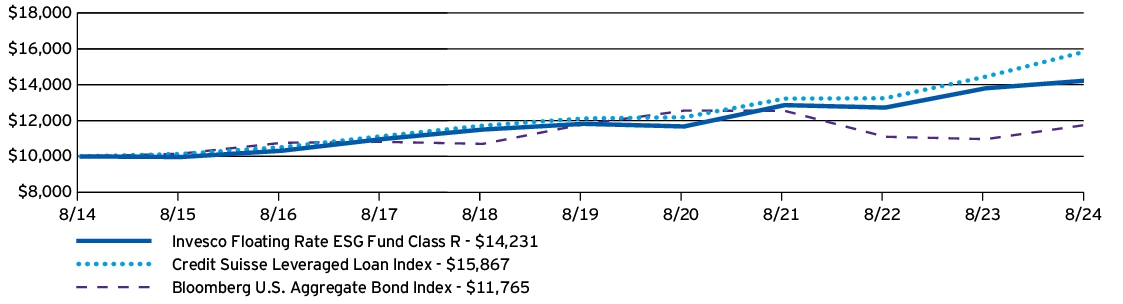

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Floating Rate ESG Fund (Class R) | 7.93% | 4.32% | 3.59% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.72% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $2,664,652,241 |

| Total number of portfolio holdings | 555 |

| Total advisory fees paid | $16,620,390 |

| Portfolio turnover rate | 46% |

(% of net assets)

| Monitronics International, Inc., Term Loan B, 13.01%, 06/30/2028 | 1.00% |

| Spin Holdco, Inc., Term Loan, 9.60%, 03/04/2028 | 0.94% |

| V Global Holdings LLC, Term Loan, 10.96%, 12/22/2027 | 0.79% |

| Virgin Media 02 - LG, Term Loan Q, 8.70%, 01/31/2029 | 0.76% |

| UPC - LG (Sunrise), Term Loan AX, 8.44%, 01/31/2029 | 0.71% |

| Restoration Forest Products Group, LLC | 0.69% |

| Robertshaw US Holding Corp., First Lien Term Loan, 0.00%, 02/28/2027 | 0.67% |

| Dun & Bradstreet Corp. (The), Incremental Term Loan B-2, 8.03%, 01/18/2029 | 0.66% |

| AI Aqua Merger Sub, Inc., Term Loan B, 8.84%, 07/31/2028 | 0.61% |

| Acrisure LLC, Term Loan B-6, 8.59%, 11/06/2030 | 0.61% |

| * Excluding money market fund holdings, if any. |

(% of total investments)

| BBB- | 1.4% |

| BB+ | 1.3% |

| BB | 8.5% |

| BB- | 7.9% |

| B+ | 14.7% |

| B | 23.3% |

| B- | 19.7% |

| CCC+ | 5.1% |

| CCC | 3.4% |

| CCC- | 0.2% |

| CC | 0.2% |

| D | 1.1% |

| Not-Rated | 9.9% |

| Equity | 3.3% |

| ** Source: S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on S&P Global Ratings’ rating methodology, please visit spglobal.com and select “Understanding Credit Ratings” under About Ratings on the homepage. |

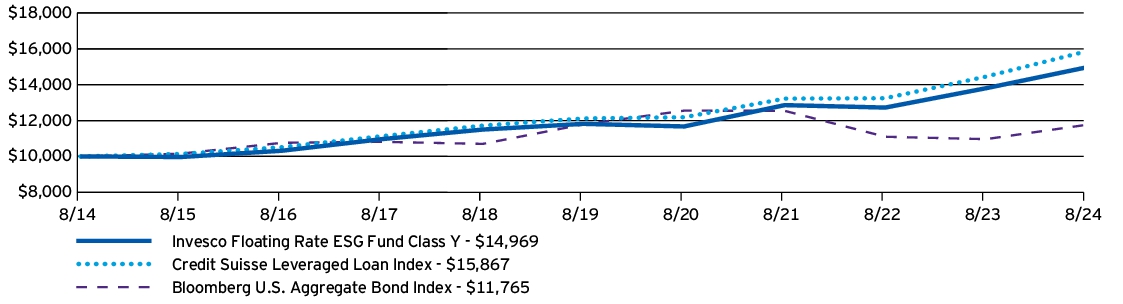

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Floating Rate ESG Fund (Class Y) | $87 | 0.84% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Floating Rate ESG Fund (Class Y) | 8.30% | 4.84% | 4.12% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.72% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $2,664,652,241 |

| Total number of portfolio holdings | 555 |

| Total advisory fees paid | $16,620,390 |

| Portfolio turnover rate | 46% |

(% of net assets)

| Monitronics International, Inc., Term Loan B, 13.01%, 06/30/2028 | 1.00% |

| Spin Holdco, Inc., Term Loan, 9.60%, 03/04/2028 | 0.94% |

| V Global Holdings LLC, Term Loan, 10.96%, 12/22/2027 | 0.79% |

| Virgin Media 02 - LG, Term Loan Q, 8.70%, 01/31/2029 | 0.76% |

| UPC - LG (Sunrise), Term Loan AX, 8.44%, 01/31/2029 | 0.71% |

| Restoration Forest Products Group, LLC | 0.69% |

| Robertshaw US Holding Corp., First Lien Term Loan, 0.00%, 02/28/2027 | 0.67% |

| Dun & Bradstreet Corp. (The), Incremental Term Loan B-2, 8.03%, 01/18/2029 | 0.66% |

| AI Aqua Merger Sub, Inc., Term Loan B, 8.84%, 07/31/2028 | 0.61% |

| Acrisure LLC, Term Loan B-6, 8.59%, 11/06/2030 | 0.61% |

| * Excluding money market fund holdings, if any. |

(% of total investments)

| BBB- | 1.4% |

| BB+ | 1.3% |

| BB | 8.5% |

| BB- | 7.9% |

| B+ | 14.7% |

| B | 23.3% |

| B- | 19.7% |

| CCC+ | 5.1% |

| CCC | 3.4% |

| CCC- | 0.2% |

| CC | 0.2% |

| D | 1.1% |

| Not-Rated | 9.9% |

| Equity | 3.3% |

| ** Source: S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on S&P Global Ratings’ rating methodology, please visit spglobal.com and select “Understanding Credit Ratings” under About Ratings on the homepage. |

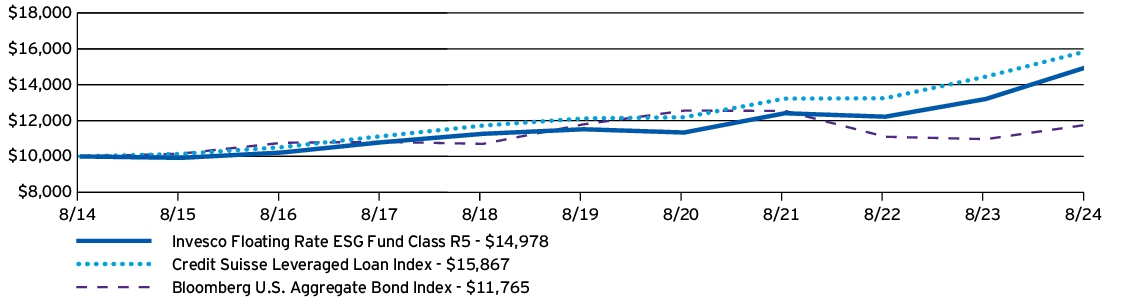

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Floating Rate ESG Fund (Class R5) | $87 | 0.84% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Floating Rate ESG Fund (Class R5) | 8.31% | 4.84% | 4.12% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.72% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $2,664,652,241 |

| Total number of portfolio holdings | 555 |

| Total advisory fees paid | $16,620,390 |

| Portfolio turnover rate | 46% |

(% of net assets)

| Monitronics International, Inc., Term Loan B, 13.01%, 06/30/2028 | 1.00% |

| Spin Holdco, Inc., Term Loan, 9.60%, 03/04/2028 | 0.94% |

| V Global Holdings LLC, Term Loan, 10.96%, 12/22/2027 | 0.79% |

| Virgin Media 02 - LG, Term Loan Q, 8.70%, 01/31/2029 | 0.76% |

| UPC - LG (Sunrise), Term Loan AX, 8.44%, 01/31/2029 | 0.71% |

| Restoration Forest Products Group, LLC | 0.69% |

| Robertshaw US Holding Corp., First Lien Term Loan, 0.00%, 02/28/2027 | 0.67% |

| Dun & Bradstreet Corp. (The), Incremental Term Loan B-2, 8.03%, 01/18/2029 | 0.66% |

| AI Aqua Merger Sub, Inc., Term Loan B, 8.84%, 07/31/2028 | 0.61% |

| Acrisure LLC, Term Loan B-6, 8.59%, 11/06/2030 | 0.61% |

| * Excluding money market fund holdings, if any. |

(% of total investments)

| BBB- | 1.4% |

| BB+ | 1.3% |

| BB | 8.5% |

| BB- | 7.9% |

| B+ | 14.7% |

| B | 23.3% |

| B- | 19.7% |

| CCC+ | 5.1% |

| CCC | 3.4% |

| CCC- | 0.2% |

| CC | 0.2% |

| D | 1.1% |

| Not-Rated | 9.9% |

| Equity | 3.3% |

| ** Source: S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on S&P Global Ratings’ rating methodology, please visit spglobal.com and select “Understanding Credit Ratings” under About Ratings on the homepage. |

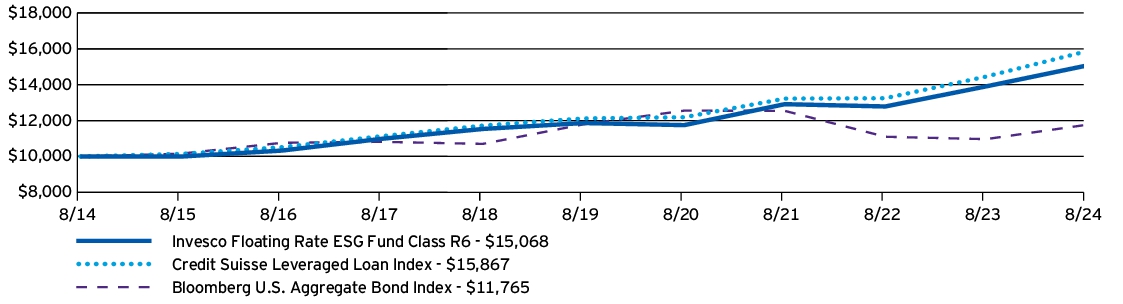

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Floating Rate ESG Fund (Class R6) | $80 | 0.77% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Floating Rate ESG Fund (Class R6) | 8.54% | 4.90% | 4.18% |

| Credit Suisse Leveraged Loan Index | 9.81% | 5.54% | 4.72% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| Fund net assets | $2,664,652,241 |

| Total number of portfolio holdings | 555 |

| Total advisory fees paid | $16,620,390 |

| Portfolio turnover rate | 46% |

(% of net assets)

| Monitronics International, Inc., Term Loan B, 13.01%, 06/30/2028 | 1.00% |

| Spin Holdco, Inc., Term Loan, 9.60%, 03/04/2028 | 0.94% |

| V Global Holdings LLC, Term Loan, 10.96%, 12/22/2027 | 0.79% |

| Virgin Media 02 - LG, Term Loan Q, 8.70%, 01/31/2029 | 0.76% |

| UPC - LG (Sunrise), Term Loan AX, 8.44%, 01/31/2029 | 0.71% |

| Restoration Forest Products Group, LLC | 0.69% |

| Robertshaw US Holding Corp., First Lien Term Loan, 0.00%, 02/28/2027 | 0.67% |

| Dun & Bradstreet Corp. (The), Incremental Term Loan B-2, 8.03%, 01/18/2029 | 0.66% |

| AI Aqua Merger Sub, Inc., Term Loan B, 8.84%, 07/31/2028 | 0.61% |

| Acrisure LLC, Term Loan B-6, 8.59%, 11/06/2030 | 0.61% |

| * Excluding money market fund holdings, if any. |

(% of total investments)

| BBB- | 1.4% |

| BB+ | 1.3% |

| BB | 8.5% |

| BB- | 7.9% |

| B+ | 14.7% |

| B | 23.3% |

| B- | 19.7% |

| CCC+ | 5.1% |

| CCC | 3.4% |

| CCC- | 0.2% |

| CC | 0.2% |

| D | 1.1% |

| Not-Rated | 9.9% |

| Equity | 3.3% |

| ** Source: S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on S&P Global Ratings’ rating methodology, please visit spglobal.com and select “Understanding Credit Ratings” under About Ratings on the homepage. |

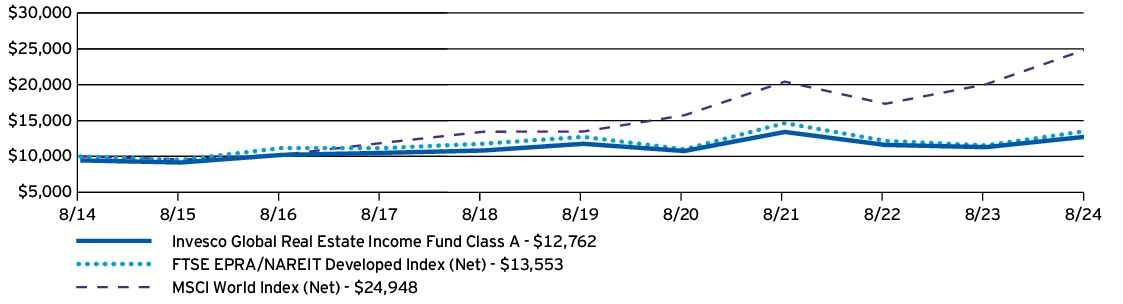

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Global Real Estate Income Fund (Class A) | $134 | 1.26% |

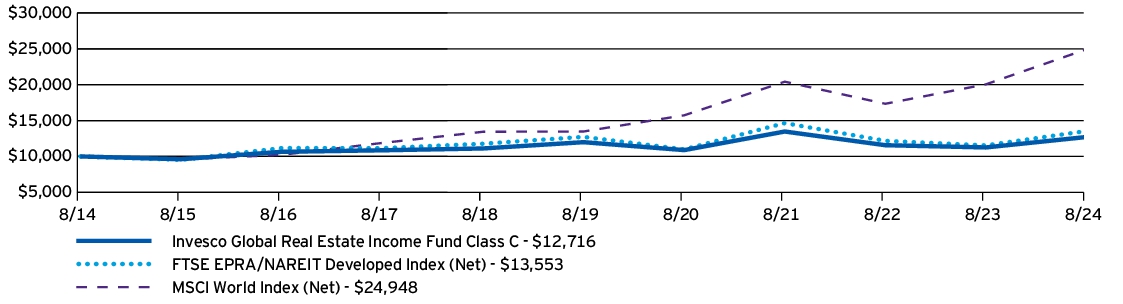

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Real Estate Income Fund (Class A) —including sales charge | 6.77% | 0.49% | 2.47% |

| Invesco Global Real Estate Income Fund (Class A) —excluding sales charge | 12.96% | 1.64% | 3.05% |

| FTSE EPRA/NAREIT Developed Index (Net) | 17.45% | 1.26% | 3.09% |

| MSCI World Index (Net) | 24.43% | 13.11% | 9.57% |

| Fund net assets | $609,339,340 |

| Total number of portfolio holdings | 93 |

| Total advisory fees paid | $4,336,302 |

| Portfolio turnover rate | 49% |

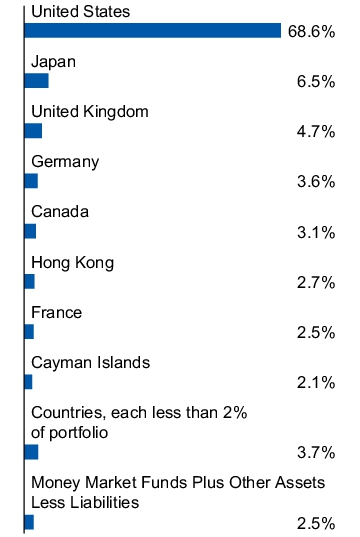

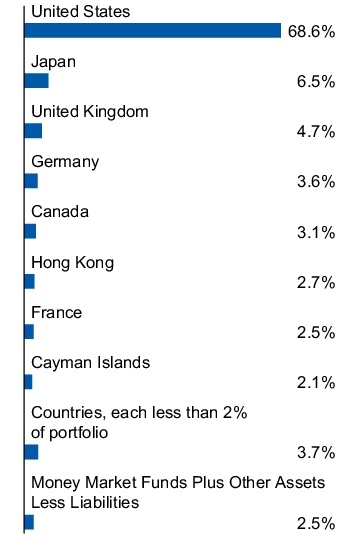

(% of net assets)

| Prologis, Inc. | 7.08% |

| Equinix, Inc. | 3.97% |

| Public Storage | 3.96% |

| Rexford Industrial Realty, Inc. | 3.20% |

| Mitsui Fudosan Co. Ltd. | 2.97% |

| Realty Income Corp. | 2.93% |

| Simon Property Group, Inc. | 2.87% |

| Alexandria Real Estate Equities, Inc. | 2.77% |

| UMH Properties, Inc., Series D, Pfd., 6.38% | 2.21% |

| Prima Capital CRE Securitization Ltd., Series 2019-RK1, Class BT, 4.45%, 04/15/2038 | 2.13% |

| * Excluding money market fund holdings, if any. |

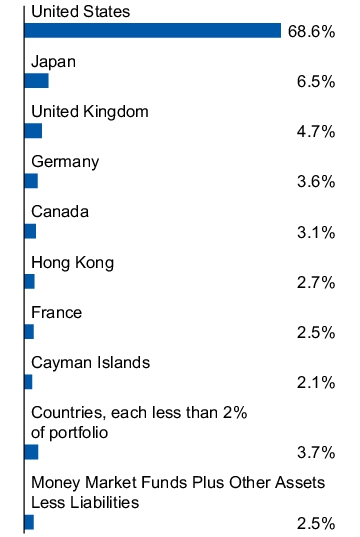

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Global Real Estate Income Fund (Class C) | $213 | 2.01% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Real Estate Income Fund (Class C) —including sales charge | 11.13% | 0.87% | 2.43% |

| Invesco Global Real Estate Income Fund (Class C) —excluding sales charge | 12.13% | 0.87% | 2.43% |

| FTSE EPRA/NAREIT Developed Index (Net) | 17.45% | 1.26% | 3.09% |

| MSCI World Index (Net) | 24.43% | 13.11% | 9.57% |

| Fund net assets | $609,339,340 |

| Total number of portfolio holdings | 93 |

| Total advisory fees paid | $4,336,302 |

| Portfolio turnover rate | 49% |

(% of net assets)

| Prologis, Inc. | 7.08% |

| Equinix, Inc. | 3.97% |

| Public Storage | 3.96% |

| Rexford Industrial Realty, Inc. | 3.20% |

| Mitsui Fudosan Co. Ltd. | 2.97% |

| Realty Income Corp. | 2.93% |

| Simon Property Group, Inc. | 2.87% |

| Alexandria Real Estate Equities, Inc. | 2.77% |

| UMH Properties, Inc., Series D, Pfd., 6.38% | 2.21% |

| Prima Capital CRE Securitization Ltd., Series 2019-RK1, Class BT, 4.45%, 04/15/2038 | 2.13% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Global Real Estate Income Fund (Class Y) | $108 | 1.01% |

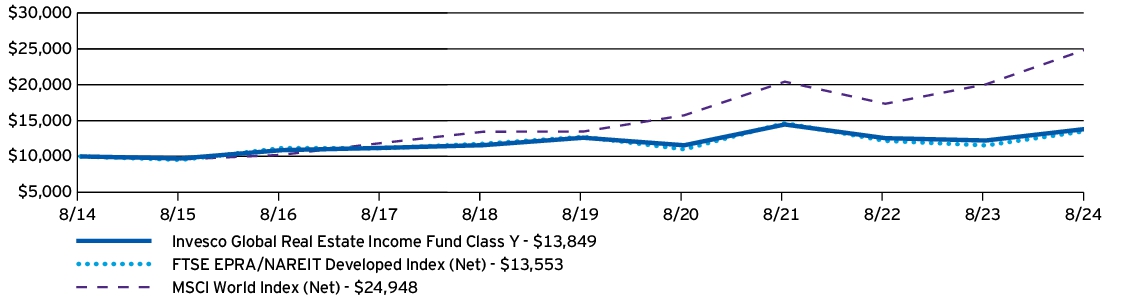

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Real Estate Income Fund (Class Y) | 13.29% | 1.89% | 3.31% |

| FTSE EPRA/NAREIT Developed Index (Net) | 17.45% | 1.26% | 3.09% |

| MSCI World Index (Net) | 24.43% | 13.11% | 9.57% |

| Fund net assets | $609,339,340 |

| Total number of portfolio holdings | 93 |

| Total advisory fees paid | $4,336,302 |

| Portfolio turnover rate | 49% |

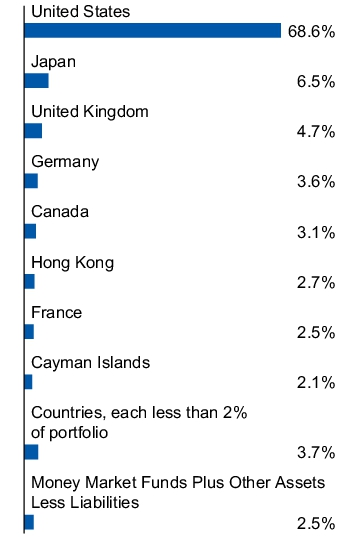

(% of net assets)

| Prologis, Inc. | 7.08% |

| Equinix, Inc. | 3.97% |

| Public Storage | 3.96% |

| Rexford Industrial Realty, Inc. | 3.20% |

| Mitsui Fudosan Co. Ltd. | 2.97% |

| Realty Income Corp. | 2.93% |

| Simon Property Group, Inc. | 2.87% |

| Alexandria Real Estate Equities, Inc. | 2.77% |

| UMH Properties, Inc., Series D, Pfd., 6.38% | 2.21% |

| Prima Capital CRE Securitization Ltd., Series 2019-RK1, Class BT, 4.45%, 04/15/2038 | 2.13% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

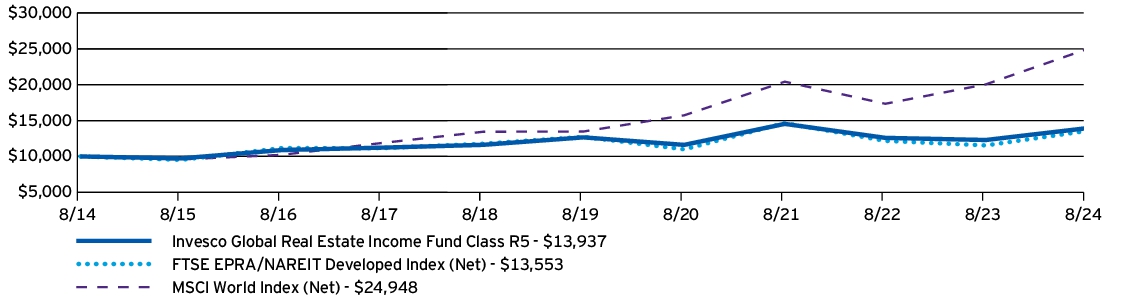

| Invesco Global Real Estate Income Fund (Class R5) | $97 | 0.91% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Real Estate Income Fund (Class R5) | 13.38% | 1.94% | 3.38% |

| FTSE EPRA/NAREIT Developed Index (Net) | 17.45% | 1.26% | 3.09% |

| MSCI World Index (Net) | 24.43% | 13.11% | 9.57% |

| Fund net assets | $609,339,340 |

| Total number of portfolio holdings | 93 |

| Total advisory fees paid | $4,336,302 |

| Portfolio turnover rate | 49% |

(% of net assets)

| Prologis, Inc. | 7.08% |

| Equinix, Inc. | 3.97% |

| Public Storage | 3.96% |

| Rexford Industrial Realty, Inc. | 3.20% |

| Mitsui Fudosan Co. Ltd. | 2.97% |

| Realty Income Corp. | 2.93% |

| Simon Property Group, Inc. | 2.87% |

| Alexandria Real Estate Equities, Inc. | 2.77% |

| UMH Properties, Inc., Series D, Pfd., 6.38% | 2.21% |

| Prima Capital CRE Securitization Ltd., Series 2019-RK1, Class BT, 4.45%, 04/15/2038 | 2.13% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

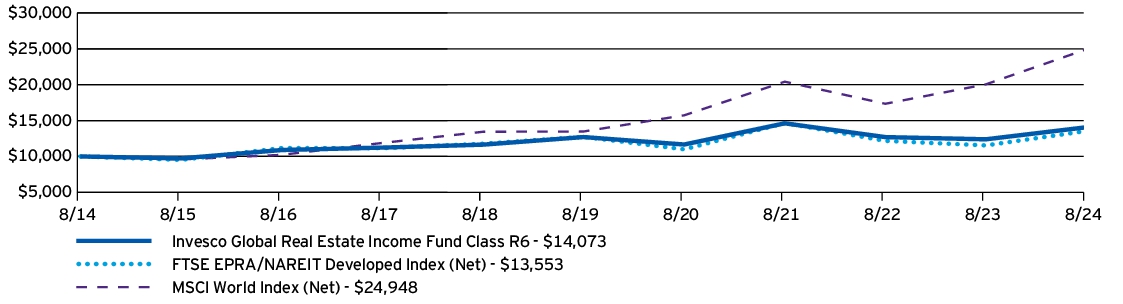

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Global Real Estate Income Fund (Class R6) | $90 | 0.84% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Real Estate Income Fund (Class R6) | 13.58% | 2.07% | 3.48% |

| FTSE EPRA/NAREIT Developed Index (Net) | 17.45% | 1.26% | 3.09% |

| MSCI World Index (Net) | 24.43% | 13.11% | 9.57% |

| Fund net assets | $609,339,340 |

| Total number of portfolio holdings | 93 |

| Total advisory fees paid | $4,336,302 |

| Portfolio turnover rate | 49% |

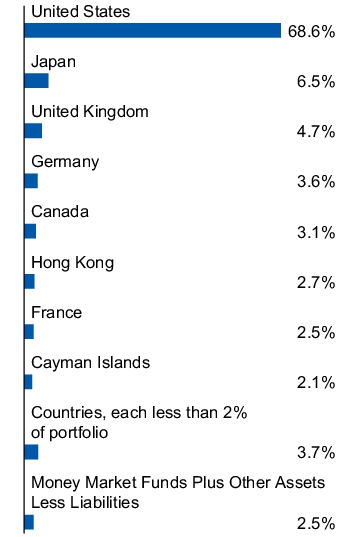

(% of net assets)

| Prologis, Inc. | 7.08% |

| Equinix, Inc. | 3.97% |

| Public Storage | 3.96% |

| Rexford Industrial Realty, Inc. | 3.20% |

| Mitsui Fudosan Co. Ltd. | 2.97% |

| Realty Income Corp. | 2.93% |

| Simon Property Group, Inc. | 2.87% |

| Alexandria Real Estate Equities, Inc. | 2.77% |

| UMH Properties, Inc., Series D, Pfd., 6.38% | 2.21% |

| Prima Capital CRE Securitization Ltd., Series 2019-RK1, Class BT, 4.45%, 04/15/2038 | 2.13% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

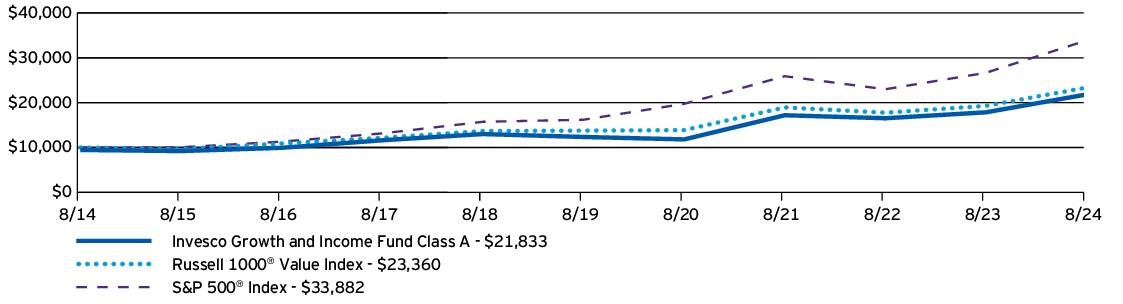

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Growth and Income Fund (Class A) | $88 | 0.79% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Growth and Income Fund (Class A) —including sales charge | 15.67% | 10.82% | 8.12% |

| Invesco Growth and Income Fund (Class A) —excluding sales charge | 22.39% | 12.08% | 8.74% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,206,083,062 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $14,251,520 |

| Portfolio turnover rate | 25% |

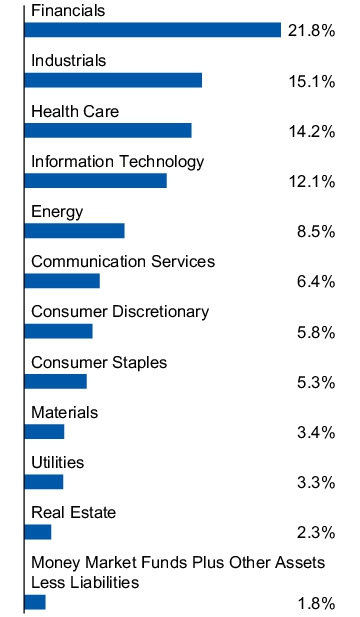

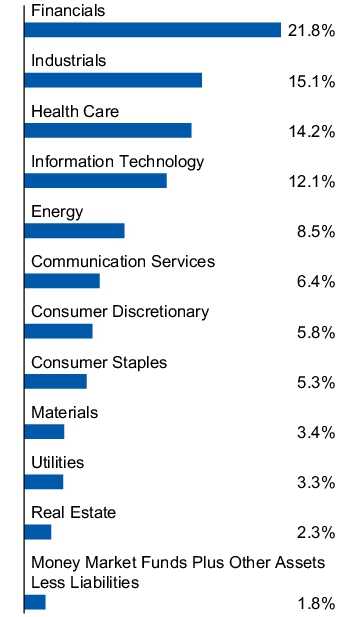

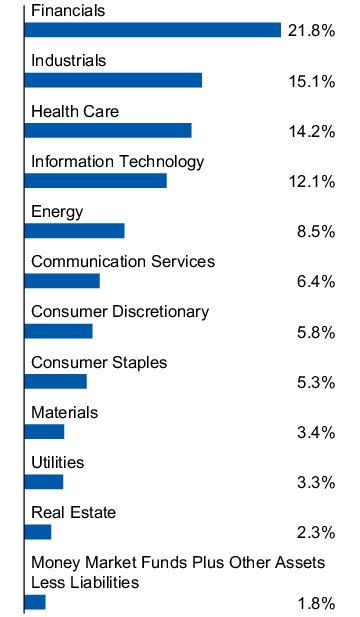

(% of net assets)

| Wells Fargo & Co. | 3.26% |

| Bank of America Corp. | 3.23% |

| Exxon Mobil Corp. | 2.31% |

| CBRE Group, Inc., Class A | 2.29% |

| Parker-Hannifin Corp. | 2.17% |

| Johnson & Johnson | 2.15% |

| Alphabet, Inc., Class A | 2.12% |

| Johnson Controls International PLC | 2.09% |

| Amazon.com, Inc. | 2.02% |

| ConocoPhillips | 1.93% |

| * Excluding money market fund holdings, if any. |

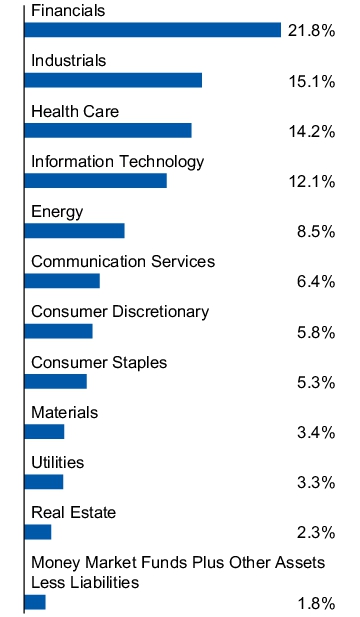

(% of net assets)

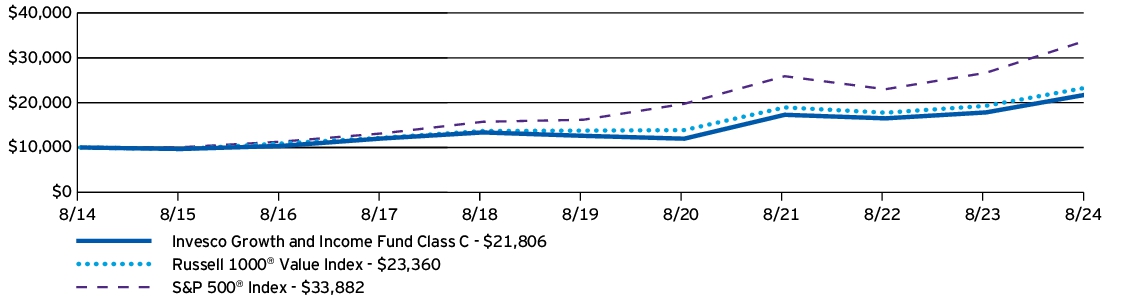

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Growth and Income Fund (Class C) | $169 | 1.53% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Growth and Income Fund (Class C) —including sales charge | 20.44% | 11.27% | 8.11% |

| Invesco Growth and Income Fund (Class C) —excluding sales charge | 21.44% | 11.27% | 8.11% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,206,083,062 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $14,251,520 |

| Portfolio turnover rate | 25% |

(% of net assets)

| Wells Fargo & Co. | 3.26% |

| Bank of America Corp. | 3.23% |

| Exxon Mobil Corp. | 2.31% |

| CBRE Group, Inc., Class A | 2.29% |

| Parker-Hannifin Corp. | 2.17% |

| Johnson & Johnson | 2.15% |

| Alphabet, Inc., Class A | 2.12% |

| Johnson Controls International PLC | 2.09% |

| Amazon.com, Inc. | 2.02% |

| ConocoPhillips | 1.93% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

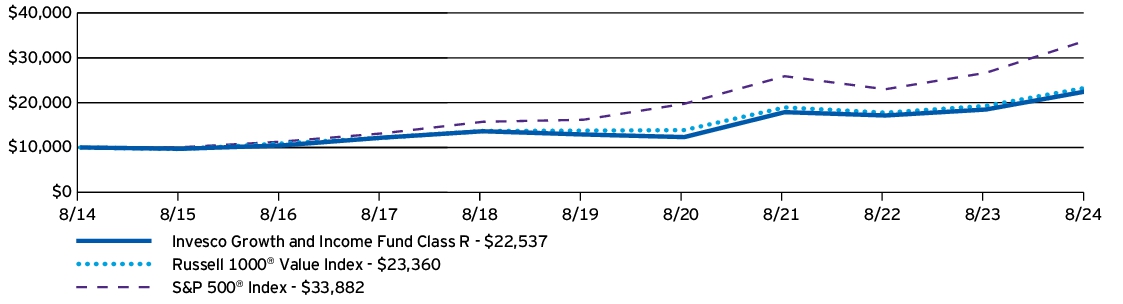

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Growth and Income Fund (Class R) | $115 | 1.04% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Growth and Income Fund (Class R) | 22.03% | 11.80% | 8.46% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,206,083,062 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $14,251,520 |

| Portfolio turnover rate | 25% |

(% of net assets)

| Wells Fargo & Co. | 3.26% |

| Bank of America Corp. | 3.23% |

| Exxon Mobil Corp. | 2.31% |

| CBRE Group, Inc., Class A | 2.29% |

| Parker-Hannifin Corp. | 2.17% |

| Johnson & Johnson | 2.15% |

| Alphabet, Inc., Class A | 2.12% |

| Johnson Controls International PLC | 2.09% |

| Amazon.com, Inc. | 2.02% |

| ConocoPhillips | 1.93% |

| * Excluding money market fund holdings, if any. |

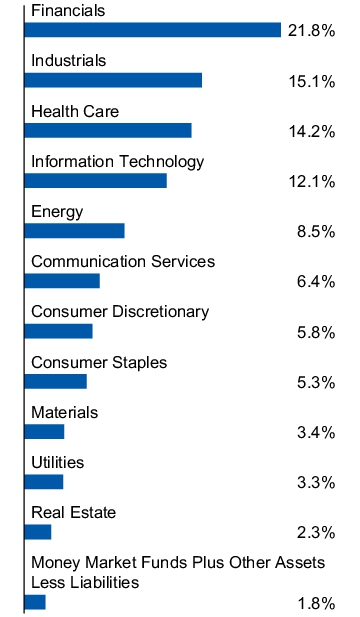

(% of net assets)

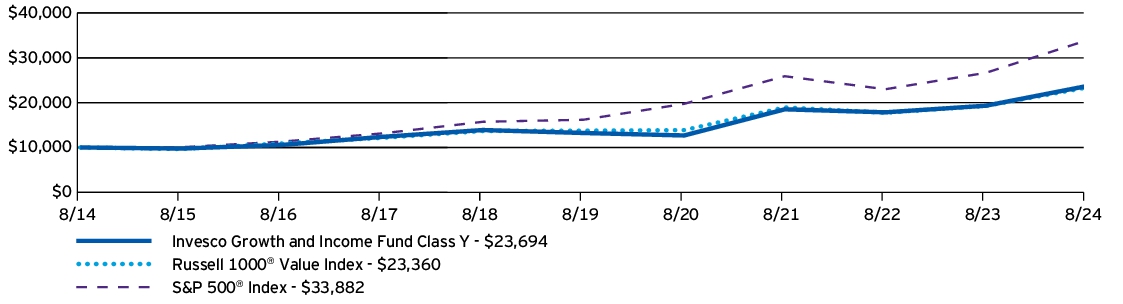

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Growth and Income Fund (Class Y) | $60 | 0.54% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Growth and Income Fund (Class Y) | 22.67% | 12.36% | 9.01% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,206,083,062 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $14,251,520 |

| Portfolio turnover rate | 25% |

(% of net assets)

| Wells Fargo & Co. | 3.26% |

| Bank of America Corp. | 3.23% |

| Exxon Mobil Corp. | 2.31% |

| CBRE Group, Inc., Class A | 2.29% |

| Parker-Hannifin Corp. | 2.17% |

| Johnson & Johnson | 2.15% |

| Alphabet, Inc., Class A | 2.12% |

| Johnson Controls International PLC | 2.09% |

| Amazon.com, Inc. | 2.02% |

| ConocoPhillips | 1.93% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

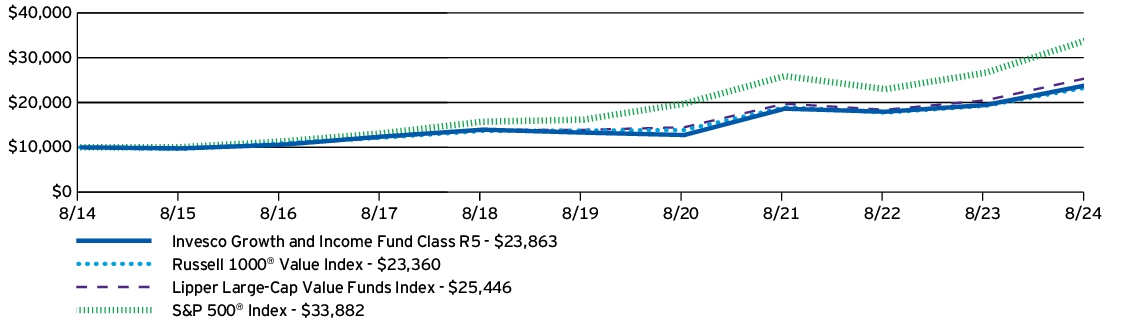

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Growth and Income Fund (Class R5) | $56 | 0.50% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Growth and Income Fund (Class R5) | 22.69% | 12.42% | 9.09% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,206,083,062 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $14,251,520 |

| Portfolio turnover rate | 25% |

(% of net assets)

| Wells Fargo & Co. | 3.26% |

| Bank of America Corp. | 3.23% |

| Exxon Mobil Corp. | 2.31% |

| CBRE Group, Inc., Class A | 2.29% |

| Parker-Hannifin Corp. | 2.17% |

| Johnson & Johnson | 2.15% |

| Alphabet, Inc., Class A | 2.12% |

| Johnson Controls International PLC | 2.09% |

| Amazon.com, Inc. | 2.02% |

| ConocoPhillips | 1.93% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

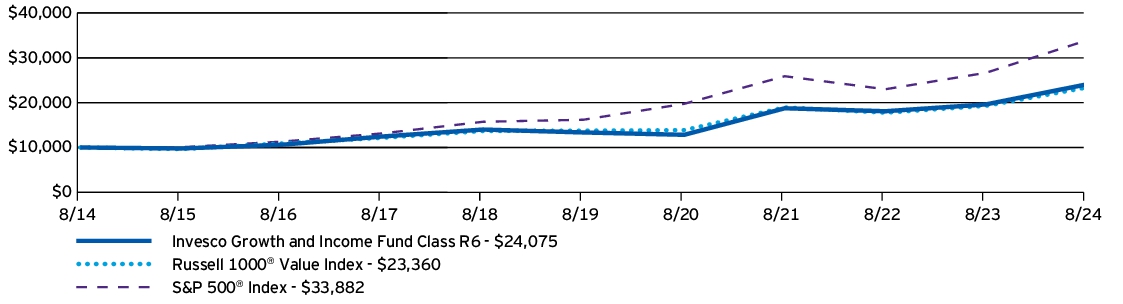

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Growth and Income Fund (Class R6) | $48 | 0.43% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Growth and Income Fund (Class R6) | 22.77% | 12.51% | 9.18% |

| Russell 1000® Value Index | 21.15% | 11.16% | 8.85% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $4,206,083,062 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $14,251,520 |

| Portfolio turnover rate | 25% |

(% of net assets)

| Wells Fargo & Co. | 3.26% |

| Bank of America Corp. | 3.23% |

| Exxon Mobil Corp. | 2.31% |

| CBRE Group, Inc., Class A | 2.29% |

| Parker-Hannifin Corp. | 2.17% |

| Johnson & Johnson | 2.15% |

| Alphabet, Inc., Class A | 2.12% |

| Johnson Controls International PLC | 2.09% |

| Amazon.com, Inc. | 2.02% |

| ConocoPhillips | 1.93% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

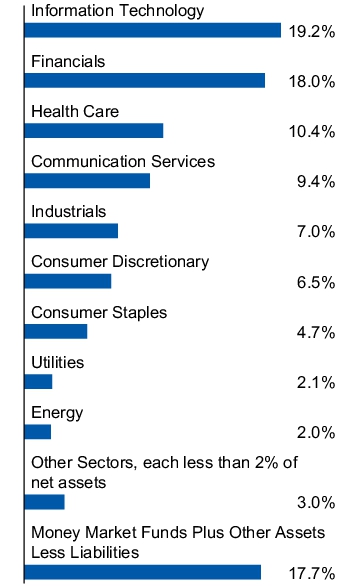

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Income Advantage U.S. Fund (Class A) | $119 | 1.09%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

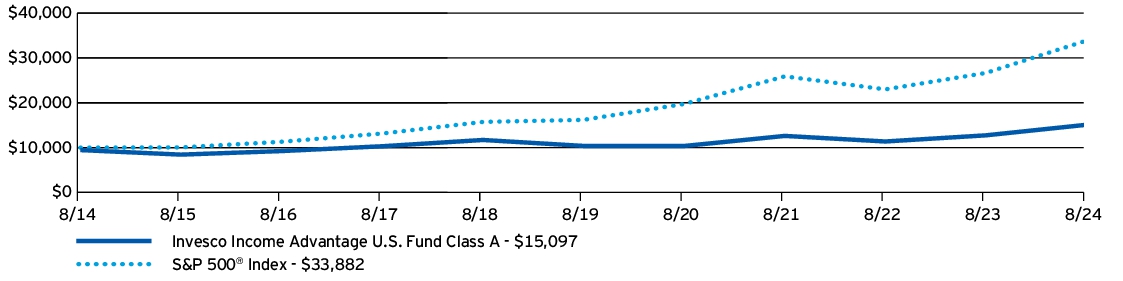

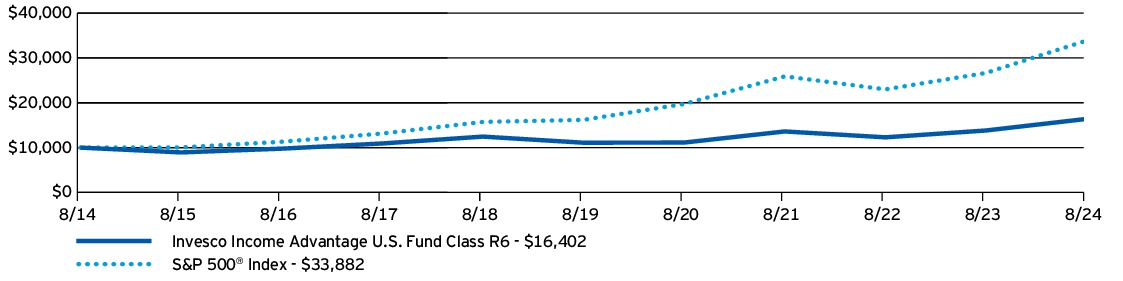

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Class A) —including sales charge | 11.93% | 6.56% | 4.21% |

| Invesco Income Advantage U.S. Fund (Class A) —excluding sales charge | 18.49% | 7.78% | 4.79% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

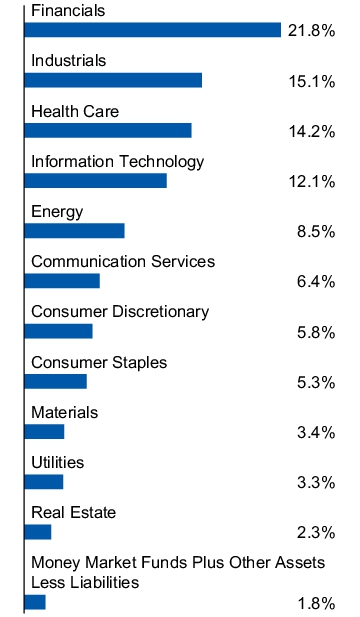

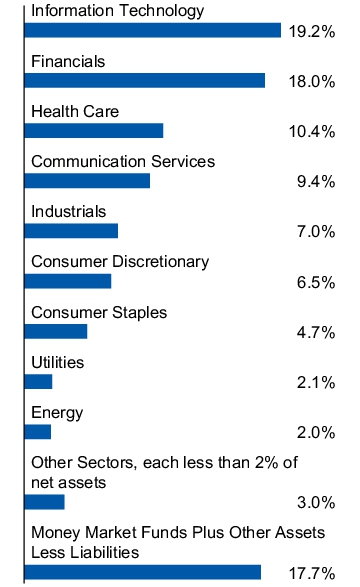

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Income Advantage U.S. Fund (Class C) | $200 | 1.84%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

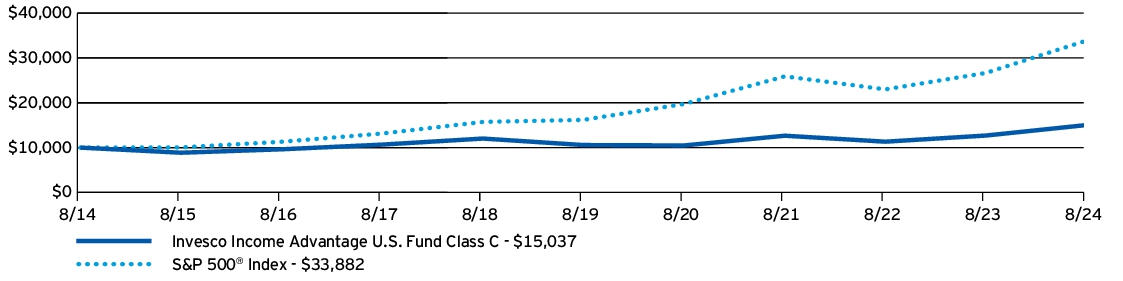

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Class C) —including sales charge | 16.61% | 6.98% | 4.16% |

| Invesco Income Advantage U.S. Fund (Class C) —excluding sales charge | 17.61% | 6.98% | 4.16% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

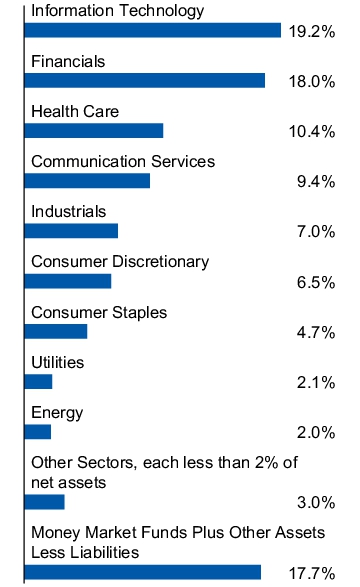

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

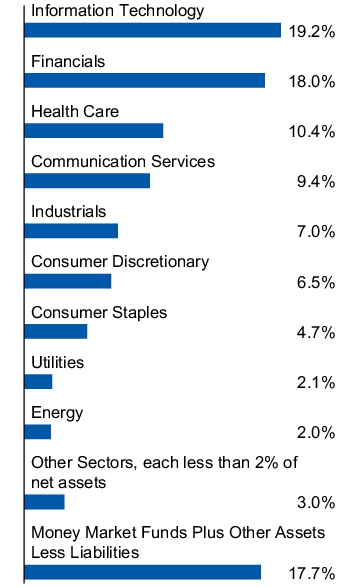

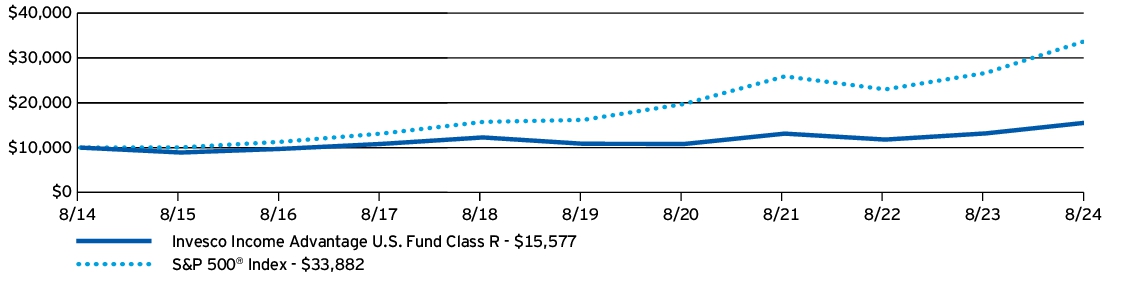

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Income Advantage U.S. Fund (Class R) | $146 | 1.34%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Class R) | 18.15% | 7.50% | 4.53% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

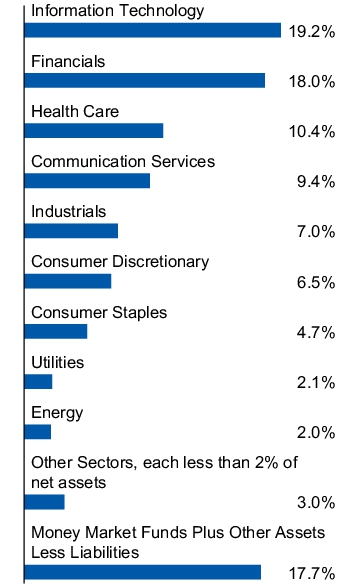

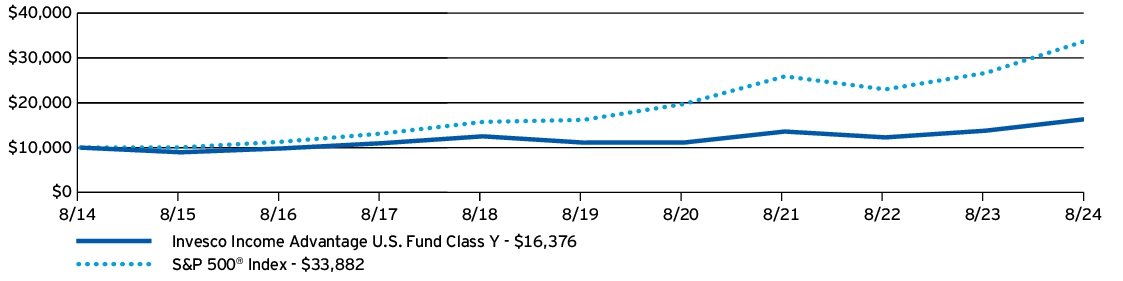

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Income Advantage U.S. Fund (Class Y) | $92 | 0.84%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Class Y) | 18.85% | 8.05% | 5.06% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

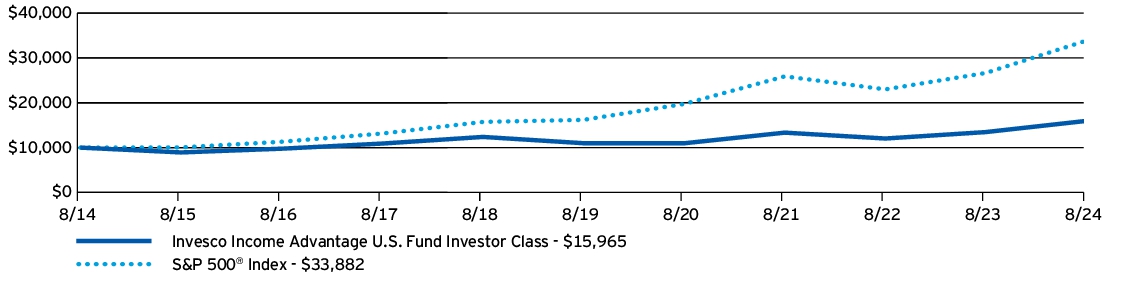

| Invesco Income Advantage U.S. Fund (Investor Class) | $119 | 1.09%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Investor Class) | 18.56% | 7.77% | 4.79% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

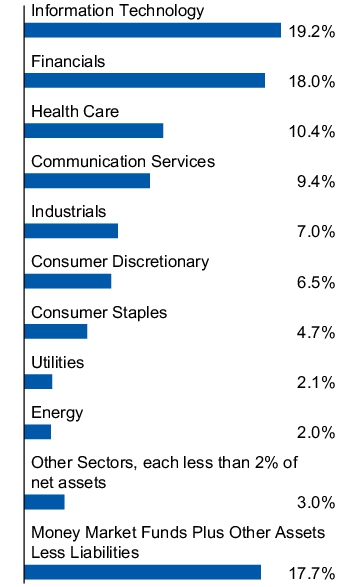

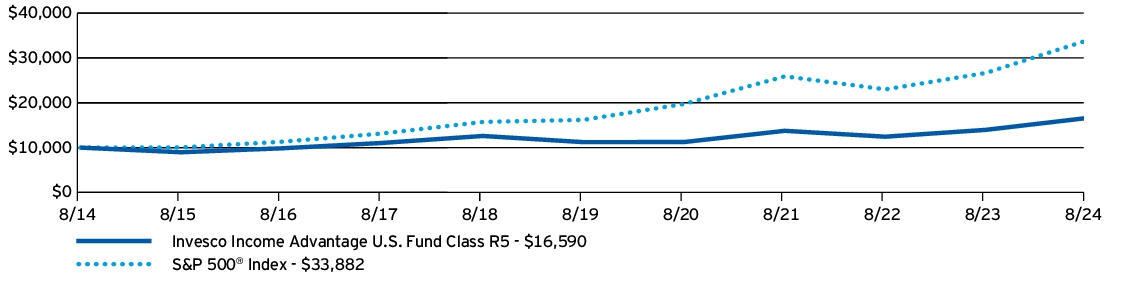

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Income Advantage U.S. Fund (Class R5) | $83 | 0.76%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Class R5) | 18.83% | 8.14% | 5.19% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco Income Advantage U.S. Fund (Class R6) | $83 | 0.76%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Income Advantage U.S. Fund (Class R6) | 18.72% | 8.14% | 5.07% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $222,448,145 |

| Total number of portfolio holdings | 385 |

| Total advisory fees paid | $1,102,446 |

| Portfolio turnover rate | 54% |

(% of net assets)

| Microsoft Corp. | 4.25% |

| NVIDIA Corp. | 3.16% |

| Apple, Inc. | 2.85% |

| Meta Platforms, Inc., Class A | 2.69% |

| Alphabet, Inc., Class A | 2.66% |

| Amazon.com, Inc. | 2.08% |

| Berkshire Hathaway, Inc., Class B | 1.76% |

| Johnson & Johnson | 1.45% |

| Visa, Inc., Class A | 1.42% |

| JPMorgan Chase & Co. | 1.29% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

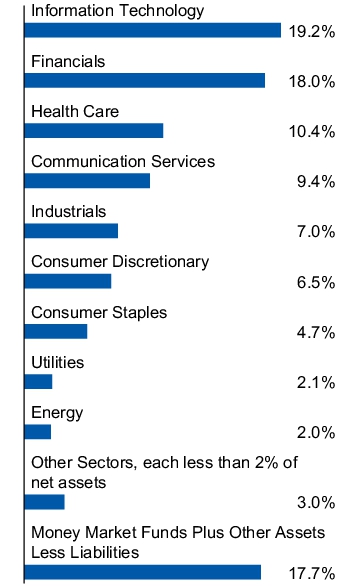

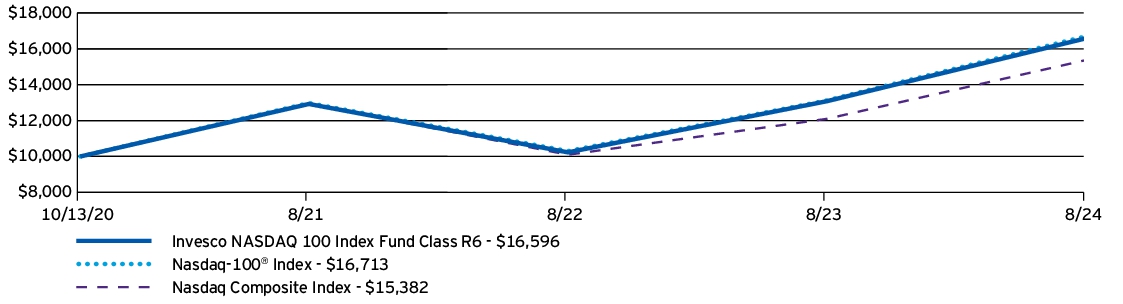

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco NASDAQ 100 Index Fund (Class R6) | $33 | 0.29%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | Since Inception (10/13/20) |

| Invesco NASDAQ 100 Index Fund (Class R6) | 26.89% | 13.94% |

| Nasdaq-100® Index | 27.30% | 14.15% |

| Nasdaq Composite Index | 27.15% | 11.73% |

| Fund net assets | $98,426,605 |

| Total number of portfolio holdings | 106 |

| Total advisory fees paid | $0 |

| Portfolio turnover rate | 7% |

(% of net assets)

| Apple, Inc. | 8.90% |

| Microsoft Corp. | 7.86% |

| NVIDIA Corp. | 7.45% |

| Broadcom, Inc. | 4.94% |

| Amazon.com, Inc. | 4.71% |

| Meta Platforms, Inc., Class A | 4.61% |

| Tesla, Inc. | 2.62% |

| Costco Wholesale Corp. | 2.59% |

| Alphabet, Inc., Class A | 2.43% |

| Alphabet, Inc., Class C | 2.35% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

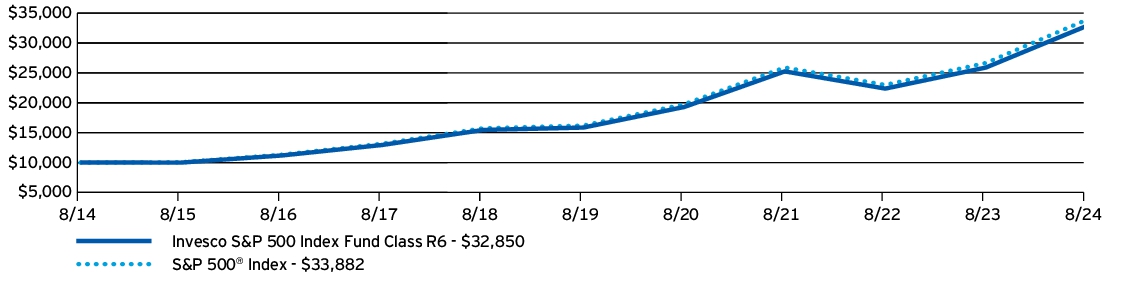

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

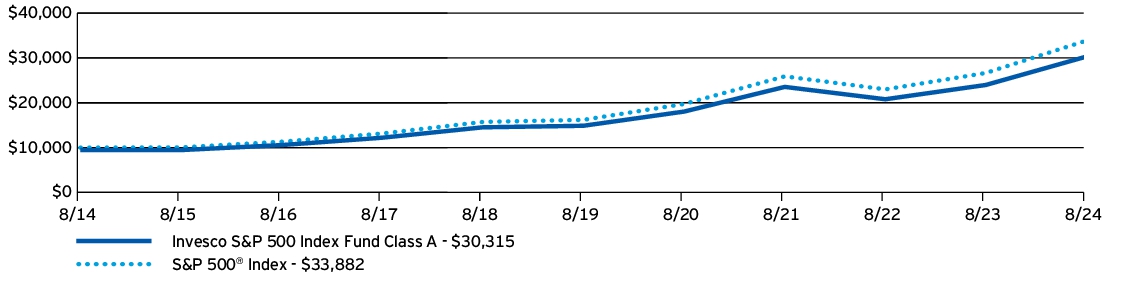

| Invesco S&P 500 Index Fund (Class A) | $61 | 0.54% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco S&P 500 Index Fund (Class A) —including sales charge | 19.48% | 14.01% | 11.73% |

| Invesco S&P 500 Index Fund (Class A) —excluding sales charge | 26.45% | 15.31% | 12.36% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Fund net assets | $3,334,591,169 |

| Total number of portfolio holdings | 508 |

| Total advisory fees paid | $3,180,343 |

| Portfolio turnover rate | 1% |

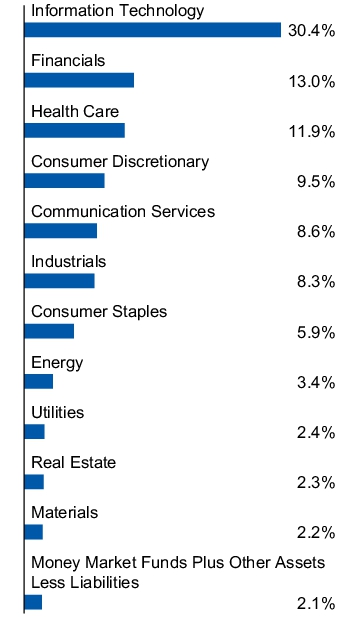

(% of net assets)

| Apple, Inc. | 6.81% |

| Microsoft Corp. | 6.40% |

| NVIDIA Corp. | 6.06% |

| Amazon.com, Inc. | 3.37% |

| Meta Platforms, Inc., Class A | 2.36% |

| Alphabet, Inc., Class A | 1.98% |

| Berkshire Hathaway, Inc., Class B | 1.78% |

| Alphabet, Inc., Class C | 1.67% |

| Eli Lilly and Co. | 1.58% |

| Broadcom, Inc. | 1.46% |

| * Excluding money market fund holdings, if any. |

(% of net assets)

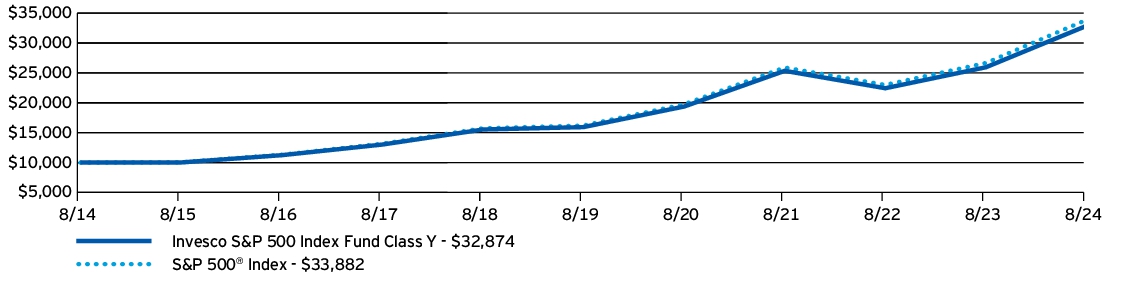

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Invesco S&P 500 Index Fund (Class C) | $145 | 1.29% |