SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

AIM Counselor Series Trust (Invesco Counselor Series Trust)

AIM Equity Funds (Invesco Equity Funds)

AIM Funds Group (Invesco Funds Group)

AIM Growth Series (Invesco Growth Series)

AIM International Mutual Funds (Invesco International Mutual Funds)

AIM Investment Funds (Invesco Investment Funds)

AIM Investment Securities Funds (Invesco Investment Securities Funds)

AIM Sector Funds (Invesco Sector Funds)

AIM Tax-Exempt Funds (Invesco Tax-Exempt Funds)

AIM Treasurer's Series Trust (Invesco Treasurer's Series Trust)

Invesco Exchange Fund

Invesco Management Trust

Invesco Securities Trust

Short-Term Investments Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

1. Title of each class of securities to which transaction applies: | ||

2. Aggregate number of securities to which transaction applies: | ||

3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

4. Proposed maximum aggregate value of transaction: | ||

| 5. Total fee paid: | ||

| [ ] | Fee paid previously with preliminary proxy materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

1) Amount Previously Paid: | ||

2) Form, Schedule or Registration Statement No.: | ||

3) Filing Party: | ||

4) Date Filed: | ||

AIM Counselor Series Trust (Invesco Counselor Series Trust)

AIM Equity Funds (Invesco Equity Funds)

AIM Funds Group (Invesco Funds Group)

AIM Growth Series (Invesco Growth Series)

AIM International Mutual Funds (Invesco International Mutual Funds)

AIM Investment Funds (Invesco Investment Funds)

AIM Investment Securities Funds (Invesco Investment Securities Funds)

AIM Sector Funds (Invesco Sector Funds)

AIM Tax-Exempt Funds (Invesco Tax-Exempt Funds)

AIM Treasurer's Series Trust (Invesco Treasurer's Series Trust)

Invesco Exchange Fund

Invesco Management Trust

Invesco Securities Trust

Short-Term Investments Trust

1555 Peachtree Street, N.E.

Atlanta, Georgia 30309

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS

To Be Held March 9, 2017

Notice is hereby given to the Shareholders of each of the series portfolios (each, a "Fund," and collectively, the "Funds") of each investment company listed above (each, a "Trust," and together, the "Trusts")1 that a Special Joint Meeting of Shareholders of the Funds (the "Meeting") will be held at 1555 Peachtree Street, N.E. Atlanta, Georgia 30309 on March 9, 2017, at 10:30 a.m. Eastern Standard Time.

The Boards of Trustees (each a "Board," and together, the "Boards") of the Funds have carefully considered the proposals below, believe that they are in the best interests of the Funds and their shareholders, and unanimously recommend that you vote FOR each of the proposals. The enclosed proxy statement provides you with detailed information on each proposal including how it will benefit shareholders.

The Meeting is to be held for the following purposes:

| 1. | For all Funds, to elect 15 trustees to each Board, each of whom will serve until his or her successor is elected and qualified. |

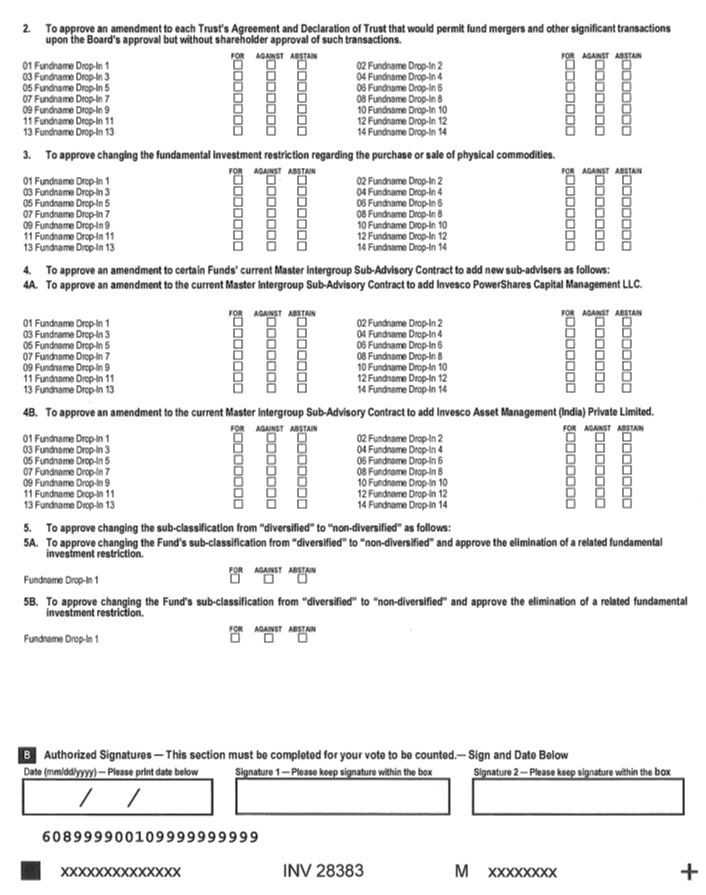

| 2. | For all Funds, to approve an amendment to each Trust's Agreement and Declaration of Trust that would permit fund mergers and other significant transactions upon the Board's approval but without shareholder approval of such transactions. |

| 3. | For all Funds, to approve changing the fundamental investment restriction regarding the purchase or sale of physical commodities. |

| 4. | To approve an amendment to certain Funds' current Master Intergroup Sub-Advisory Contract to add new sub-advisers as follows (includes two (2) sub-proposals): |

(a) For all Funds (other than Premier U.S. Government Money Portfolio, Invesco Short Duration High Yield Municipal Fund, Invesco Strategic Real Return Fund, Invesco Alternative Strategies Fund, Invesco Multi-Asset Inflation Fund, Invesco Multi-Asset Income Fund, Invesco Macro Allocation Strategy Fund, Invesco Macro International Equity Fund, Invesco Macro Long/Short Fund, Invesco Global Market Neutral Fund, Invesco Global Targeted Returns Fund, Invesco Low Volatility Emerging Markets Fund, Invesco All Cap Market Neutral Fund, Invesco Long/Short Equity Fund, Invesco Global Infrastructure Fund, Invesco MLP Fund, Invesco Global Opportunities Fund, Invesco Global Responsibility Equity Fund, Invesco International Companies Fund, Invesco Select Opportunities Fund, Invesco Balanced-Risk Aggressive Allocation Fund and Invesco Conservative Income Fund), to approve an amendment to the current Master Intergroup Sub-Advisory Contract to add Invesco PowerShares Capital Management LLC.

1 Certain other Invesco funds are issuing separate proxy solicitation materials but will also be included in the Special Joint Meeting of Shareholders to be held on March 9, 2017.

1

(b) For all Funds other than Premier U.S. Government Money Portfolio, to approve an amendment to the current Master Intergroup Sub-Advisory Contract to add Invesco Asset Management (India) Private Limited.

| 5. | To approve changing the sub-classification from "diversified" to "non-diversified" as follows (includes two (2) sub-proposals): |

(a) For Invesco Macro Allocation Strategy Fund, to approve changing the Fund's sub-classification from "diversified" to "non-diversified" and approve the elimination of a related fundamental investment restriction.

(b) For Invesco World Bond Fund, to approve changing the Fund's sub-classification from "diversified" to "non-diversified" and approve the elimination of a related fundamental investment restriction.

6. To transact such other business as may properly come before the Meeting or any adjournments thereof.

Shareholders of record of each Fund on December 12, 2016 are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement of the Meeting.

THE BOARD OF TRUSTEES OF EACH FUND UNANIMOUSLY RECOMMENDS THAT YOU CAST YOUR VOTE FOR ALL OF THE APPLICABLE PROPOSALS LISTED IN THE JOINT PROXY STATEMENT.

By order of the Boards of Trustees,

Senior Vice President, Chief Legal Officer and Secretary

December __, 2016

IT IS VERY IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING IN PERSON OR BY PROXY. PLEASE PROMPTLY SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD(S) IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD(S), REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE MEETING.

If you attend the Meeting and wish to vote in person, you will be able to do so and your vote at the Meeting will revoke any proxy you may have submitted. Merely attending the Meeting, however, will not revoke a previously given proxy.

In order to avoid the additional expense of further solicitation, we ask that you mail your proxy card(s) or record your voting instructions by telephone or via the internet promptly.

Your vote is extremely important. No matter how many or how few shares you own, please send in your proxy card(s), or vote by telephone or the internet today.

2

AIM Counselor Series Trust (Invesco Counselor Series Trust) ("ACST")

AIM Equity Funds (Invesco Equity Funds) ("AEF")

AIM Funds Group (Invesco Funds Group) ("AFG")

AIM Growth Series (Invesco Growth Series) ("AGS")

AIM International Mutual Funds (Invesco International Mutual Funds) ("AIMF")

AIM Investment Funds (Invesco Investment Funds) (AIF")

AIM Investment Securities Funds (Invesco Investment Securities Funds) ("AIS")

AIM Sector Funds (Invesco Sector Funds) ("ASEF")

AIM Tax-Exempt Funds (Invesco Tax-Exempt Funds) ("ATEF")

AIM Treasurer's Series Trust (Invesco Treasurer's Series Trust) ("ATST")

Invesco Exchange Fund ("IEF")

Invesco Management Trust ("IMT")

Invesco Securities Trust ("IST")

Short-Term Investments Trust ("STIT")

1555 Peachtree Street, N.E.

Atlanta, Georgia 30309

SPECIAL JOINT MEETING OF SHAREHOLDERS

To Be Held March 9, 2017

INTRODUCTION

This Joint Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (each a "Board," and together, the "Boards") of each investment company listed above (each, a "Trust," and together, the "Trusts")2. Each of the separate funds within a Trust is referred to as a "Fund," and they are collectively referred to as the "Funds." The proxies are to be voted at a Special Joint Meeting of Shareholders of the Funds, and all adjournments thereof (the "Meeting"), to be held at 1555 Peachtree Street, N.E. Atlanta, Georgia 30309, on March 9, 2017, at 10:30 a.m. Eastern Standard Time. The approximate mailing date of this Joint Proxy Statement and accompanying proxy cards is on or about [January 4], 2017.

The Board has fixed December 12, 2016 as the record date (the "Record Date") for the determination of holders of shares of each Fund entitled to vote at the Meeting. Shareholders of record of any class of a Fund as of the close of business on the Record Date are entitled to vote their respective shares at the Meeting. A list of all of the Funds, along with the number of shares outstanding of each class of each Fund on the Record Date, can be found in Annex A. Each share of a Fund that you own entitles you to one vote on each proposal set forth in the table below that applies to such Fund (a fractional share has a fractional vote).

If you have any questions about the information set forth in this Joint Proxy Statement, please contact us at the 24-hour Automated Investor Line at 1-800-246-5463 or online at www/invesco.com/us.

Important Notice Regarding the Availability of Proxy Materials for the Meeting

This Joint Proxy Statement and a copy of the Proxy Cards (together, the "Proxy Materials") are available at www.proxy-direct/inv-28383. The Proxy Materials will be available on the internet through the day of the Meeting.

We have previously sent to shareholders the most recent annual report for their Fund, including financial statements, and the most recent semiannual report for the period after the annual report, if any. If you have not received such report(s) or would like to receive an additional copy, without charge, a request should be directed to the Secretary of the respective Fund by calling 1-800-959-4246, or by writing to the Secretary of the respective Fund at 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173.

Only one copy of this Joint Proxy Statement will be mailed to multiple shareholders sharing an address unless we have received contrary instructions from one or more of the shareholders. Upon request, we will mail a separate copy of this Joint Proxy Statement

1 Certain other Invesco funds are issuing separate proxy solicitation materials, but will also be included in the Special Joint Meeting of Shareholders to be held on March 9, 2017.

3

to a shareholder at a shared address to which a single copy of this Joint Proxy Statement was mailed. Any shareholder who wishes to receive a separate proxy statement should contact their Fund at 1-866-209-2450.

4

The following table summarizes the proposals to be presented at the Meeting (each a "Proposal" and, together, the "Proposals") and the shareholders entitled to vote. The Boards unanimously approved each of the Proposals.

| Proposal | Funds Voting on the Proposal | |

| 1. To elect 15 trustees to each Board, each of whom will serve until his or her successor is elected and qualified. | All Funds | |

| 2. To approve an amendment to each Trust's Agreement and Declaration of Trust that would permit fund mergers and other significant transactions upon the Board's approval but without shareholder approval of such transactions. | All Funds | |

3. To approve changing the fundamental investment restriction regarding the purchase or sale of physical commodities. | All Funds | |

4. To approve an amendment to certain Funds' current Master Intergroup Sub-Advisory Contract for Mutual Funds to add new sub-advisers as follows (includes two (2) sub-proposals): (a) To approve an amendment to the current Master Intergroup Sub-Advisory Contract to add Invesco PowerShares Capital Management LLC. | Funds identified in Annex B | |

(b) To approve an amendment to the current Master Intergroup Sub-Advisory Contract to add Invesco Asset Management (India) Private Limited. | All Funds except Premier U.S. Government Money Portfolio | |

5. To approve changing the sub-classification from "diversified" to "non-diversified" as follows (includes two (2) sub-proposals): (a) To approve changing the Fund's sub-classification from "diversified" to "non-diversified" and approve the elimination of a related fundamental investment restriction. | Invesco Macro Allocation Strategy Fund (formerly known as Invesco Global Markets Strategy Fund) | |

(b) To approve changing the Fund's sub-classification from "diversified" to "non-diversified" and approve the elimination of a related fundamental investment restriction. | Invesco World Bond Fund (formerly known as Invesco International Total Return Fund) |

Voting at the Meeting

Shareholders of a Fund on the Record Date are entitled to one vote per share, and a proportional vote for each fractional share, with respect to each Proposal for which they are entitled to vote, with no share having cumulative voting rights. A quorum of shareholders is necessary to hold a valid meeting. The voting and quorum requirements for each Proposal are described below.

If you intend to attend the Meeting in person and you are a record holder of a Fund's shares, in order to gain admission you must show photographic identification, such as your driver's license. If you intend to attend the Meeting in person and you hold your shares through a bank, broker or other custodian (i.e., in "street name"), in order to gain admission to the Meeting you must show photographic identification, such as your driver's license, and satisfactory proof of ownership of shares of a Fund, such as your voting instruction form (or a copy thereof) or broker's statement indicating ownership as of a recent date.

5

If you hold your shares in street name, you will not be able to vote your shares in person at the Meeting unless you have previously requested and obtained a "legal proxy" from your broker, bank or other nominee and present it at the Meeting.

You may contact the Funds at 1-800-959-4246 to obtain directions to the site of the Meeting.

The Funds do not know of any business other than the Proposals that will, or is proposed to, be presented for consideration at the Meeting. If any other matters are properly presented, the persons named on the enclosed proxy cards shall vote proxies in accordance with their best judgment.

THE BOARD OF EACH FUND RECOMMENDS THAT YOU CAST YOUR VOTE FOR EACH PROPOSAL.

Investment Adviser of the Funds

The investment adviser for each Fund is Invesco Advisers, Inc. (the "Adviser"). The Adviser is an indirect, wholly owned subsidiary of Invesco Ltd. The Adviser is located at 1555 Peachtree Street, N.E., Atlanta, Georgia 30309. The Adviser, as successor in interest to multiple investment advisers, has been an investment adviser since 1976.

Sub-Advisers of the Funds

The Adviser has entered into a sub-advisory agreement with certain affiliates to serve as sub-advisers, pursuant to which these affiliated sub-advisers may be appointed by the Adviser from time to time to provide discretionary investment management services, investment advice, and/or order execution services to a Fund. The affiliated sub-advisers, each of which is a registered investment adviser under the Investment Advisers Act of 1940, as amended, are Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc., and Invesco Canada Ltd. (each a "Sub-Adviser" and collectively, the "Sub-Advisers"). Additionally, Invesco PowerShares Capital Management LLC currently serves as a sub-adviser to Invesco Short Duration High Yield Municipal Fund, Invesco Strategic Real Return Fund, Invesco Alternative Strategies Fund , Invesco Multi-Asset Inflation Fund, Invesco Multi-Asset Income Fund, Invesco Macro Allocation Strategy Fund, Invesco Macro International Equity Fund, Invesco Macro Long/Short Fund, Invesco Global Market Neutral Fund, Invesco Global Targeted Returns Fund, Invesco Low Volatility Emerging Markets Fund, Invesco All Cap Market Neutral Fund, Invesco Long/Short Equity Fund, Invesco Global Infrastructure Fund, Invesco MLP Fund, Invesco Global Opportunities Fund, Invesco Global Responsibility Equity Fund, Invesco International Companies Fund, Invesco Select Opportunities Fund, Invesco Balanced-Risk Aggressive Allocation Fund and Invesco Conservative Income Fund. Each Sub-Adviser is an indirect, wholly owned subsidiary of Invesco Ltd.

Each Sub-Adviser is located at the address listed below.

Invesco Asset Management Deutschland GmbH

An der Welle 5

1st Floor

Frankfurt, Germany 60322

Invesco Asset Management Ltd.

Perpetual Park

Perpetual Park Drive

Henley-on-Thames

Oxfordshire RG91HH

United Kingdom

Invesco Asset Management (Japan) Limited

Roppongi Hills Mori Tower 14F

6-10-1 Roppongi

Minato-ku, Tokyo 106-6114

6

Invesco Hong Kong Limited

41/F Citibank Tower

3 Garden Road, Central

Hong Kong

Invesco Senior Secured Management, Inc.

1166 Avenue of the Americas

New York, NY 10036

Invesco Canada Ltd.

5140 Yonge Street

Suite 800

Toronto, Ontario

Canada M2N 6X7

Invesco PowerShares Capital Management LLC

3500 Lacey Road

Suite 700

Downers Grove, IL 60515

Other Service Providers of the Funds

Administrative Services

Each Fund has entered into a master administrative services agreement with the Adviser, pursuant to which the Adviser performs or arranges for the provision of accounting and other administrative services to each Fund which are not required to be performed by the Adviser under its investment advisory agreement with each Fund.

Principal Underwriter

The principal underwriter for each Fund is Invesco Distributors Inc., located at 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173.

Custodian and Transfer Agent

The custodian for each Fund, other than Government & Agency Portfolio, Treasury Obligations Portfolio, Liquid Assets Portfolio, STIC Prime Portfolio, Tax-Free Cash Reserve Portfolio, Treasury Portfolio, Premier Portfolio, Premier Tax-Exempt Portfolio, Premier U.S. Government Money Portfolio, Invesco Government Money Market, Invesco Conservative Income Fund and Invesco Tax-Exempt Cash Fund is State Street Bank and Trust Company located at One Lincoln Street, Boston, Massachusetts 02111. The custodian for Government & Agency Portfolio, Treasury Obligations Portfolio, Liquid Assets Portfolio, STIC Prime Portfolio, Tax-Free Cash Reserve Portfolio, Treasury Portfolio, Premier Portfolio, Premier Tax-Exempt Portfolio, Premier U.S. Government Money Portfolio, Invesco Government Money Market Fund, Invesco Conservative Income Fund and Invesco Tax-Exempt Cash Fund is Bank of New York Mellon, 2 Hanson Place, Brooklyn, New York 11217-1431. The transfer agent for each Fund is Invesco Investment Services, Inc., 11 Greenway Plaza, Suite 1000, Houston, Texas 77046, a wholly owned subsidiary of Invesco Ltd.

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE PROPOSALS

Below is a brief overview of the subject of the shareholder vote. Your vote is important, no matter how large or small your holdings may be. Please read the full text of this Joint Proxy Statement, which contains additional information about the Proposals, and keep it for future reference.

WHEN AND WHERE WILL THE MEETING BE HELD?

We are holding the Meeting at 1555 Peachtree Street, N.E. Atlanta, Georgia 30309 on March 9, 2017, at 10:30 a.m. Eastern Standard Time.

7

HOW DO I VOTE IN PERSON?

If you do attend the Meeting, were the record owner of your shares on the Record Date, and wish to vote in person, we will provide you with a ballot prior to the vote. However, if you hold your shares in street name, you are required to obtain a "legal proxy" from your broker, bank or other nominee indicating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote. The letter must also state whether before the Meeting you authorized a proxy to vote for you and if so, how you instructed such proxy to vote. Please call the Trusts at [(800) 952-3502] if you plan to attend the Meeting.

HOW DO I VOTE BY PROXY?

Whether you plan to attend the Meeting or not, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Meeting or to vote at the Meeting if you choose to do so. If you properly complete and sign your proxy card and send it to us in time to vote at the Meeting, your "proxy" (the individual(s) named on your proxy card) will vote your shares as you have directed. If you sign your proxy card but do not make specific choices, your proxy will vote your shares "FOR" each Proposal, as recommended by the Board of your Trust, and in accordance with management's recommendation on other matters. Proxies marked "WITHHOLD" will not be voted "FOR" a Proposal, but will be counted for purposes of determining whether a quorum is present, and will therefore have the same effect as a vote "AGAINST" each applicable Proposal, other than Proposals 1 and 2. An unfavorable vote on a Proposal by the shareholders of one Fund or Trust will not affect the implementation of such Proposal by another Fund or Trust if the Proposal is approved by the shareholders of the other Fund or Trust, as applicable. An unfavorable vote on a Proposal by the shareholders of a Fund will not affect such Fund's implementation of other Proposals that receive a favorable vote. There is no cumulative voting with respect to the election of Trustees or any other matter.

Your proxy will have the authority to vote and act on your behalf at any adjournment or postponement of the Meeting. Shareholders may also transact any other business not currently contemplated that may properly come before the Meeting in the discretion of the proxies or their substitutes.

HOW DO I VOTE BY TELEPHONE OR THE INTERNET?

You may vote your shares by telephone or through a website established for that purpose by following the instructions that appear on the proxy card accompanying this Joint Proxy Statement.

MAY I REVOKE MY VOTE?

If you authorize a proxy to vote for you, you may revoke the authorization at any time before it is exercised. You can do this in one of four ways:

- You may send in another duly executed proxy card bearing a later date, prior to the Meeting.

- You may submit a proxy by telephone, via the internet, or via an alternative method of voting permitted by your broker, with a later date.

- You may notify the Trusts' Secretary in writing before the Meeting that you have revoked your proxy.

- You may vote in person at the Meeting, as set forth above under the heading, "How Do I Vote in Person?"

8

WILL ANY OTHER MATTERS BE VOTED ON AT THE MEETING?

Management is not aware of any matters to be presented at the Meeting other than those discussed in this Joint Proxy Statement. However, if any other matters properly come before the Meeting, it is the intention of the Boards that proxies will be voted on such matters in accordance with the judgment of the persons designated therein as proxies consistent with their fiduciary duties as set forth in Statement on Adjournment of Investment Company Shareholder Meetings and Withdrawal of Proposed Rule 20a-4 and Amendment to Rule 20a-1, Investment Company Act Release No. 7659 (Feb. 6, 1973) (the ''1973 Release'').

WHAT IS THE QUORUM REQUIREMENT?

A quorum of shareholders is necessary to hold a valid meeting. A quorum will exist for Proposals 1 and 2 for a particular Trust if shareholders entitled to vote one-third of the issued and outstanding shares of such Trust on the Record Date are present at the Meeting in person or by proxy. A quorum will exist for Proposals 3 through 5 for a particular Fund, as applicable, if shareholders entitled to vote one-third of the issued and outstanding shares of such Fund on the Record Date are present at the Meeting in person or by proxy. Under rules applicable to broker-dealers, if your broker holds your shares in its name, we expect that the broker will be entitled to vote your shares on Proposal 1 even if it has not received instructions from you. However, your broker likely will not be entitled to vote on any other Proposal unless it has received instructions from you.

A "broker non-vote" occurs when a broker has not received voting instructions from a shareholder and is barred from voting the shares without shareholder instructions because the proposal is considered to be non-routine. Because Proposals 2 through 5 may be considered non-routine, your broker likely will not be permitted to vote your shares if it has not received instructions from you, and the shares will be considered "broker non-votes." As a result, we urge you to complete and send in your proxy or voting instructions so your vote can be counted.

Abstentions and broker non-votes will count as shares present at the Meeting for purposes of establishing a quorum.

COULD THERE BE AN ADJOURNMENT OF THE MEETING?

If a quorum is not present at the Meeting or a quorum is present but sufficient votes to approve a Proposal are not received, the Meeting may be adjourned to allow for further solicitation of proxies. If a quorum is present but sufficient votes to approve a Proposal are not received, a shareholder vote may be taken on other Proposals described in this Joint Proxy Statement prior to any adjournment if sufficient votes have been received for such other Proposals.

If a quorum is not present at the Meeting, then the affirmative vote of a majority of Shares present in person or by proxy and entitled to vote at the Meeting (even though not constituting a quorum) will have the power to adjourn the Meeting from time to time without notice other than an announcement at the Meeting. If a quorum is present at the Meeting but sufficient votes to approve one or more of the Proposals described in the original notice of the Meeting are not obtained, then the affirmative vote of one-third of Shares present in person or by proxy and entitled to vote at the Meeting will have the power to adjourn the Meeting with regard to a particular Proposal, or to adjourn the Meeting entirely, without notice other than an announcement at the Meeting. Provided a quorum is present, any business may be transacted at such adjourned meeting that might have been transacted at the Meeting as originally notified.

A meeting may be adjourned from time to time without further notice to shareholders to a date not more than 120 days after the original meeting date. The persons named as proxies will vote in their discretion on questions of adjournment for those shares for which proxies have been received. With respect to adjournments, the Funds or their officers, as applicable, will adhere to the guidelines provided in the 1973 Release, and weigh carefully the decision whether to adjourn a shareholder meeting for the purpose of soliciting shareholders to obtain additional proxies. In any such case, the persons named as proxies and/or the officers of the Funds will consider whether an adjournment and additional solicitation is reasonable and in the interest of shareholders, or whether such procedures would constitute an abuse of office.

9

WHAT IS THE VOTE NECESSARY TO APPROVE EACH PROPOSAL?

Proposal 1: The affirmative vote of a plurality of the votes cast by shareholders of a Trust is required to elect each nominee for Trustee of the Trust. A vote requiring a plurality to elect nominees for Trustees of a Trust means that the nominees receiving the largest number of votes cast will be elected to fill the available positions for that Trust. Abstentions will not count as votes cast and will have no effect on the outcome of this Proposal. We expect that brokers will be entitled to vote on this Proposal, but any broker non-vote will have no effect on the outcome of this Proposal.

Proposal 2: The affirmative vote of a majority of the votes cast by shareholders of a Trust is required to approve Proposal 2 with respect to such Trust. Abstentions and broker non-votes will not count as votes cast and will have no effect on the outcome of this Proposal.

Proposals 3 through 5: For each Fund, the approval of each of Proposals 3 through 5, as applicable, requires the lesser of (a) the affirmative vote of 67% or more of the voting securities present or represented by proxy, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy, or (b) the affirmative vote of more than 50% of the outstanding voting securities of the Fund. Abstentions and broker non-votes are counted as votes present for purposes of achieving a quorum but are not considered votes cast at the Meeting. As a result, they have the same effect as a vote against Proposals 3 through 5 because approval of Proposals 3 through 5 requires the affirmative vote of a percentage of a Fund's voting securities present or represented by proxy or a percentage of the outstanding voting securities.

HOW WILL PROXIES BE SOLICITED AND WHO WILL PAY?

The Trusts have engaged the services of Computershare Fund Services (the "Solicitor") to assist in the solicitation of proxies for the Meeting. The Solicitor's costs for the Funds are currently estimated to be in the aggregate approximately $[ ]. The Trusts expect to solicit proxies principally by mail, but the Trusts or Solicitor may also solicit proxies by telephone, facsimile, internet or personal interview. The Trusts' officers will not receive any additional or special compensation for any such solicitation. The Funds will pay the cost of soliciting proxies, except that the Adviser has agreed to pay $500,000 of the Funds' proxy solicitation costs. In addition, the Adviser will bear indirectly another $___ of proxy solicitation costs as a result of the expense limitation arrangements in place between the Adviser and the Funds.

HOW MAY A SHAREHOLDER PROPOSAL BE SUBMITTED?

As a general matter, the Funds do not hold regular meetings of shareholders. Shareholder proposals for consideration at a meeting of shareholders of a Fund should be submitted to the Secretary of the applicable Trust at the address set forth on the first page of this Joint Proxy Statement. To be considered for presentation at a meeting of shareholders, the applicable Trust must receive proposals within a reasonable time, as determined by the Trust's management, before proxy materials are prepared for the meeting. Such proposals also must comply with applicable law.

For a discussion of procedures that must be followed for a shareholder to nominate an individual as a trustee, please refer to the section of this Joint Proxy Statement entitled "Proposal 1 – Board Committees -- Governance Committee."

PROPOSAL 1: ELECTION OF TRUSTEES

WHAT IS THE ROLE OF THE BOARD OF TRUSTEES?

Each Trust is governed by a Board of Trustees, which has oversight responsibility for the management of the Trust's business affairs. Trustees establish procedures and oversee and review the performance of the investment adviser, the distributor, and others who perform services for the Trust. Each of the Boards is comprised of the same Trustees.

WHO ARE THE TRUSTEE NOMINEES AND HOW WERE THEY SELECTED?

Shareholders are being asked to elect 15 Trustees (the "Trustee Nominees") to the Board of each Trust. Eleven of the 15 Trustee Nominees standing for election are presently members of the Boards. Two members of the Boards retired effective December 31,

10

2016 and are not standing for re-election. Each Board considered the qualifications of prospective Board members and has nominated and selected the Trustee Nominees and recommends that the Trustee Nominees be elected. Biographical information on each of the Trustee Nominees is provided in this Joint Proxy Statement under Proposal 1.

PROPOSAL 2: AMENDMENT OF EACH TRUST'S AGREEMENT AND DECLARATION OF TRUST

WHAT IS THE PROPOSED CHANGE?

The proposed amendments would allow the Trustees to authorize (i) a merger, consolidation or sale of assets (including, but not limited to, mergers, consolidations or sales of assets between two series of a Trust, or between a series of a Trust and a series of any other registered investment company), and (ii) the combination of two or more classes of shares of any series into a single class, each without shareholder approval.

WHY SHOULD SHAREHOLDERS APPROVE THIS PROPOSAL?

The proposed change would provide the Trustees with additional flexibility to make decisions that they believe are in shareholders' best interests without causing a Fund to incur the delay and expense of soliciting shareholder approval except as required by applicable law. The Board believes that this would make the administration of the Trusts more efficient and cost-effective, and provide greater flexibility for the operations of the Trusts.

PROPOSAL 3: AMENDMENT OF EACH FUND'S FUNDAMENTAL INVESTMENT RESTRICTION RELATED TO INVESTING IN PHYSICAL COMMODITIES

WHY ARE SHAREHOLDERS BEING ASKED TO APPROVE THIS CHANGE?

The 1940 Act requires investment companies to establish and disclose in their registration statements certain "fundamental" investment policies that can only be changed by shareholder vote, including a policy that restricts a fund's ability to purchase or sell commodities. Proposal 3 would permit each Fund to purchase and sell physical commodities to the extent permitted under the 1940 Act or other governing statute, by the rules thereunder, or by the Securities and Exchange Commission (the "SEC") or other regulatory agency with authority over the Fund. Since the adoption of each Fund's current fundamental investment limitation regarding investments in commodities, the financial markets and related regulations have evolved, and new types of financial instruments have become available as potential investment opportunities. The proposed change will provide the Funds with greater flexibility to trade in the various types of modern derivative instruments; however, no change in the manner in which any Fund is managed is anticipated as a result of the implementation of the amended fundamental investment limitation.

PROPOSAL 4: AMENDMENT TO THE MASTER INTERGROUP SUB-ADVISORY CONTRACT TO ADD INVESCO POWERSHARES CAPITAL MANAGEMENT LLC AND INVESCO ASSET MANAGEMENT (INDIA) PRIVATE LIMITED AS SUB-ADVISERS FOR CERTAIN FUNDS

FOR WHICH FUNDS ARE SHAREHOLDERS BEING ASKED TO APPROVE THESE NEW SUB-ADVISERS?

Proposal 4 includes two sub-Proposals—sub-Proposal 4(a) and sub-Proposal 4(b)—each of which involves a separate vote. In sub-Proposal 4(a), shareholders of each Fund listed in Annex B (together, the "Identified Funds") are being asked to approve an amendment to each Fund's Master Intergroup Sub-Advisory Contract to add Invesco PowerShares Capital Management LLC ("Invesco PowerShares") as a sub-adviser. In sub-Proposal 4(b), shareholders of all Funds, except Premier U.S. Government Money Portfolio, are being asked to approve an amendment to each Fund's Master Intergroup Sub-Advisory Contract to add Invesco Asset Management (India) Private Limited ("Invesco India") as a sub-adviser for the Funds.

WHY ARE SHAREHOLDERS BEING ASKED TO APPROVE THESE AMENDMENTS?

Each Fund has entered into a Master Intergroup Sub-Advisory Contract (the "Sub-Advisory Contract"), under which several affiliates of the Adviser are available to serve as sub-advisers for the Fund at the discretion of the Adviser. The Sub-Advisory Contract allows the Adviser and the Funds to receive investment advice and research services from Sub-Advisers that are parties to the Sub-Advisory

11

Contract, and also permits the Adviser to grant one or more of those Sub-Advisers investment management authority for a particular Fund, or a portion of a Fund, if the Adviser believes doing so would benefit that Fund and its shareholders. The Adviser and the Board believe that the addition of Invesco PowerShares and Invesco India to the pool of sub-advisers available to the Funds voting on sub-Proposal 4(a) and 4(b), respectively, will benefit the Funds and their shareholders by providing the Adviser with increased flexibility in assigning portfolio managers to the Funds and will give the Funds access to additional portfolio managers and investment personnel with more specialized expertise on local companies, markets and economies or on various types of investments and investment techniques.

HOW WILL THESE AMENDMENTS AFFECT ME AS A SHAREHOLDER?

The Funds and their investment objectives will not change as a result of the amendments. To the extent assets are allocated to them, Invesco PowerShares and Invesco India will be paid by the Adviser out of its advisory fee, so there will be no additional fees or expenses for any Fund as a result of the approval of an amendment to the Sub-Advisory Contract to add Invesco PowerShares or Invesco India as a sub-adviser to the Fund.

PROPOSAL 5: APPROVAL OF A CHANGE IN THE SUB-CLASSIFICATION UNDER THE 1940 ACT FROM DIVERSIFIED TO NON-DIVERSIFIED AND ELIMINATION OF A RELATED FUNDAMENTAL INVESTMENT RESTRICTION

WHICH FUNDS ARE AFFECTED BY THIS PROPOSAL?

This proposal relates to Invesco Macro Allocation Strategy Fund (the "Macro Allocation Fund") and Invesco World Bond Fund ("World Bond Fund").

WHAT WILL THESE CHANGEs DO IF APPROVED?

Proposal 5 includes two sub-Proposals—sub-Proposal 5(a) and sub-Proposal 5(b)—each of which involves a separate vote. In sub-Proposal 5(a), shareholders of the Macro Allocation Fund are being asked to approve changing the Fund's sub-classification from a diversified fund to a non-diversified fund, as defined under the 1940 Act. In sub-Proposal 5(b), shareholders of the World Bond Fund are being asked to approve changing the Fund's sub-classification from a diversified fund to a non-diversified fund, as defined under the 1940 Act. These changes will give each of these Funds the ability to invest a greater percentage of its assets in the obligations or securities of a smaller number of issuers than a diversified fund.

WHY ARE SHAREHOLDERS OF THESE FUNDS BEING ASKED TO APPROVE THIS CHANGE?

As explained more fully in sub-Proposal 5(a) below, the Macro Allocation Fund's portfolio management team believes that reclassifying the Fund as non-diversified will help the Fund to meet the requirements of the SEC's proposed amendments to the rules governing the use of derivatives by registered funds (the "Derivatives Rule"). If the Derivatives Rule is implemented, the team may need to shift from futures to physical holdings to comply with the limitations on notional leverage set forth in the Derivatives Rule, which would make it difficult for the Fund to comply with applicable testing limits. The Adviser believes the proposed change will allow the Fund to better implement its investment strategy and remain compliant with the limits of the 1940 Act. The Fund's exposure to underlying reference assets is not expected to materially change in connection with the shift to non-diversified fund status.

As explained more fully in sub-Proposal 5(b) below, the World Bond Fund's portfolio management team believes it will be better able to capture its investment philosophy regarding exposure to various global markets if given the ability to concentrate its exposures from time to time, and specifically, to target investment in a particular country's interest rate term structure which the team believes is best reflected in that country's government bonds. The Fund's current diversified status requires the team to gain exposure to a particular country's bond market through multiple smaller holdings of diverse issuers that are often less liquid and less available securities, thereby increasing transaction costs and other inefficiencies in positioning. The team believes that if the Fund is reclassified as non-diversified, it could gain exposure to various global markets more efficiently and cost effectively by having the flexibility to take larger positions in fewer non-US government securities.

12

PROPOSAL 1

ELECTION OF TRUSTEES

Shareholders of each Trust are being asked to elect 15 Trustees (together, the "Trustee Nominees") to the Board of the Trust of which the Fund is a series. Each Trust currently has the same Board. Eleven of the current 13 Trustees of the Board—specifically, Martin L. Flanagan, Phillip A. Taylor, Bruce L. Crockett, David C. Arch, James T. Bunch, Jack M. Fields, Dr. Eli Jones, Dr. Prema Mathai-Davis, Dr. Larry Soll, Raymond Stickel, Jr. and Robert C. Troccoli—have been nominated for re-election to the Board. Additionally, each of Cynthia Hostetler, Teresa M. Ressel, Ann Barnett Stern and Christopher L. Wilson (together, the "New Nominees") have been nominated for election to the Board for the first time. Current Trustees Albert R. Dowden and Suzanne H. Woolsey retired effective December 31, 2016 and are not standing for re-election. The New Nominees were recommended by a third party search firm or a current Trustee prior to their nomination as Trustees.

All Trustee Nominees have consented to being named in this Joint Proxy Statement and have agreed to serve if elected. If elected, each Trustee Nominee will serve until his or her successor has been duly elected and qualified or until his or her earlier death, resignation or removal. In addition, it is the current policy of the Board that any trustees who are not affiliated with Invesco may serve on the Board until December 31 of the year in which the trustee turns 75. If shareholders fail to elect one or more of the Trustee Nominees, then the Board will take such further action as it deems to be in the best interests of the Trusts' shareholders, which may include reducing the size of the Board in such a manner that a majority of the Trustees of the Trusts consist of Trustees previously elected by shareholders, or reproposing the election of any Trustee Nominees who are not elected.

In the case of any vacancy on the Board, each Trust's Agreement and Declaration of Trust provides that the remaining Trustees may fill such vacancy by appointing a replacement or reduce the size of the Board. Any such appointment would be subject to the 1940 Act requirement regarding election of trustees.

Information Regarding the Trustee Nominees

The business and affairs of the Trusts are managed under the direction of each Board. This section of this Joint Proxy Statement provides you with information regarding each Trustee Nominee. Trustees generally serve until their successors are duly elected and qualified or until their earlier death, resignation, removal or retirement pursuant to the policy noted above. The tables below list the Trustee Nominees, their principal occupations, other directorships held by them during the past five years, and any affiliations with the Adviser or its affiliates. If all Trustee Nominees are elected, the Boards will be composed of 15 Trustees, including 13 Trustees who are not "interested persons" of the Funds, as that term is defined in the 1940 Act (collectively, the "Independent Trustees" and each an "Independent Trustee").

The term "Invesco Fund Complex" includes each of the open-end and closed-end registered investment companies advised by the Adviser as of the Record Date. As of the date of this Joint Proxy Statement, there were 146 funds in the Invesco Fund Complex.

The mailing address of each Trustee and each Trustee Nominee is 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173.

Name, year of Birth and Position(s) Held with the Trusts | Trustee Since | Principal Occupation(s) During Past 5 years | Number of Funds in Invesco Fund Complex Overseen or to be Overseen by Trustee Nominee | Other Trusteeship(s)/ Directorship(s) Held by Trustee Nominee During Past 5 Years | |

Interested Trustee Nominees | |||||

Martin L. Flanagan(1) - 1960 Trustee | 2007 | Executive Director, Chief Executive Officer and President, Invesco Ltd. (ultimate parent of Invesco and a global investment management firm); Advisor to the Board, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Trustee, The Invesco Funds; Vice Chair, Investment Company Institute; and Member of Executive Board, SMU | 146 | None | |

13

Name, year of Birth and Position(s) Held with the Trusts | Trustee Since | Principal Occupation(s) During Past 5 years | Number of Funds in Invesco Fund Complex Overseen or to be Overseen by Trustee Nominee | Other Trusteeship(s)/ Directorship(s) Held by Trustee Nominee During Past 5 Years |

Cox School of Business Formerly: Chairman and Chief Executive Officer, Invesco Advisers, Inc. (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Holding Company (US), Inc. (formerly IVZ Inc.) (holding company); INVESCO Group Services, Inc. (service provider) and Invesco North American Holdings, Inc. (holding company); Director, Chief Executive Officer and President, Invesco Holding Company Limited (parent of Invesco and a global investment management firm); Director, Invesco Ltd.; Chairman, Investment Company Institute and President, Co-Chief Executive Officer, Co-President, Chief Operating Officer and Chief Financial Officer, Franklin Resources, Inc. (global investment management organization) | ||||

Philip A. Taylor(2) - 1954 President and Principal Executive Officer | 2006 | Head of the Americas Retail and Senior Managing Director, Invesco Ltd.; Director, Co-Chairman, Co-President and Co-Chief Executive Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Management Group, Inc. (formerly known as Invesco Aim Management Group, Inc.) (financial services holding company); Director and Chairman, Invesco Investment Services, Inc. (formerly known as Invesco Aim Investment Services, Inc.) (registered transfer agent) Chief Executive Officer, Invesco Corporate Class Inc. (corporate mutual fund company) Director, Chairman and Chief Executive Officer, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent); Trustee and Senior Vice President, The Invesco Funds; Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Director, Chief Executive Officer and President, Van Kampen Exchange Corp. Formerly: President and Principal Executive Officer, The Invesco Funds (other than AIM Treasurer's Series Trust (Invesco Treasurer's Series Trust), Short-Term Investments Trust and Invesco Management Trust); Executive Vice President, The Invesco Funds (AIM Treasurer's Series Trust (Invesco Treasurer's Series Trust), Short-Term Investments Trust and Invesco Management Trust only); Director and President, INVESCO Funds Group, Inc. (registered investment adviser and registered transfer agent); Director and Chairman, IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.) (registered broker dealer); Director, President and Chairman, Invesco Inc. (holding company), Invesco Canada Holdings Inc. (holding company), Trimark Investments Ltd./Placements Trimark Ltèe and Invesco Financial Services Ltd/Services Financiers Invesco Ltèe; Chief Executive Officer, Invesco Canada Fund Inc (corporate mutual fund company); Director and Chairman, Van Kampen Investor Services Inc.; Director, Chief Executive Officer and President, 1371 Preferred Inc. (holding company) and Van Kampen Investments Inc.; Director and President, AIM GP Canada Inc. (general partner for limited partnerships) and Van Kampen Advisors, Inc.; Director and Chief Executive Officer, Invesco Trimark Dealer Inc. (registered broker dealer); Director, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.) (registered broker dealer); Manager, Invesco | 146 | None |

14

Name, year of Birth and Position(s) Held with the Trusts | Trustee Since | Principal Occupation(s) During Past 5 years | Number of Funds in Invesco Fund Complex Overseen or to be Overseen by Trustee Nominee | Other Trusteeship(s)/ Directorship(s) Held by Trustee Nominee During Past 5 Years | |

PowerShares Capital Management LLC; Director, Chief Executive Officer and President, Invesco Advisers, Inc.; Director, Chairman, Chief Executive Officer and President, Invesco Aim Capital Management, Inc.; President, Invesco Trimark Dealer Inc. and Invesco Trimark Ltd./Invesco Trimark Ltèe; Director and President, AIM Trimark Corporate Class Inc. and AIM Trimark Canada Fund Inc.; Senior Managing Director, Invesco Holding Company Limited; Director and Chairman, Fund Management Company (former registered broker dealer); President and Principal Executive Officer, The Invesco Funds (AIM Treasurer's Series Trust (Invesco Treasurer's Series Trust), and Short-Term Investments Trust only); President, AIM Trimark Global Fund Inc. and AIM Trimark Canada Fund Inc. | |||||

| Independent Trustee Nominees | |||||

Bruce L. Crockett – 1944 Trustee and Chair | 1978 | Chairman, Crockett Technologies Associates (technology consulting company) Formerly: Director, Captaris (unified messaging provider); Director, President and Chief Executive Officer, COMSAT Corporation; Chairman, Board of Governors of INTELSAT (international communications company); ACE Limited (insurance company); Independent Directors Council and Investment Company Institute | 146 | Chairman of Audit Committee, ALPS (Attorneys Liability Protection Society) (insurance company); Member of the Audit Committee, Ferroglobe PLC (metallurgical company); Member of the Audit Committee, Investment Company Institute; Member of the Executive Committee and Chair of the Governance Committee, Independent Directors Council | |

David C. Arch – 1945 Trustee | 2010 | Chairman of Blistex Inc., a consumer health care products manufacturer | 146 | Board member of the Illinois Manufacturers' Association | |

James T. Bunch – 1942 Trustee | 2000 | Managing Member, Grumman Hill Group LLC (family office/private equity investments) Formerly: Chairman of the Board, Denver Film Society, Chairman of the Board of Trustees, Evans Scholarship Foundation; Chairman, Board of Governors, Western Golf Association | 146 | Trustee, Evans Scholarship Foundation | |

Jack M. Fields – 1952 Trustee | 1997 | Chief Executive Officer, Twenty First Century Group, Inc. (government affairs company); and Discovery Learning Alliance (non-profit) Formerly: Owner and Chief Executive Officer, Dos Angeles Ranch L.P. (cattle, hunting, corporate entertainment); Director, Insperity, Inc. (formerly known as Administaff); Chief | 146 | None | |

15

Name, year of Birth and Position(s) Held with the Trusts | Trustee Since | Principal Occupation(s) During Past 5 years | Number of Funds in Invesco Fund Complex Overseen or to be Overseen by Trustee Nominee | Other Trusteeship(s)/ Directorship(s) Held by Trustee Nominee During Past 5 Years |

Executive Officer, Texana Timber LP (sustainable forestry company); Director of Cross Timbers Quail Research Ranch (non-profit); and member of the U.S. House of Representatives | ||||

Cynthia Hostetler – 1962 Nominee | † | Retired. Formerly: Head of Investment Funds and Private Equity, Overseas Private Investment Corporation; President, First Manhattan Bancorporation, Inc.; and Attorney, Simpson Thacher & Bartlett LLP | 146† | Vulcan Materials Company; Trilinc Global Impact Fund; and Aberdeen Investment Funds |

Eli Jones – 1961 Trustee | 2016 | Professor and Dean, Mays Business School - Texas A&M University Formerly: Professor and Dean, Walton College of Business, University of Arkansas and E.J. Ourso College of Business, Louisiana State University and Director, Arvest Bank | 146 | Director of Insperity, Inc. (formerly known as Administaff) |

Prema Mathai-Davis – 1950 Trustee | 2003 | Retired. Formerly: Chief Executive Officer, YWCA of the U.S.A. | 146 | None |

Teresa M. Ressel – 1962 Nominee | † | Retired. Formerly: Chief Financial Officer, The Olayan Group (manufacture, wholesale, retail and distribution of various consumer, financial and industrial products and services); Chief Executive Officer, UBS Securities LLC; Group Chief Operating Officer, Americas, UBS AG; Assistant Secretary for Management and Budget and Chief Financial Officer, U.S. Department of the Treasury; Executive Change Consultant, Cigna Healthcare; Senior Vice President, Kaiser Permanente; Program Manager, Hewlett-Packard Company; Nuclear Test & Construction Engineer, General Dynamics Corporation | 146† | Atlantic Power Corporation; ON Semiconductor Corp. |

Larry Soll – 1942 Trustee | 1997 | Retired. Formerly: Chairman, Chief Executive Officer and President, Synergen Corp. (a biotechnology company) | 146 | None |

Ann Barnett Stern – 1957 Nominee | † | President and Chief Executive Officer, Houston Endowment (private philanthropic institution). Formerly: Executive Vice President and General Counsel, Texas Children's Hospital; Attorney, Beck, Redden and Secrest, LLP; Business Law Instructor, University of St. Thomas; Attorney, Andrews & Kurth LLP. | 146† | Federal Reserve Bank of Dallas |

Raymond Stickel, Jr. – 1944 Trustee | 2005 | Retired. Formerly: Director, Mainstay VP Series Funds, Inc. (25 portfolios) and Partner, Deloitte & Touche | 146 | None |

Robert C. Troccoli – 1949 Trustee | 2016 | Adjunct Professor, University of Denver – Daniels College of Business Formerly: Senior Partner, KPMG LLP | 146 | None |

Christopher L. Wilson – 1957 Nominee | † | Managing Partner, CT2, LLC (investing and consulting firm) Formerly: President/Chief Executive Officer, Columbia Funds, LLC, an Ameriprise Financial, Inc. Corporation; President/Chief Executive Officer, CDC IXIS Asset | 146† | TD Asset Management USA Inc.; ISO New England, Inc. |

16

Name, year of Birth and Position(s) Held with the Trusts | Trustee Since | Principal Occupation(s) During Past 5 years | Number of Funds in Invesco Fund Complex Overseen or to be Overseen by Trustee Nominee | Other Trusteeship(s)/ Directorship(s) Held by Trustee Nominee During Past 5 Years |

| † | Management Services, Inc.; Director of Operations, Scudder Funds, Scudder, Stevens & Clark, Inc.; Assistant Vice President, Fidelity Investments | |||

| (1) | Mr. Flanagan is considered an interested person (within the meaning of the Section 2(a)(19) of the 1940 Act) of the Funds because he is an officer of the Adviser, and an officer and a director of Invesco Ltd., the ultimate parent of the Adviser. |

| (2) | Mr. Taylor is considered an interested person (within the meaning of the Section 2(a)(19) of the 1940 Act) of the Funds because he is an officer and a director of the Adviser. |

| † | Current nominee for election. |

Board Qualifications and Experience

Interested Trustee Nominees.

Martin L. Flanagan, Trustee

Martin L. Flanagan has been a member of the Board of Trustees of the Invesco Funds since 2007. Mr. Flanagan is president and chief executive officer of Invesco Ltd., a position he has held since August 2005. He is also a member of the Board of Directors of Invesco Ltd.

Mr. Flanagan joined Invesco, Ltd. from Franklin Resources, Inc., where he was president and co-chief executive officer from January 2004 to July 2005. Previously he had been Franklin's co-president from May 2003 to January 2004, chief operating officer and chief financial officer from November 1999 to May 2003, and senior vice president and chief financial officer from 1993 until November 1999.

Mr. Flanagan served as director, executive vice president and chief operating officer of Templeton, Galbraith & Hansberger, Ltd. before its acquisition by Franklin in 1992. Before joining Templeton in 1983, he worked with Arthur Andersen & Co.

Mr. Flanagan is a chartered financial analyst and a certified public accountant. He serves as vice chairman of the Investment Company Institute and a member of the executive board at the SMU Cox School of Business.

The Board believes that Mr. Flanagan's long experience as an executive in the investment management area benefits the Funds.

Philip A. Taylor, Trustee

Philip A. Taylor has been a member of the Board of Trustees of the Invesco Funds since 2006. Mr. Taylor has headed Invesco's North American retail business as Senior Managing Director of Invesco Ltd. since April 2006. He previously served as chief executive officer of Invesco Trimark Investments since January 2002.

Mr. Taylor joined Invesco in 1999 as senior vice president of operations and client services and later became executive vice president and chief operating officer.

Mr. Taylor was president of Canadian retail broker Investors Group Securities from 1994 to 1997 and managing partner of Meridian Securities, an execution and clearing broker, from 1989 to 1994. He held various management positions with Royal Trust, now part of Royal Bank of Canada, from 1982 to 1989. He began his career in consumer brand management in the U.S. and Canada with Richardson-Vicks, now part of Procter & Gamble.

17

The Board believes that Mr. Taylor's long experience in the investment management business benefits the Funds.

Independent Trustee Nominees.

Bruce L. Crockett, Trustee and Chair

Bruce L. Crockett has been a member of the Board of Trustees of the Invesco Funds since 1978, and has served as Independent Chair of the Board of Trustees and their predecessor funds since 2004.

Mr. Crockett has more than 30 years of experience in finance and general management in the banking, aerospace and telecommunications industries. From 1992 to 1996, he served as president, chief executive officer and a director of COMSAT Corporation, an international satellite and wireless telecommunications company.

Mr. Crockett has also served, since 1996, as chairman of Crockett Technologies Associates, a strategic consulting firm that provides services to the information technology and communications industries. Mr. Crockett also serves on the Board of ALPS (Attorneys Liability Protection Society) and he is a life trustee of the University of Rochester Board of Trustees. He is a member of the Audit Committee of the Investment Company Institute and Ferroglobe PLC (metallurgical company). He is also a member of the Executive Committee and Chair of the Governance Committee of the Independent Directors Council.

The Board of Trustees elected Mr. Crockett to serve as its Independent Chair because of his extensive experience in managing public companies and familiarity with investment companies.

David C. Arch, Trustee

David C. Arch has been a member of the Board of Trustees of the Invesco Funds and their predecessor funds since 2010. From 1984 to 2010, Mr. Arch served as Director or Trustee of investment companies in the Van Kampen Funds complex.

Mr. Arch is the Chairman of Blistex Inc., a consumer health care products manufacturer. Mr. Arch is a member of the Board of the Illinois Manufacturers' Association and a member of the World Presidents' Organization.

The Board believes that Mr. Arch's experience as the CEO of a public company and his experience with investment companies benefits the Funds.

James T. Bunch, Trustee

James T. Bunch has been a member of the Board of Trustees of the Invesco Funds since 2000.

From 1988 to 2010, Mr. Bunch was Founding Partner of Green Manning & Bunch, Ltd., an investment banking firm previously located in Denver, Colorado. Mr. Bunch began his professional career as a practicing attorney. He joined the prominent Denver-based law firm of Davis Graham & Stubbs in 1970 and later rose to the position of Chairman and Managing Partner of the firm.

At various other times during his career, Mr. Bunch has served as Chair of the National Association of Securities Dealers, Inc. (NASD) Business District Conduct Committee, and Chair of the Colorado Bar Association Ethics Committee.

In June 2010, Mr. Bunch became the Managing Member of Grumman Hill Group LLC, a family office private equity investment manager.

The Board believes that Mr. Bunch's experience as an investment banker and investment management lawyer benefits the Funds.

Jack M. Fields, Trustee

18

Jack M. Fields has been a member of the Board of Trustees of the Invesco Funds since 1997.

Mr. Fields served as a member of Congress, representing the 8th Congressional District of Texas from 1980 to 1997. As a member of Congress, Mr. Fields served as Chairman of the House Telecommunications and Finance Subcommittee, which has jurisdiction and oversight of the Federal Communications Commission and the SEC. Mr. Fields co-sponsored the National Securities Markets Improvements Act of 1996, and played a leadership role in enactment of the Securities Litigation Reform Act.

Mr. Fields currently serves as Chief Executive Officer of the Twenty-First Century Group, Inc. in Washington, D.C., a bipartisan Washington consulting firm specializing in Federal government affairs.

Mr. Fields also served as a Director of Insperity, Inc. (formerly known as Administaff), a premier professional employer organization with clients nationwide until 2015. In addition, Mr. Fields sits on the Board of Discovery Learning Alliance, a nonprofit organization dedicated to providing educational resources to people in need around the world through the use of technology.

The Board believes that Mr. Fields' experience in the House of Representatives, especially concerning regulation of the securities markets, benefits the Funds.

Cynthia Hostetler

Cynthia Hostetler is currently a member of the board of directors/trustees of the Vulcan Materials Company, a public company engaged in the production and distribution of construction materials, Trilinc Global Impact Fund LLC, a publicly registered non-traded limited liability company that invests in a diversified portfolio of private debt instruments, and the Aberdeen Investment Funds, a mutual fund complex. Previously, Ms. Hostetler served as a member of the board of directors of Edgen Group Inc., a public company that provides products and services to energy and construction companies, from 2012 to 2013, prior to its sale to Sumitomo.

From 2001 to 2009 Ms. Hostetler served as Head of Investment Funds and Private Equity at Overseas Private Investment Corporation ("OPIC"), a government agency that supports US investment in the emerging markets. Ms. Hostetler oversaw a multi-billion dollar investment portfolio in private equity funds. Prior to joining OPIC, Ms. Hostetler served as President and member of the board of directors of First Manhattan Bancorporation, a bank holding company, and its largest subsidiary, First Savings Bank, from 1991 to 2001.

The Board believes that Ms. Hostetler should be elected to serve as an Independent Trustee because of her knowledge of financial services and investment management, her experience as a director of other companies, including a mutual fund complex, her legal background, and other professional experience gained through her prior employment.

Dr. Eli Jones, Trustee

Dr. Eli Jones has been a member of the Board of Trustees of the Invesco Funds since 2016. Dr. Jones is the dean of the Mays Business School at Texas A&M University and holder of the Peggy Pitman Mays Eminent Scholar Chair in Business. Dr. Jones has served as a director of Insperity, Inc. since April 2004 and is chair of the Compensation Committee and a member of the Nominating and Corporate Governance Committee. Prior to his current position, from 2012-2015, Dr. Jones was the dean of the Sam M. Walton College of Business at the University of Arkansas and holder of the Sam M. Walton Leadership Chair in Business. Prior to joining the faculty at the University of Arkansas, he was dean of the E. J. Ourso College of Business and Ourso Distinguished Professor of Business at Louisiana State University from 2008 to 2012; professor of marketing and associate dean at the C.T. Bauer College of Business at the University of Houston from 2007 to 2008; an associate professor of marketing from 2002 to 2007; and an assistant professor from 1997 until 2002. He taught at Texas A&M University for several years before joining the faculty of the University of Houston.

Dr. Jones served as the executive director of the Program for Excellence in Selling and the Sales Excellence Institute at the University of Houston from 1997 to 2007. Before becoming a professor, he worked in sales and sales management for three Fortune 100 companies: Quaker Oats, Nabisco, and Frito-Lay. Dr. Jones is a past director of Arvest Bank. He received his Bachelor of Science degree in journalism in 1982, his MBA in 1986 and his Ph.D. in 1997, all from Texas A&M University.

The Board believes that Dr. Jones' experience in academia and his experience in marketing benefits the Funds.

19

Dr. Prema Mathai-Davis, Trustee

Dr. Prema Mathai-Davis has been a member of the Board of Trustees of the Invesco Funds since 1998.

Prior to her retirement in 2000, Dr. Mathai-Davis served as Chief Executive Officer of the YWCA of the USA. Prior to joining the YWCA, Dr. Mathai-Davis served as the Commissioner of the New York City Department for the Aging. She was a Commissioner of the Metropolitan Transportation Authority of New York, the largest regional transportation network in the U.S. Dr. Mathai-Davis also serves as a Trustee of the YWCA Retirement Fund, the first and oldest pension fund for women, and on the advisory board of the Johns Hopkins Bioethics Institute. Dr. Mathai-Davis was the president and chief executive officer of the Community Agency for Senior Citizens, a non-profit social service agency that she established in 1981. She also directed the Mt. Sinai School of Medicine-Hunter College Long-Term Care Gerontology Center, one of the first of its kind.

The Board believes that Dr. Mathai-Davis' extensive experience in running public and charitable institutions benefits the Funds.

Teresa M. Ressel

Teresa M. Ressel has previously served across both the private sector and the U.S. government. Formerly, Ms. Ressel served from 2004 to 2012 in various capacities at UBS AG, including most recently as Chief Executive Officer of UBS Securities LLC, a broker-dealer division of UBS Investment Bank, and Group Chief Operating Officer of the Americas group at UBS AG. In these roles, Ms. Ressel managed a broad array of operational risk controls, supervisory control, regulatory, compliance, and logistics functions covering the United States and Canada, as well as banking activities covering the Americas.

Between 2001 and 2004, Ms. Ressel served at the U.S. Treasury first as Deputy Assistant Secretary for Management and Budget and then as Assistant Secretary for Management and Chief Financial Officer. Ms. Ressel was confirmed by the U.S. Senate and handles a broad array of management duties including finance & accounting, operational risk, audit and performance measurement along with information technology and infrastructure security.

Ms. Ressel also currently serves as a member of the board of directors and as a member of the audit committee of ON Semiconductor Corporation, a publicly traded technology company. Ms. Ressel currently chairs their Corporate Governance and Nominating Committee. ON Semiconductor is a leading supplier of semiconductor-based solutions, many of which reduce global energy use. She has served on the ON Semiconductor board since 2012.

Ms. Ressel also currently serves as a member of the board of directors at Atlantic Power, a publicly traded company which owns and operates a diverse fleet of power generation across the United States and Canada. She serves on the audit committee and compensation committees and has been on the Atlantic Power board since 2014.

The Board believes that Ms. Ressel should be elected to serve as an Independent Trustee because of her extensive knowledge of risk management and financial services in both the public and private sectors, her experience as a director and audit committee member of other companies, and other professional experience gained through her prior employment.

Dr. Larry Soll, Trustee

Dr. Larry Soll has been a member of the Board of Trustees of the Invesco Funds since 1997.

Formerly, Dr. Soll was Chairman of the Board (1987 to 1994), Chief Executive Officer (1982 to 1989; 1993 to 1994) and President (1982 to 1989) of Synergen Corp., a public company, and in such capacities supervised the activities of the Chief Financial Officer. Dr. Soll also has served as a director of three other public companies and as treasurer of a non-profit corporation. Dr. Soll currently serves as a trustee and a member of the Audit Committee of each of the funds within the Invesco Funds.

The Board believes that Dr. Soll's experience as a chairman of a public company benefits the Funds.

Ann Barnett Stern

20

Ann Barnett Stern is currently the President and Chief Executive Officer of Houston Endowment Inc., a private philanthropic institution. She has served in this capacity since 2012. Formerly, Ms. Stern served in various capacities at Texas Children's Hospital from 2003 to 2012, including General Counsel and Executive Vice President.

Ms. Stern is also currently a member of the Dallas Board of the Federal Reserve Bank of Dallas, a role she has held since 2013.

The Board believes that Ms. Stern should be elected to serve as an Independent Trustee because of her knowledge of financial services and investment management, her experience as a director, and other professional experience gained through her prior employment.

Raymond Stickel, Jr., Trustee

Raymond Stickel, Jr. has been a member of the Board of Trustees of the Invesco Funds since 2005.

Mr. Stickel retired after a 35-year career with Deloitte & Touche. For the last five years of his career, he was the managing partner of the investment management practice for the New York, New Jersey and Connecticut region. In addition to his management role, he directed audit and tax services for several mutual fund clients.

Mr. Stickel began his career with Touche Ross & Co. (the Firm) in Dayton, Ohio, became a partner in 1976 and managing partner of the office in 1985. He also started and developed an investment management practice in the Dayton office that grew to become a significant source of investment management talent for the Firm. In Ohio, he served as the audit partner on numerous mutual funds and on public and privately held companies in other industries. Mr. Stickel has also served on the Firm's Accounting and Auditing Executive Committee.

The Board believes that Mr. Stickel's experience as a partner in a large accounting firm working with investment managers and investment companies, and his status as an Audit Committee Financial Expert, benefits the Funds.

Robert C. Troccoli, Trustee

Robert C. Troccoli has been a member of the Board of Trustees of the Invesco Funds since 2016.

Mr. Troccoli retired in 2010 after a 39-year career with KPMG LLP. Since 2013 he has been an adjunct professor at the University of Denver's Daniels College of Business.

Mr. Troccoli's leadership roles during his career with KPMG included managing partner and partner in charge of the Denver office's Financial Services Practice. He served regulated investment companies, investment advisors, private partnerships, private equity funds, sovereign wealth funds, and financial services companies. Toward the end of his career, Mr. Troccoli was a founding member of KPMG's Private Equity Group in New York City, where he served private equity firms and sovereign wealth funds. Mr. Troccoli also served mutual fund clients along with several large private equity firms as Global Lead Partner of KPMG's Private Equity Group.

The Board believes that Mr. Troccoli's experience as a partner in a large accounting firm and his knowledge of investment companies, investment advisors, and private equity firms benefits the Funds.

Christopher L. Wilson

Christopher L. Wilson started a career in the investment management business in 1980. From 2004 to 2009, Mr Wilson served as President and Chief Executive Officer of Columbia Funds, a mutual fund complex with over $350 billion in assets. Mr. Wilson is currently a Managing Partner of CT2, LLC, an early stage investing and consulting firm for start-up companies. He has served in this capacity since 2009.

From 2014 to 2016, Mr. Wilson served as a member of the Board of Directors of the mutual fund company managed by TDAM USA Inc., an affiliate of TD Bank, N.A.

21

Mr. Wilson also currently serves as a member of the Board of Directors of ISO New England, Inc., the company that establishes the wholesale electricity market and manages the electrical power grid in New England. Mr. Wilson is currently the chair of the Audit and Finance Committee, which also oversees cybersecurity, and a member of the systems planning committee of ISO-NE, Inc. He previously served as chair of the Human Resources and Compensation Committee and was a member of the Markets Committee. He has served on the ISO New England, Inc. board since 2011.

The Board believes that Mr. Wilson should be elected to serve as an Independent Trustee because of his extensive knowledge of financial services and investment management, his experience as a director and audit committee member of other companies, including a mutual fund company, and other professional experience gained through his prior employment.

Trustee Nominee and Trustee Ownership of Fund Shares

As of October 31, 2016, each Trustee Nominee and Trustee beneficially owned shares of the Funds and, on an aggregate basis, any funds in the Invesco Fund Complex overseen by the Trustee Nominee in the amounts specified in Annex C.

Board Leadership Structure

Each Board has appointed an Independent Trustee to serve in the role of Chairman of the Board. The Chairman's primary role is to participate in the preparation of the agenda for meetings of the Board and the identification of information to be presented to the Board and matters to be acted upon by the Board. The Chairman also presides at all meetings of the Board and acts as a liaison with service providers, officers, attorneys, and other Trustees generally between meetings. The Chairman may perform such other functions as may be requested by the Board from time to time. Except for any duties specified herein or pursuant to a Fund's charter documents, the designation of Chairman does not impose on such Independent Trustee any duties, obligations or liability that is greater than the duties, obligations or liability otherwise imposed on such person as a member of the Board, generally. As discussed below, the Board has established committees to assist the Board in performing its oversight responsibilities.

Board Role in Risk Oversight

The Board considers risk management issues as part of its general oversight responsibilities throughout the year at its regular meetings and at regular meetings of each of the Investments Committee, Audit Committee, Compliance Committee, Governance Committee and Valuation, Distribution and Proxy Oversight Committee (as further described below) (for purposes of this section only, the "Risk Committees"). These Risk Committees in turn report to the full Board and recommend actions and approvals for the full Board to take.

The Adviser, or its affiliates, prepares regular reports that address certain investment, valuation and compliance matters, and the Board as a whole or the Risk Committees also receive special written reports or presentations on a variety of risk issues at the request of the Board, a Risk Committee or the Senior Officer.

The Investments Committee and its sub-committees receive regular written reports describing and analyzing the investment performance of the Funds. In addition, Invesco's Chief Investment Officers and the portfolio managers of the Funds meet regularly with the Investments Committee or its subcommittees to discuss portfolio performance, including investment risk, such as the impact on the Funds of investments in particular types of securities or instruments, such as derivatives. To the extent that a Fund changes a particular investment strategy that could have a material impact on the Fund's risk profile, the Board generally is consulted in advance with respect to such change.