As filed with the Securities and Exchange Commission on January 14, 2019

File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | |

| THE SECURITIES ACT OF 1933 | | |

| Pre-Effective Amendment No. | | ☐ |

| Post-Effective Amendment No. | | ☐ |

(Check appropriate box or boxes)

AIM Counselor Series Trust

(Invesco Counselor Series Trust)

(Exact Name of Registrant as Specified in Charter)

11 Greenway Plaza, Suite 1000, Houston, TX 77046

(Address of Principal Executive Offices) (Number, Street, City, State, Zip Code)

(713) 626-1919

(Registrant’s Area Code and Telephone Number)

Jeffrey H. Kupor, Esquire

11 Greenway Plaza, Suite 1000, Houston, TX 77046

(Name and address of Agent for Service)

Copy to:

| | |

| Peter A. Davidson, Esquire | | Matthew R. DiClemente, Esquire |

| Invesco Advisers, Inc. | | Stradley Ronon Stevens & Young, LLP |

| 11 Greenway Plaza, Suite 1000 | | 2005 Market Street, Suite 2600 |

| Houston, TX 77046-1173 | | Philadelphia, PA 19103-7018 |

Approximate Date of Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of securities being registered:

Class A, Class C, Class R, Class Y and Class R6 shares of beneficial interest, without par value, of the Invesco Oppenheimer Real Estate Fund, Invesco Oppenheimer Senior Floating Rate Fund, Invesco Oppenheimer Capital Appreciation Fund, Invesco Oppenheimer Discovery Fund and Invesco Oppenheimer Equity Income Fund, each a series of the Registrant;

Class A, Class C, Class Y and Class R6 shares of beneficial interest, without par value, of the Invesco Oppenheimer Senior Floating Rate Plus Fund, a series of the Registrant;

Class A, Class C and Class Y shares of beneficial interest, without par value, of the Invesco Oppenheimer Rochester Short Duration High Yield Municipal Fund and Invesco Oppenheimer Short Term Municipal Fund, a series of the Registrant; and

Class R6 shares of beneficial interest, without par value, of the Invesco Oppenheimer Master Loan Fund, a series of the Registrant.

It is proposed that this Registration Statement will become effective on February 13, 2019 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

OPPENHEIMER FUNDS

6803 South Tucson Way

Centennial, Colorado 80112-3924

(800) 225-5677

[ ], 2019

Dear Shareholder:

You are cordially invited to a joint special meeting of shareholders (together with any postponements or adjournments thereof, the “Meeting”) of each of the Oppenheimer Funds identified in the enclosed Notice of Joint Special Meeting of Shareholders (the “Notice”), which will be held at 1:00 p.m., Mountain Time, at the offices of the Oppenheimer Funds at 6803 South Tucson Way, Centennial, Colorado 80112-3924 on April 12, 2019. The purpose of the Meeting is to vote on an important proposal that affects the Oppenheimer Funds identified in the Notice (each, an “Oppenheimer Fund,” and collectively, the “Oppenheimer Funds”).

On October 17, 2018, Massachusetts Mutual Life Insurance Company (“MassMutual”), an indirect corporate parent of OppenheimerFunds, Inc. (“OFI”) and its subsidiaries, including OFI Global Asset Management, Inc., the investment adviser to the Oppenheimer Funds (collectively, “Oppenheimer”), entered into an agreement with Invesco Ltd. (“Invesco”), a leading independent global investment management company, whereby Invesco will acquire MassMutual’s asset management affiliate, OFI. In turn, MassMutual and OFI’s employee shareholders will receive a combination of common and preferred equity consideration, and MassMutual will become a significant shareholder of Invesco (the “Transaction”). In connection with the Transaction, the Board of Trustees of each Oppenheimer Fund has approved, pursuant to an Agreement and Plan of Reorganization (the “Agreement”), the transfer of the assets and liabilities of each Oppenheimer Fund to a corresponding, newly formed fund (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”) in the Invesco family of funds (the “Reorganization”). Although each Acquiring Fund will be managed by Invesco Advisers, Inc., a different investment adviser, each Acquiring Fund has the same investment objective and substantially similar principal investment strategies and risks as the corresponding Oppenheimer Fund. At the Meeting, you will be asked to vote on the proposed Reorganization. If shareholders approve the Agreement and certain other closing conditions are satisfied or waived, you will receive after the closing of the Reorganization (in accordance with the terms of the Agreement), a number of shares of beneficial interest of the corresponding Acquiring Fund equal in value to the net asset value of the shares of your Oppenheimer Fund(s) held immediately prior to the Reorganization.

In connection with the Transaction, it is anticipated that certain of the investment personnel associated with the Oppenheimer mutual fund business, as well as other Oppenheimer personnel, would transition to Invesco at closing. As a result, Invesco is anticipating that the current portfolio management teams associated with each Oppenheimer Fund will continue to manage the corresponding Acquiring Fund.

Combining the Oppenheimer Funds and the Invesco family of funds onto a single operating platform will create a larger fund family that offers a broad range of equity, fixed-income, alternative and other investment options.

After careful consideration of the proposed Reorganizations, the Board of Trustees of each Oppenheimer Fund has unanimously approved and recommends that you vote “FOR” the Reorganization proposal.

The enclosed Joint Proxy Statement/Prospectus describes the proposal and compares each Oppenheimer Fund to its corresponding Acquiring Fund. You should review these materials carefully. Oppenheimer also sponsors other funds that are not part of this Joint Proxy Statement/Prospectus. Shareholders of those other Oppenheimer funds are voting on a similar proposal that will involve their Oppenheimer fund combining with other funds in the Invesco family of funds, as described in a separate joint proxy statement/prospectus.

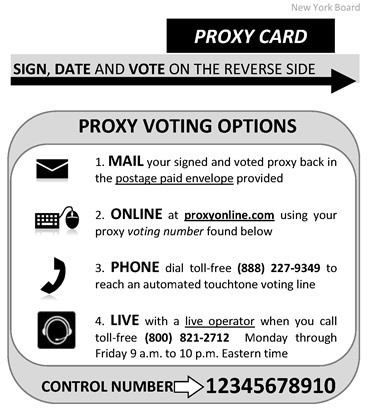

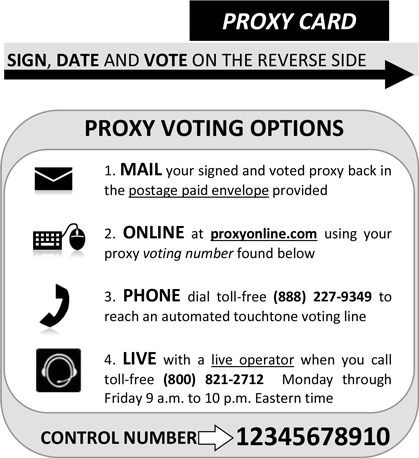

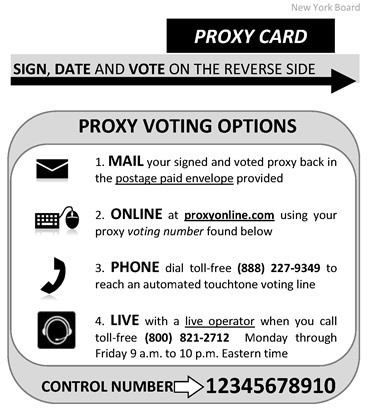

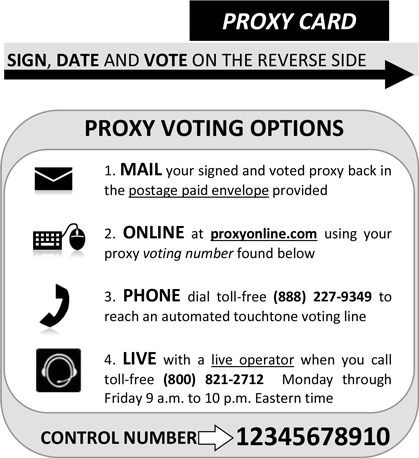

Your vote is important no matter how many shares you own. Please take a moment after reviewing the enclosed materials to sign and return your proxy card in the enclosed postage paid return envelope. You may also vote by telephone or through a website established for that purpose by following the instructions that appear on the enclosed proxy card. If you attend the Meeting, you may vote in person. If you have questions, please call our proxy solicitor, AST Fund Solutions, LLC, at (800) 821-2712. If we do not hear from you, you may receive a telephone call from our proxy solicitor reminding you to vote.

Sincerely,

|

|

| Arthur P. Steinmetz |

| President |

OPPENHEIMER FUNDS

6803 South Tucson Way

Centennial, Colorado 80112-3924

(800) 225-5677

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

To Be Held on April 12, 2019

Notice is hereby given that a joint special meeting (together with any postponements or adjournments thereof, the “Meeting”) of shareholders of the Oppenheimer Funds identified in the chart below (each, an “Oppenheimer Fund” and collectively, the “Oppenheimer Funds”) will be held on April 12, 2019 at 1:00 p.m., Mountain Time, at 6803 South Tucsan Way, Centennial, Colorado 80112-3924 to vote on the following proposal:

To approve an Agreement and Plan of Reorganization (the “Agreement”) that provides for the reorganization of each Oppenheimer Fund into a corresponding, newly formed fund in the Invesco family of funds as set forth in the chart below (each, an “Acquiring Fund,” and collectively, the “Acquiring Funds”), including: (i) the transfer of all or substantially all of the assets of the Oppenheimer Fund to the Acquiring Fund solely in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of the liabilities of the Oppenheimer Fund, (ii) the distribution of shares of the Acquiring Fund to shareholders of the Oppenheimer Fund in complete liquidation of the Oppenheimer Fund; and (iii) the cancellation of the outstanding shares of the Oppenheimer Fund (all of the foregoing being referred to as the “Reorganization”).

| | |

Oppenheimer Funds | | Acquiring Funds |

| OFI Pictet Global Environmental Solutions Fund | | Invesco OFI Pictet Global Environmental Solutions Fund |

| Oppenheimer Capital Appreciation Fund | | Invesco Oppenheimer Capital Appreciation Fund |

| Oppenheimer Developing Markets Fund | | Invesco Oppenheimer Developing Markets Fund |

| Oppenheimer Discovery Fund | | Invesco Oppenheimer Discovery Fund |

| Oppenheimer Discovery Mid Cap Growth Fund | | Invesco Oppenheimer Discovery Mid Cap Growth Fund |

| Oppenheimer Dividend Opportunity Fund | | Invesco Oppenheimer Dividend Opportunity Fund |

| Oppenheimer Emerging Markets Innovators Fund | | Invesco Oppenheimer Emerging Markets Innovators Fund |

| Oppenheimer Equity Income Fund | | Invesco Oppenheimer Equity Income Fund |

| Oppenheimer Fundamental Alternatives Fund | | Invesco Oppenheimer Fundamental Alternatives Fund |

| Oppenheimer Global Fund | | Invesco Oppenheimer Global Fund |

| Oppenheimer Global Allocation Fund | | Invesco Oppenheimer Global Allocation Fund |

| Oppenheimer Global Focus Fund | | Invesco Oppenheimer Global Focus Fund |

| Oppenheimer Global Multi-Asset Growth Fund | | Invesco Oppenheimer Global Multi-Asset Growth Fund |

| Oppenheimer Global Multi-Asset Income Fund | | Invesco Oppenheimer Global Multi-Asset Income Fund |

| Oppenheimer Global Opportunities Fund | | Invesco Oppenheimer Global Opportunities Fund |

| Oppenheimer Gold & Special Minerals Fund | | Invesco Oppenheimer Gold & Special Minerals Fund |

| Oppenheimer Government Money Market Fund | | Invesco Oppenheimer Government Money Market Fund |

| Oppenheimer Institutional Government Money Market Fund | | Invesco Oppenheimer Institutional Government Money Market Fund |

| Oppenheimer Intermediate Term Municipal Fund | | Invesco Oppenheimer Intermediate Term Municipal Fund |

| Oppenheimer International Diversified Fund | | Invesco Oppenheimer International Diversified Fund |

| Oppenheimer International Equity Fund | | Invesco Oppenheimer International Equity Fund |

| Oppenheimer International Growth Fund | | Invesco Oppenheimer International Growth Fund |

| | |

Oppenheimer Funds | | Acquiring Funds |

| Oppenheimer International Small-Mid Company Fund | | Invesco Oppenheimer International Small-Mid Company Fund |

| Oppenheimer Limited-Term Bond Fund | | Invesco Oppenheimer Limited-Term Bond Fund |

| Oppenheimer Macquarie Global Infrastructure Fund | | Invesco Oppenheimer Macquarie Global Infrastructure Fund |

| Oppenheimer Mid Cap Value Fund | | Invesco Oppenheimer Mid Cap Value Fund |

| Oppenheimer Municipal Fund | | Invesco Oppenheimer Municipal Fund |

| Oppenheimer Portfolio Series: Active Allocation Fund | | Invesco Oppenheimer Portfolio Series: Active Allocation Fund |

| Oppenheimer Portfolio Series: Conservative Investor Fund | | Invesco Oppenheimer Portfolio Series: Conservative Investor Fund |

| Oppenheimer Portfolio Series: Equity Investor Fund [to be renamed Oppenheimer Portfolio Series: Growth Investor Fund] | | Invesco Oppenheimer Portfolio Series: Growth Investor Fund |

| Oppenheimer Portfolio Series: Moderate Investor Fund | | Invesco Oppenheimer Portfolio Series: Moderate Investor Fund |

| Oppenheimer Real Estate Fund | | Invesco Oppenheimer Real Estate Fund |

| Oppenheimer Rising Dividends Fund | | Invesco Oppenheimer Rising Dividends Fund |

| Oppenheimer Rochester® AMT-Free Municipal Fund | | Invesco Oppenheimer Rochester® AMT-Free Municipal Fund |

| Oppenheimer Rochester® AMT-Free New York Municipal Fund | | Invesco Oppenheimer Rochester® AMT-Free New York Municipal Fund |

| Oppenheimer Rochester® California Municipal Fund | | Invesco Oppenheimer Rochester® California Municipal Fund |

| Oppenheimer Rochester® Fund Municipals | | Invesco Oppenheimer Rochester® Municipals Fund |

| Oppenheimer Rochester® High Yield Municipal Fund | | Invesco Oppenheimer Rochester® High Yield Municipal Fund |

| Oppenheimer Rochester® Limited Term California Municipal Fund | | Invesco Oppenheimer Rochester® Limited Term California Municipal Fund |

| Oppenheimer Rochester® Limited Term New York Municipal Fund | | Invesco Oppenheimer Rochester® Limited Term New York Municipal Fund |

| Oppenheimer Rochester® New Jersey Municipal Fund | | Invesco Oppenheimer Rochester® New Jersey Municipal Fund |

| Oppenheimer Rochester® Pennsylvania Municipal Fund | | Invesco Oppenheimer Rochester® Pennsylvania Municipal Fund |

| Oppenheimer Rochester® Short Duration High Yield Municipal Fund | | Invesco Oppenheimer Rochester® Short Duration High Yield Municipal Fund |

| Oppenheimer Short Term Municipal Fund | | Invesco Oppenheimer Short Term Municipal Fund |

| Oppenheimer Small Cap Value Fund | | Invesco Oppenheimer Small Cap Value Fund |

| Oppenheimer Value Fund | | Invesco Oppenheimer Value Fund |

If shareholders of an Oppenheimer Fund approve the Agreement, and certain other closing conditions are satisfied or waived, shareholders of the Oppenheimer Fund will receive after the closing of the Reorganization (in accordance with the terms of the Agreement), a number of shares of beneficial interest of the corresponding Acquiring Fund equal in value, to the net asset value of the shares of the Oppenheimer Fund held immediately prior to the Reorganization. Each Acquiring Fund will have the same investment objectives and substantially similar principal investment strategies and risks as its corresponding Oppenheimer Fund. The Reorganization is discussed in detail in the Joint Proxy Statement/Prospectus attached to this notice. Please read those materials carefully for information concerning the Reorganization.

Shareholders of record as of the close of business on January 14, 2019 are entitled to notice of, and to vote at, the Meeting, even if such shareholders no longer own shares of the Oppenheimer Fund(s) at the time of the

Meeting. The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting. Shareholders of each Oppenheimer Fund will vote separately on the proposed Reorganization of the Oppenheimer Fund, and the proposed Reorganization will be effected as to a particular Oppenheimer Fund only if that Fund’s shareholders approve the Reorganization.

The Board of Trustees of the Oppenheimer Funds has unanimously approved and recommends that you cast your vote “FOR” the Reorganization of your Oppenheimer Fund as described in the Joint Proxy Statement/Prospectus.

You are requested to complete, date, and sign the enclosed proxy card(s) and return it (them) promptly in the envelope provided for that purpose. Your proxy card(s) also provides instructions for voting via telephone or the Internet if you wish to take advantage of these voting options.

Some shareholders hold shares of more than one Oppenheimer Fund and may receive proxy cards or proxy materials for each Oppenheimer Fund owned. Please sign and return the proxy card in the postage paid return envelope, or vote via telephone or the Internet, for each Oppenheimer Fund held. Your vote is important regardless of the number of shares owned.

You may revoke your proxy at any time before it is exercised by submitting a written notice of revocation or a subsequently executed proxy or by attending the Meeting and voting in person.

|

By Order of the Board of Trustees of the Oppenheimer Funds, |

|

|

Cynthia Lo Bessette |

Secretary |

, 2019 |

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD(S) IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD(S) BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR INTERNET BY FOLLOWING THE ENCLOSED INSTRUCTIONS. IF YOU VOTE BY TELEPHONE OR VIA THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD(S) UNLESS YOU ELECT TO CHANGE YOUR VOTE.

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND

AND VOTE ON THE PROPOSAL

We are providing you with this overview of the proposal on which your vote is requested. Please read the full text of the Joint Proxy Statement/Prospectus, which contains additional information about the proposal, and keep it for future reference. Your vote is important.

Questions and Answers

Q. What am I being asked to vote upon?

A. You are being asked to approve the reorganization of the Oppenheimer Fund(s) of which you own shares into a new mutual fund family. Specifically, as a shareholder of one or more Oppenheimer Funds identified on the Notice of Joint Special Meeting of Shareholders (each, an “Oppenheimer Fund,” and, collectively, the “Oppenheimer Funds”), you are being asked to consider and approve an Agreement and Plan of Reorganization (the “Agreement”) under which the assets and liabilities of your Oppenheimer Fund will be transferred to a newly formed fund in the Invesco family of funds with the same investment objectives and substantially similar principal investment strategies and risks as the corresponding Oppenheimer Fund (each, an “Acquiring Fund,” and, collectively, the “Acquiring Funds”). (A table showing each Oppenheimer Fund and its corresponding Acquiring Fund is included in Exhibit A to the Joint Proxy Statement/Prospectus.)

If shareholders of an Oppenheimer Fund approve the Agreement, and certain other closing conditions are satisfied or waived, Oppenheimer Fund shareholders will receive shares of equal value of a corresponding Acquiring Fund in exchange for shares of their respective Oppenheimer Fund, and the outstanding shares of the Oppenheimer Funds will be cancelled as permitted by the organizational documents of the Oppenheimer Funds and applicable law. Each Oppenheimer Fund for which shareholders have approved the Agreement will thereafter wind up its affairs and be dissolved under applicable law and deregistered under the Investment Company Act of 1940, as amended (the “1940 Act”). We refer to each such reorganization as a “Reorganization” and collectively as the “Reorganizations.”

Q. Why are the Reorganizations being proposed?

A. On October 17, 2018, Massachusetts Mutual Life Insurance Company (“MassMutual”), an indirect corporate parent of OppenheimerFunds, Inc. (“OFI”) and its subsidiaries (collectively, “Oppenheimer”) entered into an agreement with Invesco Ltd. (“Invesco”), a leading independent global investment management company, whereby Invesco will acquire MassMutual’s asset management affiliate, OFI. As part of the Transaction, MassMutual and OFI’s employee shareholders will receive a combination of common and preferred equity consideration, and MassMutual will become a significant shareholder in Invesco (the “Transaction”). In connection with the Transaction, the Board of Trustees of each Oppenheimer Fund (the “Oppenheimer Board”) has approved that each Oppenheimer Fund be reorganized into its corresponding Acquiring Fund by transferring the assets and liabilities of each Oppenheimer Fund to a newly formed Acquiring Fund in the Invesco family of funds with the same investment objective and substantially similar principal investment strategies and risks as the corresponding Oppenheimer Fund. In addition, it is currently anticipated that certain of the investment personnel associated with the Oppenheimer mutual fund business, as well as other Oppenheimer personnel, would transition to Invesco at closing. As a result, Invesco is anticipating that the current portfolio management teams associated with each Oppenheimer Fund will continue to manage the corresponding Acquiring Fund.

Combining the Oppenheimer Funds and the Invesco family of funds onto a single operating platform will create a larger family of funds that will offer a broader range of equity, fixed-income, alternative and other investment options.

Q/A-1

Q. What effect will a Reorganization have on me as a shareholder of an Oppenheimer Fund?

A. Immediately after the closing of a Reorganization, you will own shares of an Acquiring Fund that are equal in total value to the total value of the shares of the corresponding Oppenheimer Fund that you held immediately prior to the closing of the Reorganization. As an Acquiring Fund shareholder, you will have access to an array of Invesco’s investment options, which upon completion of the Reorganizations, will include more than 195 mutual funds managed by Invesco and its affiliates. You will also have full access to Invesco’s shareholder and transfer agency servicing platforms, which provide customer assistance through the Internet, by telephone and by mail. Other than for custody services, the Acquiring Funds use different service providers than the Oppenheimer Funds and, as a result, the processes and mechanisms that shareholders who purchase shares directly from the Oppenheimer Funds (and not through a financial intermediary) currently utilize and the persons or entities that such shareholders currently contact to buy, redeem and exchange shares and otherwise manage their account may change. In addition, certain investor services and investment privileges will be different. These differences are described in the Joint Proxy Statement/Prospectus.

Q. Are there any significant differences between the investment objectives and principal investment strategies and risks of each Oppenheimer Fund and its corresponding Acquiring Fund?

A. No. Each Acquiring Fund has the same investment objectives and substantially similar principal investment strategies and risks as its corresponding Oppenheimer Fund. One notable difference is that the Oppenheimer Developing Markets Fund and Oppenheimer Gold & Special Minerals Fund each have an investment objective that is identical to its Acquiring Fund counterpart, but the Oppenheimer Fund’s investment objective is fundamental and requires shareholder approval to change while the Acquiring Fund’s investment objective does not. All of the other Oppenheimer Funds and their corresponding Acquiring Funds have an investment objective that may be changed without shareholder approval.

Q. Are there any significant differences in the advisory fee or total annual fund operating expenses of each Oppenheimer Fund and its corresponding Acquiring Fund?

A. No. The advisory fee of each Oppenheimer Fund and its corresponding Acquiring Fund are the same. In addition, Invesco Advisers, Inc. (“Invesco Advisers”), the investment adviser to the Acquiring Funds, has agreed to waive its advisory fee and/or reimburse fund expenses of each Acquiring Fund through two years from the closing date of the Reorganization so that each Acquiring Fund’s total annual fund operating expenses will be no greater than the total annual fund operating expenses of its corresponding Oppenheimer Fund. Absent Invesco Advisers’ fee waiver arrangement, the total annual fund operating expenses of each Oppenheimer Fund may be higher than the total annual fund operating expenses of the corresponding Acquiring Fund. The fee waiver arrangement and a comparison of the gross and net total annual fund operating expenses of the Oppenheimer Funds and the Acquiring Funds are described in the “Comparison of Fees and Expenses” section of the Joint Proxy Statement/Prospectus.

Q. Will there be any sales load, commission or other transactional fee in connection with the Reorganization?

A. No. The total value of the shares of an Oppenheimer Fund that you own will be exchanged for shares of the corresponding Acquiring Fund without the imposition of any sales load, commission or other transactional fee.

Q. What are the expected federal income tax consequences of the Reorganizations?

A. Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes and, as a condition of closing, the Oppenheimer Funds will receive an opinion of counsel to the effect that each Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended. Thus, while there can be no guarantee that the U.S. Internal Revenue Service will adopt a similar position, it is expected, subject to the limited exceptions described in the Joint Proxy Statement/Prospectus under the heading “Federal Income Tax Consequences,” that neither shareholders, nor the Oppenheimer Funds, will recognize gain or loss as a direct result of a Reorganization, and the holding period for, and the aggregate tax basis of the Acquiring Fund’s shares that you receive in the Reorganization will include the holding period for, and will be the same as the aggregate tax basis of the shares that you surrender in the Reorganization. Shareholders should consult their tax adviser about state and local tax consequences of the Reorganization, if any, because the

Q/A-2

information about tax consequences in the Joint Proxy Statement/Prospectus relates to the federal income tax consequences of the Reorganizations only.

Q. Has the Oppenheimer Board considered the Reorganizations, and how do they recommend that I vote?

A. The Oppenheimer Board, including the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Oppenheimer Funds, has carefully considered the Reorganizations and unanimously recommends that you vote “FOR” the Reorganizations. A summary of the considerations of the Oppenheimer Board in making this recommendation is provided in the “BOARD CONSIDERATIONS” section of the Joint Proxy Statement/Prospectus.

Q. What is the anticipated timing of the Reorganizations?

A. A joint special meeting of shareholders of the Oppenheimer Funds will be held on April 12, 2019 (together with any postponements or adjournments thereof, the “Meeting”). If shareholders of an Oppenheimer Fund approve the Reorganization, it is anticipated that such Reorganization will occur in the second quarter of 2019, simultaneous with the closing of the Transaction.

Q. What will happen if shareholders of an Oppenheimer Fund do not approve the Reorganization?

A. While the consummation of any particular Reorganization is not conditioned upon the specific consummation of any other Reorganization, the Reorganizations may not close unless certain conditions to the closing of the Transaction are met or waived. If such conditions are not met or waived, none of the Reorganizations will be consummated, even if shareholders of an Oppenheimer Fund approved the Reorganization, and the Oppenheimer Funds will not be reorganized into the Acquiring Funds. If this occurs, the Oppenheimer Board will consider what action, if any, for each Oppenheimer Fund to take. The “Terms of the Reorganizations” section of the Joint Proxy Statement/Prospectus generally describes the conditions to closing of the Reorganizations.

Additionally, if the shareholders of an Oppenheimer Fund do not approve the Reorganization, it is anticipated that such Oppenheimer Fund would either liquidate or follow Rule 15a-4 under the 1940 Act, which permits the Oppenheimer Board to approve, and for the Oppenheimer Fund to enter into, an interim investment advisory contract with Invesco Advisers pursuant to which Invesco Advisers, as an interim adviser, may serve as the investment adviser to the Oppenheimer Fund for a period not to exceed 150 days following the termination of the current advisory agreement, to be able to continue uninterrupted portfolio management services for such Oppenheimer Fund. After the 150 day period has expired, if shareholders of an Oppenheimer Fund still have not approved the Reorganization, the Oppenheimer Board will consider other possible courses of action for such fund, including possibly liquidating the fund.

Q. What if I do not wish to participate in the Reorganization?

A. If you do not wish to have the shares of your Oppenheimer Fund exchanged for shares of the corresponding Acquiring Fund as part of a Reorganization that is approved by shareholders, you may redeem your shares prior to the consummation of the Reorganization. If you redeem your shares, you will incur any applicable deferred sales charge and if you hold shares in a taxable account, you will recognize a taxable gain or loss equal to the difference between your tax basis in the shares and the amount you receive for them.

Q. Why are you sending me the Joint Proxy Statement/Prospectus?

A. You are receiving a Joint Proxy Statement/Prospectus because you own shares in one or more Oppenheimer Funds and have the right to vote on the very important proposal described therein concerning your Oppenheimer Fund(s). The Joint Proxy Statement/Prospectus contains information that you should know before voting on the proposed Reorganizations and which, if such proposed Reorganizations are approved, will result in your investment in the Acquiring Funds. The document is both a proxy statement of the Oppenheimer Funds and also a prospectus for the corresponding Acquiring Funds.

Q/A-3

Q. Will any Oppenheimer Fund or Acquiring Fund pay the costs of this proxy solicitation or any additional costs in connection with the proposed Reorganization?

A. No. None of the Oppenheimer Funds or Acquiring Funds will bear these costs. Invesco and MassMutual or their affiliates will bear all expenses arising in connection with the Reorganizations.

Q. What is the required vote to approve the Proposal?

A. For each Oppenheimer Fund, shareholder approval of a Reorganization requires the affirmative vote of the lesser of (i) 67% or more of the shares present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding shares of such Oppenheimer Fund are present or represented by proxy; or (ii) more than 50% of the outstanding shares of such Oppenheimer Fund.

Q. How do I vote my shares?

A. For your convenience, there are several ways you can vote:

| | • | | Voting in Person: If you attend the Meeting, were the beneficial owner of your shares as of January 14, 2019, the record date for the Meeting (“Record Date”), and wish to vote in person, we will provide you with a ballot prior to the vote. However, if your shares were held in the name of your broker, bank or other nominee, you are required to bring a letter from the nominee indicating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote. |

| | • | | Voting by Proxy: Whether or not you plan to attend the Meeting, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Meeting and vote. If you properly fill in and sign your proxy card and send it to us in time to vote at the Meeting, your “proxy” (the individuals named on your proxy card) will vote your shares as you have directed. If you sign your proxy card but do not make specific choices, your proxy will vote your shares “FOR” the proposal, as recommended by the Oppenheimer Board, and in their best judgment on other matters. Your proxy will have the authority to vote and act on your behalf at any adjournment or postponement of the Meeting. If you authorize a proxy to vote for you, you may revoke the authorization at any time before it is exercised by sending in another proxy card with a later date or by notifying the Secretary of the Oppenheimer Funds in writing to the address of the Oppenheimer Funds set forth on the cover page of the Joint Proxy Statement/Prospectus before the Meeting that you have revoked your proxy. In addition, although merely attending the Meeting will not revoke your proxy, if you are present at the Meeting you may withdraw your proxy and vote in person. |

| | • | | Voting by Telephone or the Internet: You may vote your shares by telephone or through a website established for that purpose by following the instructions that appear on the proxy card accompanying the Joint Proxy Statement/Prospectus. |

Q. Whom should I call for additional information about the Reorganizations or the Joint Proxy Statement/Prospectus?

A. If you need any assistance, or have any questions regarding the Reorganizations or how to vote your shares, please call AST Fund Solutions, LLC at (800) 821-2712.

Q/A-4

| | |

| OPPENHEIMER FUNDS | | INVESCO FUNDS |

| 6803 South Tucson Way | | 11 Greenway Plaza, Suite 1000 |

| Centennial, Colorado 80112-3924 | | Houston, Texas 77046 |

| (800) 225-5677 | | (800) 959-4246 |

JOINT PROXY STATEMENT/PROSPECTUS

[ , 2019]

Introduction

This joint proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”) is being furnished to shareholders of the Oppenheimer Funds identified on Exhibit A of this Joint Proxy Statement/Prospectus (each, an “Oppenheimer Fund” and collectively, the “Oppenheimer Funds”) in connection with the solicitation by the Board of Trustees of the Oppenheimer Funds (the “Oppenheimer Board”) of proxies to be used at a special joint meeting of the shareholders of the Oppenheimer Funds, which will be held at 6803 South Tucson Way, Centennial, Colorado 80112-3924 on April 12, 2019 at 1:00 p.m. Mountain Time (together with any postponements or adjournments thereof, the “Meeting”). At the Meeting, shareholders of each Oppenheimer Fund are being asked to consider the following proposal:

To approve an Agreement and Plan of Reorganization (the “Agreement”) that provides for the reorganization of each Oppenheimer Fund into a corresponding, newly formed fund in the Invesco family of funds as identified on Exhibit A of this Joint Proxy Statement/Prospectus (each, an “Acquiring Fund,” and collectively, the “Acquiring Funds”) including: (i) the transfer of all or substantially all of the assets of the Oppenheimer Fund to the Acquiring Fund solely in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of the liabilities of the Oppenheimer Fund, (ii) the distribution of shares of the Acquiring Fund to shareholders of the Oppenheimer Fund in complete liquidation of the Oppenheimer Fund; and (iii) the cancellation of the outstanding shares of the Oppenheimer Fund (all of the foregoing being referred to as the “Reorganization”).

This Joint Proxy Statement/Prospectus contains information that shareholders of the Oppenheimer Funds should know before voting on the proposed Reorganizations that are described herein, and should be retained for future reference. It is both the proxy statement of the Oppenheimer Funds and also a prospectus for the Acquiring Funds. Each Oppenheimer Fund and Acquiring Fund is a registered open-end management investment company or series thereof. We sometimes refer to the Oppenheimer Funds and the Acquiring Funds collectively as the “Funds” and to each fund individually as a “Fund.”

The Reorganization of each Oppenheimer Fund with and into its corresponding Acquiring Fund as described in the Agreement will involve three steps:

| | • | | In accordance with the terms of the Agreement, the transfer by each Oppenheimer Fund of all of its assets to its corresponding Acquiring Fund in return for the Acquiring Fund assuming the liabilities of the Oppenheimer Fund and issuing shares of the corresponding Acquiring Fund to the Oppenheimer Fund equal to the aggregate net asset value of the corresponding Oppenheimer Fund’s shares owned by the Oppenheimer Fund’s shareholders on the closing date of the Reorganization; |

| | • | | the pro rata distribution of shares of the same or a comparable class of the Acquiring Fund to the shareholders of record of the Oppenheimer Fund as of the closing date of the Reorganization and the cancellation of the outstanding shares of the Oppenheimer Fund held by such shareholders, as permitted by the organizational documents of the Oppenheimer Fund and applicable law; and |

| | • | | the winding up of the affairs of the Oppenheimer Fund and dissolution under applicable law and de-registration of the Oppenheimer Fund under the Investment Company Act of 1940, as amended (the “1940 Act”). |

If shareholders approve the Agreement and certain other closing conditions are satisfied or waived, the total value of the Acquiring Fund shares that you will receive after the closing of the Reorganization (in accordance with the terms of the Agreement) will be the same as the total value of the shares of the Oppenheimer Fund that you held immediately prior to the Reorganization. Each Reorganization is intended to be a tax-free reorganization for federal income tax purposes, meaning that you should not be required to pay any federal income tax in connection with the Reorganization. No sales charges, redemption fees or minimum investment amounts will be imposed in connection with the Reorganizations.

The Oppenheimer Board has fixed the close of business on January 14, 2019 as the record date (“Record Date”) for the determination of shareholders entitled to notice of, and to vote at, the Meeting. Shareholders of an Oppenheimer Fund on the Record Date will be entitled to one vote for each full share of the Oppenheimer Fund held, and a proportionate fractional vote for each fractional share. We intend to mail this Joint Proxy Statement/Prospectus, the enclosed Notice of Joint Special Meeting of Shareholders and the enclosed proxy card on or about [ ], 2019 to all shareholders entitled to vote at the Meeting.

After careful consideration of the proposed Reorganizations, the Oppenheimer Board has unanimously approved the Agreement and each Reorganization and has determined that it is in the best interest of each Oppenheimer Fund and its shareholders.

If shareholders of an Oppenheimer Fund do not approve the Reorganization, the Oppenheimer Board will consider what further action is appropriate.

This Joint Proxy Statement/Prospectus is being used in order to reduce the preparation, printing, handling and postage expenses that would result from the use of a separate proxy statement/prospectus for each Oppenheimer Fund.

Additional information about the Funds is available in the:

| | • | | Prospectuses for the Oppenheimer Funds and the Acquiring Funds; |

| | • | | Annual and Semi-Annual Reports to shareholders of the Oppenheimer Funds; |

| | • | | Statements of Additional Information (“SAIs”) for the Oppenheimer Funds and the Acquiring Funds; and |

| | • | | SAI relating to this Joint Proxy Statement/Prospectus. |

Exhibit B contains a list of the specific prospectuses incorporated by reference into the Joint Proxy Statement/Prospectus.

These documents are on file with the Securities and Exchange Commission (the “SEC”). The prospectuses of the Oppenheimer Funds are incorporated herein by reference and are legally deemed to be part of this Joint Proxy Statement/Prospectus. A copy of the prospectus of each Acquiring Fund that corresponds to the Oppenheimer Fund that you own accompanies this Joint Proxy Statement/Prospectus and is incorporated herein by reference and is deemed to be part of this Joint Proxy Statement/Prospectus. The SAI to this Joint Proxy Statement/Prospectus, dated the same date as this Joint Proxy Statement/Prospectus, also is incorporated by reference and is deemed to be part of this document and is available upon oral or written request from the Invesco Funds, at the address and toll-free telephone number noted below. The Oppenheimer Funds’ prospectuses, the most recent Annual Report to Shareholders containing audited financial statements for the most recent fiscal year, and the most recent Semi-Annual Report to Shareholders of the Oppenheimer Funds have been previously mailed to shareholders and are available on the Oppenheimer Funds’ web site at www.oppenheimerfunds.com.

Copies of all of these documents are available upon request without charge by visiting, writing to or calling:

| | |

| For Oppenheimer Fund Documents: | | For Acquiring Fund Documents: |

| OPPENHEIMER FUNDS | | INVESCO FUNDS |

| 6803 South Tucson Way | | 11 Greenway Plaza, Suite 1000 |

| Centennial, Colorado 80112-3924 | | Houston, Texas 77046 |

| (800) 225-5677 | | (800) 959-4246 |

You also may view or obtain these documents from the SEC’s Public Reference Room, which is located at 100 F Street, N.E., Washington, D.C. 20549-2736, or from the SEC’s website at www.sec.gov. Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at 1-202-551-8090. You can also request copies of these materials, upon payment at the prescribed rates of the duplicating fee, by electronic request to the SEC’s e-mail address (publicinfo@sec.gov) or by writing the Public Reference Branch, Office of Consumer Affairs and Information Services, SEC, Washington, DC 20549-0102.

These securities have not been approved or disapproved by the SEC or CFTC nor has the SEC or CFTC passed upon the accuracy or adequacy of this Joint Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

i

Exhibits

| | |

EXHIBIT A Oppenheimer Funds and Corresponding Acquiring Funds | | A-1 |

EXHIBIT B Prospectuses Incorporated by Reference into the Joint Proxy Statement/Prospectus | | B-1 |

EXHIBIT C Comparison of Fundamental Investment Restrictions | | C-1 |

EXHIBIT D Oppenheimer Funds’ Custodians | | D-1 |

EXHIBIT E Form of Agreement and Plan of Reorganization | | E-1 |

EXHIBIT F Financial Highlights Tables | | F-1 |

EXHIBIT G Outstanding Shares of the Oppenheimer Funds | | G-1 |

EXHIBIT H Ownership of Shares of the Oppenheimer Funds | | H-1 |

ii

PROPOSAL:

APPROVAL OF AN AGREEMENT AND PLAN OF REORGANIZATION

Summary

On October 17, 2018, Massachusetts Mutual Life Insurance Company (“MassMutual”), an indirect corporate parent of OppenheimerFunds, Inc. (“OFI”) and its subsidiaries (collectively, “Oppenheimer”) entered into an agreement with Invesco Ltd. (“Invesco”), a leading independent global investment management company, whereby Invesco will acquire MassMutual asset management affiliate, OFI. In turn, MassMutual and OFI’s employee shareholders will receive a combination of common and preferred equity consideration, and MassMutual will become a significant shareholder of Invesco (the “Transaction”). In connection with the Transaction, the Oppenheimer Board was asked to approve the reorganization of each Oppenheimer Fund into a corresponding Acquiring Fund by transferring the assets and liabilities of each Oppenheimer Fund to a newly formed fund with the same investment objective and substantially similar principal investment strategies and risks as the corresponding Oppenheimer Fund. In addition, it is currently anticipated that certain of the investment personnel associated with the Oppenheimer mutual fund business, as well as other Oppenheimer personnel, would transition to Invesco at closing. As a result, Invesco is anticipating that the current portfolio management teams associated with each Oppenheimer Fund will continue to manage the corresponding Acquiring Fund.

On January 11, 2019, the Oppenheimer Board on behalf of each Oppenheimer Fund unanimously voted to approve each Reorganization, subject to approval by shareholders of the applicable Oppenheimer Fund and other closing conditions. In the Reorganizations, each Oppenheimer Fund will transfer its assets and liabilities to its corresponding Acquiring Fund. The Acquiring Fund will then issue shares to the Oppenheimer Fund, which will distribute such shares to shareholders of the Oppenheimer Fund. Any shares you own of an Oppenheimer Fund at the time of the Reorganization will be cancelled and you will receive shares, in the same or a comparable share class, of the corresponding Acquiring Fund having an aggregate value equal to the value of your shares of the Oppenheimer Fund (even though the net asset value per share may differ). It is expected that no gain or loss will be recognized by any shareholder of an Oppenheimer Fund in connection with the Reorganization, as discussed below under “Federal Income Tax Consequences.” If approved by shareholders and certain other conditions are met, each Reorganization is expected to occur in the second quarter of 2019.

Reasons for Recommending the Reorganization

The Oppenheimer Board considered the Transaction and each proposed Reorganization and concluded that participation in the proposed Reorganization is in the best interests of each Oppenheimer Fund and its shareholders. In reaching that conclusion, the Oppenheimer Board considered, among other things:

| | 1. | the potential benefits to Oppenheimer Fund shareholders from participating in an enlarged global asset management platform with broad distribution opportunities; |

| | 2. | the expected level of continuity in the new structure, in part as a result of the level of retention arrangements that have been put in place for certain key Oppenheimer employees; |

| | 3. | information provided by Invesco as to the nature and quality of advisory and other services provided to Invesco’s existing funds and expected to be provided to the Acquiring Funds, and the level of advisory and other fees and expenses expected to be charged (including projected expense savings to Oppenheimer Fund shareholders through expense caps); |

| | 4. | the history, reputation, qualifications and background of Invesco, along with its financial resources, including its level of operational, administrative, internal audit and compliance services and the quality and structure of the boards of trustees of the Acquiring Funds, taking into account the nomination of certain Oppenheimer Fund trustees to serve on those boards to provide historical background and knowledge; |

| | 5. | other assurances from Invesco, including, without limitation, that the shareholders of the Oppenheimer Funds would not be diluted as a result of the applicable Reorganizations, and as to Invesco’s capability to meet the challenges of placing the Acquiring Funds on its common operating platform; |

| | 6. | the structure proposed for the Transaction, including the Agreement, the form of Invesco Advisers Advisory Agreement and related agreements; |

| | 7. | the fact that the costs related to the proxy solicitation and the proposed Reorganization will be borne by Invesco and MassMutual or their affiliates; and |

| | 8. | the agreements by Invesco, MassMutual and Oppenheimer to conduct, and use reasonable best efforts to cause their affiliates to conduct, their respective businesses in compliance with Section 15(f) of the 1940 Act so as not to impose an “unfair burden” on the funds, despite differences in the manner and level by which certain expenses are charged on the Invesco Funds’ platform from those on the Oppenheimer Funds. |

For a more complete discussion of the factors considered by the Oppenheimer Board in approving the Reorganization, see the section entitled “BOARD CONSIDERATIONS” in this Joint Proxy Statement/Prospectus.

Comparison of Investment Objectives and Principal Investment Strategies

Each of the Acquiring Funds was recently created solely to acquire the assets and assume the liabilities of the corresponding Oppenheimer Fund in a Reorganization. Each Acquiring Fund’s investment objective is the same and its principal investment strategies are substantially similar as those of the corresponding Oppenheimer Fund. The investment objective and principal investment strategies of the Oppenheimer Fund of which you are the record owner can be found in the Oppenheimer Fund prospectus that you received upon purchasing shares in that Oppenheimer Fund and any updated prospectuses that you may have subsequently received. The investment objective and principal investment strategies of the corresponding Acquiring Fund can be found in the Acquiring Fund’s prospectus, which is enclosed with this Joint Proxy Statement/Prospectus.

Each Oppenheimer Fund and its corresponding Acquiring Fund, other than the Oppenheimer Developing Markets Fund and Oppenheimer Gold & Special Minerals Fund, have the same investment objective that is not classified as fundamental, which means it can be changed by a Fund’s Board of Trustees with notice to shareholders. The investment objective of the Oppenheimer Developing Markets Fund and Oppenheimer Gold & Special Minerals

1

Fund is substantially the same as its corresponding Acquiring Fund’s investment objective, but the investment objective of these Oppenheimer Funds are classified as fundamental, which means they cannot be changed without shareholder approval.

Additional information about the investment objectives, principal investment strategies and risks of the Acquiring Funds can be found in the Acquiring Funds’ prospectuses, which are enclosed with this Joint Proxy Statement/Prospectus.

Risks Associated with the Acquiring Funds

Each Oppenheimer Fund and its corresponding Acquiring Fund have the same investment objectives and substantially similar principal investment strategies and invest in the same types of securities under the same portfolio management team. As a result, the risks associated with an investment in each Acquiring Fund are substantially similar to the risks associated with an investment in the corresponding Oppenheimer Fund, although the Acquiring Funds may describe such risks somewhat differently. The enclosed prospectuses of the Acquiring Funds contain a discussion of these risks. For more information on the risks associated with an Acquiring Fund, see the “Investment Strategies and Risks” section of the Acquiring Fund’s SAI. The cover page of this Joint Proxy Statement/Prospectus describes how you can obtain a copy of the SAI.

Comparison of Fundamental Investment Restrictions

The 1940 Act requires, and each of the Oppenheimer Funds and the Acquiring Funds have, fundamental investment restrictions relating to diversification, borrowing, issuing senior securities, underwriting, investing in real estate, investing in physical commodities, making loans, and concentrating in particular industries. Fundamental investment restrictions of a fund cannot be changed without shareholder approval. Each Oppenheimer Fund and its corresponding Acquiring Fund have substantially similar fundamental investment restrictions, except as noted below. A chart providing a side-by-side comparison of each fundamental investment restriction can be found on Exhibit C.

One notable difference in the fundamental investment restrictions of the Acquiring Funds is that each of the Acquiring Funds, unlike its Oppenheimer Fund counterpart, has a fundamental investment restriction that permits it to invest all of its assets in the securities of a single open-end management investment company with substantially similar fundamental investment objectives, policies and restrictions as the Acquiring Fund, notwithstanding any other fundamental investment restriction or limitation. While the Acquiring Funds have adopted this fundamental investment restriction, they have also adopted a non-fundamental investment restriction stating that, notwithstanding the fundamental restriction with regard to investing all assets in an open-end fund, an Acquiring Fund may not invest all of its assets in the securities of a single open-end management investment company with the same fundamental investment objectives, policies and restrictions as the Acquiring Fund.

Another notable difference with regard to the fundamental investment restrictions of the Acquiring Funds relates to certain exclusions that apply to the restriction on underwriting securities. The Acquiring Fund may not underwrite the securities of other issuers, but this restriction does not prevent the Acquiring Fund from engaging in transactions involving the acquisition, disposition or resale of its portfolio securities, regardless of whether the Fund may be considered to be an underwriter under the Securities Act of 1933 (the “1933 Act”). The exclusions relating to the Oppenheimer Fund’s restriction on underwriting are a little broader and provide that the Oppenheimer Fund may not underwrite securities of other issuers, except to the extent permitted under the Investment Company Act or the 1933 Act, the rules or regulations thereunder or any exemption therefrom that is applicable to the Fund, as such statutes, rules, regulations or exemption may be amended or interpreted from time to time by the SEC, its staff, or other authority with appropriate jurisdiction.

Both the Oppenheimer Funds and Acquiring Funds may be subject to other investment restrictions that are not identified above. The full list of each Oppenheimer Fund’s and each Acquiring Fund’s investment restrictions may be found in its respective SAI. See the cover page of this Joint Proxy Statement/Prospectus for a description of how you can obtain a copy of the Funds’ SAIs.

2

Comparison of Fees and Expenses

The following table compares the shareholder fees and annual fund operating expenses, expressed as a percentage of net assets (“expense ratios”), of each Oppenheimer Fund with the shareholder fees and pro forma expense ratios of the corresponding Acquiring Fund. Pro forma expense ratios of the Acquiring Funds give effect to the Reorganizations. The pro forma expense ratios shown project anticipated expenses but actual expenses may be greater or less than those shown. You should know that the Acquiring Funds have implemented fee waivers through two years from the closing date of the Reorganization and if those waivers are not renewed upon the end of the two years after the Closing Date of the Reorganization, the expense ratios of certain Acquiring Funds after two years from the closing date of the Reorganization may be higher than the current expense ratios of the corresponding Oppenheimer Funds.

3

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shareholder Fees

(fees paid directly from your

investment† | | | Annual Fund Operating Expenses‡

(expenses that you pay each year as a percentage of the value of your investment) | |

| Class | | Maximum

Sales Charge

(Load)

Imposed on

Purchases | | | Maximum

Deferred

Sales

Charge

(Load) | | | Management

Fees | | | Distribution

and/or Service

(12b-1) Fees | | | Interest

Expenses* | | | Other

Expenses | | | Total Other

Expenses | | | Acquired

Fund Fees

and Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or Expense

Reimbursement | | | Total Annual

Operating

Expenses After

Fee Waivers and

Expense

Reimbursements | |

OFI Pictet Global Environmental Solutions Fund as of 4/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.75 | % | | | None | | | | 0.00 | % | | | 0.98 | % | | | 0.98 | % | | | 0.00 | % | | | 1.73 | % | | | 0.78 | %1 | | | 0.95 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.75 | % | | | None | | | | 0.00 | % | | | 0.83 | % | | | 0.83 | % | | | 0.00 | % | | | 1.58 | % | | | 0.73 | %1 | | | 0.85 | % |

Pro Forma Invesco OFI Pictet Global Environmental Solutions Fund as of 4/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Y | | | None | | | | None | | | | 0.75 | % | | | None | | | | 0.00 | % | | | 0.99 | %2 | | | 0.99 | %2 | | | 0.00 | % | | | 1.74 | % | | | 0.79 | %3 | | | 0.95 | % |

I/R6 | | | None | | | | None | | | | 0.75 | % | | | None | | | | 0.00 | % | | | 0.83 | %2 | | | 0.83 | %2 | | | 0.00 | % | | | 1.58 | % | | | 0.73 | %3 | | | 0.85 | % |

Oppenheimer Capital Appreciation Fund4 as of 8/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.59 | % | | | 0.25 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.05 | % | | | 0.00 | % | | | 1.05 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.59 | % | | | 1.00 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.80 | % | | | 0.00 | % | | | 1.80 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.59 | % | | | 0.50 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.30 | % | | | 0.00 | % | | | 1.30 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.59 | % | | | None | | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 0.80 | % | | | 0.00 | % | | | 0.80 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.59 | % | | | None | | | | 0.00 | % | | | 0.04 | % | | | 0.04 | % | | | 0.00 | % | | | 0.63 | % | | | 0.00 | % | | | 0.63 | % |

Pro Forma Invesco Oppenheimer Capital Appreciation Fund as of 8/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.59 | % | | | 0.25 | % | | | 0.00 | % | | | 0.19 | %2 | | | 0.19 | %2 | | | 0.00 | % | | | 1.03 | % | | | 0.00 | %3 | | | 1.03 | % |

C | | | None | | | | 1.00 | % | | | 0.59 | % | | | 1.00 | % | | | 0.00 | % | | | 0.19 | %2 | | | 0.19 | %2 | | | 0.00 | % | | | 1.78 | % | | | 0.00 | %3 | | | 1.78 | % |

R | | | None | | | | None | | | | 0.59 | % | | | 0.50 | % | | | 0.00 | % | | | 0.19 | %2 | | | 0.19 | %2 | | | 0.00 | % | | | 1.28 | % | | | 0.00 | %3 | | | 1.28 | % |

Y | | | None | | | | None | | | | 0.59 | % | | | None | | | | 0.00 | % | | | 0.19 | %2 | | | 0.19 | %2 | | | 0.00 | % | | | 0.78 | % | | | 0.00 | %3 | | | 0.78 | % |

I/R6 | | | None | | | | None | | | | 0.59 | % | | | None | | | | 0.00 | % | | | 0.02 | %2 | | | 0.02 | %2 | | | 0.00 | % | | | 0.61 | % | | | 0.00 | %3 | | | 0.61 | % |

Oppenheimer Developing Markets Fund as of 8/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.77 | % | | | 0.25 | % | | | 0.00 | % | | | 0.27 | % | | | 0.27 | % | | | 0.00 | % | | | 1.29 | % | | | 0.00 | % | | | 1.29 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.77 | % | | | 1.00 | % | | | 0.00 | % | | | 0.28 | % | | | 0.28 | % | | | 0.00 | % | | | 2.05 | % | | | 0.00 | % | | | 2.05 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.77 | % | | | 0.50 | % | | | 0.00 | % | | | 0.28 | % | | | 0.28 | % | | | 0.00 | % | | | 1.55 | % | | | 0.00 | % | | | 1.55 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.77 | % | | | None | | | | 0.00 | % | | | 0.28 | % | | | 0.28 | % | | | 0.00 | % | | | 1.05 | % | | | 0.00 | % | | | 1.05 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.77 | % | | | None | | | | 0.00 | % | | | 0.10 | % | | | 0.10 | % | | | 0.00 | % | | | 0.87 | % | | | 0.00 | % | | | 0.87 | % |

Pro Forma Invesco Oppenheimer Developing Markets Fund as of 8/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.77 | % | | | 0.25 | % | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 1.26 | % | | | 0.00 | %3 | | | 1.26 | % |

C | | | None | | | | 1.00 | % | | | 0.77 | % | | | 1.00 | % | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 2.01 | % | | | 0.00 | %3 | | | 2.01 | % |

R | | | None | | | | None | | | | 0.77 | % | | | 0.50 | % | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 1.51 | % | | | 0.00 | %3 | | | 1.51 | % |

Y | | | None | | | | None | | | | 0.77 | % | | | None | | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 1.01 | % | | | 0.00 | %3 | | | 1.01 | % |

I/R6 | | | None | | | | None | | | | 0.77 | % | | | None | | | | 0.00 | % | | | 0.08 | %2 | | | 0.08 | %2 | | | 0.00 | % | | | 0.85 | % | | | 0.00 | %3 | | | 0.85 | % |

4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shareholder Fees

(fees paid directly from your

investment† | | | Annual Fund Operating Expenses‡

(expenses that you pay each year as a percentage of the value of your investment) | |

| Class | | Maximum

Sales Charge

(Load)

Imposed on

Purchases | | | Maximum

Deferred

Sales

Charge

(Load) | | | Management

Fees | | | Distribution

and/or Service

(12b-1) Fees | | | Interest

Expenses* | | | Other

Expenses | | | Total Other

Expenses | | | Acquired

Fund Fees

and Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or Expense

Reimbursement | | | Total Annual

Operating

Expenses After

Fee Waivers and

Expense

Reimbursements | |

Oppenheimer Discovery Fund4 as of 9/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.63 | % | | | 0.25 | % | | | 0.00 | % | | | 0.20 | % | | | 0.20 | % | | | 0.00 | % | | | 1.08 | % | | | 0.00 | % | | | 1.08 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.63 | % | | | 1.00 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.84 | % | | | 0.00 | % | | | 1.84 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.63 | % | | | 0.50 | % | | | 0.00 | % | | | 0.20 | % | | | 0.20 | % | | | 0.00 | % | | | 1.33 | % | | | 0.00 | % | | | 1.33 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.63 | % | | | None | | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 0.84 | % | | | 0.00 | % | | | 0.84 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.63 | % | | | None | | | | 0.00 | % | | | 0.04 | % | | | 0.04 | % | | | 0.00 | % | | | 0.67 | % | | | 0.00 | % | | | 0.67 | % |

Pro Forma Invesco Oppenheimer Discovery Fund as of 9/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.63 | % | | | 0.25 | % | | | 0.00 | % | | | 0.22 | %2 | | | 0.22 | %2 | | | 0.00 | % | | | 1.10 | % | | | 0.02 | %3 | | | 1.08 | % |

C | | | None | | | | 1.00 | % | | | 0.63 | % | | | 1.00 | % | | | 0.00 | % | | | 0.22 | %2 | | | 0.22 | %2 | | | 0.00 | % | | | 1.85 | % | | | 0.01 | %3 | | | 1.84 | % |

R | | | None | | | | None | | | | 0.63 | % | | | 0.50 | % | | | 0.00 | % | | | 0.22 | %2 | | | 0.22 | %2 | | | 0.00 | % | | | 1.35 | % | | | 0.02 | %3 | | | 1.33 | % |

Y | | | None | | | | None | | | | 0.63 | % | | | None | | | | 0.00 | % | | | 0.22 | %2 | | | 0.22 | %2 | | | 0.00 | % | | | 0.85 | % | | | 0.01 | %3 | | | 0.84 | % |

I/R6 | | | None | | | | None | | | | 0.63 | % | | | None | | | | 0.00 | % | | | 0.03 | %2 | | | 0.03 | %2 | | | 0.00 | % | | | 0.66 | % | | | 0.00 | %3 | | | 0.66 | % |

Oppenheimer Discovery Mid Cap Growth Fund4 as of 10/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.66 | % | | | 0.25 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.12 | % | | | 0.00 | % | | | 1.12 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.66 | % | | | 1.00 | % | | | 0.00 | % | | | 0.20 | % | | | 0.20 | % | | | 0.00 | % | | | 1.86 | % | | | 0.00 | % | | | 1.86 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.66 | % | | | 0.50 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.37 | % | | | 0.00 | % | | | 1.37 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.66 | % | | | None | | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 0.87 | % | | | 0.00 | % | | | 0.87 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.66 | % | | | None | | | | 0.00 | % | | | 0.04 | % | | | 0.04 | % | | | 0.00 | % | | | 0.70 | % | | | 0.00 | % | | | 0.70 | % |

Pro Forma Invesco Oppenheimer Discovery Mid Cap Growth Fund as of 10/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.66 | % | | | 0.25 | % | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 1.15 | % | | | 0.03 | %3 | | | 1.12 | % |

C | | | None | | | | 1.00 | % | | | 0.66 | % | | | 1.00 | % | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 1.90 | % | | | 0.04 | %3 | | | 1.86 | % |

R | | | None | | | | None | | | | 0.66 | % | | | 0.50 | % | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 1.40 | % | | | 0.03 | %3 | | | 1.37 | % |

Y | | | None | | | | None | | | | 0.66 | % | | | None | | | | 0.00 | % | | | 0.24 | %2 | | | 0.24 | %2 | | | 0.00 | % | | | 0.90 | % | | | 0.03 | %3 | | | 0.87 | % |

I/R6 | | | None | | | | None | | | | 0.66 | % | | | None | | | | 0.00 | % | | | 0.03 | %2 | | | 0.03 | %2 | | | 0.00 | % | | | 0.69 | % | | | 0.00 | %3 | | | 0.69 | % |

5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shareholder Fees

(fees paid directly from your

investment† | | | Annual Fund Operating Expenses‡

(expenses that you pay each year as a percentage of the value of your investment) | |

| Class | | Maximum

Sales Charge

(Load)

Imposed on

Purchases | | | Maximum

Deferred

Sales

Charge

(Load) | | | Management

Fees | | | Distribution

and/or Service

(12b-1) Fees | | | Interest

Expenses* | | | Other

Expenses | | | Total Other

Expenses | | | Acquired

Fund Fees

and Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or Expense

Reimbursement | | | Total Annual

Operating

Expenses After

Fee Waivers and

Expense

Reimbursements | |

Oppenheimer Dividend Opportunity Fund4 as of 4/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.65 | % | | | 0.25 | % | | | 0.00 | % | | | 0.24 | % | | | 0.24 | % | | | 0.00 | % | | | 1.14 | % | | | 0.00 | % | | | 1.14 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.65 | % | | | 1.00 | % | | | 0.00 | % | | | 0.23 | % | | | 0.23 | % | | | 0.00 | % | | | 1.88 | % | | | 0.00 | % | | | 1.88 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.65 | % | | | 0.50 | % | | | 0.00 | % | | | 0.22 | % | | | 0.22 | % | | | 0.00 | % | | | 1.37 | % | | | 0.00 | % | | | 1.37 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.65 | % | | | None | | | | 0.00 | % | | | 0.23 | % | | | 0.23 | % | | | 0.00 | % | | | 0.88 | % | | | 0.00 | % | | | 0.88 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.65 | % | | | None | | | | 0.00 | % | | | 0.06 | % | | | 0.06 | % | | | 0.00 | % | | | 0.71 | % | | | 0.00 | % | | | 0.71 | % |

Pro Forma Invesco Oppenheimer Dividend Opportunity Fund as of 4/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.65 | % | | | 0.25 | % | | | 0.00 | % | | | 0.32 | %2 | | | 0.32 | %2 | | | 0.00 | % | | | 1.22 | % | | | 0.08 | %3 | | | 1.14 | % |

C | | | None | | | | 1.00 | % | | | 0.65 | % | | | 1.00 | % | | | 0.00 | % | | | 0.32 | %2 | | | 0.32 | %2 | | | 0.00 | % | | | 1.97 | % | | | 0.09 | %3 | | | 1.88 | % |

R | | | None | | | | None | | | | 0.65 | % | | | 0.50 | % | | | 0.00 | % | | | 0.32 | %2 | | | 0.32 | %2 | | | 0.00 | % | | | 1.47 | % | | | 0.10 | %3 | | | 1.37 | % |

Y | | | None | | | | None | | | | 0.65 | % | | | None | | | | 0.00 | % | | | 0.32 | %2 | | | 0.32 | %2 | | | 0.00 | % | | | 0.97 | % | | | 0.09 | %3 | | | 0.88 | % |

I/R6 | | | None | | | | None | | | | 0.65 | % | | | None | | | | 0.00 | % | | | 0.06 | %2 | | | 0.06 | %2 | | | 0.00 | % | | | 0.71 | % | | | 0.00 | %3 | | | 0.71 | % |

Oppenheimer Emerging Markets Innovators Fund4 as of 8/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 1.15 | % | | | 0.25 | % | | | 0.00 | % | | | 0.31 | % | | | 0.31 | % | | | 0.01 | % | | | 1.72 | % | | | 0.02 | %6,7 | | | 1.70 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 1.15 | % | | | 1.00 | % | | | 0.00 | % | | | 0.31 | % | | | 0.31 | % | | | 0.01 | % | | | 2.47 | % | | | 0.01 | %6,7 | | | 2.46 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 1.15 | % | | | 0.50 | % | | | 0.00 | % | | | 0.33 | % | | | 0.33 | % | | | 0.01 | % | | | 1.99 | % | | | 0.01 | %6,7 | | | 1.98 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 1.15 | % | | | None | | | | 0.00 | % | | | 0.31 | % | | | 0.31 | % | | | 0.01 | % | | | 1.47 | % | | | 0.02 | %6,7 | | | 1.45 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 1.15 | % | | | None | | | | 0.00 | % | | | 0.14 | % | | | 0.14 | % | | | 0.01 | % | | | 1.30 | % | | | 0.05 | %6,7 | | | 1.25 | % |

Pro Forma Invesco Oppenheimer Emerging Markets Innovators Fund as of 8/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 1.15 | % | | | 0.25 | % | | | 0.00 | % | | | 0.30 | %2 | | | 0.30 | %2 | | | 0.01 | %2 | | | 1.71 | % | | | 0.01 | %3 | | | 1.70 | % |

C | | | None | | | | 1.00 | % | | | 1.15 | % | | | 1.00 | % | | | 0.00 | % | | | 0.30 | %2 | | | 0.30 | %2 | | | 0.01 | %2 | | | 2.46 | % | | | 0.01 | %3 | | | 2.45 | % |

R | | | None | | | | None | | | | 1.15 | % | | | 0.50 | % | | | 0.00 | % | | | 0.30 | %2 | | | 0.30 | %2 | | | 0.01 | %2 | | | 1.96 | % | | | 0.01 | %3 | | | 1.95 | % |

Y | | | None | | | | None | | | | 1.15 | % | | | None | | | | 0.00 | % | | | 0.30 | %2 | | | 0.30 | %2 | | | 0.01 | %2 | | | 1.46 | % | | | 0.01 | %3 | | | 1.45 | % |

I/R6 | | | None | | | | None | | | | 1.15 | % | | | None | | | | 0.00 | % | | | 0.12 | %2 | | | 0.12 | %2 | | | 0.01 | %2 | | | 1.28 | % | | | 0.03 | %3 | | | 1.25 | % |

6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shareholder Fees

(fees paid directly from your

investment† | | | Annual Fund Operating Expenses‡

(expenses that you pay each year as a percentage of the value of your investment) | |

| Class | | Maximum

Sales Charge

(Load)

Imposed on

Purchases | | | Maximum

Deferred

Sales

Charge

(Load) | | | Management

Fees | | | Distribution

and/or Service

(12b-1) Fees | | | Interest

Expenses* | | | Other

Expenses | | | Total Other

Expenses | | | Acquired

Fund Fees

and Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or Expense

Reimbursement | | | Total Annual

Operating

Expenses After

Fee Waivers and

Expense

Reimbursements | |

Oppenheimer Equity Income Fund4 as of 10/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.58 | % | | | 0.25 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.04 | % | | | 0.00 | % | | | 1.04 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.58 | % | | | 1.00 | % | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 1.79 | % | | | 0.00 | % | | | 1.79 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.58 | % | | | 0.50 | % | | | 0.00 | % | | | 0.22 | % | | | 0.22 | % | | | 0.00 | % | | | 1.30 | % | | | 0.00 | % | | | 1.30 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.58 | % | | | None | | | | 0.00 | % | | | 0.21 | % | | | 0.21 | % | | | 0.00 | % | | | 0.79 | % | | | 0.00 | % | | | 0.79 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.58 | % | | | None | | | | 0.00 | % | | | 0.05 | % | | | 0.05 | % | | | 0.00 | % | | | 0.63 | % | | | 0.00 | % | | | 0.63 | % |

Pro Forma Invesco Oppenheimer Equity Income Fund as of 10/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.58 | % | | | 0.25 | % | | | 0.00 | % | | | 0.17 | %2 | | | 0.17 | %2 | | | 0.00 | % | | | 1.00 | % | | | 0.00 | %3 | | | 1.00 | % |

C | | | None | | | | 1.00 | % | | | 0.58 | % | | | 1.00 | % | | | 0.00 | % | | | 0.17 | %2 | | | 0.17 | %2 | | | 0.00 | % | | | 1.75 | % | | | 0.00 | %3 | | | 1.75 | % |

R | | | None | | | | None | | | | 0.58 | % | | | 0.50 | % | | | 0.00 | % | | | 0.17 | %2 | | | 0.17 | %2 | | | 0.00 | % | | | 1.25 | % | | | 0.00 | %3 | | | 1.25 | % |

Y | | | None | | | | None | | | | 0.58 | % | | | None | | | | 0.00 | % | | | 0.17 | %2 | | | 0.17 | %2 | | | 0.00 | % | | | 0.75 | % | | | 0.00 | %3 | | | 0.75 | % |

I/R6 | | | None | | | | None | | | | 0.58 | % | | | None | | | | 0.00 | % | | | 0.03 | %2 | | | 0.03 | %2 | | | 0.00 | % | | | 0.61 | % | | | 0.00 | %3 | | | 0.61 | % |

7

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shareholder Fees

(fees paid directly from your

investment)† | | | Annual Fund Operating Expenses‡

(expenses that you pay each year as a percentage of the value of your investment) | |

| Class | | Maximum

Sales Charge

(Load)

Imposed on

Purchases | | | Maximum

Deferred Sales

Charge

(Load) | | | Management

Fees | | | Distribution

and/or

Service

(12b-1) Fees | | | Interest

Expenses

and

Dividend

Expenses on

Securities

Sold Short | | | Other

Expenses | | | Total

Other

Expenses | | | Acquired Fund

Fees and

Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or Expense

Reimbursement | | | Total Annual

Operating

Expenses After

Fee Waivers and

Expense

Reimbursements | |

Oppenheimer Fundamental Alternatives Fund4 as of 10/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A merging into Acquiring Fund A | | | 5.75 | % | | | None | | | | 0.87 | %8 | | | 0.25 | % | | | 0.64 | % | | | 0.24 | % | | | 0.88 | % | | | 0.00 | % | | | 2.00 | % | | | 0.03 | %9 | | | 1.97 | % |

C merging into Acquiring Fund C | | | None | | | | 1.00 | % | | | 0.87 | %8 | | | 1.00 | % | | | 0.64 | % | | | 0.24 | % | | | 0.88 | % | | | 0.00 | % | | | 2.75 | % | | | 0.03 | %9 | | | 2.72 | % |

R merging into Acquiring Fund R | | | None | | | | None | | | | 0.87 | %8 | | | 0.50 | % | | | 0.64 | % | | | 0.26 | % | | | 0.90 | % | | | 0.00 | % | | | 2.27 | % | | | 0.03 | %9 | | | 2.24 | % |

Y merging into Acquiring Fund Y | | | None | | | | None | | | | 0.87 | %8 | | | None | | | | 0.64 | % | | | 0.25 | % | | | 0.89 | % | | | 0.00 | % | | | 1.76 | % | | | 0.03 | %9 | | | 1.73 | % |

I merging into Acquiring Fund R6 | | | None | | | | None | | | | 0.87 | %8 | | | None | | | | 0.64 | % | | | 0.10 | % | | | 0.74 | % | | | 0.00 | % | | | 1.61 | % | | | 0.03 | %9 | | | 1.58 | % |

Pro Forma Invesco Oppenheimer Fundamental Alternatives Fund as of 10/31/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A | | | 5.50 | % | | | None | 5 | | | 0.84 | %10 | | | 0.25 | % | | | 0.64 | % | | | 0.24 | %2 | | | 0.88 | %2 | | | 0.00 | % | | | 1.97 | % | | | 0.00 | %3 | | | 1.97 | % |

C | | | None | | | | 1.00 | % | | | 0.84 | %10 | | | 1.00 | % | | | 0.64 | % | | | 0.24 | %2 | | | 0.88 | %2 | | | 0.00 | % | | | 2.72 | % | | | 0.00 | %3 | | | 2.72 | % |

R | | | None | | | | None | | | | 0.84 | %10 | | | 0.50 | % | | | 0.64 | % | | | 0.24 | %2 | | | 0.88 | %2 | | | 0.00 | % | | | 2.22 | % | | | 0.00 | %3 | | | 2.22 | % |

Y | | | None | | | | None | | | | 0.84 | %10 | | | None | | | | 0.64 | % | | | 0.24 | %2 | | | 0.88 | %2 | | | 0.00 | % | | | 1.72 | % | | | 0.00 | %3 | | | 1.72 | % |

I/R6 | | | None | | | | None | | | | 0.84 | %10 | | | None | | | | 0.64 | % | | | 0.08 | %2 | | | 0.72 | %2 | | | 0.00 | % | | | 1.56 | % | | | 0.01 | %3 | | | 1.55 | % |

8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shareholder Fees

(fees paid directly from your

investment)† | | | Annual Fund Operating Expenses‡

(expenses that you pay each year as a percentage of the value of your investment) | |

| Class | | Maximum

Sales Charge

(Load)

Imposed on

Purchases | | | Maximum

Deferred

Sales

Charge

(Load) | | | Management

Fees | | | Distribution

and/or Service

(12b-1) Fees | | | Interest

Expenses* | | | Other

Expenses | | | Total Other

Expenses | | | Acquired

Fund Fees

and Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or Expense

Reimbursement | | | Total Annual

Operating Expenses

After Fee Waivers

and Expense

Reimbursements | |

Oppenheimer Global Fund4 as of 9/30/18 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |