UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

First Federal Bancshares, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

N/A

| 2) | Aggregate number of securities to which transaction applies: |

N/A

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

N/A

| 4) | Proposed maximum aggregate value of transaction: |

N/A

| 5) | Total Fee paid: |

N/A

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

N/A

| 2) | Form, Schedule or Registration Statement No.: |

N/A

| 3) | Filing Party: |

N/A

| 4) | Date Filed: |

N/A

April 18, 2006

Dear Fellow Stockholder:

You are cordially invited to attend the annual meeting of stockholders of First Federal Bancshares, Inc. We will hold the meeting at the Holiday Inn located at 201 S. Third Street, Quincy, Illinois on May 23, 2006 at 2:00 p.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we also will report on the operations of the Company. Directors and officers of the Company, as well as a representative of Crowe Chizek and Company LLC, the Company’s independent auditors, will be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

| Sincerely, |

|

| James J. Stebor |

| President and Chief Executive Officer |

First Federal Bancshares, Inc.

109 East Depot Street

Colchester, Illinois 62326

(309) 776-3225

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE | 2:00 p.m. on Tuesday, May 23, 2006 | |||

| PLACE | The Holiday Inn located at 201 S. Third Street, Quincy Illinois | |||

| ITEMS OF BUSINESS | (1) | The election of three directors of the Company; | ||

| (2) | The ratification of the appointment of Crowe Chizek and Company LLC as independent auditors for the Company for the fiscal year ending December 31, 2006; and | |||

| (3) | Such other matters as may properly come before the annual meeting or any adjournments thereof. The Board of Directors is not aware of any other business to come before the annual meeting. | |||

| RECORD DATE | In order to vote, you must have been a stockholder at the close of business on April 3, 2006. | |||

| PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy card. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the proxy statement. | |||

|

Millie R. Shields |

| Corporate Secretary |

NOTE: Whether or not you plan to attend the annual meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy card in the enclosed envelope.

FIRST FEDERAL BANCSHARES, INC.

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of First Federal Bancshares, Inc. (“First Federal Bancshares” or the “Company”) to be used at the annual meeting of stockholders of the Company. First Federal Bancshares is the holding company for First Federal Bank (“First Federal” or the “Bank”). The annual meeting will be held at the Holiday Inn located at 201 S. Third Street, Quincy, Illinois on May 23, 2006 at 2:00 p.m., local time. This proxy statement and the enclosed proxy card are being first mailed to stockholders of record on or about April 18, 2006.

General Information about Voting

Who Can Vote at the Meeting

You are entitled to vote your First Federal Bancshares common stock only if the records of the Company show that you held your shares as of the close of business on April 3, 2006. As of the close of business on April 3, 2006, a total of 1,242,264 shares of First Federal Bancshares common stock were outstanding. Each share of common stock has one vote. The Company’s Certificate of Incorporation provides that record holders of the Company’s common stock who beneficially own, either directly or indirectly, in excess of 10% of the Company’s outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit. With respect to shares held by a broker, bank or nominee, the Company generally will look beyond the holder of the shares to the person or entity for whom the shares are held when applying the voting limitation. However, where the ultimate owner of the shares has granted voting authority to the broker, bank or nominee that holds the shares, the Company would apply the 10% voting limitation to the broker, bank or nominee.

Attending the Meeting

If you are a beneficial owner of First Federal Bancshares common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of First Federal Bancshares common stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Vote Required

The annual meeting will be held only if there is a quorum present. A quorum exists if a majority of the outstanding shares of common stock entitled to vote is represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

The Company’s Board of Directors consists of eight members. At this year’s annual meeting, shareholders will elect three directors to serve a term of three years. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected. There is no cumulative voting for the election of directors. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In voting on the ratification of the appointment of Crowe Chizek and Company LLC as independent auditors, you may vote in favor of the proposal, vote against the proposal or abstain from voting. The ratification of Crowe Chizek and Company LLC as independent auditors will be decided by the affirmative vote of a majority of the votes cast at the annual meeting. On this matter, abstentions and broker non-votes will have no effect on the voting.

Voting by Proxy

The Board of Directors of First Federal Bancshares is sending you this proxy statement for the purpose of requesting that you allow your shares of First Federal Bancshares common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of First Federal Bancshares common stock represented at the annual meeting by properly executed and dated proxy cards will be voted according to the instructions indicated on the card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

The Board of Directors recommends a vote:

for each of the Board of Directors’ nominees for director; and

for ratification of Crowe Chizek and Company LLC as independent auditors.

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their own best judgment to determine how to vote your shares. If the annual meeting is postponed or adjourned, your First Federal Bancshares common stock may be voted by the persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the annual meeting.

If your First Federal Bancshares common stock is held in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted.

How to Revoke Your Proxy

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy you must either advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy, or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in

2

itself constitute revocation of your proxy. The Company’s Corporate Secretary can be reached at the following address:

Millie R. Shields

Corporate Secretary

First Federal Bancshares, Inc.

P.O. Box 256

Colchester, Illinois 62326

Participants in the First Federal Bank ESOP or 401(k) Plan

If you participate in the First Federal Bank Employee Stock Ownership Plan (the “ESOP”) or if you held shares through the First Federal Bank Employee’s Savings & Profit Sharing Plan and Trust (the “401(k) Plan”), you will receive with this proxy statement a voting instruction form for each plan that reflects all shares you may vote under the plans. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary duties, will vote all unallocated shares of Company common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. Under the terms of the 401(k) Plan, a participant is entitled to direct the trustee as to the shares in the First Federal Bancshares, Inc. Stock Fund credited to his or her account. The trustee will vote all shares for which no directions are given or for which instructions were not timely received in the same proportion as shares for which the trustee received voting instructions. The deadline for returning your voting instructions to each plan’s trustee is May 16, 2006.

Corporate Governance

General

First Federal Bancshares periodically reviews its corporate governance policies and procedures to ensure that First Federal Bancshares meets the highest standards of ethical conduct, reports results with accuracy and transparency and maintains full compliance with the laws, rules and regulations that govern First Federal Bancshares’ operations. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for First Federal Bancshares.

Corporate Governance Policy

First Federal Bancshares has adopted a corporate governance policy to govern certain activities, including:

| (1) | the duties and responsibilities of the Board of Directors and each director; |

| (2) | the composition and operation of the Board of Directors; |

| (3) | the establishment and operation of Board committees; |

3

| (4) | convening executive sessions of independent directors; |

| (5) | succession planning; |

| (6) | the Board of Directors’ interaction with management and third parties; and |

| (7) | the evaluation of the performance of the Board of Directors and of the chief executive officer. |

Code of Ethics and Business Conduct

First Federal Bancshares has adopted a Code of Ethics and Business Conduct that is designed to ensure that the Company’s directors, executive officers and employees meet the highest standards of ethical conduct. The Code of Ethics and Business Conduct requires that the Company’s directors, executive officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. Under the terms of the Code of Ethics and Business Conduct, directors, executive officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code.

As a mechanism to encourage compliance with the Code of Ethics and Business Conduct, the Company has established procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Ethics and Business Conduct also prohibits the Company from retaliating against any director, executive officer or employee who reports actual or apparent violations of the Code.

Meetings of the Board of Directors

The Company and First Federal conduct business through meetings and activities of their Boards of Directors and their committees. During the year ended December 31, 2005, the Board of Directors of the Company held 12 regular meetings and three special meetings and the Board of Directors of First Federal held 12 regular meetings and no special meetings. No director attended fewer than 75% of the total meetings of the Boards of Directors and committees on which he served.

4

Committees of the Board of Directors of First Federal Bancshares

The following table identifies our standing committees and their members as of December 31, 2005.

Director | Audit Committee | Compensation Committee | Nomination and Governance Committee | Executive Committee | ||||

B. Bradford Billings | X | X | X | |||||

Gerald L. Prunty | X* | X | X | X | ||||

James J. Stebor | X* | |||||||

Dr. Stephan L. Roth | X | X | ||||||

Richard D. Stephens | X | X | ||||||

Franklin M. Hartzell | X* | X* | X | |||||

Murrel Hollis | X | X | X | |||||

Mark K. Bross | X | X | X | |||||

*Chairman | ||||||||

Number of Meetings in 2005 | 6 | 1 | 1 | 97 |

Audit Committee.The Board of Directors has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee meets periodically with independent auditors and management to review accounting, auditing, internal control structure and financial reporting matters. This committee met six times during the year ended December 31, 2005. Each member of the Audit Committee is independent in accordance with the listing standards of the Nasdaq Stock Market. The Board of Directors has determined that Gerald L. Prunty is an audit committee financial expert under the rules of the Securities and Exchange Commission. The Audit Committee acts under a written charter adopted by the Board of Directors, a copy of which was included in the Company’s 2004 proxy statement. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Proposal 2–Ratification of Independent Auditors–Report of Audit Committee.”

Compensation Committee. The Compensation Committee is responsible for all matters regarding the Company’s and the Bank’s employee compensation and benefit programs. This committee met once during the year ended December 31, 2005. Each member of the Compensation Committee is independent under the listing standards of the Nasdaq Stock Market. The report of the Compensation Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Compensation Committee Report on Executive Compensation.”

Executive Committee. The Executive Committee evaluates issues of major importance to the Company between regularly scheduled Board meetings and reviews and approves loan applications that do not require the approval of the full Board of Directors. Designated members

5

of management sit on this committee for the purpose of reviewing and approving loan applications. In addition, Eldon M. Snowden, a director emeritus of the Company and First Federal, sits on this committee. This committee met 97 times during the year ended December 31, 2005.

Nomination and Governance Committee. The Nomination and Governance Committee takes a leadership role in shaping First Federal Bancshares’ governance policies and practices, including recommending to the Board of Directors the corporate governance policies and guidelines applicable to First Federal Bancshares and monitoring compliance with these policies and guidelines. In addition, the Nomination and Governance Committee is responsible for identifying individuals qualified to become Board members and recommending to the Board the director nominees for election at the next annual meeting of stockholders. This committee also leads the Board in its annual review of the Board’s performance and recommends to the Board director candidates for each committee for appointment by the Board. The Nomination and Governance Committee met once during the year ended December 31, 2005.

Each member of the Nomination and Governance Committee is independent as independence for nominating committee members is defined in the listing standards of the Nasdaq Stock Market. The Nomination and Governance Committee acts under a written charter adopted by the Board of Directors. The charter is not available on the Company’s website, but a copy of the charter was included in the Company’s 2004 proxy statement. The procedures of the Nomination and Governance Committee required to be disclosed by the rules of the Securities and Exchange Commission are included in this proxy statement. See“Nomination and Governance Committee Procedures.”

Attendance at the Annual Meeting

The Board of Directors requires directors to attend the annual meeting of stockholders. All directors attended the 2005 annual meeting of stockholders.

Directors’ Compensation

Cash Retainer and Meeting Fees for All Directors. The following table sets forth the applicable retainers and fees that will be paid to our non-employee directors for their service on our Board of Directors during 2006.

Fees per Board Meeting: | |||

Meetings of the Company | $ | 200 | |

Meetings of the Bank | $ | 800 | |

Annual Retainer for Chairman of the Board of the Company | $ | 5,000 | |

Fee per Audit Committee Meeting | $ | 50 | |

6

Non-Employee Director Compensation.The following table sets forth the total cash paid to our non-employee directors for their service on our Board of Directors during 2005. No director received equity compensation during 2005.

Director | Cash | ||

B. Bradford Billings | $ | 12,200 | |

Mark K. Bross | 7,500 | ||

Franklin M. Hartzell | 11,900 | ||

Murrel Hollis | 12,150 | ||

Gerald L. Prunty | 12,200 | ||

Dr. Stephan L. Roth | 11,900 | ||

Richard D. Stephens | 11,900 | ||

Stock Ownership

The following table provides information as of April 3, 2006 about the persons, other than directors and executive officers, known to First Federal Bancshares to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investing power.

Name and Address | Number of Shares Owned | Percent of Common Stock Outstanding | ||||

First Federal Bank Employee Stock Ownership Plan 109 East Depot Street Colchester, Illinois 62326 | 172,038 | (1) | 13.8 | % | ||

Wellington Management Company, LLP 75 State Street Boston, Massachusetts 02109 | 66,369 | (2) | 5.3 | % | ||

| (1) | As of April 3, 2006, 86,823 shares had been allocated to participants in the ESOP. The trustee of the ESOP is First Bankers Trust Company, N.A. See“General Information about Voting—Participants in the First Federal Bank ESOP” for discussion of the ESOP’s voting procedures. |

| (2) | Based on a Schedule 13G/A filed February 14, 2006. According to this filing, Wellington Management Company, LLP has no voting power over these shares and shares dispositive power over these shares with its advisory clients. |

7

The following table provides information as of April 3, 2006 about the shares of First Federal Bancshares common stock that may be considered to be beneficially owned by each director, each nominee for director and all directors and executive officers of the Company as a group. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting power and sole investment power with respect to the number of shares shown.

Name | Number of Shares Owned | Options Exercisable Within 60 Days | Percent of Common Stock Outstanding(1) | |||||

B. Bradford Billings | 2,000 | (2) | 3,341 | *% | ||||

Mark K. Bross | 1,164 | (3) | — | * | ||||

Franklin M. Hartzell | 24,085 | (4) | 6,870 | 2.48 | ||||

Murrel Hollis | 20,835 | (5) | 6,470 | 2.19 | ||||

Gerald L. Prunty | 23,485 | (6) | 4,970 | 2.28 | ||||

Dr. Stephan L. Roth | 22,671 | (7) | 3,484 | 2.10 | ||||

James J. Stebor | 35,419 | (8) | 33,880 | 5.43 | ||||

Richard D. Stephens | 21,728 | (9) | 6,727 | 2.28 | ||||

Mark A. Tyrpin | 27,564 | (10) | 26,910 | 4.29 | ||||

All directors and executive officers as a group (12 persons) | 223,981 | 126,182 | 25.59 | % |

| * | Does not exceed 1.0% of the Company’s voting securities. |

| (1) | Based on 1,242,264 shares of Company common stock outstanding and entitled to vote as of April 3, 2006, plus the number of shares that may be acquired within 60 days by each individual (or group of individuals) by exercising stock options. |

| (2) | Includes 1,200 shares held by Mr. Billings’ spouse. |

| (3) | Includes 300 shares held by Mr. Bross as custodian for his children. |

| (4) | Includes 2,500 shares held by Mr. Hartzell’s spouse. Also includes 897 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Mr. Hartzell has voting power but not investment power. |

| (5) | Includes 3,750 shares held by Mr. Hollis’ spouse. Also includes 897 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Mr. Hollis has voting power but not investment power. |

| (6) | Includes 5,550 shares held in trust by Mr. Prunty’s spouse. Also includes 897 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Mr. Prunty has voting power but not investment power. |

| (7) | Includes 4,000 shares held in trust by Dr. Roth’s spouse. Also includes 897 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Dr. Roth has voting power but not investment power. |

| (8) | Includes 10,356 shares allocated to Mr. Stebor’s account under the ESOP as to which he has voting but not dispositive power. Also includes 3,588 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Mr. Stebor has voting power but not investment power. |

| (9) | Includes 897 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Mr. Stephens has voting power but not investment power. |

8

| (10) | Includes 5,594 shares allocated to Mr. Tyrpin’s account under the ESOP as to which he has voting but not dispositive power. Includes 1,794 unvested shares awarded under the Company’s 2001 Stock-Based Incentive Plan for which Mr. Tyrpin has voting power but not investment power. Also includes 3,000 shares held in trust by Mr. Tyrpin’s mother. |

Proposal 1 — Election of Directors

The Company’s Board of Directors consists of eight members, all of whom are independent under the listing standards of the Nasdaq Stock Market, except James J. Stebor, who is an employee of the Company. The Board is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. The Board of Directors’ nominees for election this year, to serve for a three-year term or until their respective successors have been elected and qualified, are B. Bradford Billings, Gerald L. Prunty and James J. Stebor. All three are currently directors of First Federal Bancshares and First Federal Bank.

Unless you indicate on the proxy card that your shares should not be voted for certain nominees, the Board of Directors intends that the proxies solicited by it will be voted for the election of all of the Board’s nominees. If any nominee is unable to serve, the persons named in the proxy card would vote your shares to approve the election of any substitute proposed by the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote “FOR” the election of Messrs. Billings, Prunty and Stebor.

Information regarding the Board of Directors’ nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his current occupation for the last five years. The age indicated for each individual is as of December 31, 2005. The indicated period of service as a director includes the period of service as a director of First Federal.

Board Nominees for Election of Directors

B. Bradford Billingshas served as the President and Chief Executive Officer of Blessing Corporate Services, a healthcare systems corporation in Quincy, Illinois, since January 2001. Prior to January 2001, Mr. Billings had served as the Senior Vice President and Chief Operating Officer of Blessing Hospital in Quincy, Illinois since 1981. Age 57. Director since 2002.

Gerald L. Prunty served as President and Chief Executive Officer of First Federal Bank from 1969 until his retirement in 1994. Mr. Prunty serves as Chairman of the Board of Directors of First Federal. Age 77. Director since 1967.

James J. Stebor has served as President and Chief Executive Officer of the Company since April 2000 and as President of First Federal since 1994. Mr. Stebor has been employed by First Federal since 1977. Age 56. Director since 1990.

9

Directors Continuing in Office

The following directors have terms ending in 2007:

Dr. Stephan L. Rothis a retired family physician. Age 80. Director since 1976.

Richard D. Stephens is a retired attorney serving as Of Counsel to the law firm of Flack, McRaven & Stephens in Macomb, Illinois. Age 78. Director since 1966.

The following directors have terms ending in 2008:

Franklin M. Hartzell is a partner in the law firm of Hartzell, Glidden, Tucker & Hartzell in Carthage, Illinois. Mr. Hartzell serves as Chairman of the Board of Directors of First Federal Bancshares. Mr. Hartzell also served as Director and Secretary of Pioneer Lumber Company, located in Dallas City, Illinois. In 2004 Pioneer Lumber Company filed a voluntary petition for bankruptcy under Chapter 7 of the United States Bankruptcy Code with the United States Bankruptcy Court. Age 82. Director since 1965.

Murrel Hollis is a retired partner and the former president of Martin-Hollis Funeral Home in Bushnell, Illinois. Mr. Hollis is also the owner and operator of the Hollis Farm. Age 64. Director since 1992.

Mark K. Bross, a certified public accountant, is the Chief Financial Officer of Chester Bross Construction Company located in Hannibal, Missouri. Mr. Bross was a director of PFSB Bancorp, Inc. prior to its merger with and into the Company in 2002 and served on the Advisory Board of the Company from November 2002 until December 2003. Age 40. Director since 2005.

Proposal 2 — Ratification of Independent Auditors

The Audit Committee of the Board of Directors has appointed Crowe Chizek and Company LLC to be the Company’s independent auditors for the 2006 fiscal year, subject to ratification by stockholders. A representative of Crowe Chizek and Company LLC is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent auditors is not approved by a majority of the votes cast by stockholders at the annual meeting, the Audit Committee will consider other independent auditors.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of independent auditors.

10

Audit Fees

The following table sets forth the fees billed to the Company for the fiscal years ending December 31, 2005 and 2004 by Crowe Chizek and Company LLC:

| 2005 | 2004 | |||||

Audit fees | $ | 80,500 | $ | 57,250 | ||

Audit-related fees(1) | 7,500 | 8,750 | ||||

Tax fees(2) | 15,050 | 19,950 | ||||

All other fees(3) | 905 | — | ||||

| (1) | Includes fees for assistance with securities filings other than periodic reports, and other services. |

| (2) | Consists of tax filing and tax related compliance and other advisory services. |

| (3) | Includes assistance with accounting related matters. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor

The Audit Committee is responsible for appointing, setting compensation, and overseeing the work of the independent auditor. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent auditor to ensure that the external auditor does not provide any non-audit services to the Company that are prohibited by law or regulation.

In addition, the Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent auditor. Requests for services by the independent auditor for compliance with the auditor services policy must be specific as to the particular services to be provided. The request may be made with respect to either specific services or a type of service for predictable or recurring services.

During the year ended December 31, 2005, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

Report of the Audit Committee

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The independent auditors are responsible for performing an independent audit of the

11

Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees) and has discussed with the independent auditors the auditors’ independence from the Company and its management. In concluding that the auditors are independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with its independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent auditors who, in their report, express an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent auditors are in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors also have approved, subject to stockholder ratification, the selection of the Company’s independent auditors.

12

Audit Committee of the Board of Directors

of First Federal Bancshares, Inc.

Gerald L. Prunty, Chairman

B. Bradford Billings

Mark K. Bross

Murrel Hollis

Executive Compensation

Summary Compensation Table

The following information is furnished for James J. Stebor, President and Chief Executive Officer, and Mark A. Tyrpin, Senior Vice President. No other executive officers of First Federal Bancshares or First Federal received a salary and bonus of $100,000 or more during the year ended December 31, 2005.

| Annual Compensation(1) | Long-Term Compensation Awards | |||||||||||||||

Name and Position | Year | Salary(2) | Bonus | Restricted Stock Awards(3) | Securities Underlying Options | All Other Compensation(4) | ||||||||||

James J. Stebor | 2005 | $ | 189,900 | $ | — | — | — | $ | 30,830 | |||||||

President and Chief Executive Officer | 2004 | 180,800 | 1,000 | (5) | — | — | 37,121 | |||||||||

| 2003 | 162,025 | 1,500 | — | — | 76,349 | |||||||||||

Mark A. Tyrpin | 2005 | $ | 102,000 | $ | — | — | — | $ | 16,964 | |||||||

Senior Vice President | 2004 | 96,000 | 1,000 | — | — | 20,219 | ||||||||||

| 2003 | 89,525 | 1,500 | — | — | 45,901 | |||||||||||

| (1) | Does not include the aggregate amount of perquisites and other personal benefits, which was less than $50,000 or 10% of the total annual salary and bonus reported. |

| (2) | For Mr. Stebor, includes board of directors and board committee fees of $11,900 for 2005. |

| (3) | Mr. Stebor and Mr. Tyrpin were granted 17,940 and 8,970, respectively, restricted stock awards in 2001. The restricted stock award vests in five equal annual installments commencing on October 10, 2002. As of December 31, 2005, the market value of the unvested shares of restricted stock held by Mr. Stebor was $66,378, while the market value of the unvested shares of restricted stock held by Mr. Tyrpin was $33,189. Dividends, if any, are paid on the restricted stock. |

| (4) | For 2005, consists of the value of stock allocation under the employee stock ownership plan. |

| (5) | Mr. Stebor’s bonus for 2004 has been restated. |

13

Option Value at Fiscal Year-End

The following table provides for Mr. Stebor and Mr. Tyrpin information regarding unexercised stock options as of December 31, 2005. Mr. Stebor and Mr. Tyrpin did not exercise any stock options during the year ended December 31, 2005.

Number of Securities at Fiscal Year-End | Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End(1) | |||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

James J. Stebor | 33,880 | 8,970 | $ | 115,192 | $ | 30,498 | ||||

Mark A. Tyrpin | 26,910 | 6,727 | 91,494 | 22,872 | ||||||

| (1) | Value of unexercised in-the-money stock options equals the market value of shares covered by in-the-money options on December 31, 2005 ($18.50 per share) less the option exercise price ($15.10 per share). Options are in-the-money if the market value of shares covered by the options is greater than the exercise price. |

Employment Agreements

First Federal and First Federal Bancshares each have entered into employment agreements with Mr. Stebor. The employment agreements provide for a three-year term. The term of the First Federal Bancshares employment agreement extends on a daily basis until written notice of non-renewal is given by the Board of Directors or Mr. Stebor. The term of the First Federal employment agreement is renewable on an annual basis. The employment agreements provide for a base salary of $110,000, subject to increase. In addition to the base salary, the employment agreements provide for, among other things, participation in stock and employee benefits plans and fringe benefits applicable to executive personnel. The employment agreements provide for termination by First Federal or First Federal Bancshares for cause, as defined in the employment agreements, at any time. If First Federal or First Federal Bancshares chooses to terminate Mr. Stebor’s employment for reasons other than for cause, or if Mr. Stebor resigns from First Federal or First Federal Bancshares after specified circumstances that would constitute constructive termination, Mr. Stebor or, if Mr. Stebor dies, his beneficiary, would be entitled to receive an amount equal to the base salary payments that would have been paid to Mr. Stebor for the remaining term of the employment agreement and the contributions that would have been made on Mr. Stebor’s behalf to any employee benefit plans of First Federal and First Federal Bancshares during the remaining term of the employment agreement. First Federal and First Federal Bancshares also would continue to pay for Mr. Stebor’s health and welfare benefit plan coverage for the remaining term of the employment agreement. Upon termination of Mr. Stebor’s employment for reasons other than cause or in connection with a change in control, Mr. Stebor must adhere to a one-year non-competition agreement.

Under the employment agreements, if, following a change in control of First Federal or First Federal Bancshares, Mr. Stebor’s employment is involuntarily terminated or if Mr. Stebor voluntarily terminates his employment in connection with circumstances specified in the agreement, then Mr. Stebor or, if Mr. Stebor dies, his beneficiary, would be entitled to a severance payment equal to the greater of the payments and benefits that would have been paid for the remaining term of the agreement or three times the average of Mr. Stebor’s five preceding taxable years’ annual compensation. First Federal and First Federal Bancshares also would continue Mr. Stebor’s health and welfare benefits coverage for thirty-six months. Even

14

though both employment agreements provide for a severance payment if a change in control occurs, Mr. Stebor would not receive duplicate payments or benefits under the agreements. Under applicable law, an excise tax would be triggered by change in control-related payments that equal or exceed three times Mr. Stebor’s average annual taxable compensation over the five years preceding the change in control. The excise tax would equal 20% of the amount of the payment in excess of one times Mr. Stebor’s average taxable compensation over the preceding five-year period.In the event that payments related to a change in control of First Federal Bancshares are subject to this excise tax, First Federal Bancshares will provide Mr. Stebor with an additional amount sufficient to enable Mr. Stebor to retain the full value of his change in control benefits as if the excise tax had not applied.

First Federal Bancshares guarantees the payments to Mr. Stebor under First Federal’s employment agreement if they are not paid by First Federal. First Federal Bancshares also will make all payments due under the First Federal Bancshares’ employment agreement. First Federal or First Federal Bancshares will pay or reimburse all reasonable costs and legal fees incurred by Mr. Stebor under any dispute or question of interpretation relating to the employment agreements, if Mr. Stebor is successful on the merits in a legal judgment, arbitration or settlement. The employment agreements also provide that First Federal and First Federal Bancshares will indemnify Mr. Stebor to the fullest extent legally allowable for all expenses and liabilities he may incur in connection with any suit or proceeding in which he may be involved by reason of his having been a director or officer of First Federal Bancshares or First Federal.

Change in Control Agreement

First Federal Bancshares has entered into a change in control agreement with Mr. Tyrpin. The change in control agreement has a term of two years, renewable annually. The change in control agreement provides that if involuntary terminated, other than for cause, or voluntary terminated (upon the occurrence of circumstances specified in the agreement) following a change in control of First Federal and First Federal Bancshares, Mr. Tyrpin would be entitled to receive a severance payment equal to two times his average annual compensation for the five most recent taxable years. First Federal would also continue to pay for Mr. Tyrpin’s health and welfare benefits coverage for 36 months following termination.

Supplemental Executive Retirement Plan

First Federal maintains a supplemental executive retirement plan to provide for supplemental retirement benefits with respect to the employee stock ownership plan. The plan provides benefits to eligible individuals (those designated by the Board of Directors of First Federal or its affiliates) that cannot be provided under the employee stock ownership plan as a result of the limitations imposed by the Internal Revenue Code, but that would have been provided under the employee stock ownership plan but for such limitations. In addition to providing for benefits lost under tax-qualified plans as a result of limitations imposed by the Internal Revenue Code, the plan also provides supplemental benefits to designated individuals upon a change of control before the complete scheduled repayment of the employee stock ownership plan loan. Generally, upon such an event, the supplemental executive retirement plan provides the individual with a benefit equal to what the individual would have received under the employee stock ownership plan and the supplemental plan had he remained employed throughout the term of the employee stock ownership plan loan less the benefits actually provided under the plans on behalf of the individual. An individual’s benefits under the

15

supplemental executive retirement plan generally become payable upon the change in control of First Federal or First Federal Bancshares. The Board of Directors has designated Mr. Stebor as a participant in the supplemental executive retirement plan.

Retirement Plan

First Federal is a participant in the Financial Institutions Retirement Fund, a multi-employer, non-contributory defined benefit retirement plan. The following table indicates the annual retirement benefits that would be payable upon retirement at age 65 to a participant electing to receive his or her retirement benefit in the standard form of benefit, assuming various specified levels of compensation and various specified years of credited service. Under the Internal Revenue Code, maximum annual benefits under the pension plan are presently limited to $170,000 per year and annual compensation for calculation purposes is limited to $210,000 per year for the 2005 calendar year.

16

| Highest Five Year Average Compensation | Years of Service | |||||||||||||||

| 15 | 20 | 25 | 30 | 35+ | ||||||||||||

| $ | 75,000 | $ | 22,500 | $ | 30,000 | $ | 37,500 | $ | 45,000 | $ | 52,500 | |||||

| 100,000 | 30,000 | 40,000 | 50,000 | 60,000 | 70,000 | |||||||||||

| 125,000 | 37,500 | 50,000 | 62,500 | 75,000 | 87,500 | |||||||||||

| 150,000 | 45,000 | 60,000 | 75,000 | 90,000 | 105,000 | |||||||||||

| 175,000 | 52,500 | 70,000 | 87,500 | 105,000 | 122,500 | |||||||||||

| 200,000 | 60,000 | 80,000 | 100,000 | 120,000 | 140,000 | |||||||||||

| 250,000 | 75,000 | 100,000 | 125,000 | 150,000 | 175,000 | |||||||||||

| 300,000 | 90,000 | 120,000 | 150,000 | 180,000 | 210,000 | |||||||||||

| 350,000 | 105,000 | 140,000 | 175,000 | 210,000 | 245,000 | |||||||||||

The retirement plan provides for monthly payments to, or on behalf of, each covered employee. All full-time employees are eligible to participate in the retirement plan after completion of one year of service to First Federal and the attainment of age 21. To obtain one year of service, an employee must complete at least 1,000 hours of service in 12 consecutive months. Benefits are based upon benefit service and salary excluding bonuses, fees, etc. Employees become vested following five years of service. As of December 31, 2005, Mr. Stebor and Mr. Tyrpin had 27 years and 5 years of credited service, respectively, under the retirement plan.

The normal retirement age is 65 and the early retirement age is before age 65, but after age 45. Normal retirement benefits are equal to 2% multiplied by the years of service to First Federal and by the employee’s average base salary for the five highest consecutive years preceding retirement. If an employee elects early retirement, but defers the receipt of benefits until age 65, the formula for computation of early retirement benefits is the same as if the employee had retired at the normal retirement age. However, if the employee elects early retirement benefits payable under the retirement plan, the benefits are equal to the benefits payable assuming retirement at age 65 reduced by applying an early retirement factor based on age and vesting service when payments begin. Payment may also be deferred to any time up to age 70, in which case the retirement allowance payable at age 65 will be increased by 0.8% for each month of deferment after age 65. The maximum increase allowable is 48%. Under the retirement plan, First Federal makes annual contributions computed on an actuarial basis to fund the benefits.

Upon retirement, the regular form of benefit under the retirement plan is an annuity payable in equal monthly installments for the life of the employee. Optional annuity or lump sum benefit forms may also be elected by the employee. Benefits under the retirement plan are not integrated with social security.

17

Compensation Committee Report on Executive Compensation

The following is a report of the Compensation Committee of the Board of Directors regarding executive compensation. The Compensation Committee’s membership and duties are described on page 5.

Compensation Policies

The Compensation Committee bases its executive compensation policy on the same principles that guide the Company in establishing all of its compensation programs. The Company designs programs to attract, retain and motivate highly talented individuals at all levels of the organization while balancing the interests of stockholders. The Company emphasizes using a competitive base salary and program of retirement benefits as a means of attracting and retaining employees, rather than performance-based cash compensation. Following the Company’s initial public offering in 2000, the Company introduced equity-based compensation as a means of promoting the creation of long-term value for stockholders.

Components of Executive Compensation

Base Salary. Salary levels for all employees, including executive officers, are set so as to reflect the duties and levels of responsibilities inherent in the position and to reflect competitive conditions in the banking business in the Company’s market area. Comparative salaries paid by other financial institutions are considered in establishing the salary for a given position. The Compensation Committee utilizes compensation surveys compiled by America’s Community Bankers and Crowe Chizek and Company LLC. Base salaries for all employees, including the executive officers, are reviewed annually by the Compensation Committee, which takes into account the competitive level of pay as reflected in the surveys consulted. In setting base salaries, the Compensation Committee also considers a number of factors relating to the particular executive, including individual performance, job responsibilities, level of experience, ability and knowledge of the position. These factors are considered subjectively in the aggregate and none of the factors is accorded a specific weight.

Long-Term Incentive Compensation. Under the Company’s 2001 Stock-Based Incentive Plan, the Compensation Committee is authorized, in its discretion, to grant stock options and restricted stock awards in such proportions and upon such terms and conditions as the Compensation Committee may determine. All stock options granted have an exercise price equal to the fair market value of the Company’s common stock at the time of grant and are exercisable within a 10-year period. In order to assure the retention of high level executives and to tie the compensation of those executives to the creation of long term value for stockholders, the Compensation Committee requires that stock options granted under the 2001 Stock-Based Incentive Plan vest in equal portions over a five-year period.

The awards of restricted stock to executive officers and other key employees represent shares of First Federal Bancshares common stock that the recipient cannot sell or otherwise transfer until the applicable restriction period lapses. Restricted stock awards also are intended to increase the ownership of executives in the Company, thereby further integrating the compensation of the executive with the creation of long term value for stockholders. The Compensation Committee has provided that restricted stock awards granted under the 2001 Stock-Based Incentive Plan vest in equal portions over five years.

In 2001, the Compensation Committee awarded a substantial number of the options and shares of restricted stock available under the 2001 Stock-Based Incentive Plan. In 2004, the Compensation Committee awarded the remaining options and shares of restricted stock available under the 2001 Stock-Based Incentive Plan.

18

James J. Stebor - Chief Executive Officer Compensation. The Compensation Committee fixed the 2005 base salary for the Company’s Chief Executive Officer, James J. Stebor, in a manner consistent with the base salary guidelines applied for executive officers of the Company as described above. In general, the Compensation Committee considers the Company’s financial performance, peer group financial performance and compensation survey data when making decisions regarding the Chief Executive Officer’s compensation. In recognition of Mr. Stebor’s leadership and contribution to the success of the Company, the Compensation Committee increased Mr. Stebor’s base salary for 2005 to $178,000 from $170,000 in 2004. Under the 2001 Stock-Based Incentive Plan, Mr. Stebor became vested in 8,970 stock options and 3,588 restricted shares in 2005 under grants made to him in 2001.

The Compensation Committee of the Board of Directors

of First Federal Bancshares, Inc.

Franklin M. Hartzell, Chairman

B. Bradford Billings

Mark K. Bross

Murrell Hollis

Gerald L. Prunty

Dr. Stephan L. Roth

Richard D. Stephens

Compensation Committee Interlocks and Insider Participation

Mr. Prunty, who serves on the Compensation Committee, is the former President and Chief Executive Officer of First Federal.

19

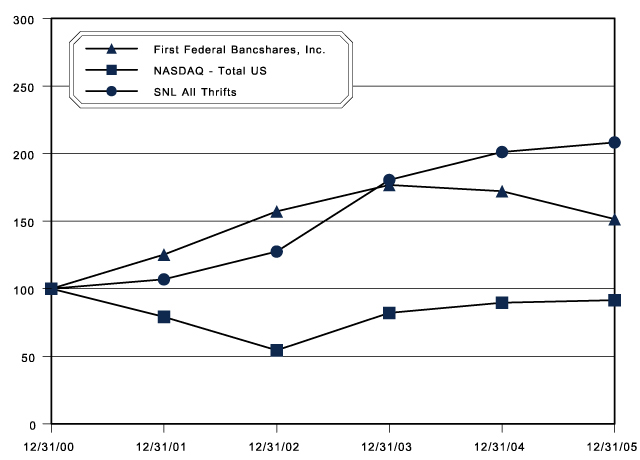

Stock Performance Graph

The following graph compares the cumulative total stockholder return on the Company’s common stock with the cumulative total return on the Nasdaq Index (U.S. Companies) and with the SNL All Thrifts Index. Total return assumes the reinvestment of all dividends. The graph assumes $100 was invested at the close of business on December 31, 2000.

| Period Ended | ||||||||||||||||||

Index | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 | ||||||||||||

First Federal Bancshares, Inc. | $ | 100.00 | $ | 125.23 | $ | 157.23 | $ | 176.77 | $ | 172.11 | $ | 151.44 | ||||||

NASDAQ - Total US | 100.00 | 79.18 | 54.44 | 82.09 | 89.59 | 91.54 | ||||||||||||

SNL Thrift Index | 100.00 | 106.88 | 127.50 | 180.50 | 201.12 | 208.21 | ||||||||||||

20

Other Information Relating to Directors and Executive Officers

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Executive officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on the Company’s review of copies of the reports it has received and written representations provided to it from the individuals required to file the reports, the Company believes that each of its executive officers and directors has complied with applicable reporting requirements for transactions in First Federal Bancshares common stock during the year ended December 31, 2005, except that Ms. Higgins, Ms. Pendell and Ms. Shields each failed to report one transaction on a Form 4 in a timely manner, Mr. Bross failed to timely file Form 3 and Mr. Tyrpin failed to timely file six transactions on two Forms 4 in a timely manner.

Transactions with Management

The Sarbanes-Oxley Act of 2002 generally prohibits loans by the Company to its executive officers and directors. However, the Sarbanes-Oxley Act contains a specific exemption from such prohibition for loans by First Federal to its executive officers and directors in compliance with federal banking regulations. Federal regulations require that all loans or extensions of credit to executive officers and directors must generally be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, unless the loan or extension of credit is made under a benefit program generally available to all other employees and does not give preference to any insider over any other employee, and must not involve more than the normal risk of repayment or present other unfavorable features. First Federal currently makes new loans and extensions of credit to First Federal’s executive officers, directors and employees at different rates than those offered to the general public; however, First Federal does not give preference to any director or officer over any other employee, and such loans do not involve more than the normal risk of repayment or present other unfavorable features. In addition, loans made to a director or executive officer in an amount that, when aggregated with the amount of all other loans to the person and his or her related interests, are in excess of the greater of $25,000 or 5% of First Federal’s capital and surplus, up to a maximum of $500,000, must be approved in advance by a majority of the disinterested members of the Board of Directors.

Nomination and Governance Committee Procedures

General

It is the policy of the Nomination and Governance Committee of the Board of Directors of Company to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Nomination and Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nomination and Governance Committee does not perceive a

21

need to increase the size of the Board of Directors. In order to avoid the unnecessary use of the Nomination and Governance Committee’s resources, the Nomination and Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders

To submit a recommendation of a director candidate to the Nomination and Governance Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Nomination and Governance Committee, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| 4. | As to the stockholder making the recommendation, the name and address, as they appear on the Company’s books, of such stockholder; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Nomination and Governance Committee at least 120 calendar days prior to the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Minimum Qualifications

The Nomination and Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. First a candidate must meet the eligibility requirements set forth in the Company’s bylaws, which include a residency requirement, an age limitation and a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

The Nomination and Governance Committee will consider the following criteria in selecting nominees: financial, regulatory and business experience; familiarity with and

22

participation in the local community; integrity, honesty and reputation; dedication to the Company and its stockholders; independence; and any other factors the Nomination and Governance Committee deems relevant, including age, diversity, size of the Board of Directors and regulatory disclosure obligations.

In addition, prior to nominating an existing director for re-election to the Board of Directors, the Nomination and Governance Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Process for Identifying and Evaluating Nominees

The process that the Nomination and Governance Committee follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors is as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Nomination and Governance Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as their knowledge of members of the communities served by First Federal. The Nomination and Governance Committee also will consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Nomination and Governance Committee has not previously used an independent search firm to identify nominees.

Evaluation. In evaluating potential nominees, the Nomination and Governance Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, the Nomination and Governance Committee will conduct a check of the individual’s background and interview the candidate.

Submission of Business Proposals and Stockholder Nominations

The Company must receive proposals that stockholders seek to include in the proxy statement for the Company’s next annual meeting no later than December 19, 2006. If next year’s annual meeting is held on a date more than 30 calendar days from May 23, 2007, a stockholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation for such annual meeting. Any stockholder proposals will be subject to the requirements of the proxy rules adopted by the Securities and Exchange Commission.

The Company’s Bylaws provides that in order for a stockholder to make nominations for the election of directors or proposals for business to be brought before the annual meeting, a stockholder must deliver notice of such nominations and/or proposals to the Secretary not less than 90 nor more than 120 days prior to the date of the annual meeting; provided that if less than 100 days’ notice or prior public disclosure of the date of the annual meeting is given to stockholders, such notice must be received not later than the close of the 10th day following the day on which notice of the date of the annual meeting was mailed to stockholders or prior public disclosure of the meeting date was made. A copy of the Bylaws may be obtained from the Company.

23

Stockholder Communications

The Company encourages stockholder communications to the Board of Directors and/or individual directors. Stockholders who wish to communicate with the Board of Directors or an individual director should send their communications to the care of Cathy Pendell, Treasurer, at P.O. Box 256, Colchester, Illinois 62326. Communications regarding financial or accounting policies should be sent to the attention of the Chairman of the Audit Committee. All other communications should be sent to the attention of the Chairman of the Nomination and Governance Committee.

Miscellaneous

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of First Federal Bancshares common stock. In addition to soliciting proxies by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone without receiving additional compensation.

The Company’s Annual Report to Stockholders has been mailed to persons who were stockholders as of the close of business on April 3, 2006. Any stockholder who has not received a copy of the Annual Report may obtain a copy by writing to the Secretary of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated in this proxy statement by reference.

A copy of the Company’s Annual Report for Form 10-K, without exhibits, for the year ended December 31, 2005, as filed with the Securities and Exchange Commission, will be furnished without charge to persons who were stockholders as of the close of business on April 3, 2006 upon written request to Cathy D. Pendell, Treasurer, First Federal Bancshares, Inc., P.O. Box 256, Colchester, Illinois 62326.

If you and others who share your address own your shares in street name, your broker or other holder of record may be sending only one annual report and proxy statement to your address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder residing at such an address wishes to receive a separate annual report or proxy statement in the future, he or she should contact the broker or other holder of record. If you own your shares in street name and are receiving multiple copies of our annual report and proxy statement, you can request householding by contacting your broker or other holder of record.

24

Whether or not you plan to attend the annual meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy card in the enclosed envelope.

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| Millie R. Shields |

| Corporate Secretary |

Colchester, Illinois

April 18, 2006

25

Proxy - FIRST FEDERAL BANCSHARES, INC.

Annual Meeting of Stockholders

Proxy Solicited by Board of Directors for Annual Meeting - May 23, 2006, 2:00 p.m., local time

The undersigned hereby appoints Franklin M. Hartzell, Murrel Hollis and Richard D. Stephens, and each of them, with full power of substitution, to act as proxy for the undersigned, and to vote all shares of common stock of First Federal Bancshares, Inc. that the undersigned is entitled to vote at the annual meeting of stockholders, to be held on May 23, 2006, at 2:00 p.m., local time, at the Holiday Inn located at 201 S. Third Street, Quincy, Illinois and at any and all adjournments thereof, with all of the powers the undersigned would possess if personally present at such meeting.

This proxy is revocable and will be voted as directed. If no instructions are specified, this proxy will be voted “FOR” both of the proposals listed. If any other business is presented at the Annual Meeting this proxy will be voted by the proxies in their best judgment. At the present time, the Board of Directors knows of no other business to be presented at the Annual Meeting. This proxy also confers discretionary authority to vote with respect to the election of any person as Director where the nominees are unable to serve or for good cause will not serve and with respect to any other business that may properly come before the Annual Meeting or any adjournment thereof.

PLEASE COMPLETE, DATE, SIGN AND PROMPTLY MAIL THIS PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

(Continue and to be voted on reverse side.)

FIRST FEDERAL BANCSHARES

¨ Mark this box with an X if you have made

changes to your name or address details above.

Annual Meeting Proxy Card

| A. | Election of Directors |

| 1. | The Board of Directors recommends a vote FOR all nominees. |

| FOR | WITHHOLD | |||||

| 01 - B. Bradford Billings | ¨ | ¨ | ||||

| 02 - Gerald L. Prunty | ¨ | ¨ | ||||

| 03 - James J. Stebor | ¨ | ¨ | ||||

| B. | Issue |

The Board of Directors recommends a vote FOR proposal 2.

| FOR | AGAINST | ABSTAIN | ||||||

| 2. | The ratification of the appointment of Crowe Chizek and Company LLC as independent auditors of First Federal Bancshares, Inc. for the fiscal year ending December 31, 2006. | ¨ | ¨ | ¨ |

| C. | Authorized Signatures – Sign Here – This section must be completed for your instructions to be executed. |

Note: Please sign exactly as your name appears on this card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder may sign but only one signature is required.

| Signature 1 – Please keep signature within the box | Signature 2 – Please keep signature within the box | Date (mm/dd/yyyy) | ||||||

First Federal Bank Letterhead

Dear ESOP Participant:

On behalf of the Board of Directors, I am forwarding to you the attachedyellow vote authorization form for the purpose of conveying your voting instructions to First Bankers Trust Services, Inc., the Trustee for the First Federal Bank Employee Stock Ownership Plan (the “ESOP”), on the proposals presented at the Annual Meeting of Stockholders of First Federal Bancshares, Inc. (the “Company”) on May 23, 2006. Also enclosed is a Notice and Proxy Statement for the Company’s Annual Meeting of Stockholders and a First Federal Bancshares, Inc. Annual Report to Stockholders.

As a participant in the ESOP you are entitled to vote all shares of Company common stock allocated to your account as of April 3, 2006, the record date for the 2006 Annual Meeting of Shareholders. As of April 3, 2006, the ESOP held 172,038 shares of Company common stock, of which 86,823 shares had been allocated to participants’ accounts. These allocated shares of Company common stock will be voted as directed by the ESOP participants, so long as timely instructions from the participants are received by the ESOP Trustee. If you do not direct the ESOP Trustee how to vote your shares on or before May 16, 2006, the ESOP Trustee will vote your shares in a manner calculated to most accurately reflect the instructions it received from other ESOP participants.

At this time, in order to direct the voting of the shares of Company common stock allocated to your ESOP account, please complete and sign the attachedyellow vote authorization form and return it in the enclosed postage-paid envelope. The ESOP Trustee must receive your instructions by May 16, 2006. Your vote will not be revealed, directly or indirectly, to any employee or director of the Company or First Federal Bank.

| Sincerely, |

|

| James J. Stebor |

| President and Chief Executive Officer |

Name:

Shares:

VOTE AUTHORIZATION FORM

I understand that First Bankers Trust Services, Inc., the ESOP Trustee, is the holder of record and custodian of all shares of First Federal Bancshares, Inc. (the “Company”) common stock allocated to me under the First Federal Bank Employee Stock Ownership Plan. I understand that my voting instructions are solicited on behalf of the Company’s Board of Directors for the Annual Meeting of Stockholders to be held on May 23, 2006.

Accordingly, you are to vote my shares as follows:

| A. | Election of Directors |

| 1. | The Board of Directors recommends a vote FOR all nominees. |

| FOR | WITHHOLD | |||||

| 01 - B. Bradford Billings | ¨ | ¨ | ||||

| 02 - Gerald L. Prunty | ¨ | ¨ | ||||

| 03 - James J. Stebor | ¨ | ¨ | ||||

| B. | Issue |

The Board of Directors recommends a vote FOR proposal 2.

| FOR | AGAINST | ABSTAIN | ||||||

| 2. | The ratification of the appointment of Crowe Chizek and Company LLC as independent auditors of First Federal Bancshares, Inc. for the fiscal year ending December 31, 2006. | ¨ | ¨ | ¨ |

The ESOP Trustee is hereby authorized to vote all shares allocated to me in its trust capacity as indicated above.

Date |

Signature |

Please date, sign and return this form in the enclosed postage-paid envelope no later than May 16, 2006.

[First Federal Bank letterhead]

Dear First Federal Bank 401(k) Plan Participant:

On behalf of the Board of Directors of First Federal Bancshares, Inc. (the “Company”), I am forwarding to you the attached blue vote authorization form for the purpose of conveying your voting instructions to the Bank of New York, the trustee for the First Federal Bancshares, Inc. Stock Fund (the “Employer Stock Fund”) in the First Federal Bank Employees’ Savings and Profit Sharing Plan & Trust (the “401(k) Plan”), on the proposals presented at the Annual Meeting of Stockholders of the Company on May 23, 2006. Also enclosed is a Notice and Proxy Statement for the Company’s Annual Meeting of Stockholders and the First Federal Bancshares, Inc. Annual Report to Stockholders.

As a 401(k) Plan participant investing in the Employer Stock Fund, you are entitled to direct the Employer Stock Fund trustee as to the voting of shares of Company common stock credited to your account as of April 3, 2006, the record date for the 2006 Annual Meeting of Stockholders.

At this time, in order to direct the voting of your shares of Company common stock held in the Employer Stock Fund, you must complete and sign the enclosedblue vote authorization form and return it in the accompanying postage-paid envelope on or before May 16, 2006. Your vote will not be revealed, directly or indirectly, to any employee or director of the Company or First Federal Bank.

| Sincerely, |

|

| James J. Stebor |

| President and Chief Executive Officer |

VOTE AUTHORIZATION FORM

I understand that the Bank of New York (the “Employer Stock Fund Trustee”), is the holder of record and custodian of all shares of First Federal Bancshares, Inc. (the “Company”) common stock credited to my account under the First Federal Bank Employees’ Savings and Profit Sharing Plan & Trust (the “401(k) Plan”). Further, I understand that my voting instructions are solicited on behalf of the Company’s board of directors for the Annual Meeting of Stockholders to be held on May 23, 2006.

The Employer Stock Fund Trustee is hereby authorized to vote all shares credited to me under the 401(k) Plan in its capacity as follows:

| A. | Election of Directors |

| 1. | The Board of Directors recommends a vote FOR all nominees. |

| FOR | WITHHOLD | |||||

| 01 - B. Bradford Billings | ¨ | ¨ | ||||

| 02 - Gerald L. Prunty | ¨ | ¨ | ||||

| 03 - James J. Stebor | ¨ | ¨ | ||||

| B. | Issue |

The Board of Directors recommends a vote FOR proposal 2.

| FOR | AGAINST | ABSTAIN | ||||||

| 2. | The ratification of the appointment of Crowe Chizek and Company LLC as independent auditors of First Federal Bancshares, Inc. for the fiscal year ending December 31, 2006. | ¨ | ¨ | ¨ |

The Employer Stock Fund Trustee is hereby authorized to vote all shares credited to my 401(k) Plan account in its trust capacity as indicated above.

Date |

Signature |

Please date, sign and return this form in the enclosed envelope no later than May 16, 2006.