UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark

One)

ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the fiscal year ended December 31, 2005 |

|

Or |

|

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-31141

Discovery Partners International, Inc.

(Exact name of registrant as specified in its charter)

Delaware State or other jurisdiction of

incorporation or organization | | 33-0655706 (I.R.S. Employer Identification No.) |

| | |

9640 Towne Centre Drive, San Diego, California (Address of principal executive offices) | | 92121 (Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (858) 455-8600

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405of the Securities Act.

o Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o |

Indicate by check mark where the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes ý No

The aggregate market value of the Common Stock of the registrant (the “Common Stock”) held by non-affiliates of the Registrant, based on the last sale price of the Common Stock on June 30, 2005 (the last business day of the registrants most recently completed second fiscal quarter) of $2.86 per share as reported by the Nasdaq National Market, was approximately $75,300,000. Shares of Common Stock held by each officer, director and holder of 10% or more of the outstanding Common Stock, if any, have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purposes. As of March 1, 2006 there were 26,436,931 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission by May 1, 2006 are incorporated by reference into Part III of this Annual Report on Form 10-K.

DISCOVERY PARTNERS INTERNATIONAL, INC.

FORM 10-K

For the Year Ended December 31, 2005

TABLE OF CONTENTS

2

PART I

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that involve a high degree of risk and uncertainty. Such statements include, but are not limited to, statements containing the words “believes,” “anticipates,” “expects,” “estimates” and words of similar import. Our actual results could differ materially from any forward-looking statements, which reflect management’s opinions only as of the date of this report, as a result of risks and uncertainties that exist in our operations, development efforts and business environment. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements You should carefully review “Risk Factors” described elsewhere in this Annual Report on Form 10-K and the risk factors described in other documents that we file from time to time with the Securities and Exchange Commission, or SEC, including our Quarterly Reports on Form 10-Q.

We were originally incorporated in California on March 22, 1995 as IRORI. In October 1998, we changed our name to Discovery Partners International and in July 2000 we reincorporated in the state of Delaware. In October 2005, we sold the assets related to our instrumentation product lines. Our consolidated financial statements and selected financial data contained herein have been recast to reflect the financial position, results of operations and cash flows of the instrumentation product lines as a discontinued operation.

We own the following trademark among others: Xenometrix®. The following trademarks, among others, are currently pending registration: µARCS™ and ChemCard™. All other brand names or trademarks appearing in this report are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this report is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

Item 1. Business.

Overview

We collaborate with pharmaceutical and biopharmaceutical companies to advance their drug discovery process through our integrated and highly efficient collection of drug discovery technologies, products and services focused from the point immediately following identification of a drug target through when a drug candidate is ready for pre-clinical studies. Despite numerous technological advances in chemistry, high throughput screening, genomics and proteomics, the process of drug discovery remains slow, expensive and often unsuccessful. In order to make the drug discovery process faster, more efficient and more likely to generate a drug candidate, we offer an integrated platform of drug discovery technologies, including assay development, high throughput screening, design and synthesis of proprietary libraries of compounds for screening and primary hit-to-lead expansion, lead compound optimization, drug discovery informatics and in vitro toxicology profiling. These products and services can be provided individually or as an integrated solution, depending on our customers’ requirements. We believe our depth of knowledge and experience, and our range of product offerings, across these areas of drug discovery differentiates us from our competitors. During 2005, we increased the focus on offering integrated drug discovery services as part of long-term collaborations, while we continued to work with companies worldwide in all aspects of drug discovery research. In late 2004, we inaugurated

3

our compound management facility sponsored under our contract with the National Institute of Mental Health of the National Institutes of Health, or NIH, as part of the new NIH chemo-genomic Roadmap Initiative. Our core compound management operation has the ability to select, manage and curate a compound collection of up to one million compounds and has begun to provide samples to the nine national screening centers that have been selected by the NIH to participate in its Roadmap Initiative. In 2005, we generated revenue from 46 customers worldwide, including Pfizer, The National Institute of Mental Health, Actelion, Allergan and Renovis.

However, even with this steady progress, it has become evident during 2005 that the basic business sector in drug discovery contract research and services was undergoing a major and quite unfavorable market shift. Worldwide improvements in communications and shipping, coupled with entrepreneurial efforts in rapidly developing locations such as India, China and Eastern Europe, enabled the highly skilled scientists in those areas to build companies providing a similar range of products and services to us and our peer group, but at significantly lower prices. New guarantees of protection of intellectual property in these locations has offered the necessary assurances to the biotech and pharmaceutical industry that the decision to outsource basic drug discovery offshore has become driven by low price. This shift has essentially resulted in the loss of our ability to consummate synthetic chemistry library contracts, the principal basis of our business in preceding years.

In the fourth quarter of 2005, discussions with Pfizer to renew our contract were ended. With the absence of a new contract with Pfizer, we began the process of reducing our combinatorial chemistry and library synthesis operational capacity through a restructuring of our South San Francisco facility and consolidation of our chemistry platform into our San Diego facility. The NIH Roadmap compound management facility remains fully staffed and operational in our South San Francisco location. In the fourth quarter of 2005, we sold our instrumentation product line, as it was not consistent with our collaborations strategy. We also believe that offshore pricing pressure on biology services, similar to those that already noted in chemistry services, has and will continue to force us to reduce our reliance on fee-for-service work as the primary basis of our business.

We enter 2006 cognizant of these changes in our business under reorganized management and with an imperative from our Board of Directors to make the best use of our current financial and scientific assets to accelerate our entry into more substantial value-creating activities. We have engaged consultants to assist us in evaluating a range of options to best deploy our resources in order to improve stockholder value, including divestiture of assets and merger or acquisition opportunities that are specifically identified to create or enhance a drug development-based product portfolio with defined risk and timelines to clinical milestones with generally acknowledged market value, and which may involve a change in control of our company. As we transition our strategic initiatives and reorganize our operational capacity, the trends and risks that apply to our business will change from those that are described in this Annual Report on Form 10-K based on our business to date, and we believe our historical operating results based on our past operational contract services model are not indicative of future results. We cannot assure that we will be successful in accomplishing any of these strategic initiatives or that any strategic transaction that may occur will be accomplished on favorable terms.

In the event that we divest the various operating assets of the company, it is possible that we may not successfully recover the $8.8 million of total long-lived assets (excluding restricted cash) that are reflected on our consolidated balance sheet at December 31, 2005, which may result in future impairment charges up to this amount. There are one or more viable alternatives that would not lead to a loss on the recoverability of our long-lived assets. In the event that we engage in a merger or acquisition transaction, it is possible that the value realized by our shareholders in such a transaction might be significantly less than the $95.1 million of shareholders’ equity recorded on our consolidated financial statements as of December 31, 2005, due to the fact that our market capitalization is significantly below the book value of our shareholders’ equity. Lastly, in the event that we are unsuccessful

4

with the divestiture of our assets or are unable to successfully conclude any merger or acquisition activity, it is possible that our Board of Directors could decide to liquidate all of our assets, in which event the value realized by our shareholders would be significantly less than the $95.1 million of shareholders’ equity recorded on our consolidated financial statements as of December 31, 2005.

Industry Background

The Genomics/Proteomics Revolution

The drug discovery process continues to undergo fundamental changes as a result of advances in genomics and proteomics, the studies of genes and the proteins they encode, and how those genes and proteins cause or prevent disease. Prior to these advances, pharmaceutical and biopharmaceutical companies addressed fewer than 500 identified drug targets in the development of drugs. Industry experts now agree that the application of genomics and proteomics has led to the identification of thousands of potential new drug targets, whose roles in disease pathology will not be fully clarified for decades. Drug targets are a subset of the numerous biological molecules, such as enzymes, receptors, other proteins and nucleic acids, which may play a role in the onset, maintenance and progression of a disease. The Pharmaceutical Research and Manufacturers of America, or PhRMA, reported that its members alone spent an estimated $38.8 billion worldwide on research and development in 2004, with approximately 25% of this total amount being spent on the stages of drug discovery in which we focus.

Genomics and proteomics have been the subject of intense scientific and commercial focus. Genomics has led to the identification of large numbers of genes encoding potential drug targets, increasing the demand for drug discovery products and services. Once a company has identified a potential drug target, it must still devote significant time and resources to validating the target’s role in the disease process and screening libraries of compounds against the target to discover potential drug candidates, which must be optimized further before commencement of human testing.

The Drug Discovery Process

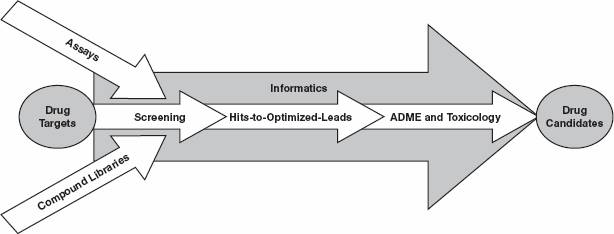

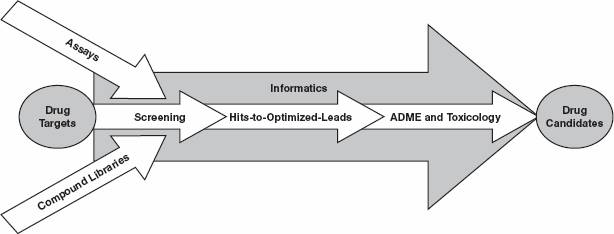

Despite numerous advances and technological breakthroughs in genomics, proteomics, high throughput screening and chemistry, the process of discovering drug candidates from drug targets, as illustrated in the following figure and described below, remains slow, expensive and often unsuccessful.

5

Drug targets. According to the official website of the Human Genome Project a program under the stewardship of the National Institutes of Health, Department of Health and Human Services, of the United States government the genomics revolution has identified between 20,000 and 25,000 human genes that encode the information for cells to produce the proteins that determine human physiology and disease. Drug discovery organizations often advance these new drug targets into discovery with varying degrees of understanding about their role in disease processes and their susceptibility to modulation by chemical compounds. Modulation is defined as the process of selectively increasing or decreasing the biological activity of a particular drug target.

Assays. Once a drug target has been identified and has been validated as having a role in a disease process, a corresponding set of biological assays, or tests, that relate to the activity of the drug target in the disease process must be developed. These assays are designed to show the effect of chemical compounds on the drug target and/or the disease process. Additionally, assays indicate the relative potency and specificity of interaction between the target and the compounds. The more potent and specific the interaction between the target and the compound, the more likely the compound is to become a drug.

Compound libraries. Typically, biologists or biochemists conduct assays in which they screen compound libraries - collections consisting of thousands of compounds each - to find those few compounds that are active in modulating the behavior of the drug targets. Up through the late 1980’s, chemists generated these compounds for testing mostly by synthesizing them one at a time, or painstakingly isolating them from natural sources. During the last decade, the pharmaceutical industry has developed more sophisticated synthetic chemistry approaches, including modular building block techniques, known as combinatorial chemistry, to generate many more diverse compounds far more quickly.

Screening. Screening is the process of testing compounds in assays to determine their potential therapeutic value. A typical screening campaign at a pharmaceutical company will entail screening hundreds of thousands of compounds from multiple compound libraries. Today’s automated high throughput screening, or HTS, systems can test hundreds of thousands of compounds per day and require only very small amounts of each compound and target material. To address the impact of chemicals on complex systems, the drug discovery industry introduced the capability of High Content Screening, or HCS. HCS enables the analysis of multiple independent or interacting targets in intact cells, thereby providing a deeper understanding of drug action and target validity.

Hit-to-lead chemistry. A successful screening process will identify a number of compounds, or hits, that show activity against the drug target. One or more of the hits are then selected for optimization based on their potency and specificity against the drug target. The hits selected for the optimization process are generally referred to as leads.

6

Optimizing a lead compound involves repeatedly producing several slight chemical variants of the lead compound and screening them in assays to discover the relationship between the changes in the molecular structure of compounds and the positive or negative effect on biological activity of the target in the assay. These relationships are called structure-activity relationships, or SARs, and are used to identify the compounds that have the optimal effect on the biological activity of the target in the assay. Traditionally, defining SARs was painstakingly slow. Within the last several years, combinatorial chemistry methods have helped to speed up this process by creating focused libraries that are comprised of dozens to hundreds of compounds, computationally designed to explore the SARs of leads.

ADME and toxicology. Once a lead compound with a well understood SAR is selected for further development, researchers undertake the process of establishing its absorption, distribution, metabolism and excretion, or ADME, and toxicology characteristics. Leads are studied in biochemical assays and pre-clinical animal studies to determine, among other things, whether they are likely to be safe in humans and stay in the body long enough to perform their intended function. Traditionally, these ADME and toxicology studies are performed at the end of the drug discovery process. There is a significant push in the industry, however, to attempt to provide ADME and toxicology information earlier in the process in order to avoid large expenditures on compounds that could ultimately fail due to their poor ADME and toxicology characteristics.

Drug candidates. If the results of the ADME and toxicology studies performed on a lead are favorable in pre-clinical studies, an investigational new drug application, or IND, may be filed with the Food and Drug Administration requesting permission to begin clinical trials of the drug candidate in humans.

Limitations of the Current Industry

To treat diseases and to meet growth expectations, pharmaceutical companies are under intense pressure to introduce new drugs, and they have increased research and development expenses more than 300% from $8 billion in 1990 to $38.8 billion in 2004 according to PhRMA. Despite major scientific and technological advances in areas such as genomics, HTS, HCS and combinatorial chemistry, the drug discovery process remains lengthy, expensive and often unsuccessful. We believe this is due to the following significant limitations to the current process of drug discovery:

Insufficient validation of targets. Drug discovery organizations are advancing many potential new drug targets into discovery without significantly understanding their role in disease processes and their susceptibility to modulation by compounds. Resources spent on pursuing these potential drug targets could be saved if there were better biological or chemical methods to eliminate, early in the process, those drug targets exhibiting undesirable characteristics in these areas.

Inadequate informatics and computational tools. Success of many drug discovery programs is predicated on screening large numbers of compounds, followed by the synthesis and testing of compounds for optimization and for their ADME and toxicology characteristics. This sequential approach is time-consuming and costly. Although many of the recent advances in drug discovery have been targeted at streamlining this process and have allowed large numbers of compounds to be generated and tested in higher throughput, these advances have been in small increments. In addition, the identification of thousands of new drug targets through the application of genomics and proteomics technologies has resulted in large amounts of data being generated. Pharmaceutical companies can save large expenditures of time and money by using informatics and computational tools to manage the data and develop increased and earlier knowledge about which targets are likely to be receptive to chemical modulation, the likely interaction of chemicals and biological targets and which compounds are likely to have unacceptable ADME and toxicological characteristics.

7

Lack of an integrated, noncompeting drug discovery solution. Many of the companies that provide drug discovery services to the pharmaceutical and biopharmaceutical industries provide only selected services. As a result, they are unable to provide the knowledge and efficiencies that can be gained by broad experience in all facets of drug discovery. Further, customers seeking a totally outsourced solution must use valuable resources to manage multiple vendors and integrate inconsistent or incompatible products. Many drug discovery service providers also compete with their potential customers by conducting internal, proprietary drug discovery activities.

Limited predictive value of model systems. Drug candidates are normally tested in animal models or in selected in vitro and ex vivo models to evaluate their efficacy. Many of these models only partially reflect the drug candidates’ effects in humans. Proof of efficacy can often only be obtained in clinical studies. Methods and systems which allow a compound to continue through the pre-clinical phase in a cost effective manner and add to the understanding of the mechanisms of action of drug candidates in complex systems might significantly improve the discovery success rate.

Our Solution

We collaborate with pharmaceutical and biopharmaceutical companies to advance their drug discovery process through our integrated and highly efficient collection of drug discovery technologies focused from the point immediately following identification of a drug target through when a drug candidate is ready for pre-clinical studies. Our customers include many major pharmaceutical companies and numerous biopharmaceutical companies. We do not discover or develop drugs for our own account and we do not compete with our customers. We believe the broad range of products and services we offer or intend to offer, either as part of long-term collaborations, or as fee-for-service contracts, will provide the following benefits:

Target validation. We have developed, through outright purchase, license and proprietary methodologies, a large number of libraries of highly diverse synthetic and natural product compounds that are expected, and in some cases, specifically designed, to modulate many drug targets. We believe the use of these compound libraries, which are not sold on a stand-alone basis but rather offered as part of an integrated drug discovery solution, may provide early information about whether a drug target is susceptible to chemical modulation and, if so, whether modulation of its activity has an important effect on the disease process or outcome. If these libraries are successful in providing this information early in the drug discovery process, our partners can save significant amounts of time and resources by abandoning the pursuit of targets that do not exhibit favorable chemical and biological characteristics.

High quality synthetic compound libraries. Our synthetic chemistries are easily replicated and our compounds rapidly replenishable because we produce detailed synthesis protocols for each chemical compound library. We are able to rapidly create focused libraries containing slight variations of hits from our original discovery or targeted libraries to study SARs. Working with our customers, we design libraries for maximum diversity using commercial and proprietary computer algorithms. Finally, after synthesis of a compound, we use multiple analytical methods to ensure a high degree of compound purity. As a consequence, our libraries contain highly diverse, drug-like compounds of high purity.

Purified natural product libraries. Our acquisition of the assets of Biofrontera Discovery GmbH, in Heidelberg, Germany, was completed in April 2005. Among the assets acquired by us at that time are rights to a large and diverse collection of bacterial and fungal microbial strains, and a library of natural products, which are chemical compounds produced by those microbes under specifically defined laboratory conditions. Our natural product libraries are differentiated from other natural product sources by their unique microbial origins, and by the methodology that is used to purify and characterize the resulting compounds. We do not screen fermentation broths or crude extracts. Rather, the libraries we utilize in screening are both fully purified

8

(approximately 100,000 samples each containing a single natural product compound), and pre-purified (approximately 145,000 samples each containing between 8 and12 natural product compounds), using a proprietary serial high performance liquid chromatography, or HPLC, process. These natural product samples can be applied to any HTS project in the same way that synthetic chemical libraries are used. Following the identification of hits, libraries are then generated by scale-up fermentation and purification, followed by semi-synthetic transformations to produce focused analog libraries for SAR determination and subsequent preclinical evaluation.

Broad range of products and services for assay development, chemistry and screening. We currently offer a broad range of drug discovery products and services to pharmaceutical and biopharmaceutical companies targeted at assay development, chemistry and screening, either as part of multi-target collaborations, or under more limited fee-for-service contracts. We have performed more than 190 discovery projects for our customers and provide access to more than 650,000 discrete synthetic chemical compounds. Our approach for efficiently finding screening hits or drug leads combines proprietary computational methods for compound selection and data mining with our high throughput screening platform. In addition, our team of chemists and biologists has worked on several hit and lead optimization projects for our customers. When applicable, we employ our µARCS technology to improve the ease of access to screening and cost effectiveness of the screening process. In addition, we possess the capability to quantitatively study the effect of drugs on a sub-cellular level.

Development of an informatics and computational tools knowledge base. We apply sophisticated computational software tools to generate predictive information in the early stages of drug discovery. We use our tools to correlate information available on families of drug targets and compounds with screening data to predict which drug targets are likely to be receptive to chemical modulation, and which chemical structures are likely to react favorably with large families of drug targets or produce unacceptable ADME or toxicological results. We have also developed computer algorithms that reduce the number of compounds that must be screened to identify hits. We believe our computational tools complement the drug discovery process and reduce the time and resources involved.

Integrated drug discovery products and services. As part of long-term collaborations, we offer an integrated drug discovery platform that provides unique value to our customers. We believe our focus on our customers’ needs, rather than our own drug development efforts, makes our product and service offerings more attractive. Additionally, we believe we have the ability to collaborate with multiple customers effectively and to efficiently maintain confidential proprietary information while successfully providing products and services to our customers.

Our Strategy

Our strategy has been to be a leading fee-for-service provider of a complete, integrated and highly efficient drug discovery technology platform designed to overcome many of the limitations associated with the slow and expensive traditional drug discovery process. However, it has become evident during 2005 that the market for drug discovery contract research and services has undergone a major and negative shift. Worldwide improvements in communications and shipping, coupled with entrepreneurial efforts in rapidly developing locations such as India, China and Eastern Europe, have enabled the highly skilled scientists in those areas to build companies providing a similar range of products and services to us and our peer group, but at significantly lower prices. New guarantees of protection of intellectual property in these locations has offered the necessary assurances to the biotech and pharmaceutical industry that the decision to outsource basic drug discovery offshore has become driven by low price. This shift has resulted in the loss of our ability to consummate synthetic chemistry library contracts, the principal basis of our business in preceding years.

In the fourth quarter of 2005, discussions with Pfizer to renew our contract were ended. With the absence of a new contract with Pfizer, we have reduced our combinatorial chemistry and

9

library synthesis operational capacity through a restructuring of our South San Francisco facility, consolidating our chemistry platform into our San Diego facility. The NIH Roadmap compound management facility remains fully staffed and operational in our South San Francisco location. We sold our instrumentation product line, as it was not consistent with our collaborations strategy. We also believe that offshore pricing pressure on biology services, similar to that already noted in chemistry services, has and will continue to force us to reduce our reliance on fee-for-service work as the primary basis of our business.

We have determined though both our own marketing efforts and the investigations of independent consultants we retained that our past strategy of providing contract research is no longer viable in the context of a public company due to the severe pricing pressures that have developed in the last year from low-cost offshore competitors. Remaining in this sector as our sole business strategy would require significant expenditures of capital over many years as a co-investment with customers. We would incur significant losses and introduce significant risk for our business as a whole.

We enter 2006 cognizant of these changes in our business under reorganized management and with an imperative from our Board of Directors to make best use of our current financial and scientific assets to accelerate our entry into more substantial value-creating activities. We are currently exploring a range of options to best deploy our resources in order to improve stockholder value, including divestiture of assets and merger or acquisition opportunities that are specifically identified to create or enhance a drug development-based product portfolio with defined risk and timelines to clinical milestones with generally acknowledged market value, and which may involve a change in control of our company. As we transition our strategic initiatives and reorganize our operational capacity, the trends and risks that apply to our business will change from those that are described in this Annual Report on Form 10-K based on our business to date, and we believe our historical operating results based on our past operational contract services model are not indicative of future results. We cannot assure that we will be successful in accomplishing any of these strategic initiatives or that any strategic transaction that may occur will be accomplished on favorable terms.

In the event that we divest the various operating assets of the company, it is possible that we may not successfully recover the $8.8 million of total long-lived assets (excluding restricted cash) that are reflected on our consolidated balance sheet at December 31, 2005, which may result in future impairment charges up to this amount. There are one or more viable alternatives that would not lead to a loss on the recoverability of our long-lived assets. In the event that we engage in a merger or acquisition transaction, it is possible that the value realized by our shareholders in such a transaction might be significantly less than the $95.1 million of shareholders’ equity recorded on our consolidated financial statements as of December 31, 2005, due to the fact that our market capitalization is significantly below the book value of our shareholders’ equity. Lastly, in the event that we are unsuccessful with the divestiture of our assets or are unable to successfully conclude any merger or acquisition activity, it is possible that our Board of Directors could decide to liquidate all of our assets, in which event the value realized by our shareholders would be significantly less than the $95.1 million of shareholders’ equity recorded on our consolidated financial statements as of December 31, 2005.

Our Technology Platform

Our technology platform has been designed to make the drug discovery process faster, more efficient and more likely to generate a high quality drug candidate. We currently have capabilities in many functional disciplines of the drug discovery process that can be purchased individually or as integrated solutions, depending on our customers’ requirements. We have continued to add to

10

our functional offerings in order to provide a comprehensive and integrated suite of drug discovery products and services to our pharmaceutical and biopharmaceutical customers.

Assays

We provide assay development services through our team of scientists who are experienced in working with major disease target classes such as protein kinases, G-protein-coupled receptors, nuclear receptors, phosphatases, and proteases. Biological systems about which we have expertise include enzymes, receptor-ligand interaction, protein-protein interaction, ion channel assays, reporter-gene assays in prokaryotic and eukaryotic cells, cellular proliferation, differentiation and physiologic response, and microbial growth. Most recently we established HCS technology in-house. This allows us to profile compounds for their effect on multiple intracellular events in one assay. We have the ability to provide assay development services through our subsidiary, Discovery Partners International AG.

We have established, through both internal development and sublicense, a high-throughput panel of in vitro assays that provide data on multiple parameters relevant to the pharmaceutical, pharmacokinetic and metabolic properties of individual compounds or whole libraries. This panel is comprised of approximately 20 assays, including those for solubility, permeability, metabolic liability, and potential for interaction with key enzymes involved in metabolism of drugs, and a critical receptor indicative of potential cardiac side effects. The resulting PK-ADMET profile, reflecting pharmacokinetic-absorption-distribution-metabolism-excretion-toxicity data, profile is a valuable adjunct data set to the potency and selectivity SAR data used to select compounds for further evaluation in subsequent more expensive and time-consuming activities.

We offer unique cell-based assays with multiple gene response indicators, which give specific information on the potential beneficial and harmful biological activities of a given pharmaceutical compound. Genetically engineered living cells allow us to determine the on and off state of gene promoters in the presence of compounds. Our portfolio of reporter cell lines may provide important efficacy and safety information to help optimize the selection of drug candidates before moving to the more costly stages of pre-clinical and clinical testing.

Proprietary Libraries of Compounds

We offer the following broad range of highly purified compound libraries for assay screening and rapid hit-to-lead activities:

Discovery libraries. We generate and sell discovery libraries, which are collections of diverse, drug-like compounds that are designed using computer programs to systematically explore specified areas of chemical space or types of chemistry. They are used in the initial stages of screening in which very little information is known about which compounds will alter the activity of the drug target in the assay.

Targeted libraries. We design and sell targeted libraries selected for a specified type of drug target. These libraries are a group of highly related compounds used much like discovery libraries, but they provide a more insightful medicinal chemistry starting point.

Focused libraries. We are able to rapidly generate focused libraries based on hits from our discovery or targeted libraries because we have previously invested significant resources to produce detailed synthesis protocols in the development of each library of compounds. Focused libraries explore subtle changes in the compound structure to quickly elicit SARs and evolve lead compounds. In addition, we develop focused libraries from hits generated by our customers.

11

Chemistry protocols. In conjunction with the provision of proprietary compounds, we generally provide detailed protocols for generating our libraries to customers that purchase those libraries. This enables our customers to replenish compounds and to create additional compounds. We use a proprietary combinatorial chemistry technology platform to generate compound libraries that employs parallel synthesis and our directed sorting technology. Our approach provides the following advantages:

• Purity: Maximum purity is important to minimize false positives during screening. We can deliver compounds that are greater than the current industry standard of 90% pure depending on customer specifications. Our quality control measures include high performance liquid chromatography, mass spectroscopy, nuclear magnetic resonance, evaporative light scattering detection and weight percent analysis. We achieve the required purity using several purification technologies including our proprietary ARW high throughput purification process;

• Diversity: Each discovery library of approximately 1,000 to 5,000 drug-like compounds is designed to contain a set of highly diverse compounds using our chemical mapping and differentiation software;

• Ease of optimization: The individual chemistries for each library are highly validated and characterized. This allows rapid generation of focused libraries around hits and rapid follow-up and modification by medicinal chemistry programs; and

• Re-supply and reproducibility: Our synthesis approaches produce large quantities that allow rapid and cost effective restocking of customers’ supplies. Our highly validated chemistries allow us or our customers to re-synthesize larger quantities on demand.

Screening

We offer high throughput screening services through an experienced staff of scientists located at our facility near Basel, Switzerland. We also offer our customers access to compounds from many of the world’s leading compound suppliers as well as a significant collection of internally developed compounds. This allows our partners access to a large and diverse collection of compounds without the need to store and manage the compound collections in their own facilities.

Our HTS modules are equipped to quickly and efficiently process the particular assay being carried out. A module consists of the appropriate plate and liquid handling equipment, coupled with the best read out technology for the assay being run. We deliver a list of validated hits to our screening customers. We also provide hit follow-up and verification services and, when desired, actual physical samples of the hit compounds.

Hit-to-Lead Chemistry

We have developed products and services to advance early stage screening hits to optimized drug leads. These products and services include the following:

Custom focused libraries. In addition to our collection of proprietary libraries, we design and produce custom, focused libraries based upon hits identified from screening. These hits may be from our compound libraries, the customer’s internal compound collection or even from another compound library supplier. Focused libraries consist of compounds that represent systematic variations of hits. Medicinal chemists use these focused libraries to begin refining hits to optimize the properties that have an effect on the drug target in the assay. Because we invest significant resources in the development of each of our compound libraries, we are able to

12

generate focused libraries based on hits from our discovery libraries or targeted libraries more rapidly than when we begin from an isolated hit resulting from a customer’s compound collection.

Medicinal chemistry. We provide a wide range of medicinal chemistry and other lead optimization services. This includes the synthesis of compounds that modify the original hit or lead for improved potency, selectivity and other pharmaceutical characteristics. We have an experienced group of synthetic organic chemists and medicinal chemists with expertise in both solid phase chemistry and solution phase chemistry. In some cases we provide medicinal chemistry services in conjunction with our computational drug discovery efforts to design and construct small libraries of compounds to act on specific targets of known structure.

Biological profiling in the hit-to-lead phase. We also provide a broad range of biological profiling including the primary screening test, specificity assays, cellular assays, ADME and in vitro toxicology tests. Our multi-parameter analysis tools allow efficient data analysis and selection of compounds that fit the product profile.

Drug Discovery Informatics; ADME and Toxicology

We employ computational tools that we believe will allow us to continue to increase our knowledge of the characteristics of targets, leads, and ligand-target interactions and which we believe can be applied throughout the drug discovery process to significantly reduce the time and cost of developing a drug. We currently have computer algorithms that allow us to design libraries of compounds with high diversity, thereby increasing the likelihood of finding hits during screening. When screened against large numbers of potential drug targets, we believe these large and highly diverse libraries will provide significant information about which drug targets are amenable to modulation by chemical means. We have developed novel algorithms to aid in the understanding and utilization of the data resulting from high throughput screening experiments. We have also developed a proprietary analysis tool, which we believe will allow us to use screening data to correlate drug target families with the types of compounds that will likely bind to them. Using this tool, we will seek to design highly effective targeted libraries for whole drug target families. In addition, we will seek to use this tool to efficiently design potent compounds for a particular drug target and to efficiently search databases of compounds available from other vendors for likely leads.

We expect to further use our computational tools and screening data to help predict ADME and toxicological reactions to classes of compounds. This will allow our customers to avoid spending money and time on hits and leads that will ultimately fail due to their ADME and toxicological characteristics.

Integrated Drug Discovery Programs

When some or all of the above discreet technology capabilities need to be accessed by a single partner on a single or multiple biological targets, we offer an integrated collaborative drug discovery program that provides access to the full range of our capabilities needed to find and advance leads to pre-clinical candidates. In these collaborations we seek to provide and manage integrated access to our computational design and analysis, chemistry, and biology capabilities for the purpose of developing a pre-clinical lead for the partner’s target of choice. As a result, these collaborations will provide our partners with the knowledge and efficiencies that we have gained from our broad experience in a number of areas of drug discovery. In addition, partners seeking a totally outsourced solution are not required to use valuable resources to manage multiple collaborators and integrate inconsistent or incompatible products. Each integrated drug discovery program is customized to increase the likelihood of success. Milestone payments, which are due upon lead compounds demonstrating specified potency and selectivity requirements, may be included in addition to service fees. In some future collaborative efforts, these contracts may include an element of risk-sharing with us, such that some of our fixed costs will only be offset by

13

milestone payments and, in some cases, royalties on future product sales resulting from the collaboration. In 2005, milestone payments represented an immaterial portion of our total revenue and are not anticipated to be material to total revenue in the foreseeable future.

Component Supply

The raw materials used in the research and development of our products and the offering of our services are available from more than one supplier.

Customers

During 2005, we generated revenue from 46 customers worldwide. The most significant by dollar volume and which we have previously disclosed are as follows:

Actelion Ltd. | | Merck & Co., Inc. |

Allergan Inc. | | National Institute of Mental Health |

Chroma Therapeutics, Ltd. | | Ono Pharmaceutical Co., Ltd. |

Renovis | | Pfizer Inc |

In 2005, 2004 and 2003, 54%, 62% and 69%, respectively, of our revenue from continuing operations came from our chemistry contracts with Pfizer Inc. Our contract with Pfizer ended by its terms on January 6, 2006, and, in the fourth quarter of 2005, discussions with Pfizer to renew our contract ended. The NIH represented 14% of our revenue in 2005 and there were no other customers that represented over 10% of our revenue in 2004 or 2003.

Sales and Marketing

We have a skilled team of business development professionals targeting pharmaceutical and biopharmaceutical customers worldwide. Additionally, our senior executives coordinate global management of our key customers and manage our general sales and marketing efforts for our drug discovery offerings to major pharmaceutical customers and prospective partners worldwide. In 2005, to supplement the efforts of our business development and marketing groups, our Chief Scientific Officer (currently acting Chief Executive Officer) initiated a new round of outreach visits to approximately 40 major pharmaceutical and biotech companies to gauge both the basic interest in, and the market potential for, our expanded integrated offerings. In addition to these direct selling efforts we also use industry trade shows and industry journal advertising for sales and marketing.

Research and Development

Our research and development expenses totaled approximately $3.9 million in 2005, $1.5 million in 2004, and $407,000 in 2003. None of these expenses were funded by outside parties. Research and development expenses increased in 2005 primarily due to the acquisition of the natural compound based discovery business from Biofrontera Discovery GmbH in April 2005, which represented $2.1 million of expenses, and from the redeployment of development scientists and engineers from direct revenue generating activities of customer funded R&D programs and collaborations to internal programs focused on in silico tools, screening assays and drug discovery process development. During 2005, we conducted internal research and development programs to enhance our technology platforms in drug discovery informatics, assay development and high-throughput screening, and natural products.

14

Changes in Comparability

In October 2005, we sold the assets related to the IRORI chemical synthesis, Crystal Farm automated protein crystallization, and Universal Store™ compound storage systems product lines to preserve our cash resources in eliminating the investment expenses required for the engineering innovation required to develop new product lines. The income and cash flows related to the instrumentation product lines and the direct transaction costs of the sale of those product lines have been presented as discontinued operations in the Condensed Consolidated Statements of Operations and Consolidated Statements of Cash Flows in the Consolidated Financial Statements to this Annual Report on Form 10-K. The assets and liabilities related to the sale of those product lines have been reclassified within the 2004 Balance Sheet in the Consolidated Financial Statements to this Annual Report on Form 10-K. The presentation of geographical data and selected financial data for 2004 and all earlier years has been adjusted to conform to the presentation in 2005.

There were no individual foreign countries where the revenue represented 10% or more of total revenues, from continuing operations, for the periods presented below. The following table presents the geographic breakdown of our revenue, from continuing operations, for our last three fiscal years.

| | Years Ended December

31, | |

| | 2005 | | 2004 | | 2003 | |

United States | | 84 | % | 82 | % | 80 | % |

Foreign Countries | | 16 | % | 18 | % | 20 | % |

The following table presents the geographic breakdown of our long-lived assets, from continuing operations, for our last two fiscal years.

| | As of December 31, | |

| | 2005 | | 2004 | |

United States | | 63 | % | 79 | % |

Foreign Countries | | 37 | % | 21 | % |

Our total backlog as of February 15, 2006 was approximately $26 million, which compares to approximately $48 million on February 27, 2005. We expect to realize approximately 62% of our total current backlog by December 31, 2006.

Backlog measures are not defined by generally accepted accounting principles and our measurement of backlog may vary from that used by others. While we believe that long-term backlog trends serve as a useful metric for assessing the growth prospects for our business, backlog is not a guarantee of future revenues and provides no information about the timing on which future revenue may be recorded.

Agreement with Pfizer

In February 2004, we entered into a broadened collaboration agreement with Pfizer that replaced our prior collaboration with Pfizer that we entered into in December 2001. Under this agreement, we collaborated with Pfizer to design and develop compounds that are owned by and exclusive to Pfizer. We manufactured and purified the compounds to high purity standards using, among other methods, our proprietary ARW purification technology. The agreement expired by its natural terms on January 6, 2006. In the fourth quarter of 2005, discussions with Pfizer to renew our contract were ended.

15

Agreement with The National Institutes of Health

Effective August 20, 2004, we entered into a multi-year contract with The NIH to establish and maintain a Small Molecule Repository to manage and provide up to one million chemical compounds to multiple NIH Screening Centers as part of the NIH Roadmap Initiative. The estimated funding available to us under this contract for the base period (August 2004 through December 2008) is approximately $24 million, assuming the contract continues for its full term. The agreement expires by its natural terms on November 30, 2008, but may be renewed on an annual basis by the NIH up to November 30, 2013. It is uncertain at this time whether the NIH will renew this agreement or whether we will be successful in entering into new agreements with this customer. This contract is funded in its entirety by the NIH and Department of Health and Human Services. Payment to us for performance under this contract is subject to audit by the Defense Contract Audit Agency and is subject to government funding. Costs incurred that are billable to the NIH under this contract include indirect costs that are based on provisional rates estimated by management at the time we submitted our proposal. Actual indirect costs may be greater or lower than our provisional rates. Negotiation for recovery of higher costs with the government may not be successful and any costs billed to the government in excess of actual costs may be required to be reimbursed to the NIH.

Intellectual Property

We pursue patents, copyrights and trademarks and otherwise endeavor to protect our technology, inventions and improvements that are commercially important to the development of our business. We also rely upon trade secrets and proprietary know-how that may be important to the development of our business.

Our success will depend in large part on our ability to:

• obtain and maintain patent and other proprietary protection for the technology, inventions and improvements we consider important to our business;

• defend our patents;

• preserve the confidentiality of our trade secrets; and

• operate without infringing the patents and proprietary rights of third parties.

We have implemented a patent strategy designed to maximize our intellectual property rights. We are pursuing patent coverage in the United States and those foreign countries that are home to the majority of our anticipated customer base. We currently own 4 issued patents in the United States.

Our United States patents generally have a term of 20 years from the application filing date or earlier claimed priority. Our foreign patents generally have a term of 20 years from the date of filing of the patent application. Because the time from filing to issuance of patent applications is often several years, this process may result in a shortened period of patent protection, which may adversely affect our ability to exclude competitors from our markets. Our issued United States patents have expiration dates ranging from 2014 through 2017. Our success will depend to a significant degree upon our ability to develop proprietary products and technologies and to obtain patents having claims that cover such products and technologies. We intend to continue to file patent applications covering any newly developed products and technologies.

Patents provide some degree of protection for our proprietary technology. However, the pursuit and assertion of patent rights, particularly in areas like pharmaceuticals and

16

biopharmaceuticals, involve complex determinations and, therefore, are characterized by some uncertainty. In addition, the laws governing patentability and the scope of patent coverage continue to evolve, particularly in the area of biopharmaceuticals, and due to the time between the filing and granting of a patent application, we may be infringing upon the patent rights of a third party without any knowledge of the patent. As a result, patents might not issue from any of our patent applications or from applications licensed to us. The scope of any of our issued patents may not be sufficiently broad to offer meaningful protection. In addition, our issued patents or patents licensed to us may be successfully challenged, invalidated, circumvented or rendered unenforceable so that our patent rights might not create an effective competitive barrier. Moreover, the laws of some foreign countries may not protect our proprietary rights to the same extent as do the laws of the United States. Any patents issued to us or our collaborators may not provide a legal basis for establishing an exclusive market for our products or services or provide us with any competitive advantages. In addition, patents issued to us or our collaborators may not ensure that the patents of others will not have an adverse effect on our ability to do business or to continue to use our technologies freely. In view of these factors, our intellectual property positions bear some degree of uncertainty.

We also rely in part on trade secret protection for certain of our technologies and proprietary know-how. The source code for our proprietary software is protected both as a trade secret and as copyrighted works. We attempt to protect our trade secrets by entering into confidentiality agreements with third parties, employees and consultants. Our employees also sign agreements requiring that they assign to us their interests in inventions and original expressions and any corresponding patents and copyrights arising from their work for us. However, it is possible that these agreements may be breached, invalidated or rendered unenforceable, and if so, there may not be an adequate corrective remedy available. Despite the measures we have taken to protect our intellectual property, parties to our agreements may breach the confidentiality provisions in our contracts or infringe or misappropriate our patents, copyrights, trademarks, trade secrets and other proprietary rights. In addition, third parties may independently discover or invent competing technologies or reverse engineer our trade secrets or other technology.

Third parties may file claims asserting that our technologies or products infringe upon their intellectual property. We cannot predict whether third parties will assert such claims against us or our licensees or against the licensors of technology licensed to us, or whether those claims will harm our business. If we are forced to defend against such claims, whether they are with or without merit, and whether they are resolved in our favor or against us, our licensees or our licensors, we will incur significant expenses and experience diversion of management’s attention and resources. As a result of any disputes over intellectual property, we may have to develop at a substantial cost non-infringing technology or enter into costly licensing agreements. These agreements, if necessary, may be unavailable on terms acceptable to us, or at all, which could seriously harm our business or financial condition.

Competition

We compete with companies in the United States and abroad that engage in the provision of drug discovery technology and services to the pharmaceutical and biotechnology industry. These competitors include companies engaged in the following areas of drug discovery:

• Assay development and screening;

• Synthetic compound libraries and lead optimization;

• Natural products libraries and chemistry;

• Informatics; and

• Gene expression profiling.

17

We face competition based on a number of factors, including size, relative expertise and sophistication, speed and costs of identifying and optimizing potential lead compounds and of developing and optimizing chemical processes. We compete with the research departments of pharmaceutical companies, biopharmaceutical companies, combinatorial chemistry companies, contract research companies, contract drug manufacturing companies and research and academic institutions. Many of these competitors have greater financial and other resources and more experience in research and development than we do. Smaller companies may also prove to be significant competitors, particularly through arrangements with large corporate collaborators.

Historically, pharmaceutical companies have maintained close control over their research and development activities, including the synthesis, screening and optimization of chemical compounds and the development of chemical processes. Many of these companies, which represent a significant potential market for our products and services, are developing or already possess in-house technologies and services offered by us. Academic institutions, governmental agencies and other research organizations are also conducting research in areas in which we provide services either on their own or through collaborative efforts.

We have faced and anticipate that we will continue to face increased competition as new companies enter the market and advanced technologies become available. Our services and expertise may be rendered obsolete or uneconomical by technological advances or entirely different approaches developed by one or more of our competitors. The existing approaches of our competitors or new approaches or technologies developed by our competitors may be more effective than those developed by us. We cannot assure that our competitors will not develop more effective or more affordable technologies or services, thus rendering our technologies and/or services obsolete, uncompetitive or uneconomical. For example, advances in informatics and virtual screening may render some of our technologies, such as our large compound libraries, obsolete.

In addition, due to improvements in global communications, combined with the supply of lower cost PhD level scientific talent, we have recognized the significant effects of the real and direct price-based competition for our chemistry, computational chemistry, and high-throughput screening services from low-cost offshore locations such as China, India and Eastern Europe. New guarantees of protection of intellectual property in these locations has offered the necessary assurances to the biotech and pharmaceutical industry so that the decision to outsource basic drug discovery offshore has become driven by low price. This shift has resulted in the loss of our ability to consummate synthetic chemistry library contracts, the principal basis of our business in preceding years. We also believe that offshore pricing pressure on biology services, similar to that already noted in chemistry services, have and will continue to force us to reduce our reliance on fee-for-service work as the primary basis of our business.

Government Regulation

We are subject to various federal, state and local laws and regulations relating to the protection of the environment. In the course of our business, we handle, store and dispose of chemicals. The laws and regulations applicable to our operations include provisions that regulate the discharge of materials into the environment. Usually these environmental laws and regulations impose strict liability, rendering a person liable without regard to negligence or fault on the part of such person. Such environmental laws and regulations may expose us to liability for the conduct of, or conditions caused by, others. We have not been required to expend material amounts in connection with our efforts to comply with environmental requirements, and we do not believe compliance with such requirements will have a material adverse effect upon our capital expenditures, results of operations or competitive position. Because the requirements imposed by these laws and regulations frequently change, we are unable to predict the cost of compliance

18

with these requirements in the future, or the effect of these laws on our capital expenditures, results of operations or competitive position.

Employees

As of February 28, 2006, we had 133 full-time employees worldwide. None of our employees are covered by a collective bargaining agreement. We believe our relationship with our employees is generally satisfactory.

Web Site Access to SEC Filings

We maintain an Internet website at www.discoverypartners.com. We make available free of charge on our Internet website our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Item 1A. Risk Factors.

In addition to the other information contained herein, you should carefully consider the following risk factors in evaluating our company.

We may engage in strategic transactions, which could adversely affect our business.

We are currently exploring a range of options to best deploy our resources and improve stockholder value in light of the changes in our business and an imperative from our Board of Directors to make best use of our current financial and scientific assets to accelerate our entry into more substantial value-creating activities. The options we are considering include divestiture of assets and merger or acquisition opportunities that are specifically identified to create or enhance a product portfolio with defined risk and timelines to milestones, which may involve a change in control of our company. As we transition our strategic initiatives and reorganize our operational capacity, the trends and risks that apply to our business will change from those that are described in this Annual Report on Form 10-K based on our business to date, and we believe our historical operating results are not indicative of future results.

We cannot assure that we will be successful in accomplishing any of these strategic initiatives or that any strategic transaction that may occur will be accomplished on favorable terms. Our consideration and completion of any strategic transaction is subject to a variety of risks that could materially and adversely affect our business and financial results, including risks that we will forego business opportunities while any transaction is being considered or is pending; that our business, including our ability to retain key employees, may suffer due to uncertainty; risks inherent in negotiating and completing any transaction; and challenges in integrating businesses and technologies in the event any transaction is completed.

In the event that we divest the various operating assets of the company, it is possible that we may not successfully recover the $8.8 million of total long-lived assets (excluding restricted cash) that are reflected on our consolidated balance sheet at December 31, 2005, which may result in future impairment charges up to this amount. There are one or more viable alternatives that would not lead to a loss on the recoverability of our long-lived assets. In the event that we engage in a merger or acquisition transaction, it is possible that the value realized by our shareholders in such a transaction might be significantly

19

less than the $95.1 million of shareholders’ equity recorded on our consolidated financial statements as of December 31, 2005, due to the fact that our market capitalization is significantly below the book value of our shareholders’ equity. Lastly, in the event that we are unsuccessful with the divestiture of our assets or are unable to successfully conclude any merger or acquisition activity, it is possible that our Board of Directors could decide to liquidate all of our assets, in which event the value realized by our shareholders would be significantly less than the $95.1 million of shareholders’ equity recorded on our consolidated financial statements as of December 31, 2005.

Our strategy of placing a high degree of emphasis on integrated drug discovery collaborations is untested, involves higher risk and complexity, requires significant upfront funding, and will likely result in continued operating losses for the foreseeable future.

We have a limited history of offering our integrated drug discovery platform in the form of a collaborative model to the pharmaceutical and biopharmaceutical industries. Our marketing efforts in this area during 2005 included discussions with over 40 current and prospective customers. Based on these discussions and other market-based analyses of competitors’ cost and pricing structures, it is uncertain whether our current service-based customers will migrate to this new business offering or whether new collaborators will enter into collaborations with us. In order to be successful, our drug discovery technology platform must meet the requirements of the pharmaceutical and biopharmaceutical industries, and we must convince potential customers to collaborate with us instead of either performing these services internally or utilizing other companies with competing drug discovery technology platforms. Because of these and other factors, some of which are beyond our control, our integrated drug discovery collaboration offering may not gain sufficient market acceptance.

In addition, our strategy of focusing on more significant value added integrated drug discovery collaborations with biotechnology companies relies upon a relatively complex form of customer engagement to generate revenue. As a result of the inherent complexity of such collaborations, we have an increased risk of being unable to reach agreement or delays in reaching agreement with the prospective customer for such collaborations or of structuring sub-optimal arrangements that fail to adequately compensate us for the risks inherent in such collaborations. If we are unable to enter into these collaborations or experience delays in entering into these collaborations, we will not be able to generate revenues when expected or at all, which would adversely affect our business. In 2005, we focused on offering long-term collaborations and experienced longer lead times for entering into these collaborations and a lower percentage of completed agreements than previously experienced in fee-for-service arrangements.

As it is unlikely that we will be able to enter into integrated drug discovery collaborations using our previous fee-for-service pricing structure, we will need to invest, at our own cost, in the feasibility phase of various projects in exchange for higher downstream rewards in the form of access fees and milestone payments that could be received during or at the conclusion of such projects. As such, our risk profile is increased as we will likely generate losses into the foreseeable future and our future success will depend on our ability to enter into collaborations where the cumulative payments received from our partners exceed our initial investment. Later-stage milestone payments and success fees dependent on confirmation of biological or pharmacological activity by compounds generated as part of such collaborations are particularly at risk for being achieved, as compounds may either lack the desired effects in preclinical studies or in clinical trials, or possess additional activities manifested as side effects that limit or preclude the advancement of such compounds in preclinical and clinical development. Additionally, even if such compounds advance through clinical development, there is no guarantee that compounds eligible for royalty payments will either be approved by the Food and Drug Administration, or similar agencies worldwide, for marketing.

20

We have incurred significant operating and net losses since our inception. As of December 31, 2005, we had an accumulated deficit of $113.9 million. Although we generated net income during 2004 and 2003 of $3.9 million and $1.1 million, respectively, we had net losses of $14.2 million and $62.1 million for the years ended December 31, 2005 and 2002, respectively. We also expect in the future to incur operating and net losses and negative cash flow from operations. We did not achieve operating profitability until the third quarter of 2003 and we may not be able to achieve or maintain profitability in any quarter in the future. We experienced an operating loss in 2005 and currently expect an operating loss in 2006. Based on the major changes in our business sector described elsewhere, we do not expect to achieve profitability in the future based on our need for continued investment in the collaborative value-based activities.

Our collaborations and services involve significant scientific risk of fulfillment.

Our ability to achieve future success-based revenues from integrated drug discovery collaborations will rely upon our scientific success. Our drug discovery collaborations may fail to meet our or our collaborators’ drug discovery objectives on a timely basis or at all. In this event, we would not achieve the success-based milestone payments necessary to recover our upfront investment in a given project.

In addition, a large portion of our revenues relies upon our customers’ scientific success. Our services and technologies may fail to assist our customers in achieving their drug discovery objectives, on a timely basis or at all. For example, when our customers deliver proteins to us for assay development or chemistry library design ideas for chemical compound development and production, we rely on our customers for timely delivery of those deliverables, and our customers rely on us for timely and effective assay design or compound library development and production that fulfills our scientific obligations to them. To the extent that either we experience delays or failures in receiving specific deliverables required for us to complete our objectives or we encounter delays in our ability to meet, or are unable to meet, our scientific obligations, we may be unable to receive and recognize revenues in accordance with our expectations.

We derive a significant percentage of our revenues from a single customer. If this customer relationship terminated, we would incur a larger net loss from operations.

A significant portion of our actual 2005 and anticipated annual 2006 revenues were and will be, as the case may be, derived from the compound procurement and management contract that we entered into with the NIH in September, 2004. The agreement expires by its natural terms on November 30, 2008, but may be renewed on an annual basis by the NIH up to November 30, 2013; however the agreement is subject to continued government funding. During the year ended December 31, 2005, revenue from the NIH represented 14% of our total revenue. Revenues under the NIH contract are earned as costs are incurred to procure, inspect and ship compounds to NIH designated screening centers. In addition, revenues are earned as compounds are purchased on behalf of the NIH at such time that the compounds pass certain quality standards as specified by the NIH and payment is made to the compound vendors. Timing of revenues earned is partially dependent on the timing of the NIH selection of compounds, the timing of procurement and processing of acquired compounds and the volume of screening activity at the NIH designated screening centers. In the event the NIH is delayed in the selection process of acquiring compounds, as it was in 2005, or such acquired compounds fail to meet the NIH specified standards, or if there are delays in the ramp up in the demand of the NIH designated screening centers, revenues recognized under this contract may be deferred to future periods. It is uncertain at this time whether the NIH will renew this agreement or whether we will be successful in entering into new agreements with this customer. Our agreement with the NIH is also subject to the risk that the U.S. government will not continue to provide the funding to support the activities pursuant to this agreement.

21

A significant portion of our actual revenues over the past three years resulted from the agreement we entered into with Pfizer in February 2004. In 2005, 2004 and 2003, 54%, 62% and 69%, respectively, of our revenue from continuing operations came from our chemistry contracts with Pfizer. Our contract with Pfizer ended by its terms on January 6, 2006, and, in the fourth quarter of 2005, discussions with Pfizer to renew our contract were ended. The loss of this customer relationship will result in a larger net loss from operations for 2006 than in previous years.

If our revenues decline, we will not be able to correspondingly reduce our operating expenses.

A large portion of our expenses, including expenses for facilities, equipment and personnel, is relatively fixed. A significant percentage of our fixed costs is directly related to the cost of operating as a public company in maintaining compliance with the regulatory requirements. Accordingly, if revenues continue to decline, we expect we will not be able to correspondingly reduce our operating expenses. Failure to achieve anticipated levels of revenues could therefore significantly harm our operating results for a particular fiscal period.

The drug discovery industry is highly competitive and subject to technological changes, and we may not have the resources necessary to compete successfully.

We compete with companies in the United States and abroad that engage in the provision of drug discovery technology to the pharmaceutical and biotechnology industry. These competitors include companies engaged in the following areas of drug discovery:

• Assay development and screening;

• Synthetic compound libraries and lead optimization;

• Natural products libraries and chemistry;

• Informatics; and

• Gene expression profiling.