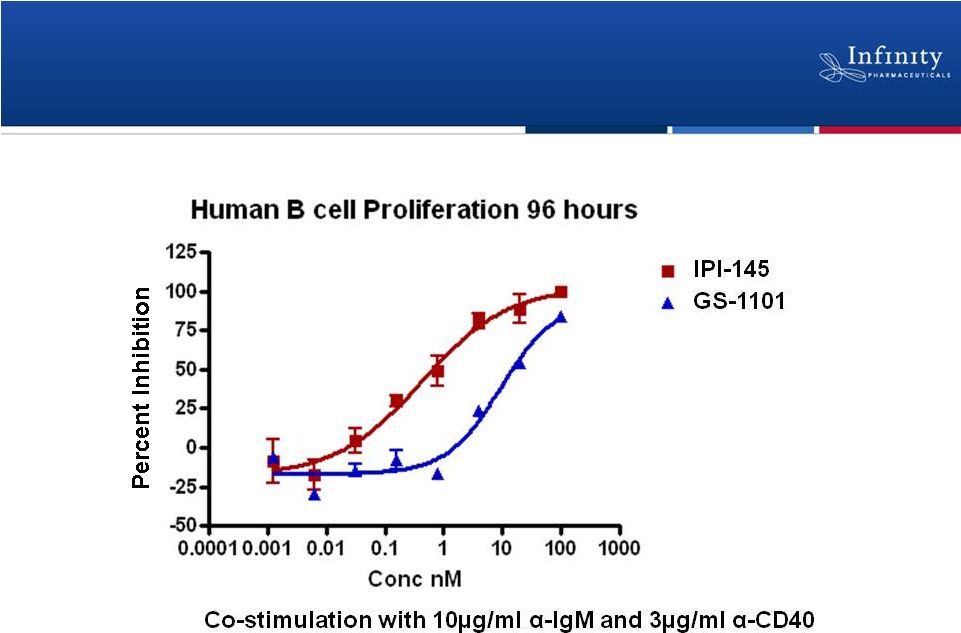

2 • This presentation contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. • These statements involve risks and uncertainties that could cause actual results to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. • Such forward-looking statements include statements regarding: the therapeutic potential of Infinity’s Hedgehog pathway, Hsp90 and PI3K inhibitors and the ability to achieve proof of concept in each of these programs by the end of 2013; the potential for data from the ongoing clinical trials to lead to multiple registration paths; the potential of saridegib and Hedgehog pathway inhibition in addressing chondrosarcoma and myelofibrosis; the potential of IPI-145 and PI3K inhibition in addressing hematologic malignancies and inflammation; the potential of combination therapy based on retaspimycin HCl in addressing non-small cell lung cancer, the future market size of non-small lung cancer therapeutics, and the expectation that Infinity: will report data in the second half of 2012 from the Phase 2 trial of saridegib in patients with myelofibrosis, the dose- escalation portion of the Phase 1b/2 trial of retaspimycin HCl in combination with everolimus in patients with NSCLC, and each of the Phase 1 trials of IPI-145; will complete enrollment in the second half of 2012 in the Phase 2 trial of saridegib in patients with chondrosarcoma and the Phase 2 trial of retaspimycin HCl in combination with docetaxel in patients with NSCLC; and will commence future clinical development of its product candidates, including a Phase 2 trial of IPI-145 in inflammation in the second half of this year. Such forward-looking statements also include estimates of 2012 financial performance and the expectation that Infinity will have a cash runway to support its current operating plan through key inflection points. • Such statements are subject to numerous factors, risks and uncertainties that may cause actual events or results to differ materially from the company’s current expectations. For example, there can be no guarantee that Infinity’s strategic alliance with Mundipharma will continue for its expected term or that it will fund Infinity’s programs as agreed, that any product candidate Infinity is developing will successfully complete necessary preclinical and clinical development phases, or that development of any of Infinity’s product candidates will continue. Further, there can be no guarantee that any positive developments in Infinity’s product portfolio will result in stock price appreciation. Management’s expectations could also be affected by risks and uncertainties relating to: Infinity’s results of clinical trials and preclinical studies, including subsequent analysis of existing data and new data received from ongoing and future studies; the content and timing of decisions made by the U.S. Food and Drug Administration and other regulatory authorities, investigational review boards at clinical trial sites and publication review bodies; Infinity’s ability to enroll patients in its clinical trials; unplanned cash requirements and expenditures, including in connection with business development activities; development of agents by Infinity’s competitors for diseases in which Infinity is currently developing its product candidates; and Infinity’s ability to obtain, maintain and enforce patent and other intellectual property protection for any product candidates it is developing. • These and other risks which may impact management's expectations are described in greater detail under the caption "Risk Factors" included in Infinity's annual report on Form 10-K for the year ended December 31, 2011, filed with the U.S. Securities and Exchange Commission on March 13, 2012. • Further, any forward-looking statements contained in this presentation speak only as of the date hereof, and Infinity expressly disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statements |