- TROW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

T. Rowe Price (TROW) DEF 14ADefinitive proxy

Filed: 21 Mar 23, 1:13pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant | |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

T. Rowe Price Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

|

| |

2023 Notice of Annual

May 9, 2023 virtualshareholdermeeting.com/TROW2023

T. Rowe Price Group

|

T. Rowe Price Group, Inc.

A Premier Global Active Asset Manager

Independent Investment Organization Focused solely on investment management and related services | Alignment of Interests Substantial employee ownership aligns interests with stockholders | Stable Investment Leadership Global investment leaders average 15 years’ tenure at T. Rowe Price | ||

Financial Strength No outstanding debt and maintains substantial cash reserves | Global Investment Platform Full range of equity, fixed income, and multi-asset solutions

|

Our Multiyear Strategic Objectives

| Deliver investment excellence |  | Innovate our investment capabilities to remain central to meeting client needs | |

| Globalize and grow client base |  | Attract and develop excellent diverse talent | |

| Deliver world-class client service |  | Leverage data and technology to support innovation and operational excellence, and drive scale |

Past performance cannot guarantee future results. As of December 31, 2022.

| (1) | Firmwide AUM includes assets managed by T. Rowe Price Associates, Inc., and its investment advisory affiliates. |

2022 Performance

Investment Results

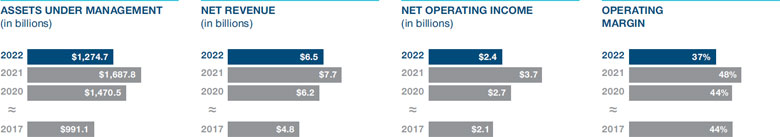

As investors, we remained focused on our strategic investing approach and delivering alpha for clients through active management. Our investment performance was solid across most asset classes, with 64%, 68%, and 74% of our U.S. mutual funds (primary share class only) outperforming their comparable Morningstar median over the 3-, 5-, and 10-year periods ended December 31, 2022, respectively.(1)

Financial Results

Our assets under management (AUM) was $1.27 trillion on December 31, 2022, with about 9.1% of our AUM domiciled outside the U.S. Average AUM was $1.40 trillion, which led to investment advisory revenues of nearly $6.0 billion. We returned $1,964.1 million to stockholders, including $855.3 million of share repurchases in 2022.

ESG Snapshot

Sustainable Investing on Behalf of Clients

Environmental, social, and governance (ESG) factors are key considerations in our investment approach—our investment teams focus on understanding the long-term sustainability of the companies in which we invest. ESG considerations are analyzed by two teams: Responsible Investing, which covers environmental and social factors, and Governance. Together, they help our investors make more informed decisions.

Reducing Our Environmental Footprint

We are committed to tackling the challenge of climate change and believe we have a responsibility to take meaningful action. We are in the process of undertaking a comprehensive climate risk assessment. Through this process, we will identify the most material climate-related risk and opportunity metrics. We anticipate that these metrics will monitor both the physical and transitional risks associated with climate change. In addition, we support the goals of the Paris Climate Agreement. We have currently set targets to manage climate-related risks and opportunities for two areas: greenhouse gas (GHG) emissions and waste. For GHG emissions, we set a target for scopes 1 and 2 emissions to achieve a 75% reduction by 2030 and net zero by 2040.

Additionally, we set a target of reducing the waste we send to landfills by 92% by 2025 compared with a 2010 baseline. This absolute target is measured by collecting data from each facility on tons of waste sent to landfills. Following best practice, data are also collected on tons of waste recycled, composted, and sent for energy recovery. We remain on track to meet this target in advance of the 2025 deadline. We are committed to building on this momentum and will seek circular economy options to tackle both our operational and embodied waste. As part of this endeavor, we embrace the need to shift from managing waste once it is created to designing out waste before it is generated.

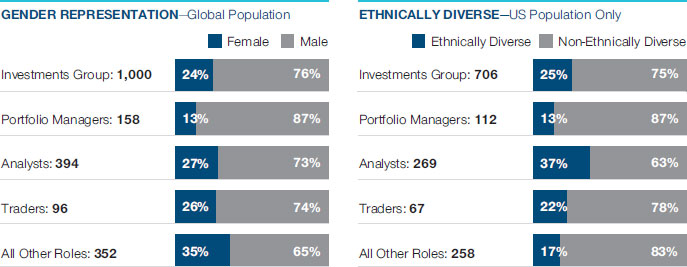

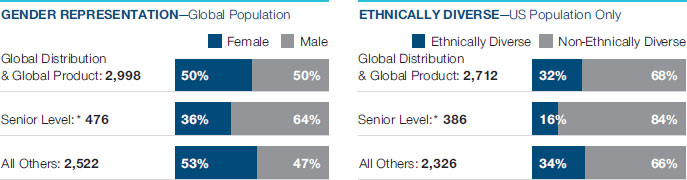

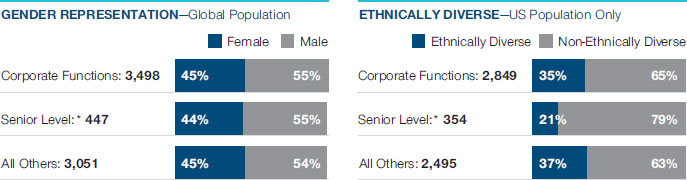

Promoting Diversity

Our long-held reputation for excellence and reliability is made possible by the diversity of backgrounds, perspectives, skills, and experiences of our associates.

To bring diversity, equity and inclusion (DEI) to life, we:

| Retain and attract diverse talent |  | Include and engage our associates |  | Develop our associates and leaders |  | Hold ourselves accountable |  | Act as an agent of change |

In 2022

| 60% | 47% | 45% | 32% | |||

| of our independent directors were ethnically diverse and/or women | of hires in senior roles were ethnically diverse and/or women(2) | of associates in our global workforce were women(2) | of our U.S. associates were ethnically diverse(2) |

| (1) | Source: © 2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Primary share class only. |

| (2) | Senior roles are defined as people leaders and/or individual contributors with significant business or functional responsibility. Information excludes OHA associates. |

|  |

Notice of 2023 Annual Meeting of Stockholders

Date and Time

Tuesday, May 9, 2023, 8 a.m. eastern time

Record Date

March 1, 2023. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting.

Virtual Meeting

This year’s Annual Meeting will be held virtually through www.virtualshareholdermeeting.com/ TROW2023

Voting Methods

| Internet |

| Telephone |

|

YOUR VOTE IS IMPORTANT!

Please vote via the internet or telephone (if such voting methods are available to you) by following the instructions on the accompanying proxy card promptly. Please see the Notice of Internet Availability of Proxy Materials, your proxy card, or the information your bank, broker, or other holder of record provided to you for more information on these options.

T. ROWE PRICE GROUP, INC.

100 EAST PRATT STREET

BALTIMORE, MD 21202

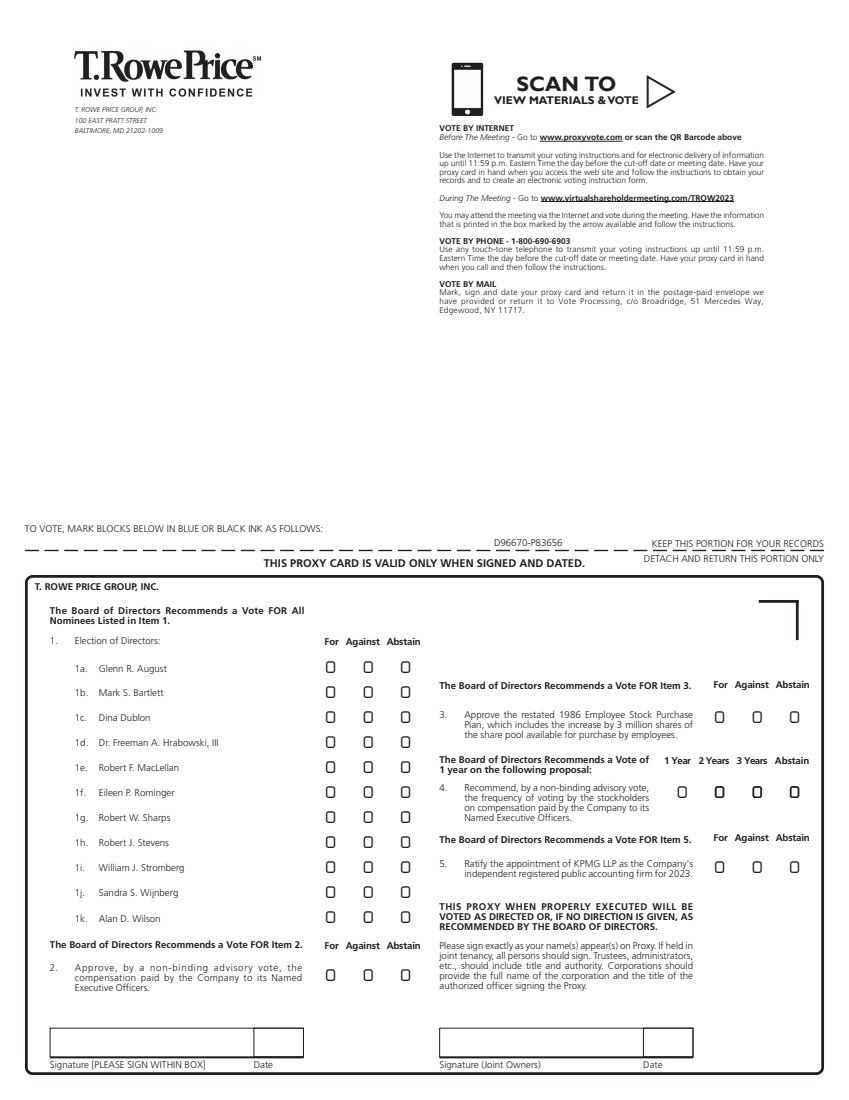

| VOTING ITEM | BOARD VOTING RECOMMENDATION | ||

| 1 | Elect a Board of 11 directors |

All Director-Nominees | |

| 2 | Approve, by a nonbinding advisory vote, the compensation paid by the Company to its Named Executive Officers |  FOR FOR | |

| 3 | Approve the restated 1986 Employee Stock Purchase Plan, which includes the increase by 3 million shares of the share pool available for purchase by employees |  FOR FOR | |

| 4 | Recommend, by a nonbinding advisory vote, the frequency of voting by the stockholders on compensation paid by the Company to its Named Executive Officers |  One Year One Year | |

| 5 | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2023 |  FOR FOR | |

Stockholders who owned shares of our common stock as of March 1, 2023, are entitled to attend and vote at the Annual Meeting or any adjournments.

By Order of the Board of Directors,

David Oestreicher

General Counsel and Corporate Secretary

Baltimore, Maryland

March 21, 2023

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 9, 2023

On or about March 21, 2023, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials directing stockholders to a website where they can access the proxy statement for our Annual Meeting and the 2022 Annual Report to Stockholders (Annual Report) and view instructions on how to vote their shares by internet or telephone. This proxy statement and our Annual Report may be viewed, downloaded, and printed, at no charge, by accessing the following internet address: materials.proxyvote.com/74144T.

Stockholders who wish to attend the Annual Meeting must follow the instructions on page 85 under the section titled “What must I do to participate in the Annual Meeting?”.

| 2023 Proxy Statement | 1 |

Introduction

This proxy statement is being made available to you in connection with the solicitation of proxies by the T. Rowe Price Group, Inc. (Price Group or the Company) Board of Directors (Board) for the 2023 Annual Meeting of Stockholders (Annual Meeting). The purpose of the Annual Meeting is to:

| ● | Elect a Board of 11 directors; |

| ● | Approve, by a nonbinding advisory vote, the compensation paid by the Company to its Named Executive Officers; |

| ● | Approve the restated 1986 Employee Stock Purchase Plan, which includes the increase by 3 million shares of the share pool available for purchase by employees; |

| ● | Recommend, by a nonbinding advisory vote, the frequency of voting by the stockholders on compensation paid by the Company to its Named Executive Officers; and |

| ● | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2023. |

This proxy statement, the proxy card, and our 2022 Annual Report to Stockholders containing our consolidated financial statements and other financial information for the year ended December 31, 2022, form your “Proxy Materials.” We have adopted the Securities and Exchange Commission’s (SEC) “Notice and Access” model of proxy notification, which allows us to furnish proxy materials online, with paper copies available upon request. We sent you a notice on how to obtain your Proxy Materials on March 21, 2023.

| 2 | T. Rowe Price Group |

Voting Road Map

| Proposal 1 |

Election of Directors

Director Nominee Demographics

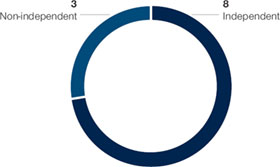

INDEPENDENCE

• Eight of 11 director nominees are independent under the NASDAQ Global Select Market standards

• All directors serving on the Audit, Executive Compensation and Management Development and Nominating and Corporate Governance Committees are independent

• A well-empowered lead independent director provides independent leadership to our Board | DIVERSITY

Of our independent director nominees:  | TENURE

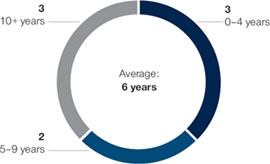

• Balanced mix of short- and long-tenured directors

• The tenure of our independent director nominees ranges from 17 months to 13 years, with an average tenure of approximately six years

• Longer-tenured directors in leadership roles |

| QUALIFICATIONS, SKILLS, AND EXPERIENCE | |||||

| 100% Executive Leadership |  | 100% Financial Management |  | 64% Investment Management |

| 82% International |  | 73% Accounting and Financial Reporting |  | 100% Strategy and Execution |

| 82% Marketing and Distribution |  | 55% Government and Regulatory |  | 36% Technology |

BOARD ENGAGEMENT

| • | The Board held seven meetings in 2022 |

| • | Each director attended at least 75% of the combined total number of meetings of the Board and Board committees of which he or she was a member |

| • | The independent directors met in executive session at all seven of the Board meetings in 2022 |

| • | All directors were at the 2022 annual meeting of stockholders, virtually, and were available to respond to questions from our stockholders |

| Recommendation of the Board | Vote Required | ||

| We recommend that you vote FOR all the director nominees under Proposal 1. |

2023 Proxy Statement 3

| Proposal 2 |

Advisory Vote on the Compensation Paid to Our Named Executive Officers

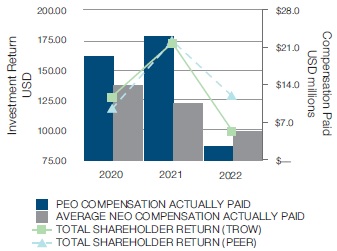

Our Named Executive Officers’ (NEOs) compensation is straight-forward, goal oriented, long-term focused, transparent, and aligned with the interests of our stockholders.

Our incentive compensation programs are designed to motivate and reward performance, as measured by several factors, including:

• the financial performance and financial stability of Price Group

• the relative investment performance of our mutual funds and other investment portfolios

• the performance of our NEOs against the corporate and individual goals established at the beginning of the year

Our executive compensation programs are also designed to reward our NEOs for other important contributions to our success, including corporate integrity, service quality, customer loyalty, risk management, corporate reputation, and the quality of our team of professionals and collaboration within that team.

Our long-term variable compensation creates a strong alignment of the financial interests of our NEOs directly to the long-term performance of our Company.

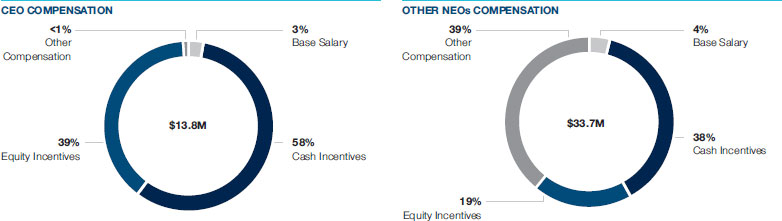

| CEO COMPENSATION | OTHER NEOs COMPENSATION (EXCLUDING FORMER CFO) | FORM OF COMPENSATION | PERFORMANCE PERIOD | PERFORMANCE ALIGNMENT | ||||||

|  |  | Cash | Ongoing | • Individual | |||||

|  |  | Cash | Annual | • Maximum bonus pool cannot exceed 5% of net operating income (adjusted) • Actual NEO bonus amounts based on Company performance against financial and strategic goals, as well as individual performance | |||||

|  |  | Performance Stock Units | Three-year performance period, then vest 50% per year over two following years | • Company operating margin performance compared with peers • Company stock price | |||||

| Restricted Stock Units | Vest one-third per year over three years | • Company stock price | ||||||||

Mutual Fund Units | Pro Rata over 3 years | • Performance of investments managed by TRPIL | ||||||||

| Carried Interest | Varies based on OHA Fund performance | • OHA Fund Performance |

| Recommendation of the Board | Vote Required | ||

| We recommend that you vote FOR this proposal. |

4 T. Rowe Price Group

| Proposal 3 |

Approve the Restated 1986 Employee Stock Purchase Plan, Which Includes the Increase by 3 Million Shares of the Share Pool Available for Purchase by Employees

We are asking stockholders to approve a restatement of the T. Rowe Price Group, Inc. 1986 Employee Stock Purchase Plan (ESPP) to increase the number of shares available for purchase by associates on and after May 9, 2023, by 3 million shares, subject to adjustment in the event of a stock or special cash dividend, stock split or reverse stock split, other changes in capitalization and other events affecting the Company or Company common stock.

Why We Support the Proposal

We believe our ESPP:

| • | Provides a key benefit to attracting and retaining top talent |

| • | Encourages our associates to purchase and retain shares of the Company’s common stock |

| • | Aligns the long-term interests of our associates with those of our stockholders |

| Recommendation of the Board | Vote Required | ||

| We recommend that you vote FOR this proposal. |

| Proposal 4 |

Advisory Vote on the Selection of Frequency for the Advisory Vote on the Compensation Paid to Our Named Executive Officers

As part of “Say on Pay” which is addressed under Proposal 2, we are required every six years to give the Price Group stockholders the opportunity to indicate, by a nonbinding advisory vote, the frequency preferred for the Say on Pay advisory vote on the compensation paid to the Company’s NEOs. The choices available under the Say on Pay rules are every year, every other year, or every third year.

| Recommendation of the Board | Vote Required | ||

| We recommend that you select one year as the desired frequency for a stockholder vote on executive compensation under the Say on Pay rules. |

| Proposal 5 |

Ratification of the Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm for 2023

The Audit Committee and the Board believe that the continued retention of KPMG as our independent registered public accounting firm is in the best interest of Price Group and our stockholders.

| Recommendation of the Board | Vote Required | ||

| We recommend that you vote FOR this proposal. |

2023 Proxy Statement 5

Table of Contents

6 T. Rowe Price Group

Information About Our Board of Directors

Board Qualifications, Skills, and Experience

We believe that the nominees presented in this proxy statement constitute a Board of Directors (Board) with an appropriate level and diversity of experience, education, skills, and independence. We routinely assess and monitor the capabilities of our existing directors and whether additional capabilities and independent directors should be added to the Board. In considering the need for additional independent directors, we review any expected director departures and retirements and factor succession planning for the Board into our deliberations, with particular focus on the specific skills and capabilities of departing directors. We are very pleased with our current complement of directors and the varied perspectives they bring to the Board.

The following are highlights of the composition of our current director nominees, all of whom currently serve on the Board:

| • | Eight of 11 of the director nominees are independent under the NASDAQ Global Select Market standards |

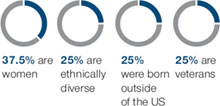

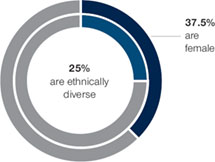

| • | Three director nominees are women, representing 37.5% of the independent director nominees |

| • | Two director nominees are ethnically diverse, representing 25% of the independent director nominees |

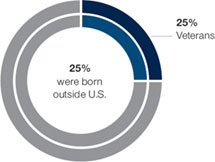

| • | Two director nominees were born outside the United States, representing 25% of the independent director nominees |

| • | Two director nominees are veterans, representing 25% of the independent director nominees |

| • | Three of the independent director nominees joined the Board within the last four years, representing 37.5% of the independent director nominees; the average independent director nominee tenure is six years |

| INDEPENDENT DIRECTOR NOMINEE COMPOSITION | ||

|  | |

INDEPENDENT DIRECTOR NOMINEE TENURE | DIRECTOR NOMINEE INDEPENDENCE | |

|  |

2023 Proxy Statement 7

The chart below summarizes the specific qualifications, attributes, and skills for each director nominee. A “■” in the chart below indicates that the director has meaningfully useful expertise in that subject area. The lack of a “■” does not mean the director does not possess knowledge or skill. Rather, a “■” indicates a specific area of focus or expertise of a director on which the Board currently relies.

| Executive Leadership | Financial Management | Investment Management Industry | International Business Experience | Technology | Strategy Formation/ Execution | Marketing/ Distribution | Government/ Regulatory | Diversity | ||

| Name |  |  |  |  |  |  |  |  |  | |

| William J. Stromberg | ■ | ■ | ■ | ■ | ■ | ■ | ||||

| Robert W. Sharps | ■ | ■ | ■ | ■ | ■ | ■ | ||||

| Glenn R. August | ■ | ■ | ■ | ■ | ■ | ■ | ||||

| Mark S. Bartlett | ■ | ■ | ■ | ■ | ||||||

| Dina Dublon | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Dr. Freeman A. Hrabowski, III | ■ | ■ | ■ | ■ | ■ | ■ | ||||

| Robert F. MacLellan | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |||

| Eileen P. Rominger | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Robert J. Stevens | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |||

| Sandra S. Wijnberg | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |

| Alan D. Wilson | ■ | ■ | ■ | ■ | ■ |

Board Diversity Matrix (As of March 1, 2023)

| Total Number of Directors | 13 | |||

| Female | Male | Non-binary | Did Not Disclose Gender | |

| Directors | 4 | 9 | 0 | 0 |

| Number of Directors Who Identify in Any of the Categories Below | ||||

| African American or Black | 1 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 1 | 0 | 0 |

| Hispanic or Latinx | 1 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 3 | 7 | 0 | 0 |

| Two or More Races or Ethnicities | 1 | 0 | 0 | 0 |

| LGBTQ+ | 0 | 0 | 0 | 0 |

| Did Not Disclose Demographic Background | 0 | 0 | 0 | 0 |

8 T. Rowe Price Group

Nominee Biographies

Each of our director nominees provides significant individual attributes important to the overall makeup and functioning of our Board, which are described in the biographical summaries provided below:

Glenn R. August, 61

Chief Executive Officer of OHA

Director since: 2021

Committee Memberships:

• Management Committee |

Mr. August has been a director of Price Group, a vice president, and an employee since 2021. He is the founder and chief executive officer of Oak Hill Advisors, L.P. (OHA), an alternative investment firm specializing in performing and distressed credit investments, which was acquired by, and operates as a standalone business within, T. Rowe Price. Mr. August is a member of the Management Committee. Mr. August co-founded the predecessor investment firm to OHA in 1987 and took responsibility for the firm’s credit and distressed investment activities in 1990. Prior to founding OHA, and cofounding its predecessor investment firm in 1987, Mr. August worked at Morgan Stanley in New York and London.

Mr. August earned a B.S. in industrial and labor relations from Cornell University and an M.B.A. from Harvard Business School, where he was a Baker Scholar.

Mr. August is a member of the board of directors of Lucid Group, Inc., where he serves on the audit, nominating/corporate governance, and pricing committees, as well as a member of the board of directors for MultiPlan, Inc., where he serves on the nominating/corporate governance committee. He is a member of the board of trustees of Horace Mann School, where he co-chairs the investment committee and serves on the executive committee. He is a member of the board of trustees of The Mount Sinai Medical Center, where he serves on the finance, human capital management and IT committees. He is a member of the board of directors of Partnership for New York City and the 92nd Street Y, where he co-chairs the governance committee.

Mr. August brings to our Board insight into the alternative investment area of our business based on his role at OHA and his decades-long success in growing the OHA platform. |

Mark S. Bartlett, 72

Retired Managing Partner

Independent Director since: 2013

Committee Memberships:

• Audit (Chair) • Executive Compensation and Management Development |

Mr. Bartlett has been an independent director of Price Group since 2013 and serves as chair of the Audit Committee and as a member on the Executive Compensation and Management Development Committee. He was a partner at Ernst & Young, serving as managing partner of the firm’s Baltimore office and senior client service partner for the mid-Atlantic region. Mr. Bartlett began his career at Ernst & Young in 1972, serving until 2012, and has extensive experience in financial services, as well as other industries.

Mr. Bartlett earned a B.S. in accounting from West Virginia University and attended the Executive Program at the Kellogg School of Business at Northwestern University. He also earned the designation of certified public accountant.

Mr. Bartlett is a member of the board of directors, chair of the audit committee, and a member of the compensation committee of WillScot Mobile Mini Holdings Corp. He is also a member of the board of directors and a member of the audit committees of FTI Consulting, Inc., and Zurn Water Solutions Corp. and also serves as Zurn Water Solutions Corp.’s lead independent director.

Mr. Bartlett offers our Board additional perspective on mergers and acquisitions, significant accounting and financial reporting experience, as well as expertise in the accounting-related rules and regulations of the SEC from his experience as a partner of a multinational audit firm. He has extensive finance knowledge, with a broad range of experience in financing alternatives, including the sale of securities, debt offerings, and syndications. |

2023 Proxy Statement 9

Dina Dublon, 69

Retired Executive Vice President and Chief Financial Officer

Independent Director since: 2019

Committee Memberships:

• Audit • Executive Compensation and Management Development | Ms. Dublon has been an independent director of Price Group since 2019 and serves as a member on the Audit Committee and the Executive Compensation and Management Development Committee. She was the executive vice president and chief financial officer of JPMorgan Chase & Co., a financial services company, from 1998 to 2004. Ms. Dublon previously held numerous positions at JPMorgan Chase & Co. and its predecessor companies, including corporate treasurer, managing director of the financial institutions’ division, and head of asset liability management.

Ms. Dublon earned a B.A. in economics and mathematics from Hebrew University of Jerusalem and an M.S. from Carnegie Mellon University.

Ms. Dublon has been a member of the board of directors of PepsiCo, Inc., since 2005, where she serves as a member of the sustainability, diversity, and public policy committee and the compensation committee. She previously served as chair of the audit committee. She also serves as a member of board of directors of Motive Capital Corp. II, where she serves as chair of the audit committee and as a member of the compensation and nominations and governance committees. She serves as a member of the independent audit quality committee of Ernst & Young USA, since 2020, and is chair of the board of advisors of Columbia University’s Mailman School of Public Health. She also serves on the boards of the Hastings Center and Westchester Land Trust. From 2002 to 2017, Ms. Dublon served as a director of Accenture PLC; from 2013 to 2018, as a director of Deutsche Bank AG; from 2005 to 2014, as a director of Microsoft Corporation; and from 1999 to 2002, as a director of Hartford Financial Services Group, Inc. She previously served on the faculty of Harvard Business School and on the boards of several nonprofit organizations, including the Women’s Refugee Commission and Global Fund for Women.

Ms. Dublon brings to our Board significant governance experience from serving on boards of global companies, accounting and financial reporting experience, as well as substantial expertise with respect to the financials sector, mergers and acquisitions, global markets, public policy, and corporate finance gained throughout her career in the financial services industry, particularly her role as executive vice president and chief financial officer of a major financial institution. |

Dr. Freeman A. Hrabowski, III, 72

President Emeritus

Independent Director since: 2013

Committee Memberships:

• Executive Compensation and Management Development • Nominating and Corporate Governance (Chair) | Dr. Hrabowski has been an independent director of Price Group since 2013 and serves as chair of the Nominating and Corporate Governance Committee and as a member on the Executive Compensation and Management Development Committee. He is the former president of the University of Maryland, Baltimore County (UMBC), a position he held from 1992 to 2023. His research and publications focus on science and math education, with special emphasis on minority participation and performance. Dr. Hrabowski is also a leading advocate for greater diversity in higher education. He serves as a consultant to the National Science Foundation, the National Institutes of Health, the National Academies, and universities and school systems nationally.

Dr. Hrabowski earned a B.A. in mathematics from Hampton University and an M.A. in mathematics and a Ph.D. in higher education administration and statistics from the University of Illinois at Urbana-Champaign.

Dr. Hrabowski is a member of the board of directors and a member of the corporate and governance committee of McCormick & Company, Inc. He also served on the board of directors of Constellation Energy Group, Inc., until 2012.

Dr. Hrabowski brings to our Board valuable strategic and management leadership experience from his role as president of UMBC, as well as his extensive knowledge and dedication to greater education and workforce development. He also contributes corporate governance oversight from his experience serving as a director on other public company boards. |

10 T. Rowe Price Group

Robert F. MacLellan, 68

Non-Executive Chairman

Independent Director since: 2010

Committee Memberships:

• Audit • Executive • Executive Compensation and Management Development (Chair) | Mr. MacLellan has been an independent director of Price Group since 2010 and serves as chair of the Executive Compensation and Management Development Committee and as a member on the Audit Committee and Executive Committee. He is the non-executive chairman of Northleaf Capital Partners, an independent global private markets fund manager and advisor. Mr. MacLellan served as chief investment officer of TD Bank Financial Group (TDBFG) from 2003 to 2009, where he was responsible for overseeing the management of investments for its Employee Pension Fund, The Toronto-Dominion Bank, TD Mutual Funds, and TD Capital Group. Earlier in his career, he was managing director of Lancaster Financial Holdings, a merchant banking group acquired by TDBFG in March 1995. Prior to that, Mr. MacLellan was vice president and director at McLeod Young Weir Limited (Scotia McLeod) and a member of the corporate finance department responsible for many corporate underwritings and financial advisory assignments.

Mr. MacLellan earned a B.Com. from Carleton University and an M.B.A. from Harvard Business School. He also earned the designation of certified public accountant.

Mr. MacLellan is the non-executive chair of the board of directors and a member of the technology committee of Magna International, Inc., a public company based in Aurora, Ontario. From 2012 to 2018, he was the chair of the board of Yellow Media, Inc., a public company based in Montreal.

Mr. MacLellan brings substantial experience and perspective to our Board with respect to the financial services industry, particularly his expertise with respect to investment-related matters, including those relating to the mutual fund industry and the institutional management of investment funds, based on his tenure as chief investment officer of a major financial institution. He also brings an international perspective to the Board as well as significant accounting and financial reporting experience. |

Eileen P. Rominger, 68

Former Senior Advisor

Independent Director since: 2021

Committee Memberships:

• Audit • Executive Compensation and Management Development | Ms. Rominger has been an independent director of Price Group since 2021 and serves as a member on the Audit Committee and the Executive Compensation and Management Development Committee. She was a senior advisor to CamberView Partners, LLC, a provider of investor-led advice for management and boards of public companies on shareholder engagement and corporate governance, from 2013 to 2018. Ms. Rominger also was the director of the Division of Investment Management at the Securities and Exchange Commission (SEC) from 2011 to 2012 and was the global chief investment officer from 2008 to 2011 and a partner from 2004 to 2011 at Goldman Sachs Asset Management. She began her career in 1981 at Oppenheimer Capital, where she worked for 18 years as a securities analyst and then as an equity portfolio manager, serving as a managing director and a member of the executive committee.

Ms. Rominger earned a B.A. in English from Fairfield University and an M.B.A. in finance from the University of Pennsylvania, The Wharton School.

Ms. Rominger served as a member of the board of directors of Swiss Re from 2018 to 2020 and served as a director on several of its subsidiaries until 2022. She previously served on the board of directors of Permal Asset Management, Inc., a private company, from 2012 to 2013.

Ms. Rominger brings a broad range of valuable leadership and investment management experience to our Board. She also has extensive experience with complex issues relevant to the Company’s business, including budget and fiscal responsibility, economic, regulatory policy, and women’s issues. |

2023 Proxy Statement 11

Robert W. Sharps, 51

Chief Executive Officer and President

Director since: 2021

Committee Memberships:

• Executive (Chair) • Management (Chair) | Mr. Sharps has been a director of Price Group since January 2022. He is the chief executive officer (CEO) and president of Price Group and is the chair of the Company’s Executive, Management, and Management Compensation and Development Committees. Mr. Sharps has been with Price Group since 1997, beginning as an analyst specializing in financial services stocks, including banks, asset managers, and securities brokers, in the U.S. Equity Division. He was the lead portfolio manager of the Institutional Large-Cap Growth Equity Strategy from 2001 to 2016. In 2016, Mr. Sharps stepped down from portfolio management to assume an investment leadership position as co-head of Global Equity, at which time he joined the Management Committee. He was head of Investments and group chief investment officer from 2017 to 2021. In February 2021, Mr. Sharps became President of Price Group and then CEO in January 2022. Prior to Price Group, he completed an internship as an equity research analyst at Wellington Management. Mr. Sharps also was employed by KPMG Peat Marwick as a senior management consultant, where he focused on corporate transactions, before leaving to pursue his M.B.A. in 1995.

Mr. Sharps earned a B.S., summa cum laude, in accounting from Towson University and an M.B.A. in finance from the University of Pennsylvania, The Wharton School. He also has earned the Chartered Financial Analyst® designation.

Mr. Sharps currently serves on the board of directors of the Baltimore Curriculum Project. He previously served on the St. Paul’s School board of trustees and was chair of the investment committee from July 2015 to June 2020. He also spent six years on Towson University’s College of Business and Economics alumni advisory board.

Mr. Sharps brings to our Board insight into the critical investment component of our business based on the leadership roles he has held in the U.S. Equity Division of Price Group and his over 25-year career with the Company.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute. |

Robert J. Stevens, 71

Retired Chairman, President, and Chief Executive Officer

Independent Director since: 2019

Committee Memberships:

• Executive Compensation and Management Development • Nominating and Corporate Governance | Mr. Stevens has been an independent director of Price Group since 2019 and serves as a member on the Executive Compensation and Management Development Committee and the Nominating and Corporate Governance Committee. He was the chairman, president, and chief executive officer of Lockheed Martin Corporation, an American aerospace, defense, arms, security, and advanced technologies company, from 2005 to 2012 and served as executive chairman in 2013. He also served as Lockheed Martin’s chief executive officer from August 2004 through 2012. Previously, Mr. Stevens held a variety of increasingly responsible executive positions with Lockheed Martin, including president and chief operating officer, chief financial officer, and head of strategic planning.

Mr. Stevens earned a B.A. in psychology from Slippery Rock University of Pennsylvania, an M.S. in industrial engineering and management from the New York University Tandon School of Engineering, and an M.S. in business from Columbia University.

Mr. Stevens serves on the advisory board of the Marine Corps Scholarship Foundation and is a member of the Council on Foreign Relations. From 2002 to 2018, he was the lead independent director of Monsanto Corporation, where he also served as the chair of the nominating and corporate governance committee and a member of the audit committee. Mr. Stevens served as a director of United States Steel Corporation from 2015 to 2018, where he was on the corporate governance and public policy committee and the compensation and organization committee.

Mr. Stevens brings to our Board significant executive management experience. He also adds additional perspective to our Board regarding financial matters, mergers and acquisitions, strategic leadership, and international operational experience based on his tenure as chief executive officer of a publicly traded, multinational corporation. |

12 T. Rowe Price Group

William J. Stromberg, 63

Non-executive Chair T. Rowe Price Group, Inc.

Director since: 2016

Committee Memberships:

• Executive | Mr. Stromberg has been a director of Price Group since 2016 and currently serves as the non-executive chair of the Board and as a member of the Executive Committee. He served as the chief executive officer of Price Group from 2016 to 2021 and was its president from 2016 to February 2021. Prior to that, Mr. Stromberg was the Company’s head of equity from 2009 to 2015, and the head of U.S. equity from 2006 to 2009. He also served as a director of Equity Research (1996 to 2006), as a portfolio manager of the Capital Opportunity Fund (2000 to 2007) and the Dividend Growth Fund (1992 to 2000), and as an equity investment analyst (1987 to 1992). Prior to joining the firm in 1987, he was employed by Westinghouse Defense as a systems engineer.

Mr. Stromberg earned a B.A. from Johns Hopkins University and an M.B.A. from the Tuck School of Business at Dartmouth. Mr. Stromberg also has earned the Chartered Financial Analyst® designation.

Mr. Stromberg is a member of the board of directors, chair of the talent, culture and compensation committee, and a member of the audit committee of GE HealthCare Technologies, Inc. He also serves on the Johns Hopkins University board of trustees and is the chair of the investment committee, and is chair of the Hopkins Whiting School of Engineering advisory council. Mr. Stromberg serves as a member of the board of the Greater Baltimore Committee (2018 to present) and the Greater Washington Partnership (2017 to present). Mr. Stromberg previously served nine years on the Catholic Charities board of trustees, with two years as board president.

Mr. Stromberg brings to our Board insight into the critical investment component of our business based on the leadership roles he has held in the equity division of Price Group and his 34-year career with the Company. |

Sandra S. Wijnberg, 66

Former Partner and Chief Administrative Officer Aquiline Holdings LLC

Independent Director since: 2016

Committee Memberships:

• Audit • Executive Compensation and Management Development | Ms. Wijnberg has been an independent director of Price Group since 2016 and serves as a member on the Audit Committee and the Executive Compensation and Management Development Committee. She was an executive advisor of Aquiline Holdings LLC, a registered investment advisory firm from 2015 to early 2019, where she previously served as a partner and chief administrative officer from 2007 to 2014. Previously, Ms. Wijnberg served as the senior vice president and chief financial officer of Marsh & McLennan Companies, Inc., and was treasurer and interim chief financial officer of YUM! Brands, Inc. Prior to that, she held financial positions with PepsiCo, Inc., and worked in investment banking at Morgan Stanley. In addition, from 2014 through 2015, Ms. Wijnberg was deputy head of mission for the Office of the Quartet, a development project under the auspices of the United Nations.

Ms. Wijnberg earned a B.A. in English literature from the University of California, Los Angeles, and an M.B.A. from the University of Southern California’s Marshall School of Business, for which she is a member of the board of leaders.

Ms. Wijnberg is a member of the board of directors, chair of the audit committee, and member of the nominating and corporate governance committee of Automatic Data Processing, Inc. She is a member of the board of directors, chair of the audit committee, and a member of the finance committee of Cognizant Technology Solutions Corp. She is a member of the board of directors, the lead director, the chair of the audit committee, and a member of the nominating and corporate governance committee of Hippo Holdings, Inc. From 2003 to 2016, Ms. Wijnberg served on the board of directors of Tyco International, PLC, and from 2007 to 2009, she served on the board of directors of TE Connectivity, Ltd. She is also a director of Seeds of Peace and is a trustee of the John Simon Guggenheim Memorial Foundation.

Ms. Wijnberg brings to our Board a global perspective along with substantial financials sector, corporate finance, and management experience based on her roles at Aquiline Capital Partners, Marsh & McLennan, and YUM! Brands, Inc. |

2023 Proxy Statement 13

Alan D. Wilson, 65

Retired Executive Chairman McCormick & Company, Inc.

Lead Independent Director

Independent Director since: 2015

Committee Memberships:

• Executive • Executive Compensation and Management Development • Nominating and Corporate Governance | Mr. Wilson has been an independent director of Price Group since 2015 and serves as a member on the Executive Committee, the Executive Compensation and Management Development Committee, and the Nominating and Corporate Governance Committee and is also the lead independent director of the Board. He was executive chair of McCormick & Company, Inc., a global leader in flavor, seasonings, and spices, and held many executive management roles, including chairman, president, and chief executive officer from 2008 to 2016.

Mr. Wilson earned a B.S. in communications from the University of Tennessee. He attended school on a R.O.T.C. scholarship and, following college, served as a U.S. Army captain, with tours in the United States, United Kingdom, and Germany.

Mr. Wilson is the non-executive chair and a member of the board of directors of Westrock Company and is the chair of the executive committee and a member of the finance and nominating and corporate governance committees. He also chairs the board of visitors of the University of Maryland, Baltimore County, and currently serves on the University of Tennessee’s board of trustees and the University of Tennessee’s Business School advisory board.

Mr. Wilson brings to our Board significant executive management experience, having led a publicly traded, multinational company. He also adds additional perspective regarding matters relating to general management, strategic leadership, and financial matters. |

Director Engagement

Meetings

During 2022, the Board held seven meetings and approved one matter via unanimous written consent. Each director attended at least 75% of the combined total number of meetings of the Board and Board committees of which he or she was a member. Consistent with the Company’s Corporate Governance Guidelines, the independent directors met in executive session at each of the Board’s regular meetings in 2022. Our Corporate Governance Guidelines provide that all directors are expected to attend the annual meeting of stockholders. All nominees for director submitted to the stockholders for approval at last year’s annual meeting on May 10, 2022 (2022 Annual Meeting), attended that meeting, and we anticipate that all director nominees will attend the 2023 Annual Meeting of Stockholders (Annual Meeting).

Beyond the Boardroom

Director Orientation and Continuing Education and Development

When a new independent director joins the Board, we provide an orientation program for the purpose of providing the new director with an understanding of the operations and the financial condition of the Company, as well as the Board’s expectations for its directors. Each director is expected to maintain the necessary knowledge and information to perform his or her responsibilities as a director. To assist the directors in understanding the Company and its industry and maintaining the level of expertise required to serve as a director, the Company will, from time to time and at least annually, offer Company-sponsored continuing education programs or presentations, in addition to briefings during Board meetings related to the industry, the competitive environment, and the Company’s goals and strategies. In addition, at most meetings the Board receives special education sessions on one or more topics related to key industry trends, topical business issues, and corporate governance.

14 T. Rowe Price Group

The Board is a member of the National Association of Corporate Directors, which provides resources that help directors strengthen board leadership. Each director is encouraged to participate at least once every three years in continuing education programs for public company directors sponsored by nationally recognized educational organizations not affiliated with the Company. The cost of all such continuing education is paid for by the Company.

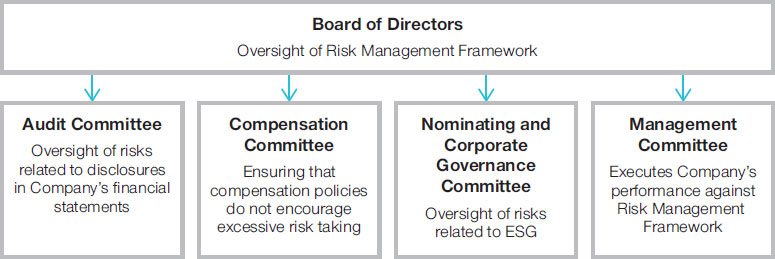

Committees of the Board

Our Board has an Audit Committee, an Executive Compensation and Management Development Committee (Compensation Committee), a Nominating and Corporate Governance Committee, and an Executive Committee. The Board has also authorized a Management Committee that is made up entirely of senior officers of the Company.

Committee Charters

The Board has adopted a separate written charter for the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Current copies of each charter, our Corporate Governance Guidelines, and our Code of Ethics for Principal Executive and Senior Financial Officers (the Code) can be found on our website, troweprice.com, by selecting “Investor Relations” and then “Corporate Governance.”

Audit Committee

| Meetings in 2022: 8 | Chair | Members | ||||||||

| The report of the committee appears on page 80. |  |  |  |  |  | |||||

| Bartlett | Dublon | MacLellan | Rominger | Wijnberg |

Qualifications and Financial Expert Determination

The Board has determined that each of the Audit Committee members meet the independence and financial literacy criteria of the NASDAQ Global Select Market and the SEC. The Board also has concluded that Messrs. Bartlett and MacLellan and Mses. Dublon and Wijnberg meet the criteria of an audit committee financial expert as established by the SEC. Mr. Bartlett is a certified public accountant, was an audit partner at Ernst & Young for 28 years until he left the firm in 2012, and serves as the chair of the audit committee of WillScot Mobile Mini Holdings Corp. and as a member of the audit committees of FTI Consulting, Inc. and Zurn Water Solutions Corp. Ms. Dublon was the executive vice president and chief financial officer of JPMorgan Chase & Co., from 1998 to 2004. She is currently the chair of the audit committee of Motive Capital Corp. II. and served as member and chair of the audit committee of PepsiCo, Inc. Mr. MacLellan is a chartered accountant, and served as chair of the audit committee of Magna International, Inc., and was a member of the audit committees of Ace Aviation Holdings, Inc., Maple Leaf Sports, and Entertainment, Ltd. Ms. Wijnberg was the chief financial officer of Marsh & McLennan Companies, Inc., from 2000 to 2006 and interim chief financial officer of YUM! Brands in 1999. She is currently the chair of the audit committees of Automatic Data Processing, Inc., Cognizant Technology Solutions Corp., and Hippo Holdings, Inc. and she previously served as member and chair of the audit committees of Tyco International and TE Connectivity, respectively.

Responsibilities

The primary purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities with respect to:

| • | The integrity of our financial statements and other financial information provided to our stockholders; |

| • | The retention of our independent registered public accounting firm, including oversight of the terms of its engagement and its performance, qualifications, and independence; |

| • | The performance of our internal audit function, internal controls, and disclosure controls; and |

| • | The Company’s risk management framework. |

The Audit Committee:

| • | Provides an avenue for communication among our internal auditors, financial management, chief risk officer, independent registered public accounting firm, and the Board; and |

2023 Proxy Statement 15

| • | Is responsible for maintaining procedures involving the receipt, retention, and treatment of complaints or concerns regarding accounting, internal accounting controls, and auditing matters, including confidential, anonymous employee submissions. |

| • | The independent registered public accounting firm reports directly to the Audit Committee and is ultimately accountable to this committee and the Board for the audit of our consolidated financial statements. |

| • | The head of the Company’s internal audit department reports directly to the Audit Committee. |

| • | The Audit Committee receives regular updates from our risk and technology departments concerning our information security program. |

Related Person Transaction Oversight

The Audit Committee is responsible under its charter for reviewing related person transactions and any change in, or waiver from, our Code. Our Board has adopted a written Policy for the Review and Approval of Transactions with Related Persons. Any transaction that would require disclosure under Item 404(a) of Regulation S-K will not be initiated or materially modified until our Audit Committee has approved such transaction or modification and will not continue past its next contractual termination date unless it is annually reapproved by our Audit Committee. During its deliberations, the Audit Committee must consider all relevant details regarding the transaction including, but not limited to, any role of our employees in arranging the transaction, the potential benefits to our Company, and whether the proposed transaction is competitively bid or otherwise is on terms comparable to those available to an unrelated third party or our employees generally. The Audit Committee approves only those transactions that it determines in good faith to be on terms that are fair to us and comparable to those that could be obtained in an arms-length negotiation with an unrelated third party. Please see the disclosure provided in the section titled "Certain Relationships and Related Transactions" beginning on page 84.

Executive Compensation and Management Development Committee

| Meetings in 2022: 5 | Chair | Members | ||||||||||

| The report of the committee appears on page 84. |  |  |  |  |  |  | ||||||

| MacLellan | Bartlett | Bush | Dublon | Hrabowski | Rominger | |||||||

|  |  | ||||||||||

| Stevens | Wijnberg | Wilson |

All of the non-employee independent directors of the Board serve on the Compensation Committee. The Board has determined that each of these members meets the independence criteria of the NASDAQ Global Select Market.

Responsibilities

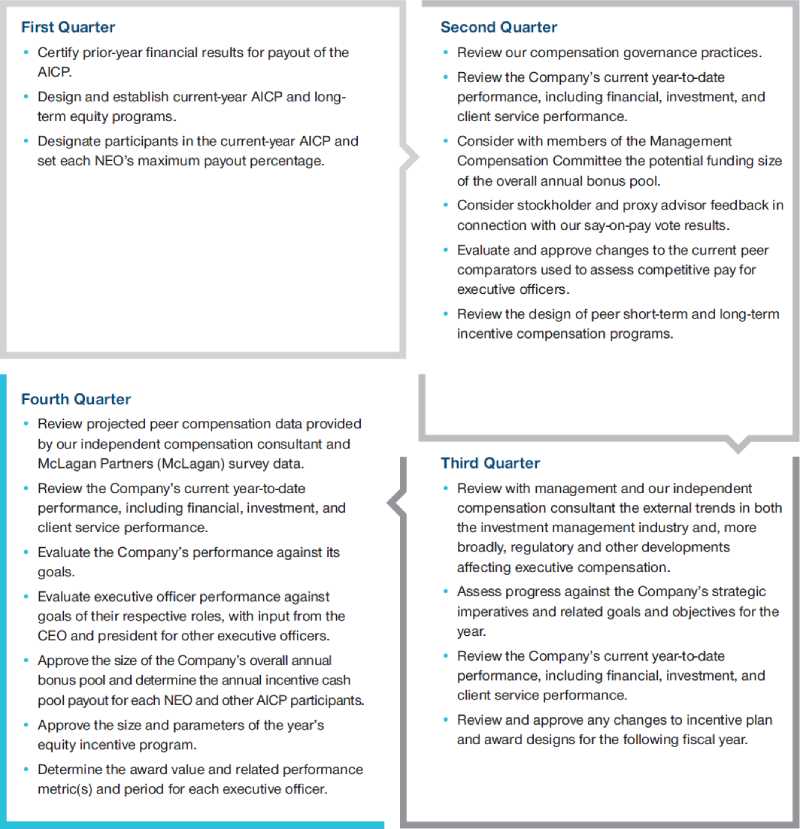

The Compensation Committee is responsible to the Board, and ultimately to our stockholders, for:

| • | Determining the compensation of our CEO and other executive officers; |

| • | Reviewing and approving general salary and compensation policies for the rest of our senior officers; |

| • | Overseeing the administration of our Annual Incentive Compensation Plan (AICP), equity incentive plans, and ESPP; |

| • | Assisting management in designing new compensation policies and plans; |

| • | Reviewing and providing guidance to management concerning succession plans and development actions for key leadership roles; |

| • | Reviewing and assisting management regarding DEI efforts across the Company; and |

| • | Reviewing and discussing the Compensation Discussion and Analysis contained in this proxy statement and other compensation disclosures with management. |

16 T. Rowe Price Group

Nominating and Corporate Governance Committee

| Meetings in 2022: 5 | Chair | Members | |||||||

| The report of the committee appears on page 20. |  |  |  |  | |||||

| Hrabowski | Bush | Stevens | Wilson |

The Board has determined that all Nominating and Corporate Governance Committee members meet the independence criteria of the NASDAQ Global Select Market.

Responsibilities

The Nominating and Corporate Governance Committee supervises and reviews the affairs of Price Group in relation to the Board, director nominees and compensation, committee composition, stockholder communications, and other corporate governance matters.

Among the Nominating and Corporate Governance Committee’s responsibilities are:

| • | Identifying, evaluating, and nominating director candidates; |

| • | Considering the continued membership of each director, and recommending the appropriate skills and characteristics of potential directors; |

| • | Developing director orientation and education opportunities; |

| • | Reviewing and approving the compensation of independent directors; |

| • | Recommending committee and chair assignments; |

| • | Overseeing procedures regarding stockholder nominations and other communications to the Board; |

| • | Reviewing the effectiveness of the Board in the corporate governance process; |

| • | Monitoring compliance with and recommending any changes to the Corporate Governance Guidelines and other governance policies; |

| • | Monitoring and oversight of, in coordination with the Compensation Committee and the Board, succession planning for the chief executive officer; |

| • | Overseeing policies related to political expenditures and political activities; |

| • | Monitoring policies related to environmental and climate matters, and recommending to the Board specific actions related thereto; |

| • | Reviewing actions in furtherance of the Company’s corporate social responsibility, including the impact of the Company’s processes on employees, stockholders, citizens, and communities; and |

| • | Reviewing key trends in legislation, regulation, litigation, and public debate to determine whether the Company should consider additional corporate environmental, social responsibility, or governance actions. |

Executive Committee

| Chair | Members | ||||||

|  |  |  | ||||

| Sharps | MacLellan | Stromberg | Wilson |

Responsibilities

The Executive Committee functions between meetings of the Board in the event that prompt action be called for that requires formal action by or on behalf of the Board in circumstances where it is impractical to call and hold a full meeting of the Board. The Executive Committee possesses the authority to exercise all the powers of the Board except as limited by Maryland law.

| 2023 Proxy Statement | 17 |

If the Executive Committee acts on matters requiring formal Board action, those acts are reported to the Board at its next meeting for ratification.

Board Policies and Procedures

Code of Ethics

Pursuant to rules promulgated under the Sarbanes-Oxley Act, the Board has adopted the Code. The Code is intended to deter wrongdoing and promote honest and ethical conduct; full, timely, and accurate reporting; compliance with laws; and accountability for adherence to the Code, including internal reporting of Code violations. A copy of the Code is available on our website. We intend to satisfy the disclosure requirements regarding any amendment to, or waiver from, a provision of the Code by making disclosures concerning such matters available on the Investor Relations page of our website, troweprice.com.

We also have a Code of Ethics and Personal Transactions Policy and a Global Code of Conduct, both of which are applicable to all employees and directors of the Company. Our Code of Ethics and Personal Transactions Policy prohibits all employees and directors of the Company from (i) any short sales of our common stock, (ii) purchasing options on our common stock, or (iii) entering into any contract or purchasing any instrument designed to hedge or offset any decrease in the market value of our common stock. It is the Company’s policy for all employees to participate annually in continuing education and training relating to the Code of Ethics and Personal Transactions Policy and Global Code of Conduct.

Corporate Governance Guidelines

The Board represents the interests of stockholders in fostering a business that is successful in all respects. The Board is responsible for determining that the Company is managed with this objective in mind and that management is executing its responsibilities. The Board’s responsibility is to regularly monitor the effectiveness of management policies and decisions, including the execution of its strategies. In addition to fulfilling its obligations for representing the interests of stockholders, the Board has responsibility to the Company’s employees, the mutual funds and investment portfolios that the Company manages, the Company’s other customers and business constituents and the communities where the Company operates. All are essential to a successful business. Our Corporate Governance Guidelines can be found on our website, troweprice.com.

Non-employee Director Independence Determinations

The Board has considered the independence of current directors and director nominees and, excluding Messrs. Stromberg, Sharps, and August, has concluded that each such director qualifies as an independent director within the meaning of the applicable rules of the NASDAQ Global Select Market. To our knowledge, there are no family relationships among our directors or executive officers.

In making its determination of independence, the Board applied guidelines that it has adopted concluding that the following relationships should not be considered material relationships that would impair a director’s independence:

| • | relationships where a director or an immediate family member of a director purchases or acquires investment services, investment securities, or similar products and services from the Company or one of its sponsored mutual funds and trusts (Price funds) so long as the relationship is on terms consistent with those generally available to other persons doing business with the Company, its subsidiaries, or its sponsored investment products; and |

| • | relationships where a corporation, partnership, or other entity with respect to which a director or an immediate family member of a director is an officer, director, employee, partner, or member purchases services from the Company, including investment management or defined contribution retirement plan services, on terms consistent with those generally available to other entities doing business with the Company or its subsidiaries. |

The Board believes that this policy sets an appropriate standard for dealing with ordinary course of business relationships that may arise from time to time.

| 18 | T. Rowe Price Group |

| Proposal 1 |

Election of Directors

In this proxy statement, 11 director nominees are presented pursuant to the recommendation of the Nominating and Corporate Governance Committee. All have been nominated by the Board to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualify.

| Recommendation of the Board | Vote Required | ||

| We recommend that you vote FOR all the director nominees under Proposal 1. |

If any director nominee becomes unable or unwilling to serve between now and the Annual Meeting, proxies will be voted FOR the election of a replacement recommended by the Nominating and Corporate Governance Committee and approved by the Board.

| 2023 Proxy Statement | 19 |

Corporate Governance

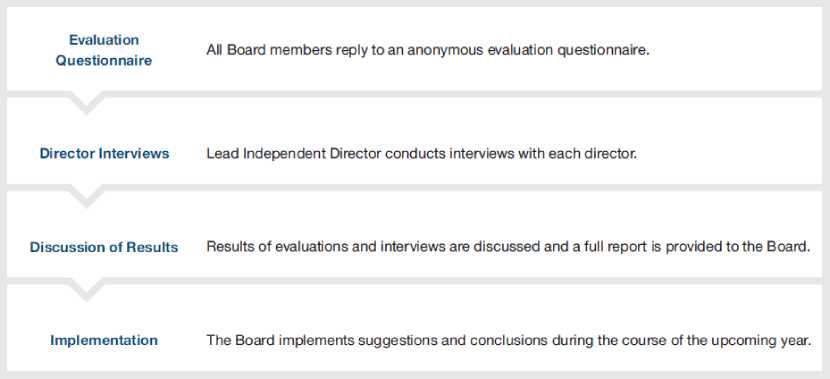

Report of the Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee has general oversight responsibility for governance of the Company, including the assessment and recruitment of new director candidates and the evaluation of director and Board performance. We monitor regulatory and other developments in the governance area with a view toward both legal compliance and maintaining governance procedures at the Company, consistent with what we consider to be best practices. In this regard, we routinely receive written and verbal information relating to best governance practices for institutions such as the Company, including input and reports from members of the Company’s proxy voting group concerning relevant trends. In addition, the Nominating and Corporate Governance Committee has oversight of the Company’s environmental and corporate social responsibility activities and the Company’s policies related to political expenditures and political activities.

Governance Highlights

Overview

Our Board employs practices that foster effective Board oversight of critical matters such as strategy, management succession planning, financial and other controls, risk management, and compliance. The Board reviews our major governance policies and processes regularly in the context of current corporate governance trends, regulatory changes, and recognized best practices.

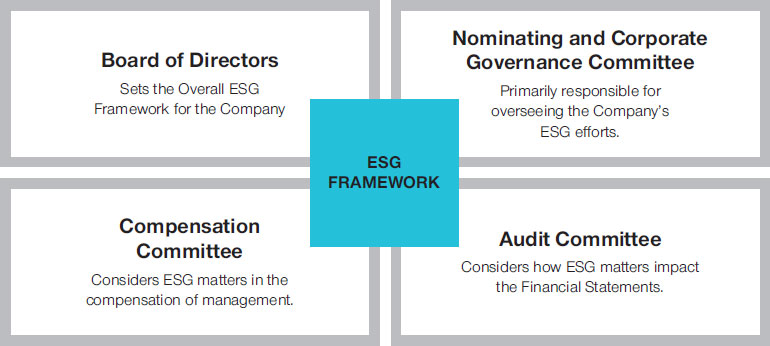

Our Nominating and Corporate Governance Committee maintains oversight of the Company’s environmental and corporate social responsibility activities, including considering the impact of the Company’s policies and processes on employees, stockholders, citizens, and communities. During the year, the Nominating and Corporate Governance Committee and the Board received updates from management on the Company’s environmental, social, and governance (ESG) efforts.

Pursuant to the Nominating and Corporate Governance Committee’s oversight of political activities, the Nominating and Corporate Governance Committee is informed of and consulted on any political developments impacting the Company. Additionally, the Nominating and Corporate Governance Committee reviews the corporate memberships that the Company maintains with trade associations and requests that these groups not use the Company’s dues for political campaign contributions or to confirm to the Company if they do. The Company does not contribute corporate funds to candidates, political party committees, political action committees, or any political organization exempt from federal income taxes. Further, the Company does not maintain a political action committee and does not spend corporate funds directly on independent expenditures.

The Nominating and Corporate Governance Committee works diligently to support effective corporate governance and believes that the Company’s governance program aligns with the Investor Stewardship Group’s (ISG) Corporate Governance Framework for U.S. Listed Companies.

| 20 | T. Rowe Price Group |

ISG Corporate Governance Principles

The following sections provide an overview of our corporate governance structure and processes, including key aspects of our Board operations, and how they align with the ISG Corporate Governance Principles for U.S. Listed Companies.

| PRINCIPLE | COMPANY PRACTICE | ||

| 1. | Boards are accountable to shareholders. | • Our directors are elected annually.

• Our Amended and Restated By-Laws (By-Laws) mandate that directors be elected under a “majority voting” standard in uncontested elections. Each director nominee must receive more votes “For” his or her election than votes “Against” in order to be elected. A director who fails to obtain the required vote in an uncontested election must submit his or her resignation to the Board.

• We have clear proxy access rules.

• We do not have a poison pill plan. | |

| 2. | Shareholders should be entitled to voting rights in proportion to their economic interest. | • We have only one class of stock outstanding, and each share is entitled to one vote. | |

| 3. | Boards should be responsive to shareholders and be proactive in order to understand their perspectives. | • Our Company actively engages with stockholders. See page 27.

• Our directors participate in our stockholder outreach, both in the preparation for such meetings and during the presentations themselves.

• We have established an email address for stockholders wishing to contact the Board. | |

| 4. | Boards should have a strong, independent leadership structure. | • We have a strong lead independent director.

• Eight of our 11 director nominees are independent.

• Our independent directors meet frequently without management. | |

| 5. | Boards should adopt structures and practices that enhance their effectiveness. | • Our directors have a diverse mix of experience and backgrounds relevant to our industry, our stockholders, our clients, and our stakeholders. See page 8.

• The average tenure on our Board is six years.

• During the year, the Board receives several key industry updates, strategic topics, and other education sessions conducted by both outside experts and Company executives, all designed to assist the Board in executing their duties.

• Our directors attended 100% of the regularly scheduled Board and Board Committee meetings and value in-person attendance at meetings. | |

| 6. | Boards should develop management incentive structures that are aligned with the long-term strategy of the company. | • Our annual and long-term incentive programs are designed to align the interests of our management with our stockholders by focusing on long-term corporate performance and value creation.

• Our executive compensation program received 93% stockholder support in 2022.

• The proxy statement clearly communicates the link between our compensation programs and the Company’s short- and long-term performance. | |

| 2023 Proxy Statement | 21 |

Board Composition

Director Nomination Process

Ongoing Assessment of Composition and Structure

In considering the overall qualifications of our director nominees and their contributions to our Board, and in determining our need for additional directors, we seek to create a Board consisting of directors with a diverse set of experiences and attributes who will be meaningfully involved in our Board activities and will facilitate a transparent and collaborative atmosphere and culture. Our directors generally develop a long-term association with the Company, which we believe facilitates a deeper knowledge of our business and its strategies, opportunities, risks, and challenges. At the same time, we periodically look for additions to our Board to enhance our capabilities and bring new perspectives and ideas to our Board.

Commitment to Diversity, Equity, and Inclusion

The Board has historically valued varying perspectives that individuals of differing backgrounds and experiences bring. We monitor the diversity profile of the Board and consider it an important factor relevant to any particular nominee and to the overall composition of our Board. In considering diversity, we recognize a person’s background and experience as well as their ethnicity, gender, sexual orientation, race, and other factors that we believe will inform the way they consider decisions brought before the Board.

Our current Board comprises individuals with a substantial variety of skills and expertise, including with respect to executive management, financial institutions, government, accounting and finance, investment management, public company boards, academia, and not-for-profit organizations. Our Board is not just composed of individuals knowledgeable about our business, but is also reflective of our clients, the communities we serve and our stakeholders. The Nominating and Corporate Governance Committee believes it is important to maintain a mix of experienced directors with a deep understanding of the Company and newer directors who bring a fresh perspective to the challenges of our industry.

Selection of Director Candidates

The Nominating and Corporate Governance Committee supervises the nomination process for directors. The Nominating and Corporate Governance Committee considers the performance, independence, diversity, and other characteristics of our incumbent directors, including their willingness to serve for an additional term and any change in their employment or other circumstances in considering their renomination each year.

Following the Annual Meeting, the Board will have 11 directors, eight of who will be independent. The tenure of our independent directors’ ranges from 17 months to 13 years, with an average tenure of approximately six years. When a director is set to retire from our Board, the Nominating and Corporate Governance Committee focuses on identifying candidates with the skills and backgrounds to complement the Board, in addition to seeking candidates who would bring further capabilities, experience, and diversity to our Board.

| 22 | T. Rowe Price Group |

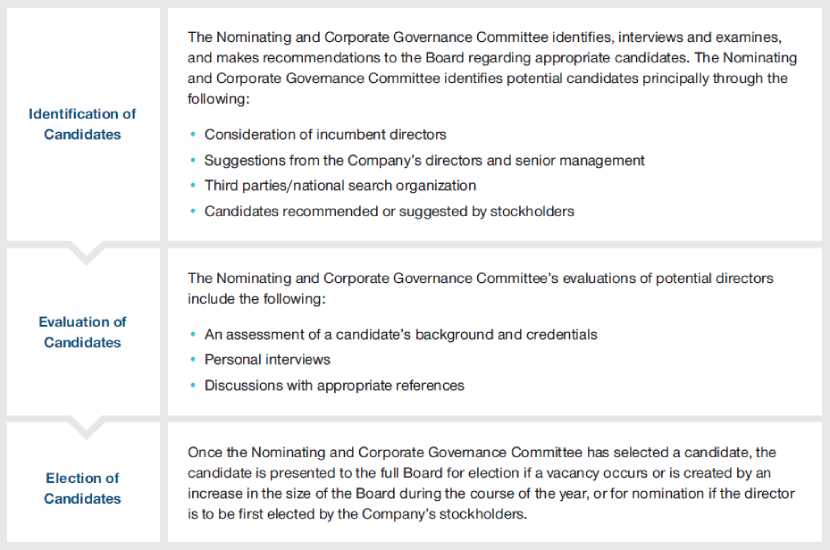

Identification and Consideration of New Nominees

In the event that a vacancy exists or we decide to increase the size of the Board, we identify, interview and examine, and make recommendations to the Board regarding appropriate candidates. We will consider Board nominees with diverse capabilities, and we generally look for nominees with capabilities in one or more of the following areas: investment and money management, general management and leadership, economics and economic policy, audit and accounting, finance and treasury functions, marketing, operations, technology and cybersecurity, human resources and personnel, risk management, strategic planning, governance, law, regulation and compliance, property management, and international and global experience relating to one or more of the foregoing areas. In evaluating potential candidates, we consider independence from management, background, experience, expertise, commitment, diversity, number of other public board and related committee seats held, and potential conflicts of interest, among other factors, and take into account the composition of the Board at the time of the assessment. All candidates for nomination must:

| • | demonstrate unimpeachable character and integrity; |

| • | have sufficient time to carry out their duties; |

| • | have experience at senior levels in areas of expertise helpful to the Company and consistent with the objective of having a diverse and well-rounded Board; and |

| • | have the willingness and commitment to assume the responsibilities required of a director of the Company. |

In addition, candidates expected to serve on the Audit Committee must meet independence and financial literacy qualifications imposed by the NASDAQ Global Select Market and by the SEC and other applicable law. Candidates expected to serve on the Nominating and Corporate Governance Committee or the Compensation Committee must meet independence qualifications set out by the NASDAQ Global Select Market, and members of the Compensation Committee must also meet additional independence tests imposed by the NASDAQ Global Select Market. Our evaluations of potential directors include, among other things, an assessment of a candidate’s background and credentials, personal interviews, and discussions with appropriate references. Once we have selected a candidate, we present him or her to the full Board for election if a vacancy occurs or is created by an increase in the size of the Board during the course of the year, or for nomination if the director is to be first elected by the Company’s stockholders. All directors serve for one-year terms and must stand for reelection annually.

| 2023 Proxy Statement | 23 |

Stockholder Recommendations and Nominations

Recommendations

A stockholder who wishes to recommend a candidate for the Board should send a letter to the chair of the Nominating and Corporate Governance Committee at the Company’s principal executive offices providing: (i) information relevant to the candidate’s satisfaction of the criteria described above under “Director Nomination Process;” and (ii) information that would be required for a director nomination under Section 1.11 of the By-Laws. The Nominating and Corporate Governance Committee will consider and evaluate candidates recommended by stockholders in the same manner it considers candidates from other sources. Acceptance of a recommendation does not imply that the Nominating and Corporate Governance Committee will recommend, and the Board will ultimately nominate, the recommended candidate.

Proxy Access and Nominations

We have adopted a proxy access right to permit a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years, to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the By-Laws. Section 1.13 of the By-Laws sets out the procedures a stockholder must follow to use proxy access. Section 1.11 of the By-Laws sets out the procedures a stockholder must follow in order to nominate a candidate for Board membership outside of the proxy access process. For these requirements, please refer to the By-Laws as of February 9, 2021, filed with the SEC on February 11, 2021, as Exhibit 3.1 to our Annual Report on Form 10-K.

Majority Voting

We have adopted a majority voting standard for the election of our directors. Under our By-Laws, in an uncontested election, a nominee will not be elected unless he or she receives more “FOR” votes than “AGAINST” votes. Under Maryland law, any incumbent director not so elected would continue in office as a “holdover” director until removed or replaced. As a result, the By-Laws also provide that any director who fails to obtain the required vote in an uncontested election must submit his or her resignation to the Board. The Board must decide whether to accept or decline the resignation, or decline the resignation with conditions, taking into consideration the Nominating and Corporate Governance Committee’s recommendation after consideration of all factors deemed relevant, within 90 days after the vote has been certified. Plurality voting will apply to contested elections.

| 24 | T. Rowe Price Group |

Board Leadership

Chair of the Board and Lead Independent Director

|  | ||

| William J. Stromberg Non-Executive Chair of the Board | Alan D. Wilson Lead Independent Director | ||

| Mr. Stromberg became the non-executive chair of the Board effective January 1, 2022, following his retirement as our CEO. Due to his long career with the Company, including as its CEO and Chair, we believe Mr. Stromberg’s service as the Board’s non-executive chair provides our independent directors with increased exposure to senior management, as well as greater insight into the needs of the business.

| Mr. Wilson was elected by our independent directors as lead independent director after the 2018 annual meeting of stockholders and is expected to be re-elected after the Annual Meeting. The lead independent director role was created in 2004 and has continually developed since that time. The lead independent director chairs Board meetings when the chair is not present, approves Board agendas and meeting schedules, and oversees Board materials distributed in advance of Board meetings. The lead independent director also calls meetings of the independent directors, chairs all executive sessions of the independent directors, and acts as a liaison between the independent directors and management. The lead independent director works with the chair of the Nominating and Corporate Governance Committee when considering new director nominees and provides input on the design and makeup of the Board and its committees. The lead independent director is available to the Company’s general counsel and corporate secretary to discuss and, as necessary, respond to stockholder communications to the Board. Finally, the lead independent director generally serves as the Board representative in various meetings with the Company’s stockholders and other key stakeholders.

Mr. Wilson’s significant executive management experience, including having served as chair and chief executive officer of a publicly traded company, makes him especially qualified to serve as the lead independent director for the Board. |

Independent Leadership