GOLDMAN SACHS US FINANCIAL SERVICES CONFERENCE — T. Rowe Price Group, Inc. December 10, 2019 A copy of this presentation is available at troweprice.gcs-web.com/investor-relations. Data as of September 30, 2019, unless otherwise noted.

Forward-looking statements This presentation, and other statements that T. Rowe Price may make, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to T. Rowe Price’s future financial or business performance, strategies, or expectations. Forward-looking statements are typically identified by (1) words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions or (2) future or conditional verbs such as “will,” “would,” “should,” “could,” “may,” and similar expressions. Forward-looking statements in this presentation may include, without limitation, information concerning future results of our operations, expenses, earnings, liquidity, cash flow and capital expenditures, industry or market conditions, amount or composition of assets under management, regulatory developments, demand for and pricing of our products, potential product offerings and the timing of their release, stock price, amount and timing of our stock repurchases, and other aspects of our business or general economic conditions. T. Rowe Price cautions that forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking statements, and future results could differ materially from historical performance. Forward-looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks and other factors described in our most recent annual, quarterly, and current reports on Form 10-K, Form 10-Q, and Form 8-K, filed with the Securities and Exchange Commission. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 2

Culture is central to our long-term success Investment Excellence The heart of everything we do Clients First We succeed if our clients succeed Long-Term Collegiality and Collaboration Leveraging our best ideas creates Success competitive advantage Trust and Mutual Respect Essential for a strong community Long-Term Time Horizon A true competitive advantage Performance-driven and collaborative T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 3

Our vision—we are executing on a longer-term plan Premier active asset manager Strong process orientation and system of internal controls Integrated investment solutions Destination of choice for top talent provider More global and diversified More adaptive and agile company asset manager Global partner for retirement-oriented Strong financial results and investors balance sheet T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 4

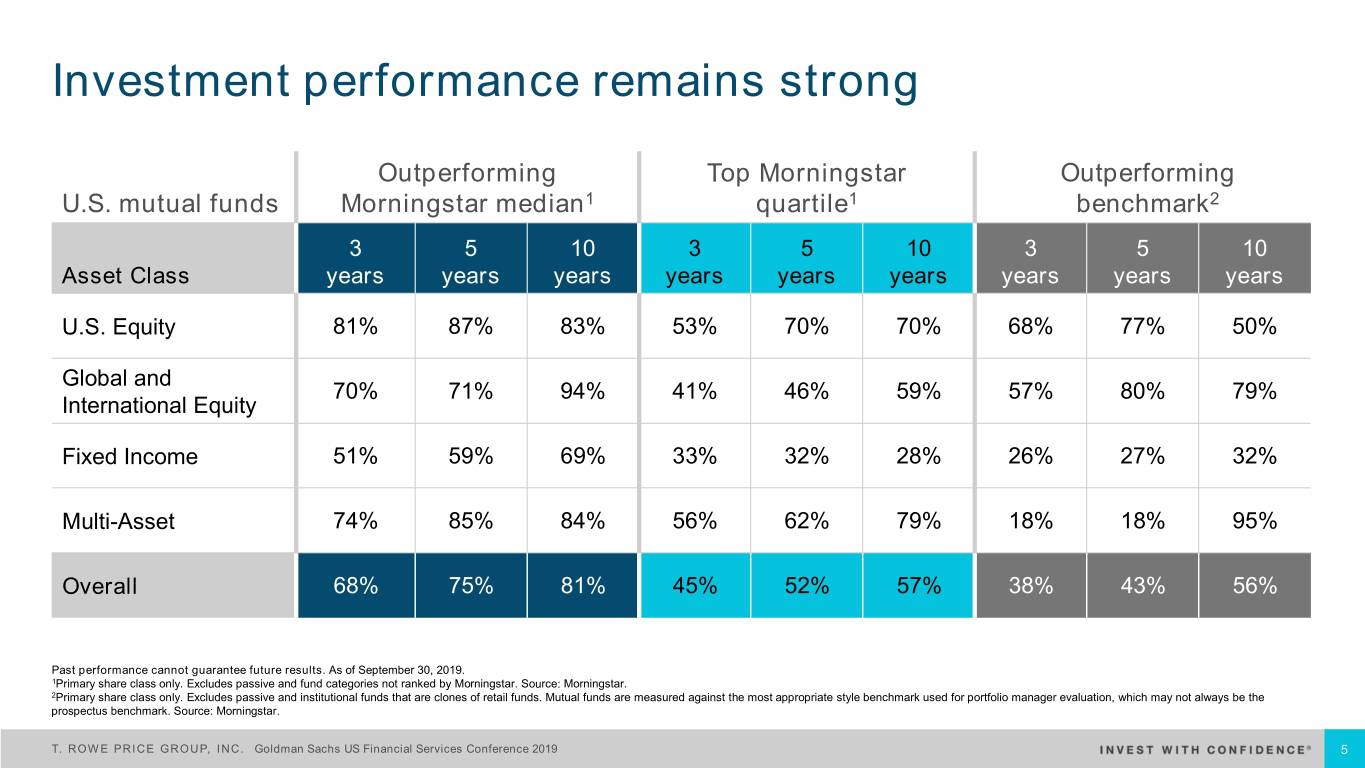

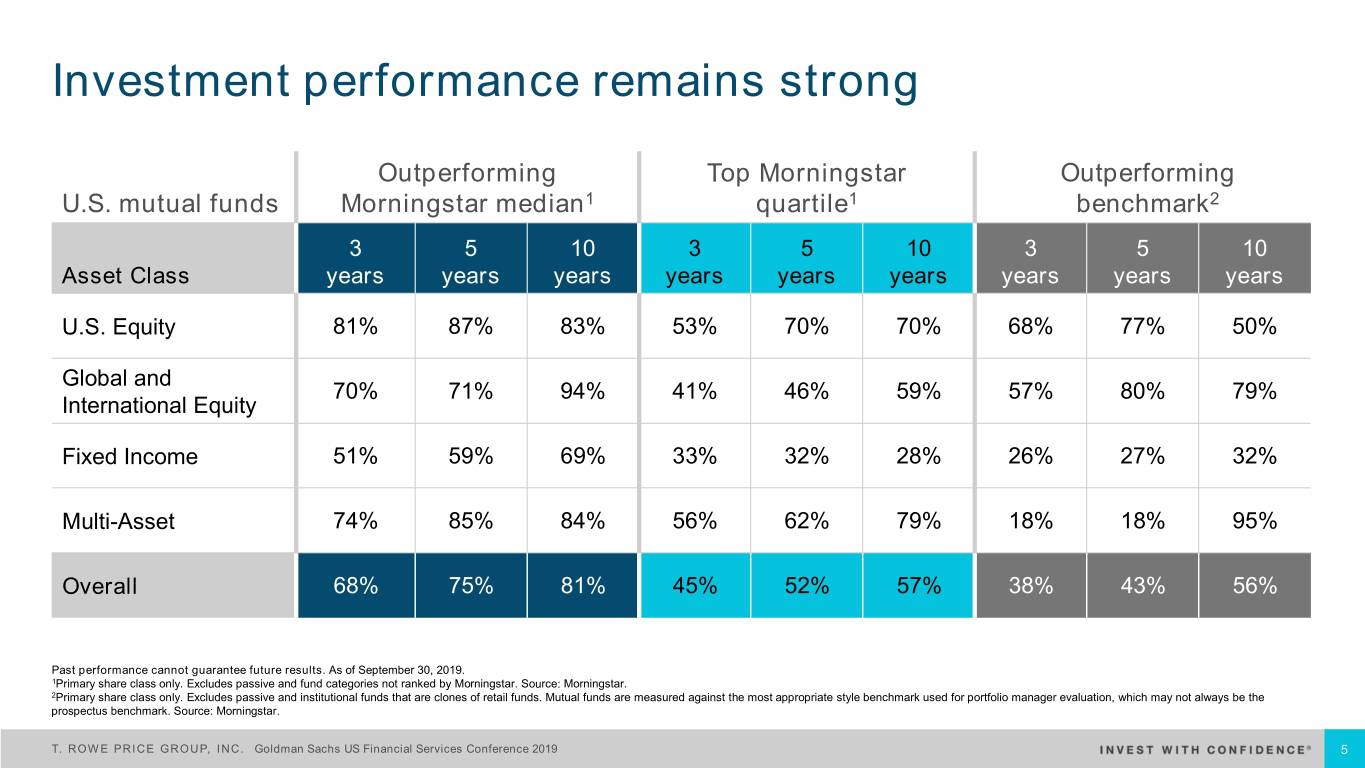

Investment performance remains strong Outperforming Top Morningstar Outperforming U.S. mutual funds Morningstar median1 quartile1 benchmark2 3 5 10 3 5 10 3 5 10 Asset Class years years years years years years years years years U.S. Equity 81% 87% 83% 53% 70% 70% 68% 77% 50% Global and 70% 71% 94% 41% 46% 59% 57% 80% 79% International Equity Fixed Income 51% 59% 69% 33% 32% 28% 26% 27% 32% Multi-Asset 74% 85% 84% 56% 62% 79% 18% 18% 95% Overall 68% 75% 81% 45% 52% 57% 38% 43% 56% Past performance cannot guarantee future results. As of September 30, 2019. 1Primary share class only. Excludes passive and fund categories not ranked by Morningstar. Source: Morningstar. 2Primary share class only. Excludes passive and institutional funds that are clones of retail funds. Mutual funds are measured against the most appropriate style benchmark used for portfolio manager evaluation, which may not always be the prospectus benchmark. Source: Morningstar. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 5

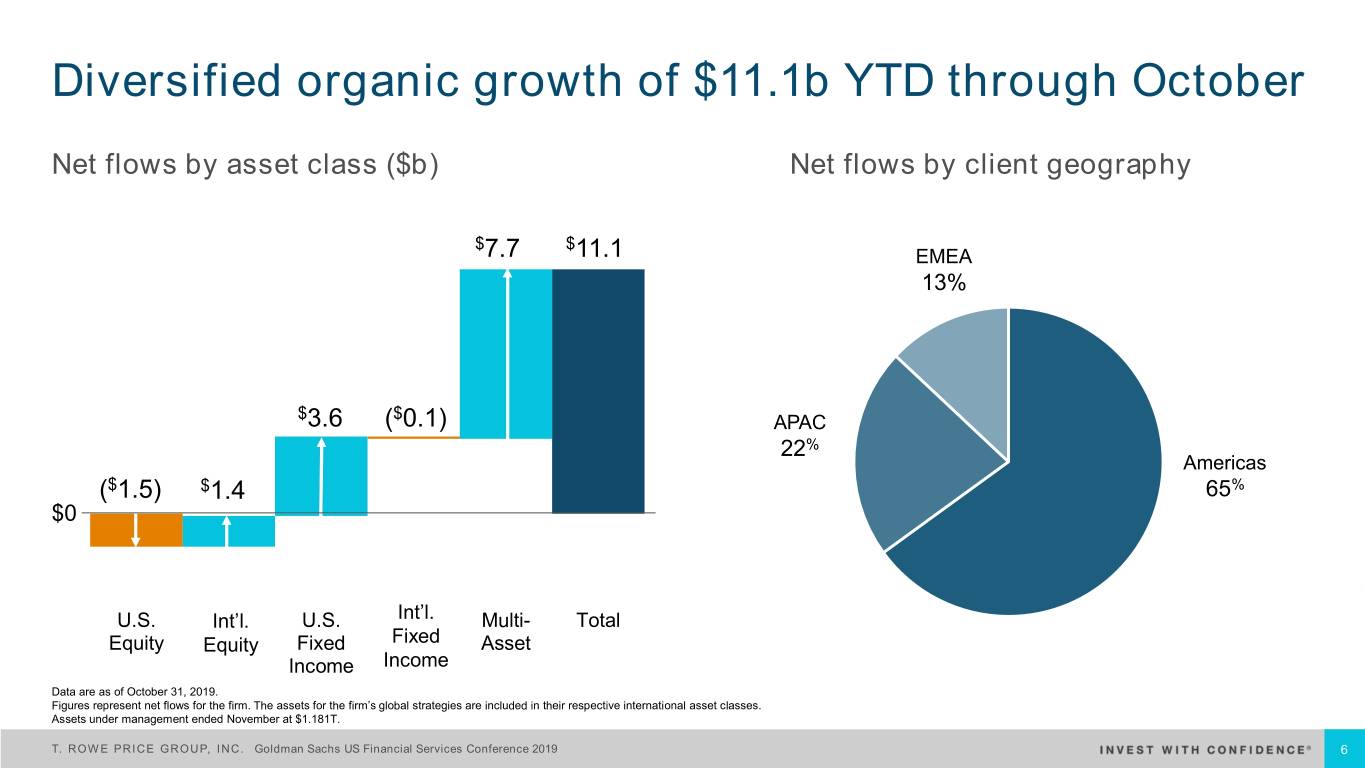

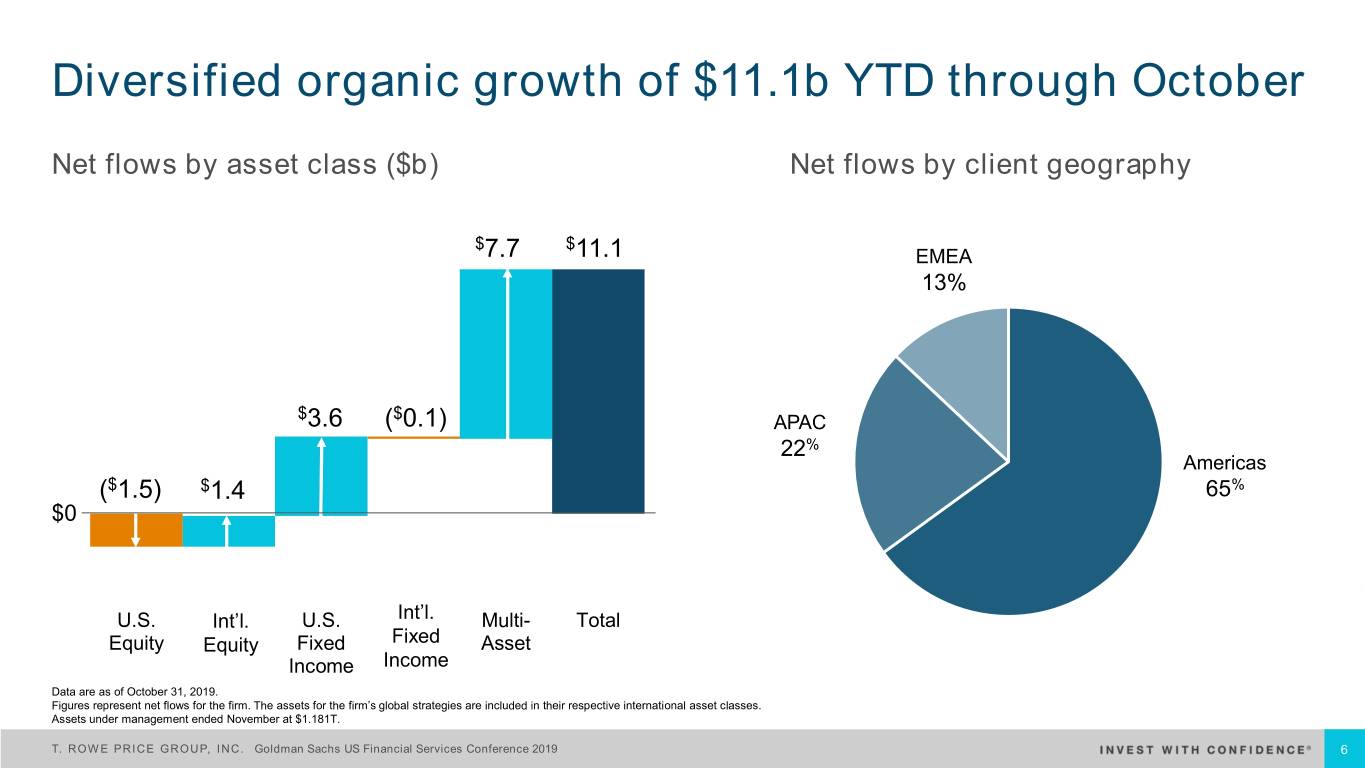

Diversified organic growth of $11.1b YTD through October Net flows by asset class ($b) Net flows by client geography $ $ 7.7 11.1 EMEA 13% $3.6 ($0.1) APAC 22% Americas ($1.5) $1.4 65% $0 U.S. Int'lInt’l. Equity U.S. Int'lInt’l. Fixed Multi- Total Equity Equity Fixed IncomeFixed Asset Income Income Data are as of October 31, 2019. Figures represent net flows for the firm. The assets for the firm’s global strategies are included in their respective international asset classes. Assets under management ended November at $1.181T. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 6

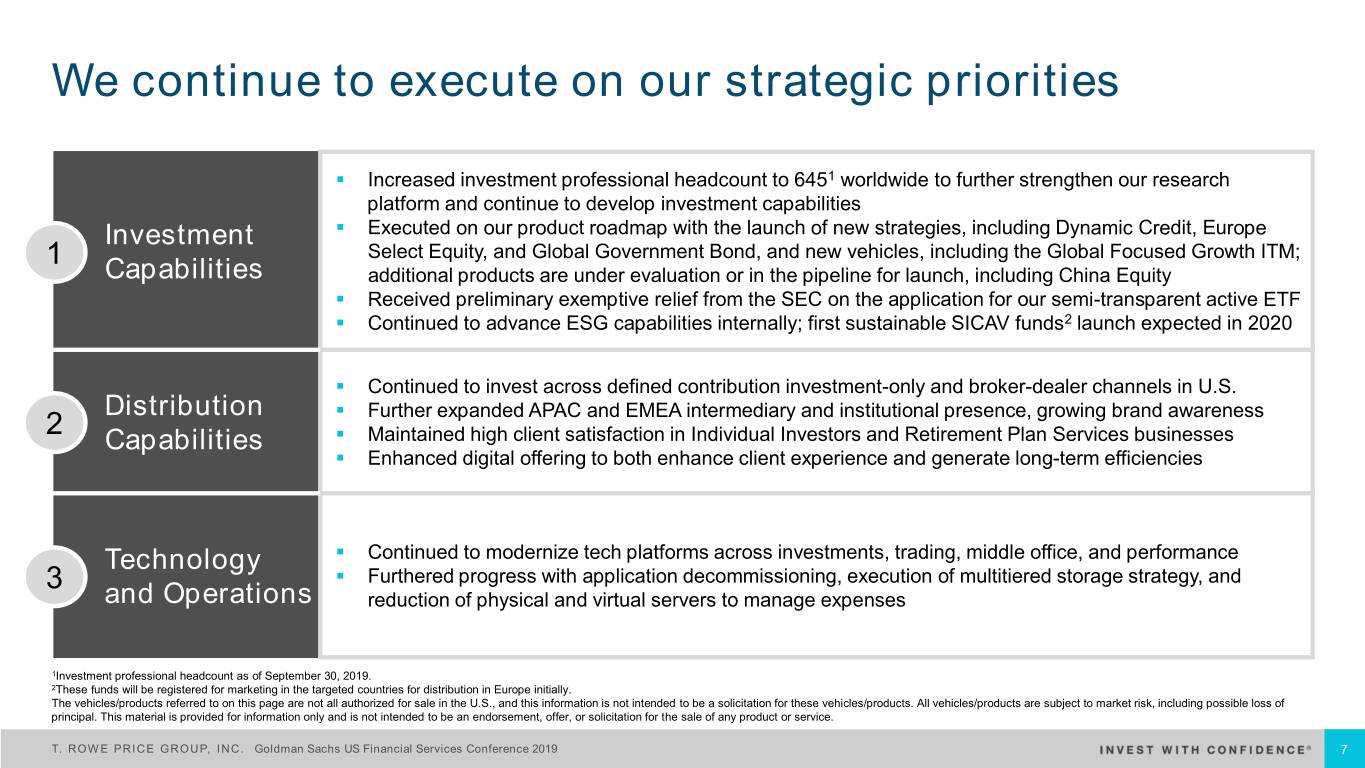

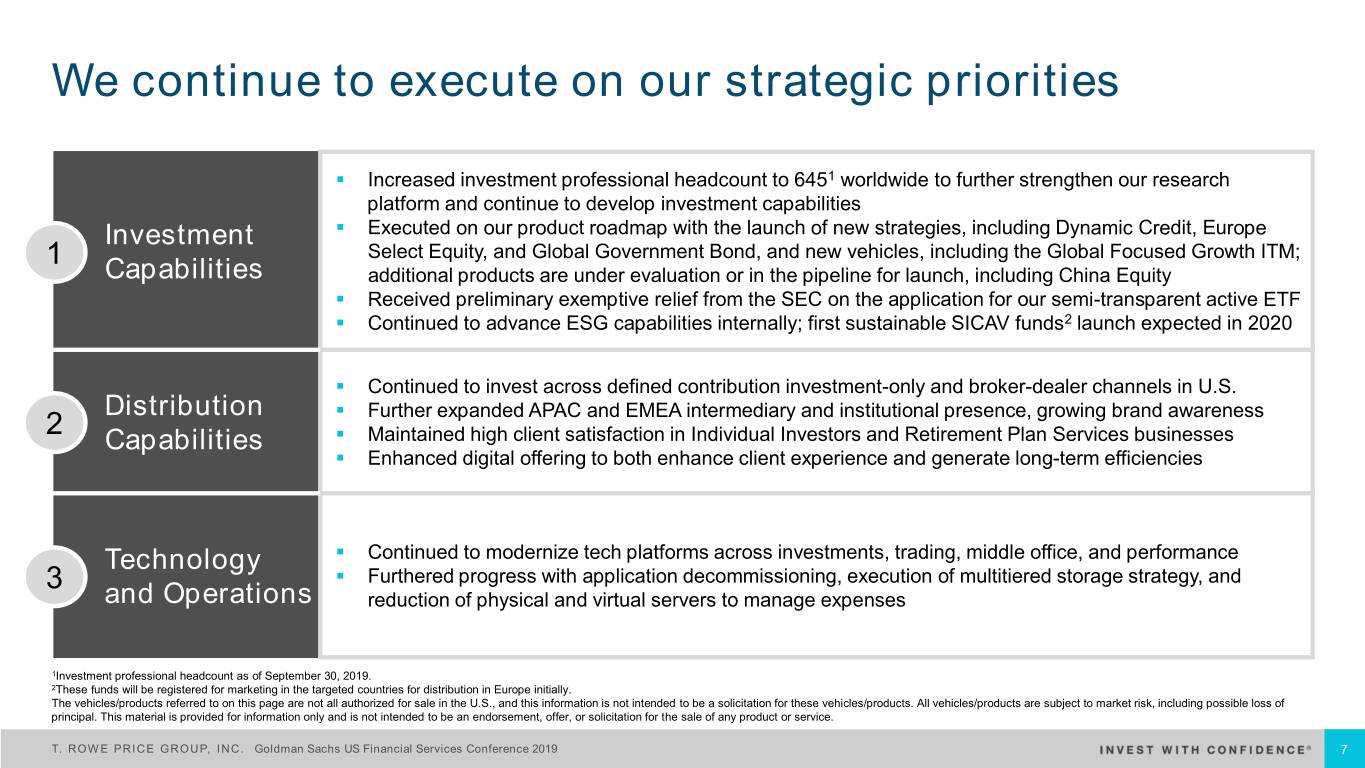

We continue to execute on our strategic priorities . Increased investment professional headcount to 6451 worldwide to further strengthen our research platform and continue to develop investment capabilities Investment . Executed on our product roadmap with the launch of new strategies, including Dynamic Credit, Europe 1 Select Equity, and Global Government Bond, and new vehicles, including the Global Focused Growth ITM; Capabilities additional products are under evaluation or in the pipeline for launch, including China Equity . Received preliminary exemptive relief from the SEC on the application for our semi-transparent active ETF . Continued to advance ESG capabilities internally; first sustainable SICAV funds2 launch expected in 2020 . Continued to invest across defined contribution investment-only and broker-dealer channels in U.S. Distribution . Further expanded APAC and EMEA intermediary and institutional presence, growing brand awareness 2 . Capabilities Maintained high client satisfaction in Individual Investors and Retirement Plan Services businesses . Enhanced digital offering to both enhance client experience and generate long-term efficiencies Technology . Continued to modernize tech platforms across investments, trading, middle office, and performance 3 . Furthered progress with application decommissioning, execution of multitiered storage strategy, and and Operations reduction of physical and virtual servers to manage expenses 1Investment professional headcount as of September 30, 2019. 2These funds will be registered for marketing in the targeted countries for distribution in Europe initially. The vehicles/products referred to on this page are not all authorized for sale in the U.S., and this information is not intended to be a solicitation for these vehicles/products. All vehicles/products are subject to market risk, including possible loss of principal. This material is provided for information only and is not intended to be an endorsement, offer, or solicitation for the sale of any product or service. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 7

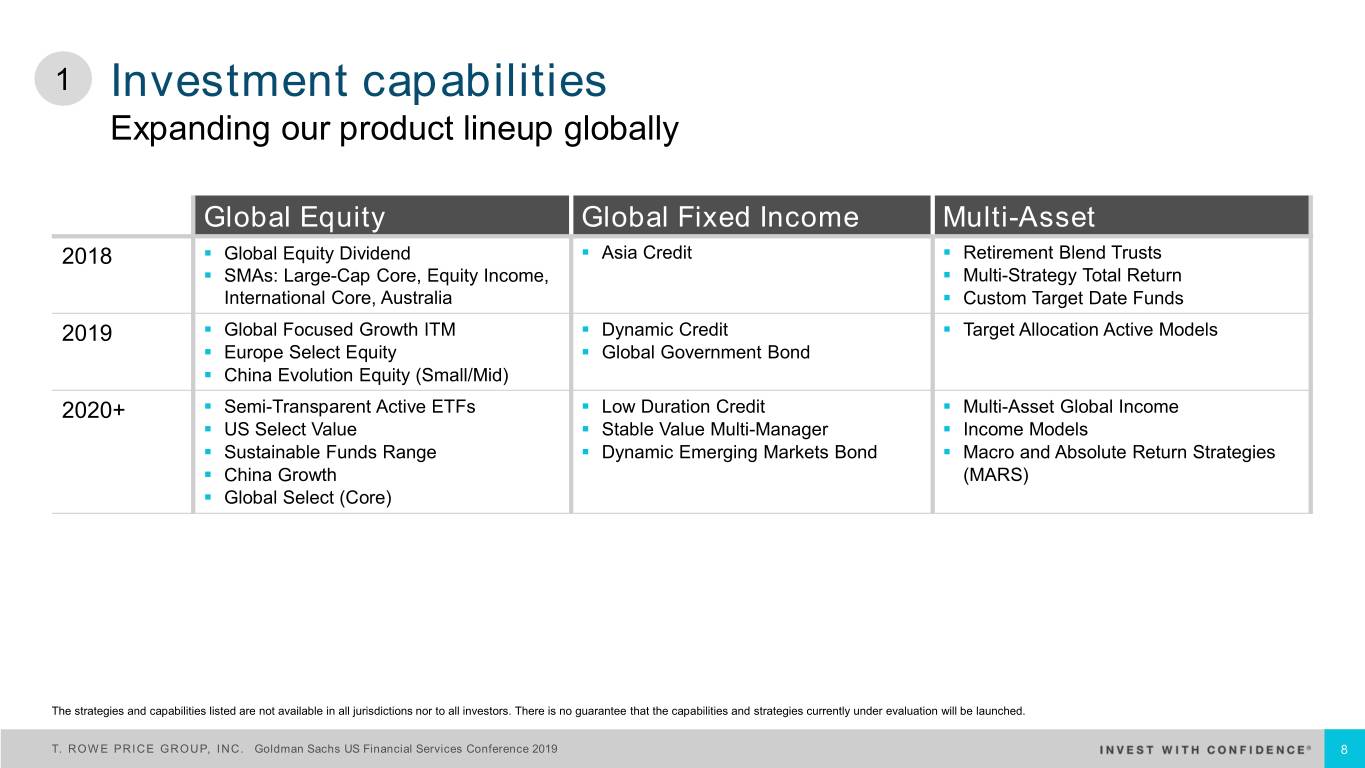

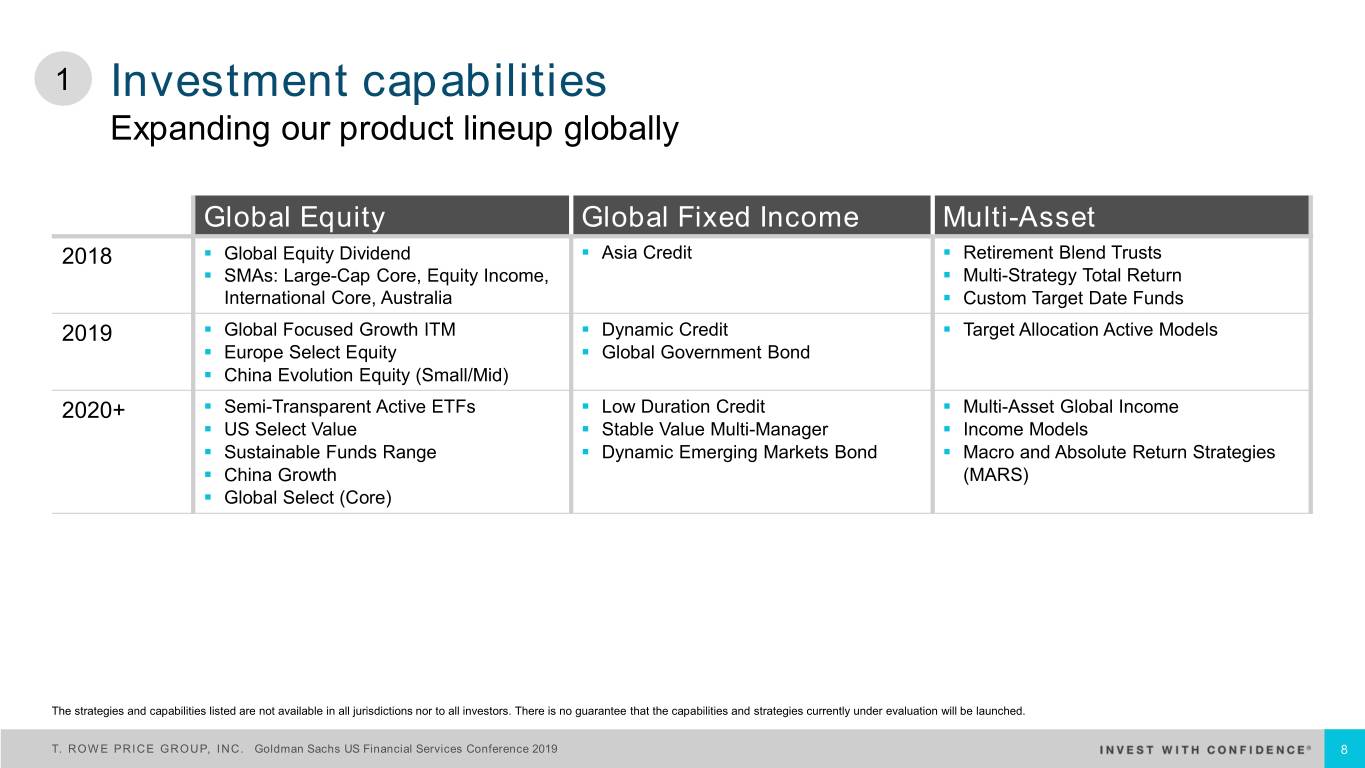

1 Investment capabilities Expanding our product lineup globally Global Equity Global Fixed Income Multi-Asset 2018 . Global Equity Dividend . Asia Credit . Retirement Blend Trusts . SMAs: Large-Cap Core, Equity Income, . Multi-Strategy Total Return International Core, Australia . Custom Target Date Funds 2019 . Global Focused Growth ITM . Dynamic Credit . Target Allocation Active Models . Europe Select Equity . Global Government Bond . China Evolution Equity (Small/Mid) 2020+ . Semi-Transparent Active ETFs . Low Duration Credit . Multi-Asset Global Income . US Select Value . Stable Value Multi-Manager . Income Models . Sustainable Funds Range . Dynamic Emerging Markets Bond . Macro and Absolute Return Strategies . China Growth (MARS) . Global Select (Core) The strategies and capabilities listed are not available in all jurisdictions nor to all investors. There is no guarantee that the capabilities and strategies currently under evaluation will be launched. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 8

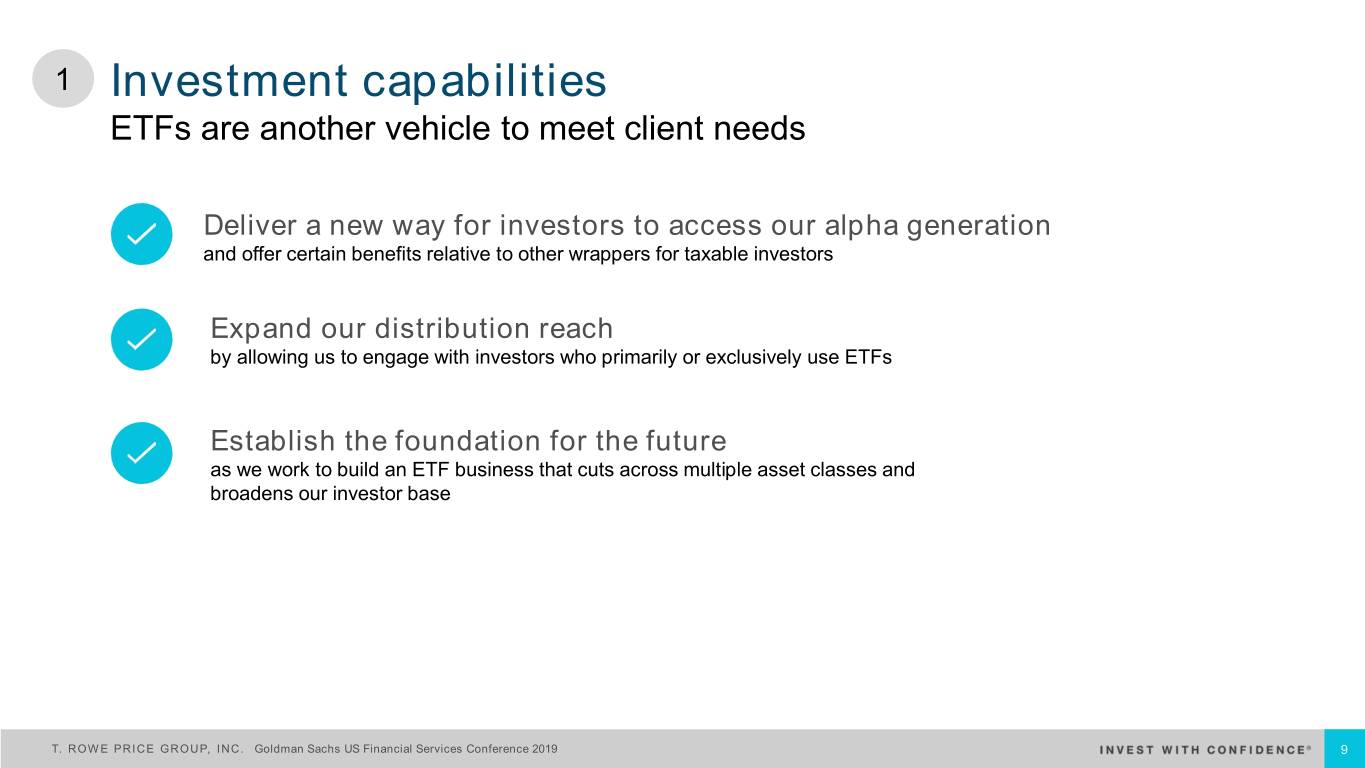

1 Investment capabilities ETFs are another vehicle to meet client needs Deliver a new way for investors to access our alpha generation and offer certain benefits relative to other wrappers for taxable investors Expand our distribution reach by allowing us to engage with investors who primarily or exclusively use ETFs Establish the foundation for the future as we work to build an ETF business that cuts across multiple asset classes and broadens our investor base T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 9

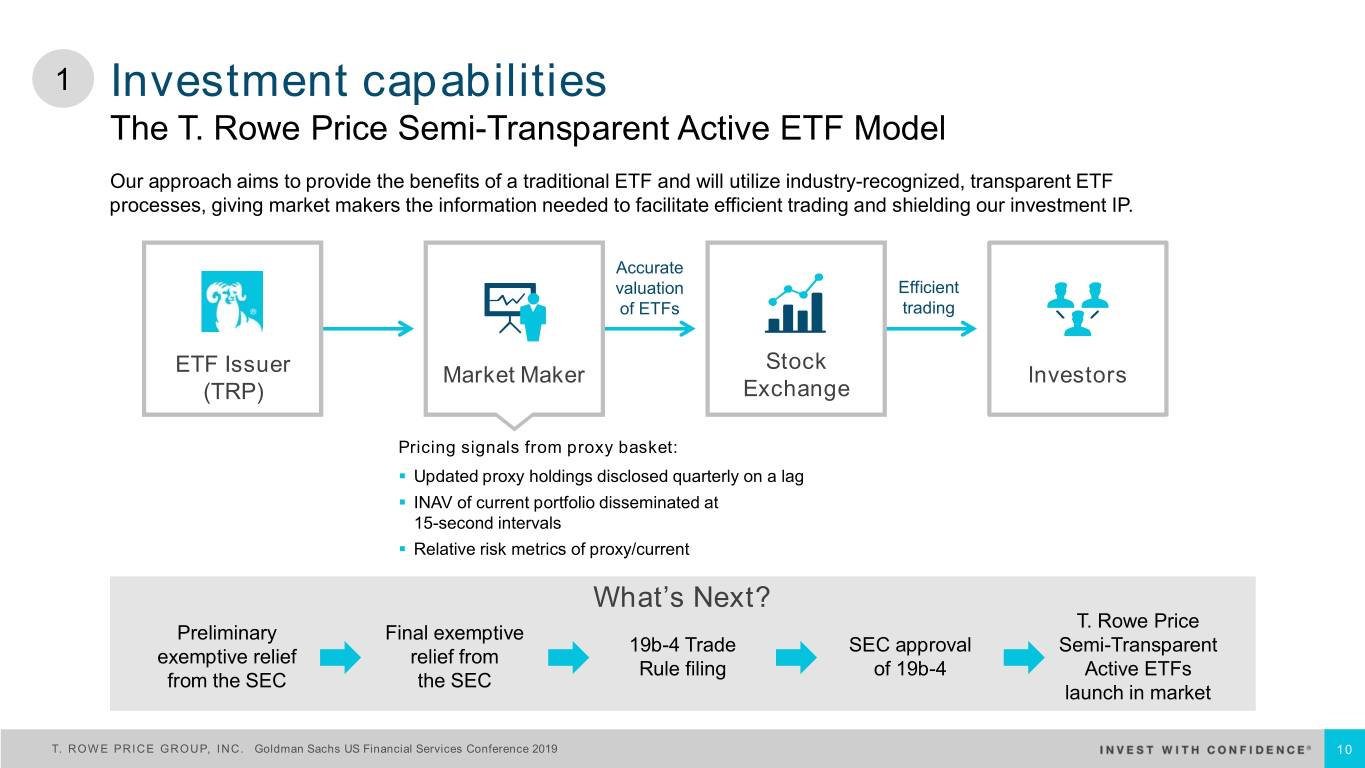

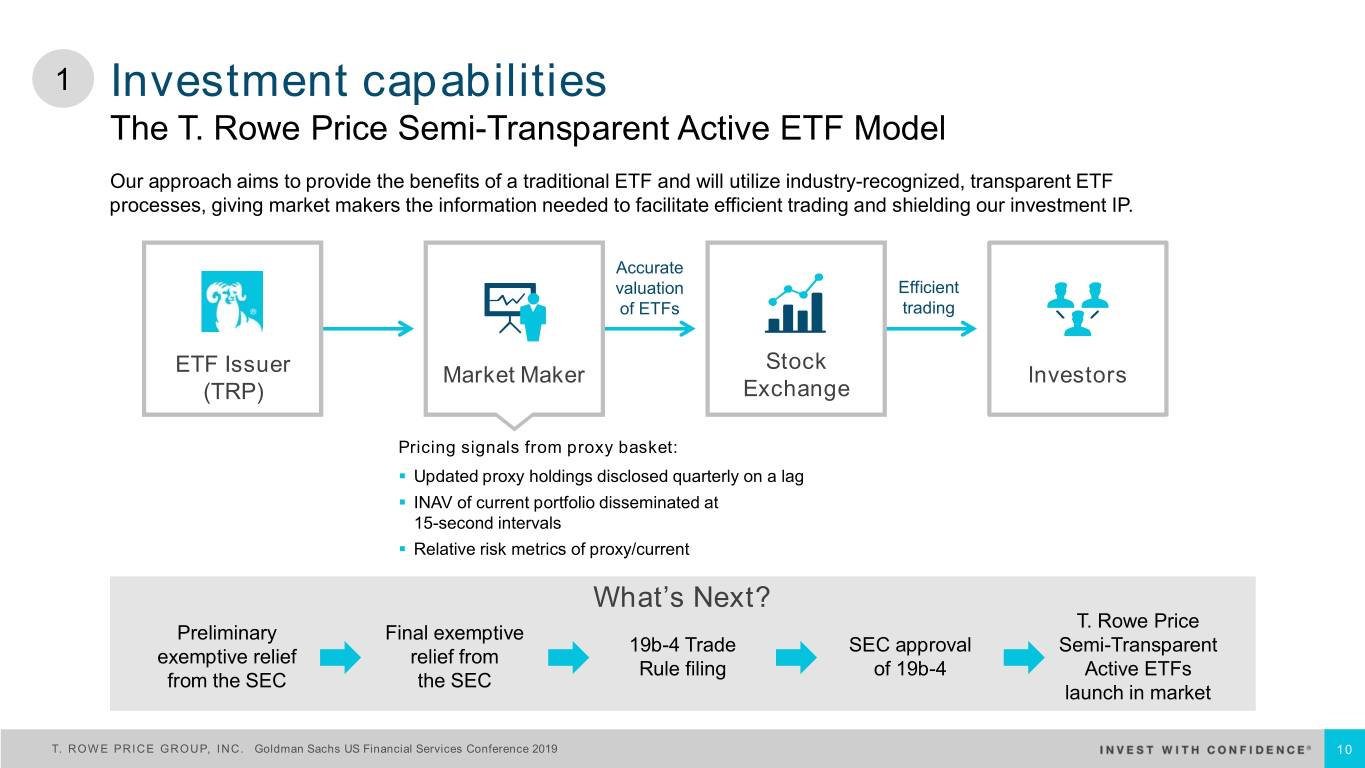

1 Investment capabilities The T. Rowe Price Semi-Transparent Active ETF Model Our approach aims to provide the benefits of a traditional ETF and will utilize industry-recognized, transparent ETF processes, giving market makers the information needed to facilitate efficient trading and shielding our investment IP. Accurate valuation Efficient of ETFs trading Stock ETF Issuer Market Maker Investors (TRP) Exchange Pricing signals from proxy basket: . Updated proxy holdings disclosed quarterly on a lag . INAV of current portfolio disseminated at 15-second intervals . Relative risk metrics of proxy/current What’s Next? T. Rowe Price Preliminary Final exemptive 19b-4 Trade SEC approval Semi-Transparent exemptive relief relief from Rule filing of 19b-4 Active ETFs from the SEC the SEC launch in market T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 10

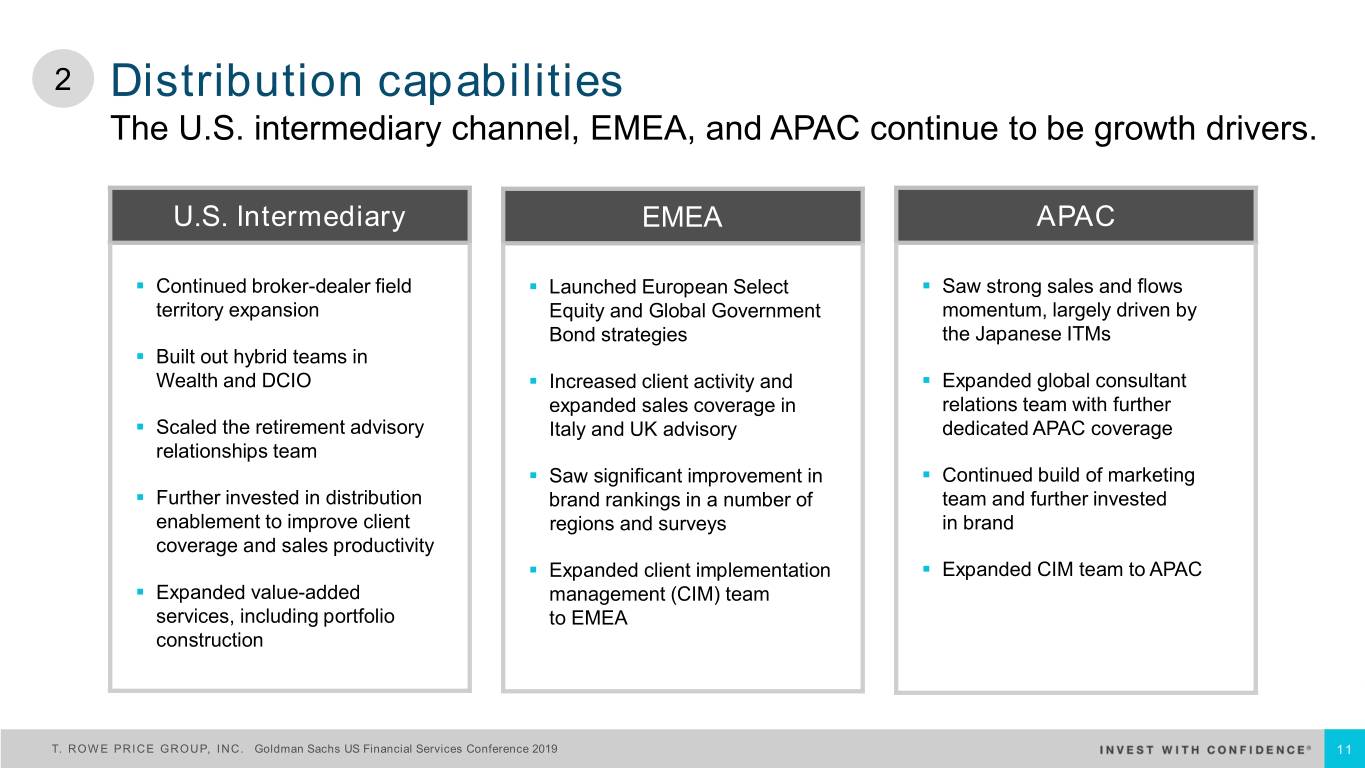

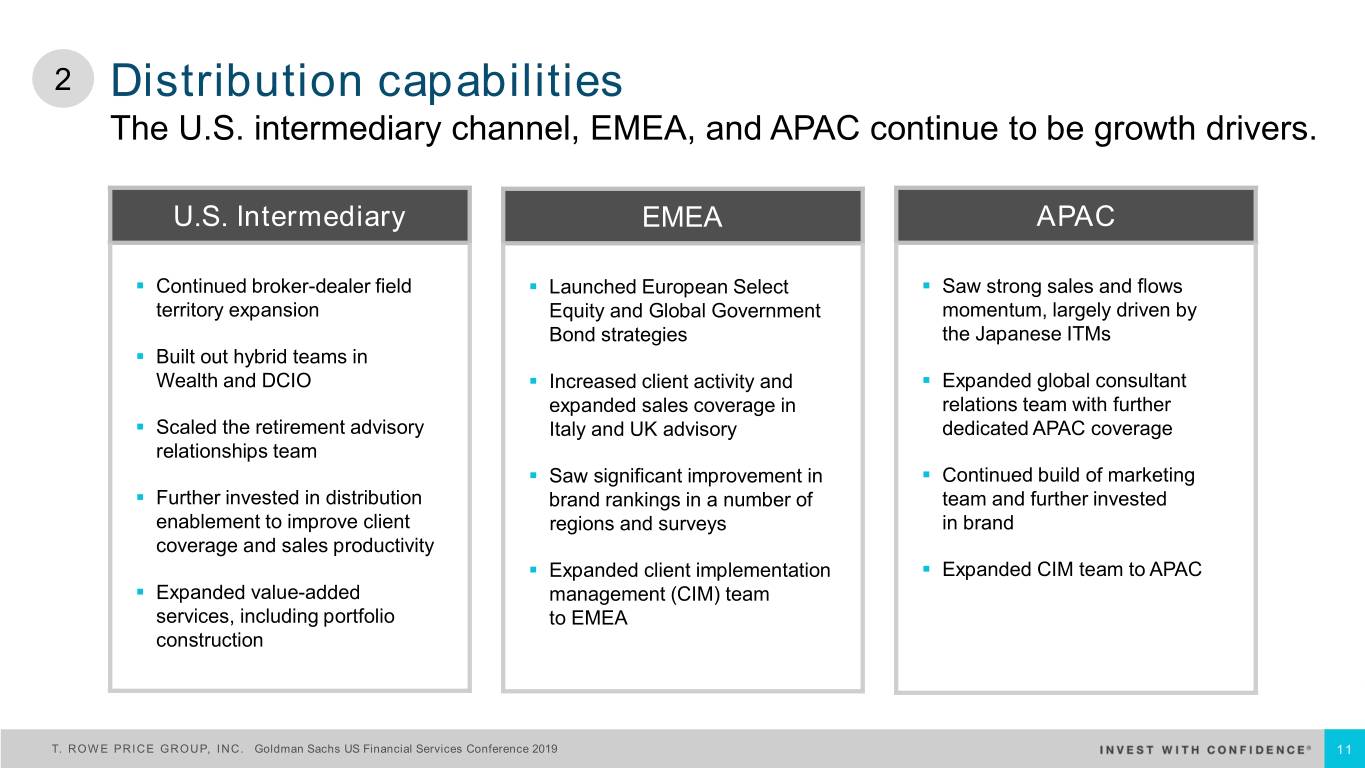

2 Distribution capabilities The U.S. intermediary channel, EMEA, and APAC continue to be growth drivers. U.S. Intermediary EMEA APAC . Continued broker-dealer field . Launched European Select . Saw strong sales and flows territory expansion Equity and Global Government momentum, largely driven by Bond strategies the Japanese ITMs . Built out hybrid teams in Wealth and DCIO . Increased client activity and . Expanded global consultant expanded sales coverage in relations team with further . Scaled the retirement advisory Italy and UK advisory dedicated APAC coverage relationships team . Saw significant improvement in . Continued build of marketing . Further invested in distribution brand rankings in a number of team and further invested enablement to improve client regions and surveys in brand coverage and sales productivity . Expanded client implementation . Expanded CIM team to APAC . Expanded value-added management (CIM) team services, including portfolio to EMEA construction T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 11

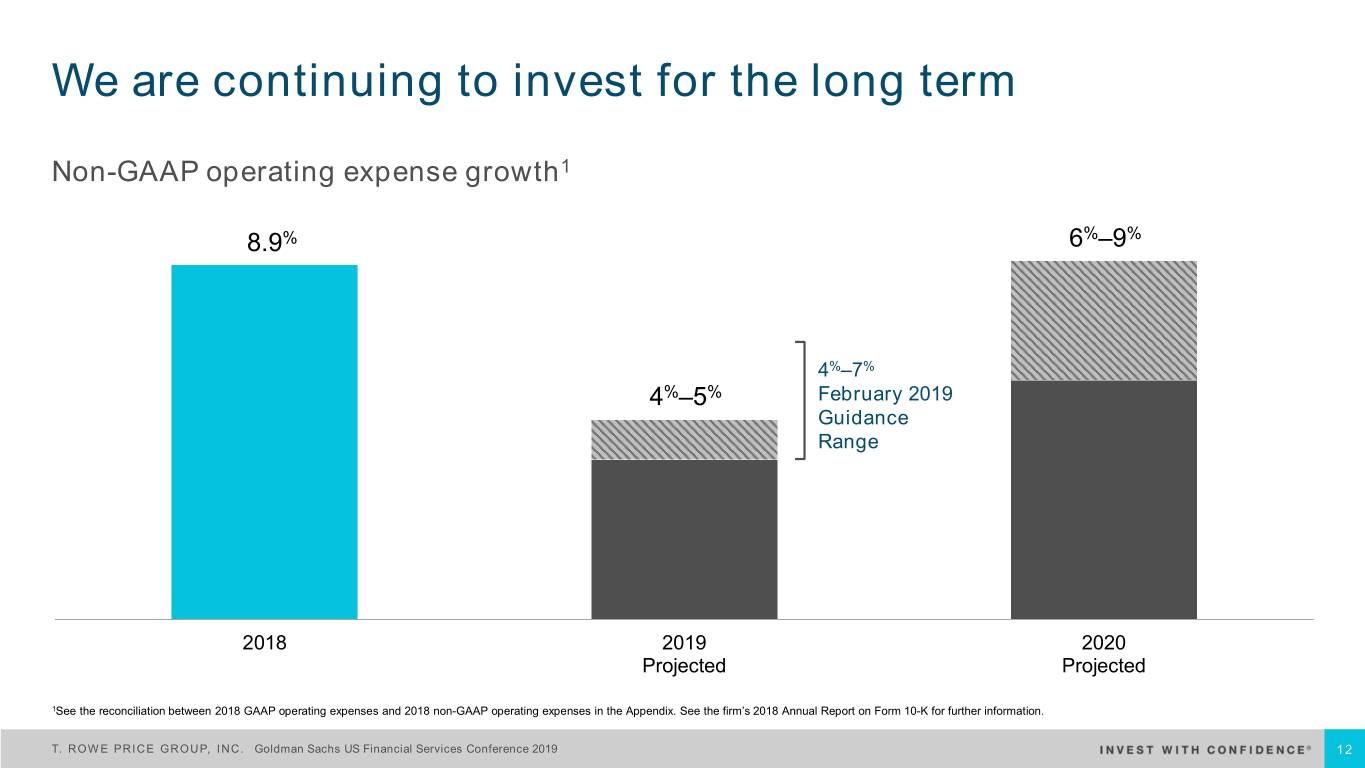

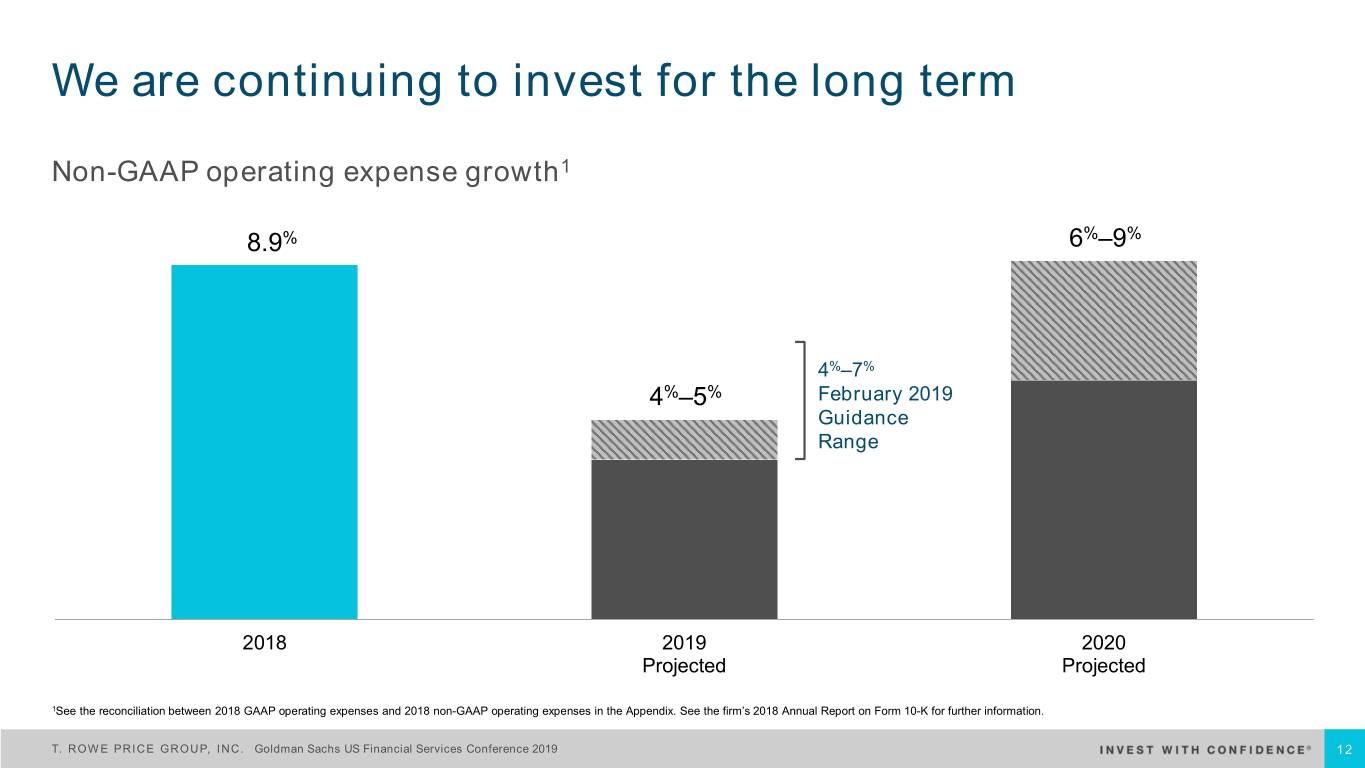

We are continuing to invest for the long term Non-GAAP operating expense growth1 8.9% 6%–9% 4%–7% 4%–5% February 2019 Guidance Range 2018 2019 2020 Projected Projected 1See the reconciliation between 2018 GAAP operating expenses and 2018 non-GAAP operating expenses in the Appendix. See the firm’s 2018 Annual Report on Form 10-K for further information. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 12

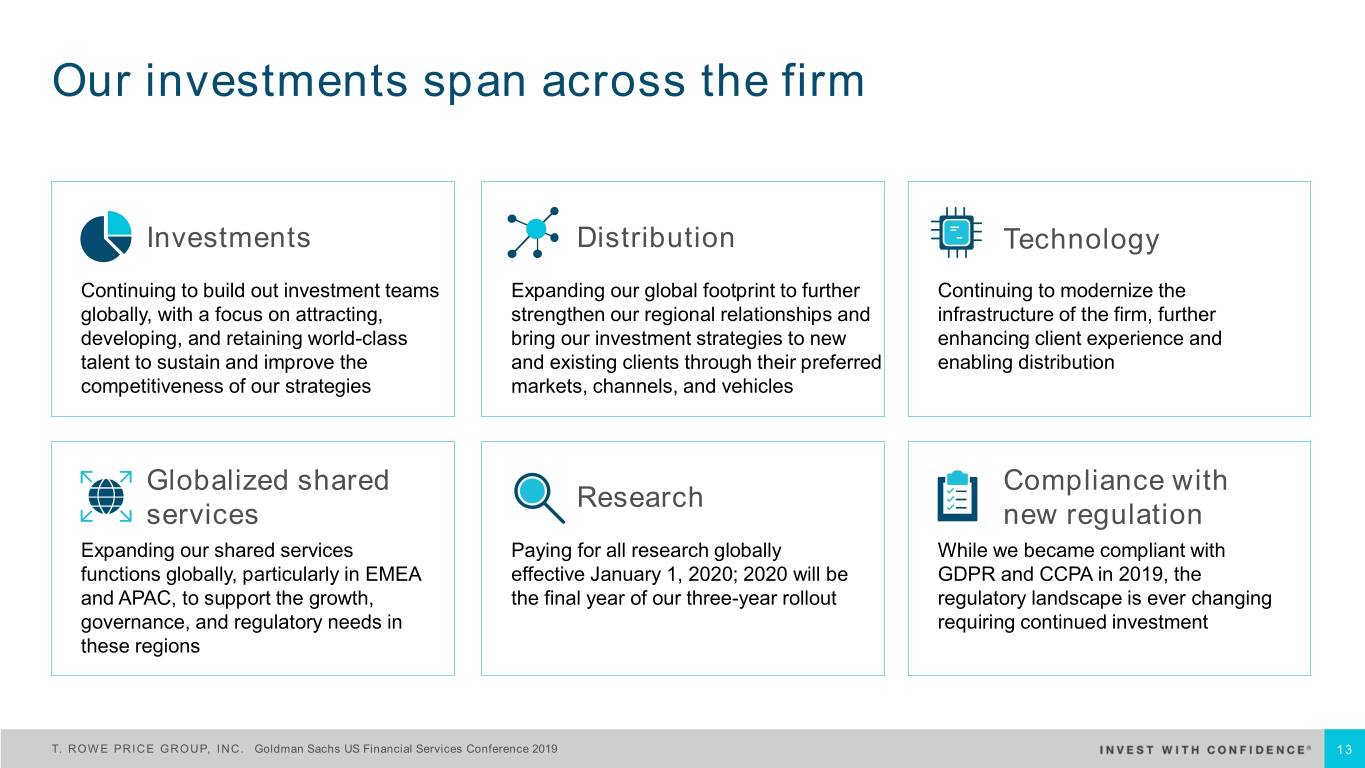

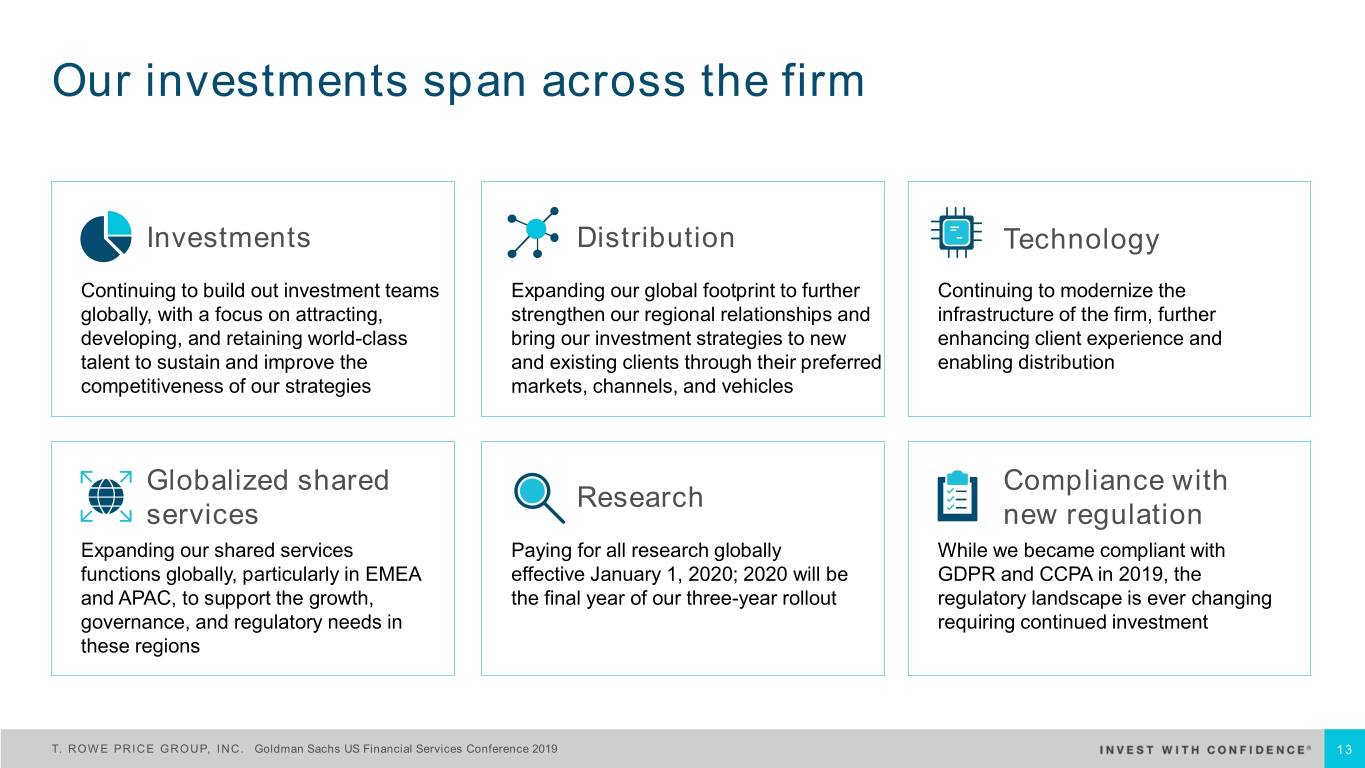

Our investments span across the firm Investments Distribution Technology Continuing to build out investment teams Expanding our global footprint to further Continuing to modernize the globally, with a focus on attracting, strengthen our regional relationships and infrastructure of the firm, further developing, and retaining world-class bring our investment strategies to new enhancing client experience and talent to sustain and improve the and existing clients through their preferred enabling distribution competitiveness of our strategies markets, channels, and vehicles Globalized shared Compliance with Research services new regulation Expanding our shared services Paying for all research globally While we became compliant with functions globally, particularly in EMEA effective January 1, 2020; 2020 will be GDPR and CCPA in 2019, the and APAC, to support the growth, the final year of our three-year rollout regulatory landscape is ever changing governance, and regulatory needs in requiring continued investment these regions T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 13

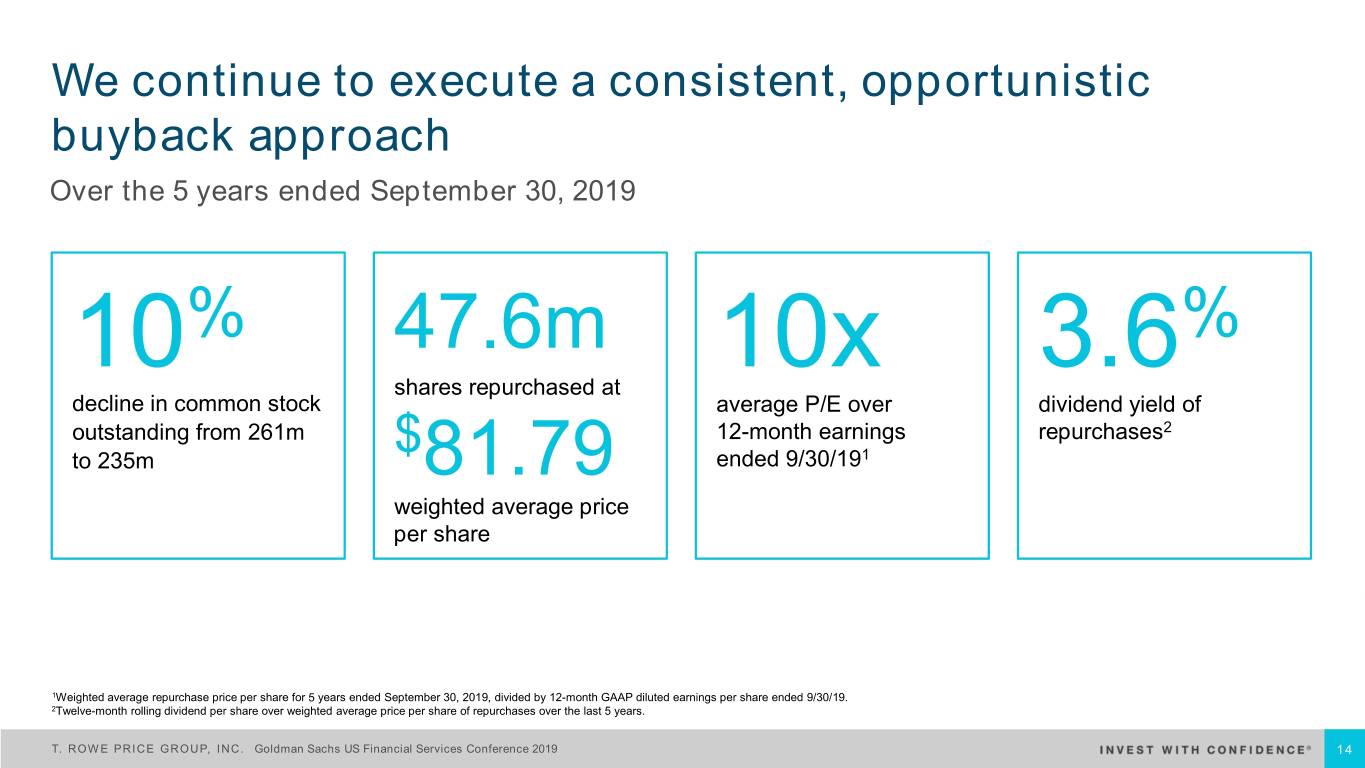

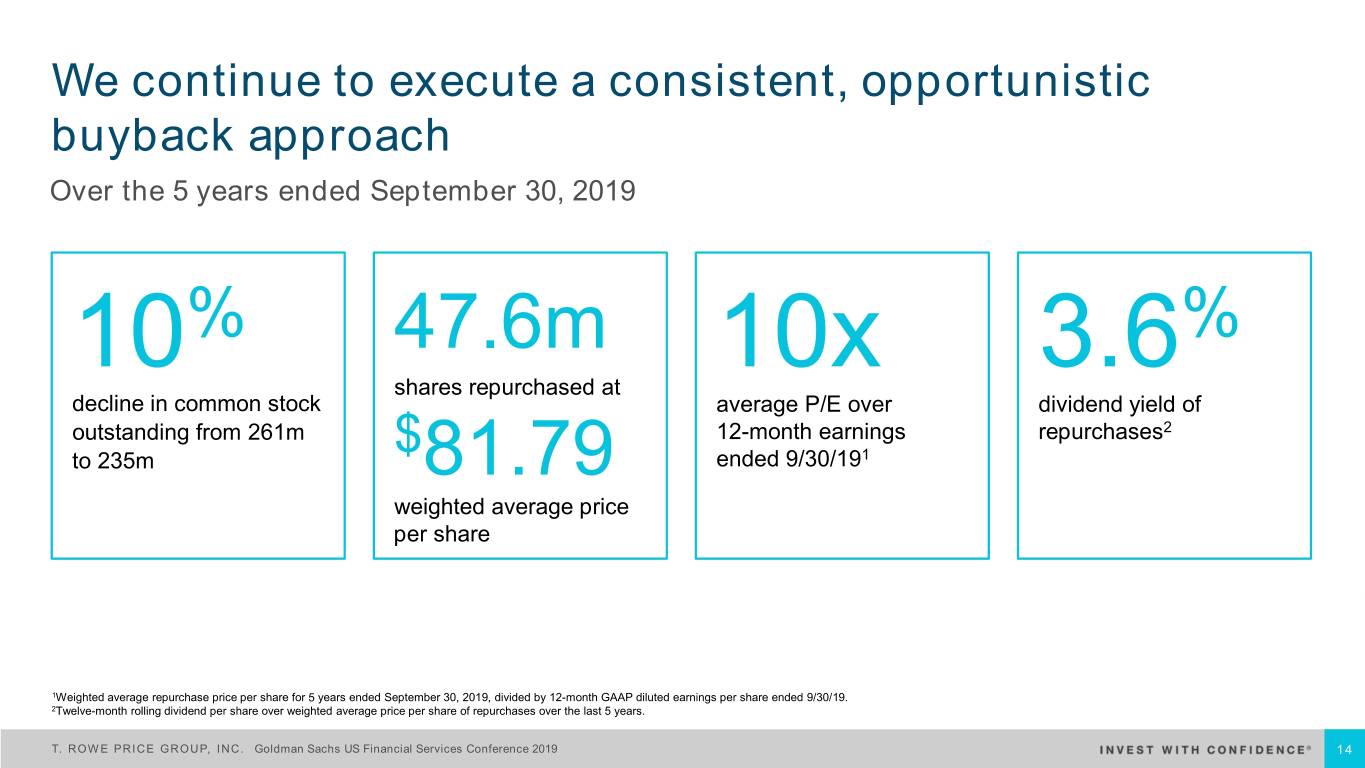

We continue to execute a consistent, opportunistic buyback approach Over the 5 years ended September 30, 2019 % 47.6m . % 10 shares repurchased at 10x 3 6 decline in common stock average P/E over dividend yield of outstanding from 261m 12-month earnings repurchases2 $ 1 to 235m 81.79 ended 9/30/19 weighted average price per share 1Weighted average repurchase price per share for 5 years ended September 30, 2019, divided by 12-month GAAP diluted earnings per share ended 9/30/19. 2Twelve-month rolling dividend per share over weighted average price per share of repurchases over the last 5 years. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 14

Appendix T. ROWE PRICE GROUP, INC. GOLDMAN SACHS US FINANCIAL SERVICES CONFERENCE 2019

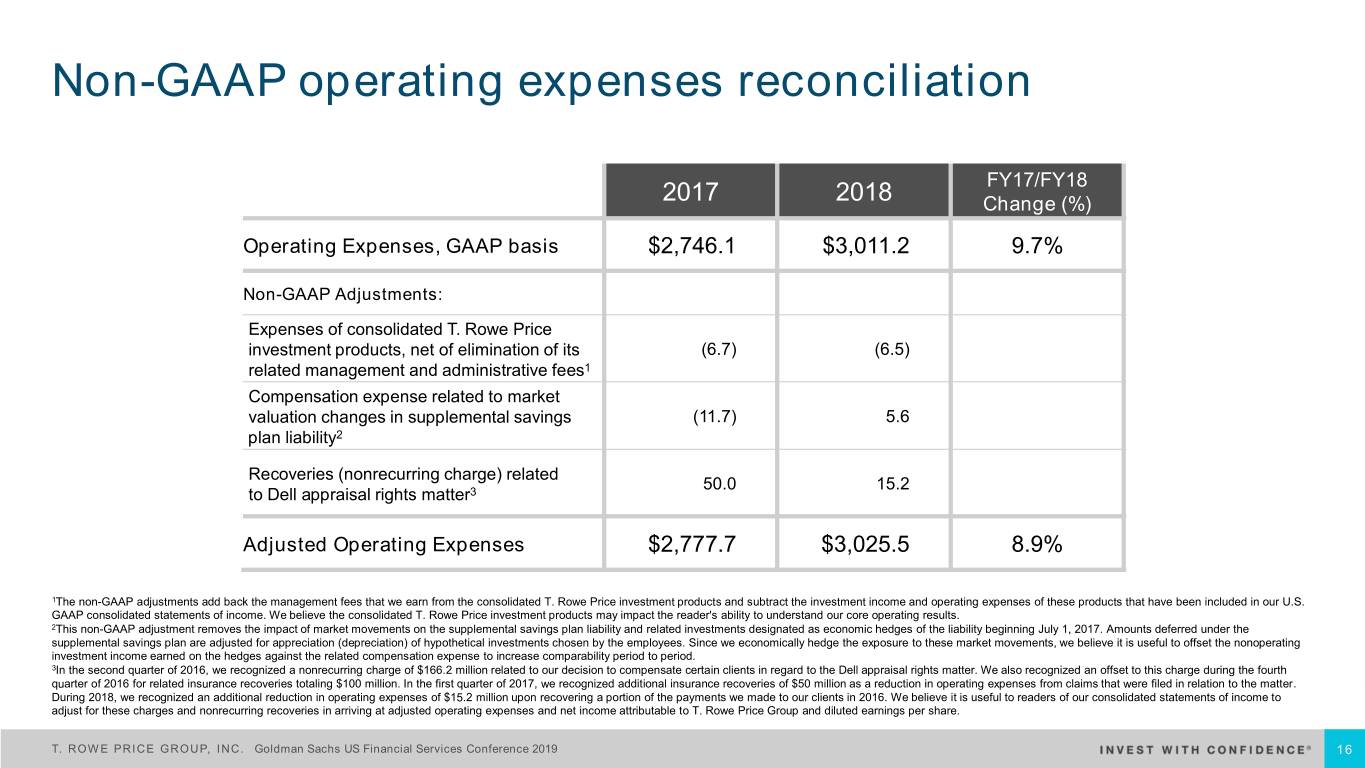

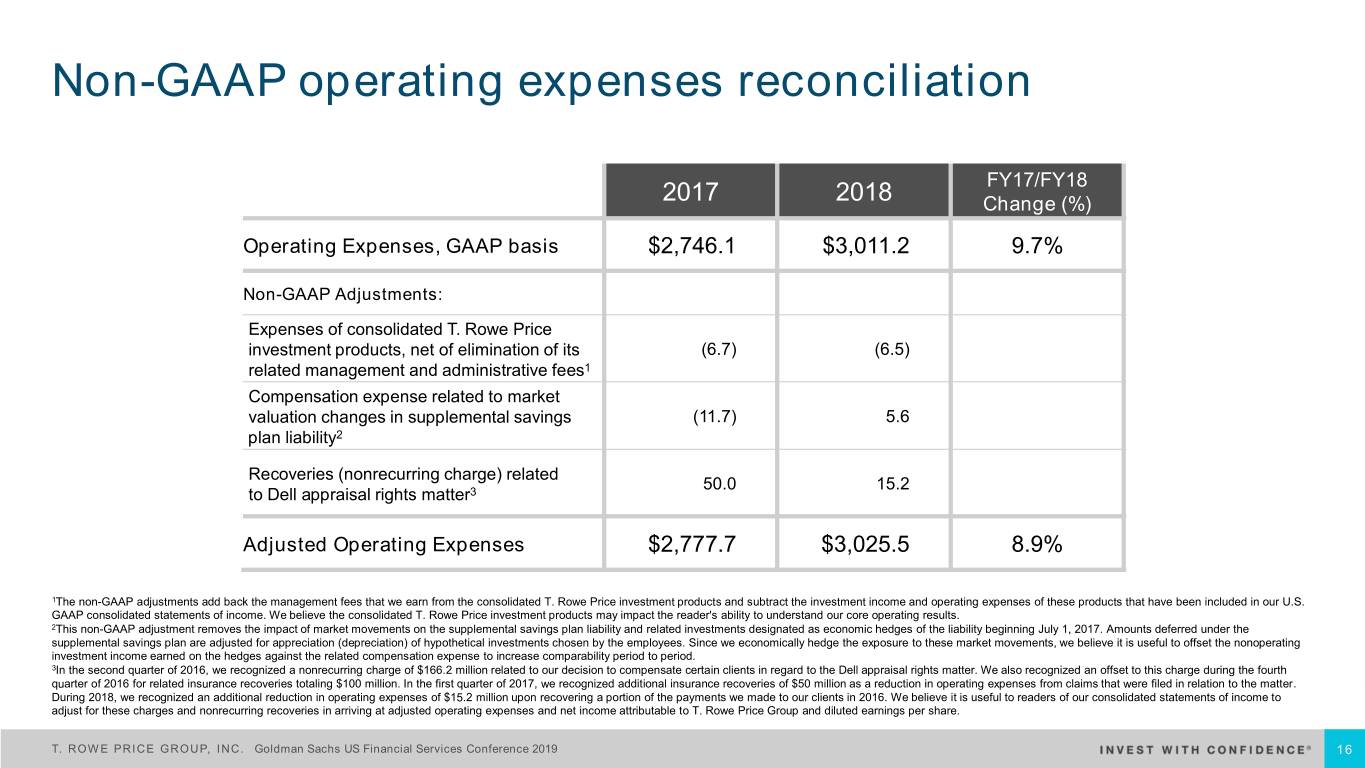

C&h3>4F+$9zqr**8@O Non-GAAP operating expenses reconciliation FY17/FY18 2017 2018 Change (%) Operating Expenses, GAAP basis $2,746.1 $3,011.2 9.7% Non-GAAP Adjustments: Expenses of consolidated T. Rowe Price investment products, net of elimination of its (6.7) (6.5) related management and administrative fees1 Compensation expense related to market valuation changes in supplemental savings (11.7) 5.6 plan liability2 Recoveries (nonrecurring charge) related 50.0 15.2 to Dell appraisal rights matter3 Adjusted Operating Expenses $2,777.7 $3,025.5 8.9% 1The non-GAAP adjustments add back the management fees that we earn from the consolidated T. Rowe Price investment products and subtract the investment income and operating expenses of these products that have been included in our U.S. GAAP consolidated statements of income. We believe the consolidated T. Rowe Price investment products may impact the reader's ability to understand our core operating results. 2This non-GAAP adjustment removes the impact of market movements on the supplemental savings plan liability and related investments designated as economic hedges of the liability beginning July 1, 2017. Amounts deferred under the supplemental savings plan are adjusted for appreciation (depreciation) of hypothetical investments chosen by the employees. Since we economically hedge the exposure to these market movements, we believe it is useful to offset the nonoperating investment income earned on the hedges against the related compensation expense to increase comparability period to period. 3In the second quarter of 2016, we recognized a nonrecurring charge of $166.2 million related to our decision to compensate certain clients in regard to the Dell appraisal rights matter. We also recognized an offset to this charge during the fourth quarter of 2016 for related insurance recoveries totaling $100 million. In the first quarter of 2017, we recognized additional insurance recoveries of $50 million as a reduction in operating expenses from claims that were filed in relation to the matter. During 2018, we recognized an additional reduction in operating expenses of $15.2 million upon recovering a portion of the payments we made to our clients in 2016. We believe it is useful to readers of our consolidated statements of income to adjust for these charges and nonrecurring recoveries in arriving at adjusted operating expenses and net income attributable to T. Rowe Price Group and diluted earnings per share. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 16

Important Information This material, including any statements, information, data and content contained within it and any materials, information, images, links, graphics or recordings provided in conjunction with this material are being furnished by T. Rowe Price for general informational purposes only. Under no circumstances should the material, in whole or part, be copied or distributed without consent from T. Rowe Price. The views contained herein are as of the date of the presentation. The information and data obtained from third-party sources which is contained in the report were obtained from the sources deemed reliable; however, its accuracy and completeness is not guaranteed. The products and services discussed in this presentation are available via subsidiaries of T. Rowe Price Group as authorized in countries through the world. The products and services are not available to all investors or in all countries. Visit troweprice.com to learn more about the products and services available in your country and the T. Rowe Price Group subsidiary which is authorized to provide them. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. The material does not constitute a distribution, an offer, an invitation, recommendation or solicitation to sell or buy any securities in any jurisdiction. The material has not been reviewed by any regulatory authority in any jurisdiction. The material does not constitute advice of any nature and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. © 2019 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are trademarks or registered trademarks of T. Rowe Price Group, Inc. in the United States and other countries. All other trademarks are the property of T. Rowe Price or their respective owners. © 2019 T. Rowe Price Group, Inc. All rights reserved. T. ROWE PRICE GROUP, INC. Goldman Sachs US Financial Services Conference 2019 17