T. ROWE PRICE GROUP, INC. INVESTOR DAY 2020 Oak Hill Advisors, L.P. (OHA) Acquisition Overview October 28, 2021 A copy of this presentation, which includes additional information, is available at troweprice.gcs-web.com/investor-relations. All figures are USD, unless otherwise noted.

2T. R O W E PR IC E G R O U P, IN C . Bill Stromberg CHIEF EXECUTIVE OFFICER T. ROWE PRICE GROUP Glenn August FOUNDER AND CHIEF EXECUTIVE OFFICER OHA Rob Sharps PRESIDENT, HEAD OF INVESTMENTS, GROUP CIO, INCOMING CEO (January 2022) T. ROWE PRICE GROUP Bill Bohnsack PRESIDENT AND SENIOR PARTNER OHA Jen Dardis CHIEF FINANCIAL OFFICER AND TREASURER T. ROWE PRICE GROUP Today’s Speakers

3T. R O W E PR IC E G R O U P, IN C . Forward-looking statements This presentation, and other statements that T. Rowe Price may make, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to the acquisition by T. Rowe Price of Oak Hill Advisors, L.P. (OHA), including regarding expected scale and distribution opportunities, operating efficiencies and results, growth, client and stockholder benefits, key assumptions, timing of closing of the transaction, revenue realization, expense synergies, financial benefits or returns, accretion and integration costs. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may,” and similar expressions. Forward-looking statements in this presentation may include, Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Important transaction-related and other risk factors that may cause such differences include: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the purchase agreement; (ii) the transaction closing conditions may not be satisfied in a timely manner or at all, including due to the failure to obtain regulatory and client approvals; (iii) the announcement and pendency of the acquisition may disrupt T. Rowe Price’s and OHA’s business operations (including the threatened or actual loss of employees, clients or suppliers); (iv) T. Rowe Price or OHA could experience financial or other setbacks if the transaction encounters unanticipated problems; (v) anticipated benefits of the transaction, including the realization of revenue, accretion, financial benefits or returns and expense and other synergies, may not be fully realized or may take longer to realize than expected; (vi) client and investor interest in T. Rowe Price or the combined business’ products may be less than anticipated, and (vii) T. Rowe Price may be unable to successfully integrate OHA’s businesses with those of T. Rowe Price or to integrate the businesses within the anticipated timeframe. Any forward-looking statements speak only as of the date on which they are made, and neither T. Rowe Price nor OHA undertake an obligation to update any forward- looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. Actual results may differ materially from those in forward-looking information because of various factors including, but not limited to, those discussed below and in Item 1A, Risk Factors, included in T. Rowe Price’s Form 10-K Annual Report for 2020.

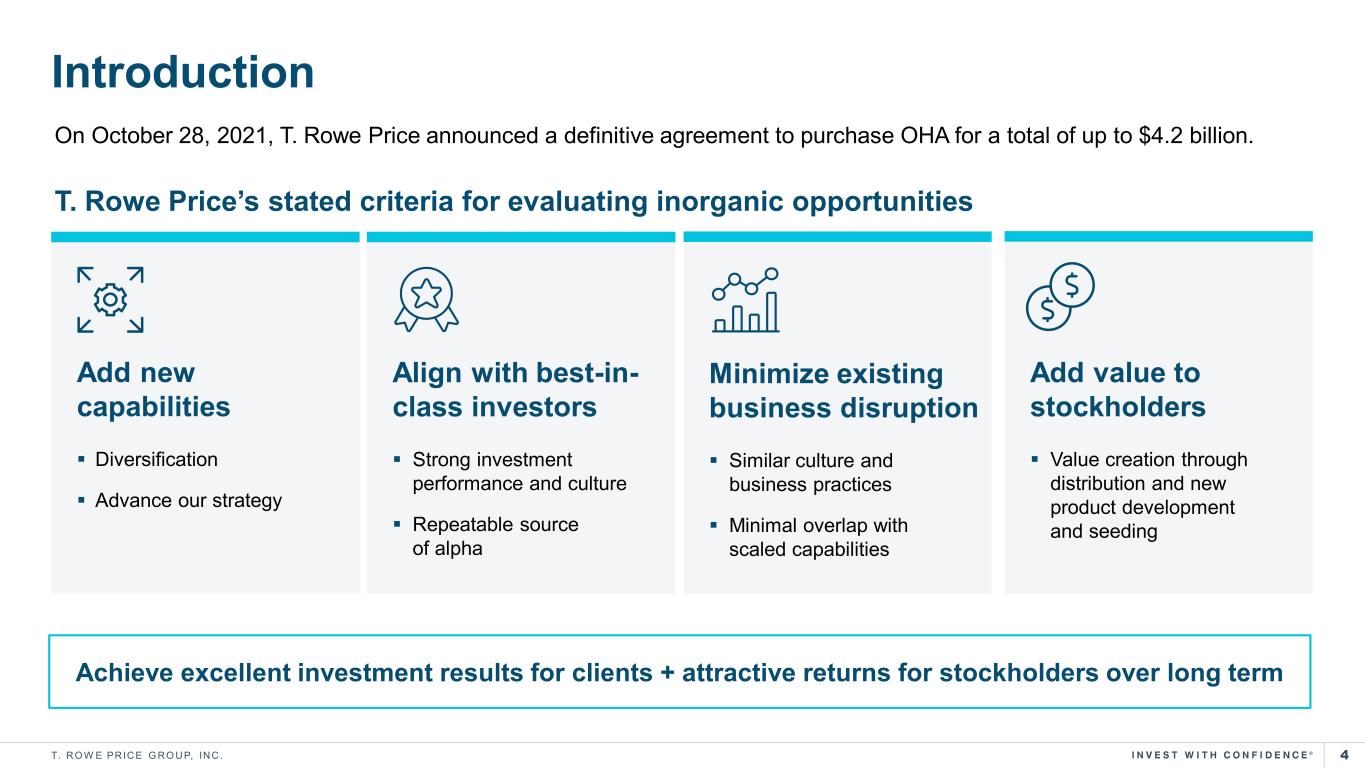

4T. R O W E PR IC E G R O U P, IN C . Introduction T. Rowe Price’s stated criteria for evaluating inorganic opportunities On October 28, 2021, T. Rowe Price announced a definitive agreement to purchase OHA for a total of up to $4.2 billion. Achieve excellent investment results for clients + attractive returns for stockholders over long term Align with best-in- class investors Strong investment performance and culture Repeatable source of alpha Minimize existing business disruption Similar culture and business practices Minimal overlap with scaled capabilities Add value to stockholders Value creation through distribution and new product development and seeding Add new capabilities Diversification Advance our strategy

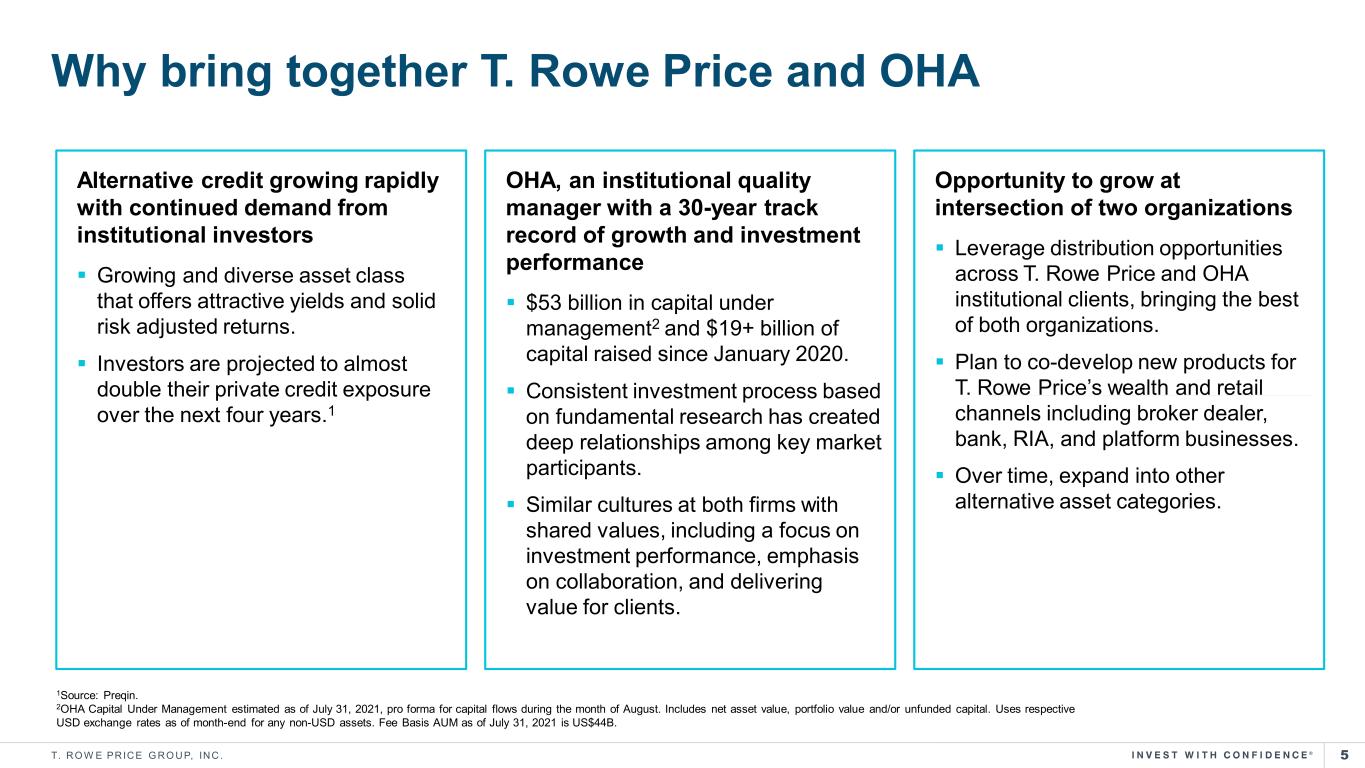

5T. R O W E PR IC E G R O U P, IN C . Why bring together T. Rowe Price and OHA 1Source: Preqin. 2OHA Capital Under Management estimated as of July 31, 2021, pro forma for capital flows during the month of August. Includes net asset value, portfolio value and/or unfunded capital. Uses respective USD exchange rates as of month-end for any non-USD assets. Fee Basis AUM as of July 31, 2021 is US$44B. Alternative credit growing rapidly with continued demand from institutional investors Growing and diverse asset class that offers attractive yields and solid risk adjusted returns. Investors are projected to almost double their private credit exposure over the next four years.1 Opportunity to grow at intersection of two organizations Leverage distribution opportunities across T. Rowe Price and OHA institutional clients, bringing the best of both organizations. Plan to co-develop new products for T. Rowe Price’s wealth and retail channels including broker dealer, bank, RIA, and platform businesses. Over time, expand into other alternative asset categories. OHA, an institutional quality manager with a 30-year track record of growth and investment performance $53 billion in capital under management2 and $19+ billion of capital raised since January 2020. Consistent investment process based on fundamental research has created deep relationships among key market participants. Similar cultures at both firms with shared values, including a focus on investment performance, emphasis on collaboration, and delivering value for clients.

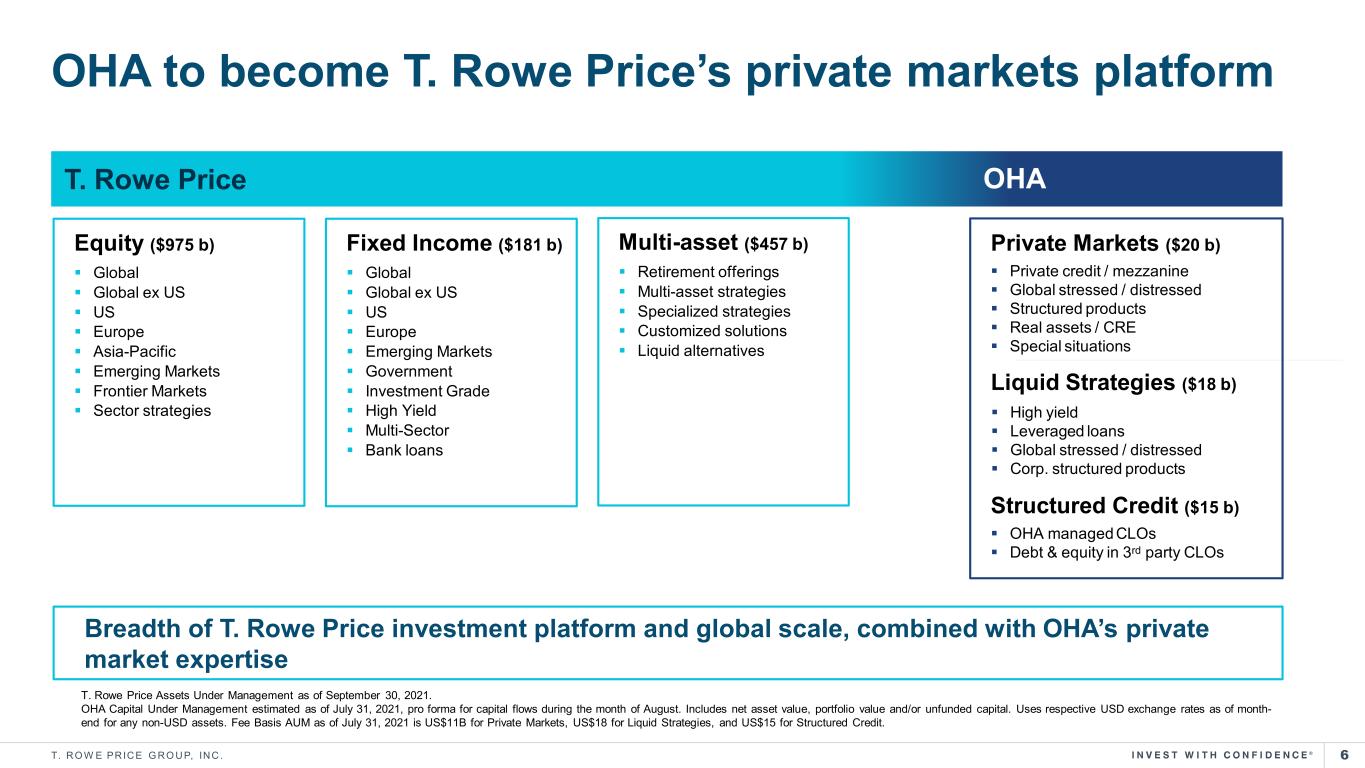

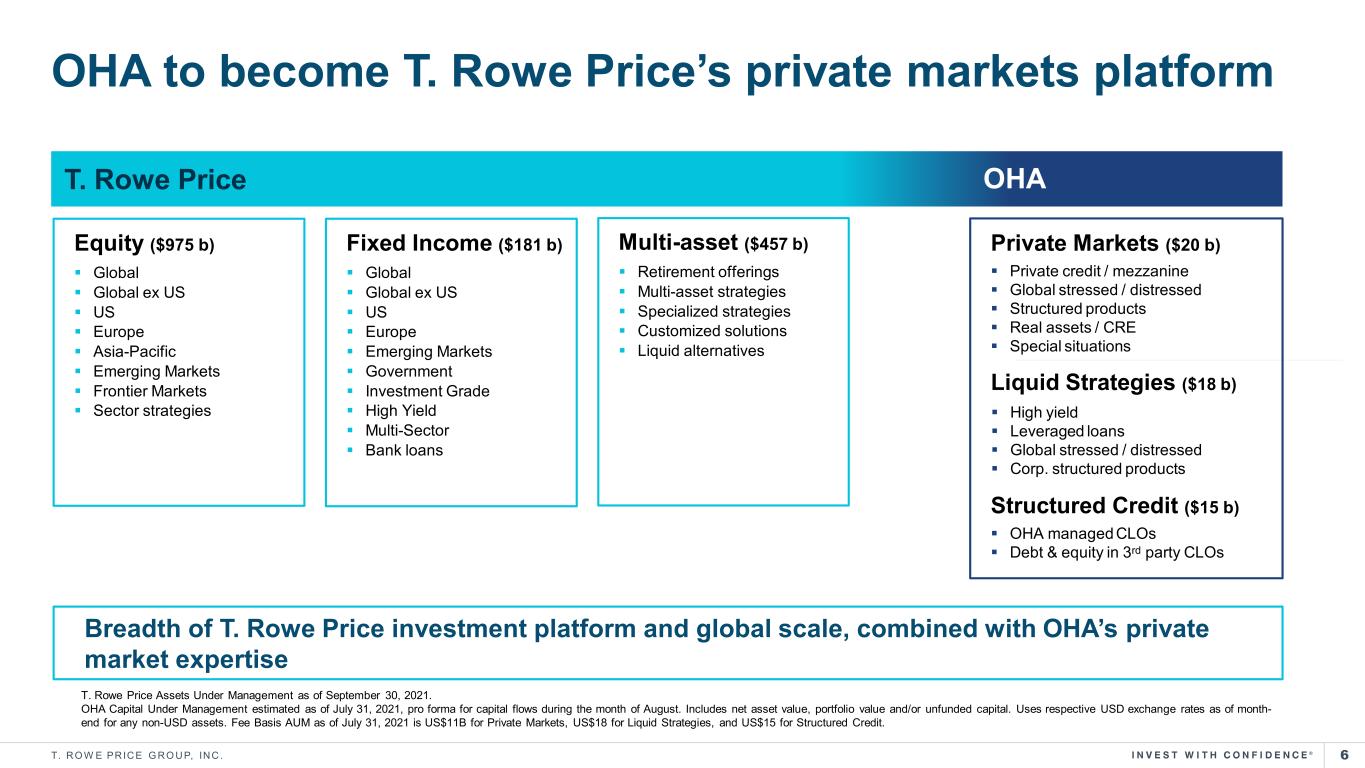

6T. R O W E PR IC E G R O U P, IN C . OHA to become T. Rowe Price’s private markets platform T. Rowe Price Assets Under Management as of September 30, 2021. OHA Capital Under Management estimated as of July 31, 2021, pro forma for capital flows during the month of August. Includes net asset value, portfolio value and/or unfunded capital. Uses respective USD exchange rates as of month- end for any non-USD assets. Fee Basis AUM as of July 31, 2021 is US$11B for Private Markets, US$18 for Liquid Strategies, and US$15 for Structured Credit. Equity ($975 b) Global Global ex US US Europe Asia-Pacific Emerging Markets Frontier Markets Sector strategies Multi-asset ($457 b) Retirement offerings Multi-asset strategies Specialized strategies Customized solutions Liquid alternatives Fixed Income ($181 b) Global Global ex US US Europe Emerging Markets Government Investment Grade High Yield Multi-Sector Bank loans T. Rowe Price OHA Breadth of T. Rowe Price investment platform and global scale, combined with OHA’s private market expertise Private Markets ($20 b) Private credit / mezzanine Global stressed / distressed Structured products Real assets / CRE Special situations Liquid Strategies ($18 b) High yield Leveraged loans Global stressed / distressed Corp. structured products Structured Credit ($15 b) OHA managed CLOs Debt & equity in 3rd party CLOs

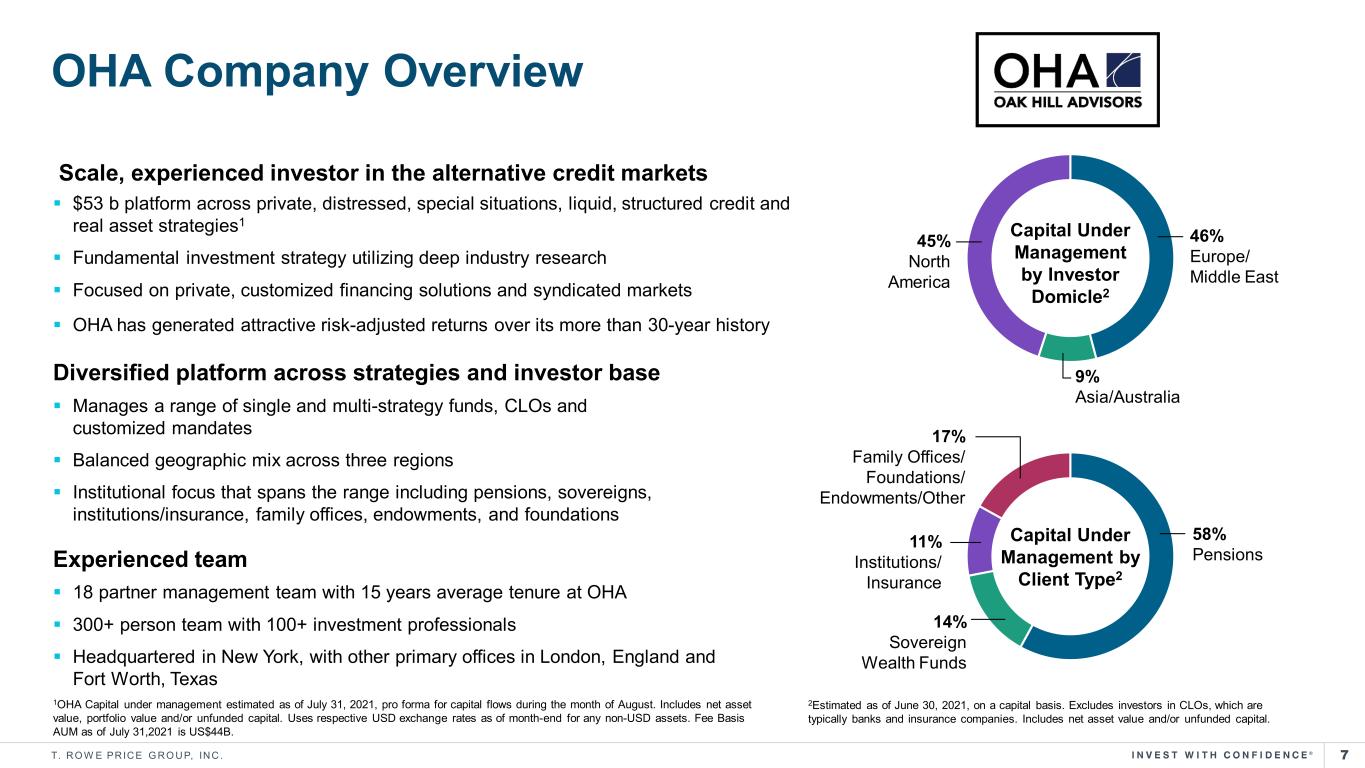

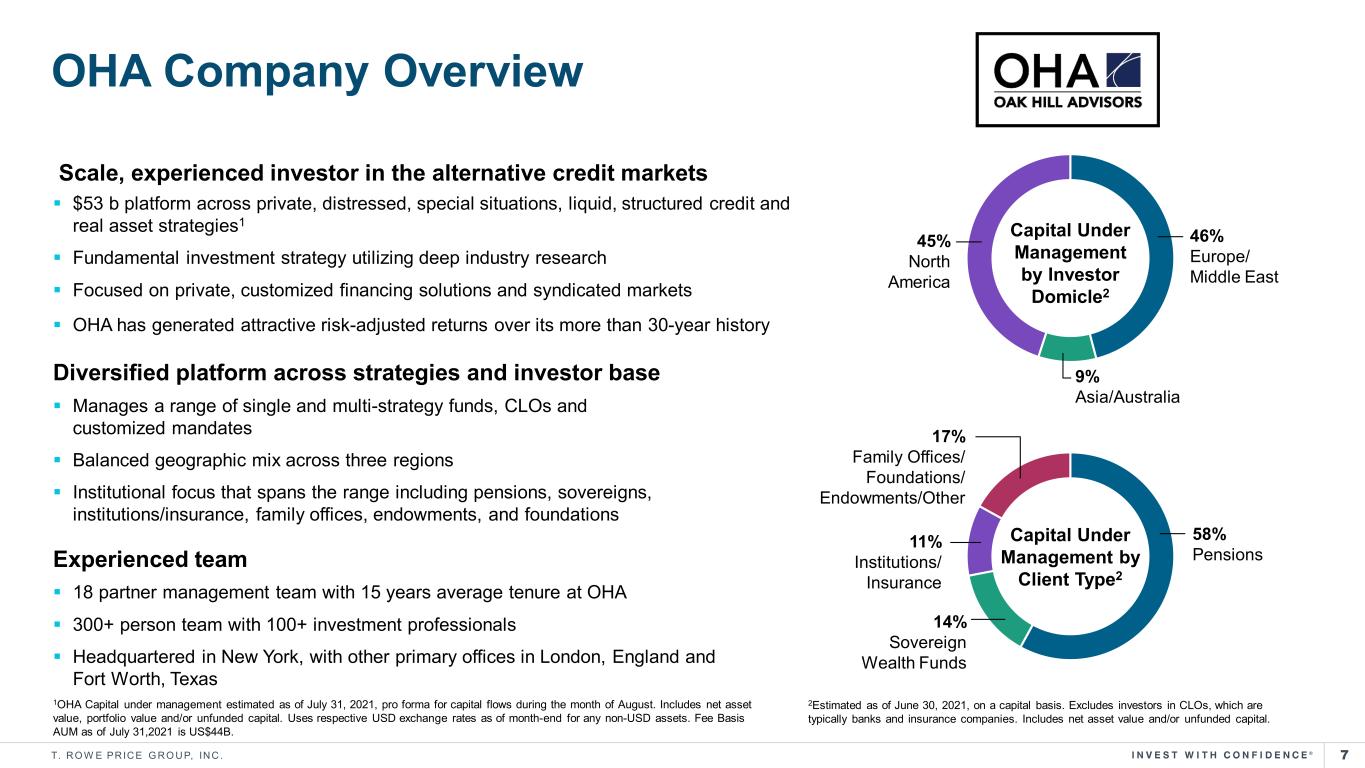

7T. R O W E PR IC E G R O U P, IN C . OHA Company Overview 1OHA Capital under management estimated as of July 31, 2021, pro forma for capital flows during the month of August. Includes net asset value, portfolio value and/or unfunded capital. Uses respective USD exchange rates as of month-end for any non-USD assets. Fee Basis AUM as of July 31,2021 is US$44B. Scale, experienced investor in the alternative credit markets $53 b platform across private, distressed, special situations, liquid, structured credit and real asset strategies1 Fundamental investment strategy utilizing deep industry research Focused on private, customized financing solutions and syndicated markets OHA has generated attractive risk-adjusted returns over its more than 30-year history Diversified platform across strategies and investor base Manages a range of single and multi-strategy funds, CLOs and customized mandates Balanced geographic mix across three regions Institutional focus that spans the range including pensions, sovereigns, institutions/insurance, family offices, endowments, and foundations Experienced team 18 partner management team with 15 years average tenure at OHA 300+ person team with 100+ investment professionals Headquartered in New York, with other primary offices in London, England and Fort Worth, Texas Capital Under Management by Investor Domicle2 46% Europe/ Middle East 9% Asia/Australia 45% North America Capital Under Management by Client Type2 58% Pensions 14% Sovereign Wealth Funds 11% Institutions/ Insurance 17% Family Offices/ Foundations/ Endowments/Other 2Estimated as of June 30, 2021, on a capital basis. Excludes investors in CLOs, which are typically banks and insurance companies. Includes net asset value and/or unfunded capital.

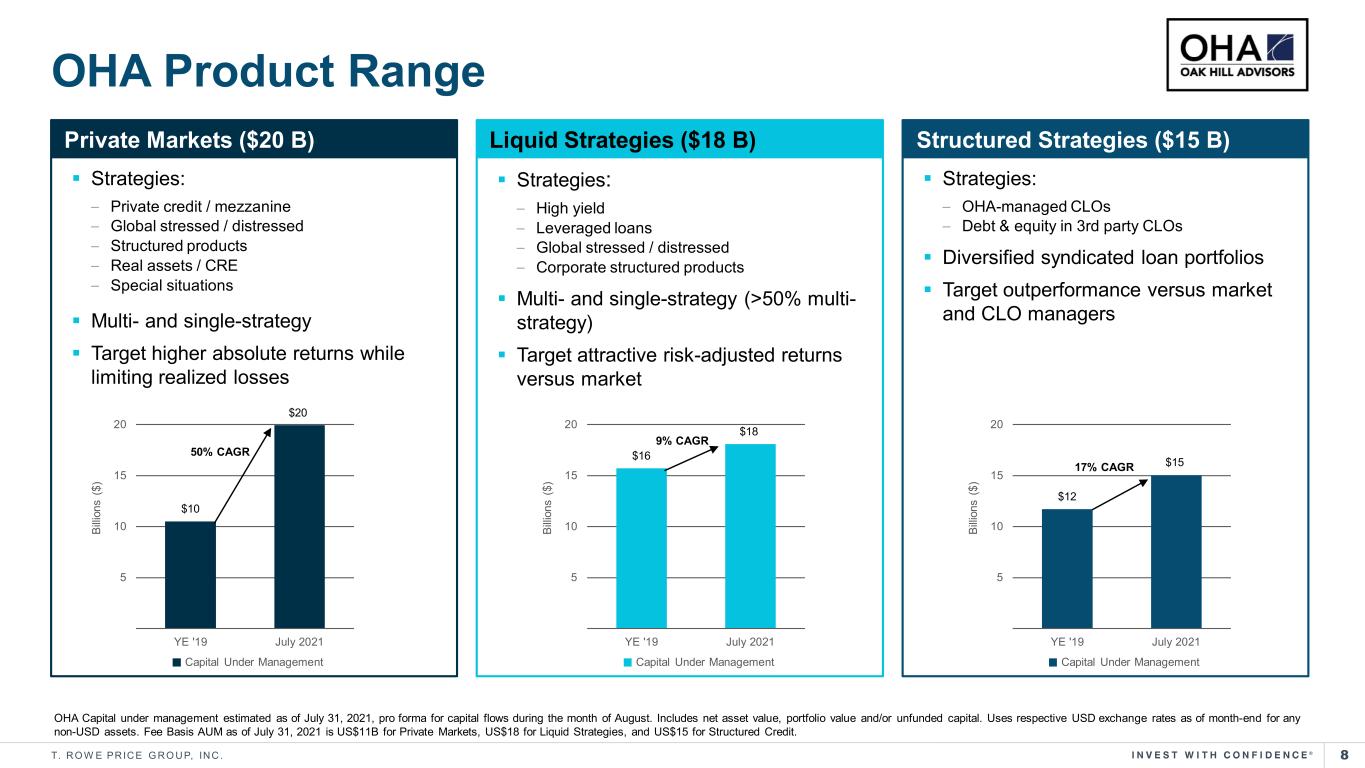

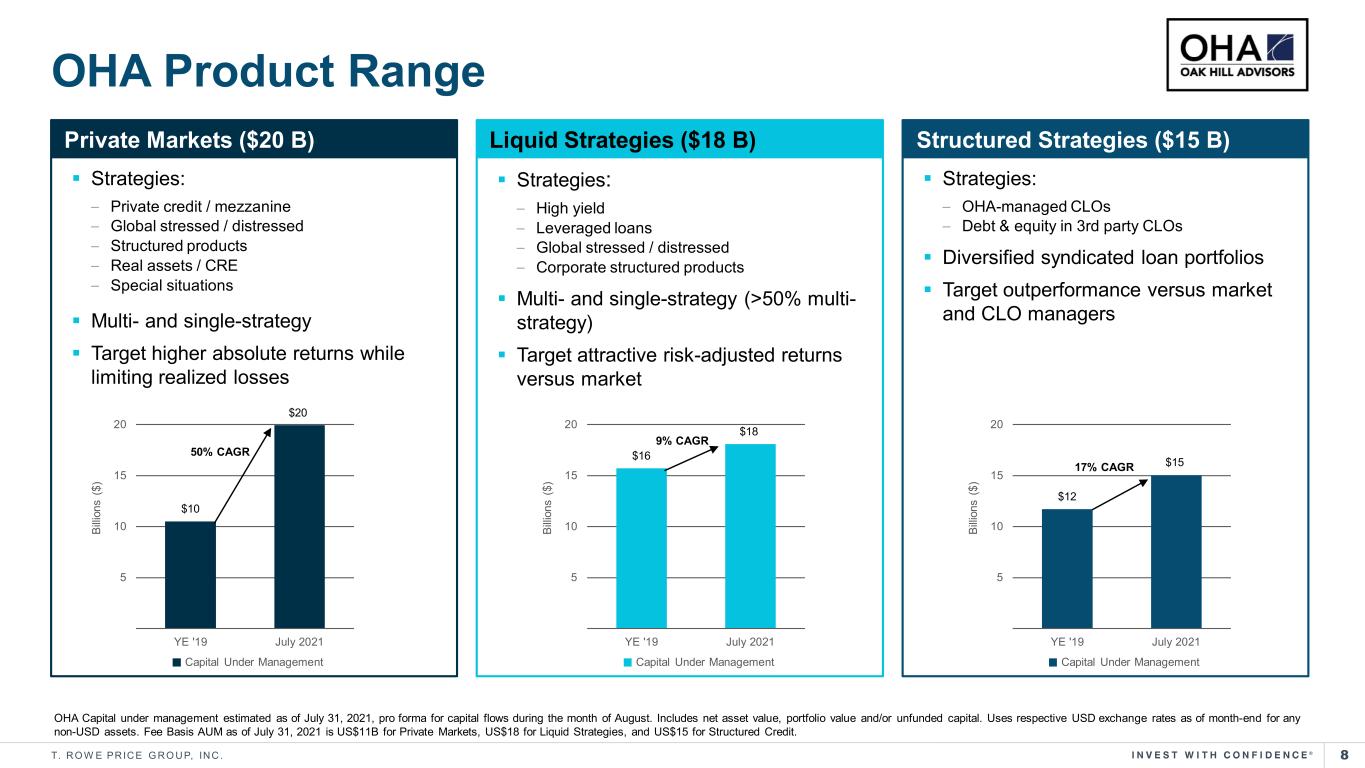

8T. R O W E PR IC E G R O U P, IN C . $10 $20 5 10 15 20 YE '19 July 2021 Bi llio ns ( $) $12 $15 5 10 15 20 YE '19 July 2021 Bi llio ns ( $) OHA Product Range OHA Capital under management estimated as of July 31, 2021, pro forma for capital flows during the month of August. Includes net asset value, portfolio value and/or unfunded capital. Uses respective USD exchange rates as of month-end for any non-USD assets. Fee Basis AUM as of July 31, 2021 is US$11B for Private Markets, US$18 for Liquid Strategies, and US$15 for Structured Credit. Strategies: – Private credit / mezzanine – Global stressed / distressed – Structured products – Real assets / CRE – Special situations Multi- and single-strategy Target higher absolute returns while limiting realized losses Private Markets ($20 B) Liquid Strategies ($18 B) Structured Strategies ($15 B) Strategies: – High yield – Leveraged loans – Global stressed / distressed – Corporate structured products Multi- and single-strategy (>50% multi- strategy) Target attractive risk-adjusted returns versus market Strategies: – OHA-managed CLOs – Debt & equity in 3rd party CLOs Diversified syndicated loan portfolios Target outperformance versus market and CLO managers $16 $18 5 10 15 20 YE '19 July 2021 Bi llio ns ( $) 9% CAGR 50% CAGR 17% CAGR Capital Under Management Capital Under Management Capital Under Management

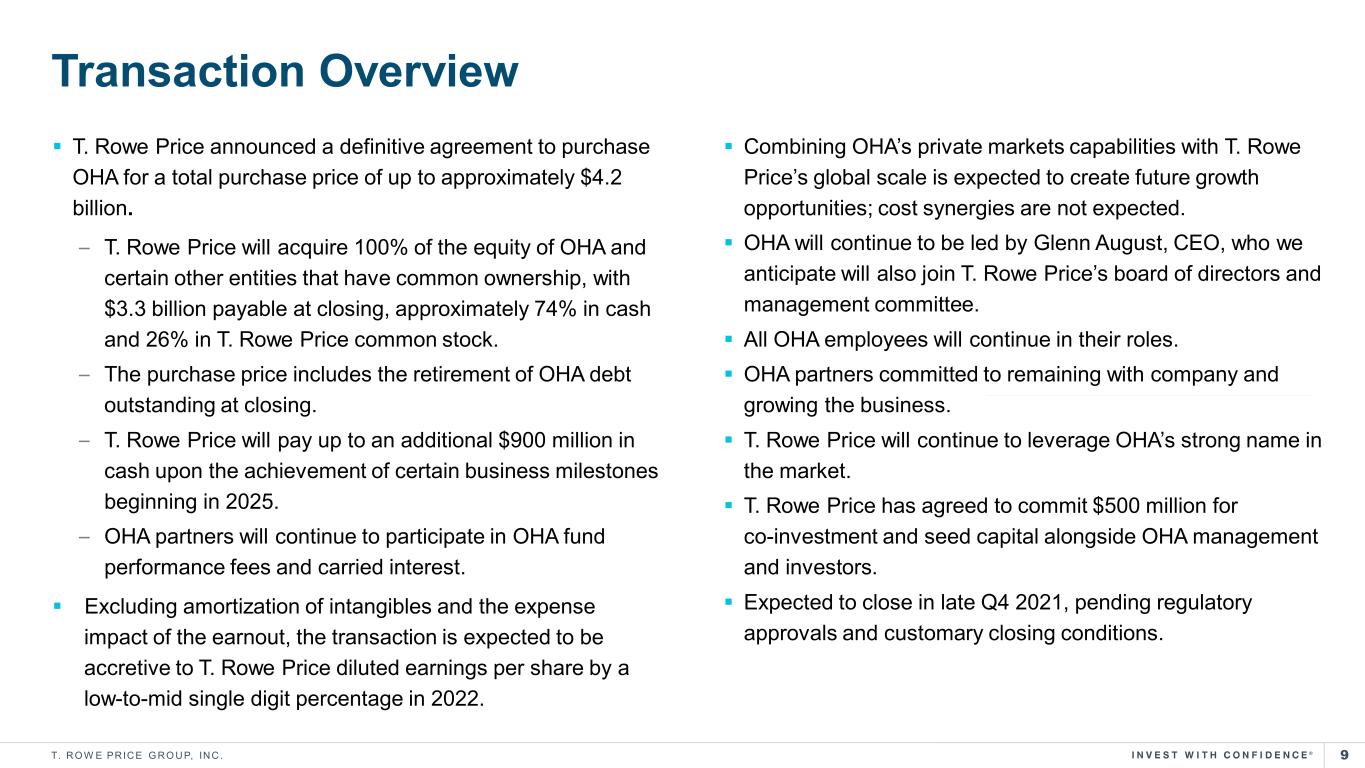

9T. R O W E PR IC E G R O U P, IN C . T. Rowe Price announced a definitive agreement to purchase OHA for a total purchase price of up to approximately $4.2 billion. – T. Rowe Price will acquire 100% of the equity of OHA and certain other entities that have common ownership, with $3.3 billion payable at closing, approximately 74% in cash and 26% in T. Rowe Price common stock. – The purchase price includes the retirement of OHA debt outstanding at closing. – T. Rowe Price will pay up to an additional $900 million in cash upon the achievement of certain business milestones beginning in 2025. – OHA partners will continue to participate in OHA fund performance fees and carried interest. Excluding amortization of intangibles and the expense impact of the earnout, the transaction is expected to be accretive to T. Rowe Price diluted earnings per share by a low-to-mid single digit percentage in 2022. Combining OHA’s private markets capabilities with T. Rowe Price’s global scale is expected to create future growth opportunities; cost synergies are not expected. OHA will continue to be led by Glenn August, CEO, who we anticipate will also join T. Rowe Price’s board of directors and management committee. All OHA employees will continue in their roles. OHA partners committed to remaining with company and growing the business. T. Rowe Price will continue to leverage OHA’s strong name in the market. T. Rowe Price has agreed to commit $500 million for co-investment and seed capital alongside OHA management and investors. Expected to close in late Q4 2021, pending regulatory approvals and customary closing conditions. Transaction Overview

T. ROWE PRICE GROUP, INC. INVESTOR DAY 2020 Questions Please submit your written questions in the box on the left of the screen.

11T. R O W E PR IC E G R O U P, IN C . Important information This material, including any statements, information, data and content contained within it and any materials, information, images, links, graphics or recordings provided in conjunction with this material are being furnished by T. Rowe Price for general informational purposes only. Under no circumstances should the material, in whole or part, be copied or distributed without consent from T. Rowe Price. The views contained herein are as of the date of the presentation. The information and data obtained from third-party sources which is contained in the report were obtained from the sources deemed reliable; however, its accuracy and completeness is not guaranteed. The products and services discussed in this presentation are available via subsidiaries of T. Rowe Price Group as authorized in countries throughout the world. The products and services are not available to all investors or in all countries. Visit troweprice.com to learn more about the products and services available in your country and the T. Rowe Price Group subsidiary which is authorized to provide them. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. The material does not constitute a distribution, offer, invitation, recommendation or solicitation to sell or buy any securities in any jurisdiction. The material has not been reviewed by any regulatory authority in any jurisdiction. The material does not constitute advice of any nature, and prospective investors are recommended to seek independent legal, financial, and tax advice before making any investment decision. © 2021 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of T. Rowe Price or their respective owners.