SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Name and address of agent for service)

| KINETICS MUTUAL FUNDS, INC. |

| Table of Contents |

| June 30, 2018 (Unaudited) |

| Page | |

| Shareholders’ Letter | 2 |

| Year 2018 Semi-Annual Investment Commentary | 5 |

| KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS AND THE KINETICS SPIN-OFF AND CORPORATE RESTRUCTURING FUND | |

| Expense Example | 12 |

| Allocation of Assets — The Kinetics Spin-off and Corporate Restructuring Fund | 19 |

| Schedule of Investments — The Kinetics Spin-off and Corporate Restructuring Fund | 20 |

| Statements of Assets & Liabilities | 23 |

| Statements of Operations | 28 |

| Statements of Changes in Net Assets | 33 |

| Notes to Financial Statements | 46 |

| Financial Highlights | 72 |

| KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS | |

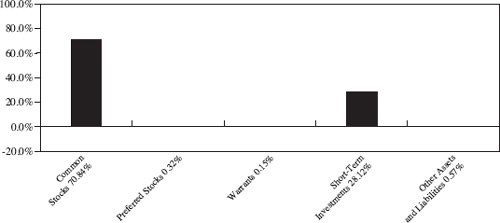

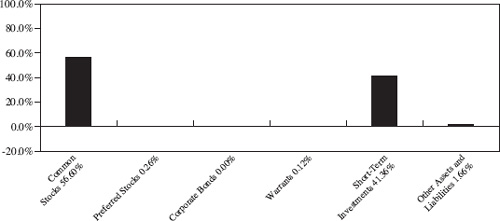

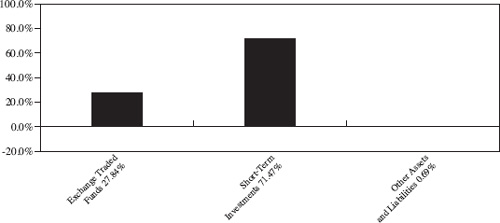

| Allocation of Consolidated Portfolio Assets | 105 |

| Consolidated Portfolio of Investments —The Internet Portfolio | 113 |

| Consolidated Portfolio of Investments — The Global Portfolio | 116 |

| Consolidated Portfolio of Investments — The Paradigm Portfolio | 120 |

| Portfolio of Investments — The Medical Portfolio | 125 |

| Consolidated Portfolio of Investments — The Small Cap Opportunities Portfolio | 127 |

| Consolidated Portfolio of Investments — The Market Opportunities Portfolio | 130 |

| Portfolio of Investments — The Alternative Income Portfolio | 133 |

| Portfolio of Investments — The Multi-Disciplinary Income Portfolio | 134 |

| Portfolio of Options Written — The Alternative Income Portfolio | 138 |

| Consolidated Statements of Assets & Liabilities | 139 |

| Consolidated Statements of Operations | 143 |

| Consolidated Statements of Changes in Net Assets | 147 |

| Consolidated Notes to Financial Statements | 151 |

1

| KINETICS MUTUAL FUNDS, INC. |

| Shareholders’ Letter |

Dear Fellow Shareholders:

We are pleased to present the Kinetics Mutual Funds (“Funds”) Semi-Annual Report for the six-month period ended June 30, 2018. The Funds are generally positioned at odds with global consensus investments and focused upon what we believe to be more conservative, yet more appealing securities. These companies tend to be well outside of the universe of securities that populate many indexes. This strategy has served our shareholders well over the fullness of time, and we are pleased to have achieved satisfying results this year, amidst surprisingly strong index returns and despite our contrarian positioning (which returns tend to deviate from the returns of these benchmarks). A performance summary for the first half of 2018 follows (No-Load Class): The Small Cap Opportunities Fund +17.91%; The Spin-off and Corporate Restructuring Fund +13.55%; The Paradigm Fund +13.25; The Market Opportunities Fund +1.95%; The Multi-Disciplinary Income Fund +0.15%; The Alternative Income Fund -0.07%; The Medical Fund -3.43%; The Global Fund -6.85%; and The Internet Fund -14.83%. This compares to returns, for equity indexes, of +2.65% for the S&P 500® Index; -0.43% for the MSCI All Country World (ACWI) Index; +8.79% for the NASDAQ Composite®; 9.39% for the S&P 600® SmallCap Index and -2.75% for the MSCI EAFE® Index; and, for bond indexes, -1.62% for the Bloomberg Barclays U.S. Aggregate Bond Index; +0.16% for the Bloomberg Barclays U.S. Corporate High Yield Bond Index and +0.11% for the Bloomberg Barclays U.S. 1-3 Year Credit Bond Index.

While we continue to provide equity and fixed income reference benchmark numbers (to aid in your understanding of how the broad asset classes have performed throughout the first half of 2018), we do not manage the Funds against any specific benchmark, as we believe that this institutionalized approach to investing is at odds with long-term wealth creation.

2

During the first quarter of 2018, markets declined, though we noted a lack of substantive factors that might have led to this phenomenon. Similarly, in the second quarter, we saw little to warrant the resumption of the temporally interrupted market ascent. One factor that we do believe has a high correlation to market movements is ETF (index) fund flows, which were negative in the beginning of the year, and resumed in earnest during April and May, only to subside in June. In hindsight, and now well into the deluge of corporate earnings for the second quarter at the time of this writing, we are further incredulous at the broader market drivers. This might lead some to rethink their asset allocations and investment methodologies.

The most basic principal of value investing holds that in the fullness of time, the market will eventually assign a fair value to a stock. This relies upon the broader market, i.e. other buyers and sellers, recognizing the value and correcting the price over time. However, in the event that said individual buyers and sellers are increasingly indifferent to security values, this premise comes into doubt. Thus, cheapness in and of itself, is insufficient for investment success. To wit, dependence upon valuation multiple expansion appears to be a lacking strategy.

However, the growing field of passive investing, limited in its definition of cheapness or value, primarily defines value in the terms of low price to book, price to sales and price to earnings. While we believe that we are disciplined value investors to be sure, we also define value within our own parameters that at times are beyond quantitative measures. The static measures utilized by the indexes result in biases towards certain sectors and industries, and lower growth enterprises that might not be a “value” when adjusted for growth or margin potential. To this end, we are not surprised by the relative underperformance of “value” indexes relative to the broader market. The magnitude of underperformance relative to “growth” indexes is less intuitive.

3

An additional interesting development in market structure, to our advantage in our opinion, is the rollout of the Markets in Financial Instruments Directive II (MiFID II) regulations. While these regulations only directly apply to the European Union, there is noticeable overflow into U.S. markets. This regulation requires investment managers to directly pay for third party investment research, as opposed to shareholders bearing the costs indirectly via trading commissions. As a result, investment managers have consolidated research relationships, to the detriment of smaller, less liquid and less promotional companies, as these companies have lower trading volumes and less marketability to clients. The largest U.S. investment managers have been forced to comply with European regulations for operations abroad, but the dynamic of a declining research community, focused on larger and liquid stocks is apparent domestically.

All of these factors lead us to have great confidence in the investment landscape, for our approach, over the next several years, but cautious regarding market structure and asset prices in the interim. We continue to approach this environment by focusing our portfolios on our highest conviction ideas, and by maintaining relatively high cash positions in certain funds, standing ready to deploy this capital as opportunities become available.

4

| KINETICS MUTUAL FUNDS, INC. |

| Investment Commentary |

There is no single investment manager who is more frequently quoted, cited or otherwise referred to than Warren Buffett of Berkshire Hathaway. The “Oracle of Omaha” has compounded the book value of Berkshire Hathaway stock at 19.1% annually, dating back to 1965, compared to 9.9% for the S&P 500 Index (“Index”) over the same period. This equates to a multiplier on initial investment of nearly 11,000x for Berkshire Hathaway versus 155x for the Index; or a difference between approximately $10.9 million and $155,000 for an initial investment of $1,000. An abundance of “value” investors claim to emulate Mr. Buffett’s approach and cite his folksy adages assembled over the years. It makes for excellent marketing materials, but few, perhaps no manager, truly emulates these tenets (at times even Mr. Buffett himself does not follow his own rules).

One adage that strikes us as being particularly astute, but somewhat impractical to follow, is the “20 Slot Rule,” which advocates investing as if you had a ticket that you would be required to punch each time you made an investment throughout your life, and upon 20 punches, you could make no more investments. Prior to discussing the application and feasibility of this rule in a portfolio, it bears considering what this mentality would achieve. It would certainly require a far higher level of conviction, and as a byproduct, research and diligence, than most investors possess. Secondarily, and perhaps as importantly, it would allow (require) investments to be held over a very long time period, both compounding in value and avoiding “trading,” as well as taxes. This alone would likely result in many investors achieving results that are magnitudes beyond the status quo allocator approach commonly utilized.

A third derivative result of this mentality would inevitably be fewer, more concentrated investment positions. Modern Portfolio Theory advocates the exact opposite: diversify portfolios to reduce risk and constantly recalibrate asset allocations to the “efficient frontier.” A cursory look at most funds would

5

suggest that far more professional investors, many of whom who consider themselves Buffett emulators, act in complete contrast to the “punch card” mentality, owning hundreds if not thousands of securities, and trading daily. The results of this style of investment management are: i.) undifferentiated market returns and ii.) transaction fees and tax inefficiency.

The Funds generally adhere to the punch card mentality within practical limitations, and this approach has resulted in differentiated returns, with a unique risk profile compared to market driven factors. The concentration of an actively managed fund highlights the investing ability of the management team, as opposed to the ability to select several hundred “decent” investments while continually repositioning. Layers of regulators, consultants and risk managers (many of whom have little or no practical investment experience) have perpetuated unsound conventions used in investment management, endeavoring to make the investment landscape safer for individuals. This wave has only gained momentum, fostering the creation and adoption of the indexation trend and proliferation of ETFs, and the subsequent appropriation of the market by these products.

Mr. Buffett has actually recently advocated indexation investing – for the average investor – citing his skepticism regarding the average investment manager’s ability to earn excess returns. If one considers that so few professional investors follow a strategy which resembles that of Mr. Buffett, it logically follows that he would recommend this course. Meanwhile, the vast majority of investors enter the summer months citing historical trends of stock returns during June – August or opining on trade deals and interest rates. To the contrary, we are following the results of our high conviction investments (these companies do in fact still operate in the summer) and seeking additional companies worthy of the punch card.

6

Kinetics offers the following funds to investors:

The Paradigm Fund focuses on companies that are valued attractively and currently have, or are expected to soon have, sustainable high business returns. The Fund has produced attractive risk adjusted returns since its inception, while maintaining amongst the lowest turnover rates in the industry. The Paradigm Fund is Kinetics’ flagship fund.

The Multi-Disciplinary Income Fund seeks to utilize stock options and fixed-income investments in order to provide investors with equity-like returns, but with more muted volatility. At times, the options strategies of the Fund may cause the manager to purchase equity securities.

The Small Cap Opportunities Fund focuses on undervalued and special situation small capitalization equities that have the potential for rewarding long-term investment results. The same investment fundamentals employed by The Paradigm Fund are used to identify such opportunities.

The Medical Fund is a sector fund, offering an investment in scientific discovery within the promising field of medical research, particularly in the development of cancer treatments and therapies. As a sector fund, The Medical Fund is likely to have heightened volatility and is not designed to be a major component of one’s equity exposure.

The Internet Fund is a sector fund that focuses on companies engaged in and/or benefitting from the evolution of Internet-related developments. As such, this Fund has been, and is likely to continue to be, quite volatile. The Internet Fund is not designed to be a major component of one’s equity

7

exposure. More recently, this Fund has been focusing on content companies, which we believe will be the winners in the next generation of Internet development.

The Global Fund is focused on selecting long life cycle international companies that can generate long-term wealth through their business operations. This Fund is presently identifying what we believe to be exciting opportunities in the more developed markets.

The Market Opportunities Fund focuses on those companies that benefit from increasing transactional volume or throughput, such as publicly-traded exchanges and credit card processors, or companies that act as facilitators, such as gaming companies, airports and publicly-traded toll roads.

The Alternative Income Fund seeks to provide current income and gains, with a secondary objective of obtaining long-term growth of capital. The Fund utilizes stock options and fixed-income investments in order generate a total return that exceeds that of most short-term U.S. fixed income indexes, with limited market value variability.

The Kinetics Spin-Off and Corporate Restructuring Fund focuses on spin-off companies and parent companies of spin-offs. The Fund’s return potential is often the result of the market’s inefficiency in initially valuing these securities, due in part to the lack of coverage by the investment community, lack of a natural shareholder base immediately following the transaction, and resulting initial, indiscriminate selling pressure.

8

Disclosure

This material is intended to be reviewed in conjunction with a current prospectus, which includes all fees and expenses that apply to a continued investment, as well as information regarding the risk factors, policies and objectives of the Funds. Read it carefully before investing.

Mutual Fund investing involves risk. Principal loss is possible. Because The Internet Fund, The Medical Fund and The Market Opportunities Fund invest in a single industry or geographic region, their shares are subject to a higher degree of risk than funds with a higher level of diversification. Internet, biotechnology and certain capital markets or gaming stocks are subject to a rate of change in technology, obsolescence and competition that is generally higher than that of other industries, hence they may experience extreme price and volume fluctuations.

International investing [for all Funds] presents special risks including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Accordingly, the share prices for these Funds are expected to be more volatile than that of U.S.-only funds. Past performance is no guarantee of future performance.

Because smaller companies [for The Small Cap Opportunities Fund] often have narrower markets and limited financial resources, they present more risk than larger, more well established, companies.

Non-investment grade debt securities [for all Funds], i.e., junk bonds, are subject to greater credit risk, price volatility and risk of loss than investment grade securities.

Further, options contain special risks including the imperfect correlation between the value of the option and the value of the underlying asset. Investments [for The Multi-Disciplinary Income Fund

9

and The Alternative Income Fund] in futures, swaps and other derivative instruments may result in loss as derivative instruments may be illiquid, difficult to price and leveraged so that small changes may produce disproportionate losses to the Funds. To the extent the Funds segregate assets to cover derivative positions, they may impair their ability to meet current obligations, to honor requests for redemption and to manage the investments in a manner consistent with their respective investment objectives. Purchasing and writing put and call options and, in particular, writing “uncovered” options are highly specialized activities that entail greater than ordinary investment risk.

As non-diversified Funds, except The Global Fund, The Alternative Income Fund and The Multi-Disciplinary Income Fund, the value of Fund shares may fluctuate more than shares invested in a broader range of industries and companies. Unlike other investment companies that directly acquire and manage their own portfolios of securities, The Kinetics Mutual Funds except The Kinetics Spin-off and Corporate Restructuring Fund, pursue their investment objectives by investing all of their investable assets in a corresponding portfolio series of the Kinetics Portfolios Trust. The Kinetics Spin-off and Corporate Restructuring Fund directly acquires and manages its own portfolio of securities.

The information concerning the Funds included in the shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

10

The MSCI All Country World Index, the S&P 500® Index, NASDAQ Composite®, S&P 600® Small Cap Index, MSCI EAFE® Index, Bloomberg Barclays U.S. 1-3 Year Credit Index, Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Corporate High Yield Bond Index each represent an unmanaged, broad-basket of stocks or bonds. They are typically used as a proxy for overall market performance.

Distributor: Kinetics Funds Distributor LLC is not an affiliate of Kinetics Mutual Funds, Inc. Kinetics Funds Distributor LLC is an affiliate of Kinetics Asset Management LLC, Investment Adviser to Kinetics Mutual Funds, Inc.

For more information, log onto www.kineticsfunds.com. July 1, 2018 — Kinetics Asset Management, LLC®

11

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example |

| June 30, 2018 (Unaudited) |

Shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvestments of dividends or other distributions made by a Fund, redemption fees, and exchange fees, and (2), ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help investors understand the ongoing costs (in dollars) of investing in a series of Kinetics Mutual Funds, Inc. (except the Spin-off Fund, each a “Feeder Fund” and including the Spin-off Fund, collectively the “Funds”), and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on January 1, 2018 and held for the entire period from January 1, 2018 to June 30, 2018.

Actual Expenses

The Actual Expenses comparison provides information about actual account values and actual expenses. Unlike other mutual funds that directly acquire and manage their own portfolio securities, each Feeder Fund invests all or generally all of its investable assets in a corresponding series of The Kinetics Portfolios Trust (each, a “Master Portfolio”, and together the “Master Portfolios”), a separately registered investment company. The Master Portfolio, in turn, invests in securities. With this type of organization, expenses can accrue specifically to the Master Portfolio or the Feeder Fund or both. Each Feeder Fund records its proportionate share of the Master Portfolio’s expenses, including directed brokerage credits, on a daily basis. Any expense reductions include Fund-specific expenses as well as the expenses allocated from the Master Portfolio. Note, the Spin-off Fund is not a Feeder Fund.

The Funds will charge shareholder fees for outgoing wire transfers, returned checks, and exchanges executed by telephone between a Fund and any other Fund. The Funds’ transfer agent charges a $5.00 transaction fee to shareholder accounts for telephone exchanges between any two Funds. The Funds’ transfer agent does not charge a transaction fee for written exchange requests. IRA accounts are assessed a $15.00 annual fee. Finally, as a disincentive to market-timing transactions, the Funds will assess a 2.00% fee on the redemption or exchange of Fund shares held for less than 30 days. These fees will be paid to the Funds to help offset transaction costs. The Funds reserve the right to waive the redemption fee, subject to their sole discretion, in instances deemed not to be disadvantageous to the Funds or shareholders as described in the Funds’ prospectus.

12

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example — (Continued) |

| June 30, 2018 (Unaudited) |

A shareholder may use the information provided in the first line, together with the amounts invested, to estimate the expenses paid over the period. A shareholder may divide his/her account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid on his/her account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical Example for Comparison Purposes provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid for the period. A shareholder may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, a shareholder would compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The expenses shown in the table are meant to highlight ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the Hypothetical Example for Comparison Purposes is useful in comparing ongoing costs only, and will not help determine the relative total costs of owning different funds. In addition, if these transactional costs were included, shareholders costs would have been higher.

13

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example — (Continued) |

| June 30, 2018 (Unaudited) |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (1/1/18 to | ||||||||||

| (1/1/18) | (6/30/18) | Ratio | 6/30/18) | ||||||||||

| The Internet Fund | |||||||||||||

| No Load Class Actual | $ | 1,000.00 | $ | 851.70 | 1.83% | $ | 8.40 | ||||||

| No Load Class Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,015.71 | 1.83% | $ | 9.15 | ||||||

| Advisor Class A Actual | $ | 1,000.00 | $ | 850.80 | 2.08% | $ | 9.55 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,014.47 | 2.08% | $ | 10.39 | ||||||

| Advisor Class C Actual | $ | 1,000.00 | $ | 848.30 | 2.58% | $ | 11.82 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,011.99 | 2.58% | $ | 12.87 | ||||||

| The Global Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 931.50 | 1.39% | $ | 6.66 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.90 | 1.39% | $ | 6.95 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 930.10 | 1.64% | $ | 7.85 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.66 | 1.64% | $ | 8.20 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 927.50 | 2.14% | $ | 10.23 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,014.18 | 2.14% | $ | 10.69 |

14

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example — (Continued) |

| June 30, 2018 (Unaudited) |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (1/1/18 to | ||||||||||

| (1/1/18) | (6/30/18) | Ratio | 6/30/18) | ||||||||||

| The Paradigm Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,132.50 | 1.64% | $ | 8.67 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.66 | 1.64% | $ | 8.20 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,130.90 | 1.89% | $ | 9.99 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,015.42 | 1.89% | $ | 9.44 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,128.00 | 2.39% | $ | 12.61 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,012.94 | 2.39% | $ | 11.93 | ||||||

| Institutional Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,133.50 | 1.44% | $ | 7.62 | ||||||

| Institutional Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.65 | 1.44% | $ | 7.20 | ||||||

| The Medical Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 965.70 | 1.39% | $ | 6.77 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.90 | 1.39% | $ | 6.95 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 963.80 | 1.64% | $ | 7.99 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.66 | 1.64% | $ | 8.20 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 961.80 | 2.14% | $ | 10.41 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,014.18 | 2.14% | $ | 10.69 |

15

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example — (Continued) |

| June 30, 2018 (Unaudited) |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (1/1/18 to | ||||||||||

| (1/1/18) | (6/30/18) | Ratio | 6/30/18) | ||||||||||

| The Small Cap Opportunities Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,179.10 | 1.64% | $ | 8.86 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.66 | 1.64% | $ | 8.20 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,177.30 | 1.89% | $ | 10.20 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,015.42 | 1.89% | $ | 9.44 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,174.40 | 2.39% | $ | 12.89 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,012.94 | 2.39% | $ | 11.93 | ||||||

| Institutional Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,179.80 | 1.44% | $ | 7.78 | ||||||

| Institutional Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.65 | 1.44% | $ | 7.20 | ||||||

| The Market Opportunities Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,019.50 | 1.64% | $ | 8.21 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.66 | 1.64% | $ | 8.20 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,017.80 | 1.89% | $ | 9.46 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,015.42 | 1.89% | $ | 9.44 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,015.70 | 2.39% | $ | 11.94 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,012.94 | 2.39% | $ | 11.93 | ||||||

| Institutional Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,020.30 | 1.44% | $ | 7.21 | ||||||

| Institutional Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.65 | 1.44% | $ | 7.20 |

16

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example — (Continued) |

| June 30, 2018 (Unaudited) |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (1/1/18 to | ||||||||||

| (1/1/18) | (6/30/18) | Ratio | 6/30/18) | ||||||||||

| The Alternative Income Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 999.30 | 0.95% | $ | 4.71 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,020.08 | 0.95% | $ | 4.76 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 997.80 | 1.20% | $ | 5.94 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,018.84 | 1.20% | $ | 6.01 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 995.40 | 1.70% | $ | 8.41 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.37 | 1.70% | $ | 8.50 | ||||||

| Institutional Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,000.10 | 0.75% | $ | 3.72 | ||||||

| Institutional Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,021.08 | 0.75% | $ | 3.76 | ||||||

| The Multi-Disciplinary Income Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,001.50 | 1.49% | $ | 7.39 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.41 | 1.49% | $ | 7.45 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,000.10 | 1.74% | $ | 8.63 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,016.17 | 1.74% | $ | 8.70 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 997.10 | 2.24% | $ | 11.09 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,013.69 | 2.24% | $ | 11.18 | ||||||

| Institutional Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,002.50 | 1.29% | $ | 6.40 | ||||||

| Institutional Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,018.40 | 1.29% | $ | 6.46 |

17

| KINETICS MUTUAL FUNDS, INC. — THE FUNDS |

| Expense Example — (Continued) |

| June 30, 2018 (Unaudited) |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | �� | Annualized | Period* | |||||||||

| Value | Value | Expense | (1/1/18 to | ||||||||||

| (1/1/18) | (6/30/18) | Ratio | 6/30/18) | ||||||||||

| The Kinetics Spin-off and Corporate Restructuring Fund | |||||||||||||

| No Load Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,135.50 | 1.45% | $ | 7.68 | ||||||

| No Load Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.61 | 1.45% | $ | 7.25 | ||||||

| Advisor Class A Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,135.00 | 1.50% | $ | 7.94 | ||||||

| Advisor Class A Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,017.36 | 1.50% | $ | 7.50 | ||||||

| Advisor Class C Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,130.80 | 2.25% | $ | 11.89 | ||||||

| Advisor Class C Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,013.64 | 2.25% | $ | 11.23 | ||||||

| Institutional Class Actual – after expense reimbursement | $ | 1,000.00 | $ | 1,136.70 | 1.25% | $ | 6.62 | ||||||

| Institutional Class Hypothetical (5% return before expenses) – after expense reimbursement | $ | 1,000.00 | $ | 1,018.60 | 1.25% | $ | 6.26 |

| Note : | Each Feeder Fund records its proportionate share of the respective Master Portfolio’s expenses on a daily basis. Any expense reductions include Feeder Fund-specific expenses as well as the expenses allocated from the Master Portfolio. |

| * | Expenses are equal to the Fund’s annualized expense ratio after expense reimbursement multiplied by the average account value over the period, multiplied by 181/365. |

18

| KINETICS MUTUAL FUNDS, INC. — THE FUND |

| Allocation of Portfolio Assets |

| June 30, 2018 (Unaudited) |

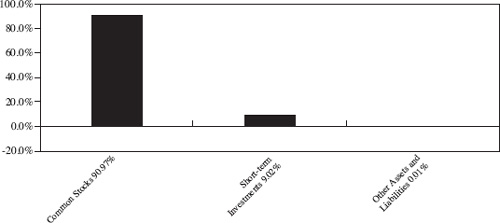

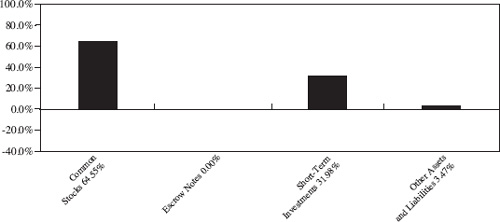

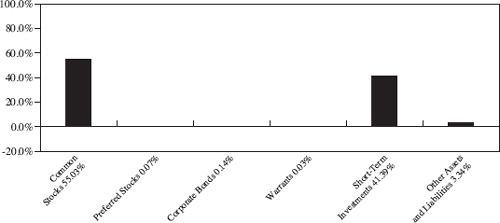

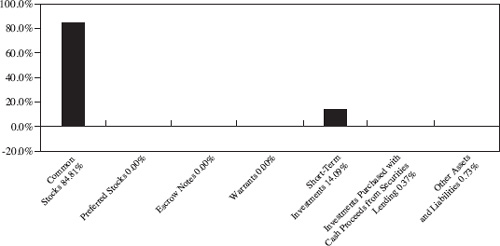

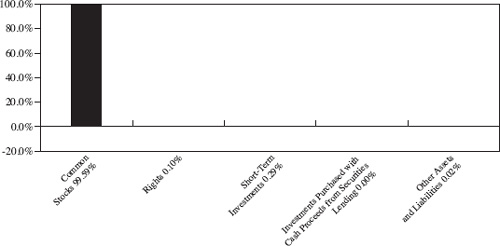

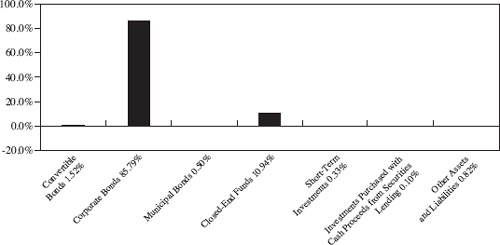

The Kinetics Spin-off and Corporate Restructuring Fund

| Percentage | |||||||

| Market | of Total | ||||||

| Sector Allocation* | Value | Net Assets | |||||

| Petroleum and Gas | $ | 7,461,106 | 30.3 | % | |||

| Manufacturing | 2,866,832 | 11.6 | % | ||||

| Information | 2,825,374 | 11.4 | % | ||||

| Real Estate and Rental and Leasing | 1,936,000 | 7.8 | % | ||||

| Finance and Insurance | 1,641,001 | 6.6 | % | ||||

| Other Services (except Public Administration) | 1,505,520 | 6.1 | % | ||||

| Administrative and Support and Waste Management and Remediation Services | 1,074,183 | 4.4 | % | ||||

| Accommodation and Food Services | 945,684 | 3.8 | % | ||||

| Educational Services | 879,150 | 3.6 | % | ||||

| Management of Companies and Enterprises | 802,978 | 3.3 | % | ||||

| Transportation and Warehousing | 491,568 | 2.0 | % | ||||

| Mining, Quarrying, and Oil and Gas Extraction | 21,428 | 0.1 | % |

| * | Excludes Short-Term Investments |

19

| KINETICS MUTUAL FUNDS, INC. — THE FUND |

| The Kinetics Spin-off and Corporate |

| Restructuring Fund |

| Schedule of Investments — June 30, 2018 (Unaudited) |

| COMMON STOCKS — 90.97% | Shares | Value | |||||

| Accommodation (except Hotels and Motels) – 3.83% | |||||||

| Civeo Corporation* | 216,900 | $ | 945,684 | ||||

| Administrative and Support Services – 4.35% | |||||||

| PayPal Holdings, Inc.* | 12,900 | 1,074,183 | |||||

| Asset Management – 5.17% | |||||||

| Associated Capital Group, Inc. — Class Ac | 33,600 | 1,275,120 | |||||

| Beverage and Tobacco Product Manufacturing – 0.38% | |||||||

| Crimson Wine Group Limited* | 10,000 | 92,500 | |||||

| Biotechnology – 0.04% | |||||||

| Rafael Holdings, Inc. — Class B* | 1,000 | 9,190 | |||||

| Broadcasting (except Internet) – 8.00% | |||||||

| Cable One, Inc. | 1,600 | 1,173,264 | |||||

| The E.W. Scripps Company — Class A | 20,000 | 267,800 | |||||

| Liberty Media Corp.-Liberty SiriusXM — Class C* | 6,000 | 272,160 | |||||

| TEGNA, Inc. | 11,600 | 125,860 | |||||

| Tribune Media Company — Class A | 3,500 | 133,945 | |||||

| 1,973,029 | |||||||

| Cable Distributor – 1.23% | |||||||

| Liberty Broadband Corporation — Series A* | 4,000 | 302,560 | |||||

| Chemical Manufacturing – 0.40% | |||||||

| Rayonier Advanced Materials, Inc. | 5,800 | 99,122 | |||||

| Educational Services – 3.56% | |||||||

| Graham Holdings Company — Class B | 1,500 | 879,150 | |||||

| Funds, Trusts, and Other Financial Vehicles – 1.27% | |||||||

| Capital Southwest Corporation | 17,300 | 313,303 | |||||

| Healthcare – 2.58% | |||||||

| Halyard Health, Inc.* | 10,600 | 606,850 | |||||

| Prestige Brands Holdings, Inc.* | 797 | 30,589 | |||||

| 637,439 |

The accompanying notes are an integral part of these financial statements.

20

| KINETICS MUTUAL FUNDS, INC. — THE FUND |

| The Kinetics Spin-off and Corporate |

| Restructuring Fund |

| Schedule of Investments — June 30, 2018 (Unaudited) — (Continued) |

| Shares | Value | ||||||

| Holding Company – 3.47% | |||||||

| Dundee Corporation — Class A* | 42,900 | $ | 52,578 | ||||

| Icahn Enterprises LP | 11,300 | 802,978 | |||||

| 855,556 | |||||||

| Home Building Products – 0.86% | |||||||

| Masco Corporation | 5,700 | 213,294 | |||||

| Lessors of Nonresidential Buildings (except Miniwarehouses) – 7.25% | |||||||

| The Howard Hughes Corporation*c | 13,500 | 1,788,750 | |||||

| Machinery Manufacturing – 3.85% | |||||||

| The Manitowoc Company, Inc.* | 8,025 | 207,527 | |||||

| Welbilt, Inc.* | 33,300 | 742,923 | |||||

| 950,450 | |||||||

| Media – 0.17% | |||||||

| Liberty Media Corp.-Liberty Braves — Class C* | 1,590 | 41,117 | |||||

| Miscellaneous Manufacturing – 3.34% | |||||||

| CSW Industrials, Inc.* | 15,600 | 824,459 | |||||

| Oil and Gas – 30.23% | |||||||

| Texas Pacific Land Trustc | 10,730 | 7,461,106 | |||||

| Oil and Gas Extraction – 0.07% | |||||||

| Atlas Energy Group LLC* | 313,600 | 18,032 | |||||

| Oilfield Services – 0.01% | |||||||

| Mammoth Energy Services, Inc.* | 100 | 3,396 | |||||

| Publishing Industries (except Internet) – 1.37% | |||||||

| Gannett Company, Inc. | 7,700 | 82,390 | |||||

| New Media Investment Group, Inc. | 13,800 | 255,024 | |||||

| 337,414 | |||||||

| Real Estate – 6.10% | |||||||

| DREAM Unlimited Corp. — Class A*c | 204,000 | 1,505,520 | |||||

| Rental and Leasing Services – 0.56% | |||||||

| Hertz Global Holdings, Inc.* | 9,000 | 138,060 | |||||

| Sporting Goods – 0.20% | |||||||

| Vista Outdoor, Inc.* | 3,200 | 49,568 |

The accompanying notes are an integral part of these financial statements.

21

| KINETICS MUTUAL FUNDS, INC. — THE FUND |

| The Kinetics Spin-off and Corporate |

| Restructuring Fund |

| Schedule of Investments — June 30, 2018 (Unaudited) — (Continued) |

| Shares | Value | ||||||

| Sports Entertainment – 0.69% | |||||||

| Liberty Media Corp.-Liberty Formula One — Class A* | 4,850 | $ | 171,254 | ||||

| Water Transportation – 1.99% | |||||||

| A.P. Moeller-Maersk A/S — Class B — ADR | 79,800 | 491,568 | |||||

| TOTAL COMMON STOCKS | |||||||

| (cost $14,530,357) | 22,450,824 | ||||||

| SHORT-TERM INVESTMENTS – 9.02% | |||||||

| Money Market Funds – 0.00% | |||||||

| Fidelity Institutional Government Portfolio — Class I, 1.77%b | 783 | 783 |

| Principal | |||||||

| Amount | |||||||

| U.S. Treasury Obligations – 9.02% | |||||||

| United States Treasury Bills | |||||||

| Maturity Date: 08/23/2018, Yield to Maturity 1.78% | $ | 2,231,000 | 2,225,139 | ||||

| TOTAL SHORT-TERM INVESTMENTS | |||||||

| (cost $2,225,964) | 2,225,922 | ||||||

| TOTAL INVESTMENTS – 99.99% | |||||||

| (cost $16,756,321) | $ | 24,676,746 |

Percentages are stated as a percent of net assets. | |

| * — Non-income producing security. | |

| b — The rate quoted is the annualized seven-day yield as of June 30, 2018. | |

| c — Significant Investment — See note 6. | |

| ADR — American Depository Receipt. | |

The accompanying notes are an integral part of these financial statements.

22

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities |

| June 30, 2018 (Unaudited) |

| The Internet | The Global | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 138,572,700 | $ | 14,235,540 | |||

| Receivable from Adviser | — | 15,247 | |||||

| Receivable for Master Portfolio interest sold | 38,106 | — | |||||

| Receivable for Fund shares sold | 283 | 30,032 | |||||

| Prepaid expenses and other assets | 33,964 | 29,273 | |||||

| Total Assets | 138,645,053 | 14,310,092 | |||||

| LIABILITIES: | |||||||

| Payable for Master Portfolio interest purchased | — | 30,032 | |||||

| Payable to Directors | 3,522 | 337 | |||||

| Payable to Chief Compliance Officer | 280 | 21 | |||||

| Payable for Fund shares repurchased | 38,389 | — | |||||

| Payable for shareholder servicing fees | 29,933 | 3,003 | |||||

| Payable for distribution fees | 5,962 | 19,142 | |||||

| Accrued expenses and other liabilities | 69,222 | 19,182 | |||||

| Total Liabilities | 147,308 | 71,717 | |||||

| Net Assets | $ | 138,497,745 | $ | 14,238,375 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 87,627,615 | $ | 11,310,017 | |||

| Accumulated net investment loss | (222,082 | ) | (93,188 | ) | |||

| Accumulated net realized gain on investments and foreign currency | 13,360,292 | 116,736 | |||||

| Net unrealized appreciation on: | |||||||

| Investments and foreign currency | 37,731,920 | 2,904,810 | |||||

| Net Assets | $ | 138,497,745 | $ | 14,238,375 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | |||||||

| Net Assets | $ | 133,495,832 | $ | 7,549,616 | |||

| Shares outstanding | 3,004,278 | 1,133,318 | |||||

| Net asset value per share (offering price and redemption price) | $ | 44.44 | $ | 6.66 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | |||||||

| Net Assets | $ | 3,249,659 | $ | 1,236,874 | |||

| Shares outstanding | 77,523 | 186,023 | |||||

| Net asset value per share (redemption price) | $ | 41.92 | $ | 6.65 | |||

| Offering price per share ($41.92 divided by .9425 and $6.65 divided by .9425) | $ | 44.48 | $ | 7.06 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | |||||||

| Net Assets | $ | 1,752,254 | $ | 5,451,885 | |||

| Shares outstanding | 46,694 | 869,385 | |||||

| Net asset value per share (offering price and redemption price) | $ | 37.53 | $ | 6.27 |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

23

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities — (Continued) |

| June 30, 2018 (Unaudited) |

| The Paradigm | The Medical | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 846,354,311 | $ | 16,806,306 | |||

| Receivable from Adviser | 108,385 | 12,940 | |||||

| Receivable for Master Portfolio interest sold | — | 6,733 | |||||

| Receivable for Fund shares sold | 2,728,953 | 994 | |||||

| Prepaid expenses and other assets | 62,805 | 25,468 | |||||

| Total Assets | 849,254,454 | 16,852,441 | |||||

| LIABILITIES: | |||||||

| Payable for Master Portfolio interest purchased | 2,377,640 | — | |||||

| Payable to Directors | 17,916 | 410 | |||||

| Payable to Chief Compliance Officer | 1,243 | 31 | |||||

| Payable for Fund shares repurchased | 351,313 | 7,726 | |||||

| Payable for shareholder servicing fees | 141,881 | 3,556 | |||||

| Payable for distribution fees | 136,140 | 862 | |||||

| Accrued expenses and other liabilities | 238,859 | 20,845 | |||||

| Total Liabilities | 3,264,992 | 33,430 | |||||

| Net Assets | $ | 845,989,462 | $ | 16,819,011 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 537,620,954 | $ | 11,760,625 | |||

| Accumulated net investment income (loss) | (7,895,685 | ) | 166,942 | ||||

| Accumulated net realized gain (loss) on investments and foreign currency | (44,017,917 | ) | 723,842 | ||||

| Net unrealized appreciation on: | |||||||

| Investments and foreign currency | 360,282,110 | 4,167,602 | |||||

| Net Assets | $ | 845,989,462 | $ | 16,819,011 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | |||||||

| Net Assets | $ | 402,050,306 | $ | 14,723,791 | |||

| Shares outstanding | 7,347,551 | 601,998 | |||||

| Net asset value per share (offering price and redemption price) | $ | 54.72 | $ | 24.46 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | |||||||

| Net Assets | $ | 118,631,116 | $ | 1,766,185 | |||

| Shares outstanding | 2,232,246 | 75,302 | |||||

| Net asset value per share (redemption price) | $ | 53.14 | $ | 23.45 | |||

| Offering price per share ($53.14 divided by .9425 and $23.45 divided by .9425) | $ | 56.38 | $ | 24.88 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | |||||||

| Net Assets | $ | 126,281,163 | $ | 329,035 | |||

| Shares outstanding | 2,532,219 | 14,511 | |||||

| Net asset value per share (offering price and redemption price) | $ | 49.87 | $ | 22.67 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – INSTITUTIONAL CLASS: | |||||||

| Net Assets | $ | 199,026,877 | N/A | ||||

| Shares outstanding | 3,611,199 | N/A | |||||

| Net asset value per share (offering price and redemption price) | $ | 55.11 | N/A |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

24

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities — (Continued) |

| June 30, 2018 (Unaudited) |

| The Small Cap | The Market | ||||||

| Opportunities | Opportunities | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 299,604,098 | $ | 85,008,861 | |||

| Receivable from Adviser | 55,723 | 27,321 | |||||

| Receivable for Fund shares sold | 1,717,970 | 12,845 | |||||

| Prepaid expenses and other assets | 41,195 | 39,025 | |||||

| Total Assets | 301,418,986 | 85,088,052 | |||||

| LIABILITIES: | |||||||

| Payable for Master Portfolio interest purchased | 1,439,623 | 1,606 | |||||

| Payable to Directors | 5,846 | 1,921 | |||||

| Payable to Chief Compliance Officer | 280 | 136 | |||||

| Payable for Fund shares repurchased | 278,348 | 11,239 | |||||

| Payable for shareholder servicing fees | 52,704 | 15,878 | |||||

| Payable for distribution fees | 11,846 | 16,961 | |||||

| Accrued expenses and other liabilities | 82,350 | 37,256 | |||||

| Total Liabilities | 1,870,997 | 84,997 | |||||

| Net Assets | $ | 299,547,989 | $ | 85,003,055 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 247,126,641 | $ | 62,866,023 | |||

| Accumulated net investment loss | (8,665,570 | ) | (1,161,816 | ) | |||

| Accumulated net realized gain (loss) on investments and foreign currency | (8,703,189 | ) | 501,792 | ||||

| Net unrealized appreciation on: | |||||||

| Investments and foreign currency | 69,790,107 | 22,797,056 | |||||

| Net Assets | $ | 299,547,989 | $ | 85,003,055 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | |||||||

| Net Assets | $ | 226,437,865 | $ | 55,539,704 | |||

| Shares outstanding | 3,747,211 | 2,039,179 | |||||

| Net asset value per share (offering price and redemption price) | $ | 60.43 | $ | 27.24 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | |||||||

| Net Assets | $ | 10,957,677 | $ | 7,966,770 | |||

| Shares outstanding | 186,876 | 296,363 | |||||

| Net asset value per share (redemption price) | $ | 58.64 | $ | 26.88 | |||

| Offering price per share ($58.64 divided by .9425 and $26.88 divided by .9425) | $ | 62.22 | $ | 28.52 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | |||||||

| Net Assets | $ | 9,137,431 | $ | 9,541,786 | |||

| Shares outstanding | 162,891 | 368,031 | |||||

| Net asset value per share (offering price and redemption price) | $ | 56.10 | $ | 25.93 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – INSTITUTIONAL CLASS: | |||||||

| Net Assets | $ | 53,015,016 | $ | 11,954,795 | |||

| Shares outstanding | 862,958 | 433,251 | |||||

| Net asset value per share (offering price and redemption price) | $ | 61.43 | $ | 27.59 |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

25

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities — (Continued) |

| June 30, 2018 (Unaudited) |

| The Multi- | |||||||

| The Alternative | Disciplinary | ||||||

| Income | Income | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 20,332,227 | $ | 41,694,954 | |||

| Receivable from Adviser | 17,718 | 21,460 | |||||

| Receivable for Master Portfolio interest sold | 105,318 | 4,419 | |||||

| Receivable for Fund shares sold | 2,922 | 250 | |||||

| Prepaid expenses and other assets | 44,350 | 35,960 | |||||

| Total Assets | 20,502,535 | 41,757,043 | |||||

| LIABILITIES: | |||||||

| Payable to Directors | 508 | 1,060 | |||||

| Payable to Chief Compliance Officer | 39 | 93 | |||||

| Payable for Fund shares repurchased | 108,241 | 4,669 | |||||

| Payable for shareholder servicing fees | 2,020 | 4,663 | |||||

| Payable for distribution fees | 3,813 | 24,635 | |||||

| Accrued expenses and other liabilities | 23,131 | 30,425 | |||||

| Total Liabilities | 137,752 | 65,545 | |||||

| Net Assets | $ | 20,364,783 | $ | 41,691,498 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 22,631,930 | $ | 44,777,955 | |||

| Accumulated net investment income | 90,167 | 10,494 | |||||

| Accumulated net realized loss on investments, foreign currency and written options | (2,261,384 | ) | (858,363 | ) | |||

| Net unrealized appreciation (depreciation) on: | |||||||

| Investments and foreign currency | (108,085 | ) | (2,238,588 | ) | |||

| Written option contracts | 12,155 | — | |||||

| Net Assets | $ | 20,364,783 | $ | 41,691,498 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | |||||||

| Net Assets | $ | 4,497,070 | $ | 6,589,970 | |||

| Shares outstanding | 46,125 | 610,447 | |||||

| Net asset value per share (offering price and redemption price) | $ | 97.50 | $ | 10.80 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | |||||||

| Net Assets | $ | 905,123 | $ | 3,551,677 | |||

| Shares outstanding | 9,412 | 330,623 | |||||

| Net asset value per share (redemption price) | $ | 96.17 | $ | 10.74 | |||

| Offering price per share ($96.17 divided by .9425 and $10.74 divided by .9425) | $ | 102.04 | $ | 11.40 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | |||||||

| Net Assets | $ | 1,265,463 | $ | 7,818,771 | |||

| Shares outstanding | 13,710 | 735,523 | |||||

| Net asset value per share (offering price and redemption price) | $ | 92.30 | $ | 10.63 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE – INSTITUTIONAL CLASS: | |||||||

| Net Assets | $ | 13,697,127 | $ | 23,731,080 | |||

| Shares outstanding | 138,514 | 2,194,035 | |||||

| Net asset value per share (offering price and redemption price) | $ | 98.89 | $ | 10.82 |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

26

| KINETICS MUTUAL FUNDS, INC. — THE FUND |

| Statement of Assets & Liabilities — (Continued) |

| June 30, 2018 (Unaudited) |

| The Kinetics | ||||

| Spin-off and | ||||

| Corporate | ||||

| Restructuring | ||||

| Fund | ||||

| ASSETS: | ||||

| Investments, at value(1) | $ | 24,676,746 | ||

| Receivable for Fund shares sold | 1,100 | |||

| Dividends and interest receivable | 21,839 | |||

| Prepaid expenses and other assets | 32,579 | |||

| Total Assets | 24,732,264 | |||

| LIABILITIES: | ||||

| Payable to Adviser | 17,793 | |||

| Payable to Directors | 564 | |||

| Payable to Chief Compliance Officer | 44 | |||

| Payable for shareholder servicing fees | 2,645 | |||

| Payable for distribution fees | 4,067 | |||

| Accrued expenses and other liabilities | 27,560 | |||

| Total Liabilities | 52,673 | |||

| Net Assets | $ | 24,679,591 | ||

| (1) Cost of investments | $ | 16,756,321 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid in capital | $ | 17,144,602 | ||

| Accumulated net investment loss | (634,007 | ) | ||

| Accumulated net realized gain on investments and foreign currency | 248,571 | |||

| Net unrealized appreciation on: | ||||

| Investments and foreign currency | 7,920,425 | |||

| Net Assets | $ | 24,679,591 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE - NO LOAD CLASS: | ||||

| Net Assets | $ | 11,695 | ||

| Shares outstanding | 925 | |||

| Net asset value per share (offering price and redemption price) | $ | 12.64 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE - ADVISOR CLASS A: | ||||

| Net Assets | $ | 4,222,677 | ||

| Shares outstanding | 348,785 | |||

| Net asset value per share (redemption price) | $ | 12.11 | ||

| Offering price per share ($12.11 divided by .9425) | $ | 12.85 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE - ADVISOR CLASS C: | ||||

| Net Assets | $ | 5,489,078 | ||

| Shares outstanding | 477,124 | |||

| Net asset value per share (offering price and redemption price) | $ | 11.50 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE - INSTITUTIONAL CLASS: | ||||

| Net Assets | $ | 14,956,141 | ||

| Shares outstanding | 1,232,056 | |||

| Net asset value per share (offering price and redemption price) | $ | 12.14 |

The accompanying notes are an integral part of these financial statements.

27

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Operations |

| For the Six Months Ended June 30, 2018 (Unaudited) |

| The Internet | The Global | ||||||

| Fund | Fund | ||||||

| INVESTMENT LOSS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends† | $ | 108,777 | $ | 28,934 | |||

| Interest | 394,374 | 47,604 | |||||

| Income from securities lending | — | 589 | |||||

| Expenses allocated from Master Portfolio | (1,064,864 | ) | (118,343 | ) | |||

| Net investment loss from Master Portfolio | (561,713 | ) | (41,216 | ) | |||

| EXPENSES: | |||||||

| Distribution fees – Advisor Class A | 4,825 | 1,726 | |||||

| Distribution fees – Advisor Class C | 7,221 | 20,235 | |||||

| Shareholder servicing fees – Advisor Class A | 4,825 | 1,726 | |||||

| Shareholder servicing fees – Advisor Class C | 2,407 | 6,745 | |||||

| Shareholder servicing fees – No Load Class | 185,378 | 9,728 | |||||

| Transfer agent fees and expenses | 57,719 | 9,310 | |||||

| Reports to shareholders | 14,823 | 2,085 | |||||

| Administration fees | 31,436 | 3,816 | |||||

| Professional fees | 13,183 | 4,415 | |||||

| Directors’ fees | 7,247 | 697 | |||||

| Chief Compliance Officer fees | 1,595 | 157 | |||||

| Registration fees | 21,179 | 21,165 | |||||

| Fund accounting fees | 4,110 | 395 | |||||

| Other expenses | 2,577 | 214 | |||||

| Total expenses | 358,525 | 82,414 | |||||

| Less, expense reimbursement | — | (77,614 | ) | ||||

| Net expenses | 358,525 | 4,800 | |||||

| Net investment loss | (920,238 | ) | (46,016 | ) | |||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain on: | |||||||

| Investments and foreign currency | 8,363,936 | 118,348 | |||||

| Net change in unrealized depreciation of: | |||||||

| Investments and foreign currency | (32,663,657 | ) | (1,202,365 | ) | |||

| Net loss on investments | (24,299,721 | ) | (1,084,017 | ) | |||

| Net decrease in net assets resulting from operations | $ | (25,219,959 | ) | $ | (1,130,033 | ) | |

| † Net of foreign taxes withheld of: | $ | 1,754 | $ | 5,513 |

The accompanying notes are an integral part of these financial statements.

28

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Operations — (Continued) |

| For the Six Months Ended June 30, 2018 (Unaudited) |

| The Paradigm | The Medical | ||||||

| Fund | Fund | ||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends† | $ | 2,925,259 | $ | 272,448 | |||

| Interest | 578,647 | 1,463 | |||||

| Income from securities lending | 5,394 | 2,057 | |||||

| Expenses allocated from Master Portfolio | (5,357,073 | ) | (130,759 | ) | |||

| Net investment income (loss) from Master Portfolio | (1,847,773 | ) | 145,209 | ||||

| EXPENSES: | |||||||

| Distribution fees - Advisor Class A | 138,004 | 3,129 | |||||

| Distribution fees - Advisor Class C | 453,865 | 1,359 | |||||

| Shareholder servicing fees - Advisor Class A | 138,004 | 3,129 | |||||

| Shareholder servicing fees - Advisor Class C | 151,288 | 453 | |||||

| Shareholder servicing fees - No Load Class | 446,018 | 19,243 | |||||

| Shareholder servicing fees - Institutional Class | 197,269 | — | |||||

| Transfer agent fees and expenses | 101,605 | 11,092 | |||||

| Reports to shareholders | 62,372 | 2,425 | |||||

| Administration fees | 158,845 | 3,641 | |||||

| Professional fees | 49,292 | 4,573 | |||||

| Directors’ fees | 33,325 | 792 | |||||

| Chief Compliance Officer fees | 7,275 | 171 | |||||

| Registration fees | 30,082 | 21,082 | |||||

| Fund accounting fees | 19,321 | 469 | |||||

| Other expenses | 15,276 | 380 | |||||

| Total expenses | 2,001,841 | 71,938 | |||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (147,952 | ) | — | ||||

| Less, expense reimbursement | (375,123 | ) | (71,302 | ) | |||

| Net expenses | 1,478,766 | 636 | |||||

| Net investment income (loss) | (3,326,539 | ) | 144,573 | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain on: | |||||||

| Investments and foreign currency | 76,764,077 | 790,653 | |||||

| Net change in unrealized appreciation (depreciation) of: | |||||||

| Investments and foreign currency | 22,995,987 | (1,572,881 | ) | ||||

| Net gain (loss) on investments | 99,760,064 | (782,228 | ) | ||||

| Net increase (decrease) in net assets resulting from operations | $ | 96,433,525 | $ | (637,655 | ) | ||

| † Net of foreign taxes withheld of: | $ | 73,790 | $ | 16,583 |

The accompanying notes are an integral part of these financial statements.

29

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Operations — (Continued) |

| For the Six Months Ended June 30, 2018 (Unaudited) |

| The Small Cap | The Market | ||||||

| Opportunities | Opportunities | ||||||

| Fund | Fund | ||||||

| INVESTMENT LOSS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends† | $ | 1,172,894 | $ | 233,988 | |||

| Interest | 399,086 | 255,481 | |||||

| Income from securities lending | 327 | 596 | |||||

| Expenses allocated from Master Portfolio | (1,674,053 | ) | (582,665 | ) | |||

| Net investment loss from Master Portfolio | (101,746 | ) | (92,600 | ) | |||

| EXPENSES: | |||||||

| Distribution fees – Advisor Class A | 14,091 | 9,370 | |||||

| Distribution fees – Advisor Class C | 32,715 | 33,335 | |||||

| Shareholder servicing fees – Advisor Class A | 14,091 | 9,370 | |||||

| Shareholder servicing fees – Advisor Class C | 10,905 | 11,111 | |||||

| Shareholder servicing fees – No Load Class | 231,428 | 68,365 | |||||

| Shareholder servicing fees – Institutional Class | 40,920 | 11,729 | |||||

| Transfer agent fees and expenses | 31,133 | 17,899 | |||||

| Reports to shareholders | 19,613 | 7,172 | |||||

| Administration fees | 49,525 | 17,778 | |||||

| Professional fees | 17,162 | 8,570 | |||||

| Directors’ fees | 10,057 | 3,827 | |||||

| Chief Compliance Officer fees | 2,100 | 845 | |||||

| Registration fees | 26,308 | 23,949 | |||||

| Fund accounting fees | 5,682 | 2,149 | |||||

| Other expenses | 4,224 | 1,198 | |||||

| Total expenses | 509,954 | 226,667 | |||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (30,690 | ) | (8,796 | ) | |||

| Less, expense reimbursement | (129,742 | ) | (90,550 | ) | |||

| Net expenses | 349,522 | 127,321 | |||||

| Net investment loss | (451,268 | ) | (219,921 | ) | |||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain on: | |||||||

| Investments and foreign currency | 532,718 | 2,155,627 | |||||

| Net change in unrealized appreciation (depreciation) of: | |||||||

| Investments and foreign currency | 38,360,365 | (613,344 | ) | ||||

| Net gain on investments | 38,893,083 | 1,542,283 | |||||

| Net increase in net assets resulting from operations | $ | 38,441,815 | $ | 1,322,362 | |||

| † Net of foreign taxes withheld of: | $ | 38,728 | $ | 10,910 |

The accompanying notes are an integral part of these financial statements.

30

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Operations — (Continued) |

| For the Six Months Ended June 30, 2018 (Unaudited) |

| The Multi- | |||||||

| The Alternative | Disciplinary | ||||||

| Income | Income | ||||||

| Fund | Fund | ||||||

| INVESTMENT INCOME ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends | $ | 49,377 | $ | 221,738 | |||

| Interest | 118,093 | 1,040,939 | |||||

| Income from securities lending | — | 7,271 | |||||

| Expenses allocated from Master Portfolio | (118,280 | ) | (322,993 | ) | |||

| Net investment income from Master Portfolio | 49,190 | 946,955 | |||||

| EXPENSES: | |||||||

| Distribution fees - Advisor Class A | 1,345 | 4,916 | |||||

| Distribution fees - Advisor Class C | 5,195 | 27,556 | |||||

| Shareholder servicing fees - Advisor Class A | 1,345 | 4,916 | |||||

| Shareholder servicing fees - Advisor Class C | 1,732 | 9,185 | |||||

| Shareholder servicing fees - No Load Class | 6,495 | 8,910 | |||||

| Shareholder servicing fees - Institutional Class | 14,473 | 27,860 | |||||

| Transfer agent fees and expenses | 12,038 | 14,470 | |||||

| Reports to shareholders | 3,095 | 4,967 | |||||

| Administration fees | 5,363 | 11,626 | |||||

| Professional fees | 4,760 | 6,085 | |||||

| Directors’ fees | 925 | 1,724 | |||||

| Chief Compliance Officer fees | 195 | 411 | |||||

| Registration fees | 27,394 | 23,712 | |||||

| Fund accounting fees | 544 | 1,194 | |||||

| Other expenses | 492 | 1,441 | |||||

| Total expenses | 85,391 | 148,973 | |||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (10,855 | ) | (20,895 | ) | |||

| Less, expense reimbursement | (95,644 | ) | (101,754 | ) | |||

| Net expenses | (21,108 | ) | 26,324 | ||||

| Net investment income | 70,298 | 920,631 | |||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized loss on: | |||||||

| Investments and foreign currency | (516 | ) | (36,404 | ) | |||

| Written option contracts expired or closed | (49,440 | ) | — | ||||

| Net change in unrealized appreciation (depreciation) of: | |||||||

| Investments and foreign currency | (53,469 | ) | (876,854 | ) | |||

| Written option contracts | 4,390 | — | |||||

| Net loss on investments | (99,035 | ) | (913,258 | ) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (28,737 | ) | $ | 7,373 |

The accompanying notes are an integral part of these financial statements.

31

| KINETICS MUTUAL FUNDS, INC. — THE FUND |

| Statement of Operations — (Continued) |

| For the Six Months Ended June 30, 2018 (Unaudited) |

| The Kinetics | ||||

| Spin-off and | ||||

| Corporate | ||||

| Restructuring | ||||

| Fund | ||||

| INVESTMENT INCOME: | ||||

| Dividends† | $ | 105,371 | ||

| Interest | 23,055 | |||

| Total investment income | 128,426 | |||

| Expenses: | ||||

| Distribution fees – Advisor Class A | 5,243 | |||

| Distribution fees – Advisor Class C | 20,473 | |||

| Shareholder servicing fees – Advisor Class A | 5,243 | |||

| Shareholder servicing fees – Advisor Class C | 6,824 | |||

| Shareholder servicing fees – No Load Class | 13 | |||

| Shareholder servicing fees – Institutional Class | 14,316 | |||

| Transfer agent fees and expenses | 12,262 | |||

| Reports to shareholders | 1,129 | |||

| Administration fees | 6,098 | |||

| Professional fees | 10,585 | |||

| Directors’ fees | 1,447 | |||

| Chief Compliance Officer fees | 215 | |||

| Registration fees | 2,744 | |||

| Fund accounting fees | 3,545 | |||

| Investment advisory fees | 119,903 | |||

| Custodian fees and expenses | 4,925 | |||

| Other expenses | 131 | |||

| Total expenses | 215,096 | |||

| Less, expense waiver for Institutional Class shareholder servicing fees | (10,737 | ) | ||

| Less, expense reimbursement | (21,929 | ) | ||

| Net expenses | 182,430 | |||

| Net investment loss | (54,004 | ) | ||

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY: | ||||

| Net realized gain on: | ||||

| Investments and foreign currency | 172,534 | |||

| Net change in unrealized appreciation of: | ||||

| Investments and foreign currency | 2,937,592 | |||

| Net gain on investments | 3,110,126 | |||

| Net increase in net assets resulting from operations | $ | 3,056,122 | ||

| † Net of foreign taxes withheld of: | $ | 1,709 |

The accompanying notes are an integral part of these financial statements.

32

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Changes in Net Assets |

| The Internet Fund | The Global Fund | ||||||||||||

| For the Period Ended June 30, 2018 (Unaudited) | For the Year Ended December 31, 2017 | For the Period Ended June 30, 2018 (Unaudited) | For the Year Ended December 31, 2017 | ||||||||||

| OPERATIONS: | |||||||||||||

| Net investment income (loss) | $ | (920,238 | ) | $ | 982,169 | $ | (46,016 | ) | $ | 140,344 | |||

| Net realized gain on sale of investments and foreign currency | 8,363,936 | 26,950,019 | 118,348 | 1,161,004 | |||||||||

| Reimbursement by Affiliate | — | 422 | — | — | |||||||||

| Net change in unrealized appreciation (depreciation) of investments and foreign currency | (32,663,657 | ) | 32,196,353 | (1,202,365 | ) | 3,026,419 | |||||||

| Net increase (decrease) in net assets resulting from operations | (25,219,959 | ) | 60,128,963 | (1,130,033 | ) | 4,327,767 | |||||||

| DISTRIBUTIONS TO SHAREHOLDERS –NO LOAD CLASS: | |||||||||||||

| Net investment income | — | — | — | (105,961 | ) | ||||||||

| Net realized gains | — | (25,520,599 | ) | — | (606,497 | ) | |||||||

| Total distributions | — | (25,520,599 | ) | — | (712,458 | ) | |||||||

| DISTRIBUTIONS TO SHAREHOLDERS –ADVISOR CLASS A: | |||||||||||||

| Net investment income | — | — | — | (18,535 | ) | ||||||||

| Net realized gains | — | (701,439 | ) | — | (109,467 | ) | |||||||

| Total distributions | — | (701,439 | ) | — | (128,002 | ) | |||||||

| DISTRIBUTIONS TO SHAREHOLDERS –ADVISOR CLASS C: | |||||||||||||

| Net investment income | — | — | — | (52,170 | ) | ||||||||

| Net realized gains | — | (327,682 | ) | — | (415,034 | ) | |||||||

| Total distributions | — | (327,682 | ) | — | (467,204 | ) | |||||||

| CAPITAL SHARE TRANSACTIONS –NO LOAD CLASS: | |||||||||||||

| Proceeds from shares sold | 13,455,320 | 13,869,121 | 941,538 | 4,438,066 | |||||||||

| Redemption fees | 52,651 | 9,591 | 4,658 | 640 | |||||||||

| Proceeds from shares issued to holders in reinvestment of dividends | — | 25,016,016 | — | 703,941 | |||||||||

| Cost of shares redeemed | (17,893,821 | ) | (19,722,027 | ) | (1,373,464 | ) | (3,673,657 | ) | |||||

| Net increase (decrease) in net assets resulting from capital share transactions | (4,385,850 | ) | 19,172,701 | (427,268 | ) | 1,468,990 | |||||||

| CAPITAL SHARE TRANSACTIONS –ADVISOR CLASS A: | |||||||||||||

| Proceeds from shares sold | 967,723 | 1,993,592 | 131,320 | 1,394,573 | |||||||||

| Redemption fees | 2,598 | 663 | 75 | 6,708 | |||||||||

| Proceeds from shares issued to holders in reinvestment of dividends | — | 620,514 | — | 109,578 | |||||||||

| Cost of shares redeemed | (1,257,276 | ) | (776,608 | ) | (304,250 | ) | (495,581 | ) | |||||

| Net increase (decrease) in net assets resulting from capital share transactions | (286,955 | ) | 1,838,161 | (172,855 | ) | 1,015,278 | |||||||

The accompanying notes are an integral part of these financial statements.

33

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Changes in Net Assets — (Continued) |

| The Internet Fund | The Global Fund | ||||||||||||

| For the Period Ended June 30, 2018 (Unaudited) | For the Year Ended December 31, 2017 | For the Period Ended June 30, 2018 (Unaudited) | For the Year Ended December 31, 2017 | ||||||||||

| CAPITAL SHARE TRANSACTIONS –ADVISOR CLASS C: | |||||||||||||

| Proceeds from shares sold | $ | 549,336 | $ | 832,414 | $ | 352,631 | $ | 2,370,433 | |||||

| Redemption fees | 277 | 916 | — | — | |||||||||

| Proceeds from shares issued to holders in reinvestment of dividends | — | 317,411 | — | 450,731 | |||||||||

| Cost of shares redeemed | (311,153 | ) | (145,331 | ) | (26,827 | ) | (228,255 | ) | |||||

| Net increase in net assets resulting from capital share transactions | 238,460 | 1,005,410 | 325,804 | 2,592,909 | |||||||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS: | (29,654,304 | ) | 55,595,515 | (1,404,352 | ) | 8,097,280 | |||||||

| NET ASSETS: | |||||||||||||

| Beginning of period | 168,152,049 | 112,556,534 | 15,642,727 | 7,545,447 | |||||||||

| End of period* | $ | 138,497,745 | $ | 168,152,049 | $ | 14,238,375 | $ | 15,642,727 | |||||

| * Including undistributed net investment income (loss) of: | $ | (222,082 | ) | $ | 698,156 | $ | (93,188 | ) | $ | (47,172 | ) | ||

| CHANGES IN SHARES OUTSTANDING – NO LOAD CLASS: | |||||||||||||

| Shares sold | 266,334 | 239,537 | 134,363 | 670,595 | |||||||||

| Shares issued in reinvestments of dividends and distributions | — | 484,056 | — | 99,427 | |||||||||

| Shares redeemed | (369,175 | ) | (411,798 | ) | (200,005 | ) | (586,998 | ) | |||||

| Net increase (decrease) in shares outstanding | (102,841 | ) | 311,795 | (65,642 | ) | 183,024 | |||||||

| CHANGES IN SHARES OUTSTANDING – ADVISOR CLASS A: | |||||||||||||

| Shares sold | 20,644 | 38,254 | 18,637 | 218,380 | |||||||||

| Shares issued in reinvestments of dividends and distributions | — | 12,715 | — | 15,477 | |||||||||

| Shares redeemed | (28,062 | ) | (17,221 | ) | (45,485 | ) | (80,469 | ) | |||||

| Net increase (decrease) in shares outstanding | (7,418 | ) | 33,748 | (26,848 | ) | 153,388 | |||||||

| CHANGES IN SHARES OUTSTANDING – ADVISOR CLASS C: | |||||||||||||

| Shares sold | 12,833 | 17,566 | 54,174 | 407,943 | |||||||||

| Shares issued in reinvestments of dividends and distributions | — | 7,244 | — | 67,374 | |||||||||

| Shares redeemed | (7,894 | ) | (3,436 | ) | (4,261 | ) | (40,660 | ) | |||||

| Net increase in shares outstanding | 4,939 | 21,374 | 49,913 | 434,657 | |||||||||

The accompanying notes are an integral part of these financial statements.

34

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Changes in Net Assets — (Continued) |

| The Paradigm Fund | The Medical Fund | ||||||||||||

| For the Period Ended June 30, 2018 (Unaudited) | For the Year Ended December 31, 2017 | For the Period Ended June 30, 2018 (Unaudited) | For the Year Ended December 31, 2017 | ||||||||||

| OPERATIONS: | |||||||||||||

| Net investment income (loss) | $ | (3,326,539 | ) | $ | (6,776,233 | ) | $ | 144,573 | $ | 164,870 | |||

| Net realized gain on sale of investments and foreign currency | 76,764,077 | 116,233,814 | 790,653 | 2,350,183 | |||||||||

| Net change in unrealized appreciation (depreciation) of investments and foreign currency | 22,995,987 | 70,690,428 | (1,572,881 | ) | (424,529 | ) | |||||||

| Net increase (decrease) in net assets resulting from operations | 96,433,525 | 180,148,009 | (637,655 | ) | 2,090,524 | ||||||||

| DISTRIBUTIONS TO SHAREHOLDERS –NO LOAD CLASS: | |||||||||||||

| Net investment income | — | — | — | (141,468 | ) | ||||||||

| Net realized gains | — | — | — | (2,136,625 | ) | ||||||||

| Total distributions | — | — | — | (2,278,093 | ) | ||||||||

| DISTRIBUTIONS TO SHAREHOLDERS – ADVISOR CLASS A: | |||||||||||||

| Net investment income | — | — | — | (19,097 | ) | ||||||||

| Net realized gains | — | — | — | (416,218 | ) | ||||||||

| Total distributions | — | — | — | (435,315 | ) | ||||||||

| DISTRIBUTIONS TO SHAREHOLDERS – ADVISOR CLASS C: | |||||||||||||

| Net investment income | — | — | — | — | |||||||||

| Net realized gains | — | — | — | (54,651 | ) | ||||||||

| Total distributions | — | — | — | (54,651 | ) | ||||||||

| CAPITAL SHARE TRANSACTIONS – NO LOAD CLASS: | |||||||||||||

| Proceeds from shares sold | 48,327,244 | 44,431,611 | 174,512 | 369,030 | |||||||||

| Redemption fees | 3,498 | 9,270 | 600 | 438 | |||||||||

| Proceeds from shares issued to holders in reinvestment of dividends | — | — | — | 2,244,865 | |||||||||

| Cost of shares redeemed | (29,648,761 | ) | (119,870,442 | ) | (979,102 | ) | (3,553,923 | ) | |||||

| Net increase (decrease) in net assets resulting from capital share transactions | 18,681,981 | (75,429,561 | ) | (803,990 | ) | (939,590 | ) | ||||||

| CAPITAL SHARE TRANSACTIONS –ADVISOR CLASS A: | |||||||||||||