As filed with the Securities and Exchange Commission on March __, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09303 & 811-09923

Kinetics Mutual Funds, Inc. & Kinetics Portfolios Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

470 Park Avenue South

New York, NY 10016

(Address of principal executive offices) (Zip code)

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

1-646-495-7333

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2020

Date of reporting period: December 31, 2020

Item 1. Report to Stockholders.

KINETICS MUTUAL FUNDS, INC.

December 31, 2020

| Page | |

| 2 | |

| 5 | |

KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS AND | |

| THE KINETICS SPIN-OFF AND CORPORATE RESTRUCTURING FUND | |

| 12 | |

| 23 | |

| 30 | |

| 31 | |

| 34 | |

| 39 | |

| 44 | |

| 57 | |

| 82 | |

| 115 | |

KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS | |

| 117 | |

| 125 | |

| 128 | |

| 131 | |

| 135 | |

| 137 | |

| 140 | |

| 144 | |

| 145 | |

| 147 | |

| 151 | |

| 155 | |

| 159 | |

| 185 | |

| 188 | |

| 194 |

1

KINETICS MUTUAL FUNDS, INC.

Dear Fellow Shareholders,

We are pleased to present the Kinetics Mutual Funds (“Fund” or “Funds”) Annual Report for the twelve-month period ended December 31, 2020. The annual performance of financial markets should be taken within the context of: 2nd quarter U.S. GDP declining nearly 10%, (approximately 40% annualized); U.S. unemployment reaching nearly 15% (the highest level in over 70 years of data); and oil contracts for delivery in the spring briefly trading at negative values. The Federal Reserve and other global central banks acted aggressively and rapidly to circumvent a liquidity crisis similar to the global financial crisis. However, unintended consequences of these actions are already apparent in financial market excesses, with additional stimulus that was pending at year end. The combination of negative real interest rates in most developed nations and implicit government support for financial markets has obscured any true market price discovery, in our opinion. That being said, new opportunities abound as a result of these policies, but markets have yet to fully recognize the longer-term implications. We believe that the Funds are positioned to benefit from these trends, although they are not well aligned with global equity benchmarks. We increasingly view this “off benchmark” exposure to be an attractive proposition. A performance summary follows. (No Load Class) for the fiscal year ended December 31, 2020: The Internet Fund +56.42%; The Global Fund +25.00%; The Paradigm Fund +3.32%; The Medical Fund +9.04%; The Small Cap Opportunities Fund +2.30%; The Market Opportunities Fund +19.55%; The Alternative Income Fund +2.23%; The Multi-Disciplinary Income Fund -1.38%; and the Kinetics Spin-Off and Corporate Restructuring Fund +5.44%. This compares to returns of: +18.40% for the S&P 500® Index; +11.29% for the S&P 600® Small Cap Index; +16.25% for the MSCI All Country World (ACWI) Index; +7.51% for the Bloomberg Barclays U.S. Aggregate Bond Index; +7.11% for the Bloomberg Barclays U.S. Corporate High Yield Bond Index; +3.69% for the Bloomberg Barclays U.S. 1-3 Year Credit Index®; +43.64% for the Nasdaq Composite®; and +7.82% for the MSCI EAFE® Index.

While we continue to provide equity and fixed income reference benchmark performance (to aid in your understanding of how broad asset classes have performed throughout the year ended December 31, 2020), we do not manage our Funds against any specific benchmark, nor have we ever done so in the history of the Funds. We believe that such benchmark adherence is highly detrimental to the long-term returns of a sound investment strategy. Furthermore, in years of both positive and negative returns, it should be noted that the Funds generated returns with little to no exposure to the top positions in the major benchmarks.

2

The S&P 500® Index annual return of 18.4% for the year is exceptional in historic terms, not least for a year in which there is a record setting global recession. Perhaps more unusual is that the equity market return actually trailed the annual return for the “risk-free” 30-Year U.S. Treasury bond, which returned 19.8% for the year. Under normal circumstances, these assets should have little or negative correlation. But, with the Federal Reserve influencing both short-term and long-term interest rates lower, strange things can occur in financial markets. While the long-term bond only yielded 2.39% at the outset of the year, the yield sunk further to 1.65% by year end, resulting in over 17% of capital appreciation. To this end, the market leadership for the year was growth stocks (S&P 500® Growth Index, +33%) and technology stocks (S&P 500® IT. Sector, +42%), both ultra-long duration assets, which benefit from lower long-term rates, given the nature of the cash flows. During the last three months of 2020, the 30-Year bond yield rose approximately 20 basis points (from 1.45% to 1.65%), resulting in a nearly 5% decline in the 30-Year bond price. This coincided with value (S&P 500® Value Index, +14.6%) and small cap stocks (S&P 600® Index, +31.2%) outperforming growth (S&P 500® Growth Index, +10.7%) and technology (S&P 500® IT. Sector, +11.5%) for the quarter. However, for the full year, the value index returned 1.2%, while the small cap index returned 11.2%, both well short of the S&P 500® Index and growth/technology indices.

As a result, our value and small/mid-cap oriented portfolios benefitted for the quarter (although not the year) from this positioning. While the 30-Year bond ended the year at a modest 1.65% yield, which is break-even or negative in real terms, the incremental shift to a slightly higher yield at year-end coincided with a dramatic shift in market leadership. We believe that many financial asset prices (equities, bonds, real estate, etc.) remain highly extended on a fundamental basis, and are very vulnerable to a shift to rising real yields. In our opinion, this is particularly true of highly speculative companies with “disruptive” business models but negative cash flow – specifically those which have recently become public enterprises via highly promotional special purpose acquisition companies (SPACs). These companies frequently defy fundamental valuation analysis because their product or service does not yet exist, or, in some cases, the end markets don’t yet exist.

These types of companies are not uncommon today, and Goldman Sachs has created an index to track the performance of unprofitable technology companies. The index, which was created in September of 2014, essentially delivered a return of zero for the five years ended in September 2019, and

3

meaningfully underperformed the market. However, the index has subsequently risen over 3.6x, including a surge of 49% in the 4th quarter of 2020. These companies were apparently invulnerable to the modest rise in long-term interest rates, as there is no cash flow to discount.

We believe that there is no single basis for the rampant financial market speculation, as it is likely a combination of fundamental, behavioral, and technical variables. For instance, one can make the argument that negative real interest rates (fundamental), fear of missing additional gains (behavioral), and passive index inflows (technical) have all aligned to send prices vertically higher in certain market niches. It is practically impossible to determine the degree to which each variable has influenced prices, but there is evidence that each contributes. In our opinion, this results in a fragile market and an ambiguous price discovery mechanism, neither of which are conducive to satisfactory long-term investment returns.

The excess valuations are not unique in market history; although based on many variables, this is the most highly valued equity market in history. We believe that the most salient feature of the current market is the combination of low interest rates, flat yield curves, and highly valued equities worldwide. In previous episodes of equity market excess, fixed income markets have offered refuge. However, investment grade and government bonds across the world are mostly offering negative real yields. While most equities (and other financial assets) have already benefited mightily from this, various companies with exposure to cyclical end markets have experienced muted returns. These end markets appear to be inflecting, albeit, unevenly, with fourth quarter returns as follows: gold (unchanged), silver (+12%), oil (+19%), natural gas (-11%), iron (+28%), copper (+17%), U.S. Dollar Index (-4%). Additionally, various measures of food inflation as tracked by the U.N. Food & Agriculture Organization spiked into year-end, with the aggregate food index +10%, led by cereals (+11%) and vegetable oils (+22%). The Funds maintain indirect exposure to many of these markets via businesses with low capital requirements and low balance sheet debt. We believe that these types of high-quality businesses, with exposure to “hard asset” end markets and minimal balance sheet risk, are amongst the few attractive investment allocations for the uncertain years ahead.

4

KINETICS MUTUAL FUNDS, INC.

Financial markets broadly delivered exceptional returns for the year, despite an exceptionally poor global economy, as measured by unemployment and GDP growth. Ultimately, the financial performance of the companies within the stock market must reconcile with economic and employment data, as the companies in the stock market are highly sensitive to businesses and consumer activity. That being said, the composition of GDP and the labor force differs substantially from the companies which drive the stock market. We can explore these differences, as well as the performance of underlying companies within the index as an indication of future risks and opportunities.

The U.S. Bureau of Labor Statistics reports U.S. employment composition by NAICS Industry Sectors, which can be compared to the composition of the leading equity index, the S&P 500® Index. The largest industry sector in the S&P 500® Index, with over a 40% weight, is manufacturing, as it includes large companies, ranging from Apple and Tesla to Johnson & Johnson and Pfizer. This compares to approximately 8% of the U.S. labor force employed in manufacturing. Furthermore, many of the employees at these companies are not based in the U.S., nor technically involved in “manufacturing.” Nonetheless, the market has a far higher exposure to these companies than does the average American. The next highest weighting in the index is information companies, at over a 21% weight, with companies such as Microsoft, Facebook, Google, Comcast, and Disney. Despite the large reach and revenues of these companies, they employ less than 2% of the U.S. workforce. Collectively, manufacturing and information companies comprise over 60% of the S&P 500® Index, yet, represent less than 10% of U.S. jobs. While the average income of those employed by these companies is far higher than median income levels, very few American employees benefit directly from the success of these enterprises.

The largest private sector industry employer, with slightly over 13% of U.S. jobs, is “professional and business services,” (federal, state and local governments employ nearly 14% of U.S. workers); yet, the S&P 500® Index holds only a 2.7% weight in these companies, which include Cisco, Accenture and IBM. The disconnect between index weight and employment is also a function of public markets, as the employment base is largely comprised of legal, accounting, consulting, advertising and other types of professional

5

services that have minimal representation in public markets. Further, these businesses are high -value-add, and require fewer employee hours of output per revenue dollar. Outside of business services, the other primary employers in the private sector are “health care and social assistance” (12.5%), “leisure and hospitality” (10.2%), and “retail trade” (9.6%). These industries represent nearly a third of U.S. jobs, yet represent less than 11% of the S&P 500® Index. Similar to the professional services industry, the organizations that employ health care workers are generally private or are small in comparison to the overall industry. Additionally, the earnings of employees in these three industries are often not aligned with the profits of the parent company, as the work force is heavily skewed towards hourly or fixed salary employees.

The composition of the stock market is extremely different from that of the U.S. labor force, but in our view the performance drivers of the market are also indicative of the divide between the market and the economy. The indices report performance distribution in the Global Industry Classification Standard (GICS) Sectors, which are different from the North American Industry Classification System (NAICS) Industry Sectors, but the overlap is fairly intuitive. The top performing sectors, driving the majority of the market gains for the year, were Information Technology and Consumer Discretionary companies (manufacturing, information and retail NAICS). These include Information and Technology (IT) companies such as Apple, Microsoft, Visa and Adobe, and consumer discretionary companies such as Amazon, Home Depot, Nike and McDonalds. In our view, the salient feature of these companies across various business segments is that software, enterprise hosting, payments, e-commerce, hardware, and quick service restaurants were all either minimally impacted, or even benefited from the travel restrictions and closure of physical commerce in 2020. These companies are also generally higher growth; hence, their stock prices benefit from declining long-term interest rates.

Conversely, energy, real estate and financial services were the biggest laggards in the index, with each sector posting negative returns for the year, despite high index level returns. These industries were obviously severely and directly impacted by the travel and physical commerce restrictions. However, while these businesses are critically important to the economy and society, we believe that are of diminishing importance to index returns given the dominance of the technology and consumer sectors. Financial services remain

6

a large weighting in the index, although well below historical levels, and the industry has been severely impaired by low interest rates, as well as the flat yield curve. The Federal Reserve’s “quantitative easing” measures aimed at lowering long-term interest rates impaired the banks and insurance companies from earning a “spread” on lending and longer-term liability management. These industries were collateral damage in the government’s efforts to combat the pandemic.

Clearly the pandemic and the government’s response to it have materially benefitted certain sectors, while marginalizing others. The many of the U.S. employees have unambiguously been financially impaired, including by being laid off, having reduced hours, or both. Every global household seeking to save for retirement or to fund existing retirement expenses has also been impaired by virtue of suppressed interest rates and financial asset inflation. In our view, this has created a wide divergence between the stock market returns and the underlying U.S. economy. Ultimately, the stock market and underlying economy must reconcile, as the two are co-dependent. We would argue that as government responses shift from monetary to fiscal and labor is prioritized over capital, the leadership of financial markets will shift. This is why our conviction in our “hard asset” positioning remains strong. As always, the timing of this shift is uncertain, but various market indicators suggest that it is already beginning.

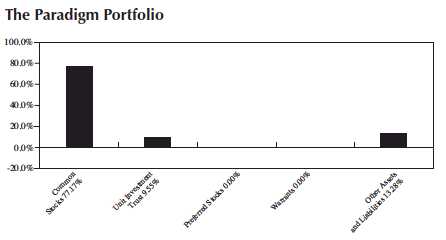

Paradigm Fund: The Fund remained defensively positioned, with an outsized cash balance given the low interest rates, high equity valuation, and various market imbalances. High quality positions in energy and real estate companies detracted from relative performance compared to the S&P 500® Index; however, these allocations outperformed their respective industries. The value orientation of the Fund was also a headwind to returns, although royalty company positions in the materials sectors contributed in both absolute and relative terms.

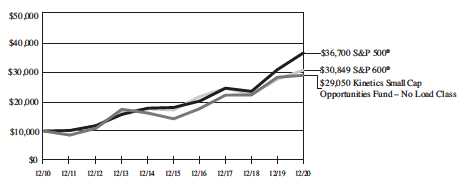

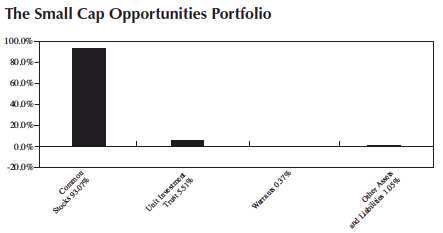

Small Cap: The Fund generated a respectable return for the year despite a headwind from the value orientation of the investments, as the small cap value index meaningfully trailed the small cap and small cap growth indices. Specifically, investments in energy, real estate and financial services negatively impacted returns, while defense technology holdings boosted returns, as did smaller positions in the materials sector.

7

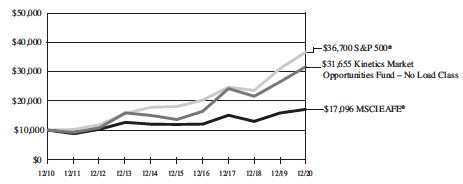

Market Opportunities Fund: The Fund outpaced broader markets despite a defensive cash balance, largely by virtue of exposure to cryptocurrency. The rationale for the cryptocurrency and defensive cash balances overlap, as both are motivated by reckless government money supply growth and interest rate controls. We believe that many of the excesses in the broader market are a function of these policies, and cryptocurrencies offer an alternative to rapidly depreciating fiat currencies. Energy and materials positions also boosted returns on an absolute basis, while real estate detracted from returns.

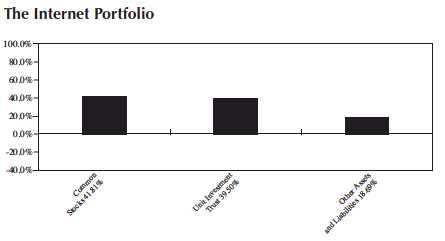

Internet Fund: The Fund outpaced broader markets despite a defensive cash balance, largely by virtue of its exposure to cryptocurrency. The rationales for the cryptocurrency and defensive cash balances overlap, as both are motivated by reckless government money supply growth and interest rate controls. We believe that many of the excesses in the broader market are a function of these policies, and cryptocurrencies offer an alternative to rapidly depreciating fiat currencies. Cryptocurrency can be viewed as a native protocol of the internet; hence, we view the exposure as appropriate given the mandate. The Fund also benefitted from exposure to financials, via an online payments processor, and to a lesser extent, from exposure to information technology via a leader search engine advertising platform.

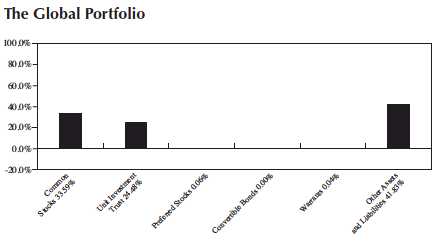

Global Fund: The Fund outpaced broader markets despite a defensive cash balance, largely by virtue of its exposure to cryptocurrency. The rationales for the cryptocurrency and defensive cash balances overlap, as both are motivated by reckless government money supply growth and interest rate controls. We believe that many of the excesses in the broader market are a function of these policies, and cryptocurrencies offer an alternative to rapidly depreciating fiat currencies. Specifically, in a global context, the U.S. Dollar is attractive compared to various foreign currencies with lower short-term interest rates and worse fiscal deficits compared to the U.S. The Fund also benefitted from exposure to the materials sector via precious metals royalty companies, while consumer discretionary positions detracted from returns, led by a remote workforce lodging company.

8

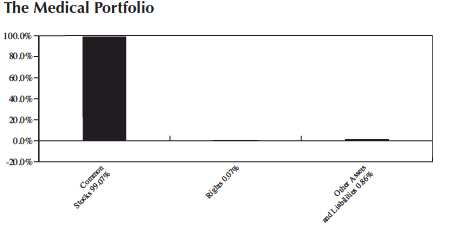

Medical Fund: The Fund generated strong absolute returns for the year due to a combination of exposure to established pharmaceutical companies with strong cash flows, as well nascent biotechnology and gene-therapeutics companies with promising pipelines. Performance was variable throughout the pharmaceutical and biotechnology positions, as poor clinical trial results and unsuccessful vaccine development efforts drove significant negative returns from two top positions.

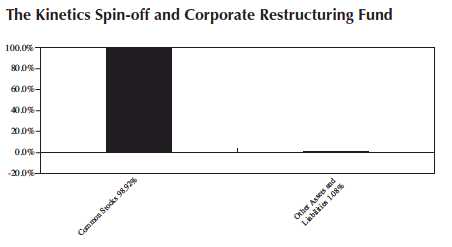

Spin-Off & Restructuring Fund: The Fund generated strong absolute returns in legacy spin-off securities, as well as from potential future spin-of companies. Exposure to consumer stocks in online payments and broadband internet boosted returns, as did precious metal royalty positions. Real estate holdings acted as a headwind to returns, posting negative absolute returns, while energy generated modest returns, also acting as a headwind to relative performance.

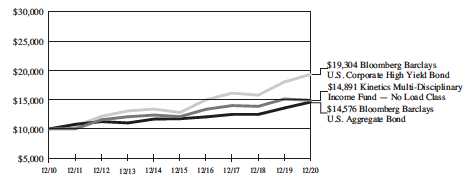

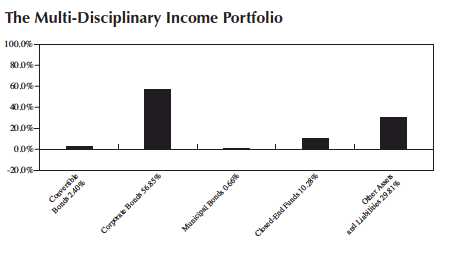

Multi-Disciplinary Income Fund: The Fund maintained core positions in high quality bonds with below investment-grade ratings, as well as a defensive cash position. The cash was held in lieu of engaging in put-writing, as we believed that even during the heightened volatility level in the spring, there was a high probability of capital impairment given the market levels. The companies underlying the bond positions generally performed well, despite the uneven performance of the bonds. The portfolio would have generated a more meaningful net return for the year if not for losses in small energy and oil field service bonds. However, these losses were more than offset by strong bond performance in issuers in the chemical and home-building industries.

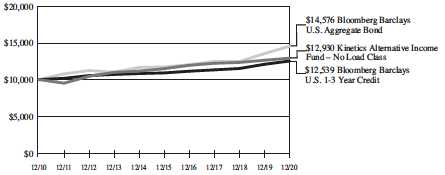

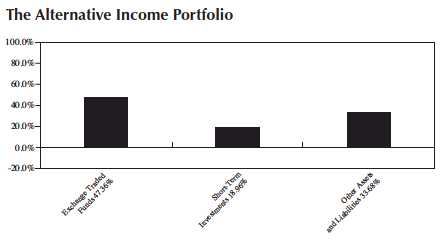

Alternative Income Fund: The Fund was extremely defensively positioned for the year, hence, earned modest returns, albeit, above the rate of inflation. The defensive cash position was held in lieu of any put option exposure given market conditions, while the fixed income portfolio was investment grade and very short duration. We believed that long duration bonds were high risk given the low absolute levels of interest rates; however, rates fell throughout the year, and short duration bonds underperformed long duration issues substantially.

9

Disclosure

This material is intended to be reviewed in conjunction with a current prospectus, which includes all fees and expenses that apply to a continued investment, as well as information regarding the risk factors, policies and objectives of the Funds. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible. Because The Internet Fund, The Medical Fund and The Market Opportunities Fund invest in a single industry or geographic region, their shares are subject to a higher degree of risk than funds with a higher level of diversification. Internet, biotechnology and certain capital markets or gaming stocks are subject to a rate of change in technology, obsolescence and competition that is generally higher than that of other industries, hence they may experience extreme price and volume fluctuations.

International investing [for all Funds] presents special risks including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Accordingly, the share prices for these Funds are expected to be more volatile than that of U.S.-only funds. Past performance is no guarantee of future performance.

Because smaller companies [for The Small Cap Opportunities Fund] often have narrower markets and limited financial resources, they present more risk than larger, more well established, companies.

Non-investment grade debt securities [for all Funds], i.e., junk bonds, are subject to greater credit risk, price volatility and risk of loss than investment grade securities.

Further, options contain special risks including the imperfect correlation between the value of the option and the value of the underlying asset. Investments [for The Multi- Disciplinary Income Fund and The Alternative Income Fund] in futures, swaps and other derivative instruments may result in loss as derivative instruments may be illiquid, difficult to price and leveraged so that small changes may produce disproportionate losses to the Funds. To the extent the Funds segregate assets to cover derivative positions, they may impair their ability to meet current obligations, to honor requests for redemption and to manage the investments in a manner consistent with their respective investment objectives. Purchasing and writing put and call

10

options and, in particular, writing “uncovered” options are highly specialized activities that entail greater than ordinary investment risk.

As non-diversified Funds, except The Global Fund, The Alternative Income Fund and The Multi-Disciplinary Income Fund, the value of Fund shares may fluctuate more than shares invested in a broader range of industries and companies. Unlike other investment companies that directly acquire and manage their own portfolios of securities, The Kinetics Mutual Funds, except Kinetics Spin-Off and Corporate Restructuring Fund, pursue their investment objectives by investing all of their investable assets in a corresponding portfolio series of the Kinetics Portfolios Trust.

The information concerning the Funds included in the shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

The MSCI All Country World Index, the S&P 500® Index, NASDAQ Composite®, S&P 600® Small Cap Index, MSCI EAFE® Index, Bloomberg Barclays U.S. 1-3 Year Credit Index, Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Corporate High Yield Bond Index each represent an unmanaged, broad-basket of stocks or bonds. They are typically used as a proxy for overall market performance.

Distributor: Kinetics Funds Distributor LLC is not an affiliate of Kinetics Mutual Funds, Inc. Kinetics Funds Distributor LLC is an affiliate of Horizon Kinetics Asset Management LLC, Investment Adviser to Kinetics Mutual Funds, Inc.

For more information, log onto www.kineticsfunds.com. January 1, 2021 — Horizon Kinetics Asset Management, LLC®

11

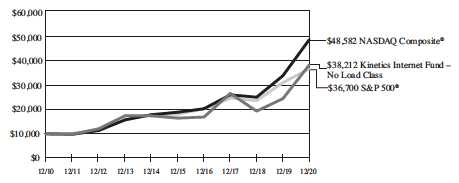

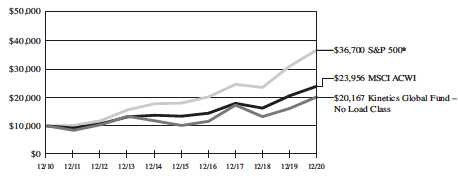

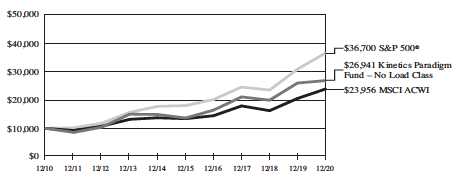

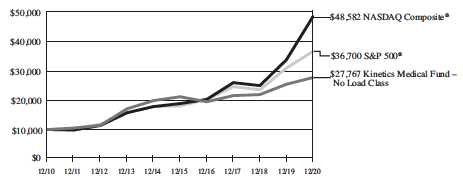

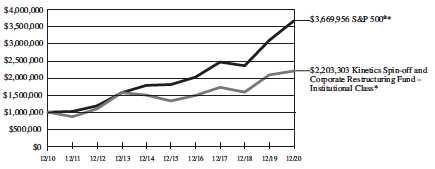

The charts show the growth of a $10,000 investment in the Feeder Funds and a $1,000,000 investment in The Kinetics Spin-Off and Restructuring Fund (“The Spin-off Fund”) as compared to the performance of one or two representative market indices. The tables below the charts show the average annual total returns on an investment over various periods. Returns for periods greater than one year are average annual total returns. The annual returns assume the reinvestment of all dividends and distributions, however, the graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is not predictive of future performance. Current performance may be lower or higher than the returns quoted below. The performance data reflects voluntary fee waivers and expense reimbursements made by the Adviser and the returns would have been lower if these waivers and expense reimbursements were not in effect. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original costs.

S&P 500® Index — is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. The S&P 500® is unmanaged and includes the reinvestment of dividends and does not reflect the payments of transaction costs and advisory fees associated with an investment in the Funds. The securities that comprise the S&P 500® may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

NASDAQ Composite® — is a broad-based capitalization-weighted index of all NASDAQ stocks. The NASDAQ Composite® is unmanaged and does not include the reinvestment of dividends and does not reflect the payment of transaction costs or advisory fees associated with an investment in the Funds. The securities that comprise the NASDAQ Composite® may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

MSCI ACWI (All Country World Index) Index — is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 50 country indices comprising 23 developed and 27 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Argentina, Brazil, Chile, China, Colombia, Czech

12

Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. The securities that compromise the MSCI ACWI may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

S&P 600® SmallCap Index — measures the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. The securities that comprise the S&P 600® may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

MSCI EAFE® Index (Europe, Australasia, Far East) — is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. As of June 2, 2014, the MSCI EAFE® Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The securities that compromise the MSCI EAFE® may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

Bloomberg Barclays U.S. 1-3 Year Credit Index — measures the performance of investment grade corporate debt and sovereign, supranational, local authority and non-U.S. agency bonds that are U.S. dollar denominated and have a remaining maturity of greater than or equal to one year and less than three years. The securities that compromise the Bloomberg Barclays U.S. 1-3 Year Credit Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

Bloomberg Barclays U.S. Aggregate Bond Index — covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The Index includes multiple types of government and corporate-issued bonds, some of which are asset-backed. The securities that compromise the Bloomberg Barclays U.S. Aggregate Bond Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

Bloomberg Barclays U.S. Corporate High Yield Bond Index —is composed of fixed-rate, publicly issued, non-investment grade debt. The securities that comprise the Bloomberg Barclays U.S. Corporate High Yield Bond Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index.

13

The Internet Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | ||||||

| Advisor | Advisor | |||||

| No Load | Class A | Class A | Advisor | NASDAQ | ||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500® | Composite® | |

One Year | 56.42% | 56.04% | 47.08% | 55.25% | 18.40% | 43.64% |

Five Years | 18.35% | 18.06% | 16.67% | 17.47% | 15.22% | 20.81% |

Ten Years | 14.35% | 14.07% | 13.39% | 13.50% | 13.88% | 17.12% |

Twenty Years | 9.52% | N/A | N/A | N/A | 7.47% | 8.61% |

Since Inception | ||||||

| No Load Class | ||||||

| (10/21/96) | 15.05% | N/A | N/A | N/A | 9.17% | 10.17% |

Since Inception | ||||||

| Advisor Class A | ||||||

| (4/26/01) | N/A | 9.53% | 9.21% | N/A | 7.94% | 9.83% |

Since Inception | ||||||

| Advisor Class C | ||||||

| (2/16/07) | N/A | N/A | N/A | 11.42% | 9.34% | 12.56% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

14

The Global Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | ||||||

| Advisor | Advisor | |||||

| No Load | Class A | Class A | Advisor | MSCI | ||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500® | ACWI | |

One Year | 25.00% | 24.70% | 17.57% | 24.11% | 18.40% | 16.25% |

Five Years | 14.67% | 14.57% | 13.22% | 13.82% | 15.22% | 12.26% |

Ten Years | 7.27% | 7.13% | 6.49% | 6.48% | 13.88% | 9.13% |

Twenty Years | 5.91% | N/A | N/A | N/A | 7.47% | 6.12% |

Since Inception | ||||||

| No Load Class | ||||||

| (12/31/99) | 0.72% | N/A | N/A | N/A | 6.61% | 5.05% |

Since Inception | ||||||

| Advisor Class A | ||||||

| (5/19/08) | N/A | 6.10% | 5.60% | N/A | 10.27% | 6.10% |

Since Inception | ||||||

| Advisor Class C | ||||||

| (5/19/08) | N/A | N/A | N/A | 5.43% | 10.27% | 6.10% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

15

The Paradigm Fund

December 31, 2010 — December 31, 2020 (Unaudited)

| Ended 12/31/2020 | |||||||

| Advisor | Advisor | ||||||

No Load | Class A | Class A | Advisor | Institutional | MSCI | ||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500® | ACWI | |

One Year | 3.32% | 3.05% | -2.87% | 2.56% | 3.55% | 18.40% | 16.25% |

Five Years | 14.52% | 14.23% | 12.89% | 13.66% | 14.76% | 15.22% | 12.26% |

Ten Years | 10.42% | 10.14% | 9.49% | 9.59% | 10.64% | 13.88% | 9.13% |

Twenty Years | 9.83% | N/A | N/A | N/A | N/A | 7.47% | 6.12% |

Since Inception | |||||||

| No Load Class | |||||||

| (12/31/99) | 9.55% | N/A | N/A | N/A | N/A | 6.61% | 5.05% |

Since Inception | |||||||

| Advisor Class A | |||||||

| (4/26/01) | N/A | 9.70% | 9.36% | N/A | N/A | 7.94% | 6.62% |

Since Inception | |||||||

| Advisor Class C | |||||||

| (6/28/02) | N/A | N/A | N/A | 9.67% | N/A | 9.67% | 8.16% |

Since Inception | |||||||

| Institutional Class | |||||||

| (5/27/05) | N/A | N/A | N/A | N/A | 8.82% | 9.85% | 7.67% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

16

The Medical Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | ||||||

| Advisor | Advisor | |||||

| No Load | Class A | Class A | Advisor | NASDAQ | ||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500® | Composite® | |

One Year | 9.04% | 8.82% | 2.56% | 8.21% | 18.40% | 43.64% |

Five Years | 5.55% | 5.29% | 4.05% | 4.76% | 15.22% | 20.81% |

Ten Years | 10.75% | 10.47% | 9.82% | 9.92% | 13.88% | 17.12% |

Twenty Years | 5.72% | N/A | N/A | N/A | 7.47% | 8.61% |

Since Inception | ||||||

| No Load Class | ||||||

| (9/30/99) | 9.11% | N/A | N/A | N/A | 7.23% | 7.55% |

Since Inception | ||||||

| Advisor Class A | ||||||

| (4/26/01) | N/A | 6.27% | 5.96% | N/A | 7.94% | 9.83% |

Since Inception | ||||||

| Advisor Class C | ||||||

| (2/16/07) | N/A | N/A | N/A | 7.84% | 9.34% | 12.56% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

17

The Small Cap Opportunities Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | |||||||

| Advisor | Advisor | ||||||

No Load | Class A | Class A | Advisor | Institutional | |||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500® | S&P 600® | |

One Year | 2.30% | 2.04% | -3.82% | 1.53% | 2.51% | 18.40% | 11.29% |

Five Years | 15.40% | 15.10% | 13.75% | 14.53% | 15.62% | 15.22% | 12.37% |

Ten Years | 11.25% | 10.97% | 10.32% | 10.42% | 11.47% | 13.88% | 11.92% |

Twenty Years | 10.03% | N/A | N/A | N/A | N/A | 7.47% | 9.77% |

Since Inception | |||||||

| No Load Class | |||||||

| (3/20/00) | 10.18% | N/A | N/A | N/A | N/A | 6.72% | 9.61% |

Since Inception | |||||||

| Advisor Class A | |||||||

| (12/31/01) | N/A | 8.77% | 8.43% | N/A | N/A | 8.60% | 9.94% |

Since Inception | |||||||

| Advisor Class C | |||||||

| (2/16/07) | N/A | N/A | N/A | 5.90% | N/A | 9.34% | 8.79% |

Since Inception | |||||||

| Institutional Class | |||||||

| (8/12/05) | N/A | N/A | N/A | N/A | 8.67% | 9.78% | 9.32% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

18

The Market Opportunities Fund

December 31, 2010 — December 31, 2020 (Unaudited)

| Ended 12/31/2020 | |||||||

| Advisor | Advisor | ||||||

No Load | Class A | Class A | Advisor | Institutional | |||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500® | MSCI EAFE® | |

One Year | 19.55% | 19.31 | 12.47% | 18.69% | 19.79% | 18.40% | 7.82% |

Five Years | 18.34% | 18.04% | 16.65% | 17.45% | 18.58% | 15.22% | 7.45% |

Ten Years | 12.21% | 11.94% | 11.28% | 11.38% | 12.45% | 13.88% | 5.51% |

Since Inception | |||||||

| No Load Class | |||||||

| (1/31/06) | 9.50% | N/A | N/A | N/A | N/A | 9.75% | 4.09% |

Since Inception | |||||||

| Advisor Class A | |||||||

| (1/31/06) | N/A | 9.23% | 8.80% | N/A | N/A | 9.75% | 4.09% |

Since Inception | |||||||

| Advisor Class C | |||||||

| (2/16/07) | N/A | N/A | N/A | 7.36% | N/A | 9.34% | 2.79% |

Since Inception | |||||||

| Institutional Class | |||||||

| (5/19/08) | N/A | N/A | N/A | N/A | 8.78% | 10.27% | 2.59% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

19

The Alternative Income Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | |||||||

| Bloomberg | Bloomberg | ||||||

| Barclays | Barclays | ||||||

| Advisor | Advisor | U.S. 1-3 | U.S. | ||||

| No Load | Class A | Class A | Advisor | Institutional | Year | Aggregate | |

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | Credit | Bond | |

One Year | 2.23% | 1.99% | -3.88% | 1.46% | 2.44% | 3.69% | 7.51% |

Five Years | 2.38% | 2.13% | 0.93% | 1.61% | 2.59% | 2.81% | 4.44% |

Ten Years | 2.60% | 2.34% | 1.73% | 1.83% | 2.83% | 2.29% | 3.84% |

Since Inception | |||||||

| No Load Class | |||||||

| (6/29/07) | 0.73% | N/A | N/A | N/A | N/A | 3.12% | 4.59% |

Since Inception | |||||||

| Advisor Class A | |||||||

| (6/29/07) | N/A | 0.48% | 0.04% | N/A | N/A | 3.12% | 4.59% |

Since Inception | |||||||

| Advisor Class C | |||||||

| (6/29/07) | N/A | N/A | N/A | -0.02% | N/A | 3.12% | 4.59% |

Since Inception | |||||||

| Institutional Class | |||||||

| (6/29/07) | N/A | N/A | N/A | N/A | 0.96% | 3.12% | 4.59% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

20

The Multi-Disciplinary Income Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | |||||||

| Bloomberg | |||||||

Bloomberg | Barclays | ||||||

| Barclays | U.S. | ||||||

| Advisor | Advisor | U.S. | Corporate | ||||

| No Load | Class A | Class A | Advisor | Institutional | Aggregate | High | |

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | Bond | Yield Bond | |

One Year | -1.38% | -1.62% | -7.23% | -2.16% | -1.25% | 7.51% | 7.11% |

Five Years | 4.26% | 4.00% | 2.77% | 3.47% | 4.46% | 4.44% | 8.59% |

Ten Years | 4.06% | 3.81% | 3.19% | 3.28% | 4.26% | 3.84% | 6.80% |

Since Inception | |||||||

| No Load Class | |||||||

| (2/11/08) | 4.21% | N/A | N/A | N/A | N/A | 4.21% | 7.90% |

Since Inception | |||||||

| Advisor Class A | |||||||

| (2/11/08) | N/A | 3.95% | 3.48% | N/A | N/A | 4.21% | 7.90% |

Since Inception | |||||||

| Advisor Class C | |||||||

| (2/11/08) | N/A | N/A | N/A | 3.43% | N/A | 4.21% | 7.90% |

Since Inception | |||||||

| Institutional Class | |||||||

| (2/11/08) | N/A | N/A | N/A | N/A | 4.41% | 4.21% | 7.90% |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

21

The Kinetics Spin-off and Corporate Restructuring Fund

December 31, 2010 — December 31, 2020 (Unaudited)

Ended 12/31/2020 | ||||||

| Advisor | Advisor | |||||

| No Load | Class A | Class A | Advisor | Institutional | ||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500® | |

One Year | 5.44% | 5.21% | -0.86% | 4.47% | 5.46% | 18.40% |

Five Years | N/A | 10.38% | 9.09% | 9.54% | 10.65% | 15.22% |

Ten Years | N/A | 7.95% | 7.43% | 7.22% | 8.22% | 13.88% |

Since Inception | ||||||

| No Load Class | ||||||

| (12/11/17) | 9.23% | N/A | N/A | N/A | N/A | 14.13% |

Since Inception | ||||||

| Advisor Class A | ||||||

| (5/4/07) | N/A | 3.19% | 2.82% | N/A | N/A | 9.19% |

Since Inception | ||||||

| Advisor Class C | ||||||

| (5/24/07) | N/A | N/A | N/A | 2.50% | N/A | 9.21% |

Since Inception | ||||||

| Institutional Class | ||||||

| (7/11/07) | N/A | N/A | N/A | N/A | 2.88% | 9.22% |

(1) Reflects front-end sales charge of 5.75%.

* Reflects the growth of a $1,000,000 investment.

Returns for periods greater than one year are average annual total returns.

22

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

December 31, 2020

Shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvestments of dividends or other distributions made by a Fund, redemption fees, and exchange fees, and (2), ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help investors understand the ongoing costs (in dollars) of investing in a series of Kinetics Mutual Funds, Inc. (except the Spin-off Fund, each a “Feeder Fund” and including the Spin-off Fund, collectively the “Funds”), and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on July 1, 2020 and held for the entire period from July 1, 2020 to December 31, 2020.

Actual Expenses

The Actual Expenses comparison provides information about actual account values and actual expenses. Unlike other mutual funds that directly acquire and manage their own portfolio securities, each Feeder Fund invests all or generally all of its investable assets in a corresponding series of The Kinetics Portfolios Trust (each, a “Master Portfolio”, and together the “Master Portfolios”), a separately registered investment company. The Master Portfolio, in turn, invests in securities. With this type of organization, expenses can accrue specifically to the Master Portfolio or the Feeder Fund or both. Each Feeder Fund records its proportionate share of the Master Portfolio’s expenses, including directed brokerage credits, on a daily basis. Any expense reductions include Fund-specific expenses as well as the expenses allocated from the Master Portfolio. Note, the Spin-off Fund is not a Feeder Fund.

The Funds will charge shareholder fees for outgoing wire transfers, returned checks, and exchanges executed by telephone between a Fund and any other Fund. The Funds’ transfer agent charges a $5.00 transaction fee to shareholder accounts for telephone exchanges between any two Funds. The Funds’ transfer agent does not charge a transaction fee for written exchange requests. IRA accounts are assessed a $15.00 annual fee. Finally, as a disincentive to market-timing transactions, the Funds will assess a 2.00% fee on the redemption or exchange of Fund shares held for less than 30 days. These fees will be paid to the Funds to help offset transaction costs. The Funds reserve the right to waive the redemption fee, subject to their sole discretion, in instances deemed not to be disadvantageous to the Funds or shareholders as described in the Funds’ prospectus.

23

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

Expense Example — (Continued)

December 31, 2020

A shareholder may use the information provided in the first line, together with the amounts invested, to estimate the expenses paid over the period. A shareholder may divide his/her account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid on his/her account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical Example for Comparison Purposes provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid for the period. A shareholder may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, a shareholder would compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The expenses shown in the table are meant to highlight ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the Hypothetical Example for Comparison Purposes is useful in comparing ongoing costs only, and will not help determine the relative total costs of owning different funds. In addition, if these transactional costs were included, shareholders costs would have been higher.

24

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

Expense Example — (Continued)

December 31, 2020

| Expenses Paid | ||||

| Beginning | Ending | During | ||

| Account | Account | Annualized | Period* | |

| Value | Value | Expense | (7/1/20 to | |

| (7/1/20) | (12/31/20) | Ratio | 12/31/20) | |

| The Internet Fund | ||||

| No Load Class Actual | $1,000.00 | $1,546.40 | 1.82% | $11.65 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) | $1,000.00 | $1,015.99 | 1.82% | $ 9.22 |

| Advisor Class A Actual | $1,000.00 | $1,544.50 | 2.07% | $13.24 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) | $1,000.00 | $1,014.73 | 2.07% | $10.48 |

| Advisor Class C Actual | $1,000.00 | $1,540.70 | 2.57% | $16.41 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) | $1,000.00 | $1,012.22 | 2.57% | $13.00 |

| The Global Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,300.90 | 1.39% | $ 8.04 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,018.15 | 1.39% | $ 7.05 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,298.10 | 1.64% | $ 9.47 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.89 | 1.64% | $ 8.31 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,295.60 | 2.14% | $12.35 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,014.38 | 2.14% | $10.84 |

25

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

Expense Example — (Continued)

December 31, 2020

| Expenses Paid | ||||

| Beginning | Ending | During | ||

| Account | Account | Annualized | Period* | |

| Value | Value | Expense | (7/1/20 to | |

| (7/1/20) | (12/31/20) | Ratio | 12/31/20) | |

| The Paradigm Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,254.59 | 1.64% | $ 9.29 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.89 | 1.64% | $ 8.31 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,253.06 | 1.89% | $10.70 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,015.63 | 1.89% | $ 9.58 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,249.84 | 2.39% | $13.52 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,013.12 | 2.39% | $12.09 |

| Institutional Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,255.78 | 1.44% | $ 8.17 |

| Institutional Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,017.90 | 1.44% | $ 7.30 |

| The Medical Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,093.30 | 1.39% | $ 7.31 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,018.15 | 1.39% | $ 7.05 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,092.10 | 1.64% | $ 8.62 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.89 | 1.64% | $ 8.31 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,088.80 | 2.14% | $11.24 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,014.38 | 2.14% | $10.84 |

26

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

Expense Example — (Continued)

December 31, 2020

| Expenses Paid | ||||

| Beginning | Ending | During | ||

| Account | Account | Annualized | Period* | |

| Value | Value | Expense | (7/1/20 to | |

| (7/1/20) | (12/31/20) | Ratio | 12/31/20) | |

| The Small Cap Opportunities Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,277.90 | 1.64% | $ 9.39 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.89 | 1.64% | $ 8.31 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,276.20 | 1.89% | $10.81 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,015.63 | 1.89% | $ 9.58 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,273.00 | 2.39% | $13.66 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,013.12 | 2.39% | $12.09 |

| Institutional Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,279.30 | 1.44% | $ 8.25 |

| Institutional Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,017.90 | 1.44% | $ 7.30 |

| The Market Opportunities Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,300.20 | 1.40% | $ 8.09 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,018.10 | 1.40% | $ 7.10 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,299.40 | 1.65% | $ 9.54 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.84 | 1.65% | $ 8.36 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,295.80 | 2.15% | $12.41 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,014.33 | 2.15% | $10.89 |

| Institutional Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,301.60 | 1.20% | $ 6.94 |

| Institutional Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,019.10 | 1.20% | $ 6.09 |

27

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

Expense Example — (Continued)

December 31, 2020

| Expenses Paid | ||||

| Beginning | Ending | During | ||

| Account | Account | Annualized | Period* | |

| Value | Value | Expense | (7/1/20 to | |

| (7/1/20) | (12/31/20) | Ratio | 12/31/20) | |

| The Alternative Income Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,003.70 | 0.95% | $ 4.78 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,020.36 | 0.95% | $ 4.82 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,002.40 | 1.20% | $ 6.04 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,019.10 | 1.20% | $ 6.09 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $ 999.90 | 1.70% | $ 8.55 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.59 | 1.70% | $ 8.62 |

| Institutional Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,004.80 | 0.75% | $ 3.78 |

| Institutional Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,021.37 | 0.75% | $ 3.81 |

| The Multi-Disciplinary Income Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,033.60 | 1.49% | $ 7.62 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,017.65 | 1.49% | $ 7.56 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,032.40 | 1.74% | $ 8.89 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,016.39 | 1.74% | $ 8.82 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,030.00 | 2.24% | $11.43 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,013.88 | 2.24% | $11.34 |

| Institutional Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,034.70 | 1.29% | $ 6.60 |

| Institutional Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,018.65 | 1.29% | $ 6.55 |

28

KINETICS MUTUAL FUNDS, INC. — THE FUNDS

Expense Example — (Continued)

December 31, 2020

| Expenses Paid | ||||

| Beginning | Ending | During | ||

| Account | Account | Annualized | Period* | |

| Value | Value | Expense | (7/1/20 to | |

| (7/1/20) | (12/31/20) | Ratio | 12/31/20) | |

| The Kinetics Spin-off and Corporate Restructuring Fund | ||||

| No Load Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,295.70 | 1.45% | $ 8.37 |

| No Load Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,017.85 | 1.45% | $ 7.35 |

| Advisor Class A Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,295.30 | 1.50% | $ 8.65 |

| Advisor Class A Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,017.60 | 1.50% | $ 7.61 |

| Advisor Class C Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,289.90 | 2.25% | $12.95 |

| Advisor Class C Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,013.83 | 2.25% | $11.39 |

| Institutional Class Actual - after expense | ||||

| reimbursement | $1,000.00 | $1,296.70 | 1.25% | $ 7.22 |

| Institutional Class Hypothetical (5% return | ||||

| before expenses) - after expense | ||||

| reimbursement | $1,000.00 | $1,018.95 | 1.25% | $ 6.34 |

| Note: Each Feeder Fund records its proportionate share of the respective Master Portfolio’s expenses on a daily basis. Any ex- |

| pense reductions include Feeder Fund-specific expenses as well as the expenses allocated from the Master Portfolio. |

| * Expenses are equal to the to the Fund’s annualized expense ratio after expense reimbursement multiplied by the average |

| account value over the period, multiplied by 184/366. |

29

KINETICS MUTUAL FUNDS, INC. — THE FUND

December 31, 2020

| Percentage | ||

| Market | of Total | |

| Sector Allocation* | Value | Net Assets |

Mining, Quarrying, and Oil and Gas Extraction | $7,705,473 | 44.0% |

Administrative and Support and Waste Management and | ||

| Remediation Services | 2,318,580 | 13.2% |

Real Estate and Rental and Leasing | 2,026,565 | 11.6% |

Manufacturing | 1,862,055 | 10.6% |

Management of Companies and Enterprises | 1,213,404 | 6.9% |

Information | 603,864 | 3.5% |

Educational Services | 533,380 | 3.0% |

Finance and Insurance | 463,762 | 2.7% |

Accommodation and Food Services | 250,200 | 1.4% |

Arts, Entertainment, and Recreation | 176,323 | 1.0% |

Transportation and Warehousing | 88,880 | 0.5% |

Retail Trade | 76,032 | 0.4% |

Professional, Scientific, and Technical Services | 23,320 | 0.1% |

Wholesale Trade | 5,068 | 0.0% |

* Excludes Short-Term Investments

30

KINETICS MUTUAL FUNDS, INC. — THE FUND

The Kinetics Spin-off and Corporate Restructuring Fund

| COMMON STOCKS — 98.92% | Shares | Value | ||||||

| Accommodation — 1.43% | ||||||||

Civeo Corporation* | 18,000 | $ | 250,200 | |||||

| Beverage and Tobacco Product Manufacturing — 0.30% | ||||||||

Crimson Wine Group Limited* | 10,000 | 53,500 | ||||||

| Broadcasting (except Internet) — 0.70% | ||||||||

The E.W. Scripps Company — Class A | 8,000 | 122,320 | ||||||

| Chemical Manufacturing — 0.37% | ||||||||

Prestige Consumer Healthcare, Inc.* | 797 | 27,791 | ||||||

Rayonier Advanced Materials, Inc.* | 5,800 | 37,816 | ||||||

65,607 | ||||||||

| Data Processing, Hosting, and Related Services — 13.22% | ||||||||

PayPal Holdings, Inc.*c | 9,900 | 2,318,580 | ||||||

| Educational Services — 3.04% | ||||||||

Graham Holdings Company — Class B | 1,000 | 533,380 | ||||||

| Fabricated Metal Product Manufacturing — 0.94% | ||||||||

Masco Corporation | 3,000 | 164,790 | ||||||

| Funds, Trusts, and Other Financial Vehicles — 1.80% | ||||||||

Capital Southwest Corporation | 17,200 | 305,300 | ||||||

Mesabi Trust | 400 | 11,220 | ||||||

316,520 | ||||||||

| Machinery Manufacturing — 1.72% | ||||||||

The Manitowoc Company, Inc.* | 2,800 | 37,268 | ||||||

Welbilt, Inc.* | 20,000 | 264,000 | ||||||

301,268 | ||||||||

| Management of Companies and Enterprises — 6.92% | ||||||||

Associated Capital Group, Inc. — Class Ac | 32,400 | 1,137,888 | ||||||

Dundee Corporation — Class A* | 30,000 | 32,700 | ||||||

Galaxy Digital Holdings Ltd.* | 5,000 | 42,816 | ||||||

1,213,404 | ||||||||

| Medical Equipment and Supplies Manufacturing — 0.26% | ||||||||

Avanos Medical, Inc.* | 1,000 | 45,880 | ||||||

The accompanying notes are an integral part of these financial statements.

31

KINETICS MUTUAL FUNDS, INC. — THE FUND

The Kinetics Spin-off and Corporate Restructuring Fund

Schedule of Investments — December 31, 2020 — (Continued)

| Shares | Value | |||||||

| Miscellaneous Manufacturing — 7.02% | ||||||||

CSW Industrials, Inc.c | 11,000 | $ | 1,231,010 | |||||

| Oil and Gas Extraction — 43.94% | ||||||||

Texas Pacific Land Trustc | 10,599 | 7,705,473 | ||||||

| Other Financial Investment Activities — 0.87% | ||||||||

GAMCO Investors, Inc. — Class A | 8,300 | 147,242 | ||||||

Morgan Group Holding Co.*f | 724 | 5,068 | ||||||

152,310 | ||||||||

| Other Telecommunications — 2.52% | ||||||||

Liberty Broadband Corporation — Series A* | 2,800 | 441,224 | ||||||

| Publishing Industries (except Internet) — 0.23% | ||||||||

Gannett Co., Inc.* | 12,000 | 40,320 | ||||||

| Real Estate — 11.56% | ||||||||

DREAM Unlimited Corp.cf | 90,800 | 1,515,830 | ||||||

The Howard Hughes Corporation* | 6,300 | 497,259 | ||||||

PrairieSky Royalty Limited | 1,700 | 13,476 | ||||||

2,026,565 | ||||||||

| Scientific Research and Development Services — 0.13% | ||||||||

Rafael Holdings, Inc. — Class B* | 1,000 | 23,320 | ||||||

| Spectator Sports — 1.01% | ||||||||

Liberty Media Corp.-Liberty Braves — Class C* | 1,590 | 39,559 | ||||||

Liberty Media Corp.-Liberty Formula One — Class A* | 3,600 | 136,764 | ||||||

176,323 | ||||||||

| Sporting Goods, Hobby, Musical Instrument, and Book Stores — 0.43% | ||||||||

Vista Outdoor, Inc.* | 3,200 | 76,032 | ||||||

| Water Transportation — 0.51% | ||||||||

A.P. Moeller-Maersk A/S — Class B — ADR | 8,000 | 88,880 | ||||||

TOTAL COMMON STOCKS | ||||||||

(cost $8,161,516) | 17,346,906 | |||||||

| TOTAL INVESTMENTS — 98.92% | ||||||||

| (cost $8,161,516) | $ | 17,346,906 | ||||||

The accompanying notes are an integral part of these financial statements.

32

KINETICS MUTUAL FUNDS, INC. — THE FUND

The Kinetics Spin-off and Corporate Restructuring Fund

Schedule of Investments — December 31, 2020 — (Continued)

Percentages are stated as a percent of net assets.

* — Non-income producing security.

c — Significant Investment — Greater than 5% of net assets.

f — Level 2 Investment.

ADR — American Depository Receipt.

The accompanying notes are an integral part of these financial statements.

33

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

December 31, 2020

| The Internet | The Global | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 173,846,943 | $ | 20,451,491 | ||||

| Receivable from Adviser | — | 16,683 | ||||||

| Receivable for Fund shares sold | 518,830 | 19,037 | ||||||

| Prepaid expenses and other assets | 30,562 | 20,068 | ||||||

| Total Assets | 174,396,335 | 20,507,279 | ||||||

| LIABILITIES: | ||||||||

| Payable for Master Portfolio interest purchased | 420,618 | 19,037 | ||||||

| Payable to Directors | 3,626 | 461 | ||||||

| Payable to Chief Compliance Officer | 176 | 25 | ||||||

| Payable for Fund shares repurchased | 98,212 | — | ||||||

| Payable for shareholder servicing fees | 33,211 | 4,078 | ||||||

| Payable for distribution fees | 2,237 | 8,303 | ||||||

| Accrued expenses and other liabilities | 40,751 | 14,910 | ||||||

| Total Liabilities | 598,831 | 46,814 | ||||||

| Net Assets | $ | 173,797,504 | $ | 20,460,465 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 87,804,378 | $ | 13,703,662 | ||||

| Accumulated earnings | 85,993,126 | 6,756,803 | ||||||

| Net Assets | $ | 173,797,504 | $ | 20,460,465 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | ||||||||

| Net Assets | $ | 169,373,991 | $ | 13,904,333 | ||||

| Shares outstanding | 3,195,170 | 1,674,892 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 53.01 | $ | 8.30 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 2,863,903 | $ | 574,371 | ||||

| Shares outstanding | 59,152 | 69,772 | ||||||

| Net asset value per share (redemption price) | $ | 48.42 | $ | 8.23 | ||||

| Offering price per share ($48.42 divided by .9425 and $8.23 | ||||||||

| divided by .9425) | $ | 51.37 | $ | 8.73 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 1,559,610 | $ | 5,981,761 | ||||

| Shares outstanding | 38,516 | 780,069 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 40.49 | $ | 7.67 | ||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

34

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Assets & Liabilities — (Continued)

December 31, 2020

| The Paradigm | The Medical | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 638,665,069 | $ | 17,596,554 | ||||

| Receivable from Adviser | 2,304 | 11,976 | ||||||

| Receivable for Master Portfolio interest sold | 537,678 | 17,579 | ||||||

| Receivable for Fund shares sold | 162,559 | 147 | ||||||

| Prepaid expenses and other assets | 38,015 | 20,533 | ||||||

| Total Assets | 639,405,625 | 17,646,789 | ||||||

| LIABILITIES: | ||||||||

| Payable to Directors | 17,414 | 489 | ||||||

| Payable to Chief Compliance Officer | 1,249 | 35 | ||||||

| Payable for Fund shares repurchased | 700,063 | 17,726 | ||||||

| Payable for shareholder servicing fees | 101,135 | 3,698 | ||||||

| Payable for distribution fees | 110,703 | 615 | ||||||

| Fund distribution payable | 174 | — | ||||||

| Accrued expenses and other liabilities | 129,400 | 14,815 | ||||||

| Total Liabilities | 1,060,138 | 37,378 | ||||||

| Net Assets | $ | 638,345,487 | $ | 17,609,411 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 304,973,686 | $ | 10,125,035 | ||||

| Accumulated earnings | 333,371,801 | 7,484,376 | ||||||

| Net Assets | $ | 638,345,487 | $ | 17,609,411 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | ||||||||

| Net Assets | $ | 274,876,063 | $ | 15,462,221 | ||||

| Shares outstanding | 5,090,949 | 549,603 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 53.99 | $ | 28.13 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 94,179,443 | $ | 2,038,672 | ||||

| Shares outstanding | 1,811,318 | 75,795 | ||||||

| Net asset value per share (redemption price) | $ | 51.99 | $ | 26.90 | ||||

| Offering price per share ($51.99 divided by .9425 and $26.90 | ||||||||

| divided by .9425) | $ | 55.16 | $ | 28.54 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 84,596,886 | $ | 108,518 | ||||

| Shares outstanding | 1,770,941 | 4,175 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 47.77 | $ | 25.99 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – INSTITUTIONAL CLASS: | ||||||||

| Net Assets | $ | 184,693,095 | N/A | |||||

| Shares outstanding | 3,387,933 | N/A | ||||||

| Net asset value per share (offering price and redemption price) | $ | 54.51 | N/A | |||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

35

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Assets & Liabilities — (Continued)

December 31, 2020

| The Small Cap | The Market | |||||||

| Opportunities | Opportunities | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 178,388,090 | $ | 96,667,160 | ||||

| Receivable from Adviser | 10,233 | 22,122 | ||||||

| Receivable for Master Portfolio interest sold | 226,875 | — | ||||||

| Receivable for Fund shares sold | 29,638 | 215,284 | ||||||

| Prepaid expenses and other assets | 28,236 | 33,395 | ||||||

| Total Assets | 178,683,072 | 96,937,961 | ||||||

| LIABILITIES: | ||||||||

| Payable for Master Portfolio interest purchased | — | 205,284 | ||||||

| Payable to Directors | 5,205 | 2,265 | ||||||

| Payable to Chief Compliance Officer | 411 | 136 | ||||||

| Payable for Fund shares repurchased | 256,513 | 10,000 | ||||||

| Payable for shareholder servicing fees | 31,007 | 16,687 | ||||||

| Payable for distribution fees | 19,160 | 11,595 | ||||||

| Accrued expenses and other liabilities | 46,157 | 27,313 | ||||||

| Total Liabilities | 358,453 | 273,280 | ||||||

| Net Assets | $ | 178,324,619 | $ | 96,664,681 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 117,087,227 | $ | 56,607,475 | ||||

| Accumulated earnings | 61,237,392 | 40,057,206 | ||||||

| Net Assets | $ | 178,324,619 | $ | 96,664,681 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | ||||||||

| Net Assets | $ | 126,349,975 | $ | 66,570,448 | ||||

| Shares outstanding | 1,891,120 | 2,089,799 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 66.81 | $ | 31.85 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 8,172,065 | $ | 6,441,662 | ||||

| Shares outstanding | 126,872 | 205,431 | ||||||

| Net asset value per share (redemption price) | $ | 64.41 | $ | 31.36 | ||||

| Offering price per share ($64.41 divided by .9425 and $31.36 | ||||||||

| divided by .9425) | $ | 68.34 | $ | 33.27 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 8,684,465 | $ | 9,392,374 | ||||

| Shares outstanding | 142,713 | 315,304 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 60.85 | $ | 29.79 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – INSTITUTIONAL CLASS: | ||||||||

| Net Assets | $ | 35,118,114 | $ | 14,260,197 | ||||

| Shares outstanding | 514,551 | 440,906 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 68.25 | $ | 32.34 | ||||

* | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

36

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Assets & Liabilities — (Continued)

December 31, 2020

| The Multi- | ||||||||

| The Alternative | Disciplinary | |||||||

| Income | Income | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 12,576,192 | $ | 26,202,312 | ||||

| Receivable from Adviser | 11,614 | 14,360 | ||||||

| Receivable for Master Portfolio interest sold | — | 60,898 | ||||||

| Receivable for Fund shares sold | 7,241 | — | ||||||

| Prepaid expenses and other assets | 22,920 | 37,409 | ||||||

| Total Assets | 12,617,967 | 26,314,979 | ||||||

| LIABILITIES: | ||||||||

| Payable for Master Portfolio interest purchased | 1,647 | — | ||||||

| Payable to Directors | 425 | 899 | ||||||

| Payable to Chief Compliance Officer | 30 | 63 | ||||||

| Payable for Fund shares repurchased | 5,593 | 60,898 | ||||||

| Payable for shareholder servicing fees | 1,218 | 3,080 | ||||||

| Payable for distribution fees | 2,984 | 10,674 | ||||||

| Fund distribution payable | 1 | — | ||||||

| Accrued expenses and other liabilities | 14,989 | 18,315 | ||||||

| Total Liabilities | 26,887 | 93,929 | ||||||

| Net Assets | $ | 12,591,080 | $ | 26,221,050 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 12,380,119 | $ | 30,580,768 | ||||

| Accumulated earnings (deficit) | 210,961 | (4,359,718 | ) | |||||

| Net Assets | $ | 12,591,080 | $ | 26,221,050 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | ||||||||

| Net Assets | $ | 2,642,399 | $ | 3,698,245 | ||||

| Shares outstanding | 26,360 | 353,817 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 100.24 | $ | 10.45 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 677,751 | $ | 1,800,841 | ||||

| Shares outstanding | 6,848 | 173,144 | ||||||

| Net asset value per share (redemption price) | $ | 98.97 | $ | 10.40 | ||||

| Offering price per share ($98.97 divided by .9425 and $10.40 | ||||||||

| divided by .9425) | $ | 105.01 | $ | 11.03 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 658,887 | $ | 5,746,571 | ||||

| Shares outstanding | 6,954 | 558,920 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 94.76 | $ | 10.28 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE – INSTITUTIONAL CLASS: | ||||||||

| Net Assets | $ | 8,612,043 | $ | 14,975,393 | ||||

| Shares outstanding | 84,790 | 1,430,093 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 101.57 | $ | 10.47 | ||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

37

KINETICS MUTUAL FUNDS, INC. — THE FUND

Statements of Assets & Liabilities — (Continued)

December 31, 2020

| The Kinetics | ||||

| Spin-off and | ||||

| Corporate | ||||

| Restructuring | ||||

| Fund | ||||

| ASSETS: | ||||

Investments, at value(1) | $ | 17,346,906 | ||

| Cash | 204,825 | |||

| Dividends and interest receivable | 4,165 | |||

| Prepaid expenses and other assets | 23,597 | |||

| Total Assets | 17,579,493 | |||

| LIABILITIES: | ||||

| Payable to Adviser | 4,588 | |||

| Payable to Directors | 510 | |||

| Payable to Chief Compliance Officer | 33 | |||

| Payable to custodian | 1,211 | |||

| Payable for Fund shares repurchased | 5 | |||

| Payable for shareholder servicing fees | 1,576 | |||

| Payable for distribution fees | 3,879 | |||

| Accrued expenses and other liabilities | 30,553 | |||

| Total Liabilities | 42,355 | |||

| Net Assets | $ | 17,537,138 | ||

(1) Cost of investments | $ | 8,161,516 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid in capital | $ | 9,381,672 | ||

| Accumulated earnings | 8,155,466 | |||

| Net Assets | $ | 17,537,138 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE – NO LOAD CLASS: | ||||

| Net Assets | $ | 18,265 | ||

| Shares outstanding | 1,358 | |||

| Net asset value per share (offering price and redemption price) | $ | 13.45 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS A: | ||||

| Net Assets | $ | 2,521,094 | ||

| Shares outstanding | 196,670 | |||

| Net asset value per share (redemption price) | $ | 12.82 | ||

| Offering price per share ($12.82 divided by .9425) | $ | 13.60 | ||

| CALCULATION OF NET ASSET VALUE PER SHARE – ADVISOR CLASS C: | ||||