Exhibit 99.2

Aeterna Zentaris

Management's Discussion and Analysis

of Financial Condition and Results of Operations

Company Overview

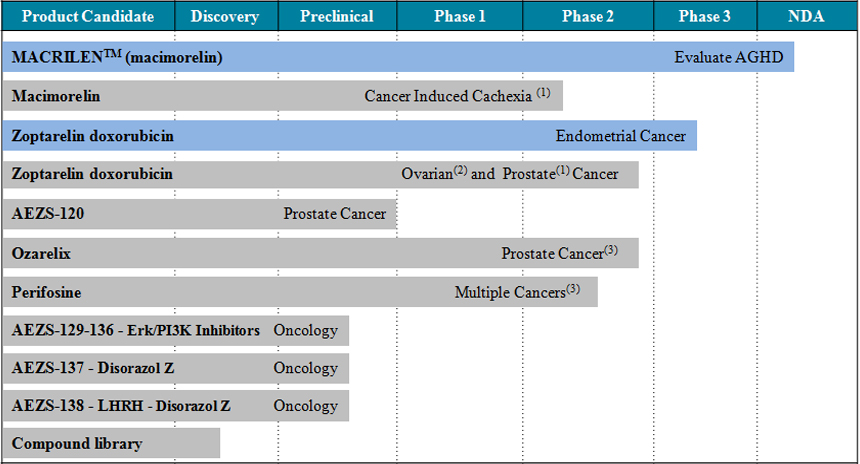

Aeterna Zentaris Inc. is a specialty biopharmaceutical company engaged in developing novel treatments in oncology and endocrinology. Our pipeline encompasses compounds at various stages of development.

Our wholly-owned, later-stage product candidates include MACRILEN™ (macimorelin), an orphan drug that evaluates growth hormone deficiency in adults, and zoptarelin doxorubicin, a targeted therapy for endometrial cancer, as well as for castration- and taxane-resistant prostate and other cancers. We are also investigating various additional compounds as potential treatments for a host of unmet medical needs.

The Company's common shares are listed on both the NASDAQ Capital Market (the "NASDAQ"), under the symbol "AEZS", and on the Toronto Stock Exchange ("TSX"), under the symbol "AEZ".

Introduction

This Management's Discussion and Analysis ("MD&A") provides a review of the results of operations, financial condition and cash flows of Aeterna Zentaris Inc. for the year ended December 31, 2013. In this MD&A, "Aeterna Zentaris", the "Company", "we", "us", "our" and the "Group" mean Aeterna Zentaris Inc. and its subsidiaries. This discussion should be read in conjunction with the information contained in the Company's consolidated financial statements and related notes as at December 31, 2013 and December 31, 2012 and for the years ended December 31, 2013, 2012 and 2011. Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

All amounts in this MD&A are presented in United States ("U.S.") dollars, except for share, option and warrant data, per share and per warrant data and as otherwise noted.

All shares, options and share purchase warrants as well as per share, option and share purchase warrant information presented in this MD&A have been adjusted, including proportionate adjustments being made to each stock option and share purchase warrant exercise price, to reflect and give effect to a consolidation, on October 2, 2012, of our issued and outstanding common shares on a six-to-one basis (the "Share Consolidation"). The Share Consolidation affected all shareholders, optionholders and warrantholders uniformly and thus did not materially affect any securityholder's percentage of ownership interest.

About Forward-Looking Statements

This document contains forward-looking statements, which reflect our current expectations regarding future events. Forward-looking statements may include words such as "anticipate", "assuming", "believe", "could", "expect", "foresee", "goal", "guidance", "intend", "may", "objective", "outlook", "plan", "seek", "should", "strive", "target" and "will".

Forward-looking statements involve risks and uncertainties, many of which are discussed in this MD&A. Results or performance may differ significantly from expectations. For example, the results of current clinical trials cannot be foreseen, nor can changes in policy or actions taken by regulatory authorities such as the the U.S. Food and Drug Administration ("FDA"), the European Medicines Agency, the Therapeutic Products Directorate of Health Canada or any other organization responsible for enforcing regulations in the pharmaceutical industry.

Given these uncertainties and risk factors, readers are cautioned not to place undue reliance on any forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, unless required to do so by a governmental authority or by applicable law.

Aeterna Zentaris

2013 Annual MD&A

About Material Information

This MD&A includes information that we believe to be material to investors after considering all circumstances, including potential market sensitivity. We consider information and disclosures to be material if they result in, or would reasonably be expected to result in, a significant change in the market price or value of our securities, or where it is likely that a reasonable investor would consider the information and disclosures to be important in making an investment decision.

The Company is a reporting issuer under the securities legislation of all of the provinces of Canada, and our securities are registered with the U.S. Securities and Exchange Commission. The Company is therefore required to file or furnish continuous disclosure information, such as interim and annual financial statements, MD&As, proxy circulars, annual reports on Form 20-F, material change reports and press releases with the appropriate securities regulatory authorities. Copies of these documents may be obtained free of charge upon request from the Company's Investor Relations department or on the Internet at the following addresses: www.aezsinc.com, www.sedar.com and www.sec.gov.

Key Developments

MACRILEN™

| |

| ▪ | On January 6, 2014, we announced that the FDA had accepted for substantive review our New Drug Application ("NDA") for our orally available peptidomimetic ghrelin receptor agonist with growth hormone secretagogue activity, MACRILEN™, for the evaluation of adult growth hormone deficiency ("AGHD"). The acceptance for filing of the NDA indicates that the FDA has determined that the application is sufficiently complete to permit a substantive review. The NDA, submitted on November 5, 2013, seeks approval for the commercialization of MACRILEN™, which, if approved, will be the first orally administered drug indicated for the evaluation of AGHD by evaluating the pituitary gland secretion of growth hormone in response to an oral dose of the product. The application is subject to a standard review and will have a Prescription Drug User Fee Act ("PDUFA") date of November 5, 2014. The PDUFA date is the goal date for the FDA to complete its review of the NDA. MACRILEN™ benefits from patent protection covering major markets; in particular, the product is protected in the U.S. at least until October 2027. Phase 3 data have demonstrated the compound to be well tolerated, with accuracy comparable to available intravenous and intramuscular testing procedures. |

Zoptarelin Doxorubicin

| |

| ▪ | On April 10, 2013 we announced the signing of a co-development and profit sharing agreement with Ergomed Clinical Research Ltd. ("Ergomed") as the contract clinical development organization for the Phase 3 ZoptEC (Zoptarelin doxorubicin in Endometrial Cancer) trial in women with locally advanced, recurrent or metastatic endometrial cancer who have progressed and who have received one chemotherapeutic regimen with platinum and taxane (either as adjuvant or first-line treatment). The ZoptEC trial is an open-label, randomized, multicenter trial conducted in North America, Europe and Israel under a Special Protocol Assessment with the FDA. The trial compares zoptarelin doxorubicin with doxorubicin as second line therapy and will involve approximately 500 patients. Patient dosing was initiated in July 2013, and the primary efficacy endpoint of the ZoptEC trial is improvement in median Overall Survival. |

Under the terms of the agreement, Ergomed has agreed to assume 30% (up to $10 million) of the clinical and regulatory costs for this trial, which are estimated at approximately $30 million over the course of the study. Ergomed will be entitled to receive an agreed upon single-digit percentage of any net income received by us for zoptarelin doxorubicin in this indication, up to a specified maximum amount.

| |

| ▪ | On June 3, 2013, we announced encouraging final data for the Phase 1 portion of the ongoing Phase 1/2 trial in men with castration- and taxane-resistant prostate cancer with zoptarelin doxorubicin. Data were presented at the American Society of Clinical Oncology Annual Meeting in Chicago by the principal investigator, Jacek Pinski, MD, PhD, of the University of Southern California's Norris Comprehensive Cancer Center. In general, zoptarelin doxorubicin was well tolerated and demonstrated promising evidence of its anti-tumor activity in this heavily pretreated population. Among the 15 evaluable patients with measurable disease, ten achieved stable disease, and a drop in Prostatic Specific Antigen was noted in three patients. The maximum tolerated dose ("MTD") of zoptarelin doxorubicin in this indication was established at 210 mg/m2, which is below the MTD reported in women with refractory endometrial and ovarian cancer. The Phase 2 portion of this trial in prostate cancer is ongoing. |

Aeterna Zentaris

2013 Annual MD&A

Cetrotide® Manufacturing Rights and Discontinued Operations

| |

| ▪ | On October 1, 2013, we announced that we had successfully completed the transactions contemplated by the transfer and service agreement and concurrent agreements with various partners and licensees with respect to the manufacturing rights for Cetrotide®, currently marketed by a subsidiary of Merck KGaA of Darmstadt, Germany ("Merck Serono") for therapeutic use as part of in vitro fertilization programs. The principal outcome of these agreements is the transfer of manufacturing rights and the grant of a license to Merck Serono for the manufacture, testing, assembling, packaging, storage and release of Cetrotide® in all territories (the "Cetrotide® Business") in exchange for a non-refundable, one-time payment of €2.5 million (approximately $3.3 million). |

| |

| ▪ | The Cetrotide® Business has been presented in our consolidated financial statements as a discontinued operation. As such, relevant amounts impacting elements of our comprehensive income (loss) and cash flows have been retroactively reclassified to reflect the Cetrotide® Business as a discontinued operation and are discussed separately from continuing operations in this MD&A. |

Perifosine

| |

| ▪ | On March 11, 2013, we announced that the Phase 3 trial in multiple myeloma was discontinued after an interim analysis by an independent Data Safety Monitoring Board reported that it was highly unlikely the study would achieve a significant difference in its primary endpoint of progression-free survival. We therefore decided not to make any further investment in the development of perifosine. |

Appointments to Executive Management Team

| |

| ▪ | On April 15, 2013, we announced the appointment of David Dodd as our President, Chief Executive Officer ("CEO") and director of the Company. Mr. Dodd's executive management experience in the pharmaceutical and biotechnology industries spans more than 35 years. Prior to joining our Company, Mr. Dodd was President, CEO and Chairman of BioReliance Corporation, a leading provider of biological safety and related testing services, and President, CEO and director of Serologicals Corporation. Mr. Dodd also held the roles of President and CEO of Solvay Pharmaceuticals, Inc. and of Chairman of its subsidiary, Unimed Pharmaceuticals, Inc., and held various senior management positions at Wyeth-Ayerst Laboratories, the Mead Johnson Laboratories Division at Bristol-Myers Squibb and at Abbott Laboratories. Mr. Dodd holds a Master's degree from Georgia State University and completed the Harvard Business School Advanced Management Program. |

| |

| ▪ | On November 1, 2013, we announced the appointment of Jude Dinges as our Senior Vice President and Chief Commercial Officer. Mr. Dinges is responsible for all activities regarding the potential commercial launch of MACRILEN™ in AGHD, as well as for identifying future commercial opportunities. Mr. Dinges began his career nearly 30 years ago at Bristol Laboratories and later at Merck & Co. in training, sales, management, marketing and market development and was a key contributor to the successful launch of brands such as Cozaar®, Fosamax®, Singulair®, Maxalt®, Vioxx®, and Vytorin®. Mr. Dinges joined Novartis Pharmaceuticals in 2006, overseeing the launch of Tekturna®, and in 2008 became the Respiratory & Infectious Disease Specialty Medicines Director. In 2009, he joined Amgen Inc. as Executive Director of Region Sales, Bone Health Business Unit. |

| |

| ▪ | On January 3, 2014, we announced the appointment of Richard Sachse, MD, PhD, as our Senior Vice President, Chief Scientific Officer and Managing Director. Dr. Sachse, who is based in Frankfurt, holds a degree in medicine from the Friedrich-Alexander-University Erlangen and a board certification in Clinical Pharmacology and has over 20 years' experience as a physician and scientist. He has extensive expertise in a variety of different therapeutic areas, including endocrinology and oncology. In addition to registration studies, Dr. Sachse is especially experienced in the design and implementation of translational programs to bridge research programs to the clinic, as well as in the design and implementation of clinical pharmacology programs, including all required profiling studies and activities, enabling successful registration of products at the international level. Before joining Aeterna Zentaris, Dr. Sachse was Vice President and Head of Global Translational Medicine at Boehringer Ingelheim. From 1996 to 2000, he was International Project Leader at the Bayer AG Institute for Clinical Pharmacology and Principal Investigator at the Bayer Clinical Pharmacology Unit. From 2001 to 2006, Dr. Sachse held a variety of management positions within early and late phase clinical development programs, including responsibilities for completed Phase 3 programs leading to successful New Drug Application / Marketing Authorization Application submissions. In 2007, he became Senior Director, Head of |

Aeterna Zentaris

2013 Annual MD&A

Experimental Medicine, at UCB in Belgium, before being appointed Vice President, Head of Global Translational Medicine, at Boehringer Ingelheim in 2010.

Corporate Developments

"At-the-Market" Issuance Program

| |

| ▪ | Between May 22, 2013 and December 31, 2013, we sold a total of approximately 1.7 million common shares under our At‑The-Market ("ATM") sales program at an average price of $1.76 per share, resulting in aggregate gross proceeds of approximately $3.0 million. This ATM sales program allows the Company to sell, at market prices prevailing at the time of sale, up to a maximum of 2.5 million of our common shares through ATM issuances on the NASDAQ for aggregate gross proceeds not to exceed $4.6 million. Between January 1, 2014 and March 20, 2014, we issued a total of 0.2 million common shares under this ATM sales program for aggregate gross proceeds of $0.3 million. |

Registered Direct Offering

| |

| ▪ | On July 30, 2013, we completed a registered direct offering of 5.2 million units at a purchase price of $1.50 per unit, generating net proceeds of approximately $7.0 million. Each unit consisted of one common share and 0.5 of a warrant to purchase one common share. Each warrant is exercisable at any time after January 30, 2014 for a period of five years from the date of issuance at an exercise price of $1.85 per share. |

Public Offerings

| |

| ▪ | On November 25, 2013 we completed a public offering of 13.1 million units, generating net proceeds of approximately $13.7 million. Each unit consisted of one common share and one whole warrant to purchase one common share, at a purchase price of $1.15 per unit. Each warrant is exercisable for a period of five years at an original exercise price of $1.60 per share, subject to certain anti-dilution provisions. |

| |

| ▪ | Subsequent to year-end, on January 14, 2014, we completed a public offering of 11.0 million units, generating net proceeds of approximately $12.2 million, with each unit consisting of one common share and 0.8 of a warrant to purchase one common share, at a purchase price of $1.20 per unit. Each warrant is exercisable for a period of five years at an original exercise price of $1.25 per share, which is subject to certain anti-dilution provisions. |

Listing Transfer to the NASDAQ Capital Market

| |

| ▪ | On August 28, 2013, we announced that our request to transfer our listing to the NASDAQ Capital Market from the NASDAQ Global Market had been approved by the NASDAQ Listing Qualifications Staff. Our common shares continue to trade on the NASDAQ Capital Market, effective August 29, 2013. |

Aeterna Zentaris

2013 Annual MD&A

Status of Our Drug Pipeline

_________________________

(1) Investigator-driven and sponsored.

(2) Phase 2 in ovarian cancer completed.

(3) Sponsored entirely by license partners.

We are focused on preparing for the launch of MACRILEN™ for the evaluation of AGHD in the U.S. and on advancing our ZoptEC Phase 3 program with zoptarelin doxorubicin in endometrial cancer, as discussed further below.

Regarding AEZS‑120, which is a targeted, live recombinant oral tumor vaccine candidate, we are reviewing the development program and our available resources related to this compound.

Ozarelix, a modified luteinizing hormone-releasing hormone ("LHRH") receptor antagonist, with the potential to treat hormone-dependent cancers as well as benign proliferative endocrinological disorders, and perifosine, an oral AKT inhibitor which is being investigated as a potential treatment option for various cancer indications, no longer require significant investment from our Company, being licensed out to Spectrum Pharmaceuticals, Inc. and to Yakult Honsha Co., Ltd. ("Yakult"), respectively. Both partners are responsible for conducting and sponsoring all ongoing development.

As for our compounds in earlier stages of development, our Erk/PI3K inhibitors and our disorazol Z product candidates, as well as our discovery activities, are both under review as part of our focused initiative to optimize research and development ("R&D") activities. Our Erk/PI3K inhibitors are part of our kinase research program, comprising the investigation of different compounds for single Erk inhibition, single PI3K inhibition and dual Erk/PI3K kinase inhibition. Disorazol Z product candidates comprise AEZS-138, a novel cytotoxic hybrid based on the natural compound disorazol Z (AEZS-137), and the LHRH receptor agonist D-Lys6-LHRH. We currently do not expect to invest significantly in these projects, unless partnered and/or sponsored through strategic alliances.

Aeterna Zentaris

2013 Annual MD&A

Consolidated Statements of Comprehensive Income (Loss) Information

|

| | | | | | | | | | | | | | | |

| | | Three-month periods ended December 31, | | Years ended December 31, |

| (in thousands, except share and per share data) | | 2013 | | 2012 | | 2013 | | 2012 | | 2011 |

| | | $ | | $ | | $ | | $ | | $ |

| Revenues | | | | | | | | | | |

| Sales | | — |

| | — |

| | 96 |

| | 834 |

| | 250 |

|

| License fees and other | | — |

| | 281 |

| | 6,079 |

| | 1,219 |

| | 4,455 |

|

| | | — |

| | 281 |

| | 6,175 |

| | 2,053 |

| | 4,705 |

|

| Operating expenses | | | | | | | | | | |

| Cost of sales | | — |

| | — |

| | 51 |

| | 591 |

| | 212 |

|

| Research and development costs, net of refundable tax credits and grants | | 5,345 |

| | 5,523 |

| | 21,284 |

| | 20,592 |

| | 24,245 |

|

| Selling, general and administrative expenses | | 2,627 |

| | 2,877 |

| | 12,316 |

| | 10,606 |

| | 11,955 |

|

| | | 7,972 |

| | 8,400 |

| | 33,651 |

| | 31,789 |

| | 36,412 |

|

| Loss from operations | | (7,972 | ) | | (8,119 | ) | | (27,476 | ) | | (29,736 | ) | | (31,707 | ) |

| Finance income | | 65 |

| | 689 |

| | 1,748 |

| | 6,974 |

| | 6,239 |

|

| Finance costs | | (2,689 | ) | | (700 | ) | | (1,512 | ) | | (382 | ) | | (8 | ) |

| Net finance (costs) income | | (2,624 | ) | | (11 | ) | | 236 |

| | 6,592 |

| | 6,231 |

|

| Loss before income taxes | | (10,596 | ) | | (8,130 | ) | | (27,240 | ) | | (23,144 | ) | | (25,476 | ) |

| Income tax expense | | — |

| | — |

| | — |

| | — |

| | (1,104 | ) |

| Net loss from continuing operations | | (10,596 | ) | | (8,130 | ) | | (27,240 | ) | | (23,144 | ) | | (26,580 | ) |

| Net income (loss) from discontinued operations | | 2,353 |

| | 1,183 |

| | 34,055 |

| | 2,732 |

| | (487 | ) |

| Net (loss) income | | (8,243 | ) | | (6,947 | ) | | 6,815 |

| | (20,412 | ) | | (27,067 | ) |

| Other comprehensive (loss) income: | | | | | | | | | | |

| Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | |

| Foreign currency translation adjustments | | 424 |

| | (204 | ) | | 1,073 |

| | (504 | ) | | (789 | ) |

| Items that will not be reclassified to profit or loss: | | | | | | | | | | |

| Actuarial gain (loss) on defined benefit plans | | 2,346 |

| | (3,705 | ) | | 2,346 |

| | (3,705 | ) | | (1,335 | ) |

| Comprehensive (loss) income | | (5,473 | ) | | (10,856 | ) | | 10,234 |

| | (24,621 | ) | | (29,191 | ) |

| Net loss per share (basic and diluted) from continuing operations | | (0.28 | ) | | (0.34 | ) | | (0.92 | ) | | (1.17 | ) | | (1.69 | ) |

| Net income (loss) (basic and diluted) from discontinuing operations | | 0.06 |

| | 0.05 |

| | 1.16 |

| | 0.14 |

| | (0.03 | ) |

| Net (loss) income (basic and diluted) per share | | (0.22 | ) | | (0.29 | ) | | 0.24 |

| | (1.03 | ) | | (1.72 | ) |

| Weighted average number of shares outstanding: | | | | | | | | | | |

| Basic | | 37,274,129 |

| | 24,181,462 |

| | 29,476,455 |

| | 19,775,073 |

| | 15,751,331 |

|

| Diluted | | 37,274,129 |

| | 24,181,462 |

| | 29,476,455 |

| | 19,806,687 |

| | 15,751,331 |

|

Aeterna Zentaris

2013 Annual MD&A

2013 compared to 2012

Revenues from Continuing Operations

Revenues are derived predominantly from license fees, which include periodic milestone payments, R&D contract fees and the amortization of upfront payments received from our licensing partners.

Sales revenues are derived from the sale of active pharmaceutical ingredients, or raw materials, to license partners. Periodic variations of sales, and, consequently, of cost of sales, are attributable to the R&D needs of the requesting license partner.

License fees and other revenues were nil and $6.1 million for the three-month period and the year ended December 31, 2013, respectively, as compared to $0.3 million and $1.2 million for the same periods in 2012.

In March 2011, we entered into an agreement with Yakult for the development, manufacture and commercialization of perifosine in all human uses, excluding leishmaniasis, in Japan. Under the terms of this agreement, Yakult had made an initial, non-refundable gross upfront payment to the Company of approximately $8.4 million. We recorded this upfront payment as deferred revenues and commenced amortizing the underlying proceeds on a straight-line basis over the estimated life cycle of perifosine in colorectal cancer ("CRC") and multiple myeloma ("MM").

On April 1, 2012, following negative results of a Phase 3 study of perifosine in CRC, we discontinued the perifosine program in that indication. Furthermore, in March 2013, following an analysis of interim results of the Phase 3 study of perifosine in MM, we also discontinued the development of perifosine in the MM indication. Given these results and the termination of these studies, we determined that we no longer had significant obligations under the agreement with Yakult to continue with the development of perifosine, and we recognized, in March 2013, the remaining unamortized amount of deferred revenue of $5.9 million related to the above licensing agreement.

On a year-over-year basis, the increase in license fees and other revenues is therefore attributable to the earlier-than-expected recognition of the previously deferred upfront license payment received from Yakult, following the discontinuance of our development of perifosine and given that the earnings process associated with this compound as pertaining to the upfront proceeds received was deemed to be complete.

License fees and other revenues are expected to decrease significantly in 2014 as compared to the year ended December 31, 2013, given the absence of any remaining unamortized license fee payments as at December 31, 2013.

Operating Expenses from Continuing Operations

R&D costs, net of refundable tax credits and grants, were $5.3 million and $21.3 million for the three-month period and the year ended December 31, 2013, respectively, compared to $5.5 million and $20.6 million for the same periods in 2012.

The following table summarizes our net R&D costs by nature of expense:

|

| | | | | | | | | | | | | | | |

| | | Three-month periods ended December 31, | | Years ended December 31, |

| (in thousands) | | 2013 | | 2012 | | 2013 | | 2012 | | 2011 |

| | | $ | | $ | | $ | | $ | | $ |

| Third-party costs | | 2,828 |

| | 2,345 |

| | 10,049 |

| | 8,679 |

| | 10,077 |

|

| Employee compensation and benefits | | 1,629 |

| | 2,145 |

| | 7,864 |

| | 8,590 |

| | 10,028 |

|

| Facilities rent and maintenance | | 466 |

| | 401 |

| | 1,758 |

| | 1,661 |

| | 1,835 |

|

| Other costs* | | 540 |

| | 744 |

| | 2,130 |

| | 2,530 |

| | 2,688 |

|

| R&D tax credits and grants | | (118 | ) | | (112 | ) | | (517 | ) | | (868 | ) | | (383 | ) |

| | | 5,345 |

| | 5,523 |

| | 21,284 |

| | 20,592 |

| | 24,245 |

|

_________________________

* Includes depreciation, amortization and impairment charges.

Aeterna Zentaris

2013 Annual MD&A

The following table summarizes primary third-party R&D costs, by product candidate, incurred by the Company during the three-month periods ended December 31, 2013 and 2012.

|

| | | | | | | | | | | | |

| (in thousands, except percentages) | | Three-month periods ended December 31, |

| Product Candidate | | 2013 | | 2012 |

| | | $ | | % | | $ | | % |

| Zoptarelin doxorubicin | | 1,667 |

| | 58.9 |

| | 282 |

| | 12.0 |

|

| MACRILEN™, macimorelin | | 284 |

| | 10.0 |

| | 30 |

| | 1.3 |

|

| Erk/PI3K inhibitors | | 312 |

| | 11.0 |

| | 199 |

| | 8.5 |

|

| Perifosine | | — |

| | — |

| | 1,434 |

| | 61.2 |

|

| Disorazol Z | | 139 |

| | 4.9 |

| | 55 |

| | 2.3 |

|

| Other | | 426 |

| | 15.2 |

| | 345 |

| | 14.7 |

|

| | | 2,828 |

| | 100.0 |

| | 2,345 |

| | 100.0 |

|

The following table summarizes primary third-party R&D costs, by product candidate, incurred by the Company during the years ended December 31, 2013, 2012 and 2011.

|

| | | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | | Years ended December 31, |

| Product Candidate | | 2013 | | 2012 | | 2011 |

| | | $ | | % | | $ | | % | | $ | | % |

| Zoptarelin doxorubicin | | 4,934 |

| | 49.1 |

| | 2,133 |

| | 24.6 |

| | 1,652 |

| | 16.4 |

|

| MACRILEN™, macimorelin | | 1,238 |

| | 12.3 |

| | 112 |

| | 1.3 |

| | 1,156 |

| | 11.5 |

|

| Erk/PI3K inhibitors | | 1,128 |

| | 11.2 |

| | 1,727 |

| | 19.9 |

| | 1,860 |

| | 18.5 |

|

| Perifosine | | 1,134 |

| | 11.3 |

| | 3,801 |

| | 43.8 |

| | 3,726 |

| | 37.0 |

|

| Disorazol Z | | 659 |

| | 6.6 |

| | 331 |

| | 3.8 |

| | 256 |

| | 2.5 |

|

| Other | | 956 |

| | 9.5 |

| | 575 |

| | 6.6 |

| | 1,427 |

| | 14.1 |

|

| | | 10,049 |

| | 100.0 |

| | 8,679 |

| | 100.0 |

| | 10,077 |

| | 100.0 |

|

Third-party R&D costs were $10.0 million for the year ended December 31, 2013, as compared to $8.7 million for the same period in 2012. This increase mainly results from the higher development costs associated with zoptarelin doxorubicin, and in particular with our Phase 3 ZoptEC trial initiated in 2013 with Ergomed, as discussed above. Additionally, we incurred higher development costs in 2013 related to MACRILEN™ and macimorelin, primarily consisting of the purchase of active pharmaceutical ingredients. These increases were partly offset by the lower comparative development costs associated with perifosine, given that we have decided not to make any further investment in this product candidate, as discussed above, and by the lower preclinical study-related costs associated with our Erk/PI3K inhibitors.

Third-party R&D costs also increased during the year ended December 31, 2013 due to higher expenditures associated with our disorazol Z product candidates, pursuant to a variety of collaboration agreements with various universities and institutes, and to the purchase of active pharmaceutical ingredients.

Excluding the impact of foreign exchange rate fluctuations, we expect net R&D costs for 2014 to increase, as compared to 2013, mainly due to the advancement of our lead ZoptEC Phase 3 trial with zoptarelin doxorubicin and related sub-studies. Based on currently available information and forecasts, we expect that we will incur net R&D costs of between $24 million and $26 million for the year ended December 31, 2014. As discussed below, however, we currently are in the process of performing a strategic review of all of our preclinical activities. This review may result in changes to our future overall R&D activities that may have a significant impact on our results of operations versus the currently available guidance. As such, our net R&D cost estimates may be revised in future periods as we continue to review our R&D activities, advance R&D development and as new information becomes available.

Aeterna Zentaris

2013 Annual MD&A

Selling, general and administrative ("SG&A") expenses were $2.6 million and $12.3 million for the three-month period and the year ended December 31, 2013, respectively, compared to $2.9 million and $10.6 million for the same periods in 2012.

For the year ended December 31, 2013, the increase in SG&A expenses, as compared to 2012, is mainly related to the recognition in the second quarter of 2013 of non-recurring termination benefits (approximately $1.4 million) paid to our former CEO and to the recording of related non-cash share-based compensation costs, amounting to approximately $0.7 million.

We expect SG&A expenses to decrease in 2014 as compared to the year ended December 31, 2013, despite the progressive ramping up of pre-commercialization activities associated with MACRILEN™, which, as discussed below and conditional upon the successful regulatory approval of our NDA, we expect to launch in the evaluation of AGHD indication in the U.S. market in 2015.

Net finance income (costs) is comprised predominantly of the change in fair value of warrant liability, gains and losses due to changes in foreign currency exchange rates and, as pertaining to 2011 only, to gains on a short-term investment. For the three-month period and the year ended December 31, 2013, net finance (costs) income totalled $(2.6) million and $0.2 million, respectively, as compared to nil and $6.6 million for the same periods in 2012, as presented below.

|

| | | | | | | | | | | | | | | |

| | | Three-month periods ended December 31, | | Years ended December 31, |

| (in thousands) | | 2013 | | 2012 | | 2013 | | 2012 | | 2011 |

| | | $ | | $ | | $ | | $ | | $ |

| Finance income | | | | | | | | | | |

| Gains due to changes in foreign currency exchange rates | | — |

| | — |

| | — |

| | — |

| | 2,197 |

|

| Change in fair value of warrant liability | | — |

| | 634 |

| | 1,563 |

| | 6,746 |

| | 2,533 |

|

| Interest income | | 65 |

| | 55 |

| | 185 |

| | 228 |

| | 223 |

|

| Gain on held-for-trading financial instrument | | — |

| | — |

| | — |

| | — |

| | 1,278 |

|

| | | 65 |

| | 689 |

| | 1,748 |

| | 6,974 |

| | 6,231 |

|

| Finance costs | | | | | | | | | | |

| Losses due to changes in foreign currency exchange rates | | (805 | ) | | (700 | ) | | (1,512 | ) | | (382 | ) | | — |

|

| Change in fair value of warrant liability | | (1,884 | ) | | — |

| | — |

| | — |

| | — |

|

| | | (2,689 | ) | | (700 | ) | | (1,512 | ) | | (382 | ) | | — |

|

| | | (2,624 | ) | | (11 | ) | | 236 |

| | 6,592 |

| | 6,231 |

|

The change in fair value of our warrant liability results from the "mark-to-market" revaluation, via the application of the Black-Scholes option pricing model, of currently outstanding share purchase warrants. The Black-Scholes "mark-to-market" warrant valuation most notably has been impacted by the closing price of our common shares, which, on the NASDAQ, has fluctuated from between $1.03 and $3.23 during the year ended December 31, 2013.

Gains or losses due to changes in foreign currency exchange rates are mainly related to the US dollar vis-à-vis the euro, which weakened from 2011 to 2012 and strengthened from 2012 to 2013, as presented below.

|

| | | | | | | | | | |

| | | Three-month periods ended December 31, | | Years ended December 31, |

| | | 2013 | | 2012 | | 2013 | | 2012 | | 2011 |

| Euro to US$ average conversion rate | | 1.3617 | | 1.2975 | | 1.3288 | | 1.2858 | | 1.3919 |

Net loss from continuing operations for the three-month period and the year ended December 31, 2013 was $10.6 million and $27.2 million, or $0.28 and $0.92 per basic and diluted share, respectively, compared to $8.1 million and $23.1 million, or $0.34 and $1.17 per basic and diluted share for the same periods in 2012.

Aeterna Zentaris

2013 Annual MD&A

The increase in net loss from continuing operations for the three-month period ended December 31, 2013, as compared to the same period in 2012, is largely due to higher net finance costs, as presented above.

The increase in net loss from continuing operations for the year ended December 31, 2013, as compared to 2012, is due largely to the recording of non-recurring termination benefits and related non-cash share-based compensation costs, lower comparative net finance income and higher comparative net R&D costs, partially offset by higher comparative license fee revenues, largely associated with the accelerated recognition of remaining net unamortized amount of deferred revenues related to the licensing agreement entered into with Yakult, as discussed above.

2012 compared to 2011

Revenues from Continuing Operations

License fees and other revenues were $1.2 million for the year ended December 31, 2012, as compared to $4.5 million for the year ended December 31, 2011. This decrease is mainly due to the recording of a $2.6 million milestone payment from Yakult with respect to the initiation of a Phase 1 trial with perifosine in CRC in Japan during the last quarter of 2011.

Operating Expenses from Continuing Operations

R&D costs, net of refundable tax credits and grants, were $20.6 million for the year ended December 31, 2012, as compared to $24.2 million for the year ended December 31, 2011. This decrease is attributable to lower R&D employee compensation and benefit costs, as well as to continued cost-rationalization initiatives, resulting in a lower number of employees. The decrease is also related to comparative lower third-party costs associated with the development of MACRILEN™ in AGHD and to the weakening of the euro against the US dollar.

SG&A expenses were $10.6 million for the year ended December 31, 2012, as compared to $12.0 million for the year ended December 31, 2011. The decrease in SG&A expenses is mainly related to non-recurring 2011 events. During the year ended December 31, 2011, we recognized an impairment loss on property, plant and equipment, an increase in onerous lease provision and we incurred marketing expenses related to the potential marketing by the Company of perifosine in Europe. In addition, the decrease in SG&A expenses is attributable to the decrease in employee benefit expenses as well as to the weakening of the euro against the US dollar, partly offset by higher transaction costs related to share purchase warrants, higher share-based compensation costs related to collaborators and higher professional fees.

Income tax expense was nil for the year ended December 31, 2012, as compared to $1.1 million for the year ended December 31, 2011, which consists of foreign withholding taxes related to an upfront payment received from a partner and to milestone license fee revenues recorded in 2011.

Net loss from continuing operations for the year ended December 31, 2012 was $23.1 million, or $1.17 per basic and diluted share, as compared to $26.6 million, or $1.69 per basic and diluted share, for the year ended December 31, 2011. This decrease is largely due to lower net R&D costs, SG&A expenses and income tax expense, as well as to higher net finance income, partly offset by the significant decrease in license fee revenues.

Discontinued Operations

Following a strategic review of our risk and prospects with respect to the Cetrotide® Business and, in particular, having taken into account, as discussed below, the previous monetization of the corresponding royalty stream, we decided to transfer all manufacturing rights of Cetrotide® and to discontinue our involvement with the Cetrotide® Business. On April 3, 2013 (the "Effective Date"), we entered into a transfer and service agreement ("TSA") and concurrent agreements with various partners and licensees with respect to our manufacturing rights for Cetrotide®, currently marketed for therapeutic use as part of in vitro fertilization programs. The principal effect of these agreements was to transfer, effective October 1, 2013 (the "Closing Date"), our manufacturing rights for Cetrotide® to Merck Serono in all territories. Also per the TSA, we agreed to provide certain transition services to Merck Serono over a period of 36 months from the Effective Date in order to assist Merck Serono in managing overall responsibility for the Cetrotide® Business.

Under the TSA, during the period commencing on the Effective Date and ending on the Closing Date (the "Interim Period"), we were obligated to continue to conduct the Cetrotide® Business in the ordinary course in a manner consistent with past practices,

Aeterna Zentaris

2013 Annual MD&A

subject to certain conditions. Per the TSA, we received a non-refundable, one-time payment of €2.5 million (approximately $3.3 million) in consideration for the transfer of our manufacturing rights referred to above, as well as other payments in exchange for the transfer, also on the Closing Date, of certain assets, such as inventory and equipment used solely for the manufacture of Cetrotide®. We recognized the non-refundable, one-time payment on the Closing Date, as we no longer had managerial involvement or effective control over the manufacturing of goods sold through the Cetrotide® Business. We provide the aforementioned transition services to Merck Serono in exchange for a monthly service fee.

As a result of the transfer of substantially all of the risks and rewards associated with the Cetrotide® Business on the Closing Date, the Cetrotide® Business has been classified as a discontinued operation in the consolidated financial statements. As such, relevant amounts in our consolidated statements of comprehensive income (loss) have been retroactively reclassified to reflect the Cetrotide® Business as a discontinued operation, as presented below.

|

| | | | | | | | | | | | | | | |

| | | Three-month periods ended December 31, | | Years ended December 31, |

| (in thousands) | | 2013 | | 2012 | | 2013 | | 2012 | | 2011 |

| | | $ | | $ | | $ | | $ | | $ |

| Revenues | | | | | | | | | | |

| Sales and royalties | | 3,057 |

| | 9,165 |

| | 63,755 |

| | 30,704 |

| | 31,056 |

|

| License fees and other* | | 3,717 |

| | 99 |

| | 4,589 |

| | 908 |

| | 292 |

|

| | | 6,774 |

| | 9,264 |

| | 68,344 |

| | 31,612 |

| | 31,348 |

|

| Operating expenses | | | | | | | | | | |

| Cost of sales | | 3,071 |

| | 7,489 |

| | 30,002 |

| | 26,229 |

| | 27,348 |

|

| Research and development costs, net of tax credits and grants | | — |

| | — |

| | 8 |

| | 12 |

| | 272 |

|

| Selling, general and administrative expenses | | 1,350 |

| | 592 |

| | 4,279 |

| | 2,639 |

| | 4,215 |

|

| | | 4,421 |

| | 8,081 |

| | 34,289 |

| | 28,880 |

| | 31,835 |

|

| Net income (loss) from discontinued operations | | 2,353 |

| | 1,183 |

| | 34,055 |

| | 2,732 |

| | (487 | ) |

_________________________

* Includes the non-refundable, one-time payment made by Merck Serono in exchange for the manufacturing rights for Cetrotide®.

2013 compared to 2012

Revenues from discontinued operations

Sales and royalties related to discontinued operations were comprised both of net sales of Cetrotide® and of royalties, which represented the amortization, under the units-of-revenue method, of the proceeds received pursuant to a transaction with Healthcare Royalty Partners L.P. (formerly Cowen Healthcare Royalty Partners L.P.) ("HRP"), in which we monetized our royalty stream related to Cetrotide®. In this transaction, we had received a payment of $52.5 million, less certain transaction costs, from HRP in exchange for our rights to royalties on future net sales of Cetrotide® generated by Merck Serono.

We had initially recorded the proceeds received from HRP as deferred revenue due to our then significant continuing involvement with the Cetrotide® Business. However, as of the Closing Date, there was no basis to continue amortizing the deferred revenue associated with HRP, primarily due to the fact that we no longer had significant continuing involvement in the Cetrotide® Business. As such, commencing on the Effective Date, we accelerated the amortization of the remaining deferred revenues of approximately $31.9 million over the Interim Period, by continuing to apply the units-of-revenue method, which is consistent with past practice. The remaining deferred revenues were fully amortized through the end of September 2013.

Sales and royalties from discontinued operations were $3.1 million and $63.8 million for the three-month period and year ended December 31, 2013, respectively, as compared to $9.2 million and $30.7 million for the same periods in 2012.

Aeterna Zentaris

2013 Annual MD&A

The decrease in sales and royalties from discontinued operations during the quarter ended December 31, 2013, as compared to the quarter ended December 31, 2012, relates to the lower comparative volume of recurring Cetrotide® sales. Specifically, we recorded no sales of Cetrotide® during the three months ended December 31, 2013, as compared to the corresponding quarter of 2012, given that the transfer of the Cetrotide® Business was effective on October 1, 2013. However, in connection with the transfer of the Cetrotide® Business, we sold Cetrotide®-related inventory (amounting to approximately $3.0 million) to Merck Serono on October 1, 2013. The sale of inventory assets, therefore, partially offset the significant comparative reduction in recurring Cetrotide® product sales.

License fees and other revenues from discontinued operations increased significantly from each of the quarters and years ended December 31, 2012 to the same periods in 2013 primarily due to the recording, on the Closing Date, of the non-refundable, one-time payment made by Merck Serono, as discussed above.

Cost of sales from discontinued operations were $3.1 million and $30.0 million for the three-month period and year ended December 31, 2013, respectively, as compared to $7.5 million and $26.2 million for the same periods in 2012. The decrease in comparative quarterly cost of sales from discontinued operations results from the absence of recurring Cetrotide® product sales in the fourth quarter of 2013 as compared to the same quarter in 2012. On a comparative annual basis, however, total cost of sales from discontinued operations increased in 2013, as compared to 2012, as a result of the higher comparative volume of Cetrotide® product sales, including the sale of inventory assets to Merck Serono, as discussed above.

Additionally, cost of sales as a percentage of sales and royalties increased to approximately 100.5% for the three-month period ended December 31, 2013, as compared to 81.7% for the same period in 2012, mainly due to the absence of royalties recognized after the Cetrotide® Business was transferred.

For the year ended December 31, 2013, cost of sales as a percentage of sales and royalties decreased to approximately 47.1%, as compared to 85.4% for the same period in 2012, predominantly due to the accelerated recognition of royalties as mentioned above.

SG&A expenses from discontinued operations amounted to $1.4 million and $4.3 million for the three-month period and year ended December 31, 2013, respectively, as compared to $0.6 million and $2.6 million for the same periods in 2012. The year-over-year increase is largely attributable to the recording of a provision for certain non-cancellable contracts related to the Cetrotide® Business that were deemed onerous due to the fact that management expects no economic benefits to flow to the Company following the transfer of the Cetrotide® Business on the Closing Date. The provisions for onerous contracts total $1.3 million and represent the present value of estimated unavoidable future royalty and patent costs associated with the intellectual property underlying Cetrotide®.

Net income from discontinued operations was $2.4 million and $34.1 million for the three-month period and year ended December 31, 2013, respectively, as compared to $1.2 million and $2.7 million for the same periods in 2012. The comparative increases reflect the net impact of items discussed above, and in particular, for comparative annual purposes, are influenced in large part by the inclusion of the accelerated recognition of previously deferred remaining HRP-related revenues as discontinued operations.

2012 compared to 2011

Revenues from discontinued operations, which included recurring sales of Cetrotide® and the ongoing amortization of the proceeds received in 2008 from HRP, were $31.6 million for the year ended December 31, 2012 as compared to $31.3 million for the year ended December 31, 2011.

Cost of sales from discontinued operations were $26.2 million for the year ended December 31, 2012 as compared to $27.3 million for the year ended December 31, 2011.

SG&A expenses from discontinued operations were $2.6 million for the year ended December 31, 2012 as compared to $4.2 million for the year ended December 31, 2011. The comparative decrease is attributable in large part to the absence of an impairment loss in 2012 on our Cetrotide® intangible asset, as compared to 2011.

Net income (loss) from discontinued operations was $2.7 million for the year ended December 31, 2012 as compared to $(0.5) million for the same periods in 2011. The comparative increase reflects the net impact of items discussed above.

Aeterna Zentaris

2013 Annual MD&A

Net (loss) income

2013 compared to 2012

Net (loss) income for the three-month period and the year ended December 31, 2013 was $(8.2) million and $6.8 million, or $(0.22) and $0.24 per basic and diluted share, respectively, compared to $(6.9) million and $(20.4) million, or $(0.29) and $(1.03) per basic and diluted share for the same periods in 2012.

The comparative quarter-to-quarter increase in net loss is mainly due to increased finance costs, partially offset by higher net income from discontinued operations and lower operating expenses. The comparative year-over-year decrease in net loss is mainly due to higher net income from discontinued operations and higher revenues, partially compensated by higher operating costs and lower finance income.

2012 compared to 2011

Net loss for the year ended December 31, 2012 was $20.4 million, or $1.03 per basic and diluted share, compared to $27.1 million, or $1.72 per basic and diluted share for the same period in 2011. The decrease in net loss for the year ended December 31, 2012 is explained above.

Quarterly Consolidated Results of Operations Information

|

| | | | | | | | | | | | |

| (in thousands, except for per share data) | | Quarters ended |

| | | December 31, 2013 | | September 30, 2013 | | June 30, 2013 | | March 31, 2013 |

| | | $ | | $ | | $ | | $ |

| Revenues | | — |

| | 17 |

| | 96 |

| | 6,062 |

|

| Loss from operations | | (7,972 | ) | | (8,648 | ) | | (9,693 | ) | | (1,163 | ) |

| Net (loss) income from continuing operations | | (10,596 | ) | | (7,799 | ) | | (9,848 | ) | | 1,003 |

|

| Net (loss) income | | (8,243 | ) | | 3,842 |

| | 9,330 |

| | 1,886 |

|

| Net (loss) income per share from continuing operations (basic and diluted)* | | (0.28 | ) | | (0.26 | ) | | (0.39 | ) | | 0.04 |

|

| Net (loss) income per share (basic and diluted)* | | (0.22 | ) | | 0.13 |

| | 0.37 |

| | 0.07 |

|

|

| | | | | | | | | | | | |

| (in thousands, except for per share data) | | Quarters ended |

| | | December 31, 2012 | | September 30, 2012 | | June 30, 2012 | | March 31, 2012 |

| | | $ | | $ | | $ | | $ |

| Revenues | | 281 |

| | 265 |

| | 402 |

| | 1,105 |

|

| Loss from operations | | (8,119 | ) | | (6,447 | ) | | (7,672 | ) | | (7,498 | ) |

| Net (loss) income from continuing operations | | (8,130 | ) | | (7,321 | ) | | 4,468 |

| | (12,161 | ) |

| Net (loss) income | | (6,947 | ) | | (6,554 | ) | | 4,540 |

| | (11,451 | ) |

| Net (loss) income per share from continuing operations (basic and diluted)* | | (0.34 | ) | | (0.39 | ) | | 0.24 |

| | (0.69 | ) |

| Net (loss) income per share (basic and diluted)* | | (0.29 | ) | | (0.35 | ) | | 0.25 |

| | (0.65 | ) |

_________________________

| |

| * | Net (loss) income per share is based on the weighted average number of shares outstanding during each reporting period, which may differ on a quarter-to-quarter basis. As such, the sum of the quarterly net (loss) income per share amounts may not equal year-to-date net (loss) income per share. |

Historical quarterly results of operations and net (loss) income cannot be taken as reflective of recurring expenditure patterns or predictable trends.

In the last eight quarters, net (loss) income has been impacted by revenues from continuing operations, which have been non-recurring and have been derived predominantly from licensing initiatives, by the comparative level of net R&D costs in

Aeterna Zentaris

2013 Annual MD&A

connection with the development and termination of our previous perifosine Phase 3 programs, by the increased development of zoptarelin doxorubicin, including the initiation in 2013 of a Phase 3 ZoptEC trial and by the development of MACRILEN™ and of certain earlier stage compounds, as well as by the net income (loss) from discontinued operations, related to the transfer of the Cetrotide® Business mentioned above.

Quarterly net (loss) income was also impacted by the recognition of termination benefits granted to our former CEO and to the related non-cash share-based compensation costs in the second quarter of 2013, as well as by foreign exchange gains or losses and changes in fair value of our warrant liability.

Consolidated Statement of Financial Position Information

|

| | | | | | |

| | | As at December 31, |

| (in thousands) | | 2013 | | 2012 |

| | | $ | | $ |

| Cash and cash equivalents | | 43,202 |

| | 39,521 |

|

| Trade and other receivables and other current assets | | 2,453 |

| | 13,780 |

|

| Restricted cash | | 865 |

| | 826 |

|

| Property, plant and equipment | | 1,351 |

| | 2,147 |

|

| Other non-current assets | | 11,325 |

| | 11,391 |

|

| Total assets | | 59,196 |

| | 67,665 |

|

| Payables and other current liabilities | | 7,242 |

| | 10,470 |

|

| Current portion of deferred revenues | | — |

| | 5,235 |

|

| Warrant liability (current and non-current portions) | | 18,010 |

| | 6,176 |

|

| Non-financial non-current liabilities* | | 16,880 |

| | 52,479 |

|

| Total liabilities | | 42,132 |

| | 74,360 |

|

| Shareholders' equity (deficiency) | | 17,064 |

| | (6,695 | ) |

| Total liabilities and shareholders' equity (deficiency) | | 59,196 |

| | 67,665 |

|

_________________________

* Comprised mainly of non-current portion of deferred revenues, employee future benefits and provisions.

The increase in cash and cash equivalents as at December 31, 2013, as compared to December 31, 2012, is due to the receipt of net proceeds of $20.8 million pursuant to registered direct and public offerings and $2.9 million in drawdowns made under our May 2013 ATM Program, the receipt of the non-refundable, one-time payment after the Closing Date of the transactions involving the discontinuation of the Cetrotide® Business, variations in components of our working capital and the relative strengthening, as at December 31, 2013, of the euro against the US dollar, as compared to December 31, 2012, partially offset by recurring disbursements.

The decrease in trade and other receivables and other current assets as at December 31, 2013, as compared to December 31, 2012, is mainly due to lower trade accounts receivable, inventory and prepaid expenses as a result of the transfer of the Cetrotide® Business, partly offset by the relative strengthening, as at December 31, 2013, of the euro against the US dollar, as compared to December 31, 2012.

The decrease in payables and other current liabilities as at December 31, 2013, as compared to December 31, 2012, is mainly due to lower trade accounts payable, lower accrued Cetrotide® services and deliveries and lower accrued R&D costs, partly offset by the relative strengthening, as at December 31, 2013, of the euro against the US dollar, as compared to December 31, 2012.

The decrease in current portion of deferred revenues as at December 31, 2013, as compared to December 31, 2012, is predominantly due to the change in the timing in the amortization of deferred revenues, as mentioned above.

Aeterna Zentaris

2013 Annual MD&A

Our warrant liability increased from December 31, 2012 to December 31, 2013 predominantly due to the issuance of 15.7 million additional share purchase warrants in connection with the registered direct and public offerings mentioned above. The increase was partly offset by net fair value gains, recorded pursuant to the periodic "mark-to-market" revaluation of the underlying outstanding share purchase warrants.

The decrease in non-financial non-current liabilities as at December 31, 2013, as compared to December 31, 2012, is mainly due to a decrease in deferred revenues, resulting predominantly from the amortization of upfront payments received from our partners in connection with Cetrotide® and perifosine, as mentioned above, and to the decrease of $1.8 million in our pension-related employee benefit obligation (due predominantly to the recording of an actuarial gain). These decreases were partly offset by the recognition of a provision for onerous contracts of $1.3 million, as mentioned above, and by the relative strengthening, as at December 31, 2013, of the euro against the US dollar, as compared to December 31, 2012.

The significant increase in shareholders' equity from December 31, 2012 to December 31, 2013 is mainly attributable to the decrease in our deficit due to the recording of net income, to the increase in share capital following the issuance of common shares pursuant to the aforementioned registered direct and public offerings and May 2013 ATM Program drawdowns, to the decrease in accumulated other comprehensive loss due to foreign currency translation gains and to the increase in other capital due to the recording of share-based compensation costs.

Financial Liabilities, Obligations and Commitments

We have certain contractual lease obligation commitments as well as other long-term obligations related to unfunded benefit pension plans and unfunded post-employment benefit plans. The following tables summarize future cash requirements with respect to these obligations.

Future minimum lease payments and future minimum sublease payments expected to be received under non-cancellable operating leases (subleases), as well as future payments in connection with utility service agreements are as follows:

|

| | | | | | | | | |

| | | As at December 31, 2013 |

| (in thousands) | | Minimum lease payments | | Minimum sublease payments | | Utilities |

| | | $ | | $ | | $ |

| Less than 1 year | | 1,795 |

| | (226 | ) | | 640 |

|

| 1 – 3 years | | 2,562 |

| | (451 | ) | | 559 |

|

| 4 – 5 years | | 515 |

| | (244 | ) | | — |

|

| More than 5 years | | — |

| | — |

| | — |

|

| Total | | 4,872 |

| | (921 | ) | | 1,199 |

|

In accordance with the assumptions used in our employee future benefits obligation calculation as at December 31, 2013, undiscounted benefits expected to be paid are as follows:

|

| | | |

| | | As at December 31, |

| (in thousands) | | 2013 |

| | | $ |

| Less than 1 year | | 531 |

|

| 1 – 3 years | | 1,177 |

|

| 4 – 5 years | | 1,259 |

|

| More than 5 years | | 26,654 |

|

| Total | | 29,621 |

|

Aeterna Zentaris

2013 Annual MD&A

Outstanding Share Data

As at March 20, 2014, we had 56,513,969 common shares issued and outstanding, as well as 2,546,740 stock options outstanding. Warrants outstanding as at March 20, 2014 represented a total of 28,907,410 equivalent common shares.

Capital Disclosures

Our objective in managing capital, consisting of shareholders' equity (deficiency), with cash and cash equivalents and restricted cash equivalents being its primary components, is to ensure sufficient liquidity to fund R&D activities, selling, general and administrative expenses, working capital and capital expenditures.

In the past, we have had access to liquidity through non-dilutive sources, including investment tax credits and grants, interest income, licensing and related services and royalties. More recently, we have increasingly raised capital via public equity offerings and drawdowns under various ATM sales programs.

Our capital management objective remains the same as that in previous periods. The policy on dividends is to retain cash to keep funds available to finance the activities required to advance our product development portfolio.

We are not subject to any capital requirements imposed by any regulators or by any other external source.

Liquidity, Cash Flows and Capital Resources

Our operations and capital expenditures have been financed through certain transactions impacting our cash flows from operating activities, public equity offerings, as well as from the drawdowns under various ATM programs, as discussed above.

Our cash and cash equivalents amounted to $43.2 million as at December 31, 2013, as compared to $39.5 million as at December 31, 2012. As at December 31, 2013, we had cash and cash equivalents amounting to $9.3 million that were denominated in euros.

Based on our assessment, which took into account current cash levels, as well as our strategic plan and corresponding budgets and forecasts, we believe that we have sufficient liquidity and financial resources to fund planned expenditures and other working capital needs for at least, but not limited to, the 12-month period following the statement of financial position date of December 31, 2013.

We may endeavour to secure additional financing, as required, through strategic alliance arrangements or through other activities, as well as via the issuance of new share capital.

Aeterna Zentaris

2013 Annual MD&A

The variations in our liquidity by activity are explained below.

|

| | | | | | | | | | | | | | | |

| (in thousands) | | Three-month periods ended December 31, | | Years ended December 31, |

| | | 2013 | | 2012 | | 2013 | | 2012 | | 2011 |

| | | $ | | $ | | $ | | $ | | $ |

| Cash and cash equivalents - Beginning of period | | 24,829 |

| | 33,202 |

| | 39,521 |

| | 46,881 |

| | 31,998 |

|

| Cash flows from operating activities: | | | | | | | | | | |

| Cash used in operating activities from continuing operations | | (6,184 | ) | | (6,481 | ) | | (30,131 | ) | | (25,681 | ) | | (22,454 | ) |

| Cash provided by (used in) operating activities from discontinued operations | | 9,622 |

| | (2,282 | ) | | 10,147 |

| | (5,134 | ) | | (3,789 | ) |

| | | 3,438 |

| | (8,763 | ) | | (19,984 | ) | | (30,815 | ) | | (26,243 | ) |

| Cash flows from financing activities: | | | | | | | | | | |

| Net proceeds from issuance of common shares and warrants | | 14,795 |

| | 15,097 |

| | 23,708 |

| | 23,619 |

| | 36,250 |

|

| Net proceeds from the exercise of share purchase warrants and other | | — |

| | — |

| | — |

| | 589 |

| | 2,306 |

|

| | | 14,795 |

| | 15,097 |

| | 23,708 |

| | 24,208 |

| | 38,556 |

|

| | | | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | | | |

| Net cash (used in) provided by investing activities from continuing operations | | (21 | ) | | (113 | ) | | (85 | ) | | (272 | ) | | 2,463 |

|

| Net cash provided by investing activities from discontinued operations | | 113 |

| | — |

| | 113 |

| | — |

| | — |

|

| | | 92 |

| | (113 | ) | | 28 |

| | (272 | ) | | 2,463 |

|

| | | | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | 48 |

| | 98 |

| | (71 | ) | | (481 | ) | | 107 |

|

| Cash and cash equivalents - End of period | | 43,202 |

| | 39,521 |

| | 43,202 |

| | 39,521 |

| | 46,881 |

|

Operating Activities

2013 compared to 2012

Cash flows provided by (used in) operating activities were $3.4 million and $(20.0) million for the three-month period and the year ended December 31, 2013, respectively, compared to $(8.8) million and $(30.8) million for the same periods in 2012. The significant decreases in cash flows used in operating activities are mainly due to the cash provided by operating activities from discontinued operations as a result of the changes in operating assets and liabilities and to the receipt, during the fourth quarter of 2013, of the non-refundable, one-time payment received from Merck Serono pursuant to the transfer of the Cetrotide® Business, as discussed above.

The year-over-year decrease in cash flows used in operating activities is partly offset by the increase in cash used in operating activities from continuing operations, which is explained by the comparable increase in R&D and SG&A expenditures, mainly related to the zoptarelin doxorubicin and MACRILEN™ projects, as well as by lower cash flows provided by license fee revenues.

We expect net cash used in operating activities to range from $33 million to $35 million for the year ended December 31, 2014, as we continue to invest in zoptarelin doxorubicin, our ZoptEC Phase 3 program and related sub-studies, as well as the pre-launch activities related to MACRILEN™ in AGHD in the U.S. market. This estimate may vary significantly in future periods, most notably as a result of the strategic review of our R&D activities, as discussed further below.

Aeterna Zentaris

2013 Annual MD&A

2012 compared to 2011

Cash flows used in operating activities totalled $30.8 million for the year ended December 31, 2012, as compared to $26.2 million for the year ended December 31, 2011. Operating cash flows for the year ended December 31, 2011 included the receipt of a non-recurring $8.4 million upfront payment made by Yakult in connection with our development, commercialization and licensing agreement for the rights related to perifosine in Japan. The increase in cash used in operating activities during 2012 was partially offset by a lower loss from operations for the year ended December 31, 2012.

Financing Activities

2012 compared to 2011

Cash flows provided by financing activities were $24.2 million for the year ended December 31, 2012, as compared to $38.6 million for the year ended December 31, 2011. The year-over-year decrease is primarily due to lower proceeds from the issuance of common shares and warrants, which resulted in the receipt of net cash proceeds of $23.6 million in 2012, as compared to $36.3 million for the same period in 2011, and to lower proceeds received on the exercise of share purchase warrants.

Investing Activities

2012 compared to 2011

Cash flows (used in) provided by investing activities totalled $(0.3) million for the year ended December 31, 2012, as compared to $2.5 million for the year ended December 31, 2011. This decrease is due to the absence, in 2012, of cash proceeds received on the sale of short-term investments, partly offset by lower cash disbursements made in connection with the purchases of laboratory and other equipment used in ongoing R&D activities.

Critical Accounting Policies, Estimates and Judgments

Our consolidated financial statements as at December 31, 2013 and December 31, 2012 and for the years ended December 31, 2013, 2012 and 2011 have been prepared in accordance with IFRS as issued by the IASB.

The preparation of consolidated financial statements in accordance with IFRS requires management to make judgments, estimates and assumptions that affect the reported amounts of our assets, liabilities, revenues, expenses and related disclosures. Judgments, estimates and assumptions are based on historical experience, expectations, current trends and other factors that management believes to be relevant at the time at which our consolidated financial statements are prepared.

Management reviews, on a regular basis, the Company's accounting policies, assumptions, estimates and judgments in order to ensure that the consolidated financial statements are presented fairly and in accordance with IFRS. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

A summary of those critical accounting estimates and assumptions, as well as critical judgments used in applying accounting policies in the preparation of our consolidated financial statements, can be found in note 3 to our consolidated financial statements as at December 31, 2013 and December 31, 2012 and for the years ended December 31, 2013, 2012 and 2011.

Recent Accounting Pronouncements

Adopted in 2013

The following new standards and amendments to standards are effective for the first time for interim periods beginning on or after January 1, 2013 and have been applied in preparing these consolidated financial statements. The accounting policies have been applied consistently by all subsidiaries of the Company.

IFRS 10, Consolidated Financial Statements ("IFRS 10"), which builds on existing principles by identifying the concept of control as the determining factor in whether an entity should be included within the consolidated financial statements of a parent company. IFRS 10 also provides additional guidance to assist in the determination of control where this is difficult to assess.

Aeterna Zentaris

2013 Annual MD&A

IFRS 11, Joint Arrangements ("IFRS 11"), which enhances accounting for joint arrangements, particularly by focusing on the rights and obligations of the arrangement, rather than the arrangement's legal form. IFRS 11 also addresses inconsistencies in the reporting of joint arrangements by requiring a single method to account for interests in jointly controlled entities and prohibits proportionate consolidation.

IFRS 12, Disclosure of Interests in Other Entities, which is a comprehensive standard on disclosure requirements for all forms of interests in other entities, including joint arrangements, associates, special purpose vehicles and other off-balance sheet vehicles.

IFRS 13, Fair Value Measurement ("IFRS 13"), which defines fair value, sets out in a single IFRS a framework for measuring fair value and requires disclosures about fair value measurements. IFRS 13 does not determine when an asset, a liability or an entity's own equity instrument is measured at fair value. Rather, the measurement and disclosure requirements of IFRS 13 apply when another IFRS requires or permits the item to be measured at fair value (with limited exceptions).

In June 2011, the IASB issued an amended version of IAS 19, Employee Benefits, including the elimination of the option to defer the recognition of actuarial gains and losses (known as the "corridor method"), the streamlining of the presentation of changes in assets and liabilities arising from defined benefit plans and the enhancement of the disclosure requirements for defined benefit plans, including additional information about the characteristics of defined benefit plans and the risks to which entities are exposed through participation in those plans.

In December 2011, the IASB issued an amended version of IFRS 7, Financial Instruments: Disclosure ("IFRS 7"), including the requirement to disclose information that enables users of an entity's financial statements to evaluate the effect, or potential effect, of offsetting financial assets and financial liabilities, to the entity's financial position.

The impact of the adoption of these standards and amendments did not have a significant impact on the Company's consolidated financial statements.

Not yet adopted

On May 29, 2013, the IASB made amendments to the disclosure requirements of IAS 36, Impairment of Assets ("IAS 36"), requiring disclosure, in certain instances, of the recoverable amount of an asset or cash generating unit, and the basis for the determination of fair value less costs of disposal, when an impairment loss is recognized or when an impairment loss is subsequently reversed. The amendments to IAS 36 are effective for annual periods beginning on or after January 1, 2014 and will be applied prospectively. The Company does not expect that these amendments will have a significant impact on the Company's consolidated financial statements.

In May 2013, the IFRS Interpretations Committee ("IFRIC") issued International Financial Reporting Standard Interpretation 21, Levies ("IFRIC 21"), an interpretation on the accounting for levies imposed by governments. IFRIC 21 is an interpretation of IAS 37, Provisions, Contingent Liabilities and Contingent Assets ("IAS 37"). IAS 37 sets out criteria for the recognition of a liability, one of which is the requirement for the entity to have a present obligation as a result of a past event (known as an obligating event). IFRIC 21 clarifies that the obligating event that gives rise to a liability to pay a levy is the activity described in the relevant legislation that triggers the payment of the levy. IFRIC 21 is effective for annual periods beginning on or after January 1, 2014 and is to be applied on a retrospective basis. The Company does not expect that IFRIC 21 will have a significant impact on the Company's consolidated financial statements.

In November 2009 and October 2010, the IASB issued IFRS 9, Financial Instruments ("IFRS 9"), which represents the completion of the first part of a three-part project to replace IAS 39, Financial Instruments: Recognition and Measurement. Under the new standard, an entity choosing to measure a liability at fair value will present the portion of the change in its fair value due to changes in the entity's own credit risk in the other comprehensive income or loss section of the entity's statement of comprehensive income (loss), rather than within profit or loss in the case where the fair value option is taken for financial liabilities. Additionally, IFRS 7, which is effective on adoption of IFRS 9, was amended to include revised guidance related to the derecognition of financial instruments. The Company is currently assessing the impact, if any, that IFRS 9 will have on the Company's consolidated financial statements.

Aeterna Zentaris

2013 Annual MD&A

Outlook for 2014

MACRILEN™

Throughout the remainder of 2014, we expect to advance the pre-launch activities related to the initial commercialization of MACRILEN™ for the evaluation of AGHD in the U.S. market. As noted above, our NDA is currently under substantive review by the FDA. Subject to the successful review and acceptance of our NDA, we expect to make MACRILEN™ available by prescription in the U.S. as soon as commercially practicable following final regulatory approval.

There are approximately 36,000 AGHD tests performed annually in the U.S. Based on published information from the U.S. Centers for Disease Control and Prevention and by Navigant Research, we estimate that the total potential U.S. market for AGHD evaluation is approximately 158,000 tests per year, including the evaluation of patients who have suffered traumatic brain injury ("TBI"). Research published in the British Journal of Neurosurgery (2007) and in the Frontiers in Endocrinology (2011) estimates that approximately 19% of hospitalized patients suffering from severe and moderate cases of TBI will develop growth hormone deficiency.

We intend to build a commercial infrastructure necessary to access the physicians who perform the majority of AGHD tests (endocrinologists) along with the major centers of AGHD influence. Commercial initiatives are likely to include the targeted selection, hiring and deployment of a contracted sales force by the end of 2014. The targeted marketing efforts of our sales force will reach endocrinology specialists of AGHD. We believe these efforts will enable the realization of a substantial portion of the potential commercial opportunity for MACRILEN™.

We are evaluating the possible final distribution channels for MACRILEN™, however, we expect that MACRILEN™ will be accessed through a mixture of specialty pharmacies, hospital pharmacies, wholesalers and other secondary channels.

To date, we have established an agreement with a contract manufacturer for the commercial supply of the product and expect to use a third-party logistics provider for key services related to logistics, warehousing and inventory management.

We will continue to evaluate the potential to commercialize MACRILEN™ in other geographic territories, including Canada and Europe.

Zoptarelin doxorubicin

We expect to complete initiation of clinical sites (over 100) for our Phase 3 ZoptEC study with Ergomed. Our goal is to secure a first interim (futility) analysis for the Phase 3 ZoptEC study during the first half of 2015 by reaching anticipated patient enrollment.

We also expect to disclose results of the Phase 2 investigator-driven study in castration- and taxane-resistant prostate cancer, for which the investigator of this study was awarded a grant from the National Institutes of Health.

Business development

With our focus to become a growth-oriented, specialty biopharmaceutical company, and in addition to our commitment to developing key product candidates in our existing pipeline, we expect to continue to evaluate potential in-licensing and/or acquisition opportunities, as well as co-promotional arrangements related to targeted commercial products.

Expectations for revenues, operating expenditures and cash flows

Revenues from continuing operations are expected to significantly decrease in 2014, as compared to 2013, mainly as a result of the transfer of the Cetrotide® Business and as all deferred revenues have been recognized in 2013.

Our main focus for R&D efforts will be on our later-stage compound, zoptarelin doxorubicin and its Phase 3 ZoptEC study, as discussed above, where we anticipate substantial investment to fund ongoing development initiatives. For earlier-stage initiatives and product candidates, we expect to recover certain R&D costs through grants, R&D credits or other collaboration agreements. As noted above, however, we currently are in the process of performing a review of all of our preclinical activities in order to streamline our operations, reduce our operating cash burn and more appropriately align our financial resources with our longer-term strategic goals. This review may result in changes to our future overall R&D activities and cost profile that may have a significant impact on our results of operations versus currently available information and forecasts, which estimates net

Aeterna Zentaris

2013 Annual MD&A