Exhibit 99.1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Introduction

This Management’s Discussion and Analysis (“MD&A”) provides a review of the results of operations, financial condition and cash flows of COSCIENS Biopharma Inc. (formerly Aeterna Zentaris Inc.) for the three-month and nine-month period ended September 30, 2024. In this MD&A, “COSCIENS”, the “Company”, “we”, “us” and “our” mean COSCIENS Biopharma Inc. and its subsidiaries. This discussion should be read in conjunction with the information contained in the Company’s unaudited interim condensed consolidated financial statements (the “interim consolidated financial statements”) and the notes thereto as of September 30, 2024, and for the nine-month periods ended September 30, 2024, and 2023. Our unaudited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

On June 3, 2024, Aeterna Zentaris Inc. and Ceapro Inc. closed their all-stock merger of equals transaction and on August 6, 2024, the Company changed its name to COSCIENS Biopharma Inc. For further details on these transactions and the basis for presentation of this MD&A, see “Plan of Arrangement” and “Name Change”, below, as well as Note 3 to the unaudited consolidated financial statements.

The Company’s common shares are listed on both The Nasdaq Capital Market (“Nasdaq”) and on the Toronto Stock Exchange (“TSX”) under the symbol “CSCI”.

All amounts in this MD&A are presented in thousands of United States (“U.S.”) dollars, except for share and per share data, or as otherwise noted. This MD&A was approved by the Company’s Board of Directors (the “Board”) on November 11, 2024. This MD&A is dated November 11, 2024.

About Forward-Looking Statements

The information in this MD&A has been prepared as of November 6, 2024. Certain statements in this MD&A, referred to herein as “forward-looking statements”, constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” under the provisions of Canadian securities laws. All statements, other than statements of historical fact, that address circumstances, events, activities, or developments that could or may or will occur are forward-looking statements. When used in this MD&A, words such as “anticipate”, “assume”, “believe”, “could”, “expect”, “forecast”, “future”, “goal”, “guidance”, “intend”, “likely”, “may”, “would” or the negative or comparable terminology as well as terms usually used in the future and the conditional are generally intended to identify forward-looking statements, although not all forward-looking statements include such words.

Forward-looking statements in this MD&A include, but are not limited to, statements, comments and expectations relating to: the Company’s patented technologies and value-driving products, and development thereof; the extraction, production and commercialization of active ingredients from natural sources and our ability to successfully market related products; the successful development and marketing of our oat-based pipeline products, including oat-beta glucan, avenanthramides and beta glucan from yeast, as well as such products’ capability to address unmet needs within the nutraceuticals markets; Macrilen® (macimorelin) and the Company’s plans in respect of same, including commercialization and clinical programs as well as in respect of the top line data from the DETECT-trial; the Company’s business strategy; the strategic decision to sunset the Company’s Amyotrophic Lateral Sclerosis (ALS) program; the Company’s positioning in its target markets; the Company’s ability to accelerate the scale-up of PGX Technology towards commercial levels;expectations for completion of the Company’s Edmonton facility and Natex Termitz facility; pre-clinical and clinical studies and trials and their expected timing and results, including the potential to bring certain products to market following such studies and trials; the ability of our pharmaceutical therapeutic assets to address unmet medical needs across a number of indications; management’s assumptions, estimates and judgements; liquidity and capital resources; adequacy of our financial resources to finance operations and expenditure requirements; limitations on internal controls over financial reporting; and the plans, objectives, future outlook and financial position of the Company in general.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic, operational and other risks, uncertainties, contingencies and other factors, including those described below, which could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements and, as such, undue reliance must not be placed on them.Forward-looking statements involve known and unknown risks and uncertainties which include, among others: the Company’s present and future business strategies; operations performance within expected ranges; anticipated future cash flows; local and global economic conditions and the environment in which the Company operates; anticipated capital and operating costs; uncertainty in technology development as well as product development and related clinical trials and validation studies, including our reliance on the success of the pediatric clinical trial in the European Union and U.S. for Macrilen® (macimorelin); the result of the DETECT-trial may not support receipt of regulatory approval in child-onset growth hormone deficiency; results from ongoing or planned pre-clinical studies of macimorelin by the University of Queensland or for our other products under development may not be successful or may not support advancing the product to human clinical trials; our ability to raise capital and obtain financing to continue our currently planned operations; our now heavy dependence on the success of Macrilen® (macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to successfully commercialize the product; the ability to secure strategic partners for late stage development, marketing, and distribution of our products, including our ability to enter into a new license agreement or similar arrangement following the termination of the license agreement with Novo Nordisk AG; our ability to enter into out-licensing, development, manufacturing, marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect; our ability to protect and enforce our patent portfolio and intellectual property; and our ability to continue to list our common shares on the Nasdaq.

Investors should consult our quarterly and annual filings with the Canadian and U.S. securities commissions for additional information on risks and uncertainties, including those discussed in our Annual Report on Form 20-F for the year ended December 31, 2023 and under the heading “Risks and Uncertainties” in Exhibit 99.2 of our Form 6-K furnished to the SEC on May 14, 2024 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. We disclaim any obligation to update any such risks or uncertainties or to publicly announce any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, unless required to do so by a governmental authority or applicable law.

Certain forward-looking statements contained herein about prospective results of operations, financial position or cash flows may constitute a financial outlook. Such statements are based on assumptions about future events that management believe to be reasonable, are given as of the date hereof and are based on economic conditions, proposed courses of action and management’s assessment of currently available relevant information. The Company’s management has approved the financial outlook as of the date hereof. Readers are cautioned that such financial outlook information contained herein should not be used for purposes other than for which it is disclosed herein.

About Material Information

This MD&A includes information that we believe to be material to investors after considering all circumstances. We consider information and disclosures to be material if they result in, or would reasonably be expected to result in, a significant change in the market price or value of our securities, or where it is likely that a reasonable investor would consider the information and disclosures to be important in making an investment decision.

We are a reporting issuer under the securities legislation of all of the provinces of Canada, and our securities are registered with the U.S. Securities and Exchange Commission (“SEC”). We are therefore required to file or furnish continuous disclosure information, such as interim and annual financial statements, management’s discussion and analysis, proxy or information circulars, annual reports on Form 20-F, material change reports and press releases with the appropriate securities regulatory authorities. Additional information about the Company and copies of these documents may be obtained free of charge upon request from our Corporate Secretary or on the Internet at the following addresses: www.cosciensbio.com, www.sedarplus.ca and www.sec.gov.

Company Overview

COSCIENS Biopharma Inc. is a specialty biopharmaceutical company developing and commercializing a diversified portfolio of products for the cosmeceutical, nutraceutical and pharmaceutical markets. Such products being produced using the Company’s proprietary technologies. The Company’s patented technologies include the Pressurized Gas eXpanded (PGX) technology, which is a unique and disruptive technology that generates high-value yields of active ingredients from natural plant resources for use in novel cosmeceutical, nutraceutical and therapeutics products. The Company’s two value-driving products, oat beta glucan and avenanthramides, are found in many household name cosmetic and personal care brands. These products are manufactured from the Company’s proprietary oat extraction manufacturing technology and are known for their well-documented health benefits.

In addition to our portfolio of nutraceutical and cosmeceutical products and programs, the Company is also conducting a Phase 1/2a clinical trial with the goal of developing our avenanthramides product as an anti-inflamatory. The Company’s lead commercial pharmaceutical product, macimorelin (Macrilen®; Ghryvelin®), is the first and only U.S. FDA and European Commission approved oral test indicated for the diagnosis of adult growth hormone deficiency (AGHD).

Plan of arrangement

On June 3, 2024, Aeterna Zentaris Inc. (“Aeterna”) and Ceapro Inc. (“Ceapro”) closed their all-stock merger of equals transaction (the “Transaction”). The Transaction was completed by way of court approved plan of arrangement pursuant to the terms of an arrangement agreement entered into by Aeterna and Ceapro on December 14, 2023. As a result of the Transaction, each outstanding Ceapro common share was exchanged for 0.02360 of an Aeterna common share. Additionally, as part of the Transaction, Aeterna issued to its shareholders immediately prior to the closing of the Transaction, 0.47698 of a share purchase warrant (a “New Warrant”) for each Aeterna common share or warrant held.

Following the closing of the Transaction, former shareholders of Ceapro owned approximately 50% of the Aeterna common shares on a fully diluted basis and former shareholders of Aeterna owned approximately 50% of the Aeterna common shares on a fully diluted basis. For financial reporting and accounting purposes, Ceapro was the acquirer of Aeterna in the Transaction. The consolidated financial statements of COSCIENS Biopharma Inc. as of September 30, 2024, and December 31, 2023 and for the three and nine months ended September 30, 2024 and 2023 reflect the results of operations and financial position of Ceapro for the periods presented and includes 120 days of the results of operations of Aeterna for the three and nine months ended September 30, 2024 subsequent to the Transaction, which was completed on June 3, 2024.

The accompanying consolidated financial statements include the accounts of COSCIENS Biopharma Inc. Inc., an entity incorporated under the Canada Business Corporations Act, and its wholly owned subsidiaries (the “Group”). COSCIENS Biopharma Inc. is the ultimate parent company of the Group. The Company currently has six wholly-owned direct and indirect subsidiaries, Ceapro Inc. and its wholly-owned subsidiaries Ceapro (P.E.I.) and JuventeDC Inc., based in Canada, Aeterna Zentaris GmbH (“AEZS Germany”) and its wholly-owned subsidiary Zentaris IVF GmbH, based in Frankfurt, Germany, and Aeterna Zentaris, Inc., an entity incorporated in the state of Delaware and with offices in Summerville, South Carolina, in the US.

Management Succession Plan

With the initial integration efforts now well underway, the Board of Directors, with the full support of current President and CEO Gilles Gagnon, M.Sc., MBA, has engaged an executive recruiting firm to identify and evaluate candidates for the next President and CEO role. This search aims to find a visionary leader who will drive COSCIENS forward and build on the company’s successes.

Name Change

At the Company’s annual general and special meeting of shareholders held on July 16, 2024 (while the Company was known as Aeterna Zentaris Inc.), the shareholders of the Company approved a special resolution authorizing the Board to effect a change of name of the Company from “Aeterna Zentaris Inc.” to “COSCIENS Biopharma Inc.” (the “Name Change”). On August 6, 2024, the Company filed articles of amendment pursuant to the Canada Business Corporations Act in order to effect the Name Change.

On August 9, 2024, the Company’s common shares began trading on the TSX and Nasdaq under the trading symbol “CSCI”, and concurrently ceased trading thereon under the former trading symbol “AEZS”. The Name Change did not result in any changes in the capitalization of the Company.

Key Operational Developments

Active ingredients

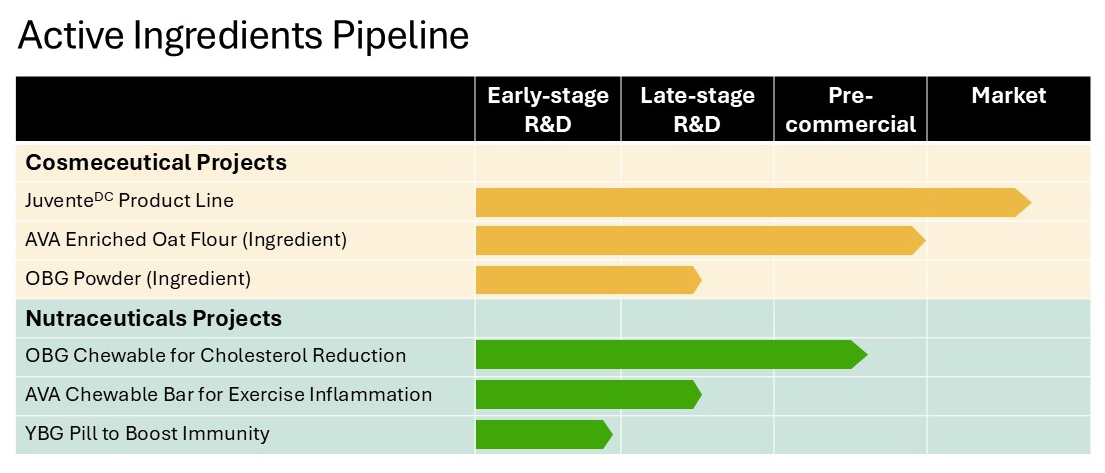

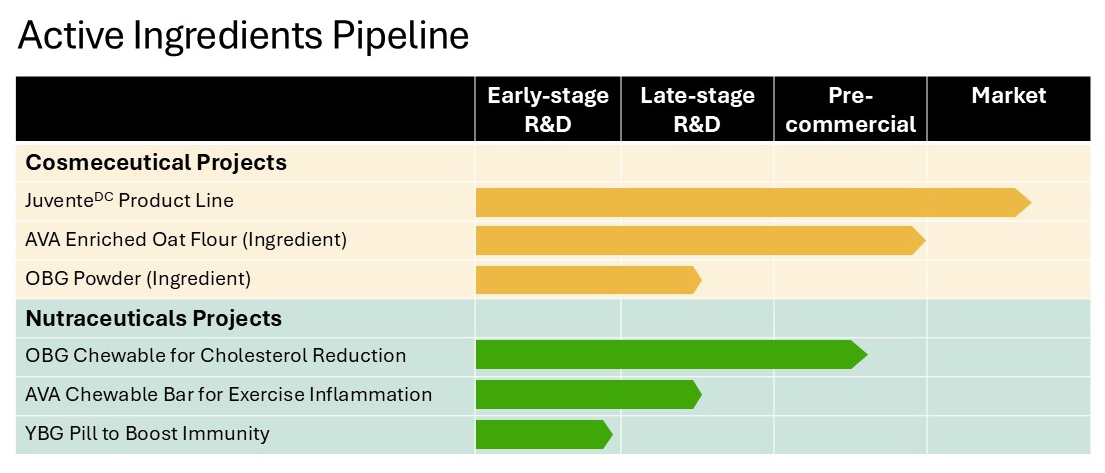

The Company’s active ingredient segment focuses on leveraging our unique expertise in the extraction, production and commercialization of active ingredients from natural sources. The Company’s commercialized products are well positioned in the cosmeceutical market and mostly focused on the documented health benefits of two bio actives extracted from oats; beta glucan and avenanthramides. These products include:

| | ● | A commercial line of natural active ingredients, including beta glucan, avenanthramides (colloidal oat extract), oat powder, oat oil, and oat peptides, which are marketed to the personal care, cosmetic, medical, and animal health industries through our distribution partners and direct sales; |

| | ● | A commercial line of natural anti-aging skincare products, utilizing active ingredients including oat beta glucan and avenanthramides, which are marketed to the cosmeceuticals market through our wholly owned subsidiary, JuventeDC Inc.; and |

| | ● | Veterinary therapeutic products, including an oat shampoo, an ear cleanser, and a dermal complex/conditioner, which are manufactured and marketed to veterinarians in Japan and Asia. |

The Company’s core technologies used to extract and process bio actives include proprietary Ethanol Fractionation Processes (EFP) and Pressurized Gas eXpanded (PGX) Technology. EFP is mostly used to produce liquid formulations while PGX is used for powder formulations. PGX is a patented, unique and disruptive technology with several key advantages over conventional drying and purification technologies that can be used to process biopolymers into high-value and novel biocomposites. In a single step and using green solvents, it has the ability to make generates purified highly porous polymer composites such as aerogels which cannot be made using conventional drying technologies. In 2023, the Company commenced a collaboration with Austria-based NATEX Prozesstechnologie GesmbH to accelerate the scale-up of PGX Technology at both its Edmonton facility and at the Natex Termitz facility, which are both expected to be completed in 2024.

Given the well-known properties of oat beta glucan and avenanthramides as cholesterol reducer and anti-inflammation respectively, we are actively developing our oat-based pipeline products to address unmet needs within the nutraceuticals markets, with a strategic focus on:

Oat Beta Glucan – Chewable for cholesterol reduction

Leveraging approved claims for the use of oat beta glucan as a proven cholesterol reduction ingredient in Canada, the United States of America and the European Union, and having received approval from Health Canada in December 2023, the Company has formulated a healthy edible product capable of delivering the appropriate dose of oat beta glucan to meet all regulatory and health requirements. Commercial manufacturing samples have been produced, proving manufacturability of a healthy and delicious edible product despite the high levels of oat beta glucan required to provide a scientifically proven cholesterol reduction in humans. The Company intends to bring this product to the wellness and functional food market B2C via various e-commerce platforms.

Avenanthramides – nutraceutical-chewable formulation to reduce inflammation

In addition to cosmetic applications, avenanthramides, when taken orally, could treat inflammation-based conditions such as exercise induced inflammation, joint inflammation as well as inflammation at the gastro-intestinal and cardiovascular levels.

Through the use of a unique chromatography purification technology, the Company has successfully developed a highly purified and well characterized pharmaceutical grade powder formulation with the goal that such active pharmaceutical ingredient (API) could be offered as both nutraceutical and pharmaceutical formulations.

The Company’s initial activities for use of avenanthramides in nutraceuticals were focused on assessing the bio-availability and bio-efficacy of the compound under the leadership of Dr. Li Li Ji at the University of Minnesota. Following the completion of the bio-availablity study in 2018, the Company successfully completed two bio-efficacy studies in 2019 using low and high doses of avenanthramides with young men and women demonstrating in a statistically significant manner the efficacy of avenanthramides in alleviating exercise-induced inflammation as evidenced by a significant decrease of inflammation biomarkers in the blood. These studies paved the way for the development of products like superfine oat flour enriched with Avenanthramides used for the production of chewable oat bar as a nutraceutical as well as for the development of a pharmaceutical grade tablet for clinical trials. The Company is initiating the production of enriched oat flour at small commercial scale at the Edmonton facility.

Beta glucan from yeast (YBG)- nutraceutical-capsule as an immune booster

While yeast beta glucan is a commercial product with well-known immune properties, the obtention of a consistently high-purity product represents a major challenge for suppliers. Using the PGX technology, the Company has successfully processed several formulations of yeast beta glucan and is now in a position to offer a very high purity YBG product with very well-defined specifications. The Company further demonstrated the mechanism of action following in vitro and in vivo studies.

This product has been used for the completion of the 5 times scale-up of the PGX technology at the Edmonton facility and will also be used for the 10 times scale-up work being conducted in Austria. Powder formulation produced in Edmonton will be offered in capsules as an immune booster product.

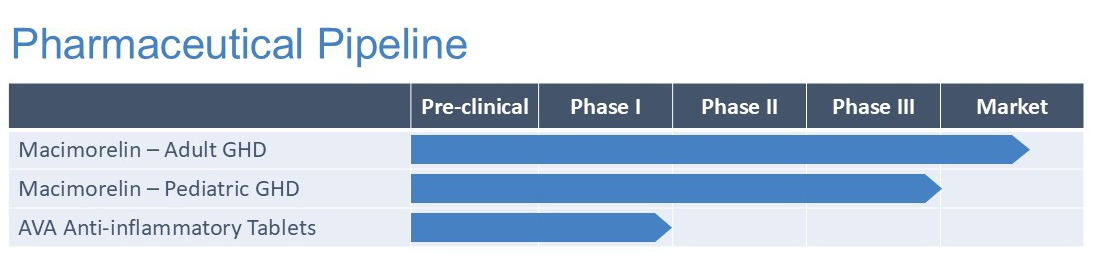

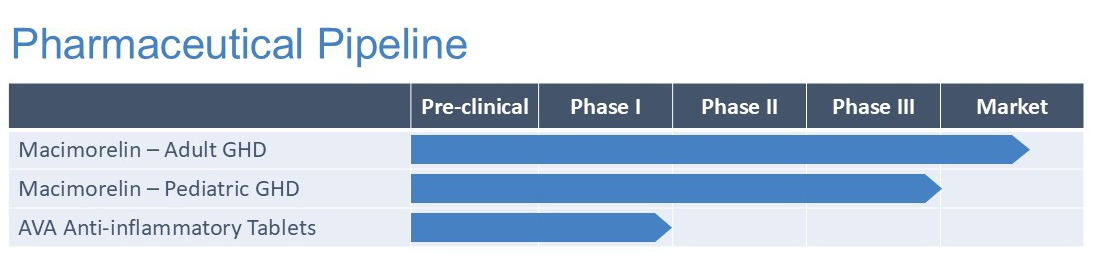

Pharmaceutical

The Company is also dedicated to the development of its pharmaceutical therapeutic assets and has established a clinical and pre-clinical development pipeline to potentially address unmet medical needs across a number of indications, including diagnostic tests for growth hormone deficiency and potential treatment of inflammation based diseases.

During the three-month period ended September 30, 2024, the Company made a strategic decision to discontinue its AIM Biological, Amyotrophic Lateral Sclerosis (ALS), and Delayed Clearance Parathyroid Hormone programs. This decision was influenced by several factors, including increasingly challenging timelines and costs associated with reaching the next value inflection point in pre-clinical development.

Macimorelin Commercialization Program

Macrilen® (macimorelin), is the first and only U.S. Food and Drug Administration (“FDA”) and European Medicines Agency (“EMA”) approved oral test indicated for the diagnosis of patients with adult growth hormone deficiency (“AGHD”). Macimorelin is currently marketed under the tradename Ghryvelin® in the European Economic Area and the United Kingdom through an exclusive licensing agreement with Pharmanovia. To date the product has launched in the United Kingdom, Sweden, Denmark, Finland, Germany, Netherlands and Austria. More EU countries will follow pending re-imbursement negotiations. The Company’s several other license and commercialization partners are also seeking approval for commercialization of macimorelin in Israel and the Palestinian Authority, the Republic of Korea, Turkey and several non-European Union Balkan countries. The Company is actively pursuing business development opportunities for the commercialization of macimorelin in North America, Asia and the rest of the world.

Macimorelin Clinical Program

In late 2020, the Company entered into the start-up phase for the clinical safety and efficacy study, AEZS-130-P02 (“DETECT-trial”), evaluating macimorelin for the diagnosis of child growth hormone deficiency (CGHD). The DETECT-trial is an open-label, single dose, multicenter and multinational study was expected to enroll approximately 100 subjects worldwide (incl. sites in U.S: and EU), with at least 40 pre-pubertal and 40 pubertal subjects. The study design was expected to be suitable to support a claim for potential stand-alone testing, if successful. On April 22, 2021, the U.S. FDA Investigational New Drug Application associated with this clinical trial became active, (see: https://clinicaltrials.gov/ct2/show/NCT04786873), and in Q2, 2024, the last patient visit was conducted successfully in Europe and the study had enrolled a combined 100 subjects in Europe and North America.

In Q3, 2024, the Company reported top line data from the DETECT trial. The findings indicated that macimorelin consistently demonstrated its ability to stimulate growth hormone release as required for a growth hormone stimulation test, however, it did not meet the primary efficacy endpoint as defined in the study protocol. The study compared the macimorelin test to current standard growth hormone stimulation tests (arginine and clonidine). Although further analysis are necessary, an initial review suggests that the comparator tests may have resulted in a high false positive rate, affecting macimorelin’s success in achieving the primary efficacy endpoint. These results necessitate further clarification and re-analysis to consider the trial outcome and the strategy moving forward.

Avenanthramides for Potential Applications in Inflammation Based Diseases

Avenanthramides have garnered significant interest due to their suggested bioactivities, including potent antioxidant and anti-inflammatory effects both in vitro and in vivo. In November 2023, the Company initiated its Phase 1 safety study evaluating its flagship product, avenanthramides, for potential applications in managing conditions related to inflammation. The Phase 1-2a study (“AvenActive”) is a double-blind, placebo-controlled, randomized, adaptive, first-in-human study designed to assess safety, tolerability, and pharmacokinetics of single and multiple ascending oral doses of avenanthramide. 72 healthy subjects will be enrolled in the Phase 1 portion of the trial. The single ascending dose (SAD) arm includes 6 cohorts of 8 healthy subjects, while the multiple ascending dose (MAD) arm will include 3 cohorts of 8 healthy subjects.

The first arm of the SAD phase of the study has been completed with 6 groups of 8 healthy subjects per group received doses ranging from 30mg to 960mg per group per day. No significant adverse reactions have been observed during this SAD phase. The Company initiated the MAD arm during Q3, the summer 2024. Following the Phase 1 portion, pending successful results, the AvenActive protocol also includes a Phase 2a portion for patients presenting evidence of mild to moderate inflammation. A total of 24 patients will be enrolled in the Phase 2a portion.

The Phase 1-2a trial is designed to evaluate the safety profile of avenanthramides and gather initial insights into its potential efficacy. As the trial progresses, the Company remains focused on collaborating with regulatory authorities, healthcare professionals, and patient communities to bring this innovative therapy to market.

Condensed Interim Consolidated Statements of Loss and Comprehensive Loss Data

| (in thousands of US dollars, except loss per share) | | Three months ended | | | Nine months ended | |

| | | September 30, | | | September 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | $ | | | $ | | | $ | | | $ | |

| Revenues | | | 1,871 | | | | 1,952 | | | | 6,265 | | | | 5,929 | |

| Cost of sales | | | (914 | ) | | | (1,147 | ) | | | (3,585 | ) | | | (3,139 | ) |

| Gross profit | | | 957 | | | | 805 | | | | 2,680 | | | | 2,790 | |

| | | | | | | | | | | | | | | | | |

| Research and development | | | 2,799 | | | | 436 | | | | 5,391 | | | | 1,551 | |

| Selling, general and administrative | | | 2,992 | | | | 1,480 | | | | 7,702 | | | | 3,832 | |

| Impairment of intangible assets | | | 1,459 | | | | - | | | | 1,459 | | | | - | |

| Loss from operations | | | (6,293 | ) | | | (1,111 | ) | | | (11,872 | ) | | | (2,593 | ) |

| | | | | | | | | | | | | | | | | |

| Gain due to changes in foreign currency | | | (55 | ) | | | - | | | | (13 | ) | | | - | |

| Finance costs | | | (22 | ) | | | (23 | ) | | | (106 | ) | | | (113 | ) |

| Other income | | | 231 | | | | 146 | | | | 389 | | | | 260 | |

| Change in fair value of warrant and DSU liabilities | | | 272 | | | | - | | | | 2,026 | | | | - | |

| Other income | | | 426 | | | | 123 | | | | 2,296 | | | | 147 | |

| | | | | | | | | | | | | | | | | |

| Loss before income taxes | | | (5,867 | ) | | | (988 | ) | | | (9,576 | ) | | | (2,446 | ) |

| | | | | | | | | | | | | | | | | |

| Income tax recovery | | | 112 | | | | 212 | | | | 998 | | | | 525 | |

| Net loss | | | (5,755 | ) | | | (776 | ) | | | (8,578 | ) | | | (1,921 | ) |

| | | | | | | | | | | | | | | | | |

| Other comprehensive loss: | | | | | | | | | | | | | | | | |

| Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | (334 | ) | | | (568 | ) | | | (841 | ) | | | (22 | ) |

| Items that will not be reclassified subsequently to profit or loss: | | | | | | | | | | | | | | | | |

| Actuarial loss on defined benefit plans | | | (936 | ) | | | - | | | | (936 | ) | | | - | |

| Comprehensive loss | | | (7,025 | ) | | | (1,344 | ) | | | (10,355 | ) | | | (1,943 | ) |

| | | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | | (1.85 | ) | | | (0.42 | ) | | | (3.58 | ) | | | (1.04 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding (basic and diluted) | | | 3,106,503 | | | | 1,847,678 | | | | 2,394,927 | | | | 1,847,068 | |

Summarized Interim Consolidated Statements of Financial Position Data

| (in thousands of US dollars) | | September 30,

2024 | | | December 31,

2023 | |

| | | $ | | | $ | |

| Cash and cash equivalents | | | 19,998 | | | | 6,678 | |

| Trade and other receivables and other assets | | | 6,725 | | | | 1,398 | |

| Inventory | | | 3,306 | | | | 4,009 | |

| Restricted cash equivalents | | | 126 | | | | 8 | |

| Property, equipment and intangible assets | | | 13,614 | | | | 11,652 | |

| Total assets | | | 43,769 | | | | 23,745 | |

| Payables and accrued liabilities and income taxes payable | | | 4,930 | | | | 1,012 | |

| Current portion of provisions | | | 504 | | | | - | |

| Current portion of deferred revenues | | | 46 | | | | - | |

| Lease liabilities | | | 1,616 | | | | 1,698 | |

| Warrants and DSU liabilities | | | 2,282 | | | | - | |

| Non-financial non-current liabilities (1) | | | 14,377 | | | | - | |

| Total liabilities | | | 23,755 | | | | 2,710 | |

| Shareholders’ equity | | | 20,014 | | | | 21,035 | |

| Total liabilities and shareholders’ equity | | | 43,769 | | | | 23,745 | |

| (1) | Comprised mainly of employee future benefits and non-current portion of deferred revenues. |

Revenue and cost of sales

The following table summarizes our gross margin earned during the periods indicated:

| (in thousands of US dollars, except percentages) | | Three months ended September 30, | |

| | | 2024 | | | 2023 | | | Change | | | Change | |

| | | $ | | | $ | | | $ | | | % | |

| Revenue | | | | | | | | | | | | | | | | |

| Active ingredients | | | 1,707 | | | | 1,952 | | | | (245 | ) | | | -13 | % |

| Pharmaceutical | | | 164 | | | | - | | | | 164 | | | | 100 | % |

| Total revenue | | | 1,871 | | | | 1,952 | | | | (81 | ) | | | -4 | % |

| Cost of sales | | | | | | | | | | | | | | | | |

| Active ingredients | | | 839 | | | | 1,147 | | | | 308 | | | | 27 | % |

| Pharmaceutical | | | 75 | | | | - | | | | (75 | ) | | | -100 | % |

| Total cost of sales | | | 914 | | | | 1,147 | | | | 233 | | | | 20 | % |

| Gross Margin | | | 957 | | | | 805 | | | | 152 | | | | 19 | % |

| Gross Margin % | | | 51 | % | | | 41 | % | | | | | | | | |

Our total revenue for the three-month period ended September 30, 2024, was $1.9 million as compared to $2.0 million for the same period in 2023, a decrease of $0.1 million. This decrease was primarily due to a $0.3 million decrease in sales of Avenanthramides, Beta Glucan and Oat Oil from prior period, offset by a $0.2 million in sales of Macrilen due to the acquisition of Aeterna as described in the plan of arrangement section above. Cost of sales for the three-month period ended September 30, 2024, decreased by $0.2 million, primarily due to the lower sales volumes during the period.

| (in thousands of US dollars, except percentages) | | Nine months ended September 30, | |

| | | 2024 | | | 2023 | | | Change | | | Change | |

| | | $ | | | $ | | | $ | | | % | |

| Revenue | | | | | | | | | | | | | | | | |

| Active ingredients | | | 6,098 | | | | 5,929 | | | | 169 | | | | 3 | % |

| Pharmaceutical | | | 167 | | | | - | | | | 167 | | | | 100 | % |

| Total revenue | | | 6,265 | | | | 5,929 | | | | 336 | | | | 6 | % |

| Cost of sales | | | | | | | | | | | | | | | | |

| Active ingredients | | | 3,506 | | | | 3,139 | | | | (367 | ) | | | -12 | % |

| Pharmaceutical | | | 79 | | | | - | | | | (79 | ) | | | -100 | % |

| Total cost of sales | | | 3,585 | | | | 3,139 | | | | (446 | ) | | | -14 | % |

| Gross Margin | | | 2,680 | | | | 2,790 | | | | (110 | ) | | | -4 | % |

| Gross Margin % | | | 43 | % | | | 47 | % | | | | | | | | |

Our total revenue for the nine-month period ended September 30, 2024, was $6.3 million as compared to $5.9 million for the same period in 2023, an increase of $0.4 million. This increase was primarily due to a $0.2 million increase in sales of Avenanthramides, Beta Glucan and Oat Oil from the prior period as well as a $0.2 million in sales of Macrilen due to the acquisition of Aeterna as described in the plan of arrangement section above. Cost of sales for the nine-month period ended September 30, 2024, increased by $0.4 million, primarily due to the lower sales volumes during the period.

Research and development expenses

The following table summarizes our research and development expenses incurred during the periods indicated:

| (in thousands of US dollars, except percentages) | | Three months ended September 30, | |

| | | 2024 | | | 2023 | | | Change | | | Change | |

| | | $ | | | $ | | | $ | | | % | |

| Direct research and development expenses: | | | | | | | | | | | | | | | | |

| Avenanthramides for inflammation-based diseases | | | 328 | | | | 72 | | | | 256 | | | | 356 | % |

| Macimorelin pediatric DETECT-trial | | | 1,301 | | | | - | | | | 1,301 | | | | 100 | % |

| PGX | | | 15 | | | | 10 | | | | 5 | | | | 50 | % |

| Additional programs | | | 638 | | | | 124 | | | | 514 | | | | 415 | % |

| Sub total | | | 2,282 | | | | 206 | | | | 2,076 | | | | 1,008 | % |

| Employee-related expenses | | | 470 | | | | 219 | | | | 251 | | | | 115 | % |

| Facilities, depreciation, and other expenses | | | 47 | | | | 11 | | | | 36 | | | | 327 | % |

| Total | | | 2,799 | | | | 436 | | | | 2,363 | | | | 542 | % |

Our total research and development expenses for the three-month period ended September 30, 2024, were $2.8 million as compared to $0.4 million for the same period in 2023, an increase of $2.4 million. This increase was primarily due to:

| | ● | Increased spending on phase 1-2a clinical study on avenanthramides for inflammation-based diseases of $0.3 million; and |

| | ● | Trial costs associated with the DETECT trial of $1.3 million and $0.5 million costs related to other pharmaceutical projects, attributable to the acquisition of Aeterna; and |

| | ● | An increase in employee and facility related costs of $0.3 million, also attributable to the acquisition of Aeterna. |

| (in thousands of US dollars, except percentages) | | Nine months ended September 30, | |

| | | 2024 | | | 2023 | | | Change | | | Change | |

| | | $ | | | $ | | | $ | | | % | |

| Direct research and development expenses: | | | | | | | | | | | | | | | | |

| Avenanthramides for inflammation-based diseases | | | 1,601 | | | | 371 | | | | 1,230 | | | | 332 | % |

| Macimorelin pediatric DETECT-trial | | | 1,682 | | | | - | | | | 1,682 | | | | 100 | % |

| PGX | | | 64 | | | | 95 | | | | (31 | ) | | | -33 | % |

| Additional programs | | | 974 | | | | 426 | | | | 548 | | | | 129 | % |

| Sub total | | | 4,321 | | | | 892 | | | | 3,429 | | | | 384 | % |

| Employee-related expenses | | | 996 | | | | 637 | | | | 359 | | | | 56 | % |

| Facilities, depreciation, and other expenses | | | 74 | | | | 22 | | | | 52 | | | | 236 | % |

| Total | | | 5,391 | | | | 1,551 | | | | 3,840 | | | | 248 | % |

Our total research and development expenses for the nine-month period ended September 30, 2024, were $5.4 million as compared to $1.6 million for the same period in 2023, an increase of $3.8 million. This increase was primarily due to:

| | ● | Increased spending on phase 1-2a clinical study on avenanthramides for inflammation-based diseases of $1.2 million; |

| | ● | An increase in trial costs associated with the DETECT trial of $1.7 million and $0.5 million costs related to other pharmaceutical projects, attributable to the acquisition of Aeterna; and |

| | ● | An increase in employee and facility-related costs of $0.4 million, also attributable to the acquisition of Aeterna. |

Selling, general and administrative expenses

The following table summarizes our Selling, general and administrative expenses incurred during the period indicated:

| (in thousands of US dollars, except percentages) | | Three months ended September 30, | |

| | | 2024 | | | 2023 | | | Change | | | Change | |

| | | $ | | | $ | | | $ | | | % | |

| Selling, general and administrative expenses: | | | | | | | | | | | | | | | | |

| Salaries & benefits | | | 1,213 | | | | 413 | | | | 800 | | | | 194 | % |

| Insurance | | | 290 | | | | 37 | | | | 253 | | | | 684 | % |

| Professional fees | | | 488 | | | | 724 | | | | (236 | ) | | | -33 | % |

| Other office & general expenses | | | 1,001 | | | | 306 | | | | 695 | | | | 227 | % |

| Total selling, general and administrative expenses | | | 2,992 | | | | 1,480 | | | | 1,512 | | | | 102 | % |

Our total selling, general and administrative expenses for the three-month period ended September 30, 2024, were $3.0 million as compared to $1.5 million for the same period in 2023, an increase of $1.5 million. This increase from the prior period is primarily due to the acquisition of Aeterna, resulting in $0.8 million additional Salary & benefit costs as a result of the additional headcount, a $0.3 million increase in Insurance and $0.7 million additional other office & general expenses offset by lower $0.2 million Professional fees related to the acquisition in the same period in 2023 that was not repeated in 2024.

| (in thousands of US dollars, except percentages) | | Nine months ended September 30, | |

| | | 2024 | | | 2023 | | | Change | | | Change | |

| | | $ | | | $ | | | $ | | | % | |

| Selling, general and administrative expenses: | | | | | | | | | | | | | | | | |

| Salaries & benefits | | | 2,068 | | | | 1,393 | | | | 675 | | | | 48 | % |

| Insurance | | | 441 | | | | 136 | | | | 305 | | | | 224 | % |

| Professional fees | | | 2,671 | | | | 1,236 | | | | 1,435 | | | | 116 | % |

| Other office & general expenses | | | 2,522 | | | | 1,067 | | | | 1,455 | | | | 136 | % |

| Total selling, general and administrative expenses | | | 7,702 | | | | 3,832 | | | | 3,870 | | | | 101 | % |

Our total selling, general and administrative expenses for the nine-month period ended September 30, 2024, were $7.7 million as compared to $3.8 million for the same period in 2023, an increase of $3.9 million. This was primarily attributable due to the acquisition of Aeterna as described in the plan of arrangement section above and resulted with:

| | ● | An increase in Salaries & benefits of $0.7 million. |

| | ● | An increase in Insurance costs $0.3 million |

| | ● | An increase in Professional fees of $1.4 million, incurred primarily in the first six months of 2024 |

| | ● | An increase in office & general expenses of $1.5 million. |

Impairment of intangible assets

During the three-month period ended September 30, 2024, the Company concluded an indicator of impairment existed related to its macimorelin patent intangible assets due to the primary efficacy endpoint for the pediatric clinical trial not being met according to the definitions in the study protocol and thus requiring further analysis of the study results. These results require further clarification and some reanalysis with the aim to consider the trial outcome and the strategy moving forward.

As a result, the Company performed an impairment test. The recoverable value of the macimorelin patent intangible assets was based on a fair value less costs of disposal determined using the royalty relief method using discounted cash flow models. Management developed assumptions related to revenue, royalty rates, discount rates and probability of possible scenarios. The royalty rate and the range of discount rates used of 21.7% to 25.8% are key assumptions classified as Level 3 in the fair value hierarchy, as they are not based on observable market data. The Company compared the carrying amount of the intangible asset to the fair value, and the recoverable amount of $1,807 was determined to be lower than the carrying value and a $1,459 impairment loss was recorded in the three months ended September 30, 2024.

A change in the assumption of the probability of possible scenarios by an increase or decrease of 10% would result in a change in the impairment by $375.

As at September 30, 2024, there remains significant uncertainty with regards to the trial outcome and the strategy moving forward.

Net other income (costs)

For the three-month period ended September 30, 2024, our net other income was $0.4 million as compared to $0.1 million for the three-month period ended September 30, 2023, an increase of $0.3 million. This was primarily attributable to the change in fair value of warrant and DSU liabilities in the amount of $0.3 million.

Net other income for the nine-month period ended September 30, 2024, was $2.3 million as compared to $0.1 million for the same period in 2023, an increase of $2.2 million. This was primarily attributable to the change in fair value of warrant and DSU liabilities in the amount of $2.0 million and an increase in net interest income of $0.2 million.

Net loss

For the three-month period ended September 30, 2024, we reported a consolidated net loss of $5.8 million, or $1.85 loss per common share, as compared with a consolidated net loss of $0.8 million, or $0.42 loss per common share for the same period in 2023. The $5.0 million increase in net loss is attributable to:

| | ● | a $0.1 million decrease in revenues offset by lower cost of sales of $0.2 million; and |

| | ● | an increase in research and development costs of $2.4 million due primarily to increase in costs associated with the avenanthramides and DETECT clinical trials; and |

| | ● | an increase in selling, general and administrative costs of $1.5 million due primarily to the acquisition of Aeterna; and |

| | ● | a $1.5 million impairment expense related to the Macrilen patents; offset by |

| | ● | an increase in other income of $0.3 million due to changes in the fair value of warrant and DSU liabilities. |

For the nine-month period ended September 30, 2024, we reported a consolidated net loss of $8.6 million, or $3.58 loss per common share, as compared with a consolidated net loss of $1.9 million, or $1.04 loss per common share for the same period in 2023. The $6.7 million increase in net loss is attributable to:

| | ● | an increase in research and development costs of $3.8 million due primarily to increase in costs associated with the avenanthramides and DETECT clinical trials; and |

| | ● | an increase in selling, general and administrative of $3.9 million due primarily to the acquisition of Aeterna; and |

| | ● | a $1.5 million impairment expense related to the Macrilen patents; offset by |

| | ● | an increase in other income of $2.0 million due to changes in the fair value of warrant and DSU liabilities; and |

| | ● | An increase in income tax recovery of $0.5 million. |

Selected quarterly financial data

| | | Three months ended | |

| (in thousands of US dollars, except for per share data) | | September 30, 2024 | | | June 30, 2024 | | | March 31, 2024 | | | December 31, 2023 | |

| | | $ | | | $ | | | $ | | | $ | |

| Revenues | | | 1,871 | | | | 2,337 | | | | 2,057 | | | | 1,213 | |

| Net loss | | | (5,755 | ) | | | (1,422 | ) | | | (1,401 | ) | | | (1,565 | ) |

| Net loss per share (basic and diluted) (1) | | | (1.85 | ) | | | (0.64 | ) | | | (0.47 | ) | | | (0.52 | ) |

| | | Three months ended | |

| (in thousands of US dollars, except for per share data) | | September 30, 2023 | | | June 30, 2023 | | | March 31, 2023 | | | December 31, 2022 | |

| | | $ | | | $ | | | $ | | | $ | |

| Revenues | | | 1,952 | | | | 1,392 | | | | 2,585 | | | | 2,447 | |

| Net (loss) / profit | | | (776 | ) | | | (860 | ) | | | (285 | ) | | | (170 | ) |

| Net (loss) / profit per share (basic and diluted) (1) | | | (0.42 | ) | | | (0.47 | ) | | | (0.09 | ) | | | (0.06 | ) |

| (1) | Net loss per share is based on the weighted average number of shares outstanding during each reporting period, which may differ on a quarter-to-quarter basis. As such, the sum of the quarterly net loss per share amounts may not equal full-year net loss per share. |

Historical quarterly results of operations and net loss cannot be taken as reflective of recurring revenue or expenditure patterns of predictable trends, largely given the non-recurring nature of certain components of our revenues, unpredictable quarterly variations in net finance income and of foreign exchange gains and losses.

Historical quarterly sales and results primarily fluctuate due to variations in the timing of customer orders of different product mixes, and changes in the optimal use of our capacity to manufacture products.

Liquidity and capital resources

The Company’s objective in managing capital, consisting of shareholders’ equity, with cash and cash equivalents being its primary components, is to ensure sufficient liquidity to fund research and development costs, production costs, selling expenses, general and administrative expenses and working capital requirements. Over the past several years, we have raised capital via public and private equity offerings and issuances and have entered licensing and collaborative arrangements, consideration from which, together with proceeds from equity issuances, has been our primary source of liquidity. The capital management objective of the Company remains the same as that in previous periods. The policy on dividends is to retain cash to keep funds available, to finance the activities required to advance the Company’s product development portfolio and to pursue appropriate commercial opportunities as they may arise. The Company is not subject to any capital requirements imposed by any regulators or by any other external source.

Cash flows

The following table shows a summary of our consolidated cash flows for the periods indicated:

| (in thousands of US dollars) | | Three months ended | | | Nine months ended | |

| | | September 30, | | | September 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | $ | | | $ | | | $ | | | $ | |

| Cash and cash equivalents – Beginning of period | | | 27,804 | | | | 8,538 | | | | 6,678 | | | | 10,190 | |

| Net cash used in operating activities | | | (7,779 | ) | | | 144 | | | | (11,569 | ) | | | (1,497 | ) |

| Net cash used in financing activities | | | (188 | ) | | | (59 | ) | | | (386 | ) | | | (192 | ) |

| Net cash used in investing activities | | | 83 | | | | (50 | ) | | | 25,399 | | | | (135 | ) |

| Effect of exchange rate changes on cash & cash equivalents | | | 78 | | | | (209 | ) | | | (124 | ) | | | (2 | ) |

| Cash and cash equivalents – End of period | | | 19,998 | | | | 8,364 | | | | 19,998 | | | | 8,364 | |

Operating Activities

Cash used by operating activities was $7.8 million for the three-month period ended September 30, 2024, as compared to $0.1 million provided by operating activities in the same period in 2023. This $7.9 million increase in operating cash outflows is attributed primarily to:

| | ● | an increase in research and development costs of $2.4 million due primarily to increase in costs associated with the avenanthramides and DETECT clinical trials as well as the additional programs; |

| | ● | an increase in selling, general and administrative costs of $1.5 million due primarily to the salaries and benefits expense as well as other office and general expenses; and |

| | ● | a decrease in operating assets and liabilities of $4.1 million, primarily due to the acquisition of Aeterna; offset by |

| | ● | an increase in gross margin of $0.1 million from prior period. |

Cash used by operating activities was $11.6 million for the nine-month period ended September 30, 2024, as compared to $1.5 million in the same period in 2023. This $10.1 million increase in operating cash outflows is attributed primarily to:

| | ● | An increase in research and development costs of $3.8 million due primarily to increase in costs associated with the avenanthramides and DETECT clinical trials as well as the additional programs; and |

| | ● | an increase in selling, general and administrative of $3.9 million due primarily to the acquisition of Aeterna as well as salaries and benefits and office and general expenses; and |

| | ● | a decrease in operating assets and liabilities of $2.4 million, primarily due to the acquisition of Aeterna. |

Investing activities

Cash provided by investing activities totaled $0.1 million for the three-month period ended September 30, 2024, as compared to cash used of $0.1 million in the same period in 2023. This $0.2 million increase in investing cash inflows is attributed primarily to a $0.2 million reduction in restricted cash equivalents.

Capital Stock

As of November 6, 2024, we had 3,123,513 common shares issued and outstanding, as well as, 80,062 stock options, 77,250 deferred share units and 672,746 warrants outstanding. Each stock option, deferred share unit and warrant is exercisable for one common share.

Adequacy of financial resources

As of September 30, 2024, the Company had retained earnings of $5.2 million, a net loss of $8.6 million and negative cash flows from operations of $11.6 million for the nine-month period ended September 30, 2024. We believe that our existing cash on hand will be sufficient to fund our anticipated operating and capital expenditure requirements for at least the next 12 months. We plan to finance our future operations and capital expenditures primarily through products sales and cash on hand. We also believe that our existing cash on hand will be sufficient to fund our anticipated operating and capital expenditure requirements beyond the next 12 months and through to 2026. We have based this estimate on assumptions that may prove to be wrong, and we could exhaust our capital resources sooner than we expect. We may also require additional capital to pursue in-licenses or acquisitions of other product candidates.

Our forecast of the period through which our financial resources will be adequate to support our operations is a forward-looking statement that involves risks and uncertainties, and actual results could vary materially as a result of a number of factors. Our future capital requirements are difficult to forecast and will depend on many factors, including:

| | ● | the terms and timing of any other collaboration, licensing, and other arrangements that we may establish; |

| | ● | the initiation, progress, timing, and completion of preclinical studies and clinical trials for our current and future potential product candidates, as well as other research and development programs; |

| | ● | our alignment with the FDA on regulatory approval requirements; |

| | ● | the number and characteristics of product candidates that we pursue; |

| | ● | the outcome, timing, and cost of regulatory approvals; |

| | ● | delays that may be caused by changing regulatory requirements; |

| | ● | the cost and timing of hiring new employees to support our continued growth and potential expense associated with any loss of key personnel; |

| | ● | the costs involved in filing and prosecuting patent applications and enforcing and defending patent claims; |

| | ● | the costs of filing and prosecuting intellectual property rights and enforcing and defending any intellectual property-related claims; |

| | ● | the costs associated with any potential late receipt or non-receipt of trade and other receivables; |

| | ● | the potential costs associated with foreign currency fluctuations or changing interest rates; |

| | ● | our ability to expand our customer base and related demand fluctuations; |

| | ● | the costs associated with any potential interruption or quality impacts on raw material supplies; |

| | ● | the costs of responding to and defending ourselves against complaints and potential litigation; |

| | ● | the costs and timing of procuring clinical and commercial supplies for our product candidates; and |

| | ● | the extent to which we acquire or in-license other product candidates and technologies. |

Contractual obligations and commitments as of September 30, 2024

Significant expenditure contracted for at the end of the reporting period but not recognized as liabilities is as follows:

| (in thousands of US dollars) | | TOTAL | |

| | | $ | |

| Less than 1 year | | | 2,715 | |

| 1 - 5 years | | | 56 | |

| | | | 2,771 | |

The Company executed various agreements including in-licensing and similar arrangements with development partners. Such agreements may require the Company to make payments on achievement of stages of development, launch or revenue milestones, although the Company generally has the right to terminate these agreements at no penalty. The Company may have to pay up to $30,016 upon achieving certain sales volumes, regulatory or other milestones related to specific products.

In addition, the Company previously entered into license agreements with Agriculture Canada (AG) for a technology to increase the concentration of avenanthramides in selected oat and with University of Alberta for a Pressurized Gaz expanded Technology (PGX) for the processing of various polymers. Royalties percentage rate would be 2% strictly for sales made from avenanthramides produced from the AG technology while royalty percentage rates would range between1.0% to 3.5% for sales made from products manufactured using the PGX Technology, the rate being according to the classification of the resulting product (cosmeceutical, nutraceutical, pharmaceutical).

The Company has entered into a purchase commitment with a European specialized engineering firm for the supply of engineering, services and equipment related to the construction of a PGX-100 pilot plant. As of September 30, 2024 the remaining purchase commitment is $491 (€438) and is expected to be completed in 2024.

Contingencies

From time to time, the Company may be a party to litigation and subject to claims incidental to its business. Although the results of litigation and claims cannot be predicted with certainty, the Company currently believes that the final outcome of these matters will not have a material adverse effect on its business. At each reporting period, the Company evaluates whether or not a potential loss amount or a potential range of loss is probable and reasonably estimable, requiring recognition of a loss accrual, or whether the potential loss is reasonably possible, requiring potential disclosure.

Critical Accounting Policies, Estimates and Judgements

The preparation of condensed interim consolidated financial statements in accordance with IFRS requires management to make judgements, estimates and assumptions about the future that affect the reported amounts of the Company’s assets, liabilities, revenues, expenses and related disclosures. Judgements, estimates and assumptions are based on historical experience, expectations, current trends and other factors that management believes to be relevant at the time at which the Company’s condensed interim consolidated financial statements are prepared.

Management reviews, on a regular basis, the Company’s accounting policies, assumptions, estimates and judgements to ensure that the condensed interim consolidated financial statements are presented fairly and in accordance with IFRS applicable to interim financial statements. Revisions to estimates are recognized prospectively. Critical accounting estimates and assumptions are those that have a significant risk of causing material adjustment and are often applied to matters or outcomes that are inherently uncertain and subject to change. As such, management cautions that future events often vary from forecasts and expectations and that estimates routinely require adjustment.

Critical accounting estimates and assumptions, as well as critical judgements used in applying accounting policies in the preparation of the Company’s condensed interim consolidated financial statements, were the same as those applied to Ceapro’s annual consolidated financial statements as of and for the year ended December 31, 2023, except for as described below:

| | ● | Measurement of defined benefit obligations: key actuarial assumptions; and |

| | ● | Business acquisition: identification of the acquirer, determination of the fair value of the consideration transferred and fair value of some of the assets acquired and liabilities assumed; and |

| | ● | Impairment of intangible assets: recoverable value of the intangible assets was based on a fair value less costs of disposal. |

Financial Risk Factors and Other Financial Instruments

The nature and extent of our exposure to risks arising from financial instruments, including credit risk, liquidity risk and market risk and how we manage those risks are described in note 15 to the Ceapro’s audited consolidated financial statements for the year ended December 31, 2023, as well as in notes 11 and 12 to the COSCIENS Biopharma interim consolidated financial statements for the nine-month period ended September 30, 2024.

Related Party Transactions

Other than employment agreements and indemnification agreements with our management, there are no related party transactions.

Off-Balance Sheet Arrangements

As of September 30, 2024, we did not have any interests in special purpose entities or any other off-balance sheet arrangements.

Risk Factors and Uncertainties

An investment in our securities involves a high degree of risk. In addition to the other information included in this MD&A and in the related consolidated financial statements, investors are urged to carefully consider the risks described under the heading “Risk Factors” in our most recent Annual Report on Form 20-F for the year ended December 31, 2023 and under the heading “Risks and Uncertainties” in Exhibit 99.2 of our Form 6-K furnished to the SEC on May 14, 2024, for a discussion of the various risks that may materially affect our business. The risks and uncertainties not presently known to us or that we currently deem immaterial may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment.

Our most recent Annual Report on Form 20-F and Exhibit 99.2 of our Form 6-K furnished to the SEC on May 14, 2024, were filed with the relevant Canadian and U.S. securities’ regulatory authorities at www.sedarplus.ca and with the SEC at www.sec.gov. Investors are urged to consult the risk factors in these documents.

Disclosure Controls and Procedures

The Chief Executive Officer and the Chief Financial Officer of the Company are responsible for establishing and maintaining our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act and Canadian securities legislation). Our disclosure controls and procedures are designed to ensure that information required to be disclosed in the reports we file or submit under U.S. and Canadian securities legislation is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including the Chief Executive Officer and the Chief Financial Officer, to allow timely decisions regarding required disclosures.

Any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objective and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. There have been no significant changes to our disclosure controls and procedures for the three-month period ended September 30, 2024, that have materially affected, or are reasonably likely to materially affect, the disclosure controls and procedures.

Internal Controls over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act and Canadian securities legislation). Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS as issued by the IASB.

Our internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of COSCIENS Biopharma Inc.; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with IFRS as issued by the IASB, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the issuer; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of Company assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Changes in Internal Controls over Financial Reporting

On June 3, 2024, we completed the business combination transaction with Ceapro, which was accounted for a reverse acquisition. We are currently in the process of integrating Ceapro’s internal controls over financial reporting.

Other than with respect to the Ceapro business combination, there have been no significant changes to our internal controls over financial reporting for the three-month period ended September 30, 2024, that have materially affected, or are reasonably likely to materially affect, internal controls over financial reporting.