QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

THE MEDICINES COMPANY | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: $ | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

PRELIMINARY COPY

April , 2005

To Our Stockholders:

We are pleased to invite you to our 2005 annual meeting of stockholders. The meeting will take place on Wednesday, May 25, 2005 at 10:00 a.m., local time, at our principal executive offices, located at 8 Campus Drive, Parsippany, New Jersey 07054. Annual meetings play an important role in maintaining communications and understanding among our management, board of directors and stockholders, and we hope you will join us.

Enclosed with this letter you will find the notice of our 2005 annual meeting of stockholders, which lists the matters to be considered at the meeting, and the proxy statement, which describes the matters listed in the notice and provides other information you may find useful in deciding how to vote. We have also enclosed our annual report to stockholders for the year ended December 31, 2004, which contains our annual report on Form 10-K filed with the Securities and Exchange Commission, including our audited consolidated financial statements and other information of interest to our stockholders.

The ability to have your vote counted at the meeting is an important stockholder right. Regardless of the number of shares you hold, and whether or not you plan to attend the meeting, we hope that you will cast your vote. If you are a stockholder of record, you may vote by mailing the enclosed proxy card in the envelope provided. You will find voting instructions in the proxy statement and on the enclosed proxy card. If your shares are held in "street name"—that is, held for your account by a bank, broker or other holder of record—you will receive instructions from the holder of record that you must follow for your shares to be voted.

Thank you for your ongoing support and continued interest in The Medicines Company.

Sincerely,

CLIVE A. MEANWELL

Chairman and Chief Executive Officer

THE MEDICINES COMPANY

8 Campus Drive

Parsippany, New Jersey 07054

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

Time and Date | 10:00 a.m., local time, on Wednesday, May 25, 2005 | |||

Place | 8 Campus Drive, Parsippany, New Jersey 07054 | |||

Items of Business | At the meeting, we will ask you and our other stockholders to: | |||

(1) | elect three class 2 directors for terms to expire at the 2008 annual meeting of stockholders; | |||

(2) | ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2005; | |||

(3) | approve an amendment to our third amended and restated certificate of incorporation in order to increase the number of shares of common stock authorized for issuance from 75,000,000 to 125,000,000; and | |||

(4) | transact any other business as may properly come before the meeting or any postponement or adjournment of the meeting. | |||

The board of directors has no knowledge of any other business to be transacted at the annual meeting. | ||||

Record Date | You may vote if you were a stockholder of record at the close of business on April 8, 2005. | |||

Proxy Voting | It is important that your shares be represented and voted at the meeting. Whether or not you plan to attend the meeting, please mark, sign, date and promptly mail your proxy card in the enclosed postage-paid envelope. You may revoke your proxy at any time before its exercise at the meeting. | |||

By order of the Board of Directors,

![]()

Paul M. Antinori

Secretary

April , 2005

Parsippany, New Jersey

| INFORMATION ABOUT THE ANNUAL MEETING | 1 | ||

| Who may vote? | 1 | ||

| How may I vote? | 1 | ||

| May I vote if my shares are held in "street name?" | 2 | ||

| How may I change my vote? | 2 | ||

| What constitutes a quorum? | 2 | ||

| What vote is required to approve each matter? | 3 | ||

| How will votes be counted? | 3 | ||

| How does the board of directors recommend that I vote? | 3 | ||

| Will any other business be conducted at the annual meeting? | 3 | ||

| Who pays for the solicitation of proxies? | 3 | ||

| How and when may I submit a proposal for the 2006 annual meeting? | 4 | ||

| DISCUSSION OF PROPOSALS | 4 | ||

| Proposal One: Election of Class 2 Directors | 4 | ||

| Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm | 7 | ||

| Proposal Three: Approval of the Amendment to our Certificate of Incorporation | 8 | ||

| INFORMATION ABOUT CORPORATE GOVERNANCE | 9 | ||

| Corporate Governance | 10 | ||

| Board of Directors | 10 | ||

| Board Independence | 10 | ||

| Board Committees | 10 | ||

| Director Candidates and Nomination Process | 12 | ||

| Code of Business Conduct and Ethics | 13 | ||

| Stockholder Communications with the Board of Directors | 14 | ||

| Director Attendance at Annual Meeting | 14 | ||

| Compensation of Directors | 14 | ||

| Report of the Audit Committee of the Board of Directors | 15 | ||

| INFORMATION ABOUT OUR EXECUTIVE OFFICERS | 17 | ||

| Compensation of Our Executive Officers | 17 | ||

| Employment Agreements | 19 | ||

| Report of the Compensation Committee on Executive Compensation | 20 | ||

| Compensation Committee Interlocks and Insider Participation; Certain Relationships and Related-Party Transactions | 23 | ||

| OTHER INFORMATION | 24 | ||

| Principal Stockholders | 24 | ||

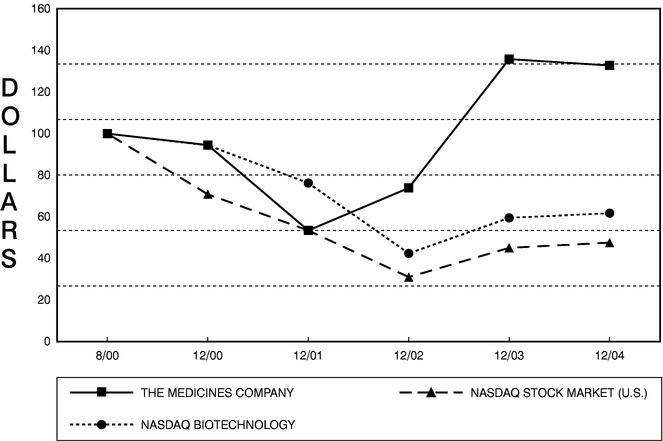

| Comparative Stock Performance | 27 | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | 27 | ||

| Householding of Annual Meeting Materials | 28 | ||

i

THE MEDICINES COMPANY

8 Campus Drive

Parsippany, New Jersey 07054

PROXY STATEMENT

For our Annual Meeting of Stockholders to be held on May 25, 2005

The Medicines Company, a Delaware corporation (often referred to as "we" or "us" in this document), is sending you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at our 2005 annual meeting of stockholders. The annual meeting will be held on Wednesday, May 25, 2005, at 10:00 a.m., local time, at our principal executive offices at 8 Campus Drive, Parsippany, New Jersey 07054. If the annual meeting is adjourned for any reason, then the proxies may be used at any adjournments of the annual meeting.

This proxy statement summarizes information about the proposals to be considered at the meeting and other information you may find useful in determining how to vote. The proxy card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

We are mailing this proxy statement and the enclosed proxy card to stockholders on or about April , 2005. In this mailing, we are also including copies of our annual report to stockholders for the year ended December 31, 2004.

Our annual report on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission and including our audited financial statements, is included in our annual report to stockholders in this mailing and is also available free of charge on our website atwww.themedicinescompany.com or through the SEC's electronic data system atwww.sec.gov. To request a printed copy of our Form 10-K, which we will provide to you free of charge, either: write to Investors Relations, The Medicines Company, 8 Campus Drive, Parsippany, New Jersey 07054, or email Investor Relations atinvestor.relations@themedco.com.

INFORMATION ABOUT THE ANNUAL MEETING

Who may vote?

Holders of record of our common stock at the close of business on April 8, 2005, the record date for the meeting, are entitled to one vote per share on each matter properly brought before the meeting. As of the close of business on April 8, 2005, we had shares of our common stock outstanding. The proxy card states the number of shares you are entitled to vote.

A list of stockholders entitled to vote will be available at the meeting. In addition, you may contact our Secretary, Paul M. Antinori, at our address set forth above, to make arrangements to review a copy of the stockholder list at our offices, for any purpose germane to the meeting, between the hours of 8:30 A.M. and 5:00 P.M., local time, on any business day from May 13, 2005 up to the time of the meeting.

How may I vote?

You may vote your shares at the meeting in person or by proxy:

- •

- to votein person, you must attend the meeting, and then complete and submit the ballot provided at the meeting.

- •

- to voteby proxy, you must mark, sign and date the enclosed proxy card and then mail the proxy card in the enclosed postage-paid envelope. Your proxy will be valid only if you complete and return the proxy card before the meeting. By completing and returning the proxy card, you will direct the designated persons to vote your shares at the meeting in the manner you specify in

1

the proxy card. If you complete the proxy card but do not provide voting instructions, then the designated persons will vote your shares FOR the election of the nominated directors, FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2005 and FOR approval of the amendment to our certificate of incorporation.

May I vote if my shares are held in "street name?"

If the shares you own are held in "street name" by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your bank or brokerage firm provides you. Many banks and brokerage firms may also solicit voting instructions over the Internet or by telephone.

Under the rules of The NASDAQ Stock Market, if you do not give instructions to your bank or brokerage firm, it will still be able to vote your shares with respect to certain "discretionary" items, but will not be allowed to vote your shares with respect to certain "non-discretionary" items. Each of the proposals to be considered at the meeting is a discretionary item under NASDAQ rules. Accordingly, your bank or brokerage firm may exercise its discretionary authority with respect to any of the proposals to be considered at the meeting if you do not provide voting instructions.

Regardless of whether your shares are held in street name, you are welcome to attend the meeting. You may not vote your shares in person at the meeting, however, unless you obtain a proxy, executed in your favor, from the holder of record (i.e., your brokerage firm or bank).

How may I change my vote?

If you are a stockholder of record, even if you complete and return a proxy card, you may revoke it at any time before it is exercised by taking one of the following actions:

- •

- send written notice to Paul M. Antinori, our Secretary, at our address above;

- •

- send us another signed proxy with a later date; or

- •

- attend the meeting, notify our Secretary that you are present, and then vote by ballot.

If you own shares in street name, your bank or brokerage firm should provide you with instructions for changing your vote.

What constitutes a quorum?

In order for business to be conducted at the meeting, a quorum must be present. A quorum consists of the holders of a majority of the shares of common stock issued, outstanding and entitled to vote at the meeting, which equals at least shares.

Shares of common stock present in person or represented by proxy (including "broker non-votes" and shares that abstain or provide no voting instructions with respect to one or more of the matters to be voted upon) will be counted for the purpose of determining whether a quorum exists. "Broker non-votes" are shares with respect to which a bank or brokerage firm does not receive voting instructions from the beneficial holder and does not exercise its discretionary authority in voting on a proposal.

If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

2

What vote is required to approve each matter?

Proposal One—Election of Directors

Directors will be elected by a plurality of the votes cast by our stockholders entitled to vote on the election. In other words, the three nominees for director receiving the highest number of votes FOR election will be elected as directors, regardless of whether any of those numbers represents a majority of the votes cast.

You may vote FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees.

Proposal Two—Ratification of Appointment of Independent Registered Public Accounting Firm

The affirmative vote of the holders of a majority of the shares of common stock present or represented and voting on the matter is needed to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2005.

Proposal Three—Approval of the Amendment to our Certificate of Incorporation

The affirmative vote of the holders of a majority of the shares of common stock issued and outstanding is needed to approve the amendment to our certificate of incorporation.

How will votes be counted?

Each share of common stock will be counted as one vote. Shares will not be voted in favor of a matter, and will not be counted as voting on a matter (1) if the holder of the shares either withholds authority in the proxy to vote for a particular director nominee or nominees, or abstains from voting on a particular matter, or (2) if the shares are broker non-votes. As a result, withheld shares, abstentions and broker non-votes will have no effect on the outcome of voting on proposal one or proposal two. Abstentions and broker non-votes, however, will have the same effect as a vote against proposal three, which requires the affirmative vote of a majority of all outstanding shares of our common stock.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote:

- •

- FOR proposal one—elect our three nominees to the board of directors

- •

- FOR proposal two—ratify the appointment of Ernst & Young as our independent registered public accounting firm for the year ending December 31, 2005

- •

- FOR proposal three—approve the amendment to our certificate of incorporation

Will any other business be conducted at the annual meeting?

Our board of directors does not know of any other business to be conducted or matters to be voted upon at the meeting. Under our by-laws, the deadline for stockholders to notify us of any proposals or nominations for director to be presented for action at the annual meeting has passed. If any other matter properly comes before the meeting, the persons named in the proxy card that accompanies this proxy statement will exercise their judgment in deciding how to vote, or otherwise act, at the meeting with respect to that matter.

Who pays for the solicitation of proxies?

We will bear the costs of soliciting proxies. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone,

3

facsimile, email, personal interviews, and other means. We will also request brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy materials to the persons for whom they hold shares and request instructions for voting the proxies. We will reimburse the brokerage houses and other persons for their reasonable out-of-pocket expenses in connection with this distribution.

How and when may I submit a proposal for the 2006 annual meeting?

If you are interested in submitting a proposal for inclusion in the proxy statement and proxy card for our 2006 annual meeting, you need to follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934. We must receive your proposal intended for inclusion in the proxy statement at our principal executive offices, 8 Campus Drive, Parsippany, New Jersey 07054 Attention: Paul M. Antinori, Secretary, no later than December , 2005.

If you wish to present a proposal at the 2006 annual meeting, but do not wish to have the proposal considered for inclusion in the proxy statement and proxy card, you must also give written notice to us at the address noted above. Our by-laws specify the information that must be included in any such notice, including a brief description of the business to be brought before the annual meeting and the name of the stockholder proposing such business. We must receive this notice at least 60 days, but not more than 90 days, prior to May 25, 2006. However, if the date of the 2006 annual meeting is prior to May 5, 2006 or after July 24, 2006, we must receive your notice no more than the 90 days prior to the 2006 annual meeting and no less than the later of 60 days prior to the 2006 annual meeting or 10 days following the date on which notice of the date of the meeting was mailed or public disclosure was made, whichever occurs first. If you fail to provide timely notice of a proposal to be presented at the 2006 annual meeting, the chairman of the meeting may exclude the proposal from being brought before the meeting.

Proposal One: Election of Class 2 Directors

Our board of directors is divided into three classes and currently consists of three class 1 directors (William W. Crouse, T. Scott Johnson and John P. Kelley), three class 2 directors (Robert J. Hugin, Clive A. Meanwell and Elizabeth H.S. Wyatt) and three class 3 directors (Leonard Bell, Armin M. Kessler and Robert G. Savage). The term of each class of directors is three years, and the terms of the three classes are staggered so that only one class is elected each year. At each annual meeting of stockholders, directors are elected to serve for a three-year term to succeed the directors of the same class whose terms are then expiring. The class 1, class 2 and class 3 directors were elected to serve until the annual meeting of stockholders to be held in 2007, 2005 and 2006, respectively, and until their respective successors are elected and qualified.

Our board of directors, on the recommendation of our nominating and corporate governance committee, has nominated Robert J. Hugin, Clive A. Meanwell and Elizabeth H.S. Wyatt for election as class 2 directors. The persons named in the enclosed proxy card will vote to elect each of these nominees as a class 2 director, unless the proxy is marked otherwise. Each class 2 director will be elected to hold office until the 2008 annual meeting of stockholders and until their successor is elected and qualified. Each of the nominees is presently a director, and each has indicated a willingness to continue serve as director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for substitute nominees selected by our board of directors.

No director or executive officer is related by blood, marriage or adoption to any other director or executive officer.

Our board of directors recommends a voteFOR each of the nominees.

4

Director Nominees

Set forth below are the names of each nominee for class 2 director, the year in which each first became a director, their ages as of April 1, 2005, their positions and offices with us, their principal occupations and business experience during the past five years and the names of other public companies for which they serve as a director.

ROBERT J. HUGIN

Age: 50

Robert J. Hugin has been a director since April 2003. Since June 1999, Mr. Hugin has been the Senior Vice President and Chief Financial Officer of Celgene Corporation, a biopharmaceutical company focused on cancer and immunological diseases. From 1985 to 1999, Mr. Hugin held positions with J.P. Morgan & Co. Inc., an investment banking firm, serving most recently as a Managing Director. Mr. Hugin also currently serves as a director of Celgene Corporation. Mr. Hugin received an A.B. from Princeton University and an M.B.A. from the University of Virginia.

CLIVE A. MEANWELL

Age: 47

Dr. Meanwell has been a director and served as our principal executive officer, or as one of our principal executive officers, continuously since 1996. He has served as our Chief Executive Officer since August 2004, and he served as our President from August 2004 to December 2004, as our Executive Chairman from September 2001 to August 2004 and as our Chief Executive Officer and President from 1996 to September 2001. From 1995 to 1996, Dr. Meanwell was a Partner and Managing Director at MPM Capital, L.P., a venture capital firm. From 1986 to 1995, Dr. Meanwell held various positions at Hoffmann-La Roche, Inc., a pharmaceutical company, including Senior Vice President from 1992 to 1995, Vice President from 1991 to 1992 and Director of Product Development from 1986 to 1991. Dr. Meanwell currently serves as a director of Endo Pharmaceuticals Inc. Dr. Meanwell received an M.D. and a Ph.D. from the University of Birmingham, United Kingdom.

ELIZABETH H.S. WYATT

Age: 57

Elizabeth H.S. Wyatt has been a director since March 2005. Prior to her retirement in 2000, Ms. Wyatt held several senior positions at Merck & Co., Inc. over the course of 20 years, including most recently, Vice President, Corporate Licensing. Ms. Wyatt joined Merck in 1980 and was responsible for many of its major licensing agreements. Previously she had been a consultant and academic administrator, responsible for Harvard Business School's first formal marketing of its executive education programs. She currently serves on the Board of Directors of Neose Technologies, Inc., ARIAD Pharmaceuticals, Inc. and MedImmune, Inc., each of which is a biopharmaceutical company, and the Boards of Trustees of Randolph-Macon College and Sweet Briar College. Ms. Wyatt received an A.B. from Sweet Briar College, an M.Ed. from Boston University and an M.B.A. from Harvard Business School.

Other Current Directors

Set forth below are the names of each of our other current directors, the year in which each first became a director, their ages as of April 1, 2005, their positions and offices with us, their principal occupations and business experience during the past five years and the names of other public companies of which they serve as a director.

5

Directors Whose Terms Expire in 2006 (Class 3 Directors)

LEONARD BELL

Age: 46

Leonard Bell, M.D. has been a director since May 2000. Since March 2002, Dr. Bell has served as the Chief Executive Officer, Secretary and Treasurer of Alexion Pharmaceuticals, Inc., a pharmaceutical company. From January 1992 to March 2002, Dr. Bell also served as the President of Alexion Pharmaceuticals, Inc. Since 1993, Dr. Bell has served as an Adjunct Assistant Professor of Medicine and Pathology at the Yale University School of Medicine. Dr. Bell is the recipient of various honors and awards from academic and professional organizations and his work has resulted in more than 45 scientific publications, invited presentations and patent applications. Dr. Bell currently also serves as a director of Alexion Pharmaceuticals, Inc. Dr. Bell received an A.B. from Brown University and an M.D. from the Yale University School of Medicine.

ARMIN M. KESSLER

Age: 67

Armin M. Kessler has been a director since October 1998. Mr. Kessler joined us after a 35-year career in the pharmaceutical industry, which included senior management positions at Sandoz Pharma Ltd. (now Novartis Pharma AG) in Switzerland, the United States and Japan and, most recently, at Hoffmann-La Roche, Basel, Switzerland, where he was Chief Operating Officer and Head of the Pharmaceutical Division until 1995. Mr. Kessler currently also serves as a director of Spectrum Pharmaceuticals, Inc., Gen-Probe Incorporated and PRA International, Inc. Mr. Kessler received degrees in physics and chemistry from the University of Pretoria, a degree in chemical engineering from the University of Cape Town, a law degree from Seton Hall and an honorary doctorate in business administration from the University of Pretoria.

ROBERT G. SAVAGE

Age: 51

Robert G. Savage has been a director since April 2003. Since May 2003, Mr. Savage has served as President of Strategic Imagery LLC, a consulting company he founded. From March 2002 to April 2003, Mr. Savage was Group Vice President and President for the General Therapeutics and Inflammation Business, of Pharmacia Corporation, a research-based pharmaceutical firm acquired by Pfizer Inc. in April 2003. From September 1996 to January 2002, Mr. Savage held several senior positions with Johnson & Johnson, including Worldwide Chairman for the Pharmaceuticals Group during 2001, Company Group Chairman responsible for the North America pharmaceuticals business from 2000 to 2001, President, Ortho-McNeil Pharmaceuticals from 1998 to 2000 and Vice President Sales & Marketing from 1996 to 1998. Mr. Savage also serves as a director for Noven Pharmaceuticals, which develops advanced drug delivery technologies, NovaDel Pharma Inc., a specialty pharmaceutical company developing drug delivery systems, and EpiCept Corporation, a specialty pharmaceutical company focused on the development and commercialization of topically-delivered prescription pain management therapeutics. Mr. Savage received a B.S. in biology from Upsala College and an M.B.A. from Rutgers University.

Directors Whose Terms Expire in 2007 (Class 1 Directors)

WILLIAM W. CROUSE

Age: 62

William W. Crouse has been a director since April 2003. Since January 1994, Mr. Crouse has been a Managing Director of HealthCare Ventures, a venture capital firm with a focus on biotechnology firms. From 1987 to 1993, Mr. Crouse served as Worldwide President of Ortho Diagnostic Systems, a

6

subsidiary of Johnson & Johnson that manufactures diagnostic tests for hospitals, and a Vice President of Johnson & Johnson International. Before joining Johnson & Johnson, Mr. Crouse was a Division Director of DuPont Pharmaceuticals Company, a pharmaceutical firm, where he was responsible for international operations and worldwide commercial development activities. Before joining Dupont, he served as President of Revlon Health Care Group's companies in Latin America, Canada, and Asia/Pacific. He also held management positions at E.R. Squibb & Sons, a pharmaceutical company. Mr. Crouse currently also serves as a director of ImClone Systems, Inc. and several private biotechnology companies and as a member of the Boards of Trustees of Lehigh University and the New York Blood Center. Mr. Crouse received a B.S. in finance and economics from Lehigh University and an M.B.A. from Pace University.

T. SCOTT JOHNSON

Age: 57

T. Scott Johnson, M.D. has been a director since September 1996. Since July 1999, Dr. Johnson has been a partner at JSB Partners, L.P., an investment bank that he founded in 1999 and which focuses on mergers and acquisitions, private financings and corporate alliances within the healthcare sector. From September 1991 to July 1999, Dr. Johnson served as a founder and managing director of MPM Capital, L.P., a venture capital firm. Dr. Johnson received both a B.S. and an M.D. from the University of Alabama.

JOHN P. KELLEY

Age: 51

John P. Kelley has been our President and Chief Operating Officer since December 2004 and a director since February 2005. Prior to joining us, Mr. Kelley held a series of positions at Aventis, an international pharmaceutical company. From September 2003 until September 2004, Mr. Kelley served as Senior Vice President, Global Marketing and Medical at Aventis, where he was accountable for worldwide brand management of Aventis' core strategic brands and managed strategic alliances with partner companies. From September 2002 to September 2003, he served as Senior Vice President, Strategic Risk Officer for Aventis, advising the Management Board and Chief Executive Officer. From January 2000 to September 2002, Mr. Kelley served as Vice President, Head of Strategic Development of Aventis where he was responsible for leading the strategic planning process of the pharmaceutical division of Aventis as well as merger and acquisition activity. Prior to the formation of Aventis, he served as a Vice President, Commercial Director, U.S. at Hoechst Marion Roussel, Inc., a life sciences firm focused on pharmaceuticals and agriculture, from March 1998 through December 1999. Prior to that, Mr. Kelley served as Vice President of Marketing of Hoechst Marion Roussel from 1995 to 1998. Mr. Kelley received a B.A. from Wilkes University and an M.B.A. from Rockhurst University.

Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm

Our audit committee, consisting of independent members of our board of directors, has appointed the firm of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2005. Ernst & Young LLP has been our independent registered public accounting firm since our inception in 1996. Although stockholder approval of the appointment of Ernst & Young LLP is not required by law, we believe that it is advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the meeting, our audit committee will reconsider this appointment.

We expect representatives of Ernst & Young LLP to be present at the annual meeting. They will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

Our board of directors recommends a voteFOR this proposal.

7

Independent Registered Public Accounting Firm Fees and Other Matters

Fees

The following table sets forth the fees billed to us for the fiscal years ended December 31, 2004 and December 31, 2003 by Ernst & Young LLP:

| Fee Category | 2004 | 2003 | |||||

|---|---|---|---|---|---|---|---|

| Audit Fees(1) | $ | 612,158 | $ | 359,876 | |||

| Audit-Related Fees(2) | 115,500 | 18,000 | |||||

| Tax Fees(3) | 101,711 | 60,457 | |||||

| All Other Fees | — | — | |||||

| Total Fees | $ | 829,369 | $ | 438,333 | |||

- (1)

- Audit fees consist of fees for the audit of our financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements.

- (2)

- Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or the review of our financial statements and which are not reported under "Audit Fees." These services relate to Sarbanes-Oxley consulting.

- (3)

- Tax fees consist of fees for tax compliance, tax advice and tax planning services. Tax compliance services, which relate to preparation of original and amended tax returns, accounted for all of the total tax fees paid for 2004 and 2003.

The audit committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm. This policy generally provides that we will not engage our independent registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by the audit committee or the engagement is entered into pursuant to the pre-approval procedure described below.

From time to time, the audit committee may delegate pre-approval authority to a committee member for specified types of services. Any such pre-approval must be reported to the committee at its next scheduled meeting. We did not approve any services provided to us by Ernst & Young LLP in 2004 or 2003 pursuant to paragraph (c)(7)(i)(c) of Rule 2-01 of Regulation S-X.

Proposal Three: Approval of the Amendment to our Certificate of Incorporation

On February 22, 2005, our board of directors voted to approve, and to recommend to our stockholders that they approve, an amendment to our third amended and restated certificate of incorporation in order to increase the number of shares of common stock authorized for issuance from 75,000,000 to 125,000,000.

To effect this change, the total number of shares of capital stock authorized in our certificate of incorporation would increase from 80,000,000 to 130,000,000, because we are currently authorized to issue up to 5,000,000 shares of undesignated preferred stock. We are not proposing any change to the authorized number of shares of preferred stock. Under Delaware corporate law, we are required to obtain approval from our stockholders to amend our certificate of incorporation to increase the number of shares of authorized common stock.

8

Reasons for Proposal

As of April 1, 2005, we had a total of 49,382,667 shares of common stock outstanding, and approximately 8,810,985 additional shares of common stock reserved for issuance pursuant to our stock option plans and our employee stock purchase plan. As a result, as of April 1, 2005, we had 16,806,348 shares of common stock available for future issuance in excess of the outstanding common stock and shares of common stock reserved under existing stock plans.

Our board of directors believes that it is important to have available for issuance a number of authorized shares of common stock to meet our future corporate needs. If our stockholders approve the proposed amendment to our certificate of incorporation, the additional authorized shares would be available for issuance for any proper corporate purpose, including future acquisitions, capital-raising transactions consisting of either equity or convertible debt, stock splits, stock dividends, or issuances under current and future stock plans. The shares would be issuable at the discretion of the board, without further stockholder action except as may be required for a particular transaction by law or the rules of the NASDAQ Stock Market. The board believes that the additional shares will provide us with needed flexibility to issue shares in the future without the potential expense and delay incident to obtaining stockholder approval for a particular issuance. Except to the extent of our existing obligations on the date of mailing of this proxy statement, we do not currently have any plans, understandings or agreements for the issuance or use of the additional shares of common stock which are subject of this proposal.

Principal Effects on Outstanding Common Stock

Holders of common stock are entitled to one vote per share on all matters submitted to a vote of our stockholders, and they are entitled to receive proportionally any dividends declared by our board of directors, subject to any preferential dividend rights of outstanding preferred stock. In the event of our liquidation or dissolution, holders of our common stock are entitled to share ratably in all assets remaining after payment of all debts and other liabilities, subject to the prior rights of any preferred stock then outstanding. Holders of our common stock do not have any redemption or conversion rights, and the rights, preferences and privileges of holders of our common stock could be adversely affected by the rights of holders of any series of preferred stock that we may designate and issue in the future.

The proposed amendment to our certificate of incorporation to increase the number of shares of authorized common stock would not affect the rights of existing holders of common stock except to the extent that future issuances of common stock will reduce each existing stockholder's proportionate ownership. Holders of common stock do not have any preemptive rights to subscribe for the purchase of any shares of common stock, which means that current holders of common stock do not have a prior right to purchase any new issue of common stock in order to maintain their proportionate ownership.

The issuance of additional shares of common stock could have the effect of making it more difficult for a third party to acquire, or discouraging a third party from attempting to acquire, control of us. We are not aware of any attempts on the part of a third party to effect a change of control of us, and the amendment has been proposed for the reasons stated above and not for any possible anti-takeover effects it may have.

Our board of directors believes the amendment to our certificate of incorporation is in our best interests and the best interests of our stockholders and recommends a voteFOR this proposal.

INFORMATION ABOUT CORPORATE GOVERNANCE

Corporate Governance

We believe that good corporate governance is important to ensure that we are managed for the long-term benefit of our stockholders. We are mindful of the provisions of the Sarbanes-Oxley Act of

9

2002, the rules of the SEC, and the listing standards of The NASDAQ Stock Market, and we expect to continue to review and, when appropriate, further strengthen our corporate governance procedures in the future.

We describe below our corporate governance structure and the key corporate governance practices that we have adopted.

Board of Directors

Our board of directors is responsible for establishing our broad corporate policies and overseeing the management of the company. Our chief executive officer and our other executive officers are responsible for our day-to-day operations. Our board evaluates our corporate performance and approves, among other things, our corporate strategies and objectives, operating plans, major commitments of corporate resources and significant policies. Our board also evaluates and elects our executive officers.

Our board of directors met 21 times during 2004, including regular, special and telephonic meetings. Each director who served as a director during 2004 attended at least 75% of the aggregate of: (1) the total number of board meetings held during the period of 2004 during which he was a director and (2) the total number of meetings held by all board committees on which he served during the period of 2004 during which he was a member of such committees.

Board Independence

Under the rules of The NASDAQ Stock Market, a director will only qualify as an "independent director" if, in the opinion of our board of directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our board of directors has determined that none of our directors, except Dr. Meanwell and Mr. Kelley, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an "independent director" as defined under Rule 4200(a)(15) of The NASDAQ Stock Market Marketplace Rules. Dr. Meanwell and Mr. Kelley are both employees and are therefore not independent. Only independent directors serve on our standing board committees.

Board Committees

Our board of directors has three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The members of the committees are as follows:

| Audit | Compensation | Nominating and Corporate Governance | ||

|---|---|---|---|---|

| Robert J. Hugin (Chair) | Robert G. Savage | William W. Crouse (Chair) | ||

| T. Scott Johnson | Armin M. Kessler | Armin M. Kessler | ||

| Armin M. Kessler | Robert G. Savage |

Each committee operates under a charter that has been approved by our board of directors. A current copy of the charters of the audit committee and the nominating and corporate governance committee is posted on the corporate governance section of "The Medicines Investment" on our website,www.themedicinescompany.com.

10

Audit Committee

The audit committee's responsibilities include:

- •

- appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm;

- •

- overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of certain reports from such firm;

- •

- reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures;

- •

- monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics;

- •

- discussing our risk management policies;

- •

- establishing policies regarding hiring employees from the independent registered public accounting firm and procedures for the receipt, retention and treatment of accounting-related complaints and concerns;

- •

- meeting independently with our independent registered public accounting firm and management; and

- •

- preparing the audit committee report required by SEC rules (which is included on page 13 of this proxy statement).

Our board of directors has determined that all of the audit committee members are independent as defined under the rules of The NASDAQ Stock Market, including the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934.

Our board of directors has also determined that we currently have two audit committee financial experts, Robert J. Hugin and Armin M. Kessler. In deciding whether members of our audit committee qualify as financial experts within the meaning of the SEC regulations and the NASDAQ listing standards, our board considered the nature and scope of experiences and responsibilities members of our audit committee have previously had with reporting companies.

The audit committee met six times during 2004.

Compensation Committee

Our compensation committee's responsibilities include:

- •

- annually reviewing and approving corporate goals and objectives relevant to the compensation of our chief executive officer;

- •

- determining the compensation of our chief executive officer;

- •

- reviewing and approving, or making recommendations to the board with respect to, the compensation of our other executive officers;

- •

- overseeing an evaluation of our senior executives;

- •

- overseeing and administering our cash and equity incentive plans; and

- •

- reviewing and making recommendations to the board with respect to director compensation.

The compensation committee met seven times during 2004.

11

Nominating and Corporate Governance Committee

The nominating and corporate governance committee identifies individuals qualified to become board members and recommends to the board the persons to be nominated by the board for election as directors at the annual meeting of stockholders. In addition, the nominating and corporate governance committee oversees the evaluation of the board of directors and develops corporate governance principles.

The nominating and corporate governance committee met two times in 2004.

Director Candidates and Nomination Process

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and the board.

The nominating and corporate governance committee evaluates director candidates based upon a number of criteria including:

- •

- reputation for integrity, honesty and high ethical standards;

- •

- demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to our current and long-term objectives and willingness and ability to contribute positively to our decision-making process;

- •

- commitment to understanding our business and our industry;

- •

- adequate time to attend and participate in meetings of the board of directors and its committees;

- •

- ability to understand the sometimes conflicting interests of the various constituencies of our company, which include stockholders, employees, customers, governmental units, creditors and the general public and to act in the interest of all stockholders;

- •

- demonstrated experience or skill set in particular management disciplines that complements, in the opinion of the members of the nominating and corporate governance committee, the existing members of the board of directors to provide a desirable balance; and

- •

- such other attributes, including independence, that satisfy requirements imposed by the Securities and Exchange Commission and The NASDAQ Stock Market.

The nominating and corporate governance committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for a prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the board to fulfill its responsibilities.

At the annual meeting, stockholders will be asked to consider the election of Elizabeth H.S. Wyatt, who has been nominated for election as a director by stockholders for the first time. Ms. Wyatt was appointed by our board as a new director in March 2005, and has been included among the board's nominees for election as a class 2 director, upon the recommendation of our nominating and corporate governance committee. Ms. Wyatt was recommended to the nominating and corporate governance committee by one of our non-management directors.

Stockholder Nominees

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates. Any such proposals should be forwarded to the

12

nominating and corporate governance committee in writing at our executive offices at 8 Campus Drive, Parsippany, New Jersey 07054 c/o Paul M. Antinori, Secretary and should include the following information:

- •

- all information relating to such candidate that is required to be disclosed pursuant to Rule 14A of the Securities Exchange Act of 1934, including such person's written consent to being named in the proxy statement as a nominee and to serving as a director, if elected;

- •

- any information reasonably necessary to determine whether the candidate is qualified to serve on our audit committee;

- •

- the number of shares of our stock beneficially owned by such candidate, if any;

- •

- as to the stockholder proposing the candidate:

- •

- such stockholder's name and address;

- •

- the number of shares beneficially owned by such stockholder;

- •

- a description of all arrangements and understandings between each stockholder and the candidate and any other person relating to the proposal to nominate the candidate; and

- •

- a representation that such stockholder intends to appear in person or by proxy to nominate the person proposed.

Assuming that appropriate biographical and background material has been provided in a timely basis, any recommendations received from stockholders will be evaluated in the same manner as potential nominees proposed by the nominating and corporate governance committee.

If our board of directors determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy card for the next annual meeting.

Stockholders also have the right under our by-laws to directly nominate director candidates, without any action or recommendation on the part of the nominating and corporate governance committee or the board, by following the procedures set forth under "Information About The Annual Meeting—How and when may I submit a proposal for the 2006 annual meeting?" in this proxy statement. Candidates nominated by stockholders in accordance with the procedures set forth in our by-laws and not in accordance with procedures of the nominating and corporate governance committee described above, will not be included in our proxy card for the next annual meeting.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics applicable to all of our directors and employees, including our principal executive officer, our principal financial officer and our controller. The code of business conduct and ethics is available on the corporate governance section of "The Medicines Investment" on our website,www.themedicinescompany.com.

Any waiver of the code of business conduct and ethics for directors or executive officers, or any amendment to the code that applies to directors or executive officers, may only be made by the board of directors. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of this code of ethics by posting such information on our website, at the address and location specified above. To date, no such waivers have been requested or granted.

13

Stockholder Communications with the Board of Directors

Any stockholder may contact the board of directors or a specified individual director by writing to the attention of the board of directors or a specified individual director and sending such communication to our executive offices at 8 Campus Drive, Parsippany, New Jersey 07054 c/o Paul M. Antinori, Secretary. Each communication from a stockholder should include the following information in order to permit stockholder status to be confirmed and to provide an address to forward a response if deemed appropriate:

- •

- the name, mailing address and telephone number of the stockholder sending the communication;

- •

- the number of shares held by the stockholder; and

- •

- if the stockholder is not a record owner of our securities, the name of the record owner of our securities beneficially owned by the stockholder.

Our Secretary will forward all communications to the board of directors or individual members of the board of directors as specified in the communication.

Director Attendance at Annual Meeting

Our board of directors has implemented a policy that all directors are expected to attend the annual meeting of stockholders. Seven of our directors attended the annual meeting of stockholders in 2004.

Compensation of Directors

2004 Compensation

In the year ended December 31, 2004, each of our non-employee directors who attended, either in person or by telephone, at least 75% of the meetings of the board of directors held during the year received annual compensation of $12,500. In addition, each member of our audit, compensation or nominating and corporate governance committee who attended, either in person or by phone, at least 75% of the meetings of the committee on which he served held during the year received an additional $12,500. Directors were reimbursed for expenses in connection with their attendance at board meetings.

In addition, non-employee directors were eligible to receive stock options and other equity awards under our 2004 stock incentive plan, or 2004 plan. In May 2004, we granted each of Drs. Bell and Johnson, and Messrs. Crouse, Hugin, Kessler and Savage an option under our 2004 plan to purchase 12,500 shares of common stock at an exercise price of $32.30 per share. In May 2004, we also granted to James Thomas, a director until his resignation in February 2005, an option under our 2004 plan to purchase 12,500 shares of common stock at an exercise price of $32.30 per share. All of the options vest in 36 equal monthly installments commencing one month after the date of grant.

2005 Compensation

On December 14, 2004, our board of directors adopted new terms of compensation for our non-employee directors as described below. The new compensation arrangements became effective on January 1, 2005.

Annual Retainer, Meeting Fees and Expenses

Each of our non-employee directors will receive an annual retainer of $25,000, payable on a quarterly basis. In addition, each non-employee director will receive meeting fees of $3,000 for each meeting of the board attended in person and $500 for each meeting of the board attended by

14

telephone. Directors will also be reimbursed for expenses in connection with their attendance at meetings of the board.

Option Grants

Each non-employee director will be granted non-statutory stock options under our 2004 plan to purchase:

- •

- 20,000 shares of our common stock on the date of his or her initial election to the board; and

- •

- 15,000 shares of our common stock on the date of each annual meeting of our stockholders, except if such non-employee director was initially elected to the board at such annual meeting.

These options will have an exercise price equal to the closing price of our common stock on the NASDAQ National Market on the date of grant and will have a ten year term. The initial options, to purchase 20,000 shares, will vest in 36 equal monthly installments beginning on the date one month after the grant date. The annual meeting options will vest in 12 equal monthly installments beginning on the date one month after the date of grant. All vested options will be exercisable at any time prior to the first anniversary of the date the director ceases to be a director.

Committee Service

Each member of a committee of the board will also receive meeting fees of $1,500 for each committee meeting attended in person and $500 for each committee meeting attended by telephone. The chairman of the audit committee will receive $8,000 annually, and the chairman of each of the other standing committees of the board (currently, the compensation committee and the nominating and corporate governance committee) will receive $4,000 annually, to be paid on a quarterly basis.

Report of the Audit Committee of the Board of Directors

The audit committee reviewed The Medicines Company's audited financial statements for the year ended December 31, 2004 and discussed these financial statements with the company's management and Ernst & Young LLP, The Medicines Company's independent registered public accounting firm. The Medicines Company's management is primarily responsible for the financial reporting process, including maintaining an adequate system of disclosure controls and procedures and internal control over financial reporting, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Medicines Company's independent registered public accounting firm is responsible for performing an independent audit of, and issuing a report on, those financial statements and management's assessment of the effectiveness of internal control over financial reporting. The audit committee is responsible for providing independent, objective oversight of these processes. The audit committee's duties and responsibilities do not include conducting audits or accounting reviews.

As appropriate, the audit committee reviews and evaluates, and discusses with management, internal accounting and financial and auditing personnel and the independent registered public accounting firm, the following:

- •

- the plan for, and the independent registered public accounting firm's report on, each audit of The Medicines Company's financial statements;

- •

- The Medicines Company's financial disclosure documents, including all financial statements and reports filed with the SEC or sent to stockholders;

- •

- management's selection, application and disclosure of critical accounting policies;

- •

- changes in The Medicines Company's accounting practices, principles, controls or methodologies;

15

- •

- significant developments or changes in accounting rules applicable to The Medicines Company; and

- •

- the adequacy of The Medicines Company's internal control over financial reporting and accounting, financial and auditing personnel.

The audit committee also reviewed and discussed the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Ernst & Young. This Statement requires Ernst & Young to discuss with The Medicines Company's audit committee, among other things, the following:

- •

- methods to account for significant unusual transactions;

- •

- the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

- •

- the process used by management in formulating particularly sensitive accounting estimates and the basis for the registered public accounting firm's conclusions regarding the reasonableness of those estimates; and

- •

- disagreements with management over the application of accounting principles, the basis for management's accounting estimates and the disclosures in the financial statements.

Ernst & Young provided the audit committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires registered public accounting firm annually to disclose in writing all relationships that in the registered public accounting firm's professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. In addition, the audit committee discussed with Ernst & Young its independence of The Medicines Company.

Based on its review of the audited financial statements, discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the audit committee recommended to the board of directors that the audited financial statements be included in The Medicines Company's annual report on Form 10-K for the year ended December 31, 2004. The audit committee also appointed Ernst & Young as The Medicines Company's independent registered public accounting firm for the year ending December 31, 2005.

By the Audit Committee of the Board of Directors

Robert J. Hugin

T. Scott Johnson

Armin M. Kessler

16

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

Compensation of Our Executive Officers

Summary Compensation

The following table presents summary information for the years ended December 31, 2004, 2003 and 2002, for:

- •

- our chief executive officer;

- •

- our former chief executive officer; and

- •

- our three other executive officers who were serving as of December 31, 2004.

These five individuals are referred to collectively as our named executive officers.

| | | | | Long-Term Compensation Awards | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation(1) | | ||||||||||

| Name And Position | | Securities Underlying Options (#) | All Other Compensation ($)(2) | ||||||||||

| Year | Salary | Bonus | |||||||||||

| Clive A. Meanwell(3) Chief Executive Officer | 2004 2003 2002 | $ $ $ | 400,000 325,000 300,000 | $ $ $ | 180,000 250,000 180,000 | 100,000 125,000 123,000 | $ $ $ | 1,170 1,065 990 | |||||

David M. Stack(4) Former President and Chief Executive Officer | 2004 2003 2002 | $ $ $ | 315,000 300,000 265,000 | $ $ $ | 157,500 150,000 115,000 | — 65,000 204,000 | $ $ $ | 1,601 1,486 1,325 | |||||

John Kelley(5) President and Chief Operating Officer | 2004 | $ | 26,250 | $ | 20,000 | 225,000 | $ | 133 | |||||

Steven H. Koehler(6) Senior Vice President and Chief Financial Officer | 2004 2003 2002 | $ $ $ | 260,417 222,500 172,689 | $ $ $ | 103,400 100,000 65,000 | 77,000 50,000 250,000 | $ $ $ | 1,288 1,083 874 | |||||

John D. Richards Vice President | 2004 2003 2002 | $ $ $ | 176,800 170,000 150,000 | $ $ $ | 64,076 105,000 48,000 | 18,500 50,000 25,000 | $ $ $ | 547 532 450 | |||||

- (1)

- The aggregate amount of perquisites for each named executive officer did not exceed the lesser of $50,000 or 10% of the executive's total salary and bonus for the respective fiscal years and have been omitted in accordance with SEC rules.

- (2)

- The dollar amount in the "All Other Compensation" column represents life insurance premium payments made by us on behalf of the named executive officer for his benefit.

- (3)

- Dr. Meanwell served as our Executive Chairman from September 2001 to August 2004. In August 2004, he became our Chief Executive Officer.

- (4)

- Mr. Stack resigned as Chief Executive Officer and President in August 2004.

- (5)

- Mr. Kelley became our President and Chief Operating Officer in December 2004, at which time he received a one-time "sign-on" bonus.

- (6)

- Mr. Koehler became our Vice President in March 2002 and our Chief Financial Officer in April 2002.

17

Option Grants in 2004

The following table summarizes information regarding options granted to each of the named executive officers during the year ended December 31, 2004. With the exception of the options granted to Mr. Kelley, options granted in 2004 to the named executive officers become exercisable in 48 equal monthly installments, commencing one month after the vesting commencement date, which is typically the grant date. The options granted to Mr. Kelley become exercisable over 48 months, with 25% of the shares covered by the option vesting 12 months after the vesting commencement date and the remainder of the shares covered by the option vesting in 36 equal monthly installments commencing one month after the first anniversary of the vesting commencement date. All options have an exercise price equal to the closing price per share of our common stock on the NASDAQ National Market on the date of grant.

Amounts in the following table represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by the rules of the SEC and do not represent an estimate or projection of our future common stock prices. These amounts represent assumed rates of appreciation in the value of our common stock from the fair market value on the date of grant. Actual gains, if any, on stock option exercises are dependent on the future performance of our common stock and overall stock market conditions. The amounts reflected in the following table may not be achieved.

Option Grants in Last Fiscal Year

| | Individual Grants(1) | | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||||||

| | Number Of Securities Underlying Options Granted | Percent of Options Granted to Employees in 2004 | | | |||||||||||

| Name | Exercise Price Per Share | Expiration Date | |||||||||||||

| 5% | 10% | ||||||||||||||

| Clive A. Meanwell | 100,000 | 4.4 | % | $ | 28.02 | 12/14/14 | $ | 1,762,163 | $ | 4,465,666 | |||||

David M. Stack | — | — | — | — | — | — | |||||||||

John Kelley | 225,000 | 10.0 | % | $ | 25.25 | 12/1/14 | $ | 3,572,908 | $ | 9,054,449 | |||||

Steven H. Koehler | 30,000 47,000 | 1.3 2.1 | % % | $ $ | 23.77 28.02 | 8/3/14 12/14/14 | $ $ | 448,465 828,216 | $ $ | 1,136,498 2,098,863 | |||||

John D. Richards | 18,500 | 0.8 | % | $ | 28.02 | 12/14/14 | $ | 326,000 | $ | 826,148 | |||||

- (1)

- The percentage of total options granted to employees in 2004 is calculated based on options granted to employees under our 1998 stock incentive plan, 2001 non-officer, non-director employee stock incentive plan and 2004 plan.

Option Exercises in 2004 and Option Values at December 31, 2004

The following table sets forth information regarding options exercised by the named executive officers during the fiscal year ended December 31, 2004 and exercisable and unexercisable stock options held as of December 31, 2004 by each of the named executive officers.

Amounts shown under the column "Value Realized" represent the difference between the option exercise price and the closing sale price of our common stock on the date of exercise. Amounts shown under the column "Value of Unexercised In-the-Money Options at December 31, 2004" have been calculated based on the closing sale price of our common stock on the NASDAQ National Market on December 31, 2004 of $28.80 per share, without taking into account any taxes that may be payable in

18

connection with the transaction, multiplied by the number of shares underlying the option, less the exercise price payable for these shares.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | | Number of Securities Underlying Unexercised Options at December 31, 2004 | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Value of Unexercised In-the-Money Options at December 31, 2004 | ||||||||||||

| Name | Shares Acquired On Exercise | Value Realized | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| Clive A. Meanwell | 145,661 | $ | 3,717,710 | 424,000 | 259,000 | $ | 7,516,000 | $ | 1,040,100 | ||||||

David M. Stack | 401,501 | $ | 5,026,433 | 40,833 | 95,107 | $ | 113,394 | $ | 1,406,968 | ||||||

John Kelley | — | — | — | 225,000 | — | $ | 798,750 | ||||||||

Steven H. Koehler | 10,000 | $ | 151,800 | 167,500 | 199,500 | $ | 2,392,400 | $ | 1,535,860 | ||||||

John D. Richards | 20,024 | $ | 453,615 | 42,792 | 72,250 | $ | 282,929 | $ | 287,893 | ||||||

Employment Agreements

Dr. Meanwell serves as our Chief Executive Officer pursuant to the terms of an employment agreement dated September 5, 1996. This agreement renews automatically on a yearly basis unless either party provides written notice of non-renewal at least 90 days prior to the expiration of the then-current term. Pursuant to the terms of the agreement, Dr. Meanwell's annual compensation is determined by our board of directors. If Dr. Meanwell terminates his employment for good reason, as defined in the agreement, or if we terminate his employment other than for cause, Dr. Meanwell will be entitled to three months salary and the same health, disability and other benefits as were provided during his employment for a period ending upon the earlier of (1) three months after the date of his termination, or (2) the date upon which Dr. Meanwell commences full-time employment with a new employer. Dr. Meanwell has agreed not to compete with us during the term of his employment and for a period of one year after his termination, unless such termination is at our election or at the election of Dr. Meanwell for good reason.

Mr. Kelley serves as our Chief Operating Officer and President pursuant to the terms of a letter agreement dated December 1, 2004. Although Mr. Kelley's employment is "at will," the letter agreement provides that he will receive an annual base salary of $315,000 and a one-time "sign-on" payment of $20,000. Mr. Kelley is eligible to receive, at the discretion of our board of directors, an annual bonus targeted to be 50 percent of his annual base salary, subject to meeting company and personal performance goals. We granted Mr. Kelley an option to purchase 225,000 shares of our common stock at an exercise price of $25.25 per share, the closing price of our common stock on December 1, 2004. The stock option vests with respect to twenty-five percent of the shares covered thereby on December 1, 2005 and with respect to the remainder of the shares in thirty-six equal monthly installments beginning January 1, 2006. If Mr. Kelley's employment is terminated without cause or for good reason or if he is terminated under certain circumstances in connection with a change of control, the stock option will continue to vest for twelve months beyond the date of termination, and Mr. Kelley will receive twelve months' base salary plus a bonus equal to the average of the preceding three years' bonuses.

Dr. Richards serves as one of our Vice Presidents pursuant to the terms of an employment agreement dated October 16, 1997. This agreement renews automatically on a yearly basis unless either party provides written notice of non-renewal. Pursuant to the terms of the agreement, Dr. Richards' annual compensation is determined by our board of directors. If Dr. Richards terminates his employment for good reason, as defined in the agreement, or if we terminate his employment other

19

than for cause, Dr. Richards will be entitled to three months salary and the same health, disability and other benefits as were provided during his employment for a period of three months after the date of his termination. Dr. Richards has agreed not to compete with us during the term of his employment and for a period of one year after his termination.

Mr. Stack served as our Chief Executive Officer and President until August 2004. In August 2004, he resigned as Chief Executive Officer and President, although he remains our employee. In connection with his resignation, we entered into an amendment to Mr. Stack's employment agreement. Pursuant to the terms of the amended agreement, which expires in April 2005, Mr. Stack has such authority, duties and responsibilities as mutually agreed upon between Mr. Stack and Dr. Meanwell or our board. The amended agreement provides that from the date of his resignation until April 30, 2005, Mr. Stack will receive a base salary of $236,250 and will receive a cash bonus of $52,500 on April 30, 2005. The amendment required Mr. Stack to surrender certain stock options for cancellation and specified a cash bonus for Mr. Stack of $157,500 for 2004. Mr. Stack has agreed not to compete with us during the term of his employment agreement.

Report of the Compensation Committee on Executive Compensation

The compensation committee of the board of directors is responsible for reviewing and establishing compensation policies and practices with respect to The Medicines Company's executive officers, including the named executive officers, and setting the compensation levels for these individuals. The compensation committee also reviews and approves corporate goals and objectives relevant to compensation levels, administers The Medicines Company's stock plans, grants stock options to The Medicines Company's employees, including the named executive officers, and reviews and makes recommendations to the board with respect to management succession planning.

Compensation Philosophy

The compensation committee seeks to achieve three broad goals in connection with The Medicines Company's executive compensation programs and decisions regarding individual compensation. First, the compensation committee structures executive compensation programs in a manner that the committee believes will enable The Medicines Company to attract, motivate and retain executives who are capable of leading The Medicines Company in achieving its business objectives. Second, the compensation committee establishes compensation programs that are designed to reward executives for the achievement of specified business objectives of The Medicines Company as a whole and/or the individual executive's particular business unit. By tying compensation in part to particular goals, the compensation committee believes that a performance-oriented environment is created for The Medicines Company's executives. Finally, The Medicines Company's executive compensation programs are intended to provide executives with an equity interest in The Medicines Company so as to link a portion of executives' compensation with the performance of The Medicines Company's common stock.

The compensation programs for The Medicines Company's executives established by the compensation committee consist of three elements based upon the goals described above: base salary, annual cash bonus and stock options granted under our 1998 stock incentive plan or 2004 plan. On an annual basis, the committee establishes an annual base salary for each executive and, when appropriate, awards cash bonuses and stock options to executives as a way to reward good performance and to incentivize continued improvement in performance.

Compensation in 2004

The compensation committee engaged an employment compensation consulting firm to provide advice with respect to the compensation of The Medicines Company's executive officers and other employees. The consultants analyzed the compensation levels of executive officers of a peer group of

20

companies for the most recently completed fiscal years, and then provided and discussed statistical information with the compensation committee. The compensation committee considered this information in reviewing executive compensation and, in particular, establishing salaries for 2004 and bonuses payable for 2004 in order to advance the compensation committee's philosophy of compensating The Medicines Company's executive officers at competitive levels.

The compensation committee also reviewed business objectives of The Medicines Company for 2004, assessed overall performance of The Medicines Company with respect to those business objectives and considered the performance of individual executives relative to individualized objectives. In particular, in considering the three elements of compensation as a whole, the compensation committee focused on:

- •

- financial performance of The Medicines Company, including revenue and earnings per share growth;

- •

- operating performance of The Medicines Company, including increase use of Angiomax by existing hospital customers, as well as penetration to new hospitals;

- •

- achievements with respect to development milestones, business development activities, commercialization goals;

- •

- challenges of managing a company experiencing rapid growth;

- •

- company size and complexity; and

- •

- stock price appreciation.

Base Salary. The minimum base salaries of our executive officers with employment agreements are established in those employment agreements. Subject to these minimums, salary levels of these executives are reviewed and normally adjusted annually. Base salaries of our executive officers without employment agreements are also reviewed and normally adjusted annually. In establishing base salaries for executives for 2004, the compensation committee considered the compensation of executive officers that had comparable qualifications, experience and responsibilities at companies in similar businesses of comparable size and success, including information provided by consultants engaged by the compensation committee. The compensation committee also considered the recommendations of the Chairman and Chief Executive Officer as to the compensation of the other executive officers, the historic salary levels of the individual and the nature of the individual's responsibilities, and compared the individual's base salary with those of The Medicines Company's other executives. To the extent determined to be appropriate in establishing base salaries of The Medicines Company's executives for 2004, the compensation committee also considered general economic conditions and The Medicines Company's financial and operating performance in 2003.