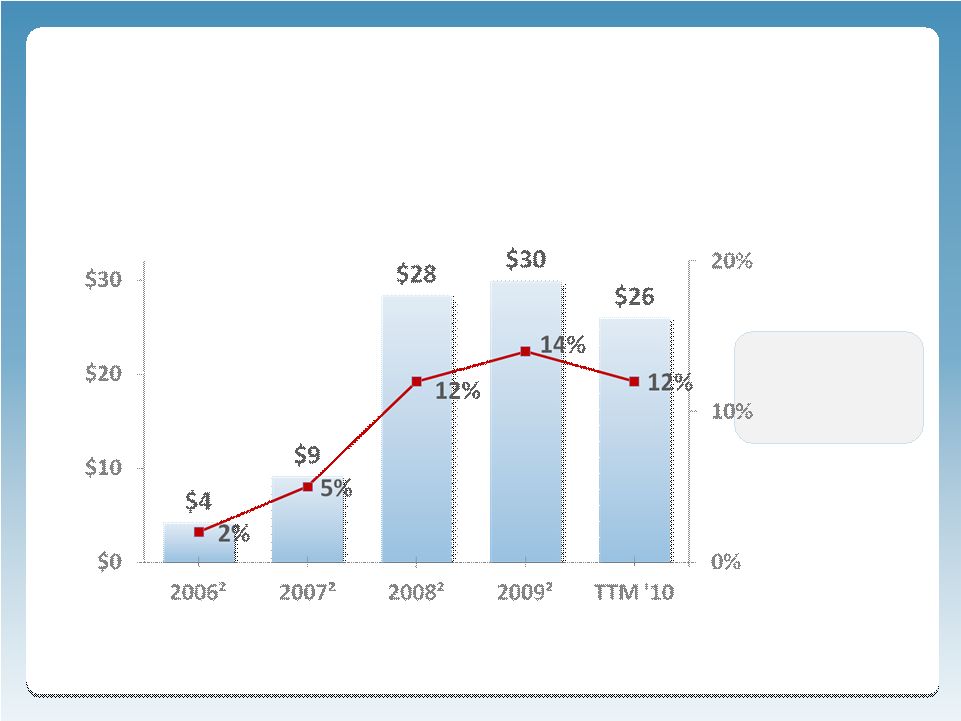

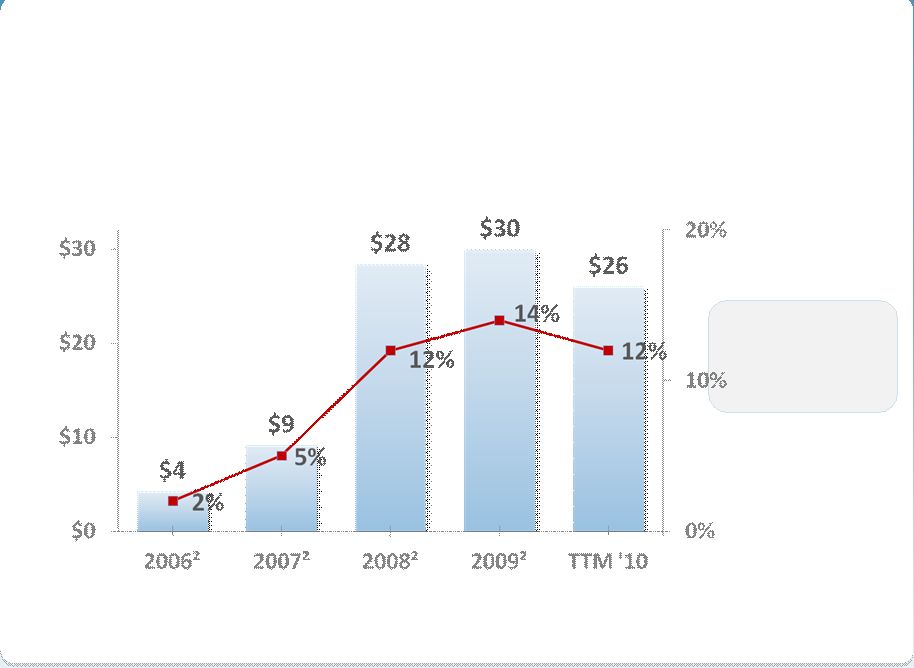

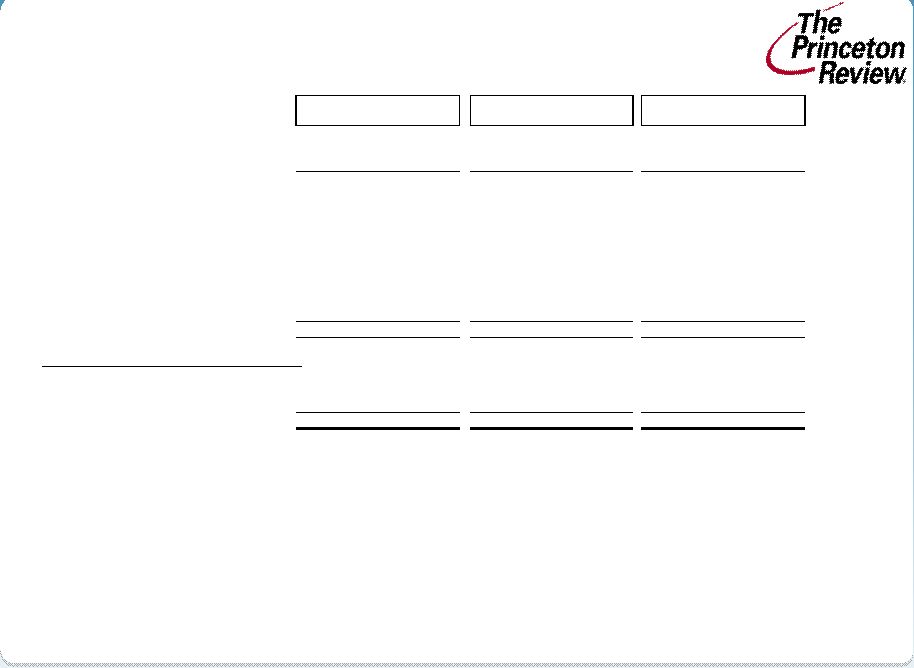

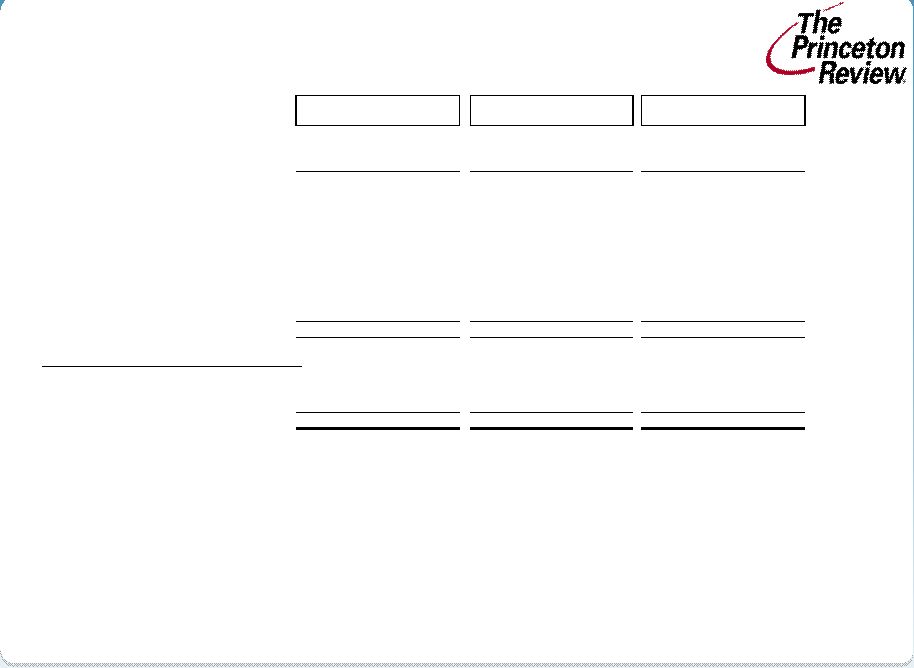

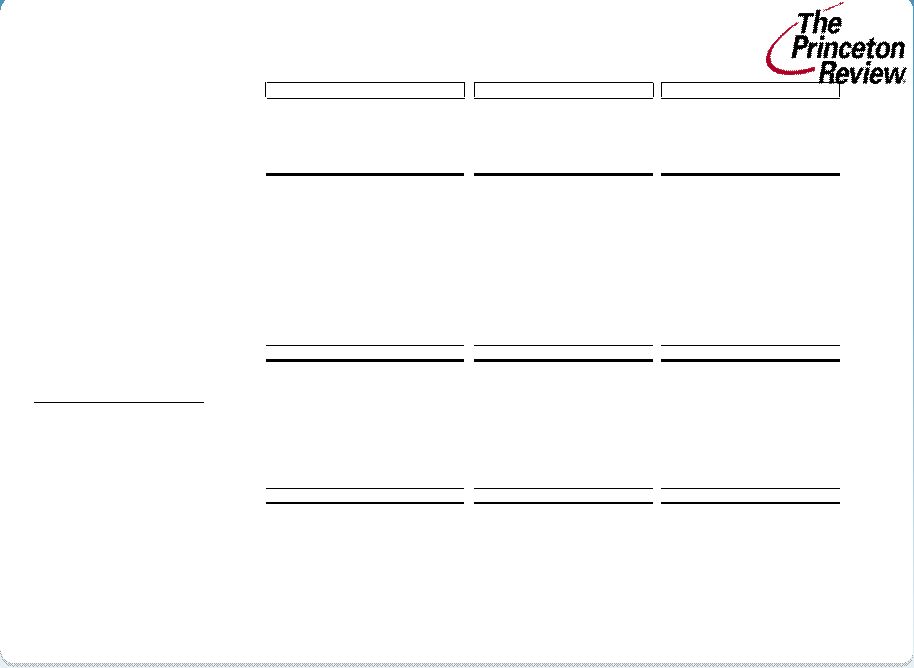

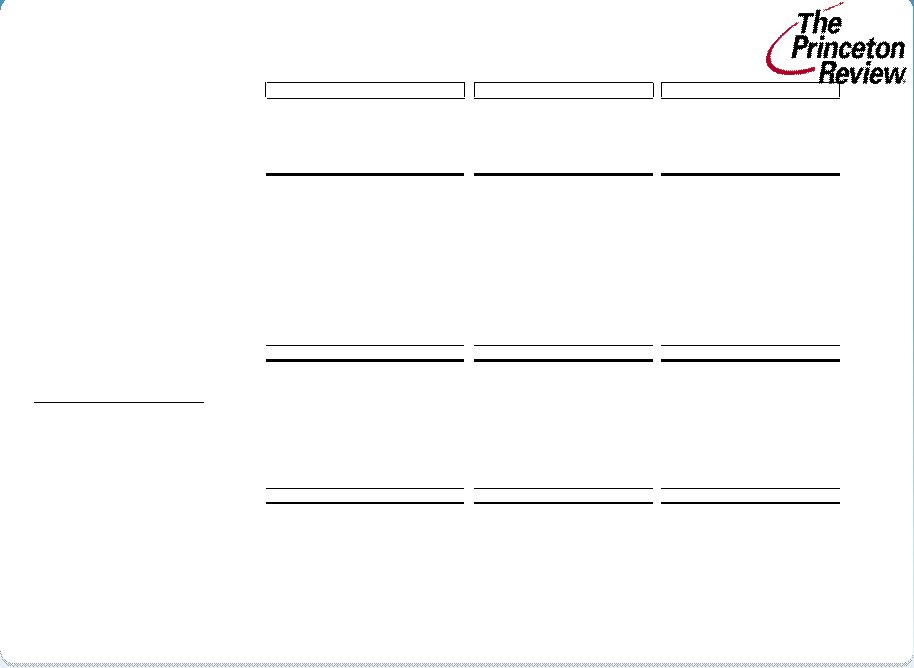

NASDAQ: REVU GAAP to Non-GAAP Reconciliation: 2008-TTM Q2’10 23 The Princeton Review, Inc. and Subsidiaries Penn Foster Education Group, Inc. Combined (Non-GAAP) Year ended December 31, 2008 Year ended December 31, 2009 Trailing Twelve Months Ended June 30, 2010 Year ended December 31, 2008 Period from January 1, 2009 to December 7, 2009 Trailing Twelve Months Ended June 30, 2010 Year ended December 31, 2008 Year ended December 31, 2009 Trailing Twelve Months Ended June 30, 2010 1,830 (10,100) (24,854) 8,188 (3,066) (6,816) 10,018 (13,166) (31,670) Depreciation and amortization 4,665 8,347 24,248 6,154 5,822 2,748 10,819 14,169 26,996 Restructuring 2,233 7,711 5,584 - - - 2,233 7,711 5,584 Acquisition expenses - 2,984 5,357 - - - - 2,984 5,357 Stock based compensation 3,868 2,979 3,880 - - - 3,868 2,979 3,880 Acquisition related adjustment to revenue - 135 821 - - - - 135 821 Non-cash inventory write-off to cost of goods and services sold - - 942 - - - - - 942 Management fees (1) - - - 429 370 155 429 370 155 Penn Foster expenses associated with divestitures (2) - - - 920 14,549 14,289 920 14,549 14,289 Other income, excluding items (see reconciliation below) 81 261 3 - - - 81 261 3 Adjusted EBITDA 12,677 12,317 15,981 15,691 17,675 10,376 28,368 29,992 26,357 Reconciliation of other (expense) income, net to other Other (expense) income, net 81 (517) (988) (817) 6 - (736) (511) (988) Loss from extinguishment of debt - 878 1,832 - - - - 878 1,832 Gain from change in fair value of derivatives - (100) (795) - - - - (100) (795) Interest income - - - (94) (6) - (94) (6) - Loss on sale of investment - - - 926 - - 926 - - Other (46) (15) - - (15) - (46) Other income, excluding items 81 261 3 - - - 81 261 3 Operating (loss) income from continuing operations (expense) income, excluding items: (1) Monthly fees charged Penn Foster by its previous owners for services provided by its affiliated private equity interests. Similar fees were not incurred following the acquisition by the Company. (2) Includes transaction bonuses, professional fees and other expenses related to Penn Foster’s sale to the Company on December 7, 2009 totaling $13,872 for the period from January 1, 2009 to December 7, 2009, including $13,734 that was funded by Penn Foster’s previous owner. Expenses totaling $920 for the year ended December 31, 2008 and the remaining $677 for the period from January 1, 2009 to December 7, 2009 consisted primarily of legal and accounting fees associated with matters related to Penn Foster’s sale on March 27, 2007. |