This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of The Princeton Review, Inc. (“The Princeton Review,” “we,” “us,” or “our”) for use at the 2005 Annual Meeting of Stockholders of The Princeton Review to be held on June 9, 2005, and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, stockholders will be asked (1) to vote upon the election of three Class I directors to our Board of Directors, (2) to ratify and approve the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005, and (3) to act upon any other matters that may properly be brought before the Annual Meeting and at any adjournments or postponements thereof.

This Proxy Statement and the accompanying Notice of Annual Meeting and Proxy Card are first being sent to stockholders on or about May 6, 2005. The Board of Directors has fixed the close of business on April 21, 2005 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). Only stockholders of record of The Princeton Review’s common stock, par value $.01 per share (the “Common Stock”), at the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 27,569,764 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Holders of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held by them on the Record Date.

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. The affirmative vote of the holders of a plurality of the shares of Common Stock cast on the matter at the Annual Meeting (assuming a quorum is present) is required for the election of Class I directors. The affirmative vote of the holders of a majority of the shares of Common Stock cast on the matter at the Annual Meeting (assuming a quorum is present) is required for the ratification of the appointment of our auditors and the approval of any other matters properly presented at the Annual Meeting. For the purpose of determining whether the stockholders have approved matters other than the election of directors under Delaware law, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Broker “non-votes,” or proxies from brokers or nominees indicating that such person has not received instructions from the beneficial owner or other person entitled to vote such shares on a particular matter with respect to which the broker or nominee does not have discretionary voting power, are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved that matter, but they are counted as present for the purpose of determining the existence of a quorum at the annual meeting.

Our stockholders are requested to complete, sign, date and promptly return the accompanying Proxy Card in the enclosed postage-prepaid envelope. Shares represented by a properly executed proxy received prior to the vote at the Annual Meeting and not revoked will be voted at the Annual Meeting as directed on the proxy. If a properly executed proxy is submitted and no instructions are given, the proxy will be voted FOR the election of the three nominees for Class I directors named in this Proxy Statement, and FOR ratification of the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005. It is not anticipated that any matters other than those set forth in the Proxy Statement will be presented at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders.

A stockholder of record may revoke a proxy at any time before it has been exercised by filing a written revocation with the Secretary of The Princeton Review at our address set forth above, by filing a duly executed proxy bearing a later date, or by appearing in person and voting by ballot at the Annual Meeting. Any stockholder of record as of the Record Date attending the Annual Meeting may vote in person whether or not a proxy has been previously given, but the presence (without further action) of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy.

The Princeton Review’s 2004 Annual Report, including financial statements for the fiscal year ended December 31, 2004, accompanies the proxy solicitation materials. The Annual Report, however, is not part of the proxy solicitation materials.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of seven members and is divided into three classes, Class I, Class II and Class III, with the directors in each class serving for a term of three years and until their successors are duly elected and qualified. The term of one class expires at each annual meeting of stockholders.

At the Annual Meeting, three directors will be elected to serve until the 2008 Annual Meeting and until their successors are duly elected and qualified. The Board of Directors has nominated Mr. John S. Katzman, Mr. Robert E. Evanson and Mr. John C. Reid to serve as Class I directors (the “Nominees”). Each of the Nominees, other than Mr. Evanson, is currently serving as a Class I director of The Princeton Review. Mr. Evanson has been nominated by the Board of Directors to take the place of Mr. Frederick S. Humphries, who has informed the Board of Directors that he will not stand for reelection. The Board of Directors anticipates that each of the Nominees will serve, if elected, as a director. However, if any person nominated by the Board of Directors is unable to accept election, the proxies will be voted for the election of such other person or persons as the Board of Directors may recommend.

The Board of Directors recommends a voteFOR the Nominees.

Information Regarding Nominees and Directors

The following biographical descriptions set forth certain information with respect to the three Nominees for election as Class I directors at the Annual Meeting and the continuing directors whose terms expire at the annual meetings of stockholders in 2006 and 2007, based upon information furnished to us by each director.

Class I Nominees for Election at 2005 Annual Meeting — Term to Expire in 2008

John S. Katzman, 45, Chairman and Chief Executive Officer, founded our company in 1981. Mr. Katzman has served as our Chief Executive Officer and director since our formation. Mr. Katzman served as our President from 1981 until August 2000. Mr. Katzman is the brother of Richard Katzman, one of the other members of the Board of Directors. Mr. Katzman received a BA from Princeton University.

Robert E. Evanson, 69, has served since 2003 as a Senior Advisor to Apax Partners, Inc., a $13 billion private equity company. From 1992 until 2002, Mr. Evanson worked at The McGraw-Hill Companies, a global information services provider and publisher. From 2000 to 2002, Mr. Evanson served as President of McGraw-Hill Education, the educational publishing unit of McGraw-Hill. From 1998 to 1999, Mr. Evanson served as Executive Vice-President, Chief Operating Officer of McGraw-Hill Education. From 1996 to 1998, Mr. Evanson served as President of McGraw-Hill’s Higher Education and Consumer Group. He also served as Executive Vice President, Corporate Development for The McGraw-Hill Companies, Inc. from 1994 until 1996. From 1992 until 1994, Mr. Evanson served as Executive Vice-President, Chief Financial Officer for the School Publishing Group of McGraw-Hill. From 1985 to 1992, Mr. Evanson held various posts at Harcourt Brace Jovanovich, Inc., including from 1991 to 1992 as Executive Vice-President and Chief Operating Officer, from 1989 to 1991 as Chief Financial Officer, and from 1987 to 1989 as Chairman and Chief Executive Officer of Sea World Theme Parks. Mr. Evanson also was a partner at Arthur Anderson & Co., where he worked from 1957 to 1972. Mr. Evanson is also a member of the boards of directors of Cadmus Communications, Inc., Public Education Needs Civic Involvement, Pace University’s Center for Downtown New York and Pace University’s Publishing Advisory Board. Mr. Evanson received a BBA from St. John’s University and an MBA from New York Institute of Technology.

John C. Reid, 54, has served as a director of our company since March 2000. Since March 2001, Mr. Reid has been Chairman of the Board of Cross-Cultural Solutions, a not-for-profit in the field of international volunteerism. From October 2001 to March 2003, Mr. Reid was Executive-in-Residence at Cedar Street Group, a venture capital company. From August 1999 to December 2001, Mr. Reid was the Chief Executive Officer of Comet Systems, a company that develops software for the Internet. From March until June of 2001, Mr. Reid also served as an executive consultant to LearnNow, Inc., a professional education management company acquired by Edison Schools, Inc., a private manager of public schools. From 1996 to 1999, Mr. Reid served as Chief Operating Officer of The Edison Project (since renamed Edison Schools, Inc.). From 1974 to 1996, Mr. Reid served in the executive management of The Coca-Cola Company, including from 1985 to 1996 as

2

Senior Vice President, Coca-Cola USA and Chief Environmental Officer, The Coca-Cola Company. Mr. Reid is also a member of the board of directors of Tutor.com, Inc. Mr. Reid received a BA from Brandeis University and an MS from Massachusetts Institute of Technology.

Class II Continuing Directors — Term Expires in 2006

Richard Katzman, 48, has served as a director of our company since 1985. Since 1997, Mr. Katzman has been the Chairman of the Board and Chief Executive Officer of Kaz, Inc., a manufacturer of humidifiers, vaporizers and other consumer appliances. From 1987 to 1997, Mr. Katzman served as President of Kaz, Inc. Mr. Katzman is the brother of John S. Katzman, the Chairman and Chief Executive Officer of our company. Mr. Katzman received a BA from Brown University.

Sheree T. Speakman, 50, has served as a director of our company since March 2000. Since March 2005, Ms. Speakman has been Chief Operating Officer, North America, for Education Overseas Ltd., a London-based provider of education management and curriculum development services to pre-K-12 schools worldwide. Since November 2003, Ms. Speakman has served as an independent consultant to the education services market. From 2001 to November 2003, Ms. Speakman was Vice President of Services and Support at EDmin.com, Inc., an enterprise solutions company focusing on K-12 education. From December 2002 to November 2003, Ms. Speakman was responsible for consulting and professional development for EDmin.com. From 1998 to 2001, Ms. Speakman was President and Chief Executive Officer of Fox River Learning, Inc., an education consulting firm acquired by EDmin.com in 2001. From 1983 to 1998, Ms. Speakman was a principal at Coopers & Lybrand LLP where she led their national efforts in K-12 financial analysis and consulting. Ms. Speakman received an AB from Albion College and an MBA from the University of Chicago.

Class III Continuing Directors — Term Expires in 2007

Richard Sarnoff, 46, has served as a director of our company since 1998. Since 2000, Mr. Sarnoff has been President of the Corporate Development Group of Random House, Inc. and in 2002 was elected to the Supervisory Board of Random House’s parent company, Bertelsman AG. From 1998 to 2000, Mr. Sarnoff was Executive Vice President and Chief Financial Officer of Random House. From 1996 to 1998, Mr. Sarnoff served as Chief Financial Officer of Bantam Doubleday Dell, a consumer book publisher, and from 1995 to 1998, he was Senior Vice President, Corporate Development of Bantam Doubleday Dell. Mr. Sarnoff is also a director of Audible, Inc., a company that provides spoken audio content, and a member of several not-for-profit boards, including the Children’s Museum of Manhattan, the Center for Communications and the American Association of Publishers. Mr. Sarnoff received a BA from Princeton University and an MBA from Harvard Business School. Mr. Sarnoff was originally elected to our Board of Directors in accordance with the terms of our stockholders’ agreement which provided that, prior to our initial public offering, Random House was entitled to have one representative serve on our Board of Directors.

Howard A. Tullman, 59, has served as a director of our company since March 2000. Since September 2002, Mr. Tullman has served as President of Kendall College, Evanston, Illinois. Since March 2000, Mr. Tullman has been the General Manager of the Chicago High Tech Investors I, LLC, an Internet-oriented investment fund. From September 2000 to July 2001, Mr. Tullman served as Chief Executive Officer and director of Worldwide Xceed Group, Inc., an Internet business consulting company. Mr. Tullman was hired by the Board of Directors of Worldwide Xceed Group to reorganize the company. In May 2001, Worldwide Xceed Group filed a voluntary petition for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code and was purchased by a third party in July 2001. From September 1996 to February 2000, Mr. Tullman was the Chief Executive Officer of Tunes.com, Inc. and its predecessors, an Internet music site he helped found, which was sold to EMusic.com, Inc. Mr. Tullman is the Chairman of the Board of The Cobalt Group, a company that provides Internet services to automobile dealers and manufacturers. Mr. Tullman received a BA from Northwestern University and a JD from Northwestern University School of Law.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities (collectively, “Section 16 reporting persons”), to file with the Securities and Exchange Commission (“SEC”) initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of The Princeton Review. Section 16 reporting persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of the copies of such reports furnished to us and on written representations that no other reports were required,

3

during the fiscal year ended December 31, 2004, the Section 16 reporting persons complied with all Section 16(a) filing requirements applicable to them, except as follows: (i) Richard Katzman, John C. Reid, Richard Sarnoff, Sheree T. Speakman and Howard A. Tullman each filed late Statements of Changes in Beneficial Ownership of Securities on Form 4 on January 7, 2005, each with respect to an option to purchase 5,000 shares of our Common Stock granted on June 1, 2004, (ii) Frederick Humphries filed a late Statement of Changes in Beneficial Ownership of Securities on Form 4 on January 11, 2005, with respect to an option to purchase 5,000 shares of our Common Stock granted on June 1, 2004, and (iii) Timothy Conroy became Executive Vice President, General Manager K-12 Services Division, on June 1, 2004 and filed a late Initial Statement of Beneficial Ownership of Securities on Form 3 on June 21, 2004, and a late Statement of Changes in Beneficial Ownership of Securities on Form 4 on June 21, 2004 with respect to an option to purchase 45,000 shares of our Common Stock granted on June 1, 2004.

The Board of Directors, Its Committees and Corporate Governance

Board of Directors. Our Board of Directors consists of seven directors, as described in “Proposal 1: Election of Directors.” Our Board of Directors believes that there should be a majority of independent directors on the Board of Directors. Our Board of Directors also believes that it is useful and appropriate to have members of management as directors. The current board members include four independent directors and one member of our senior management.

The Board of Directors has determined that each of Mr. Robert E. Evanson, Mr. John C. Reid, Ms. Sheree T. Speakman and Mr. Howard A. Tullman qualify as “independent” in accordance with the rules of The Nasdaq Stock Market, Inc. (“Nasdaq”). The Nasdaq independence definitions include a series of objective tests, including that the director is not an employee of the company and has not been engaged in various types of business relationships with the company. In addition, as also required by the Nasdaq rules, the Board of Directors has made a subjective determination with respect to each independent director that no relationships exist which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment by such director in carrying out the responsibilities of a director.

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Nominating Committee. During 2004, the Audit Committee met eight times, and the Compensation Committee met one time. The Nominating Committee, which consists of the entire Board of Directors, was established in the first quarter of 2004 and met once in 2004.

Audit Committee. On February 26, 2004, the Board of Directors adopted an amended and restated charter for the Audit Committee (the “Charter”). A copy of the Charter was attached to the Proxy Statement for the 2004 Annual Meeting of Stockholders. The Charter contains the Audit Committee’s mandate, membership requirements and duties and obligations. The Audit Committee assists the Board of Directors in its oversight of our financial accounting and reporting processes. In accordance with the Charter, the Audit Committee has the sole authority for the appointment, replacement, compensation, and oversight of the work of our independent auditor, reviews the scope and results of audits with our independent auditor, reviews with management and our auditors our annual and interim operating results, considers the effectiveness of our internal control over financial reporting and our disclosure controls and procedures, considers our auditors’ independence, and reviews and approves in advance all engagements of any accounting firm (including the fees and terms thereof). The Audit Committee is also responsible for establishing procedures for the receipt, retention and treatment of complaints regarding our accounting, internal control over financial reporting, or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee consists of John C. Reid, Sheree T. Speakman and Howard A. Tullman. Each member of the Audit Committee is “independent” under the standards established by the Securities and Exchange Commission (the “SEC”) and Nasdaq Rule 4200(a)(15) for members of audit committees. The Audit Committee also includes a member who has been determined by our Board of Directors to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules, including that the person meets the relevant definition of an “independent director.” The Board of Directors has determined that Sheree T. Speakman is an audit committee financial expert. The designation as audit committee financial expert is a disclosure requirement of the SEC related to Ms. Speakman’s experience and understanding of certain accounting and auditing matters. The designation does not impose upon Ms. Speakman any duties, obligations or liability that are greater than are generally imposed on her as a member of the Audit Committee, and her designation as audit committee financial expert does not affect the duties, obligations or liability of any other member of the Audit Committee.

4

Compensation Committee. The Compensation Committee has the sole authority and responsibility for reviewing and determining, or recommending to the Board of Directors for determination, the salary and other matters relating to the compensation of our Chief Executive Officer and all other executive officers. The Compensation Committee is also responsible for the administration of The Princeton Review, Inc. 2000 Stock Incentive Plan, as amended (the “Stock Incentive Plan”), including reviewing management recommendations with respect to grants of awards and taking other actions as may be required in connection with our compensation and incentive plans. The Compensation Committee consists of John C. Reid, Sheree T. Speakman and Howard A. Tullman. Each member of the Compensation Committee is “independent” under the standards established by the SEC and Nasdaq.

Nominating Committee. The Nominating Committee has the authority and responsibility to identify, vet and recommend to the Board of Directors qualified candidates to serve as directors on our Board of Directors. In addition to considering candidates suggested by stockholders, the Nominating Committee solicits recommendations from our directors, members of management and others familiar with and experienced in the education services industry. The Nominating Committee establishes criteria for the selection of nominees and reviews the appropriate skills and characteristics required of board members. In evaluating candidates, the Nominating Committee considers issues of independence, diversity and expertise in numerous areas, including experience in the education services industry, finance, marketing, international experience and culture. The Nominating Committee selects individuals of the highest personal and professional integrity who have demonstrated exceptional ability and judgment in their field and who would work effectively with the other directors and nominees to the Board of Directors. The Nominating Committee also monitors and reviews the committee structure of the Board of Directors, and each year it recommends to the Board of Directors for its approval directors to serve as members of each committee. The Nominating Committee conducts an annual review of the adequacy of the Nominating and Governance Charter (described below) and recommends proposed changes. The Nominating Committee consists of all seven members of the Board of Directors, a majority of whom are “independent” under the standards established by the SEC and Nasdaq.

Attendance at Board, Committee and Annual Stockholders’ Meetings. The Board of Directors met five times during 2004. Each of our directors is expected to attend each meeting of the Board of Directors and the committees on which he or she serves. In 2004, each of our directors attended at least 75% of the meetings of the Board of Directors and of the committees on which he or she served, except for Mr. Humphries who attended 40%. We do not currently have a policy requiring attendance of our directors at our annual meetings of stockholders. One of our directors attended the 2004 Annual Meeting of Stockholders.

Communications from Stockholders to Board members. Our Board of Directors believes that it is important to offer stockholders the opportunity to communicate with our directors. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Board of Directors, The Princeton Review, Inc., 2315 Broadway, New York, NY 10024 or by email to Board@review.com. The name of any intended recipient should be noted in the communication. Communications sent or emailed to the Board of Directors are automatically forwarded to Mr. John Reid, one of our independent directors and a member of the Audit Committee. Upon receipt of a communication, Mr. Reid forwards the correspondence to the intended recipients; however, the Board of Directors has also instructed Mr. Reid to review such correspondence and, in his discretion, not to forward items that are deemed commercial, frivolous or otherwise inappropriate for consideration by the Board of Directors. In such cases, correspondence may be forwarded elsewhere for review and possible response.

Corporate Governance Guidelines. On February 26, 2004, the Board of Directors adopted a Nominating and Governance Charter that sets forth (i) corporate governance principles intended to promote efficient, effective and transparent governance, and (ii) procedures for the identification and selection of individuals qualified to become directors. At the same time, the Board of Directors also adopted a Code of Business Conduct, which applies to all of our directors, executive officers and employees. The Code of Business Conduct sets forth our commitment to conduct our business in accordance with the highest standards of business ethics and to promote the highest standards of honesty and ethical conduct by our directors, executive officers and employees.

Among other matters, our Nominating and Governance Charter and Code of Business Conduct set forth the following governing principles:

| • | | A majority of the directors on the Board of Directors should be “independent” as defined in the rules adopted by the SEC and Nasdaq. |

5

| • | | In order to facilitate critical discussion, the independent directors are required to meet apart from other board members and management representatives. |

| • | | Compensation of our non-employee directors should be a combination of cash and equity-based compensation. Employee directors are not paid for their board service in addition to their regular employee compensation. Non-employee directors may not receive consulting, advisory or other compensatory fees from us in addition to their compensation as directors. |

| • | | The Audit Committee and Compensation Committee shall consist entirely of independent directors. |

| • | | Directors, executive officers and all employees must act at all times in accordance with the requirements of our Code of Business Conduct. This obligation includes adherence to our policies with respect to conflicts of interest; full, accurate and timely disclosure; compliance with securities laws; confidentiality of our information; protection and proper use of our assets; ethical conduct in business dealings, and respect for and compliance with applicable law. Any change to or waiver of the requirements of the Code of Business Conduct with respect to any director, principal financial officer, principal accounting officer or persons performing similar functions may be granted only by the Board of Directors. Any such change or waiver will be promptly disclosed as required by law or Nasdaq regulations. |

Our Nominating and Corporate Governance Charter and our Code of Business Conduct are posted on our Investor Relations web site athttp://ir.princetonreview.com.

Stockholder Nominations. Stockholders who wish to recommend individuals for consideration by the Nominating Committee to become nominees for election to the Board of Directors may do so by submitting a written recommendation to: The Princeton Review, Inc., 2315 Broadway, New York, New York 10024, Attn: Mark Chernis, Secretary. Submissions must include sufficient biographical information concerning the recommended individual, including age; five-year employment history with job titles, responsibilities, employer names and a description of the employer’s business; whether such individual can read and understand basic financial statements; and board membership (if any). Each submission must be accompanied by contact information for two business references and a signed, written consent of the individual to stand for election if nominated by the Board of Directors and to serve if elected by the stockholders. Submissions by shareholders must be received by the Secretary of the Company not less than 60 days nor more than 90 days prior to the anniversary date of the immediately preceding annual meeting of stockholders.

Our by-laws prescribe an alternative procedure with regard to the nomination by stockholders of candidates for election as directors (the “Nomination Procedure”). The by-laws provide that a stockholder seeking to nominate candidates for election as directors at an annual meeting of stockholders must provide timely notice in writing. To be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices not less than 60 days nor more than 90 days prior to the anniversary date of the immediately preceding annual meeting of stockholders. However, in the event that the annual meeting is called for a date that is not within 30 days before or after that anniversary date, notice by the stockholder in order to be timely must be received not later than the close of business on the tenth day following the date on which notice of the date of the annual meeting was mailed to stockholders or made public, whichever first occurs. Our by-laws also specify requirements as to the form and content of a stockholder’s notice. These provisions may preclude stockholders from making nominations for directors at an annual meeting of stockholders. Any such nomination should be mailed to: The Princeton Review, Inc., 2315 Broadway, New York, New York 10024, Attn: Mark Chernis, Secretary.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2004, John C. Reid, Sheree T. Speakman and Howard A. Tullman served as the members of our Compensation Committee. None of the members of our Compensation Committee is, or has been, an officer or employee of ours or any of our subsidiaries. John Katzman, our Chairman and Chief Executive Officer, serves as a director and member of the compensation committee of Kaz, Inc. Richard Katzman, Chairman and Chief Executive Officer of Kaz, Inc., serves as a director of our company.

6

Compensation of Directors

The Board of Directors believes that compensation for our non-employee directors should be a combination of cash and equity-based compensation. Employee directors are not paid for their service on the Board of Directors in addition to their compensation as employees. Our independent directors do not receive consulting, advisory or other compensatory fees from us in addition to their compensation as directors.

In May 2002, the Board of Directors adopted The Princeton Review, Inc. Non-Employee Director Compensation Plan (the “Director Compensation Plan”). The Director Compensation Plan provides for annual compensation of our non-employee directors comprised of cash and options granted under the Stock Incentive Plan as set forth in the following table:

Option to purchase shares of our Common Stock granted on initial appointment

as director | 15,000 shares |

| Annual director retainer (paid quarterly) | $10,000 |

| Additional annual retainer for committee chairs (paid quarterly) | $4,000 |

Option to purchase shares of our Common Stock in recognition of ongoing

service (granted each June 1 after the second anniversary of appointment) | 5,000 shares |

| Reimbursement of expenses related to board attendance | Reasonable expenses

reimbursed as incurred |

In accordance with the terms of the Director Compensation Plan, in June 2004, each of our non-employee directors received an option to purchase 5,000 shares of Common Stock in recognition of their ongoing service as directors. These options have an exercise price of $7.31 per share and vest as to 6.25% of such shares each quarter until fully vested. Each of the options has a term of 10 years, subject to earlier termination in the event of termination of service as a director.

We reimburse our directors for reasonable expenses they incur in attending meetings of our Board of Directors and its committees.

7

REPORT OF THE AUDIT COMMITTEE

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee has, among other activities, (i) reviewed and discussed with management our audited annual financial statements for the fiscal year ended December 31, 2004 and interim quarterly results, (ii) discussed with Ernst & Young LLP, our independent registered public accounting firm, the matters required to be discussed by American Institute of Certified Public Accountants Auditing Standards Board on Auditing Standards No. 61 “Communications with Audit Committees,” (iii) considered the independence of Ernst & Young LLP, by having discussions with representatives of Ernst & Young LLP, and received a letter from them including disclosures required by the Independence Standards Board Standard No. 1 “Independence Discussions with Audit Committees,” and (iv) discussed with Ernst & Young, with and without management present, the results of their audit of the financial statements, their audit of the internal control over financial reporting and the overall quality of the Company’s financial reporting. On the basis of the above, the Audit Committee has recommended to the Board of Directors that our audited financial statements for the fiscal year ended December 31, 2004 be included in our Annual Report on Form 10-K for the year ended December 31, 2004.

Submitted by the Audit Committee of the Board of Directors

Sheree T. Speakman, Chairperson

John C. Reid

Howard A. Tullman

8

EXECUTIVE COMPENSATION

The following table shows the total compensation paid for the last three fiscal years to our Chief Executive Officer and the other four most highly compensated executive officers whose annual salary and bonus exceeded $100,000 in 2004. The individuals included in the following table are collectively referred to as the “Named Executive Officers.”

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

|---|

| | Annual Compensation

| | Number of

Securities

Underlying

Options

| |

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | All Other

Compensation

|

|---|

| John S. Katzman | | | 2004 | | | $ | 433,755 | | | | — | | | | — | | | | — | |

| Chairman and Chief | | | 2003 | | | | 400,675 | | | | — | | | | — | | | | — | |

| Executive Officer | | | 2002 | | | | 400,000 | | | | — | | | | — | | | | — | |

| | Mark Chernis | | | 2004 | | | | 338,831 | | | | — | | | | 125,000 | | | | — | |

| President, Chief Operating | | | 2003 | | | | 329,020 | | | | — | | | | — | | | | — | |

| Officer and Secretary | | | 2002 | | | | 305,347 | | | | — | | | | 134,286 | (1) | | | — | |

| | Stephen Quattrociocchi | | | 2004 | | | | 291,252 | | | $ | 29,174 | | | | 40,000 | | | | — | |

| Executive Vice President, Test | | | 2003 | | | | 282,820 | | | | — | | | | — | | | | — | |

| Preparation Services Division | | | 2002 | | | | 269,315 | | | | — | | | | 83,687 | (2) | | | — | |

| | Bruce Task | | | 2004 | | | | 296,849 | | | | — | (3) | | | 50,000 | | | | — | |

| Executive Vice President, Princeton | | | 2003 | | | | 288,716 | | | | 40,000 | | | | — | | | | — | |

| Review Ventures | | | 2002 | | | | 279,292 | | | | — | | | | 58,638 | (4) | | | — | |

| | Stephen Melvin | | | 2004 | | | | 274,501 | | | | — | | | | 70,000 | | | | — | |

| Chief Financial Officer and Treasurer | | | 2003 | | | | 258,284 | | | | — | | | | — | | | | — | |

| | | | 2002 | | | | 250,687 | | | | — | | | | 28,571 | (5) | | | — | |

| (1) | | Includes 34,286 options granted in lieu of a cash bonus for the 2002 fiscal year. These options were granted on March 31, 2003, are fully vested and have an exercise price of $4.12 per share, the closing price of our Common Stock on the date of grant. |

| (2) | | Includes 33,687 options granted in lieu of a cash bonus for the 2002 fiscal year. These options were granted on March 31, 2003, are fully vested and have an exercise price of $4.12 per share, the closing price of our Common Stock on the date of grant. |

| (3) | | Mr. Task will receive a bonus earned in 2004, but the amount of such bonus is not calculable as of the date hereof. |

| (4) | | Includes 18,638 options granted in lieu of a cash bonus for the 2002 fiscal year. These options were granted on March 31, 2003, are fully vested and have an exercise price of $4.12 per share, the closing price of our Common Stock on the date of grant. |

| (5) | | These options were granted in lieu of a cash bonus for the 2002 fiscal year on March 31, 2003, are fully vested and have an exercise price of $4.12 per share, the closing price of our Common Stock on the date of grant. |

Option Grants in 2004

The following table shows grants of stock options to our Chief Executive Officer and to the other Named Executive Officers during 2004. The exercise price per share of each option was not less than the fair market value of the Common Stock on the date of grant. All options shown in the following table vest as to 6.25% of the total grant each quarter following the grant date until fully vested. All of the options have a term of 10 years, subject to earlier termination in the event of a termination of employment.

Potential realizable values are net of exercise price before taxes and are based on the assumption that our Common Stock appreciates at the annual rate shown, compounded annually, from the date of grant until the expiration of the 10-year

9

term. These numbers are calculated based on the requirements of the SEC and do not reflect our estimate of future stock price growth. Unless the market price of the Common Stock appreciates over the option term, no value will be realized from the option grants shown in the table below.

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates

of Stock Price

Appreciation

for Option

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total

Options

Granted to

Employees in

Fiscal Year

| | Exercise

Price

per Share

| | Expiration

Date

| |

|---|

Name

| | | | | | 5%

| | 10%

|

|---|

| John S. Katzman | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Mark Chernis | | | 125,000 | | | | 11.38 | % | | $ | 7.30 | | | | 6/4/14 | | | $ | 573,750 | | | $ | 1,452,500 | |

| Stephen Melvin | | | 70,000 | | | | 6.37 | % | | $ | 7.30 | | | | 6/4/14 | | | $ | 321,300 | | | $ | 813,400 | |

| Stephen Quattrociocchi | | | 40,000 | | | | 3.64 | % | | $ | 7.30 | | | | 6/4/14 | | | $ | 183,600 | | | $ | 464,800 | |

| Bruce Task | | | 50,000 | | | | 4.55 | % | | $ | 7.30 | | | | 6/4/14 | | | $ | 229,500 | | | $ | 581,000 | |

Aggregated Option Exercises And Year-End Option Values

The following table provides information on options exercised during 2004, and options held at year end, by the Named Executive Officers.

| | Shares

Acquired on

Exercise

| | Value

Realized

| | Number of Shares

Underlying Unexercised

Options at 2004 Year-End

| | Value of Unexercised

In-the-Money Options

at 2004 Year-End

|

|---|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| John S. Katzman | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Mark Chernis | | | — | | | | — | | | | 389,924 | | | | 146,875 | | | $ | 173,244 | | | | — | |

| Stephen Melvin | | | 6,116 | | | $ | 22,227 | | | | 236,525 | | | | 86,250 | | | $ | 89,429 | | | $ | 23,750 | |

| Stephen Quattrociocchi | | | — | | | | — | | | | 187,222 | | | | 53,750 | | | $ | 137,500 | | | | — | |

| Bruce Task | | | — | | | | — | | | | 104,437 | | | | 58,750 | | | $ | 99,974 | | | | — | |

Equity Compensation Plan Information

Since the amount of benefits to be received by any participant in the Plan is determined by the Compensation Committee, the amount of future benefits allocated to any participant or group of participants in any particular year is not determinable. The following table sets forth certain information about shares of our stock outstanding and available for issuance under the Plan as of March 31, 2005. The table details the number of securities to be issued upon exercise of outstanding options under the Plan, the weighted average exercise price of outstanding options and the number of securities remaining available for future issuance under the Plan.

Plan category

| | Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

| | Weighted-

average exercise

price of

outstanding

options,

warrants and

rights

| | Number of securities

remaining available

for future issuance

under equity

compensation plans*

|

|---|

| Stock Incentive Plan | | | 3,320,577 | | | | $7.12 | | | | 682,048 | |

| * | | The number of securities remaining available for future issuance under our equity compensation plan is subject to annual increases as described in the Stock Incentive Plan. |

10

Employment Agreements

We have entered into employment agreements with each of our Named Executive Officers. The specific material terms of each of these employment agreements are set forth in the table below. Each of the agreements provides for an annual base salary that increases by 3% each year and includes a performance bonus calculated as a percentage of annual base salary. Each agreement provides for an initial term of between one and two years with automatic renewal for additional two-year periods on each termination date of the preceding term of the agreement until the executive voluntarily terminates employment or until we give written notice of non-renewal at least six months prior to the anniversary date of the agreement.

Certain of the employment agreements provide for, upon execution of the agreement, the grant to the executive of options to purchase shares of our Common Stock at a price equal to the fair market value of our Common Stock on the grant date. These stock options are subject to the provisions of our Stock Incentive Plan. The stock options granted to each executive vest in equal quarterly installments until the fourth anniversary of the date of the option grant. Regardless of these vesting provisions, the stock options become 100% exercisable upon the occurrence of a “change in control,” as defined in our Stock Incentive Plan.

Under these agreements, if we terminate the executive’s employment without cause or if we do not renew the agreement, we have agreed to pay the executive his annual base salary, and, in certain cases, to reimburse the executive for any payments he makes to maintain medical and dental insurance, for a specified amount of time following termination.

Each executive has agreed not to compete with us in the business of providing assistance with respect to preparation for standardized examinations or the college, professional school, or graduate school admissions process for 18 months following the expiration or termination of his agreement. Each executive has also agreed that for 18 months after the expiration or termination of his agreement, he will not solicit the services of any of our employees or our franchisees’ employees, and he will not take any action that results, or might reasonably result, in any employee ceasing to perform services for us or any of our franchisees and then commencing services for the executive.

Certain Material Terms of Employment Agreements with Named Executive Officers

Executive

| | Date of

Agreement

| | Initial Annual

Base Salary

| | Performance Bonus

As Percentage of

Annual Base Salary

| | Number of

Options Granted

Upon Execution

of Agreement

| | Duration of

Severance

Payments

|

|---|

| John S. Katzman | | | 4/11/02 | | | | $400,000 | | | | Up to 100 | % | | | — | | | | 18 months | (3) |

| Mark Chernis | | | 3/26/02 | | | | 320,000 | | | | Up to 50 | % | | | 100,000 | (1) | | | 18 months | (3) |

| Stephen Melvin | | | 6/7/04 | | | | 280,000 | | | | Up to 50 | % | | | 70,000 | (2) | | | 10 months | |

| Steve Quattrociocchi | | | 4/10/02 | | | | 275,000 | | | | Up to 50 | % | | | 50,000 | (1) | | | 12 months | |

| Bruce Task | | | 6/7/04 | | | | 281,377 | | | | 7.5% – 60 | % | | | 50,000 | (2) | | | 12 months | (4) |

| (1) | | Stock option granted in 2002 with an exercise price of $7.65 per share. |

| (2) | | Stock option granted in 2004 with an exercise price of $7.30 per share. |

| (3) | | Severance to be paid on termination also includes reimbursement for medical and dental insurance payments for the duration of the specified period. |

| (4) | | Severance to be paid on termination also includes reimbursement for medical and dental insurance payments for the number of weeks equal to twice the number of years Mr. Task was employed by us. Additionally, if Mr. Task voluntarily terminates his employment, we have agreed to pay him his base salary for six months following such termination. |

11

Report on Executive Compensation

The Compensation Committee has the sole authority and responsibility to review and determine, or recommend to the Board of Directors for determination, the compensation package of the Chief Executive Officer. The Compensation Committee also considers the design and effectiveness of the compensation program for the other executive officers of the company and approves the final compensation package, employment agreements and stock option grants for all executive officers. The Compensation Committee is composed entirely of independent directors who have never served as officers of The Princeton Review.

Executive Compensation Objectives and Philosophy. The objective of The Princeton Review’s executive compensation program is to attract, retain and motivate talented executives who are critical for the continued growth and success of the company and to align the interests of these executives with those of our stockholders. In order to achieve this objective, in addition to annual base salaries, the executive compensation program utilizes a combination of annual incentives through cash bonuses and long-term incentives through equity-based compensation. In establishing overall executive compensation levels, the Compensation Committee considers a number of criteria, including the executive’s scope of responsibilities, prior and current period performance, compensation levels for similar positions at companies in our industry and attainment of individual and overall company performance objectives. The Princeton Review’s policy is to enter into employment agreements with all executive officers. These employment agreements are typically for an initial term of two years, renewing automatically for additional two-year periods, and set forth initial base salary levels and bonus ranges, with minimum increases provided for within a specified range.

Base Salary. In establishing base salaries, the Compensation Committee primarily considers prior and current period performance, scope of responsibilities and compensation levels for similar positions at companies similar to The Princeton Review. Base salaries are generally specified under employment agreements with executive officers, providing for minimum yearly increases within a specified range.

Annual Incentives. In addition to base salaries, executive officers are eligible to receive annual cash bonuses. Cash bonuses payable to executives are based primarily upon achievement of specified individual and company performance objectives. Minimum annual bonus eligibility is generally set forth in the executive’s employment agreement and is expressed as a percentage of base salary. Bonuses are determined after an evaluation of the level of attainment of specified individual and company performance goals. None of the Named Executive Officers other than Steve Quattrociocchi and Bruce Task will receive a bonus for the 2004 fiscal year. Mr. Quattrociocchi will receive a cash bonus of $29,174, and Mr. Task’s bonus for 2004 has not been determined as of the date hereof.

Long-Term Equity-Based Incentive Awards. Long-term equity-based incentives are provided by the company to executive officers through the granting of stock options. Stock option grants are designed to align the executive’s interests with those of the stockholders and provide each executive officer with a significant incentive to manage the company in a manner which maximizes stockholder value. Stock options are granted pursuant to our Stock Incentive Plan, which also authorizes grants of restricted and deferred stock awards. The Compensation Committee determines the size of the stock option grants according to each executive’s position with, and contribution to, the company and sets a level it considers appropriate to create a meaningful opportunity for stock ownership. In addition, the Compensation Committee takes into account each individual’s potential for future responsibility and promotion, the levels of equity ownership of executives in similar positions at comparable companies and the number of options held by that individual at the time of the new grant. Each of Mark Chernis, Steve Melvin, Steve Quattrociocchi and Bruce Task received option grants during the 2004 fiscal year. The material terms of these stock option grants are described above in “Option Grants in 2004.”

Chief Executive Officer Compensation. The principal factors considered by the Compensation Committee for Mr. Katzman’s compensation package are generally the same as those considered by the Compensation Committee in relation to the compensation of the other executive officers, with the exception that Mr. Katzman’s compensation does not have a long term equity-based incentive component, since Mr. Katzman already holds a large percentage of the company’s stock. Mr. Katzman’s base salary for the fiscal year 2004 was $433,755, which was consistent with the initial base salary set forth in his employment agreement and was set by the Compensation Committee after an evaluation of the company’s performance for the 2001 fiscal year. Mr. Katzman’s employment agreement also provides that his bonus, if any, for 2004 is to be calculated utilizing a formula that takes into account the company’s success in achieving certain statement of operations-based performance objectives and the company’s stock price. Mr. Katzman did not receive a bonus for the 2004 fiscal year. The material terms of Mr. Katzman’s employment agreement are described above under “Employment Agreements.”

12

Tax Deductibility of Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the deductibility on The Princeton Review’s tax return of compensation over $1 million to any of the Named Executive Officers unless, in general, the compensation is paid pursuant to a plan which is performance-related, non-discretionary and has been approved by the company’s stockholders. The Compensation Committee’s policy with respect to section 162(m) is to make every reasonable effort to ensure that compensation is deductible to the extent permitted while simultaneously providing the company’s executives with appropriate compensation for their performance. The Princeton Review did not pay any compensation during 2004 that would be subject to the limitations set forth in section 162(m).

Submitted by the Compensation Committee of the Board of Directors

Howard A. Tullman, Chairman

John C. Reid

Sheree T. Speakman

13

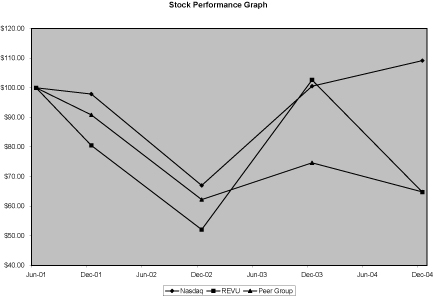

STOCK PERFORMANCE GRAPH

The following graph provides a comparison of the cumulative total stockholder return on our Common Stock for the period from June 19, 2001 (the date upon which our Common Stock commenced trading on the Nasdaq National Market) to December 31, 2004 with the cumulative total return for (i) the Nasdaq Stock Market Composite Index (the “NASDAQ Index”) and (ii) a peer group that we selected that consists of companies that provide various educational services. The peer group is comprised of Devry, Inc. (DV), eCollege.com, Inc. (ECLG), Learning Care Group, Inc. (LCGI) (formerly named Childtime Learning Center, Inc. (CTIM)), Nobel Learning Communities, Inc. (NLCI), Plato Learning, Inc. (TUTR), Renaissance Learning, Inc. (RLRN) and Scholastic Corp. (SCHL) (the “Peer Index”). The Peer Index no longer includes Lightspan, Inc., Sylvan Learning Systems, Inc. and Riverdeep Group plc. We removed Lightspan from the Peer Index last year because it was acquired by Plato Learning, and its stock is no longer publicly traded in the United States. We removed Sylvan Learning Systems from the Peer Index last year because in March 2003, Sylvan Learning Systems agreed to sell its tutoring business and learning centers, and to disband its division focusing on online-learning initiatives. We removed Riverdeep Group from the Peer Index in 2003 because it was de-listed from the Nasdaq National Market in 2002, and its stock is no longer publicly traded in the United States.

Total return values were calculated based on cumulative total return assuming the investment, at the closing price on June 19, 2001, of $100 in each of the Common Stock, the NASDAQ Index and the Peer Index.

| | | | 6/19/01

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

|---|

| The Princeton Review, Inc. | | | | $ | 100 | | | $ | 80.53 | | | $ | 52.11 | | | $ | 102.63 | | | $ | 64.74 | |

| Nasdaq | | | | $ | 100 | | | $ | 97.88 | | | $ | 67.02 | | | $ | 100.54 | | | $ | 109.17 | |

| Peer Index | | | | $ | 100 | | | $ | 90.82 | | | $ | 62.22 | | | $ | 74.65 | | | $ | 64.83 | |

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933 or the Exchange Act that might incorporate future filings made by us under those statutes, the preceding Compensation Committee Report on Executive Compensation and the Stock Performance Graph will not be incorporated by reference into any of those prior filings, nor will such report or graph be incorporated by reference into any future filings made by us under those statutes.

14

OWNERSHIP OF SECURITIES

The following table shows, as of March 31, 2005, information with respect to the beneficial ownership of shares of our Common Stock by each of our current directors or Nominees, each of our Named Executive Officers, each person known by us to beneficially own more than 5% of our Common Stock, and all of our directors and executive officers as a group. Beneficial ownership is determined under the rules of the SEC and includes voting or investment power with respect to the securities.

Unless indicated otherwise below, the address for each listed director and officer is The Princeton Review, Inc., 2315 Broadway, New York, New York 10024. Except as indicated by footnote, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. The number of shares of Common Stock outstanding used in calculating the percentage for each listed person includes the shares of Common Stock underlying options held by that person that are exercisable within 60 days following March 31, 2005, but excludes shares of Common Stock underlying options held by any other person. Percentage of beneficial ownership is based on 27,569,764 shares of Common Stock outstanding as of March 31, 2005.

Name of Beneficial Owner

| | | | Number of Shares

Beneficially Owned

| | Percentage

Beneficially

Owned

|

|---|

| John S. Katzman(1) | | | | | 9,120,885 | | | | 33.08 | % |

Wellington Management Company, LLP(2)

75 State Street

Boston, MA 02109

| | | | | 2,461,200 | | | | 8.93 | |

SGC Partners II, LLC(3)

1221 Avenue of the Americas

New York, NY 10020

| | | | | 2,105,054 | | | | 7.64 | |

Columbia Wanger Asset Management, L.P.(4)

227 W. Monroe Street, Suite 3000

Chicago, IL 60606

| | | | | 1,850,000 | | | | 6.71 | |

Random House TPR, Inc.(5)

1745 Broadway

New York, NY 10036

| | | | | 1,515,353 | | | | 5.50 | |

| Mark Chernis(6) | | | | | 782,085 | | | | 2.80 | |

| Bruce Task(7) | | | | | 276,616 | | | | 1.00 | |

| Stephen Melvin(8) | | | | | 276,278 | | | | * | |

| Stephen Quattrociocchi(9) | | | | | 243,180 | | | | * | |

| Robert E. Evanson | | | | | 0 | | | | * | |

| Frederick S. Humphries(10) | | | | | 12,188 | | | | * | |

| Richard Katzman(11) | | | | | 56,482 | | | | * | |

| John C. Reid(12) | | | | | 23,848 | | | | * | |

| Richard Sarnoff(12) | | | | | 23,848 | | | | * | |

| Sheree T. Speakman(12) | | | | | 23,848 | | | | * | |

| Howard A. Tullman(12) | | | | | 34,172 | | | | * | |

All executive officers, directors and nominees as a group

(14 persons)(13) | | | | | 9,745,178 | | | | 37.97 | % |

(footnotes continued on next page)

15

(footnotes continued from previous page)

| (1) | | Includes 102,160 shares held by Mr. Katzman’s wife. Mr. Katzman disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest. Also includes 923,921 shares held by Katzman Business Holdings, L.P. and 452 shares held by Katzman Management, Inc. Katzman Management is the general partner of Katzman Business Holdings and is wholly owned by Mr. Katzman. Also includes 828,638 shares held by Mr. Katzman that Mr. Katzman pledged to Reservoir Capital Partners, L.P. as security in connection with Mr. Katzman’s personal guaranty of debt obligations of Student Advantage, Inc. to Reservoir Capital Partners and other lending parties. |

| (2) | | Wellington Management Company, LLP, is a limited liability partnership, and in its capacity as investment adviser, may be deemed to beneficially own these shares which are held of record by clients of Wellington Management Company. |

| (3) | | SGC Partners II is a wholly-owned subsidiary of SG Merchant Banking Fund, L.P. The general partner of SG Merchant Banking Fund is SG Capital Partners, LLC. The managing member of SG Capital Partners is SG Cowen Securities Corporation. As a result of these relationships, SG Merchant Banking Fund, SG Capital Partners and SG Cowen Securities Corporation may each be deemed to share beneficial ownership of these shares. Each of these entities disclaims beneficial ownership. |

| (4) | | Columbia Wanger Asset Management, L.P. is a limited partnership whose general partner is WAM Acquisition GP, Inc. Columbia Acorn Trust is a discretionary client of Columbia Wanger Asset Management on whose behalf certain of these shares were acquired. Columbia Wanger Asset Management, WAM Acquisition GP and Columbia Acorn Trust share voting and dispositive power over these shares and may each be deemed to share beneficial ownership of these shares. |

| (5) | | Random House TPR, Inc. is a wholly-owned subsidiary of Random House, Inc. |

| (6) | | Includes 410,238 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (7) | | Includes 112,562 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (8) | | Includes 253,400 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (9) | | Includes 195,972 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (10) | | Includes 12,188 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (11) | | Includes 48,864 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (12) | | Includes 23,484 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

| (13) | | Includes 1,166,535 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2005. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Random House, Inc.

During 2004, we derived a total of approximately $3.7 million in revenue from royalties, marketing fees, advances, copy editing fees and other fees from Random House, Inc. under a number of publication agreements. Random House, through its subsidiary Random House TPR, Inc., beneficially owned approximately 5.5% of our Common Stock, as of March 31, 2005. Richard Sarnoff, President of the Corporate Development Group of Random House, also serves on our Board of Directors.

We believe that our transactions with Random House were in our best interests and were made on terms no less favorable to us than could have been obtained from unaffiliated third parties.

16

Acquisition of Princeton Review of Boston, Inc. and Princeton Review of New Jersey, Inc.

On March 2, 2001, we acquired the assets comprising the businesses of two of our former franchisees, Princeton Review of Boston, Inc. and Princeton Review of New Jersey, Inc. Robert L. Cohen, who became our Executive Vice President, K-12 Services division immediately following this transaction, is co-founder and 50% owner of Princeton Review of Boston and co-founder and 47.5% owner of Princeton Review of New Jersey. Upon the consummation of this acquisition, Mr. Cohen executed an employment agreement with us. In addition, Joel Rubin, the spouse of Linda Nessim-Rubin, our Executive Vice President, Communications, is an employee and 5% owner of Princeton Review of New Jersey and is an employee of Princeton Review of Boston.

The total purchase price paid by us in connection with this acquisition was approximately $13.8 million and was determined through arm’s length negotiations between us and the sellers, including Mr. Cohen. Approximately $10,175,000 of the purchase price was paid in cash at the time of the closing and the remaining $3,625,000 was paid by delivery of two subordinated promissory notes. Mr. Cohen’s interest in the consideration paid by us for the assets of these businesses corresponds to his percentage ownership in Princeton Review of Boston and Princeton Review of New Jersey. Mr. Cohen also received a payment from us in the amount of $200,000 in consideration for the non-competition and non-solicitation restrictions set forth in the asset purchase agreement relating to the transaction.

Mr. Rubin’s interest in the consideration paid by us for the assets of Princeton Review of New Jersey corresponds to his 5% equity interest in that company. Mr. Rubin’s interest in the consideration paid by us for the assets of Princeton Review of Boston is governed by a long-term employment agreement that gives him a right to a bonus equal to 5% of the proceeds from the sale of the assets of Princeton Review of Boston.

Other Transactions

Under an employment agreement with Mark Chernis, our President and Chief Operating Officer, in 2001 we agreed to lend Mr. Chernis on a fully non-recourse basis up to an aggregate principal amount of $500,000. The loan is represented by two separate promissory notes, each of which is payable in four consecutive, equal annual installments with the first payment to be made on the earlier of November 27, 2005 or 60 days after termination of employment, subject to earlier prepayment upon the occurrence of specified events. The loan accrues interest at 7.3% per year and is secured by 178,316 shares of our Common Stock owned by Mr. Chernis. The loan is evidenced by a promissory note and a pledge and security agreement entered into on November 27, 2001, and a second promissory note entered into on March 7, 2002. As of March 31, 2005, $500,000 had been advanced and was outstanding under the loan, and $500,000 is the largest principal amount outstanding since the loan was made.

Under an employment agreement with Bruce Task, our Executive Vice President, Princeton Review Ventures, in 2001 we agreed to lend Mr. Task on a fully non-recourse basis up to an aggregate principal amount of $500,000. The loan is payable in four consecutive, equal annual installments with the first payment to be made on the earlier of August 15, 2005 or 60 days after termination of employment, subject to earlier prepayment upon the occurrence of specified events. The loan accrues interest at 7.3% per year and is secured by 120,750 shares of our Common Stock owned by Mr. Task. The loan is evidenced by a promissory note and a pledge and security agreement entered into on August 15, 2001. As of March 31, 2005, $500,000 had been advanced and was outstanding under the loan, and $500,000 is the largest principal amount outstanding since the loan was made.

On July 30, 2002, the Sarbanes-Oxley Act of 2002, a broad accounting and corporate governance reform act, became law. Among other things, the Sarbanes-Oxley Act prohibits us from entering into personal loans to or for any of our directors or executive officers. We entered into the transactions described above before the passage of the Sarbanes-Oxley Act. In accordance with the Sarbanes-Oxley Act, we will not renew or materially modify the terms of existing personal loans with directors or executive officers or enter into any new personal loans with any of our directors or executive officers.

17

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

In accordance with the Audit Committee Charter, the Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2005. The Board of Directors hereby requests that the stockholders ratify such appointment. Representatives of Ernst & Young LLP are not expected to be present at the Annual Meeting.

Fees Paid to Ernst & Young LLP

The following table sets forth the fees that we paid or accrued for the audit and other services provided by Ernst & Young in fiscal year 2004 and 2003:

| | | | 2004

| | 2003

|

|---|

| Audit Fees | | | | $ | 1,600,000 | (1) | | $ | 469,505 | |

| Audit-Related Fees | | | | | 35,303 | | | | 19,325 | |

| Tax Fees | | | | | — | | | | 3,000 | |

| All Other Fees | | | | | 1,629 | | | | 1,629 | |

| Total | | | | $ | 1,636,932 | | | $ | 493,459 | |

| (1) | | Includes total estimated fees for the 2004 annual audit and 2004 Sarbanes-Oxley-related fees. |

Audit Fees. This category includes the audit of our annual financial statements, audit of our internal control over financial reporting, reviews of financial statements included in our Quarterly Reports on Form 10-Q, and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for the listed fiscal years. This category also includes fees for advice on accounting matters that arose during, or as a result of, the annual audit or the reviews of interim financial statements.

Audit-Related Fees. This category consists of assurance and related services provided by Ernst & Young that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” The services for the fees disclosed under this category include benefit plan audits, other accounting consulting, vendor compliance audits, royalty audits and due diligence services rendered in connection with acquisitions of our franchised operations.

Tax Fees. This category consists of professional services rendered by Ernst & Young, primarily in connection with strategic planning with respect to possible acquisitions.

All Other Fees. This category consists of fees for subscriptions and other miscellaneous items.

Pre-Approval Policies and Procedures. In accordance with the Audit Committee Charter, the Audit Committee reviews and approves in advance on a case-by-case basis each engagement (including the fees and terms thereof) by us of accounting firms that will perform permissible non-audit services or audit, review or attest services for the Company. The Audit Committee is authorized to establish detailed pre-approval policies and procedures for pre-approval of such engagements without a meeting of the Audit Committee, but the Audit Committee has not established any such pre-approval procedures at this time.

All audit fees, audit-related fees, tax fees and all other fees of our principal accounting firm for 2004 were pre-approved by the Audit Committee.

The Board of Directors recommends a voteFOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2005.

18

OTHER MATTERS

Solicitation of Proxies

The cost of solicitation of proxies in the form enclosed herewith will be paid by The Princeton Review. In addition to the solicitation of proxies by mail, our directors, officers and employees may also solicit proxies personally or by telephone without additional compensation for such activities. We will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send proxy materials to and obtain proxies from such beneficial owners. We will reimburse such holders for their reasonable expenses.

Stockholder Proposals

For stockholder proposals to be included in our proxy materials relating to our Annual Meeting of Stockholders to be held in 2006 (the “2006 Annual Meeting”), all applicable requirements of Rule 14a-8 promulgated under the Exchange Act (“Rule 14a-8”) must be satisfied and such proposals must be received by us at our principal executive offices no later than Thursday, December 29, 2005.

Stockholders who do not wish to submit a proposal for inclusion in our proxy materials relating to our 2006 Annual Meeting in accordance with Rule 14a-8 may submit a proposal for consideration at the 2006 Annual Meeting in accordance with our bylaws. Such stockholders must provide timely notice in writing. To be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices not less than 60 days nor more than 90 days prior to the anniversary date of the Annual Meeting. Accordingly, for our 2006 Annual Meeting, proposals must be received at our principal executive offices not earlier than Saturday, March 11, 2006 and not later than Monday, April 10, 2006. However, in the event that the 2006 Annual Meeting is called for a date that is not within 30 days before or after the anniversary date of the Annual Meeting, notice by the stockholder in order to be timely must be received not later than the close of business on the tenth day following the date on which notice of the date of the 2006 Annual Meeting is mailed to stockholders or made public, whichever first occurs. Our bylaws also specify requirements as to the form and content of a stockholder’s notice. These provisions may preclude stockholders from bringing matters before an annual meeting of stockholders.

All notices of proposals by stockholders, whether or not to be included in our proxy materials, should be mailed to: The Princeton Review, Inc., 2315 Broadway, New York, New York 10024, Attn: Mark Chernis, Secretary.

Other Matters

The Board of Directors does not know of any matters other than those described in this Proxy Statement that will be presented for action at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the best judgment of the proxy holders.

BY ORDER OF THE BOARD OF DIRECTORS

Mark Chernis

Secretary

Dated: April 28, 2005

19

THE PRINCETON REVIEW, INC.

This Proxy is Solicited on Behalf of The Board Of Directors

The undersigned stockholder of The Princeton Review, Inc. (the “Company”), hereby appoints John S. Katzman, Mark Chernis, Margot Lebenberg and Stephen Melvin and each of them, with power of substitution to each, true and lawful Proxies of the undersigned and hereby authorizes them to represent and vote, as specified herein, all shares of common stock of the Company held of record by the undersigned as of the close of business on April 21, 2005 at the Annual Meeting of Stockholders of the Company to be held on Thursday, June 9, 2005 at 10:00 a.m., local time, at The Princeton Review, Inc., located at 2315 Broadway, New York, New York 10024 (the “Annual Meeting”), and any adjournments or postponements thereof.

The shares represented by this proxy will be voted in the manner directed. If no direction is given, the shares will be voted FOR the three nominees of the Board of Directors listed in Proposal 1 and FOR Proposal 2. In their discretion, the Proxies are each authorized to vote upon such other matters as may properly come before the Annual Meeting and any adjournments or postponements thereof.

PROPOSAL 1. Election of Directors

oFOR all nominees listed below | oWITHHOLD authority to vote for all nominees listed below |

| |

To withhold authority to vote for any individual nominee, strike a line through the nominee’s name in the list below: |

|

Robert E. Evanson | John S. Katzman | John C. Reid |

| | |

Our Board of Directors unanimously recommends a vote FOR each of the nominees named above. |

PROPOSAL 2. To ratify and approve the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2005.

oFOR PROPOSAL 2 | oAGAINST PROPOSAL 2 | oABSTAIN ON PROPOSAL 2 |

| | |

Our Board of Directors unanimously recommends a vote FOR the approval of Proposal 2. |

The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement dated April 28, 2005.

| Date: | |

| |

| Signature: | |

| Signature: | |

| (This Proxy should be marked, dated, signed by the stockholder(s) exactly as his or her name appears hereon, and returned promptly in the enclosed envelope. Persons signing in a fiduciary capacity should so indicate. If shares are held by joint tenants or as community property, both should sign.) |

| | | | |

PLEASE SIGN, DATE AND RETURN IMMEDIATELY