Keryx Biopharmaceuticals, Inc. Fourth Quarter and Full Year 2016 Financial Results March 1, 2017 Building a Leading Renal Company Exhibit 99.2

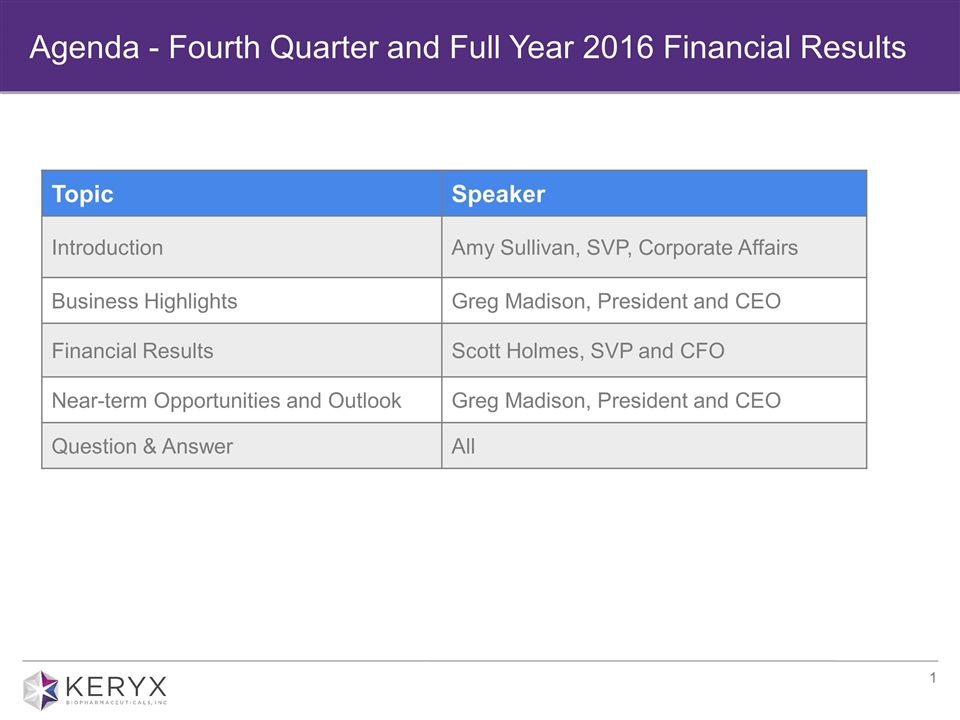

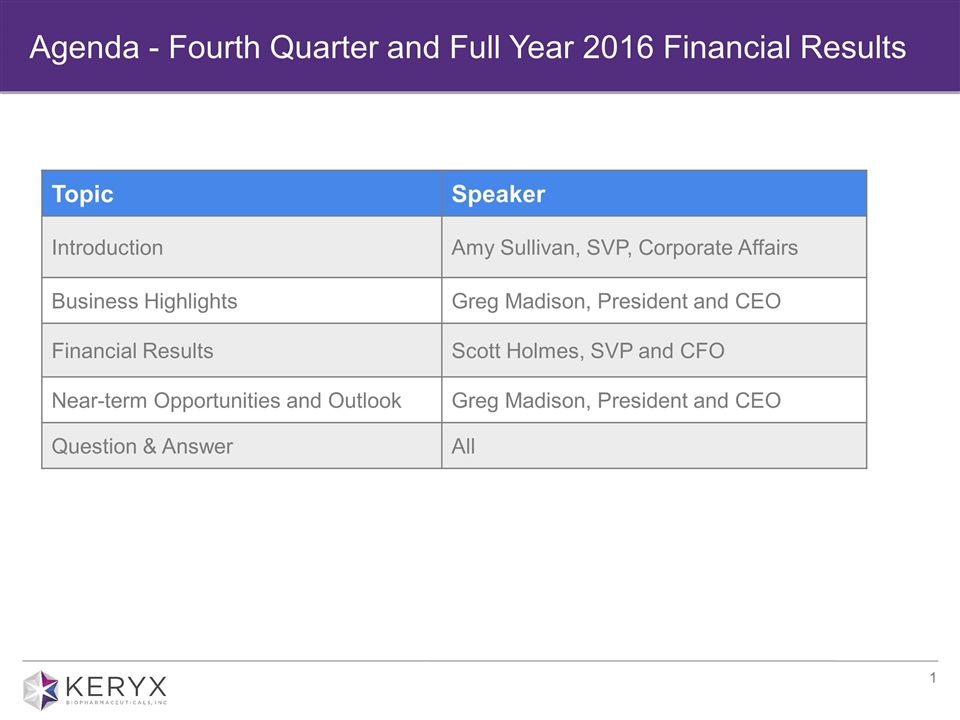

Agenda - Fourth Quarter and Full Year 2016 Financial Results Topic Speaker Introduction Amy Sullivan, SVP, Corporate Affairs Business Highlights Greg Madison, President and CEO Financial Results Scott Holmes, SVP and CFO Near-term Opportunities and Outlook Greg Madison, President and CEO Question & Answer All

Forward-looking Statements Some of the statements included in this presentation, particularly those regarding the commercialization and ongoing clinical development of Auryxia, the submission of an sNDA to the FDA to expand the label of ferric citrate to include the treatment of IDA in adults with stage 3-5 NDD-CKD and the potential approval in this indication and the impact thereof on Keryx, may be forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: whether we can increase adoption of Auryxia in patients with CKD on dialysis; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; the risk that the FDA may not concur with our interpretation of our Phase 3 study results in NDD- CKD, supportive data, conduct of the studies, or any other part of our regulatory submission and could ultimately deny approval of ferric citrate for the treatment of IDA in adults with stage 3-5 NDD-CKD; the risk that if approved for use in NDD-CKD that we may not be able to successfully market Auryxia for use in this indication; our ability to continue to supply Auryxia following the recent resupply to the market; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward looking statements set forth in this presentation speak only as of the date of this presentation. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof. This presentation is available on our website at http://www.keryx.com. The information found on our website is not incorporated by reference into this presentation and is included for reference purposes only.

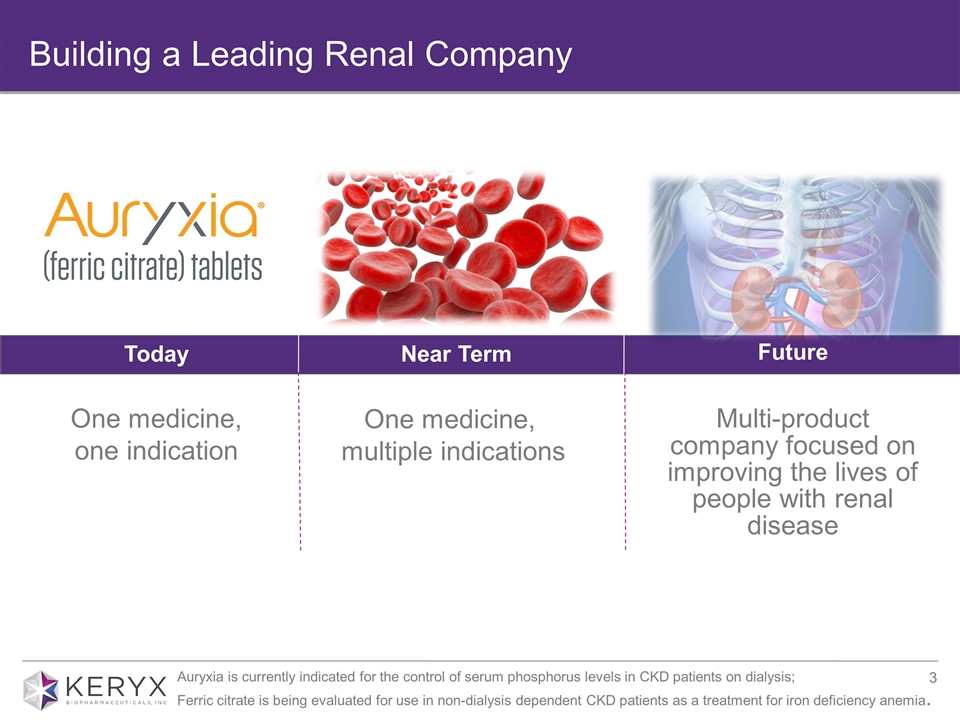

Building a Leading Renal Company Today Near Term Future One medicine, multiple indications Multi-product company focused on improving the lives of people with renal disease One medicine, one indication Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

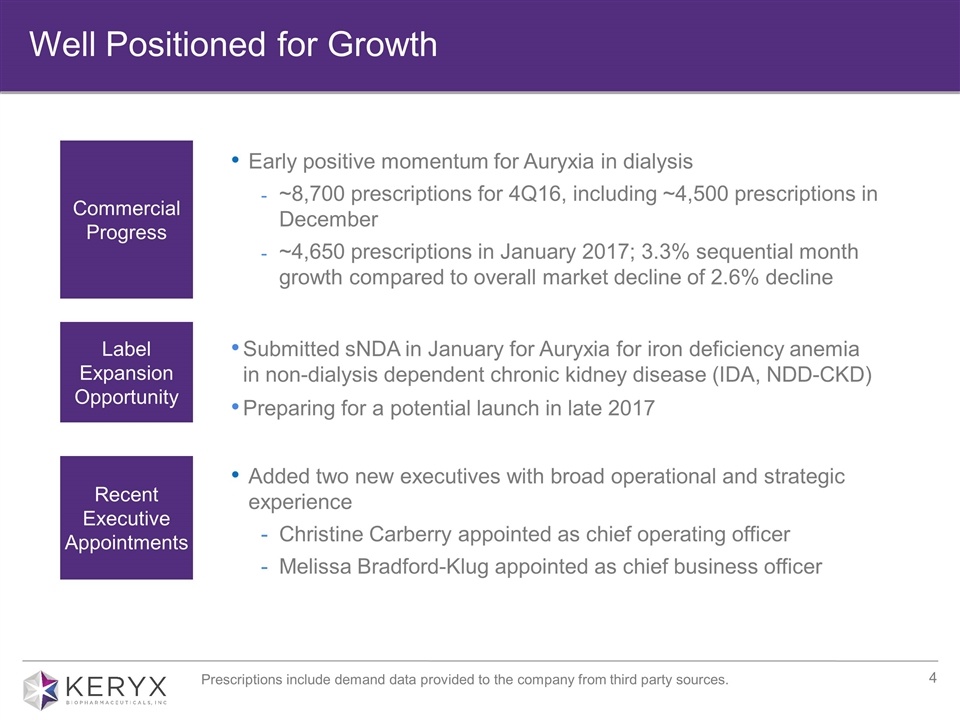

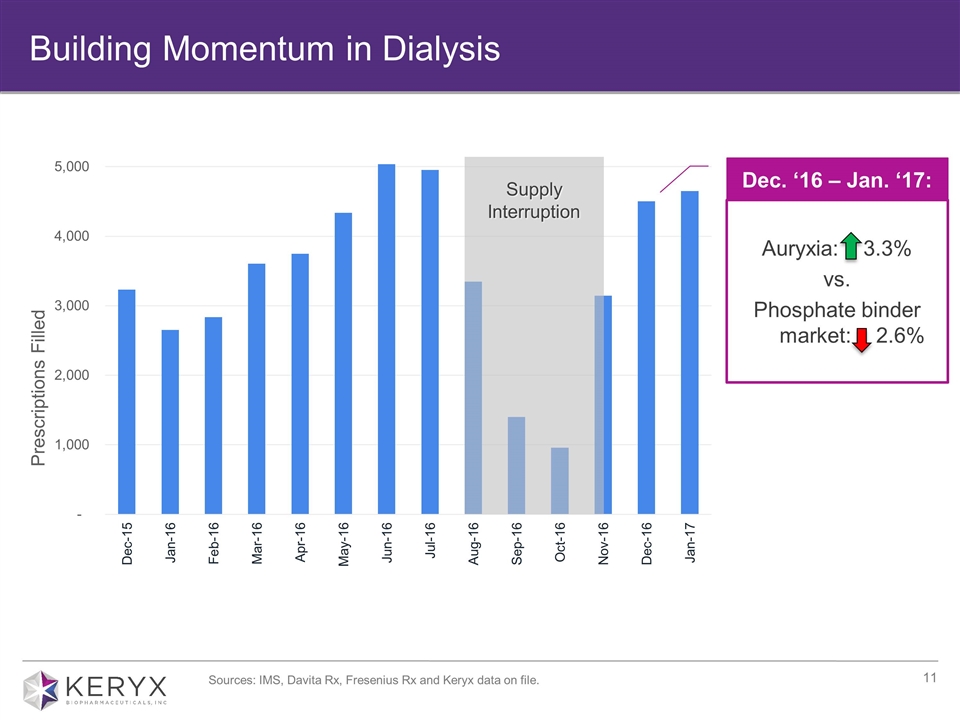

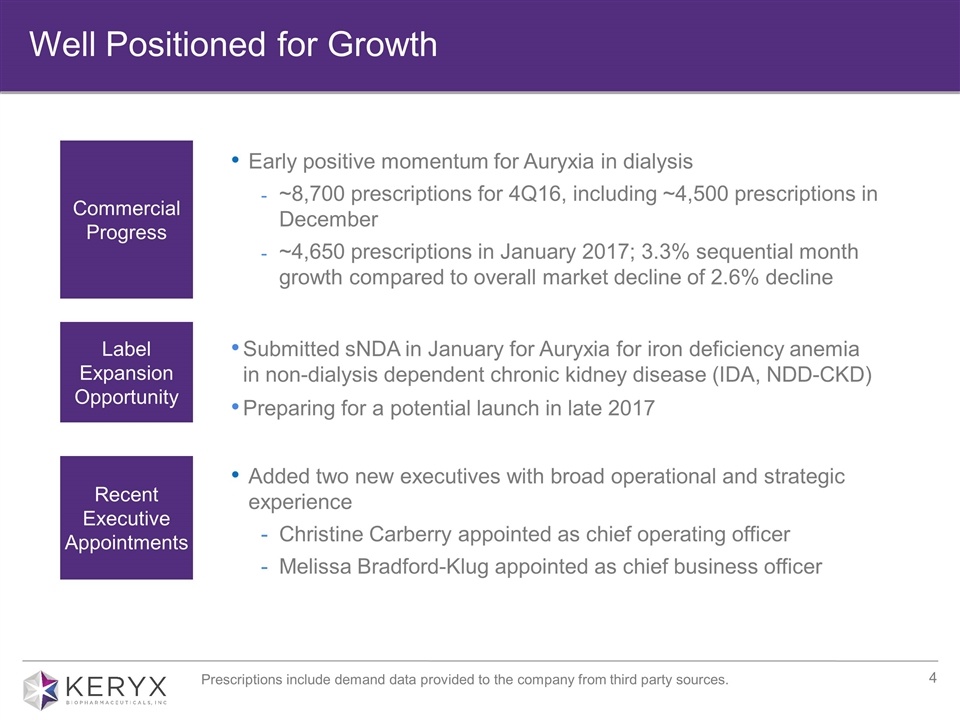

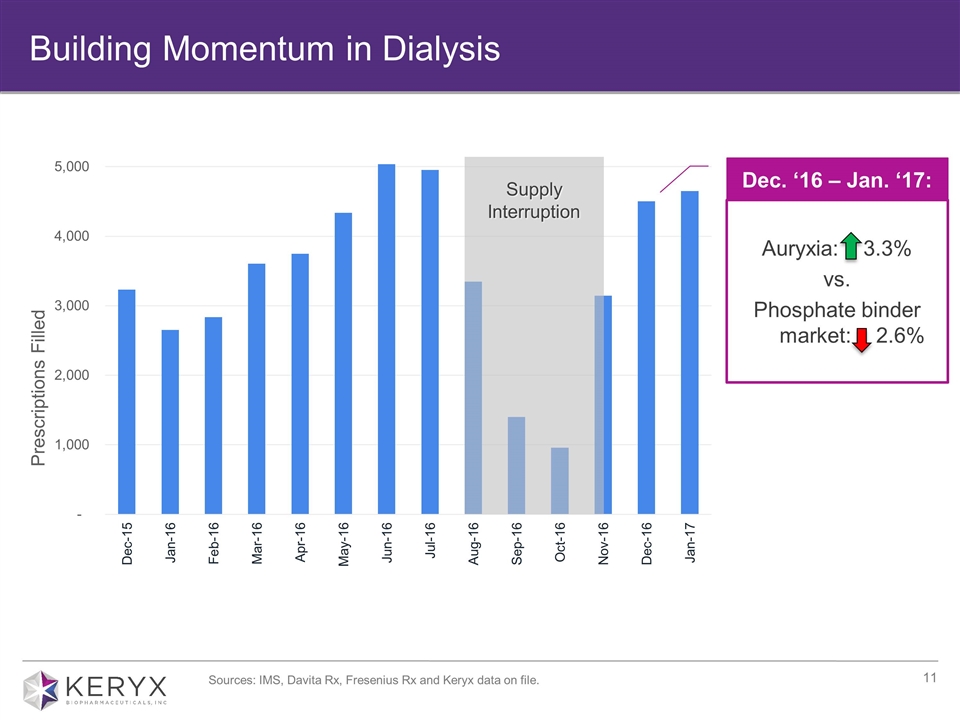

Early positive momentum for Auryxia in dialysis ~8,700 prescriptions for 4Q16, including ~4,500 prescriptions in December ~4,650 prescriptions in January 2017; 3.3% sequential month growth compared to overall market decline of 2.6% decline Well Positioned for Growth Commercial Progress Label Expansion Opportunity Submitted sNDA in January for Auryxia for iron deficiency anemia in non-dialysis dependent chronic kidney disease (IDA, NDD-CKD) Preparing for a potential launch in late 2017 Prescriptions include demand data provided to the company from third party sources. Recent Executive Appointments Added two new executives with broad operational and strategic experience Christine Carberry appointed as chief operating officer Melissa Bradford-Klug appointed as chief business officer

Financial Highlights Scott Holmes SVP and Chief Financial Officer

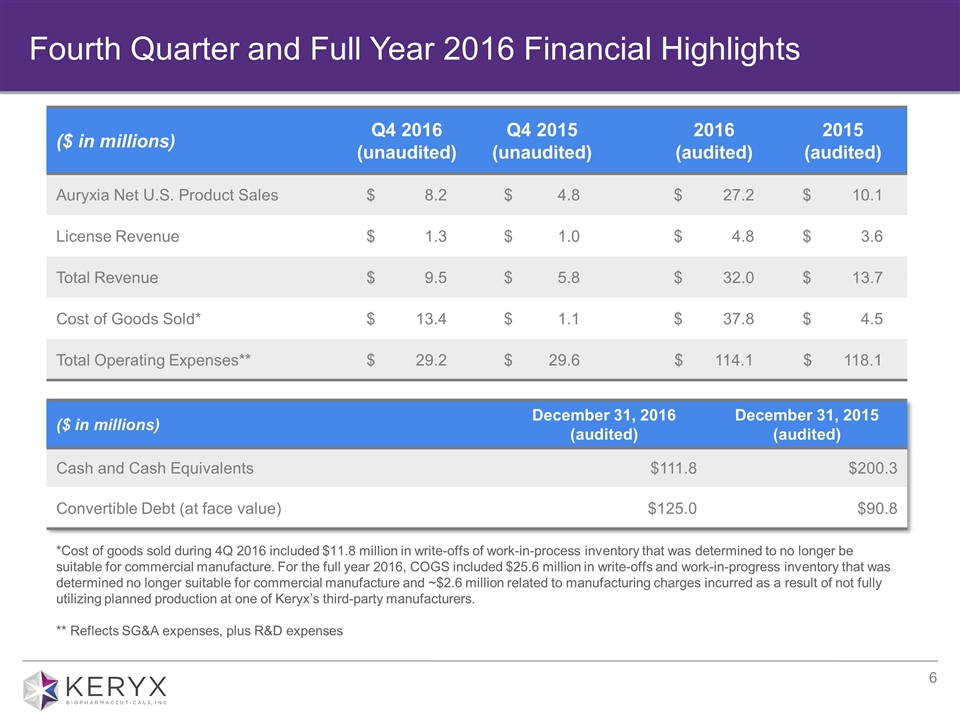

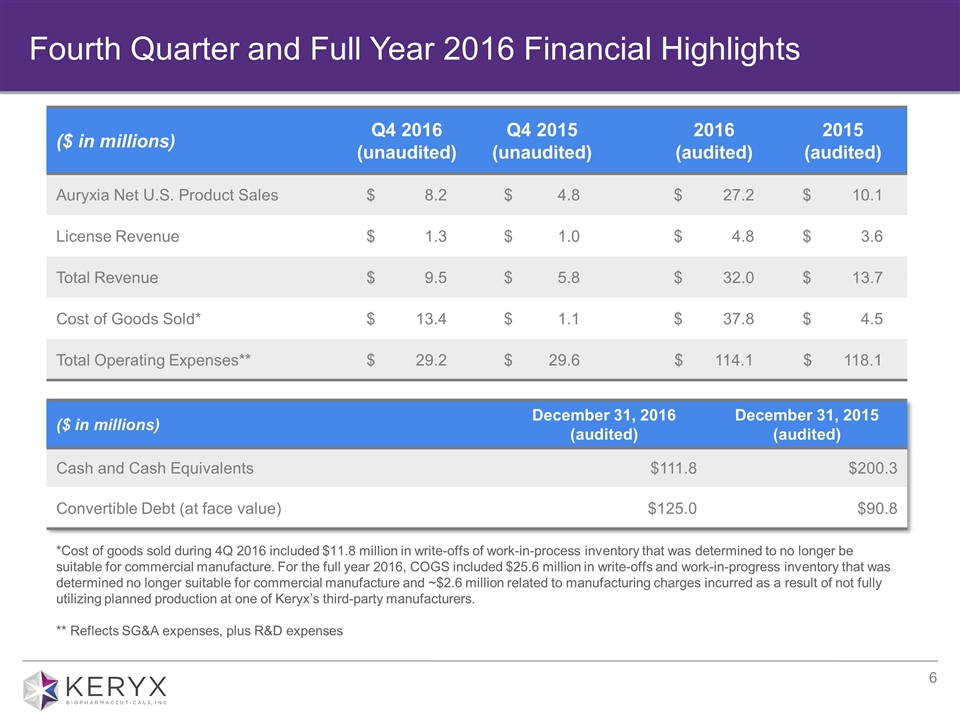

Fourth Quarter and Full Year 2016 Financial Highlights ($ in millions) Q4 2016 (unaudited) Q4 2015 (unaudited) 2016 (audited) 2015 (audited) Auryxia Net U.S. Product Sales $ 8.2 $ 4.8 $ 27.2 $ 10.1 License Revenue $ 1.3 $ 1.0 $ 4.8 $ 3.6 Total Revenue $ 9.5 $ 5.8 $ 32.0 $ 13.7 Cost of Goods Sold* $ 13.4 $ 1.1 $ 37.8 $ 4.5 Total Operating Expenses** $ 29.2 $ 29.6 $ 114.1 $ 118.1 ($ in millions) December 31, 2016 (audited) December 31, 2015 (audited) Cash and Cash Equivalents $111.8 $200.3 Convertible Debt (at face value) $125.0 $90.8 *Cost of goods sold during 4Q 2016 included $11.8 million in write-offs of work-in-process inventory that was determined to no longer be suitable for commercial manufacture. For the full year 2016, COGS included $25.6 million in write-offs and work-in-progress inventory that was determined no longer suitable for commercial manufacture and ~$2.6 million related to manufacturing charges incurred as a result of not fully utilizing planned production at one of Keryx’s third-party manufacturers. ** Reflects SG&A expenses, plus R&D expenses

Near-term Opportunities and Outlook Greg Madison President and Chief Executive Officer

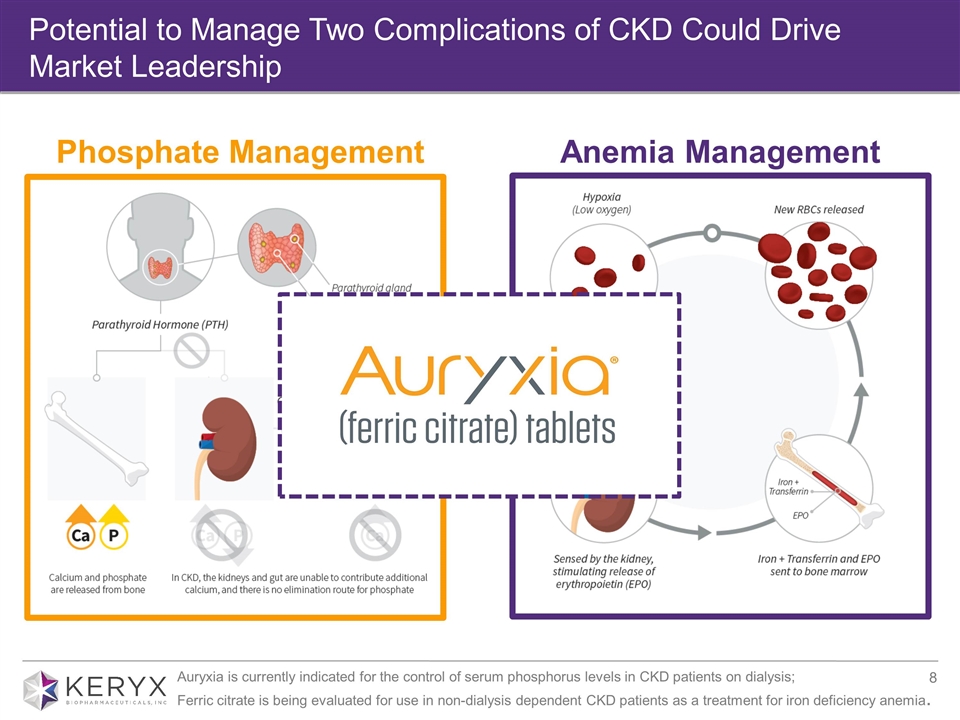

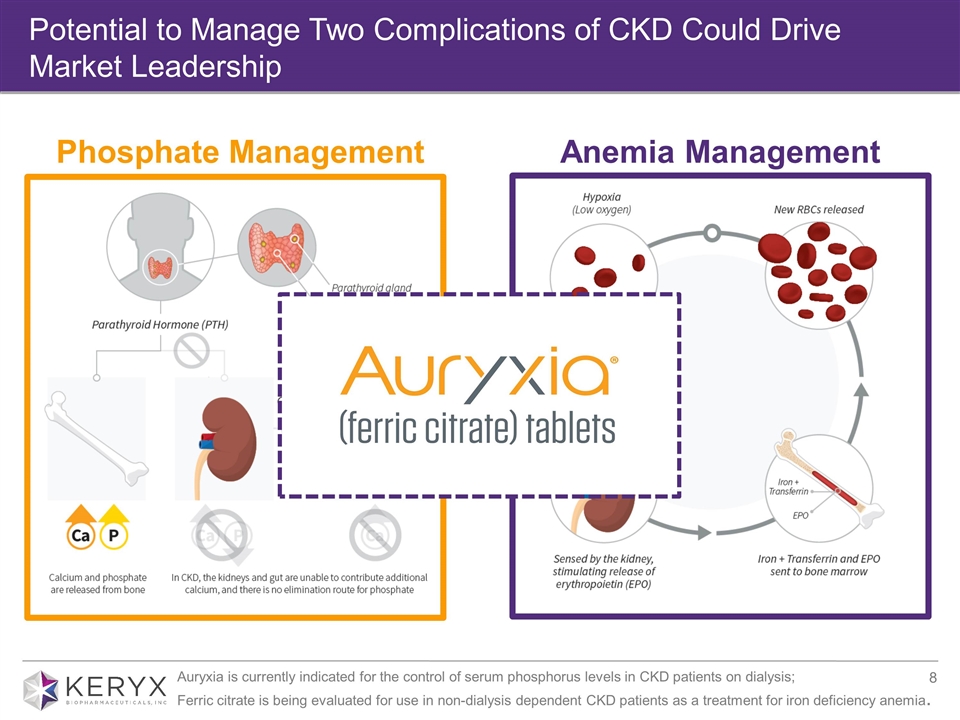

Potential to Manage Two Complications of CKD Could Drive Market Leadership Phosphate Management Anemia Management Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

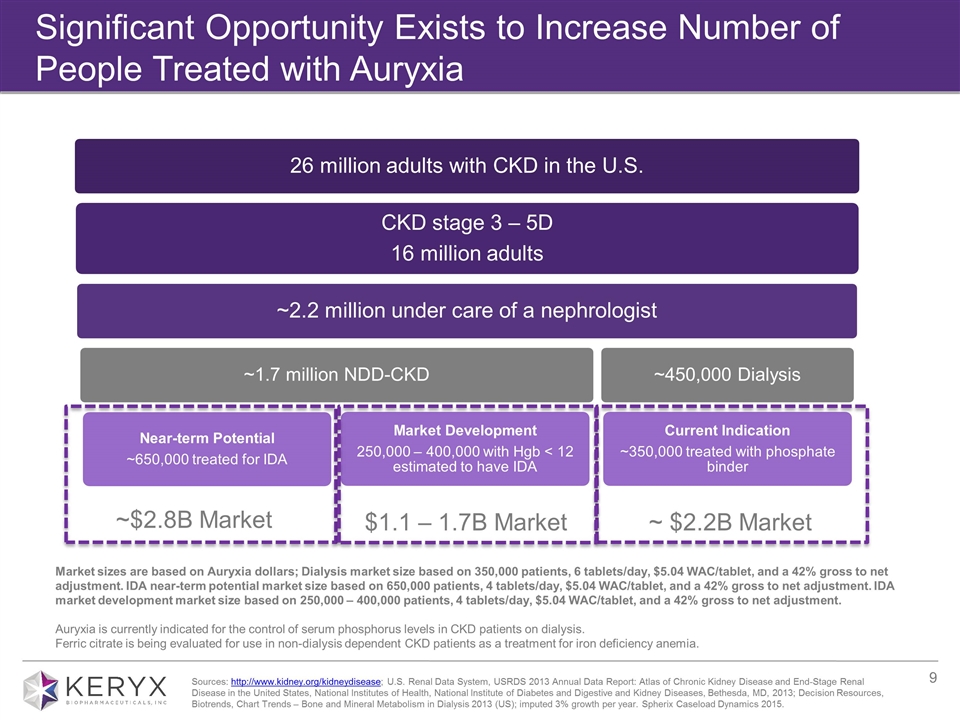

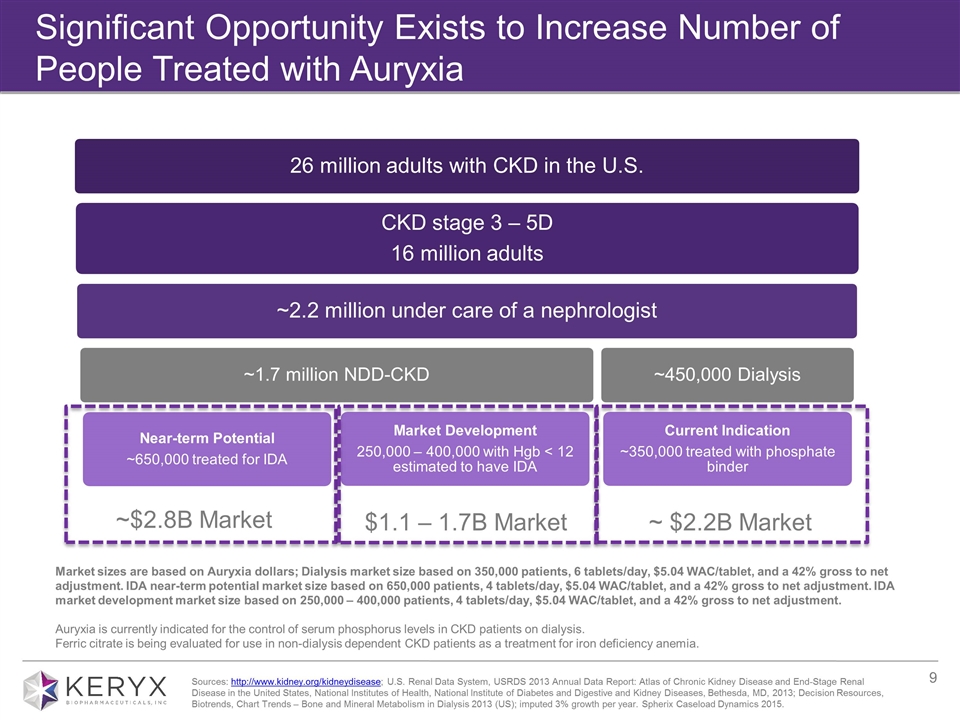

Significant Opportunity Exists to Increase Number of People Treated with Auryxia ~ $2.2B Market ~$2.8B Market Market sizes are based on Auryxia dollars; Dialysis market size based on 350,000 patients, 6 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. IDA near-term potential market size based on 650,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. IDA market development market size based on 250,000 – 400,000 patients, 4 tablets/day, $5.04 WAC/tablet, and a 42% gross to net adjustment. Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis. Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia. $1.1 – 1.7B Market Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2013 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; Decision Resources, Biotrends, Chart Trends – Bone and Mineral Metabolism in Dialysis 2013 (US); imputed 3% growth per year. Spherix Caseload Dynamics 2015. CKD stage 3 – 5D 16 million adults ~2.2 million under care of a nephrologist ~450,000 Dialysis ~1.7 million NDD-CKD Near-term Potential ~650,000 treated for IDA Current Indication ~350,000 treated with phosphate binder 26 million adults with CKD in the U.S. Market Development 250,000 – 400,000 with Hgb < 12 estimated to have IDA

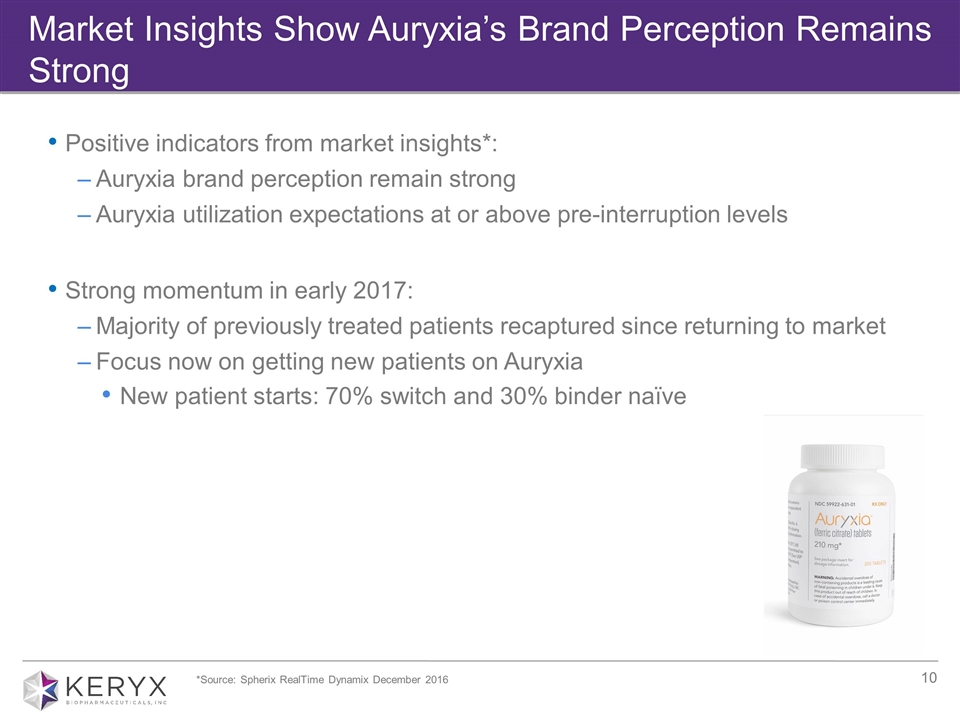

Positive indicators from market insights*: Auryxia brand perception remain strong Auryxia utilization expectations at or above pre-interruption levels Strong momentum in early 2017: Majority of previously treated patients recaptured since returning to market Focus now on getting new patients on Auryxia New patient starts: 70% switch and 30% binder naïve Market Insights Show Auryxia’s Brand Perception Remains Strong *Source: Spherix RealTime Dynamix December 2016

Building Momentum in Dialysis Supply Interruption Prescriptions Filled Sources: IMS, Davita Rx, Fresenius Rx and Keryx data on file. Dec. ‘16 – Jan. ‘17: Auryxia: + 3.3% vs. Phosphate binder market: - 2.6%

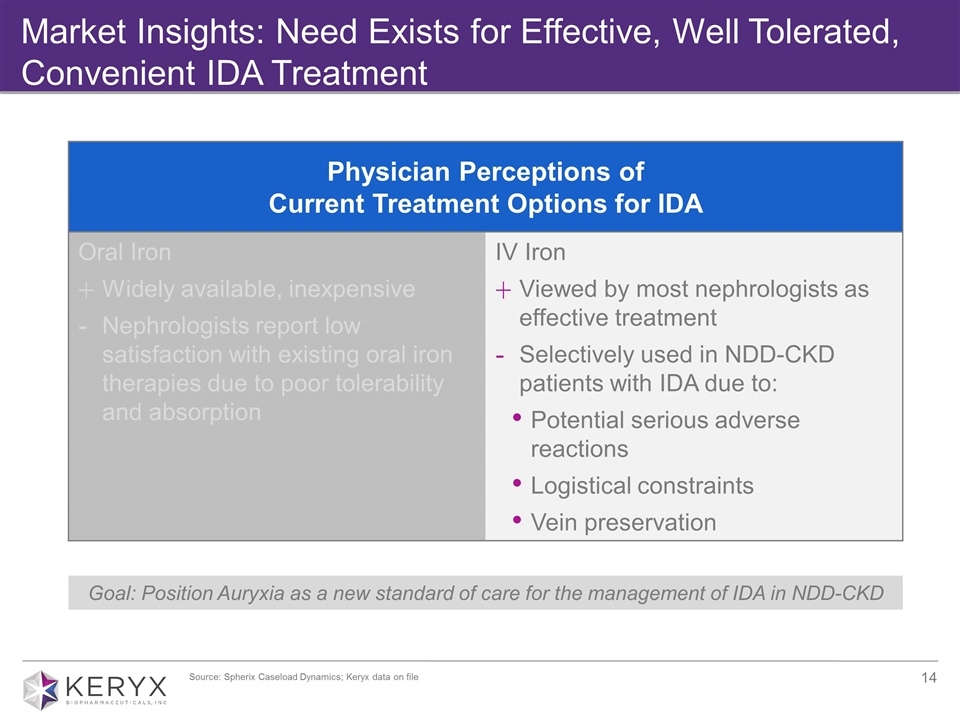

Market Insights: Need Exists for Effective, Well Tolerated, Convenient IDA Treatment Goal: Position Auryxia as a new standard of care for the management of IDA in NDD-CKD Physician Perceptions of Current Treatment Options for IDA Oral Iron Widely available, inexpensive Nephrologists report low satisfaction with existing oral iron therapies due to poor tolerability and absorption IV Iron Viewed by most nephrologists as effective treatment Selectively used in NDD-CKD patients with IDA due to: Potential serious adverse reactions Logistical constraints Vein preservation Source: Spherix Caseload Dynamics; Keryx data on file

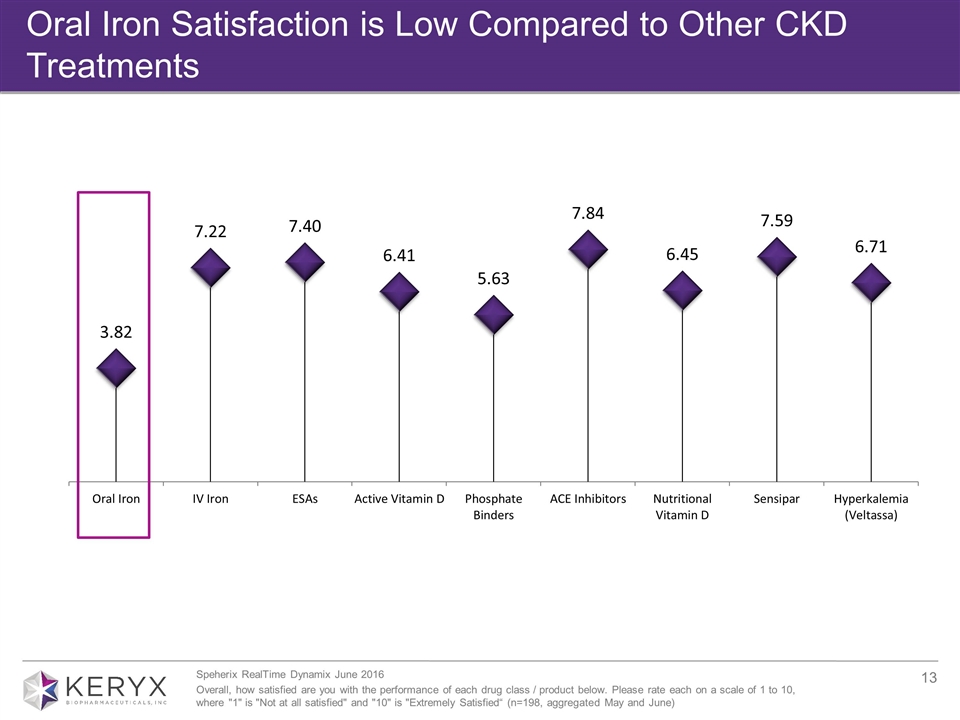

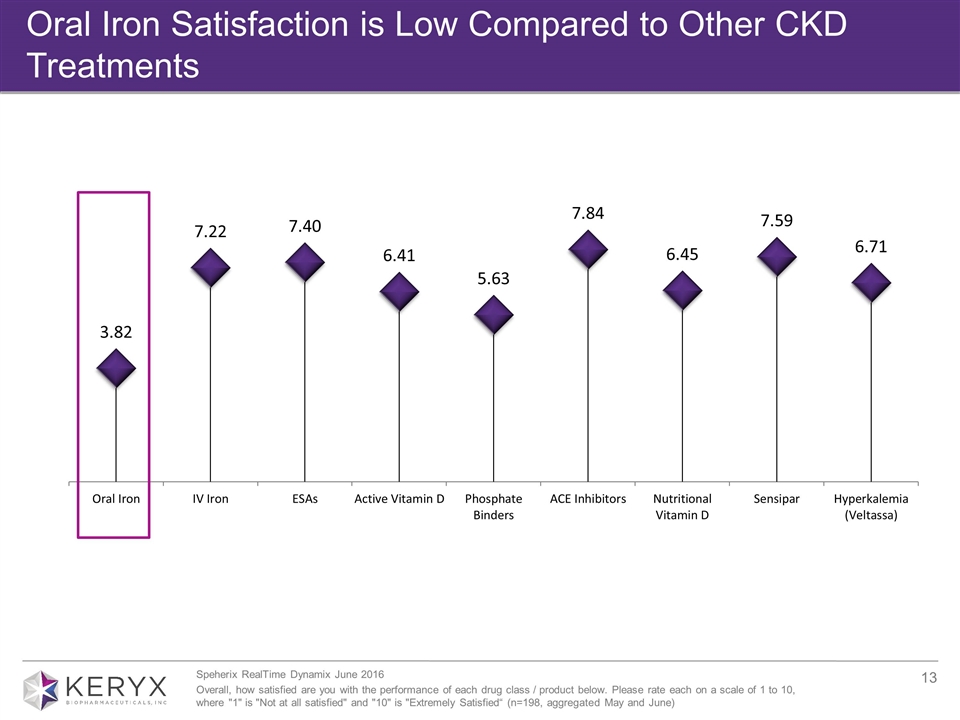

Oral Iron Satisfaction is Low Compared to Other CKD Treatments Speherix RealTime Dynamix June 2016 Overall, how satisfied are you with the performance of each drug class / product below. Please rate each on a scale of 1 to 10, where "1" is "Not at all satisfied" and "10" is "Extremely Satisfied“ (n=198, aggregated May and June)

Market Insights: Need Exists for Effective, Well Tolerated, Convenient IDA Treatment Goal: Position Auryxia as a new standard of care for the management of IDA in NDD-CKD Physician Perceptions of Current Treatment Options for IDA Oral Iron Widely available, inexpensive Nephrologists report low satisfaction with existing oral iron therapies due to poor tolerability and absorption IV Iron Viewed by most nephrologists as effective treatment Selectively used in NDD-CKD patients with IDA due to: Potential serious adverse reactions Logistical constraints Vein preservation Source: Spherix Caseload Dynamics; Keryx data on file

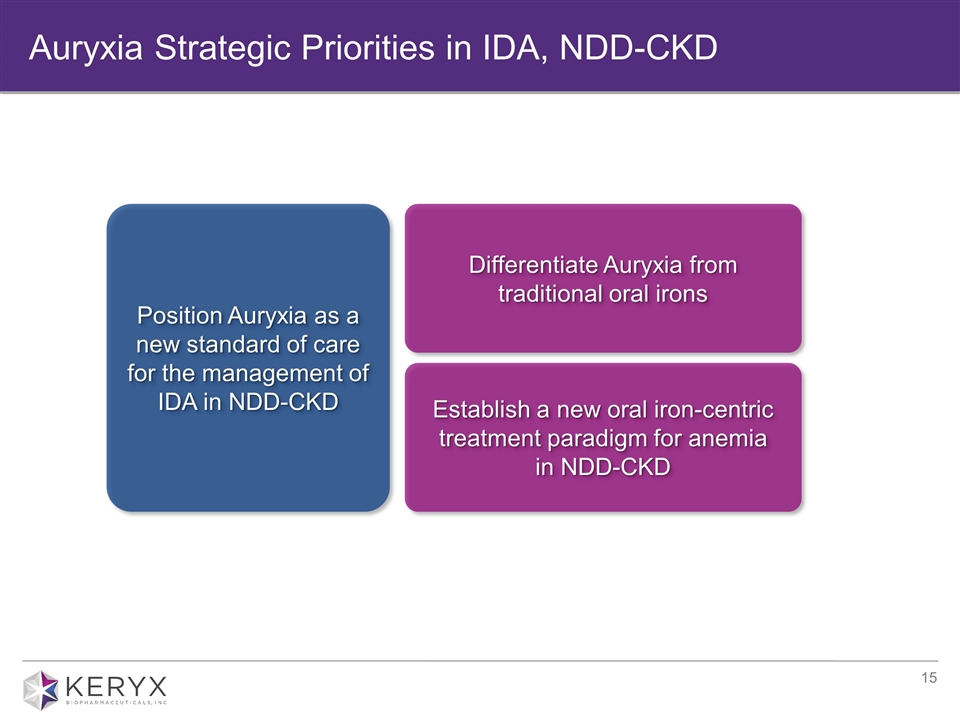

Auryxia Strategic Priorities in IDA, NDD-CKD Establish a new oral iron-centric treatment paradigm for anemia in NDD-CKD Differentiate Auryxia from traditional oral irons Position Auryxia as a new standard of care for the management of IDA in NDD-CKD

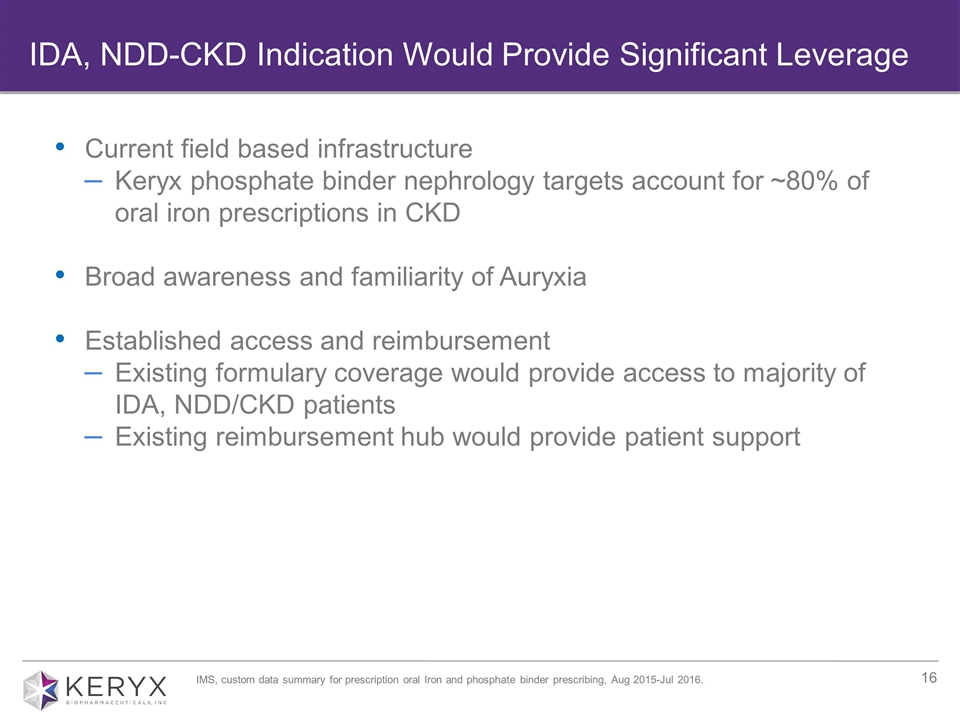

Current field based infrastructure Keryx phosphate binder nephrology targets account for ~80% of oral iron prescriptions in CKD Broad awareness and familiarity of Auryxia Established access and reimbursement Existing formulary coverage would provide access to majority of IDA, NDD/CKD patients Existing reimbursement hub would provide patient support IDA, NDD-CKD Indication Would Provide Significant Leverage IMS, custom data summary for prescription oral Iron and phosphate binder prescribing, Aug 2015-Jul 2016.

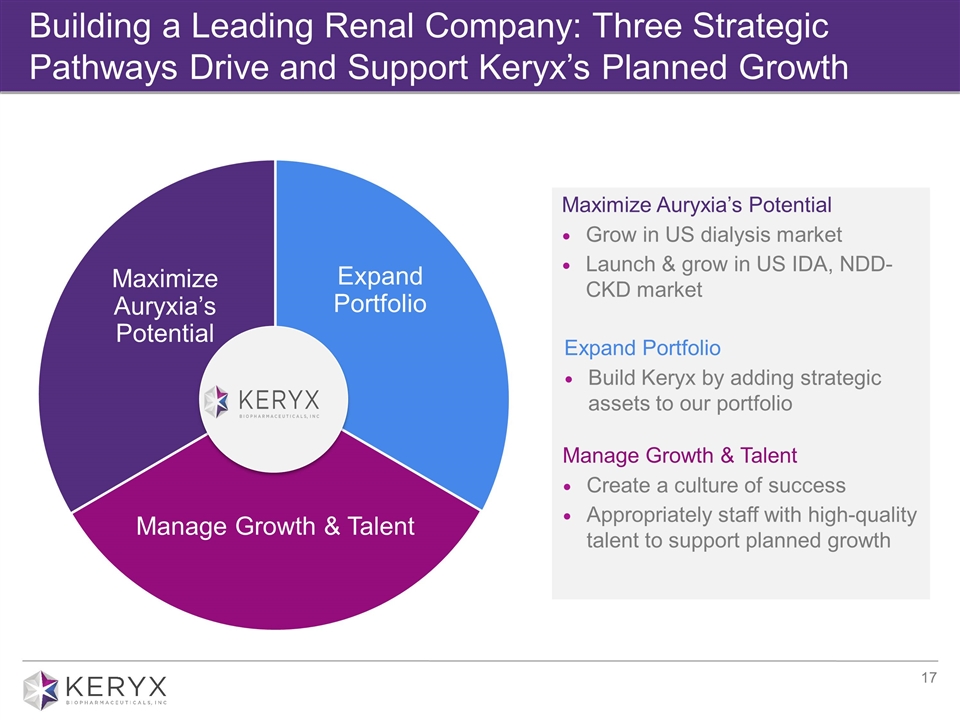

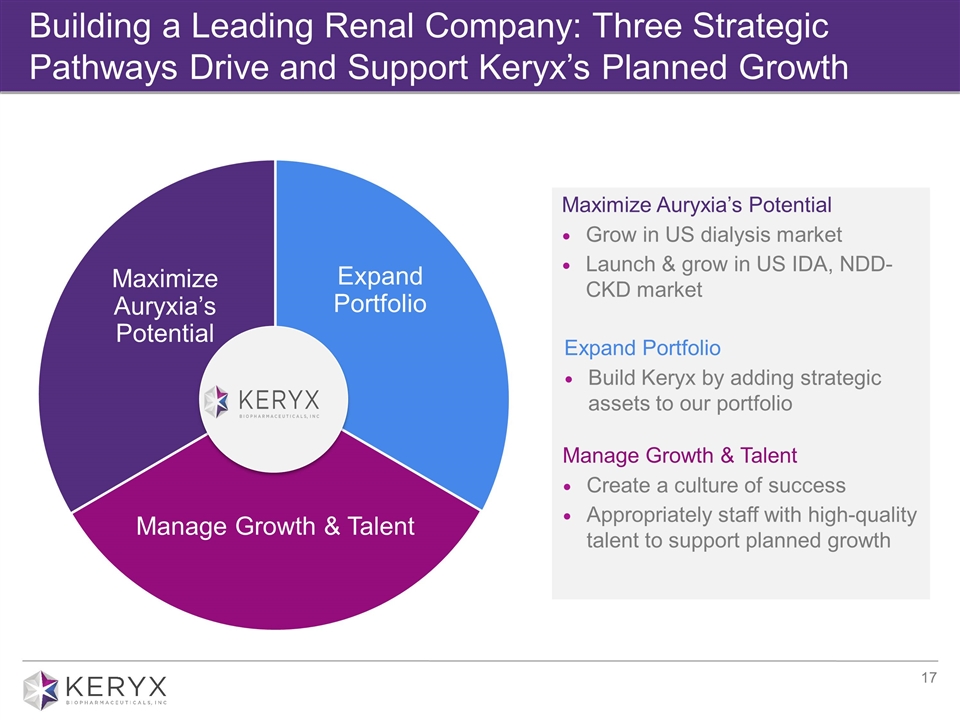

Building a Leading Renal Company: Three Strategic Pathways Drive and Support Keryx’s Planned Growth GROW INSPIRE Maximize Auryxia’s Potential Grow in US dialysis market Launch & grow in US IDA, NDD- CKD market Expand Portfolio Build Keryx by adding strategic assets to our portfolio Manage Growth & Talent Create a culture of success Appropriately staff with high-quality talent to support planned growth Expand Portfolio Manage Growth & Talent Maximize Auryxia’s Potential

Key Takeaways Strong prescription momentum entering 2017 sNDA submitted in January 2017 seeking potential label expansion of Auryxia Large market opportunity for Auryxia in hyperphosphatemia and iron deficiency anemia IDA, NDD-CKD indication would leverage existing field based infrastructure, access and familiarity established with Auryxia Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

Keryx Biopharmaceuticals Fourth Quarter and Full Year 2016 Financial Results March 1, 2017 Building a Leading Renal Company