Keryx Biopharmaceuticals, Inc. Second Quarter 2017 Financial Results July 27, 2017 Building a Leading Renal Company Exhibit 99.2

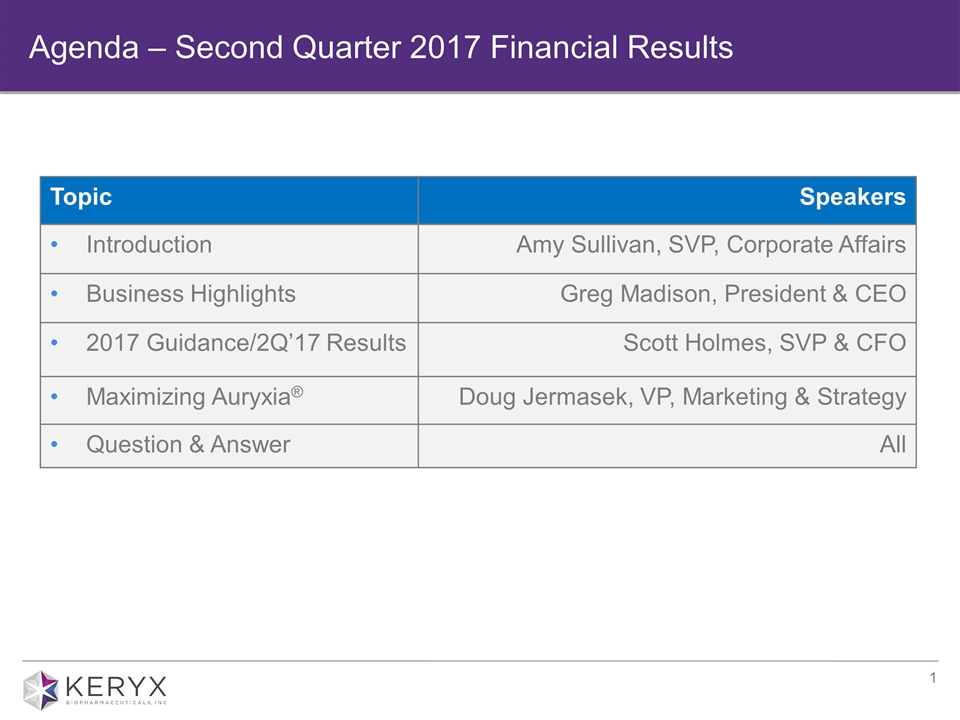

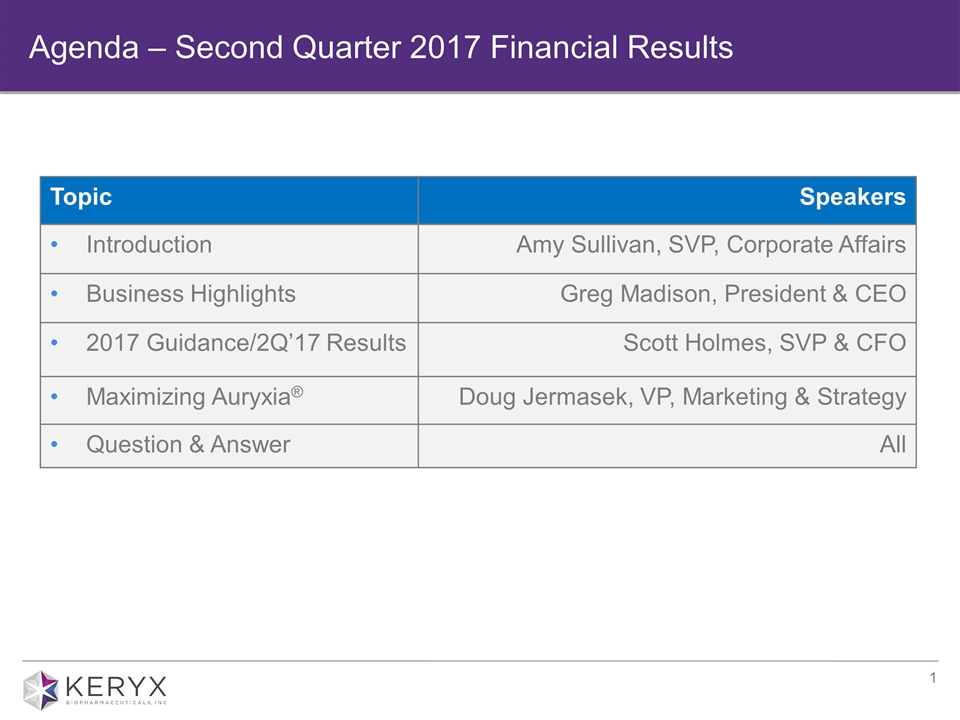

Agenda – Second Quarter 2017 Financial Results Topic Speakers Introduction Amy Sullivan, SVP, Corporate Affairs Business Highlights Greg Madison, President & CEO 2017 Guidance/2Q’17 Results Scott Holmes, SVP & CFO Maximizing Auryxia® Doug Jermasek, VP, Marketing & Strategy Question & Answer All

Forward-looking Statements Some of the statements included in this presentation, particularly those regarding the commercialization and ongoing clinical development of Auryxia, our updated 2017 financial guidance and the submission of an sNDA to the FDA to expand the label of ferric citrate to include the treatment of IDA in adults with stage 3-5 NDD-CKD and the potential approval in this indication and the impact thereof on Keryx, may be forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: whether we can increase adoption of Auryxia in patients with CKD on dialysis in order to achieve our 2017 financial guidance; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; the risk that the FDA may not concur with our interpretation of our Phase 3 study results in NDD- CKD, supportive data, conduct of the studies, or any other part of our regulatory submission and could ultimately deny approval of ferric citrate for the treatment of IDA in adults with stage 3-5 NDD-CKD; the risk that if approved for use in NDD-CKD that we may not be able to successfully market Auryxia for use in this indication; our ability to continue to supply Auryxia to the market; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward looking statements set forth in this presentation speak only as of the date on the first slide. We do not undertake to update any of these forward looking statements to reflect events or circumstances that occur after the date hereof. The second quarter 2017 press release and prior releases are available at http://www.keryx.com. The information found on our website is not incorporated by reference into this presentation and is included for reference purposes only.

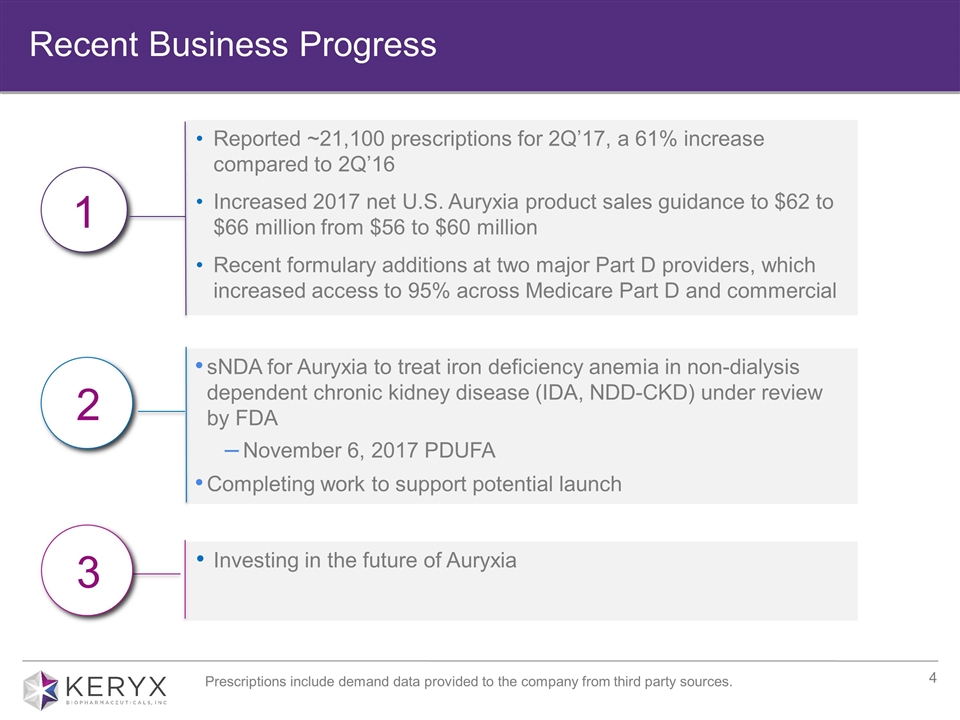

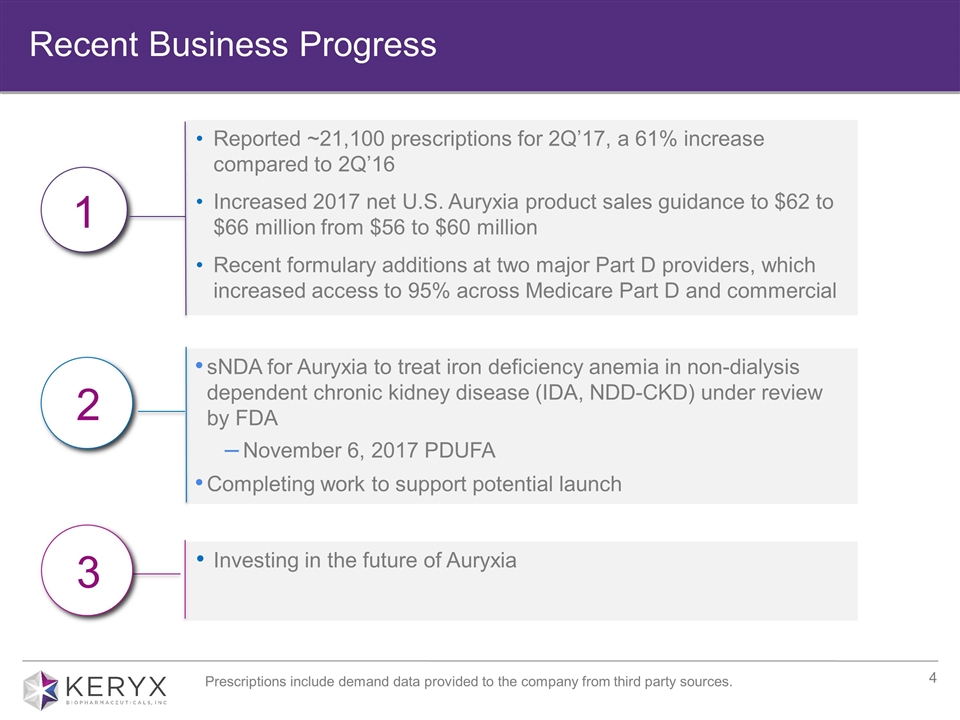

Recent Business Progress Greg Madison President and Chief Executive Officer

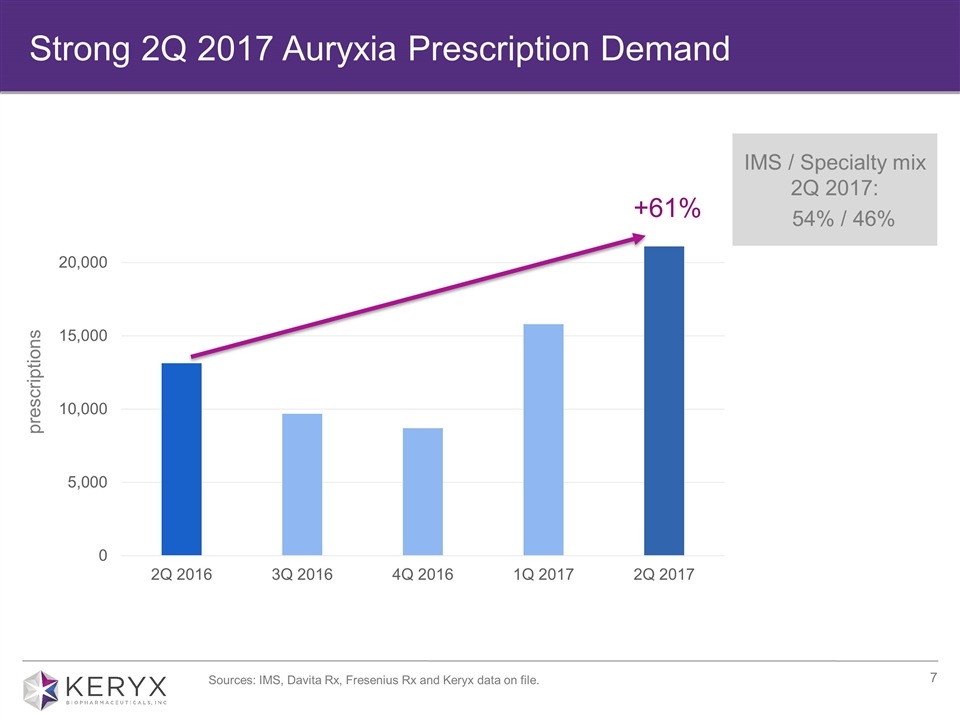

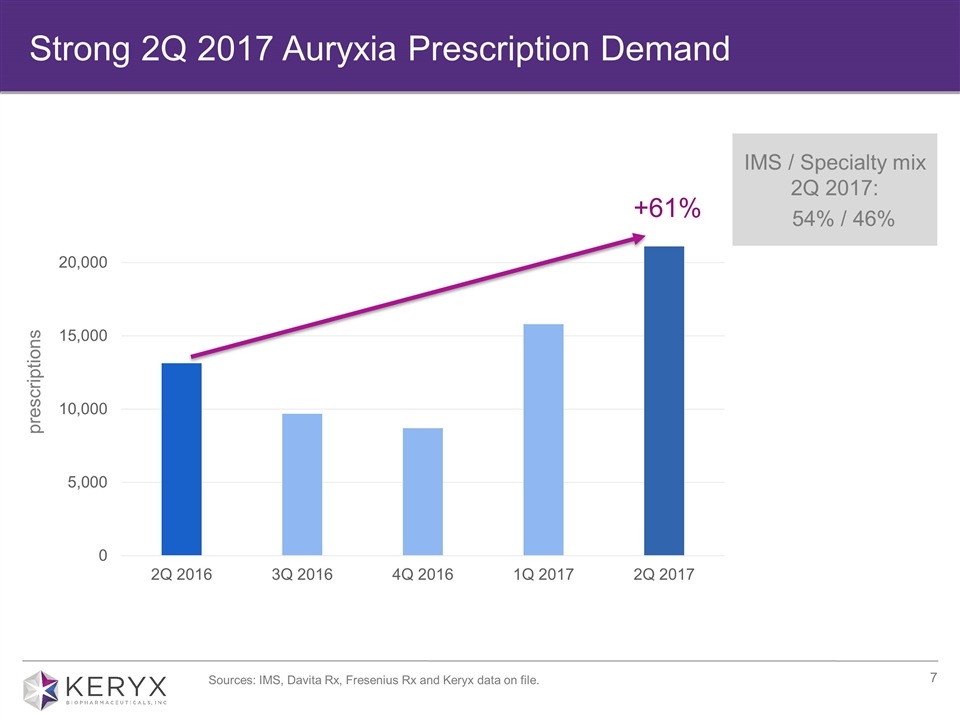

Reported ~21,100 prescriptions for 2Q’17, a 61% increase compared to 2Q’16 Increased 2017 net U.S. Auryxia product sales guidance to $62 to $66 million from $56 to $60 million Recent formulary additions at two major Part D providers, which increased access to 95% across Medicare Part D and commercial Recent Business Progress sNDA for Auryxia to treat iron deficiency anemia in non-dialysis dependent chronic kidney disease (IDA, NDD-CKD) under review by FDA November 6, 2017 PDUFA Completing work to support potential launch Prescriptions include demand data provided to the company from third party sources. Investing in the future of Auryxia 3 2 1

Financial Highlights Scott Holmes SVP and Chief Financial Officer

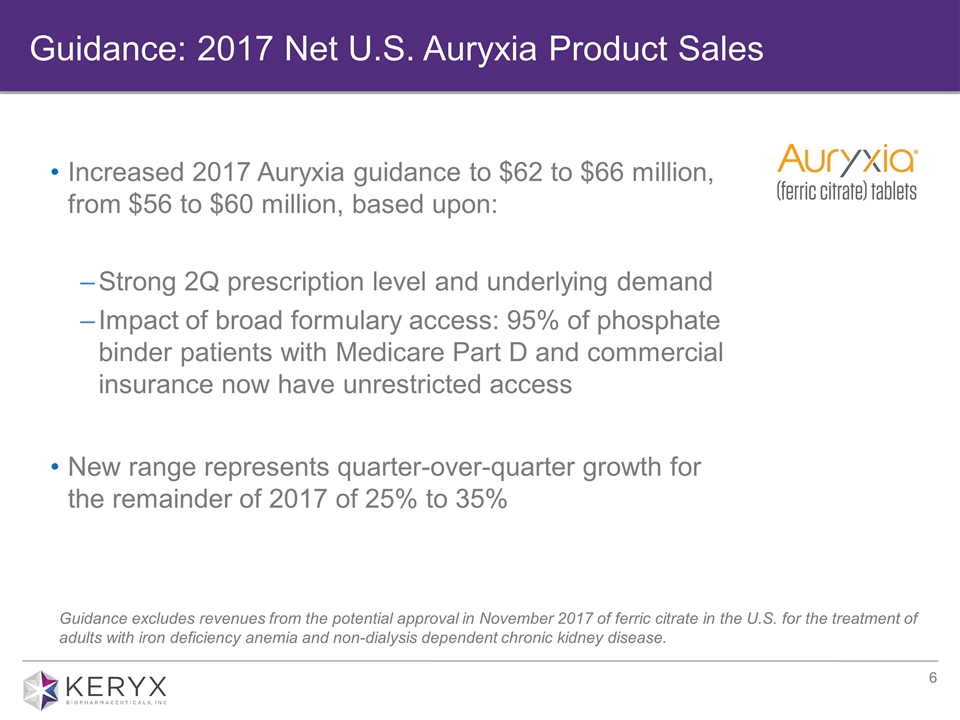

Guidance: 2017 Net U.S. Auryxia Product Sales Increased 2017 Auryxia guidance to $62 to $66 million, from $56 to $60 million, based upon: Strong 2Q prescription level and underlying demand Impact of broad formulary access: 95% of phosphate binder patients with Medicare Part D and commercial insurance now have unrestricted access New range represents quarter-over-quarter growth for the remainder of 2017 of 25% to 35% Guidance excludes revenues from the potential approval in November 2017 of ferric citrate in the U.S. for the treatment of adults with iron deficiency anemia and non-dialysis dependent chronic kidney disease.

Sources: IMS, Davita Rx, Fresenius Rx and Keryx data on file. Strong 2Q 2017 Auryxia Prescription Demand +61% IMS / Specialty mix 2Q 2017: 54% / 46% prescriptions

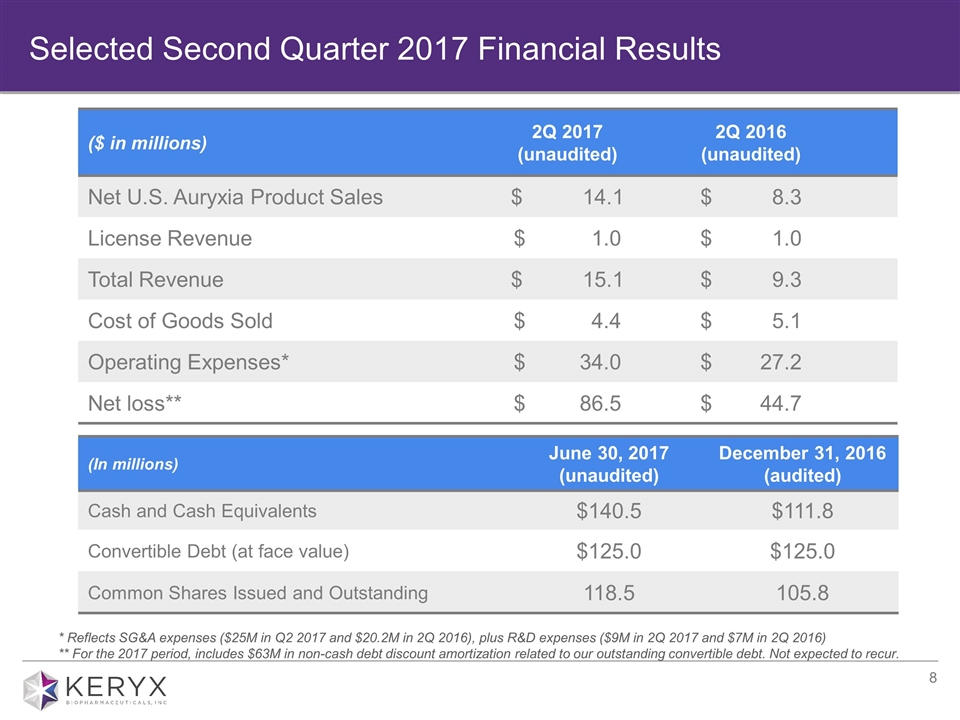

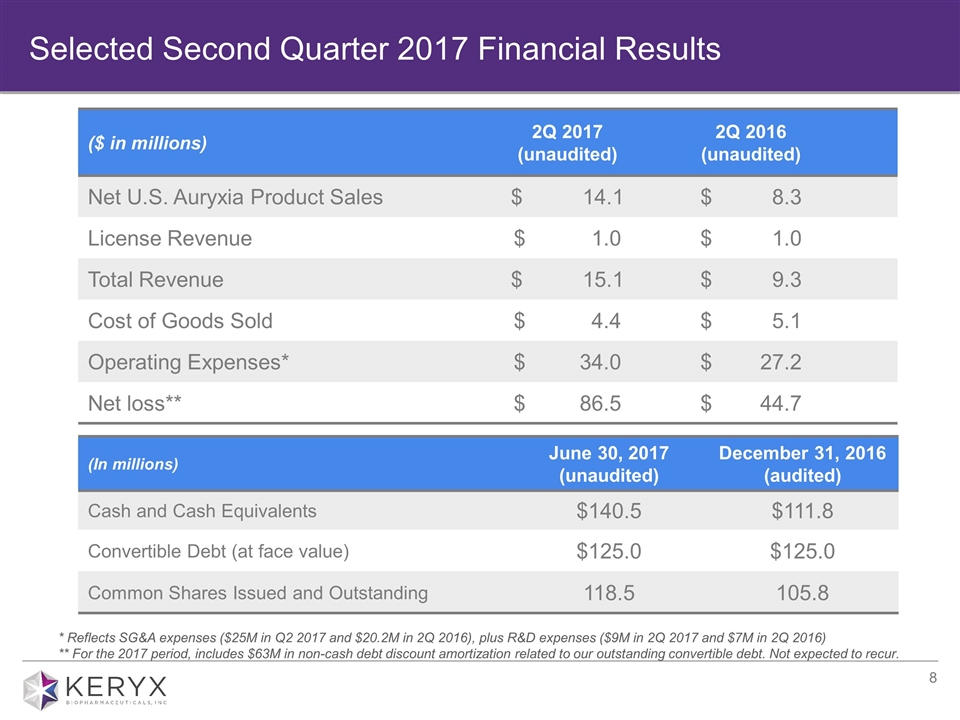

Selected Second Quarter 2017 Financial Results ($ in millions) 2Q 2017 (unaudited) 2Q 2016 (unaudited) Net U.S. Auryxia Product Sales $ 14.1 $ 8.3 License Revenue $ 1.0 $ 1.0 Total Revenue $ 15.1 $ 9.3 Cost of Goods Sold $ 4.4 $ 5.1 Operating Expenses* $ 34.0 $ 27.2 Net loss** $ 86.5 $ 44.7 (In millions) June 30, 2017 (unaudited) December 31, 2016 (audited) Cash and Cash Equivalents $140.5 $111.8 Convertible Debt (at face value) $125.0 $125.0 Common Shares Issued and Outstanding 118.5 105.8 * Reflects SG&A expenses ($25M in Q2 2017 and $20.2M in 2Q 2016), plus R&D expenses ($9M in 2Q 2017 and $7M in 2Q 2016) ** For the 2017 period, includes $63M in non-cash debt discount amortization related to our outstanding convertible debt. Not expected to recur.

Maximizing Auryxia® Doug Jermasek Vice President, Marketing and Strategy

Increased breadth and depth of prescribing High level of brand awareness and growing clinical familiarity Increased yield from our prescriber interactions and growth in number of new Auryxia patients Positive clinical experience with Auryxia Early signs of recent Medicare Part D formulary additions driving demand Access to Auryxia now on par with market leaders Non-calcium, non-chewable messaging resonating with prescribers Strong Performance Driven by Multiple Factors KDIGO MBD Practice Guidelines strengthen language restricting use of calcium-based binders.

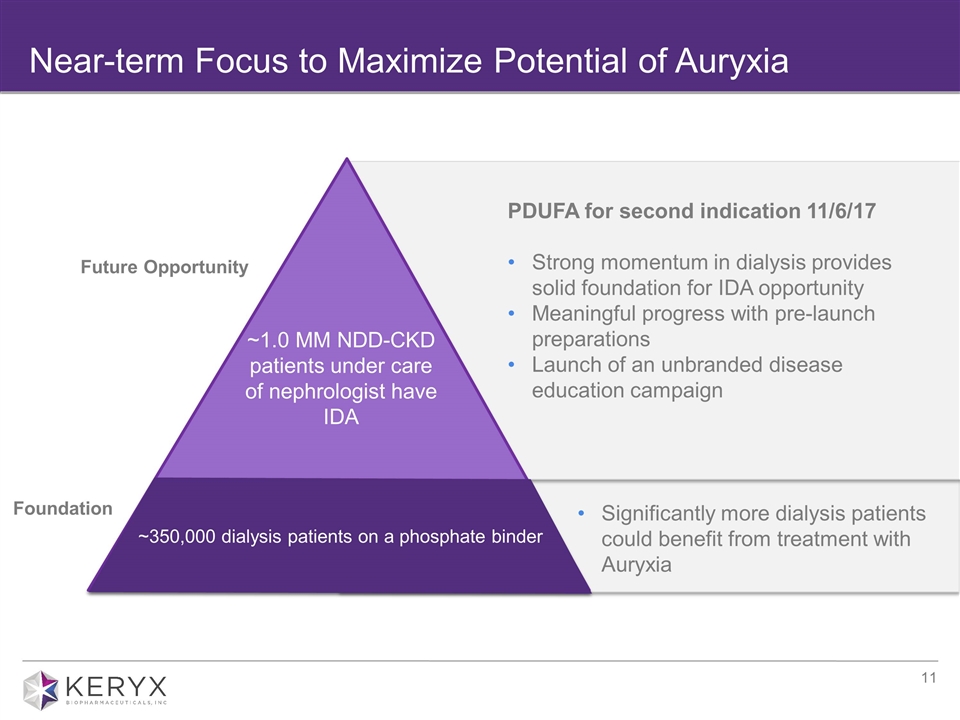

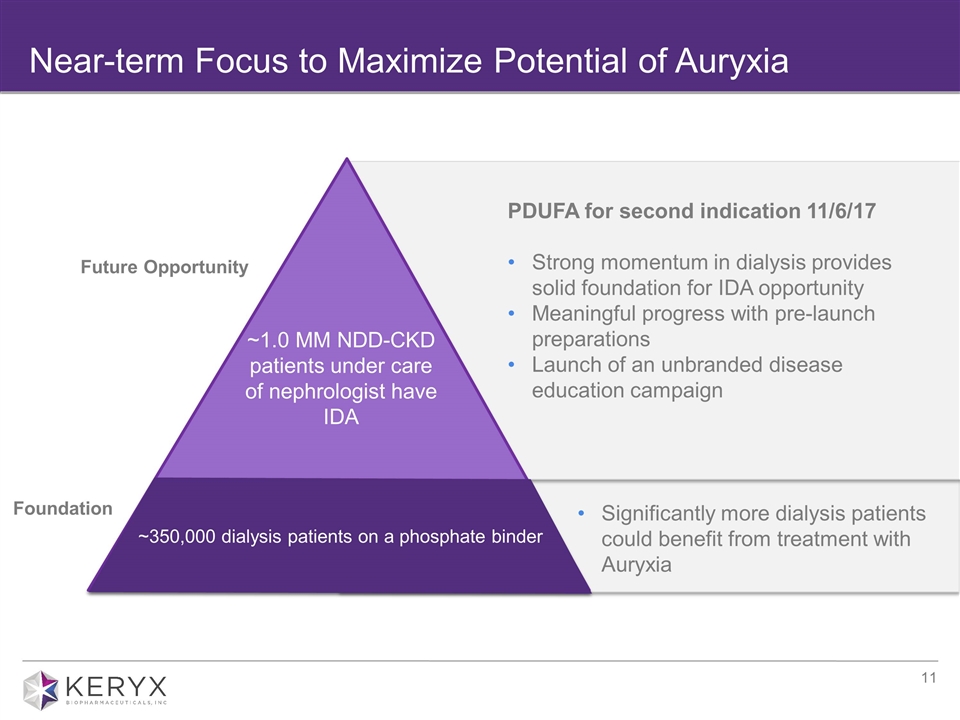

Near-term Focus to Maximize Potential of Auryxia Significantly more dialysis patients could benefit from treatment with Auryxia Foundation PDUFA for second indication 11/6/17 Strong momentum in dialysis provides solid foundation for IDA opportunity Meaningful progress with pre-launch preparations Launch of an unbranded disease education campaign Future Opportunity ~350,000 dialysis patients on a phosphate binder ~1.0 MM NDD-CKD patients under care of nephrologist have IDA

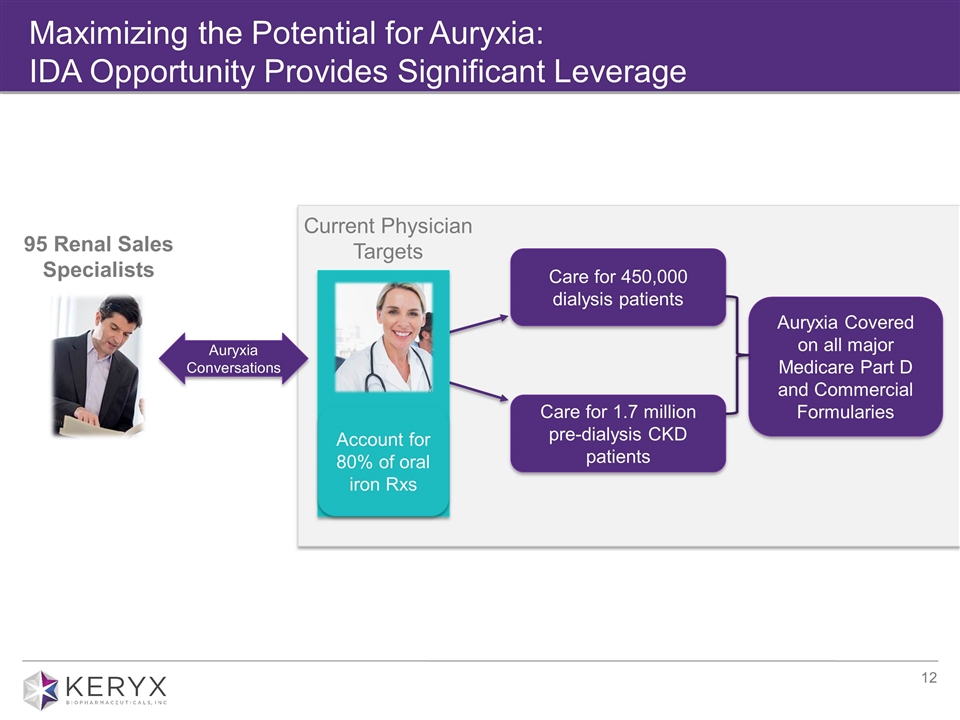

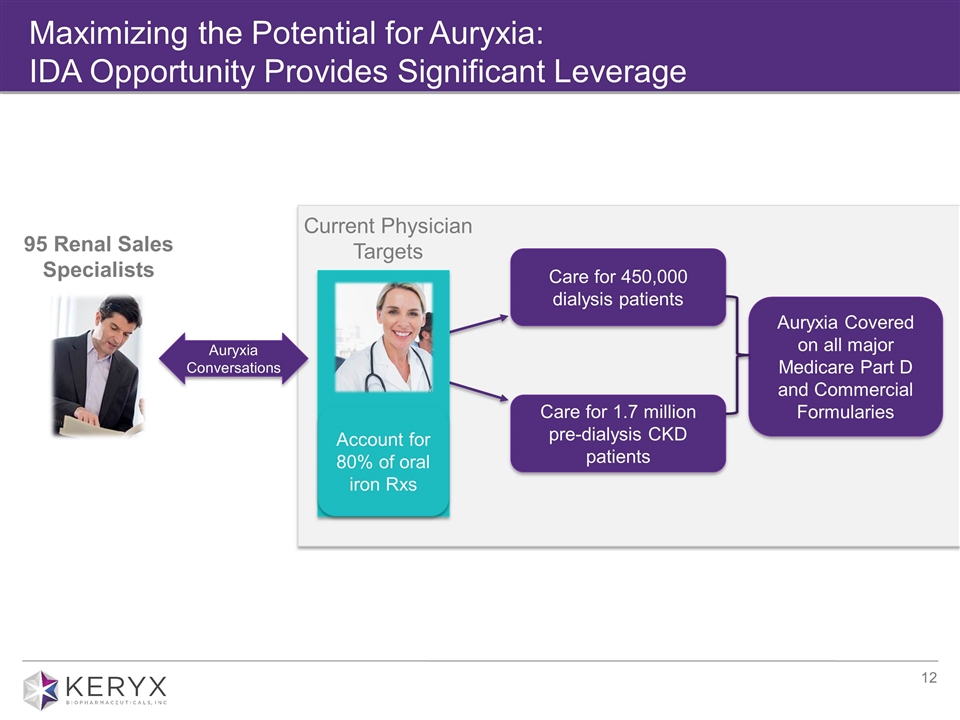

Maximizing the Potential for Auryxia: IDA Opportunity Provides Significant Leverage 95 Renal Sales Specialists Current Physician Targets Care for 450,000 dialysis patients Care for 1.7 million pre-dialysis CKD patients Auryxia Conversations Auryxia Covered on all major Medicare Part D and Commercial Formularies Account for 80% of oral iron Rxs

Closing Remarks Greg Madison President and Chief Executive Officer

Key Takeaways Strong second quarter 2017 growth supports $62 to $66 million in full year 2017 net U.S. Auryxia product sales guidance Large unmet need in iron deficiency anemia; preparing for potential launch of Auryxia for second indication, pending approval in November 2017 Second indication would provide operational efficiencies by leveraging existing field based infrastructure, access and familiarity established with Auryxia Building foundation to achieve vision of a multi-product renal company Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

Keryx Biopharmaceuticals, Inc. Second Quarter 2017 Financial Results July 27, 2017 Building a Leading Renal Company