Exhibit 99.1

HYDRO ONE INC.

2021 STATEMENT OF EXECUTIVE COMPENSATION

April 22, 2022

| I. | BACKGROUND |

In March 2019, Hydro One Inc. was granted exemptive relief (the “Executive Compensation Exemptive Relief”) by securities regulatory authorities in each of the provinces of Canada, exempting Hydro One Inc. from the requirement to provide executive compensation disclosure required by securities laws in its annual information form, for so long as: (i) Hydro One Inc. files such executive compensation disclosure as a stand-alone document with the securities regulatory authorities in each of the provinces of Canada no later than 140 days after its most recently completed financial year and (ii) Hydro One Inc. includes in its annual information form in respect of a financial year a notice that its executive compensation disclosure in respect of that financial year, when filed, is deemed to be incorporated by reference in its annual information form.

This Statement of Executive Compensation is the stand-alone document contemplated by the Executive Compensation Exemptive Relief in respect of the 2021 financial year. This Statement of Executive Compensation, upon filing with the securities regulatory authorities in each of the provinces of Canada, will be deemed to be incorporated by reference into and form an integral part of the annual information form of Hydro One Inc. (the “AIF”) dated February 25, 2022 for the fiscal year ended December 31, 2021. Capitalized terms used herein and not defined have the meaning given to such terms in the AIF.

Hydro One Inc. is a wholly owned subsidiary of Hydro One Limited. The board of directors of Hydro One Inc., and the human resources committee of the board of directors of Hydro One Inc., are comprised of the same directors as the board of directors and human resources committee of Hydro One Limited, respectively, and each of the boards and committees hold joint meetings. This allows them to make joint compensation decisions in respect of officers of both corporations and results in the same compensation practices applying to both corporations. As a result, employees of Hydro One Inc. and its subsidiaries participate in the compensation plans of Hydro One Limited. References herein to “HRC” mean collectively the human resources committee of Hydro One Limited and the human resources committee of Hydro One Inc. and references to the “Board” mean collectively the board of directors of Hydro One Limited and the board of directors of Hydro One Inc. The President and Chief Executive Officer (“President and CEO”), the Chief Financial Officer (“CFO”) and the Chief Legal Officer (“CLO”) of Hydro One Inc. have the same titles and roles in Hydro One Limited. The Chief Corporate Affairs and Customer Care Officer and the Chief Operating Officer (“COO”) are positions held only in Hydro One Networks Inc., a wholly owned subsidiary of Hydro One Inc. Although decisions may be made jointly, they do not result in duplicative compensation. References to “executive(s)” refer to employees who hold a vice president role and above, which includes the NEOs. The Executive Leadership Team (“ELT”) includes the direct reports to the President and CEO holding an Executive Vice President (“EVP”) or Senior Vice President (“SVP”) title. This Statement of Executive Compensation pertains to Hydro One Inc. although as noted above, the compensation practices described herein largely reflect the compensation practices of Hydro One Limited. References herein to “Hydro One” or the “Company” refer to Hydro One Inc. and its subsidiaries taken together as a whole. References to “Hydro One Inc.” refer to Hydro One Inc. only and references to “Hydro One Limited” refer to Hydro One Limited only. Information in this Statement of Executive Compensation is provided as of March 28, 2022 and dollar amounts are in Canadian dollars, unless indicated otherwise.

| II. | COMPENSATION DISCUSSION AND ANALYSIS |

This Compensation Discussion and Analysis provides information regarding Hydro One’s 2021 compensation approach as well as its compensation practices, policies and plans during that year. In particular, it includes disclosure about the President and CEO, the CFO and the three other most highly

S-1

compensated executive officers who provided services to the Company during 2021 (collectively, the “NEOs”):

| Name | Title | Summary of Information (where applicable) | ||

Mark Poweska | President and CEO | See Page S-28 | ||

Chris Lopez | CFO | See Page S-29 | ||

Jason Fitzsimmons | Chief Corporate Affairs and Customer Care Officer | See Page S-29 | ||

Paul Harricks | Chief Legal Officer | See Page S-30 | ||

David Lebeter | Chief Operating Officer | See Page S-30 | ||

Hydro One Limited is subject to an executive compensation framework established pursuant to the Hydro One Accountability Act and approved by the Management Board of Cabinet in March 2019. The directive sets out certain requirements for Hydro One’s executives.

Hydro One is committed to attracting, retaining and motivating the talent necessary to achieve its strategy, through reasonable compensation programs which include a base salary, short- and long-term incentives, and pension and benefits within the compensation framework.

This compensation framework remained in place for 2021 and was designed to adhere to the requirements set forth in the Hydro One Accountability Act which were proclaimed in force by the Province of Ontario (“Province”) on August 15, 2018.

Key elements of the executive compensation framework include, among other things:

| • | maximum total direct compensation (base salary, short-term incentive and long-term incentive) of $1,500,000 for the President and CEO in 2019 ($1,531,500 in 2020 reflecting an increase of 2.1% and $1,542,221 in 2021 reflecting an increase of 0.7% aligned with the legislative requirements described below); |

| • | maximum total direct compensation for other executives no greater than 75% of the President and CEO’s total maximum direct compensation; |

| • | the maximum total direct compensation may be adjusted annually by the lesser of the rate of Ontario Consumer Price Index (“CPI”) and the annual rate at which total maximum direct compensation may be adjusted for non-executive managerial employees; |

| • | pension and benefits entitlements shall not be in excess of those provided to non-executive managers; and |

| • | other bonuses (including signing bonuses), perquisites, or share options are not permitted. |

Hydro One Limited will continue to monitor best practices in executive compensation governance, and will adjust its compensation programs as needed to ensure they meet all relevant government regulations and shareholder expectations. Please refer to the section titled “Executive Compensation Framework Compliance – Supplemental Disclosure” starting on page S-39 for details of NEO compensation relative to the executive compensation framework requirements.

S-2

| (a) | Compensation Philosophy and Practices |

This Statement of Executive Compensation is primarily focused on the compensation summary for the NEOs for the year that ended on December 31, 2021 and the executive compensation philosophy, practices and policies that were in place during the year.

2021 Executive Compensation Philosophy

The executive compensation program provides total compensation opportunities designed to attract, retain, motivate and reward executives with the calibre of talent and skills necessary to deliver on Hydro One’s corporate strategy, balance stakeholder interests, grow its business and increase Hydro One Limited’s shareholder value. The following table outlines the principles confirmed by the Board and used to inform our compensation decisions:

| Principle | Objective | |

Performance-oriented | To provide pay-for-performance and align performance objectives to strategy and core values over both the short-term and long-term horizons to reinforce our strategic business objectives and a performance-oriented culture. | |

Long-term focus | To reward sustainable growth that supports long-term value creation for shareholders and customers. | |

Market competitive | To attract and retain high performing employees with market aligned compensation. | |

Individual accountability | To foster a culture of individual ownership and accountability, while encouraging teamwork. | |

Balanced approach to risk | To support an appropriate level of risk-taking that balances short-term and long-term Company objectives. | |

Shared responsibility | To require employees to share the risks and responsibilities for their current and future needs. | |

Simple and integrated | To provide programs that are simple to understand and administer and communicate the integrated value of monetary and non-monetary rewards. | |

| (b) | Compensation Governance |

Risk Management Process

Hydro One’s executive compensation program is structured to provide an appropriate balance of risk and reward consistent with the Company’s risk profile and to ensure that compensation practices do not encourage excessive risk-taking by executives, all within legislative constraints. Such risk mitigation practices include the compensation practices outlined below. Hydro One’s compensation practices are reviewed annually by the HRC to ensure they align with the Company’s strategic plans, risk profile and risk management principles.

S-3

Compensation Practices

| Practice | Description | |

| Anti-Hedging | Directors, executives and other employees are prohibited from purchasing financial instruments that are designed to hedge, offset or otherwise reduce or limit their economic risk, including with respect to a decrease in market value of equity securities of Hydro One Limited granted, as compensation or held, directly or indirectly, by such individuals, or otherwise undermining their alignment with shareholder interests, except with the prior written approval of the HRC.

Prohibited transactions include hedging strategies, equity monetization transactions, transactions using short sales, put options, call options, exchange contracts, derivatives and other types of financial instruments (including, but not limited to, prepaid variable forward contracts, equity swaps, collars and exchange funds), and the pledging of or granting of any other security interest in equity securities of Hydro One Limited as security for any loan where recourse is limited to the pledged security. | |

| Clawbacks | Executives may be required to forfeit outstanding incentive awards and repay incentive compensation that has already been paid if, among other things, there is wrongdoing, misconduct, a material misstatement of Hydro One Limited’s or Hydro One Inc.’s financial results, an error in any financial or operating measure used to determine incentive compensation amounts, or as may be required by applicable laws, stock exchange rules or other regulatory requirements. This applies to cash bonuses, options, performance share units (“PSUs”), restricted share units (“RSUs”), other equity-based compensation and performance cash-settled LTIP awards, whether vested or unvested, including those which have been paid or settled. | |

| Incentive Compensation Adjustments – Principles and Practices | Hydro One is committed to meeting all targets established at the outset of the incentive compensation performance periods. However, exceptional circumstances outside of management’s control may occur.

The HRC has established principles and practices for incentive compensation adjustments.

The purpose of these principles and practices is to provide clarity on the circumstances and process for considering any such exceptions. | |

| Share Ownership Requirements(1) | To better align the interests of the Company’s executives with the interests of Hydro One Limited’s shareholders, Hydro One Limited has share ownership requirements based on the level of the position. Under these requirements, the Company’s executives are subject to share ownership requirements which can be met through direct or beneficial ownership of Hydro One Limited’s common shares, management deferred share units (“management DSUs”), and 25% of performance cash-settled long term incentive plan (“LTIP”) grants.(1) Individuals have until the later of seven years from: (a) the closing date of the initial public offering of Hydro One Limited’s shares in November 2015; and (b) the date they first became subject to the share ownership requirements. Executives who are promoted to a level with a higher share ownership requirement have until the seventh anniversary of the date of their promotion to meet their new share ownership requirement. The executives must generally maintain the ownership level as of the date of retirement for 24 months (in the case of the President and CEO) or 12 months (in the case of other executives).

| |

S-4

| Practice | Description | |

For purposes of assessing the requirement, 25% of the target value of outstanding cash-settled LTIP is counted during the vesting period. This practice reflects the Company’s inability to grant equity based awards (which would count toward the requirement), under the current executive compensation framework. The expectation is upon the vesting of cash-settled LTIP awards, executives will use a portion of the proceeds to purchase common shares of Hydro One Limited. Once cash-settled awards have vested they are not counted toward the achievement of ongoing share ownership requirements. | ||

The share ownership requirements as a multiple of annual base salary are set forth below:

President and CEO 3x

EVP or equivalent Direct Report to the President and CEO 2x

All Other Executives – SVP or equivalent, and Vice President Level or equivalent 1x | ||

| Trading Restrictions | Executives are prohibited from trading Hydro One Limited and Hydro One Inc. securities during a company’s trading blackout period, and at any other time when they possess undisclosed material information. | |

Note:

| (1) | Cash-settled LTIP grants with 100% performance-based payouts were designed to continue the alignment of company performance with shareholder interests, while ensuring that compensation for Hydro One’s executives also remain within the guidelines established by the executive compensation framework. For purposes of assessing the requirement, 25% of the target value of annual cash-settled LTIP is counted towards the executive share ownership requirement during the vesting period. Upon vesting and settlement in cash, the awards no longer count towards the requirement. |

Environment, Social and Governance (“ESG”)

Hydro One is committed to operating safely in an environmentally and socially responsible manner and to partnering with customers and communities to build a brighter future for all. Hydro One understands that the Company’s long-term performance depends on incorporating sustainability into all aspects of its business and remaining focused on what matters: standing up for people, the planet and communities across Ontario.

The Board oversees the Company’s approach to environmental, social and governance matters relating to the long-term health and sustainability of the Company. This oversight includes reviewing and approving the Company’s key sustainability priorities and its annual sustainability report.

Hydro One directly links a variety of ESG measures to compensation outcomes through the Short-Term Incentive Plan for members of our ELT and other management and non-represented employees. The 2021 team scorecard includes Safety, System Reliability and Customer measures, which supplement a variety of specific ESG indicators included on the ELT and leader’s individual scorecards.

Hydro One Limited is committed to releasing an annual sustainability report and to continuously increasing the transparency and accountability of our ESG disclosures. Hydro One is guided in its reporting by the Global Reporting Initiative core standards; the Sustainability Accounting Standards Board (“SASB”); and the Company’s report is prepared broadly following the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”).

Hydro One continues to strengthen its commitment to ESG, with a focus on the three priority areas where the Company believes it can make the greatest impact.

S-5

In 2020, Hydro One made significant commitments to advance its performance in these priority areas. Hydro One plans to annually review its priority areas and publicly report on progress on achieving these goals in future sustainability reports.

People: Hydro One values Diversity, Equity, and Inclusion (“DEI”) and stands for racial equality at all levels of the organization. The Company seeks to create a workforce that reflects the diverse populations of the communities where we live and work. Hydro One is committed to setting broader diversity and inclusion hiring goals and identifying, eliminating and preventing systemic barriers in the workplace. To support the Company’s work with DEI, it has a cross-functional council that highlights and supports DEI programs throughout Hydro One. Hydro One Limited has signed the BlackNorth Initiative Pledge and Hydro One is committed to achieving 3.5% Black executives and Board directors and 5% Black student hires by 2025. Additionally, as a signatory to the Catalyst Accord, Hydro One is committed to achieving at least 30% female executives and Board members.

Planet: Hydro One’s unique position within Ontario’s electricity landscape means it has a pivotal role to play in transmitting and distributing clean electricity across the province. Hydro One owns and operates vital infrastructure necessary to help Ontario achieve its climate change goals and transition toward a low-carbon economy. One of Hydro One Limited’s key corporate strategies is to plan, design and build a grid for the future that is reliable, resilient and flexible. Hydro One Limited has climate transition action plans in place for adaptation and mitigation and discloses its independently assured Scope 1 and 2 GHG emissions annually in its sustainability report. Under the board of directors of Hydro One Limited’s oversight, Hydro One Limited has also set ambitious climate reduction targets, committing to achieve net zero emissions by 2050, with an interim emissions reduction target of 30% by 2030. Key components of Hydro One Limited’s emissions reduction strategy include: conversion of fleet vehicles to electric and hybrids; facility automation and energy efficiency; reducing the need for diesel generation at remote northern communities by connecting communities to the provincial electricity grid; reducing sulfur hexafluoride (“SF6”) emissions; and implementing carbon capture initiatives such as tree planting and pollinator meadows. Hydro One will also be exploring opportunities as new technologies and innovations become available. Hydro One Limited is committed to reporting annually on its progress in achieving the Company’s climate change targets in its annual sustainability report. In 2021, for the first time, Hydro One Limited began aligning its climate-disclosures to the recommendations of the TCFD. Hydro One recognizes that implementing these TCFD recommendations within the Company is a journey and Hydro One is committed to the continuous improvement of our TCFD reporting.

Community: Hydro One is committed to being a trusted partner to Indigenous communities, customers, partners, and all Ontarians. The Company will continue to stand with these communities, customers, and partners to promote a more inclusive economic recovery and a more equitable future for all. Hydro One will continue to strive for industry-leading and innovative engagement with Indigenous communities through open dialogue, respect for cultural traditions and knowledge, all underpinned by trust-based relationships. Hydro One Limited has committed to increasing our Indigenous procurement spend to 5% of the company’s purchases of materials and services by 2026 and to ensuring that 20% of its corporate donations and sponsorships support Indigenous communities.

Further information including details on our management and governance approach can be found in Hydro One Limited’s most recent sustainability report available at: https://www.hydroone.com/sustainability/.

Human Resources Committee

Hydro One’s management team, the HRC and our compensation advisors all play a key role in determining compensation for the executives and in managing compensation risk. One of the HRC’s responsibilities is to assist the Board in fulfilling its oversight responsibilities relating to the delivery of sustained corporate results through the attraction and retention of key senior management.

S-6

Details concerning the HRC, its mandate and its members are as follows:

Human Resources Committee: | ||

Committee Members:

Melissa Sonberg (chair)

Blair Cowper-Smith Jessica McDonald Russel Robertson

The committee met in camera without management present at each of its regularly scheduled meetings.

The committee is satisfied it carried out its duties and responsibilities under its mandate. | Committee Membership: The HRC must consist of at least three directors, all of whom must be independent.

Duties and Responsibilities include overseeing:

• ensuring the effectiveness of the Company’s human capital and human resources strategy, policies, programs and procedures, including diversity and inclusion policies and practices;

• the compensation and incentive policies, programs and plans of the Company designed to attract, retain and develop executives and employees with the skills and expertise needed for the company to carry out its strategies, business and operations;

• the compensation of the President and CEO and other direct reports and other key employees of Hydro One Limited and its subsidiaries as the HRC or Board may determine (the “Designated Employees”);

• retaining external consultants and advisors to receive independent and objective advice on the compensation and human resources policies and programs of the Company;

• reviewing matters relating to succession planning of the Company’s President and CEO and the Designated Employees;

• the Company’s policies and programs to promote a culture of integrity and responsible stewardship, including through its oversight of the Code of Business Conduct and the Whistleblower Policy, and related practices and procedures; and

• the Company’s labour relations strategy.

2021 Accomplishments and Highlights include:

• Reviewed:

- the enterprise risk management updates;

- incentive compensation information and benchmarking;

- performance reports for both the defined benefit pension plan (“DBPP”) and the defined contribution pension plan (“DCPP”);

- an evaluation of the committee’s compensation consultant;

- the Company’s diversity, equity and inclusion strategy;

- talent management and succession planning for the ELT;

- executive share ownership holdings against requirements;

- 2022 individual performance scorecards for Designated Employees; and

- a compensation risk assessment.

• Reviewed and approved:

| |

S-7

Human Resources Committee: | ||

- merit increases and salary structure adjustments for management employees;

- 2020 short-term incentive plan (“STIP”) aggregate individual performance multipliers for management and non-represented employees;

- 2020 STIP performance multiplier for the ELT;

- 2021 LTIP grants for management and Designated Employees;

- 2020 DBPP, DCPP and year-end financial statements and DBPP statement of investment policies and procedures;

- the Company’s people strategy;

- bargaining mandates; and

- DCPP and DBPP amendments.

• Reviewed and recommended:

- President and CEO’s position description;

- 2020 STIP corporate scorecard results and performance multiplier;

- 2020 STIP for the President and CEO;

- 2021 and 2022 STIP corporate scorecard;

- 2021 and 2022 LTIP performance measures;

- 2021 LTIP grant for President and CEO;

- 2018 performance share unit performance multiplier;

- the President and CEO succession plan; and

- 2022 individual scorecard and LTIP performance measures for the President and CEO.

| ||

All of the HRC members have gained the following relevant experience in human resources and compensation by serving as an executive officer (or equivalent) of a major organization and/or through prior service on the human resources committee of a stock exchange-listed company or otherwise, and through ongoing Board and committee education sessions. HRC members have a wide array of talent management responsibilities as per the broad mandate of the HRC. The following are specific areas of experience and expertise related to total rewards:

| • | human resources experience (experience with benefit, pension and compensation programs, particularly executive compensation); |

| • | risk management experience (knowledge and experience with internal risk controls, risk assessments and reporting as it pertains to executive compensation); and |

| • | executive leadership experience (experience as a senior executive/officer of a public company or major organization). |

Please refer to the AIF for biographical information concerning each member of the HRC.

S-8

| (c) | Compensation Advisors |

The HRC engages with independent, external consultants for advice and consultation on executive and director compensation matters.

Since October 2018, Mercer (Canada) Limited (“Mercer”) has served as the independent consultant to the HRC, providing data and advice to assist the HRC in carrying out its mandate.

All decisions and actions taken by the HRC and the Board have been based on numerous factors and considerations which may, but do not necessarily, reflect the information provided by, or advice of, the advisors.

Aggregate compensation advisor fees (rounded and including taxes) paid to Mercer for executive compensation or related services provided to the HRC during 2021 and 2020 are as follows:

| Professional Service Fees (CAD) | ||||||||||

| Compensation Advisor | Year | | Executive Compensation- Related Fees ($) |

| | Other Fees(1) ($) |

| |||

Mercer (Canada) Limited(1) | 2021 | 88,208 | 565,283 | |||||||

| 2020 | 54,114 | 294,674 | ||||||||

Note:

| (1) | In 2020 and 2021, Mercer provided specific market compensation benchmarking analysis in the form of a custom compensation survey directed by the Ontario Energy Board (“OEB”) for purposes of the Company’s joint (distribution and transmission) rate application filing before the OEB. This analysis is not related to executive compensation. While the HRC is not required to approve work related to the OEB benchmarking study prior to completion, the work is completed by a separate Mercer consultant distinct from the Mercer consultant providing advice to the HRC. No fees other than for executive compensation-related matters were charged by the independent advisor in either 2020 or 2021 for work requested by the HRC or the Board. |

| (d) | Executive Compensation Decision-Making Process |

Hydro One’s compensation decision-making process involves management, the HRC, independent compensation advisors, and the Board for final approval. Outlined below is a general overview of the process that the Company (together with Hydro One Limited) has historically followed in determining compensation.

To promote robust decisions and analysis of recommendations and to ensure the implications on diverse stakeholders are considered, management recommendations are initially brought forward at an HRC meeting and then reviewed and recommended to the Board for approval at a subsequent meeting.

By having discussion and approvals conducted at separate meetings, we believe we are able to develop thoughtful solutions that consider the impacts of such on all of our stakeholders. If appropriate, additional analysis may be requested by the HRC or the Board.

In 2021, the HRC continued to monitor the compensation program to ensure it was achieving its intended results and to understand the impact of the global pandemic on operations and stakeholders. The HRC may refine the program over time to ensure that it continues to be aligned with the Company’s strategy and long-term objectives, subject to the requirements of the Hydro One Accountability Act and the directive issued thereunder.

S-9

Design of the Compensation Program

The table below summarizes the Company’s compensation decision-making process.

| Management | HRC | Compensation Advisors | Board | |||||

Design of Compensation Structure | Designs and recommends compensation program to HRC | Reviews and, where appropriate, revises and recommends the compensation structure to the Board for approval | Provides input based on best practice to the HRC | Approves compensation program including any material changes | ||||

Choice of Performance Measures and Annual Targets | Develops annual Company objectives aligned with the strategy and incentive plan performance measures including weighting | Reviews and, where appropriate, revises and recommends the incentive plan performance measures to the Board for approval | Provides input to the HRC on market practice | Approves performance measures and targets | ||||

Set Targets for Executive Compensation | Develops and recommends to HRC target compensation and variable pay for executives | Recommends President and CEO’s target compensation to Board for approval Reviews and approves target compensation for direct reports to the President and CEO | Assists the HRC in developing target compensation | Approves the President and CEO target compensation | ||||

Assess Company Performance | Recommends corporate performance results to the HRC | Reviews and, where appropriate, adjusts corporate performance results and recommends to the Board for approval | Supports the HRC in reviewing performance results, identifies areas where adjustments should be considered | Approves the performance results | ||||

Assess Individual Performance | President and CEO assesses performance of direct reports, recommends compensation decisions to the HRC | Assesses the President and CEO’s performance and recommends same to the Board Reviews performance of the President and CEO’s direct reports | Approves the President and CEO’s performance results | |||||

S-10

| Management | HRC | Compensation Advisors | Board | |||||

Award Compensation | President and CEO recommends compensation for the President and CEO’s direct reports | Reviews, finalizes, and approves compensation for the President and CEO’s direct reports Recommends the President and CEO’s compensation to Board for approval | Provides analysis to support compensation decision-making where applicable | Approves compensation for the President and CEO | ||||

Hydro One’s management team, the HRC, the Board and the Company’s compensation advisors all play a key role in determining compensation for the Company’s executives and in managing compensation risk.

| (e) | Approach to Compensation for 2021 |

The following section discusses the compensation structure, programs and significant elements of compensation for the NEOs during 2021.

Benchmarking and Pay Positioning for the NEOs

In 2019, the Board engaged Mercer to perform a comprehensive review of Hydro One’s executive compensation program. As part of this review, Mercer developed an updated 2019 compensation peer group that consists of 13 Canadian organizations, including publicly traded organizations in the energy and utilities industries and large government-owned utilities.

This peer group remained unchanged for 2021 and reflects:

| • | Hydro One’s core business as Canada’s largest electricity transmission and distribution service provider; |

| • | the unique dynamic of Hydro One Limited’s ownership structure, recognizing the complexity of a publicly traded company with significant investment by the Province; and |

| • | the particular considerations inherent with highly-regulated organizations having large societal impact. |

This peer group was used to inform total direct compensation design for the NEOs, each of whom is required to possess a high level of skill and proven experience leading large and complex organizations. The compensation for the NEOs has been structured to comply with the requirements of the Hydro One Accountability Act, and therefore has not been targeted to a specific percentile (such as the median) of this peer group. In line with peer practices and consistent with Hydro One’s compensation philosophy, NEO total direct compensation is aligned with clear performance measures and Hydro One Limited shareholder expectations over the short-term and long-term.

For details on the NEOs’ 2021 target total direct compensation, see “Target Compensation Mix” on page S-26.

S-11

Primary Compensation Reference Peer Group

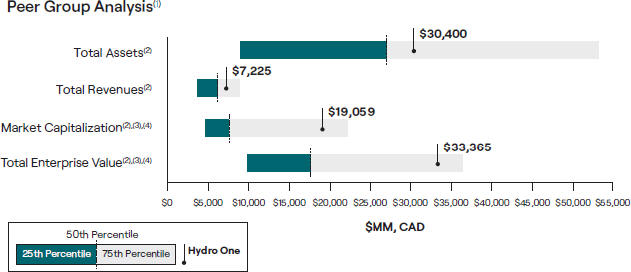

Reference peers were selected based on a number of considerations including industry, size and ownership structure (i.e., private- and public-sector organizations). The organizations selected were similar in size to Hydro One Limited and Hydro One Limited is currently positioned above the 50th percentile of the peer group for each scoping criterion.

| Private Sector Peers | Public Sector Peers | |

AltaGas Ltd. | British Columbia Hydro and Power Authority | |

ATCO Ltd. | ENMAX Corporation | |

Emera Incorporated | Hydro-Québec | |

Fortis Inc. | Ontario Power Generation Inc. | |

Inter Pipeline Ltd.(1) | Toronto Hydro Corporation | |

Keyera Corp. | ||

Pembina Pipeline Corporation | ||

TransAlta Corporation | ||

Notes:

| (1) | Inter Pipeline Ltd. was acquired by Brookfield Infrastructure in the fourth quarter of 2021. The organization was included in the comparison peer group for 2021, however, due to the acquisition Inter Pipeline Ltd. will be removed from the peer group for 2022. |

Notes:

| (1) | Inter Pipeline Ltd. was acquired by Brookfield Infrastructure in the fourth quarter of 2021. As a result, the organization was excluded from the figures presented above. |

| (2) | Except as noted in footnote one above, the total assets and total revenues are calculated using data for the most recently reported 12-month period ending December 31, 2021. Peer information included in this chart was prepared by Mercer using data from S&P Capital IQ. |

| (3) | The market capitalization of Hydro One Limited was approximately $19.1 billion and its total enterprise value was approximately $33.4 billion as at December 31, 2021. |

| (4) | Market capitalization is calculated based on the number of common shares of Hydro One Limited outstanding multiplied by the closing share price of the common shares of Hydro One Limited and total enterprise value is calculated based on market capitalization plus net debt. Public Sector organizations are excluded from these statistics as market capitalization and total enterprise value cannot be calculated. |

S-12

Components and Decisions of 2021 Compensation

Hydro One’s compensation structure includes base salary, short-term and long-term incentives, share ownership plan, and pension and benefits.

The table below describes the components of compensation for the NEOs and the objective of each:

Component | Form | Objectives | ||||

Fixed | Base Salary | Cash | • Attract and retain highly qualified and experienced executives

• Provide a predictable and steady income | |||

Pension | Defined Contribution Pension Plan | • Provide market-competitive, sustainable retirement arrangements to attract and retain talent | ||||

Benefits | Group health, life and disability benefits | • Indirect compensation to assist employees in covering select life events and promoting health and wellness | ||||

Variable | Short-term Incentive | Cash – executives can choose to receive some or all in the form of deferred share units (“management DSUs”) | • Motivate and reward achievement of annual business performance objectives

• Align individual performance and rewards with corporate objectives | |||

Long-term Incentive | Cash-settled performance based | • Motivate and align executives with long-term strategy and shareholders’ interests

• Encourage sustained long-term performance

• Balance short- and long-term results focus | ||||

Management Employee Share Ownership Plan (“Management ESOP”) | Market-purchased shares acquired up to a maximum 6% of base salary with a 50% company match up to a maximum of $25,000 per year | • Encourage share ownership and increase alignment with shareholders’ interests | ||||

| (i) | Base Salary |

Base salary is the guaranteed component of compensation which is based on job function, individual performance, operational experience and market alignment. This component is designed to enable Hydro

S-13

One to attract, retain and motivate qualified employees, including executives. Base salaries are aligned with the executive compensation framework.

Base Salary Decisions for 2021

The following table documents the base salary increases for the five NEOs in 2021.

Following Hydro One’s typical practice, the 2021 base salary changes were approved by the Board in February 2021, and were effective April 1, 2021 for all NEOs. The 0.7% increase to base salary is aligned with the requirements outlined under the executive compensation framework.

| Named Executive Officer | 2020 Base Salary(1) | 2021 Base Salary(1) | % Change | |||

Mark Poweska | $ 510,500 | $ 514,074 | 0.7% | |||

Chris Lopez | $ 408,400 | $ 411,259 | 0.7% | |||

Jason Fitzsimmons | $ 377,770 | $ 380,415 | 0.7% | |||

Paul Harricks | $ 382,875 | $ 385,555 | 0.7% | |||

David Lebeter | $ 400,000 | $ 402,800 | 0.7% |

Notes:

| (1) | These columns reflect the NEOs’ base salary as of December 31 of the relevant year, and do not take into account any proration for base salary changes during fiscal years 2020 and 2021, respectively. |

(ii) 2021 Short-Term Incentive Plan (“STIP”)

The STIP was designed to:

| • | provide market competitive “pay-at-risk” necessary to attract, motivate and retain employees and executives; |

| • | reinforce strategic business objectives and a performance-oriented culture with significant elements of compensation at risk; |

| • | focus participants on the drivers of value creation; and |

| • | reward participants for achievement of annual corporate and individual performance goals. |

All full-time non-union employees, including executives, are eligible to participate in the STIP. A summary of the components of the STIP is provided below.

| Elements of the Short-Term Incentive Plan | Impact on Award | |||

| How the Award is Determined | The amount of the award is a function of the executive’s incentive target, corporate performance and individual performance.

For NEOs, awards are weighted 80% on achievement of corporate goals and 20% on achievement of individual goals. | |||

Corporate | Corporate performance is based on financial and non-financial measures | |||

S-14

| Elements of the Short-Term Incentive Plan | Impact on Award | |||

Performance | which seek to align corporate performance with the Company’s strategy as detailed in the corporate scorecard.

ESG and Other Non-Financial Measures

• Health and Safety – to reinforce the importance of keeping our employees safe

• Customer – Overall Favourable Impression – to align employees with customer perceptions of Hydro One

• Work Program – to align employees with regulatory and customer goals

Financial Measures

• Net Income of Hydro One Limited – to increase Hydro One Limited’s shareholder value by increasing earnings

• Productivity Savings – to increase Hydro One Limited shareholder value by decreasing operating, maintenance and administration and capital-related costs

See pages S-32 to S-36 for more information about the performance measures and results related to the Company’s corporate scorecard. | |||

Individual Performance | Individual performance is assessed based on the achievement of corporate-aligned performance objectives with a focus on delivering differentiated rewards to top performers. See each NEO’s key accomplishments starting on page S-36. | |||

Range of Awards | Awards may range from 0 to 100% for the President and CEO and EVPs, and from 0 to 150% of target short-term incentive for employees who hold an SVP level role (and below), based on corporate and individual performance. | |||

HRC/Board Judgment | The HRC considers whether adjustments are necessary or appropriate to reflect unusual or unanticipated events occurring during the performance period and recommends the “overall STIP performance multiplier” to the board for approval using informed judgment to ensure that compensation reflects the actual performance of the business. | |||

Payout | The payout may be in cash or, at the option of an eligible executive, management DSUs. Management DSUs are fully vested notional shares and accrue dividend equivalents when dividends are paid on the common shares of Hydro One Limited and are redeemable for cash at the prevailing market price of the common shares of Hydro One Limited upon settlement after the executive ceases to be employed. | |||

Clawbacks | Amounts can be forfeited or clawed back under certain conditions. Specifically, an executive’s STIP may be required to be repaid in situations where it later becomes clear that the performance metrics used to determine payment were not achieved, or in the event of a material restatement of Hydro One Limited’s earnings (or other Hydro One Limited-specific results) that significantly reduces shareholder value. | |||

S-15

The STIP payout is calculated based on the following formula.

Note:

Consistent with the requirements of the executive compensation framework, STIP payouts for the President and CEO and EVPs are capped at 100% of the target award.

| (ii) | Former Equity-Settled Long-Term Incentive Plan |

This plan is applicable to the 2016, 2017 and 2018 LTIP grants. There are currently no outstanding grants under this plan. A summary of the key terms of the former Hydro One Limited LTIP (in which employees of Hydro One were allowed to participate) are presented below:

| Types of Awards | PSUs and RSUs.

• Options. An option is the right to acquire a common share on a future date on payment of the exercise price. The exercise price of an option may not be less than the fair market value of a common share of Hydro One Limited on the date of grant. The term of an option may not exceed 10 years, unless extended due to the existence of a company trading blackout period.

While none of the following have been granted, the LTIP also contemplates the possibility of grants of:

• Restricted shares. A restricted share award is an award of common shares of Hydro One Limited subject to forfeiture restrictions.

• DSUs. A DSU is an award that entitles the participant to receive common shares of Hydro One Limited following termination of employment or service with the Company. DSUs may be subject to performance conditions or other vesting conditions.

• SARs. A share appreciation right (“SAR”) is the right to receive common shares of Hydro One Limited equal in value to the appreciation in the value of a common share over a period. The base price against which a SAR is to be measured may not be less than the fair market value of a common share on the date of grant. An option and a SAR may be granted in tandem, in which event the SAR will vest and be exercisable on the same dates as the related option and the exercise of the option results in the surrender of the SAR, and vice versa. The term of a SAR may not exceed 10 years, unless extended due to the existence of a company trading blackout period.

• Other awards. Other awards are awards that are convertible into or |

S-16

otherwise based on the common shares of Hydro One Limited. | ||||

| Eligibility | Employees and consultants of Hydro One and its affiliates as determined by the HRC.

Non-employee directors on the Board are not eligible. | |||

| Maximum No. of Shares Authorized | 11,900,000 common shares of Hydro One Limited or approximately 2% of the issued and outstanding common shares of Hydro One Limited. Within that limit the maximum number of common shares of Hydro One Limited which may be issued as PSUs, RSUs or DSUs is 4,760,000 common shares (or approximately 0.8% of the issued and outstanding common shares of Hydro One Limited as of December 31, 2021). As of December 31, 2021, there were 8,617,720 common shares available for future awards (approximately 1.44% of the issued and outstanding common shares of Hydro One Limited).

If an award expires without exercise, is cancelled, forfeited or terminated or otherwise is settled without the issuance of common shares of Hydro One Limited, the common shares of Hydro One Limited which were issuable under the award will be available for future grants. Common shares of Hydro One Limited issued under awards of an acquired company that are converted, replaced or adjusted in connection with the acquisition will not reduce the number of shares available for awards under the LTIP unless otherwise required by law or stock exchange rule. | |||

| Insider Limits | Under the LTIP and any other Hydro One Limited security-based compensation arrangements:

• maximum number of common shares of Hydro One Limited issuable to insiders at any time is 10% of the outstanding common shares of Hydro One Limited.

• maximum number of common shares of Hydro One Limited issuable to insiders within any one-year period is 10% of the outstanding common shares of Hydro One Limited.

• The LTIP does not provide for a maximum number of common shares of Hydro One Limited which may be issued to an individual pursuant to the LTIP and any other security-based compensation arrangement (expressed as a percentage or otherwise). | |||

| Fair Market Value | Under the LTIP, the fair market value is based on the closing common share price of Hydro One Limited on the TSX on the applicable date. | |||

| Company Trading Blackout Periods | If an award is scheduled to expire during, or within five business days after, a company trading blackout period restricting employees from trading in common shares of Hydro One Limited, then the award shall expire ten business days after such restricted trading period expires. | |||

| Death & Disability | Unless otherwise determined by the HRC, a pro rata portion of the next instalment of the award due to vest shall immediately vest, based on the number of days elapsed since the last instalment vested compared to the period from the last vesting date to the next vesting date (or if none have vested, the date of grant). Any performance targets are deemed to have been met at 100% of the target performance level. Vested awards subject to exercise will remain exercisable for 90 days, or the award’s normal expiration date if earlier. | |||

| Retirement | Unless otherwise determined by the HRC, all unvested awards continue to vest and are settled and exercised in accordance with their terms. | |||

S-17

“Retirement” means:

(a) If the employee:

i. is the President and CEO (or reports directly to the President and CEO), the retirement has been approved by the Board and the employee complies with such conditions as the Board may require;

ii. is not i. above, the employee has reached age 65 or reached age 55 with a minimum of 10 years of service or such lesser age and/or service thresholds as the HRC may determine;

iii. achieved the age and service eligibility criteria for an undiscounted early retirement pension as defined by the DBPP applicable to the participant;

iv. has achieved such lesser age and/or service thresholds as the Plan Administrator may determine.

(b) the employee has given formal notice of their intention to retire six months in advance or such lesser period as the Plan Administrator may approve;

(c) no cash severance payment or retirement allowance or equivalent is paid; and

(d) the employee has complied with such transitional activities as may be reasonably required by Hydro One until the date the individual has ceased active employment. | ||||

| Resignation | Unless otherwise determined by the HRC, all unvested awards are forfeited. Vested awards subject to exercise will remain exercisable for 90 days, or the award’s normal expiration date if earlier. | |||

| Termination For Cause | All awards, whether vested or unvested, are forfeited and cancelled. | |||

| Termination Without Cause(1) | If the employee has five (5) years of service or more and has not committed and has not failed to take any action, in each case that in the determination of the plan administrator has resulted or could damage the Company or its reputation, then, a pro-rated portion of the next instalment of any awards due to vest shall immediately vest with PSUs at deemed to have met 100% of the specified performance targets. Options shall remain exercisable for 90 days from the termination date.

Unless otherwise determined by the HRC and except if termination occurs within 24 months following a change in control, all unvested awards are forfeited. Vested awards subject to exercise will remain exercisable for 90 days, or the award’s normal expiration date if earlier. | |||

| Termination Without Cause Within 24 Months Following a Change in Control | If, within 24 months following a change in control, the executive’s employment is terminated by the Company without cause then, without any action by the plan administrator:

i. if the change in control is one of the circumstances set out in paragraphs (a) to (c) or (g) of the definition of change in control (as defined below) the prior awards held by the executive on the change in control (the “Affected Awards”) shall continue to vest and be settled or exercised in accordance with their terms; and

ii. if the change in control is one of the circumstances set out in paragraphs (d) to (f) of the definition of change in control noted below, 1) the | |||

S-18

Affected Awards shall vest and become exercisable, realizable or payable as of the termination date, 2) any performance goals assigned to any such Affected Awards shall be deemed to have been met at 100% of the specified target level of performance for such performance goals and 3) any Affected Award that is an Option or SAR shall continue to be exercisable until, and will expire on, the earlier of its expiry date and 90 days following the termination date. | ||||

| Change in Control(2) | The HRC may provide for the conversion or exchange of outstanding awards for new awards or other securities of substantially equivalent value (or greater value) in any entity participating in or resulting from the change in control, or, for the accelerated vesting or delivery of shares under awards, or for a cash-out of outstanding awards. | |||

| Definition of Change in Control | Subject to certain exceptions, means:

(a) more than 50% of the outstanding voting securities of Hydro One Limited are acquired;

(b) all or substantially all of the assets of Hydro One Limited are sold, assigned or transferred, other than to a wholly owned subsidiary;

(c) an acquisition of Hydro One Limited via merger, amalgamation, consolidation, statutory arrangement or otherwise or the dissolution or liquidation of Hydro One Limited;

(d) individuals who, at the beginning of any two-year period constitute the Board cease to constitute a majority of the Board, excluding any individuals whose service ceased due to death during such two-year period;(3)

(e) pursuant to its rights in the Governance Agreement, the Province replaces the entire Board (other than the President and CEO) and, in its discretion, the Chair;(3)

(f) a change is made to an Ontario law or regulation that:

i. both (A) expressly states that it applies either (1) to Hydro One Limited or an affiliate or (2) companies in the electrical transmission and/or distribution business generally but has a disproportionate effect on Hydro One Limited and its affiliates as a whole, and (B) would materially adversely affect the ability of Hydro One to achieve any corporate performance measures set out in any outstanding awards; or

ii. imposes limits on the quantum of compensation that may be paid to non-union employees of Hydro One or its affiliates other than restrictions established for rate approval or other purposes which do not restrict amounts actually paid;(3) or

(g) the board of directors of Hydro One Limited passes a resolution confirming that a change in control has occurred.

As a result of limitations on the ownership of Hydro One Limited’s shares under the Electricity Act, there would have to be an amendment to such statute for a change in control to occur in certain circumstances. | |||

| Assignability | Options are generally not assignable or transferable. Other awards may be assigned to a ‘permitted assign’ (as defined under Canadian securities law), which includes a spouse, registered retirement savings plan, registered retirement income fund or personal holding company. | |||

S-19

| Discretion | The HRC may accelerate vesting or exercisability of an award. The HRC may adjust performance objectives in an objectively determinable manner to reflect events occurring during the performance period that affect the applicable performance objective. | |||

| Clawback | The HRC may provide that an award may be subject to potential cancellation, recoupment, rescission, payback or other action in accordance with the terms of any clawback, recoupment or similar policy adopted by the Company or as otherwise required by law or applicable stock exchange listing standards. | |||

| Adjustments | The HRC may make adjustments as it determines in its sole discretion to the terms of any award, the number and type of securities issuable under the award and the number of common shares of Hydro One Limited issuable under the LTIP in the event of a subdivision or consolidation of common shares or any similar capital reorganization, or a payment of a stock dividend (other than a stock dividend that is in lieu of a cash dividend), or in the event of an amalgamation, combination, arrangement, merger or other transaction or reorganization of the Hydro One Limited that does not constitute a change in control. | |||

| Amendment | The HRC may amend the LTIP or outstanding awards or terminate the LTIP as to future grants of awards, except that a change that would affect materially and adversely an employee’s rights under the award is subject to the employee’s consent unless expressly provided in the LTIP or the terms of the award at the time of grant.

Approval of the shareholders of Hydro One Limited is required for any amendment that:

(a) increases the number of common shares of Hydro One Limited available for issuance under the LTIP or increases the limits on awards to insiders (except with respect to the adjustments described above),

(b) permits non-employee directors to receive awards,

(c) reduces the exercise price of an award (including by cancelling an award and reissuing an award to the same participant with a lower exercise price) except pursuant to the provisions of the LTIP which permit the HRC to make equitable adjustments in the event of transactions affecting the Company or its capital,

(d) extends the term of any award beyond its original expiration date (except where the expiration date would have fallen within a company blackout period or within five business days thereof),

(e) permits an award to be exercisable or settled beyond 10 years from its grant date (except where the expiration date would have fallen within a company blackout period),

(f) permits awards to be transferred other than to a “permitted assign” (as defined under Canadian securities law) or for normal estate settlement purposes, or

(g) deletes or reduces the range of amendments which require Hydro One Limited shareholder approval. | |||

Notes:

| (1) | Represents a change to the LTIP which was approved by the board of directors of Hydro One Limited on May 14, 2018; the TSX accepted notice of the amendment on August 10, 2018. |

| (2) | As noted above in the “Termination and Change in Control Provisions” table, in the event of a resignation for good reason |

S-20

following a Change in Control, the vesting of awards granted prior to the change in control continues or accelerates. |

| (3) | Represents a change to the LTIP which was approved by the board of directors of Hydro One Limited on November 10, 2017; the TSX accepted notice of the amendment on December 28, 2017. |

The above description of the former Hydro One Limited equity-settled LTIP is summary in nature and is qualified in its entirety by the text of the Hydro One Limited equity-settled LTIP.

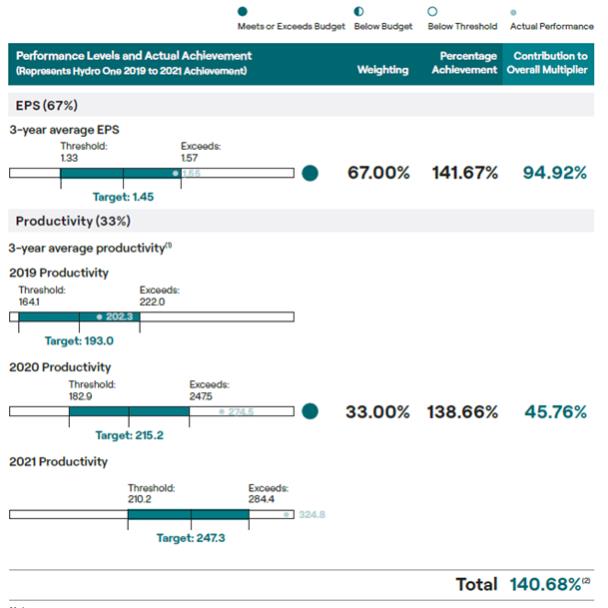

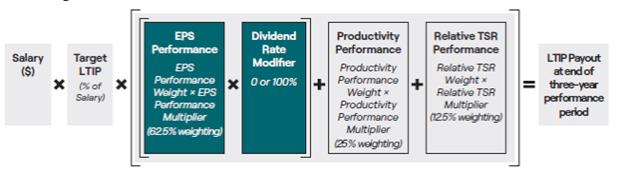

(iv) Cash-Settled Long-Term Incentive Plan

Hydro One Limited’s LTIP (in which employees of Hydro One are allowed to participate) is designed to:

| • | provide market competitive compensation; |

| • | attract and retain highly qualified and experienced talent; |

| • | foster alignment with shareholder interests; and |

| • | reward executives for longer term value creation. |

To align with the executive compensation framework, and ensure that executives do not exceed the maximum compensation levels, a cash-settled LTIP was introduced in 2019. The grants under this plan are not tied to Hydro One Limited’s share price nor are they eligible for dividend equivalents. Therefore, no share-based awards or options were issued in 2021.

The Hydro One Limited cash-settled LTIP provides strong alignment with shareholder interests as they are 100% performance based with the following performance measures:

| • | EPS, which reward executives for delivering increased earnings to shareholders and includes the requirement that the dividend does not decrease in any rolling 12 months during the performance period; |

| • | productivity savings, which reward executives for achieving improvements in productivity and efficiency, which ultimately drive value for both shareholders and customers; and |

| • | relative TSR, which rewards executives for achieving shareholder returns that are consistent with or better than the returns provided by peer organizations. |

LTIP is available to executives and certain non-union employees of Hydro One Limited and its subsidiaries as determined by the HRC. Non-employee directors are not eligible to participate.

A summary of the components of the current LTIP is as follows:

| Elements of the Long-Term Incentive Program | Impact on Award | |||

| Types of Awards | Cash-Settled LTIP: An award that will be settled in cash in the future, subject to the achievement of specified performance criteria. The awards are not tied to share price nor do they accumulate dividend equivalents. | |||

| Vesting | Awards granted in 2021 vest after the three-year performance period (February 28, 2024), subject to a performance multiplier based on achievement of specific performance measures, unless otherwise determined by the HRC. | |||

S-21

| Performance Multiplier | Each cash-settled LTIP award granted in 2021 is 100% performance based, subject to achieving certain performance levels for the period from January 1, 2021 to December 31, 2023 (the “Performance Period”).

(1) three-year average adjusted EPS (subject to a dividend rate modifier) – 62.5% weighting;

(2) three-year productivity savings – 25% weighting; and

(3) three-year relative TSR, (S&P/TSX Capped Utilities Index) – 12.5% weighting.

The EPS and Relative TSR performance measures demonstrate a commitment to achieving long-term growth for Hydro One Limited’s shareholders, which is consistent with or better than the growth delivered by other Canadian utilities, while the productivity measure is aligned with the Company’s strategic focus on operating efficiencies.

Three-year average EPS: The adjusted net income attributable to Hydro One Limited’s shareholders for such fiscal period divided by the average outstanding shares during such fiscal period.

Dividend rate: If the 12 month rolling average dividend rate during the Performance Period falls below the annualized quarterly dividend rate at the time of grant, a 0% modifier will be applied to the EPS performance multiplier. If the 12 month rolling average dividend rate during the Performance Period does not decrease from the level at grant, a 100% modifier will be applied to the EPS performance multiplier.

Three-year productivity measure: Hydro One’s commitment to achieving incremental and continuous productivity improvements is central to the planning and execution of work programs across the Company. Identified savings were quantified and embedded in the business plan having regard to the mutual benefit to customers and Hydro One Limited shareholders.

Relative TSR: Measures Hydro One Limited’s total shareholder return over the performance period relative to the total shareholder return for the S&P/TSX Capped Utilities Index for the same period. | |||

| Range of Awards | The LTIP payout is a function of the overall performance multiplier which is based on the three-year average EPS performance (62.5% weighting) with a dividend rate modifier, and the productivity performance (25% weighting), and the relative TSR performance (12.5% weighting). Under the executive compensation framework, the total award is subject to an overall maximum payout of 100% for the President and CEO and EVPs, and 150% for all other employees. | |||

HRC/Board Judgment | The HRC considers whether adjustments are necessary or appropriate to reflect unusual or unanticipated events occurring during the performance period and recommends the “overall STIP performance multiplier” to the board for approval using informed judgment to ensure that compensation reflects the actual performance of the business. | |||

| Clawbacks | Amounts can be forfeited or clawed back under certain conditions. Specifically, an executive’s vested long-term incentives may be required to be repaid in situations where it later becomes clear that the performance metrics used to determine payment were not achieved, or in the event of a material restatement | |||

S-22

of Hydro One Limited’s earnings (or other Hydro One Limited-specific results) that significantly reduces shareholder value. | ||||

(v) Pension Benefits

Defined Contribution Pension Plan (“DCPP”)

Hydro One established a registered DCPP effective January 1, 2016. Hydro One’s DCPP is designed to:

| • | attract and retain employees; |

| • | result in lower and more stable cost over time compared to the Defined Benefit Pension Plan (“DBPP”); and |

| • | promote sharing of retirement savings responsibility between Hydro One and its employees. |

A summary of the key terms of the DCPP is presented below:

| • | Eligibility: Eligible non-union employees hired on or after January 1, 2016, as well as non-union employees hired before January 1, 2016 who were not eligible or had not irrevocably elected to join the DBPP as of September 30, 2015. All NEOs participate in the DCPP. |

| • | Employee Contribution: Mandatory contribution of a minimum of 4% of pensionable earnings and a maximum contribution of 6% of pensionable earnings, subject to the limit outlined under the “Supplemental Plan” heading below. |

| • | Employer Match: Employee contributions are matched by Hydro One. |

| • | Pensionable Earnings: Base salary plus actual short-term incentive (but not exceeding 50% of base salary). |

| • | Supplemental Plan: Effective as of January 1, 2018, once the total employee and employer contributions for the calendar year has reached the maximum contribution level permissible under a registered pension plan, as per the Income Tax Act, employee contributions cease and employer contributions are allocated to a notional supplemental pension plan account for the employee’s benefit. The notional supplemental pension plan was approved by the Board on December 8, 2017 and replaced a non-registered savings plan in which employer contributions were made on an after-tax basis. |

(vi) Management Employee Share Ownership Plan

Hydro One strongly supports share ownership of Hydro One Limited by its employees and, accordingly, offers an employee share ownership plan for non-union employees (“Management ESOP”). The plan provides participants with the opportunity to acquire common shares of Hydro One Limited purchased on the market through payroll deduction.

It is designed to:

| • | promote an ownership culture among non-union employees; |

| • | align the interests of non-union employees with Hydro One Limited shareholder interests; and |

S-23

| • | increase employee awareness and alignment with Hydro One performance. |

All regular employees not represented by a union who have completed at least six months of continuous service with the Company prior to the date of enrolment in the plan are eligible to participate.

A summary of the components of the Management ESOP is provided below.

| Element | Description | |||

| Source of shares | Shares of Hydro One Limited are purchased on the market at prevailing prices (non-dilutive). | |||

| Employee contribution | Between 1% and 6% of base salary, through payroll deduction. | |||

| Employer match | Hydro One matches 50% of the employee contribution up to a maximum of $25,000 per year. | |||

| Vesting | All shares purchased with employee and employer contributions vest immediately | |||

(vii) Other Benefits

NEOs (other than those with legacy provisions) are not eligible for any other perquisites that are not offered to non-union employees to align with the executive compensation framework and the directive.

| (f) | 2021 Compensation Decisions |

Biographies

The biographies for our executive officers as of December 31, 2021 are as follows:

Mark Poweska, 52

President and Chief Executive Officer | Mark Poweska is President and CEO of Hydro One Limited. With approximately 1.5 million valued customers, over $30 billion in assets and 2021 annual revenues of approximately $7.2 billion, Mr. Poweska leads Ontario’s largest electricity transmission and distribution provider and is a proven leader with a reputation for prioritizing safety, exceeding customer expectations, cutting costs and improving operational performance.

With a team of approximately 9,200 skilled and dedicated employees (on average during 2021), Mr. Poweska has devised a corporate strategy that sets a clear vision for the future of Hydro One. Mr. Poweska has deep industry knowledge and an ability to develop enduring relationships with industry partners, unions, Indigenous communities, regulators and all levels of government.

Prior to joining Hydro One in 2019, Mr. Poweska served as Executive Vice President, Operations at BC Hydro. During his tenure in the role,

Mr. Poweska successfully led the merger of the former Transmission and Distribution organization with the Generation organization. During his 30 years in the industry at BC Hydro and Hydro One, Mr. Poweska has proven that he can build a strong safety culture, put customers first, improve efficiency and increase shareholder value. Mr. Poweska is a mechanical engineer with experience at all levels of the electricity | |||

S-24

industry, from the front line to the executive team.

Mr. Poweska holds a Bachelor of Applied Sciences in Mechanical Engineering from the University of Saskatchewan. He is also the chair of the board of directors of the Ontario Energy Association and serves on the board of the Western Energy Institute. He was recognized by the Ontario Energy Association as Leader of the Year for 2020 for his leadership of Hydro One’s transformation to be more customer-driven, sustainable, safe, and efficient. | ||||

Chris Lopez, 47

Chief Financial Officer | Chris Lopez is the Chief Financial Officer (CFO) of Hydro One Limited and Hydro One Inc., a position he assumed after being appointed as Acting CFO in late 2018. Mr. Lopez joined Hydro One in 2016 as the Senior Vice President of Finance and has more than 22 years of progressive experience in the utilities industry in Canada, the United States and Australia.

As CFO, Mr. Lopez is responsible for the corporate finance function, including treasury and tax, as well as internal audit, investor relations, risk, pensions and shared services, including supply chain, strategy and growth, Acronym Solutions Inc., and mergers and acquisitions.

Prior to joining the organization, Mr. Lopez was the Vice President, Corporate Planning and Mergers & Acquisitions at TransAlta Corporation from 2011 to 2015, and the Director of Operations Finance at TransAlta from 2007 to 2011 in Alberta, Canada. He also held senior financial roles for TransAlta in his native Australia, from 1999 to 2007. At the start of his career, he worked as a financial accountant with Rio Tinto in Australia.

Mr. Lopez holds a Bachelor of Business degree from Edith Cowan University in Australia, and a Chartered Accountant designation. He received a graduate diploma in corporate governance and directorships from the Australian Institute of Company Directors in 2007. | |||

Jason Fitzsimmons, 51

Chief Corporate Affairs and Customer Care Officer | Jason Fitzsimmons is the Chief Corporate Affairs and Customer Care Officer of Hydro One Networks. In this role, held since August 2018, Mr. Fitzsimmons has oversight of the company’s customer service, external relations, communications and marketing, sustainability and Indigenous relations functions. Prior to his current role, he served as the company’s Vice President of Labour Relations.

With more than 27 years of experience in the electricity sector, Mr. Fitzsimmons is a highly regarded leader with a proven track record for executing large-scale transformations and building strong relationships with key stakeholders.

Before joining the company in 2016, Mr. Fitzsimmons was the Chief Negotiations Officer at the Ontario Hospital Association and held a number of executive roles at Ontario Power Generation, including Vice President of Human Resources for its Nuclear division.

He is a Certified Human Resource Executive known for his broad experience in labour management, as well as his passion for health and safety in the workplace. Mr. Fitzsimmons currently serves on the Board of Directors of the Electricity Distributors Association and on the Advisory Board of the Ivey Energy Policy and Management Centre. He | |||

S-25

is also a member of the Canadian Chamber of Commerce’s Net Zero Council. He is a former member of the Advisory Board for Ryerson University’s Centre for Labour Management Relations and has served on the Board of Directors for the Electrical Power Sector Construction Association. | ||||

Paul Harricks, 67

Chief Legal Officer | Paul Harricks is the Executive Vice President and Chief Legal Officer of Hydro One Limited and Hydro One Inc., leading all aspects of the organization’s regulatory, legal, compliance, corporate governance and business ethics activities.

Prior to joining Hydro One in September 2019, Mr. Harricks practiced law for about 40 years, working extensively in the energy and infrastructure industries and serving as a partner and leader of the Energy Sector Industry Group of Gowling WLG Canada LLP, a major Canadian law firm.

A seasoned and trusted legal and strategic advisor, Mr. Harricks has delivered effective results in the fields of electricity distribution, transmission and generation and has led a range of public and private mergers and acquisitions.

Mr. Harricks is a past Director of the Association of Power Producers of Ontario and is a current member and a past Chair of the Energy Transition Committee of the Toronto Region Board of Trade. He is also a Director and Audit Committee and Compensation Committee member of Pioneering Technology Corp. and an active member of the International Bar Association.

He holds a Bachelor’s Degree from the University of Toronto and an LLB from Osgoode Hall Law School. | |||

David Lebeter, 62

Chief Operating Officer | David Lebeter is the Chief Operating Officer (COO) of Hydro One Networks Inc. (“Hydro One Networks”), a role he assumed in January 2020. Mr. Lebeter is responsible for transmission and distribution at the utility including construction, maintenance, vegetation management as well as system operations, asset planning and engineering. He is also responsible for Hydro One Remote Communities Inc., which serves remote communities in Ontario’s far north.

Mr. Lebeter has over 40 years’ experience in the utility and forestry sectors, and has been a vocal leader and a strong advocate for a safe and engaged workforce. Under his stewardship, teams have improved their safety performance, customer satisfaction and driven waste and costs out of the business.

Before joining the organization, he held executive positions at BC Hydro from 2010 to 2019, including Senior Vice President of Safety and Vice President of Transmission & Distribution Field Operations. Mr. Lebeter spent 23 years in the forestry industry prior to joining the utility sector, working in leadership positions responsible for operations.

He has previously served as an Executive Board Member for Smart Grid Northwest, as an Operations Board Member for Western Energy Institute, and as the Chairman of the Distribution Council with the Canadian Electricity Association. He currently serves on the Board of the Canadian Electricity Association. He holds his ICD.D from the Institute of Corporate Directors.

| |||

S-26

| Mr. Lebeter holds a Bachelor’s degree in Forestry from the University of British Columbia, and is a registered professional forester. In addition, Mr. Lebeter holds an Executive Masters of Business Administration from Simon Fraser University. |

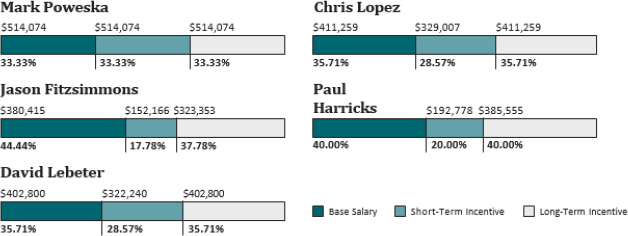

Target Compensation Mix

The target compensation mix aligns with the executive compensation framework and the Hydro One Accountability Act and reflects the compensation philosophy of emphasizing pay for performance and at risk compensation, ranging from 55.56% to 66.67% of NEO total compensation.

The following summarizes the target compensation mix by NEO.(1)(2)

Notes:

(1) Base salary reflects the annualized base salary as of December 31, 2021.

(2) The short-term and long-term incentive targets are based on base salary as of December 31, 2021.

Short-Term Incentive Decisions for 2021

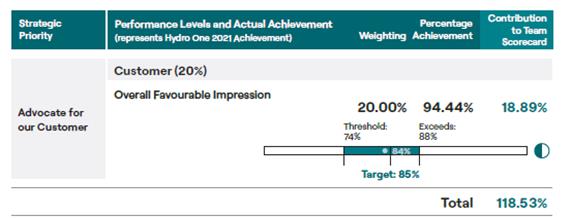

| (i) | Corporate Performance Scorecard |

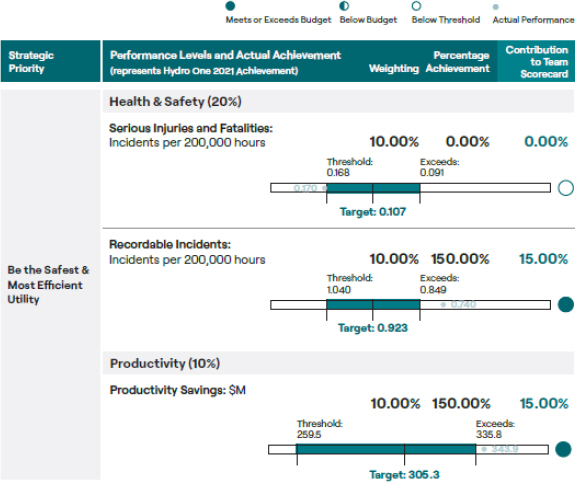

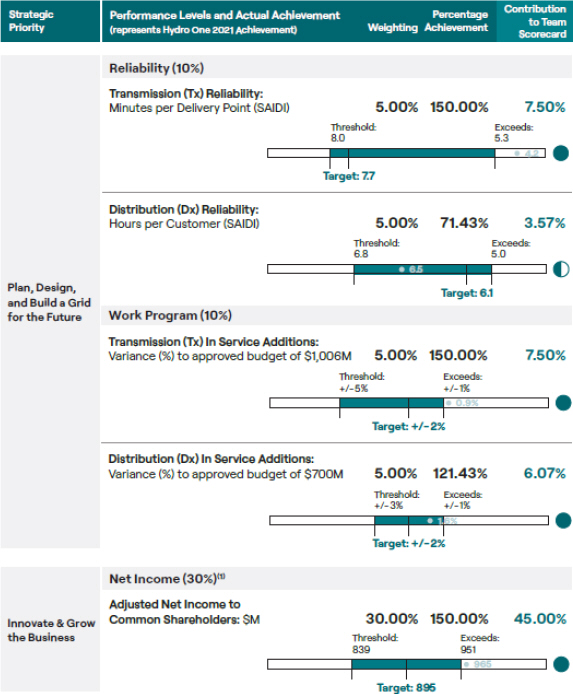

Hydro One’s corporate scorecard was developed by management and approved by the Board, on the recommendation of the HRC at the beginning of 2021. The scorecard performance measures were based on Hydro One Limited’s (and indirectly, Hydro One’s) objectives and business plan for the year and established “threshold”, “target” and “exceeds” performance levels for each performance measure. The scorecard is a balanced scorecard measuring ESG, other non-financial and financial objectives with the aim of focusing the organization on key performance indicators that drive stakeholder value and align with the organization’s strategy.

To establish the performance levels for each performance measure, management models a broad range of scenarios and provides benchmarking data to support the rationale behind the proposed measures and demonstrate the rigour embedded in the performance levels (threshold, target and exceeds) relative to similar organizations.

In addition, Hydro One continues to monitor comparators and emerging trends to ensure our approach is appropriate and aligned with best practice. The HRC, with input from its independent compensation

S-27

advisors, had the opportunity to review and modify (as appropriate) the performance measures and levels before recommending the scorecard to the Board for approval.

Hydro One is focused on corporate social responsibility and outlines its practices in Hydro One Limited’s annual Sustainability Report. The scorecard is aligned with the sustainability issues that matter most to customers, employees, communities and shareholders, including safety, improving reliability and customer satisfaction.

Payouts under the STIP for 2021 were based on Hydro One Limited’s performance (and indirectly, Hydro One’s performance) and individual performance relative to the scorecards. In determining the Company’s performance, the HRC reviewed management’s assessment of Hydro One’s performance against pre-established performance level for each performance measure, and based on this and, using its informed judgment, approved the resulting performance payout.

The following table sets out Hydro One Limited’s (and indirectly, Hydro One’s) corporate performance measures and results for 2021. Based on Hydro One Limited’s results, the HRC recommended, and the Board approved, an overall STIP performance multiplier equal to 118.53% of the target for 2021 for the corporate component.

S-28

Note: