| Amendment No. 1 dated October 4, 2016* to the PRICING SUPPLEMENT |

$650,000,000 UBS AG FI Enhanced Global High Yield ETN due March 3, 2026

The UBS AG FI Enhanced Global High Yield ETN due March 3, 2026 (the “Securities”) are a series of FI Enhanced ETNs linked to the MSCI World High Dividend Yield USD Gross Total Return Index (the “Index”). The Securities are senior unsecured debt securities issued by UBS AG (UBS). The Securities are designed to provide a two times leveraged long exposure to the performance of the Index compounded on a quarterly basis, reduced by the Accrued Fees (as defined in the accompanying product supplement). Because the Securities are two times leveraged with respect to the Index, the Securities may benefit from two times any positive, but will be exposed to two times any negative, quarterly compounded performance of the Index. The return on the Securities, however, can, and most likely will, differ significantly from two times the return on a direct investment in the Index. The Securities are very sensitive to changes in the performance of the Index, and returns on the Securities may be negatively impacted in complex ways by volatility of the Index on a quarterly basis.

The Securities should be purchased only by knowledgeable investors who understand the potential consequences of investing in the Index and of seeking quarterly compounding leveraged investment results. Investors should actively and frequently monitor their investment in the Securities.

You will receive a cash payment at maturity, acceleration or upon exercise by UBS of its call right based on the quarterly compounded leveraged performance of the Index less the Accrued Fees, calculated as described in the accompanying product supplement. Payments upon early redemption are calculated in the same manner except that a Redemption Fee (as defined in accompanying product supplement) will be deducted.You will not receive any interest payments or coupon payments during the term of the Securities. In particular, you will not receive any periodic payments based on dividends on the Index Constituent Securities (as defined in the accompanying product supplement); however, because the Securities are linked to a “total return” index, dividends on the Index Constituent Securities are reflected in the level of the Index.

Payment at maturity, early redemption, acceleration or upon exercise by UBS of its call right will be subject to the creditworthiness of UBS. In addition, the actual and perceived creditworthiness of UBS will affect the interim market value, if any, of the Securities.

INVESTING IN THE SECURITIES INVOLVES SIGNIFICANT RISKS. YOU MAY LOSE ALL OR A SUBSTANTIAL PORTION OF YOUR INVESTMENT AT MATURITY, EARLY REDEMPTION, ACCELERATION OR UPON EXERCISE BY UBS OF ITS CALL RIGHT IF THE QUARTERLY COMPOUNDED LEVERAGED RETURN OF THE INDEX IS NOT SUFFICIENT TO OFFSET THE NEGATIVE EFFECT OF THE ACCRUED FEES AND THE REDEMPTION FEE AND/OR THE LOSS REBALANCING FEE, IF APPLICABLE. YOU WILL NOT RECEIVE ANY INTEREST PAYMENTS OR COUPON PAYMENTS DURING THE TERM OF THE SECURITIES. WE URGE YOU TO READ “RISK FACTORS” BEGINNING ON PAGE PS-1 OF THIS PRICING SUPPLEMENT AND ON PAGE S-19 OF THE ACCOMPANYING PRODUCT SUPPLEMENT FOR A FURTHER DISCUSSION OF THESE RISKS.

The general terms of the FI Enhanced ETNs are described in the accompanying product supplement under the heading “General Terms of the Securities”, beginning on page S-35 of the product supplement. These general terms include, among others, the manner in which any payments on the Securities will be calculated, such as the payment at maturity, the Redemption Amount, the Call Settlement Amount or the Acceleration Amount, as applicable. These general terms are supplemented and/or modified by the specific terms of the Securities listed below. If there is any inconsistency between the terms described in the accompanying product supplement and the accompanying prospectus, and those described in this pricing supplement, the terms described in this pricing supplement will be controlling.Capitalized terms used herein but not otherwise defined have the meanings specified in the accompanying product supplement.

The principal terms of the Securities are as follows:

| Issuer: | UBS AG, London Branch |

| Initial Trade Date: | February 19, 2016 |

| Initial Settlement Date: | February 24, 2016 |

| Term: | 10 years, subject to your right to receive payment for your Securities upon redemption, acceleration upon minimum indicative value or exercise by UBS of its call right, each as described in the accompanying product supplement. |

| Denomination/Principal Amount: | $100.00 per Security |

| Maturity Date: | March 3, 2026, subject to adjustment |

| Index: | The return on the Securities is linked to the MSCI World High Dividend Yield USD Gross Total Return Index. The level of the Index reflects both the price performance of the Index Constituent Securities and the reinvestment of dividends on the Index Constituent Securities. For a detailed description of the Index and its methodology, see “MSCI World High Dividend Yield USD Gross Total Return Index” beginning on page PS-12. The level of the Index is published approximately every 15 seconds from 12:00 a.m. to 4:15 p.m., New York City time, and a daily Index Closing Level is published at approximately 6:00 p.m., New York City time, on each Trading Day. |

| Index Closing Level: | The closing level of the Index as published by the Index Sponsor and reported by Bloomberg under the ticker symbol “MHDYWOUG<Index>". |

Amendment No. 1 dated October 4, 2016 to the pricing supplement dated February 19, 2016

See “Risk Factors” beginning on page PS-1 of this pricing supplement and on page S-19 of the accompanying product supplement for risks related to an investment in the Securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement, the accompanying product supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| UBS Investment Bank | (cover continued on next page) |

| PS-ii |

| Annual Tracking Rate: | 0.80% per annum |

| Financing Spread: | 0.85% per annum |

| Loss Rebalancing Fee: | Upon each occurrence of a Loss Rebalancing Event, you will incur a 0.05% reduction in the LR Current Principal Amount of Your Securities and may also have a further reduction due to a breakage computation. See “General Terms of the Securities — Loss Rebalancing Event Upon Large Decreases in the Indicative Value” on page S-44 of the accompanying product supplement for the definition of the Loss Rebalancing Fee and all other defined pertaining to the Loss Rebalancing Event. |

| Redemption Procedures: | The redemption procedures for Early Redemption are specified under "General Terms of the Securities - Redemption Procedures" in the accompanying product supplement, provided that any reference in the accompanying product supplement to 12:00 noon (New York City time) as the cutoff time (1) to deliver notice of redemption and (2) for aggregating redemption requests to determine whether an early redemption is a Regular Redemption or a Large Redemption shall be 9:00 a.m. (New York City time). |

| First Redemption Date: | March 2, 2016 for Regular Redemptions, March 8, 2016 for Large Redemptions |

| Final Redemption Date: | February 24, 2026 |

| First Call Date: | The first date that UBS may exercise its Call Right is February 24, 2017 |

| Quarterly Initial Closing Level for the Initial Calendar Quarter: | 1,494.907, the Index Closing Level (as defined in the accompanying product supplement) on the Initial Trade Date. |

| Quarterly Reset Dates: | For each calendar quarter, the Quarterly Reset Date is the first Trading Day of that quarter beginning on April 1, 2016 and ending on January 2, 2026, subject to adjustment. |

| Quarterly Valuation Dates: | For each Quarterly Reset Date, the Quarterly Valuation Date is the last Trading Day of the previous calendar quarter, beginning on March 31, 2016 and ending on December 31, 2025, subject to adjustment. |

| Floor Level: | The “Floor Level” is equal to $20.00 (subject to adjustment as described under “Valuation of the Index and the Securities¾ Split or Reverse Split of the Securities” in the accompanying product supplement). |

| Index Sponsor: | MSCI, Inc. |

| Listing: | The Securities have been approved for listing, subject to official notice of issuance, on NYSE Arca under the symbol “FIHD.” |

| Calculation Date: | February 20, 2026, unless that day is not a Trading Day, in which case the Calculation Date will be the next Trading Day, subject to adjustment. |

| Index Symbols: | The intraday level of the Index is reported by Bloomberg under the ticker symbol "M2WDHDVD <Index>". The Index Closing Level is reported by Bloomberg under the ticker symbol "MHDYWOUG <Index>". |

| Intraday Indicative Value Symbol: | FIHDIV(Bloomberg) |

| CUSIP No.: | 90274D218 |

| ISIN No.: | US90274D2181 |

On the Initial Trade Date, we sold $25,000,000 aggregate Principal Amount of Securities to UBS Securities LLC at 100.00% of their stated Principal Amount. After the Initial Trade Date, from time to time we may sell a portion of the Securities at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. We will receive proceeds equal to 100.00% of the price at which the Securities are sold to the public, less any commissions paid to UBS Securities LLC. UBS Securities LLC may charge normal commissions in connection with any purchase or sale of the Securities and may receive a portion of the Accrued Tracking Fee. Please see “Supplemental Plan of Distribution (Conflicts of Interest)” on page PS-22 for more information.

We may use this pricing supplement, the accompanying product supplement and the accompanying prospectus in the initial sale of the Securities. In addition, UBS Securities LLC or another of our affiliates may use this pricing supplement, the accompanying product supplement and the accompanying prospectus in market-making transactions in any Securities after their initial sale.Unless we or our agent informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this pricing supplement, the accompanying product supplement and the accompanying prospectus are being used in a market-making transaction.

The Securities are not deposit liabilities of UBS AG and are not FDIC insured.

*This Amendment No. 1 dated October 4, 2016 to the pricing supplement dated February 19, 2016 (as amended, the “pricing supplement”) relates to $650,000,000 aggregate Principal Amount of the Securities, $200,000,000 aggregate Principal Amount of which we refer to as the “Original Securities” and $450,000,000 aggregate Principal Amount of which we refer to as the “Reopened Securities”. This Amendment No. 1 is being filed for the purpose of reflecting (i) the aggregate Principal Amount throughout this pricing supplement and (ii) that we prepared a new prospectus dated April 29, 2016, which replaced the prospectus dated June 12, 2015. Otherwise, all other terms of the Securities remain unchanged.

| PS-iii |

UBS has filed a registration statement (including a prospectus as supplemented by a product supplement) with the Securities and Exchange Commission, or SEC, for the offering to which this pricing supplement relates. When you read the accompanying product supplement, please note that all references therein to the prospectus dated June 12, 2015, or to any sections therein, should refer instead to the accompanying prospectus dated April 29, 2016, or to the corresponding sections in the accompanying prospectus, unless otherwise specified or the context otherwise requires. Before you invest, you should read these documents and any other documents relating to this offering that UBS has filed with the SEC for more complete information about UBS and this offering. You may obtain these documents for free from the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC web site is 0001114446. Alternatively, UBS will arrange to send you these documents if you so request by calling 203 719 7777.

You may access these documents on the SEC website at www.sec.gov as follows:

Prospectus dated April 29, 2016:

http://www.sec.gov/Archives/edgar/data/1114446/000119312516569341/d161008d424b3.htm

Product Supplement dated February 12, 2016:

http://www.sec.gov/Archives/edgar/data/1114446/000091412116000841/ub34079781-424b2_sx5pgv.htm

References to “UBS,” “we,” “our” and “us” refer only to UBS AG and not to its consolidated subsidiaries. Also, references to the “accompanying prospectus” mean the UBS prospectus titled “Debt Securities and Warrants,” dated April 29, 2016, and references to the “accompanying product supplement” mean the UBS product supplement “UBS AG FI Enhanced ETN,” dated February 12, 2016.

You should rely only on the information incorporated by reference or provided in this pricing supplement, the accompanying product supplement or the accompanying prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of the Securities in any state where the offer is not permitted. You should not assume that the information in this pricing supplement, the accompanying product supplement or the accompanying prospectus is accurate as of any date other than the date on the front of the document.

UBS reserves the right to change the terms of, or reject any offer to purchase, the Securities prior to their issuance. In the event of any changes to the terms of the Securities, UBS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case UBS may reject your offer to purchase.

| PS-iv |

Risk Factors

We issued the Original Securities having an aggregate Principal Amount of $200,000,000 on February 24, 2016 and issued Reopened Securities having an aggregate Principal Amount of $450,000,000. The Reopened Securities, together with the Original Securities, are part of a single series of debt securities issued under our indenture more particularly described in the accompanying prospectus. In this pricing supplement, the term “Securities” collectively refers to the Reopened Securities and the Original Securities, unless the context otherwise requires.

Your investment in the Securities will involve significant risks. The Securities are not secured debt and are significantly riskier than ordinary unsecured debt securities. Unlike ordinary debt securities, the return on the Securities is linked to the performance of the Index. The Securities are two times leveraged with respect to the Index and, as a result, may benefit from two times any positive, but will be exposed to two times any negative, quarterly performance of the Index. As described in more detail below, the trading price of the Securities may vary considerably before the Maturity Date, due to, among other things, fluctuations in the markets to which the Index Constituent Securities are tied and events that are difficult to predict and beyond our control. Investing in the Securities is not equivalent to investing directly in the Index Constituent Securities or in the Index itself.

As more fully described in the accompanying product supplement, investing in the Securities, a series of FI Enhanced ETNs, involves significant risks. In addition to the risks relating to the Index, the structure of the Securities involves the risk of loss of your entire investment, leverage risk, correlation and compounding risk and market risk, among other complex risks. In addition, you will not receive any interest payments or coupon payments during the term of your Securities. As a result, the Securities may not be a suitable investment for some investors. We urge you to read the more detailed explanation of these risks described under “Risk Factors” in the accompanying product supplement, together with “Considerations Relating to Indexed Securities” in the accompanying prospectus and the other information in this pricing supplement, the accompanying product supplement and the accompanying prospectus, before investing in the Securities.

You will not receive interest payments or coupon payments on the Securities and there is no guarantee that you will receive your initial investment back or any return on the Securities.

You will not receive any periodic interest payments, coupon payments or other cash distributions on the Securities. While the dividends paid on the Index Constituent Securities are reflected in the level of the Index, you will not receive any periodic interest or coupon payments based on such dividends. No payments will be made on your Securities prior to the Maturity Date, Call Settlement Date, Redemption Date or Acceleration Settlement Date, as applicable. Further, as described in the accompanying product supplement, there is no guarantee that you will receive at maturity, early redemption, acceleration or upon exercise by UBS of its call right, your initial investment back or any return on that investment.We urge you to read the more detailed explanation of the structure of the Securities and the risks associated with the Securities under “Risk Factors” in the accompanying product supplement.

Risks of investing in equity securities.

The Index is comprised of equity securities. Common stock holds the lowest priority in the capital structure of a company, and therefore takes the largest share of the company’s risk and its accompanying volatility. An adverse event, such as an unfavorable earnings report, may depress the value of a particular common stock. In addition, the level of the Index can rise or fall sharply due to general market factors, such as market volatility, interest rate levels, exchange rates and economic and political conditions. Decreases in the prices of the Index Constituent Securities will result in a decrease in the Index level and, therefore, may have an adverse effect on the market value of the Securities.

In addition, common stock does not assure dividend payments, and common stockholders may receive dividends only after the company has provided for payment to its creditors, bondholders and preferred stockholders. Dividends are paid only when declared by an Index Constituent’s board of directors, and the amount of any dividend may vary over time.

| PS-1 |

Risk Factors

Credit risk of UBS

The Securities are unsubordinated, unsecured debt obligations of the issuer, UBS, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Securities, including payments at maturity, early redemption, acceleration or upon exercise by UBS of its call right, depends on the ability of UBS to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of UBS may affect the market value of the Securities and, in the event UBS were to default on its obligations, you may not receive any amounts owed to you under the terms of the Securities and you could lose your entire initial investment.

The Index is subject to strategy risk

The Index is designed to track the performance of large and mid-cap stocks, excluding Real Estate Investment Trusts, across 23 developed market countries selected from the MSCI World Index (the "Parent Index") on the basis of higher than average dividend yields that are potentially also sustainable and persistent. Only companies with a track record of consistent dividend payments and with the expected capacity to sustain dividend payouts into the future as determined by the index methodology are eligible index constituents. The companies are also screened based on certain "quality" factors such as return on equity (ROE), earnings variability, debt to equity (D/E) as well as recent one-year price performance. The goal is to exclude stocks with potentially deteriorating fundamentals that could be forced to cut or reduce dividends. However, the Index will not necessarily be successful in selecting the index constituents with the highest dividend yields available from the Parent Index that are potentially also sustainable and persistent. Furthermore, the performance of the Index may be lower than the performance of an index composed of equity securities not selected using these screening mechanisms or lower than the performance of an index of equity securities with high dividend yields chosen by a different methodology.

Risks associated with non-U.S. securities markets

Certain Index Constituent Securities are equity securities of non-U.S. companies. Investments in securities linked to the values of such Index Constituent Securities involve risks associated with the securities markets in those countries, including risks of volatility in those markets, governmental intervention in those markets and cross-shareholdings in companies in certain countries. Also, there is generally less publicly available information about companies in some of these jurisdictions than about U.S. companies that are subject to the reporting requirements of the Securities and Exchange Commission, and generally, non-U.S. companies are subject to accounting, auditing and financial reporting standards and requirements and securities trading rules different from those applicable to U.S. reporting companies.

Certain Index Constituent Securities are equity securities of non-U.S. companies whose hours of trading may not conform to the hours during which the Securities are traded

To the extent that U.S. markets are closed while the international markets in which certain Index Constituent Securities trade remain open, significant movements may take place in the levels, values or prices of the Index or certain Index Constituent Securities that will not be reflected immediately in the price of the Securities. Similarly, to the extent that the trading market for the Securities, if any, is open during periods when the primary markets for certain Index Constituent Securities are closed, the intraday indicative value and closing indicative value will be based on the last reported Index Closing Level and the absence of last-sale or similar information and the limited availability of quotations will make it difficult for many investors to obtain timely, accurate data about the state of the market for the Index and certain Index Constituent Securities. Any periods in which trading markets for the Index, Index Constituent Securities and Securities are not open may have an adverse effect on liquidity for the Securities and related bid-ask spreads.

Currency exchange risk

Because the prices of certain Index Constituent Securities are converted into U.S. dollars for the purposes of calculating the value of the Index, the holders of the Securities will be exposed to currency exchange rate risk with respect to each of the currencies in which such Index Constituent Securities trade. An investor’s net exposure will depend on the extent to which such currencies strengthen or weaken against the U.S. dollar and the relative weight of such Index Constituent Securities denominated in each such currency. If, taking into account such weighting, the

| PS-2 |

Risk Factors

U.S. dollar strengthens against such currencies, the value of the Index will be adversely affected and the payment at maturity, early redemption, acceleration or upon exercise by UBS of its call right of the Securities may be reduced.

Changes in the volatility of exchange rates, and the correlation between those rates and the value of the Index are likely to affect the market value of the Securities

The exchange rate between the U.S. dollar and each of the currencies in which certain Index Constituent Securities are denominated refers to a foreign exchange spot rate that measures the relative values of two currencies — the particular currency in which the applicable Index Constituent Security is denominated and the U.S. dollar. This exchange rate reflects the amount of the particular currency in which such Index Constituent Security is denominated that can be purchased for one U.S. dollar and thus increases when the U.S. dollar appreciates relative to the particular currency in which such Index Constituent Security is denominated. The volatility of the exchange rate between the U.S. dollar and each of the currencies in which certain Index Constituent Securities are denominated refers to the size and frequency of changes in that exchange rate.

Because the Index is calculated, in part, by converting the closing prices of such Index Constituent Securities into U.S. dollars, the volatility of the exchange rate between the U.S. dollar and each of the currencies in which such Index Constituent Securities are denominated could affect the market value of the Securities and the payment you receive at maturity, early redemption, acceleration or upon exercise by UBS of its call right. The correlation of the exchange rate between the U.S. dollar and each of the currencies in which such Index Constituent Securities are denominated and the value of the Index refers to the relationship between the percentage changes in that exchange rate and the percentage changes in the value of the Index. The direction of the correlation (whether positive or negative) and the extent of the correlation between the percentage changes in the exchange rate between the U.S. dollar and each of the currencies in which such Index Constituent Securities are denominated and the percentage changes in the value of the Index could affect the value of your Securities and the payment you receive at maturity or upon redemption or an automatic termination event.

Any change in the dividends paid by or the dividend policies of the Index Constituent Securities may have an adverse impact on the performance of the Index, and therefore the market value of the Securities.

The Index is a total return index, which means that the level of the Index reflects both the price performance of the Index Constituent Securities, as well as the reinvestment of dividends paid on the Index Constituent Securities. As a result, any change in the amount of dividends paid on the Index Constituent Securities may have an adverse impact on the level of the Index, and therefore on the market value of the Securities. The issuers of the Index Constituent Securities may decide at any time to alter its dividend policies, including by ceasing to pay dividends entirely, and have no obligation to consider the interests of holders of the Securities when making such decisions.

UBS and its affiliates have no affiliation with the Index Sponsor and are not responsible for its public disclosure of information.

We and our affiliates are not affiliated with the Index Sponsor and have no ability to control or predict its actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the Index. If the Index Sponsor discontinues or suspends the calculation or publication of the Index, or if the Index Sponsor terminates our right to use the Index, it may become difficult to determine the market value of the Securities and the payment at maturity, early redemption, acceleration or upon exercise by UBS of its call right. The Calculation Agent may designate a successor index. If the Calculation Agent determines that no successor index comparable to the Index exists, the payment you receive at maturity, early redemption, acceleration or upon exercise by UBS of its call right will be determined by the Calculation Agent, as described under “General Terms of the Securities — Discontinuance of or Adjustments to the Relevant Index; Alteration of Method of Calculation” and “ — Calculation Agent” in the accompanying product supplement. The Index Sponsor is not involved in the offer of the Securities in any way and has no obligation to consider your interest as an owner of the Securities in taking any actions that might affect the market value of your Securities.

We have derived the information about the Index Sponsor and the Index from publicly available information, without independent verification. UBS has not conducted any independent review or due diligence of the Index or

| PS-3 |

Risk Factors

the Index Sponsor, including the publicly available information with respect to the Index Sponsor or the Index.You, as an investor in the Securities, should make your own independent investigation into the Index Sponsor and the Index.

Significant aspects of the tax treatment of the Securities are uncertain.

Significant aspects of the tax treatment of the Securities are uncertain. We do not plan to request a ruling from the Internal Revenue Service (“IRS”) regarding the tax treatment of the Securities, and the IRS or a court may not agree with the tax treatment described in this pricing supplement. Please read carefully the section entitled “Material U.S. Federal Income Tax Consequences”. You should consult your tax advisor about your own tax situation.

It is possible, for instance, that the IRS could possibly assert that you should be required to take into account dividends paid on the Index Constituent Securities during the time you hold your Securities as ordinary income, either when such dividends are paid or upon the sale, exchange, redemption or maturity of your Securities, even if you are not treated as if you owned the Index Constituent Securities. In addition, the IRS could potentially assert that you should be required to treat amounts attributable to the Accrued Fees, Redemption Fee, and Loss Rebalancing Fees, if any, as amounts of expense. The deduction of any such deemed expenses would generally be subject to the 2% floor on miscellaneous itemized deductions. Such amounts would correspondingly increase the amount of gain or decrease the amount of loss that you recognize with respect to your Securities.

The IRS released a notice in 2007 that may affect the taxation of holders of the Securities. According to the notice, the IRS and the Treasury Department are actively considering, among other things, whether holders of instruments such as the Securities should be required to accrue ordinary income on a current basis, whether gain or loss recognized upon the sale or maturity of such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax, and whether the special “constructive ownership rules” of Section 1260 of the Internal Revenue Code of 1986, as amended (the “Code”), should be applied to such instruments. Similarly, the IRS and the Treasury Department have current projects open with regard to the tax treatment of pre-paid forward contracts and contingent notional principal contracts. While it is impossible to anticipate how any ultimate guidance would affect the tax treatment of instruments such as the Securities (and while any such guidance may be issued on a prospective basis only), such guidance could be applied retroactively and could in any case increase the likelihood that you will be required to accrue income over the term of an instrument such as the Securities. The outcome of this process is uncertain.

Furthermore, in 2007, legislation was introduced in Congress that, if enacted, would have required holders of the Securities purchased after the bill was enacted to accrue interest income over the term of the Securities despite the fact that there will be no interest payments over the term of the Securities. It is not possible to predict whether a similar or identical bill will be enacted in the future and whether any such bill would affect the tax treatment of your Securities.

Holders are urged to consult their tax advisors concerning the significance and the potential impact of the above considerations. We intend to treat your Securities for United States federal income tax purposes in accordance with the treatment described above and under “Material U.S. Federal Income Tax Consequences” unless and until such time as there is a change in law or the Treasury Department or IRS determines that some other treatment is more appropriate.

| PS-4 |

Hypothetical Examples

The following examples one through four illustrate how the Securities would perform at maturity, early redemption or upon exercise by UBS of its call right, in hypothetical circumstances. The fifth example illustrates how the Securities would perform upon an acceleration upon minimum indicative value in hypothetical circumstances. We have included an example in which the Index Closing Level increases at a constant rate of 3.00% per quarter for twenty quarters (Example 1), as well as an example in which the Index Closing Level decreases at a constant rate of 3.00% per quarter for twenty quarters (Example 2). In addition, Example 3 shows the Index Closing Level increasing by 3.00% per quarter for the first ten quarters and then decreasing by 3.00% per quarter for the next 10 quarters, whereas Example 4 shows the reverse scenario of the Index Closing Level decreasing by 3.00% per quarter for the first ten quarters, and then increasing by 3.00% per quarter for the next ten quarters. Example 5 shows the Index Closing Level decreasing by 7.00% per quarter and an acceleration upon minimum indicative value occurring on the fifth Trading Day prior to the last Trading Day of the eleventh quarter.For ease of analysis and presentation, examples one through four assume that the term of the Securities is twenty quarters, the last Trading Day of the Call Measurement Period, or the Redemption Valuation Date, occurs on the quarter end and (i) that no acceleration upon minimum indicative value has occurred, (ii) that no Loss Rebalancing Event has occurred and (iii) that there was no Large Redemption request made during the term of the Securities. Example five assumes that an acceleration upon minimum indicative value occurs on the fifth Trading Day prior to the last Trading Day of the eleventh quarter and the last Trading Day of the Acceleration Measurement Period occurs on the quarter end, and (i) that no Loss Rebalancing Event has occurred and (ii) that there was no Large Redemption request made during the term of the Securities.

The following assumptions are used in each of the four examples:

| † | the initial level for the Index is 1000; | |

| † | the rate used to compute the Redemption Fee (as defined in the accompanying product supplement) is 0.125%; | |

| † | the Financing Rate (the Financing Spread plus three month LIBOR, as defined in the accompanying product supplement) is 1.45%; | |

| † | the Current Principal Amount (as defined in the accompanying product supplement) on the first day is $100.00; | |

| † | the Annual Tracking Rate is 0.80%; and | |

| † | the Floor Level is $20.00. |

Examples one through four highlight the effect of two times leverage and quarterly compounding, and the impact of the Accrued Fees (as defined in the accompanying product supplement) on the payment at maturity, early redemption, or upon exercise by UBS of its call right, under different circumstances. Example five highlights the effect of an acceleration upon minimum indicative value, two times leverage and quarterly compounding, and the impact of the Accrued Fees on the payment upon an acceleration upon minimum indicative value. The assumed Financing Rate is not an indication of the Financing Rate throughout the term of the Securities. The Financing Rate will change during the term of the Securities, which will affect the performance of the Securities.

Because the Accrued Fees take into account the quarterly performance of the Index, as measured by the Index Closing Level, the absolute level of the Accrued Fees are dependent on the path taken by the Index Closing Level to arrive at its ending level. The figures in these examples have been rounded for convenience. The Current Principal Amount figures in examples one through four for quarter twenty are as of the end of the hypothetical Final Measurement Period, and given the indicated assumptions, a holder will receive payment at maturity in the indicated amount, according to the indicated formula. The Current Principal Amount figures in example five for quarter eleven are as of the end of the hypothetical Acceleration Measurement Period, and given the indicated assumptions, a holder will receive payment on the Acceleration Settlement Date in the indicated amount, according to the indicated formula.

| PS-5 |

Hypothetical Examples

Example 1: The Index Closing Level increases at a constant rate of 3.00% per quarter for twenty quarters.

Quarter End | Index Closing Level* | Index Performance Ratio | Index Factor | Accrued Financing Charge | Current Indicative Value | Accrued Tracking Fee for the Applicable Quarter*** | Accrued Fees | Current Principal Amount | Redemption Amount |

A | B | C | D | E | F | G | H | I | J |

((Index Valuation Level - Quarterly Initial Closing Level)/ Quarterly Initial Closing Level) | (1+(2 x C)) | (Previous Current Principal Amount´ Financing Rate | (Previous Current Principal Amount | (Annual Tracking Rate´ (the average of F and the Current Indicative Value for the prior Quarter)´ Act/365) | (E + G) | ((Previous Current Principal Amount | (I - Redemption Fee) | ||

| 1 | 1030.00 | 0.0300 | 1.060 | $0.3625 | $106.00 | $0.2032 | $0.5657 | $105.4343 | $105.2946 |

| 2 | 1060.90 | 0.0300 | 1.060 | $0.3822 | $111.76 | $0.2148 | $0.5970 | $111.1634 | $111.0161 |

| 3 | 1092.73 | 0.0300 | 1.060 | $0.4030 | $117.83 | $0.2264 | $0.6294 | $117.2044 | $117.0491 |

| 4 | 1125.51 | 0.0300 | 1.060 | $0.4249 | $124.24 | $0.2388 | $0.6636 | $123.5727 | $123.4089 |

| 5 | 1159.27 | 0.0300 | 1.060 | $0.4480 | $130.99 | $0.2517 | $0.6997 | $130.2862 | $130.1135 |

| 6 | 1194.05 | 0.0300 | 1.060 | $0.4723 | $138.10 | $0.2654 | $0.7377 | $137.3661 | $137.1841 |

| 7 | 1229.87 | 0.0300 | 1.060 | $0.4980 | $145.61 | $0.2798 | $0.7778 | $144.8299 | $144.6380 |

| 8 | 1266.77 | 0.0300 | 1.060 | $0.5250 | $153.52 | $0.2950 | $0.8200 | $152.7006 | $152.4983 |

| 9 | 1304.77 | 0.0300 | 1.060 | $0.5535 | $161.86 | $0.3111 | $0.8646 | $160.9973 | $160.7840 |

| 10 | 1343.92 | 0.0300 | 1.060 | $0.5836 | $170.66 | $0.3280 | $0.9116 | $169.7472 | $169.5223 |

| 11 | 1384.23 | 0.0300 | 1.060 | $0.6153 | $179.93 | $0.3458 | $0.9611 | $178.9690 | $178.7319 |

| 12 | 1425.76 | 0.0300 | 1.060 | $0.6488 | $189.71 | $0.3646 | $1.0133 | $188.6946 | $188.4446 |

| 13 | 1468.53 | 0.0300 | 1.060 | $0.6840 | $200.02 | $0.3844 | $1.0684 | $198.9472 | $198.6836 |

| 14 | 1512.59 | 0.0300 | 1.060 | $0.7212 | $210.89 | $0.4053 | $1.1265 | $209.7587 | $209.4807 |

| 15 | 1557.97 | 0.0300 | 1.060 | $0.7604 | $222.34 | $0.4273 | $1.1877 | $221.1572 | $220.8641 |

| 16 | 1604.71 | 0.0300 | 1.060 | $0.8017 | $234.43 | $0.4505 | $1.2522 | $233.1746 | $232.8657 |

| 17 | 1652.85 | 0.0300 | 1.060 | $0.8453 | $247.16 | $0.4750 | $1.3203 | $245.8445 | $245.5187 |

| 18 | 1702.43 | 0.0300 | 1.060 | $0.8912 | $260.59 | $0.5008 | $1.3920 | $259.2015 | $258.8581 |

| 19 | 1753.51 | 0.0300 | 1.060 | $0.9396 | $274.76 | $0.5280 | $1.4676 | $273.2882 | $272.9260 |

| 20 | 1806.11 | 0.0300 | 1.060 | $0.9907 | $289.68 | $0.5567 | $1.5474 | $288.1364 | $287.7546 |

| Cumulative Index Return: | 80.61% |

| Return on Securities (assumes no early redemption): | 188.14% |

| * | The Index Closing Level is also: (i) the Quarterly Initial Closing Level for the following quarter; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the payment at maturity. |

| ** | Accrued Financing Charge is calculated on an act/360 basis (30-day months are assumed for the above calculations). |

| *** | Accrued Tracking Fee is calculated on an act/365 basis (30-day months are assumed for the above calculations). The actual Accrued Tracking Fee will be computed using the daily values of the Current Indicative Values for the immediately preceding Trading Day for each day in the applicable quarter. However for simplification the computations above assume the Current Indicative Value is the average of the Current Indicative Values as of the last Trading Day in the current and immediately prior quarter. |

| **** | Previous Current Principal Amount is also the Financing Level. |

| # | This is also the Call Settlement Amount. |

| ^ | For the final quarter, this is also the payment at maturity. |

| PS-6 |

Hypothetical Examples

Example 2:The Index Closing Level decreases at a constant rate of 3.00% per quarter for twenty quarters.

Quarter End | Index Closing Level* | Index Performance Ratio | Index Factor | Accrued Financing Charge | Current Indicative Value | Accrued Tracking Fee for the Applicable Quarter*** | Accrued Fees | Current Principal Amount | Redemption Amount |

A | B | C | D | E | F | G | H | I | J |

((Index Valuation Level - Quarterly Initial Closing Level)/Quarterly Initial Closing Level) | (1 +(2´ C)) | (Previous Current Principal Amount´ Financing Rate | (Previous Current Principal Amount | (Annual Tracking Rate´ (the average of F and the Current Indicative Value for the prior Quarter)´ Act/365) | (E + G) | ((Previous Current Principal Amount | (I - Redemption Fee) | ||

| 1 | 970.00 | -0.0300 | 0.940 | $0.3625 | $94.00 | $0.1913 | $0.5538 | $93.4462 | $93.3364 |

| 2 | 940.90 | -0.0300 | 0.940 | $0.3387 | $87.84 | $0.1793 | $0.5181 | $87.3213 | $87.2187 |

| 3 | 912.67 | -0.0300 | 0.940 | $0.3165 | $82.08 | $0.1676 | $0.4841 | $81.5973 | $81.5015 |

| 4 | 885.29 | -0.0300 | 0.940 | $0.2958 | $76.70 | $0.1566 | $0.4524 | $76.2491 | $76.1595 |

| 5 | 858.73 | -0.0300 | 0.940 | $0.2764 | $71.67 | $0.1463 | $0.4227 | $71.2512 | $71.1675 |

| 6 | 832.97 | -0.0300 | 0.940 | $0.2583 | $66.98 | $0.1368 | $0.3950 | $66.5814 | $66.5032 |

| 7 | 807.98 | -0.0300 | 0.940 | $0.2414 | $62.59 | $0.1278 | $0.3691 | $62.2172 | $62.1441 |

| 8 | 783.74 | -0.0300 | 0.940 | $0.2255 | $58.48 | $0.1194 | $0.3449 | $58.1392 | $58.0708 |

| 9 | 760.23 | -0.0300 | 0.940 | $0.2108 | $54.65 | $0.1116 | $0.3223 | $54.3288 | $54.2650 |

| 10 | 737.42 | -0.0300 | 0.940 | $0.1969 | $51.07 | $0.1043 | $0.3012 | $50.7674 | $50.7078 |

| 11 | 715.30 | -0.0300 | 0.940 | $0.1840 | $47.72 | $0.0974 | $0.2815 | $47.4402 | $47.3845 |

| 12 | 693.84 | -0.0300 | 0.940 | $0.1720 | $44.59 | $0.0911 | $0.2630 | $44.3307 | $44.2786 |

| 13 | 673.03 | -0.0300 | 0.940 | $0.1607 | $41.67 | $0.0851 | $0.2458 | $41.4257 | $41.3770 |

| 14 | 652.84 | -0.0300 | 0.940 | $0.1502 | $38.94 | $0.0795 | $0.2297 | $38.7106 | $38.6651 |

| 15 | 633.25 | -0.0300 | 0.940 | $0.1403 | $36.39 | $0.0743 | $0.2146 | $36.1728 | $36.1303 |

| 16 | 614.25 | -0.0300 | 0.940 | $0.1311 | $34.00 | $0.0694 | $0.2006 | $33.8016 | $33.7619 |

| 17 | 595.83 | -0.0300 | 0.940 | $0.1225 | $31.77 | $0.0649 | $0.1874 | $31.5869 | $31.5498 |

| 18 | 577.95 | -0.0300 | 0.940 | $0.1145 | $29.69 | $0.0606 | $0.1751 | $29.5160 | $29.4813 |

| 19 | 560.61 | -0.0300 | 0.940 | $0.1070 | $27.74 | $0.0566 | $0.1636 | $27.5813 | $27.5489 |

| 20 | 543.79 | -0.0300 | 0.940 | $0.1000 | $25.93 | $0.0529 | $0.1529 | $25.7733 | $25.7430 |

| Cumulative Index Return: | -45.62% |

| Return on Securities (assumes no early redemption): | -74.23% |

| * | The Index Closing Level is also: (i) the Quarterly Initial Closing Level for the following quarter; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the payment at maturity. |

| ** | Accrued Financing Charge is calculated on an act/360 basis (30-day months are assumed for the above calculations). |

| *** | Accrued Tracking Fee is calculated on an act/365 basis (30-day months are assumed for the above calculations). The actual Accrued Tracking Fee will be computed using the daily values of the Current Indicative Values for the immediately preceding Trading Day for each day in the applicable quarter. However for simplification the computations above assume the Current Indicative Value is the average of the Current Indicative Values as of the last Trading Day in the current and immediately prior quarter. |

| **** | Previous Current Principal Amount is also the Financing Level. |

| # | This is also the Call Settlement Amount. |

| ^ | For the final quarter, this is also the payment at maturity. |

| PS-7 |

Hypothetical Examples

Example 3: The Index Closing Level increases by 3.00% per quarter for the first ten quarters and then decreases by 3.00% per quarter for the next ten quarters.

Quarter End | Index Closing Level* | Index Performance Ratio | Index Factor | Accrued Financing Charge | Current Indicative Value | Accrued Tracking Fee for the Applicable Quarter*** | Accrued Fees | Current Principal Amount | Redemption Amount |

A | B | C | D | E | F | G | H | I | J |

((Index Valuation Level - Quarterly Initial Closing Level)/Quarterly Initial Closing Level) | (1 +(2´ C)) | (Previous Current Principal Amount´ Financing Rate | (Previous Current Principal Amount | (Annual Tracking Rate´ (the average of F and the Current Indicative Value for the prior Quarter)´ Act/365) | (E + G) | ((Previous Current Principal Amount | (I - Redemption Fee) | ||

| 1 | 1030.00 | 0.0300 | 1.060 | $0.3625 | $106.00 | $0.2032 | $0.5657 | $105.4343 | $105.2946 |

| 2 | 1060.90 | 0.0300 | 1.060 | $0.3822 | $111.76 | $0.2148 | $0.5970 | $111.1634 | $111.0161 |

| 3 | 1092.73 | 0.0300 | 1.060 | $0.4030 | $117.83 | $0.2264 | $0.6294 | $117.2044 | $117.0491 |

| 4 | 1125.51 | 0.0300 | 1.060 | $0.4249 | $124.24 | $0.2388 | $0.6636 | $123.5727 | $123.4089 |

| 5 | 1159.27 | 0.0300 | 1.060 | $0.4480 | $130.99 | $0.2517 | $0.6997 | $130.2862 | $130.1135 |

| 6 | 1194.05 | 0.0300 | 1.060 | $0.4723 | $138.10 | $0.2654 | $0.7377 | $137.3661 | $137.1841 |

| 7 | 1229.87 | 0.0300 | 1.060 | $0.4980 | $145.61 | $0.2798 | $0.7778 | $144.8299 | $144.6380 |

| 8 | 1266.77 | 0.0300 | 1.060 | $0.5250 | $153.52 | $0.2950 | $0.8200 | $152.7006 | $152.4983 |

| 9 | 1304.77 | 0.0300 | 1.060 | $0.5535 | $161.86 | $0.3111 | $0.8646 | $160.9973 | $160.7840 |

| 10 | 1343.92 | 0.0300 | 1.060 | $0.5836 | $170.66 | $0.3280 | $0.9116 | $169.7472 | $169.5223 |

| 11 | 1303.60 | -0.0300 | 0.940 | $0.6153 | $159.56 | $0.3257 | $0.9410 | $158.6208 | $158.4344 |

| 12 | 1264.49 | -0.0300 | 0.940 | $0.5750 | $149.10 | $0.3044 | $0.8794 | $148.2236 | $148.0494 |

| 13 | 1226.56 | -0.0300 | 0.940 | $0.5373 | $139.33 | $0.2845 | $0.8218 | $138.5095 | $138.3467 |

| 14 | 1189.76 | -0.0300 | 0.940 | $0.5021 | $130.20 | $0.2658 | $0.7679 | $129.4303 | $129.2782 |

| 15 | 1154.07 | -0.0300 | 0.940 | $0.4692 | $121.67 | $0.2484 | $0.7176 | $120.9475 | $120.8054 |

| 16 | 1119.44 | -0.0300 | 0.940 | $0.4384 | $113.69 | $0.2321 | $0.6706 | $113.0184 | $112.8856 |

| 17 | 1085.86 | -0.0300 | 0.940 | $0.4097 | $106.24 | $0.2169 | $0.6266 | $105.6113 | $105.4872 |

| 18 | 1053.29 | -0.0300 | 0.940 | $0.3828 | $99.28 | $0.2027 | $0.5855 | $98.6902 | $98.5743 |

| 19 | 1021.69 | -0.0300 | 0.940 | $0.3578 | $92.77 | $0.1894 | $0.5472 | $92.2214 | $92.1131 |

| 20 | 991.04 | -0.0300 | 0.940 | $0.3343 | $86.69 | $0.1770 | $0.5113 | $86.1770 | $86.0757 |

| Cumulative Index Return: | -0.90% |

| Return on Securities (assumes no early redemption): | -13.82% |

| * | The Index Closing Level is also: (i) the Quarterly Initial Closing Level for the following quarter; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the payment at maturity. |

| ** | Accrued Financing Charge is calculated on an act/360 basis (30-day months are assumed for the above calculations). |

| *** | Accrued Tracking Fee is calculated on an act/365 basis (30-day months are assumed for the above calculations). The actual Accrued Tracking Fee will be computed using the daily values of the Current Indicative Values for the immediately preceding Trading Day for each day in the applicable quarter. However for simplification the computations above assume the Current Indicative Value is the average of the Current Indicative Values as of the last Trading Day in the current and immediately prior quarter. |

| **** | Previous Current Principal Amount is also the Financing Level. |

| # | This is also the Call Settlement Amount. |

| ^ | For the final quarter, this is also the payment at maturity. |

| PS-8 |

Hypothetical Examples

Example 4: The Index Closing Level decreases by 3.00% per quarter for the first ten quarters, and then increases by 3.00% per quarter for the next ten quarters.

Quarter End | Index Closing Level* | Index Performance Ratio | Index Factor | Accrued Financing Charge | Current Indicative Value | Accrued Tracking Fee for the Applicable Quarter*** | Accrued Fees | Current Principal Amount | Redemption Amount |

A | B | C | D | E | F | G | H | I | J |

((Index Valuation Level - Quarterly Initial Closing Level)/Quarterly Initial Closing Level) | (1 +(2´ C)) | (Previous Current Principal Amount´ Financing Rate | (Previous Current Principal Amount | (Annual Tracking Rate´ (the average of F and the Current Indicative Value for the prior Quarter)´ Act/365) | (E + G) | ((Previous Current Principal Amount | (I - Redemption Fee) | ||

| 1 | 970.00 | -0.0300 | 0.940 | $0.3625 | $94.00 | $0.1913 | $0.5538 | $93.4462 | $93.3364 |

| 2 | 940.90 | -0.0300 | 0.940 | $0.3387 | $87.84 | $0.1793 | $0.5181 | $87.3213 | $87.2187 |

| 3 | 912.67 | -0.0300 | 0.940 | $0.3165 | $82.08 | $0.1676 | $0.4841 | $81.5973 | $81.5015 |

| 4 | 885.29 | -0.0300 | 0.940 | $0.2958 | $76.70 | $0.1566 | $0.4524 | $76.2491 | $76.1595 |

| 5 | 858.73 | -0.0300 | 0.940 | $0.2764 | $71.67 | $0.1463 | $0.4227 | $71.2512 | $71.1675 |

| 6 | 832.97 | -0.0300 | 0.940 | $0.2583 | $66.98 | $0.1368 | $0.3950 | $66.5814 | $66.5032 |

| 7 | 807.98 | -0.0300 | 0.940 | $0.2414 | $62.59 | $0.1278 | $0.3691 | $62.2172 | $62.1441 |

| 8 | 783.74 | -0.0300 | 0.940 | $0.2255 | $58.48 | $0.1194 | $0.3449 | $58.1392 | $58.0708 |

| 9 | 760.23 | -0.0300 | 0.940 | $0.2108 | $54.65 | $0.1116 | $0.3223 | $54.3288 | $54.2650 |

| 10 | 737.42 | -0.0300 | 0.940 | $0.1969 | $51.07 | $0.1043 | $0.3012 | $50.7674 | $50.7078 |

| 11 | 759.55 | 0.0300 | 1.060 | $0.1840 | $53.81 | $0.1034 | $0.2875 | $53.5270 | $53.4561 |

| 12 | 782.33 | 0.0300 | 1.060 | $0.1940 | $56.74 | $0.1090 | $0.3031 | $56.4346 | $56.3598 |

| 13 | 805.80 | 0.0300 | 1.060 | $0.2046 | $59.82 | $0.1150 | $0.3195 | $59.5012 | $59.4223 |

| 14 | 829.98 | 0.0300 | 1.060 | $0.2157 | $63.07 | $0.1212 | $0.3369 | $62.7352 | $62.6521 |

| 15 | 854.88 | 0.0300 | 1.060 | $0.2274 | $66.50 | $0.1278 | $0.3552 | $66.1442 | $66.0566 |

| 16 | 880.52 | 0.0300 | 1.060 | $0.2398 | $70.11 | $0.1347 | $0.3745 | $69.7374 | $69.6450 |

| 17 | 906.94 | 0.0300 | 1.060 | $0.2528 | $73.92 | $0.1421 | $0.3949 | $73.5275 | $73.4300 |

| 18 | 934.15 | 0.0300 | 1.060 | $0.2665 | $77.94 | $0.1498 | $0.4163 | $77.5231 | $77.4204 |

| 19 | 962.17 | 0.0300 | 1.060 | $0.2810 | $82.17 | $0.1579 | $0.4389 | $81.7348 | $81.6265 |

| 20 | 991.04 | 0.0300 | 1.060 | $0.2963 | $86.64 | $0.1665 | $0.4628 | $86.1769 | $86.0627 |

| Cumulative Index Return: | -0.90% |

| Return on Securities (assumes no early redemption): | -13.82% |

| * | The Index Closing Level is also: (i) the Quarterly Initial Closing Level for the following quarter; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the payment at maturity. |

| ** | Accrued Financing Charge is calculated on an act/360 basis (30-day months are assumed for the above calculations). |

| *** | Accrued Tracking Fee is calculated on an act/365 basis (30-day months are assumed for the above calculations). The actual Accrued Tracking Fee will be computed using the daily values of the Current Indicative Values for the immediately preceding Trading Day for each day in the applicable quarter. However for simplification the computations above assume the Current Indicative Value is the average of the Current Indicative Values as of the last Trading Day in the current and immediately prior quarter. |

| **** | Previous Current Principal Amount is also the Financing Level. |

| # | This is also the Call Settlement Amount. |

| ^ | For the final quarter, this is also the payment at maturity. |

| PS-9 |

Hypothetical Examples

Example 5: The Index Closing Level decreases by 7.00% per quarter and an acceleration upon minimum indicative value occurs on the fifth Trading Day prior to the last Trading Day in the eleventh quarter.

Quarter End | Index Closing Level* | Index Performance Ratio | Index Factor | Accrued Financing Charge | Current Indicative Value | Accrued Tracking Fee for the Applicable Quarter*** | Accrued Fees | Current Principal Amount |

A | B | C | D | E | F | G | H | I |

((Index Valuation Level - Quarterly Initial Closing Level)/Quarterly Initial Closing Level) | (1 +(2´ C)) | (Previous Current Principal Amount´ Financing Rate | (Previous Current Principal Amount | (Annual Tracking Rate´ (the average of F and the Current Indicative Value for the prior Quarter)´ Act/365) | (E + G) | ((Previous Current Principal Amount | ||

| 1 | 930.00 | -0.0700 | 0.860 | $0.3625 | $86.00 | $0.1835 | $0.5460 | $85.4540 |

| 2 | 864.90 | -0.0700 | 0.860 | $0.3098 | $73.49 | $0.1573 | $0.4671 | $73.0234 |

| 3 | 804.36 | -0.0700 | 0.860 | $0.2647 | $62.80 | $0.1344 | $0.3991 | $62.4015 |

| 4 | 748.05 | -0.0700 | 0.860 | $0.2262 | $53.66 | $0.1149 | $0.3411 | $53.3235 |

| 5 | 695.69 | -0.0700 | 0.860 | $0.1933 | $45.86 | $0.0982 | $0.2915 | $45.5672 |

| 6 | 646.99 | -0.0700 | 0.860 | $0.1652 | $39.19 | $0.0839 | $0.2491 | $38.9385 |

| 7 | 601.70 | -0.0700 | 0.860 | $0.1412 | $33.49 | $0.0717 | $0.2128 | $33.2742 |

| 8 | 559.58 | -0.0700 | 0.860 | $0.1206 | $28.62 | $0.0613 | $0.1819 | $28.4338 |

| 9 | 520.41 | -0.0700 | 0.860 | $0.1031 | $24.45 | $0.0523 | $0.1554 | $24.2978 |

| 10 | 483.98 | -0.0700 | 0.860 | $0.0881 | $20.90 | $0.0447 | $0.1328 | $20.7631 |

| 11 | 450.10 | -0.0700 | 0.860 | $0.0753 | $17.86^ | $0.0382 | $0.1135 | $17.7427 |

| Cumulative Index Return: | -54.99% |

| Return on Securities (assumes no early redemption): | -82.26% |

| * | The Index Closing Level is also the Quarterly Initial Closing Level for the following quarter and (ii) the Index Valuation Level for calculating the Acceleration Amount. |

| ** | Accrued Financing Charge is calculated on an act/360 basis (30-day months are assumed for the above calculations). |

| *** | Accrued Tracking Fee is calculated on an act/365 basis (30-day months are assumed for the above calculations). The actual Accrued Tracking Fee will be computed using the daily values of the Current Indicative Values for the immediately preceding Trading Day for each day in the applicable quarter. However for simplification the computations above assume the Current Indicative Value is the average of the Current Indicative Values as of the last Trading Day in the current and immediately prior quarter. |

| **** | Previous Current Principal Amount is also the Financing Level. |

| ^ | $17.86 represents the Current Indicative Value as of the last Trading Day in the quarter and Acceleration Measurement Period. This example assumes that the indicative value was equal to or less than the Floor Level, and thus an acceleration upon minimum indicative value occurred, on the fifth Trading Day prior to the last Trading Day in the quarter. |

| PS-10 |

Hypothetical Examples

We cannot predict the actual Index Closing Level or indicative value on any Trading Day or the market value of your Securities, nor can we predict the relationship between the Index Closing Level or indicative value and the market value of your Securities at any time prior to the Maturity Date. The actual amount that a holder of the Securities will receive at maturity, early redemption, acceleration, or upon exercise by UBS of its call right, as the case may be, and the rate of return on the Securities, will depend on the quarterly compounded leveraged return of the Index and, if positive, whether it will be sufficient to offset the negative effect of the Accrued Fees and the Loss Rebalancing Fees, if applicable, over the relevant period and, if applicable, the Redemption Fee. Moreover, the assumptions on which the hypothetical returns are based are purely for illustrative purposes. Consequently, the amount, in cash, to be paid in respect of your Securities, if any, on the Maturity Date, Call Settlement Date, Acceleration Settlement Date or the relevant Redemption Date, as applicable, may be very different from the information reflected in the tables above.

The hypothetical examples above are provided for purposes of information only. The hypothetical examples are not indicative of the future performance of the Index on any Trading Day, the Index Valuation Level, or what the value of your Securities may be. Fluctuations in the hypothetical examples may be greater or less than fluctuations experienced by the holders of the Securities. The performance data shown above is for illustrative purposes only and does not represent the actual or expected future performance of the Securities.

| PS-11 |

The MSCI World High Dividend Yield USD Gross Total Return Index

We have derived all information contained in this prospectus supplement regarding the MSCI World High Dividend Yield USD Gross Total Return Index (the “Index”), including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. Such information reflects the policies of, and is subject to change by MSCI, Inc. (the “Index Sponsor” or “MSCI”). UBS has not conducted any independent review or due diligence of any publicly available information with respect to the Index .You should make your own investigation into the Index.

Index Description

Except as otherwise noted, all information regarding the Index set forth in this pricing supplement reflects the policies of, and is subject to change by, the Index Sponsor. The Index is calculated, maintained and published by the Index Sponsor. The intraday level of the Index is reported by Bloomberg under the ticker symbol “M2WDHDVD <Index>”. The Index Closing Level is reported by Bloomberg under the ticker symbol “MHDYWOUG <Index>”.

The Index is designed to track the performance of large- and mid-cap stocks (excluding REITS) across 23 developed markets countries tracked by the MSCI World Index (the “Parent Index”) with higher than average dividend yields that are potentially both sustainable and persistent. The Index also incorporates certain screening mechanisms based on certain “quality” characteristics and recent 1-year price performance that seek to exclude stocks with potentially deteriorating fundamentals that may force them to cut or reduce dividends.

The information in this section is intended to be a summary of the significant features of the Index and is not a complete description. For a detailed explanation of methodology underlying the Index and other information about how the Index is maintained, see the “MSCI Global Investable Market Indexes Methodology”, which is available at http://www.msci.com. In connection with any offering of the Securities, neither we nor any of our agents or dealers have participated in the preparation of the information describing the Index or the Index Constituent Securities nor have we or they made any due diligence inquiry with respect to the Index Sponsor. Neither we nor any of our agents or dealers makes any representation or warranty as to the accuracy or completeness of such information or any other publicly available information regarding the Index or the Index Sponsor.

You, as an investor in the Securities, should make your own investigation into the Index, the Index Constituent Securities and the Index Sponsor. The Index Sponsor is not involved in any offer of Securities in any way and has no obligation to consider your interests as a holder of the Securities. The Index Sponsor has no obligation to continue to publish the Index and may discontinue or suspend publication of the Index at any time in its sole discretion.

Historical performance of the Index is not an indication of future performance. Future performance of the Index may differ significantly from historical performance, either positively or negatively.

Information contained on the websites mentioned in this section is not incorporated by reference in, and should not be considered part of, this pricing supplement or the accompanying product supplement and prospectus.

Index Construction

The Index is a free float adjusted market capitalization weighted index calculated, published and disseminated daily by the Index Sponsor. The securities comprising the Index (the “Index Constituent Securities”) are selected from the equity securities included in the Parent Index. Only companies with a track record of consistent dividend payments and with the expected capacity to sustain dividend payouts into the future as determined by the index methodology are eligible Index Constituent Securities. The companies are also screened based on certain “quality” factors such as return on equity (ROE), earnings variability, debt to equity (D/E) as well as recent one-year price performance. The goal is to exclude stocks with potentially deteriorating fundamentals that could be forced to cut or reduce dividends. From the list of eligible companies, only those with a dividend yield which is at least 30% higher than the dividend yield of the Parent Index are selected for inclusion in the Index. The weight of each individual issuer in the Index is capped at 5%. The process of index construction is described in more details below.

| PS-12 |

The MSCI World High Dividend Yield USD Gross Total Return Index

The following tables show the sector weights and country weights of the Index Constituent Securities as of August 31, 2016.

| Sector | Weighting in Index (%) |

| Financials | 19.69% |

| Information Technology | 14.78% |

| Health Care | 12.97% |

| Consumer Discretionary | 12.53% |

| Industrials | 11.03% |

| Consumer Staples | 10.74% |

| Energy | 6.55% |

| Materials | 4.88% |

| Telecommunication Services | 3.49% |

| Utilities | 3.33% |

| Country | Weighting in Index (%) |

| United States | 59.59% |

| Japan | 8.78% |

| United Kingdom | 7.02% |

| France | 3.55% |

| Canada | 3.52% |

| Other | 17.54% |

Defining the Eligible Universe

The Index Constituent Securities are selected from the equity securities included in the Parent Index (the “Parent Index Constituent Securities”). The Parent Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of certain developed equity markets. As of August 31, 2016, the Parent Index consists of large and mid-cap equity securities from the following 23 developed equity markets: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. As of August 31, 2016, the Parent Index covers approximately 85% of the free float-adjusted market capitalization in each developed equity market. Pursuant to an announcement by MSCI on June 11, 2013 of its decision to reclassify Greece from developed market to emerging market, companies from Greece have been removed from the Parent Index effective at the semi-annual index review on November 27, 2013.

All securities belonging to the Parent Index are eligible for inclusion in the Index, with the exception of REITs. REITs have structurally very high dividend yield and, if included, would represent a very significant proportion of the Index. Also, typically, regulatory constraints restrict the inclusion of REITs in meaningful proportions in many institutional portfolios. The Parent Index Constituent Securities eligible for inclusion in the Index are referred to as the “eligible universe”.

Applying Dividend Sustainability and Persistence Screening

The eligible universe is then screened using dividend sustainability screening and dividend persistence screening. Dividend yield strategies typically target not only high dividend yield but also companies where that dividend is sustainable and/or persistent. Therefore, the Index considers the following dividend sustainability and persistence screens to determine Parent Index Constituent Securities that will be included in the Index:

| · | Securities in the eligible universe whose dividend payout is extremely high or negative, and therefore, where future dividend payments might be in jeopardy are not considered for inclusion in the Index (the “dividend sustainability screening”); and |

| · | Securities without a good historical track record of consistent dividend payment are also not considered for inclusion (the "dividend persistence screening”). |

| PS-13 |

The MSCI World High Dividend Yield USD Gross Total Return Index

Securities in the eligible universe with an extremely high payout ratio, which occurs when earnings are low relative to dividends and may also indicate that the dividend payment might not be sustainable in the future, are not considered for inclusion in the Index. Under this screen, securities in the eligible universe with extremely high payout ratios, defined to be the top 5% of securities by number within the eligible universe with positive payout, are not considered eligible for inclusion in the Index. The use of a relative payout ratio screen seeks to ensure that the companies at most relative risk of dividend cuts are excluded irrespective of the absolute level of the payout.

Additionally, securities in the eligible universe with zero or negative payout ratios (as defined below) are also not considered for inclusion in the Index as they either do not pay dividends or have negative earnings which may put their future dividend payments at risk.

The “payout ratio” is calculated as follows:

payout ratio = dividends per share (“DPS”) / earnings per share

The most recently reported earnings value is used to calculate earnings per share while the current annualized dividend per share is used to calculate for dividends per share.

Securities in the eligible universe with a negative 5Y DPS growth rate are also excluded from the Index as their dividend growth is shrinking which could be a precursor to lower dividends.

“5Y DPS growth rate” is calculated by (1) applying a regression (ordinary least squares method) to the last 5 yearly DPS, (2) estimating an average DPS and (3) obtaining the growth trend.

In order to compute a meaningful long-term historical growth trend for the DPS, 5 years of comparable data are generally required. In the event that comparable restated pro forma data are unavailable, MSCI may restate the data using adjustments. A minimum of the last four DPS values are required for calculating the growth and growth trends for securities without sufficient DPS values are considered to be missing (except in the case of IPOs where it will be on a case-by-case basis.).

Applying Quality Screening

This screening aims to exclude securities with potentially deteriorating fundamentals that may force them to cut or reduce dividends. The Quality Z-Scores are calculated by combining Z-Scores of three fundamental variables, namely return on equity (ROE), earnings variability and debt to equity ratio (D/E).

As part of the standardization process, outlier fundamental variable values are “winsorized” to ensure that the average values used to standardize the variables are less affected by extreme values. To do this, for a given variable, the values for all securities are first ranked in ascending order within the eligible universe. Missing values are excluded from the ranking. Then, for securities that lie below the 5th percentile rank or above the 95th percentile rank, their value is set equal to the value of the 5th percentile ranked or 95th percentile ranked security, as applicable. This process is repeated for each of the three fundamental variables.

After winsorizing all the three variables within the eligible universe, the Z-Score for each of the three variables for each security can be calculated using the mean and standard deviation of the relevant variable within the eligible universe. Computing a Z-Score is a widely used method of standardizing a variable in order to combine it with other variables that may have a different unit of measurement or a different scale. Because it has a mean value of zero and a standard deviation of 1, the value of a Z-Score shows how many standard deviations a given value lies from the mean.

After standardizing each of the three variable values for each security, MSCI calculates a composite Quality Z-Score for each security. The Quality Z-Scores are computed by averaging the Z-Scoresof all the three fundamental variables. Securities with a negative Quality Z-Score are not considered for inclusion in the Index.

Applying Price Performance Screening

This screening aims to exclude securities with declining stock price performance, which signals potentially deteriorating fundamentals that may lead the companies to cut or reduce dividends. Securities in the eligible universe ranked in the bottom 5% of the eligible universe with negative one-year price performance are excluded

| PS-14 |

The MSCI World High Dividend Yield USD Gross Total Return Index

from the Index. This screen applies to all securities in the eligible universe, regardless of whether they are currently Index Constituent Securities.

Selecting High Yielding Securities

Securities that have passed the above screens are then considered for inclusion in the Index. Only securities with a dividend yield greater than or equal to 1.3 times the dividend yield of the Parent Index are included in the Index. “Dividend yield” is calculated as follows:

dividend yield = current annualized dividend per share / price of security

The “current annualized dividend per share” is the trailing 12-month dividend per share derived from the current fiscal year-end dividend per share plus the difference between the interim dividend per share of the current fiscal year and the previous fiscal year. For the Parent Index Constituent Securities domiciled in the USA and Canada, the current annualized dividend per share is calculated by annualizing the latest published quarterly dividend. For purposes of calculating the dividend yield, yields are gross, before withholding tax, and take into account special tax credits when applicable. However, for purposes of determining the level of the Index, the amount notionally reinvested is the entire dividend distributed to holders of the relevant security, but does not include tax credits.

Weighting the Securities in the Index

The Index is a free float adjusted market capitalization weighted index. Additionally, constituent weights are capped at 5% at issuer level to mitigate concentration risk. If the cap value determined results in infeasible weighting because the number of issuers in the Index is not sufficient, the cap value will be rounded up to the next multiple of 5 and will be increased in the steps of 5% until a feasible weighting solution is reached.

Index Maintenance

Semi-Annual Index Review

The Index is rebalanced semi-annually. Changes are implemented as of the close of the last business day of May and November to coincide with the semi-annual index reviews of the Parent Index. MSCI will generally announce the pro forma Index nine business days before the effective date.

The fundamental data used to determine the Index is maintained monthly. For the May and November semi-annual index reviews, the fundamental data as of the end of April and the end of October is used respectively.

The semi-annual index review involves a comprehensive review of the Index. During each semi-annual index review, the Parent Index Constituent Securities are screened for potential inclusion in the Index according to the screening process described above.

Existing constituents of the Index will also be evaluated for continued inclusion using the following screening process:

| · | If a security is already an Index Constituent Security, it will remain in the Index until it reaches the top 2% by increasing order of dividend payout. If it is within the top 2% limit, it will be excluded from the Index. |

| · | If a security is already an Index Constituent Security but its 5Y DPS growth rate turns negative, it will still be allowed to remain in the Index, provided that the 1Y DPS growth rate of that security is non-negative. This allows current Index Constituent Securities that suffer only a temporary decline in the 5Y DPS growth rate to remain in the Index and thus avoid excessive index turnover. |

| · | If a security is already an Index Constituent Security, it will remain in the Index as long as its Quality Z-score is higher than or equal to - 0.5. |

| · | If a security is already an Index Constituent Security, it will remain in the Index as long as its dividend yield is higher than or equal to the Parent Index yield. |

The “1Y DPS growth rate” is the difference between the current and previous annual DPS.

| PS-15 |

The MSCI World High Dividend Yield USD Gross Total Return Index

Quarterly Index Review

The Quarterly Index Review of the Parent Index will not result in any change in the Index, except for deletions from the Parent Index, as noted below. Between semi-annual index reviews, the Index follows the event maintenance of the Parent Index. IPOs and other newly listed securities will only be considered for inclusion at the next Semi-annual index review, even if they qualify for early inclusion in the Parent Index. There will be no early inclusion of new securities to the Index, except when the new security results from an event affecting an existing Index Constituent Security (e.g., spin off, merger). An Index Constituent Security deleted from the Parent Index following a corporate event will be simultaneously deleted from the Index.

Index Calculation

The Index is a gross total return index, which means that that the level of the Index reflects both price performance and dividends. The amount of any dividends is fully reinvested in the Index as a “gross” amount, without any deduction for withholding taxes.

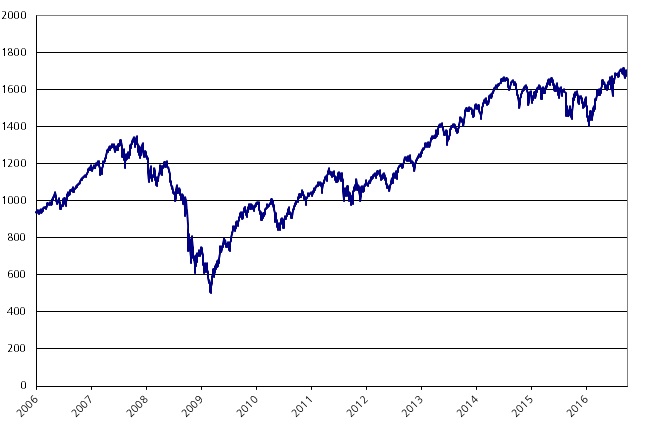

Historical Performance

The historical information presented below is based on the actual performance of the Index. Any historical upward or downward trend in value of the Index during the period shown below is not an indication that the value of the Index is more or less likely to increase or decrease at any time during the term of the Securities. The historical Index returns do not give an indication of the future performance of the Index. UBS cannot make any assurance that the future performance of the Index will result in holders of the Securities receiving a positive return on their investment.

The table below sets forth the quarterly high and low closing levels for the MSCI World High Dividend Yield USD Gross Total Return Index, based on the daily closing levels as reported by Bloomberg, without independent verification. UBS has not conducted any independent review or due diligence of publicly available information obtained from Bloomberg. The closing level of the MSCI World High Dividend Yield USD Gross Total Return Index on February 19, 2016 was 1,494.907.

| Quarter Begin | Quarter End | Quarterly Closing High | Quarterly Closing Low | Quarterly Close |

| 1/3/2012 | 3/30/2012 | 1,163.469 | 1,078.715 | 1,152.880 |

| 4/2/2012 | 6/29/2012 | 1,163.897 | 1,050.772 | 1,137.610 |

| 7/2/2012 | 9/28/2012 | 1,235.264 | 1,117.284 | 1,213.994 |

| 10/1/2012 | 12/31/2012 | 1,253.471 | 1,161.072 | 1,239.823 |

| 1/2/2013 | 3/28/2013 | 1,350.057 | 1,258.666 | 1,347.670 |

| 4/1/2013 | 6/28/2013 | 1,417.214 | 1,303.230 | 1,333.871 |

| 7/1/2013 | 9/30/2013 | 1,452.581 | 1,333.026 | 1,431.788 |

| 10/1/2013 | 12/31/2013 | 1,523.607 | 1,404.456 | 1,523.607 |

| 1/2/2014 | 3/31/2014 | 1,565.617 | 1,444.007 | 1,565.617 |

| 4/1/2014 | 6/30/2014 | 1,659.446 | 1,557.173 | 1,654.215 |

| 7/1/2014 | 9/30/2014 | 1,670.588 | 1,595.755 | 1,597.916 |

| 10/1/2014 | 12/31/2014 | 1,626.315 | 1,498.847 | 1,573.621 |

| 1/2/2015 | 3/31/2015 | 1,626.178 | 1,527.580 | 1,580.340 |

| 4/1/2015 | 6/30/2015 | 1,663.311 | 1,571.386 | 1,571.386 |

| 7/1/2015 | 9/30/2015 | 1,616.288 | 1,439.594 | 1,466.197 |

| 10/1/2015 | 12/31/2015 | 1,591.916 | 1,467.077 | 1,536.195 |

| 1/4/2016 | 3/31/2016 | 1,603.831 | 1,402.319 | 1,597.857 |

| 4/1/2016 | 6/30/2016 | 1,671.708 | 1,565.851 | 1,651.036 |

| 7/1/2016 | 9/30/2016 | 1,717.419 | 1,637.579 | 1,696.604 |

| 10/3/2016* | 10/3/2016* | 1,693.065 | 1,693.065 | 1,693.065 |

| * | As of the date of this pricing supplement, available information for the fourth calendar quarter of 2016 includes data for October 3, 2016. Accordingly, the “Quarterly Closing High,” “Quarterly Closing Low” and “Quarterly Close” data indicated are for this date only and do not reflect complete data for the fourth calendar quarter of 2016. |

| PS-16 |

The graph below illustrates the performance of the MSCI World High Dividend Yield USD Gross Total Return Index from January 3, 2006 through October 3, 2016, based on information from Bloomberg.Past performance of the Index is not indicative of the future performance of the Index.

License Agreement