14

h)

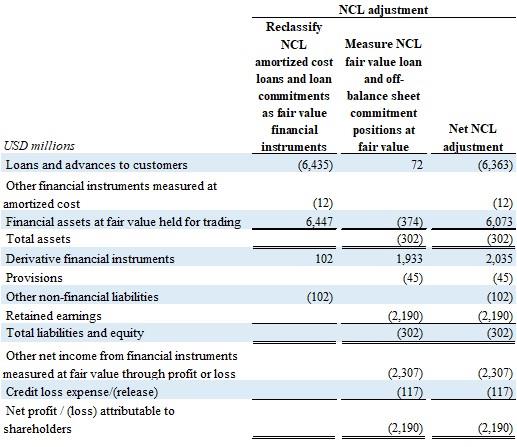

For the purpose of the condensed combined pro forma financial information,

differences between accounting for

credit losses between U.S. GAAP and IFRS have been considered. An estimated

additional allowance of 64m has

been recorded against the carrying value of non-impaired Loans

and advances to customers and an estimated

additional provision for credit losses of 26m has been recognized for qualifying

off-balance sheet commitments and

guarantees that are not impaired. The increase in comparison with the Credit Suisse Parent

Bank U.S. GAAP credit

loss provision reflects the estimated impact of applying UBS’s

scenarios and scenario weights, calibration of model

outputs with UBS’s model outputs

and scope differences. This is partly offset by

ECL reductions related to

performing loans and loan commitments which are not subject to a significant

increase of credit risk (SICR) since

their inception (stage 1 positions), and hence are valued on the basis of a

one-year horizon rather than on a lifetime

approach, which was applied under U.S. GAAP.

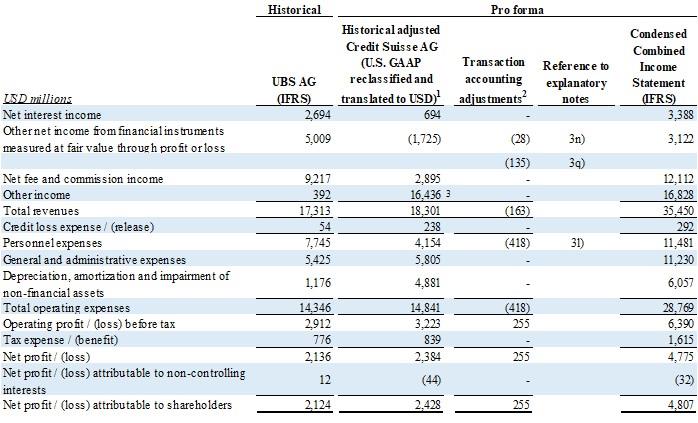

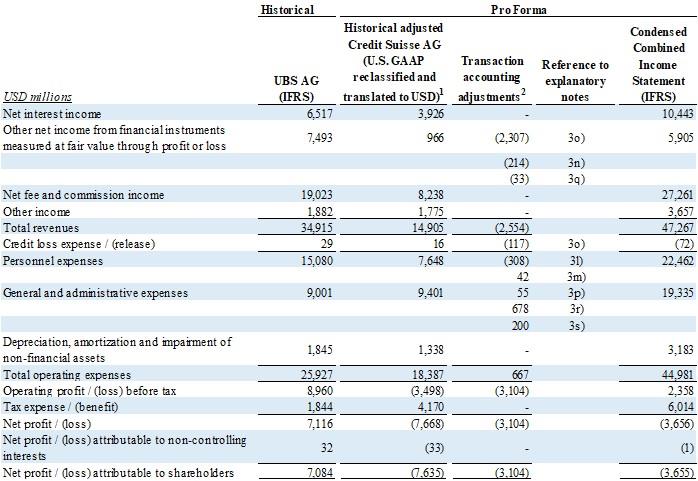

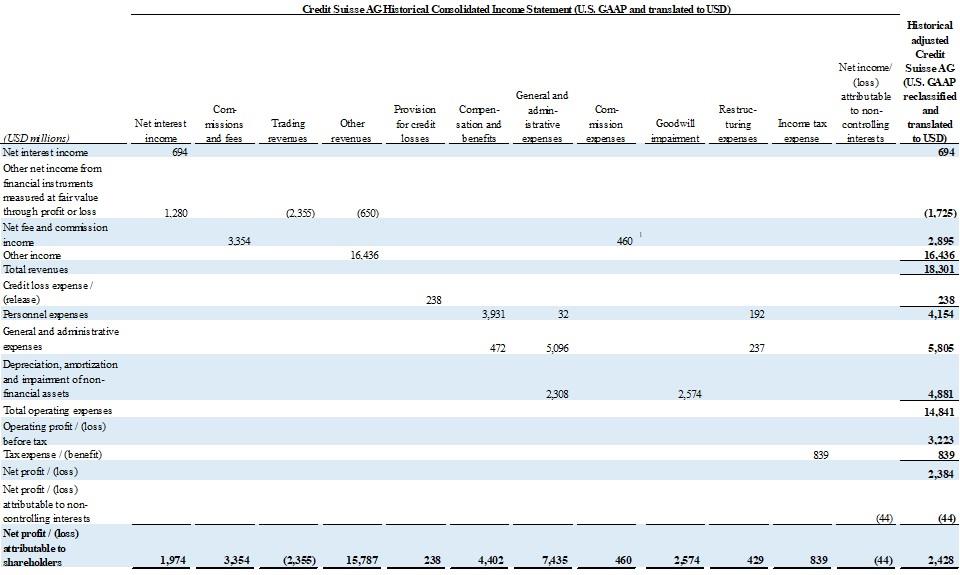

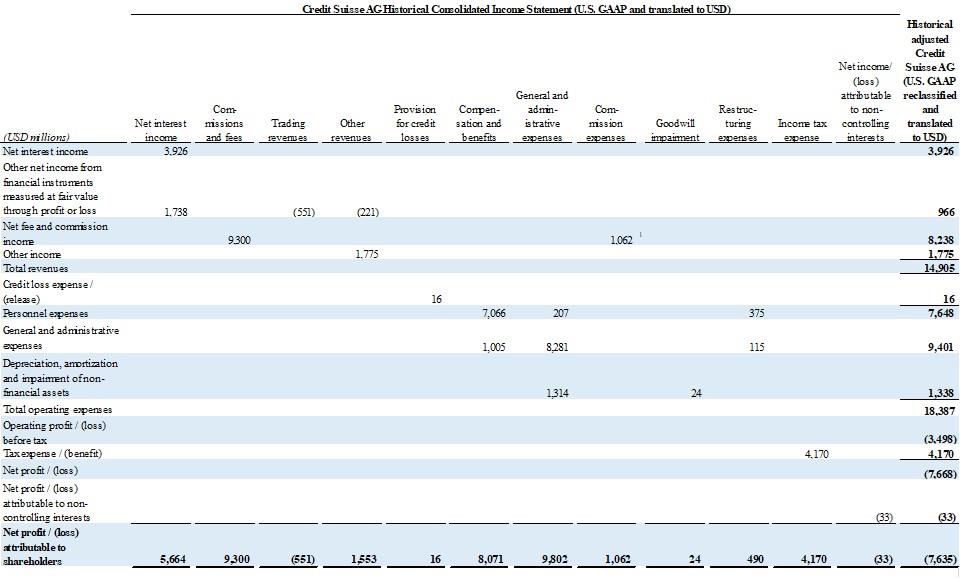

The estimated impact on the condensed combined pro forma

income statement for the year ended 31 December 2022 and the six-month

period ended 30 June 2023 is not

material.

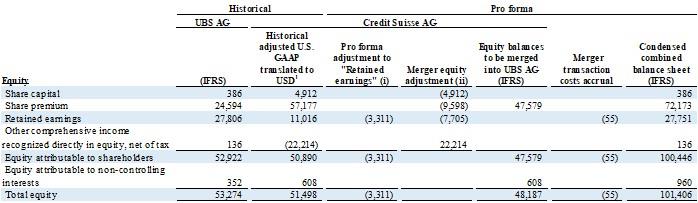

i)

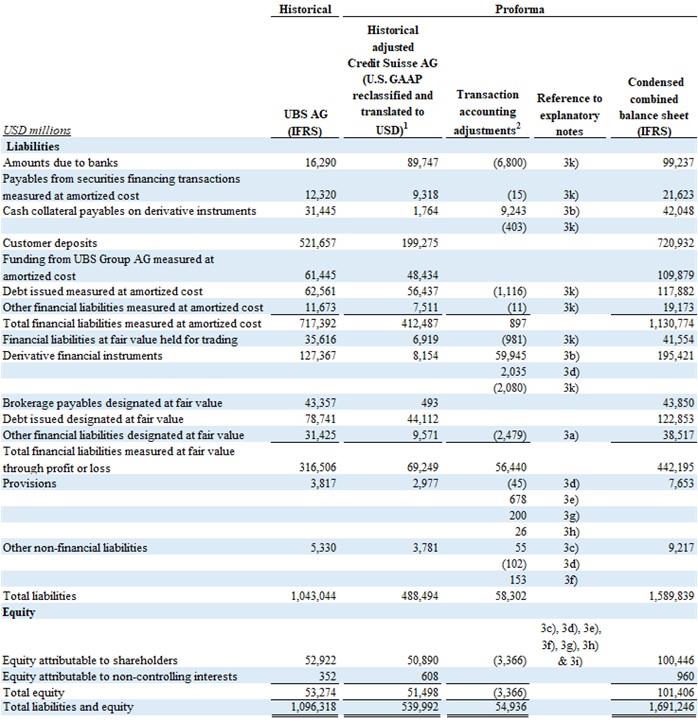

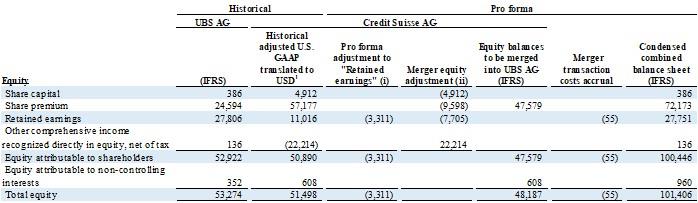

The transaction is considered to be a contribution by UBS Group AG of Credit Suisse AG’s

business into UBS AG

and, upon the merger, UBS AG recorded

an entry in “Share Premium” to reflect the net carrying amount of the

contributed Credit Suisse AG assets and liabilities. The table below

summarizes the impact of the pro forma

adjustments on the combined equity of UBS Parent Bank as of 30 June 2023, which

include:

i.

Credit Suisse Parent Bank’s historical

shareholders’ equity components are adjusted for the pro

forma

adjustments made relating to the reclassification and measurement of

NCL assets and liabilities (Note 3d)),

recognition of provisions

for onerous contracts (Note 3e)), recognition of an additional share award

compensation liability (Note 3f)), recognition of real estate onerous

contract provisions (Note 3g)) and

additional credit allowance and credit loss provision (Note 3h)).

ii.

Under the carry over basis, at the time of the Group merger on

31 May 2023, Credit Suisse Parent Bank

balances under “Retained earnings” and “Other comprehensive income recognized

directly in equity, net of

tax” are reset to zero and the “Share capital” balance is eliminated, with

an offsetting adjustment in “Share

premium” (in line with the accounting applied at the UBS Group

AG level for the Group merger).

1.

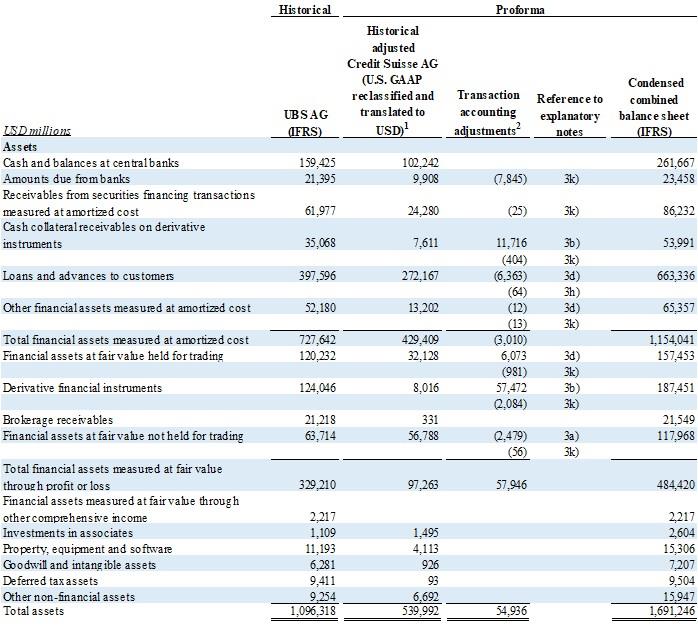

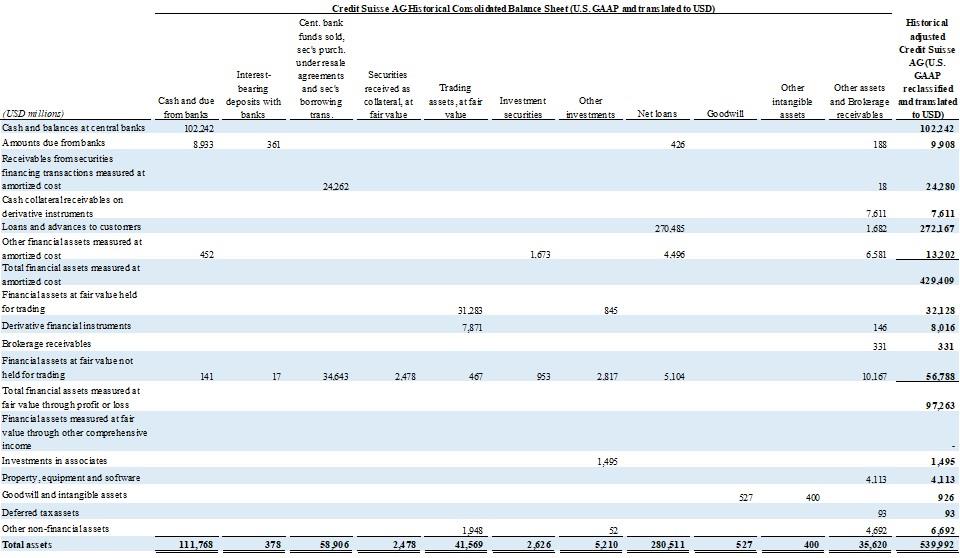

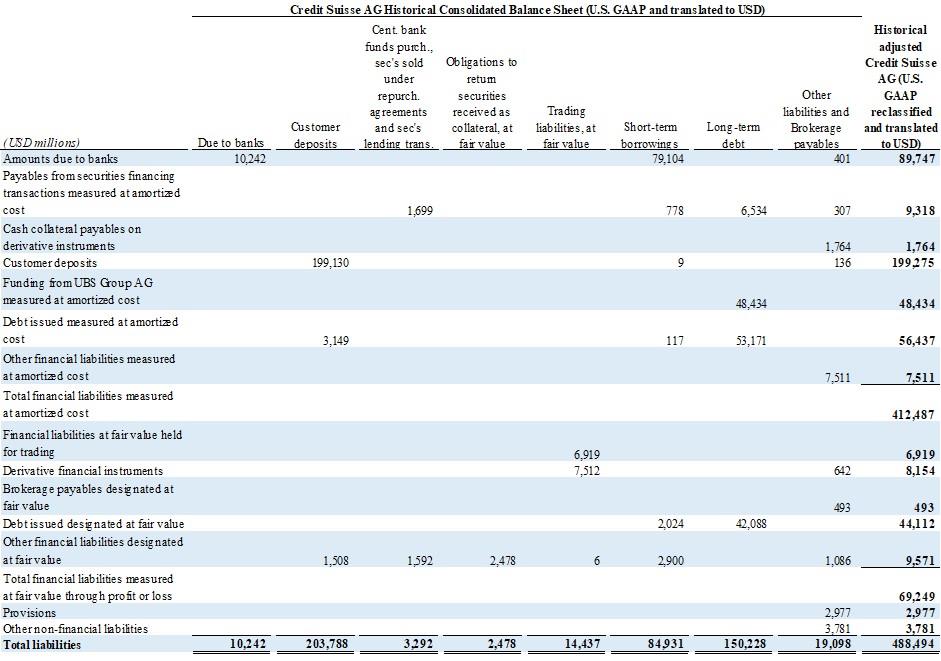

Reflects the U.S. GAAP balance sheet for Credit Suisse

Parent Bank as of 30 June 2023 translated to US

dollars at a rate of 1.12 (CHF/USD) and

reflecting UBS Parent Bank’s equity component presentation.

j)

All pro forma pre-tax adjustments have been considered and no

tax expense or benefit has been recognized in

connection with the pre-tax adjustments in the pro forma condensed

combined income statement as it is assumed

that the pre-tax adjustments will either not be recognized for tax purposes, or they will generally

relate to entities

with tax losses carried forward that are not recognized as deferred

tax assets. Any changes to the pro forma

condensed combined income statement for the year ended 31 December

2022 and for the six-month period ended 30

June 2023 in respect of these entities would, therefore, only affect

the amount of their unrecognized tax losses

carried forward and would have no impact on their tax expenses or benefits for the

year ended 31 December 2022

and for the six-month period ended 30 June 2023. This assessment includes assumptions

and represents UBS Parent

Bank’s best estimate as to the likely tax

impacts. The assessment could change as further information becomes

available, including how the entities and businesses in each location will be

reorganized, receipt of revised profit

forecasts for those entities, and discussions with the relevant tax authorities.

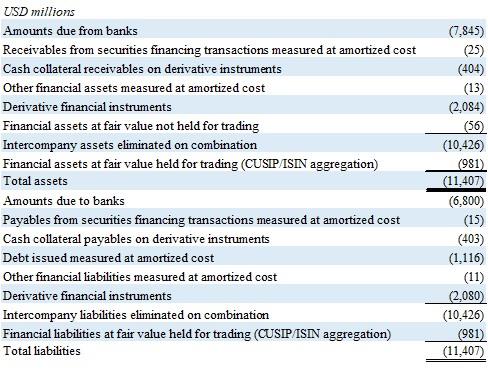

k)

UBS Parent Bank has reviewed exposures and transactions with Credit Suisse Parent

Bank as of 30 June 2023

and

applied intercompany asset and liability elimination adjustments of

10.4bn as summarized in the table below.

UBS

Parent Bank also aggregated the estimated long/short positions in trading

securities in both UBS Parent Bank and

Credit Suisse Parent Bank by security (CUSIP/ISIN) and aggregated

the positions into a single net asset/liability

amount by individual security.

This resulted in a balance sheet asset and liability reduction of 981m as set out

in the

table below. Estimated

intercompany effects on the income statement are not

considered to be material and thus