Filed Pursuant to Rule 424 (b) (3)

Registration No. 333-178960

CALCULATION OF REGISTRATION FEE

| | | | |

Title of Each Class of Securities Offered | | Maximum Aggregate

Offering Price | | Amount of

Registration Fee |

| Debt Securities of UBS AG | | $100,000,000 | | (1)(2) |

| (1) | Calculated in accordance with Rule 457(r) of the Securities Act of 1933. |

| (2) | Registration fee of $11,460.00 was previously paid as of May 22, 2012 in connection with a Rule 424(b)(2) filing (Registration Statement No. 333-178960). |

| | |

| | Amendment No. 1 dated August 5, 2013* to PRICING SUPPLEMENT dated May 22, 2012 (To Product Supplement dated August 5, 2013 and Prospectus dated January 11, 2012) |

$100,000,000 ETRACS Monthly Pay 2xLeveraged Dow Jones Select Dividend Index ETN due May 22, 2042

The ETRACS Monthly Pay 2xLeveraged Dow Jones Select Dividend Index ETN due May 22, 2042 (the “Securities”) are a series of Monthly Pay 2xLeveraged Exchange Traded Access Securities (ETRACS) linked to the Dow Jones U.S. Select Dividend IndexSM (the “Index”). The Securities are senior unsecured debt securities issued by UBS AG (UBS). The Securities provide a monthly compounded two times leveraged long exposure to the performance of the Index, reduced by the Accrued Fees. Because the Securities are two times leveraged with respect to the Index, the Securities may benefit from two times any positive, but will be exposed to two times any negative, monthly compounded performance of the Index. The Securities may pay a monthly coupon during their term linked to two times the cash distributions, if any, on the Index Constituent Securities.But if the Index Constituent Securities do not make any cash distributions, you will not receive a monthly coupon. You will receive a cash payment at maturity, upon acceleration or upon exercise by UBS of its Call Right based on the monthly compounded leveraged performance of the Index less the Accrued Fees, calculated as described in the accompanying product supplement. You will receive a cash payment upon early redemption based on the monthly compounded leveraged performance of the Index less the Accrued Fees and the Redemption Fee, calculated as described in the accompanying product supplement. Payment at maturity or call, upon acceleration or upon early redemption will be subject to the creditworthiness of UBS. In addition, the actual and perceived creditworthiness of UBS will affect the market value, if any, of the Securities prior to maturity, call, acceleration or early redemption.Investing in the Securities involves significant risks. You may lose some or all of your principal at maturity, early redemption, acceleration or upon exercise by UBS of its call right if the monthly compounded leveraged return of the Index is not sufficient to offset the negative effect of the Accrued Fees and the Redemption Fee, if applicable. You may not receive any monthly coupon payment during the term of the Securities.

The general terms of the Monthly Pay 2xLeveraged ETRACS are described in the accompanying product supplement under the heading “General Terms of the Securities”, beginning on pageS-31 of the product supplement. These general terms include, among others, the manner in which any payments on the Securities will be calculated, such as the Cash Settlement Amount at Maturity, the Redemption Amount, the Call Settlement Amount or the Acceleration Amount, as applicable, and the Coupon Amount, if any. These general terms are supplemented and/or modified by the specific terms of the Securities listed below. If there is any inconsistency between the terms described in the accompanying product supplement and the accompanying prospectus, and those described in this pricing supplement, the terms described in this pricing supplement will be controlling. Capitalized terms used herein but not otherwise defined have the meanings specified in the accompanying product supplement.

The principal terms of the Securities are as follows:

| | |

Issuer: | | UBS AG (London Branch) |

| |

Initial Trade Date: | | May 22, 2012 |

| |

Initial Settlement Date: | | May 25, 2012 |

| |

Term: | | 30 years, subject to your right to receive payment for your Securities upon redemption, acceleration upon minimum indicative value or exercise of the UBS Call Right, each as described in the accompanying product supplement. |

| |

| Denomination/Principal Amount: | | $25.00 per Security |

| |

Maturity Date: | | May 22, 2042, subject to adjustment |

| |

Coupon Payment Dates: | | The 15th Trading Day following each Coupon Valuation Date, commencing on July 23, 2012 (subject to adjustment). The final Coupon Payment Date will be the Maturity Date. |

| |

Initial Coupon Valuation Date: | | June 29, 2012 |

| |

Underlying Index: | | The return on the Securities is linked to the performance of the Dow Jones U.S. Select Dividend IndexSM. The Index is designed to measure the performance of 100 stocks, selected by dividend yield, subject to screens for dividend-per-share growth rate, dividend payout ratio and average daily trading volume. See “The Dow Jones U.S. Select Dividend IndexSM.” |

| |

Annual Tracking Rate: | | 0.35% per annum |

| |

Financing Spread: | | 0.40% per annum |

| |

First Redemption Date: | | June 1, 2012 |

| |

| Final Redemption Date: | | May 15, 2042 |

| |

| First Call Date: | | The first date that UBS may exercise its Call Right is May 28, 2013. |

See “Risk Factors” beginning on pagePS-1 of this pricing supplement and on pageS-18 of the accompanying product supplement for risks related to an investment in the Securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement, the accompanying product supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | |

| UBS Investment Bank | | (cover continued on next page) |

Pricing Supplement dated August 5, 2013

| | |

Monthly Initial Closing Level for the Initial | | |

| Calendar Month: | | 391.44, the Index Closing Level (as defined in the accompanying product supplement) on the Initial Trade Date |

| |

| Monthly Reset Dates: | | For each calendar month, the Monthly Reset Date is the first Trading Day of that month beginning on June 1, 2012 and ending on May 1, 2042, subject to adjustment. |

| |

| Monthly Valuation Dates: | | For each Monthly Reset Date, the Monthly Valuation Date is the last Trading Day of the previous calendar month, beginning on May 31, 2012 and ending on April 30, 2042, subject to adjustment. |

| |

Index Sponsor and Index Calculation Agent: | | Dow Jones Indexes |

| |

| Listing: | | The Securities are listed on the NYSE Arca under the symbol “DVYL”. |

| |

| Calculation Date: | | May 13, 2042, unless that day is not a Trading Day, in which case the Calculation Date will be the next Trading Day, subject to adjustment. |

| |

| Index Symbol: | | DJDVP (Bloomberg); .DJDVP (Thomson Reuters) |

| |

| Intraday Indicative Value Symbol: | | DVYLIV |

| |

| CUSIP No.: | | 90268G607 |

| |

| ISIN No.: | | US90268G6070 |

On the Initial Trade Date, we sold $10,000,000 aggregate Principal Amount of Securities to UBS Securities LLC at 100% of their stated Principal Amount. After the Initial Trade Date, from time to time we may sell a portion of the Securities at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. We will receive proceeds equal to 100% of the price at which the Securities are sold to the public, less any commissions paid to UBS Securities LLC. UBS Securities LLC may charge normal commissions in connection with any purchase or sale of the Securities and may receive a portion of the Annual Tracking Fee. Please see “Supplemental Plan of Distribution” on pagePS-17 for more information.

We may use this pricing supplement, the accompanying product supplement and the accompanying prospectus in the initial sale of the Securities. In addition, UBS Securities LLC or another of our affiliates may use this pricing supplement, the accompanying product supplement and the accompanying prospectus in market-making transactions in any Securities after their initial sale.Unless we or our agent informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this pricing supplement, the accompanying product supplement and the accompanying prospectus are being used in a market-making transaction.

The Securities are not deposit liabilities of UBS AG and are not FDIC insured.

| * | This Amendment No. 1 to the pricing supplement dated May 22, 2012 (as amended, the “pricing supplement”) is being filed for the purpose of (i) reflecting the execution of the Fourth Supplemental Indenture, dated August 5, 2013, which modified the definition of Call Settlement Date, (ii) referencing the new Product Supplement, filed on August 5, 2013, which replaced the Product Supplement dated March 20, 2012 and (ii) updating “The Dow Jones U.S. Select Dividend IndexSM” and “Material U.S. Federal Income Tax Consequences”. |

UBS has filed a registration statement (including a prospectus as supplemented by a product supplement) with the Securities and Exchange Commission, or SEC, for the offering to which this pricing supplement relates. Before you invest, you should read these documents and any other documents relating to this offering that UBS has filed with the SEC for more complete information about UBS and this offering. You may obtain these documents for free from the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC web site is 0001114446. Alternatively, UBS will arrange to send you these documents if you so request by calling toll-free800-722-7370.

You may access these documents on the SEC website at www.sec.gov as follows:

Prospectus dated January 11, 2012:

http://www.sec.gov/Archives/edgar/data/1114446/000119312512008669/d279364d424b3.htm

Product Supplement dated August 5, 2013:

http://www.sec.gov/Archives/edgar/data/1114446/000119312513318895/d578411d424b2.htm

References to “UBS,” “we,” “our” and “us” refer only to UBS AG and not to its consolidated subsidiaries. Also, references to the “accompanying prospectus” mean the UBS prospectus titled “Debt Securities and Warrants,” dated January 11, 2012, and references to the “accompanying product supplement” mean the UBS product supplement “UBS AG Monthly Pay 2xLeveraged Exchange Traded Access Securities (ETRACS),” dated August 5, 2013.

You should rely only on the information incorporated by reference or provided in this pricing supplement, the accompanying product supplement or the accompanying prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of the Securities in any state where the offer is not permitted. You should not assume that the information in this pricing supplement, the accompanying product supplement or the accompanying prospectus is accurate as of any date other than the date on the front of the document.

UBS reserves the right to change the terms of, or reject any offer to purchase, the Securities prior to their issuance. In the event of any changes to the terms of the Securities, UBS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case UBS may reject your offer to purchase.

-i-

Risk Factors

Your investment in the Securities will involve significant risks. The Securities are not secured debt and are significantly riskier than ordinary unsecured debt securities. Unlike ordinary debt securities, the return on the Securities is linked to the performance of the Index. The Securities are two times leveraged with respect to the Index and, as a result, may benefit from two times any positive, but will be exposed to two times any negative, monthly performance of the Index. As described in more detail below, the trading price of the Securities may vary considerably before the Maturity Date, due to events that are difficult to predict and beyond our control. Investing in the Securities is not equivalent to investing directly in the Index Constituent Securities (as defined in the accompanying product supplement) or the Index itself.We urge you to read the following information about these risks as well as the risks described under “Risk Factors” in the accompanying product supplement and “Considerations Relating to Indexed Securities” in the accompanying prospectus, together with the other information in this pricing supplement, the accompanying product supplement and the accompanying prospectus, before investing in the Securities.

UBS and its affiliates have no affiliation with the Index Sponsor and are not responsible for its public disclosure of information.

We and our affiliates are not affiliated with the Index Sponsor (except for licensing arrangements discussed under “The Dow Jones U.S. Select Dividend IndexSM — Licensing Agreement”) and have no ability to control or predict its actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the Index. If the Index Sponsor discontinues or suspends the calculation of the Index, it may become difficult to determine the market value of the Securities and the payment at maturity or call, upon acceleration or upon early redemption. The Calculation Agent may designate a successor index in its sole discretion. If the Calculation Agent determines in its sole discretion that no successor index comparable to the Index exists, the payment you receive at maturity or call, upon acceleration or upon early redemption will be determined by the Calculation Agent in its sole discretion. See “General Terms of the Securities — Market Disruption Event” and “ — Calculation Agent” in the accompanying product supplement. The Index Sponsor is not involved in the offer of the Securities in any way and has no obligation to consider your interest as an owner of the Securities in taking any actions that might affect the market value of your Securities.

We have derived the information about the Index Sponsor and the Index from publicly available information, without independent verification. Neither we nor any of our affiliates assume any responsibility for the adequacy or accuracy of the information about the Index Sponsor or the Index contained in this pricing supplement.You, as an investor in the Securities, should make your own independent investigation into the Index Sponsor and the Index.

Market disruption events may require an adjustment to the calculation of the Index.

At any time during the term of the Securities, the intraday and daily calculations of the level of the Index may be adjusted in the event that the Index Calculation Agent determines that there has been an unscheduled market closure for any of the Index Constituent Securities. Any such Index calculation disruption event may have an adverse impact on the level of the Index or the manner in which it is calculated and, therefore, may have an adverse effect on the market value of the Securities.

Significant aspects of the tax treatment of the Securities are uncertain.

Significant aspects of the tax treatment of the Securities are uncertain. We do not plan to request a ruling from the Internal Revenue Service (“IRS”) regarding the tax treatment of the Securities, and the IRS or a court may not agree with the tax treatment described in this pricing supplement. Please read carefully the

PS-1

Risk Factors

section entitled “Material U.S. Federal Income Tax Consequences” on page PS-15. You should consult your tax advisor about your own tax situation.

The IRS released a notice in 2007 that may affect the taxation of holders of the Securities. According to the notice, the IRS and the Treasury Department are actively considering, among other things, whether holders of instruments such as the Securities should be required to accrue ordinary income on a current basis, whether any gain or loss recognized upon the sale, exchange, redemption or maturity of such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax, and whether the special “constructive ownership rules” of Section 1260 of the Internal Revenue Code of 1986, as amended, should be applied to such instruments. Similarly, the IRS and the Treasury Department have current projects open with regard to the tax treatment ofpre-paid forward contracts and contingent notional principal contracts. While it is impossible to anticipate how any ultimate guidance would affect the tax treatment of instruments such as the Securities (and while any such guidance may be issued on a prospective basis only), such guidance could be applied retroactively and could in any case increase the likelihood that you will be required to accrue income over the term of an instrument such as the Securities. The outcome of this process is uncertain.

Furthermore, in 2007, legislation was introduced in Congress that, if enacted, would have required holders of the Securities purchased after the bill was enacted to accrue interest income over the term of the Securities despite the fact that there will be no interest payments over the term of the Securities. It is not possible to predict whether a similar or identical bill will be enacted in the future and whether any such bill would affect the tax treatment of your Securities.

Holders are urged to consult their tax advisors concerning the significance and the potential impact of the above considerations. We intend to treat your Securities for United States federal income tax purposes in accordance with the treatment described above and under “Material U.S. Federal Income Tax Consequences” on page PS-15 unless and until such time as there is a change in law or the Treasury Department or IRS determines that some other treatment is more appropriate.

PS-2

Hypothetical Examples

The following four examples illustrate how the Securities would perform at maturity or call, or upon early redemption, in hypothetical circumstances. We have included an example in which the Index Closing Level increases at a constant rate of 3.00% per month for twelve months (Example 1), as well as an example in which the Index Closing Level decreases at a constant rate of 3.00% per month for twelve months (Example 2). In addition, Example 3 shows the Index Closing Level increasing by 3.00% per month for the first six months and then decreasing by 3.00% per month for the next six months, whereas Example 4 shows the reverse scenario of the Index Closing Level decreasing by 3.00% per month for the first six months, and then increasing by 3.00% per month for the next six months. For ease of analysis and presentation,the following four examples assume that the term of the Securities is twelve months, the last Trading Day of the Call Measurement Period, or the Redemption Valuation Date, occurs on the month end, that no acceleration upon minimum indicative value has occurred, no Coupon Amount has been paid during the term of the Securities and that no Stub Reference Distribution Amount was paid at maturity, call upon acceleration or upon early redemption.

The following assumptions are used in each of the four examples:

| | Ø | | the initial level for the Index is 400; |

| | Ø | | the Redemption Fee Rate is 0.125%; |

| | Ø | | the Financing Rate (as defined in the accompanying product supplement) is 0.90%; |

| | Ø | | the Current Principal Amount (as defined in the accompanying product supplement) on the first day is $25.00; and |

| | Ø | | the Annual Tracking Rate (as defined in the accompanying product supplement) is 0.35%. |

The examples highlight the effect of two times leverage and monthly compounding, and the impact of the Accrued Fees (as defined in the accompanying product supplement) on the payment at maturity or call, or upon early redemption, under different circumstances. The assumed Financing Rate is not an indication of the Financing Rate throughout the term of the Securities. The Financing Rate will change during the term of the Securities, which will affect the performance of the Securities.

Because the Accrued Fees take into account the monthly performance of the Index, as measured by the Index Closing Level, the absolute level of the Accrued Fees is dependent on the path taken by the Index Closing Level to arrive at its ending level. The figures in these examples have been rounded for convenience. The Cash Settlement Amount figures for month twelve are as of the hypothetical Calculation Date, and given the indicated assumptions, a holder will receive payment at maturity in the indicated amount, according to the indicated formula.

PS-3

Hypothetical Examples

Example 1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index

Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ( ( Index Closing

Level- Monthly Initial

Closing Level ) /

Monthly Initial

Closing Level ) | | | ( 1 + ( 2 x C ) ) | | | (Previous

Current

Principal

Amount x

Financing

Rate x

Act/360 ) | | | ( Previous

Current

Principal

Amount x D )* | | | ( Annual Tracking

Rate x F x Act/365 ) | | | ( E + G ) | | | ( ( Previous

Current

Principal

Amount x D )

- H ) | | | ( I - Redemption Fee ) | |

| 1 | | | 412.00 | | | | 0.0300 | | | | 1.060 | | | | 0.0188 | | | $ | 26.50 | | | $ | 0.0076 | | | $ | 0.0264 | | | $ | 26.47 | | | $ | 26.4424 | |

| 2 | | | 424.36 | | | | 0.0300 | | | | 1.060 | | | | 0.0199 | | | $ | 28.06 | | | $ | 0.0081 | | | $ | 0.0279 | | | $ | 28.03 | | | $ | 28.0010 | |

| 3 | | | 437.09 | | | | 0.0300 | | | | 1.060 | | | | 0.0210 | | | $ | 29.72 | | | $ | 0.0085 | | | $ | 0.0296 | | | $ | 29.69 | | | $ | 29.6515 | |

| 4 | | | 450.20 | | | | 0.0300 | | | | 1.060 | | | | 0.0223 | | | $ | 31.47 | | | $ | 0.0091 | | | $ | 0.0313 | | | $ | 31.44 | | | $ | 31.3994 | |

| 5 | | | 463.71 | | | | 0.0300 | | | | 1.060 | | | | 0.0236 | | | $ | 33.32 | | | $ | 0.0096 | | | $ | 0.0332 | | | $ | 33.29 | | | $ | 33.2502 | |

| 6 | | | 477.62 | | | | 0.0300 | | | | 1.060 | | | | 0.0250 | | | $ | 35.29 | | | $ | 0.0102 | | | $ | 0.0351 | | | $ | 35.25 | | | $ | 35.2101 | |

| 7 | | | 491.95 | | | | 0.0300 | | | | 1.060 | | | | 0.0264 | | | $ | 37.37 | | | $ | 0.0107 | | | $ | 0.0372 | | | $ | 37.33 | | | $ | 37.2856 | |

| 8 | | | 506.71 | | | | 0.0300 | | | | 1.060 | | | | 0.0280 | | | $ | 39.57 | | | $ | 0.0114 | | | $ | 0.0394 | | | $ | 39.53 | | | $ | 39.4834 | |

| 9 | | | 521.91 | | | | 0.0300 | | | | 1.060 | | | | 0.0296 | | | $ | 41.90 | | | $ | 0.0121 | | | $ | 0.0417 | | | $ | 41.86 | | | $ | 41.8107 | |

| 10 | | | 537.57 | | | | 0.0300 | | | | 1.060 | | | | 0.0314 | | | $ | 44.37 | | | $ | 0.0128 | | | $ | 0.0442 | | | $ | 44.33 | | | $ | 44.2753 | |

| 11 | | | 553.69 | | | | 0.0300 | | | | 1.060 | | | | 0.0332 | | | $ | 46.99 | | | $ | 0.0135 | | | $ | 0.0468 | | | $ | 46.94 | | | $ | 46.8851 | |

| 12 | | | 570.30 | | | | 0.0300 | | | | 1.060 | | | | 0.0352 | | | $ | 49.76 | | | $ | 0.0143 | | | $ | 0.0495 | | | $ | 49.71 | | | $ | 49.6487 | |

| Cumulative Index Return: | | | | 42.58% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | 98.83% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge is calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-4

Hypothetical Examples

Example 2

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index

Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ((Index Closing

Level - Monthly Initial

Closing Level) /

Monthly Initial

Closing Level) | | | ( 1 + ( 2 x

C ) ) | | | ( Previous

Current

Principal

Amount x

Financing

Rate x

Act/360) | | | ( Previous

Current

Principal

Amount x D)* | | | (Annual Tracking

Rate x F x

Act/365) | | | ( E + G ) | | | ( ( Previous Current Principal

Amount x D) -

H ) | | | ( I - Redemption Fee) | |

| 1 | | | 388.00 | | | | -0.0300 | | | | 0.940 | | | | 0.0188 | | | $ | 23.50 | | | $ | 0.0068 | | | $ | 0.0255 | | | $ | 23.47 | | | $ | 23.4432 | |

| 2 | | | 376.36 | | | | -0.0300 | | | | 0.940 | | | | 0.0176 | | | $ | 22.07 | | | $ | 0.0063 | | | $ | 0.0240 | | | $ | 22.04 | | | $ | 22.0127 | |

| 3 | | | 365.07 | | | | -0.0300 | | | | 0.940 | | | | 0.0165 | | | $ | 20.72 | | | $ | 0.0060 | | | $ | 0.0225 | | | $ | 20.70 | | | $ | 20.6695 | |

| 4 | | | 354.12 | | | | -0.0300 | | | | 0.940 | | | | 0.0155 | | | $ | 19.46 | | | $ | 0.0056 | | | $ | 0.0211 | | | $ | 19.43 | | | $ | 19.4082 | |

| 5 | | | 343.49 | | | | -0.0300 | | | | 0.940 | | | | 0.0146 | | | $ | 18.27 | | | $ | 0.0053 | | | $ | 0.0198 | | | $ | 18.25 | | | $ | 18.2239 | |

| 6 | | | 333.19 | | | | -0.0300 | | | | 0.940 | | | | 0.0137 | | | $ | 17.15 | | | $ | 0.0049 | | | $ | 0.0186 | | | $ | 17.13 | | | $ | 17.1119 | |

| 7 | | | 323.19 | | | | -0.0300 | | | | 0.940 | | | | 0.0129 | | | $ | 16.11 | | | $ | 0.0046 | | | $ | 0.0175 | | | $ | 16.09 | | | $ | 16.0677 | |

| 8 | | | 313.50 | | | | -0.0300 | | | | 0.940 | | | | 0.0121 | | | $ | 15.12 | | | $ | 0.0044 | | | $ | 0.0164 | | | $ | 15.11 | | | $ | 15.0873 | |

| 9 | | | 304.09 | | | | -0.0300 | | | | 0.940 | | | | 0.0113 | | | $ | 14.20 | | | $ | 0.0041 | | | $ | 0.0154 | | | $ | 14.19 | | | $ | 14.1666 | |

| 10 | | | 294.97 | | | | -0.0300 | | | | 0.940 | | | | 0.0106 | | | $ | 13.33 | | | $ | 0.0038 | | | $ | 0.0145 | | | $ | 13.32 | | | $ | 13.3022 | |

| 11 | | | 286.12 | | | | -0.0300 | | | | 0.940 | | | | 0.0100 | | | $ | 12.52 | | | $ | 0.0036 | | | $ | 0.0136 | | | $ | 12.51 | | | $ | 12.4905 | |

| 12 | | | 277.54 | | | | -0.0300 | | | | 0.940 | | | | 0.0094 | | | $ | 11.76 | | | $ | 0.0034 | | | $ | 0.0128 | | | $ | 11.74 | | | $ | 11.7283 | |

| Cumulative Index Return: | | | | -30.62% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | -53.02% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge is calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-5

Hypothetical Examples

Example 3

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index

Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ( ( Index Closing

Level- Monthly

Initial Closing

Level ) /Monthly

Initial Closing

Level ) | | | ( 1 + ( 2 x C ) ) | | | ( Previous

Current

Principal

Amount x

Financing

Rate x

Act/360 ) | | | ( Previous

Current

Principal

Amount x D )* | | | ( Annual Tracking Rate x F x Act/365 ) | | | ( E + G ) | | | ( ( Previous Current

Principal Amount x D ) -

H ) | | | ( I - Redemption Fee ) | |

| 1 | | | 412.00 | | | | 0.0300 | | | | 1.060 | | | | 0.0188 | | | $ | 26.50 | | | $ | 0.0076 | | | $ | 0.0264 | | | $ | 26.47 | | | $ | 26.4424 | |

| 2 | | | 424.36 | | | | 0.0300 | | | | 1.060 | | | | 0.0199 | | | $ | 28.06 | | | $ | 0.0081 | | | $ | 0.0279 | | | $ | 28.03 | | | $ | 28.0010 | |

| 3 | | | 437.09 | | | | 0.0300 | | | | 1.060 | | | | 0.0210 | | | $ | 29.72 | | | $ | 0.0085 | | | $ | 0.0296 | | | $ | 29.69 | | | $ | 29.6515 | |

| 4 | | | 450.20 | | | | 0.0300 | | | | 1.060 | | | | 0.0223 | | | $ | 31.47 | | | $ | 0.0091 | | | $ | 0.0313 | | | $ | 31.44 | | | $ | 31.3994 | |

| 5 | | | 463.71 | | | | 0.0300 | | | | 1.060 | | | | 0.0236 | | | $ | 33.32 | | | $ | 0.0096 | | | $ | 0.0332 | | | $ | 33.29 | | | $ | 33.2502 | |

| 6 | | | 477.62 | | | | 0.0300 | | | | 1.060 | | | | 0.0250 | | | $ | 35.29 | | | $ | 0.0102 | | | $ | 0.0351 | | | $ | 35.25 | | | $ | 35.2101 | |

| 7 | | | 463.29 | | | | -0.0300 | | | | 0.940 | | | | 0.0264 | | | $ | 33.14 | | | $ | 0.0095 | | | $ | 0.0360 | | | $ | 33.10 | | | $ | 33.0566 | |

| 8 | | | 449.39 | | | | -0.0300 | | | | 0.940 | | | | 0.0248 | | | $ | 31.11 | | | $ | 0.0090 | | | $ | 0.0338 | | | $ | 31.08 | | | $ | 31.0395 | |

| 9 | | | 435.91 | | | | -0.0300 | | | | 0.940 | | | | 0.0233 | | | $ | 29.22 | | | $ | 0.0084 | | | $ | 0.0317 | | | $ | 29.18 | | | $ | 29.1454 | |

| 10 | | | 422.83 | | | | -0.0300 | | | | 0.940 | | | | 0.0219 | | | $ | 27.43 | | | $ | 0.0079 | | | $ | 0.0298 | | | $ | 27.40 | | | $ | 27.3670 | |

| 11 | | | 410.15 | | | | -0.0300 | | | | 0.940 | | | | 0.0206 | | | $ | 25.76 | | | $ | 0.0074 | | | $ | 0.0280 | | | $ | 25.73 | | | $ | 25.6970 | |

| 12 | | | 397.84 | | | | -0.0300 | | | | 0.940 | | | | 0.0193 | | | $ | 24.19 | | | $ | 0.0070 | | | $ | 0.0263 | | | $ | 24.16 | | | $ | 24.1290 | |

| Cumulative Index Return: | | | | -0.54% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | -3.36% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge is calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-6

Hypothetical Examples

Example 4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index

Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ( ( Index Closing

Level- Monthly Initial

Closing Level ) / Monthly Initial

Closing Level ) | | | ( 1 + ( 2 x C ) ) | | | (Previous

Current

Principal

Amount x

Financing

Rate x

Act/360 ) | | | ( Previous

Current

Principal

Amount x D )* | | | ( Annual Tracking Rate x F x Act/365 ) | | | ( E + G ) | | | ( ( Previous Current Principal Amount x D ) -

H ) | | | ( I - Redemption Fee ) | |

| 1 | | | 388.00 | | | | -0.0300 | | | | 0.940 | | | | 0.0188 | | | $ | 23.50 | | | $ | 0.0068 | | | $ | 0.0255 | | | $ | 23.47 | | | $ | 23.4432 | |

| 2 | | | 376.36 | | | | -0.0300 | | | | 0.940 | | | | 0.0176 | | | $ | 22.07 | | | $ | 0.0063 | | | $ | 0.0240 | | | $ | 22.04 | | | $ | 22.0127 | |

| 3 | | | 365.07 | | | | -0.0300 | | | | 0.940 | | | | 0.0165 | | | $ | 20.72 | | | $ | 0.0060 | | | $ | 0.0225 | | | $ | 20.70 | | | $ | 20.6695 | |

| 4 | | | 354.12 | | | | -0.0300 | | | | 0.940 | | | | 0.0155 | | | $ | 19.46 | | | $ | 0.0056 | | | $ | 0.0211 | | | $ | 19.43 | | | $ | 19.4082 | |

| 5 | | | 343.49 | | | | -0.0300 | | | | 0.940 | | | | 0.0146 | | | $ | 18.27 | | | $ | 0.0053 | | | $ | 0.0198 | | | $ | 18.25 | | | $ | 18.2239 | |

| 6 | | | 333.19 | | | | -0.0300 | | | | 0.940 | | | | 0.0137 | | | $ | 17.15 | | | $ | 0.0049 | | | $ | 0.0186 | | | $ | 17.13 | | | $ | 17.1119 | |

| 7 | | | 343.18 | | | | 0.0300 | | | | 1.060 | | | | 0.0129 | | | $ | 18.16 | | | $ | 0.0052 | | | $ | 0.0181 | | | $ | 18.14 | | | $ | 18.1233 | |

| 8 | | | 353.48 | | | | 0.0300 | | | | 1.060 | | | | 0.0136 | | | $ | 19.23 | | | $ | 0.0055 | | | $ | 0.0191 | | | $ | 19.21 | | | $ | 19.1916 | |

| 9 | | | 364.08 | | | | 0.0300 | | | | 1.060 | | | | 0.0144 | | | $ | 20.37 | | | $ | 0.0059 | | | $ | 0.0203 | | | $ | 20.35 | | | $ | 20.3228 | |

| 10 | | | 375.01 | | | | 0.0300 | | | | 1.060 | | | | 0.0153 | | | $ | 21.57 | | | $ | 0.0062 | | | $ | 0.0215 | | | $ | 21.55 | | | $ | 21.5208 | |

| 11 | | | 386.26 | | | | 0.0300 | | | | 1.060 | | | | 0.0162 | | | $ | 22.84 | | | $ | 0.0066 | | | $ | 0.0227 | | | $ | 22.82 | | | $ | 22.7893 | |

| 12 | | | 397.84 | | | | 0.0300 | | | | 1.060 | | | | 0.0171 | | | $ | 24.19 | | | $ | 0.0070 | | | $ | 0.0241 | | | $ | 24.16 | | | $ | 24.1326 | |

| Cumulative Index Return: | | | | -0.54% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | -3.36% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge is calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-7

Hypothetical Examples

You may receive Coupon Amounts during the term of the Securities and a Stub Reference Distribution Amount at maturity, call, acceleration or upon early redemption. The hypothetical returns displayed in all of the examples above do not reflect any Coupon Amounts you may be entitled to receive during the term of the Securities or any Stub Reference Distribution Amount you may be entitled to receive at maturity, call, acceleration or upon early redemption. If any Stub Reference Distribution Amount was paid at maturity or call, or upon early redemption, the hypothetical Cash Settlement Amounts, Call Settlement Amounts or Redemption Amounts displayed above would have been higher (as the Cash Settlement Amounts, Call Settlement Amounts or Redemption Amounts would have been increased by the Stub Reference Distribution Amount). If any net cash distributions were paid on the Index Constituent Securities during the term of the Securities, those distributions would also offset the Accrued Fees.

We cannot predict the actual Index Closing Level on any Trading Day or the market value of your Securities, nor can we predict the relationship between the Index Closing Level and the market value of your Securities at any time prior to the Maturity Date. The actual amount that a holder of the Securities will receive at maturity or call, upon acceleration or upon early redemption, as the case may be, and the rate of return on the Securities, will depend on the monthly compounded leveraged return of the Index, and, if positive, whether it will be sufficient to offset the negative effect of the Accrued Fees over the relevant period and, if applicable, the Redemption Fee, whether any Coupon Amounts were paid during the term of the Securities and whether any Stub Reference Distribution Amount is payable at maturity or call, or upon early redemption or acceleration. Moreover, the assumptions on which the hypothetical returns are based are purely for illustrative purposes. Consequently, the amount, in cash, to be paid in respect of your Securities, if any, on the Maturity Date, Call Settlement Date, Acceleration Settlement Date or the relevant Redemption Date, as applicable, may be very different from the information reflected in the tables above.

The hypothetical examples above are provided for purposes of information only. The hypothetical examples are not indicative of the future performance of the Index on any Trading Day, the Index Valuation Level, or what the value of your Securities may be. Fluctuations in the hypothetical examples may be greater or less than fluctuations experienced by the holders of the Securities. The performance data shown above is for illustrative purposes only and does not represent the actual or expected future performance of the Securities.

PS-8

The Dow Jones U.S. Select Dividend IndexSM

We have derived all information contained in this pricing supplement regarding the Dow Jones U.S. Select Dividend IndexSM, including, without limitation, itsmake-up, performance, method of calculation and changes in its constituents, from publicly available sources, which are summarized but not incorporated by reference herein, including the “ Dow Jones U.S. Select Dividend IndexSMMethodology” published by Dow Jones Indexes (“Dow Jones” or the “Index Sponsor”), which is available at www.djindexes.com. Such information reflects the policies of and is subject to change by the Index Sponsor. We make no representation or warranty as to the accuracy or completeness of such information. The composition of the Index is determined, maintained and published by the Index Sponsor and the intraday index value is calculated and published by the Index Sponsor. The Index Sponsor has no obligation to continue to publish, and may discontinue the publication of, the Index. Daily closing index levels are available at www.djindexes.com.

Introduction

The Dow Jones U.S. Select Dividend IndexSMrepresents the country’s top stocks by dividend yield, selected annually and subject to screening and buffering criteria. The Index is weighted by indicated annual dividend of its components and the weight of any individual company is restricted to 10%. The Index is a price return index (i.e., the reinvestment of dividends is not reflected in the Index). As of June 30, 2013, the Index was comprised of 100 Index Constituent Securities with the largest Index Constituent Security weighted at 3.72% and the smallest Index Constituent Security weighted at 0.20%. Updated weightings of the Index Constituent Securities in the Index are available at www.djindexes.com.

Constituent Selection

In order for a company to be eligible for selection in the Index, it must (i) be a dividend-paying company in the Dow Jones U.S. IndexSM that has anon-negative historical five-yeardividend-per-share growth rate; (ii) have a five-year average dividend toearnings-per-share ratio of less than or equal to 60%; (iii) have paid dividends in each of the previous five years and (iv) have a three-month average trading volume of 200,000 shares. Current Index components are eligible for selection regardless of their payout ratio or trading volume.

In the annual December Index composition review, companies that are eligible for selection in the Index are ranked as follows:

| | 1. | Issues are ranked in descending order of indicated annual yield, defined as a stock’s indicated annual dividend (not including any special dividends) divided by its price. |

| | 2. | Any current component stock with a three-month average daily trading volume of less than 100,000 shares is deemed ineligible for selection. |

| | 3. | All remaining current component stocks ranked 200 and above on the December selection list are retained in the Index assuming they continue to meet all other eligibility requirements. |

| | 4. | Stocks that are not current components are added to the Index until the component count reaches 100. |

Base Value and Date

The base value of the Index is 100 as of December 31, 1991. The Index was first calculated on November 3, 2003 (the “Index Commencement Date”).

PS-9

The Dow Jones U.S. Select Dividend IndexSM

Calculation of the Index

The Index is disseminated on each Trading Day to market data vendors every 15 seconds, beginning at 9:30 a.m., New York City time, and ending at 5:15 p.m., New York City time.

Constituent Weighting

A company’s weighting in the Index is based on its indicated annual dividend. The weight of any individual company is restricted to 10%. Such restrictions, when required, are implemented on a quarterly basis. In the event of a stock split affecting a component company, weighting factors are adjusted immediately to keep the component weights constant.

Constituent Review

Components with significant negative dividend growth or negative earnings from continuing operations over the past twelve-month period are reviewed to determine if the affected company can sustain an appropriate dividend program to remain in the Index. If the Dow Jones Indexes Oversight Committee determines the company’s dividend program is at significant risk, the company will be removed from the Index after the close of trading on the third Friday of March, June, September or December. The component will be replaced by the highest-rankingnon-component on the most recently published selection list. The companies under review for possible deletion are indicated on the selection lists posted to www.djindexes.com at the beginning of March, June, September and December. Component changes resulting from the quarterly review process are announced approximately two weeks prior to the implementation date. Share factor calculations for all Index components are conducted only at the annual review in December. A company added to the Index during the March, June, September or December review will be included in the Index at a weight commensurate with its own indicated annual dividend.

Extraordinary Constituent Deletions

Under the following circumstances, a component stock is immediately removed from the Index, independent of the annual review:

| | Ø | | The component company is affected by a corporate action such as a delisting or bankruptcy; |

| | Ø | | The component company eliminates its dividend; or |

| | Ø | | The component company lowers but does not eliminate its dividend, and its new yield is less than that of the lowest yieldingnon-component on the latest monthly selection list. |

A component stock that is removed from the Index as the result of an extraordinary deletion is immediately replaced by the next-highest ranked stock by indicated annual yield as of the most recent monthly selection list. The new stock is added to the Index at a weight commensurate with its own indicated annual dividend. A component company that is removed from the Dow Jones U.S. IndexSM during the course of the year because of a reduction in market capitalization will simultaneously be removed from the Dow Jones U.S. Select Dividend IndexSM.

PS-10

The Dow Jones U.S. Select Dividend IndexSM

Index Calculations

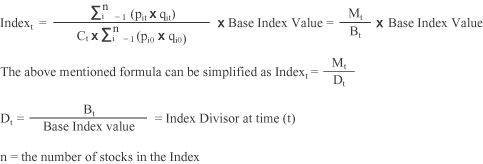

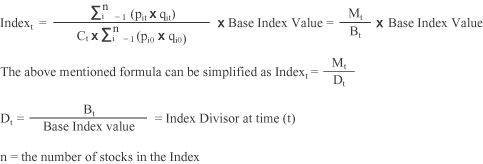

The Index is computed as follows:

pi0 = the closing price of stock i at the base date

qi0 = the number of shares of company i at the base date

pit = the price of stock i at time (t)

qit = the number of shares of company i at time (t)

Ct = the adjustment factor for the base date market capitalization

Mt = market capitalization of the Index at time (t)

Bt = adjusted base date market capitalization of the Index at time (t)

The “Index Divisor” is used in the definition of “Reference Holder” in the accompanying product supplement.

Corporate Actions

In the event of a corporate action, the Index will be adjusted as follows:

| | Ø | | Merger between two Index components (stock consideration): The target company is deleted from the Index and is replaced by the next-highest ranked stock by indicated annual yield as of the most recent monthly selection list. |

| | Ø | | Merger between two Index components (cash and stock consideration): The target company is deleted from the Index and is replaced by the next-highest ranked stock by indicated annual yield as of the most recent monthly selection list. |

| | Ø | | Merger between two Index components (cash consideration): The target company is deleted from the Index and is replaced by the next-highest ranked stock by indicated annual yield as of the most recent monthly selection list. |

| | Ø | | Merger betweennon-component and Index component: The target company is deleted from the Index and is replaced by the next-highest ranked stock by indicated annual yield as of the most recent monthly selection list. |

| | Ø | | Extraordinary deletion (bankruptcy, delisting): The target company is deleted from the Index and is replaced by the next-highest ranked stock by indicated annual yield as of the most recent monthly selection list. |

| | Ø | | Spin off: If an Index Constituent is restructured into two or more new companies, the new company is not added to the Index provided that the parent company maintains their dividends for the current-year. |

PS-11

The Dow Jones U.S. Select Dividend IndexSM

If the dividend payment of the original company transfers from the parent to the child company, then the new company is added.

| | Ø | | Stock Split/Stock Dividend/ Rights Offering: The weighting factor is adjusted based on ratio of the stock split/stock dividend to maintain the same weight for the company in the Index. |

| | Ø | | Special Cash Dividend: The price is adjusted by the amount of the special cash dividend on theex-date. There will be no change to the weighting factor, resulting in a Divisor change. |

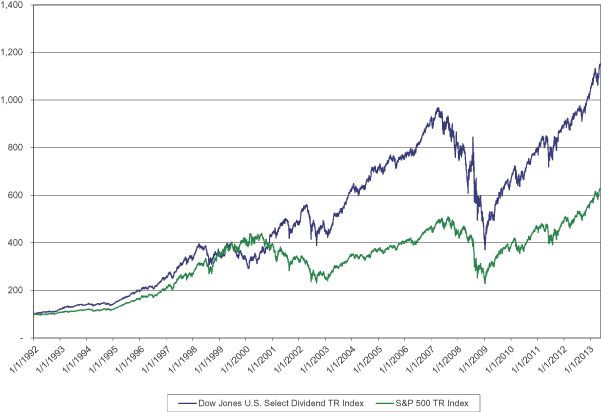

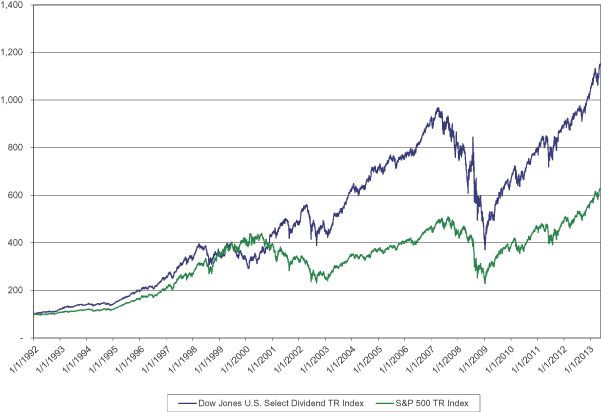

Historical and Estimated Historical Performance

The estimated historical information for the period from the Base Date, January 1, 1992, to the Index Commencement Date is hypothetical and is provided as an illustration of how the Index would have performed during that period had the Index Calculation Agent begun calculating the Index on the Base Date using the methodology described above. The level of the Index is deemed to have been 100 on the Base Date. This data does not reflect actual performance, nor was a contemporaneous investment model run of the Index. Index historical information for the period from and after the Index Commencement Date is based on the actual performance of the Index.

Any historical and estimated historical upward or downward trend in value of the Index during any period shown below is not an indication that the value of the Index is more or less likely to increase or decrease at any time during the term of the Securities. The historical or estimated historical Index returns do not give an indication of the future performance of the Index. UBS cannot make any assurance that the future performance of the Index will result in holders of the Securities receiving a positive return on their investment.

The table below shows the historical performance of the Index from the Index Commencement Date through July 31, 2013 and the estimated historical performance of the Index from December 31, 1992 to the Index Commencement Date.

Historical and Estimated Historical Results for the

period December 31, 1992 through July 31, 2013

| | | | | | | | | | | | | | | | |

Year | | Price Return

Ending Level | | | Annual Return | | | Total Return

Ending Level | | | Annual Return | |

| | | | |

| 1992 | | | 122.65 | | | | | | | | 117.41 | | | | | |

| 1993 | | | 140.55 | | | | 14.59 | % | | | 129.24 | | | | 10.08 | % |

| 1994 | | | 140.28 | | | | -0.19 | % | | | 123.25 | | | | -4.63 | % |

| 1995 | | | 200.32 | | | | 42.80 | % | | | 168.47 | | | | 36.69 | % |

| 1996 | | | 250.57 | | | | 25.08 | % | | | 203.00 | | | | 20.50 | % |

| 1997 | | | 345.37 | | | | 37.83 | % | | | 270.63 | | | | 33.32 | % |

| 1998 | | | 360.34 | | | | 4.33 | % | | | 273.17 | | | | 0.94 | % |

| 1999 | | | 345.63 | | | | -4.08 | % | | | 253.14 | | | | -7.33 | % |

| 2000 | | | 431.56 | | | | 24.86 | % | | | 301.65 | | | | 19.16 | % |

| 2001 | | | 488.05 | | | | 13.09 | % | | | 328.06 | | | | 8.76 | % |

| 2002 | | | 468.80 | | | | -3.94 | % | | | 302.11 | | | | -7.91 | % |

| 2003 | | | 610.17 | | | | 30.16 | % | | | 376.91 | | | | 24.76 | % |

| 2004 | | | 720.84 | | | | 18.14 | % | | | 428.70 | | | | 13.74 | % |

| 2005 | | | 748.13 | | | | 3.79 | % | | | 429.57 | | | | 0.20 | % |

| 2006 | | | 894.35 | | | | 19.54 | % | | | 495.52 | | | | 15.35 | % |

| 2007 | | | 848.18 | | | | -5.16 | % | | | 453.34 | | | | -8.51 | % |

| 2008 | | | 585.48 | | | | -30.97 | % | | | 298.18 | | | | -34.23 | % |

| 2009 | | | 650.64 | | | | 11.13 | % | | | 315.67 | | | | 5.87 | % |

| 2010 | | | 769.82 | | | | 18.32 | % | | | 358.46 | | | | 13.56 | % |

| 2011 | | | 865.41 | | | | 12.42 | % | | | 386.82 | | | | 7.91 | % |

| 2012 | | | 1152.70 | | | | 20.17 | % | | | 484.76 | | | | 17.73 | % |

| Through 7/31/13 | | | 959.21 | | | | 10.84 | % | | | 411.76 | | | | 6.45 | % |

PS-12

The Dow Jones U.S. Select Dividend IndexSM

Historical or estimated historical results are not indicative of future results.

The table below shows the historical and estimated historical returns of the Index from January 1, 1992 through July 31, 2013 in comparison with the S&P 500® Index.

| | | | | | | | |

| | | Index | | | S&P 500® Index | |

| Total Return | | | 1,052.70 | % | | | 524.59 | % |

| Annualized Return | | | 11.99 | % | | | 8.85 | % |

The data for the Index for the period prior to the Index Commencement Date is estimated and is derived by using the Index’s calculation methodology with historical prices.

Historical information presented is as of July 31, 2013, and is furnished as a matter of information only. Historical and estimated historical performance of the Index is not an indication of future performance. Future performance of the Index may differ significantly from historical and estimated historical performance, either positively or negatively.

The graph below is based on the levels of the Index and the S&P 500® Index.

Licensing Agreement

CME Indexes and UBS have entered into a licensing agreement providing for the license to UBS, and certain of its affiliated or subsidiary companies, in exchange for a fee, of the right to use certain service marks owned by Dow Jones in connection with certain products, including the Securities.

PS-13

The Dow Jones U.S. Select Dividend IndexSM

The Dow Jones U.S. Select Dividend IndexSM is a product of Dow Jones Indexes, the marketing name and a licensed trademark of CME Indexes, and has been licensed for use. “Dow Jones®”, “Dow Jones U.S. Select Dividend IndexSM” and “Dow Jones Indexes” are service marks of Dow Jones Trademark Holdings, LLC (“Dow Jones”) and have been licensed for use for certain purposes by UBS.The Securities are not sponsored, endorsed, sold or promoted by Dow Jones, CME Indexes or their respective affiliates. Dow Jones, CME Indexes and their respective affiliates make no representation or warranty, express or implied, to the owners of the Securities or any member of the public regarding the advisability of trading in the Securities. Dow Jones’, CME Index’s and their respective affiliates’ only relationship to UBS is the licensing of certain trademarks and trade names of Dow Jones and of the Index, which is determined, composed and calculated by CME Indexes without regard to UBS or the Securities. Dow Jones and CME Indexes have no obligation to take the needs of UBS or the owners of the Securities into consideration in determining, composing or calculating the Index. Dow Jones, CME Indexes and their respective affiliates are not responsible for and have not participated in the determination of the timing, prices, or quantities of the Securities to be sold or in the determination or calculation of the equation by which the Securities are to be converted into cash. Dow Jones, CME Indexes and their respective affiliates have no obligation or liability in connection with the administration, marketing or trading of the Securities. Notwithstanding the foregoing, CME Group Inc. and its affiliates may independently issue and/or sponsor financial products unrelated to the Securities currently being issued by UBS, but which may be similar to and competitive with the Securities. In addition, CME Group Inc. and its affiliates may trade financial products which are linked to the performance of the Index. It is possible that this trading activity will affect the value of the Index and the Securities.

Disclaimer

DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN AND DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES MAKE NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY UBS, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN. DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL DOW JONES, CME INDEXES OR THEIR RESPECTIVE AFFILIATES HAVE ANY LIABILITY FOR ANY LOST PROFITS OR INDIRECT, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES OR LOSSES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN CME INDEXES AND UBS, OTHER THAN THE LICENSORS OF CME INDEXES.

PS-14

Material U.S. Federal Income Tax Consequences

The United States federal income tax consequences of your investment in the Securities are uncertain. The discussion below supplements the discussion under “U.S. Tax Considerations” in the accompanying prospectus and the discussion under “Material U.S. Federal Income Tax Consequences” on pageS-49 of the accompanying product supplement and is subject to the assumptions, limitations and exceptions set forth therein. Except as otherwise noted under “Non-United States Holders” below, this discussion only applies to you if you are a United States holder, as that term is defined under “Material U.S. Federal Income Tax Consequences” on pageS-49 of the accompanying product supplement.

In the opinion of our counsel, Sullivan & Cromwell LLP, it would be reasonable to treat the Securities as a coupon-bearingpre-paid derivative contract with respect to the Index and the terms of the Securities require you and us (in the absence of a statutory, regulatory, administrative or judicial ruling to the contrary) to treat the Securities for all tax purposes in accordance with such characterization. Under that treatment, (i) you will likely be required to include the Coupon Amounts (including amounts received upon the sale or exchange of the Securities in respect of accrued but unpaid Coupon Amounts) and the Stub Reference Distribution Amount, if any, in ordinary income at the time such amounts accrue or are received, in accordance with your regular method of tax accounting, and (ii) you should generally recognize capital gain or loss upon the sale, exchange, redemption or maturity of your Securities in an amount equal to the difference between the amount realized (other than any amount attributable to accrued but unpaid Coupon Amounts, which will likely be treated as ordinary income) and the amount you paid for your Securities. Such gain or loss should generally be long-term capital gain or loss if you held your Securities for more than one year. In general, your tax basis in your Securities will be equal to the price you paid for them. Capital gain of anon-corporate United States holder is generally taxed at preferential rates where the property is held for more than one year. The deductibility of capital losses is subject to limitations. Your holding period for your Securities will generally begin on the date after the issue date (i.e., the settlement date) for your Securities and, if you hold your Securities until maturity, your holding period will generally include the maturity date.

Under the required tax treatment of the Securities set forth in the previous paragraph, the Coupon Amounts (including amounts received upon the sale or exchange of the Securities in respect of accrued but unpaid Coupon Amounts) and the Stub Reference Distribution Amount, if any, will (i) not be eligible for the special tax rate applicable to “qualified dividends”, notwithstanding that such amounts may be attributable to dividends on the Index Constituent Securities that would have been “qualified dividends” if the Index Constituent Securities had been held directly by an investor in the Securities, and (ii) in the case of a corporate holder of Securities, not be eligible for the dividends received deduction, notwithstanding that such amounts may be attributable to dividends on the Index Constituent Securities that would have been eligible for the dividends received deduction if the Index Constituent Securities had been held directly by a corporate investor in the Securities.

Alternative Treatments. For a discussion of the possible alternative treatments of your Securities, please see the discussion under “Material U.S. Federal Income Tax Consequences — Alternative Treatments” on pageS-51 of the accompanying product supplement.

Non-United States Holders. If you are anon-United States holder, as that term is defined under “Material U.S. Federal Income Tax Consequences —Non-United States Holders” on pageS-53 of the accompanying product supplement, and if your Securities are treated as a coupon-bearingpre-paid derivative contract with respect to the Index, and subject to the discussion of withholdable payments under “Material U.S. Federal Income Tax Consequences — Withholdable Payments to Foreign Financial Entities and Other Foreign Entities” on pageS-53 of the accompanying product supplement and backup

PS-15

Material U.S. Federal Income Tax Consequences

withholding under “Material U.S. Federal Income Tax Consequences —Non-United States Holders” on pageS-53 of the accompanying product supplement, payments on your Securities should not currently be subject to withholding tax. However, the IRS and the Treasury Department have issued proposed regulations under which payments of the Coupon Amount and the Stub Reference Distribution Amount, if any, on the Securities made after December 31, 2013 (and any amount that you receive after such date upon the sale or exchange of your Securities that is attributable to such amounts) could be treated as a “dividend equivalent” payment that is subject to tax at a rate of 30% (or a lower rate under an applicable treaty), which, in the case of any payments that we or other payors make to you, would be collected via withholding. While significant aspects of the application of these regulations to the Securities are uncertain, we intend to withhold at a rate of 30% with respect to payments of the Coupon Amount and the Stub Reference Distribution Amount for which we are the withholding agent (or a lower rate under an applicable treaty), if the proposed regulations are finalized in their current form. We may request that you make certain certifications to us prior to the payment of any Coupon Amount or Stub Reference Distribution Amount on the Securities in order to avoid or minimize withholding obligations, and we could withhold accordingly (subject to your potential right to claim a refund from the IRS) if such certifications were not received or were not satisfactory.If we or other payors decide to impose such withholding tax (or any other withholding tax), we will not be required to pay any additional amounts with respect to amounts so withheld, and we will not be required to take any action in order to enable you to avoid the imposition of such withholding tax. You should consult your tax advisor concerning the potential application of these regulations to payments you receive on the Securities when these regulations are finalized.

Please see the discussion under “Material U.S. Federal Income Tax Consequences —Non-United States Holders” on pageS-53 of the accompanying product supplement for a further discussion of the U.S. federal income tax consequences of acquiring, holding, and disposing of the Securities that may apply to you.

Prospectivenon-United States holders are urged to consult their tax advisors with respect to the tax consequences to them of an investment in the Securities, including any possible alternative characterizations and treatments of the Securities.

PS-16

Supplemental Plan of Distribution

On the Initial Trade Date, we sold $10,000,000 aggregate Principal Amount of Securities to UBS Securities LLC at 100% of their stated Principal Amount. After the Initial Trade Date, from time to time we may sell a portion of the Securities at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. We will receive proceeds equal to 100% of the price at which the Securities are sold to the public, less any commissions paid to UBS Securities LLC. UBS Securities LLC may charge normal commissions in connection with any purchase or sale of the Securities and may receive a portion of the Annual Tracking Fee. Additional Securities may be offered and sold from time to time through UBS Securities LLC, as agent, to investors and to dealers acting as principals for resale to investors. We are not, however, obliged to, and may not, sell the full aggregate principal amount of the Securities. We may suspend or cease sales of the Securities at any time, at our discretion. Sales of the Securities after the Initial Trade Date will be made at market prices prevailing at the time of the sale, at prices related to market prices or at negotiated prices. UBS will receive proceeds equal to 100% of the price at which the Securities are sold to the public less any commissions paid to UBS Securities LLC. UBS Securities LLC may charge normal commissions in connection with any purchase or sale of the Securities. For more information about the plan of distribution and possible market-making activities, see “Plan of Distribution” in the accompanying prospectus.

Broker-dealers may make a market in the Securities, although none of them are obligated to do so and any of them may stop doing so at any time without notice. This prospectus (including this pricing supplement, the accompanying product supplement and the accompanying prospectus) may be used by such dealers in connection withmarket- making transactions. In these transactions, dealers may resell a Security covered by this prospectus that they acquire from us or from other holders after the original offering and sale of the Securities, or they may sell a Security covered by this prospectus in short sale transactions.

As described in more detail under “Use of Proceeds and Hedging” in the accompanying product supplement, we or one of our affiliates may enter into swap agreements or related hedge transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the Securities. UBS and/or its affiliates may earn additional income as a result of payments pursuant to these swap or related hedge transactions.

Broker-dealers and other persons are cautioned that some of their activities may result in their being deemed participants in the distribution of the Securities in a manner that would render them statutory underwriters and subject them to the prospectus delivery and liability provisions of the U.S. Securities Act of 1933. Among other activities, broker-dealers and other persons may make short sales of the Securities and may cover such short positions by borrowing Securities from UBS or its affiliates or by purchasing Securities from UBS or its affiliates subject to its obligation to repurchase such Securities at a later date. As a result of these activities, these market participants may be deemed statutory underwriters. A determination of whether a particular market participant is an underwriter must take into account all the facts and circumstances pertaining to the activities of the participant in the particular case, and the example mentioned above should not be considered a complete description of all the activities that would lead to designation as an underwriter and subject a market participant to the prospectus delivery and liability provisions of the U.S. Securities Act of 1933. This prospectus will be deemed to cover any short sales of Securities by market participants who cover their short positions with Securities borrowed or acquired from us or our affiliates in the manner described above.

UBS reserves the right to pay a portion of the Annual Tracking Rate to UBS Securities LLC and certain broker-dealers in consideration for services relating to the Securities including, but not limited to, promotion and distribution.

PS-17

Supplemental Plan of Distribution

Conflicts of Interest

UBS Securities LLC is an affiliate of UBS and, as such, has a “conflict of interest” in this offering within the meaning of FINRA Rule 5121. In addition, UBS will receive the net proceeds from the offering of the Securities, thus creating an additional conflict of interest within the meaning of Rule 5121. Consequently, the offering is being conducted in compliance with the provisions of Rule 5121. UBS Securities LLC is not permitted to sell Securities in this offering to an account over which it exercises discretionary authority without the prior specific written approval of the account holder.

PS-18

ANNEX A

NOTICE OF EARLY REDEMPTION

To:e-tracsredemptions@ubs.com

Subject: ETRACS Notice of Early Redemption, CUSIP No.: 90268G607

[BODY OF EMAIL]

Name of broker: [ ]

Name of beneficial holder: [ ]

Number of Securities to be redeemed: [ ]

Applicable Redemption Valuation Date: [ ], 20[ ]*

Broker Contact Name: [ ]

Broker Telephone #: [ ]

Broker DTC # (and any relevantsub-account): [ ]

The undersigned acknowledges that in addition to any other requirements specified in the product supplement relating to the Securities being satisfied, the Securities will not be redeemed unless (i) this notice of redemption is delivered to UBS Securities LLC by 12:00 noon (New York City time) on the Trading Day prior to the applicable Redemption Valuation Date; (ii) the confirmation, as completed and signed by the undersigned is delivered to UBS Securities LLC by 5:00 p.m. (New York City time) on the same day the notice of redemption is delivered; (iii) the undersigned has booked a delivery vs. payment (“DVP”) trade on the applicable Redemption Valuation Date, facing UBS Securities LLC DTC 642 and (iv) the undersigned instructs DTC to deliver the DVP trade to UBS Securities LLC as booked for settlement via DTC at or prior to 10:00 a.m. (New York City time) on the applicable Redemption Date.

The undersigned further acknowledges that the undersigned has read the section “Risk Factors — You will not know the Redemption Amount at the time you elect to request that we redeem your Securities” in the product supplement relating to the Securities and the undersigned understands that it will be exposed to market risk on the Redemption Valuation Date.

| * | Subject to adjustment as described in the product supplement relating to the Securities. |

A-1

ANNEX B

BROKER’S CONFIRMATION OF REDEMPTION

[TO BE COMPLETED BY BROKER] Dated:

UBS Securities LLC

UBS Securities LLC, as Calculation Agent

Fax:(203) 719-0943

To Whom It May Concern:

The holder of UBS AG $[ ] Medium-Term Notes, Series A, Exchange Traded Access Securities due May 22, 2042, CUSIP No. 90268G607, redeemable for a cash amount based on the performance of the Dow Jones U.S. Select Dividend IndexSM (the “Securities”) hereby irrevocably elects to receive, on the Redemption Date of[holder to specify],* with respect to the number of Securities indicated below, as of the date hereof, the Redemption Amount as described in the product supplement relating to the Securities, as supplemented by the pricing supplement relating to the Securities (as so supplemented, the “Prospectus”). Terms not defined herein have the meanings given to such terms in the Prospectus.

The undersigned certifies to you that it will (i) book a DVP trade on the applicable Redemption Valuation Date with respect to the number of Securities specified below at a price per Security equal to the Redemption Amount, facing UBS Securities LLC DTC 642 and (ii) deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m. (New York City time) on the applicable Redemption Date.

The undersigned acknowledges that in addition to any other requirements specified in the Prospectus being satisfied, the Securities will not be redeemed unless (i) this confirmation is delivered to UBS Securities LLC by 5:00 p.m. (New York City time) on the same day the notice of redemption is delivered; (ii) the undersigned has booked a DVP trade on the applicable Redemption Valuation Date, facing UBS Securities LLC DTC 642; and (iii) the undersigned will deliver the DVP trade to UBS Securities LLC as booked for settlement via DTC at or prior to 10:00 a.m. (New York City time) on the applicable Redemption Date.

| | |

| | Very truly yours, |

| |

| | [NAME OF DTC PARTICIPANT HOLDER] |

| |

| | |

| | Name: |

| | Title: |

| | Telephone: |

| | Fax: |

| | E-mail: |

Number of Securities surrendered for redemption:

DTC # (and any relevantsub-account):

Contact Name:

Telephone:

Fax:

E-mail:

(At least 50,000 Securities must be redeemed at one time to receive the Redemption Amount on any Redemption Date.)

| * | Subject to adjustment as described in the product supplement relating to the Securities. |

B-1

You should rely only on the information incorporated by reference or provided in this pricing supplement, the accompanying product supplement or the accompanying prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this pricing supplement is accurate as of any date other than the date on the front of the document.

TABLE OF CONTENTS

| | | | |

| Pricing Supplement | | | | |

| |

Risk Factors | | | PS-1 | |

Hypothetical Examples | | | PS-3 | |

The Dow Jones U.S. Select Dividend IndexSM | | | PS-9 | |

Material U.S. Federal Income Tax Consequences | | | PS-15 | |

Supplemental Plan of Distribution | | | PS-17 | |

Conflicts of Interest | | | PS-18 | |

Notice of Early Redemption | | | A-1 | |

| Broker’s Confirmation of Redemption | | | B-1 | |

| |

| Product Supplement | | | | |

| |

| Product Supplement Summary | | | S-1 | |

| Hypothetical Examples | | | S-12 | |

| Risk Factors | | | S-18 | |

| Valuation of the Index and the Securities | | | S-29 | |

| General Terms of the Securities | | | S-31 | |

| Use of Proceeds and Hedging | | | S-48 | |

Material U.S. Federal Income Tax Consequences | | | S-49 | |

| Benefit Plan Investor Considerations | | | S-55 | |

| Supplemental Plan of Distribution | | | S-57 | |

Conflicts of Interest | | | S-57 | |

| Form of Notice of Early Redemption | | | A-1 | |

Form of Broker’s Confirmation of Redemption | | | B-1 | |

| |

| Prospectus | | | | |

| |

| Introduction | | | 1 | |

Cautionary Note Regarding Forward-Looking Statements | | | 3 | |

Incorporation of Information About UBS AG | | | 4 | |

| Where You Can Find More Information | | | 5 | |

| Presentation of Financial Information | | | 6 | |

Limitations on Enforcement of U.S. Laws Against UBS AG, Its Management and Others | | | 6 | |

| UBS | | | 7 | |

Use of Proceeds | | | 9 | |

Description of Debt Securities We May Offer | | | 10 | |

Description of Warrants We May Offer | | | 30 | |

Legal Ownership and Book-Entry Issuance | | | 45 | |

Considerations Relating to Indexed Securities | | | 50 | |

Considerations Relating to Securities Denominated or Payable in or Linked to a Non-U.S. Dollar Currency | | | 53 | |

U.S. Tax Considerations | | | 55 | |

Tax Considerations Under the Laws of Switzerland | | | 66 | |

Benefit Plan Investor Considerations | | | 68 | |

Plan of Distribution | | | 70 | |

Conflicts of Interest | | | 72 | |

Validity of the Securities | | | 73 | |

Experts | | | 73 | |

$100,000,000 ETRACS

Monthly Pay 2×Leveraged

Dow Jones Select Dividend Index ETN due May 22, 2042

Amendment No.1 dated August 5, 2013* to Pricing Supplement dated May 22, 2012

(To Product Supplement dated August 5, 2013 and Prospectus dated January 11, 2012)

UBS Investment Bank