Filed Pursuant to Rule 424(b)(3)

Registration No. 333-178960

CALCULATION OF REGISTRATION FEE

| | | | | | |

Title of Each Class of Securities Offered | | Maximum

Aggregate

Offering Price | | | Amount of

Registration

Fee |

| Debt Securities of UBS AG | | $ | 100,000,000 | | | (1)(2) |

| (1) | Calculated in accordance with Rule 457(r) of the Securities Act of 1933. |

| (2) | Registration fee of $11,460.00 was previously paid as of March 21, 2012 in connection with a Rule 424(b)(2) filing (Registration Statement No. 333-178960). |

| | |

| | Amendment No. 1 dated August 5, 2013* to PRICING SUPPLEMENT dated March 20, 2012 (To Product Supplement dated August 5, 2013 and Prospectus dated January 11, 2012) |

$100,000,000 ETRACS Monthly Pay 2xLeveraged Dow Jones International Real Estate ETN due March 19, 2042

The ETRACS Monthly Pay 2xLeveraged Dow Jones International Real Estate ETN due March 19, 2041 (the “Securities”) are a series of Monthly Pay 2xLeveraged Exchange Traded Access Securities (ETRACS) linked to the Dow Jones Global ex-U.S. Select Real Estate Securities IndexSM (the “Index”). The Securities are senior unsecured debt securities issued by UBS AG (UBS). The Securities provide a monthly compounded two times leveraged long exposure to the performance of the Index, reduced by the Accrued Fees. Because the Securities are two times leveraged with respect to the Index, the Securities may benefit from two times any positive, but will be exposed to two times any negative, monthly compounded performance of the Index. The Securities may pay a monthly coupon during their term linked to two times the cash distributions, if any, on the Index Constituent Securities. You will receive a cash payment at maturity, upon acceleration or upon exercise by UBS of its Call Right based on the monthly compounded leveraged performance of the Index less the Accrued Fees, calculated as described in the accompanying product supplement. You will receive a cash payment upon early redemption based on the monthly compounded leveraged performance of the Index less the Accrued Fees and the Redemption Fee, calculated as described in the accompanying product supplement. Payment at maturity or call, upon acceleration or upon early redemption will be subject to the creditworthiness of UBS. In addition, the actual and perceived creditworthiness of UBS will affect the market value, if any, of the Securities prior to maturity, call, acceleration or early redemption.Investing in the Securities involves significant risks. You may lose some or all of your principal at maturity, early redemption, acceleration or upon exercise by UBS of its call right if the monthly compounded leveraged return of the Index is not sufficient to offset the negative effect of the Accrued Fees and the Redemption Fee, if applicable.

The general terms of the Monthly Pay 2xLeveraged ETRACS are described in the accompanying product supplement under the heading “General Terms of the Securities”, beginning on page S-31 in the product supplement. These general terms include, among others, the manner in which any payments on the Securities will be calculated, such as the Cash Settlement Amount at Maturity, the Redemption Amount, the Call Settlement Amount or the Acceleration Amount, as applicable, and the Coupon Amount, if any. These general terms are supplemented and/or modified by the specific terms of the Securities listed below and in “Additional Terms of the Securities” on page PS-24 of this pricing supplement. Capitalized terms used herein but not otherwise defined have the meanings specified in the accompanying product supplement.

Issuer: | UBS AG (London Branch) |

Initial Trade Date: | March 20, 2012 |

Initial Settlement Date: | March 23, 2012 |

Term: | 30 years, subject to your right to receive payment for your Securities upon redemption, acceleration upon minimum indicative value or exercise of the UBS Call Right, each as described in the accompanying product supplement. |

Denomination/Principal Amount: | $25.00 per Security |

Maturity Date: | March 19, 2042, subject to adjustment |

Coupon Payment Dates: | The 15th Trading Day following each Coupon Valuation Date, commencing on April 23, 2012 (subject to adjustment). The final Coupon Payment Date will be the Maturity Date. |

Initial Coupon Valuation Date: | March 30, 2012 |

Underlying Index: | The return on the Securities is linked to the performance of the Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM. The Index represents real estate investment trusts and real estate operating companies traded globally, excluding the United States. See “The Dow Jones Globalex-U.S. Select Real Estate Securities Index”. |

Annual Tracking Rate: | 0.60% per annum |

Financing Spread: | 0.40% per annum |

First Redemption Date: | March 30, 2012 |

Final Redemption Date: | March 12, 2042 |

First Call Settlement Date: | The first date that UBS may exercise its Call Right was March 25, 2013. |

Monthly Initial Closing Level for the Initial Calendar Month: | 2603.68, the Index Closing Level (as defined in the accompanying product supplement) on the Initial Trade Date |

Monthly Reset Dates: | For each calendar month, the Monthly Reset Date is the first Trading Day of that month beginning on April 1, 2012 and ending on March 1, 2042, subject to adjustment. |

Monthly Valuation Dates: | For each Monthly Reset Date, the Monthly Valuation Date is the last Trading Day of the previous calendar month, beginning on March 31, 2012 and ending on February 28, 2042, subject to adjustment. |

See “Risk Factors” beginning on page PS-1 of this pricing supplement and on pageS-18 of the accompanying product supplement for risks related to an investment in the Securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement, the accompanying product supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | |

| UBS Investment Bank | | (cover continued on next page) |

Pricing Supplement dated August 5, 2013

Index Calculation Agent: | Dow Jones Indexes |

Listing: | The Securities are listed on the NYSE Arca under the symbol “RWXL”. |

Calculation Date: | March 10, 2042, unless that day is not a Trading Day, in which case the Calculation Date will be the next Trading Day, subject to adjustment. |

Index Symbol: | DWXRS (Bloomberg); .DWXRS (Thomson Reuters) |

Intraday Indicative Value Symbol: | RWXLIV |

On the Initial Trade Date, we sold $10,000,000 aggregate Principal Amount of Securities to UBS Securities LLC at 100% of their stated Principal Amount. After the Initial Trade Date, from time to time we may sell a portion of the Securities at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices. We will receive proceeds equal to 100% of the price at which the Securities are sold to the public, less any commissions paid to UBS Securities LLC. UBS Securities LLC may charge normal commissions in connection with any purchase or sale of the Securities and may receive a portion of the Annual Tracking Fee. Please see “Supplemental Plan of Distribution” on pagePS-27 for more information.

We may use this pricing supplement, the accompanying product supplement and the accompanying prospectus in the initial sale of the Securities. In addition, UBS Securities LLC or another of our affiliates may use this pricing supplement, the accompanying product supplement and the accompanying prospectus in market-making transactions in any Securities after their initial sale.Unless we or our agent informs you otherwise in the confirmation of sale or in a notice delivered at the same time as the confirmation of sale, this prospectus, the accompanying product supplement and the accompanying prospectus are being used in a market-making transaction.

The Securities are not deposit liabilities of UBS AG and are not FDIC insured.

| * | This Amendment No. 1 to the pricing supplement dated March 20, 2012 (as amended, the “pricing supplement”) is being filed for the purpose of (i) reflecting the execution of the Fourth Supplemental Indenture, dated August 5, 2013, which modified the definition of Call Settlement Date, (ii) referencing the new Product Supplement, filed on August 5, 2013, which replaced the Product Supplement dated March 20, 2012 and (ii) updating “The Dow Jones Global ex-U.S. Select Real Estate Securities IndexSM” and “Material U.S. Federal Income Tax Consequences”. |

UBS has filed a registration statement (including a prospectus as supplemented by a product supplement) with the Securities and Exchange Commission, or SEC, for the offering to which this pricing supplement relates. Before you invest, you should read these documents and any other documents relating to this offering that UBS has filed with the SEC for more complete information about UBS and this offering. You may obtain these documents for free from the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC web site is 0001114446. Alternatively, UBS will arrange to send you these documents if you so request by calling toll-free800-722-7370.

You may access these documents on the SEC website at www.sec.gov as follows:

Prospectus dated January 11, 2012:

http://www.sec.gov/Archives/edgar/data/1114446/000119312512008669/d279364d424b3.htm

Product Supplement dated August 5, 2013:

http://www.sec.gov/Archives/edgar/data/1114446/000119312513318895/d578411d424b2.htm

References to “UBS,” “we,” “our” and “us” refer only to UBS AG and not to its consolidated subsidiaries. Also, references to the “accompanying prospectus” mean the UBS prospectus titled “Debt Securities and Warrants,” dated January 11, 2012, and references to the “accompanying product supplement” mean the UBS product supplement “UBS AG Monthly Pay 2xLeveraged Exchange Traded Access Securities (ETRACS),” dated August 5, 2013.

You should rely only on the information incorporated by reference or provided in this pricing supplement, the accompanying product supplement or the accompanying prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of the Securities in any state where the offer is not permitted. You should not assume that the information in this pricing supplement, the accompanying product supplement or the accompanying prospectus is accurate as of any date other than the date on the front of the document.

UBS reserves the right to change the terms of, or reject any offer to purchase, the Securities prior to their issuance. In the event of any changes to the terms of the Securities, UBS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case UBS may reject your offer to purchase.

-i-

Risk Factors

Your investment in the Securities will involve significant risks. The Securities are not secured debt and are significantly riskier than ordinary unsecured debt securities. Unlike ordinary debt securities, the return on the Securities is linked to the performance of the Index. The Securities are two times leveraged with respect to the Index and, as a result, may benefit from two times any positive, but will be exposed to two times any negative, monthly performance of the Index. As described in more detail below, the trading price of the Securities may vary considerably before the Maturity Date, due to events that are difficult to predict and beyond our control. Investing in the Securities is not equivalent to investing directly in the Index Constituent Securities (as defined in the accompanying product supplement) or the Index itself.We urge you to read the following information about these risks as well as the risks described under “Risk Factors” in the accompanying product supplement and “Considerations Relating to Indexed Securities” in the accompanying prospectus, together with the other information in this pricing supplement, the accompanying product supplement and the accompanying prospectus, before investing in the Securities.

The Index is concentrated in the global real estate industry, excluding the United States.

The Index Constituent Securities are concentrated in the global real estate sector, excluding the United States, which means the Index, and, consequently, the Securities, will be more affected by the performance of the global,non-U.S. real estate sector than an Index that was more diversified. Moreover, the Index is different than an Index that tracks U.S. real estate securities. Adverse economic, business, political or social developments affecting international real estate could have a major effect on the Index Closing Level, the Index Valuation Level (as defined in the accompanying product supplement) and the return on the Securities. Those factors include:

| | Ø | | decreases in real estate values; |

| | Ø | | other risks related to local or general economic conditions; |

| | Ø | | increases in operating costs and property taxes; |

| | Ø | | changes in zoning laws; |

| | Ø | | casualty or condemnation losses; |

| | Ø | | possible environmental liabilities; |

| | Ø | | regulatory limitations on rent; and |

| | Ø | | fluctuations in rental income. |

Certain real estate securities have a relatively small market capitalization, which may tend to increase the volatility of the market price of these securities. Real estate securities are dependent upon specialized management skills, have limited diversification and are, therefore, subject to risks inherent in operating and financing a limited number of projects. Real estate securities are also subject to heavy cash flow dependency and defaults by borrowers.

The Index Constituent Securities are subject to foreign currency exchange rate risk.

The Index Calculation Agent will convert each Index Constituent Security’s closing price on its primary market to U.S. dollars using the official WM/Reuters closing currency spot rate calculated at or around 4:00 p.m. U.K. time in order to determine the Index Closing Level. A Security holder’s net exposure will

PS-1

Risk Factors

depend on the extent to which the currencies represented in the Index strengthen or weaken against the U.S. dollar and the relative weight of each relevant currency represented in the Index. If, taking into account such weighting, the dollar strengthens against the component currencies of the various Index Constituent Securities, the value of the Index (as measured by the Index Valuation Level) will be adversely affected and the amount payable at maturity or call, upon acceleration or upon early redemption may be reduced.

Foreign currency exchange rates vary over time, and may vary considerably during the term of the Securities. Changes in a particular exchange rate result from the interaction of many factors directly or indirectly affecting economic and political conditions. Of particular importance are:

| | Ø | | the balance of payments among countries; |

| | Ø | | the extent of government surpluses or deficits in the relevant foreign country and the United States; |

| | Ø | | government or central bank intervention, or intervention by supranational entities, in each case in the foreign exchange or other financial markets; and |

| | Ø | | other financial, economic, military and political factors. |

All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the governments of the relevant foreign countries and the United States and other countries important to international trade and finance.

The intraday indicative value of the Securities and payment at maturity or call, upon acceleration or upon early redemption could also be adversely affected by delays in, or refusals to grant, any required governmental approval for conversions of a local currency and remittances abroad with respect to the relevant Index Constituent Securities or other de facto restrictions on the repatriation of U.S. dollars.

The Coupon Amount, Reference Distribution Amount and Stub Reference Distribution Amount are subject to exchange rate risk.

The Reference Distribution Amount and the Stub Reference Distribution Amount (each as defined in the accompanying product supplement) are calculated based on the cash distributions, if any, of the Index Constituent Securities. Coupon Amounts (as defined in the accompanying product supplement), if any, are based on the Reference Distribution Amount and will be paid in U.S. dollars. Because some of the cash distributions on the Index Constituent Securities will be paid innon-U.S. dollar currencies, they will be converted into U.S. dollars by the Calculation Agent as described in this pricing supplement under “Additional Terms of the Securities” and, consequently, will be subject to exchange rate risk.

Your exposure to exchange rate risk will depend on the extent to which thenon-U.S. dollar currency strengthens or weakens against the U.S. dollar. If the U.S. dollar strengthens against the relevantnon-U.S. dollar currency, the U.S. dollar value of the Index Constituent Security’s cash distributions will be adversely affected and the Coupon Amount, Reference Distribution Amount and Stub Reference Distribution Amount will be reduced.

Foreign currency exchange rates vary over time, and may vary considerably during the term of any series of the Securities. Changes in a particular exchange rate result from the interaction of many factors directly or indirectly affecting economic and political conditions. Of particular importance are:

| | Ø | | the balance of payments among countries; |

PS-2

Risk Factors

| | Ø | | the extent of government surpluses or deficits in the relevant foreign country and the United States; |

| | Ø | | government or central bank intervention, or intervention by supranational entities, in each case in the foreign exchange or other financial markets; and |

| | Ø | | other financial, economic, military and political factors. |

All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the governments of the relevant foreign countries and the United States and other countries important to international trade and finance. See “Additional Terms of the Securities” for more information about cash distributions.

The calculation of the Reference Distribution Amount and Stub Reference Distribution Amount may have to take into account withholding taxes, consequently reducing the Coupon Amount.

As discussed above, the Reference Distribution Amount and the Stub Reference Distribution Amount are calculated based on the cash distributions, if any, on the Index Constituent Securities. Such cash distributions may be adjusted to account for withholding taxes imposed by the taxing authority of the applicable Index Constituent. Such taxes could reduce any potential Coupon Amount. In the event that the calculation of the Reference Distribution Amount or the Stub Reference Distribution Amount is affected by any applicable withholding taxes, UBS will not compensate for those withholding taxes by paying the additional amounts described in the accompanying prospectus under “Description of Debt Securities We May Offer — Payment of Additional Amounts”.

Even though currencies tradearound-the-clock, the Securities will not.

As discussed above, the closing levels for the Index Constituent Securities on their primary markets are adjusted by the Index Calculation Agent to reflect their U.S. dollar value in calculating the Index Closing Level. Similarly, anynon-U.S. dollar currencies in which the cash distributions on the Index Constituent Securities are paid will be converted into U.S. dollars in calculating the Coupon Amount. The interbank market in foreign currencies is a global,around-the-clock market. Therefore, the hours of trading for the Securities, if any trading market develops, will not conform to the hours during which the currencies in which the Index Constituent Securities or the cash distributions thereon are denominated or in which the Index Constituent Securities. Significant price and rate movements may take place in the underlying foreign currency exchange markets that will not be reflected immediately in the price of your Securities. The possibility of these movements should be taken into account in relating the value of your Securities to those in the underlying foreign currency exchange markets. There is no systematic reporting of last-sale information for foreign currencies. Reasonably current bid and offer information is available in certain brokers’ offices, in bank foreign currency trading offices and to others who wish to subscribe for this information, but this information will not necessarily be reflected in the Index Closing Level, Index Valuation Level or the Coupon Amount. There is no regulatory requirement that those quotations be firm or revised on a timely basis. The absence of last-sale information and the limited availability of quotations to individual investors may make it difficult for many investors to obtain timely, accurate data about the state of the underlying foreign currency exchange markets.

Intervention in the foreign currency exchange markets by the countries issuing any currency of an Index Constituent Security could materially and adversely affect the value of the Securities and the Coupon Amount.

Specific foreign currencies’ exchange rates are volatile and are affected by numerous factors specific to each foreign country. Foreign currency exchange rates can be fixed by the sovereign government, allowed to float within a range of exchange rates set by the government, or left to float freely. Governments, including those issuing the currencies in which the Index Constituent Securities trade, use a variety of

PS-3

Risk Factors

techniques, such as intervention by their central bank or imposition of regulatory controls or taxes, to affect the exchange rates of their respective currencies. Currency developments may occur in any of the countries issuing the currencies in which the Index Constituent Securities trade and in which the cash distributions on the Index Constituent Securities are made. Often, these currency developments impact foreign currency exchange rates in ways that cannot be predicted.

Governments may also issue a new currency to replace an existing currency, fix the exchange rate or alter the exchange rate or relative exchange characteristics by devaluation or revaluation of a currency. Thus, a special risk in purchasing the Securities is that their liquidity, trading value and payment amount could be affected by the actions of sovereign governments that could change or interfere with previously freely determined currency valuations, fluctuations in response to other market forces and the movement of currencies across borders.

The Calculation Agent is not obligated to make any offsetting adjustment or change in the event of any other devaluation or revaluation or imposition of exchange or other regulatory controls or taxes or in the event of other developments affecting Index Constituent Securities whose closing prices on their primary markets are converted into U.S. dollars by the Index Calculation Agent. The Calculation Agent is also not obligated to make any such offsetting adjustment or change with respect to cash distributions on the Index Constituent Securities, if such cash distribution are made innon-U.S. dollar currencies, when calculating the Reference Distribution Amount, Stub Reference Distribution Amount or Coupon Amount.

Suspensions or disruptions in market trading in one or more foreign currencies may adversely affect the value of the Securities and the Coupon Amount.

The foreign currency exchange markets are subject to temporary distortions or other disruptions due to various factors, including government regulation and intervention, the lack of liquidity in the markets and the participation of speculators. Because the closing levels for the Index Constituent Securities on their primary markets are adjusted by the Index Calculation Agent to reflect their U.S. dollar value in calculating the Index Closing Level, these circumstances could adversely affect the relevant foreign currency exchange rates and, therefore, the amount payable at maturity or call, upon acceleration or upon early redemption may be reduced. Those same circumstances could also cause an adverse effect on the Coupon Amount, if any.

The Securities are exposed to risks associated with foreign securities markets.

The Index is comprised of stocks issued by foreign companies. You should be aware that investments in securities linked to the value of foreign equity securities involve particular risks. The foreign securities markets in which the Index Constituent Securities trade may have less liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information about foreign companies than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange Commission, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies.

Securities prices in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors, which could negatively affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies,

PS-4

Risk Factors

the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural disaster or adverse public health development in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency.

Certain of the countries in which the primary market for any Index Constituent Security is located may be considered to be countries with emerging market economies. Countries with emerging market economies may have relatively less stable governments, may present the risks of nationalization of businesses, restrictions on foreign ownership and prohibitions on the repatriation of assets, and may have less protection of property rights than more developed countries. Emerging market economies may be based on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. Local securities markets may trade a small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times.

UBS and its affiliates have no affiliation with the Index Sponsor and are not responsible for its public disclosure of information.

We and our affiliates are not affiliated with the Index Sponsor (except for licensing arrangements discussed under “Dow Jones Globalex-U.S. Real Estate Securities Index — License Agreement”) and have no ability to control or predict its actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the Index. If the Index Sponsor discontinues or suspends the calculation of the Index, it may become difficult to determine the market value of the Securities and the payment at maturity or call, upon acceleration or upon early redemption. The Calculation Agent may designate a successor index in its sole discretion. If the Calculation Agent determines in its sole discretion that no successor index comparable to the Index exists, the payment you receive at maturity or call, upon acceleration or upon early redemption will be determined by the Calculation Agent in its sole discretion. See “General Terms of the Securities — Market Disruption Event” and “ — Calculation Agent” in the accompanying product supplement. The Index Sponsor is not involved in the offer of the Securities in any way and has no obligation to consider your interest as an owner of the Securities in taking any actions that might affect the market value of your Securities.

We have derived the information about the Index Sponsor and the Index from publicly available information, without independent verification. Neither we nor any of our affiliates assume any responsibility for the adequacy or accuracy of the information about the Index Sponsor or the Index contained in this pricing supplement.You, as an investor in the Securities, should make your own independent investigation into the Index Sponsor and the Index.

Significant aspects of the tax treatment of the Securities are uncertain.

Significant aspects of the tax treatment of the Securities are uncertain. We do not plan to request a ruling from the Internal Revenue Service (“IRS”) regarding the tax treatment of the Securities, and the IRS or a court may not agree with the tax treatment described in this pricing supplement. Please read carefully the section entitled “Material U.S. Federal Income Tax Consequences” on pagePS-25. You should consult your tax advisor about your own tax situation.

The IRS released a notice in 2007 that may affect the taxation of holders of the Securities. According to the notice, the IRS and the Treasury Department are actively considering, among other things, whether holders of instruments such as the Securities should be required to accrue ordinary income on a current

PS-5

Risk Factors

basis, whether additional gain or loss upon the sale, exchange, redemption or maturity of such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax on any deemed income accruals, and whether the special “constructive ownership rules” of Section 1260 of the Internal Revenue Code of 1986, as amended, should be applied to such instruments. Similarly, the IRS and the Treasury Department have current projects open with regard to the tax treatment ofpre-paid forward contracts and contingent notional principal contracts. While it is impossible to anticipate how any ultimate guidance would affect the tax treatment of instruments such as the Securities (and while any such guidance may be issued on a prospective basis only), such guidance could be applied retroactively and could in any case increase the likelihood that you will be required to accrue income over the term of an instrument such as the Securities. The outcome of this process is uncertain.

Furthermore, in 2007, legislation was introduced in Congress that, if enacted, would have required holders of the Securities purchased after the bill was enacted to accrue interest income over the term of the Securities despite the fact that there will be no interest payments over the term of the Securities. It is not possible to predict whether a similar or identical bill will be enacted in the future and whether any such bill would affect the tax treatment of your Securities.

Holders are urged to consult their tax advisors concerning the significance and the potential impact of the above considerations. We intend to treat your Securities for United States federal income tax purposes in accordance with the treatment described above and under “Material U.S. Federal Income Tax Consequences” on page PS-25 unless and until such time as there is a change in law or the Treasury Department or IRS determines that some other treatment is more appropriate.

PS-6

Hypothetical Examples

The following four examples illustrate how the Securities would perform at maturity or call, or upon early redemption, in hypothetical circumstances. We have included an example in which the Index Closing Level increases at a constant rate of 3.00% per month for twelve months (Example 1), as well as an example in which the Index Closing Level decreases at a constant rate of 3.00% per month for twelve months (Example 2). In addition, Example 3 shows the Index Closing Level increasing by 3.00% per month for the first six months and then decreasing by 3.00% per month for the next 6 months, whereas Example 4 shows the reverse scenario of the Index Closing Level decreasing by 3.00% per month for the first six months, and then increasing by 3.00% per month for the next six months. For ease of analysis and presentation,the following four examples assume that the term of the Securities is twelve months, the last Trading Day of the Call Measurement Period, or the Redemption Valuation Date, occurs on the month end, that no acceleration upon minimum indicative value has occurred, no Coupon Amount has been paid during the term of the Securities and that no Stub Reference Distribution Amount was paid at maturity, call or upon early redemption.

The following assumptions are used in each of the four examples:

| Ø | | the initial level for the Index is 2500; |

| Ø | | the Redemption Fee Rate is 0.125%; |

| Ø | | the Financing Rate (as defined in the accompanying product supplement) is 0.90%; |

| Ø | | the Current Principal Amount (as defined in the accompanying product supplement) on the first day is $25.00; and |

| Ø | | the Annual Tracking Rate (as defined in the accompanying product supplement) is 0.60%. |

The examples highlight the effect of two times leverage and monthly compounding, and the impact of the Accrued Fees (as defined in the accompanying product supplement) on the payment at maturity or call, or upon early redemption, under different circumstances. The assumed Financing Rate is not an indication of the Financing Rate throughout the term of the Securities. The Financing Rate will change during the term of the Securities, which will affect the performance of the Securities.

Because the Accrued Fees take into account the monthly performance of the Index, as measured by the Index Closing Level, the absolute level of the Accrued Fees are dependent on the path taken by the Index Closing Level to arrive at its ending level. The figures in these examples have been rounded for convenience. The Cash Settlement Amount figures for month twelve are as of the hypothetical Calculation Date, and given the indicated assumptions, a holder will receive payment at maturity in the indicated amount, according to the indicated formula.

PS-7

Hypothetical Examples

Example 1: The Index Closing Level increases at a constant rate of 3.00% per month for twelve months.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ((Index Closing

Level-

Monthly Initial

Closing Level)/

Monthly Initial

Closing Level) | | | (1 +(2 x

C)) | | | (Previous

Current

Principal

Amount x

Financing

Rate x

Act/360) | | | (Previous

Current

Principal

Amount

x D)* | | | (Annual

Tracking

Rate x F x

Act/365) | | | (E + G) | | | ((Previous

Current

Principal

Amount x D)-

H) | | | (I -

Redemption

Fee) | |

| 1 | | | 2575.00 | | | | 0.0300 | | | | 1.060 | | | | 0.0188 | | | $ | 26.50 | | | $ | 0.0131 | | | $ | 0.0318 | | | $ | 26.47 | | | $ | 26.4369 | |

| 2 | | | 2652.25 | | | | 0.0300 | | | | 1.060 | | | | 0.0199 | | | $ | 28.06 | | | $ | 0.0138 | | | $ | 0.0337 | | | $ | 28.02 | | | $ | 27.9895 | |

| 3 | | | 2731.82 | | | | 0.0300 | | | | 1.060 | | | | 0.0210 | | | $ | 29.70 | | | $ | 0.0146 | | | $ | 0.0357 | | | $ | 29.67 | | | $ | 29.6332 | |

| 4 | | | 2813.77 | | | | 0.0300 | | | | 1.060 | | | | 0.0223 | | | $ | 31.45 | | | $ | 0.0155 | | | $ | 0.0378 | | | $ | 31.41 | | | $ | 31.3735 | |

| 5 | | | 2898.19 | | | | 0.0300 | | | | 1.060 | | | | 0.0236 | | | $ | 33.30 | | | $ | 0.0164 | | | $ | 0.0400 | | | $ | 33.26 | | | $ | 33.2160 | |

| 6 | | | 2985.13 | | | | 0.0300 | | | | 1.060 | | | | 0.0249 | | | $ | 35.25 | | | $ | 0.0174 | | | $ | 0.0423 | | | $ | 35.21 | | | $ | 35.1667 | |

| 7 | | | 3074.68 | | | | 0.0300 | | | | 1.060 | | | | 0.0264 | | | $ | 37.32 | | | $ | 0.0184 | | | $ | 0.0448 | | | $ | 37.28 | | | $ | 37.2319 | |

| 8 | | | 3166.93 | | | | 0.0300 | | | | 1.060 | | | | 0.0280 | | | $ | 39.51 | | | $ | 0.0195 | | | $ | 0.0474 | | | $ | 39.47 | | | $ | 39.4185 | |

| 9 | | | 3261.93 | | | | 0.0300 | | | | 1.060 | | | | 0.0296 | | | $ | 41.83 | | | $ | 0.0206 | | | $ | 0.0502 | | | $ | 41.78 | | | $ | 41.7334 | |

| 10 | | | 3359.79 | | | | 0.0300 | | | | 1.060 | | | | 0.0313 | | | $ | 44.29 | | | $ | 0.0218 | | | $ | 0.0532 | | | $ | 44.24 | | | $ | 44.1843 | |

| 11 | | | 3460.58 | | | | 0.0300 | | | | 1.060 | | | | 0.0332 | | | $ | 46.89 | | | $ | 0.0231 | | | $ | 0.0563 | | | $ | 46.83 | | | $ | 46.7791 | |

| 12 | | | 3564.40 | | | | 0.0300 | | | | 1.060 | | | | 0.0351 | | | $ | 49.64 | | | $ | 0.0245 | | | $ | 0.0596 | | | $ | 49.58 | | | $ | 49.5263 | |

| Cumulative Index Return: | | | | 42.58% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | 98.34% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge are calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-8

Hypothetical Examples

Example 2: The Index Closing Level decreases at a constant rate of 3.00% per month for twelve months.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ((Index Closing

Level-

Monthly Initial

Closing Level)/

Monthly Initial

Closing Level) | | | (1 + (2 x

C )) | | | (Previous

Current

Principal

Amount x

Financing

Rate x

Act/360) | | | (Previous

Current

Principal

Amount

x D)* | | | (Annual

Tracking

Rate x F x

Act/365) | | | (E + G) | | | ((Previous

Current

Principal

Amount x D)-

H) | | | (I -

Redemption

Fee) | |

| 1 | | | 2425.00 | | | | -0.0300 | | | | 0.940 | | | | 0.0188 | | | $ | 23.50 | | | $ | 0.0116 | | | $ | 0.0303 | | | $ | 23.47 | | | $ | 23.4384 | |

| 2 | | | 2352.25 | | | | -0.0300 | | | | 0.940 | | | | 0.0176 | | | $ | 22.06 | | | $ | 0.0109 | | | $ | 0.0285 | | | $ | 22.03 | | | $ | 22.0037 | |

| 3 | | | 2281.68 | | | | -0.0300 | | | | 0.940 | | | | 0.0165 | | | $ | 20.71 | | | $ | 0.0102 | | | $ | 0.0267 | | | $ | 20.68 | | | $ | 20.6567 | |

| 4 | | | 2213.23 | | | | -0.0300 | | | | 0.940 | | | | 0.0155 | | | $ | 19.44 | | | $ | 0.0096 | | | $ | 0.0251 | | | $ | 19.42 | | | $ | 19.3923 | |

| 5 | | | 2146.84 | | | | -0.0300 | | | | 0.940 | | | | 0.0146 | | | $ | 18.25 | | | $ | 0.0090 | | | $ | 0.0236 | | | $ | 18.23 | | | $ | 18.2052 | |

| 6 | | | 2082.43 | | | | -0.0300 | | | | 0.940 | | | | 0.0137 | | | $ | 17.14 | | | $ | 0.0085 | | | $ | 0.0221 | | | $ | 17.11 | | | $ | 17.0908 | |

| 7 | | | 2019.96 | | | | -0.0300 | | | | 0.940 | | | | 0.0128 | | | $ | 16.09 | | | $ | 0.0079 | | | $ | 0.0208 | | | $ | 16.07 | | | $ | 16.0446 | |

| 8 | | | 1959.36 | | | | -0.0300 | | | | 0.940 | | | | 0.0120 | | | $ | 15.10 | | | $ | 0.0074 | | | $ | 0.0195 | | | $ | 15.08 | | | $ | 15.0625 | |

| 9 | | | 1900.58 | | | | -0.0300 | | | | 0.940 | | | | 0.0113 | | | $ | 14.18 | | | $ | 0.0070 | | | $ | 0.0183 | | | $ | 14.16 | | | $ | 14.1404 | |

| 10 | | | 1843.56 | | | | -0.0300 | | | | 0.940 | | | | 0.0106 | | | $ | 13.31 | | | $ | 0.0066 | | | $ | 0.0172 | | | $ | 13.29 | | | $ | 13.2748 | |

| 11 | | | 1788.25 | | | | -0.0300 | | | | 0.940 | | | | 0.0100 | | | $ | 12.49 | | | $ | 0.0062 | | | $ | 0.0161 | | | $ | 12.48 | | | $ | 12.4622 | |

| 12 | | | 1734.61 | | | | -0.0300 | | | | 0.940 | | | | 0.0094 | | | $ | 11.73 | | | $ | 0.0058 | | | $ | 0.0151 | | | $ | 11.71 | | | $ | 11.6994 | |

| Cumulative Index Return: | | | | -30.62% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | -53.14% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge are calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-9

Hypothetical Examples

Example 3: The Index Closing Level increases by 3.00% per month for the first six months and then decreases by 3.00% per month for the next 6 months.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ((Index Closing

Level-

Monthly Initial

Closing Level)/

Monthly Initial

Closing Level) | | | (1 + (2 x

C )) | | | (Previous

Current

Principal

Amount x

Financing

Rate x

Act/360) | | | (Previous

Current

Principal

Amount

x D)* | | | (Annual

Tracking

Rate x F x

Act/365) | | | (E + G) | | | ((Previous

Current

Principal

Amount x D)-

H) | | | (I -

Redemption

Fee ) | |

| 1 | | | 2575.00 | | | | 0.0300 | | | | 1.060 | | | | 0.0188 | | | $ | 26.50 | | | $ | 0.0131 | | | $ | 0.0318 | | | $ | 26.47 | | | $ | 26.4369 | |

| 2 | | | 2652.25 | | | | 0.0300 | | | | 1.060 | | | | 0.0199 | | | $ | 28.06 | | | $ | 0.0138 | | | $ | 0.0337 | | | $ | 28.02 | | | $ | 27.9895 | |

| 3 | | | 2731.82 | | | | 0.0300 | | | | 1.060 | | | | 0.0210 | | | $ | 29.70 | | | $ | 0.0146 | | | $ | 0.0357 | | | $ | 29.67 | | | $ | 29.6332 | |

| 4 | | | 2813.77 | | | | 0.0300 | | | | 1.060 | | | | 0.0223 | | | $ | 31.45 | | | $ | 0.0155 | | | $ | 0.0378 | | | $ | 31.41 | | | $ | 31.3735 | |

| 5 | | | 2898.19 | | | | 0.0300 | | | | 1.060 | | | | 0.0236 | | | $ | 33.30 | | | $ | 0.0164 | | | $ | 0.0400 | | | $ | 33.26 | | | $ | 33.2160 | |

| 6 | | | 2985.13 | | | | 0.0300 | | | | 1.060 | | | | 0.0249 | | | $ | 35.25 | | | $ | 0.0174 | | | $ | 0.0423 | | | $ | 35.21 | | | $ | 35.1667 | |

| 7 | | | 2895.58 | | | | -0.0300 | | | | 0.940 | | | | 0.0264 | | | $ | 33.10 | | | $ | 0.0163 | | | $ | 0.0427 | | | $ | 33.05 | | | $ | 33.0090 | |

| 8 | | | 2808.71 | | | | -0.0300 | | | | 0.940 | | | | 0.0248 | | | $ | 31.07 | | | $ | 0.0153 | | | $ | 0.0401 | | | $ | 31.03 | | | $ | 30.9884 | |

| 9 | | | 2724.45 | | | | -0.0300 | | | | 0.940 | | | | 0.0233 | | | $ | 29.17 | | | $ | 0.0144 | | | $ | 0.0377 | | | $ | 29.13 | | | $ | 29.0915 | |

| 10 | | | 2642.71 | | | | -0.0300 | | | | 0.940 | | | | 0.0218 | | | $ | 27.38 | | | $ | 0.0135 | | | $ | 0.0354 | | | $ | 27.35 | | | $ | 27.3107 | |

| 11 | | | 2563.43 | | | | -0.0300 | | | | 0.940 | | | | 0.0205 | | | $ | 25.71 | | | $ | 0.0127 | | | $ | 0.0332 | | | $ | 25.67 | | | $ | 25.6389 | |

| 12 | | | 2486.53 | | | | -0.0300 | | | | 0.940 | | | | 0.0193 | | | $ | 24.13 | | | $ | 0.0119 | | | $ | 0.0312 | | | $ | 24.10 | | | $ | 24.0695 | |

| Cumulative Index Return: | | | | -0.54% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | -3.59% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge are calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-10

Hypothetical Examples

Example 4: The Index Closing Level decreases by 3.00% per month for the first six months, and then increases by 3.00% per month for the next six months.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Month End | | Index Closing

Level* | | | Index

Performance

Ratio | | | Index

Factor | | | Accrued

Financing

Charge

for the

Applicable

Month** | | | Current

Indicative

Value | | | Accrued

Tracking

Fee for the

Applicable

Month*** | | | Accrued

Fees for

the

Applicable

Month | | | Current

Principal

Amount#^**** | | | Redemption

Amount | |

A | | B | | | C | | | D | | | E | | | F | | | G | | | H | | | I | | | J | |

| | | | | ((Index Closing

Level-

Monthly Initial

Closing Level)/

Monthly Initial

Closing Level) | | | (1 + (2 x

C)) | | | (Previous

Current

Principal

Amount x

Financing

Rate x

Act/360) | | | (Previous

Current

Principal

Amount

x D)* | | | (Annual

Tracking

Rate x F x

Act/365) | | | (E + G) | | | ((Previous

Current

Principal

Amount x D)-

H) | | | (I-

Redemption

Fee) | |

| 1 | | | 2425.00 | | | | -0.0300 | | | | 0.940 | | | | 0.0188 | | | $ | 23.50 | | | $ | 0.0116 | | | $ | 0.0303 | | | $ | 23.47 | | | $ | 23.4384 | |

| 2 | | | 2352.25 | | | | -0.0300 | | | | 0.940 | | | | 0.0176 | | | $ | 22.06 | | | $ | 0.0109 | | | $ | 0.0285 | | | $ | 22.03 | | | $ | 22.0037 | |

| 3 | | | 2281.68 | | | | -0.0300 | | | | 0.940 | | | | 0.0165 | | | $ | 20.71 | | | $ | 0.0102 | | | $ | 0.0267 | | | $ | 20.68 | | | $ | 20.6567 | |

| 4 | | | 2213.23 | | | | -0.0300 | | | | 0.940 | | | | 0.0155 | | | $ | 19.44 | | | $ | 0.0096 | | | $ | 0.0251 | | | $ | 19.42 | | | $ | 19.3923 | |

| 5 | | | 2146.84 | | | | -0.0300 | | | | 0.940 | | | | 0.0146 | | | $ | 18.25 | | | $ | 0.0090 | | | $ | 0.0236 | | | $ | 18.23 | | | $ | 18.2052 | |

| 6 | | | 2082.43 | | | | -0.0300 | | | | 0.940 | | | | 0.0137 | | | $ | 17.14 | | | $ | 0.0085 | | | $ | 0.0221 | | | $ | 17.11 | | | $ | 17.0908 | |

| 7 | | | 2144.90 | | | | 0.0300 | | | | 1.060 | | | | 0.0128 | | | $ | 18.14 | | | $ | 0.0089 | | | $ | 0.0218 | | | $ | 18.12 | | | $ | 18.0972 | |

| 8 | | | 2209.25 | | | | 0.0300 | | | | 1.060 | | | | 0.0136 | | | $ | 19.21 | | | $ | 0.0095 | | | $ | 0.0231 | | | $ | 19.18 | | | $ | 19.1600 | |

| 9 | | | 2275.53 | | | | 0.0300 | | | | 1.060 | | | | 0.0144 | | | $ | 20.33 | | | $ | 0.0100 | | | $ | 0.0244 | | | $ | 20.31 | | | $ | 20.2852 | |

| 10 | | | 2343.79 | | | | 0.0300 | | | | 1.060 | | | | 0.0152 | | | $ | 21.53 | | | $ | 0.0106 | | | $ | 0.0258 | | | $ | 21.50 | | | $ | 21.4765 | |

| 11 | | | 2414.11 | | | | 0.0300 | | | | 1.060 | | | | 0.0161 | | | $ | 22.79 | | | $ | 0.0112 | | | $ | 0.0274 | | | $ | 22.76 | | | $ | 22.7378 | |

| 12 | | | 2486.53 | | | | 0.0300 | | | | 1.060 | | | | 0.0171 | | | $ | 24.13 | | | $ | 0.0119 | | | $ | 0.0290 | | | $ | 24.10 | | | $ | 24.0731 | |

| Cumulative Index Return: | | | | -0.54% | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on Securities (assumes no early redemption): | | | | -3.59% | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Index Closing Level is also: (i) the Monthly Initial Closing Level for the following month; and (ii) the Index Valuation Level for calculating the Call Settlement Amount, the Redemption Amount and the Cash Settlement Amount |

| ** | Accrued Financing Charge are calculated on an act/360 basis(30-day months are assumed for the above calculations) |

| *** | Accrued Tracking Fee is calculated on an act/365 basis(30-day months are assumed for the above calculations) |

| **** | Previous Current Principal Amount is also the Financing Level |

| # | This is also the Call Settlement Amount |

| ^ | For month twelve, this is also the Cash Settlement Amount |

PS-11

Hypothetical Examples

You may receive Coupon Amounts during the term of the Securities and a Stub Reference Distribution Amount at maturity or call, or upon early redemption. The hypothetical returns displayed in all of the examples above do not reflect any Coupon Amounts you may be entitled to receive during the term of the Securities or any Stub Reference Distribution Amount you may be entitled to receive at maturity or call, or upon early redemption. If any Stub Reference Distribution Amount was paid at maturity or call, or upon early redemption, the hypothetical Cash Settlement Amounts, Call Settlement Amounts or Redemption Amounts displayed above would have been higher (as the Cash Settlement Amounts, Call Settlement Amounts or Redemption Amounts would have been increased by the Stub Reference Distribution Amount).

We cannot predict the actual Index Closing Level on any Trading Day or the market value of your Securities, nor can we predict the relationship between the Index Closing Level and the market value of your Securities at any time prior to the Maturity Date. The actual amount that a holder of the Securities will receive at maturity or call, upon acceleration or upon early redemption, as the case may be, and the rate of return on the Securities, will depend on the monthly compounded leveraged return of the Index, and, if positive, whether it will be sufficient to offset the negative effect of the Accrued Fees over the relevant period and, if applicable, the Redemption Fee, whether any Coupon Amounts were paid during the term of the Securities and whether any Stub Reference Distribution Amount is payable at maturity or call, or upon early redemption or acceleration. Moreover, the assumptions on which the hypothetical returns are based are purely for illustrative purposes. Consequently, the amount, in cash, to be paid in respect of your Securities, if any, on the Maturity Date, Call Settlement Date, Acceleration Settlement Date or the relevant Redemption Date, as applicable, may be very different from the information reflected in the tables above.

The hypothetical examples above are provided for purposes of information only. The hypothetical examples are not indicative of the future performance of the Index on any Trading Day, the Index Valuation Level, or what the value of your Securities may be. Fluctuations in the hypothetical examples may be greater or less than fluctuations experienced by the holders of the Securities. The performance data shown above is for illustrative purposes only and does not represent the actual or expected future performance of the Securities.

PS-12

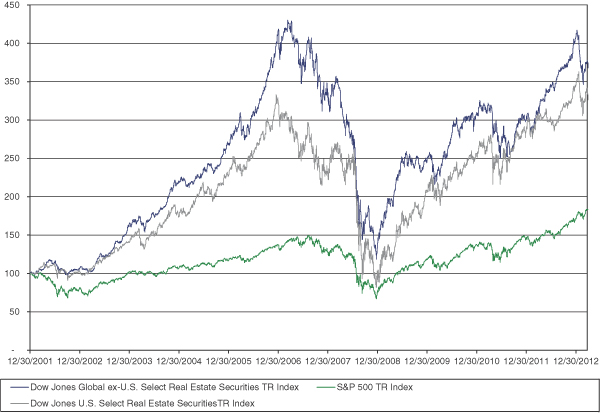

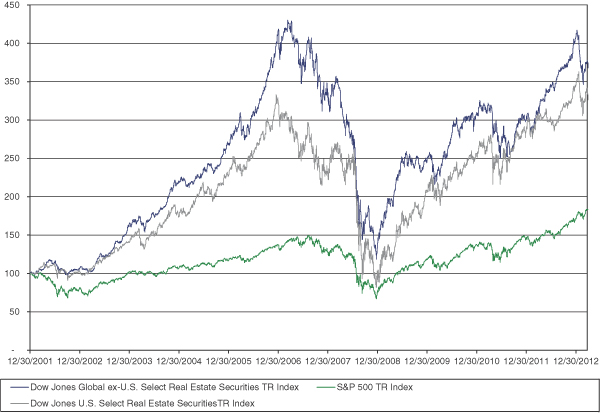

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

We have derived all information contained in this pricing supplement regarding the Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM (the “Index”) , including, without limitation, itsmake-up, performance, method of calculation and changes in its constituents, from publicly available sources, including the “Guide to the Dow Jones Total Stock Market Indexes (the “Rulebook”), which is summarized but not incorporated by reference herein. The Rulebook is proprietary to Dow Jones Indexes (“Dow Jones” or the “Index Sponsor”) and is available at www.djindexes.com. The Rulebook reflects the policies of and is subject to change by the Index Sponsor. We make no representation or warranty as to the accuracy or completeness of such information. The composition of the Index is determined by the Index Sponsor and the intraday Index value is calculated and published by Dow Jones, as Index Calculation Agent, in consultation with the Index Sponsor. Neither the Index Sponsor nor the Index Calculation Agent has any obligation to continue to publish, and may discontinue the publication of, the Index. Daily Index Closing Levels are available at www.djindexes.com. “Dow Jones Indexes”, the marketing name of CME Group Index Services LLC (“CME Indexes”), is a trademark of Dow Jones Trademark Holdings LLC.

Introduction

The Index is a float-adjusted, market capitalization index designed to measure the performance of publicly traded real estate securities. The Index represents equity real estate investment trusts (REITs) and real estate operating companies (REOCs) traded globally, excluding in the United States. The Index is a price return index (i.e., the reinvestment of dividends is not reflected in the Index). As of June 30, 2013, the Index was comprised of 123 Index Constituent Securities, with the largest Index Constituent Security weighted at 6.88% and the smallest Index Constituent Security weighted at 0.04%.

Base Value and Date

The base value of the Index is 1000 as of December 31, 1992. The Index was first calculated on March 21, 2006 (the “Index Commencement Date”).

Calculation of the Index

Daily Calculation Cycle. The Index calculation week begins at 6:00 p.m. New York time on Sunday and ends at 5:00 p.m. New York time on Friday. The closing value of the Index is calculated on a24-hour day that ends at 5:00 p.m. New York time, using the official WM Company (“WM”) closing spot rates as reported by Reuters and each component stock’s closing price on its primary market during the previous24-hour period. The WM closing spot rates, which are widely used for portfolio valuation and investment performance measurement, are based on the rates at 4:00 p.m. U.K. time each trading day and are published at 4:15 p.m. U.K. time. Following the determination of the previous day’s closing price, Index values for the then-current day are updated on a real-time basis beginning at 6:00 p.m. New York time whenever any of the exchanges represented in the Index are open.(Next-day trading prices from Asia-Pacific markets are not included in the Index calculation until 6.00 p.m. New York time to insure that each day’s price history includes only one day’s trading.)

Stock Prices. The Index is computed using each security’s last-traded price on its primary exchange. Index closing values are calculated using each component’s primary exchange closing price. Until a particular stock opens, its latest adjusted closing price is used for Index computation. If trading in a stock is suspended while its market is open, the last traded price for that stock is used for all subsequent Index computations until trading resumes. If trading is suspended before the opening, the stock’s latest adjusted closing price is used to calculate the Index until trading resumes. However, if a market is closed due to an exchange holiday, the previous closing price for each of its Index components, coupled with the most

PS-13

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

recent intraday currencymid-price, is used to determine the Index’s then-current U.S. dollar value until the opening of trading after the holiday. At that time, a stock’s adjusted closing price is used for Index computations until its first trading price is received.

However, when a stock is suspended from trading due to financial distress and subsequently delisted by its primary market prior to resumption of trading, the rules for pricing suspended securities above are not appropriate for determining the value of the stock when it is removed from the Index. Whenever practicable, Dow Jones Indexes will use the best-available alternate pricing source to determine the value at which the company should be removed from the Index.

Index Currencies. Intraday stock prices are in local currencies and U.S. dollars. All intradaynon-U.S. dollar stock prices are converted to U.S. dollars based on the latest available relevant intraday currency bid price.

Index Construction

The Index is weighted by float-adjusted market capitalization.

To be included in the Index, a company must satisfy all of the following criteria:

| | Ø | | The company must be both an equity owner and operator of commercial and/or residential real estate; |

| | Ø | | At least 75% of the company’s total revenue must be derived from the ownership and operation of real estate assets; |

| | Ø | | The company must have a minimum total market capitalization of USD 200 million at the time of its inclusion; and |

| | Ø | | The liquidity of the company’s stock must be commensurate with that of other institutionally held real estate securities. |

| | Ø | | The following companies are excluded from the Index: |

| | Ø | | Mortgage REITs,net-lease REITs, real estate finance companies, mortgage brokers and bankers, commercial and residential real estate brokers and estate agents, home builders, large landowners and subdividers of unimproved land, hybrid REITs and timber REITs; and |

| | Ø | | Companies that have more than 25% of their assets in direct mortgage investments. |

Index Maintenance

Periodic and ongoing reviews of the Index composition and shares are conducted based on the following rules:

| | Ø | | Routine additions and deletions to the Index, as well as shares updates, are made quarterly after the close of trading on the third Friday of March, June, September and December. The changes become effective at the opening of trading on the next business day. |

| | Ø | | A company will be removed from the Index if direct mortgage investments represent more than 25% of the company’s assets for two consecutive quarters or if the company is reclassified as a mortgage or hybrid REIT. |

| | Ø | | A company will be removed from the Index if less than 50% of its total revenue is generated from the ownership and operation of real estate assets for two consecutive quarters. |

| | Ø | | A company will be removed from the Index if its stock becomes illiquid or had more than 10 non-trading days during the previous quarter. |

PS-14

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

| | Ø | | A company will be removed from the Index if its stock is delisted by its primary market due to failure to meet financial or regulatory requirements. |

| | Ø | | A company will be removed from the Index if its total market capitalization falls below $100 million and remains at that level for two consecutive quarters. |

| | Ø | | If a component company enters bankruptcy proceedings, it will be removed from the Index and will remain ineligible forre-inclusion until it has emerged from bankruptcy. However, the Dow Jones Index Oversight Committee may, following a review of the bankrupt company and the issues involved in the filing, decide to keep the company in the Index. |

| | Ø | | The Dow Jones Index Oversight Committee may, at its discretion and if it has determined a company to be in extreme financial distress, remove the company from the Index if the committee deems the removal necessary to protect the integrity of the Index and the interests of investors in products linked to the Index. |

Determining a Company’s Country. A company’s country assignment is based on several factors, primarily the country of the company’s headquarters and primary market listing, which typically also match its country of incorporation. In cases where company headquarters and primary market listing don’t match, such as where there is no readily accessible home-equity market or where a company is domiciled in one country solely for tax or regulatory purposes, the companies will be analyzed on acase-by-case basis.

Share Class. Index candidates must be common shares or other securities that have the characteristics of common equities. All classes of common shares, both fully and partially paid, are eligible. Fixed-dividend shares and securities such as convertible notes, warrants, rights, mutual funds, unit investment trusts, publicly traded partnerships, limited liability corporations, royalty trusts andclosed-end fund shares are not eligible. Income participating securities and similar structures such as South African loan stock companies, which combine stock and debt ownership, are not eligible. Temporary issues arising from corporate actions, such as “when-issued shares,” are considered on acase-by-case basis when necessary to maintain continuity in a company’s Index membership. REITs, listed property trusts and similar real-property-owning pass-through structures taxed as REITs by their domiciles also are eligible. In Canada, income trusts, including Canadian REITs, are eligible. Multiple classes of shares are included if each issue, on its own merit, meets the other eligibility criteria.

Preliminary component changes that result from the quarterly reviews will be preannounced after the close of trading on the second Friday of the review month. Shares and float changes that result from the quarterly review will be announced after the close of trading on the second Friday of March, June, September and December. These changes will be implemented after the official closing values have been established on the third Friday of March, June, September and December. The changes go into effect at the opening on the next business day.

Ongoing Maintenance. In addition to the scheduled reviews, the Index is reviewed on an ongoing basis. Changes in Index composition and related weight adjustments are necessary whenever there are extraordinary events such as delistings, bankruptcies, spinoffs, mergers or takeovers involving Index components. In these cases, each event will be taken into account as soon as it is effective. If the impact of a corporate action during the period between scheduled updates changes a company’s float-adjusted shares outstanding by 10% or more, the company’s shares and float factor are updated as soon as prudently possible. Share and float changes based on corporate actions are implemented using the procedures described in “— Float Adjustment” below. Whenever possible, the changes in the Index’s components will be announced at least two business days prior to the change implementation date.

| | Ø | | Changes of eligible securities. In the event that a component no longer meets the eligibility requirements described under “— Defining the investable universe” above, it will be removed from the Index. |

PS-15

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

| | Ø | | Changes of primary market listing. When a company’s primary market listing changes to an exchange ineligible for its current country index, it will be removed from its current country and regional indexes when it is delisted and, if applicable, will be considered for immediate addition to its new country’s index. If the company is added to the new country’s index, it also will be added to that country’s regional indexes. If added to the new country index, the company will remain in its global sector indexes. If added to a new country index, it will be simultaneously removed from its previous country’s index. |

| | Ø | | Changes in industry classification. Companies are assigned to industry groups based on the revenues received in their respective lines of business. Mergers, takeovers, and spinoffs can require immediate industry and sector transfers, based on the company’s revenue breakdowns, when the transaction becomes effective. If a company’s primary revenues shift from one line of business to another due to organic changes, the company will be assigned to its new industry, supersector, sector and subsector during a quarterly review. |

| | Ø | | Splits and spinoffs. If an Index Constituent splits or spins off a portion of its business to form one or more new companies, all of the companies involved in the spinoff are to be included in the Index when trading in them begins, if they would otherwise qualify for membership. All companies involved in the event are to be classified as the same size-segment and style as the parent company and will retain those classifications until the next size-segment and style Index reviews. However, each involved company will be reclassified at the time of the split or spinoff into its appropriate industry group according to Dow Jones Indexes’ proprietary classification system. |

| | Ø | | Mergers. If two Index Constituents merge, their component positions will be replaced by the surviving company when the transaction becomes effective. Dow Jones Indexes will modify the float-adjusted shares outstanding for the surviving company to reflect the changes in both its total shares and any float blocks, regardless of the percentage changes in the survivor. If an Index Constituent merges with anon-component company, its component position will be replaced by the new company, if the new company meets all eligibility criteria described under “— Defining the investable universe” above. |

| | Ø | | Takeovers. If an Index component is taken over by another component company, the former will be removed from the Index upon completion of the takeover. If an Index component is taken over by anon-component company, it will be replaced by the acquiring company, if the acquiring company meets all the eligibility criteria described under “— Defining the investable universe” above. |

| | Ø | | Share offerings, tenders and purchases. If a component is involved in anon-mandatory action such as a secondary share offering or conversion of debt or preferred stock to common shares that results in an increase of more than 10% in float-adjusted shares outstanding, Dow Jones Indexes will adjust the shares outstanding and float as soon as practicable following completion of the transaction, subject to atwo-day notification period. Dow Jones Indexes also will adjust float adjusted shares outstanding decreases of 10% or more due to Dutch auctions, share repurchase programs, and block purchases by insiders, subject to atwo-day notification period. |

| | Ø | | Removal of companies due to delisting, bankruptcy or extreme financial distress. If an Index Constituent is delisted by its primary market, or is in bankruptcy proceedings, it will be removed from the Index with a minimum of two business days’ notice. If an Index component enters bankruptcy proceedings, it will be removed from the Index and will remain ineligible forre-inclusion until it has emerged from bankruptcy. However, the Dow Jones Index Oversight Committee may, at its discretion, following a review of the bankrupt company and the issues involved in the filing, retain the company in the Index. The Dow Jones Index Oversight |

PS-16

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

| | Committee may, at its discretion, remove a company it has determined to be in extreme financial distress from the Index, if the committee deems the removal necessary to protect the integrity of the Index and the interests of investors in products linked to the Index. |

Float Adjustment

Float-adjusted rather than full-market capitalization is used to reflect the number of shares actually available to investors.

Float Factors. Float factors for companies in the Index are determined using the following steps:

| | Ø | | Shares outstanding for companies with multiple share classes that share the same economic rights are added to the primary issue’s shares outstanding to determine the company’s total market capitalization; |

| | Ø | | float adjustments are based on block ownership of each class of stock, and then are combined to determine total |

| | Ø | | float for a company’s combined shares. Share classes with no public market are blocked at 100%. Restricted shares |

| | Ø | | and shares subject to lockups are also treated as one block until the restrictions or lockup periods expire; and |

| | Ø | | float-adjustment factors will be implemented only if the blocked shares are 5% or more of the company’s total shares outstanding. |

Qualifications. The following four types of block ownership are considered during float adjustment:

| | Ø | | cross ownership — shares that are owned by other companies, including banks and life insurance companies not acting in a fiduciary capacity; |

| | Ø | | government ownership — shares that are owned by governments (central or municipal) or their agencies; |

| | Ø | | private ownership — shares that are owned by individuals, families or charitable trusts and foundations; and |

| | Ø | | restricted shares — shares that are not allowed to be traded during a certain time period. |

A company’s outstanding shares are not adjusted by institutional investors’ passive holdings, which include, but are not limited to, the following categories:

| | Ø | | mutual funds(open-end andclosed-end funds); and |

Positions held by institutional investors represented on a company’s board of directors or by institutions attempting to control a company will be blocked.

Threshold. A company’s outstanding shares are adjusted if, and only if, an entity in any of the four qualified categories listed above owns 5% or more of the company. Its shares will not be adjusted if the block ownership is less than 5%. If an existing block owner’s position drops below 5%, the block will be removed.

PS-17

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

Foreign Restrictions. The float adjustment rules also apply to foreign companies that have cross ownership of 5% or more. If a government has a foreign ownership restriction of 5% or more, the lesser of free-float shares or the portion that is available for foreign investment will be used for Index calculation.

Calculation and Adjustments

Input Data Sources. Real-time stock prices are currently provided by Reuters. The latest trading price is used for Index calculation. The number of shares is determined separately for each class of stock. This information is obtained from regulatory filings, a variety of data vendors, and the companies themselves. Corporate actions are sourced from public news services, regulatory filings, data vendors and the companies. Float data are obtained from a variety of sources including data vendors, exchanges, regulators and the companies themselves.

Index Formula. The Index is computed as follows:

| | | | | | | | | | |

Indext = | | Sin=1 (pit x qit) | | x Base Index Value = | | Mt | | x Base Index Value | | |

| | Ct x Sin= 1 (pi0 x qi0) | | | Bt | | |

| | |

The above mentioned formula can be simplified as Indext = | | Mt |

| | Dt |

| | | | | | |

Dt = | | Bt | | = Index Divisor at times (t) | | |

| | Base Index value | | |

n = the number of stocks in the Index

pi0 = the closing price of stock i at the base date

qio = the number of shares of company i at the base date

pit = the price of stock i at time (t)

qit = the number of shares of company i at time (t)

Ct = the adjustment factor for the base date market capitalization

Mt = market capitalization of the Index at times (t)

Bt = adjusted base date market capitalization of the Index at times (t)

Index Divisor Adjustments. Corporate actions affect the share capital of component stocks and therefore could trigger Index increases or decreases. To avoid distortion, the Index Divisor is adjusted accordingly. Changes in Index market capitalization due to changes in the composition (additions, deletions or replacements), weighting (following quarterly reviews or changes of more than 10% in a single component’s float-adjusted shares outstanding) or corporate actions (mergers, spinoffs, rights offerings, repurchase of shares, public offerings, return of capital, or special cash or stock distributions of other stocks) result in an Index Divisor change to maintain Index continuity before and after the event.

The following formulae will be used for Index Divisor adjustments. (Note: No Index Divisor adjustments are necessary for stock splits, since market capitalization does not change and the share number and share price are adjusted prior to the opening of trading on the split’sex-date.)

| | | | | | |

Dt+1 = Dt × | | S (pit x qit) + D MCt+1 | | | | |

| | S (pit x qit) | | | | |

PS-18

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

where

Dt = Index Divisor at time (t)

Dt + 1 = Index Divisor at time (t + 1)

pit = stock price of company at time (t)

qit = number of shares of company t at time (t)

DMCt+ 1 = | add new components’ market capitalization and adjusted market capitalization (calculated with adjusted closing price and shares effective at time t + 1) and/or minus market capitalization of companies to be deleted (calculated with closing prices and shares at time t) |

Adjustment for Corporate Actions. The Index Divisor may decrease (q) or increase (p) or remain constant (n) when corporate actions occur for a component stock. Assuming shareholders receive “B” new shares for every “A” share held for the following corporate actions:

| | |

| Index Divisorq | | 1) Special Cash Dividend adjusted price = closing price- dividend announced by the company |

| Index Divisorn | | 2) Split and Reverse Split adjusted price = closing price * A / B new number of shares = old number of shares * B / A |

| Index Divisorp | | 3) Rights Offering adjusted price = (closing price * A + subscription price * B) / (A + B) new number of shares = old number of shares * (A + B) / A |

| Index Divisorn | | 4) Stock Dividend adjusted price = closing price * A / (A + B) new number of shares = old number of shares * (A + B) / A |

| Index Divisorq | | 5) Stock Dividend of a Different Company Security adjusted price = (closing price * A - price of the different company security * B) / A |

| Index Divisorq | | 6) Return of Capital and Share Consolidation adjusted price = (closing price - dividend announced by company) * A / B new number of shares = old number of shares * B / A |

| Index Divisorq | | 7) Repurchase Shares–Self Tender adjusted price = [(price before tender * old number of shares) - (tender price * number of tendered shares)] /(old number of shares - number of tendered shares) new number of shares = old number of shares - number of tendered shares |

| Index Divisorq | | 8) Spinoffs adjusted price = (closing price * A - price of spun-off shares * B) / A spun-off company is added to the present company Index until the next review |

PS-19

The Dow Jones Globalex-U.S. Select Real Estate Securities IndexSM

| | |

| Index Divisorp | | 9) Combination Stock Distribution (Dividend or Split) and Rights Offering Shareholders receive B new shares from the distribution and C new shares from the rights offering for every A shares held: — If rights are applicable after stock distribution (one action applicable to other) adjusted price = [closing price * A + subscription price * C * (1 + B / A)] / [(A + B) * (1 + C / A)] new number of shares = old number of shares * [(A + B) * (1 + C / A)] / A — If the stock distribution is applicable after rights (one action applicable to other) adjusted price = [closing price * A + subscription price * C] / [(A + C) * (1 + B / A)] new number of shares = old number of shares * [(A + C) * (1 + B / A)] / A |