the Index or the GLD Shares or options, futures, swaps or other derivatives on the Index or the futures contracts relating to the Index, the GLD Shares or the Options (including but not limited to exchange-imposed position limits), (ii) shall materially increase the cost to the Issuer, our affiliates, third parties with whom we transact or similarly situated third parties in performing our or their obligations in connection with the ETNs, (iii) shall have a material adverse effect on the ability of the Issuer, our affiliates, third parties with whom we transact or a similarly situated third party to perform our or their obligations in connection with the ETNs or (iv) shall materially affect our ability to issue or transact in exchange traded notes similar to the ETNs; (c) any event that occurs on or after the Inception Date that makes it a violation of any law, regulation or rule of the United States (or any political subdivision thereof), or any jurisdiction in which a Primary Exchange or Related Exchange (each as defined herein) is located, or of any official administrative decision, judicial decision, administrative action, regulatory interpretation or other official pronouncement interpreting or applying those laws, regulations or rules, (i) for the Issuer or its affiliates to hold, acquire or dispose of options contracts relating to the Index or the GLD Shares or options, futures, swaps or other derivatives on the Index, the GLD Shares or the Options (including but not limited to exchange-imposed position limits), (ii) for the Issuer, our affiliates, third parties with whom we transact or similarly situated third parties to perform our or their obligations in connection with the ETNs or (iii) for us to issue or transact in exchange traded notes similar to the ETNs; (d) any event, as determined by us or the Calculation Agent, that we or any of our affiliates or a similarly situated party would, after using commercially reasonable efforts, be unable to, or would incur a materially increased amount of tax, duty, expense or fee (other than brokerage commissions) to acquire, establish, re-establish, substitute, maintain, unwind or dispose of any transaction or asset it deems necessary to hedge the risk of the ETNs, or realize, recover or remit the proceeds of any such transaction or asset; (e) if, at any point, the Intraday Indicative Value is equal to or less than five percent (5%) of the prior day’s Closing Indicative Value of such ETNs; or (f) if the primary exchange or market for trading for the ETNs, if any, announces that pursuant to the rules of such exchange or market, as applicable, the ETNs cease (or will cease) to be listed, traded or publicly quoted on such exchange or market, as applicable, for any reason and are not immediately re-listed, re-traded or re-quoted on an exchange or quotation system located in the same country as such exchange or market, as applicable. If we accelerate the ETNs, you will only receive an amount equal to, in the event of an acceleration in whole, the arithmetic average, as determined by the Calculation Agent, of the Closing Indicative Values of such ETNs during the applicable Accelerated Valuation Period, or, in the event of an acceleration in part, the Closing Indicative Value on the applicable Valuation Date, and you will not receive any other compensation or amount for the loss of the investment opportunity of holding the ETNs. See “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement for further information.

Furthermore, if we choose to exercise our right to effect an Optional Acceleration and the ETNs are accelerated, you will lose the opportunity to continue to hold your ETNs and participate in any future performance of the Index, as applicable, and you may be unable to invest in other securities with a risk/return profile similar to that of the ETNs.

The Index has limited performance history and may perform in unexpected ways. Any historical and retrospectively calculated performance of the Index should not be taken as an indication of the future performance of the Index

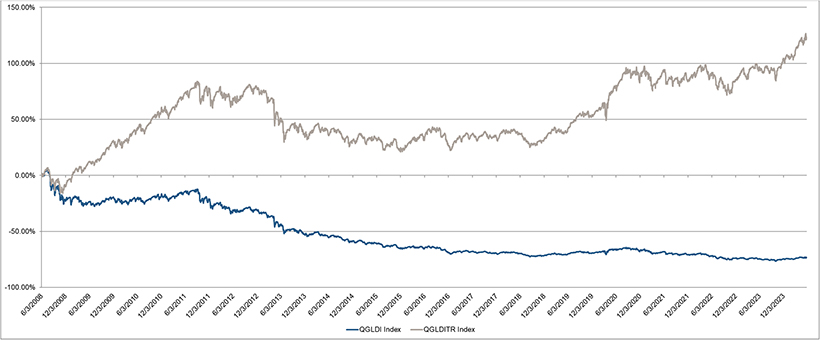

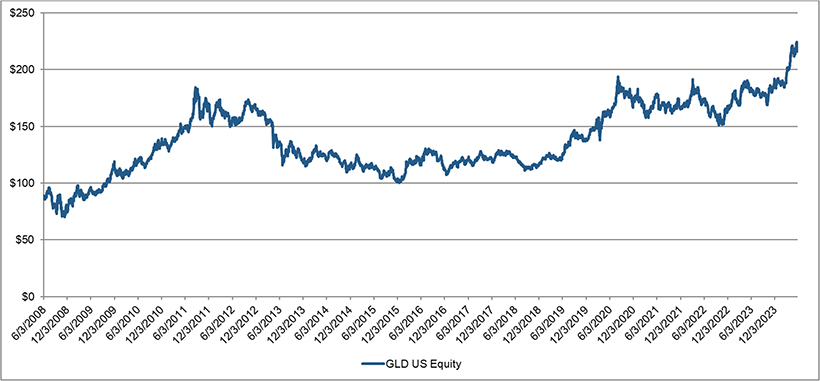

Publication of the Index began on October 19, 2012. Accordingly, the Index has limited historical data, and that historical data may not be representative of the Index’s potential performance under other market conditions. Because the Index has limited performance history, an investment in the ETNs may involve a greater risk than an investment in a financial product linked to one or more indices with a longer record of performance. A longer history of actual performance may have provided more reliable information on which to assess the validity of the Index’s proprietary methodology as the basis for an investment decision. Furthermore, any back-tested or historical performance of the Index is not an indication of how the Index will perform in the future.

Index levels prior to October 19, 2012 represent the retrospectively calculated performance of the Index, had it existed at the relevant time, based on certain data, assumptions and estimates, not all of which may be specified herein. These data, assumptions and estimates may be different from those that someone else might use to retrospectively calculate the Index levels. In calculating the retrospectively calculated performance of the Index, we have assumed that no disruption events or modifications to the methodology occurred during the period prior to October 19, 2012. There can be no assurance that there will not be any such disruption events or modifications which would adversely affect the level of the Index in the future. Retrospectively calculated Index levels based on different assumptions or for a different time period may produce different results. In any event, no information presented on the prior performance of the Index, whether actual or retrospectively calculated, should be relied on as an indicator of the future performance of the Index. It is impossible to know whether the level of the Index will rise or fall in the future.

PS-34