♦Market risk — The return on the Securities, which may be negative, is directly linked to the performance of the underlying assets and indirectly linked to the performance of the underlying constituents. The levels of the underlying assets can rise or fall sharply due to factors specific to each underlying asset, its underlying constituents and the issuers of the underlying equity constituents (each, an “underlying constituent issuer”), and with respect to an underlying equity, the issuer of such underlying equity (its “underlying equity issuer”), such as stock or commodity price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock and commodity market volatility and levels, interest rates and economic, political and other conditions. You, as an investor in the Securities, should conduct your own investigation into these entities and the underlying assets. For additional information regarding the underlying assets, please see “Information About the Underlying Assets” herein and any SEC filings referred to in that section. We urge you to review financial and other information filed periodically by an underlying equity issuer with the SEC.

♦There can be no assurance that the investment view implicit in the Securities will be successful — It is impossible to predict whether and the extent to which the levels of the underlying assets will rise or fall and there can be no assurance that the final level of each underlying asset will be equal to or greater than its digital barrier or downside threshold. The levels of the underlying assets will be influenced by complex and interrelated political, economic, financial and other factors that affect the underlying constituent issuers and, with respect to an underlying equity, its underlying equity issuer. You should be willing to accept the downside risks associated with each underlying asset in general and its underlying constituents in particular, and the risk of losing some or all of your initial investment.

♦Changes affecting an underlying index, including regulatory changes, could have an adverse effect on the market value of, and return on, your Securities — The policies of any index sponsor as specified under “Information About the Underlying Assets” (each, an “index sponsor”), concerning additions, deletions and substitutions of the underlying constituents and the manner in which such index sponsor takes account of certain changes affecting those underlying constituents may adversely affect the level of the applicable underlying index. The policies of an index sponsor with respect to the calculation of the applicable underlying index could also adversely affect the level of such underlying index. An index sponsor may discontinue or suspend calculation or dissemination of the applicable underlying index. Further, indices like each underlying index have been, and continue to be, the subject of regulatory guidance and proposal for reform, including the European Union’s Regulation (EU) 2016/1011. The occurrence of a benchmark event (as defined in the accompanying product supplement under “General Terms of the Securities — Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation”), such as the failure of a benchmark (the applicable underlying index) or the administrator (its index sponsor) or user of a benchmark (such as UBS), to comply with the authorization, equivalence or other requirements of the benchmarks regulation, may result in the discontinuation of the relevant benchmark or a prohibition on its use. If these or other events occur, then the calculation agent may select a successor index, reference a replacement basket or use an alternative method of calculation, in each case, in a manner it considers appropriate, or, if it determines that no successor index, replacement basket or alternative method of calculation would be comparable to the original underlying index, it may deem the closing level of the original underlying index on the trading day immediately prior to the date of such event to be its closing level on each applicable date. Such events and the potential adjustments are described further in the accompanying product supplement under “— Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation”. Notwithstanding the ability of the calculation agent to make any of the foregoing adjustments, any such change or event could adversely affect the market value of, and return on, the Securities.

♦There is no affiliation between any underlying equity issuer, underlying constituent issuer or index sponsor and UBS, and UBS is not responsible for any disclosure by such entities — We are not affiliated with any underlying equity issuer, underlying constituent issuer, any index sponsor or the index sponsor of any target index. We and our affiliates may currently, or from time to time in the future engage in business with an underlying equity issuer, underlying constituent issuer or index sponsor. However, we are not affiliated with any such entity and are not responsible for its public disclosure of information, whether contained in SEC filings or otherwise. You, as an investor in the Securities, should conduct your own investigation into such entities, the underlying assets and the underlying constituents. No such entity is involved in the Securities offered hereby in any way or has any obligation of any sort with respect to your Securities or has any obligation to take your interests into consideration for any reason, including when taking any corporate actions that might affect the value of, and return on, your Securities.

♦The value of an underlying equity may not completely track the value of its underlying constituents — Although the trading characteristics and valuations of an ETF will usually mirror the characteristics and valuations of its underlying constituents, the level of an ETF may not completely track the value of its underlying constituents. The level of each underlying equity will reflect transaction costs and fees that the underlying constituents in which an ETF invests do not have. In addition, although an ETF may be currently listed for trading on an exchange, there is no assurance that an active trading market will continue for an ETF or that there will be liquidity in the trading market.

♦Fluctuation of NAV — The net asset value (the “NAV”) of an ETF may fluctuate with changes in the market value of its underlying constituents. The market prices of an ETF may fluctuate in accordance with changes in NAV and supply and demand on the applicable stock exchanges. In addition, the market price of an ETF may differ from its NAV per share; an ETF may trade at, above or below its NAV per share, meaning the level of each underlying equity may not reflect its NAV.

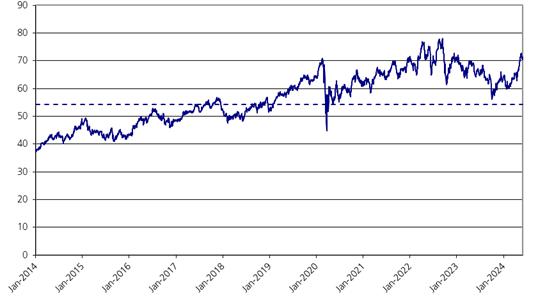

♦Failure of the Utilities Select Sector SPDR® Fund to track the level of its target index — While the Utilities Select Sector SPDR® Fund is designed and intended to track the level of a specific index as specified herein (its “target index”), various factors, including fees and other transaction costs, will prevent an ETF from correlating exactly with changes in the level of its target index. Additionally, although the performance of an ETF seeks to replicate the performance of its target index, an ETF may not invest in all the securities, futures contracts or commodities comprising its target index but rather may invest in a representative sample of the assets comprising its target index. ETFs, including the Utilities Select Sector SPDR® Fund are therefore subject to the risk that the investment strategy selected by its investment advisor does not successfully track the level of its target index, as discussed further herein. Accordingly, the performance of the Utilities Select Sector SPDR® Fund will not be equal to the performance of its target index during the term of the Securities.

♦The Utilities Select Sector SPDR® Fund utilizes a passive indexing investment approach — The Utilities Select Sector SPDR® Fund is not managed according to traditional methods of “active” investment management, which involve the buying and selling of securities based on economic, financial and market analysis and investment judgment. Instead, the Utilities Select Sector SPDR® Fund utilizing a “passive” or indexing investment approach, attempts to approximate the investment performance of its target index by investing in a portfolio of stocks that generally replicate or provide a representative sample of such target index. Therefore, unless a specific underlying constituent is removed from its target index, the Utilities Select Sector SPDR® Fund generally would not sell a security because the issuer of such underlying constituent (its “underlying constituent issuer”) was in financial trouble. In addition, the Utilities Select Sector SPDR® Fund is subject to the risk that the investment strategy of its investment advisor may not produce the intended results.

♦The Securities are subject to risks associated with the utilities sector— All or substantially all of the underlying constituents held by the Utilities Select Sector SPDR® Fund are issued by companies whose primary business is directly associated with the utilities sector. The assets of the Utilities Select Sector SPDR® Fund will be concentrated in the utilities sector, which means that it will be more affected by the performance of the utilities sector than a fund that is more diversified. Utility companies are affected by supply and demand, operating costs, government regulation, environmental factors, liabilities for environmental damage and general civil liabilities, and rate caps or rate changes. Although rate changes of a regulated utility usually fluctuate in approximate correlation with financing costs, due to political and regulatory factors rate changes ordinarily occur only following a delay after the changes in financing costs. This factor will tend to favorably affect a regulated utility company's earnings and dividends in times of decreasing costs, but conversely, will tend to