♦Because the Notes are linked to the least performing underlying asset, you are exposed to a greater risk of not receiving the call return and losing a significant portion or all of your initial investment at maturity than if the Notes were linked to a single underlying asset or fewer underlying assets — The risk that you will not receive the call return and will lose a significant portion or all of your initial investment in the Notes is greater if you invest in the Notes than the risk of investing in substantially similar securities that are linked to the performance of only one underlying asset or to fewer underlying assets. With more underlying assets, it is more likely that the closing level or final level, as applicable, of an underlying asset will be less than its call threshold level or downside threshold on any observation date or the final valuation date, respectively, than if the Notes were linked to a single underlying asset or fewer underlying assets. In addition, the lower the correlation between a pair of underlying assets, the greater the likelihood that one of the underlying assets will decline to a closing level or final level, as applicable, that is less than its call threshold level or downside threshold on any observation date or on the final valuation date, respectively. Although the correlation of the underlying assets’ performance may change over the term of the Notes, the economic terms of the Notes, including the call return rate, downside thresholds and call threshold levels are determined, in part, based on the correlation of the underlying assets’ performance calculated using our internal models at the time when the terms of the Notes are finalized. All things being equal, a higher call return rate and lower downside thresholds and call threshold levels are generally associated with lower correlation of the underlying assets. Therefore, if the performance of a pair of underlying assets is not correlated to each other or is negatively correlated, the risk that you will not receive any call return and that the final level of any underlying asset will be less than its downside threshold is even greater despite lower call threshold levels and downside thresholds, respectively. With three underlying assets, it is more likely that the performance of one pair of underlying assets will not be correlated, or will be negatively correlated. Therefore, it is more likely that you will not receive any call return, that the final level of any underlying asset will be less than its downside threshold and that you will lose a significant portion or all of your initial investment at maturity.

♦Market risk — The return on the Notes, which may be negative, is directly linked to the performance of the underlying assets and indirectly linked to the performance of the underlying constituents and their issuers (the “underlying constituent issuers”). The levels of the underlying assets can rise or fall sharply due to factors specific to each underlying asset or its underlying constituents, such as stock or commodity price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock and commodity market volatility and levels, interest rates and economic, political and other conditions. You, as an investor in the Notes, should conduct your own investigation into the underlying assets and underlying constituents.

♦There can be no assurance that the investment view implicit in the Notes will be successful — It is impossible to predict whether and the extent to which the levels of the underlying assets will rise or fall. There can be no assurance that the closing level or final level, as applicable, of each underlying asset will be equal to or greater than its call threshold level on any observation date (including the final valuation date)or, if the Notes are not subject to an automatic call, that the final level of each underlying asset will be equal to or greater than its downside threshold. The levels of the underlying assets will be influenced by complex and interrelated political, economic, financial and other factors that affect the underlying constituent issuers. You should be willing to accept the downside risks associated with each underlying asset in general and its underlying constituents in particular, and the risk of losing a significant portion or all of your initial investment.

♦Changes affecting an underlying asset, including regulatory changes, could have an adverse effect on the market value of, and return on, your Notes — The policies of any index sponsor as specified under “Information About the Underlying Assets” (each, an “index sponsor”), concerning additions, deletions and substitutions of the underlying constituents and the manner in which such index sponsor takes account of certain changes affecting those underlying constituents may adversely affect the level of the applicable underlying asset. The policies of an index sponsor with respect to the calculation of the applicable underlying asset could also adversely affect the level of such underlying asset. An index sponsor may discontinue or suspend calculation or dissemination of the applicable underlying asset. Further, indices like each underlying asset have been, and continue to be, the subject of regulatory guidance and proposal for reform, including the European Union’s Regulation (EU) 2016/1011. The occurrence of a benchmark event (as defined in the accompanying product supplement under “General Terms of the Securities — Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation”), such as the failure of a benchmark (the applicable underlying asset) or the administrator (its index sponsor) or user of a benchmark (such as UBS), to comply with the authorization, equivalence or other requirements of the benchmarks regulation, may result in the discontinuation of the relevant benchmark or a prohibition on its use. If these or other events occur, then the calculation agent may select a successor index, reference a replacement basket or use an alternative method of calculation, in each case, in a manner it considers appropriate, or, if it determines that no successor index, replacement basket or alternative method of calculation would be comparable to the original underlying asset, it may deem the closing level of the original underlying asset on the trading day immediately prior to the date of such event to be its closing level on each applicable date. Such events and the potential adjustments are described further in the accompanying product supplement under “— Discontinuance of, Adjustments to, or Benchmark Event or Change in Law Affecting, an Underlying Index; Alteration of Method of Calculation”. Notwithstanding the ability of the calculation agent to make any of the foregoing adjustments, any such change or event could adversely affect the market value of, and return on, the Notes.

♦UBS cannot control actions by the index sponsors and the index sponsors have no obligation to consider your interests — UBS and its affiliates are not affiliated with the index sponsors and have no ability to control or predict their actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the underlying assets. The index sponsors are not involved in the Notes offering in any way and has no obligation to consider your interest as an owner of the Notes in taking any actions that might affect the market value of, and return on, your Notes.

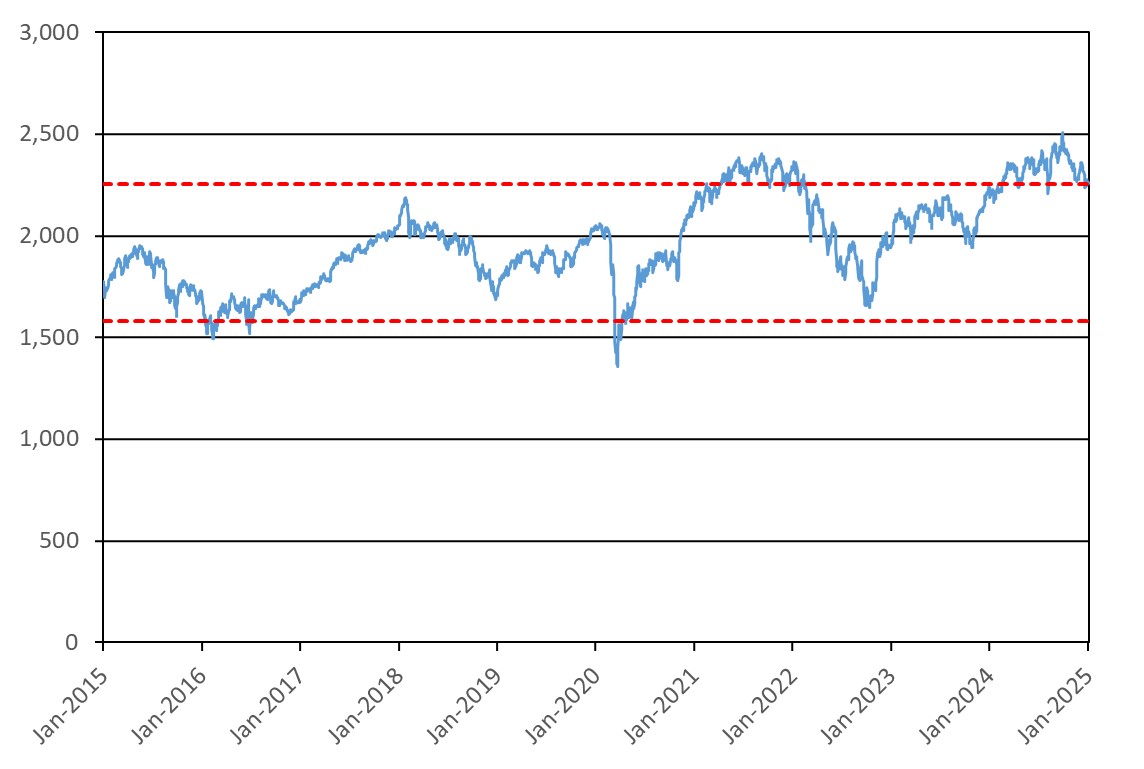

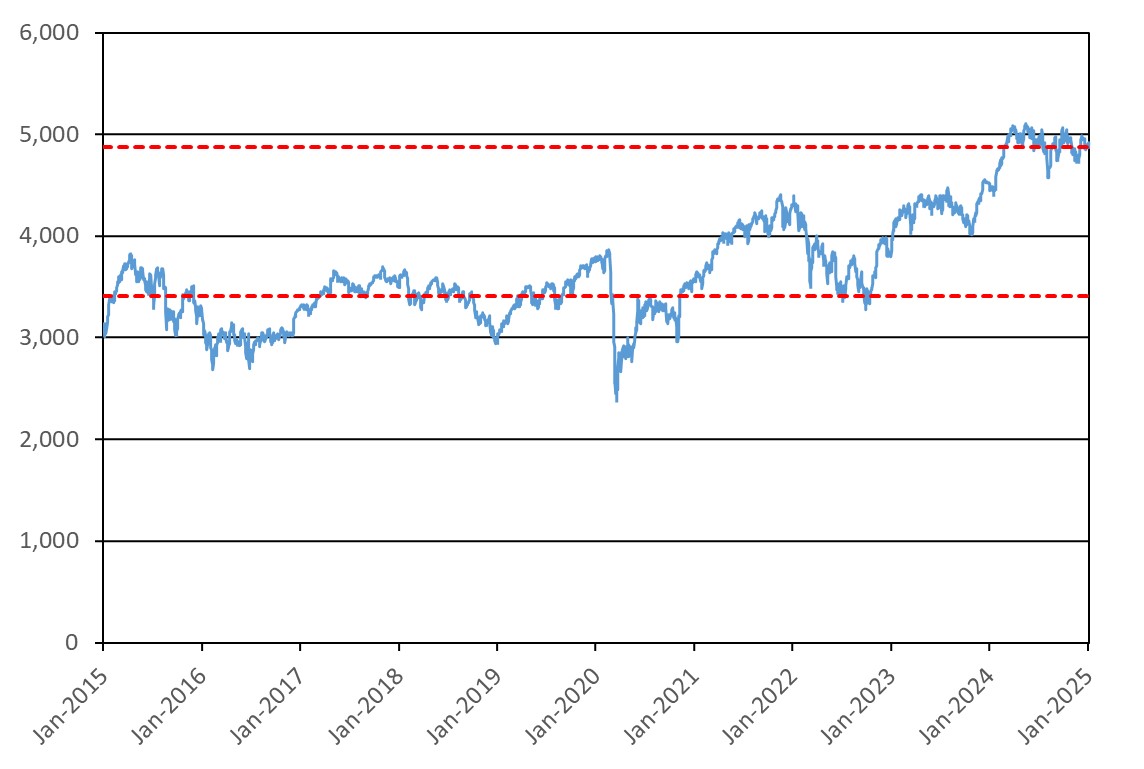

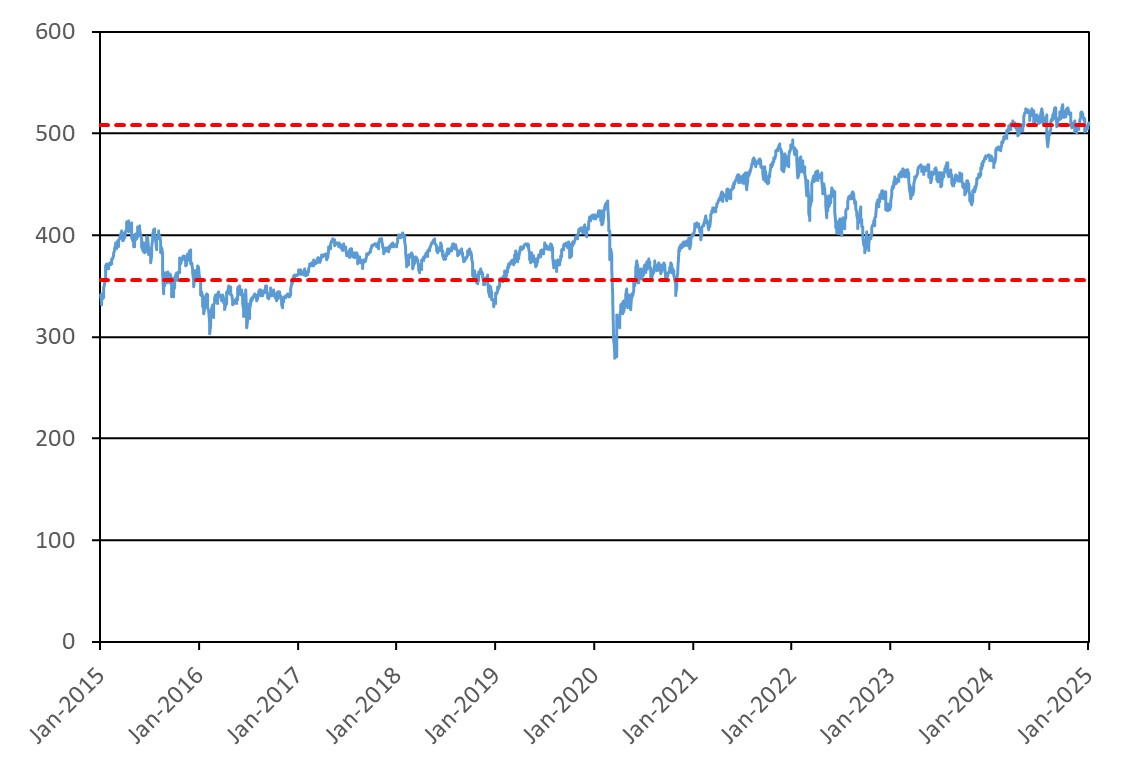

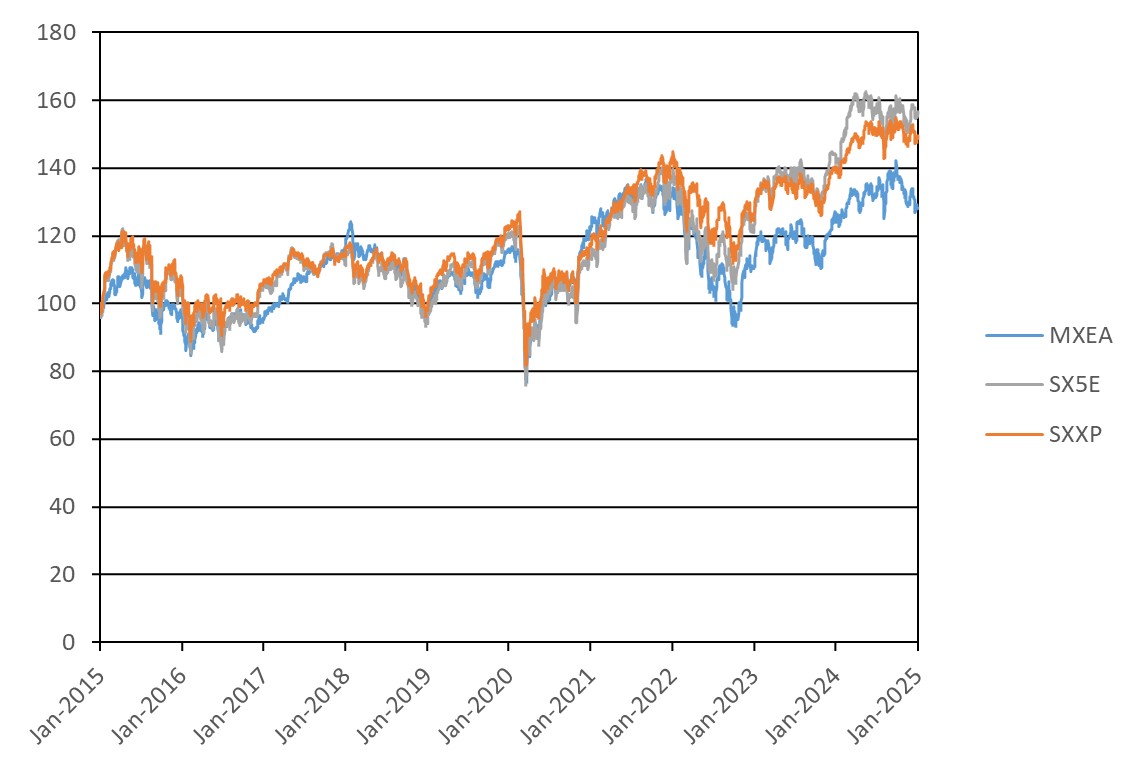

♦The MSCI EAFE® Index, EURO STOXX 50® Index and STOXX® Europe 600 Index reflects price return, not total return — The return on the Notes is based on the performance of the MSCI EAFE® Index, EURO STOXX 50® Index and STOXX® Europe 600 Index, which reflects the changes in the market prices of its underlying constituents. The MSCI EAFE® Index, EURO STOXX 50® Index and STOXX® Europe 600 Index is not a “total return” index or strategy, which, in addition to reflecting those price returns, would also reflect any dividends paid on its underlying constituents. The return on the Notes will not include such a total return feature or dividend component.

♦The Notes are subject to currency exchange rate risks — The Notes are subject to currency exchange rate risks because the MSCI EAFE® Index is comprised of stocks that are traded and quoted in non-U.S. currencies on non-U.S. markets. The prices of the underlying constituents are converted into U.S. dollars for purposes of calculating the level of such index. As a result, holders of the Notes will be exposed to currency exchange rate risk with respect to each of the currencies represented in such index. The values of the currencies of the underlying constituents of such index may be subject to a high degree of fluctuation due to changes in interest rates, the effects of monetary policies issued by the United States, non-U.S. governments, central banks or supranational entities, the imposition of currency controls or other national or global political or economic developments. The level of such index will depend on the extent to which the relevant non-U.S. currencies strengthen or weaken against the U.S. dollar and the relative weight of each of its non-U.S. constituents. If, taking into account such weighting, the U.S. dollar strengthens against the relevant non-U.S. currencies, the value of the applicable underlying constituents, and therefore the level of such index, and the market value of, and return on, the Notes, may be adversely affected.

♦The Notes are subject to risks associated with non-U.S. securities markets — The Notes are subject to risks associated with non-U.S. securities markets because the MSCI EAFE® Index, EURO STOXX 50® Index and STOXX® Europe 600 Index is comprised of stocks that are traded in one or more non-U.S. securities markets. Investments linked to the value of non-U.S. equity securities involve particular risks. Any non-U.S. securities market may be less liquid, more volatile and affected by global or domestic market developments in a different way than are the U.S. securities market or other non-U.S. securities markets. Both government intervention in a non-U.S. securities market, either directly or indirectly, and cross-shareholdings in non-U.S. companies, may affect trading prices and volumes in that market. Also, there is generally less publicly available information about non-U.S. companies than about U.S.