Basket closing level: for any given trading day, the sum of the products, as calculated for each basket underlier, of the closing level for each basket underlier on such trading day multiplied by the weighting multiplier for each such basket underlier

Closing level: as described under “General Terms of the Notes — Closing Level” in the accompanying product supplement

Initial underlier level: for each of the basket underliers, the closing level of such basket underlier on the trade date, as determined by the calculation agent and set forth under “About the Basket” herein

Final underlier level: for each of the basket underliers, the closing level of such basket underlier on the determination date, as determined by the calculation agent, except in the limited circumstances described under “General Terms of the Notes — Market Disruption Event — Consequences of a Market Disruption Event or a Non-Trading Day” and “— Discontinuance of, Adjustments to or Benchmark Event Affecting an Index Underlier or an Index Basket Underlier; Alteration of Method of Calculation” in the accompanying product supplement

Final basket level: the basket closing level on the determination date

Basket return: the quotient of (1) the final basket level minus the initial basket level divided by (2) the initial basket level, expressed as a percentage

Weighting percentage: for each basket underlier, the applicable percentage weight of such basket underlier within the basket of underliers as set forth under “About the Basket” herein; the sum of the weighting percentages of all basket underliers is equal to 100%

Weighting multiplier: for each basket underlier, a positive amount equal to the quotient of (i) the product of the initial basket level times the weighting percentage for such basket underlier divided by (ii) the initial underlier level for such basket underlier; as set forth under “About the Basket” herein; the weighting multipliers will remain constant for the term of the notes

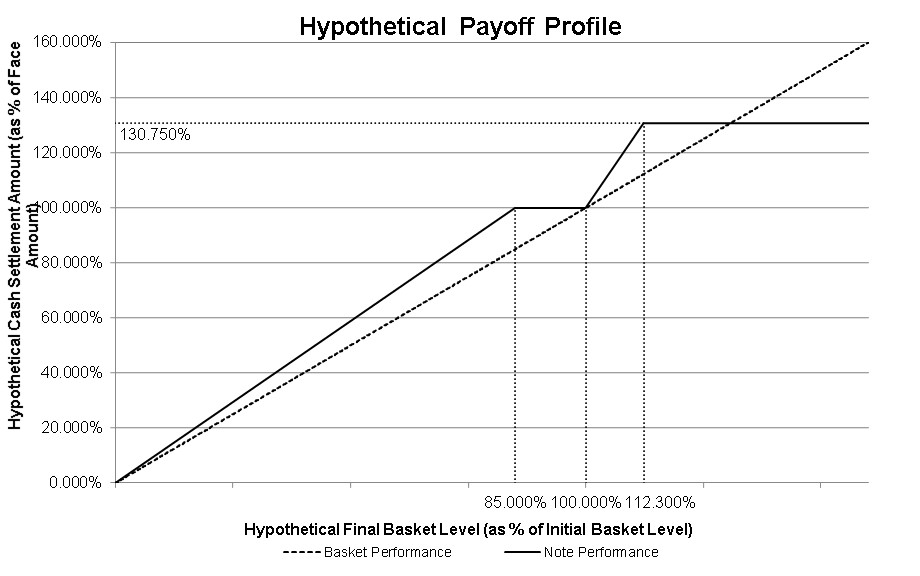

Upside participation rate: 250.00%

Cap level: 112.30% of the initial basket level

Maximum settlement amount: $1,307.50

Buffer level: 85.00, which is 85.00% of the initial basket level

Buffer amount: 15.00%

Buffer rate: the quotient of the initial basket level divided by the buffer level, expressed as a percentage, which equals approximately 117.65%

Trade date: January 7, 2025

Original issue date (settlement date): January 14, 2025

Determination date: December 2, 2026, subject to adjustment as described under “General Terms of the Notes — Determination Date” in the accompanying product supplement.

Stated maturity date: December 4, 2026, subject to adjustment as described under “General Terms of the Notes — Stated Maturity Date” in the accompanying product supplement, provided, however, that if the determination date is postponed as provided under “Determination date” above, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Additional Market Disruption Event: Notwithstanding any provision to the contrary in the accompanying product supplement, if the EURO STOXX 50® Index is calculated and published by its sponsor (the “underlier sponsor”), a market disruption event may occur if (a) underlier stocks constituting 20% or more, by weight, of such basket underlier, or (b) any option or futures contracts, if available, relating to (i) such basket underlier or (ii) underlier stocks constituting 20% or more, by weight, of such basket underlier do not trade on what were the respective primary markets for those underlier stocks or contracts, as determined by the calculation agent, including when one or more applicable markets are closed for trading under ordinary circumstances.

No interest: The offered notes do not bear interest.

No redemption: The offered notes will not be subject to a redemption right or price dependent redemption right.

No listing: The offered notes will not be listed on any securities exchange or interdealer quotation system.

Business day: as described under “General Terms of the Notes — Business Day” in the accompanying product supplement

Trading day: When we refer to a trading day with respect to a basket underlier, we mean (i) for TOPIX, the FTSE® 100 Index, the Swiss Market Index and the S&P/ASX 200 Index, a day as described under “General Terms of the Notes — Trading Day” in the accompanying product supplement and (ii) for the EURO STOXX 50® Index, a day on which such basket underlier is calculated and published by its underlier sponsor.