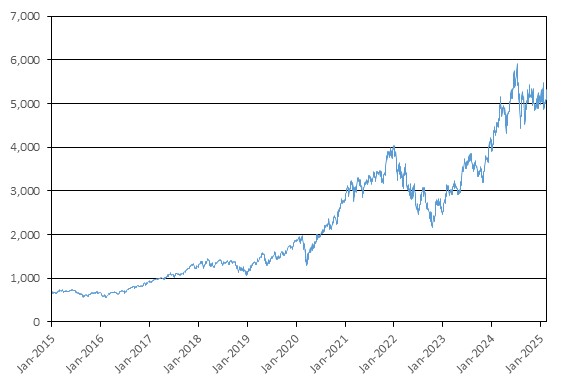

PHLX Semiconductor Sector IndexTM

We have derived all information regarding the PHLX Semiconductor Sector IndexTM (the “SOX”) contained in this document, including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. Such information reflects the policies of, and is subject to change by The Nasdaq OMX Group, Inc. and its affiliates (collectively, “Nasdaq OMX”) (its “index sponsor” or “Nasdaq OMX”).

The SOX is published by Nasdaq OMX, but Nasdaq OMX has no obligation to continue to publish the SOX, and may discontinue publication of the SOX at any time. The SOX is determined, comprised and calculated by Nasdaq OMX without regard to this instrument.

The SOX is designed to measure the performance of the 30 largest US-listed semiconductor companies. The PHLX Semiconductor Sector Index is a modified capitalization-weighted index. The PHLX Semiconductor Sector Index employs a two-stage weight adjustment scheme. Index components’ initial weights are determined by dividing each component’s market capitalization by the aggregate market capitalizations of all index components.

Stage 1: Initial index weights are adjusted to meet the following Stage 1 constraint, producing the Stage 1 weights:

●·No Index Security weight may exceed 8%.

Stage 2: Stage 1 weights are adjusted to meet the following Stage 2 constraints, producing the final weights:

●For Index Securities with the five largest market capitalizations, Stage 1 weights are maintained.

For all other Index Securities, no weight may exceed 4%.

The final weights meet the following constraints:

●No Index Security weight may exceed 8% of the index; five may exceed 4%.

If trading in an index component security is halted on its primary listing market, the most recent last sale price is used for all index computations until trading on such market resumes. Likewise, the most recent last sale price is used if trading in a security is halted on its primary listing market before the market is open. The SOX began on December 1, 1993 at a base value of 100.00, as adjusted.

Eligibility. Index eligibility is limited to specific security types only. The security types eligible for the SOX include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests.

Initial Security Eligibility Criteria. To be eligible for inclusion in the SOX, a security must meet the following criteria: (1) a security must be listed on the Nasdaq Stock Market, the New York Stock Exchange, or NYSE American, or the CBOE Exchange; (2) the security must be classified as Semiconductors or Production Technology Equipment at the subsector level according to the ICB; (3) only one class of security per issuer is allowed; (4) the security must have a market capitalization of at least $100 million; (5) the security must have traded at least 1.5 million shares in each of the last six months; (6) the security must have listed options on a recognized options market in the U.S. or be eligible for listed-options on a recognized options market in the U.S.; (7) the security may not be issued by an issuer currently in bankruptcy proceedings; (8) the issuer of the security may not have entered into a definitive agreement or other arrangement which would likely result in the security no longer being eligible; and (9) the issuer of the security must have “seasoned” on a recognized market for at least 3 months, not including the month of initial listing.

Index Maintenance. Changes in the price and/or Index Shares driven by corporate events such as stock dividends, stock splits and certain spin-offs and rights issuances are adjusted on the ex-date. If the change in total shares outstanding arising from other corporate actions is greater than or equal to 10%, the change is made as soon as practicable. Otherwise, if the change in total shares outstanding is less than 10%, then all such changes are accumulated and made effective at one time on a quarterly basis after the close of trading on the third Friday in each of March, June, September and December. The Index Shares are derived from the security’s total shares outstanding. Intraquarter, the Index Shares are adjusted by the same percentage amount by which the total shares outstanding have changed. In the case of a special cash dividend, a determination is made on an individual basis whether to make a change to the price of an index component security in accordance with its index dividend policy. If it is determined that a change will be made, it will become effective on the ex-date. Ordinarily, whenever there is a change in Index Shares, a change in an index component security, or a change to the price of an index component security due to spin-offs, rights issuance or special cash dividends, the divisor is adjusted to ensure that there is no discontinuity in the value of the SOX which might otherwise be caused by any such change. All changes are announced in advance and are reflected in the SOX prior to market open on the SOX effective date.

Index Rebalancing. The SOX employs a modified market capitalization-weighting methodology. At each quarter, the SOX is rebalanced such that the maximum weight of any index component security does not exceed 8% and no more than 5 securities are at that cap. The excess weight of any capped security is distributed proportionally across the remaining index component securities. If after redistribution, any of the 5 highest ranked index component securities are weighted below 8%, these securities are not capped. Next, any remaining index component securities in excess of 4% are capped at 4% and the excess weight is redistributed proportionally across the remaining index component securities. The process is repeated, if necessary, to derive the final weights.

The modified market capitalization-weighting methodology is applied to the capitalization of each index component security, using the last sale price of the security at the close of trading on the last trading day in February, May, August and November and after applying quarterly changes to the total shares outstanding. Index Shares are then calculated multiplying the weight of the security derived above by the new market value of the SOX and dividing the modified market capitalization for each index component security by its corresponding Last Sale Price. The changes are effective after trading on the third Friday in March, June, September and December.

Information from outside sources is not incorporated by reference in, and should not be considered part of, this document or any document incorporated herein by reference. UBS has not conducted any independent review or due diligence of any publicly available information with respect to the underlying asset.

License Agreement

We have entered into a non-exclusive license agreement with Nasdaq, Inc., which grants us a license in exchange for a fee to use the SOX in connection with the issuance of certain securities, including the Securities.

The Securities are not sponsored, endorsed, sold or promoted by Nasdaq, Inc. or its affiliates (collectively the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the Securities. The Corporations make no representation or warranty, express or implied to the owners of the Securities or any member of the public regarding the advisability of investing in securities generally or in the Securities particularly, or the ability of the PHLX Semiconductor Sector IndexTM to track general stock market performance. The Corporations’ only relationship to UBS AG (“Licensee”) is in the licensing of the PHLX Semiconductor Sector IndexTM trademarks or service marks, and certain trade names of the Corporations and the use of the PHLX Semiconductor Sector IndexTM which is determined, composed and calculated by the Corporations without regard to Licensee or the Securities. The Corporations have no obligation to take the needs of the Licensee or the owners of the Securities into consideration in determining, composing or calculating the PHLX Semiconductor Sector IndexTM. The Corporations are not responsible for and have not participated in the determination of the timing