Exhibit 99.2

Greatbatch to Acquire Enpath Webcast Presentation April 30, 2007

Forward Looking Statements Some of the statements made in the presentation whether written or oral may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of Securities Exchange Act of 1934, as amended, and involve a number of risks and uncertainties. These statements can be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are based on the company’s current expectations. The company’s actual results could differ materially from those stated or implied in such forward-looking statements. The company assumes no obligations to update forward-looking information, including information in this presentation, to reflect changed assumptions, the occu

rrence of unanticipated events or changes in future operating results, financial conditions or prospects.

Agenda ⑀⍽ Strategic Rationale Thomas Hook ⑀⍽ Financial Highlights Thomas Mazza ⑀⍽ Enpath Company Overview John Hertig ⑀⍽ Key Take-Aways Thomas Hook

Exciting Strategic Opportunity ⑀⍽ Expands Product Offering to include single use medical device products - Introducers - Advanced Delivery Catheters - Implantable Stimulation Leads ⑀⍽ Complements Existing CRM Franchise ⑀⍽ Customer and Market Diversification ⑀⍽ Offers Greater Ability to Service Neurostimulation Market ⑀⍽ Adds Extensive Intellectual Property Portfolio ⑀⍽ Synergistic with Our Current R,D & E Capabilities - Significantly enhances our MRI capabilities ⑀⍽ Strong Management Team Creates Platform for Increased Revenue Growth

Agenda ⑀⍽ Strategic Rationale Thomas Hook ⑀⍽ Financial Highlights Thomas Mazza ⑀⍽ Enpath Company Overview John Hertig ⑀⍽ Key Take-Aways Thomas Hook

Proposed Offer ⑀⍽ Cash Tender Offer ⑀⍽ Price per Share = $14.38 ⑀⍽ Total Equi

ty Value = $96.0 MM ⑀⍽ Total Enterprise Value = $102.00 MM ⑀⍽ Estimated Close Mid to Late June 2007 - Subject to Customary Regulatory and Cash Tender Processes

Financial Impact ⑀⍽ Accelerates Revenue Growth ⑀⍽ Enpath Achieved 2006 Sales of $37 million ⑀⍽ Similar Hi

storical Gross Margins 36% - 38% ⑀⍽ Accretion/Dilution • Expected to be Accretive in 2008 • Accretive in 2009 • Subject to final purchase accounting

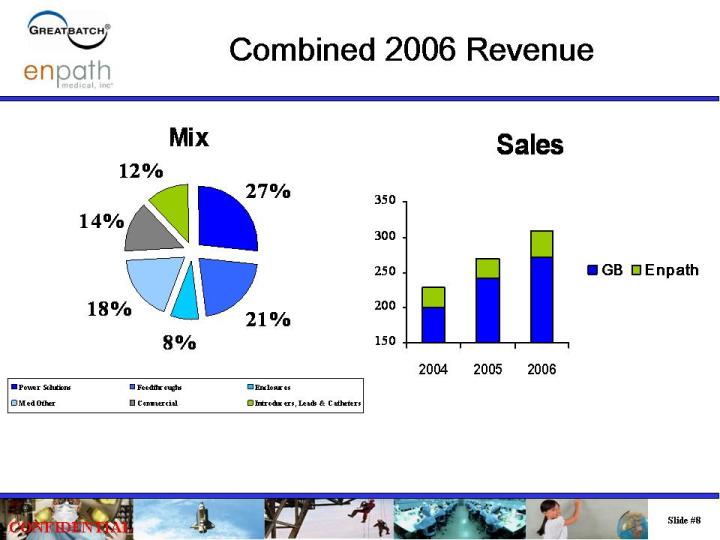

Combined 2006 Revenue Mix 27% 21% 8% 18% 14% 12% Power Solutions Feedthroughs Enclosures Me

d Other Commercial Introducers, Leads & Catheters Sales 150 200 250 300 350 2004 2005 2006 GB Enpath

Agenda ⑀⍽ Strategic Rationale Thomas Hook ⑀⍽ Financial Highlights Thomas Mazza ⑀⍽ Enpath Company Overview John Hertig ⑀⍽ Key Take

-Aways Thomas Hook

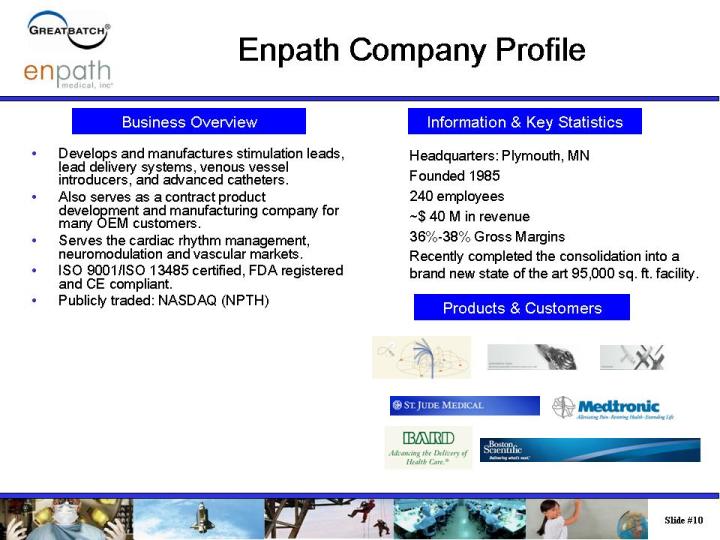

Enpath Company Profile Business Overview • Develops and manufactures stimulation leads, lead delivery systems, venous vessel introducers, and advanced catheters. • Also serves as a contract product development and manufacturing company for many OEM customers. • Serves the cardiac rhythm management, neuromodulation and vascular markets. • ISO 9001/ISO 13485 certified, FDA registered and CE compliant. • Publicly

traded: NASDAQ (NPTH) Headquarters: Plymouth, MN Founded 1985 240 employees ~$ 40 M in revenue 36%-38% Gross Margins Recently completed the consolidation into a brand new state of the art 95,000 sq. ft. facility. Information & Key Statistics Products & Customers

Agenda ⑀⍽ Strategic Rationale Thomas Hook ⑀⍽ Financial Highlights Thomas Mazza ⑀⍽ Enpath Company Overview John Hertig ⑀⍽ Key Take-Aw

ays Thomas Hook

Key Take-Aways ⑀⍽ Diversifies Customers and Markets ⑀⍽ S

ynergistic RD&E activities ⑀⍽ Accelerates Revenue Growth Rate ⑀⍽ Offers greater ability to service the growing Neurostimulation and CRM markets

Contact Information Tony Borowicz Treasurer & Director of Investor Relations Grea

tbatch, Inc. 9645 Wehrle Drive Clarence, NY 14031 ⑀⍽ Telephone 716.759.5809 ⑀⍽ Fax 716.759.5614 ⑀⍽ E-Mail tborowicz@greatbatch.com Contact Information

Greatbatch to Acquire Enpath Webcast Presentation April 30, 2007