Exhibit 99.1

JP Morgan Conference January 13-16, 2014

GREATBATCH TEAM Thomas J. Hook President & CEO Michael Dinkins Executive Vice President & CFO Betsy Cowell Vice President Finance & Treasurer

FORWARD-LOOKING STATEMENTS

We will be making forward-looking statements during today’s presentation Please refer to the appendix of this presentation and our most recent SEC filings for more information and cautionary language surrounding these statements

Greatbatch Today Value Proposition 2013 Accomplishments 2014 Strategic Initiatives 2014 Financial Guidance

NYSE: GB $660 Million Diversified Revenue Base Over 3,300 Associates 1,500 Patents and Patents Pending

GREATBATCH TODAY

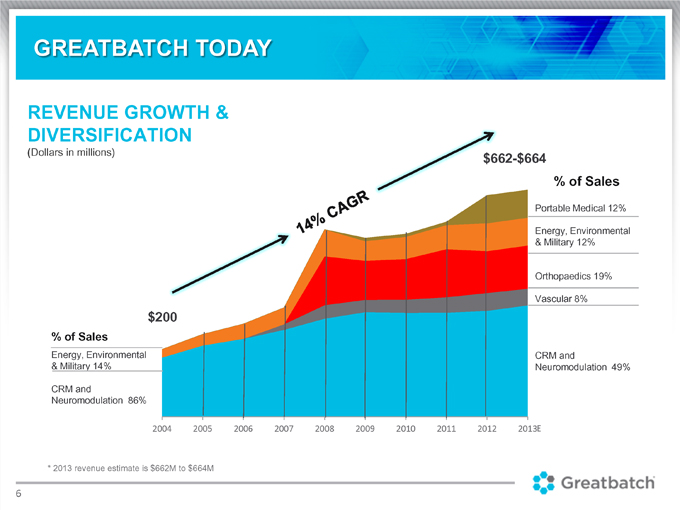

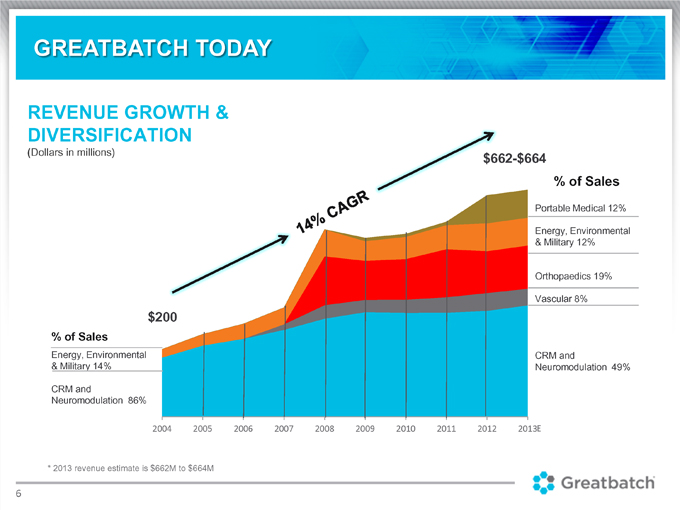

REVENUE GROWTH & DIVERSIFICATION (Dollars in millions) $664 % of Sales Portable Medical 12% Energy, Environmental & Military 12% Orthopaedics 19% Vascular 8% CRM and Neuromodulation 49% % of Sales Energy, Environmental & Military 14% CRM and Neuromodulation 86% * 2013 revenue estimate is $662M to $664M

GREATBATCH TODAY

A leader in critical technologies serving four large and growing medical device markets Cardiac & Neuromodulation Orthopaedics $1.5B Opportunity $3B Opportunity 3% Average Market Unit CAGR 6%—12% Average Market Unit CAGR Portable Medical Vascular $1B Opportunity $1.3B Opportunity 6%—9% Average Market CAGR

GREATBATCH TODAY

OUR VALUE PROPOSITION Organic Growth

Greatbatch intellectual property helps Greatbatch customers gain greater share of the markets they serve Combination of intellectual property, world-class operations and sales expertise leading to long-term agreements with blue chip customers Margin Expansion Leveraging global operations footprint raising capacity utilization 60% of revenues produced at locations built since 2005 Emerging Medical Device Portfolio Pipeline of medical device systems attractive markets and potential for significant market share gain Targeted Acquisitions Enhance our top line and bottom line growth trajectory, expand our pipeline of technologies and improve our ROIC

2013 Accomplishments

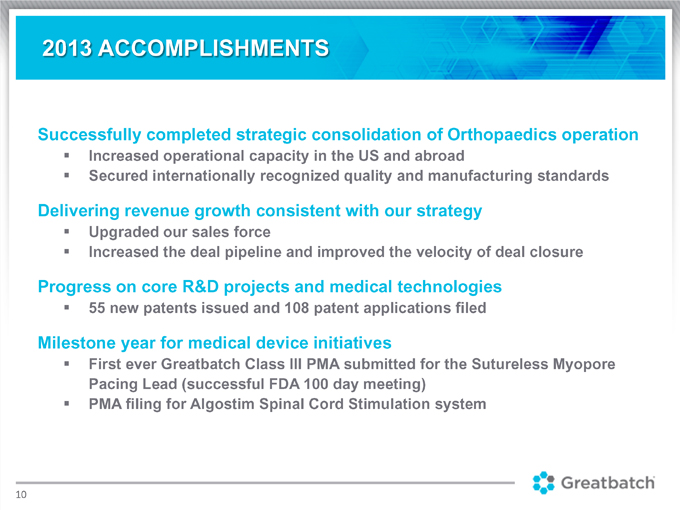

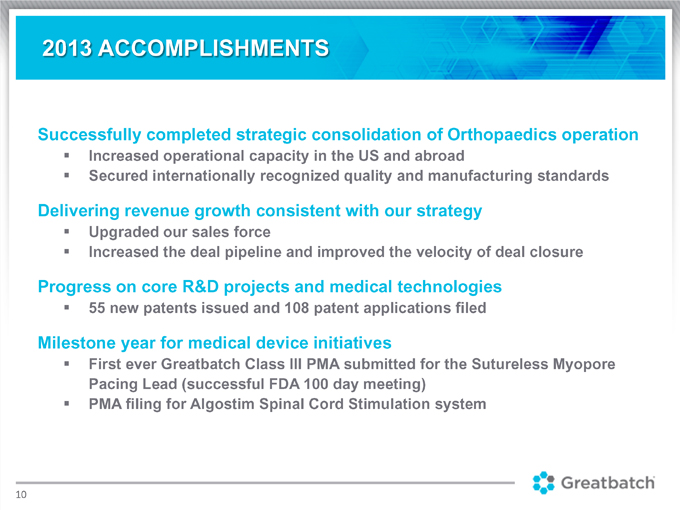

2013 ACCOMPLISHMENTS

Successfully completed strategic consolidation of Orthopaedics operation Increased operational capacity in the US and abroad Secured internationally recognized quality and manufacturing standards Delivering revenue growth consistent with our strategy Upgraded our sales force Increased the deal pipeline and improved the velocity of deal closure Progress on core R&D projects and medical technologies 55 new patents issued and 108 patent applications filed Milestone year for medical device initiatives First ever Greatbatch Class III PMA submitted for the Sutureless Myopore Pacing Lead (successful FDA 100 day meeting) ? PMA filing for Algostim Spinal Cord Stimulation system

2014 Strategic Initiatives

THE PLAN: STAY THE COURSE OF EXECUTING OUR STRATEGY

Sales and marketing team expansion to leverage IP to drive sustainable organic top line growth Operational excellence to drive cost reduction and margin expansion Commercialization and continued development of full medical device systems Inorganic growth opportunities

ORGANIC GROWTH

ORGANIC GROWTH:

BLUE CHIP CUSTOMER BASE AND LONG-TERM AGREEMENTS

ORGANIC GROWTH:

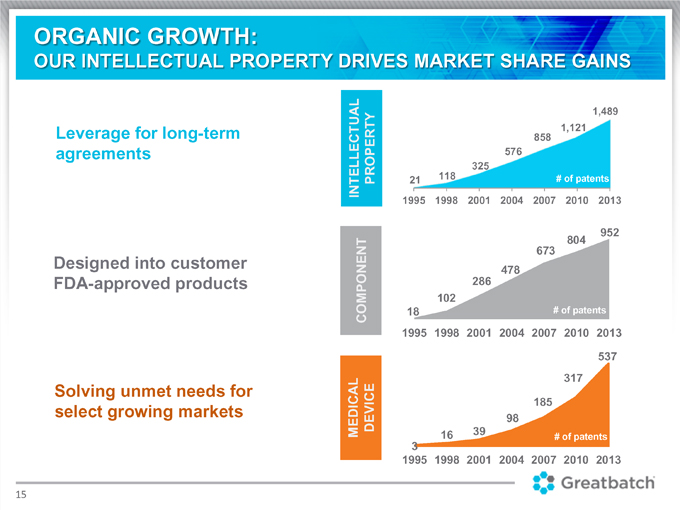

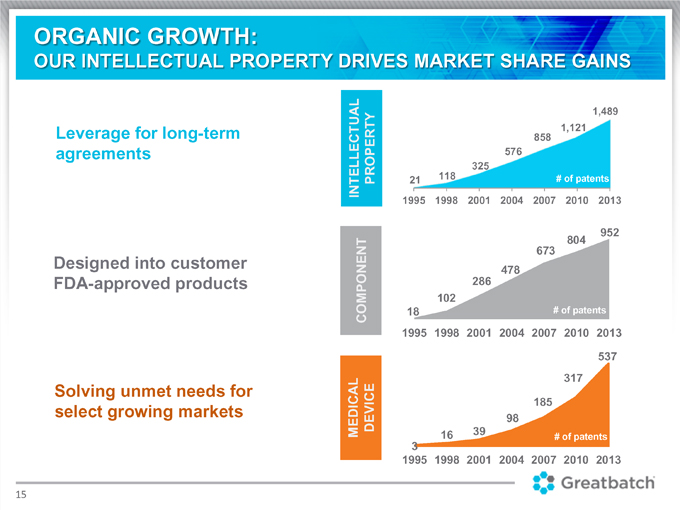

OUR INTELLECTUAL PROPERTY DRIVES MARKET SHARE GAINS

Leverage for long-term agreements

Designed into customer FDA-approved products

Solving unmet needs for select growing markets

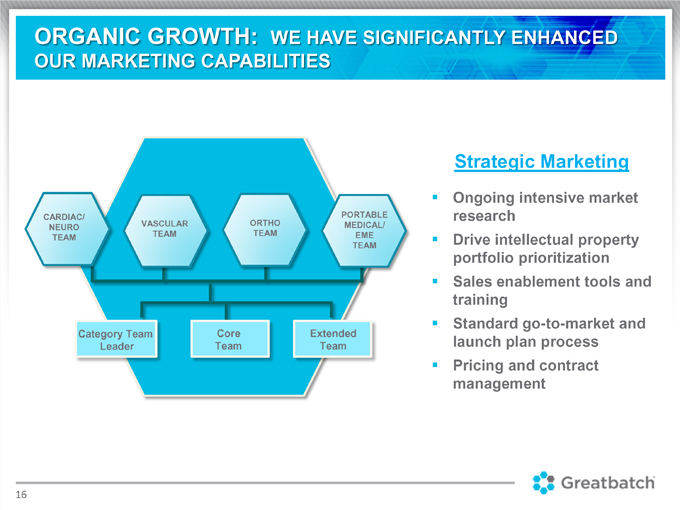

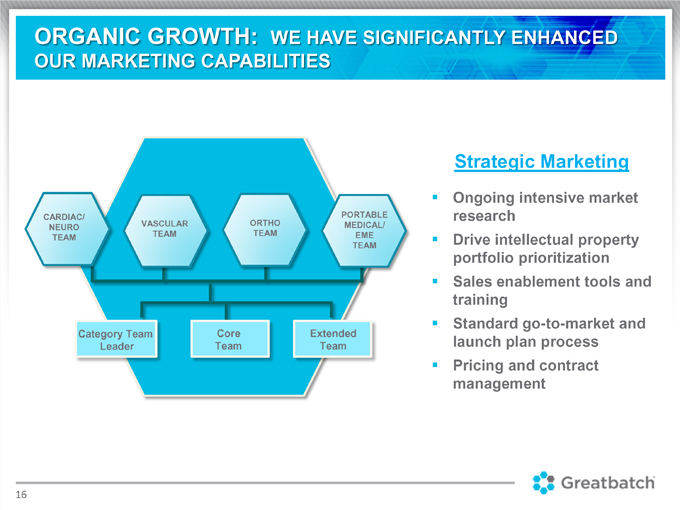

Strategic Marketing

Ongoing intensive market research Drive intellectual property portfolio prioritization Sales enablement tools and training Standard go-to-market and launch plan process Pricing and contract management

ORGANIC GROWTH: SALES FORCE PRODUCTIVITY DRIVEN BENEFITS

Sales Force Placement of all account executives closer to major customers 31% U.S. expansion Upgraded 25% of remaining sales force with new sales talent Governance – sales and operations qualify all deals Variable sales compensation introduced to compensate on revenue and deal quotas Cardiac/Neuro Vascular Orthopaedic Portable Medical Energy, Military. Environmental Applications Engineers

MARGIN EXPANSION

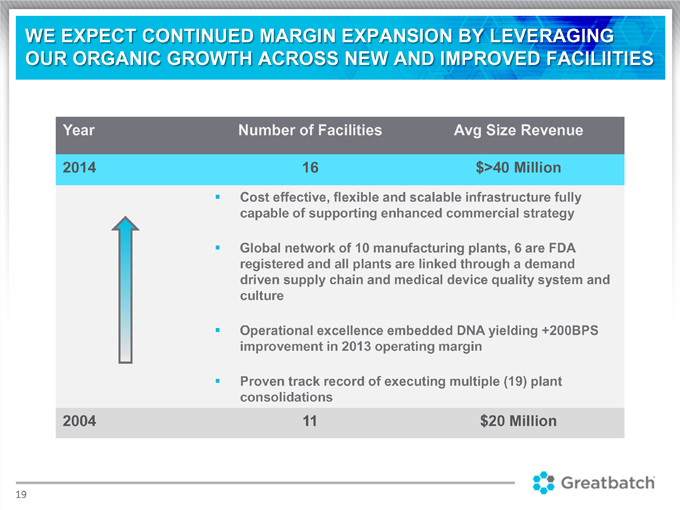

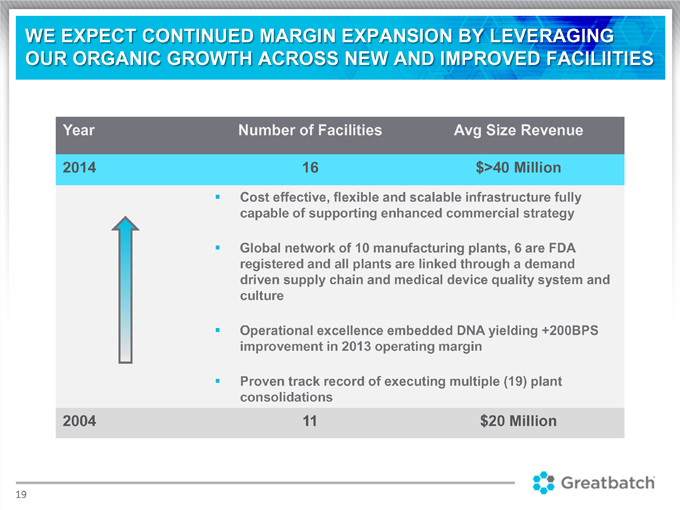

WE EXPECT CONTINUED MARGIN EXPANSION BY LEVERAGING OUR ORGANIC GROWTH ACROSS NEW AND IMPROVED FACILIITIES Year Number of Facilities Avg Size Revenue 2014 16 $>40 Million

Cost effective, flexible and scalable infrastructure fully capable of supporting enhanced commercial strategy Global network of 10 manufacturing plants, 6 are FDA registered and all plants are linked through a demand driven supply chain and medical device quality system and culture Operational excellence embedded DNA yielding +200BPS improvement in 2013 operating margin Proven track record of executing multiple (19) plant consolidations

MEDICAL DEVICE SYSTEMS

EMERGING MEDICAL DEVICE PORTFOLIO

QiG was established in 2008 to facilitate the development of complete medical devices 120 R&D professionals across the US working on a portfolio of new and innovative product opportunities QiG has established relationships with highly specialized physicians across the US and EU to support the design of medical devices with unique benefits to improve clinical outcomes QiG has provided differentiated medical devices to OEM customers by accelerating the velocity of innovation while delivering optimized supply chain and cost efficiencies We are utilizing our market research to drive our intellectual property portfolio prioritization with a goal of improved ROIC

EMERGING MEDICAL DEVICE PORTFOLIO

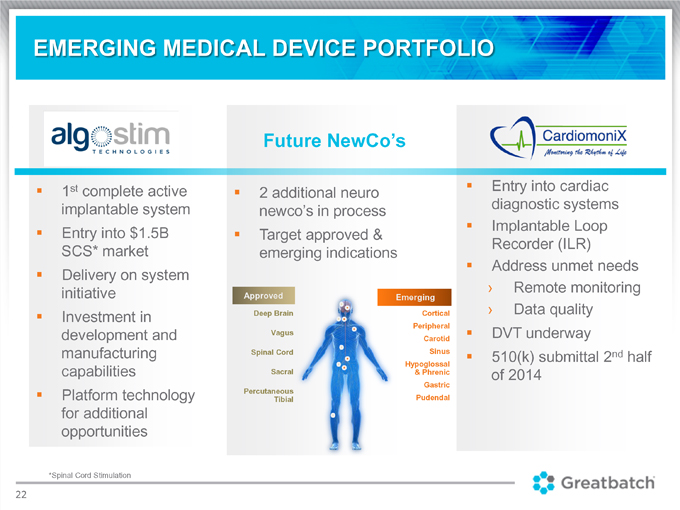

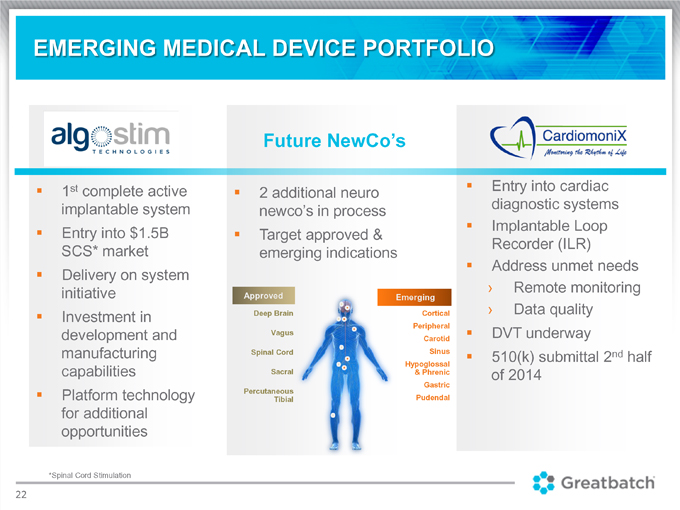

Future NewCo’s 1st complete active 2 additional neuro Entry into cardiac implantable system newco’s in process diagnostic systems Implantable Loop Entry into $1.5B Target approved & Recorder (ILR) SCS* market emerging indications Address unmet needs Delivery on system initiative Remote monitoring Approved Emerging Deep Brain Cortical Data quality Investment in Peripheral development and Vagus DVT underway Carotid manufacturing Spinal Cord Sinus 510(k) submittal 2nd half Sacral Hypoglossal capabilities & Phrenic of 2014 Gastric Platform technology Percutaneous Tibial Pudendal for additional opportunities

ALGOSTIM SYSTEM ACCOMPLISHMENT

ALGOSTIM VALUE PROPOSITION

“A highly differentiated complete SCS system and platform with extensive offering of innovation, IP, advanced safety features, and future generation capabilities in the fast growing 2013E $1.5B SCS market” Highly under-penetrated market (<10%) History of large market share shifts with technology innovation Strong SCS* growth rate (7%+ CAGR) market growing to $1.7B 1% market share represents $17M revenue to partner in 2015 Extensive IP portfolio Gen 1: Technology innovation will drive market share Gen 2: Breakthrough technology can enable market leadership

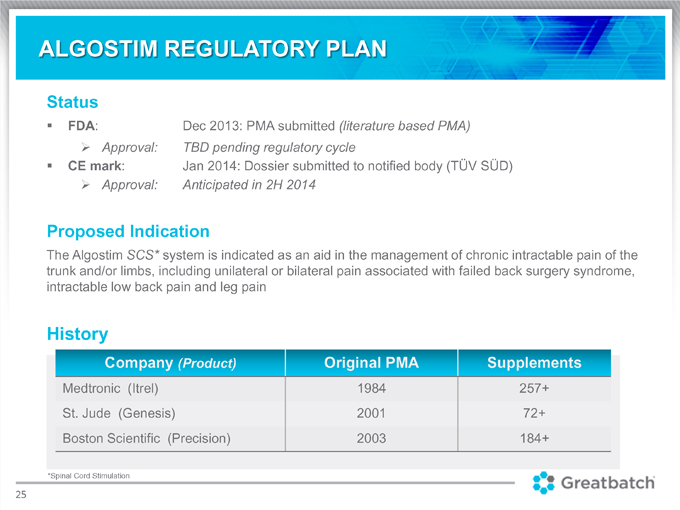

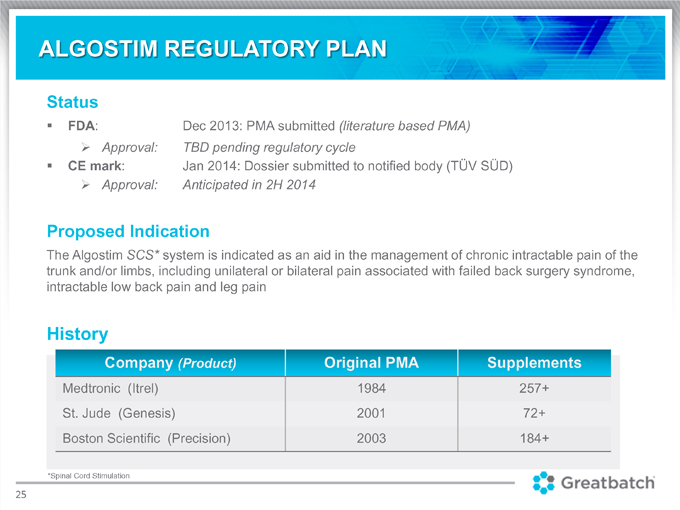

ALGOSTIM REGULATORY PLAN

Status FDA: Dec 2013: PMA submitted (literature based PMA) Approval: TBD pending regulatory cycle CE mark: Jan 2014: Dossier submitted to notified body (TÜV SÜD) Approval: Anticipated in 2H 2014 Proposed Indication The Algostim SCS system is indicated as an aid in the management of chronic intractable pain of the trunk and/or limbs, including unilateral or bilateral pain associated with failed back surgery syndrome, intractable low back pain and leg pain History Company (Product) Medtronic (Itrel) 1984 257+ St. Jude (Genesis) 2001 72+ Boston Scientific (Precision) 2003 184+

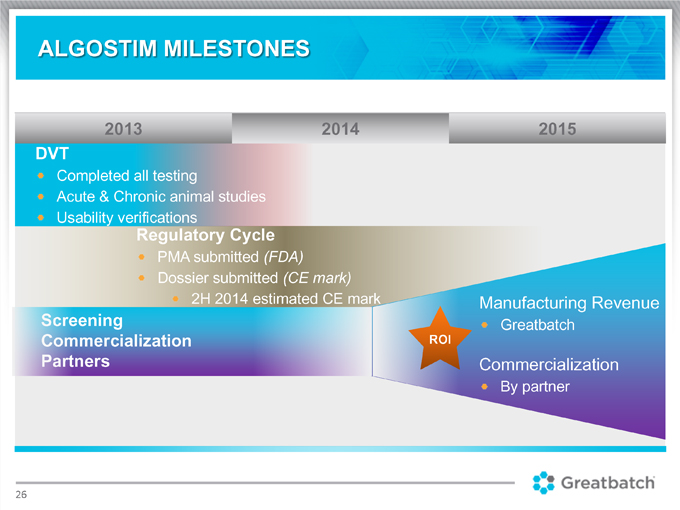

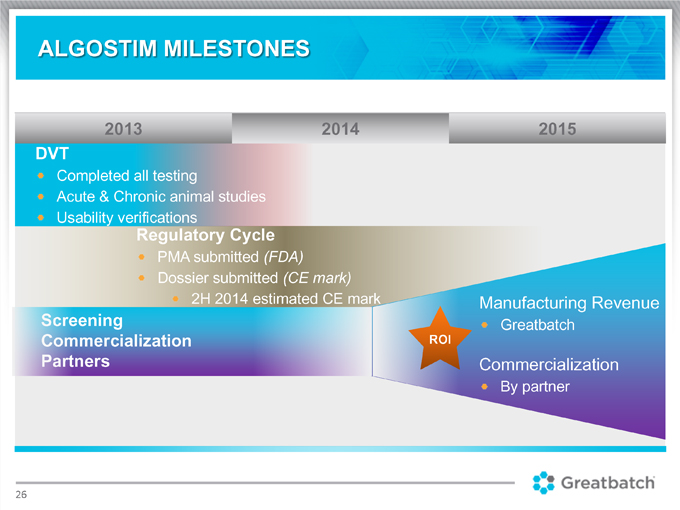

ALGOSTIM MILESTONES

2013 2014 2015 DVT

Completed all testing

Acute & Chronic animal studies Usability verifications Regulatory Cycle PMA submitted (FDA) Dossier submitted (CE mark) 2H 2014 estimated CE mark Manufacturing Revenue Screening Greatbatch Commercialization ROI Partners Commercialization

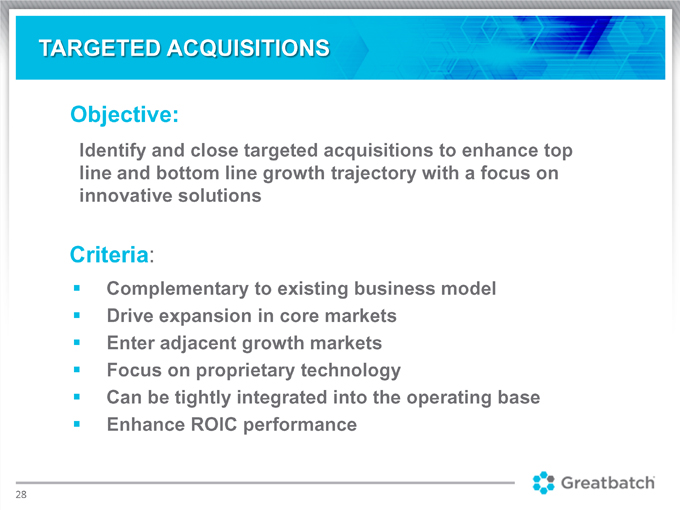

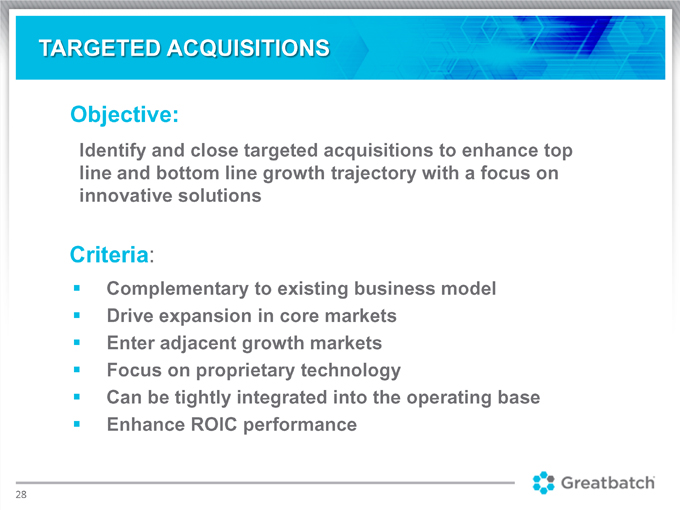

TARGETED ACQUISITIONS

TARGETED ACQUISITIONS Objective: Identify and close targeted acquisitions to enhance top line and bottom line growth trajectory with a focus on innovative solutions Criteria: Complementary to existing business model Drive expansion in core markets Enter adjacent growth markets Focus on proprietary technology Can be tightly integrated into the operating base Enhance ROIC performance

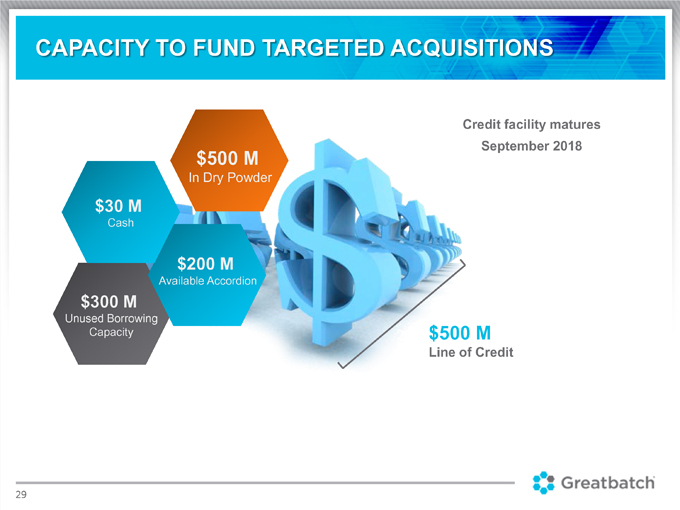

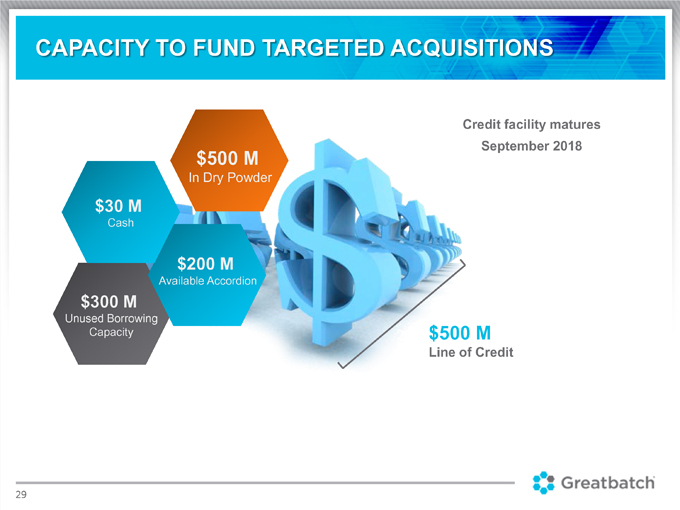

CAPACITY TO FUND TARGETED ACQUISITIONS

2014 Financial Guidance

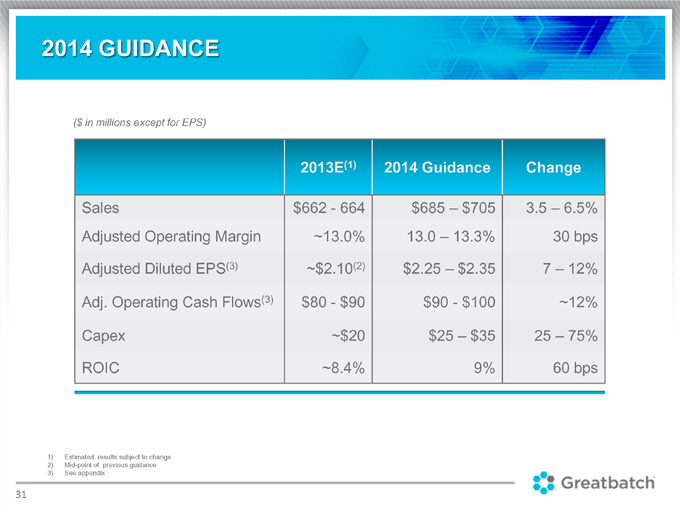

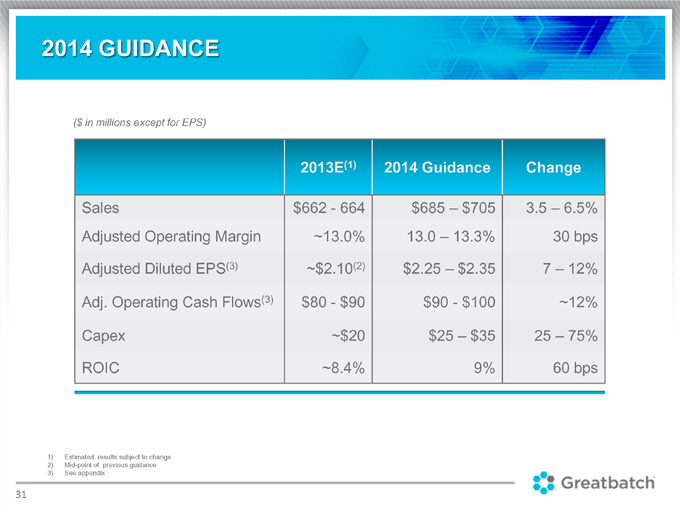

2014 GUIDANCE

($ in millions except for EPS) 2013E(1) 2014 Guidance Change Sales $662 664 $685 $705 3.5 6.5% Adjusted Operating Margin 13.0% 13.0 13.3% 30 bps Adjusted Diluted EPS(3) $2.10(2) $2.25 – $2.35 7 12% Adj. Operating Cash Flows(3) $80—$90 $90—$100 12% Capex ~$20 $25 – $35 25 – 75% ROIC ~8.4% 9% 60 bps 1) Estimated results subject to change 2) Mid-point of previous guidance 3) See appendix

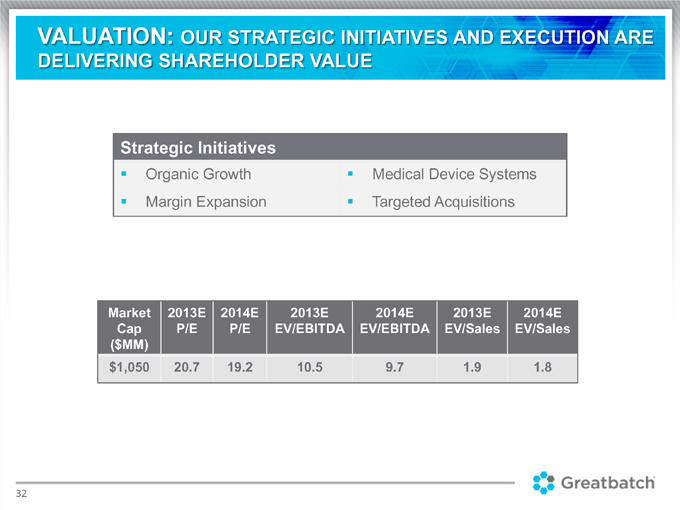

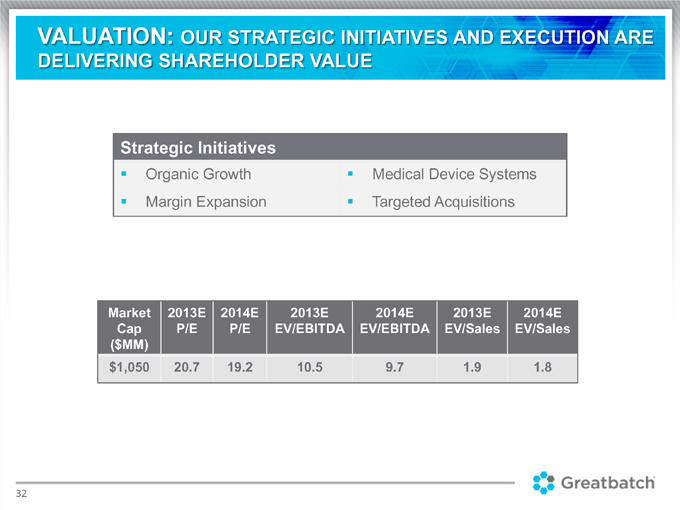

VALUATION: OUR STRATEGIC INITIATIVES AND EXECUTION ARE DELIVERING SHAREHOLDER VALUE Strategic Initiatives Organic Growth Medical Device Systems Margin Expansion Targeted Acquisitions Market 2013E 2014E 2013E 2014E 2013E 2014E Cap P/E P/E EV/EBITDA EV/EBITDA EV/Sales EV/Sales ($MM) $1,050 20.7 19.2 10.5 9.7 1.9 1.8

Appendix

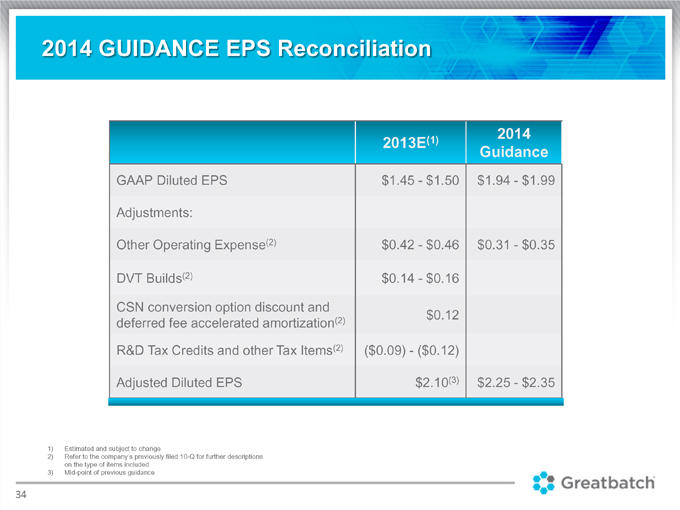

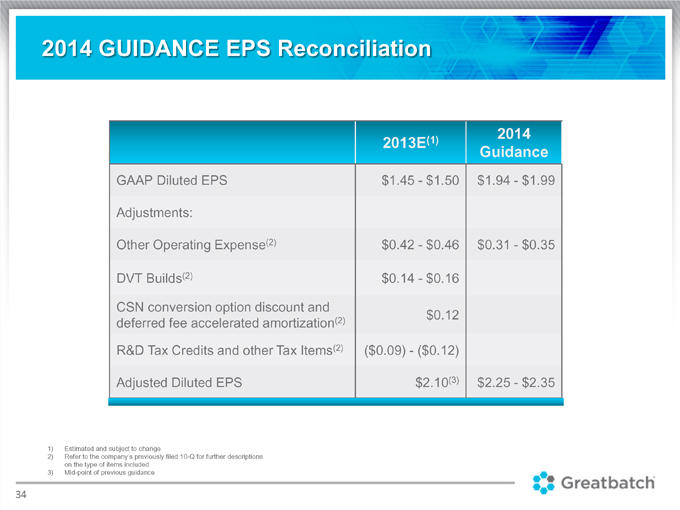

2014 GUIDANCE EPS Reconciliation (1) 2014 2013E Guidance GAAP Diluted EPS $1.45 $1.50 $1.94 $1.99 Adjustments: Other Operating Expense(2) $0.42—$0.46 $0.31—$0.35 DVT Builds(2) $0.14—$0.16 CSN conversion option discount and (2) $0.12 deferred fee accelerated amortization R&D Tax Credits and other Tax Items(2) ($0.09) ($0.12) Adjusted Diluted EPS $2.10(3) $2.25—$2.35 1) Estimated and subject to change 2) Refer to the company’s previously filed 10-Q for further descriptions on the type of items included 3) Mid-point of previous guidance

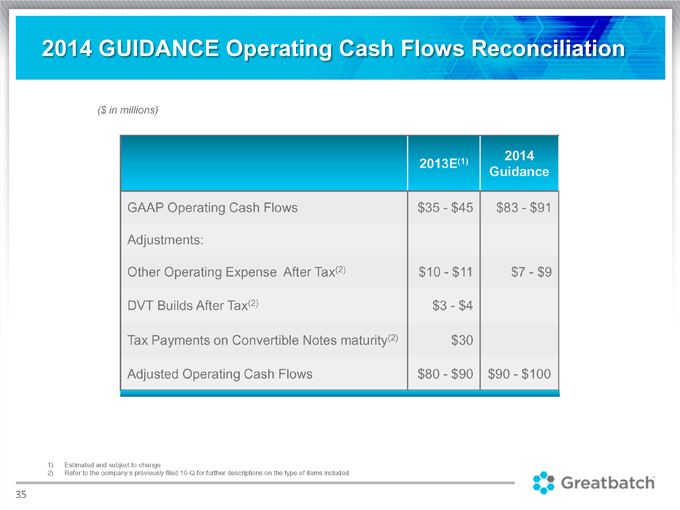

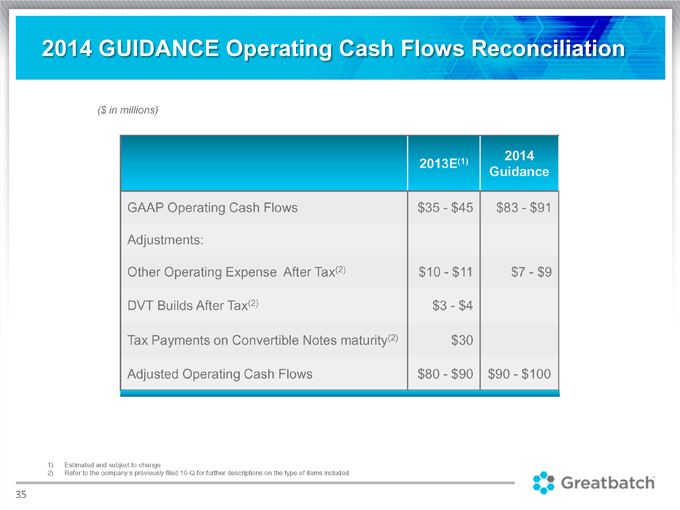

2014 GUIDANCE Operating Cash Flows Reconciliation

($ in millions)

(1) 2014 2013E Guidance GAAP Operating Cash Flows $35—$45 $83—$91 Adjustments: Other Operating Expense After Tax(2) $10 $11 $7 $9 DVT Builds After Tax(2) $3—$4 Tax Payments on Convertible Notes maturity(2) $30 Adjusted Operating Cash Flows $80—$90 $90—$100

1) Estimated and subject to change

2) Refer to the company’s previously filed 10-Q for further descriptions on the type of items included

FORWARD-LOOKING STATEMENT

Some of the statements made in the presentation whether written or oral may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of Securities Exchange Act of 1934, as amended, and involve a number of risks and uncertainties. These statements can be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are based on the company’s current expectations. The company’s actual results could differ materially from those stated or implied in such forward-looking statements. The company assumes no obligations to update forward-looking information, including information in this presentation, to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects.

CONTACT INFOMATION Betsy Cowell

Vice President Finance & Treasurer Greatbatch 2595 Dallas Parkway Suite 310 Frisco, Texas 75034 214 618 4982 ecowell@greatbatch.com www.greatbatch.com