Filed Pursuant to Rule 424(b)(3)

Registration No. 333-74014

PART ONE — DISCLOSURE DOCUMENT

CAMPBELL ALTERNATIVE ASSET TRUST

$201,000,000

UNITS OF BENEFICIAL INTEREST

The Offering

The Trust trades speculatively in the U.S. and international futures, forward and option markets. Specifically, the Trust trades in a portfolio primarily focused on financial futures and forwards, which are instruments designed to hedge or speculate on changes in interest rates, currency exchange rates or stock index values. A secondary emphasis is on metals and energy products. Campbell & Company, Inc., a futures fund manager, allocates the Trust's assets across a broad spectrum of markets.

As of April 30, 2007, the net asset value per unit was $1,748.28. There is no fixed termination date for the offering of the units. The Trust offers the units during the continuing offering at the net asset value per unit as of each month-end closing date on which subscriptions are accepted. Campbell & Company may suspend, limit or terminate the continuing offering period at any time.

The units are no longer offered to the public generally. Units are being offered exclusively for sale to the Campbell & Company, Inc. 401(k) Plan.

The Risks

These are speculative securities. Before you decide whether to invest, read this entire prospectus carefully and consider "The Risks You Face" and "Conflicts of Interest."

| • | The Trust is speculative and leveraged. The Trust's assets are leveraged at a ratio which can range from 5:1 to 20:1. |

| • | Past results of Campbell & Company are not necessarily indicative of future performance of the Trust, and the Trust's performance can be volatile. The net asset value per unit may fluctuate significantly in a single month. |

| • | You could lose all or a substantial amount of your investment in the Trust. |

| • | Campbell & Company has total trading authority over the Trust and the Trust is dependent upon the services of Campbell & Company. The use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. |

| • | There is no secondary market for the units and none is expected to develop. While the units have redemption rights, there are restrictions. For example, redemptions can occur only at the end of a month. |

| • | Transfers of interest in the units are subject to limitations, such as 30 days' advance written notice of any intent to transfer. Also, Campbell & Company may deny a request to transfer if it determines that the transfer may result in adverse legal or tax consequences for the Trust. |

| • | Substantial expenses must be offset by trading profits and interest income. An investor is expected to break-even on his/her investment in the first twelve months of trading, assuming an initial investment of $10,000, provided that the Trust does not lose more than 0.20% per annum or $20 of the assumed initial investment. |

| • | A substantial portion of the trades executed for the Trust takes place on foreign exchanges. No U.S. regulatory authority or exchange has the power to compel the enforcement of the rules of a foreign board of trade or any applicable foreign laws. |

| • | The Trust is subject to conflicts of interest. There are no independent experts representing investors. |

_______________

Investors are required to make representations and warranties relating to their suitability in connection with this investment. Each investor is encouraged to discuss the investment with his/her individual financial, legal and tax adviser.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED UPON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

_______________

CAMPBELL & COMPANY, INC.

Managing Owner

June 29, 2007

(This page has been left blank intentionally.)

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL BEGINNING AT PAGE 32 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK-EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 3.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, BEGINNING AT PAGE 6.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

PERFORMANCE INFORMATION FOR OTHER POOLS AND ACCOUNTS MANAGED BY CAMPBELL & COMPANY, INC. ARE AVAILABLE UPON REQUEST.

_______________

This prospectus does not include all of the information or exhibits in the Trust's registration statement. You can read and copy the entire registration statement at the public reference facilities maintained by the Securities and Exchange Commission in Washington, D.C.

The Trust files monthly, quarterly and annual reports with the SEC. You can read and copy these reports at the SEC public reference facilities in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information.

The Trust's filings will be posted at the SEC website at http://www.sec.gov.

_______________

CAMPBELL & COMPANY, INC.

Managing Owner

210 West Pennsylvania Avenue

Towson, Maryland 21204

(410) 296-3301

PART ONE — DISCLOSURE DOCUMENT

TABLE OF CONTENTS

| | Page |

| SUMMARY | 1 |

| General | 1 |

| Plan of Distribution | 1 |

| A Summary of Risk Factors You Should Consider Before Investing in the Trust | 2 |

| Investment Factors You Should Consider Before Investing in the Trust | 3 |

| Campbell & Company, Inc. | 3 |

| Charges to the Trust | 3 |

| Estimate of Break-Even Level | 3 |

| Distributions and Redemptions | 4 |

| Federal Income Tax Aspects | 4 |

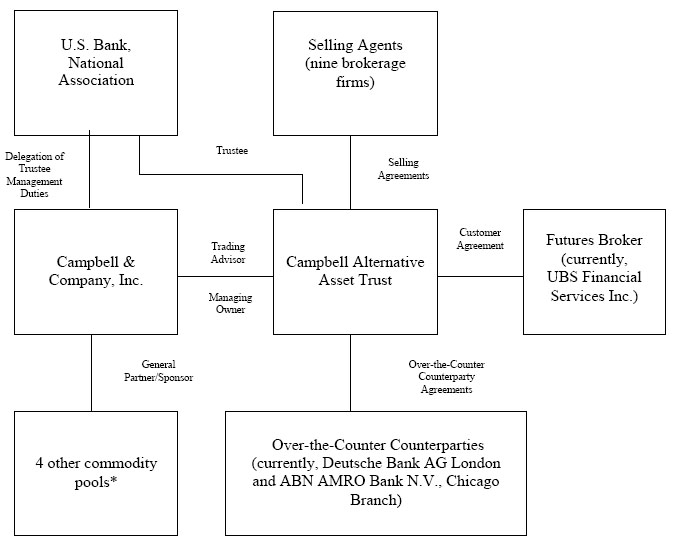

| CAMPBELL ALTERNATIVE ASSET TRUST ORGANIZATIONAL CHART | 5 |

| THE RISKS YOU FACE | 6 |

| Market Risks | 6 |

You Could Possibly Lose Your Total Investment in the Trust | 6 |

The Trust is Highly Leveraged | 6 |

Your Investment Could be Illiquid | 6 |

Forward and Option Transactions are Over-the-Counter, are Not Regulated and are Subject to Credit Risk | 6 |

Options on Futures and Over-the-Counter Contracts are Speculative and Highly Leveraged | 7 |

An Investment in the Trust May Not Diversify an Overall Portfolio | 7 |

| Trading Risks | 7 |

Campbell & Company Analyzes Primarily Technical Market Data | 7 |

Increased Competition from Other Trend-Following Traders Could Reduce Campbell & Company's Profitability | 7 |

Speculative Position Limits May Alter Trading Decisions for the Trust | 7 |

Increase in Assets Under Management May Make Profitable Trading More Difficult | 7 |

Investors Will Not be Able to Review the Trust's Holdings on a Daily Basis | 8 |

| Other Risks | 8 |

Fees and Commissions are Charged Regardless of Profitability and are Subject to Change | 8 |

The Futures Broker Could Fail and Has Been Subject to Disciplinary Action | 8 |

Investors Must Not Rely on the Past Performance of Either Campbell & Company or the Trust in Deciding Whether to Buy Units | 8 |

Parties to the Trust Have Conflicts of Interest | 8 |

There are No Independent Experts Representing Investors | 9 |

The Trust Places Significant Reliance on Campbell & Company | 9 |

The Trust Could Terminate Before Expiration of its Stated Term | 9 |

The Trust is Not a Regulated Investment Company | 9 |

Proposed Regulatory Change is Impossible to Predict | 9 |

Forwards, Options, Swaps, Hybrids and Other Derivatives are Not Subject to CFTC Regulation | 9 |

The Trust is Subject to Foreign Market Credit and Regulatory Risk | 9 |

The Trust is Subject to Foreign Exchange Risk | 10 |

Transfers Could Be Restricted | 10 |

A Single-Advisor Fund May Be More Volatile Than a Multi-Advisor Fund | 10 |

The Performance Fee Could be an Incentive to Make Riskier Investments | 10 |

The Trust May Distribute Profits to Unitholders at Inopportune Times | 10 |

Potential Inability to Trade or Report Due to Systems Failure | 10 |

Potential Disruption or Inability to Trade Due to a Failure to Receive Timely and Accurate Market Data from Third Party Vendors | 10 |

| SELECTED FINANCIAL DATA | 12 |

| SUPPLEMENTARY FINANCIAL INFORMATION | 12 |

| CAMPBELL & COMPANY, INC | 13 |

| Description | 13 |

| The Trading Advisor | 15 |

| Trading Systems | 15 |

| | Page |

| MANAGEMENT'S ANALYSIS OF OPERATIONS | 18 |

| Introduction | 18 |

| Critical Accounting Policies | 19 |

| Capital Resources | 19 |

| Liquidity | 19 |

| Results of Operations | 19 |

| Off-Balance Sheet Risk | 24 |

| Disclosures About Certain Trading Activities that Include Non-Exchange Traded Contracts Accounted for at Fair Value | 24 |

| Quantitative and Qualitative Disclosures About Market Risk | 24 |

| General | 28 |

| PAST PERFORMANCE OF THE CAMPBELL ALTERNATIVE ASSET TRUST | 29 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 30 |

| CONFLICTS OF INTEREST | 30 |

| Campbell & Company, Inc | 30 |

| The Futures Broker and the Over-the-Counter Counterparties | 31 |

| Fiduciary Duty and Remedies | 31 |

| Indemnification and Standard of Liability | 31 |

| CHARGES TO THE TRUST | 32 |

| Brokerage Fee | 32 |

| Other Trust Expenses | 32 |

| Campbell & Company, Inc | 32 |

| The Futures Broker | 33 |

| The Over-the-Counter Counterparties | 33 |

| The Selling Agents | 33 |

| Organization and Offering Expenses | 33 |

| Other Expenses | 34 |

| Investments Made by the Campbell & Company, Inc. 401(k) Plan | 34 |

| USE OF PROCEEDS | 34 |

| THE FUTURES BROKER | 34 |

| THE OVER-THE-COUNTER COUNTERPARTIES | 37 |

| CAPITALIZATION | 37 |

| DISTRIBUTIONS AND REDEMPTIONS | 38 |

| Distributions | 38 |

| Redemptions | 38 |

| Net Asset Value | 38 |

| DECLARATION OF TRUST & TRUST AGREEMENT | 38 |

| Organization and Limited Liability | 38 |

| Management of Trust Affairs | 38 |

| The Trustee | 38 |

| Sharing of Profits and Losses | 39 |

| Dispositions | 39 |

| Dissolution and Termination of the Trust | 40 |

| Amendments and Meetings | 40 |

| Indemnification | 40 |

| Reports to Unitholders | 40 |

| FEDERAL INCOME TAX ASPECTS | 41 |

| The Trust's Partnership Tax Status | 41 |

| Unrelated Business Taxable Income | 41 |

| IRS Audits of the Trust and its Unitholders | 41 |

| INVESTMENT BY ERISA ACCOUNTS | 41 |

| General | 41 |

| Special Investment Consideration | 41 |

| The Trust Should Not Be Deemed to Hold "Plan Assets" | 42 |

| Ineligible Purchasers | 42 |

| | Page |

| PLAN OF DISTRIBUTION | 42 |

| Subscription Procedure | 42 |

| Representations and Warranties of Investors in the Subscription Agreement | 43 |

| Investor Suitability | 43 |

| The Selling Agents | 43 |

| UNITHOLDER PRIVACY POLICY | 44 |

| LEGAL MATTERS | 44 |

| EXPERTS | 44 |

| MONTHLY REPORT | 45 |

| INDEX TO FINANCIAL STATEMENTS | 46 |

PART TWO — STATEMENT OF ADDITIONAL INFORMATION TABLE OF CONTENTS |

| |

| The Futures, Forward, Option and Swap Markets | 95 |

| | |

EXHIBITS | |

| | |

| EXHIBIT A: Third Amended and Restated Declaration of Trust and Trust Agreement | A-1 |

| EXHIBIT B: Request for Redemption | B-1 |

| EXHIBIT C: Subscription Requirements | C-1 |

| EXHIBIT D: Subscription Agreement and Power of Attorney | D-1 |

SUMMARY

This summary of all material information provided in this Prospectus is intended for quick reference only. The remainder of this Prospectus contains more detailed information; you should read the entire Prospectus, including all exhibits to the Prospectus, before deciding to invest in any Units. This Prospectus is dated June 29, 2007.

General

Campbell Alternative Asset Trust, or the Trust, was formed as a Delaware statutory trust on May 3, 2000. The Trust issues units of beneficial interest, or Units, which represent units of fractional undivided beneficial interests in and ownership of the Trust. The Trust will continue in existence until December 31, 2030 (unless terminated earlier in certain circumstances). The principal offices of the Trust are located at c/o Campbell & Company, Inc., 210 West Pennsylvania Avenue, Towson, Maryland 21204, and its telephone number is (410) 296-3301. The books and records of the Trust are maintained at the offices of Campbell & Company, Inc. Unitholders or their duly authorized representatives may inspect the Trust’s books and records during normal business hours upon reasonable written notice to Campbell & Company, Inc. and may obtain copies of such records (including by post upon payment of reasonable mailing costs), upon payment of reasonable reproduction costs; provided, however, upon request by Campbell & Company, Inc., the Unitholder will represent that the inspection and/or copies of such records will not be for commercial purposes unrelated to such Unitholder's interest as a beneficial owner of the Trust.

Campbell Alternative Asset Trust allows you to participate in alternative or non-traditional investments, namely the U.S. and international futures, forward and option markets. Specifically, the Trust trades in a portfolio primarily focused on financial futures and forwards, which are instruments designed to hedge or speculate on changes in interest rates, currency exchange rates or stock index values. A secondary emphasis is on metals and energy products. The Trust will attempt to generate profits through the investment in the Financial, Metal & Energy Large Portfolio advised by Campbell & Company, the Trust's managing owner. Campbell & Company uses its computerized, trend-following, technical trading and risk control methods to seek substantial medium- and long-term capital appreciation while, at the same time, seeking to manage risk and volatility. Campbell & Company provides advisory services to numerous other funds and individually managed accounts similar to the services Campbell & Company provides to the Trust. Campbell & Company has been using its technical approach since 1972 — one of the longest performance records of any currently active futures fund manager and has developed and refined its approach over the past 35 years. See “Past Performance of the Campbell Alternative Asset Trust” for the performance data required to be disclosed for the most recent five calendar years and year-to-date.

Futures are standardized contracts traded on commodity exchanges that call for the future delivery of commodities at a specified time and place. While futures contracts are traded on a wide variety of commodities, the Trust will concentrate its futures trading in financial instruments such as interest rates, foreign exchange and stock index contracts, and metal and energy contracts. The U.S. futures markets are regulated under the Commodity Exchange Act, which is administered by the CFTC. The Trust will trade futures positions on margin, meaning that the Trust will utilize leverage in its trading.

Currencies and other commodities may be purchased or sold by the Trust for future delivery or cash settlement through banks or dealers pursuant to forward and option contracts. Unlike futures contracts, forward and option contracts are not standardized and these markets are largely unregulated.

The following summary provides a review in outline form of important aspects of an investment in the Trust.

Plan of Distribution

How to Subscribe for Units

| | • | During the continuing offering period, units will be offered at a price of net asset value per unit. The net assets of the Trust are its assets less its liabilities determined in accordance with the Trust Agreement. The net asset value per unit equals the net assets of the Trust divided by the number of units outstanding as of the date of determination. |

| | • | The continuing offering period can be terminated by Campbell & Company at any time. Campbell & Company has no present intention to terminate the offering. |

| | • | Interest earned while subscriptions are being processed will be paid to subscribers in the form of additional units. |

| | • | There is no limit on the number of Units that may be offered by the Trust, provided, however, that all such Units must be registered with the U.S. Securities and Exchange Commission prior to issuance. |

Who May Invest in the Trust

The Trust is being offered exclusively for sale to the Campbell & Company, Inc. 401(k) Plan.

Is the Campbell Alternative Asset Trust a Suitable Investment for You?

An investment in the Trust is speculative and involves a high degree of risk. The Trust is not a complete investment program. Campbell & Company offers the Trust as a diversification opportunity for an investor's entire investment portfolio, and therefore an investment in the Trust should only be a limited portion of the investor's portfolio.

A Summary of Risk Factors You Should Consider Before Investing in the Trust

| | • | The Trust is a highly volatile and speculative investment. There can be no assurance that the Trust will achieve its objectives or avoid substantial losses. You must be prepared to lose all or a substantial amount of your investment. Campbell & Company has from time to time in the past incurred substantial losses in trading on behalf of its clients. |

| | • | Futures, forward and option trading is a "zero-sum" economic activity in which for every gain there is an equal and offsetting loss (disregarding transaction costs), as opposed to a typical securities investment, in which there is an expectation of constant yields (in the case of debt) or participation over time in general economic growth (in the case of equity). It is possible that the Trust could incur major losses while stock and bond prices rise substantially in a prospering economy. |

| | • | The Trust trades in futures, forward and option contracts. Therefore, the Trust is a party to financial instruments with elements of off-balance sheet market risk, including market volatility and possible illiquidity. There is also a credit risk that a counterparty will not be able to meet its obligations to the Trust. |

| | • | Campbell & Company’s current equity under management is at or near its all-time high. Notwithstanding Campbell & Company’s research, risk and portfolio management efforts, there may come a time when the combination of available markets and new strategies may not be sufficient for Campbell & Company to add new assets without detriment to diversification. Reduced diversification and more concentrated portfolios may have a detrimental effect on your investment. |

| | • | The Trust is subject to numerous conflicts of interest including the following: |

| | 1) | Campbell & Company is both the managing owner and trading advisor of the Trust and its fees were not negotiated at arm's length. For these reasons, Campbell & Company has a disincentive to add or replace advisors, even if doing so may be in the best interest of the Trust; |

| | 2) | Campbell & Company may have incentives to favor other accounts over the Trust; |

| | 3) | Campbell & Company, the Trust's futures broker and over-the-counter counterparties and their respective principals and affiliates may trade in the futures, forward and option markets for their own accounts and may take positions opposite or ahead of those taken for the Trust; and |

| | 4) | Campbell & Company operates other commodity pool offerings which may have materially different terms and operate at a lower overall cost structure. |

| | • | Unitholders take no part in the management of the Trust and although Campbell & Company is an experienced professional manager, past performance is not necessarily indicative of future results. |

| | • | Campbell & Company will be paid a brokerage fee of up to 3.5% annually, irrespective of profitability. Campbell & Company will also be paid quarterly performance fees equal to 20% of aggregate cumulative appreciation, excluding interest income, in net asset value, if any. A portion of these fees are rebated in the form of additional units on investments made by the Campbell & Company, Inc. 401(k) Plan. |

| | • | The Trust is a single-advisor fund which may be inherently more volatile than multi-advisor managed futures products. |

| | • | Although the Trust is liquid compared to other alternative investments such as real estate or venture capital, liquidity is restricted, as the units may only be redeemed on a monthly basis, upon ten business days' advance written notice to Campbell & Company. You may transfer or assign your units after 30 days' advance written notice, and only with the consent of Campbell & Company. |

Investment Factors You Should Consider Before Investing in the Trust

| | • | The Trust is a leveraged investment fund managed by an experienced, professional trading advisor and it trades in a wide range of futures, forward and option markets. |

| | • | Campbell & Company utilizes several independent and different proprietary trading systems for the Trust. |

| | • | The Trust has the potential to help diversify traditional securities portfolios. A diverse portfolio consisting of assets that perform in an unrelated manner, or non-correlated assets, has the potential to increase overall return and/or reduce the volatility (a primary measure of risk) of a portfolio. As a risk transfer activity, futures, forward and option trading has no inherent correlation with any other investment. However, non-correlation will not provide any diversification advantages unless the non-correlated assets are outperforming other portfolio assets, and there is no guarantee that the Trust will outperform other sectors of an investor's portfolio or not produce losses. The Trust's profitability also depends on the success of Campbell & Company's trading techniques. If the Trust is unprofitable, then it will not increase the return on an investor's portfolio or achieve its diversification objectives. |

| | • | Investors in the Trust get the advantage of limited liability in highly leveraged trading. |

Campbell & Company, Inc.

Campbell & Company, the managing owner and trading advisor for the Trust, administers the Trust and directs its trading. Campbell & Company has over 35 years of experience trading in the futures, forward and option markets. As of April 30, 2007, Campbell & Company, and its affiliates, were managing approximately $12.4 billion in the futures, forward and securities markets, including approximately $10.0 billion in its Financial, Metal & Energy Large Portfolio. The Financial, Metal & Energy Large Portfolio, to which all of the Trust’s assets are currently allocated, is concentrated in the financial markets such as interest rates, foreign exchange and stock indices, as well as metals and energy products. Campbell & Company has sole authority and responsibility for directing investment and reinvestment of the Trust's assets.

Campbell & Company uses a systematic approach combined with quantitative portfolio management analysis and seeks to identify and profit from price movements in the futures, forward and option markets. Multiple models are utilized in most markets traded. Each model analyzes market movements and internal market and price configurations. Campbell & Company utilizes a proprietary, volatility-based system for allocating capital to a portfolio's constituent markets. Each market is assigned a dollar risk value based on contract size and volatility, which forms the basis for structuring a risk-balanced portfolio.

Charges to the Trust

Trust expenses must be offset by trading gains or interest income in order to avoid depletion of the Trust's assets. A portion of these expenses are rebated in the form of additional units on investments made by the Campbell & Company, Inc. 401(k) Plan. These units will only pay up to the 0.65% which is payable to the futures broker and the over-the-counter counterparties.

Campbell & Company

| | • | Brokerage fee of up to 3.5% of net assets per annum, of which up to 0.65% is paid to the futures broker and the over-the-counter counterparties, 0.35% is paid to the selling agents for administrative services and Campbell & Company retains the remainder. |

| | • | 20% of quarterly appreciation in the Trust's net assets, excluding interest income and as adjusted for subscriptions and redemptions. |

| | • | Reimbursement of organization and offering expenses incurred in the initial and continuous offering following incurrence of each such expense, estimated at, and not to exceed, 0.9% of net assets per annum. |

Dealers and Others

| | • | "Bid-ask" spreads and prime brokerage fees for off-exchange contracts. |

| | • | Operating expenses such as legal, auditing, administration, printing and postage, up to a maximum of 0.4% of net assets per year. |

Estimate of Break-Even Level

The estimated amount of fees and expenses which are anticipated to be incurred by a new investor in units of the Trust during the first twelve months of investment is 3.5% per annum of the net asset value. Interest income is expected to be approximately 5.0% per annum, based on current interest rates. An investor is expected to break-even on his/her investment in the first twelve months of trading, assuming an initial investment of $10,000, provided that the Trust does not lose more than 0.20% per annum or $20 of the assumed initial investment. The break-even analysis does not account for the bid-ask spreads in connection with the Trust’s forward and option contract trading. No performance fee is included in the break-even analysis since all operating expenses of the Trust must be offset before a performance fee is accrued. The break-even analysis is calculated as follows:

| | | | | |

| | | | | |

| Assumed Initial Investment | | $ | 10,000.00 | |

| | | | | |

| Brokerage Fee (3.5%) | | | 350.00 | |

| | | | | |

| Organization & Offering Expense Reimbursement (0.9%) | | | 90.00 | |

| | | | | |

| Operating Expenses (0.4%) | | | 40.00 | |

| | | | | |

| Less: Interest Income (5.0%)* | | | (500.00 | ) |

| | | | | |

| Amount of Trading Income Required to Break-Even on an Investor’s Initial Investment in The First Year of Trading | | $ | (20.00 | ) |

| | | | | |

| Percentage of Initial Investment Required to Break-Even | | | (0.20)% | |

The maximum organization and offering expense and operating expense reimbursement is 0.9% and 0.4% of net assets per annum, respectively. The estimates do not account for the bid-ask spreads in connection with the Trust's forward and option contract trading. No performance fee is included in the calculation of the "break-even" level since all operating expenses of the Trust must be offset before a performance fee is accrued.

*Variable based on current interest rates.

Distributions and Redemptions

The Trust is intended to be a medium- to long-term, i.e., 3- to 5-year, investment. Units are transferable, but no market exists for their sale and none will develop. Monthly redemptions are permitted upon ten (10) business days' advance written notice to Campbell & Company. Campbell & Company reserves the right to make distributions of profits at any time in its sole discretion.

Federal Income Tax Aspects

In the opinion of Sidley Austin LLP, counsel to Campbell & Company, the Trust is classified as a partnership and will not be considered a publicly traded partnership taxable as a corporation for federal income tax purposes based on the type of income it is expected to earn. The Trust’s income from its investments in futures contracts, options and forward contracts and its interest income is expected to be exempt from the tax imposed on unrelated business taxable income, and the Trust does not expect that any of its income will be debt-financed income within the meaning of such rules. Accordingly, tax-exempt unitholders, including the Campbell & Company 401 (k) Plan, will not be required to pay federal income tax on their share of the income or gains of the Trust, provided that such unitholders do not purchase units with borrowed funds.

[REMAINDER OF THIS PAGE LEFT BLANK INTENTIONALLY.]

CAMPBELL ALTERNATIVE ASSET TRUST

Organizational Chart

The organizational chart below illustrates the relationships among the various service providers of this offering. Campbell & Company is both the managing owner and trading advisor for the Trust. The selling agents (other than Campbell Financial Services, Inc.), futures broker and over-the-counter counterparties are not affiliated with Campbell & Company or the Trust.

* Campbell & Company presently serves as commodity pool operator for four other commodity pools.

THE RISKS YOU FACE

Market Risks

You Could Possibly Lose Your Total Investment in the Trust

Futures, forward and option contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Consequently, you could lose all or a substantial amount of your investment in the Trust.

The Trust Is Highly Leveraged

Because the amount of margin funds necessary to be deposited in order to enter into a futures, forward or option contract position is typically about 2% to 10% of the total value of the contract, Campbell & Company is able to hold positions in the Trust's account with face values equal to several times the Trust's net assets. The ratio of margin to equity is typically 10% to 20%, but can range from 5% to 30%. As a result of this leveraging, even a small movement in the price of a contract can cause major losses.

Your Investment Could Be Illiquid

Futures, forward and option positions cannot always be liquidated at the desired price. The prices at which a sale or purchase occur may differ from the prices expected because there may be a delay between receiving a quote and executing a trade, particularly in circumstances where a market has limited trading volume and prices are often quoted for relatively limited quantities. A market disruption, such as when foreign governments may take or be subject to political actions which disrupt the markets in their currency or major exports, can also make it difficult to liquidate a position. In addition, most U.S. futures exchanges have established “daily price fluctuation limits” which preclude the execution of trades at prices outside of the limit, and, from time to time, the CFTC or the exchanges may suspend trading in market disruption circumstances. In these cases, it is possible that Campbell & Company, as trading advisor, could be required to maintain a losing position that it otherwise would exit and incur significant losses or be unable to establish a position and miss a profit opportunity.

Unexpected market illiquidity has caused major losses in recent years in such sectors as emerging markets and mortgage-backed securities. There can be no assurance that the same will not happen to the Trust at any time or from time to time. The large size of the positions which Campbell & Company will acquire for the Trust increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so.

Also, there is no secondary market for the units and none is expected to develop. While the units have redemption rights, there are restrictions. For example, redemptions can occur only at the end of a month. If a large number of redemption requests were to be received at one time, the Trust might have to liquidate positions to satisfy the requests. Such a forced liquidation could adversely affect the Trust and consequently your investment.

Transfers of interest in the units are subject to limitations, such as 30 days' advance written notice of any intent to transfer. Also, Campbell & Company may deny a request to transfer if it determines that the transfer may result in adverse legal or tax consequences for the Trust. See "Declaration of Trust and Trust Agreement — Dispositions."

Forward and Option Transactions are Over-the-Counter, are Not Regulated and are Subject to Credit Risk

The Trust trades forward and option contracts in foreign currencies, metals and energy. Such contracts are typically traded over-the-counter through a dealer market, which is dominated by major money center and investment banks, and is not regulated by the Commodity Futures Trading Commission. Thus, you do not receive the protection of CFTC regulation or the statutory scheme of the Commodity Exchange Act in connection with this trading activity by the Trust. The market for forward and option contracts relies upon the integrity of market participants in lieu of the additional regulation imposed by the CFTC on participants in the futures markets. This regulation includes, for example, trading practices and other customer protection requirements, and minimum financial and trade reporting requirements. The absence of regulation could expose the Trust to significant losses in the event of trading abuses or financial failure by participants in the forward and option markets which it might otherwise have avoided. Also, the Trust faces the risk of non-performance by its counter-parties to forward and option contracts and such non-performance may cause some or all of its gain to remain unrealized.

The Trust has a substantial portion of its assets on deposit with financial institutions. In the event of a financial institution's insolvency, recovery of Trust assets on deposit may be limited to account insurance or other protection afforded such deposits, if any. Campbell & Company seeks to minimize credit risk primarily by depositing and maintaining the Trust's assets at financial institutions and brokers that Campbell & Company believes to be creditworthy.

Options on Futures and Over-the-Counter Contracts are Speculative and Highly Leveraged

Options on futures and over-the-counter contracts may be used by the Trust to generate premium income or capital gains. The buyer of an option risks losing the entire purchase price (the premium as well as any commissions and fees) of the option. The writer (seller) of an option risks losing the difference between the premium received for the option and the price of the commodity, futures or forward contract underlying the option which the writer must purchase or deliver upon exercise of the option (which losses can be unlimited). Specific market movements of the commodity, futures or forward contracts underlying an option cannot accurately be predicted. Successful options trading requires an accurate assessment of near-term volatility in the underlying instruments, as that volatility is immediately reflected in the price of the option. Correct assessment of market volatility can therefore be of much greater significance in trading options than it is in trading futures and forwards, where volatility may not have as great an effect on price.

An Investment in the Trust May Not Diversify an Overall Portfolio

Historically, alternative investments such as managed futures funds have been generally non-correlated to the performance of other asset classes such as stocks and bonds. Non-correlation means that there is no statistically valid relationship between the past performance of futures, forward and option contracts on the one hand and stocks or bonds on the other hand. Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be exactly opposite. Because of this non-correlation, the Trust cannot be expected to be automatically profitable during unfavorable periods for the stock market, or vice versa. The futures, forward and option markets are fundamentally different from the securities markets in that for every gain made in a futures, forward or option transaction, the opposing side of that transaction will have an equal and off-setting loss. If the Trust does not perform in a manner non-correlated with the general financial markets or does not perform successfully, you will obtain no diversification benefits by investing in the units and the Trust may have no gains to offset your losses from other investments.

Trading Risks

Campbell & Company Analyzes Primarily Technical Market Data

The trading systems used by Campbell & Company for the Trust are primarily technical. The profitability of trading under these systems depends on, among other things, the occurrence of significant price movements, up or down, in futures, forward and option prices. Such price movements may not develop; there have been periods in the past without such price movements.

The likelihood of the units being profitable could be materially diminished during periods when events external to the markets themselves have an important impact on prices. During such periods, Campbell & Company's historic price analysis could establish positions on the wrong side of the price movements caused by such events.

Increased Competition from Other Trend-Following Traders Could Reduce Campbell & Company's Profitability

There has been a dramatic increase in the volume of assets managed by trend-following trading systems like some of the Campbell & Company programs.. For example in 1980, the assets in the managed futures industry were estimated at approximately $300 million; by the end of 2006, this estimate had risen to approximately $170 billion. Increased trading competition from other trend-following traders could operate to the detriment of the Trust. It may become more difficult for the Trust to implement its trading strategy if other trading advisors using technical systems are, at the same time, also attempting to initiate or liquidate futures, forward or option positions, or otherwise alter trading patterns.

Speculative Position Limits May Alter Trading Decisions for the Trust

The CFTC has established limits on the maximum net long or net short positions which any person may hold or control in certain futures contracts. Some exchanges also have established such limits. All accounts controlled by Campbell & Company, including the account of the Trust, are combined for speculative position limit purposes. If positions in those accounts were to approach the level of the particular speculative position limit, such limits could cause a modification of Campbell & Company's trading decisions for the Trust or force liquidation of certain futures positions. Either of these actions may not be in the best interest of the investors.

Increase in Assets Under Management May Make Profitable Trading More Difficult

Campbell & Company's current equity under management is at or near its all-time high. Campbell & Company has not agreed to limit the amount of additional equity which it may manage, and is actively engaged in raising assets for existing and new accounts. The more equity Campbell & Company manages, the more difficult it may be for Campbell & Company to trade profitably because of the difficulty of trading larger positions without adversely affecting prices and performance. Accordingly, such increases in equity under management may require Campbell & Company to modify its trading decisions for the Trust which could have a detrimental effect on your investment. Such considerations may also cause Campbell & Company to eliminate smaller markets from consideration for inclusion in its Financial, Metal & Energy Large Portfolio, reducing the range of markets in which trading opportunities may be pursued. Campbell & Company reserves the right to make distributions of profits to unitholders in an effort to control asset growth. In addition, Campbell & Company may have an incentive to favor other accounts because the compensation received from some other accounts does exceed the compensation it receives from managing the Trust's account. Because records with respect to other accounts are not accessible to unitholders in the Trust, the unitholders will not be able to determine if Campbell & Company is favoring other accounts. See “Campbell & Company, Inc. - Trading Capacity.”

Investors Will Not Be Able to Review the Trust's Holdings on a Daily Basis

Campbell & Company makes the Trust's trading decisions. While Campbell & Company receives daily trade confirmations from the futures broker and over-the-counter counterparties, the Trust's trading results are reported to unitholders monthly. Accordingly, an investment in the Trust does not offer unitholders the same transparency, i.e., an ability to review all investment positions daily, that a personal trading account offers.

Other Risks

Fees and Commissions are Charged Regardless of Profitability and are Subject to Change

The Trust is subject to substantial charges payable irrespective of profitability, in addition to performance fees which are payable based on the Trust’s profitability. Included in these charges are brokerage fees and operating expenses. On the Trust’s forward and option trading, “bid-ask” spreads and prime brokerage fees are incorporated into the pricing of the Trust’s forward and option contracts by the counterparties in addition to the brokerage fees paid by the Trust. It is not possible to quantify the “bid-ask” spreads paid by the Trust because the Trust cannot determine the profit its counterparty is making on the forward and option transactions. Such spreads can at times be significant. In addition, while currently not contemplated, the Trust Agreement allows for changes to be made to the brokerage fee and performance fee upon sixty days’ notice to the unitholders.

The Futures Broker Could Fail and Has Been Subject to Disciplinary Action

The current futures broker for the Trust is UBS Financial Services Inc. The Commodity Exchange Act generally requires a futures broker to segregate all funds received from customers from such broker's proprietary assets. If the futures broker fails to do so, the assets of the Trust might not be fully protected in the event of the bankruptcy of the futures broker. Furthermore, in the event of the futures broker's bankruptcy, the Trust could lose the entire amount, or be limited to recovering only a pro rata share of all available funds segregated on behalf of the futures broker's combined customer accounts, even though certain property specifically traceable to the Trust (for example, Treasury bills deposited by the Trust with the futures broker as margin) was held by the futures broker. The futures broker has been the subject of certain regulatory and private causes of action. The material actions are described under "The Futures Broker."

Furthermore, dealers in forward and option contracts are not regulated by the Commodity Exchange Act and are not obligated to segregate customer assets. As a result, you do not have such basic protections in the Trust's forward and option contract trading.

Investors Must Not Rely on the Past Performance of Either Campbell & Company or the Trust in Deciding Whether to Buy Units

The future performance of the Trust is not predictable, and no assurance can be given that the Trust will perform successfully in the future. Past performance is not necessarily indicative of future results.

Parties to the Trust Have Conflicts of Interest

Campbell & Company has not established any formal procedures to resolve the following conflicts of interest. Consequently, there is no independent control over how Campbell & Company resolves these conflicts which can be relied upon by investors as ensuring that the Trust is treated equitably with other Campbell & Company clients.

Campbell & Company has a conflict of interest because it acts as the managing owner and sole trading advisor for the Trust.

Since Campbell & Company acts as both trading advisor and managing owner for the Trust, it is very unlikely that its advisory contract will be terminated by the Trust. The fees payable to Campbell & Company were established by it and were not the subject of arm's-length negotiation. These fees consist of up to a 3.5% brokerage fee (of which 2.5% is retained) and a 20% performance fee. Campbell & Company, as managing owner, determines whether or not distributions are made and it receives increased fees to the extent distributions are not made. Campbell & Company has the authority to make such distributions at any time in its sole discretion.

Other conflicts are also present in the operation of the Trust. See "Conflicts of Interest."

There Are No Independent Experts Representing Investors

Campbell & Company has consulted with counsel, accountants and other experts regarding the formation and operation of the Trust. No counsel has been appointed to represent the unitholders in connection with the offering of the units. Accordingly, each prospective investor should consult his own legal, tax and financial advisers regarding the desirability of an investment in the Trust.

The Trust Places Significant Reliance on Campbell & Company

The incapacity of Campbell & Company's principals could have a material and adverse effect on Campbell & Company's ability to discharge its obligations under the Trust Agreement. However, there are no individual principals at Campbell & Company whose absence would result in a material and adverse effect on Campbell & Company's ability to adequately carry out its advisory responsibilities.

The Trust Could Terminate Before Expiration of its Stated Term

As managing owner, Campbell & Company may withdraw from the Trust upon 120 days' notice, which would cause the Trust to terminate unless a substitute managing owner were obtained. Other events, such as a long-term substantial loss suffered by the Trust, could also cause the Trust to terminate before the expiration of its stated term. This could cause you to liquidate your investments and upset the overall maturity and timing of your investment portfolio. If the registrations with the CFTC or memberships in the National Futures Association of Campbell & Company or the futures broker were revoked or suspended, such entity would no longer be able to provide services to the Trust.

The Trust Is Not a Regulated Investment Company

Although the Trust and Campbell & Company are subject to regulation by the CFTC, the Trust is not an investment company subject to the Investment Company Act of 1940 and Campbell & Company is not registered as an investment advisor under the Investment Advisors Act of 1940. Accordingly, you do not have the protections afforded by those statutes which, for example, require investment companies to have a majority of disinterested directors and regulates the relationship between the adviser and the investment company.

Proposed Regulatory Change Is Impossible to Predict

The futures markets are subject to comprehensive statutes, regulations and margin requirements. In addition, the CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily price limits and the suspension of trading. The regulation of futures, forward and option transactions in the United States is a rapidly changing area of law and is subject to modification by government and judicial action. In addition, various national governments have expressed concern regarding the disruptive effects of speculative trading in the currency markets and the need to regulate the "derivatives" markets in general. The effect of any future regulatory change on the Trust is impossible to predict, but could be substantial and adverse.

Forwards, Options, Swaps, Hybrids and Other Derivatives Are Not Subject to CFTC Regulation

The Trust trades foreign exchange contracts and options in the interbank market. In the future, the Trust may also trade swap agreements, hybrid instruments and other off-exchange contracts. Swap agreements involve trading income streams such as fixed rate for floating rate interest. Hybrids are instruments which combine features of a security with those of a futures contract. The dealer market for off-exchange instruments is becoming more liquid. There is no exchange or clearinghouse for these contracts and they are not regulated by the CFTC. The Trust will not receive the protections which are provided by the CFTC's regulatory scheme for these transactions.

The Trust is Subject to Foreign Market Credit and Regulatory Risk

A substantial portion of Campbell & Company's trades takes place on markets or exchanges outside the United States. From time to time, as much as 20% to 50% of the Trust's overall market exposure could involve positions taken on foreign markets. The risk of loss in trading foreign futures contracts and foreign options can be substantial. Participation in foreign futures contracts and foreign options transactions involves the execution and clearing of trades on, or subject to the rules of, a foreign board of trade. Non-U.S. markets may not be subject to the same degree of regulation as their U.S. counterparts. None of the CFTC, NFA or any domestic exchange regulates activities of any foreign boards of trade, including the execution, delivery and clearing of transactions, nor do they have the power to compel enforcement of the rules of a foreign board of trade or any applicable foreign laws. Trading on foreign exchanges also presents the risks of exchange controls, expropriation, taxation and government disruptions.

The Trust is Subject to Foreign Exchange Risk

The price of any foreign futures or foreign options contract and, therefore, the potential profit and loss thereon, may be affected by any variance in the foreign exchange rate between the time a position is established and the time it is liquidated, offset or exercised. Certain foreign exchanges may also be in a more or less developmental stage so that prior price histories may not be indicative of current price dynamics. In addition, the Trust may not have the same access to certain positions on foreign exchanges as do local traders, and the historical market data on which Campbell & Company bases its strategies may not be as reliable or accessible as it is in the United States. The rights of clients (such as the Trust) in the event of the insolvency or bankruptcy of a non-U.S. market or broker are also likely to be more limited than in the case of U.S. markets or brokers.

Transfers Could be Restricted

You may transfer or assign your units only upon 30 days’ prior written notice to Campbell & Company and only if Campbell & Company is satisfied that the transfer complies with applicable laws and would not result in adverse legal or tax consequences for the Trust.

A Single-Advisor Fund May Be More Volatile Than a Multi-Advisor Fund

The Trust is currently structured as a single-advisor managed futures fund. You should understand that many managed futures funds are structured as multi-advisor funds in order to attempt to control risk and reduce volatility through combining advisors whose historical performance records have exhibited a significant degree of non-correlation with each other. As a single-advisor managed futures fund, the Trust may have increased performance volatility and a higher risk of loss than investment vehicles employing multiple advisors. Campbell & Company may retain additional trading advisors on behalf of the Trust in the future.

The Performance Fee Could be an Incentive to Make Riskier Investments

Campbell & Company employs a speculative strategy for the Trust and receives performance fees based on the trading profits earned by it for the Trust. Campbell & Company would not agree to manage the Trust's account in the absence of such a performance fee arrangement. Accordingly, Campbell & Company may make investments that are riskier than might be made if the Trust's assets were managed by a trading advisor that did not require performance-based compensation.

The Trust May Distribute Profits to Unitholders at Inopportune Times

Campbell & Company reserves the right to make distributions of profits of the Trust to unitholders at any time in its sole discretion in order to control the growth of the assets under Campbell & Company's management. Unitholders will have no choice in receiving these distributions as income, and may receive little notice that these distributions are being made. Distributions may be made at an inopportune time for the unitholders.

Potential Inability to Trade or Report Due to Systems Failure

Campbell & Company's strategies are dependent to a significant degree on the proper functioning of its internal computer systems. Accordingly, systems failures, whether due to third party failures upon which such systems are dependent or the failure of Campbell & Company's hardware or software, could disrupt trading or make trading impossible until such failure is remedied. Any such failure, or consequential inability to trade (even for a short time), could, in certain market conditions, cause the Trust to experience significant trading losses or to miss opportunities for profitable trading. Additionally, any such failures could cause a temporary delay in reports to investors.

Potential Disruption or Inability to Trade Due to a Failure to Receive Timely and Accurate Market Data from Third Party Vendors

Campbell & Company’s strategies are dependent to a significant degree on the receipt of timely and accurate market data from third party vendors. Accordingly, the failure to receive such data in a timely manner or the receipt of inaccurate data, whether due to the acts or omissions of such third party vendors or otherwise, could disrupt trading to the detriment of the Trust or make trading impossible until such failure or inaccuracy is remedied. Any such failure or inaccuracy could, in certain market conditions, cause the Trust to experience significant trading losses, effect trades in a manner which it otherwise would not have done, or miss opportunities for profitable trading. For example, the receipt of inaccurate market data may cause the Trust to establish (or exit) a position which it otherwise would not have established (or exited), or fail to establish (or exit) a position which it otherwise would have established (or exited), and any subsequent correction of such inaccurate data may cause the Trust to reverse such action or inaction, all of which may ultimately be to the detriment of the Trust.

[REMAINDER OF THIS PAGE LEFT BLANK INTENTIONALLY.]

SELECTED FINANCIAL DATA

Dollars in thousands, except per unit amounts.

| | | 4-Month Period Ended | | | Year Ended December 31, | |

| | | April 30, 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| Total Assets | | $ | 41,190,105 | | $ | 43,619,109 | | $ | 40,221,009 | | $ | 35,225,567 | | $ | 33,165,538 | | $ | 34,524,465 | |

| Total Unitholders' Capital | | | 40,698,605 | | | 42,871,715 | | | 39,856,467 | | | 34,955,385 | | | 32,821,418 | | | 32,854,478 | |

Total Trading Gain (Loss) (Net of brokerage commissions) | | | (1,707,210 | ) | | 2,971,747 | | | 5,125,300 | | | 5,125,392 | | | 9,269,009 | | | 4,996,237 | |

| Net Income (Loss) | | | (1,461,786 | ) | | 3,250,791 | | | 4,799,375 | | | 3,249,651 | | | 7,263,843 | | | 3,761,201 | |

Net Income (Loss) Per Managing Owner and Other Unitholder Unit* | | | (62.13 | ) | | 135.31 | | | 204.75 | | | 135.90 | | | 292.55 | | | 161.99 | |

Increase (Decrease) in Net Asset Value per Managing Owner and Other Unitholder Unit | | | (67.25 | ) | | 123.59 | | | 190.55 | | | 123.76 | | | 253.05 | | | 150.94 | |

* Based on weighted average number of units outstanding during the period.

SUPPLEMENTARY FINANCIAL INFORMATION

The following summarized quarterly financial information presents the results of operations for the three month periods ending March 31, 2007 and March 31, June 30, September 30, and December 31, 2006 and 2005.

| | 1st Qtr. 2007 | |

Total Trading Gain (Loss) (Net of brokerage commissions) | | $ | (2,580,343 | ) |

| Net Income (Loss) | | | (2,393,538 | ) |

Net Income (Loss) per Managing Owner and Other Unitholder Unit* | | | (101.57 | ) |

| Increase (Decrease) in Net Asset Value per Managing Owner and Other Unitholder Unit | | | (105.72 | ) |

Net Asset Value per Managing Owner And Other Unitholder Unit at the End of the Period | | | 1,709.81 | |

| | 1st Qtr. 2006 | | 2nd Qtr. 2006 | | 3rd Qtr. 2006 | | 4th Qtr. 2006 | |

Total Trading Gain (Loss) (Net of brokerage commissions) | | $ | 2,254,666 | | $ | (2,317,933 | ) | $ | (1,229,377 | ) | $ | 4,264,391 | |

| Net Income (Loss) | | | 1,997,584 | | | (2,159,035 | ) | | (1,034,081 | ) | | 4,446,323 | |

Net Income (Loss) per Managing Owner and Other Unitholder Unit* | | | 83.93 | | | (89.15 | ) | | (42.70 | ) | | 186.33 | |

Increase (Decrease) in Net Asset Value per Managing Owner and Other Unitholder Unit | | | 80.03 | | | (93.11 | ) | | (46.52 | ) | | 183.19 | |

Net Asset Value per Managing Owner And Other Unitholder Unit at the End of the Period | | | 1,771.97 | | | 1,678.86 | | | 1,632.34 | | | 1,815.53 | |

| | 1st Qtr. 2005 | | 2nd Qtr. 2005 | | 3rd Qtr. 2005 | | 4th Qtr. 2005 | |

Total Trading Gain (Loss) (Net of brokerage commissions) | | $ | (890,145 | ) | $ | 4,598,526 | | $ | (111,008 | ) | $ | 1,527,927 | |

| Net Income (Loss) | | | (946,303 | ) | | 4,430,020 | | | (100,714 | ) | | 1,416,372 | |

Net Income (Loss) per Managing Owner and Other Unitholder Unit* | | | (40.35 | ) | | 188.63 | | | (4.30 | ) | | 60.63 | |

Increase (Decrease) in Net Asset Value per Managing Owner and Other Unitholder Unit | | | (43.80 | ) | | 184.87 | | | (7.50 | ) | | 56.98 | |

Net Asset Value per Managing Owner And Other Unitholder Unit at the End of the Period | | | 1,457.59 | | | 1,642.46 | | | 1,634.96 | | | 1,691.94 | |

___________________________

* Based on weighted average number of units outstanding during the period.

CAMPBELL & COMPANY, INC.

Description

Campbell & Company is the managing owner and trading advisor of the Trust. It is a Maryland corporation organized in April 1978 as a successor to a partnership originally organized in January 1974. Its offices are located at 210 West Pennsylvania Avenue, Towson, Maryland 21204, and its telephone number is (410) 296-3301. Its primary business is the trading and management of discretionary futures and forward accounts, including commodity pools. As of April 30, 2007, Campbell & Company, and its affiliates, had approximately $12.4 billion under management in the futures, forward and option markets (including approximately $10.0 billion traded pursuant to the same Financial, Metal & Energy Large Portfolio as traded by the Trust). Please refer to "Campbell & Company, Inc. — Trading Systems" for a discussion of all of the portfolios offered by Campbell & Company, which includes the Financial, Metal & Energy Large Portfolio. Please refer to "Past Performance of the Campbell Alternative Asset Trust” on page 29 for the performance data required to be disclosed for the most recent five calendar years and year-to-date.

Campbell & Company is a member of the NFA and has been registered as a commodity pool operator since September 10, 1982 and as a commodity trading advisor since May 6, 1978. Pools currently operated by Campbell & Company include: Campbell Financial Futures Fund, Limited Partnership; Campbell Fund Trust; Campbell Global Assets Fund Limited; and Campbell Strategic Allocation Fund, L.P. Campbell & Company's compensation is discussed in "Charges to the Trust."

The Campbell & Company, Inc. 401(k) Plan is an investor in the Trust; the individual principals of Campbell & Company, in their individual capacity, have not purchased, and do not intend to purchase, units.

Campbell & Company has agreed that its capital account as managing owner at all times will equal at least 1% of the net aggregate capital contributions of all unitholders.

There have never been any material administrative, civil or criminal proceedings brought against Campbell & Company or its principals, whether pending, on appeal or concluded.

Campbell & Company's principals are G. William Andrews, Theresa D. Becks, D. Keith Campbell, William C. Clarke, III, Bruce L. Cleland, Greg T. Donovan, Michael S. Harris, Michael J. Hebrank, Kevin M. Heerdt, James M. Little and Thomas P. Lloyd. The majority voting stockholder of Campbell & Company is D. Keith Campbell.

G. William Andrews, born in 1972, has been employed by Campbell & Company since April 1997 and was appointed Vice President: Director of Research Operations in March 2006 and has served as Vice President: Director of Operations since April 2007. His duties include managing daily research and trade operations, new research product implementation and code management. From 1995 to 1997, Mr. Andrews was employed at Legg Mason as a Research Analyst in the Realty Group. Before immigrating to the United States, he was employed by the Japanese Department of Education in the town of Fujimi, Nagano prefecture. Mr. Andrews holds an M.B.A. in Finance from Loyola College in Maryland and a Bachelor of Social Science from Waikato University, New Zealand. Mr. Andrews became listed as a Principal of Campbell & Company effective June 21, 2006.

Theresa D. Becks, born in 1963, joined Campbell & Company in June 1991 and has served as President and Chief Executive Officer since April 2007, Chief Financial Officer and Treasurer since 1992, and Secretary and a Director since 1994. Ms. Becks is also the President, Chief Executive Officer and Chief Financial Officer of Campbell & Company Investment Adviser LLC, a wholly-owned subsidiary of Campbell & Company, and Trustee, President, Chief Executive Officer and Chief Financial Officer of The Campbell Multi-Strategy Trust, a registered investment company. Ms. Becks previously served as a member of the Board of Directors of the Managed Funds Association. From 1987 to 1991, she was employed by Bank Maryland Corp, a publicly held company, as a Vice President and Chief Financial Officer. Prior to that time, she worked with Ernst & Young. Ms. Becks is a C.P.A. and has a B.S. in Accounting from the University of Delaware. Ms. Becks became registered as an Associated Person and listed as a Principal of Campbell & Company effective May 7, 1999 and March 10, 1993, respectively. Ms. Becks became registered as an Associated Person and listed as a Principal of Campbell & Company Investment Adviser LLC effective December 14, 2005 and December 12, 2005, respectively.

D. Keith Campbell, born in 1942, has served as the Chairman of the Board of Directors of Campbell & Company since it began operations, was President until 1994, and was Chief Executive Officer until 1997. Mr. Campbell is the majority voting stockholder of Campbell & Company. From 1971 to 1978, he was a registered representative of a futures commission merchant. Mr. Campbell has acted as a commodity trading advisor since 1972 when, as general partner of the Campbell Fund, a limited partnership engaged in commodity futures trading, he assumed sole responsibility for trading decisions made on behalf of the Fund. Since then, he has applied various technical trading models to numerous discretionary futures trading accounts. Mr. Campbell is registered with the CFTC and NFA as a commodity pool operator. Mr. Campbell became registered as an Associated Person and listed as a Principal of Campbell & Company effective September 29, 1978 and October 29, 1997, respectively. Mr. Campbell became listed as a Principal of his Commodity Pool Operator effective March 10, 1975.

William C. Clarke, III, born in 1951, joined Campbell & Company in June 1977 and has served as an Executive Vice President from January 1991 until his retirement as of May 31, 2007, and as Director since 1984. Mr. Clarke holds a B.S. in Finance from Lehigh University where he graduated in 1973. Prior to his retirement, Mr. Clarke supervised all aspects of research, which involved the development of proprietary trading models and portfolio management methods. Mr. Clarke became listed as a Principal of Campbell & Company effective January 24, 1991.

Bruce L. Cleland, born in 1947, joined Campbell & Company in January 1993 and has served as Vice Chairman of the Board of Directors of Campbell & Company since April 2007, was President from 1994-2007, and Chief Executive Officer from1997-2007. Until April 2007, Mr. Cleland was also the President and Chief Executive Officer of Campbell & Company Investment Adviser LLC, a wholly-owned subsidiary of Campbell & Company, and Trustee, Chief Executive Officer and President of The Campbell Multi-Strategy Trust, a registered investment company. Mr. Cleland has worked in the international derivatives industry since 1973, and has owned and managed firms engaged in global clearing, floor brokerage, trading and portfolio management. Mr. Cleland is currently a member of the Board of Directors of the National Futures Association, and previously served as a member of the Board of Directors of the Managed Funds Association and as a member of the Board of Governors of the COMEX, in New York. Mr. Cleland is a graduate of Victoria University in Wellington, New Zealand where he earned a Bachelor of Commerce and Administration degree. Mr. Cleland became registered as an Associated Person and listed as a Principal of Campbell & Company effective December 15, 1993 and September 15, 1993, respectively. Mr. Cleland became registered as an Associated Person and listed as a Principal of Campbell & Company Investment Adviser LLC effective December 14, 2005 and December 13, 2005, respectively. Mr. Cleland withdrew his registration as an Associated Person and a Principal of Campbell & Company Investment Adviser LLC effective April 3, 2007.

Gregory T. Donovan, born in 1972, has been employed by Campbell & Company since October 2006 as Senior Vice President of Accounting and Finance. His duties include oversight of accounting and finance functions and review of accounting policies and procedures. Mr.Donovan is also the Treasurer and Assistant Secretary of both Campbell & Company Investment Adviser LLC, a wholly-owned subsidiary of Campbell & Company, and The Campbell Multi-Strategy Trust, a registered investment company. From November 2003 to October 2006, Mr. Donovan was employed by Huron Consulting Services serving as Director in the Financial and Economic Consulting Practice. From May 1998 until November 2003, Mr. Donovan was employed by KPMG LLP in which he served in the capacity as Manager in the Forensic and Litigation Services Practice. Mr. Donovan is a C.P.A. and has a B.S. in Business Administration with concentrations in Accounting and Management from Castleton State College and holds a M.S. in Finance from the University of Baltimore. Mr. Donovan became listed as a Principal of Campbell & Company and Campbell & Company Investment Adviser LLC effective May 9, 2007 and May 16, 2007 respectively.

Michael S. Harris, born in 1975, has been employed by Campbell & Company since July 2000, was appointed Deputy Manager of Trading in September 2004 and has served as Vice President and Director of Trading since June 2006. His duties include managing daily trade execution for the assets under Campbell & Company’s management. From 1999 to 2000, Mr. Harris worked as a futures and options broker for Refco Inc. (NY). From 1997 to 1999, he worked in the Sales and Product Development groups at Morgan Stanley Managed Futures. Mr. Harris holds a B.A. in Economics and Japanese Studies from Gettysburg College. He also spent time studying abroad at Kansai Gaidai University in Osaka, Japan. Mr. Harris became registered as an Associated Person and listed as a Principal of Campbell & Company effective September 21, 2000 and June 15, 2006, respectively

Michael J. Hebrank, born in 1955, joined Campbell & Company in April 2004 and has served as Chief Technology Officer since then. From February 1999 to April 2004, Mr. Hebrank was the Chief Information Officer at Greater Baltimore Medical Center, the fourth largest healthcare system in Maryland. Mr. Hebrank holds a B.S. in Applied Statistics from the University of Baltimore and an M.S. in Computer Engineering from Loyola College of Maryland. Mr. Hebrank became listed as a Principal of Campbell & Company effective June 21, 2006.

Kevin M. Heerdt, born in 1958, joined Campbell & Company in March 2003 and has served as Executive Vice President-Research since then and Chief Operating Officer since June 2005. His duties include risk management, research, and the development of quantitatively based hedge fund and options strategies. Mr. Heerdt is also the Vice President and Chief Operating Officer of both Campbell & Company Investment Adviser LLC, a wholly-owned subsidiary of Campbell & Company, and The Campbell Multi-Strategy Trust, a registered investment company. From February 2002 to March 2003, he was the sole proprietor of Integrity Consulting, a start-up business consulting firm. Previously, Mr. Heerdt worked for twelve years at Moore Capital Management, Inc., where he was a Director until 1999, and a Managing Director from 2000 to 2002. Mr. Heerdt holds a B.A. in Economics and in International Relations from the University of Southern California. Mr. Heerdt became registered as an Associated Person and listed as a Principal of Campbell & Company effective April 15, 2003. Mr. Heerdt became registered as an Associated Person and listed as a Principal of Campbell & Company Investment Adviser LLC effective December 14, 2005.

James M. Little, born in 1946, joined Campbell & Company in April 1990 and has served as Executive Vice President-Business Development and a Director since 1992. Mr. Little is also the Vice President of both Campbell & Company Investment Adviser LLC, a wholly-owned subsidiary of Campbell & Company, and The Campbell Multi-Strategy Trust, a registered investment company. Mr. Little holds a B.S. in Economics and Psychology from Purdue University. From 1989 to 1990, Mr. Little was a registered representative of A.G. Edwards & Sons, Inc. From 1984 to 1989, he was the Chief Executive Officer of James Little & Associates, Inc., a commodity pool operator and broker-dealer. Mr. Little is the co-author of The Handbook of Financial Futures, and is a frequent contributor to investment industry publications. Mr. Little became registered as an Associate Person and listed as a Principal of Campbell & Company effective April 7, 1992 and April 19, 1993 respectively. Mr. Little became registered as an Associated Person and listed as a Principal of Campbell & Company Investment Adviser LLC effective December 14, 2005 and December 12, 2005, respectively.

Thomas P. Lloyd, born in 1959, joined Campbell & Company in September 2005 as General Counsel and Executive Vice President-Legal and Compliance. In this capacity, he is involved in all aspects of legal affairs, compliance and regulatory oversight. Since April 2007, Mr. Lloyd has also overseen Campbell & Company’s fund administration function. Mr. Lloyd is also the Secretary, Chief Compliance Officer and Assistant Treasurer of both Campbell & Company Investment Adviser LLC, a wholly-owned subsidiary of Campbell & Company, and The Campbell Multi-Strategy Trust, a registered investment company. From July 1999 to September 2005, Mr. Lloyd was employed by Deutsche Bank Securities Inc. ("DBSI") in several positions, including Managing Director and head of the legal group for Deutsche Bank Alex. Brown, the Private Client Division of DBSI. From 1997 to 1999, Mr. Lloyd was an attorney in the Enforcement Department of NASD Regulation, Inc., and, from 1995 to 1997, he served as a senior counsel in the Division of Enforcement of the United States Securities and Exchange Commission. From 1989 to 1995, he was engaged in the private practice of law. Mr. Lloyd holds a B.A. in Economics from the University of Maryland, and a J.D. from the University of Baltimore School of Law. Mr. Lloyd is a member of the Bars of the State of Maryland and the United States Supreme Court. Mr. Lloyd became listed as a Principal of Campbell & Company and Campbell & Company Investment Adviser LLC effective October 20, 2005 and December 12, 2005, respectively.

The Trading Advisor

Pursuant to the Trust Agreement, Campbell & Company has the sole authority and responsibility for directing the investment and reinvestment of the Trust's assets. Although Campbell & Company will initially serve as the sole trading advisor of the Trust, it may, in the future, retain other trading advisors to manage a portion of the assets of the Trust. Unitholders will receive prior notice, in the monthly report from the Trust or otherwise, in the event that additional trading advisors are to be retained on behalf of the Trust.

Trading Systems

Campbell & Company makes the Trust's trading decisions using proprietary computerized trading models which analyze market statistics. There can be no assurance that the trading models will produce results similar to those produced in the past. In addition, unitholders will not have any vote or consent with respect to the trading approaches utilized by Campbell & Company or any other trading advisor. Existing unitholders will be notified in advance via their monthly statements with regard to any anticipated changes to trading advisors or any changes deemed to be a material change from the trading approach as currently described. Campbell & Company currently offers the following portfolios:

| 1) | The Financial, Metal & Energy Large Portfolio, and |

| 2) | The Global Diversified Large Portfolio. |

The Trust Agreement allows Campbell & Company to utilize any of its offered portfolios in its sole discretion in trading on behalf of the Trust. All of the Trust's assets are currently allocated to the Financial, Metal & Energy Large Portfolio, which trades futures, forward and option contracts on precious and base metals, energy products, stock market indices, interest rate instruments and foreign currencies. In the future, Campbell & Company may allocate the Trust's assets to the Global Diversified Large Portfolio, which trades in all sectors included in the Financial, Metal & Energy Large Portfolio with the addition of agricultural products.

The percentage of component risk for each major sector is as follows: 98% to financial contracts, 1% to energy products and 1% to metals. Sector component risk and the specific markets traded, may frequently fluctuate in response to changes in market volatility. See the following pie chart for a current listing of contracts, by sector.

[REMAINDER OF THIS PAGE LEFT BLANK INTENTIONALLY.]

Because the risk of a whole portfolio is generally less than the sum of the risks of the individual sectors making up that portfolio, “component risk” is used to describe the contribution of each sector’s risk to the overall portfolio risk. In some cases, a sector may “hedge” the portfolio, and thus reduce risk, in which case the component risk for that sector would be negative. By definition, the component risk will always add to 100% of total portfolio risk.

Campbell & Company's trading models are designed to detect and exploit medium- to long-term price changes, while also applying proven risk management and portfolio management principles. No one market exceeds 15% of a total portfolio allocation. Portfolio composition, including contracts traded and percentage allocations to each sector, may change at any time if Campbell & Company determines such change to be in the best interests of the Trust. Each sector traded by the Trust appears as a caption in the preceding "component risk" diagram. As an example, natural gas is a market that is traded within the energy sector.