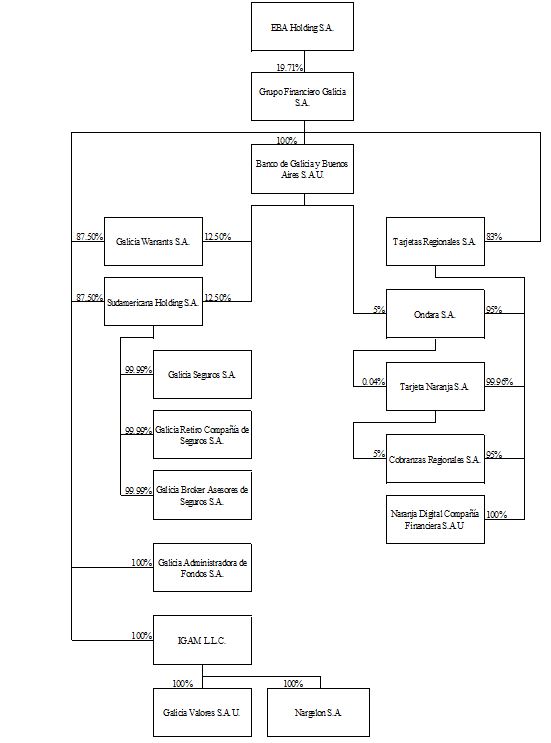

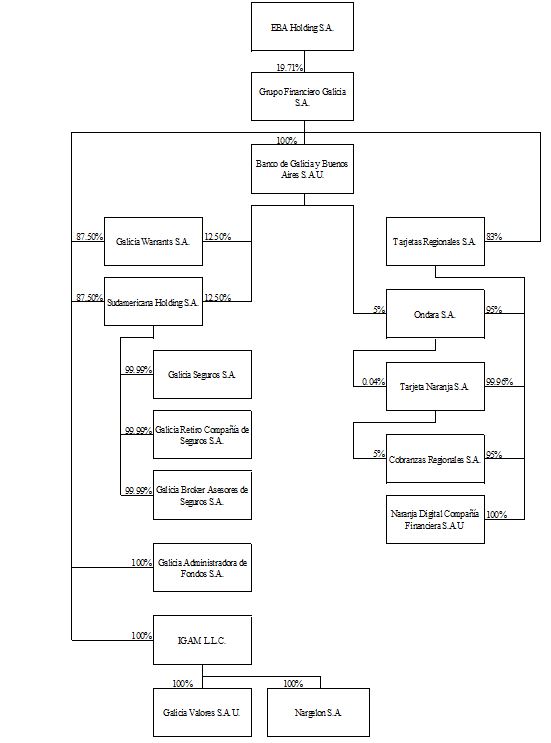

Grupo Financiero Galicia S.A. (“Grupo Financiero Galicia”, “Grupo Galicia”, “GFG” or the “Company”) is a financial services holding company incorporated in Argentina and is one of Argentina’s largest financial services groups. In this annual report, references to “we”, “our”, and “us” are to Grupo Financiero Galicia and its consolidated subsidiaries, except where otherwise noted. Our consolidated financial statements consolidate the accounts of the following companies:

- Grupo Financiero Galicia;

- Banco de Galicia y Buenos Aires S.A.U. (“Banco Galicia” or the “Bank”), our largest subsidiary, consolidated with (i) Tarjetas Regionales S.A. and its operating subsidiaries, until December 31, 2017 (effective January 1, 2018, Tarjetas Regionales S.A. was transferred to be an operating subsidiary of Grupo Financiero Galicia), (ii) Tarjetas del Mar S.A. (“Tarjetas del Mar”) until March 31, 2017 (effective April 1, 2017 Tarjetas del Mar was sold), (iii) Galicia Valores S.A.U. (“Galicia Valores”) until August 31, 2019 (effective September 1, 2019, Galicia Valores was sold to Grupo Financiero Galicia and transferred to IGAM LLC), (iv) Fideicomiso Financiero Galtrust I until December 31, 2017 and (v) Fideicomiso Saturno Créditos until December 31, 2018;

- Tarjetas Regionales S.A. (“Tarjetas Regionales”) and its subsidiaries (which has been reported on a consolidated basis with Grupo Financiero Galicia since January 1, 2018);

- Sudamericana Holding S.A. (“Sudamericana”) and its subsidiaries;

- Galicia Warrants S.A. (“Galicia Warrants”);

- Net Investment S.A. (“Net Investment”) (liquidated as of December 31, 2017);

- Galicia Administradora de Fondos S.A. (“Galicia Administradora de Fondos”); and

- IGAM LLC (“IGAM”) and its subsidiaries.

These consolidated financial statements have been prepared in accordance and in compliance with the International Financial Reporting Standards (“IFRS”) issued by the International Financial Reporting Standards Board (“IASB”) and the interpretations of the International Financial Reporting Interpretations Committee. IFRS in force as of the date of preparation of these consolidated financial statements for the fiscal years ended December 31, 2019, 2018 and 2017 have been applied. We maintain our financial books and records in Argentine Pesos and prepare our financial statements in conformity with IFRS, as issued by the IASB, effective as of the fiscal year beginning on January 1, 2018. Grupo Galicia has also adjusted its financial statements for the year ended December 31, 2017 in accordance with IFRS to serve as a comparative basis for the financial statements for the year ended December 31, 2019 and December 31, 2018.

As of July 1, 2018, Argentina qualified as a hyperinflationary economy for accounting purposes. Grupo Galicia’s functional currency is the Argentine peso and its financial statements have been prepared in accordance with IAS 29 Financial Reporting in Hyperinflationary Economies as if the Argentine economy had always been hyperinflationary. The financial position and results of operations as of December 31, 2019 and 2018 and for the years ended December 31, 2019, 2018 and 2017 are reflected in terms of current purchasing power using the Consumer Price Index (“CPI”) as of December 31, 2019.

In this annual report, references to “US$” and “Dollars” are to United States Dollars and references to “Ps.” or “Pesos” are to Argentine Pesos. The exchange rate used in translating Pesos into Dollars and used in calculating the convenience translations included in the following tables is the “Reference Exchange Rate” that is published by

the Argentine Central Bank and that was Ps.59.8950, Ps.37.8083 and Ps.18.7742 per US$1.00 as of December 31, 2019, December 31, 2018 and December 31, 2017, respectively. The exchange rate translations contained in this annual report should not be construed as representations that the stated Peso amounts actually represent or have been or could be converted into Dollars at the rates indicated or at any other rate.

Our fiscal year ends on December 31, and references in this annual report to any specific fiscal year are to the twelve-month period ended December 31 of such year.

Unless otherwise indicated, all information regarding deposit and loan market shares and other financial industry information has been derived from information published by the Argentine Central Bank, which is not adjusted according to the IAS 29.

We have expressed all amounts in millions of Pesos, except percentages, ratios, multiples and per-share data.

Certain figures included in this annual report have been rounded for purposes of presentation. Percentage figures included in this annual report have been calculated on the basis of such rounded figures. Certain numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them due to rounding.

This annual report contains forward-looking statements that involve substantial risks and uncertainties, including, in particular, statements about our plans, strategies and prospects under the captions Item 4. “Information on the Company”-A.”History and Development of the Company”-“Capital Investments and Divestitures,” Item 5. “Operating and Financial Review and Prospects”-A.“Operating Results-Principal Trends” and B.“Liquidity and Capital Resources.” All statements other than statements of historical facts contained in this annual report (including statements regarding our future financial position, business strategy, budgets, projected costs and management’s plans and objectives for future operations) are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of such words as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue” or other similar terminology. Although we believe that the expectations reflected in these forward-looking statements are reasonable, no assurance can be provided with respect to these statements. Because these statements are subject to risks and uncertainties, actual results may differ materially and adversely from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially and adversely from those contemplated in such forward-looking statements include but are not limited to:

- changes in general political, legal, social or other conditions in Argentina, Latin America or other countries or regions;

- changes in the macroeconomic situation at the regional, national or international levels, and the influence of these changes on the microeconomic conditions of the financial markets in Argentina;

- changes in capital markets in general that may affect policies or attitudes toward lending to Argentina or Argentine companies, including expected or unexpected turbulence or volatility in domestic or international financial markets;

- financial difficulties of the Argentine government and its ability (or inability) to reach to an agreement to restructure its outstanding debt that is held by international credit entities and private sector bondholders;

- changes in Argentine government regulations applicable to financial institutions, including tax regulations and changes in or failures to comply with banking or other regulations;

- volatility of the Peso and the exchange rates between the Peso and foreign currencies;

- fluctuations in the Argentine rate of inflation, including hyperinflation;

- increased competition in the banking, financial services, credit card services, insurance, asset management, mutual funds and related industries;

- Grupo Financiero Galicia’s subsidiaries’ inability to sustain or improve their performance;

- a loss of market share by any of Grupo Financiero Galicia’s main businesses;

- a change in the credit cycle, increased borrower defaults and/or a decrease in the fees charged to clients;

- changes in the saving and consumption habits of its customers and other structural changes in the general demand for financial products, such as those offered by Banco Galicia;

- changes in interest rates which may, among other things, adversely affect margins;

- Banco Galicia’s inability to obtain additional debt or equity financing on attractive conditions or at all, which may limit its ability to fund existing operations and to finance new activities;

- technological changes and changes in Banco Galicia’s ability to implement new technologies;

- impact of COVID-19 (or other future outbreaks, epidemics or pandemics) on the global, regional and national economy, on financial activity on global trade -both in terms of volumes and prices-, and on the Company’s ability to recover from the negative effects of the pandemic (or other future outbreak);

- other factors discussed under Item 3. “Key Information” - D.“Risk Factors” in this annual report.

You should not place undue reliance on forward-looking statements, which speak only as of the date that they were made. Moreover, you should consider these cautionary statements in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to forward-looking statements after completion of this annual report to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this annual report might not occur and are not guarantees of future performance.

Not applicable.

Not applicable.

The following table presents summary historical financial and other information about us as of the dates and for the periods indicated.

The selected consolidated financial information as of December 31, 2019 and December 31, 2018, and for the fiscal years ended December 31, 2019, December 31, 2018 and December 31, 2017 has been derived from our audited consolidated financial statements included in this annual report.

You should read this data in conjunction with Item 5. “Operating and Financial Review and Prospects” and our audited consolidated financial statements included in this annual report.

The tables included below have been prepared in accordance with IFRS.

|

|

| Year Ended December 31, |

|

|

|

| 2019 |

|

|

| 2018 |

|

|

| 2017 |

|

|

| (in millions of Pesos, except as noted) |

Consolidated Statement of Income in Accordance with IFRS | | | | | | | | | | | | |

Net Income from Interest | | | 34,830 | | | | 51,324 | | | | 45,956 | |

Net Fee Income | | | 28,083 | | | | 32,875 | | | | 32,563 | |

Net Income from Financial Instruments | | | 72,830 | | | | 26,694 | | | | 13,016 | |

Loan and Other Receivables Loss Provisions | | | (22,203 | ) | | | (25,074 | ) | | | (11,220 | ) |

Net Operating Income | | | 147,256 | | | | 112,443 | | | | 106,110 | |

Loss on Net Monetary Position | | | (30,798 | ) | | | (27,788 | ) | | | (10,496 | ) |

Operating Income | | | 36,858 | | | | 5,191 | | | | 22,456 | |

Income Tax from Continuing Operations | | | (13,038 | ) | | | (10,634 | ) | | | (11,259 | ) |

Income (Loss) for the Year Attributable to GFG | | | 23,708 | | | | (5,332 | ) | | | 10,451 | |

Other Comprehensive Income | | | 403 | | | | (135 | ) | | | (669 | ) |

Total Comprehensive Income (Loss) Attributable to GFG | | | 24,111 | | | | (5,467 | ) | | | 9,782 | |

Ordinary Shares Outstanding for the year | | | 1,427 | | | | 1,427 | | | | 1,427 | |

Basic Earnings per Share (in Pesos) | | | 16.62 | | | | (3.74 | ) | | | 7.32 | |

Diluted Earnings per Share (in Pesos) | | | 16.62 | | | | (3.74 | ) | | | 7.32 | |

Cash Dividends per Share (in Pesos) | | (1) | | | | 1.86 | | | | 1.74 | |

Book Value per Share (*) (in Pesos) | | | 79.85 | | | | 64.82 | | | | 69.56 | |

(1) The cash dividend distribution for the fiscal year ended at December 31, 2019, is pending approval. For more information see Item 8. “Financial Information”-A.“Consolidated Statements and Other Financial Information”-“Dividend Policy and Dividends”-“Dividends” -“Grupo Financiero Galicia”.

(2 ) Total Shreholders´ Equity attributable to GFG divided Ordinary Shares Outstanding for the year.

| |

| For the Year Ended December 31, | |

| |

| 2019 | | | 2018 | | | 2017 | |

| | (in millions of Pesos, except as noted) | |

Consolidated Statement of Financial Position in Accordance with IFRS | | | | | | | | | | | | |

Cash and Due from Banks | | | 130,649 | | | | 220,456 | | | | 133,903 | |

Debt Securities at Fair Value Through Profit or Loss | | | 65,690 | | | | 116,813 | | | | 65,760 | |

Loans and Other Financing | | | 358,559 | | | | 434,900 | | | | 437,430 | |

Total Assets | | | 685,519 | | | | 876,371 | | | | 753,227 | |

Deposits | | | 393,735 | | | | 553,946 | | | | 455,909 | |

Other Liabilities | | | 174,949 | | | | 227,283 | | | | 193,514 | |

Shareholders’ Equity attributable to GFG | | | 113,942 | | | | 92,492 | | | | 99,260 | |

Percentage of Period-end Balance Sheet Items Denominated in Dollars: | | | | | | | | | | | | |

Loans and Other Financing | | | 39 | % | | | 35 | % | | | 21 | % |

Total Assets | | | 45 | % | | | 39 | % | | | 26 | % |

Deposits | | | 52 | % | | | 45 | % | | | 35 | % |

Total Liabilities | | | 49 | % | | | 34 | % | | | 30 | % |

| | For the Year Ended December 31, | | |

| | 2019 | | | | 2018 | | | 2017 | | |

Selected Ratios (*) | | | | | | | | | | | |

Profitability and Efficiency | | | | | | | | | | | |

Net Yield on Interest Earning Assets (1) | | | 19.93 | | % | | | 13.99 | | % | | 10.71 | | % |

Financial Margin (2) | | | 21.07 | | % | | | 12.49 | | % | | 13.11 | | % |

Return on Assets (3) | | | 3.46 | | % | | | (0.61 | ) | % | | 1.39 | | % |

Return on Shareholders’ Equity (4) | | | 20.81 | | % | | | (5.76 | ) | % | | 10.53 | | % |

Efficiency ratio (5) | | | 50.72 | | % | | | 64.13 | | % | | 58.24 | | % |

Capital | | | | | | | | | | | | | | |

Shareholders’ Equity as a Percentage of Total Assets | | | 16.62 | | % | | | 10.55 | | % | | 13.18 | | % |

Total Liabilities as a Multiple of Shareholders’ Equity | | | 4.99 | | x | | | 8.45 | | x | | 6.54 | | x |

Total Capital Ratio | | | 17.53 | | % | | | 15.11 | | % | | 10.69 | | % |

Liquidity | | | | | | | | | | | | | | |

Cash and Due from Banks as a Percentage of Total Deposits | | | 33.18 | | % | | | 39.80 | | % | | 29.37 | | % |

Loans and other financing, Net as a Percentage of Total Assets | | | 52.30 | | % | | | 49.63 | | % | | 58.07 | | % |

Credit Quality | | | | | | | | | | | | | | |

Non-Accrual Instruments (6) as a Percentage of Total Financial Instruments Portfolio | | | 4.63 | | % | | | 3.51 | | % | | 2.20 | | % |

Allowance for Financial Instruments as a Percentage of Non-accrual Financial Instruments (6) | | | 130.34 | | % | | | 137.40 | | % | | 129.75 | | % |

Net Charge-Offs as a Percentage of Financial Instruments Portfolio | | | 5.12 | | % | | | 4.98 | | % | | 2.24 | | % |

Inflation and Exchange Rate | | | | | | | | | | | | | | |

Wholesale Price Index | | 58.49 | | % | | 73.50 | | % | 18.80 | | % |

Consumer Price Index | | 53.83 | | % | | 47.65 | | % | 24.80 | | % |

Exchange Rate Variation (7) | | | 58.42 | | % | | | 101.44 | | % | | 18.42 | | % |

CER (8) | | | 18.70 | | | | | 12.34 | | | | 8.38 | | |

UVA (9) | | | 47.16 | | | | | 31.06 | | | 21.15 | | |

(*) All of the ratios disclosed above are included because they are considered significant by the management of Grupo Financiero Galicia.

(1) Net interest earned divided by interest-earning assets. For a description of net interest earned, see Item 4. “Information on the Company”-A.“Business Overview”-“Selected Statistical Information”-“Average Balance Sheet and Income from Interest-Earning Assets and Expenses from Interest-Bearing Liabilities”.

(2) Financial margin represents net interest income plus net result from financial instruments plus foreign currency quotation differences plus insurance premiums earned plus certain items included in other operating income and expenses, divided by the average balance of interest-earning assets.

(3) Net income attributable to GFG as a percentage of total assets.

(4) Net income attributable to GFG as a percentage of shareholders’ equity.

(5) Personnel expenses plus administrative expenses plus depreciation and devaluations of assets, divided by net interest income plus net fee income plus net result from financial instruments plus foreign currency quotation differences plus insurance premiums earned plus certain items included in other operating income and expenses plus loss on net monetary position.

(6) Non-Accrual Financial Instruments are defined as those Financial Instruments in Stage 3. Assets categorized in Stage 3 are impaired financial assets and/or assets subject to a serious risk of impairment.

(7) Annual change in the end-of-period exchange rate expressed in Pesos per Dollar.

(8) The “CER” is the “Coeficiente de Estabilización de Referencia”, an adjustment coefficient based on changes in CPI.

(9) The “UVA” is the “Unidad de Valor Adquisitivo”, an adjustment coefficient based on changes in the CER.

The tables below reflecting Grupo Galicia’s financial results for the fiscal years ended December 31, 2016 and 2015, are not adjusted for inflation, and were prepared in accordance with Argentine Banking GAAP (“Previous GAAP”). The information based on Previous GAAP included below and elsewhere is this annual report is not comparable to information prepared in accordance with IFRS.

| |

| Fiscal Year Ended December 31, | |

| |

| 2016

| | | 2015 | |

| | (in millions of Pesos, except as noted) | |

Consolidated Income Statement in Accordance with Argentine Banking GAAP | | | | | | | | |

Financial Income | | | 36,608 | | | | 25,844 | |

Financial Expenses | | | 20,239 | | | | 13,402 | |

Gross Brokerage Margin (1) | | | 16,369 | | | | 12,442 | |

Provision for Losses on Loans and Other Receivables | | | 3,533 | | | | 2,214 | |

Income before Taxes | | | 9,371 | | | | 7,139 | |

Income Tax | | | (3,353 | ) | | | (2,801 | ) |

Net Income | | | 6,018 | | | | 4,338 | |

Basic Earnings per Share (in Pesos) | | 4.63 | | | 3.34 | |

Diluted Earnings per Share (in Pesos) | | 4.63 | | | 3.34 | |

Cash Dividends per Share (in Pesos) | | 0.18 | | | 0.12 | |

Book Value per Share (in Pesos) | | 15.66 | | | 11.14 | |

Amounts in Accordance with U.S. GAAP | | | | | | | | |

Net Income | | | 6,037 | | | | 4,336 | |

Basic and Diluted Earnings per Share (in Pesos) | | 4.64 | | | 3.33 | |

Book Value per Share (in Pesos) | | 15.45 | | | 11.06 | |

Financial Income | | | 34,549 | | | | 24,252 | |

Financial Expenses | | | 19,410 | | | | 12,826 | |

Gross Brokerage Margin | | | 15,139 | | | | 11,426 | |

Provision for Losses on Loans and Other Receivables | | | 3,192 | | | | 1,985 | |

Income Tax | | | 3,195 | | | | 2,644 | |

Consolidated Balance Sheet in Accordance with Argentine Banking GAAP | | | | | | | | |

Cash and Due from Banks | | | 61,166 | | | | 30,835 | |

Government Securities, Net | | | 13,701 | | | | 15,525 | |

Loans, Net | | | 137,452 | | | | 98,345 | |

Total Assets | | | 242,251 | | | | 161,748 | |

Deposits | | | 151,688 | | | | 100,039 | |

Other Funds (2) | | | 70,210 | | | | 47,224 | |

Total Shareholders’ Equity | | | 20,353 | | | | 14,485 | |

Average Total Assets (3) | | | 184,395 | | | | 122,684 | |

Percentage of Period-end Balance Sheet Items | | | | | | | | |

Denominated in Dollars: | | | | | | | | |

Loans, Net of Allowances | | 12.77 | | | 3.26 | |

Total Assets | | 27.56 | | | 16.88 | |

Deposits | | 33.63 | | | 14.37 | |

Total Liabilities | | 30.82 | | | 18.86 | |

Amounts in Accordance with U.S. GAAP | | | | | | | | |

Trading Securities | | | 17,196 | | | | 16,148 | |

Available-for-Sale Securities | | | 5,423 | | | | 4,385 | |

Total Assets | | | 260,403 | | | | 180,142 | |

Total Liabilities | | | 240,316 | | | | 165,759 | |

Shareholders’ Equity | | | 20,087 | | | | 14,383 | |

(1) Gross Brokerage Margin primarily represents income from interest on loans and other receivables resulting from financial brokerage plus net income earned from government and corporate debt securities holdings, minus interest on deposits and other liabilities from financial intermediation. It also includes the CER/UVA adjustment.

(2) Primarily includes debt securities, loans with other banks and international entities and amounts payable for spot and forward purchases to be settled.

(3) Average Total Assets, including the related interest that is due thereon is calculated on a daily basis for Banco Galicia and for Galicia Uruguay, as well as for Tarjetas Regionales consolidated with its operating subsidiaries, and on a monthly basis for Grupo Financiero Galicia and its non-banking subsidiaries.

| | Fiscal Year Ended December 31, |

| | 2016 | | | 2015 | |

Selected Ratios in Accordance with Argentine Banking GAAP | | | | | | | | |

Profitability and Efficiency | | | | | | | | |

Net Yield on Interest Earning Assets (1) | | | 13.26 | % | | | 14.18 | % |

Financial Margin (2) | | | 12.10 | | | 13.12 | |

Return on Average Assets (3) | | 3.48 | | | 3.83 | |

Return on Average Shareholders’ Equity (4) | | 35.03 | | | 35.54 | |

Net Income from Services as a Percentage of Operating Income (5) | | 39.63 | | | 38.65 | |

Efficiency ratio (6) | | 64.98 | | | 63.64 | |

Capital | | | | | | | | |

Shareholders’ Equity as a Percentage of Total Assets | | | 8.40 | % | | | 8.96 | % |

Total Liabilities as a Multiple of Shareholders’ Equity | | 10.9x | | | 10.17x | |

Total Capital Ratio | | | 15.04 | % | | | 13.38 | % |

Liquidity | | | | | | | | |

Cash and Due from Banks(7) as a Percentage of Total Deposits | | | 47.18 | % | | | 42.93 | % |

Loans, Net as a Percentage of Total Assets | | 56.74 | | | | 60.80 | |

Credit Quality | | | | | | | | |

Past Due Loans (8) as a Percentage of Total Loans | | | 2.43 | % | | | 2.46 | % |

Non-Accrual Loans (9) as a Percentage of Total Loans | | 3.31 | | | 3.11 | |

Allowance for Loan Losses as a Percentage of Non-accrual Loans(9) | | 100.06 | | | 112.41 | |

Net Charge-Offs (10) as a Percentage of Average Loans | | 1.67 | | | 1.26 | |

Ratios in Accordance with U.S. GAAP | | | | | | | | |

Capital | | | | | | | | |

Shareholders’ Equity as a Percentage of Total Assets | | 7.71 | | | 7.98 | |

Total Liabilities as a Multiple of Total Shareholders’ Equity | | 11.96x | | | 11.52x | |

Liquidity | | | | | | | | |

Loans, Net as a Percentage of Total Assets | | | 52.76 | % | | | 54.55 | % |

Credit Quality | | | | | | | | |

Allowance for Loan Losses as a Percentage of Non-Accrual Loans | | 128.53 | | | 135.35 | |

Inflation and Exchange Rate | | | | | | | | |

Wholesale Inflation (11) | | | 34.59 | % | | | 12.65 | % |

Consumer Inflation (12) | | | 41.05 | % | | | 26.90 | % |

Exchange Rate Variation (13) (%) | | 21.88 | | | 52.07 | |

CER (14) | | 6.84 | | | 5.04 | |

UVA (15) | | 17.26 | | | - | |

(1) Net interest earned divided by interest-earning assets.

(2) Financial margin represents gross brokerage margin divided by average interest-earning assets.

(3) Net income excluding non-controlling interest as a percentage of average total assets.

(4) Net income as a percentage of average shareholders’ equity.

(5) Operating income is defined as gross brokerage margin plus net income from services.

(6) Administrative expenses as a percentage of operating income as defined above.

(7) Liquid assets of Banco Galicia include cash and receivables, Lebacs, net call money, short-term loans to other Argentine financial institutions, special guarantee accounts at the Argentine Central Bank, and repurchase and reverse repurchase transactions in the Argentine financial market.

(8) Past-due loans are defined as the aggregate principal amount of a loan plus any accrued interest that is due and payable for which either the principal or any interest payment is 91 days or more past due.

(9) Non-Accrual loans are defined as those loans in the categories of: (a) Consumer portfolio: “Medium Risk”, “High Risk”, “Uncollectible”, and “Uncollectible Due to Technical Reasons”, and (b) Commercial portfolio: “With problems”, “High Risk of Insolvency”, “Uncollectible”, and “Uncollectible Due to Technical Reasons”.

(10) Direct charge-offs minus amounts recovered.

(11) As of December 31, 2015, as measured by the interannual change between the October 2014 and the October 2015 Wholesale Price Index (“WPI”), published by INDEC (as defined herein), because the measurement of this index was discontinued for the remainder of 2015. In 2016 the measure was reinstated.

(12) In 2015, annual variation of the Consumer Price Index (“CPI”) was calculated using the Consumer Price Index of the City of Buenos Aires, an alternative measure of inflation proposed by INDEC after it discontinued its index.

(13) Annual change in the end-of-period exchange rate expressed in Pesos per Dollar.

(14) The “CER” is the “Coeficiente de Estabilización de Referencia”, an adjustment coefficient based on changes in the CPI.

(15) The “UVA” is the “Unidad de Valor Adquisitivo”, an adjustment coefficient based on changes in the CER.

Not applicable.

Not applicable.

You should carefully consider the risks described below in addition to the other information contained in this annual report. In addition, most, if not all, of the risks described below must be evaluated bearing in mind that our most important asset is our equity interest in Banco Galicia. Thus, a material change in Banco Galicia’s shareholders’ equity or income statement would also adversely affect our businesses and results of operations. We may also face risks and uncertainties that are not presently known to us or that we currently deem immaterial, which may impair our business. Our operations, property and customers are located in Argentina. Accordingly, the quality of our customer portfolio, loan portfolio, financial condition and results of operations depend, to a significant extent, on the macroeconomic and political conditions prevailing in Argentina. In general, the risk assumed when investing in the securities of issuers from countries such as Argentina is higher than when investing in the securities of issuers from developed countries.

Risk Factors Relating to Argentina

The current state of the Argentine economy, together with uncertainty regarding the government, may adversely affect our business and prospects.

Grupo Galicia’s results of operations may be affected by inflation, fluctuations in the exchange rate, modifications in interest rates, changes in the Argentine government’s policies and other political or economic developments either internationally or in Argentina that affect the country.

During the course of the last few decades, Argentina’s economy has been marked by a high degree of instability and volatility, periods of low or negative economic growth and high, fluctuating levels of inflation and devaluation. Grupo Galicia’s results of operations, the rights of holders of securities issued by Grupo Galicia and the value of such securities could be materially and adversely affected by a number of possible factors, some of which include Argentina’s inability to resume a sustainable economic growth path, the effects of inflation, Argentina’s ability to obtain financing, a decline in the international prices for Argentina’s main commodity exports, fluctuations in the exchange rates of other countries against which Argentina competes and the vulnerability of the Argentine economy to external shocks.

Since 2012, Argentina has experienced a period of stagflation. Figures of economic activity reflect a slowdown in domestic production, together with an increasing inflation rate at a higher pace than that noted in previous years. In the past decade, the economy has been characterized by a lack of institutional transparency, the absence of long-term economic policies and a systematically expansive fiscal policy, which resulted in a lack of investment and a lax monetary policy. This has, in turn, led to low economic growth and high inflation. At the end of 2015, when the former government took office, it implemented monetary policies that maintained a certain laxity in their fiscal policy while strongly restricting its monetary policy, resulting in high interest rates, a marked growth in public debt and an overvaluation of the Peso. However, at the beginning of 2018, international investors began withdrawing from emerging markets, including Argentina. The country’s loss of access to the international debts markets resulted in a considerable devaluation of the Argentine Peso. This resulted in an acceleration of inflation and a new contraction in economic activity during the second half of 2018 and most of 2019. During 2019, the political uncertainty stemming from the presidential election race worsened the economic outlook. The impact of the measures implemented by the previous Administration in order to cope with the situation -such as a devaluation of the Peso with respect to the Dollar- as well as the impact of any measures that the current Government may implement in the future, is unknown and could have a material and adverse impact on the results of Grupo Galicia’s operations.

No assurance can be given that additional events in the future, such as the enactment of new regulations by the Argentine government or authorities, will not occur. As a result of the foregoing, the financial position and results of operations of private sector companies in Argentina, including Grupo Galicia, the rights of the holders of securities issued by such institutions and the value thereof may be negatively and adversely impacted.

Economic conditions in Argentina may deteriorate, which may adversely impact Grupo Galicia’s business and financial condition.

A less favorable international context, a decrease in the competitiveness of the Peso as compared to foreign currencies, the low consumer confidence and low confidence from both local and foreign investors and a higher inflation rate, among other factors, may affect the development and growth of the Argentine economy and cause volatility in the local capital markets. Such events may adversely impact Grupo Galicia’s business and financial condition.

In particular, the Argentine economy continues to be vulnerable to several factors, including:

- volatility in the growth rate of the economy;

- a high rate of government expenditures;

- high inflation rates;

- regulatory uncertainty for certain economic activities and sectors;

- decreases in the prices for commodities as the economic recovery has depended on high prices for commodities, which prices are volatile and beyond the control of the government;

- the effects of a restrictive U.S. monetary policy, which could generate an increase in financial costs for Argentina;

- fluctuations in the Argentine Central Bank’s international reserves; and

- uncertainty with respect to exchange and capital controls.

No assurance can be provided that a decline in economic growth or certain economic instability will not occur. In particular, the Argentine economy contracted in 2018 and 2019 and may continue to decrease in the future due to international and domestic conditions. Any such stagnation, slowdown or increased economic and political instability could have a significant adverse effect on Grupo Galicia’s business, financial position and results of operations, and the trading price for its ADSs.

The ability of the current administration to implement economic policy reforms, and the impact that these measures and any future measures taken by a new administration will have on the Argentine economy, remains uncertain.

As the date of this annual report, the impact that the reforms adopted by the Fernández administration will have on the Argentine economy as a whole, and the financial sector in particular, cannot be predicted. In addition, it is currently unclear what additional measures the Fernández administration may implement in the future and what the effects of the same may be on the Argentine economy.

Since taking office, the Fernández administration has announced and implemented several significant economic measures. In particular, on December 20, 2019, the Argentine National Congress passed Law No. 27,541 aimed at Social Solidarity and Productive Reactivation. Such law declared a public emergency in economic, financial, fiscal, administrative, pension, energy, health and social matters. It also delegated to the National Executive Branch, broad authority and power to take actions designed to, among other things, ensure the sustainability of the level of public debt, restructure the rate the energy system through a renegotiation of the current comprehensive tariff regime and restructure the regulatory entities for the energy system. In addition, the Fernández administration is beginning a debt restructuring process. The FX market restrictions imposed by the Fernández administration, in combination with a relatively moderate monetary and fiscal policy, additional restrictions on foreign trade and the impacts of changes to the social security policy could result in lower economic growth rates in Argentina for the coming years. An adverse result in the debt restructuring that the Government is carrying out could affect access to the capital market, and may affect the growth of the country, provinces and private companies. It is impossible to predict the impact of these measures, as well as any future measures that may be adopted, on the Argentine economy overall and the financial sector in particular.

In particular, economic intervention by current measures or future measures may be disruptive to the economy and may fail to benefit, or may harm, our business. In particular, Grupo Galicia has no control over the implementation of the reforms to the regulatory framework that governs its operations and cannot guarantee that these reforms will be implemented or that they will be implemented in a manner that will benefit its business. The failure of these measures to achieve their intended goals could adversely affect the Argentine economy and Grupo Galicia’s business, financial position and results of operations and the trading price for its ADSs.

If the high levels of inflation continue, the Argentine economy and Grupo Galicia’s financial position and business could be adversely affected.

Since 2007, the Argentine economy has experienced high levels of inflation. According to private estimates, since 2007: inflation in Argentina has been systematically above 20% and reached a maximum of 53.8 % in 2019. Moreover, between 2007 and 2015 official figures became unreliable and private estimates of inflation had to be used (as further described below). Combined with such high inflation rates. Argentina has also displayed high volatility in its prices during the same period, as a consequence of alternating periods in which inflation was controlled by pegging the Peso to other currencies in combination with expansive monetary and fiscal policies—which lead to an over appreciation of the peso—and periods in which the Peso appreciation was adjusted, leading to the consequent acceleration of inflation.

As noted above, between 2007 and 2015, official inflation figures became unreliable. Specifically, INDEC (Índice Nacional de Estadísticas y Censos “INDEC” for its acronym in Spanish), is the only institution in Argentina with legal power to produce official national statistics. During such time period, INDEC, went through a process of major institutional and methodological reforms that led to controversies related to the reliability of the information it produces. In the month of January 2016, the Government of Mauricio Macri declared an administrative emergency regarding the national statistical system and INDEC that lasted, until December 31, 2016. During such emergency time, period INDEC stopped publishing certain statistical data until it had completed a reorganization of its technical and administrative structure to recover its ability to produce relevant and sufficient information.

Despite the fact that, due to the reforms implemented in recent years, the inflation rates calculated by INDEC are generally accepted, the possibility that they may be manipulated in the future cannot be ruled out. Any such future manipulation could affect the Argentine economy in general and the financial sector in particular.

.

In the past, inflation has materially undermined the Argentine economy and the Argentine government’s ability to generate conditions that fostered economic growth. In addition, high inflation or a high level of volatility with respect to the same may materially and adversely affect the business volume of the financial system and prevent the growth of financial intermediation activity. This, in turn, could adversely affect economic activity and employment.

A high inflation rate also affects Argentina’s competitiveness abroad, as well as real salaries, employment rates, consumption rates and interest rates. A high level of uncertainty with regard to these economic variables, and lack of stability in terms of inflation, could lead to shortened contractual terms and affect the ability to plan and make decisions. This may have a negative impact on economic activity and on the income of consumers and their purchasing power, all of which could materially and adversely affect Grupo Galicia’s financial position, results of operations and business, and the trading price for its ADSs.

Argentina’s and Argentine companies’ ability to obtain financing and to attract direct foreign investment is limited and may adversely affect Grupo Galicia’s financial position, results of operations and business.

Argentina and Argentine companies have had limited access to foreign financing in recent years, primarily as a result of a default in December 2001 by Argentina on its debt to foreign bondholders, multilateral financial institutions and other financial institutions. Argentina settled all of its outstanding debt with the IMF in 2006, carried out a variety of debt swaps with certain bondholders between 2004 and 2010, and reached an agreement with the Paris Club in 2014. After several years of litigation, on March 1, 2016, an agreement was reached between the Argentine government and certain creditors to which the Argentine government was previously in default.

On April 18, 2016, in order to make the payment to bondholders in similar conditions, Argentina issued bonds in an amount of US$16.5 billion, with interest rates between 6.25% and 8% and maturities of three, five, ten and thirty years. The payment of approximately US$9.3 billion to the bondholders was made on April 22, 2016, thus reaching a final solution to the Argentine debt in default.

During the remainder of 2016, 2017 and the first four months of 2018, the Argentine government continued to seek financing from international markets. Following the exchange rate crisis beginning in April 2018, however, Argentina has not been able to access the international capital markets, resulting in the Argentine government requesting a loan from the IMF (pursuant to a Stand-By Agreement for a total of US$57 billion).

In the short term, Argentina must restructure its debt with its current bondholders and the IMF, which may require a commitment to implement restrictive monetary and fiscal policies, which could have a significant adverse effect on Argentina’s economy and on Argentine companies or Grupo Galicia’s ability to obtain international financing, and could also adversely affect local credit conditions. If Argentina is not be able to reach an agreement with its bondholders or the IMF Argentina may default on such debt and would likely again lose access to the international financial markets. This would also have an adverse effect on the Argentine economy, including Grupo Galicia., and would likely negative impact the ability of companies, including Grupo Galicia, to obtain foreign financing.

A decline in the international prices of Argentina’s main commodities exports and a real appreciation of the Peso against the Dollar could affect the Argentine economy and create new pressures on the foreign exchange market and have a material adverse effect on Grupo Galicia’s financial condition, prospects and operating results.

The reliance on the export of certain commodities, (particularly soybeans and its by products, corn and wheat), has made the country more vulnerable to fluctuations in their prices. A decrease in commodity prices may adversely affect the Argentine government’s fiscal revenues and the Argentine economy as a whole. Given its reliance on such agricultural commodities, the country is also vulnerable to weather events—such as 2018’s drought—that may negatively affect the production of such commodities, reducing fiscal revenues and the inflow of US dollars.

In order to counterbalance and diversify its reliance on the above noted agricultural commodities as well as to add an additional source of revenue, Argentina has been focused on increasing its oil and gas exports. A long-term decrease in the international price of oil would negatively impact such oil and gas prospects and result in a decrease in foreign investment in such sectors.

A significant increase in the real appreciation of the Peso could affect Argentina’s competitiveness, substantially affecting exports, and this in turn could prompt new recessionary pressures on Argentina’s economy and a new imbalance in the foreign exchange market, which could exacerbate exchange rate volatility. Given the strong reliance on revenues from taxes on exports, a significant appreciation of the real exchange rate could substantially reduce Argentine public sector’s tax revenues in real terms. The occurrence of the foregoing could exacerbate the existing inflationary environment and potentially materially and adversely affect the Argentine economy, as well as Grupo Galicia’s financial condition and operating results and, thus, the trading prices for its ADSs.

Volatility in the regulatory framework could have a material and adverse effect on Argentina’s economy in general, and on Grupo Galicia’s financial position, specifically.

From time to time the Argentine government has enacted several laws amending the regulatory framework governing a number of different activities as a measure to stimulate the economy, some of which have had adverse effects on Grupo Galicia’s business. Although former administration has eliminated some of these regulations, political and social pressures could inhibit the Argentine government’s implementation of policies designed to generate growth and enhance consumer and investor confidence.

No assurance can be provided that future regulations, and especially those related to the financial system, will not materially and adversely affect the assets, revenues and operating income of private sector companies, including Grupo Galicia, the rights of holders of securities issued by those entities, or the value of those securities.

The lack of regulatory foresight could impose significant limitations on activities of the financial system and Grupo Galicia’s business, and would generate uncertainty regarding its future financial position and result of operations and trading price for its ADSs.

The Argentine economy and its goods, financial services and securities markets remain vulnerable to external factors, which could affect Argentina’s economic growth and Grupo Galicia’s prospects.

The financial and securities markets in Argentina are influenced, to varying degrees, by economic and market conditions in other countries. Although such conditions may vary from country to country, investor reactions to events occurring in one country may affect capital flows to issuers in other countries, and consequently affect the trading prices of their securities. Decreased capital inflows and lower prices in the stock market of a country may have a material adverse effect on the real economy of those countries in the form of higher interest rates and foreign exchange volatility.

During periods of uncertainty in international markets, investors generally choose to invest in high-quality assets (“flight to quality”) over emerging market assets. This has caused and could continue to cause an adverse impact on the Argentine economy and could continue to adversely affect the country’s economy in the near future.

The problems faced by the European Union’s countries, resulting from a combination of factors such as low growth, fiscal woes and financial pressures, were particularly acute. Reestablishing financial and fiscal stability to offset such low or zero growth continues to pose a challenge. As a result, the leading economies of the European Union imposed emergency economic plans in such countries, which plans are still in place. During 2018, the U.S. Federal Reserve increased the Federal Funds rate by 100 basis points and continued to cut its asset purchase and its monetary easing programs. Such changes continued to strengthen the Dollar globally, affecting commodity prices and reducing the inflow of capital to emerging market countries, including Argentina. However, during 2019 the U.S. Federal Reserve implemented several haircuts on the Federal Funds rate (1.75%-1.50% range), a preemptive measure amidst a trade war with China and the European Union, even though the U.S. economy displayed strong fundamentals—record-high employment levels, a strong economy and low inflation rates. During March 2020, the U.S. Federal Reserve decide to implement two aggressive interest-rate cuts during two unscheduled meetings: a 0.5 percentage point cut on March 3rd and a 1 percentage point cut on March 15th. This decision was made in order to help mitigate the economic consequences from the COVID-19 pandemic.

Brazil, Argentina’s main trade partner, has experienced a slight increase in GDP in recent years, increasing 1.3% in 2017 and 2018 and 1.1% in 2019. Although Brazil’s economic outlook may be improving, a further deterioration of activity, a delay in Brazil’s expected economic recovery or a slower pace of economic improvement in Brazil may have a negative impact on Argentine exports and on the overall level of economic and industrial activity in Argentina, particularly with respect to the automotive industry. In addition, the inauguration of Jair Bolsonaro as the president of Brazil has contributed to geopolitical volatility in this region as a result of his polarizing ideologies.

China, which is the main importer of Argentine raw materials, experienced an economic slowdown in 2018 and 2019 when compared to recent years. The prices for Argentine commodities, in particular oilseeds, have displayed a falling trend in recent years. If this trend continues, it could affect the inflow of foreign currency into Argentina from exports. The slowdown of the Chinese economy and increased volatility of its financial markets could impact financial markets worldwide, which, in turn, could increase the cost and availability of financing both domestically and internationally for Argentine companies.

The international financial environment may also result in a devaluation of regional currencies and exchange rates, including the Peso, which would likely also cause volatility in Argentina. A new global economic and/or financial crisis or the effects of deterioration in the current international context, could affect the Argentine economy and, consequently, Grupo Galicia’s results of operations, financial condition and the trading price for its ADSs.

A potential additional devaluation of the Peso may hinder or potentially prevent Grupo Galicia from being able to honor its foreign currency denominated obligations.

The Argentine Peso depreciated 15.6% as compared to the U.S. Dollar in 2017, 50.3% in 2018 and 36.9% in 2019 according to the official quotation of the Central Bank. If the Peso further depreciates against the U.S. Dollar, as has recently occurred and which could occur again in the future, this could have an adverse effect on the ability of Argentine companies to make timely payments on their debts denominated in or indexed or otherwise connected to a foreign currency, generate very high inflation rates, reduce real salaries significantly, and have an adverse effect on companies focused on the domestic market, such as public utilities and the financial industry. Such a potential devaluation could also adversely affect the Argentine government’s capacity to honor its foreign debt, with adverse consequences for Grupo Galicia’s and Banco Galicia’s businesses, which could affect Grupo Galicia’s capacity to meet obligations denominated in a foreign currency which, in turn, could have a material adverse effect on the trading prices for Grupo Galicia’s ADSs.

Additionally, the Central Bank may intervene in the foreign exchange market to influence exchange rates. Purchases of Pesos by the Central Bank could result in a decrease of its international reserves. A significant decrease in the Central Bank’s international reserves may have an adverse impact on Argentina’s ability to withstand external shocks to the economy, and any adverse effects to the Argentine economy could, in turn, adversely affect the financial position and business of Grupo Galicia and its subsidiaries.

In order to control the depreciation of the Peso, on September 1, 2019 the Executive Branch introduced capital controls through decree No. 609/2019, whose validity was extended indefinitely by the government of Fernández through Decree No. 91/2019 and Communication "A" 6854 and 6856 of the Central Bank. These controls include the need to obtain authorization from the Central Bank to purchase foreign currency in excess of US$200 per month per person, and the mandatory liquidation of exporters’ foreign exchange earnings in the local market within five days, among other measures. This allows the Central Bank to exercise control over the Peso and therefore to prevent the Argentine currency from depreciating.

A depreciation of the Peso could adversely affect the Argentine economy and Grupo Financiero Galicia’s financial condition, its business and its ability to service its existing debt obligations. Moreover, an acceleration of inflation caused by an exchange rate crisis would raise the costs associated with Grupo Galicia’s subsidiaries servicing their foreign currency-denominated, which could increase Grupo Galicia’s costs and therefore have a material adverse effect on Grupo Galicia’s financial condition and results of operations.

Changes or new regulations in the Argentine foreign exchange market may adversely affect the ability and the manner in which Grupo Galicia repays its obligations denominated in, indexed to or otherwise connected to a foreign currency.

Since December 2001, different government administrations have established and implemented various restrictions on foreign currency transfers (both in respect of transfer into and out of Argentina). Such is the case of the current measures that limit the ability of residents to purchase foreign currency for saving purposes and by capping the amount that can be purchased by the general public at US$200 per month and imposing a 30% tax on all such foreign currency purchases, as well as on any purchases in foreign currency made with debit or credit cards and on the purchase of international flights, hotels or tourism packages.

The impact that these measures or potential future measures will have on the Argentine economy and Grupo Galicia is uncertain. No assurance can be provided that the regulations will not be amended, or that no new regulations will be enacted in the future imposing greater limitations on funds flowing into and out of the Argentine foreign exchange market. Any such new measures, as well as any additional controls and/or restrictions, could materially affect Grupo Galicia’s ability to access the international capital markets and may undermine its ability to make payments of principal and/or interest on its obligations denominated in a foreign currency or transfer funds abroad (in total or in part) to make payments on its obligations (which could affect Grupo Galicia’s financial condition and results of operations). Therefore, Argentine resident or non-resident investors should take special notice of these regulations (and their amendments) that limit access to the foreign exchange market. In the future Grupo Galicia may be prevented from making payments in U.S. Dollars and/or making payments outside of Argentina due to the restrictions in place at that time in the foreign exchange market and/or due to the restrictions on the ability of companies to transfer funds abroad.

It may be difficult to effect service of process against Grupo Galicia’s executive officers and directors, and foreign judgments may be difficult to enforce or may be unenforceable.

Service of process upon individuals or entities which are not resident in the United States may be difficult to obtain in the United States. Grupo Galicia and its subsidiaries are companies incorporated under the laws of Argentina. Most of their shareholders, directors, members of the Supervisory Syndics’ Committee, officers, and some specialists named herein are domiciled in Argentina and the most significant part of their assets is located in Argentina. Although Grupo Galicia has an agent to receive service of process in any action against it in the United States with respect to its ADSs, none of its executive officers or directors has consented to service of process in the United States or to the jurisdiction of any United States court. As a result, it may be difficult to effect service of process against Grupo Galicia’s executive officers and directors. Additionally, under Argentine law, the enforcement of foreign judgments will only be allowed if the requirements in sections 517 to 519 of the National Code of Civil and Commercial Procedures or the applicable local code of procedures are met, and provided that the foreign judgment does not infringe on concepts of public policy in Argentine law, as determined by the competent courts of Argentina. As such, an Argentine court may find that the enforcement in Argentina of a foreign judgment (including a U.S. court) that requires payment be made by an Argentine individual to holders of its foreign currency-denominated securities outside of Argentina is contrary to the public policy if, for instance, there are legal restrictions in place prohibiting Argentine debtors from transferring foreign currency abroad to pay off debts.

The intervention of the Argentine government in the electric power sector could have a material adverse impact on the Argentine economy, which may have a material adverse impact on Grupo Galicia’s results of operations.

Historically, the Argentine government has played an active role in the electric power sector through the ownership and management of state-owned companies engaged in the generation, transmission and distribution of electric power. To address the Argentine economic crisis of 2001 and 2002, the Argentine government adopted Law No.25,561 and other regulations, which made a number of material changes to the regulatory framework applicable to the electric power sector and have significantly distorted supply and demand in the sector. These changes included the freezing of distribution margins, the revocation of adjustment and inflation indexation mechanisms for tariffs, a limitation on the ability of electric power distribution companies to pass on to the consumer increases in costs due to regulatory charges and the introduction of a new price-setting mechanism in the wholesale electricity market, all of which had a significant impact on electric power generators and caused substantial price differences within the market.

The former administration initiated significant reforms in the electric power sector. As part of such reforms, such administration took actions designed to guarantee the supply of electric power in Argentina, such as instructing the Ministry of Energy and Mining to develop and implement a coordinated program to guarantee the quality of the electric power system and ration individuals’ and public entities’ consumption of energy by increasing tariffs. In the past, the Argentine government and certain provincial governments have approved significant price adjustments and tariff increases applicable to certain generation and distribution companies, resulting in an increase in cost of energy prices for consumers.

On March 31, 2017, the Ministry of Energy and Mining released a new tariff schedule that increased the price consumers pay for electricity and natural gas by 36% with the goal of reducing government subsidies for energy consumption as part of efforts to reduce the Argentine government’s fiscal deficit. Following a public hearing, the Minister of Energy and Mining released a revised tariff schedule in December 2017, which further increased rates between 34% and 57% (depending on the province) for natural gas and approximately 34% for other electricity. On December 28, 2018, the government further increased gas and electricity tariffs to 40% and 55%, respectively, which were implemented during 2019.

As a result, there has been a significant increase in the cost of energy in Argentina, which could have a material adverse effect on consumers’ disposable income, and therefore, Grupo Galicia’s financial condition and results of operations and the trading price of our ADSs.

The measures adopted by the Argentine government and the claims filed by workers on an individual basis or as part of a labor union action may lead to pressures to increase salaries or additional benefits, which would increase companies’, including Grupo Galicia’s, operating costs. Additionally, labor union activity could lead to strikes or work stoppages, which may materially and adversely affect Grupo Galicia’s results of operations.

In the past, the Argentine government has passed laws and regulations requiring private sector companies to maintain certain salary levels and provide their employees with additional work-related benefits. Furthermore, employers, both in the public sector and in the private sector, have been experiencing intense pressure from their personnel, or from the labor unions representing such personnel, demanding salary increases and certain benefits for the workers, given the prevailing high inflation rates. Specifically, during the early months of 2019 the Argentine union that represents employees in the banking sector declared general strikes. These strikes did not have a direct effect on banks but did impact the clients of banks who were not able to access to banks’ branches. Strikes similar to the one that took place in 2019, however, can deteriorate the perception the public has of banks, which could have a reputational cost for us. Labor pressure is active in Argentina and can potentially lead to further strikes or work stoppages if demands are not satisfied, which could have a material and adverse effect on Grupo Galicia’s operations.

There can be no assurance that the Argentine government will not adopt measures in the future mandating salary increases or the provision of additional employee benefits, or that employees or their unions will not exert pressure on companies, such as Grupo Galicia, in demanding the implementation of such measures. The implementation of any such measures could have a material and adverse effect on Grupo Galicia’s expenses and business, results of operations and financial condition and, thus, on the trading prices for its ADSs.

High levels of government expenditures in Argentina could generate long lasting adverse consequences for the Argentine economy.

Since 2007, Argentina increased its spending to GDP to reach a maximum of 24% in 2015, quite above the ratio of the rest of the countries in the region. Since then, a decreasing trend in expenditures was observed until the year 2019.

Despite the trend of recent years, if government expenditures increases to an extent that outpaces Argentina’s revenues, the country’s fiscal deficit is likely to increase, and the Argentine government may be forced to seek assistance from the Central Bank and/or the National Administrator of Pensions.

Any such increase in Argentina’s deficit could have a negative effect on the government’s ability to access to the long term financial markets, and in turn, could limit the access to such markets for Argentine companies, such as Grupo Galicia and its subsidiaries. The same may have a material and adverse effect on Grupo Galicia’s financial condition and results of operations.

The novel coronavirus could have an adverse effect on our business operations.

In late December 2019 a notice of pneumonia originating from Wuhan, Hubei province (COVID-19, caused by a novel coronavirus) was reported to the World Health Organization, with cases soon confirmed in multiple provinces in China, as well as in other countries. Several measures were undertaken by the Chinese government and other countries to control the coronavirus, including the use of quarantine (with approximately 60 million people affected in China), travel restrictions to and from China by certain air carriers and foreign governments. Since such initial outbreak, COVID-19 has been declared a pandemic and the virus spread and continues to spread globally, as of the date of this annual report, affecting more than 148 countries and territories around the world, including Argentina. To date, COVID-19s has caused significant social and market disruption.

The long-term effects to the global economy and to Grupo Galicia of epidemics, pandemics and other public health crises, such as COVID-19, are difficult to assess or predict, and may include risks to employee’s health and safety, and reduce our business operations. Any prolonged restrictive measures put in place to control an outbreak of a contagious disease or virus or other adverse public health development in any of our targeted markets may have a material and adverse effect on our business operations. We may also be affected by a decline in the demand of our services, or the need to implement policies limiting the efficiency and effectiveness of our operations, including the implementation of work from home policies. The impact epidemics, pandemics and other health crises, such as COVID-19 may have on the methods we use to sell and distribute our products and services, on our human capital resources productivity, and on the ability of our suppliers and consultants to provide goods and services and other resources in a timely manner to support our business, are also impossible to assess or predict at this moment.

Furthermore, certain measures imposed by the local administration, such as travel restrictions, border closures and lock-down measures which have forced us to set in place work from home arrangements for our employees, may also have a material impact on our ability to operate and achieve our business goals.

Considering the current health crisis, and the related halt in economy the world is facing, we may also experience higher default rates on the financings granted to our clients, liquidity deficiencies, difficulties in our ability to service our debts and other financial obligations. We may also face difficulties in trying to access to debt and capital markets and be forced to refinance preexisting financing arrangements. Although the actual impact is impossible to assess, the occurrence of any of such events could have a material adverse effect on our operations.

Finally, it is unclear whether these challenges and uncertainties will be contained or resolved, and what effects they may have on the global political and economic conditions in the long term. Neither can we predict how the disease will evolve (and potentially, spread) in Argentina, nor anticipate future restrictions the Argentine government may impose.

The Argentine economy could be negatively affected by external factors that have an impact in the whole world, such as COVID-19’s spread and the consequent implementation of measures destined to deal with the mentioned pandemic, and its economic impact both on a local and an international level.

The Argentine economy is vulnerable to external factors. In this sense, most economies in the world (including Argentina and its main trade partners) are being affected by the spread of COVID-19. The virus’ progression, which has been declared a pandemic by the World Health Organization, has led to the application of measures that have a severe economic impact.

In Argentina, these measures include the implementation of a generalized quarantine with the intention of hindering the virus’ advancement and to avoid the collapse of the local health system. This entails a halt in most economic activities (excluding essential ones, such as healthcare services, manufacturing of food products, medical equipment or pharmaceuticals, supermarkets and pharmacies, security forces) and the suspension of road and air travels, among others. These measures, and any others the Argentine government might implement in the future, have a negative and direct impact on the country’s economy, by reducing both aggregate supply and demand.

Additionally, the progression of the virus and the consequent measures destined to fight the virus could entail a reduction in the economic growth in any of Argentina’s trade partners (such as Brazil, the European Union, China and the United States). The contraction of the economies of our trade partners could have a sizeable and adverse impact on Argentina’s trade balance and economy through a fall in the demand for Argentine exports or a decline in the prices of agricultural commodities.

On the other hand, higher uncertainty levels associated with the progress of a global pandemic implies the strengthening of the U.S. Dollar and the devaluation of the currencies of emerging countries, Argentina’s trade partners included. This could increase the financial pressure on the Argentine peso and lead to a devaluation of the local exchange rate, or cause the loss of competitiveness against our trade partners.

Any of these potential risks to the Argentine economy could have a significant and negative effect on the business, financial situation and operational results of the Company.

Failure to adequately address actual and perceived risks arising from institutional deterioration and corruption could adversely affect Argentina’s economy and financial position and the ability of Argentine companies to attract foreign investment.

The lack of a solid institutional framework and corruption have been identified as serious problems for Argentina and may continue to be. In the Transparency International’s Corruption Perceptions Index 2019, which measures corruption in 180 countries, Argentina ranked No.66. In the World Bank’s “Doing Business” report in 2019, Argentina Ranked No.119 out of 190 countries. The failure to address these issues could increase the risk of political instability, distort the decision-making process, adversely affect Argentina’s international reputation and its ability and the ability of its companies to attract foreign investment.

A deterioration in the Argentine reputation could have a material and adverse effect on Grupo Galicia’s financial condition and results of operations.

Risk Factors Relating to the Argentine Financial System

The stability of the Argentine financial system is dependent upon the ability of financial institutions, including Banco Galicia, the main subsidiary of Grupo Galicia, to maintain and increase the confidence of depositors.

The measures implemented by the Argentine government in late 2001 and early 2002, in particular the restrictions imposed on depositors to withdraw money freely from banks and the pesification and restructuring of their deposits, were strongly opposed by depositors due to the losses on their savings and undermined their confidence in the Argentine financial system and in all financial institutions operating in Argentina.

If depositors once again withdraw their money from banks in the future, there may be a substantial negative impact on the manner in which financial institutions, including Banco Galicia, conduct their business, and on their ability to operate as financial intermediaries. Loss of confidence in the international financial markets may also adversely affect the confidence of Argentine depositors in local banks.

An adverse economic situation, even if it is not related to the financial system, could trigger a massive withdrawal of capital from local banks by depositors, as an alternative to protect their assets from potential crises. Any massive withdrawal of deposits could cause liquidity issues in the financial sector and, consequently, a contraction in credit supply.

The occurrence of any of the above could have a material and adverse effect on Grupo Galicia’s expenses and business, results of operations and financial condition and, thus, on the trading prices for its ADSs.

If financial intermediation activity volumes relative to GDP are not restored to significant levels, the capacity of financial institutions, including Banco Galicia, the main subsidiary of Grupo Galicia, to generate profits may be negatively affected.

As a result of the 1999-2002 financial crisis (in which the Argentine economy fell 18.4%), the volume of financial intermediation activity dropped dramatically: private sector credit plummeted from 24% of GDP in December 2000 to 7.7% in June 2004 and total deposits as a percentage of GDP fell from 31% to 23.2% during the same period. The depth of the crisis and the effect it had on depositors’ confidence in the financial system created uncertainty regarding its ability to act as an intermediary between savings and credit. Furthermore, the ratio of the total financial system’s private-sector deposits and loans to GDP remains low when compared to international levels and continues to be lower than the periods prior to the crisis, especially in the case of private-sector deposits and loans, which amounted to 12.8% and 8.6% of GDP, respectively, as of December 31, 2019.

There is no assurance that financial intermediation activities will continue in a manner sufficient to reach the necessary volumes to provide financial institutions, including Banco Galicia, with sufficient capacity to generate income, or that those actions will be sufficient to prevent Argentine financial institutions, such as Banco Galicia, from having to assume excessive risks in terms of maturity mismatches. Under these circumstances, for an undetermined period of time, the scale of operations of Argentine-based financial institutions, including Banco Galicia, their business volume, the size of their assets and liabilities or their income-generation capacity could be much lower than before the 1999-2002 crisis which may, in turn, impact the results of operations of Banco Galicia and, potentially, the trading price for Grupo Galicia’s ADSs.

The Argentine financial system’s growth and income, including that of Banco Galicia, the main subsidiary of Grupo Galicia, depend in part on the development of medium- and long-term funding sources.

In spite of the fact that the financial system’s and Banco Galicia’s deposits continue to grow, they are mostly demand or short-term time deposits and the sources of medium- and long-term funding for financial

institutions are currently limited. If Argentine financial institutions, such as Banco Galicia, are unable to access adequate sources of medium and long-term funding or if they are required to pay high costs in order to obtain the same and/or if they cannot generate profits and/or maintain their current volume and/or scale of their business, this may adversely affect Grupo Galicia’s ability to honor its debts.

Argentine financial institutions (including Banco Galicia) continue to have exposure to public sector debt (including securities issued by the Argentine Central Bank) and its repayment capacity, which in periods of economic recession, may negatively affect their results of operations.

Argentine financial institutions continue to be exposed, to some extent, to the public sector debt and its repayment capacity. The Argentine government’s ability to honor its financial obligations is dependent on, among other things, its ability to establish economic policies that succeed in fostering sustainable growth and development in the long term, generating tax revenues and controlling public expenditures, which could, either partially or totally, fail to take place.

Banco Galicia’s exposure to the public sector as of December 31, 2019 was Ps.110,957 million, representing approximately 19% of its total assets and 142% of its shareholders’ equity. Of this total, Ps.58,141 million were Argentine Central Bank debt instruments, Ps.22,759 million corresponded to Argentine government securities, while the remaining Ps.30,057 million corresponded to other receivables resulting from financial brokerage. As a result, Grupo Galicia’s income-generating capacity may be materially impacted or may be particularly affected by the Argentine public sector’s repayment capacity and the performance of public sector bonds, which, in turn, is dependent on the factors referred to above. Banco Galicia’s ability to honor its financial obligations may be adversely affected by the Argentine government’s repayment capacity or its failure to meet its obligations in respect of Argentine government obligations owed to Banco Galicia.

The Consumer Protection Law may limit some of the rights afforded to Grupo Galicia and its subsidiaries.

Argentine Law No.24,240 (as amended by Law No. 26,361, Law No. 27,250, Law No. 27,265 and Law No. 27,266, the “Consumer Protection Law”) sets forth a series of rules and principles designed to protect consumers, which include Banco Galicia’s customers. Additionally, Law No.25,065 (as amended by Law No.26,010 and Law No.26,361, the “Credit Card Law”) also sets forth public policy regulations designed to protect credit card holders. On October 1, 2014, a new Civil and Commercial Code was sanctioned, which captured the principles of Consumer Protection Law and established their application to banking agreements.

On September 17, 2014, Law No.26,993 was enacted, which created a “System to Solve Disputes in Consumer Relationships”, introducing new administrative and legal procedures within the framework of the Consumer Protection Law; namely, an administrative and a judicial regime for such matters.

The application of both the Consumer Protection Law and the Credit Card Law by administrative authorities and courts at the federal, provincial and municipal levels has increased. This trend has led to an increase in general consumer protection levels. In the event that Grupo Galicia and its subsidiaries are found to be liable for violations of any of the provisions of the Consumer Protection Law or the Credit Card Law, the potential penalties could limit some of Grupo Galicia and its subsidiaries’ rights, for example, with respect to their ability to collect payments due from services and financing provided by Grupo Galicia or its subsidiaries, and adversely affect their financial results of operations. There can be no assurance that court and administrative rulings based on the newly enacted regulation or measures adopted. by the enforcement authorities will not increase the degree of protection given to its debtors and other customers in the future, or that they will not favor the claims brought by consumer groups or associations.

This may prevent or hinder the collection of payments resulting from services rendered and financing granted by Grupo Galicia’s subsidiaries, which may have an adverse effect on their results and operations.

Class actions against financial institutions for an indeterminate amount may adversely affect the profitability of the financial system and of Banco Galicia, specifically.

Certain public and private organizations have initiated class actions against financial institutions in Argentina, including Banco Galicia. Class actions are contemplated in the Argentine National Constitution and the Consumer Protection Law, but their use is not regulated. The courts, however, have admitted class actions in spite of lacking specific regulations, providing some guidance with respect to the procedures for the same. These courts have admitted several complaints filed against financial institutions to defend collective interests, based on arguments that object to charges applied to certain products, applicable interest rates and the advisory services rendered in the sale of government securities, among others.

Final judgments entered against financial institutions under these class actions may affect the profitability of financial institutions in general and of Banco Galicia specifically in relation to class actions filed against Banco Galicia. For further information regarding class actions brought against Banco Galicia, please refer to the Item 8. “Financial Information”─A. “Consolidated Statements and Other Financial Information”—“Legal Proceedings”— “Banco Galicia”.

Administrative procedures filed by the tax authorities of certain provinces against financial institutions, such as Banco Galicia (the primary subsidiary of Grupo Galicia) and amendments to tax laws applicable to Grupo Galicia could generate losses for Grupo Galicia.

City of Buenos Aires tax authorities, as well as certain provincial tax authorities, have initiated administrative proceedings against financial institutions in order to collect higher gross income taxes from such financial institutions beginning in 2002 and onward.