UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. 1 )

| | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant o | | |

Check the appropriate box:

| | o | Preliminary Proxy Statement |

| | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | x | Definitive Proxy Statement |

| | o | Definitive Additional Materials |

| | o | Soliciting Material Pursuant to §240.14a-12 |

KENEXA CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | o | Fee paid previously with preliminary materials. |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Explanatory Note

The purpose of this Amendment No. 1 to Schedule 14A, originally filed with the Securities and Exchange Commission on April 4, 2011, is to correct the disclosure regarding the number of shares outstanding as of March 21, 2011. The Proxy Statement delivered to the Registrant’s shareholders will include the information as reflected in this Amendment No. 1.

650 EAST SWEDESFORD ROAD, SECOND FLOOR

WAYNE, PENNSYLVANIA 19087

April 4, 2011

To our Shareholders:

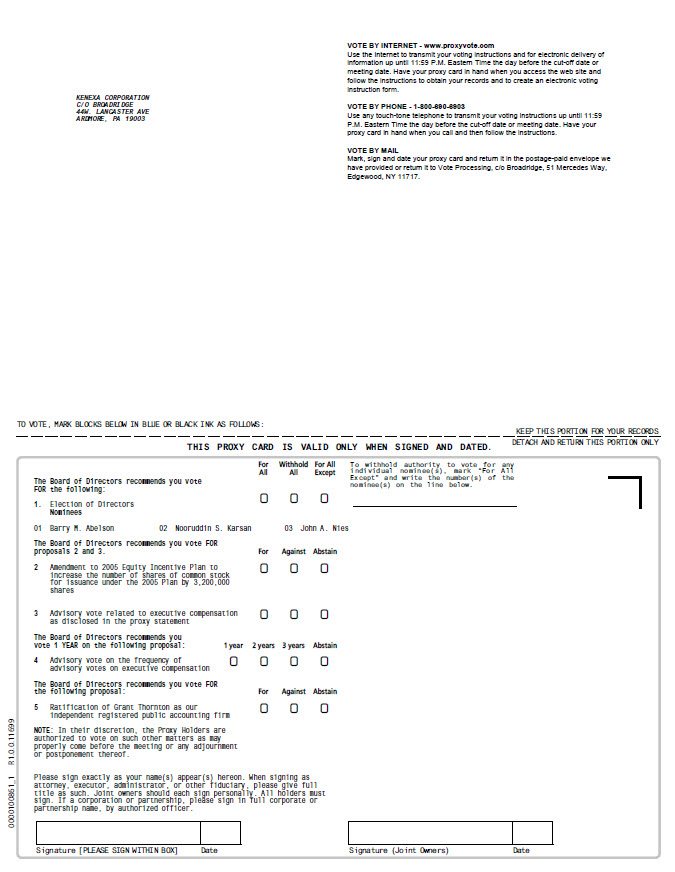

You are cordially invited to attend the 2011 Annual Meeting of Shareholders of Kenexa Corporation. Our Annual Meeting will be held on Wednesday, May 18, 2011, at 8:00 a.m. EDT at the offices of Pepper Hamilton LLP, Eighteenth & Arch Streets, 3000 Two Logan Square, Philadelphia, PA 19103-2799.

We describe in detail the actions we expect to take at our Annual Meeting in the attached Notice of 2011 Annual Meeting of Shareholders and proxy statement. Included with this proxy statement is a copy of our Annual Report for our year ended December 31, 2010. We encourage you to read our Annual Report. It includes information on our operations, products and services, as well as our audited financial statements.

Please use this opportunity to take part in our corporate affairs by voting on the business to come before this meeting. Whether or not you plan to attend the meeting, please complete, sign, date and return the accompanying proxy in the enclosed postage-paid envelope or vote electronically via the Internet or telephone. See “How Do I Vote?” in the proxy statement for more details. Returning the proxy or voting electronically does NOT deprive you of your right to attend the meeting or to vote your shares owned of record by you in person for the matters acted upon at the meeting.

We look forward to seeing you at the Annual Meeting.

Sincerely, |

|

Nooruddin (Rudy) S. Karsan |

Chairman and Chief Executive Officer |

650 EAST SWEDESFORD ROAD, SECOND FLOOR

WAYNE, PENNSYLVANIA 19087

————————————————

NOTICE OF 2011 ANNUAL MEETING OF SHAREHOLDERS

————————————————

TIME AND DATE | | 8:00 a.m. Eastern Daylight Time on Wednesday, May 18, 2011. |

PLACE | | Offices of Pepper Hamilton LLP Eighteenth & Arch Streets, 3000 Two Logan Square, Philadelphia, Pennsylvania 19103-2799. |

| ITEMS OF BUSINESS | | (1) | | To elect three directors to serve through the 2014 Annual Meeting of Shareholders; |

| | | (2) | | To approve an amendment to our 2005 Equity Incentive Plan to increase the number of shares available for award thereunder; |

| | | (3) | | To hold an advisory vote on executive compensation; |

| | | (4) | | To hold an advisory vote on the frequency of holding an advisory vote on executive compensation; |

| | | (5) | | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for 2011; and |

| | | (6) | | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

RECORD DATE | | In order to vote, you must have been a shareholder at the close of business on March 21, 2011. |

PROXY VOTING | | It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. You also have the option of voting your shares on the Internet or by telephone. Voting instructions are printed on your proxy card and included in the accompanying proxy statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the proxy statement. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 18, 2011: The Notice of Annual Meeting, Proxy Statement and 2010 Annual Report to Shareholders are available at http://www.kenexa.com/investor-relations/annual-reports |

By order of the Board of Directors |

|

Cynthia P. Dixon |

Assistant Secretary |

| | Page |

| 2 |

| 6 |

| 7 |

| 9 |

| 18 |

| 20 |

| 37 |

| 38 |

| 39 |

| 40 |

| 41 |

| 42 |

| 43 |

| 47 |

| 48 |

| 49 |

| 50 |

| 50 |

| 50 |

| Annex A | 51 |

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON

MAY 18, 2011

—————————————————————————————————————————————————————————————————————————

We are providing these proxy materials to you in connection with our 2011 Annual Meeting of Shareholders, which we refer to in these proxy materials as the Annual Meeting. The Notice of Internet Availability of Proxy Materials was first mailed to our shareholders beginning on or about April 4, 2011. The attached proxy statement and Annual Report on Form 10-K for the year ending December 31, 2010 are being made available to our shareholders beginning on or about April 4, 2011. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

| Who is soliciting my vote? |

Our board of directors is soliciting your vote at the 2011 Annual Meeting of Shareholders.

| What is the purpose of the Annual Meeting? |

You will be voting on:

| | ● | the election of three directors to serve through the 2014 Annual Meeting of Shareholders; |

| | ● | the adoption of an amendment to our 2005 Equity Incentive Plan to increase the number of shares available for award thereunder; |

| | | an advisory resolution relating to executive compensation; |

| | ● | an advisory resolution concerning the frequency of advisory votes relating to executive compensation; |

| | ● | ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for 2011; and |

| | ● | any other business that may properly come before the meeting. |

| What is the board of directors’ recommendations? |

Our board of directors recommends a vote:

| | ● | for the election of each of Barry M. Abelson, Nooruddin S. Karsan and John A. Nies to serve as directors through the 2014 Annual Meeting of Shareholders; |

| | ● | for the adoption of an amendment to our 2005 Equity Incentive Plan to increase the number of shares available for award thereunder; |

| | ● | for approval, on an advisory basis, of the compensation for our named executive officers; |

| | ● | for approval, on an advisory basis, of an annual advisory vote on executive compensation; |

| | ● | for the ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for 2011; and |

| | ● | for or against other matters that come before the Annual Meeting, as the proxy holders deem advisable. |

| Who is entitled to vote at the Annual Meeting? |

Our board of directors set March 21, 2011 as the record date for the Annual Meeting, which we refer to in these proxy materials as the record date. All shareholders who owned our common stock at the close of business on March 21, 2011 may vote at the Annual Meeting, either in person or by proxy.

| How many votes do I have? |

You have one vote for each share of our common stock that you owned at the close of business on the record date, provided that on the record date those shares were either held directly in your name as the shareholder of record or were held for you as the beneficial owner through a broker, bank or other nominee.

| What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

Most of our shareholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record. If your shares are registered directly in your name with our transfer agent, StockTrans, a Broadridge Company, you are considered to be the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you by us. As a shareholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or nominee (which is considered to be the shareholder of record with respect to those shares). As a beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. Your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the broker, bank or nominee regarding how to vote your shares. However, since you are not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a proxy, executed in your favor, from the holder of record of such shares.

| How many votes can be cast by all shareholders? |

Each share of our common stock is entitled to one vote. There is no cumulative voting. Shares of common stock outstanding and entitled to vote on the record date were 23,209,231.

| How many votes must be present to hold the Annual Meeting? |

A majority of the outstanding shares of our common stock as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Your shares will be counted as being present at the Annual Meeting if either you are present and vote in person at the Annual Meeting or a proxy card has been properly submitted by you or on your behalf and such proxy card indicates a vote on at least one matter to be considered at the Annual Meeting. Both abstentions and “broker non-votes” (under certain circumstances described below) are counted as present for the purpose of determining the presence of a quorum.

| What if I don’t vote for some of the items listed on my proxy card or voting instruction card? |

If you return your signed proxy card in the enclosed envelope but do not mark selections, your shares will be voted in accordance with the recommendations of our board of directors. If you indicate a choice with respect to any matter to be acted upon on your proxy card your shares will be voted in accordance with your instructions.

If you are a beneficial owner and hold your shares in street name through a broker and do not give voting instructions to the broker, the broker will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the ratification of the selection of accounting firms, but do not have discretion to vote on non-routine matters. Recent regulatory changes applicable to New York Stock Exchange member brokerage firms (many of whom are the record holders of shares of Nasdaq-listed companies like us) have changed the matters that are considered “routine” matters: for example, the uncontested election of directors is no longer considered a routine matter. As a result, if you are a beneficial owner and hold your shares in street name, but do not give your broker or other nominee instructions on how to vote your shares with respect to the election of directors, no votes will be cast on your behalf.

If you do not provide voting instructions to your broker and your broker indicates on its proxy card that it does not have discretionary authority to vote on a particular proposal, your shares will be considered to be “broker non-votes” with regard to that matter. Proxy cards that reflect a broker non-vote with respect to at least one proposal to be considered at the Annual Meeting (so long as they do not apply to all proposals to be considered) will be considered to be represented for purposes of determining a quorum but generally will not be considered to be entitled to vote with respect to that proposal. Broker non-votes are not counted in the tabulation of the voting results with respect to proposals that require a plurality of the votes cast or proposals that require a majority of the votes cast. With respect to a proposal that requires a majority of the outstanding shares (of which there are presently none for this Annual Meeting), a broker non-vote has the same effect as a vote against the proposal.

| What is the vote required to pass each proposal to be presented at the Annual Meeting? |

Proposal | | Vote Required | | Broker Discretionary Voting Allowed |

| Proposal No. 1 — Election of Directors | | Plurality of Votes Cast | | No |

| Proposal No. 2 — Amendment to 2005 Equity Incentive Plan | | Majority of Votes Cast | | No |

| Proposal No. 3 — Advisory Vote Related to Executive Compensation | | Majority of Votes Cast | | No |

| Proposal No. 4 — Advisory Vote on Frequency of Advisory Votes on Executive Compensation | | Majority of Votes Cast | | No |

| Proposal No. 5 — Ratification of Selection of Independent Registered Public Accounting Firm | | Majority of Votes Cast | | Yes |

With respect to Proposal No. 1, you may vote For all nominees, Withhold your vote as to all nominees, or For all nominees except those specific nominees from whom you Withhold your vote. The three nominees receiving the most For votes will be elected. A properly executed proxy marked Withhold with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than three directors and shareholders may not cumulate votes in the election of directors.

With respect to Proposals Nos. 2, 3 and 5 you may vote For, Against or Abstain. If you Abstain from voting on any of these Proposals, the abstention will have the same effect as an Against vote.

With respect to Proposal No. 4, you may vote For Every Year, For Every Two Years, For Every Three Years, or Abstain. If you abstain from voting on any of these matters, your shares will be counted as present and entitled to vote on that matter for purposes of establishing a quorum, but will not be counted for purposes of determining the number of votes cast.

What is the Notice of Internet Availability of Proxy Materials?

Pursuant to the rules of the Securities and Exchange Commission (“SEC”), we are making this proxy statement and our Annual Report on Form 10-K available to certain of our shareholders electronically via the Internet. Accordingly, in compliance with this e-proxy process, on or about April 4, 2011, we mailed to our beneficial owners a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statement and our Annual Report on Form 10-K via the Internet and how to vote online. As a result, unless otherwise required, you may not receive a copy of the proxy materials unless you request a copy. All shareholders will be able to access the proxy materials on a Web site referred to in the Notice and in this proxy statement and to request to receive a set of the proxy materials by mail or electronically, in either case, free of charge. If you would like to receive a printed or electronic copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice. By participating in the e-proxy process, we will save money on the cost of printing and mailing documents to you and reduce the impact of our annual meeting of shareholders on the environment.

| Can I change or revoke my vote after I return my proxy card or voting instruction card? |

Yes. Even if you sign the proxy card or voting instruction card in the form accompanying this proxy statement, vote by telephone or vote on the Internet, you retain the power to revoke your proxy or change your vote. If you are a shareholder of record, you can revoke your proxy or change your vote at any time before it is exercised by giving written notice to our Secretary or Assistant Secretary, 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087, specifying such revocation. You may also change your vote by timely delivery of a later-dated vote by telephone or on the Internet, or by voting by ballot at the Annual Meeting. If you hold your shares through a broker, bank or other nominee, you can revoke your proxy by contacting the broker, bank or other nominee and submitting a later dated voting instruction card.

| Who can attend the Annual Meeting? |

All shareholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. Each shareholder may also bring one guest to the Annual Meeting, space permitting. Only our shareholders of record will be entitled to speak at the Annual Meeting.

| What do I need to attend the Annual Meeting and when should I arrive? |

In order to be admitted to the Annual Meeting, a shareholder must present an admission ticket or proof of ownership of our common stock on the record date. Any holder of a proxy from a shareholder must present the proxy card, properly executed, and an admission ticket to be admitted. Shareholders and proxy holders must also present a form of government-issued photo identification such as a passport or driver’s license.

An admission ticket is provided on the back cover page of your proxy statement. If you plan to attend the Annual Meeting, please keep this ticket and bring it with you to the Annual Meeting. If you receive this proxy statement electronically, you can obtain a ticket in advance of the Annual Meeting by printing the final page of this proxy statement. If a shareholder does not bring an admission ticket, proof of ownership of our common stock on the record date will be needed to be admitted. If your shares are held in the name of a bank, broker or other holder of record, a brokerage statement or letter from the bank or broker is an example of proof of ownership.

Admission to the Annual Meeting will begin at 7:30 a.m., EDT. Seating will be limited. In order to ensure that you are seated by the commencement of the Annual Meeting at 8:00 a.m., we recommend that you arrive early.

The Annual Meeting will be held at the offices of Pepper Hamilton, LLP, Eighteenth and Arch Streets, 3000 Two Logan Square, Philadelphia, Pennsylvania 19103-2799. When you arrive, signs will direct you to the appropriate meeting room. Please note that due to security reasons, all bags will be subject to search. We will be unable to admit anyone who does not comply with these security procedures. Cameras and other recording devices will not be permitted in the meeting room.

| Who pays for the proxy solicitation and how will we solicit votes? |

We will bear the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or e-mail. They will not be paid any additional compensation for such solicitation. We will request brokers and nominees who hold shares of our common stock in their names to furnish proxy materials to beneficial owners of the shares. We will reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners.

| How can I access Kenexa’s proxy materials and annual report electronically? |

This proxy statement and our 2010 Annual Report are available on our website at

http://www.kenexa.com/Investor-Relations/Annual-Reports

Is a list of shareholders available?

The names of shareholders of record entitled to vote at the Annual Meeting will be available for review by shareholders at the Annual Meeting.

| How do I find out the voting results? |

Preliminary voting results will be announced at the Annual Meeting, and final voting results will be published in a Current Report on Form 8-K which we will file with the SEC within 4 business days following the Annual Meeting. After that Form 8-K has been filed, you may obtain a copy by visiting our website, by contacting our Investor Relations department by calling (866) 888-8121, by writing to Investor Relations, Kenexa Corporation, 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087 or by sending an email to InvestorRelations@kenexa.com.

| What if I have questions about lost stock certificates or I need to change my mailing address? |

Shareholders of record may contact our transfer agent, StockTrans, a Broadridge Company, by calling 1-866-578-5350 or writing to StockTrans, a Broadridge Company, 44 West Lancaster Avenue, Ardmore, Pennsylvania 19003, or by visiting their website at www.StockTrans.com, to get more information about these matters.

What is the address of Kenexa’s principal executive offices?

Our principal executive offices are located at 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087.

Your vote is important. You may vote by telephone, on the Internet, by mail or by attending the Annual Meeting and voting by ballot, all as described below. For our shareholders of record, telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Daylight Time, on May 17, 2011.

| | ● | If you are a shareholder of record, you can vote your shares by calling the toll-free telephone number on your proxy card. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. |

| | ● | If your shares are held in the name of a broker, bank or other nominee, you may vote your shares over the telephone by following the telephone voting instructions, if any, provided on the voting instruction card you receive from such broker, bank or other nominee. |

| | ● | If you are a shareholder of record, you can vote your shares over the Internet by following the instructions on your proxy card. As with telephone voting, you can confirm that your instructions have been properly recorded. |

| | ● | If your shares are held in the name of a broker, bank or other nominee, you may vote your shares over the Internet by following the voting instructions, if any, provided on the voting instruction card you receive from such broker, bank or other nominee. |

| | ● | If you vote on the Internet, please note that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies for which you will be responsible. |

| | ● | If you are a shareholder of record, you can vote your shares by mail simply by marking your proxy card, dating and signing it, and returning it to StockTrans, a Broadridge Company in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card to Kenexa Corporation, c/o StockTrans, a Broadridge Company, Investor Services, 44 West Lancaster Avenue, Ardmore, Pennsylvania 19003. |

| | ● | If your shares are held in the name of a broker, bank or other nominee, you may vote your shares by mail by following the voting instructions, if any, provided on the voting instruction card you receive from such broker, bank or other nominee. |

| Voting at the Annual Meeting |

The method or timing of your vote will not limit your right to vote at the Annual Meeting if you attend the meeting and vote in person. However, if your shares are held in the name of a broker, bank or other nominee, you must obtain a proxy, executed in your favor, from the holder of record of your shares to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record of your shares.

Those shares represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy card will be voted as recommended by our board of directors.

Our board of directors is composed of eight members and is divided into three classes with staggered three-year terms. Unless otherwise specified in the accompanying proxy, the shares voted pursuant thereto will be cast for each of Barry M. Abelson, Nooruddin S. Karsan and John A. Nies. If, for any reason, at the time of election, any of the nominees named should decline or be unable to accept his nomination or election, it is intended that such proxy will be voted for a substitute nominee, who would be recommended by our board of directors. Our board of directors, however, has no reason to believe that any of the nominees will be unable to serve as a director.

The following biographical information is furnished as to each nominee for election as a director and each of the current directors:

| Nominees for Election to the Board of Directors for a Three-Year Term Expiring at the 2014 Annual Meeting |

Barry M. Abelson, 64, has been a member of our board of directors since 2000. Since 1992, Mr. Abelson has been a partner in the law firm of Pepper Hamilton LLP, which has provided legal services to us since 1997. Mr. Abelson received an A.B. in sociology from Dartmouth College and a J.D. from the University of Pennsylvania Law School.

Areas of Relevant Experience: Executive level leadership at a well established law firm dealing with a myriad of corporate legal matters.

Nooruddin (Rudy) S. Karsan, 53, co-founded our predecessor company in 1987 and has served as the chairman of our board of directors since 1997 and as our chief executive officer since 1991. Prior to that, Mr. Karsan headed marketing actuarial services for the Mercantile & General Insurance Company in Toronto, Canada. Mr. Karsan received a B. Math in actuarial science from the University of Waterloo. Mr. Karsan holds the designation of Fellow of the Society of Actuaries.

Areas of Relevant Experience: Proven ability to drive and oversee our business strategy; comprehensive knowledge of our strategic and operational opportunities and challenges and our competitive environment.

John A. Nies, 42, has been a member of our board of directors since 2002. In July 2010, Mr. Nies was elected as the company’s lead independent director, reinforcing our commitment to best practices in the area of corporate governance. Mr. Nies is a managing director of JMH Capital, a private equity firm, which he joined in May 2006. From 2002 to 2006, Mr. Nies served as a principal of Sage River Partners, LLC and Maplegate Holdings, LLC, private equity firms investing on behalf of individual investors. From 2001 to 2002, Mr. Nies worked for Parthenon Capital, Inc., a private equity investment firm, most recently serving as its managing director, operations, a position in which he was responsible for post-transaction performance of portfolio companies. Mr. Nies received an A.B. in economics from Dartmouth College and an M.B.A. from Harvard Business School.

Areas of Relevant Experience: Business acumen derived from evaluating a variety of venture proposals and implementing the necessary corporate governance procedures to ensure an entity’s success.

Members of the Board of Directors Continuing in Office for a Term Expiring at the 2013 Annual Meeting

Joseph A. Konen, 63, has been a member of our board of directors since 2000. Mr. Konen, who is now retired, has held a number of executive positions, most recently serving from 1994 to 1999 as the president and chief operating officer of Ameritrade Holding Corporation, a provider of brokerage services. Mr. Konen received a B.A. in economics and an M.B.A. in finance and management from Indiana University at Bloomington.

Areas of Relevant Experience: Experience in executive level positions at multiple highly successful organizations, with specific areas of focus in operations and finance.

Richard J. Pinola, 65, has been a member of our board of directors since 2005. From 1992 until his retirement in 2004, Mr. Pinola served as the chairman and chief executive officer of Right Management Consultants, a human resources consulting firm. From 1989 to 1991, Mr. Pinola served as the chief operating officer of Penn Mutual Life Insurance Company. Mr. Pinola also serves as a director of Nobel Learning Communities, Inc., a for-profit provider of education and educational services; and Corporate Property Associates 14 Inc., Corporate Property Associates 15 Inc., and Corporate Property Associates 16 Inc., each a real estate investment trust. Mr. Pinola previously served as a director of K-Tron International, Inc., a manufacturer of material handling equipment and systems and Bankrate, Inc., an Internet financial services provider. Mr. Pinola received a B.S. in accounting from King’s College.

Areas of Relevant Experience: Experience in executive level positions at several highly successful organizations, with specific areas of focus in both operations and finance.

Members of the Board of Directors Continuing in Office for a Term Expiring at the 2012 Annual Meeting

Renee B. Booth, 52, has served as a member of our board of directors since May 2006. Since 1999, Dr. Booth has served as the president of Leadership Solutions, Inc., a boutique human resources consulting firm specializing in leadership assessments, selection, development and motivation. Dr. Booth received a B.A. in psychology from the University of Maryland and a M.S. and Ph.D. in industrial/organizational psychology from Pennsylvania State University.

Areas of Relevant Experience: Practical experience in the HR assessment business and executive leadership consulting.

Troy A. Kanter, 43, joined us in 1997 and has served as a member of our board of directors since May 2006 and as our President and Chief Operating Officer since November 2006. From 2003 until November 2006, Mr. Kanter served as our president, Human Capital Management. From 1997 to 2003, Mr. Kanter served as our executive vice president, sales and business development. From 1997 to 1999, he managed our HCM Consulting, Retention Services operations. From 1995 to 1997, Mr. Kanter was the president of Human Resources Innovations, Inc., a company he co-founded that provided employee survey research and consulting and which we acquired in 1997. Mr. Kanter received a B.A. in corporate communications from Doane College.

Areas of Relevant Experience: Executive level experience in both large and medium size organizations serving in sales, business development and operations.

Rebecca J. Maddox, 57, has been a member of our board of directors since October 2006. Ms. Maddox is a founding principal, president and chief executive officer of Maddox Smye LLC, an international specialty sales consulting firm, and has served in that capacity since 1993. Prior to that, Ms. Maddox held positions that included chief executive officer of Capital Rose, Inc., senior vice president, marketing of Capital Holding, and senior vice president, marketing, Citicorp. Ms. Maddox received a B.S. in business administration from Pennsylvania State University and an M.B.A. in marketing and finance from Columbia University.

Areas of Relevant Experience: Knowledge gained from working in senior level positions within the financial services industry and relationship expertise on how gender plays a critical part in developing a successful marketing strategy.

While each of our board of director members possess specific qualities which make them well suited for their roles at Kenexa, their individual areas of expertise, stage in their career, and accumulated work experience are varied enough to ensure that there is adequate diversity among our board members. In determining whether a prospective board member is a good fit for Kenexa’s board, our governance committee considers, among other factors, how the prospect’s diversity will impact the effectiveness of the board.

Table of Contents

OF THE BOARD OF DIRECTORS

| Corporate Governance Policy |

We regularly monitor developments in the area of corporate governance and review our processes and procedures in light of such developments. In those efforts, we review federal laws affecting corporate governance, such as the Sarbanes-Oxley Act of 2002, as well as rules adopted by the SEC and The Nasdaq Stock Market LLC (“Nasdaq”). We believe that our procedures and practices, including the policies described below, are designed to enhance our shareholders’ interests.

Our business, property and affairs are managed under the direction of our board of directors. Members of our board of directors are kept informed of our business through discussions with our Chairman and Chief Executive Officer, President, Chief Financial Officer and other officers and employees, by reviewing materials provided to them, by visiting our offices and by participating in meetings of our board of directors and its committees.

Our board of directors met four times during 2010. During 2010, the committees of our board of directors held a total of 21 meetings. Each director attended at least 75% of the total number of meetings of the board of directors and each committee of the board on which such director served.

| Shareholder Communications with the Board of Directors |

Shareholders may initiate in writing any communication with our board of directors or any individual director by sending the correspondence to our General Counsel, c/o Kenexa Corporation, 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087 or by sending an email to ShareholderCommunications@kenexa.com. This centralized process assists our board of directors in reviewing and responding to shareholder communications in an appropriate manner. Any communication should not exceed 500 words in length and must be accompanied by the following information:

| | ● | a statement of the type and amount of our securities that the person holds; |

| | ● | any special interest of the shareholder in the subject matter of the communication (i.e. - not in such person’s capacity as one of our shareholders); and |

| | ● | the name, address, telephone number and e-mail address, if any, of the person submitting the communication. |

In addition, e-mails from shareholders to our board of directors should not contain attachments. Any attachments contained in such email messages will be automatically removed. If you wish to provide additional materials with your communications, please use regular mail, sent to the address above.

All communications that comply with the above procedural requirements will be relayed to the appropriate member of the board of directors. We will not forward any communications:

| | ● | regarding individual grievances or other interests that are personal to the party submitting the communication and could not reasonably be construed to be of concern to our security holders or other constituencies generally; |

| | ● | that advocate our engaging in illegal activities; |

| | ● | that, under community standards, contain offensive, scurrilous or abusive content; or |

| | ● | that have no rational relevance to our business or operations. |

| Board Attendance at the Annual Meeting |

Although we encourage each member of our board of directors to attend our annual meetings of shareholders, we do not have a formal policy requiring the members of our board of directors to attend. All of our directors attended our 2010 Annual Meeting of Shareholders.

Independence Determination

Our board of directors has and will continue to observe all applicable criteria for independence established by Nasdaq and other governing laws and applicable regulations. No director is deemed to be independent unless our board of directors determines that the director has no relationship which would interfere with the exercise of independent judgment in carrying out his or her responsibilities as a director. Our board of directors has determined that the following directors are independent as determined by the Nasdaq listing standards and other applicable regulations: Barry M. Abelson, Renee B. Booth, Joseph A. Konen, Rebecca J. Maddox, John A. Nies and Richard J. Pinola.

| Code of Business Conduct and Ethics |

In 2005, we adopted a Code of Business Conduct and Ethics. We require all employees, including our principal executive officer and principal financial officer and other senior officers and our directors, to read and to adhere to our Code of Business Conduct and Ethics in discharging their work related responsibilities. Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of our Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics is available on our website at http://www.kenexa.com/Investor-Relations/Corporate-Governance.aspx and can be obtained by writing to Investor Relations, Kenexa Corporation, 650 East Swedesford Road, Wayne, Pennsylvania 19087 or by sending an email to InvestorRelations@kenexa.com.

Our board of directors maintains several standing committees, including an Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, a Compensation Committee, and a Nominating and Governance Committee. These committees and their functions are described below. Our board of directors may also establish various other committees to assist it in its responsibilities.

Our board of directors has adopted a written charter for each of its standing committees. The full text of each charter is available on our website at http://www.kenexa.com/Investor-Relations/Corporate-Governance.aspx and can be obtained by writing to Investor Relations, Kenexa Corporation, 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087 or by sending an email to InvestorRelations@kenexa.com.

The following table shows the current members (indicated by an “X” or “Chair”) of each of our standing board committees and the number of committee meetings held and number of actions taken by unanimous written consents during 2010:

| | | Audit | | Nominating and Governance | | Compensation |

Barry M. Abelson | | — | | X | | — |

Renee B. Booth | | — | | X | | Chair |

Troy A. Kanter | | — | | — | | — |

Rudy S. Karsan | | — | | — | | — |

Joseph A. Konen | | Chair | | — | | — |

Rebecca J. Maddox | | X | | — | | X |

John A. Nies | | — | | Chair | | — |

Richard J. Pinola | | X | | — | | X |

| | | | | | | |

Number of Meetings | | 11 | | 6 | | 4 |

Number of Consents | | — | | — | | — |

Audit Committee

Our Audit Committee is composed of Mr. Konen (chair), Ms. Maddox and Mr. Pinola. Our board of directors has determined that each of Messrs. Konen and Pinola is an “Audit Committee financial expert” as currently defined under the SEC’s rules implementing Section 407 of the Sarbanes-Oxley Act of 2002. We believe that the composition and functioning of our Audit Committee complies with all applicable requirements of the Sarbanes-Oxley Act of 2002, Nasdaq and the SEC’s rules and regulations, including those regarding the independence of our Audit Committee members. We intend to comply with future requirements to the extent that they become applicable to us.

Our Audit Committee oversees our corporate accounting and financial reporting processes. Our Audit Committee:

| | ● | evaluates the qualifications, independence and performance of our registered independent public accounting firm; |

| | ● | determines the engagement of our registered independent public accounting firm; |

| | ● | approves the retention of our registered independent public accounting firm to perform any proposed permissible non-audit services; |

| | ● | ensures the rotation of the partners of our registered independent public accounting firm on our engagement team as required by law; |

| | ● | reviews our systems of internal controls established for finance, accounting, legal compliance and ethics; |

| | ● | reviews our accounting and financial reporting processes; |

| | ● | provides for effective communication between our board of directors, our senior and financial management and our independent auditors; |

| | ● | discusses with management and our independent auditors the results of our annual audit and the review of our quarterly financial statements; |

| | ● | reviews the audits of our financial statements; |

| | ● | implements a pre-approval policy for certain audit and non-audit services performed by our registered independent public accounting firm; |

| | | reviews and approves any related party transactions in which we are involved; and |

| | | meets periodically with management and the independent public accountants to review our major financial risk exposures and the steps taken to monitor and control such exposures. |

Nominating and Governance Committee

Our Nominating and Governance Committee is composed of Mr. Nies (chair), Mr. Abelson and Dr. Booth. We believe that the composition of our Nominating and Governance Committee complies with any applicable requirements of the Sarbanes-Oxley Act of 2002, Nasdaq and the SEC’s rules and regulations, including those regarding the independence of our Nominating and Governance Committee members. We intend to comply with future requirements to the extent that they become applicable to us.

Our Nominating and Governance Committee’s responsibilities include the selection of potential candidates for our board of directors. The committee also makes recommendations to our board of directors concerning the structure and membership of the other board committees and considers director candidates recommended by others, including our Chief Executive Officer, other board members, third parties and shareholders. In addition, our Nominating and Governance Committee develops and monitors our corporate governance guidelines, and assesses succession planning for senior management of the company.

Our Compensation Committee is currently composed of Dr. Booth (chair), Ms. Maddox and Mr. Pinola. We believe that the composition and functioning of our Compensation Committee complies with all applicable requirements of the Sarbanes-Oxley Act of 2002, Nasdaq and the SEC’s rules and regulations, including those regarding the independence of our Compensation Committee members. We intend to comply with future requirements to the extent that they become applicable to us.

Our Compensation Committee administers the compensation program for our executive officers. Our Compensation Committee:

| | ● | reviews and either approves, on behalf of our board of directors, or recommends to our board of directors for approval, (i) annual salaries, bonuses, and other compensation for our executive officers, and (ii) individual equity awards for our employees and executive officers; |

| | ● | oversees our compensation policies and practices; |

| | ● | coordinates our board of directors’ role in establishing performance criteria for executive officers; |

| | ● | annually evaluates each of our executive officers’ performance; |

| | ● | reviews and approves the annual salary, bonus, stock options and other benefits, direct and indirect, of our executive officers, including our Chief Executive Officer; |

| | ● | reviews and recommends new executive compensation programs; |

| | ● | annually reviews the operation and efficacy of our executive compensation programs; |

| | ● | periodically reviews that executive compensation programs comport with the Compensation Committee’s stated compensation philosophy; |

| | ● | establishes and periodically reviews policies in the area of senior management perquisites; |

| | ● | reviews and recommends to the board of directors the appropriate structure and amount of compensation for our directors; |

| | ● | reviews and approves material changes in our employee benefit plans; |

| | ● | administers our equity compensation and employee stock purchase plans; and |

| | ● | reviews the adequacy of the Compensation Committee and its charter and recommends any proposed changes to the board of directors not less than annually. |

In deciding upon the appropriate level of compensation for our executive officers, the Compensation Committee regularly reviews our compensation programs relative to our strategic objectives and emerging market practice and other changing business and market conditions. In addition, the Compensation Committee also takes into consideration the recommendations of our Chief Executive Officer concerning compensation actions for our other executive officers and any recommendations of compensation consultants. The primary role of consultants is to provide objective data, analysis and advice to the Compensation Committee. In providing data and recommendations to the Compensation Committee, our consultants work with our Chief Executive Officer and management to obtain information needed to carry out its assignments. See the section below entitled “Executive Compensation and Executive Officers—Compensation Discussion and Analysis” for further discussion of the Compensation Committee’s role in determining the compensation of our executive officers.

| Board Leadership Structure |

Mr. Karsan serves as both the Chairman of our board of directors and our CEO. Our board of directors’ decision to assign these two roles to a single person was guided by several important attributes of Mr. Karsan, including:

| | | his unique skills, insight, and experience as a founder of Kenexa; |

| | | the confidence he is able to inspire in our board of directors, the company and our shareholders; |

| | | his ability to coalesce and effect positive change in our company; and |

| | | his ability to execute on both the company’s short-term and long-term strategies necessary for the challenging marketplace in which the company competes. |

While these attributes were important, our board of directors would not have considered combining the roles of Chairman and CEO if it did not firmly believe that we have in place sound checks and balances to ensure that we maintain the highest standards of corporate governance and continued accountability of the CEO to the board of directors. For example:

| | | Each of the board of directors’ standing committees, including the Audit, Compensation, and Nominating and Governance Committees, are comprised of and chaired solely by non-employee directors who meet the independence requirements under the NASDAQ listing standards and other governing laws and regulations. |

| | | Review and determination of Mr. Karsan’s compensation and performance continues to be within the purview of the Compensation Committee. |

| | | The independent directors continue to meet in regular executive sessions without management present to discuss the effectiveness of the company’s management, the quality of the board of directors meetings and any other issues and concerns. |

| | | The board of directors continues to oversee succession planning. |

Mr. Nies serves as both the lead independent director and Chairman of our Nominating and Governance Committee. The primary roles and responsibilities of the lead director include:

| | | communication with the Chairman and CEO in areas including: |

| | | — | strategy, possible change of control and restructuring opportunities and other key executive changes before they are established; |

| | | — | preparations for board of directors meetings; |

| | | offering counsel to individual directors on the performance of their duties; |

| | | facilitating communications amongst directors; |

| | | facilitating the process of the board's self-evaluation; |

| | | presiding over and scheduling all meetings of the board of directors at which the Chairman and CEO is not present, including executive sessions. |

The following table sets forth the amount of compensation that we paid to each of our directors for the year ended December 31, 2010, other than our employee directors who did not receive any additional compensation for their role as a director.

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(2) | | | Total ($) | |

Barry M. Abelson | | | 32,500 | | | | 32,996 | | | | 65,795 | | | | 131,292 | |

Renee B. Booth | | | 37,500 | | | | 32,996 | | | | 65,795 | | | | 136,292 | |

Joseph A. Konen | | | 40,000 | | | | 32,996 | | | | 65,795 | | | | 138,792 | |

Rebecca J. Maddox | | | 37,500 | | | | 32,996 | | | | 65,795 | | | | 136,292 | |

John A. Nies | | | 55,000 | | | | 32,996 | | | | 65,795 | | | | 153,792 | |

Richard J. Pinola | | | 37,500 | | | | 32,996 | | | | 65,795 | | | | 136,292 | |

| (1) | Represents the aggregate grant date fair value with respect to 2,293 shares of restricted stock awarded to each non-employee director in May 2010, computed in accordance with FASB ASC Topic 718. |

| (2) | Represents the aggregate grant date fair value with respect to options to purchase 10,387 shares of common stock granted to each director in May 2010, computed in accordance with FASB ASC Topic 718. For purposes of computing such amounts, we disregarded estimates of forfeitures related to service-based vesting conditions. Please refer to Note 12 - “Stock Plans” to our consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2010, for a discussion of the assumptions made in the calculation of these amounts. |

Each member of our board of directors, other than those directors who are our employees or employees or partners of our affiliates, are entitled to receive an annual retainer of $30,000 for service on our board of directors. The chair of each of our Compensation Committee and our Nominating and Governance Committee receives an additional annual fee of $5,000, while each other member of those committees receives an annual fee of $2,500 for each committee upon which the member serves. The chair of our Audit Committee receives an additional annual fee of $10,000 and each other member of our Audit Committee receives an additional annual fee of $5,000. The lead independent director receives an additional fee of $20,000. We also reimburse members of our board of directors for travel, lodging and other reasonable out-of-pocket expenses incurred in attending board and committee meetings.

Our Compensation Committee periodically reviews the compensation that we offer to our non-employee directors in light of the duties of our directors and the compensation offered by our peer companies to their directors. Based upon this review, we may from time to time adjust the compensation that we offer to our non-employee directors in order to help us attract and retain the most qualified individuals to serve on our board of directors.

As of December 31, 2010 each of our directors held restricted stock and options to purchase the following number of shares of our common stock:

| Name | | Aggregate options to purchase | | | Restricted Stock | |

Barry M. Abelson | | | 54,387 | | | | 2,293 | |

Renee B. Booth | | | 52,387 | | | | 2,293 | |

Joseph A. Konen | | | 54,387 | | | | 2,293 | |

Rebecca J. Maddox | | | 52,387 | | | | 2,293 | |

John A. Nies | | | 54,387 | | | | 2,293 | |

Richard J. Pinola | | | 54,387 | | | | 2,293 | |

Minimum Qualifications of Directors

In making its recommendations as to nominees for election to our board of directors, our Nominating and Governance Committee may consider, in its sole judgment, recommendations of our Chief Executive Officer and other senior executives, other board members, shareholders and third parties. Our Nominating and Governance Committee may also retain third-party search firms to identify candidates. Shareholders desiring to recommend nominees should submit their recommendations in accordance with the instructions in the section of this proxy statement below entitled “Shareholder Nominations of Directors and Other Business-Recommendations of Nominees.” The Committee has not adopted any criteria for evaluating a candidate for nomination that differ depending on whether a candidate is nominated by a shareholder versus by a director, member of management or other third party.

Our Nominating and Governance Committee considers the following criteria in determining whether a nominee is qualified to serve on our board of directors:

| | ● | the nominee's personal ethics, integrity and values; |

| | ● | whether the nominee has an inquiring and independent mind; |

| | ● | whether the nominee has a global business and social perspective; |

| | ● | the nominee’s practical wisdom and mature judgment; |

| | ● | the extent and breadth of the nominee’s training and experience at the policy or decision-making level in business, government, education or technology; |

| | ● | the nominee’s willingness to devote the required amount of time to fulfill the duties and responsibilities of board of directors membership; |

| | ● | the nominee’s commitment to serve on our board of directors over a period of years to develop knowledge about our operations; and |

| | ● | the nominee’s involvement in activities or interests that do not create a conflict with the nominee’s responsibilities to us and our shareholders. |

Our Nominating and Governance Committee also considers such other factors as it deems appropriate, including the current composition of our board of directors.

If the committee decides, on the basis of its preliminary review of a candidate, to proceed with further consideration of a candidate, members of the committee, as well as other members of our board of directors as appropriate, interview the candidate. After completing this evaluation and interview, the committee makes the final determination whether to nominate or appoint the candidate as a new board member.

| Shareholder Nominations of Directors and Other Business; Recommendations of Nominees |

Shareholder Nominations of Directors and Other Business. Our bylaws provide procedures by which a shareholder may nominate for election to our board of directors at any meeting of shareholders individuals or bring business before an annual meeting of shareholders. A shareholder desiring to nominate a director for election to our board of directors, or to bring any other business before an annual meeting of shareholders, should deliver a notice to our Secretary at our principal executive offices at 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087, no later than the 60th day nor earlier than the 90th day prior to the first anniversary of the preceding year’s annual meeting of shareholders. In the event that the date of the annual meeting of shareholders is more than 30 days before or more than 60 days after the anniversary of the preceding year’s annual meeting of shareholders, notice by the shareholder must be so received not earlier than the 90th day prior to the annual meeting of shareholders and not later than the later of the 60th day prior to the annual meeting of shareholders or the 15th day following the day on which public announcement of the date of the meeting is first made. In the event that a special meeting of shareholders is called at which directors are to be elected pursuant to the notice of that meeting, a shareholder desiring to nominate a director for election to our board of directors at that meeting should deliver a notice to our Secretary at our principal executive offices at 650 East Swedesford Road, Second floor, Wayne, Pennsylvania 19087, not later than the later of the 60th day prior to that meeting or the 15th day after the public announcement of that meeting nor earlier than the 90th day prior to that meeting.

The shareholder’s notice must set forth:

| | ● | as to each person whom the shareholder proposes to nominate for election or reelection as a director: (i) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest or is otherwise required pursuant to Regulation 14A under the Exchange Act; (ii) a description of any arrangements or understandings among the shareholder and each such person and any other person with respect to such nomination; and (iii) the consent of each such person to being named in the proxy statement as a nominee and to serving as a member of our board of directors if so elected; |

| | ● | as to any other business that the shareholder proposes to bring before an annual meeting of shareholders: (i) a brief description of the business desired to be brought before the meeting; (ii) the reasons for conducting such business at the meeting; and (iii) any material interest in such business of such shareholder and the beneficial owner, if any, on whose behalf the proposal is made; and |

| | ● | as to the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made: (i) the name and address of such shareholder, as they appear on our books, and of such beneficial owner; (ii) the class and number of shares which are owned beneficially and of record by such shareholder and such beneficial owner; and (iii) a representation that such shareholder and beneficial owner intend to appear in person or by proxy at the meeting. |

Shareholder Recommendations of Nominees. Our Nominating and Governance Committee considers suggestions from many sources, including shareholders, regarding possible candidates for director. The committee will give consideration to shareholder recommendations for positions on our board of directors where the committee has determined not to re-nominate a qualified incumbent director. The committee will only consider recommendations of candidates who satisfy the minimum qualifications prescribed by the committee for board nominees, including that a director must represent the interests of all shareholders and not serve for the purpose of favoring or advancing the interests of any particular shareholder group or other constituency.

To be considered by our Nominating and Governance Committee, a shareholder recommendation must be submitted to our Secretary and include a complete description of the nominee’s qualifications, experience and background, together with a statement signed by the nominee in which he or she consents to serve as a director if nominated and elected.

Although our Nominating and Governance Committee has not established a minimum number of shares that a shareholder must own in order to suggest a candidate for consideration, or a minimum length of time during which the shareholder must own its shares, the committee will take into account the size and duration of a recommending shareholder’s ownership interest. Our Nominating and Governance Committee will also consider the extent to which the shareholder making the suggestion intends to maintain its ownership interest in shares of our common stock.

| Compensation Committee Interlocks and Insider Participation |

During the last fiscal year, Dr. Booth, Ms. Maddox, and Mr. Pinola served as members of our Compensation Committee. None of these individuals was at any time an officer or employee of ours. In addition, none of our executive officers serves as a member of the board of directors or Compensation Committee of any entity that has one or more executive officers serving as a member of our board of directors or Compensation Committee.

Board of Directors Role in Risk Oversight

Our board of directors as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant committees that report on their deliberations to the board of directors. The oversight responsibility of our board of directors and its committees is enabled by management reporting processes that are designed to provide visibility to our board of directors about the identification, assessment and management of critical risks and management’s risk mitigation strategies. These areas of focus include competitive, economic, operational, financial (accounting, credit, liquidity and tax), legal, regulatory, compliance and reputational risks. The board of directors and its committees oversee risks associated with their respective principal areas of focus, as summarized below.

| Committee | | Primary Areas of Risk Oversight |

| Audit Committee | | Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting, financial policies, investment guidelines and credit and liquidity matters. |

| Nominating and Governance Committee | | Risks and exposures associated with leadership, succession planning and corporate governance. |

| Compensation Committee | | Risks and exposures associated with executive compensation programs and arrangements, including incentive plans. |

Table of Contents

The following table sets forth certain information, as of March 21, 2011, with respect to the beneficial ownership of our common stock by: (i) each shareholder known by us to be the beneficial owner of more than 5% of our common stock; (ii) each director or director nominee; (iii) each executive officer named in the Summary Compensation Table under “Executive Compensation and Executive Officers” in these proxy materials; and (iv) all current executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. Shares of our common stock subject to options currently exercisable or exercisable within 60 days of March 21, 2011 are deemed to be outstanding for calculating the percentage of outstanding shares of the person holding those options, but are not deemed outstanding for calculating the percentage of any other person. Percentage of beneficial ownership is based upon 23,209,231 shares of our common stock outstanding as of March 21, 2011. To our knowledge, except as set forth in the footnotes to this table and subject to applicable community property laws, each person named in the table has sole voting and investment power with respect to the shares set forth opposite such person’s name. Except as otherwise indicated, the address of each of the persons in this table is c/o Kenexa Corporation, 650 East Swedesford Road, Second Floor, Wayne, Pennsylvania 19087.

| | Amount of Beneficial Ownership | | | Percent of Class | |

| FMR LLC (1) | | | 2,279,637 | | | | 9.8 | % |

| The Gund Group (2) | | | 2,208,539 | | | | 9.5 | % |

| Columbia Wanger Asset Management, L.P. (3) | | | 2,025,000 | | | | 8.7 | % |

| Stadium Capital Management, LLC (4) | | | 1,690,398 | | | | 7.3 | % |

| BlackRock, Inc. (5) | | | 1,240,763 | | | | 5.3 | % |

| Nooruddin S. Karsan (6) | | | 1,537,344 | | | | 6.6 | % |

| Troy A. Kanter (7) | | | 484,852 | | | | 2.1 | % |

| Donald F. Volk (8) | | | 283,924 | | | | 1.2 | % |

| Richard J. Pinola (9) | | | 90,380 | | | | * | |

| James P. Restivo (10) | | | 83,500 | | | | * | |

| John A. Nies (11) | | | 69,380 | | | | * | |

| Barry M. Abelson (12) | | | 68,010 | | | | * | |

| Renee B. Booth (13) | | | 57,380 | | | | * | |

| Rebecca J. Maddox (14) | | | 57,380 | | | | * | |

| Archie L. Jones, Jr. (15) | | | 45,500 | | | | * | |

| Joseph A. Konen (16) | | | 39,380 | | | | * | |

| All executive officers and directors as a group - 11 persons (17) | | | 2,817,030 | | | | 9.9 | % |

(1) | Information is based on Amendment no. 1 to Schedule 13G filed with the Securities and Exchange Commission on March 10, 2011 by FMR LLC. FMR LLC's principal place of business is 82 Devonshire Street, Boston, MA 02109. FMR LLC is a parent holding company in accordance with section 240.13d-1(b)(ii)(G). FMR LLC is the beneficial owner of 2,279,637 shares of our common stock. |

| | |

(2) | Information is based on Amendment no. 4 to Schedule 13G filed with the Securities and Exchange Commission on February 11, 2011 by Grant Gund, individually and as trustee for the Kelsey Laidlaw Gund Gift Trust, the Llura Blair Gund Gift Trust, and the Grant Owen Gund Gift Trust; Rebecca H. Dent, as trustee for the G. Zachary Gund Descendants’ Trust, Kelsey Laidlaw Gund Gift Trust, the Llura Blair Gund Gift Trust and the Grant Owen Gund Gift Trust; G. Zachary Gund, individually and as trustee for the G. Zachary Gund Descendants’ Trust; Llura L. Gund, individually and as trustee for the Dionis Trust; and Gordon Gund, individually and as trustee for the Dionis Trust (“Gund Group”). The Gund Group’s principal place of business is 14 Nassau Street, Princeton, NJ 08542. The Gund Group may be deemed to beneficially own 2,208,539 shares of our common stock. |

| | |

(3) | Information is based on Amendment no. 3 to Schedule 13G filed with the Securities and Exchange Commission on February 10, 2011 by Columbia Wanger Asset Management, LLC (“Columbia Wanger”). Columbia Wanger’s principal place of business is 227 West Monroe Street, Suite 3000, Chicago, IL 60606. Columbia Wanger is an investment advisor registered in accordance with Rule 13d-1(b)(1)(ii)(E). Columbia Wanger is the beneficial owner of 2,025,000 shares as a result of acting as investment advisor. These shares include the shares held by Columbia Acorn Trust, a Massachusetts business trust that is advised by Columbia Wanger. |

| (4) | Information is based on Amendment no. 5 to Schedule 13G filed with the Securities and Exchange Commission on February 14, 2011 by Stadium Capital Management, LLC, Alexander M. Seaver, Bradley R. Kent, and Stadium Relative Value Partners, L.P. (“Stadium Capital”). Stadium Capital’s principal place of business is 550 NW Franklin Avenue, Suite 478, Bend, OR, 97701. Stadium Capital is an Investment Advisor in accordance with section 240.13d-1(b)(1)(ii)(E). Stadium Capital is the beneficial owner of 1,690,398 shares of our common stock. |

| | |

| (5) | Information is based on Amendment no. 1 to Schedule 13G filed with the Securities and Exchange Commission on February 7, 2011 by BlackRock, Inc. (“BlackRock”). BlackRock’s principal place of business is 40 East 52nd Street, New York, NY 10022. BlackRock is a parent holding company in accordance with Rule 13d-1(b)(1)(ii)(G). BlackRock is the beneficial owner of 1,240,763 shares of our common stock. |

| | |

| (6) | Nooruddin S. Karsan beneficially owns an aggregate of 1,537,344 shares of Common Stock jointly with his wife, Shirin N. Karsan. Mr. Karsan has pledged 200,000 shares of Common Stock pursuant to a variable post-paid forward contract and 600,000 shares of Common Stock against a line of credit, in each case to secure his obligations under the respective arrangement; the reporting persons, however, have retained the power to vote such shares. Includes options to purchase 291,250 shares of our common stock held by Mr. Karsan that may be exercised within 60 days of March 21, 2011. |

| | |

| (7) | Includes options to purchase 176,647 shares of common stock held by Mr. Kanter that may be exercised within 60 days of March 21, 2011. |

| | |

| (8) | Includes options to purchase 227,500 shares of our common stock held by Mr. Volk that may be exercised within 60 days of March 21, 2011. All of the shares owned by Mr. Volk are held jointly with his wife, Susan Volk. |

| | |

| (9) | Includes options to purchase 54,387 shares of our common stock held by Mr. Pinola that may be exercised within 60 days of March 21, 2011. |

| | |

| (10) | Includes options to purchase 63,750 shares of our common stock held by Mr. Restivo that may be exercised within 60 days of March 21, 2011. |

| | |

| (11) | Includes options to purchase 54,387 shares of our common stock held by Mr. Nies that may be exercised within 60 days of March 21, 2011. |

| | |

| (12) | Includes options to purchase 54,387 shares of our common stock held by Mr. Abelson that may be exercised within 60 days of March 21, 2011. |

| | |

| (13) | Includes options to purchase 52,387 shares of our common stock held by Dr. Booth that may be exercised within 60 days of March 21, 2011. |

| | |

| (14) | Includes options to purchase 52,387 shares of our common stock held by Ms. Maddox that may be exercised within 60 days of March 21, 2011. |

| | |

| (15) | Includes options to purchase 45,500 shares of our common stock held by Mr. Jones that may be exercised within 60 days of March 21, 2011. |

| | |

| (16) | Includes options to purchase 34,387 shares of our common stock held by Mr. Konen that may be exercised within 60 days of March 21, 2011. |

| | |

| (17) | Includes options to purchase 1,106,969 shares of our common stock that may be exercised within 60 days of March 21, 2011. |

Table of Contents

Executive Officers

The following are biographical summaries of our executive officers, except for Messrs. Karsan and Kanter, whose biographies are included under the heading “Board of Directors.”

Donald F. Volk, 61, has served as our Chief Financial Officer since December 1996. Prior to joining us, Mr. Volk was a partner in the accounting firm of Brinker, Simpson, Nicastro & Volk. Mr. Volk received a B.S. in Accounting from Villanova University and an M.S. in Taxation from the Villanova University School of Law. Mr. Volk became a Certified Public Accountant in 1974.

Archie L. Jones, Jr., 39, has served as our Vice President of Business Development since August 2005. In 2008, his responsibilities were expanded to include Global Operations and Delivery and its financial impact. From 2003 until 2005, Mr. Jones served as managing director of Maplegate Holdings, a private equity investment firm that he co-founded that focuses on small-cap buyouts. From 1998 until 2002, Mr. Jones was a principal and charter member of Parthenon Capital, Inc., a private equity investment firm. Mr. Jones served on our board of directors from 1999 until 2002. He served on the board of directors of Franco Apparel Group from 1998 until 2004 and held the role of that organization’s interim CFO in 1999. Mr. Jones received an M.B.A. from Harvard Business School and a B.A. in Accounting and Business Administration from Morehouse College.

James P. Restivo, 50, has served as our Chief Knowledge Officer since October 2006. Prior to joining us, Mr. Restivo was the founder, President and Chief Executive Officer of Blue Angel Technologies. Between 1993 and 1997, he also served as the Vice President of Development for Vertex Inc., the leading provider of corporate sales tax software. Mr. Restivo received a S.M. in electrical engineering and computer science from the Massachusetts Institute of Technology and a B.S. with a double major in computer science and applied mathematics and statistics the State University of New York at Stony Brook.

Compensation Discussion and Analysis

The Role of the Compensation Committee in Determining Executive Compensation

The Compensation Committee of the board of directors, which is comprised entirely of independent directors, is responsible for ensuring that our executive compensation policies and programs are competitive within the markets in which we compete for talent and reflect a strong focus on shareholder value. The Compensation Committee reviews and approves the compensation levels and benefit programs for annual salary, bonus, stock options, and other benefits (direct and non-direct) for all of our Named Executive Officers (“NEOs”). Our NEOs consist of Mr. Karsan, our principal executive officer, Mr. Volk, our principal financial officer, Mr. Kanter, Mr. Jones and Mr. Restivo, who are our most highly compensated executive officers (other than our principal executive officer and principal financial officer) serving as of December 31, 2010 and whose total compensation exceeded $100,000 during the year ended December 31, 2010. The Compensation Committee reviews and approves the corporate goals and objectives relevant to the NEOs’ compenstion, reviews the evaluation of their performance against these objectives and, based on that evaluation, approves the NEOs’ compensation programs.

In late 2009, the Compensation Committee retained Exequity, LLP (“Exequity”) as its independent compensation consultant. Exequity reports directly to the Compensation Committee, which retains full authority over Exequity’s activities, including the authority to terminate the relationship. In 2009, the Compensation Committee commissioned Exequity to gather, among other things, customized peer group data for both its NEOs and outside Directors. In 2010, Exequity completed its competitive benchmarking analysis for the Compensation Committee on the pay of our top executive officers compared to the market. Exequity also provided the Compensation Committee with general information on recent trends in executive compensation.

As part of its duties, the Compensation Committee annually reviews the independence of its compensation consultant and in 2010, concluded that Exequity was independent.

Our management and compensation staff provides additional analysis and counsel as requested by the Compensation Committee. You can learn more about the Committee’s purpose, responsibilities, structure, and other details by reading the Compensation Committee’s charter which can be found in the Corporate Governance section of our website at www.Kenexa.com. See “Structure and Practices of The Board of Directors - Committees” on page 6.

Performance Overview

Following one of the worst recessions on record, we began 2010 realizing operational improvements made during the downturn and benefits from our investment in sales and marketing We emerged with improved results and additional offerings through our acquisition of Salary.com. In comparison to 2009, GAAP revenue improved in the first, second and third quarters of 2010, increasing 2%, 14% and 26%, respectively from the prior year results. Our fourth quarter results in 2010 reflected an even greater increase, as we reported non-GAAP revenues from strengthening demand across all regions and products categories, of $64 million, which represented a 26% increase compared to the third quarter of 2010, and a 64% increase in comparison to the fourth quarter of 2009. These improvements translated into a significant increase in our stock price at the end of 2010 which was up 67% compared to the end of 2009.

| | | 2010 ($ in millions, except per share amounts) | | | 2009 ($ in millions, except per share amounts) | | | Change (%) | |

| Revenue (GAAP) (1) | | | 196.4 | | | | 157.7 | | | | 25 | |

| Revenue (non-GAAP) (2) | | | 199.4 | | | | 157.7 | | | | 26 | |

| Operating Loss (GAAP) (1) | | | (0.3 | ) | | | (29.0 | ) | | NM | |

| Operating Income (non-GAAP) (3) | | | 17.6 | | | | 15.9 | | | | 11 | |

| Stock Price per Share as of December 31, | | | 21.79 | | | | 13.03 | | | | 67 | |

(1) | | Revenue and Operating Loss (GAAP) results are based on U.S. generally accepted accounting principles (GAAP). |

(2) | | Revenue (non-GAAP) for 2010 excludes the write down of deferred revenue associated with purchase accounting for the Salary.com acquisition. |

(3) | | Operating Income (non-GAAP) for 2010 excludes share-based compensation expense of $4.5 million, amortization of acquired intangibles of $5.8 million, acquisition related fees of $4.6 million and deferred revenue associated with our Salary.com acquisition of $3.1 million. Operating Income (non-GAAP) for 2009 excludes share-based compensation expense of $5.4 million, amortization of acquired intangibles of $4.5 million, professional fees associated with our variable interest entity of $0.7 million, severance expense of $1.2 million, goodwill impairment of $33.3 million and an adjustment for noncontrolling interests of $(0.1) million . |

Compensation Objectives & Philosophy

As a provider of integrated human capital solutions, we believe that the value we deliver to our customers depends in large part upon the quality of our people. Our business model is based on our ability to establish long-term relationships with customers, and to maintain a strong mission, customer focus, entrepreneurial spirit, and team orientation. The compensation programs we provide to our executives are designed to support our vision to become the most profitable and recognized leader for integrated human capital solutions by: